Impact of Digital Finance on Industrial Green Transformation: Evidence from the Yangtze River Economic Belt

Abstract

:1. Introduction

2. Literature Review

3. Theoretical Analysis and Research Hypothesis

3.1. The Direct Impact of DF on IGT

3.2. The Indirect Impact of DF on IGT

3.3. The Spatial Effect of DF on IGT

4. Research Methods and Data Sources

4.1. Research Methods

4.1.1. Super-Efficiency SBM Model

4.1.2. Baseline Regression Model

4.1.3. Intermediary Effect Model

4.1.4. Spatial Econometric Model

- (1)

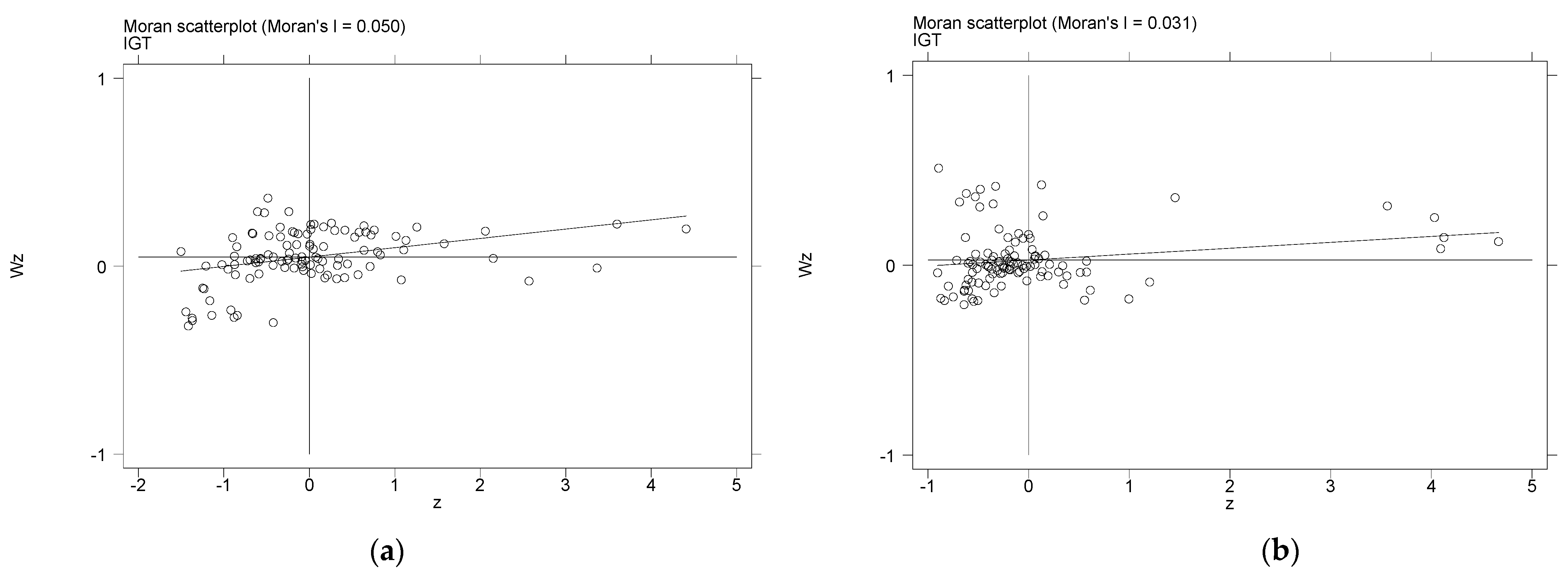

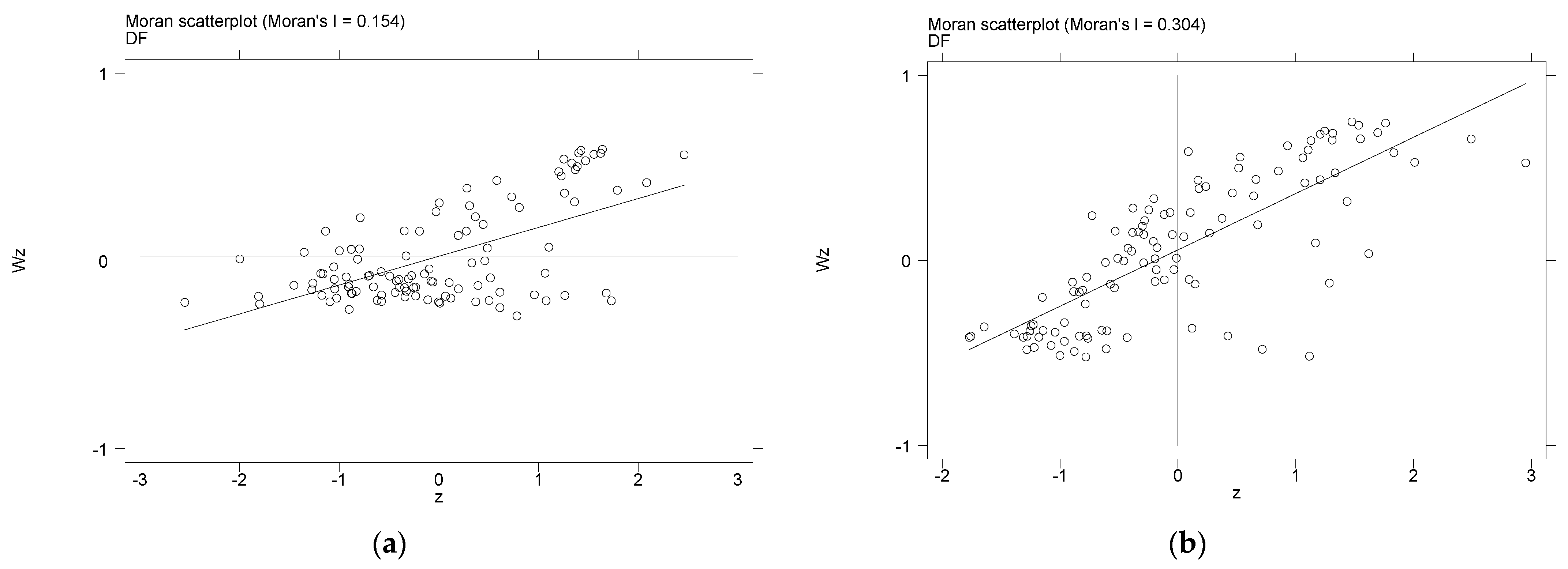

- Spatial correlation test

- (2)

- Spatial panel model

4.2. Variable Specification

4.2.1. The Dependent Variable

4.2.2. Key Independent Variable

4.2.3. Intermediate Variables

4.2.4. Control Variables

4.3. Data Description

5. Results and Discussion

5.1. Baseline Regression Results and Discussion

5.2. Endogeneity Treatment and Robustness Tests

5.2.1. Endogeneity Treatment

5.2.2. Excluding Macro-Systemic Influences

5.2.3. Substitution of Explanatory Variables

5.3. Analysis of Mechanism Test Results

5.4. Analysis of Spatial Spillover Effects

5.5. Analysis of Heterogeneous Results

5.5.1. Regional Heterogeneity

5.5.2. Urban Hierarchy Heterogeneity

5.5.3. Traditional Finance Heterogeneity

6. Conclusions and Policy Implications

6.1. Conclusions

6.2. Policy Implications

6.3. Future Perspectives and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Sharif, A.; Saha, S.; Loganathan, N. Does tourism sustain economic growth? Wavelet-based evidence from the United States. Tour. Anal. 2017, 22, 467–482. [Google Scholar] [CrossRef]

- Khan, M.K.; Khan, M.I.; Rehan, M. The relationship between energy consumption, economic growth and carbon dioxide emissions in Pakistan. Financ. Innov. 2020, 6, 1–22. [Google Scholar] [CrossRef]

- Xin, L.; Sun, H.; Xia, X.C. Spatial-temporal differentiation and dynamic spatial convergence of inclusive low-carbon development: Evidence from China. Environ. Sci. Pollut. Res. 2022, 30, 5197–5215. [Google Scholar] [CrossRef]

- Kemp, R.; Never, B. Green transition, industrial policy, and economic development. Oxf. Rev. Econ. Policy 2017, 33, 66–84. [Google Scholar] [CrossRef]

- Liu, C.Y.; Xin, L.; Li, J.Y.; Sun, H.P. The impact of renewable energy technology innovation on industrial green transformation and upgrading: Beggar thy neighbor or benefiting thy neighbor. Sustainability 2022, 14, 11198. [Google Scholar] [CrossRef]

- Zheng, C.J.; Deng, F.; Zhuo, C.F.; Sun, W.H. Green credit policy, institution supply and enterprise green innovation. J. Econ. Anal. 2022, 1, 20–34. [Google Scholar] [CrossRef]

- Tadesse, S. Financial architecture and economic performance: International evidence. J. Financ. Intermediation 2002, 11, 429–454. [Google Scholar] [CrossRef]

- Tripathy, N. Does measure of financial development matter for economic growth in India? Quant. Financ. Econ. 2019, 3, 508–525. [Google Scholar] [CrossRef]

- Sassi, S.; Goaied, M. Financial development, ICT difusion and economic growth: Lessons from MENA region. Telecommun. Policy 2013, 37, 252–261. [Google Scholar] [CrossRef]

- Kapoor, A. Financial inclusion and the future of the Indian economy. Futures. 2014, 56, 35–42. [Google Scholar] [CrossRef]

- Robb, A.M.; Robinson, D.T. The capital structure decisions of new frms. Rev. Financ. Stud. 2014, 27, 153–179. [Google Scholar] [CrossRef]

- Graedel, T.E.; Allenby, B.R.; Comrie, P.R. Matrix approaches to abridged life cycle assessment. Environ. Sci. Technol. 1995, 29, 134–139. [Google Scholar] [CrossRef]

- Alba, J.M.D.; Todorov, V. How green is manufacturing? Status and prospects of national green industrialisation. The case of Morocco. Int. J. Innov. Sustain. Dev. 2018, 12, 308–326. [Google Scholar] [CrossRef]

- Wang, Y.; Hu, H.; Dai, W.J.; Burns, K. Evaluation of industrial green development and industrial green competitiveness: Evidence from Chinese urban agglomerations. Ecol. Indic. 2021, 124, 107371. [Google Scholar] [CrossRef]

- Qi, Y.W.; Zou, X.Y.; Xu, M. Impact of Chinese fiscal decentralization on industrial green transformation: From the perspective of environmental fiscal policy. Front. Environ. Sci. 2022, 10, 1006274. [Google Scholar] [CrossRef]

- Chen, S.Y.; Golley, J. Environmental efficiency growth in China’s industrial economy. Energy Econ. 2014, 44, 89–98. [Google Scholar] [CrossRef]

- Guo, X.; Wang, J. Outward foreign direct investment, green financial development, and green total factor productivity: Evidence from china. Environ. Sci. Pollut. Res. Int. 2023, 30, 47485–47500. [Google Scholar] [CrossRef]

- Fukuyama, H.; Weber, W.L. A Directional Slacks-Based Measure of Technical Inefficiency. Socio Econ. Plan. Sci. 2009, 43, 274–287. [Google Scholar] [CrossRef]

- Liu, K.; Qiao, Y.R.; Zhou, Q. Analysis of China’s Industrial Green Development Efficiency and Driving Factors: Research Based on MGWR. Int. J. Environ. Res. Public Health 2021, 18, 3960. [Google Scholar] [CrossRef]

- Chen, H.X.; Shi, Y.; Xu, M.; Xu, Z.H.; Zou, W.J. China’s industrial green development and its influencing factors under the background of carbon neutrality. Environ. Sci. Pollut. Res. Int. 2022, 30, 81929–81949. [Google Scholar] [CrossRef]

- Li, W.; Wang, J.; Chen, R.X.; Xi, Y.Q.; Liu, S.Q.; Wu, F.M.; Masoud, M.; Wu, X.P. Innovation-driven industrial green development: The moderating role of regional factors. J. Clean. Prod. 2019, 222, 344–354. [Google Scholar] [CrossRef]

- Li, W.; Xi, Y.Q.; Liu, S.Q.; Li, M.J.; Chen, L.; Wu, X.P.; Zhu, S.P.; Masoud, M. An improved evaluation framework for industrial green development: Considering the underlying conditions. Ecol. Indic. 2020, 112, 106044. [Google Scholar] [CrossRef]

- Shang, D.; Lu, H.Y.; Liu, C.; Wang, D.; Diao, G. Evaluating the green development level of global paper industry from 2000–2030 based on a market-extended LCA model. J. Clean. Prod. 2022, 380, 135108. [Google Scholar] [CrossRef]

- Hou, J.; Teo, T.S.H.; Zhou, F.L.; Lim, M.K.; Chen, H. Does industrial green transformation successfully facilitate a decrease in carbon intensity in China? An environmental regulation perspective. J. Clean. Prod. 2018, 184, 1060–1071. [Google Scholar] [CrossRef]

- Allan, B.; Lewis, J.I.; Oatley, T. Green industrial policy and the global transformation of climate politics. Glob. Environ. Politics 2021, 21, 1–19. [Google Scholar] [CrossRef]

- Khan, T.; Khan, A.; Wei, L.; Khan, T.; Ayub, S. Industrial innovation on the green transformation of manufacturing commerce. J. Mark. Strateg. 2022, 4, 283–304. [Google Scholar] [CrossRef]

- Du, K.; Cheng, Y.Y.; Yao, X. Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Econ. 2021, 98, 105247. [Google Scholar] [CrossRef]

- Han, D.R.; Li, T.C.; Feng, S.S.; Shi, Z.Y. Does renewable energy consumption successfully promote the green transformation of China’s industry? Energies 2020, 13, 229. [Google Scholar] [CrossRef]

- Yue, J.P.; Zhang, F.Q. Evaluation of industrial green transformation in the process of urbanization: Regional difference analysis in China. Sustainability 2022, 14, 4280. [Google Scholar] [CrossRef]

- Zhai, X.Q.; An, Y.F. Analyzing influencing factors of green transformation in China’s manufacturing industry under environmental regulation: A structural equation model. J. Clean. Prod. 2020, 251, 119760. [Google Scholar] [CrossRef]

- Chen, H.X.; Yang, Y.P.; Yang, M.T.; Huang, H. The impact of environmental regulation on China’s industrial green development and its heterogeneity. Front. Ecol. Evol. 2022, 10, 967550. [Google Scholar] [CrossRef]

- Shao, S.; Luan, R.R.; Yang, Z.B.; Li, C.Y. Does directed technological change get greener: Empirical evidence from Shanghai’s industrial green development transformation. Ecol. Indic. 2016, 69, 758–770. [Google Scholar] [CrossRef]

- Zhu, X.H.; Chen, Y.; Feng, C. Green total factor productivity of China’s mining and quarrying industry: A global data envelopment analysis. Resour. Policy 2018, 57, 1–9. [Google Scholar] [CrossRef]

- Miao, C.L.; Fang, D.B.; Sun, L.Y.; Luo, Q.L.; Yu, Q. Driving effect of technology innovation on energy utilization efficiency in strategic emerging industries. J. Clean. Prod. 2018, 170, 1177–1184. [Google Scholar] [CrossRef]

- Chen, L.L.; Zhang, X.D.; He, F.; Yuan, R.S. Regional green development level and its spatial relationship under the constraints of haze in China. J. Clean. Prod. 2019, 210, 376–387. [Google Scholar] [CrossRef]

- Rajan, R.; Zingales, L. Financial dependence and growth. Am. Econ. Rev. 1998, 88, 559–586. [Google Scholar]

- Jabeen, G.; Ahmad, M.; Zhang, Q.Y. Combined role of economic openness, fnancial deepening, biological capacity, and human capital in achieving ecological sustainability. Ecol. Inform. 2023, 73, 101932. [Google Scholar] [CrossRef]

- Levine, R. Finance and Growth: Theory and Evidence. In Handbook of Economic Growth; Elsevier: Amsterdam, The Netherlands, 2005; Volume 1, pp. 865–934. [Google Scholar]

- Yuan, H.X.; Zhang, T.S.; Feng, Y.D.; Liu, Y.B.; Ye, X.Y. Does financial agglomeration promote the green development in China? A spatial spillover perspective. J. Clean. Prod. 2019, 237, 117808. [Google Scholar] [CrossRef]

- Liu, S.; Koster, S.; Chen, X.Y. Digital divide or dividend? The impact of digital finance on the migrants’ entrepreneurship in less developed regions of China. Cities 2022, 131, 103896. [Google Scholar] [CrossRef]

- Jagtiani, J.; Lemieux, C. Do fintech lenders penetrate areas that are underserved by traditional banks? J. Econ. Bus. 2018, 100, 43–54. [Google Scholar] [CrossRef]

- Wang, K.L.; Zhu, R.R.; Cheng, Y.Y. Does the development of digital finance contribute to haze pollution control? Evidence from China. Energies 2022, 15, 2660. [Google Scholar] [CrossRef]

- Zhuang, R.L.; Mi, K.N.; Zhi, M.L.; Zhang, C.Y. Digital Finance and Green Development: Characteristics, Mechanisms, and Empirical Evidences. Int. J. Environ. Res. Public Health 2022, 19, 16940. [Google Scholar] [CrossRef]

- He, Z.M.; Chen, H.C.; Hu, J.W.; Zhang, Y.T. The impact of digital inclusive finance on provincial green development efficiency: Empirical evidence from China. Environ. Sci. Pollut Res. 2022, 29, 90404–90418. [Google Scholar] [CrossRef]

- Lei, T.Y.; Luo, X.; Jiang, J.J.; Zou, K. Emission reduction effect of digital finance: Evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 62032–62050. [Google Scholar] [CrossRef] [PubMed]

- Razzaq, A.; Yang, X.D. Digital finance and green growth in China: Appraising inclusive digital finance using web crawler technology and big data. Technol. Forecast. Soc. Chang. 2023, 188, 122262. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Lu, L.R. Promoting SME Finance in the Context of the Fintech Revolution: A Case Study of the UK’s Practice and Regulation. Bank. Financ. Law Rev. 2018, 33, 317–343. [Google Scholar]

- Pierrakis, Y.; Collins, L. Crowdfunding: A new innovative model of providing funding to projects and businesses. SSRN Electron. J. 2013, 2395226. [Google Scholar] [CrossRef]

- Kong, T.; Sun, R.J.; Sun, G.L.; Song, Y.T. Effects of Digital Finance on Green Innovation considering Information Asymmetry: An Empirical Study Based on Chinese Listed Firms. Emerg. Mark. Financ. Trade 2022, 58, 4399–4411. [Google Scholar] [CrossRef]

- Lin, M.; Prabhala, N.R.; Viswanathan, S. Judging borrowers by the company they keep: Friendship networks and information asymmetry in online peer-to-peer lending. Manag. Sci. 2013, 59, 17–35. [Google Scholar] [CrossRef]

- Demertzis, M.; Merler, S.; Wolf, G.B. Capital Markets Union and the Fintech Opportunity. J. Financ. Regul. 2018, 4, 157–165. [Google Scholar] [CrossRef]

- Itay, G.; Wei, J.; Karolyi, G.A. To FinTech and Beyond. Rev. Financ. Stud. 2019, 32, 1647–1661. [Google Scholar]

- Wang, X.Y.; Wang, Q. Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resour. Policy 2021, 74, 102436. [Google Scholar] [CrossRef]

- Nambisan, S.; Wright, M.; Feldman, M. The digital transformation of innovation and entrepreneurship: Progress, challenges and key themes. Res. Policy 2019, 48, 103773. [Google Scholar] [CrossRef]

- Li, J.; Wu, Y.; Xiao, J.J. The impact of digital finance on household consumption: Evidence from China. Econ. Model. 2020, 86, 317–326. [Google Scholar] [CrossRef]

- Li, F.; Wu, Y.F.; Liu, J.L.; Zhong, S. Does digital inclusive finance promote industrial transformation? New evidence from 115 resource-based cities in China. PLoS ONE 2022, 17, e0273680. [Google Scholar] [CrossRef]

- Kling, G. Measuring financial exclusion of firms. Financ. Res. Lett. 2021, 39, 101568. [Google Scholar] [CrossRef]

- Shi, Y.; Gong, L.; Chen, J. The effect of financing on firm innovation: Multiple case studies on chinese manufacturing enterprises. Emerg. Mark. Financ. Trade 2019, 55, 863–888. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Zhong, K.Y. Does the digital finance revolution validate the environmental Kuznets curve? Empirical Findings from China. PLoS ONE 2022, 17, e0257498. [Google Scholar] [CrossRef]

- Liu, J.M.; Jiang, Y.L.; Gan, S.D.; He, L.; Zhang, Q.F. Can digital finance promote corporate green innovation? Environ. Sci. Pollut. Res. 2022, 29, 35828–35840. [Google Scholar] [CrossRef]

- Xu, X.H. Does green finance promote green innovation? Evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 27948–27964. [Google Scholar] [CrossRef]

- Wang, K.L.; Sun, T.T.; Xu, R.Y.; Miao, Z.; Cheng, Y.H. How does internet development promote urban green innovation efficiency? Evidence from China. Technol. Forecast. Soc. Chang. 2022, 184, 122017. [Google Scholar] [CrossRef]

- Du, M.Y.; Hou, Y.F.; Zhou, Q.J.; Ren, S.Y. Going green in China: How does digital finance affect environmental pollution? Mechanism discussion and empirical test. Environ. Sci. Pollut. Res. 2022, 29, 89996–90010. [Google Scholar] [CrossRef]

- Shen, Y.; Hu, W.X.; Hueng, C.J. Digital Financial Inclusion and Economic Growth: A Cross-country Study. Procedia Comput. Sci. 2021, 187, 218–223. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Oh, D.H. A global Malmquist-Luenberger productivity index. J. Product. Anal. 2010, 34, 183–197. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Ran, Q.Y.; Yang, X.D.; Yan, H.C.; Xu, Y.; Cao, J.H. Natural resource consumption and industrial green transformation: Does the digital economy matter? Resour. Policy 2023, 81, 103396. [Google Scholar] [CrossRef]

- Xiao, Y.; Lu, L.W. Measurement of industrial green transformation efficiency in resource-based cities—Based on 108 resource-based cities’s panel data. Financ. Econ. 2019, 9, 86–98. [Google Scholar]

- Guo, F.; Wang, J.Y.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z.Y. Measuring China’s digital financial inclusion: Index compilation and spatial characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar]

- Zhao, J.H.; He, G.H. Research on the impact of digital finance on the green development of Chinese cities. Discrete Dyn. Nat. Soc. 2022, 11, 3813474. [Google Scholar] [CrossRef]

- Copeland, B.R.; Taylor, M.C. North-South Trade and the Environment. Q. J. Econ. 1994, 109, 755–787. [Google Scholar] [CrossRef]

- Liu, Y.; Xiong, R.C.; Lv, S.G.; Gao, D. The Impact of Digital Finance on Green Total Factor Energy Efficiency: Evidence at China’s City Level. Energies 2022, 15, 5455. [Google Scholar] [CrossRef]

- Chen, W.J.; Mei, F.Q. Green Transformation Efficiency of Industries in China’s Resource-Based Cities: Its Spatiotemporal Evolution and Driving Factors. Ecol. Econ. 2022, 38, 78–87. (In Chinese) [Google Scholar]

- Jiang, X.X.; Wang, X.; Ren, J.; Xie, Z.M. The Nexus between Digital Finance and Economic Development: Evidence from China. Sustainability 2021, 13, 7289. [Google Scholar] [CrossRef]

- Abdo, A.B.; Li, B.; Zhang, X.D.; Lu, J.; Rasheed, A. Influence of FDI on environmental pollution in selected arab countries: A spatial econometric analysis perspective. Environ. Sci. Pollut. Res. 2020, 27, 28222–28246. [Google Scholar] [CrossRef] [PubMed]

- Xie, X.L.; Shen, Y.; Zhang, H.X.; Guo, F.J. Can digital finance promote entrepreneurship? Evidence from China. China Econ. Q. 2018, 7, 1557–1580. [Google Scholar]

- Elhorst, J.P. Spatial Econometrics: From Cross-Sectional Data to Spatial Panels; Springer: Heidelberg, Germany, 2014; pp. 37–67. [Google Scholar]

- Lesage, J.P.; Pace, R.K. Introduction to Spatial Econometrics, 1st ed.; CRC Press: New York, NY, USA, 2009. [Google Scholar]

| Target Level | Code Level | Indicator Level |

|---|---|---|

| IGT | Input indicators | Sum of the number of employees in extractive industries, manufacturing, electricity, heat, gas, and water production and supply (persons) |

| Total fixed assets of industrial enterprises above scale (million) Industrial power consumption (million kilowatts) | ||

| Industrial water consumption (million tons) | ||

| Output indicators | Total industrial output value above scale (million) | |

| Industrial wastewater discharge (million tons) | ||

| Industrial sulfur dioxide emissions (tons) | ||

| Industrial fume and dust emissions (tons) |

| Variable | Obs | Mean | Std. Dev | Min | Max |

|---|---|---|---|---|---|

| IGT | 1080 | 0.1853 | 0.1371 | 0.0135 | 1.2644 |

| DF | 1080 | 0.4900 | 0.1999 | 0.0403 | 0.9110 |

| PGDP | 1080 | 10.7239 | 0.5913 | 9.0912 | 12.2011 |

| OPEN | 1080 | 0.1801 | 0.2646 | 0.0003 | 2.5139 |

| GOV | 1080 | 0.1979 | 0.0846 | 0.0760 | 0.6750 |

| REG | 1080 | 0.8356 | 0.1958 | 0.0593 | 1.0000 |

| INF | 1080 | 2.8362 | 0.4403 | 0.8109 | 3.8373 |

| ISU | 1080 | 0.9377 | 0.4244 | 0.2723 | 4.9322 |

| GTI | 1080 | 0.9379 | 1.3251 | 0.0040 | 11.5161 |

| FIN | 1080 | 2.4012 | 0.9477 | 0.7642 | 6.5594 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variable | IGT | IGT | IGT | IGT | IGT | IGT |

| DF | 0.494 *** | 0.504 *** | 0.453 *** | 0.462 *** | 0.480 *** | 0.507 *** |

| (2.968) | (3.000) | (2.708) | (2.746) | (2.862) | (3.105) | |

| PGDP | 0.047 | 0.050 | 0.029 | 0.026 | 0.024 | |

| (1.221) | (1.293) | (0.816) | (0.717) | (0.659) | ||

| OPEN | −0.673 ** | −0.615 * | −0.640 ** | −0.659 ** | ||

| (−2.005) | (−1.886) | (−2.026) | (−2.107) | |||

| GOV | −0.245 *** | −0.221 ** | −0.219 ** | |||

| (−2.613) | (−2.361) | (−2.317) | ||||

| REG | −0.097 *** | −0.096 *** | ||||

| (−3.277) | (−3.263) | |||||

| INF | 0.015 | |||||

| (1.142) | ||||||

| Cons | −0.057 | −0.564 | −0.559 | −0.290 | −0.186 | −0.222 |

| (−0.702) | (−1.276) | (−1.266) | (−0.724) | (−0.460) | (−0.557) | |

| City | YES | YES | YES | YES | YES | YES |

| Year | YES | YES | YES | YES | YES | YES |

| R2 | 0.547 | 0.548 | 0.550 | 0.552 | 0.557 | 0.557 |

| N | 1080 | 1080 | 1080 | 1080 | 1080 | 1080 |

| Hausman test | 21.44 (0.000) |

| (1) | (2) | (3) | (4) | ||

|---|---|---|---|---|---|

| Variable | NET | L.DF | Excluding Macro Factors | Replace the Explanatory Variable | |

| IGT | IGT | IGT | IGT | SO2 | |

| DF | 0.922 * | 0.386 *** | 0.507 *** | 1.314 * | −0.174 *** |

| (1.766) | (7.723) | (2.996) | (1.660) | (−3.808) | |

| Cons | −0.496 | −0.771 | −0.222 | −0.132 | −0.140 |

| (−0.754) | (−0.959) | (−0.609) | (−0.094) | (−1.423) | |

| Control | YES | YES | YES | YES | YES |

| Province effect | NO | NO | YES | YES | NO |

| Province∗year effect | NO | NO | NO | YES | NO |

| City | YES | YES | YES | YES | YES |

| Year | YES | YES | YES | YES | YES |

| KP rk LM statistics | 85.290 | 45.765 | |||

| (0.000) | (0.000) | ||||

| KP rk Wald F statistics | 58.936 | 59.656 | |||

| (16.38) | (16.38) | ||||

| R2 | 0.553 | 0.555 | 0.557 | 0.734 | 0.743 |

| N | 1080 | 1080 | 1080 | 1080 | 1080 |

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| IGT | ISU | IGT | GTI | IGT | |

| DF | 0.507 *** | 1.756 *** | 0.413 *** | 0.314 *** | 0.401 ** |

| (3.105) | (6.132) | (2.695) | (5.824) | (2.478) | |

| ISU | 0.054 ** | ||||

| (2.130) | |||||

| GTI | 0.338 *** | ||||

| (2.763) | |||||

| Cons | −0.222 | −3.647 *** | −0.026 | 0.255 ** | −0.136 |

| (−0.558) | (−6.282) | (−0.065) | (2.170) | (−0.335) | |

| Control | YES | YES | YES | YES | YES |

| City | YES | YES | YES | YES | YES |

| Year | YES | YES | YES | YES | YES |

| R2 | 0.557 | 0.908 | 0.560 | 0.936 | 0.562 |

| N | 1080 | 1080 | 1080 | 1080 | 1080 |

| Intermediary Variables | Intermediary Effect Contribution Rate | |||

|---|---|---|---|---|

| ISU | 1.756 | 0.054 | 0.413 | 18.70% |

| GTI | 0.314 | 0.338 | 0.401 | 20.93% |

| Year | IGT | DF | ||

|---|---|---|---|---|

| Moran’s I | Z-Value | Moran’s I | Z-Value | |

| 2011 | 0.050 *** | 4.902 | 0.154 *** | 13.225 |

| 2012 | 0.029 *** | 3.292 | 0.187 *** | 15.923 |

| 2013 | 0.015 ** | 2.187 | 0.209 *** | 17.742 |

| 2014 | 0.043 *** | 4.843 | 0.231 *** | 19.481 |

| 2015 | 0.015 *** | 2.316 | 0.222 *** | 18.764 |

| 2016 | 0.009 ** | 1.721 | 0.180 *** | 15.474 |

| 2017 | 0.017 *** | 2.425 | 0.230 *** | 19.495 |

| 2018 | 0.007 * | 1.570 | 0.281 *** | 23.602 |

| 2019 | 0.034 *** | 3.605 | 0.289 *** | 24.220 |

| 2020 | 0.031 *** | 3.468 | 0.304 *** | 25.475 |

| Inspection Type | Test Statistics Results | p-Value |

|---|---|---|

| LM-Error test | 9.664 | 0.001 |

| LM-Lag test | 12.785 | 0.000 |

| R-LM-Error test | 4.180 | 0.041 |

| R-LM-Lag test | 7.300 | 0.007 |

| Wald-sar test | 24.71 | 0.000 |

| Wald-sem test | 25.54 | 0.000 |

| LR-SDM-SAR test | 24.68 | 0.000 |

| LR-SDM-SEM test | 25.79 | 0.000 |

| Hausman test | 69.53 | 0.000 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Elasticity Coefficient | Direct Effect | Indirect Effect | Total Effect | |

| DF | 0.013 ** | 0.014 ** | 0.281 *** | 0.295 *** |

| (2.426) | (2.205) | (2.630) | (2.686) | |

| W×DF | 0.281 ** | |||

| (2.529) | ||||

| Control | YES | YES | YES | YES |

| rho | 0.021 * | |||

| (1.917) | ||||

| R2 | 0.027 | |||

| City | YES | YES | YES | YES |

| Year | YES | YES | YES | YES |

| Log-likelihood | 1060.994 |

| Variable | Regional Difference | Urban Hierarchy | Traditional Financial | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Mid-Eastern Region | Western Region | Center | Peripheral | Developed | Underdeveloped | |

| DF | 0.475 * | 0.324 | 0.034 | 0.620 *** | 0.222 | 0.973 ** |

| (1.962) | (1.164) | (0.278) | (3.207) | (1.643) | (2.584) | |

| Cons | 0.361 | −1.137 ** | −0.152 | −0.205 | −0.777 | 0.855 |

| (0.736) | (−2.268) | (−0.463) | (−0.468) | (−1.115) | (1.455) | |

| Control | YES | YES | YES | YES | YES | YES |

| City | YES | YES | YES | YES | YES | YES |

| Year | YES | YES | YES | YES | YES | YES |

| R2 | 0.483 | 0.745 | 0.889 | 0.551 | 0.618 | 0.574 |

| N | 770 | 310 | 120 | 960 | 540 | 540 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fang, L.; Zhao, B.; Li, W.; Tao, L.; He, L.; Zhang, J.; Wen, C. Impact of Digital Finance on Industrial Green Transformation: Evidence from the Yangtze River Economic Belt. Sustainability 2023, 15, 12799. https://doi.org/10.3390/su151712799

Fang L, Zhao B, Li W, Tao L, He L, Zhang J, Wen C. Impact of Digital Finance on Industrial Green Transformation: Evidence from the Yangtze River Economic Belt. Sustainability. 2023; 15(17):12799. https://doi.org/10.3390/su151712799

Chicago/Turabian StyleFang, Liuhua, Bin Zhao, Wenyu Li, Lixia Tao, Luyao He, Jianyu Zhang, and Chuanhao Wen. 2023. "Impact of Digital Finance on Industrial Green Transformation: Evidence from the Yangtze River Economic Belt" Sustainability 15, no. 17: 12799. https://doi.org/10.3390/su151712799

APA StyleFang, L., Zhao, B., Li, W., Tao, L., He, L., Zhang, J., & Wen, C. (2023). Impact of Digital Finance on Industrial Green Transformation: Evidence from the Yangtze River Economic Belt. Sustainability, 15(17), 12799. https://doi.org/10.3390/su151712799