The Impact of Carbon Emission Trading on Renewable Energy: A Comparative Analysis Based on the CGE Model

Abstract

:1. Introduction

2. Methodology

2.1. CEEEA2.0 Model: A Computable General Equilibrium Model

2.2. Data Source

2.3. Dynamics

2.4. Scenario Settings

- The Business as Usual (BaU) scenario, which assumes China continues its current development path without implementing carbon trading or carbon tax policies, but still experiences heterogeneous technological progress and improvements in energy efficiency.

- The Emission Trading Scheme-benchmark (ETS-benchmark) scenario, which builds on the BaU scenario and introduces a carbon emission trading mechanism. The covered industries for carbon trading are the same as the current ones in China, namely only the electricity sector. However, starting from 2025, the covered industries will follow the initial plan set by the National Development and Reform Commission in 2016, which includes eight high-energy-consuming industries: petrochemical, chemical, construction materials, iron and steel, nonferrous metals, papermaking, electricity, and aviation. This covers 18 subindustries, including crude oil processing and ethylene production. The total carbon quota and allocation plan are based on a carbon intensity-based grandfathering method. Since the Chinese government has committed to peaking carbon emissions by 2030, we assume that the government will control carbon emissions through carbon emission trading to achieve this peak by 2030. However, considering the current situation, China’s carbon peak target seems relatively easy to achieve, so we additionally consider two more ambitious scenarios.

- The ETS-strengthened scenario, which is similar to the ETS-benchmark scenario. The only difference is that carbon emissions in this scenario will peak around 2025 and the peak emission will be lower. This scenario is more likely to occur considering the almost-reaching-peak coal consumption and the lowered economic growth. In addition, other papers also have the similar results [51].

- The ETS-enhanced scenario, which is also similar to the ETS-benchmark scenario. The only difference is that carbon emissions in this scenario will reach the peak immediately, and the peak will be lower than the previous two scenarios.

3. Results

3.1. Impact on Electricity Mix

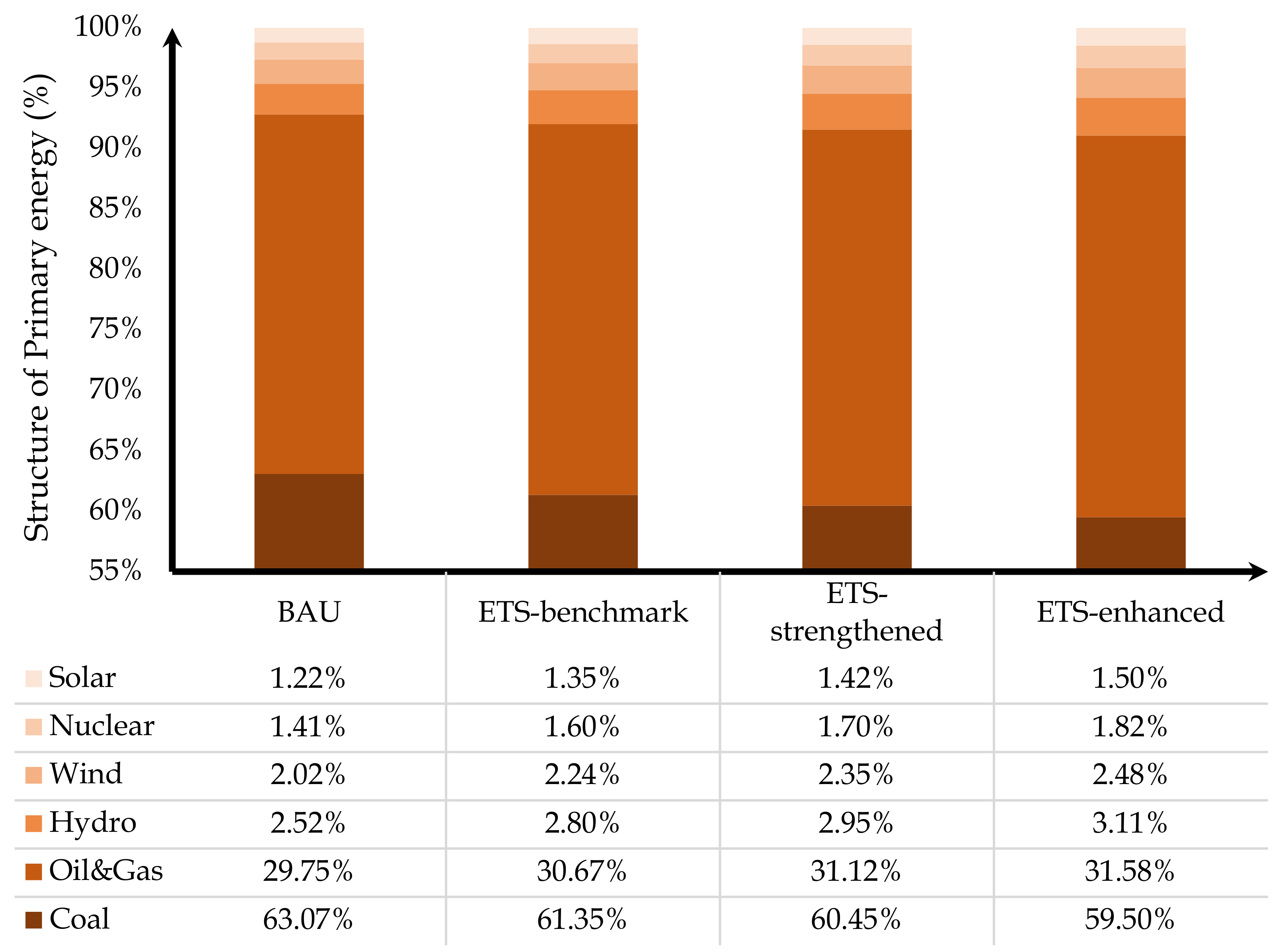

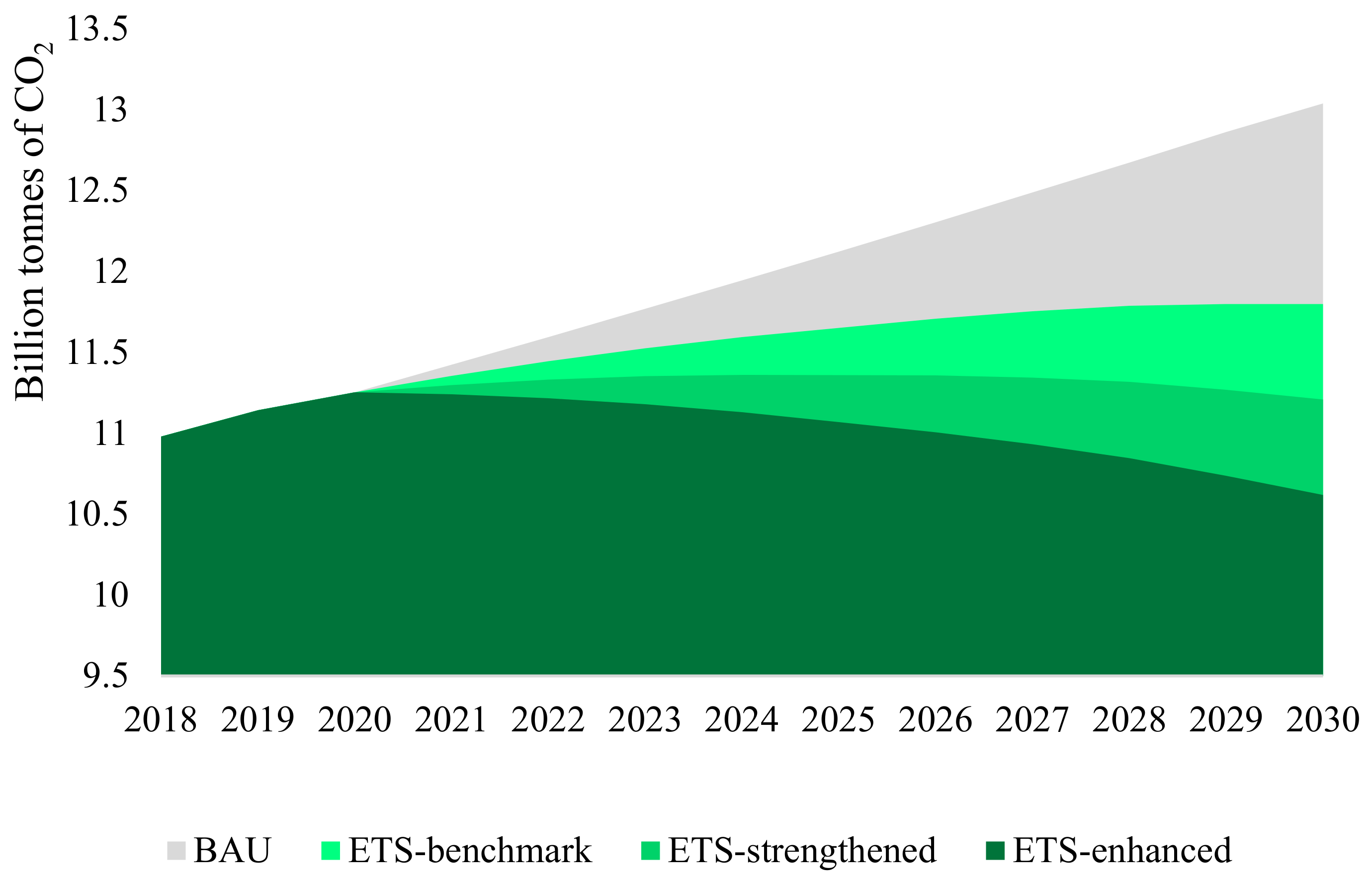

3.2. Impact on Primary Energy Mix and CO2 Emissions

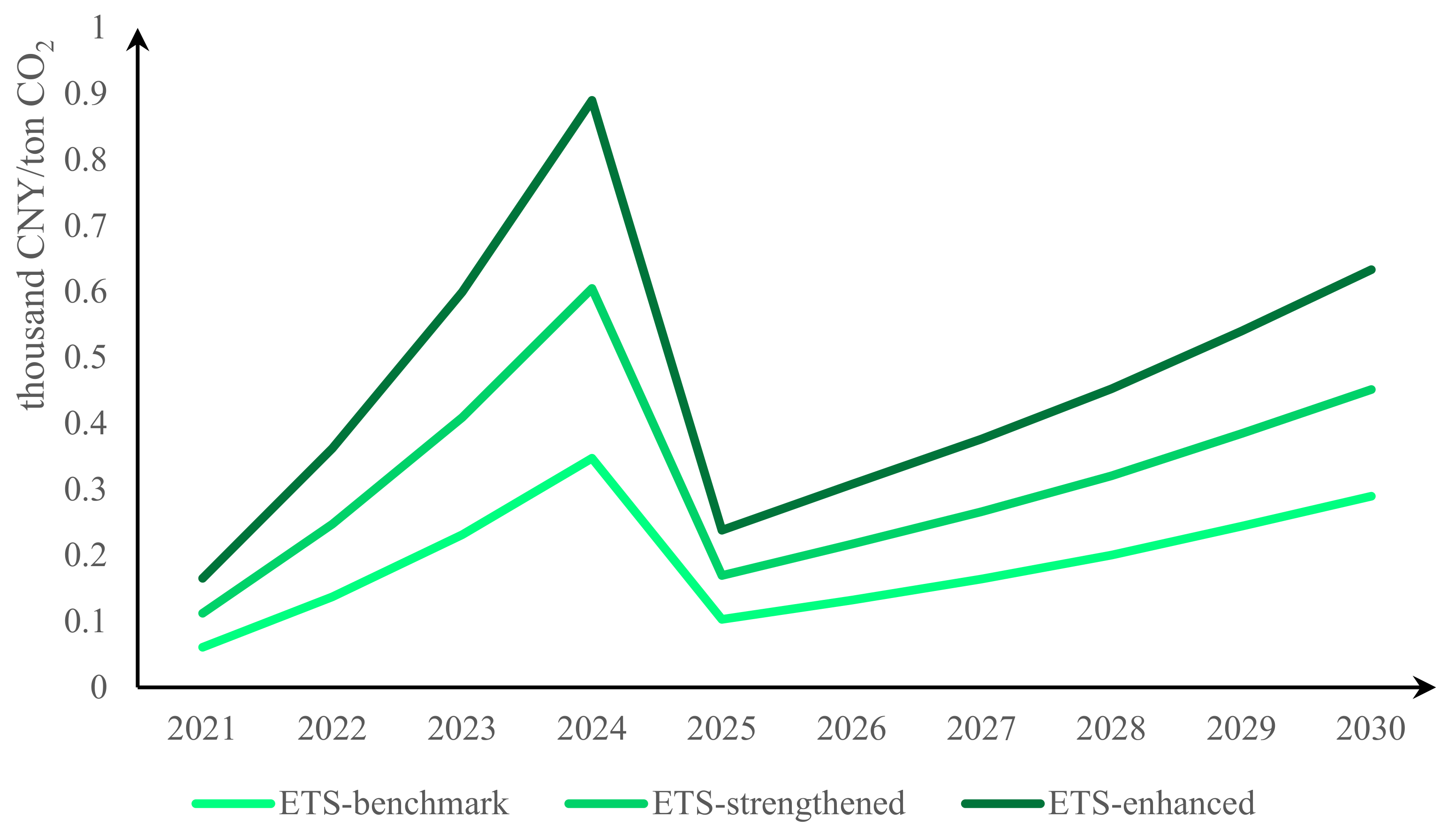

3.3. Impact on Carbon Pricing

4. Further Analysis

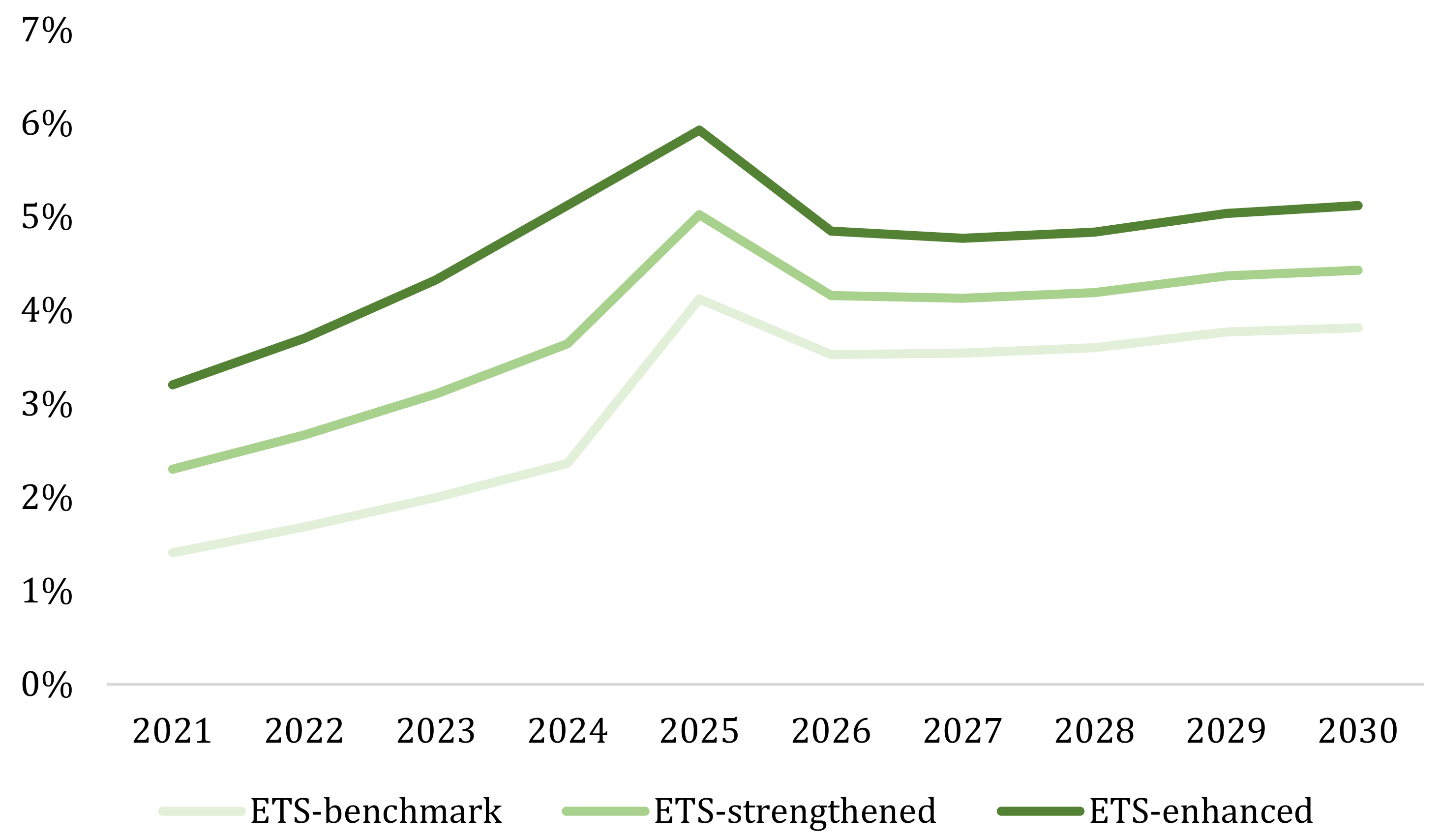

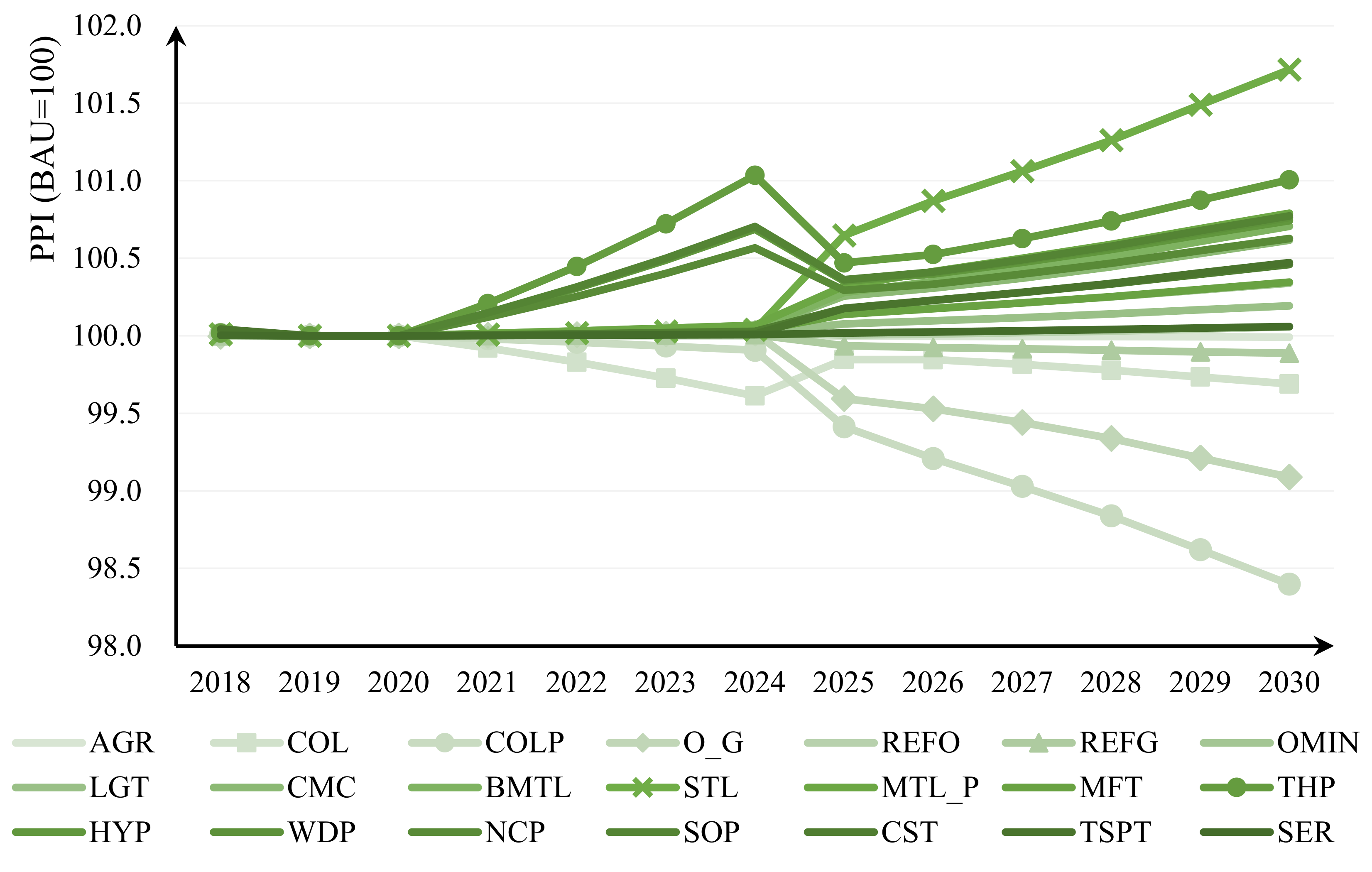

4.1. Producer Price Index

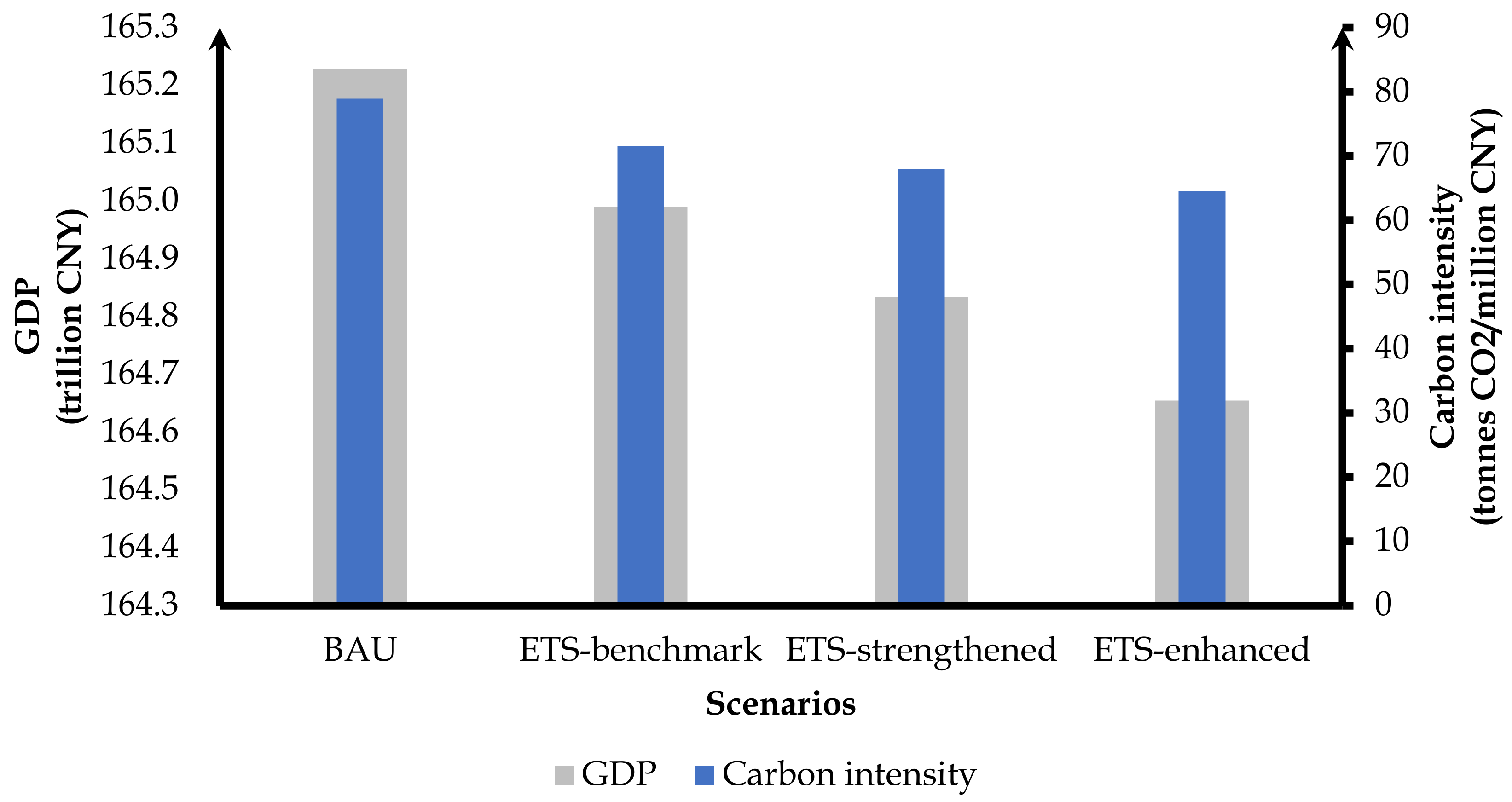

4.2. GDP

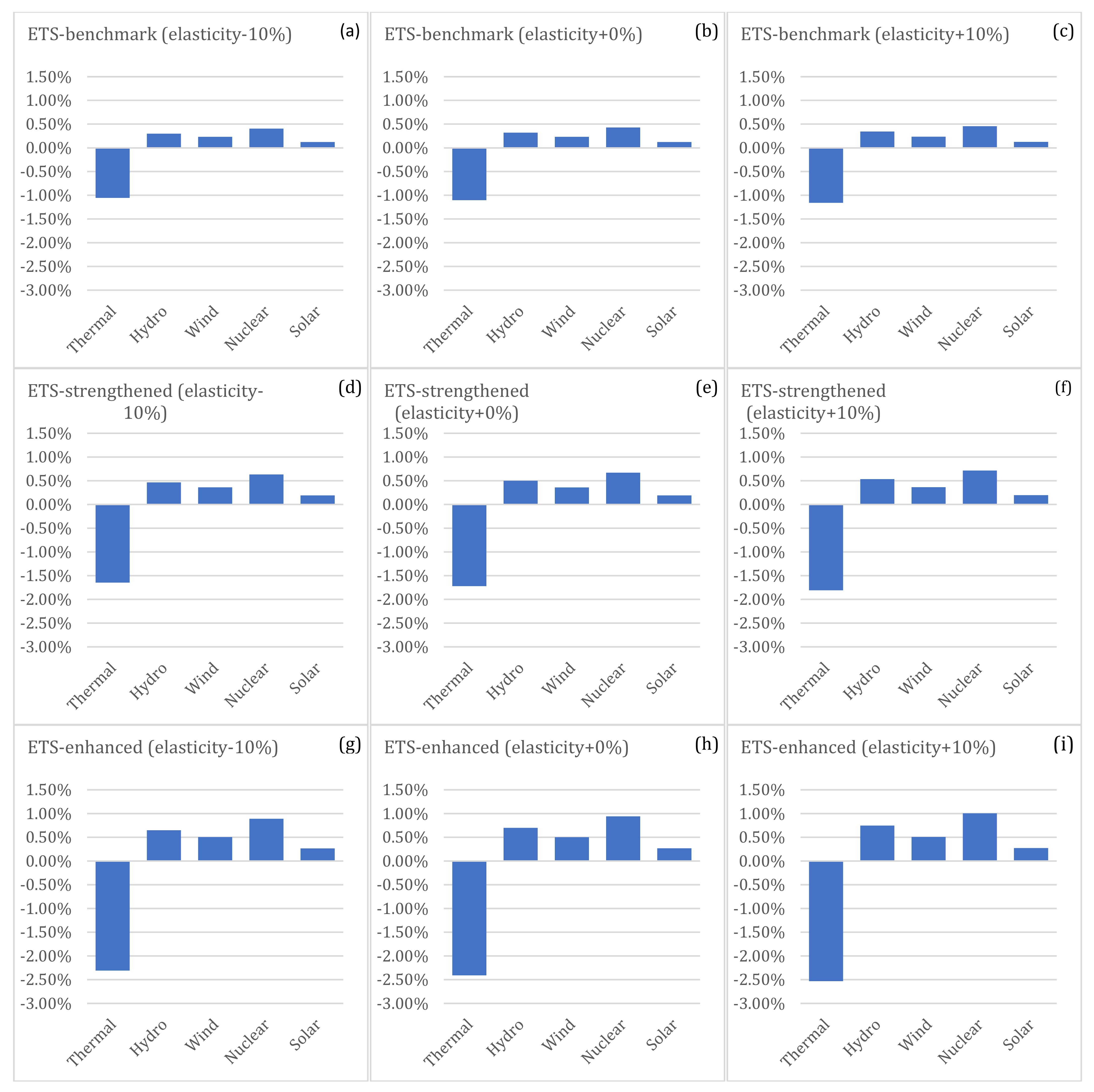

4.3. Sensitivity Analysis

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Cao, R.; Xiao, Y.; Yin, F. Spatio-Temporal Evolution of High-Quality Development and the Impact of Carbon Emissions Trading Schemes. Sustainability 2023, 15, 2900. [Google Scholar] [CrossRef]

- Zhang, R.; Fujimori, S.; Dai, H.; Hanaoka, T. Contribution of the Transport Sector to Climate Change Mitigation: Insights from a Global Passenger Transport Model Coupled with a Computable General Equilibrium Model. Appl. Energy 2018, 211, 76–88. [Google Scholar] [CrossRef]

- Salehi, M.; Fahimifard, S.H.; Zimon, G.; Bujak, A.; Sadowski, A. The Effect of CO2 Gas Emissions on the Market Value, Price and Shares Returns. Energies 2022, 15, 9221. [Google Scholar] [CrossRef]

- Zheng, L.; Omori, A.; Cao, J.; Guo, X. Environmental Regulation and Corporate Environmental Performance: Evidence from Chinese Carbon Emission Trading Pilot. Sustainability 2023, 15, 8518. [Google Scholar] [CrossRef]

- Xu, S.; Pan, W.; Wen, D. Do Carbon Emission Trading Schemes Promote the Green Transition of Enterprises? Evidence from China. Sustainability 2023, 15, 6333. [Google Scholar] [CrossRef]

- Higgins, A.; Foliente, G.; McNamara, C. Modelling Intervention Options to Reduce GHG Emissions in Housing Stock—A Diffusion Approach. Technol. Forecast. Soc. Change 2011, 78, 621–634. [Google Scholar] [CrossRef]

- Ortas, E.; Álvarez, I. The Efficacy of the European Union Emissions Trading Scheme: Depicting the Co-Movement of Carbon Assets and Energy Commodities through Wavelet Decomposition. J. Clean. Prod. 2015, 116, 40–49. [Google Scholar] [CrossRef]

- Creti, A.; Joets, M. Multiple Bubbles in the European Union Emission Trading Scheme. Energy Policy 2017, 107, 119–130. [Google Scholar] [CrossRef]

- Koch, N.; Themann, M. Catching up and Falling behind: Cross-Country Evidence on the Impact of the EU ETS on Firm Productivity. Resour. Energy Econ. 2022, 69, 101315. [Google Scholar] [CrossRef]

- Pattak, D.C.; Tahrim, F.; Salehi, M.; Voumik, L.C.; Akter, S.; Ridwan, M.; Sadowska, B.; Zimon, G. The Driving Factors of Italy’s CO2 Emissions Based on the STIRPAT Model: ARDL, FMOLS, DOLS, and CCR Approaches. Energies 2023, 16, 5845. [Google Scholar] [CrossRef]

- Jia, Z. The Hidden Benefit: Emission Trading Scheme and Business Performance of Downstream Enterprises. Energy Econ. 2023, 117, 106488. [Google Scholar] [CrossRef]

- Hanoteau, J.; Talbot, D. Impacts of the Québec Carbon Emissions Trading Scheme on Plant-Level Performance and Employment. Carbon Manag. 2019, 10, 287–298. [Google Scholar] [CrossRef]

- Richter, J.L.; Mundaca, L. Achieving and Maintaining Institutional Feasibility in Emissions Trading: The Case of New Zealand. Mitig. Adapt. Strateg. Glob. Change 2015, 20, 1487–1509. [Google Scholar] [CrossRef]

- Inderberg, T.H.J.; Bailey, I.; Harmer, N. Designing New Zealand’s Emissions Trading Scheme. Glob. Environ. Politics 2017, 17, 31–50. [Google Scholar] [CrossRef]

- Wei, Y.; Li, Y.; Wang, Z. Multiple Price Bubbles in Global Major Emission Trading Schemes: Evidence from European Union, New Zealand, South Korea and China. Energy Econ. 2022, 113, 106232. [Google Scholar] [CrossRef]

- Wang-Helmreich, H.; Kreibich, N. The Potential Impacts of a Domestic Offset Component in a Carbon Tax on Mitigation of National Emissions. Renew. Sustain. Energy Rev. 2019, 101, 453–460. [Google Scholar] [CrossRef]

- Yan, Y.; Sun, M.; Guo, Z. How Do Carbon Cap-and-Trade Mechanisms and Renewable Portfolio Standards Affect Renewable Energy Investment? Energy Policy 2022, 165, 112938. [Google Scholar] [CrossRef]

- Chen, W.; Chen, J.; Ma, Y. Renewable Energy Investment and Carbon Emissions under Cap-and-Trade Mechanisms. J. Clean. Prod. 2021, 278, 123341. [Google Scholar] [CrossRef]

- Wei, C.; Li-Feng, Z.; Hong-Yan, D. Impact of Cap-and-Trade Mechanisms on Investments in Renewable Energy and Marketing Effort. Sustain. Prod. Consum. 2021, 28, 1333–1342. [Google Scholar] [CrossRef]

- Kim, K.-T.; Lee, D.-J.; An, D. Real Option Valuation of the R&D Investment in Renewable Energy Considering the Effects of the Carbon Emission Trading Market: A Korean Case. Energies 2020, 13, 622. [Google Scholar] [CrossRef]

- Qi, L.; Lin, X.; Shi, X.; Zhang, Y.; Pan, H.; Sharp, B. Feed-in Tariffs and the Carbon Emission Trading Scheme under China’s Peak Emission Target: A Dynamic CGE Analysis for the Development of Renewable Electricity. J. Environ. Manag. 2023, 335, 117535. [Google Scholar] [CrossRef] [PubMed]

- Chang, K.; Zhang, C.; Wang, H.W. Asymmetric Dependence Structures between Emission Allowances and Energy Markets: New Evidence from China’s Emissions Trading Scheme Pilots. Environ. Sci. Pollut. Res. 2020, 27, 21140–21158. [Google Scholar] [CrossRef] [PubMed]

- Bird, L.A.; Holt, E.; Levenstein Carroll, G. Implications of Carbon Cap-and-Trade for US Voluntary Renewable Energy Markets. Energy Policy 2008, 36, 2063–2073. [Google Scholar] [CrossRef]

- Zhang, M.; Ge, Y.; Liu, L.; Zhou, D. Impacts of Carbon Emission Trading Schemes on the Development of Renewable Energy in China: Spatial Spillover and Mediation Paths. Sustain. Prod. Consum. 2022, 32, 306–317. [Google Scholar] [CrossRef]

- Zimon, G.; Tarighi, H.; Salehi, M.; Sadowski, A. Assessment of Financial Security of SMEs Operating in the Renewable Energy Industry during COVID-19 Pandemic. Energies 2022, 15, 9627. [Google Scholar] [CrossRef]

- Huang, J.; Xue, F.; Song, X. Simulation Analysis on Policy Interaction Effects between Emission Trading and Renewable Energy Subsidy. J. Mod. Power Syst. Clean Energy 2013, 1, 195–201. [Google Scholar] [CrossRef]

- Ying, Z.; Xin-gang, Z. The Impact of Renewable Portfolio Standards on Carbon Emission Trading under the Background of China’s Electricity Marketization Reform. Energy 2021, 226, 120322. [Google Scholar] [CrossRef]

- Möst, D.; Fichtner, W. Renewable Energy Sources in European Energy Supply and Interactions with Emission Trading. Energy Policy 2010, 38, 2898–2910. [Google Scholar] [CrossRef]

- Jiang, C.; Wu, Y.-F.; Li, X.-L.; Li, X. Time-Frequency Connectedness between Coal Market Prices, New Energy Stock Prices and CO2 Emissions Trading Prices in China. Sustainability 2020, 12, 2823. [Google Scholar] [CrossRef]

- Hu, H.; Zhao, L.; Dong, W. How to Achieve the Goal of Carbon Peaking by the Energy Policy? A Simulation Using the DCGE Model for the Case of Shanghai, China. Energy 2023, 278, 127947. [Google Scholar] [CrossRef]

- Cai, Y.; Woollacott, J.; Beach, R.H.; Rafelski, L.E.; Ramig, C.; Shelby, M. Insights from Adding Transportation Sector Detail into an Economy-Wide Model: The Case of the ADAGE CGE Model. Energy Econ. 2023, 123, 106710. [Google Scholar] [CrossRef] [PubMed]

- Hu, Y.; Cutler, H.; Mao, Y. Economic Loss Assessment for Losses Due to Earthquake under an Integrated Building, Lifeline, and Transportation Nexus: A Spatial Computable General Equilibrium Approach for Shelby County, TN. Sustainability 2023, 15, 8610. [Google Scholar] [CrossRef]

- Ma, M.; Huang, D.; Hossain, S.S. Opportunities or Risks: Economic Impacts of Climate Change on Crop Structure Adjustment in Ecologically Vulnerable Regions in China. Sustainability 2023, 15, 6211. [Google Scholar] [CrossRef]

- O’Ryan, R.; Nasirov, S.; Osorio, H. Assessment of the Potential Impacts of a Carbon Tax in Chile Using Dynamic CGE Model. J. Clean. Prod. 2023, 403, 136694. [Google Scholar] [CrossRef]

- Jia, Z.; Wen, S.; Liu, Y. China’s Urban-Rural Inequality Caused by Carbon Neutrality: A Perspective from Carbon Footprint and Decomposed Social Welfare. Energy Econ. 2022, 113, 106193. [Google Scholar] [CrossRef]

- Jia, Z.; Lin, B. CEEEA2.0 Model: A Dynamic CGE Model for Energy-Environment-Economy Analysis with Available Data and Code. Energy Econ. 2022, 112, 106117. [Google Scholar] [CrossRef]

- Xu, J.; Wei, W. The Effects of Tax and Fee Reduction Policy on Mitigating Shock of the COVID-19 Epidemic in China. Appl. Econ. 2021, 53, 5303–5318. [Google Scholar] [CrossRef]

- Duan, H.; Bao, Q.; Tian, K.; Wang, S.; Yang, C.; Cai, Z. The Hit of the Novel Coronavirus Outbreak to China’s Economy. China Econ. Rev. 2021, 67, 101606. [Google Scholar] [CrossRef]

- Bekkers, E.; Koopman, R.B.; Rêgo, C.L. Structural Change in the Chinese Economy and Changing Trade Relations with the World. China Econ. Rev. 2021, 65, 101573. [Google Scholar] [CrossRef]

- Cui, Q.; He, L.; Liu, Y.; Zheng, Y.; Wei, W.; Yang, B.; Zhou, M. The Impacts of COVID-19 Pandemic on China’s Transport Sectors Based on the CGE Model Coupled with a Decomposition Analysis Approach. Transp. Policy 2021, 103, 103–115. [Google Scholar] [CrossRef]

- Jia, Z.; Wen, S.; Lin, B. The Effects and Reacts of COVID-19 Pandemic and International Oil Price on Energy, Economy, and Environment in China. Appl. Energy 2021, 302, 117612. [Google Scholar] [CrossRef] [PubMed]

- An, K.; Zhang, S.; Zhou, J.; Wang, C. How Can Computable General Equilibrium Models Serve Low-Carbon Policy? A Systematic Review. Environ. Res. Lett. 2023, 18, 033002. [Google Scholar] [CrossRef]

- Clora, F.; Yu, W.; Corong, E. Alternative Carbon Border Adjustment Mechanisms in the European Union and International Responses: Aggregate and within-Coalition Results. Energy Policy 2023, 174, 113454. [Google Scholar] [CrossRef]

- Goulder, L.H.; Hafstead, M.A.C.; Kim, G.; Long, X. Impacts of a Carbon Tax across US Household Income Groups: What Are the Equity-Efficiency Trade-Offs? J. Public Econ. 2019, 175, 44–64. [Google Scholar] [CrossRef]

- Jia, Z. What Kind of Enterprises and Residents Bear More Responsibilities in Carbon Trading? A Step-by-Step Analysis Based on the CGE Model. Environ. Impact Assess. Rev. 2023, 98, 106950. [Google Scholar] [CrossRef]

- Rajbhandari, S.; Winyuchakrit, P.; Pradhan, B.B.; Chaichaloempreecha, A.; Pita, P.; Limmeechokchai, B. Thailand’s Net-Zero Emissions by 2050: Analysis of Economy-Wide Impacts. Sustain. Sci. 2023, 4, 1–14. [Google Scholar] [CrossRef] [PubMed]

- Fereira, S.B.; Cateia, J.V. Trade Reform, Infrastructure Investment, and Structural Transformation in Africa: Evidence from Guinea-Bissau. Emerg. Mark. Rev. 2023, 55, 101027. [Google Scholar] [CrossRef]

- Fujimori, S.; Masui, T.; Matsuoka, Y. AIM/CGE [Basic] Manual; Center for Social and Environmental Systems Research: Kyoto, Japan, 2012. [Google Scholar]

- Babatunde, K.A.; Begum, R.A.; Said, F.F. Application of Computable General Equilibrium (CGE) to Climate Change Mitigation Policy: A Systematic Review. Renew. Sustain. Energy Rev. 2017, 78, 61–71. [Google Scholar] [CrossRef]

- Lamperti, F.; Dosi, G.; Napoletano, M.; Roventini, A.; Sapio, A. Faraway, So Close: Coupled Climate and Economic Dynamics in an Agent-Based Integrated Assessment Model. Ecol. Econ. 2018, 150, 315–339. [Google Scholar] [CrossRef]

- Liu, J.; Wang, K.; Zou, J.; Kong, Y. The Implications of Coal Consumption in the Power Sector for China’s CO2 Peaking Target. Appl. Energy 2019, 253, 113518. [Google Scholar] [CrossRef]

- Yu, M.; He, M.; Liu, F. Impact of Emissions Trading System on Renewable Energy Output. Procedia Comput. Sci. 2017, 122, 221–228. [Google Scholar] [CrossRef]

| Abbreviations | Sectors’ Full Name |

|---|---|

| AGR | Agriculture |

| COL | Coal mining |

| COLP | Coal processing |

| O_G | Oil and gas exploitation |

| REFO | Refined oil |

| REFG | Refined gas |

| OMIN | Other mining |

| LGT | Light industry |

| CMC | Chemicals |

| BMTL | Building material |

| STL | Steel |

| MTL_P | Metal product |

| MFT | Manufacturing |

| THP | Thermal power |

| HYP | Hydropower |

| WDP | Wind power |

| NCP | Nuclear power |

| SOP | Solar power |

| CST | Construction |

| TSPT | Transportation |

| SER | Services |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, S.; Du, C.; Jin, X.; Zhang, D.; Wen, S.; Jia, Z. The Impact of Carbon Emission Trading on Renewable Energy: A Comparative Analysis Based on the CGE Model. Sustainability 2023, 15, 12649. https://doi.org/10.3390/su151612649

Huang S, Du C, Jin X, Zhang D, Wen S, Jia Z. The Impact of Carbon Emission Trading on Renewable Energy: A Comparative Analysis Based on the CGE Model. Sustainability. 2023; 15(16):12649. https://doi.org/10.3390/su151612649

Chicago/Turabian StyleHuang, Shenhai, Chao Du, Xian Jin, Daini Zhang, Shiyan Wen, and Zhijie Jia. 2023. "The Impact of Carbon Emission Trading on Renewable Energy: A Comparative Analysis Based on the CGE Model" Sustainability 15, no. 16: 12649. https://doi.org/10.3390/su151612649

APA StyleHuang, S., Du, C., Jin, X., Zhang, D., Wen, S., & Jia, Z. (2023). The Impact of Carbon Emission Trading on Renewable Energy: A Comparative Analysis Based on the CGE Model. Sustainability, 15(16), 12649. https://doi.org/10.3390/su151612649