Regional Big Data Application Capability and Firm Green Technology Innovation

Abstract

:1. Introduction

2. Literature Review

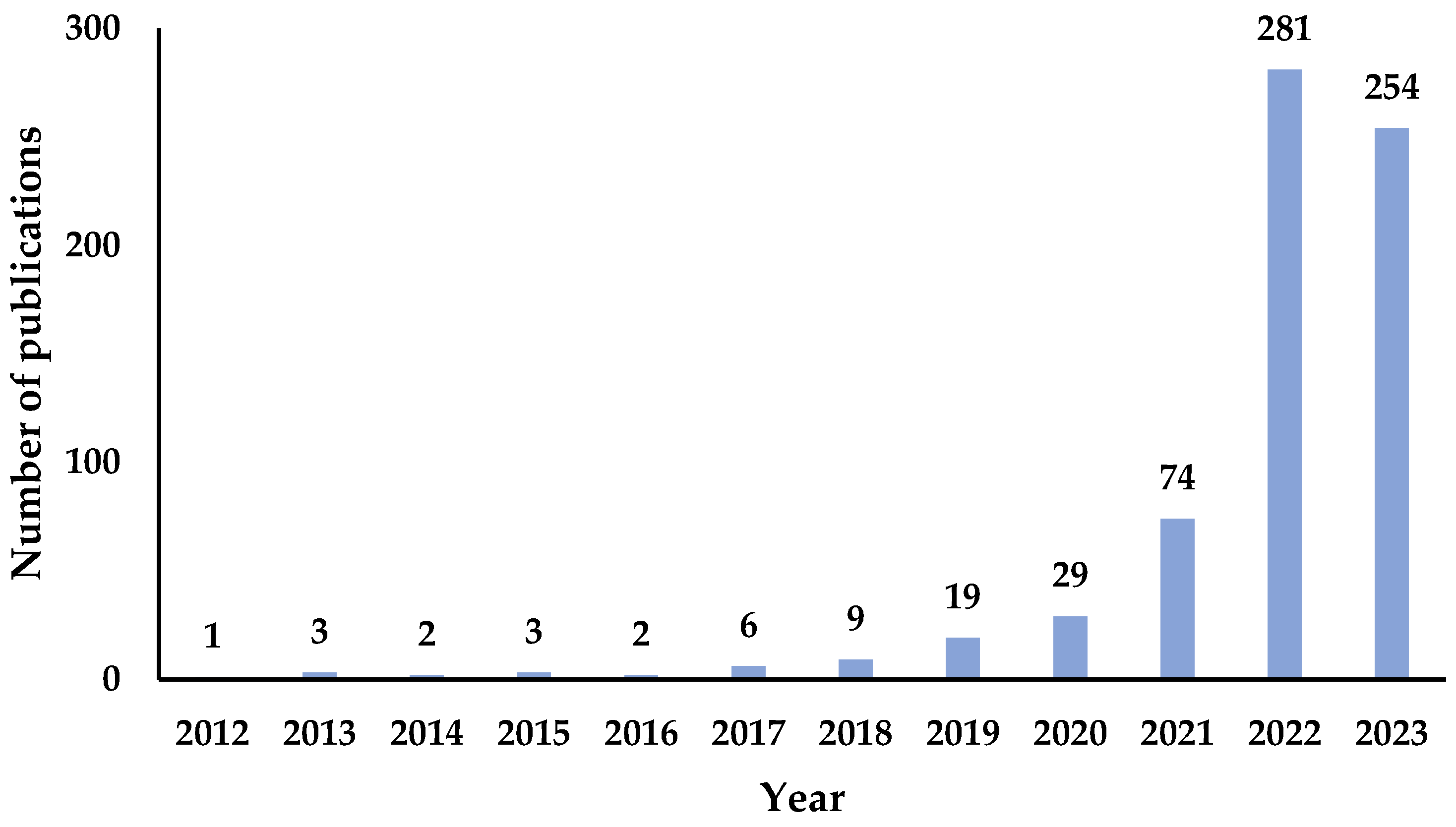

2.1. Studies on Big Data

2.2. Studies on GTI

3. Theoretical Analysis and Research Hypotheses

3.1. The Impact of RBDAC and GTI

3.2. Moderating Role of Government Subsidy

3.3. Moderating Role of Analyst Coverage

4. Methodology and Data

4.1. Model Specification

4.2. Variable Selection and Interpretation

4.2.1. Dependent Variable: Green Technology Innovation

4.2.2. Explanatory Variables: Variables Related to Big Data Pilot Zone

- (1)

- Whether the area is in the big data comprehensive pilot zone (TREAT), Guizhou, Beijing, Tianjin, Hebei, Guangdong, Shanghai, Henan, Chongqing, Liaoning, and Inner Mongolia are selected for the big data pilot zone, according to the State Council’s Action Plan for Promoting the Development of Big Data and other documents issued by pilot cities;

- (2)

- Whether the time point is after the implementation of the big data pilot zone (TIME), 2016 is identified as the first year when the policy is operational;

- (3)

- The interaction term between TREAT and TIME (DID) is used to assess the micro-effects of regional big data pilot policy.

4.2.3. Moderator Variables

- (1)

- Government assistance. Following the practice of Xue et al. [41], the natural logarithm of the government subsidy in that year as recorded in the financial statement is used as a variable to assess the government subsidy (SUBSIDY);

- (2)

- Coverage by analysts. According to the study of Liu and Xu [62], the number of financial analysts is used as a variable to assess the intensity of analyst coverage (ANALYST).

4.2.4. Control Variables

- (1)

- Firm size (SIZE), expressed as the natural logarithm of the firm total asset;

- (2)

- Asset–liability ratio (LEV), expressed as the ratio of liabilities to assets;

- (3)

- Total asset growth rate (GROWTH), expressed as the ratio of the difference between the total assets at the end of the year and the total assets at the beginning of the year to the total assets at the beginning of the year;

- (4)

- The ratio of independent boards (OUT), expressed as the percentage of the number of independent directors on the board of directors;

- (5)

- The share ratio of the managers (MSR), expressed as dividing the number of shares held by executives by the number of total shares;

- (6)

- Whether to pay cash dividends (DIV), expressed as a dummy variable that equals “1” if the firm pays cash dividends in that year, and “0” otherwise;

- (7)

- The duality of chairman and general manager (DUAL), expressed as a dummy variable that equals “1” if the chairman and general manager are the same person, and “0” otherwise.

4.3. Data Collection and Descriptive Statistics

5. Empirical Results and Analysis

5.1. Baseline Results

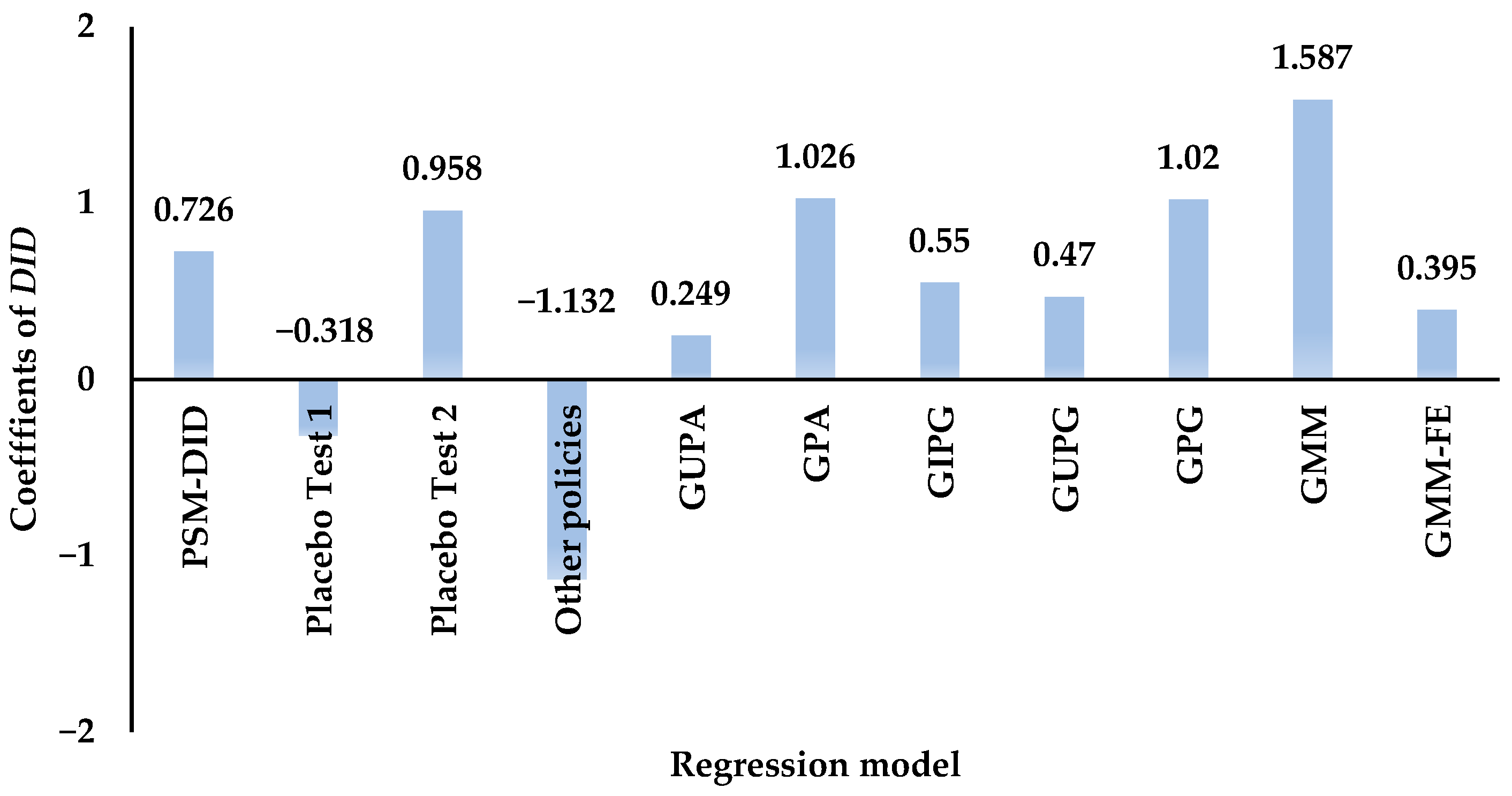

5.2. Robustness Test

5.2.1. Parallel Trend Assumptions

5.2.2. PSM-DID

5.2.3. Placebo Test

5.2.4. Excluding the Interference from Other Policies

5.2.5. Replacing the Dependent Variable

5.2.6. Dynamic Panel Estimates

6. Extensive Analysis

6.1. Test of the Impact Mechanism

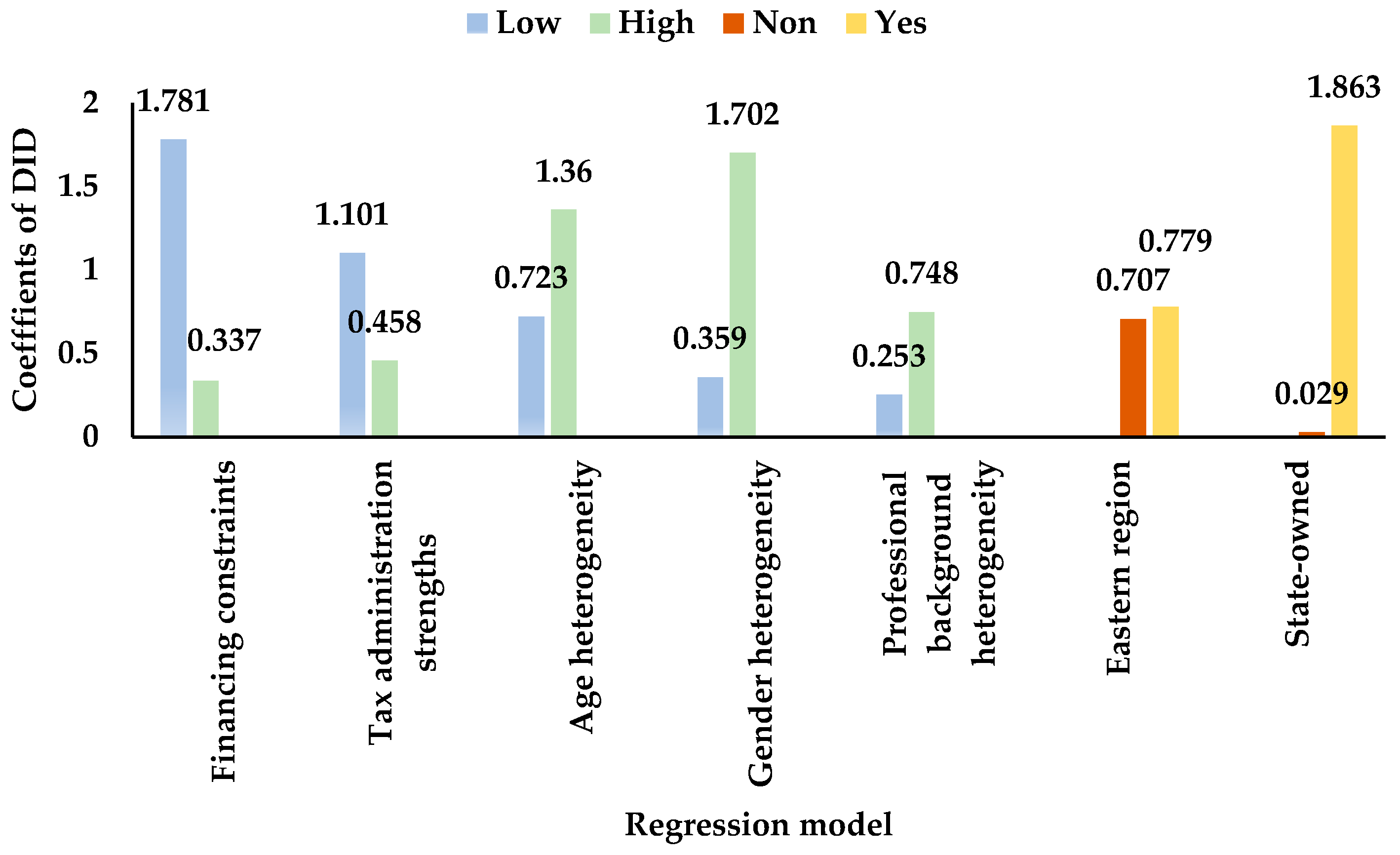

6.2. Test of Heterogeneity

6.2.1. Heterogeneity of Institutional Environment

- (1)

- Finance constraints. To begin with, Hadlock and Pierce inspire to construct the SA index model related to the degree of finance constraints [65]. The equation is formatted as follows:

- (2)

- Tax administration strengths. The institutional context influences the heterogeneity of the RBDAC innovation impact, so this article selects tax administration strengths to assess firm institutional pressure. However, the high tax administration may be detrimental to firm digitalization. Meanwhile, the potential to innovate driven by RBDAC is also inhibited. Based on the results of Cao et al. [67], the following tax revenue prediction model is formed as follows:

- (3)

- Regional heterogeneity. As the geographical environment of firms influences the innovation heterogeneity induced by RBDAC, this article investigates the effects of regional heterogeneity on GTI. The sample area is divided into two groups in this article: the eastern region (including Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan) and the non-eastern region. The paper then investigates if regional heterogeneity influences the beneficial effects of regional big data progress on GTI. As shown in columns 5 and 6 of Table 10, the grouping results of the eastern area and non-eastern region reveal that big data development boosts the GTI more significantly for firms located in the eastern region. However, the DID coefficient for the eastern region group is close to that of the non-eastern region. The fact that the coefficients of the eastern region and non-eastern region are not significantly different may be due to governments in the central and western regions recognizing the ability of big data to drive innovation and beginning to deeply integrate big data with the industrial economy, thereby stimulating firm innovation in the region.

6.2.2. Heterogeneity of Firms

- (1)

- The heterogeneity of property rights. From the nature of property rights, different property rights have an impact on innovative heterogeneity for developing big data applications. State-owned firms are more responsive to policies than non-state-owned firms; therefore, they are more likely to obtain government support and have stronger financing capabilities. However, more research is needed to find out if the incentive effect of RBDAC can be reinforced for firms that are both state-owned and located in a big data pilot zone. This article divides the sample firms into state-owned and non-state-owned groups based on the real control of firms, and then investigates whether the nature of property rights and regional heterogeneity affect the innovation incentive effect from RBDAC. The grouping results of non-state-owned and state-owned firms are presented in columns 1 and 2 of Table 11, confirming that state-owned firms benefit more from the innovative effects of big data development than non-state-owned firms. This could be because state-owned firms have a natural advantage of obtaining government support, and firms located in big data pilot zones are more likely to gain technical support. Thus, the state-owned firms located in big data pilot zones perform better in boosting the GTI of the national manufacturing industry.

- (2)

- The heterogeneity of the top management team. According to the upper echelons theory, big data is an entirely new technology, hence its development is vulnerable to decisions made by the top management team. As a result, the level of heterogeneity in senior executives is critical for decision-making. This article chooses three factors for top management team heterogeneity testing: age, gender, and professional experience. The age heterogeneity is measured by the age coefficient of variation which is the ratio of the standard deviation of age to the age mean. In addition, the gender (female and male) and professional background heterogeneity (including production, R&D, design, human resources, management, marketing, finance, law, etc.) are measured through the Herfindal–Hirschman Index. The formula is constructed as follows:

6.3. Test of Economic Outcomes

7. Conclusions

7.1. Research Conclusions

- (1)

- Based on data from manufacturing firms in Shanghai and Shenzhen A-shares from 2010 to 2020, the research finds that RBDAC has promoted the GTI level of manufacturing firms to a certain extent. This is in line with the literature [10], supporting that big data play an important role in promoting firm innovation. We have answered the goal of hypothesis 1, that is regional big data development can drive firms’ digital transformation, so as to develop the customization requirements for products in a green way, and thus advance firm GTI.

- (2)

- The GTI incentive effect of RBDAC is moderated by the positive effect of government subsidy and analyst coverage, that is, the innovation incentive level of RBDAC is more significant in firms with high government subsidy and high analyst coverage. This is in line with the literature [62], supporting that government subsidy and analyst coverage play an important role in promoting firms’ green innovation. We have answered the goal of hypothesis 2 and 3, which is that regional big data development can attract firms that are expected to apply for subsidies and improve analyst information recognition ability, then the government subsidy and analyst attention can attract more investors’ attention. Thus, government subsidy and analyst coverage can improve firm financing and provide financial support for green innovation practices.

- (3)

- The sub-sample regression test examines the heterogeneity effects of the external institutional environment and internal conditions of firms on the impact of RBDAC on GTI. Regarding the aspect of the external institutional environment, the result shows that firms in regions with low levels of financial constraints and tax administration strengths and firms located in the eastern region can strengthen the effect of RBDAC on GTI. On the other aspect of internal conditions of firms, the result shows that state-owned firms and firms with a high heterogeneity of the top management team in terms of age, gender, and professional background have a stronger influence on the positive effects of RBDAC on GTI.

- (4)

- The economic consequence test demonstrates that RBDAC improves firm ESG performance and that this influence sustains over time. This is in line with the literature [3], supporting that big data play an important role in promoting firms’ environmental and social performance. The result clarifies that the improvement of regional big data development can help firms to reduce resource waste, raise resource efficiency, increase firm return, and provide support for green governance. As the widespread use of new technologies promotes environmental performance and fosters a positive image of actively engaging in social duties, firm ESG practice will be elevated to a new and higher level.

7.2. Implication

- (1)

- Promote the development of regional big data strategy, and enhance the incentive role of big data in GTI. There is an increasing consciousness of the value of developing the RBDAC to accelerate the advancement of GTI. Since RBDAC promotes the GTI in manufacturing firms, the established national big data comprehensive pilot zone should continue to work on the implementation and supplementation of big data policies, as well as the acceleration of big data infrastructure construction. The provinces that did not participate in the pilot should also follow the national policy orientation, with a focus on promoting big data initiatives and driving the innovative role of regional big data in empowering the local economy.

- (2)

- The government should improve government subsidy policies related to digital technology and green innovation, while the capital market should regulate a set of criteria for analyst coverage to monitor firms. Existing government subsidy policies are not so efficient at determining whether funds are earmarked for GTI. As a result, big data should be used to standardize the review and approval process of subsidy applications, as well as conduct follow-up investigations on the actual usage situation of the subsidies to ensure the high efficiency of using government subsidies. Subsidy requirements should be moderately lowered if firms perform excellently in green development, so that they might be encouraged to scale up green innovation and achieve a win-win situation for the economy and the environment. Analyst coverage is one of the most efficient channels for connecting firms and the market. The government supervision of financial analysts is to enable analysts to better leverage their important function in reducing information asymmetry and promoting innovation. The government should use big data to help investors understand the lags in the economic and environmental performance of firms, encourage analysts to identify high-quality firms with strong GTI capabilities, and motivate firms to carry out effective GTI activities.

7.3. The Research Limitations and Agenda

- (1)

- The performance of GTI is simply quantified as the number of patent applications. Quantity is a crucial indicator of the GTI development, but the quality of innovation is also an assignable component. As a result, future research should consider innovation quality.

- (2)

- This study only discusses the relationship between RBDAC and GTI and confirms a positive effect of RBDAC on GTI. However, a study of the interaction mechanism is lacking, thus future research should focus on investigating this mechanism.

- (3)

- The manufacturing industry is used as a case study to investigate the relationship between RBDAC and GTI, but GTI has far-reaching implications for heavily polluted industries. As a result, greater research into the effects of GTI on polluting firms is required.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Niebel, T.; Rasel, F.; Viete, S. BIG data–BIG gains? Understanding the link between big data analytics and innovation. Econ. Innov. New Technol. 2018, 28, 296–316. [Google Scholar] [CrossRef]

- Hao, S.; Zhang, H.; Song, M. Big Data, Big Data Analytics Capability, and Sustainable Innovation Performance. Sustainability 2019, 11, 7145. [Google Scholar] [CrossRef]

- Dubey, R.; Gunasekaran, A.; Childe, S.J.; Papadopoulos, T.; Luo, Z.; Wamba, S.F.; Roubaud, D. Can big data and predictive analytics improve social and environmental sustainability? Technol. Forecast. Soc. Chang. 2019, 144, 534–545. [Google Scholar] [CrossRef]

- Wang, Y.; Yang, Y.; Fu, C.; Fan, Z.; Zhou, X. Environmental regulation, environmental responsibility, and green technology innovation: Empirical research from China. PLoS ONE 2021, 16, e0257670. [Google Scholar] [CrossRef] [PubMed]

- Ramadan, M.; Shuqqo, H.; Qtaishat, L.; Asmar, H.; Salah, B. Sustainable Competitive Advantage Driven by Big Data Analytics and Innovation. Appl. Sci. 2020, 10, 6784. [Google Scholar] [CrossRef]

- El-Kassar, A.N.; Singh, S.K. Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technol. Forecast. Soc. Chang. 2019, 144, 483–498. [Google Scholar] [CrossRef]

- Ghasemaghaei, M. Improving Organizational Performance Through the Use of Big Data. J. Comput. Inform. Syst. 2018, 60, 395–408. [Google Scholar] [CrossRef]

- Fan, W.; Bifet, A. Mining big data. ACM SIGKDD Explor. Newsl. 2013, 14, 1–5. [Google Scholar] [CrossRef]

- Mazhar, T.; Irfan, H.M.; Khan, S.; Haq, I.; Ullah, I.; Iqbal, M.; Hamam, H. Analysis of Cyber Security Attacks and Its Solutions for the Smart grid Using Machine Learning and Blockchain Methods. Future Internet 2023, 15, 83. [Google Scholar] [CrossRef]

- Ghasemaghaei, M.; Calic, G. Assessing the impact of big data on firm innovation performance: Big data is not always better data. J. Bus. Res. 2020, 108, 147–162. [Google Scholar] [CrossRef]

- Akoka, J.; Comyn-Wattiau, I.; Laoufi, N. Research on Big Data–A systematic mapping study. Comput. Stand. Inter. 2017, 54, 105–115. [Google Scholar] [CrossRef]

- Xie, W.; Zhang, Q.; Lin, Y.; Wang, Z.; Li, Z. The Effect of Big Data Capability on Organizational Innovation: A Resource Orchestration Perspective. J. Knowl. Econ. 2023. ahead-of-print. [Google Scholar] [CrossRef]

- Mikalef, P.; Boura, M.; Lekakos, G.; Krogstie, J. Big data analytics and firm performance: Findings from a mixed-method approach. J. Bus. Res. 2019, 98, 261–276. [Google Scholar] [CrossRef]

- Wang, L.; Wu, Y.; Huang, Z.; Wang, Y. How big data drives green economic development: Evidence from China. Front. Environ. Sci. 2022, 10, 1055162. [Google Scholar] [CrossRef]

- Wei, J.; Zhang, X. The Role of Big Data in Promoting Green Development: Based on the Quasi-Natural Experiment of the Big Data Experimental Zone. Int. J. Environ. Res. Public Health 2023, 20, 4097. [Google Scholar] [CrossRef]

- Soofi, A.; Awan, A. Classification Techniques in Machine Learning: Applications and Issues. J. Basic Appl. Sci. 2017, 13, 459–465. [Google Scholar] [CrossRef]

- Aljumah, A.I.; Nuseir, M.T.; Alam, M.M. Organizational performance and capabilities to analyze big data: Do the ambidexterity and business value of big data analytics matter? Bus. Process. Manag. J. 2021, 27, 1088–1107. [Google Scholar] [CrossRef]

- Prange, C.; Verdier, S. Dynamic capabilities, internationalization processes and performance. J. World Bus. 2011, 46, 126–133. [Google Scholar] [CrossRef]

- Haq, I.; Mazhar, T.; Malik, M.A.; Kamal, M.M.; Ullah, I.; Kim, T.; Hamdi, M.; Hamam, H. Lung Nodules Localization and Report Analysis from Computerized Tomography (CT) Scan Using a Novel Machine Learning Approach. Appl. Sci. 2022, 12, 12614. [Google Scholar] [CrossRef]

- Ali, T.M.; Nawaz, A.; Ur Rehman, A.; Ahmad, R.Z.; Javed, A.R.; Gadekallu, T.R.; Chen, C.; Wu, C. A Sequential Machine Learning-cum-Attention Mechanism for Effective Segmentation of Brain Tumor. Front. Oncol. 2022, 12, 873268. [Google Scholar] [CrossRef]

- Lin, S.Z.; Lin, J.B. How organizations leverage digital technology to develop customization and enhance customer relationship performance: An empirical investigation. Technol. Forecast. Soc. Chang. 2023, 188, 122254. [Google Scholar] [CrossRef]

- Jaouadi, M.H.O. Investigating the influence of big data analytics capabilities and human resource factors in achieving supply chain innovativeness. Comput. Ind. Eng. 2022, 168, 108055. [Google Scholar] [CrossRef]

- Lozada, N.; Arias-Perez, J.; Perdomo-Charry, G. Big data analytics capability and co-innovation: An empirical study. Heliyon 2019, 5, e02541. [Google Scholar] [CrossRef] [PubMed]

- Tunc-Abubakar, T.; Kalkan, A.; Abubakar, A.M. Impact of big data usage on product and process innovation: The role of data diagnosticity. Kybernetes 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Li, H.Y.; Liu, Q.; Ye, H.Z. Digital Development Influencing Mechanism on Green Innovation Performance: A Perspective of Green Innovation Network. IEEE Access 2023, 11, 22490–22504. [Google Scholar] [CrossRef]

- Zhang, Z.; Shang, Y.; Cheng, L.; Hu, A. Big Data Capability and Sustainable Competitive Advantage: The Mediating Role of Ambidextrous Innovation Strategy. Sustainability 2022, 14, 8249. [Google Scholar] [CrossRef]

- Wamba, S.F.; Gunasekaran, A.; Akter, S.; Ren, S.J.-F.; Dubey, R.; Childe, S.J. Big data analytics and firm performance: Effects of dynamic capabilities. J. Bus. Res. 2017, 70, 356–365. [Google Scholar] [CrossRef]

- Belhadi, A.; Kamble, S.S.; Zkik, K.; Cherrafi, A.; Touriki, F.E. The integrated effect of Big Data Analytics, Lean Six Sigma and Green Manufacturing on the environmental performance of manufacturing companies: The case of North Africa. J. Clean. Prod. 2020, 252, 119903. [Google Scholar] [CrossRef]

- Sahoo, S.; Kumar, A.; Upadhyay, A. How do green knowledge management and green technology innovation impact corporate environmental performance? Understanding the role of green knowledge acquisition. Bus. Strateg. Environ. 2022, 32, 551–569. [Google Scholar] [CrossRef]

- Deng, Q.; Zhou, S.; Peng, F. Measuring Green Innovation Efficiency for China’s High-Tech Manufacturing Industry: A Network DEA Approach. Math. Probl. Eng. 2020, 2020, 8902416. [Google Scholar] [CrossRef]

- Lin, X.; Yu, L.; Zhang, J.; Lin, S.; Zhong, Q. Board Gender Diversity and Corporate Green Innovation: Evidence from China. Sustainability 2022, 14, 15020. [Google Scholar] [CrossRef]

- Castellacci, F.; Lie, C.M. A taxonomy of green innovators: Empirical evidence from South Korea. J. Clean. Prod. 2017, 143, 1036–1047. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.V.D. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Fan, Y.; Su, Q.; Wang, X.; Fan, M. Digitalization and green innovation of enterprises: Empirical evidence from China. Front. Env. Sci. 2023, 11, 1120806. [Google Scholar] [CrossRef]

- Rui, Z.; Lu, Y. Stakeholder pressure, corporate environmental ethics and green innovation. Asian J. Technol. Innov. 2020, 29, 70–86. [Google Scholar] [CrossRef]

- Zhang, Z.; Duan, H.; Shan, S.; Liu, Q.; Geng, W. The Impact of Green Credit on the Green Innovation Level of Heavy-Polluting Enterprises-Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 650. [Google Scholar] [CrossRef]

- Han, S.; Zhang, Z.; Yang, S. Green Finance and Corporate Green Innovation: Based on China’s Green Finance Reform and Innovation Pilot Policy. J. Environ. Public Health 2022, 2022, 1833377. [Google Scholar] [CrossRef]

- Rao, H.; Chen, D.; Shen, F.; Shen, Y. Can Green Bonds Stimulate Green Innovation in Enterprises? Evidence from China. Sustainability 2022, 14, 15631. [Google Scholar] [CrossRef]

- Wang, G. Research on the Influence of Environmental Regulation on Enterprise Green Innovation Performance. IOP Conf. Ser. Earth Environ. Sci. 2021, 647, 012179. [Google Scholar] [CrossRef]

- Wang, C.; Chen, P.; Hao, Y.; Dagestani, A.A. Tax incentives and green innovation—The mediating role of financing constraints and the moderating role of subsidies. Front. Environ. Sci. 2022, 10, 1067534. [Google Scholar] [CrossRef]

- Xue, L.; Zhang, Q.; Zhang, X.; Li, C. Can Digital Transformation Promote Green Technology Innovation? Sustainability 2022, 14, 7497. [Google Scholar] [CrossRef]

- Wang, C.; Yan, G.; Ou, J. Does Digitization Promote Green Innovation? Evidence from China. Int. J. Environ. Res. Public Health 2023, 20, 3893. [Google Scholar] [CrossRef] [PubMed]

- Javed, M.; Wang, F.; Usman, M.; Ali Gull, A.; Uz Zaman, Q. Female CEOs and green innovation. J. Bus. Res. 2023, 157, 113515. [Google Scholar] [CrossRef]

- Wang, P.; Bu, H.; Liu, F. Internal Control and Enterprise Green Innovation. Energies 2022, 15, 2193. [Google Scholar] [CrossRef]

- Amore, M.D.; Bennedsen, M. Corporate governance and green innovation. J. Environ. Econ. Manage. 2016, 75, 54–72. [Google Scholar] [CrossRef]

- Zhao, J.; Qu, J.; Wei, J.; Yin, H.; Xi, X. The effects of institutional investors on firms’ green innovation. J. Prod. Innovat. Manag. 2022, 40, 195–230. [Google Scholar] [CrossRef]

- Wang, F.; Sun, Z.; Feng, H. Can Media Attention Promote Green Innovation of Chinese Enterprises? Regulatory Effect of Environmental Regulation and Green Finance. Sustainability 2022, 14, 11091. [Google Scholar] [CrossRef]

- Huang, Z.; Liao, G.; Li, Z. Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Chang. 2019, 144, 148–156. [Google Scholar] [CrossRef]

- Luo, L.; Yang, Y.; Luo, Y.; Liu, C. Export, subsidy and innovation: China’s state-owned enterprises versus privately-owned enterprises. Econ. Political Stud. 2016, 4, 137–155. [Google Scholar] [CrossRef]

- Li, J.; Lee, R.P.; Wan, J. Indirect effects of direct subsidies: An examination of signaling effects. Ind. Innov. 2019, 27, 1040–1061. [Google Scholar] [CrossRef]

- Wang, H.; Xue, C.; Li, Y.; Zhao, P. The impact of government subsidies on the human resources and innovation output of makerspaces according to signal theory. Int. J. Technol. Manag. 2023, 92, 139–158. [Google Scholar] [CrossRef]

- Lee, Y.N.; Walsh, J.P. Inventing while you work: Knowledge, non-R&D learning and innovation. Res. Pol. 2016, 45, 345–359. [Google Scholar] [CrossRef]

- Xu, J.; Wang, X.; Liu, F. Government subsidies, R&D investment and innovation performance: Analysis from pharmaceutical sector in China. Technol. Anal. Strateg. Manag. 2020, 33, 535–553. [Google Scholar] [CrossRef]

- Song, M.; Tao, W.; Shen, Z. The impact of digitalization on labor productivity evolution: Evidence from China. J. Hosp. Tour. Technol. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Guo, B.; Pérez-Castrillo, D.; Toldrà-Simats, A. Firms’ innovation strategy under the shadow of analyst coverage. J. Financ. Econ. 2019, 131, 456–483. [Google Scholar] [CrossRef]

- Gentry, R.J.; Shen, W. The impacts of performance relative to analyst forecasts and analyst coverage on firm R&D intensity. Strategic. Manag. J. 2013, 34, 121–130. [Google Scholar] [CrossRef]

- Hao, J. Retail investor attention and corporate innovation in the big data era. Int. Rev. Financ. Anal. 2023, 86, 102486. [Google Scholar] [CrossRef]

- Zhang, H.; Xiao, Y. Customer involvement in big data analytics and its impact on B2B innovation. Ind. Market. Manag. 2020, 86, 99–108. [Google Scholar] [CrossRef]

- Zhong, R. Transparency and firm innovation. J. Acc. Econ. 2018, 66, 67–93. [Google Scholar] [CrossRef]

- Han, M.; Lin, H.; Sun, D.; Wang, J.; Yuan, J. The Eco-Friendly Side of Analyst Coverage: The Case of Green Innovation. IEEE Trans. Eng. Manag. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- He, L.; Gan, S.; Zhong, T. The impact of green credit policy on firms’ green strategy choices: Green innovation or green-washing? Environ. Sci. Pollut. Res. Int. 2022, 29, 73307–73325. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.; Xu, H.; Wang, X. Government subsidy, asymmetric information and green innovation. Kybernetes 2021, 51, 3681–3703. [Google Scholar] [CrossRef]

- Fan, J.; Zhou, Y. Empirical Analysis of Financing Efficiency and Constraints Effects on the Green Innovation of Green Supply Chain Enterprises: A Case Study of China. Sustainability 2023, 15, 5300. [Google Scholar] [CrossRef]

- Wu, Y.; Sun, H.; Sun, H.; Xie, C. Impact of Public Environmental Concerns on the Digital Transformation of Heavily Polluting Enterprises. Int. J. Environ. Res. Public Health 2022, 20, 203. [Google Scholar] [CrossRef] [PubMed]

- Hadlock, C.J.; Pierce, J.R. New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Bertrand, M.; Mullainathan, S. Enjoying the Quiet Life? Corporate Governance and Managerial Preferences. J. Polit. Econ. 2003, 111, 1043–1075. [Google Scholar] [CrossRef]

- Cao, Y.; Hu, X.; Lu, Y.; Su, J. Customer Concentration, Tax Collection Intensity, and Corporate Tax Avoidance. Emerg. Mark. Financ. Trade 2019, 56, 2563–2593. [Google Scholar] [CrossRef]

- Tang, H. The Effect of ESG Performance on Corporate Innovation in China: The Mediating Role of Financial Constraints and Agency Cost. Sustainability 2022, 14, 3769. [Google Scholar] [CrossRef]

- Peattie, K.; Ratnayaka, M. Responding to the green movement. Ind. Market. Manag. 1992, 21, 103–110. [Google Scholar] [CrossRef]

- Xu, J.; Liu, F.; Shang, Y. R&D investment, ESG performance and green innovation performance: Evidence from China. Kybernetes 2021, 50, 737–756. [Google Scholar] [CrossRef]

- Subramaniam, M.; Youndt, M. The Influence of Intellectual Capital on the Types of Innovative Capabilities. Acad. Manag. J. 2005, 48, 450–463. [Google Scholar] [CrossRef]

- Wang, F.; Sun, Z. Does the Environmental Regulation Intensity and ESG Performance Have a Substitution Effect on the Impact of Enterprise Green Innovation: Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 8558. [Google Scholar] [CrossRef] [PubMed]

| Abbreviations | Full Form |

|---|---|

| RBDAC | Regional big data application capability |

| GTI | Green technology innovation |

| SEM | Structural equation model |

| DID | Difference-in-differences |

| PLS | Partial least squares |

| OLS | Ordinary least squares |

| FE | Fixed effects |

| R&D | Research and development |

| GMM | Generalized method of moment |

| ESG | Environmental, Social, and Governance |

| Performance Outcome | Literature | Data | Observations | Method |

|---|---|---|---|---|

| Sustainable competitive advantage | [5] | Firm-level | 117 | Survey; PLS-SEM |

| [26] | Firm-level | 229 | Survey; Regression | |

| Firm innovation | [1] | Firm-level | 2706 | Probit models |

| [12] | Firm-level | 179 | Survey; PLS | |

| Supply chain innovation | [22] | Firm-level | 341 | Survey; SEM |

| Co-innovation | [23] | Firm-level | 112 | Survey; PLS-SEM |

| Product and process innovation | [24] | Firm-level | 97 | Survey; PLS-SEM |

| Organizational performance | [7] | Firm-level | 140 | Survey; SEM |

| [27] | Firm-level | 297 | Survey; PLS-SEM | |

| [17] | Firm-level | 295 | Survey; PLS-SEM | |

| Innovation performance | [10] | Firm-level | 239 | Survey; PLS-SEM |

| Environmental performance | [28] | Firm-level | 201 | Survey; two-stage hybrid factorial analysis-SEM |

| Social and environmental performance | [3] | Firm-level | 205 | Survey; PLS-SEM |

| Sustainable innovation performance | [2] | Firm-level | 1109 | Quadratic regression model |

| Green total factor productivity | [14] | Province-level | 240 | Panel data model |

| [15] | City-level | 3640 | Difference-in-differences (DID) |

| Category | Influencing Factors | Literature | Observations | Method |

|---|---|---|---|---|

| Macro-level | ||||

| Financial policy | Green credit | [36] | 12,048 | DID |

| Green finance | [37] | 18,775 | DID | |

| Green bonds | [38] | 7835 | FE | |

| Environmental legislation | Environmental regulation | [4] | 3121 | Mediating effects model |

| [39] | 308 | Survey; Structural equation model (SEM) | ||

| Tax policy | Tax incentives | [40] | 9744 | FE |

| Digitalization | Digital transformation | [41] | 15,029 | Panel data models |

| Digitalization | [34] | 3547 | FE | |

| [42] | 13,140 | FE | ||

| Micro-level | ||||

| Leadership personality | Female CEOs | [43] | 9997 | FE |

| Board gender diversity | [31] | 15,615 | FE | |

| Internal control | Internal control | [44] | 23,215 | Regression |

| Corporate governance | Corporate governance | [45] | 31,659 | Ordinary least squares (OLS) |

| Stakeholder | Stakeholder pressure | [35] | 255 | Hierarchical regression |

| Institutional investors | [46] | 5473 | FE | |

| Media attention | [47] | 9637 | FE | |

| Types | Variables | Symbols | Descriptions | Literature Source |

|---|---|---|---|---|

| Dependent Variables | Green technology innovation | GIPA | The number of green innovation patents lagging one year | [47] |

| Explanatory variables | Whether it is the area for a big data pilot zone | TREAT | Dummy variables of policy. “1” for if the firm is in Guizhou, Beijing, Tianjin, Hebei, Guangdong, Shanghai, Henan, Chongqing, Liaoning, or Inner Mongolia, otherwise”0” | [15] |

| Whether time is after 2016 | TIME | Dummy variable of time, “1” for 2016 and onward, otherwise “0” | [61] | |

| The interaction term of DID | DID | The interaction term of TREAT TIME | [36] | |

| Moderator variables | Government subsidy | SUBSIDY | The logarithm of government subsidy in that year noted in the financial statement | [41] |

| The coverage of financial analysts | ANALYST | Number of financial analysts | [62] | |

| Control variables | Firm size | SIZE | The logarithm of the total assets | [63] |

| Asset–liability ratio | LEV | Total liability/Total assets | [39] | |

| Total asset growth rate | GROWTH | (Total assets at the end of the year—Total assets at the beginning of the year)/Total assets at the beginning of the year | [64] | |

| The ratio of independent boards | OUT | Number of independent boards/Number of the board of directors | [34] | |

| The share ratio of the managers | MSR | Number of shares held by executives/Number of total shares | [38] | |

| Whether to pay cash dividends | DIV | “1” for if the firm pays cash dividends in that year, otherwise “0” | [65] | |

| The duality of chairman and general manager | DUAL | “1” for if the chairman and general manager are the same person, otherwise “0” | [57] |

| Variables | Sample | Mean | SD | Minimum | Median | Maximum |

|---|---|---|---|---|---|---|

| GIPA | 15,993 | 1.105 | 8.237 | 0 | 0 | 450 |

| DID | 15,993 | 0.221 | 0.415 | 0 | 0 | 1 |

| TREAT | 15,993 | 0.389 | 0.487 | 0 | 0 | 1 |

| TIME | 15,993 | 0.563 | 0.496 | 0 | 1 | 1 |

| SUBSIDY | 15,993 | 16.284 | 2.466 | 0 | 16.485 | 20.758 |

| ANALYST | 15,993 | 1.451 | 1.190 | 0 | 1.386 | 3.932 |

| SIZE | 15,993 | 22.085 | 1.152 | 19.630 | 21.941 | 25.750 |

| LEV | 15,993 | 0.413 | 0.193 | 0.033 | 0.406 | 0.934 |

| GROWTH | 15,993 | 0.169 | 0.377 | −0.371 | 0.090 | 5.116 |

| OUT | 15,993 | 0.375 | 0.054 | 0.286 | 0.333 | 0.571 |

| MSR | 15,993 | 0.094 | 0.156 | 0 | 0.001 | 0.690 |

| DIV | 15,993 | 0.739 | 0.439 | 0 | 1 | 1 |

| DUAL | 15,993 | 0.286 | 0.452 | 0 | 0 | 1 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | OLS-no CVs | FE-no CVs | OLS-CVs | FE-CVs |

| DID | 0.418 ** | 0.764 ** | 0.416 ** | 0.777 ** |

| (0.199) | (0.324) | (0.168) | (0.330) | |

| TREAT | 0.895 *** | 0.653 ** | ||

| (0.254) | (0.257) | |||

| TIME | 0.336 *** | 0.753 ** | −0.220 | 0.590 * |

| (0.086) | (0.345) | (0.238) | (0.327) | |

| SIZE | 1.495 ** | 0.210 * | ||

| (0.573) | (0.106) | |||

| LEV | −0.039 | −0.600 | ||

| (0.411) | (1.134) | |||

| GROWTH | −0.556 ** | −0.099 | ||

| (0.212) | (0.096) | |||

| OUT | −0.024 | −3.715 | ||

| (1.479) | (2.624) | |||

| MSR | 1.187 * | −0.462 | ||

| (0.618) | (0.654) | |||

| DIV | 0.104 | 0.217 | ||

| (0.170) | (0.218) | |||

| DUAL | 0.743 | 0.179 | ||

| (0.797) | (0.375) | |||

| Constant | 0.476 *** | 0.359 | −32.413 ** | −2.654 |

| (0.062) | (0.234) | (12.426) | (3.134) | |

| Observations | 15,993 | 15,993 | 15,993 | 15,993 |

| Firm fixed effects | No | Yes | No | Yes |

| Year fixed effects | No | Yes | No | Yes |

| Adjust R2 | 0.00538 | 0.0106 | 0.0445 | 0.0111 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | PTT_OLS | PTT_FE | PSM-DID | Placebo Test 1 | Placebo Test 2 | Other Policies |

| Before2 | 0.071 | 0.404 | ||||

| (0.267) | (0.276) | |||||

| Before1 | 0.415 | 0.538 | ||||

| (0.275) | (0.362) | |||||

| Current | 0.896 * | 0.965 ** | ||||

| (0.481) | (0.467) | |||||

| After1 | 1.227 ** | 1.421 ** | ||||

| (0.555) | (0.524) | |||||

| After2 | 1.573 ** | 1.789 *** | ||||

| (0.644) | (0.578) | |||||

| After3_ | −0.362 | 0.349 | ||||

| (0.429) | (0.368) | |||||

| DID | 0.726 * | −0.318 | 0.958 * | −1.132 ** | ||

| (0.370) | (0.465) | (0.474) | (0.434) | |||

| TIME | −0.221 | 0.522 * | −0.580 | 0.345 *** | 0.224 | 1.366 *** |

| (0.156) | (0.266) | (0.597) | (0.114) | (0.192) | (0.371) | |

| SIZE | 1.495 *** | 0.209 * | 0.243 | 0.061 | −0.065 | 0.180 * |

| (0.357) | (0.107) | (0.161) | (0.224) | (0.245) | (0.106) | |

| LEV | −0.054 | −0.673 | −1.446 | −2.236 | 0.191 | −0.817 |

| (0.377) | (1.147) | (1.754) | (1.694) | (0.410) | (1.152) | |

| GROWTH | −0.599 *** | −0.096 | −0.112 | 0.232 | −0.004 | −0.078 |

| (0.179) | (0.096) | (0.169) | (0.350) | (0.100) | (0.099) | |

| OUT | 0.016 | −3.676 | −6.214 * | −3.977 | −0.659 | −3.475 |

| (2.341) | (2.605) | (3.438) | (3.529) | (1.507) | (2.641) | |

| MSR | 1.203 * | −0.445 | −0.956 | −3.524 | 0.789 | −0.354 |

| (0.639) | (0.655) | (0.781) | (3.633) | (0.610) | (0.651) | |

| DIV | 0.070 | 0.194 | 0.338 | 0.079 | 0.090 | 0.250 |

| (0.145) | (0.220) | (0.357) | (0.091) | (0.166) | (0.218) | |

| DUAL | 0.757 * | 0.185 | 0.352 | 0.108 | 0.241 | 0.196 |

| (0.453) | (0.384) | (0.601) | (0.224) | (0.301) | (0.375) | |

| Constant | −32.390 *** | −2.600 | 0.055 | 1.910 | 2.160 | −2.356 |

| (7.723) | (3.147) | (4.081) | (6.968) | (5.782) | (3.107) | |

| Observations | 15,993 | 15,993 | 10,283 | 5547 | 7805 | 15,993 |

| Firm fixed effects | No | Yes | Yes | Yes | Yes | Yes |

| Year fixed effects | No | Yes | Yes | Yes | Yes | Yes |

| Adjust R2 | 0.0465 | 0.0122 | 0.0118 | 0.00533 | 0.0133 | 0.0119 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Variables | GUPA | GPA | GIPG | GUPG | GPG | GMM | GMM-FE |

| L.GIPA | 0.507 *** | 0.553 *** | |||||

| (0.06) | (0.07) | ||||||

| DID | 0.249 | 1.026 ** | 0.550 *** | 0.470 | 1.020 ** | 1.587 *** | 0.395 ** |

| (0.182) | (0.472) | (0.194) | (0.296) | (0.452) | (0.28) | (0.18) | |

| TREAT | −0.902 *** | −0.155 * | |||||

| (0.14) | (0.09) | ||||||

| TIME | 0.467 *** | 1.056 ** | 0.354 *** | 0.627 *** | 0.981 *** | −0.753 *** | −0.337 *** |

| (0.151) | (0.393) | (0.073) | (0.210) | (0.261) | (0.13) | (0.12) | |

| SIZE | 0.201 *** | 0.411 *** | 0.018 | 0.262 *** | 0.280 ** | 0.357 *** | 0.198 *** |

| (0.061) | (0.144) | (0.087) | (0.082) | (0.130) | (0.05) | (0.06) | |

| LEV | 0.031 | −0.569 | 0.229 | −0.344 | −0.115 | 0.04 | 0.15 |

| (0.321) | (1.413) | (0.518) | (0.660) | (1.066) | (0.15) | (0.14) | |

| GROWTH | −0.098 ** | −0.197 * | −0.090 ** | −0.170 ** | −0.260 *** | −0.073 * | −0.061 * |

| (0.039) | (0.104) | (0.035) | (0.065) | (0.078) | (0.04) | (0.03) | |

| OUT | −0.595 | −4.310 | 0.723 | −0.240 | 0.484 | 0.43 | 0.66 |

| (0.404) | (2.696) | (0.747) | (0.722) | (1.164) | (0.46) | (0.81) | |

| MSR | −0.474 ** | −0.935 | 0.446 | −0.065 | 0.381 | 0.247 * | 0.12 |

| (0.206) | (0.799) | (0.268) | (0.268) | (0.375) | (0.14) | (0.23) | |

| DIV | −0.035 | 0.182 | 0.173 * | −0.061 | 0.112 | 0.127 *** | 0.395 ** |

| (0.037) | (0.249) | (0.093) | (0.070) | (0.149) | (0.05) | (0.16) | |

| DUAL | −0.027 | 0.152 | 0.089 | 0.065 | 0.154 | 0.05 | (0.01) |

| (0.131) | (0.502) | (0.196) | (0.185) | (0.371) | (0.06) | (0.08) | |

| Constant | −3.705 *** | −6.359 * | −0.939 | −5.097 *** | −6.036 ** | −7.344 *** | −4.522 *** |

| (1.266) | (3.570) | (1.826) | (1.829) | (2.937) | (1.18) | (1.26) | |

| Observations | 15,993 | 15,993 | 15,993 | 15,993 | 15,993 | 15,194 | 15,194 |

| Firm fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | No | Yes |

| Adjust R2 | 0.0135 | 0.0139 | 0.0159 | 0.00875 | 0.0152 | ||

| AR (1) test | 0.000 | 0.000 | |||||

| AR (2) test | 0.168 | 0.262 | |||||

| Sargan test | 0.000 | 0.000 | |||||

| Hansen test | 0.159 | 0.129 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | Government Subsidy | Analyst Coverage | Government Subsidy | Analyst Coverage |

| SUBSIDY × DID | 0.515 ** | 3.367 ** | ||

| (0.213) | (1.564) | |||

| SUBSIDY × TREAT | −0.434 ** | −4.164 ** | ||

| (0.205) | (1.788) | |||

| SUBSIDY × TIME | 0.173 *** | 1.813 *** | ||

| (0.043) | (0.405) | |||

| SUBSIDY | −0.088 *** | −0.700 ** | ||

| (0.030) | (0.288) | |||

| ANALYST × DID | 1.146 ** | 0.895 ** | ||

| (0.427) | (0.354) | |||

| ANALYST × TREAT | −0.449 * | −0.381 * | ||

| (0.258) | (0.209) | |||

| ANALYST × TIME | 0.350 *** | 0.276 *** | ||

| (0.115) | (0.090) | |||

| ANALYST | −0.199 *** | −0.150 ** | ||

| (0.070) | (0.056) | |||

| DID | −7.646 ** | −1.024 ** | −1.765 | −0.984 ** |

| (3.157) | (0.435) | (1.058) | (0.457) | |

| SIZE | 0.191 | −0.103 | 0.200 * | −0.094 |

| (0.115) | (0.183) | (0.105) | (0.187) | |

| LEV | −0.521 | −0.458 | −0.656 | −0.462 |

| (1.093) | (1.081) | (1.143) | (1.072) | |

| GROWTH | −0.034 | 0.015 | −0.081 | 0.007 |

| (0.113) | (0.129) | (0.099) | (0.127) | |

| OUT | −3.889 | −3.950 | −3.731 | −3.983 |

| (2.674) | (2.600) | (2.647) | (2.584) | |

| MSR | −0.653 | −0.730 | −0.362 | −0.710 |

| (0.673) | (0.690) | (0.641) | (0.693) | |

| DIV | 0.192 | 0.171 | 0.213 | 0.172 |

| (0.221) | (0.211) | (0.217) | (0.215) | |

| DUAL | 0.172 | 0.179 | 0.180 | 0.173 |

| (0.391) | (0.361) | (0.386) | (0.359) | |

| Constant | 1.853 | 4.804 | −0.724 | 4.601 |

| (3.982) | (5.240) | (3.340) | (5.337) | |

| Observations | 15,993 | 15,993 | 15,993 | 15,993 |

| Firm fixed effects | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes |

| Adjust R2 | 0.0177 | 0.0183 | 0.0118 | 0.0180 |

| Financing Constraints | Tax Administration Strengths | Regional Heterogeneity | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Variables | Low | High | Low | High | Non-Eastern Region | Eastern Region |

| DID | 1.781 ** | 0.337 | 1.101 *** | 0.458 | 0.707 | 0.779 * |

| (0.688) | (0.569) | (0.281) | (0.470) | (0.590) | (0.419) | |

| TIME | −0.489 | 0.803 ** | 0.255 | 0.110 | −0.321 | −0.471 |

| (0.959) | (0.328) | (0.413) | (0.231) | (0.298) | (0.588) | |

| SIZE | −0.021 | 0.274 | 0.370 ** | 0.237 * | 0.409 * | 0.082 |

| (0.256) | (0.193) | (0.148) | (0.121) | (0.236) | (0.110) | |

| LEV | −2.209 | −0.001 | −2.867 | 0.865 ** | −0.172 | −0.790 |

| (3.244) | (0.417) | (2.165) | (0.414) | (0.641) | (1.743) | |

| GROWTH | 0.069 | −0.156 | −0.111 | −0.099 * | −0.212 | −0.017 |

| (0.213) | (0.106) | (0.216) | (0.054) | (0.146) | (0.144) | |

| OUT | −8.302 | 0.906 | −7.406 | −0.101 | −0.677 | −5.653 |

| (5.632) | (1.340) | (5.617) | (0.808) | (1.355) | (3.971) | |

| MSR | −0.137 | −0.067 | −1.163 | 0.154 | 0.641 | −0.751 |

| (1.074) | (0.622) | (0.835) | (0.602) | (0.461) | (0.819) | |

| DIV | 0.428 | 0.053 | −0.087 | 0.337 | 0.160 | 0.247 |

| (0.499) | (0.097) | (0.202) | (0.310) | (0.176) | (0.345) | |

| DUAL | 0.634 | −0.050 | 0.590 | −0.233 *** | −0.311 | 0.410 |

| (0.847) | (0.208) | (0.732) | (0.079) | (0.216) | (0.523) | |

| Constant | 3.386 | −5.840 | −3.257 | −5.470 * | −8.492 | 1.002 |

| (6.549) | (4.485) | (5.649) | (2.738) | (5.042) | (3.989) | |

| Observations | 7997 | 7996 | 8048 | 7945 | 5478 | 10,515 |

| Firm fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjust R2 | 0.0152 | 0.0155 | 0.0121 | 0.0193 | 0.0207 | 0.00985 |

| Heterogeneity of Top Management Team | ||||||||

|---|---|---|---|---|---|---|---|---|

| Property Rights | Age | Gender | Professional Background | |||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Variables | Non-State-Owned | State-Owned | Low | High | Low | High | Low | High |

| DID | 0.029 | 1.863 * | 0.723 | 1.360 * | 0.359 | 1.702 ** | 0.253 | 0.748 * |

| (0.127) | (0.926) | (0.623) | (0.761) | (0.475) | (0.632) | (0.208) | (0.369) | |

| TIME | −1.258 | 1.158 ** | −0.879 | 0.256 | −0.676 *** | 0.966 ** | −0.055 | −1.281 |

| (0.845) | (0.476) | (0.711) | (0.206) | (0.243) | (0.380) | (0.119) | (1.165) | |

| SIZE | 0.247 *** | 0.589 * | 0.190 | 0.130 | 0.409 ** | −0.114 | 0.083 | 0.320 * |

| (0.087) | (0.301) | (0.154) | (0.140) | (0.162) | (0.210) | (0.085) | (0.176) | |

| LEV | −0.271 | −0.647 | 0.161 | −1.515 | 0.427 | −0.609 | 0.169 | −1.560 |

| (0.472) | (2.871) | (1.233) | (1.568) | (0.468) | (1.784) | (0.180) | (2.083) | |

| GROWTH | −0.025 | −0.446 ** | 0.020 | −0.056 | −0.173 * | −0.010 | −0.015 | −0.116 |

| (0.104) | (0.213) | (0.193) | (0.080) | (0.099) | (0.083) | (0.063) | (0.228) | |

| OUT | −2.121 | −6.783 | −3.412 | −2.134 | −1.139 | −5.523 ** | 1.647 | −8.388 |

| (2.140) | (4.898) | (2.612) | (3.188) | (2.950) | (2.578) | (1.183) | (4.997) | |

| MSR | −0.898 | −1.345 | −2.089 | 0.351 | −0.585 | 1.098 * | 0.116 | −1.163 |

| (0.943) | (2.017) | (2.624) | (0.613) | (0.804) | (0.571) | (0.519) | (1.375) | |

| DIV | 0.023 | 0.421 | 0.549 | −0.177 | 0.001 | 0.428 | 0.024 | 0.268 ** |

| (0.046) | (0.656) | (0.373) | (0.162) | (0.168) | (0.467) | (0.109) | (0.116) | |

| DUAL | −0.020 | 0.834 | −0.163 | 0.478 | 0.169 | 0.257 | −0.085 | 0.336 |

| (0.136) | (1.128) | (0.275) | (0.545) | (0.300) | (0.433) | (0.170) | (0.387) | |

| Constant | −3.074 | −10.091 * | −2.326 | −1.518 | −8.152 * | 3.771 | −2.271 | −1.997 |

| (2.764) | (5.814) | (4.310) | (3.995) | (4.072) | (4.489) | (1.973) | (5.784) | |

| Observations | 10,763 | 5230 | 8130 | 7863 | 8780 | 7213 | 8089 | 7904 |

| Firm fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjust R2 | 0.00779 | 0.0204 | 0.0148 | 0.00837 | 0.0187 | 0.0106 | 0.0132 | 0.0124 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | ESG | L1.ESG | L2.ESG |

| DID | 0.066 * | 0.073 * | 0.089 ** |

| (0.039) | (0.039) | (0.041) | |

| TIME | 0.073 | −0.323 *** | −0.110 *** |

| (0.056) | (0.038) | (0.038) | |

| SIZE | 0.184 *** | 0.155 *** | 0.098 *** |

| (0.029) | (0.034) | (0.036) | |

| LEV | −0.606 *** | −0.250 ** | −0.013 |

| (0.092) | (0.099) | (0.105) | |

| GROWTH | 0.004 | −0.054 *** | −0.059 *** |

| (0.020) | (0.019) | (0.021) | |

| OUT | −0.472 ** | −0.258 | −0.063 |

| (0.240) | (0.250) | (0.261) | |

| MSR | 0.486 *** | 0.924 *** | 0.631 *** |

| (0.109) | (0.200) | (0.213) | |

| DIV | 0.183 *** | 0.108 *** | 0.059 *** |

| (0.022) | (0.022) | (0.021) | |

| DUAL | −0.043 | −0.010 | 0.026 |

| (0.029) | (0.030) | (0.030) | |

| Constant | 2.367 *** | 3.098 *** | 4.258 *** |

| (0.622) | (0.755) | (0.813) | |

| Observations | 15,993 | 13,456 | 11,080 |

| Firm fixed effects | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes |

| Adjust R2 | 0.0541 | 0.0460 | 0.0339 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cao, G.; Fang, X.; Chen, Y.; She, J. Regional Big Data Application Capability and Firm Green Technology Innovation. Sustainability 2023, 15, 12830. https://doi.org/10.3390/su151712830

Cao G, Fang X, Chen Y, She J. Regional Big Data Application Capability and Firm Green Technology Innovation. Sustainability. 2023; 15(17):12830. https://doi.org/10.3390/su151712830

Chicago/Turabian StyleCao, Guixiang, Xintong Fang, Ying Chen, and Jinghuai She. 2023. "Regional Big Data Application Capability and Firm Green Technology Innovation" Sustainability 15, no. 17: 12830. https://doi.org/10.3390/su151712830

APA StyleCao, G., Fang, X., Chen, Y., & She, J. (2023). Regional Big Data Application Capability and Firm Green Technology Innovation. Sustainability, 15(17), 12830. https://doi.org/10.3390/su151712830