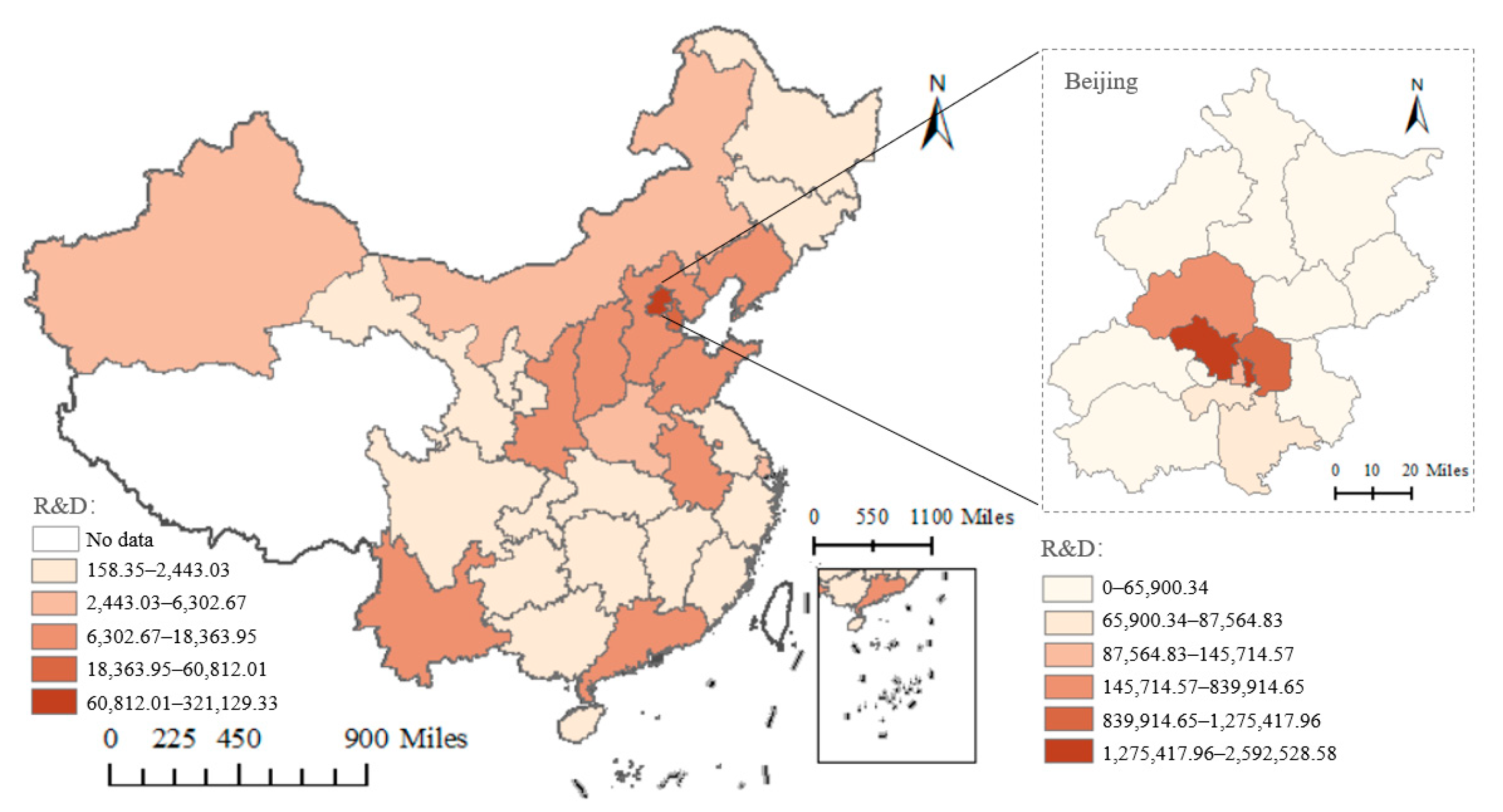

The Impact of Green Technology Research and Development (R&D) Investment on Performance: A Case Study of Listed Energy Companies in Beijing, China

Abstract

1. Introduction

2. Literature Review

2.1. Correlation between Green Technology R&D Investment and Firm Performance

2.2. Determinants of Variability in the Relationship between Green Technology R&D Investment and Firm Performance

3. Research Design

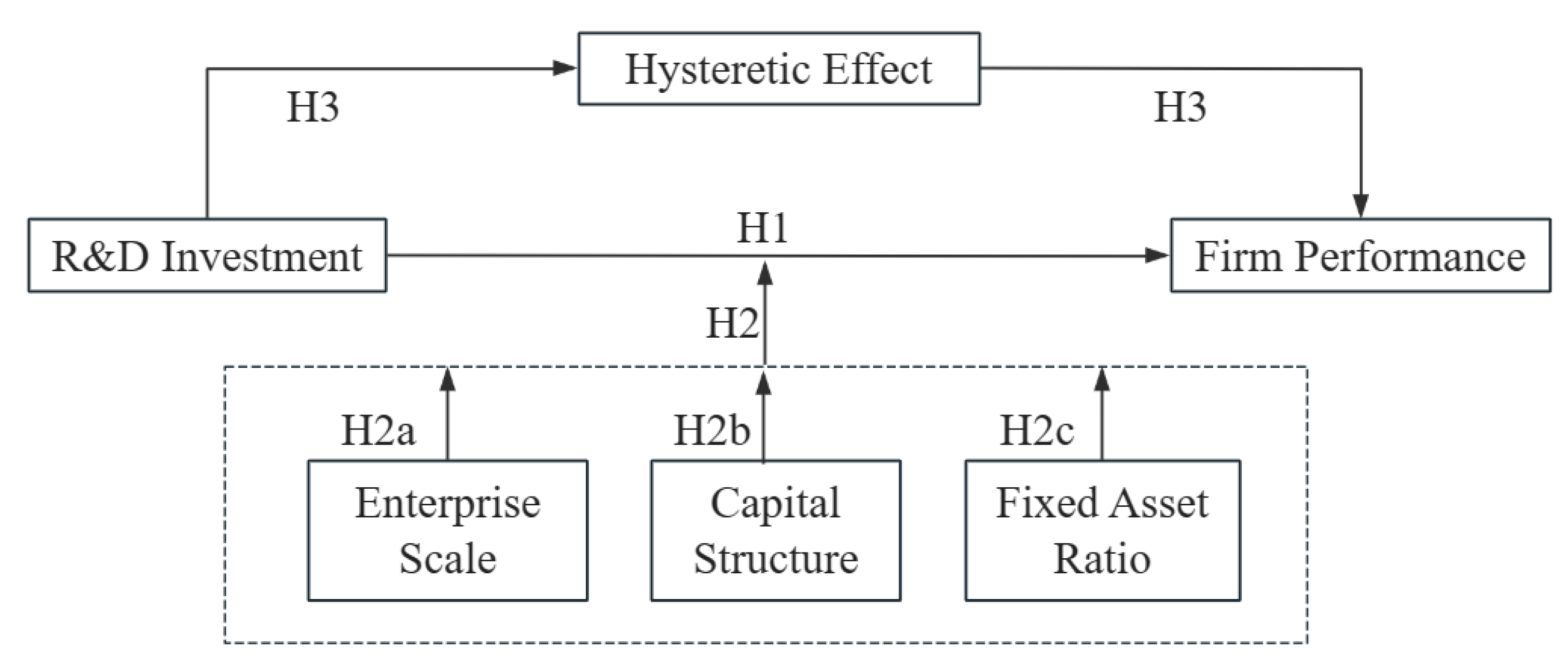

3.1. Hypotheses

3.2. Model Settings

- Model I:

- Model II:

- Model III:where are the estimated thresholds and is the indicator function that takes the value 1 if the conditions in parentheses are satisfied and takes the value 0 otherwise. are the coefficient estimates of the green technology R&D inputs, are the coefficient estimates of the control variables, is the residual term, are the cross-multiplier terms for individual and time fixed effects, respectively, and the specific variables are as defined in Table 1. Table 1 lists the variables in the model: The performance of enterprise me in year t is the dependent variable , and the independent variable is green technology R&D investment. The threshold variables are enterprise size , asset structure and capital intensity . The control variables are operating capacity and earnings quality .

- The impact of green technology R&D investment on firm performance is moderated by firm size [61], and the resource advantages of firms of different sizes can have a significant impact on firm performance [4]. In this study, firm size () is defined as the logarithm of fixed assets. The use of the logarithmic index of fixed assets not only reflects the size of the enterprise but also effectively prevents errors in statistical analysis due to differences in the fixed assets of the enterprise.

- The capital structure refers to the combination of the value of all of the assets of the company and the debt–equity ratio. The company’s gearing ratio () is a measure of the relationship between the company’s total liabilities and its total assets. This ratio reflects the asset structure of the company and the effectiveness of debt control. A reasonable and adequate asset structure can not only reduce a company’s total cost of capital ratio but also increase the profit from debt and further enhance the value of the company [77,79]. In this study, is chosen as a threshold variable that helps to measure corporate risk.

- Finally, capital density () is chosen in this study as a threshold variable for the share of fixed assets in the total assets of energy companies [35].

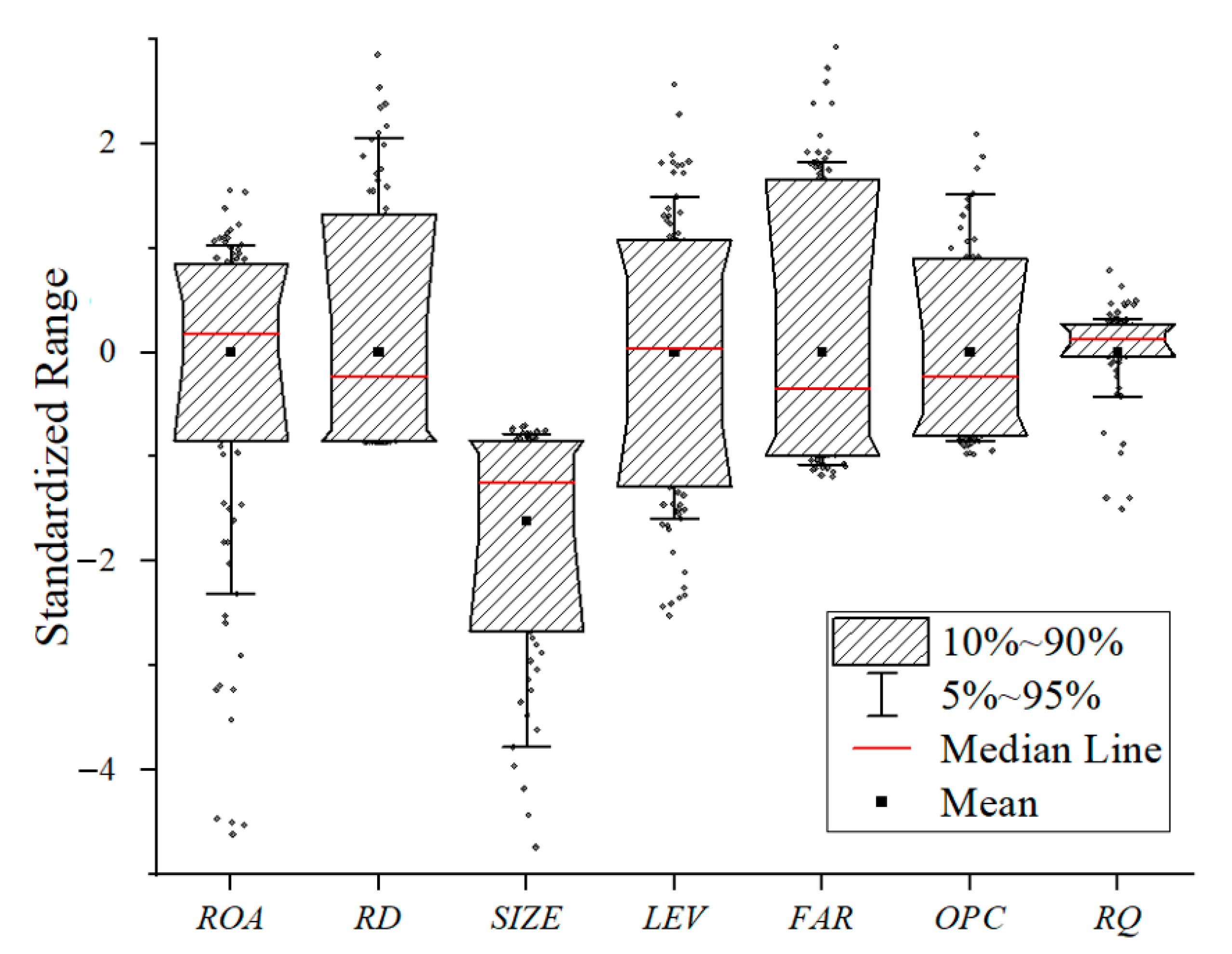

3.3. Descriptive Statistics

4. Empirical Analysis

4.1. Discussion of Nonlinear Correlations

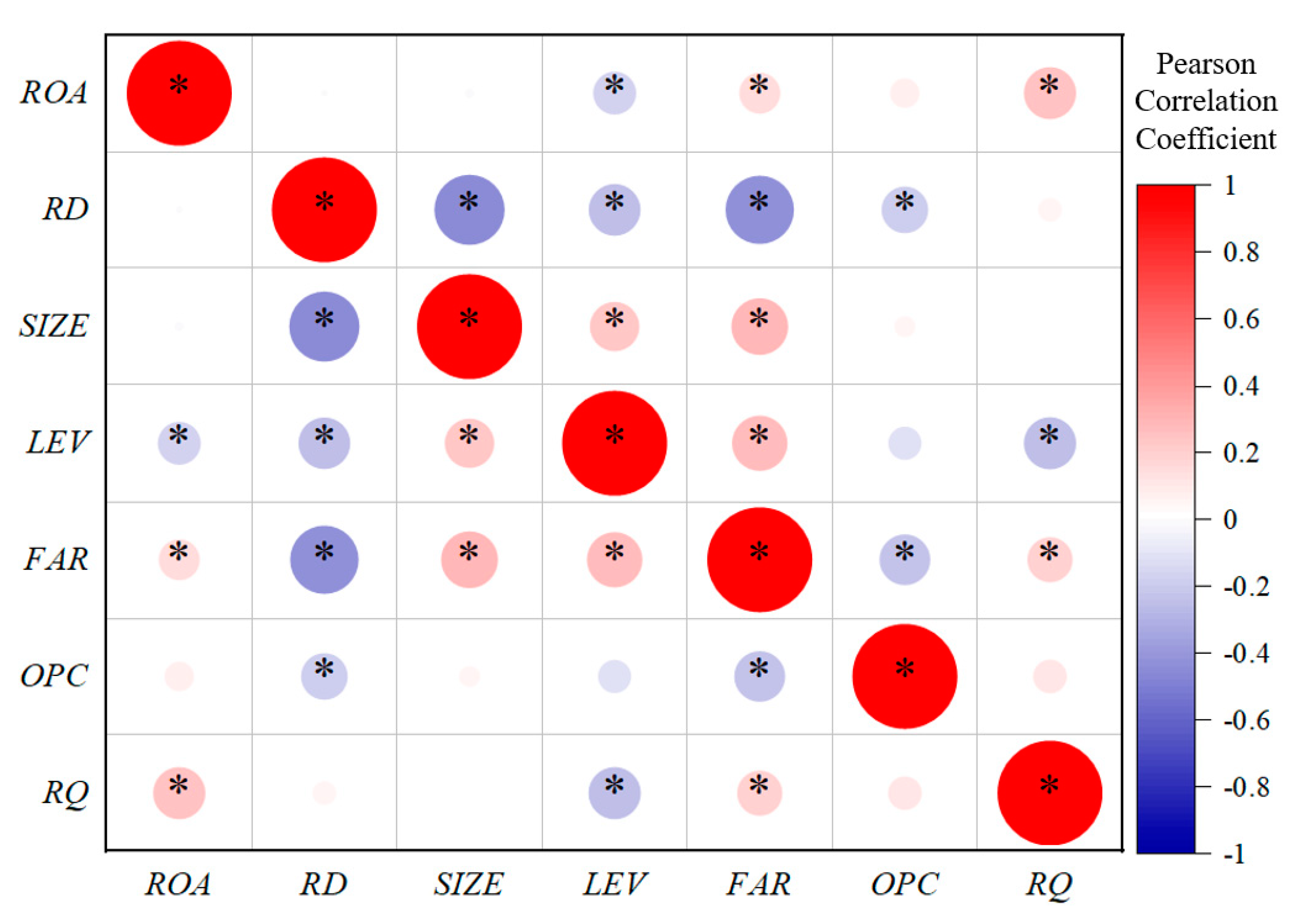

4.1.1. Correlation Analysis

4.1.2. Threshold Effect Model

4.2. Impact Study of Threshold Variables

4.2.1. Threshold Effect Model Results

4.2.2. Discussion of Threshold Effect

- (1)

- The Threshold Effect of Firm Size on the Relationship between green technology R&D Investment and Firm Performance

- (2)

- The Threshold Effect of Capital Structure on the Relationship between green technology R&D Investment and Firm Performance

- (3)

- The Threshold Effect of Capital Intensity on the Relationship between green technology R&D Investment and Firm Performance

4.3. Hysteresis Effect Analysis

4.4. Endogenous Problems Discussion

4.5. Robustness Tests

5. Discussions

5.1. Main Findings

- (1)

- There is an inverse-W-shaped, nonlinear relationship between green technology R&D investment and firm performance, where the optimal green technology R&D investment intensity has a positive effect on firm performance. Extreme green technology R&D investment (which can be too low or too high) has a negative impact on firm performance. Therefore, companies should conduct adequate preliminary research before investing in green technology R&D. Appropriate green technology R&D investment can not only reduce green technology R&D costs but also maximise the benefits to the company. When green technology R&D investment increases, the company can efficiently discover, absorb and apply new knowledge and technologies, resulting in new products that improve the company’s performance. However, when green technology R&D investment reaches a certain threshold, new product development bottlenecks may occur, and the impact on company performance may diminish. A further increase in green technology R&D investment could break through the bottleneck and lead to newer products and technologies, thus improving company performance. Nevertheless, when green technology R&D investment enters the high investment phase, it may consume the company’s internal resources and limit investment in other areas, leading to higher opportunity costs that negatively impact the company’s performance.

- (2)

- Green technology R&D investment and firm performance exhibit an inversely-U-shaped, nonlinear relationship when firm size matters. The relationship is initially positive but slows down after the −0.3965 threshold is exceeded. Iterative innovation and breakthrough innovation were used to explain that if the firm is too small, it is difficult to take advantage of the learning effect and the scale effect, which reduces the efficiency of green technology R&D investment to increase performance. Additionally, if the company is too large, it tends to opt for iterative innovations based on the existing green technology R&D base and avoid risks. Only when the company is of moderate size is it easiest to stimulate breakthrough innovations for optimal benefit.

- (3)

- Under the threshold condition of capital structure, green technology R&D investment has a negative and nonlinear relationship with firm performance. Excessive debt increases the liquidity risk and operational risk of the firm and increases the uncertainty of green technology R&D investment. When the capital structure exceeds the threshold, the relationship between green technology R&D investment and the firm changes from a non-significant negative correlation to a highly significant negative correlation, and the magnitude of the effect increases significantly.

- (4)

- Under the threshold condition of capital intensity, there is an inverse-N-shaped nonlinear relationship between green technology R&D investment and firm performance. Too high a proportion of current assets tends to lead to excessive green technology R&D investment, while too low a proportion of current assets tends to limit the use of green technology R&D investment funds. Adequate capital density enables firms to better perform green technology R&D and generate profits.

- (5)

- Given the long cycle and high cost of green technology R&D investment in energy firms, the lag effect between green technology R&D investment and firm performance has also been analysed. The lag effect influences the relationship between green technology R&D investment and firm performance. When the relationship is positive, the lag effect reduces the impact of subsequent green technology R&D investments and vice versa. Therefore, the right interval for green technology R&D investment is crucial for companies.

5.2. Policy and Practice Recommendations

5.3. Limitations and Future Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Liu, M.Z.; Liu, L.Y.; Xu, S.C.; Du, M.W.; Liu, X.X.; Zhang, Y.Q. The Influences of Government Subsidies on Performance of New Energy Firms: A Firm Heterogeneity Perspective. Sustainability 2019, 11, 4518. [Google Scholar] [CrossRef]

- Cui, Y.; Khan, S.U.; Li, Z.X.; Zhao, M.J. Environmental effect, price subsidy and financial performance: Evidence from Chinese new energy enterprises. Energy Policy 2021, 149, 112050. [Google Scholar] [CrossRef]

- Habtewold, T.M. Impacts of internal R&D on firms’ performance and energy consumption: Evidence from Ethiopian firms. Int. J. Innov. Stud. 2023, 7, 47–67. [Google Scholar] [CrossRef]

- Ciftci, M.; Cready, W.M. Scale effects of R&D as reflected in earnings and returns. J. Account. Econ. 2011, 52, 62–80. [Google Scholar] [CrossRef]

- Miao, K.; Li, K.; Su, L. Panel threshold models with interactive fixed effects. J. Econom. 2020, 219, 137–170. [Google Scholar] [CrossRef]

- Zhu, X.; Asimakopoulos, S.; Kim, J. Financial development and innovation-led growth: Is too much finance better? J. Int. Money Financ. 2020, 100, 102083. [Google Scholar] [CrossRef]

- Li, N.; Deng, M.; Mou, H.; Tang, D.; Fang, Z.; Zhou, Q.; Cheng, C.; Wang, Y. Government Participation in Supply Chain Low-Carbon Technology R&D and Green Marketing Strategy Optimization. Sustainability 2022, 14, 8342. [Google Scholar] [CrossRef]

- Al Halbusi, H.; Klobas, J.E.; Ramayah, T. Green core competence and firm performance in a post-conflict country. Iraq. Bus. Strategy Environ. 2022. [Google Scholar] [CrossRef]

- Liang, H.; Li, G.; Zhang, W.; Chen, Z. The Impact of Green Innovation on Enterprise Performance: The Regulatory Role of Government Grants. Sustainability 2022, 14, 13550. [Google Scholar] [CrossRef]

- Liu, T.; Wang, Y.; Zhou, W. The impact of stock liquidity on green technology innovation of new energy enterprises: Evidence from China. Environ. Dev. Sustain. 2023. [Google Scholar] [CrossRef]

- Hurtado-Torres, N.E.; Aragon-Correa, J.A.; Ortiz-de-Mandojana, N. How does R & D internationalization in multinational firms affect their innovative performance? The moderating role of international collaboration in the energy industry. Int. Bus. Rev. 2018, 27, 514–527. [Google Scholar] [CrossRef]

- Lazzarotti, V.; Manzini, R.; Mari, L. A model for R&D performance measurement. Int. J. Prod. Econ. 2011, 134, 212–223. [Google Scholar] [CrossRef]

- Salimi, N.; Rezaei, J. Evaluating firms’ R & D performance using best worst method. Eval. Program Plann. 2018, 66, 147–155. [Google Scholar] [CrossRef]

- Garcia-Manjon, J.V.; Romero-Merino, M.E. Research, development, and firm growth. Empirical evidence from European top R&D spending firms. Res. Policy 2012, 41, 1084–1092. [Google Scholar] [CrossRef]

- Sharma, P.; Davcik, N.S.; Pillai, K.G. Product innovation as a mediator in the impact of R&D expenditure and brand equity on marketing performance. J. Bus. Res. 2016, 69, 5662–5669. [Google Scholar] [CrossRef]

- Xin, K.; Chen, X.; Zhang, R.; Sun, Y.C. R&D intensity, free cash flow, and technological innovation: Evidence from high-tech manufacturing firms in China. Asian J. Technol. Innov. 2019, 27, 214–238. [Google Scholar] [CrossRef]

- Coluccia, D.; Dabic, M.; Del Giudice, M.; Fontana, S.; Solimene, S. R&D innovation indicator and its effects on the market. An empirical assessment from a financial perspective. J. Bus. Res. 2020, 119, 259–271. [Google Scholar] [CrossRef]

- James, B.E.; McGuire, J.B. Transactional-institutional fit: Corporate governance of R&D investment in different institutional contexts. J. Bus. Res. 2016, 69, 3478–3486. [Google Scholar] [CrossRef]

- Wang, Y.Q.; Guo, B.; Yin, Y.J. Open innovation search in manufacturing firms: The role of organizational slack and absorptive capacity. J. Knowl. Manag. 2017, 21, 656–674. [Google Scholar] [CrossRef]

- Patel, P.C.; Guedes, M.J.; Soares, N.; Goncalves, V.D. Strength of the association between R&D volatility and firm growth: The roles of corporate governance and tangible asset volatility. J. Bus. Res. 2018, 88, 282–288. [Google Scholar] [CrossRef]

- Su, C.; Kong, L.S.; Ciabuschi, F.; Holm, U. Demand and willingness for knowledge transfer in springboard subsidiaries of Chinese multinationals. J. Bus. Res. 2020, 109, 297–309. [Google Scholar] [CrossRef]

- Cao, Q.; Gedajlovic, E.; Zhang, H.P. Unpacking Organizational Ambidexterity: Dimensions, Contingencies, and Synergistic Effects. Organ. Sci. 2009, 20, 781–796. [Google Scholar] [CrossRef]

- Adomako, S.; Amankwah-Amoah, J.; Danso, A.; Danquah, J.K.; Hussain, Z.; Khan, Z. R&D intensity, knowledge creation process and new product performance: The mediating role of international R&D teams. J. Bus. Res. 2021, 128, 719–727. [Google Scholar] [CrossRef]

- Bustinza, O.F.; Gomes, E.; Vendrell-Herrero, F.; Baines, T. Product-service innovation and performance: The role of collaborative partnerships and R&D intensity. R. D. Manag. 2019, 49, 33–45. [Google Scholar] [CrossRef]

- Paruchuri, S.; Eisenman, M. Microfoundations of Firm R&D Capabilities: A Study of Inventor Networks in a Merger. J. Manag. Stud. 2012, 49, 1509–1535. [Google Scholar] [CrossRef]

- Vithessonthi, C.; Racela, O.C. Short-and long-run effects of internationalization and R&D intensity on firm performance. J. Multinatl. Financ. Manag. 2016, 34, 28–45. [Google Scholar] [CrossRef]

- Guo, H.; Minier, J. Borders, geography, and economic activity: The case of China. Reg. Sci. Urban Econ. 2021, 90, 103700. [Google Scholar] [CrossRef]

- Hazarika, N. R&D Intensity and Its Curvilinear Relationship with Firm Profitability: Perspective from the Alternative Energy Sector. Sustainability 2021, 13, 5060. [Google Scholar] [CrossRef]

- Martin, G.P.; Wiseman, R.M.; Gomez-Mejia, L.R. Going Short-Term or Long-Term? Ceo Stock Options and Temporal Orientation in the Presence of Slack. Strateg. Manag. J. 2016, 37, 2463–2480. [Google Scholar] [CrossRef]

- Lee, C.Y.; Wu, H.L.; Pao, H.W. How does R&D intensity influence firm explorativeness? Evidence of R&D active firms in four advanced countries. Technovation 2014, 34, 582–593. [Google Scholar] [CrossRef]

- Graham, J.R.; Harvey, C.R.; Rajgopal, S. The economic implications of corporate financial reporting. J. Account. Econ. 2005, 40, 3–73. [Google Scholar] [CrossRef]

- Si, K.; Xu, X.L.; Chen, H.H. Examining the Interactive Endogeneity Relationship between R&D Investment and Financially Sustainable Performance: Comparison from Different Types of Energy Enterprises. Energies 2020, 13, 2332. [Google Scholar] [CrossRef]

- Lin, B.W.; Lee, Y.; Hung, S.C. R&D intensity and commercialization orientation effects on financial performance. J. Bus. Res. 2006, 59, 679–685. [Google Scholar] [CrossRef]

- Mudambi, R.; Swift, T. Proactive R&D management and firm growth: A punctuated equilibrium model. Res. Policy 2011, 40, 429–440. [Google Scholar] [CrossRef]

- Alam, A.; Uddin, M.; Yazdifar, H.; Shafique, S.; Lartey, T. R&D investment, firm performance and moderating role of system and safeguard: Evidence from emerging markets. J. Bus. Res. 2020, 106, 94–105. [Google Scholar] [CrossRef]

- Wang, C.Q.; Yi, J.T.; Kafouros, M.; Yan, Y.N. Under what institutional conditions do business groups enhance innovation performance? J. Bus. Res. 2015, 68, 694–702. [Google Scholar] [CrossRef]

- Teece, D.J. Profiting from Technological Innovation—Implications for Integration, Collaboration, Licensing and Public-Policy. Res. Policy 1986, 15, 285–305. [Google Scholar] [CrossRef]

- Zhu, Z.S.; Liao, H.; Liu, L. The role of public energy R&D in energy conservation and transition: Experiences from IEA countries. Renew. Sust. Energ. Rev. 2021, 143, 110978. [Google Scholar] [CrossRef]

- Czarnitzki, D.; Toole, A.A. The R&D Investment-Uncertainty Relationship: Do Strategic Rivalry and Firm Size Matter? MDE. Manag. Decis. Econ. 2013, 34, 15–28. [Google Scholar] [CrossRef]

- Leung, T.Y.; Sharma, P. Differences in the impact of R&D intensity and R&D internationalization on firm performance—Mediating role of innovation performance. J. Bus. Res. 2021, 131, 81–91. [Google Scholar] [CrossRef]

- Huang, L.; Wang, C.H.; Chin, T.C.; Huang, J.H.; Cheng, X.M. Technological knowledge coupling and green innovation in manufacturing firms: Moderating roles of mimetic pressure and environmental identity. Int. J. Prod. Res. 2022, 248, 108482. [Google Scholar] [CrossRef]

- Su, H.; Qu, X.; Tian, S.; Ma, Q.; Li, L.; Chen, Y. Artificial intelligence empowerment: The impact of research and development investment on green radical innovation in high-tech enterprises. Syst. Res. Behav. Sci. 2022, 39, 489–502. [Google Scholar] [CrossRef]

- Sun, W.; Zhang, X.; Hazarika, N. Dilemmas of R&D investment risks and sustainability in the clean-tech economy: Evidence from Nasdaq clean edge index components. Int. J. Green. Energy 2023, 20, 139–152. [Google Scholar] [CrossRef]

- Xu, X.; Chen, X.; Liu, Y.; Huang, N. Effect of government subsidies on firm innovative performance in China’s shale gas industry. Energy Environ. 2023. [Google Scholar] [CrossRef]

- Wang, R.Q.; Wang, F.J.; Xu, L.Y.; Yuan, C.H. R&D expenditures, ultimate ownership and future performance: Evidence from China. J. Bus. Res. 2017, 71, 47–54. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Gao, G.Y.; Zhao, H.X. State Ownership and Firm Innovation in China: An Integrated View of Institutional and Efficiency Logics. Adm. Sci. Q. 2017, 62, 375–404. [Google Scholar] [CrossRef]

- Abbas, S.; Adapa, S.; Sheridan, A.; Azeem, M.M. Informal competition and firm level innovation in South Asia: The moderating role of innovation time off and R&D intensity. Technol. Forecast. Soc. Chang. 2022, 181, 121751. [Google Scholar] [CrossRef]

- Qi, X.Y.; Guo, Y.S.; Guo, P.B.; Yao, X.L.; Liu, X.L. Do subsidies and R&D investment boost energy transition performance? Evidence from Chinese renewable energy firms. Energy Policy 2022, 164, 112909. [Google Scholar] [CrossRef]

- Chang, S.H.; Li, Y.; Gao, F.L. The impact of delaying an investment decision on R&D projects in real option game. Chaos Solitons Fractals 2016, 87, 182–189. [Google Scholar] [CrossRef]

- Yeh, M.L.; Chu, H.P.; Sher, P.J.; Chiu, Y.C. R&D intensity, firm performance and the identification of the threshold: Fresh evidence from the panel threshold regression model. Appl. Econ. 2010, 42, 389–401. [Google Scholar] [CrossRef]

- Bolivar-Ramos, M.T. The impact of corporate science on environmental innovations: The role of universities and research institutions. R. D. Manag. 2023, 53, 503–523. [Google Scholar] [CrossRef]

- Hall, D.L.; Nauda, A. An Interactive Approach for Selecting Ir-and-D Projects. IEEE. Trans. Eng. Manag. 1990, 37, 126–133. [Google Scholar] [CrossRef]

- Lootsma, F.A.; Meisner, J.; Schellemans, F. Multicriteria Decision-Analysis as an Aid to the Strategic-Planning of Energy Research-and-Development. Eur. J. Oper. Res. 1986, 25, 216–234. [Google Scholar] [CrossRef]

- Lee, Y.; Son, S.; Park, H. Analysis of Korea’s nuclear R&D priorities based on private Sector’s domestic demand using AHP. Nucl. Eng. Technol. 2020, 52, 2660–2666. [Google Scholar] [CrossRef]

- Cui, Q.; Wei, Y.M.; Li, Y. Exploring the impacts of the EU ETS emission limits on airline performance via the Dynamic Environmental DEA approach. Appl. Energy 2016, 183, 984–994. [Google Scholar] [CrossRef]

- Cui, Q.; Li, Y. Airline efficiency measures using a Dynamic Epsilon-Based Measure model. Transp. Res. Part A Policy Pract. 2017, 100, 121–134. [Google Scholar] [CrossRef]

- Xiong, X.; Yang, G.L.; Guan, Z.C. Assessing R&D efficiency using a two-stage dynamic DEA model: A case study of research institutes in the Chinese Academy of Sciences. J. Informetr. 2018, 12, 784–805. [Google Scholar] [CrossRef]

- Wang, L.; Zeng, T.; Li, C. Behavior decision of top management team and enterprise green technology innovation. J. Clean. Prod. 2022, 367, 133120. [Google Scholar] [CrossRef]

- Aarstad, J.; Kvitastein, O.A.; Jakobsen, S.E. What Drives Enterprise Product Innovation? Assessing How Regional, National, and International Inter-Firm Collaboration Complement or Substitute for R&D Investments. Int. J. Innov. Manag. 2019, 23, 1950040. [Google Scholar]

- Sun, Y.F.; Zhang, Y.J.; Su, B. Impact of government subsidy on the optimal R&D and advertising investment in the cooperative supply chain of new energy vehicles. Energy Policy 2022, 164, 112885. [Google Scholar] [CrossRef]

- Ugur, M.; Trushin, E.; Solomon, E. Inverted-U relationship between R&D intensity and survival: Evidence on scale and complementarity effects in UK data. Res. Policy 2016, 45, 1474–1492. [Google Scholar] [CrossRef]

- Zhang, D.; Rong, Z.; Ji, Q. Green innovation and firm performance: Evidence from listed companies in China. Resour. Conserv. Recycl. 2019, 144, 48–55. [Google Scholar] [CrossRef]

- Wenbo, J. Green entrepreneurial orientation for enhancing firm performance: A dynamic capability perspective. J. Clean. Prod. 2018, 198, 1311–1323. [Google Scholar] [CrossRef]

- Moreda, T. Beyond land rights registration: Understanding the mundane elements of land conflict in Ethiopia. J. Peasant Stud. 2022, 1–29. [Google Scholar] [CrossRef]

- Xu, J.; Liu, F.; Chen, Y.H. R&D, Advertising and Firms’ Financial Performance in South Korea: Does Firm Size Matter? Sustainability 2019, 11, 3764. [Google Scholar] [CrossRef]

- Kim, E.S.; Choi, Y.; Byun, J. Big Data Analytics in Government: Improving Decision Making for R&D Investment in Korean SMEs. Sustainability 2020, 12, 202. [Google Scholar] [CrossRef]

- Bianco, F.; Venezia, M. Features of R&D Teams and Innovation Performances of Sustainable Firms: Evidence from the “Sustainability Pioneers” in the IT Hardware Industry. Sustainability 2019, 11, 4524. [Google Scholar] [CrossRef]

- Yoo, J.; Lee, S.; Park, S. The Effect of Firm Life Cycle on the Relationship between R&D Expenditures and Future Performance, Earnings Uncertainty, and Sustainable Growth. Sustainability 2019, 11, 2371. [Google Scholar] [CrossRef]

- Zabolotnyy, S.; Wasilewski, M. The Concept of Financial Sustainability Measurement: A Case of Food Companies from Northern Europe. Sustainability 2019, 11, 5139. [Google Scholar] [CrossRef]

- Zheng, W.Z.; Lou, Y.T.; Chen, Y. On the Unsustainable Macroeconomy with Increasing Inequality of Firms Induced by Excessive Liquidity. Sustainability 2019, 11, 3075. [Google Scholar] [CrossRef]

- Falk, M. Quantile estimates of the impact of R&D intensity on firm performance. Small Bus. Econ. 2012, 39, 19–37. [Google Scholar] [CrossRef]

- Zabala, A.; Pascual, U.; Garcia-Barrios, L. Payments for Pioneers? Revisiting the Role of External Rewards for Sustainable Innovation under Heterogeneous Motivations. Ecol. Econ. 2017, 135, 234–245. [Google Scholar] [CrossRef]

- Liu, D.Y.; Chen, T.; Liu, X.Y.; Yu, Y.Z. Do more subsidies promote greater innovation? Evidence from the Chinese electronic manufacturing industry. Econ. Model. 2019, 80, 441–452. [Google Scholar] [CrossRef]

- Bigliardi, B.; Galati, F. Innovation trends in the food industry: The case of functional foods. Trends Food Sci. Technol. 2013, 31, 118–129. [Google Scholar] [CrossRef]

- Boeing, P. The allocation and effectiveness of China’s R&D subsidies—Evidence from listed firms. Res. Policy 2016, 45, 1774–1789. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef]

- Kotlar, J.; De Massis, A.; Frattini, F.; Bianchi, M.; Fang, H.Q. Technology Acquisition in Family and Nonfamily Firms: A Longitudinal Analysis of Spanish Manufacturing Firms. J. Prod. Innov. Manag. 2013, 30, 1073–1088. [Google Scholar] [CrossRef]

- Alam, M.S.; Atif, M.; Chien-Chi, C.; Soytas, U. Does corporate R&D investment affect firm environmental performance? Evidence from G-6 countries. Energy Econ. 2019, 78, 401–411. [Google Scholar] [CrossRef]

- Chen, L.; Yang, W.H. R&D tax credits and firm innovation: Evidence from China. Technol. Forecast. Soc. Chang. 2019, 146, 233–241. [Google Scholar] [CrossRef]

- Sun, X.L. Human Capital, Market Environment, and Firm Innovation in Chinese Manufacturing Firms. Sustainability 2022, 14, 12642. [Google Scholar] [CrossRef]

- Seo, M.H.; Kim, S.; Kim, Y.J. Estimation of dynamic panel threshold model using Stata. Stata J. 2019, 19, 685–697. [Google Scholar] [CrossRef]

- Zhang, H.M.; Li, L.S.; Zhou, D.Q.; Zhou, P. Political connections, government subsidies and firm financial performance: Evidence from renewable energy manufacturing in China. Renew. Energ. 2014, 63, 330–336. [Google Scholar] [CrossRef]

- Jensen, M.C. Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. Am. Econ. Rev. 1986, 76, 323–329. [Google Scholar] [CrossRef]

- Brahmi, M.; Esposito, L.; Parziale, A.; Dhayal, K.S.; Agrawal, S.; Giri, A.K.; Loan, N.T. The Role of Greener Innovations in Promoting Financial Inclusion to Achieve Carbon Neutrality: An Integrative Review. Economies 2023, 11, 194. [Google Scholar] [CrossRef]

| Category | Name | Symbol | Definition | References Source |

|---|---|---|---|---|

| Dependent Variable | Firm performance | ROA | The profit growth of the enterprise | [18,20,77,78] |

| Independent Variable | green technology R&D investment | RD | Total green technology R&D expense | [13,34,45,47,77] |

| Threshold Variable | Enterprise scale | SIZE | Logarithm of fixed assets | [18,45,73] |

| Capital structure | LEV | Asset–liability ratio | [34,35,45,48,79] | |

| Fixed Asset Ratio | FAR | Ratio of fixed assets to total assets | [26,35,73] | |

| Control Variables | Operating Capacity | OPC | Enterprise operation capability | [48,63,73] |

| Quality of earnings | RQ | Enterprise value reliable information | [4,17] |

| Min | Max | Median | Mean | S.D | |

|---|---|---|---|---|---|

| RD | 0.00003 | 0.7570 | 0.033 | 0.051 | 0.0780 |

| ROA | −228.2580 | 23.5500 | 2.4020 | 0.362 | 17.6790 |

| FS * | 0.6600 | 27000 | 100 | 1900 | 4700 |

| LEV | 0.002847 | 0.8758 | 0.1806 | 0.2623 | 0.6600 |

| FAR | 0.06181 | 30.6750 | 0.5473 | 0.6789 | 2.1294 |

| OPC | 0.0060 | 3.2152 | 0.4593 | 0.5542 | 0.4691 |

| RQ | −6546.8100 | 901.7400 | 80.1800 | −12.2400 | 562.8929 |

| Threshold Test | Models | Threshold Estimates | LR Statistical Quantities | Bootstrap p-Value | BS Times |

|---|---|---|---|---|---|

| Overall sample testing | Single Threshold | −0.368 | 14.06066 | 0.0030 | 300 |

| Double Threshold | 1.247 | 14.2050 | 0.0030 | 300 | |

| Three thresholds | 1.918 | 15.7590 | 0.0000 | 300 |

| Test | RD 1 | RD 2 | RD 3 | RD 4 | OPC | RQ |

|---|---|---|---|---|---|---|

| Overall sample test | 0.5244 * (1.8234) | −0.1524 * (−1.7616) | 0.0926 ** (2.1634) | −0.6912 * (−1.6935) | 0.0701 ** (2.4272) | −0.0171 (−0.7443) |

| Threshold Vars | Models | Threshold Estimates | LR Statistical Quazntities | Bootstrap p-Value | BS Times |

|---|---|---|---|---|---|

| FS | Single Threshold | −0.3985 | 798.4822 | 0.0000 | 300 |

| Double Threshold | −0.3965 | 473.4431 | 0.0000 | 300 | |

| Three thresholds | −0.3923 | 402.2496 | 0.0000 | 300 | |

| LEV | Single Threshold | −0.1024 | 4.6556 | 0.0167 | 300 |

| Double Threshold | 0.0906 | 3.8229 | 0.4767 | 300 | |

| Three thresholds | 0.0990 | 39.5859 | 0.3167 | 300 | |

| FAR | Single Threshold | −1.1516 | 663.8746 | 0.0000 | 300 |

| Double Threshold | −1.1446 | 40.6406 | 0.0033 | 300 | |

| Three thresholds | −0.6700 | 719.5633 | 0.0000 | 300 |

| Constraints | RD 1 | RD 2 | RD 3 | RD 4 | OPC | RQ |

|---|---|---|---|---|---|---|

| FS | 2.1002 ** (2.3109) | 0.1269 ** (2.0340) | −0.2147 ** (−1.6975) | −0.0658 * (−1.6486) | 0.0538 ** (2.2021) | 0.0091 (1.1245) |

| LEV | −0.0508 ** (2.1581) | −0.7921 * (−1.7242) | 0.0627 ** (2.1538) | 0.0003 (0.0234) | ||

| FAR | −0.2030 *** (−3.7599) | −2.0919 * (−1.9488) | 0.1610 ** (2.2878) | −0.1661 ** (−2.5611) | 0.0615 ** (2.6960) | 0.0124 (1.5184) |

| Threshold Variables | Models | Threshold Estimates | LR Statistical Quantities | Bootstrap p-Value | BS Times |

|---|---|---|---|---|---|

| Lagged one-period test | Single Threshold | −0.479 | 16.7531 | 0.0000 | 300 |

| Double Threshold | 1.213 | 11.4459 | 0.0300 | 300 | |

| Three thresholds | 1.576 | 10.4473 | 0.0360 | 300 |

| Test | RD 1 | RD 2 | RD 3 | RD 4 | OPC | RQ |

|---|---|---|---|---|---|---|

| Lagged one-period test | 0.1813 * (1.8369) | −0.2942 ** (−1.9665) | 0.0210 ** (2.3822) | −0.07216 * (−1.6821) | 0.0262 * (1.9380) | 0.0116 (0.5508) |

| Constraints | RD 1 | RD 2 | RD 3 | RD 4 |

|---|---|---|---|---|

| RD | 4.991 * | −0.638 | 0.801 *** | −0.483 *** |

| (1.668) | (−1.042) | (3.053) | (−2.960) | |

| FS | 1.198 | 31.581 *** | −13.703 *** | −0.483 * |

| (0.497) | (3.037) | (−2.693) | (−1.960) | |

| LEV | −66.877 ** | −10.014 *** | ||

| (−2.006) | (−5.580) | |||

| FAR | −113.614 ** | −5.027 ** | 1.828 *** | −1.725 ** |

| (−2.132) | (−2.432) | (3.362) | (−2.109) |

| Threshold Variables | Models | Threshold Estimates | LR Statistical Quantities | Bootstrap p-Value | BS Times |

|---|---|---|---|---|---|

| Overall sample robustness test | Single Threshold | −0.6447 | 14.4822 | 0.0030 | 300 |

| Double Threshold | 1.2476 | 9.9879 | 0.0466 | 300 | |

| Three thresholds | 1.4375 | 12.8156 | 0.0267 | 300 | |

| One period lag Robustness test | Single Threshold | 0.0056 | 10.2161 | 0.0397 | 300 |

| Double Threshold | 0.0580 | 12.5995 | 0.0130 | 300 | |

| Three thresholds | 0.1224 | 14.7075 | 0.0033 | 300 |

| Test | RD 1 | RD 2 | RD 3 | RD 4 | OPC | RQ |

|---|---|---|---|---|---|---|

| Overall sample robustness test | 0.1226 ** (2.4096) | −0.0752 * (−1.6858) | 0.1600 *** (3.2153) | −0.0116 ** (−2.3846) | −0.0009 (−0.0851) | 0.0151 *** (2.7590) |

| One period lag Robustness test | 2.7955 *** (3.3359) | −1.7444 ** (−2.5272) | −0.9821 * (−1.6484) | −0.1621 *** (−4.453) | −0.0093 * (−1.8557) | 0.0169 *** (3.4415) |

| Threshold Variables | Models | Threshold Estimates | LR Statistical Quantities | Bootstrap p-Value | BS Times |

|---|---|---|---|---|---|

| Overall sample robustness test | Single Threshold | −0.6879 | 8.9801 | 0.0000 | 300 |

| Double Threshold | 0.3383 | 9.0325 | 0.0000 | 300 | |

| Three thresholds | 0.3815 | 9.0415 | 0.0000 | 300 | |

| One period lag Robustness test | Single Threshold | −0.3877 | 7.8134 | 0.0000 | 300 |

| Double Threshold | 0.1539 | 7.6103 | 0.0000 | 300 | |

| Three thresholds | 0.3639 | 7.6811 | 0.0000 | 300 |

| Test | RD 1 | RD 2 | RD 3 | RD 4 | OPC | RQ |

|---|---|---|---|---|---|---|

| Overall sample robustness test | 0.3419 ** (2.2109) | −0.5200 ** (−2.1702) | 1.9525 * (1.7029) | −0.0128 * (1.7703) | −0.0451 (−0.3667) | 0.1193 (1.0800) |

| One period lag Robustness test | 0.5538 * (1.6551) | −2.6757 *** (−3.3853) | 0.7724 ** (2.0307) | −0.1112 * (−1.9460) | −0.0920 (−0.6749) | 0.3095 ** (2.3192) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, P.; Gu, Y.; Su, B.; Tanveer, A.; Peng, Q.; Gao, W.; Wu, S.; Zeng, S. The Impact of Green Technology Research and Development (R&D) Investment on Performance: A Case Study of Listed Energy Companies in Beijing, China. Sustainability 2023, 15, 12370. https://doi.org/10.3390/su151612370

Song P, Gu Y, Su B, Tanveer A, Peng Q, Gao W, Wu S, Zeng S. The Impact of Green Technology Research and Development (R&D) Investment on Performance: A Case Study of Listed Energy Companies in Beijing, China. Sustainability. 2023; 15(16):12370. https://doi.org/10.3390/su151612370

Chicago/Turabian StyleSong, Piaopeng, Yuxiao Gu, Bin Su, Arifa Tanveer, Qiao Peng, Weijun Gao, Shaomin Wu, and Shihong Zeng. 2023. "The Impact of Green Technology Research and Development (R&D) Investment on Performance: A Case Study of Listed Energy Companies in Beijing, China" Sustainability 15, no. 16: 12370. https://doi.org/10.3390/su151612370

APA StyleSong, P., Gu, Y., Su, B., Tanveer, A., Peng, Q., Gao, W., Wu, S., & Zeng, S. (2023). The Impact of Green Technology Research and Development (R&D) Investment on Performance: A Case Study of Listed Energy Companies in Beijing, China. Sustainability, 15(16), 12370. https://doi.org/10.3390/su151612370