1. Introduction

Against the backdrop of increasingly fierce technological competition, innovation has become the engine of economic growth in various countries. Innovation is not only the source of competitive advantage for enterprises, but also the key to improving their value [

1]. By improving the level of enterprise innovation and enhancing core competitiveness, innovation has become a core factor in driving a country’s economic growth and in achieving industrial optimization and upgrading. Only by improving innovation efficiency and sustainability can enterprises achieve high-speed development. However, due to the constraints of technological resources and R and D personnel, relying on internal R and D to improve the technological level is relatively slow [

2,

3]. Obtaining professional technical resources from external sources has become an important way for enterprises to improve their independent innovation capabilities. Technological innovation is also an important means for enterprises to enhance their core competitiveness [

4]. Technology mergers and acquisitions refer to the acquisition of technological resources by enterprises through external mergers and acquisitions to fill technological gaps and to update and enhance their internal technological innovation capabilities [

5,

6,

7].

Oliver E. Williamson, the founder of “New Institutional Economics”, was the first to fully expound the theory of technology mergers and acquisitions. Technology mergers and acquisitions are mergers and acquisitions conducted by a company that seeks to acquire technology-related resources, such as the target company’s technology, research and development personnel, and products, in order to supplement its own research and development activities [

8].

With the increasing demand for innovation among enterprises, acquiring external technology has become an increasingly important motivation for mergers and acquisitions. The open innovation theory believes that mergers and acquisitions are a fast way for enterprises to acquire heterogeneous knowledge, which can obtain professional technologies that cannot be independently purchased through factor markets [

9,

10]. This is a shortcut for enterprises to narrow the gap in innovation capabilities with industry leaders [

11]. Technology mergers and acquisitions are also one of the most effective strategies for enterprises to quickly acquire innovative resources and enhance their technological innovation capabilities to cope with changes in their business models [

12].

Numerous emerging technologies such as big data, intelligence, Internet of Things, and cloud computing are developing rapidly. The external environment of enterprises is changing rapidly, especially during COVID-19 epidemic. Facing the challenges of Industrial Revolution 4.0, the application of information technology is particularly important for enterprise operations and decision-making. Information technology will improve business agility and business elasticity and affect the ability of enterprises to observe and analyze changes. By using information technology, enterprises can more effectively identify and deal with business opportunities, customers, and resources, thereby improving the viability of enterprises [

13]. Industrial Revolution 4.0 has had an impact on many enterprise businesses. The application of modern technology not only promotes enterprise product innovation, but also promotes enterprise service innovation. The development of digital technology can reduce enterprise costs, simplify business processes, and improve enterprise efficiency. The adoption of digital technology will improve the sustainability of enterprise development, and Fintech technology will also have a significant impact on enterprise innovation [

14]. Technology mergers and acquisitions provide more possibilities for enterprises to diversify and develop rapidly [

15]. The impact of technology on the independent innovation capabilities of mergers and acquisitions has become the focus of many scholars and business managers [

16,

17,

18].

Information technology and innovation are becoming more and more important to the sustainable development of enterprises, and related research will be a hot topic in the future. However, there is no consistent conclusion about the impact of technology mergers and acquisitions on corporate innovation, and the research on its impact mechanism is not comprehensive. In this paper, relevant literature is searched through the database, and the literature database is established and sorted according to relevance and citation frequency. We summarized, organized, and classified the literature in detail according to the research content. This paper points out the debates between existing research viewpoints, establishes connections between viewpoints, and expands and deepens existing research. By summarizing relevant literature, the shortcomings of current research are clarified, which will enrich future research fields. This provides an important theoretical support for the strategic decision-making of corporate technology mergers and acquisitions under the guidance of innovation, and also provides a reference for further optimizing the innovation incentive environment. The theoretical contributions of this paper are mainly reflected in two aspects. First, it enriches the theory of knowledge innovation. Previous research has mainly focused on product production technology innovation. This paper proposes to improve research on innovation types and enrich research on service technology innovation. Second, it enriches the theory of corporate governance. Previous research has mainly focused on the role of board governance in technology mergers and acquisitions and enterprise innovation. Corporate governance is the main factor that determines and affects company decision-making, and major shareholder shareholding, as an important element of corporate governance mechanism, has a significant impact on the effectiveness of corporate governance. Major shareholder shareholding has a significant impact on company technology mergers and acquisitions decision-making. This paper proposes to study technology mergers and acquisitions and enterprise innovation from the perspective of major shareholder shareholding. This paper consists of nine parts. The first part is the introduction. The second part is the research method and the third part is the theoretical basis. The fourth part is the study of the motivation for technology mergers and acquisitions. The fifth part is the research on the measurement methods of technology mergers and acquisitions and enterprise innovation. The sixth part is the research on the impact mechanism and path of technology mergers and acquisitions on enterprise innovation. The seventh part studies the economic consequences of technology mergers and acquisitions for enterprise innovation. The eighth part is research inspiration and future prospects. The ninth part is the research conclusion.

2. Methodology

2.1. Collection of Literature and Establishment of Literature Pool

Following a systematic literature review approach, we conducted the study in three phases [

19]. The literature with the keyword Technology Merger and Acquisitions has been included in the Web of Science database. A total of 390 papers were found. Technology M&A is an emerging research hotspot, which has received extensive attention from scholars. A further search with the keywords “technological mergers and acquisitions and innovation” found 219 articles in total, including 149 articles in the fields of business and economics.

2.2. Literature Analysis

2.2.1. Analysis of Literature Time Distribution

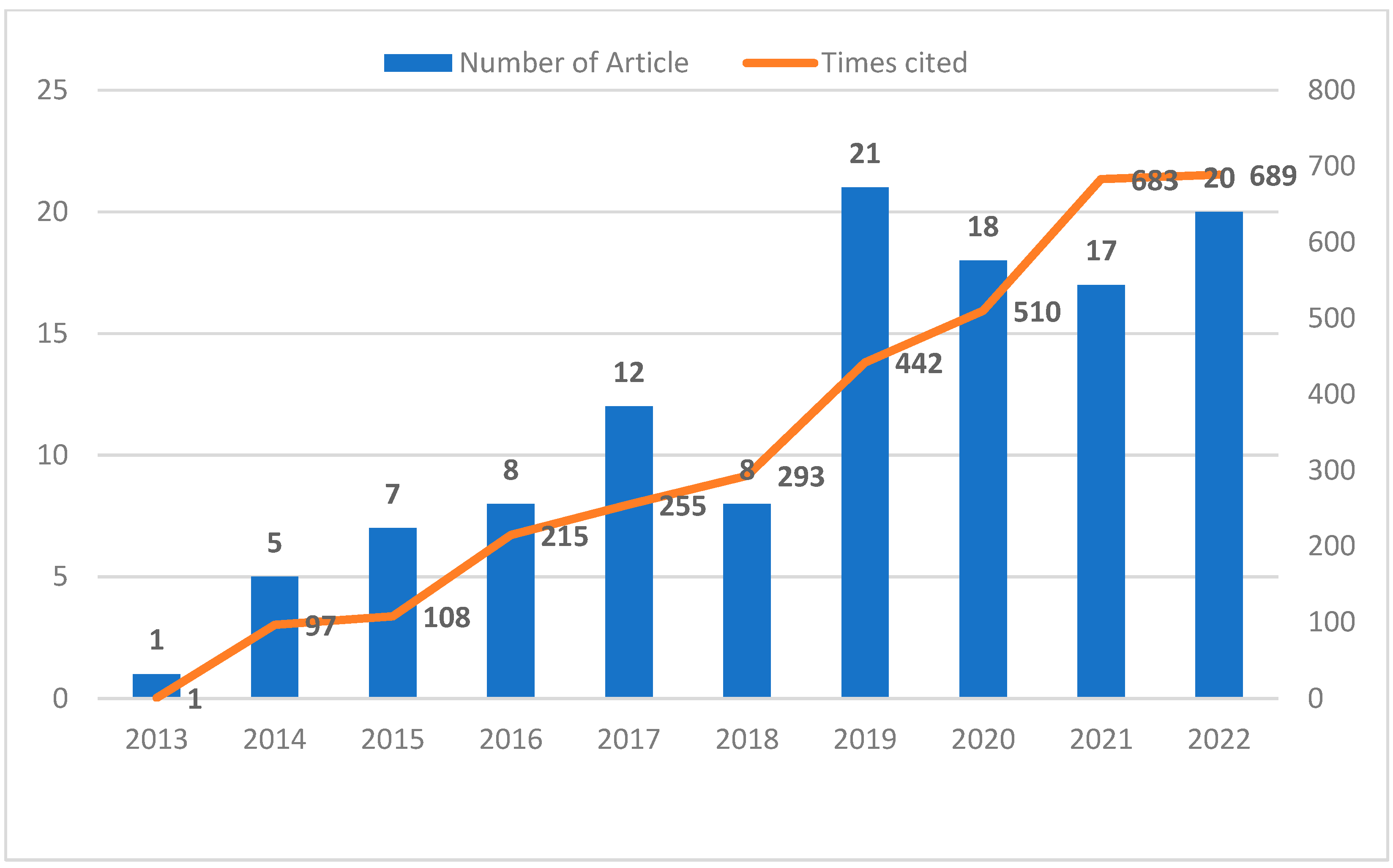

In this phase, the visualization of the data is analyzed. Selected papers are spread across disciplines. The literature is mainly after 2009, and the number of papers published each year increases from 1 in 2004 to 25 in 2022. The growth rate of papers in 2019 is relatively high and fast. This bodes well for tech M&A, which is expected to receive more attention in 2019 and peak in 2022. Tech M&A and corporate innovation are still new topics. The average annual citations of papers from 2014 to 2022 is 202. The number of published papers and the number of citations in the past 10 years are shown in

Figure 1 and

Table 1.

We then analyzed citation reports. The selected 149 papers were carefully reviewed, collated, and screened based on relevance and citation rate, and irrelevant papers were excluded. Finally, 86 papers closely related to technology mergers and acquisitions and corporate innovation were selected.

The following table shows the specific publication volume and citation frequency data of papers from 2013 to 2022.

The following table shows the specific publication quantity and citation frequency of papers from 2013 to 2022.

2.2.2. Analysis of Literature Spatial Distribution

Based on a statistical analysis of the distribution of publishing countries, it can be seen in

Table 2 that the top three countries in terms of publishing volume are China, the United States, and Germany, which are closely related to the trend of technology mergers and enterprise innovation development in these three countries. This also indicates that these countries have a high level of attention to technology mergers and enterprise innovation. Other major countries are The Netherlands, Italy, Republic of Korea, etc.

2.2.3. Analysis of Journal Distribution of Literature Publications

This study conducted a statistical analysis on the number of publications in journals. According to

Table 3, the number of Research Policy publications is 8, accounting for 5.369% of the total number of publications (149). Second, the number of Journal of Business Research journals published is 7, accounting for 4.698% of the total number of publications (149). The table shows the distribution of the top 10 journals in terms of publication quantity and publication quantity.

2.3. Literature Classification Based on Research Content

According to the research, this study divides the relevant literature into the following modules: research on the motivation of technology mergers and acquisitions, research on the measurement methods of technology mergers and acquisitions and enterprise innovation, research on the impact mechanism and path of technology mergers and acquisitions on enterprise innovation, and research on the economic consequences of technology mergers and acquisitions on enterprise innovation. The research roadmap is shown in

Figure 2.

3. Theoretical Basis

3.1. Resource-Based Theory

Resource-based theory holds that an enterprise is a collection of various resources fully and rationally utilized in business decisions to maximize their value. These resources are unique, strategic, and difficult to replicate, and they are the source of ensuring the competitive advantage of enterprises [

20]. The competitive advantage of an enterprise mainly comes from heterogeneous resources. If a valuable and scarce resource owned by an enterprise cannot be imitated or replaced by other enterprises, then this resource is called a heterogeneous resource. Enterprise technology research and development has disadvantages such as high risk, large capital investment, and long research and development cycle, which, to a certain extent inhibits the enthusiasm of enterprise regarding technology research and development. Based on the resource-based theory, technology mergers and acquisitions of enterprises can quickly acquire the advanced technology of the acquiree, absorb and integrate internal and external resources, transform the technological advantages of the acquiree into their own advantages, and enhance the competitiveness of enterprises [

21].

3.2. Absorptive Capacity Theory

One of the main purposes of technology mergers and acquisitions is to enlist the technology of the acquired party and internalize it through a series of integration measures, and the premise of this technology transfer process is the absorptive capacity. Based on the concept of absorptive capacity, arguing that enterprises can identify valuable external knowledge and enhance the flexibility and creativity of enterprises by absorbing new knowledge, enterprises can gain competitive advantages [

22]. The process of enterprises absorbing knowledge from outside was classified into four stages: acquisition, absorption, transformation, and application, and pointed out that absorptive capacity is a dynamic ability that can continuously internalize external knowledge and skills [

23]. When companies face technical difficulties, mergers and acquisitions become the fastest way to make up for related defects [

24]. To fully realize the value of mergers and acquisitions, it is necessary to absorb the technical assets of the target company and improve the innovation ability of the acquired company. Enterprises with strong absorptive capacity can effectively identify and judge whether the target enterprise is a suitable target according to their own technical needs before implementing mergers and acquisitions. In addition, enterprises with a strong absorptive capacity can effectively digest and absorb the technology of the target party after technology mergers and acquisitions, thereby improving the technological level of the enterprise.

3.3. Synergy Theory

The synergy theory suggests that enterprises can achieve resource sharing in technology, management, and capabilities between both parties through mergers and acquisitions. By complementing their advantages, the overall value of the company can be greater than the sum of the values generated by individual departments, thereby improving the performance and value of both parties and achieving a win-win situation [

25]. Collaborative effects mainly include management collaboration, operational collaboration, and financial collaboration. If two companies with different resource levels engage in mergers and acquisitions, resource complementarity can be achieved and synergies can be formed [

26]. The motivation for most companies to engage in M&A activities is to improve management efficiency and pursue synergies [

27].

4. Research on the Motivation of Technology Mergers and Acquisitions

Scholars have conducted in-depth and extensive research on the motivation for mergers and acquisitions. They believe that there are many sources of motivation for mergers and acquisitions. First, based on the assumption of maximizing profits, mergers and acquisitions can bring additional economic benefits to both parties. These benefits are covered in market power theory, synergy theory, diversification theory, undervaluation theory, and transaction cost theory. The second motivation is based on the principal-agent theory, including the theory of reducing agency costs, the inefficient manager theory, the manager overconfidence hypothesis, and the free cash flow hypothesis [

28,

29,

30].

With the deepening of economic globalization, enterprises are in a fiercely competitive environment, and most companies choose technology mergers and acquisitions to directly acquire technological resources in order to reduce the cost of acquiring technology. Williamson first elaborated on the concept of technology mergers and acquisitions from the perspective of M&A motivation. He believes that technology mergers and acquisitions refer to mergers and acquisitions initiated by large enterprises to acquire technological resources from technology-based small enterprises [

31]. Research has shown that the main motivation for technology mergers and acquisitions is to obtain high-quality and scarce technological resources from the target enterprise in order to enhance innovation capabilities [

32]. Bena and Li analyzed the mergers and acquisitions of listed companies in the United States from 1984 to 2006 and found that nearly two-thirds of mergers and acquisitions involve acquiring the target company’s technological resources and innovation capabilities [

33]. From the perspective of different industries, almost all mergers and acquisitions in the high-tech industry are driven by technology, and high-tech enterprises must have unique technical resources or proprietary knowledge to achieve rapid development [

34].

5. Measurement of Technology Mergers and Corporate Innovation

5.1. Technology Mergers and Acquisitions

Technology mergers and acquisitions mainly include three conditions. First, the target company has patent technology within the past five years. Second, the merger announcement clearly states that the main purpose of a business merger is to obtain a certain patent or technology. Third, the merger and acquisition activities are in the field of high-tech industries [

35].

5.2. Measurement Methods for Enterprise Innovation

Existing research mainly measures the innovation level and the performance of enterprises from the perspective of the innovation process and innovation output.

- (1)

The innovation process mainly measures the degree of resource investment of enterprises in technology mergers and acquisitions, including innovation process indicators such as R&D investment intensity and proportion of technical personnel [

36], using R&D investment to measure innovation performance [

37], employing the ratio of R&D investment to sales revenue to measure the intensity of innovation investment, and treating it as a proxy variable for innovation performance [

38]. Some scholars also believe that measuring corporate performance based on innovation investment is unreasonable and lacks constraints on investment efficiency and that there is significant room for manipulation in the disclosure of R&D innovation data [

39]. High-tech enterprises often obtain government subsidies by manipulating research and development data, leading to issues regarding matters such as the authenticity of research and development investment data [

40].

- (2)

Innovation output is measured in terms of patent output, product market, and product profit indicators [

41]. The indicators of patent output and product market mainly include the number of patents obtained that year, the number of invention patents/average total assets, the number of patent citations, the development process of new markets, the uniqueness of products, the market share of new products, and other innovation output indicators [

42]. Profit indicators mainly include the return on research and development investment, the degree of profitability that innovation can bring, profits, and the growth rate of profits [

43].

Some studies have also pointed out that the sales uncertainty of new products is relatively high, and some patents ultimately cannot be applied to product production. In contrast, using the number of patents to reflect a company’s innovation situation would be more comprehensive [

44,

45]. In-depth research on the alternative variables of innovation performance has proposed a comprehensive indicator of industrial technology innovation performance to measure innovation performance [

37] (

Table 4).

6. Research on the Consequences of Technology Mergers and Acquisitions on Enterprise Innovation

Most scholars use empirical research methods to explore the impact of enterprise technology mergers and acquisitions on enterprise innovation, but a unified conclusion has not yet been formed. Research generally believes that technology mergers and acquisitions can bring new external knowledge to enterprises, and the conclusion on how external technology resources can promote enterprise innovation mainly includes two different aspects: positive promotion and negative inhibition.

6.1. Positive Promotion Theory

Forward promotion is mainly analyzed based on economies of scale and synergy theory. According to the theory of economies of scale, mergers and acquisitions will increase the company’s production scale and quantity, and reduce the unit cost of products, thereby generating economies of scale, which will lead to an increase in the company’s profits. Through mergers and acquisitions, companies can gain or strengthen market power and improve overall competitiveness. Synergy theory holds that mergers and acquisitions will increase efficiency [

27]. After the enterprise obtains the core technical resources of the acquired party, it learns to absorb these technical resources and transform them into its own knowledge, thereby improving the innovation level of the enterprise [

47]. Existing literature has studied the relationship between the two from different perspectives. Research suggests that the stronger a company’s technological absorption capacity, the stronger its technological relevance and the smaller its technological differences. Technological mergers and acquisitions have a more significant promoting effect on the innovation performance of the company after the merger and acquisition [

12,

48]. Technology mergers and acquisitions not only directly bring technological innovation output performance to the acquired enterprise, but also bring technological innovation promotion performance to the acquired company [

49,

50].

Specifically, technology mergers and acquisitions can significantly increase the output and the citation frequency of patents of listed companies after mergers and acquisitions. This promoting effect is more significant in enterprises with weaker technological capabilities. This promoting effect is more significant in enterprises with weaker technological capabilities before mergers and acquisitions [

51,

52]. Further research has found differences in the impact of technology mergers and acquisitions on corporate innovation among different industries [

46]. The possibility of mergers and acquisitions in the same industry and the level of bargaining power have improved the R&D level of enterprises by enhancing the competitiveness of the industry.

6.2. Negative Inhibition Theory

Contrary research shows that technology mergers and acquisitions reduce the innovation level of firms. The reason for this may come from various factors such as resource occupation, post-merger integration, and merger motivation. The theory of limited resources holds that mergers and acquisitions will occupy corporate resources. After the merger, the complexity of the organizational structure and the tightening of financing constraints will lead to a reduction in research and development expenses, and the attention of managers themselves will be scarce. After M&A, managers with limited time and energy turn their attention to external technology procurement [

53]. Instead of increasing R&D productivity post-merger, it actually declined. Excessive reliance on external acquisitions leads to a decline in the company’s independent innovation capabilities [

23,

54]. Mergers and acquisitions may even inhibit the increase in the acquirer’s innovation investment and the decrease in the number of patents, leading to a decline in corporate innovation performance [

55,

56].

Research based on M&A motivation suggests that differences in M&A motivation can also have different impacts on the technological innovation activities of both of the parties involved in the merger. Research has pointed out that the purpose of technology mergers and acquisitions is to avoid market competition, rather than to effectively absorb and internalize the acquired technology. Therefore, technology mergers and acquisitions cannot enhance the independent innovation ability of enterprises [

57]. Furthermore, studies have pointed out, from the perspective of post-merger resource utilization, that due to managers shifting their attention to external technology procurement, the R&D productivity of enterprises after mergers and acquisitions has not improved, but rather, has decreased. Therefore, excessive reliance on external acquisitions has led to a decrease in the company’s independent innovation ability [

38,

58]. There are also studies that suggest, from the perspective of post-merger integration, that if sufficient integration measures are not taken after mergers and acquisitions, or if there is inertia in independent innovation due to technology purchases, it will have a negative impact on the innovation performance of enterprises (

Table 5).

7. Research on the Mechanism and Path of the Impact of Technology Mergers and Acquisitions on Enterprise Innovation

Existing research has studied the mechanism and the impact path of technology mergers and acquisitions on corporate innovation from different perspectives, mainly including the following aspects.

7.1. Institutional Environment

With the continuous improvement in the status of emerging market economies, the role of institutional factors in emerging market research is receiving increasing attention from scholars. The reason that institutions are so important is because, as a social transaction rule, they reduce uncertainty in the market transaction process by establishing a stable structure. Government policy support and institutional constraints in the institutional environment are the foundation for the effective utilization of technological resources. Porta et al., demonstrated the significant impact of the institutional environment on capital market size, governance structure, corporate value, equity structure, and dividend policy, thus pioneering the field of “law and finance” research [

60].

Generally speaking, the institutional environment refers to the external environment faced by a company, usually including political, economic, cultural, and legal environments such as market competition, government governance, institutional reform, and legal aspects. The system determines the transaction cost, the coordination cost, and the innovation level of social activities. Unlike institutional research in a single context, overseas mergers and acquisitions involve cross-border situations and inevitably involve institutional differences between countries [

61]. These differences constitute institutional differences and knowledge distances between countries. The traditional view is that, as institutional differences and knowledge distances between countries increase, acquirers need to spend more time understanding the business environment, the cultural customs, and other aspects of the host country. Therefore, the cost of information collection will increase, and the difficulty of resource acquisition will also increase. At the same time, the larger the institutional differences and knowledge distance, the harder it is for both parties to understand the operational rules of the other company. This can make it difficult for the acquiring party to acquire technology and transfer knowledge at the later stage. Institutional factors determine the risk, return, and innovation level of external investment [

61]. Meanwhile, high-tech enterprises may benefit from national policy support for cross-border mergers and acquisitions and gain competitive advantages [

62].

7.2. Corporate Governance

In the field of mergers and acquisitions, the impact of internal governance mechanisms on merger and acquisition performance has mainly been studied from three aspects: equity structure, board governance, and management governance. The ownership structure is the core of corporate governance research, and related research mainly focuses on the equity concentration ratio, equity balance, and the nature of controlling equity. The concentration of equity varies, and the motivation and the ability of shareholders to govern and supervise also differ. Scattered small and medium-sized shareholders are highly likely to engage in “free riding” behavior, so the higher the concentration of equity, the more conducive it is to improving merger and acquisition performance [

52,

63]. There are also contrary studies that believe that, in the case of highly concentrated equity, there is a serious second type of principal–agent problem, which ultimately inhibits the improvement in M&A performance. The nature of equity holders in enterprises varies, and their interests and demands will also vary, thus having varying degrees of impact on mergers and acquisitions.

In terms of board governance, research is mainly conducted from the perspective of board structure, including board size, independent directors, and dual role integration. The relevant research conclusions are also inconsistent [

64]. Management governance is mainly divided into two aspects: management shareholding and management compensation. Low levels of management shareholding make effective mergers and acquisitions easier, and management compensation affects attitudes towards mergers and acquisitions [

65]. Executive shareholding can play an active role in governance, effectively alleviating the principal–agent problem in mergers and acquisitions and improving the performance of mergers and acquisitions [

66].

7.3. Technical Relevance

Makri et al., first classified mergers and acquisitions into technology similarity mergers and acquisitions and complementary mergers and acquisitions, based on the degree of technological relevance [

49]. According to various motivations of mergers and acquisitions, technology mergers and acquisitions can be roughly divided into two types: technology- independent mergers and acquisitions and technology-related mergers and acquisitions. Technology-related mergers and acquisitions also include technology-similar mergers and technology-complementary mergers and acquisitions. Technology-independent mergers and acquisitions, also known as breakthrough mergers and acquisitions, refer to the direct acquisition of core technologies in this field by enterprises through technology mergers and acquisitions. Technology-similar M&A refers to the acquisition of technologies that are often highly specialized. Through technology mergers and acquisitions, mergers and acquisitions obtain technologies that have a certain degree of similarity with their own technical knowledge and integrate and absorb them to achieve new technological breakthroughs or consolidate existing technological advantages. Technology-complementary mergers and acquisitions can expand the breadth and depth of technical knowledge and strengthen the company’s technical advantages.

Technology-similarity mergers and acquisitions can reduce information asymmetry in mergers and acquisitions, and similar knowledge sources can promote connectivity between the knowledge bases of both parties. Mergers and acquisitions that are technically related will generate more patents [

33]. The absorption and integration of knowledge is beneficial for improving innovation productivity. Similar mergers and acquisitions make it easier to achieve economies of scope and scale in the short term [

37,

49]. The performance of technology acquisition largely depends on the overlap of knowledge between the acquiring parties [

2]. Technology-complementary mergers and acquisitions can help enterprises better acquire the knowledge and capabilities of the acquired party, accelerate the integration and application of new knowledge, and complementary science and technology can promote the absorption of knowledge and stimulate the generation of new technologies [

67]. Complementary technical knowledge can introduce heterogeneous knowledge to the main and enterprise, expanding the degree of diversification of technical knowledge [

12]. The technological differences in segmented fields can stimulate enterprises to conduct external searches, activate their own and external resources, and thereby improve innovation capabilities and performance [

49].

7.4. Technical Absorption Capacity

Whether a company can smoothly utilize external technology after technology mergers and acquisitions depends, to a certain extent, on whether the company has the knowledge foundation to absorb, utilize, and transform external technology [

68,

69]. Cohen and Levinthal first proposed the concept of absorptive capacity, believing that enterprises can identify valuable external knowledge and enhance their flexibility and creativity by absorbing new knowledge, thereby gaining a competitive advantage. Based on the resource-based theory, sufficient and effective knowledge integration is key to improving the innovation ability of enterprises after technology mergers and acquisitions. The creation of new knowledge in technological innovation first requires the recombination of existing knowledge, and the different integration capabilities of enterprises depend on differentiated knowledge reserves and knowledge absorption efficiency [

70,

71].

Zahra and George further divided the process of enterprises absorbing knowledge from the outside into four stages: acquisition, absorption, transformation, and application, and pointed out that absorption is a dynamic ability that can continuously internalize external knowledge and skills [

72]. The ability to absorb knowledge can promote the transfer of knowledge and technology, contributing to the research and development of new technologies and, thus, enhancing the independent innovation ability of enterprises [

47,

59,

73,

74]. Enterprises with strong knowledge absorption capabilities are more likely to transform the external knowledge that they absorb into innovative outputs, and to internalize external resources into their own innovation capabilities, in order to better obtain and maintain competitive advantages [

7,

75].

In the field of cross-border M&A research, the impact of corporate absorption capacity on the relationship between M&A and innovation has received special attention [

76,

77]. Enterprises with strong knowledge absorption capabilities can more effectively promote the flow of internal and external resources, dynamically absorb and innovate external technological resources introduced by technology mergers and acquisitions, and enhance their independent research and development capabilities, especially in highly uncertain innovation environments [

78]. This avoids internal core rigidity, accelerates the coordination of internal and external technological resources, effectively enhances the independent innovation ability of the enterprise, and thus enhances the overall innovation ability of the enterprise.

7.5. Impact on Internal Research and Development

Existing research generally believes that technology mergers and acquisitions can quickly acquire target technologies, but there is still controversy over whether their promotion effect on enterprise innovation is higher than that of internal research and development [

79]. The promotion theory suggests that, with the intensification of external competition and the increasing complexity of technological structures, companies need to respond through breakthrough innovation due to internal resource and capacity limitations. Due to the long-term nature and the high uncertainty of internal research and innovation, internal research and development may face higher risks [

64]. Developing all of the technologies within a company may not be economical [

80], while technology mergers and acquisitions can help companies acquire the necessary technical knowledge in a short period of time [

2]. Technology mergers and acquisitions can bring complementary innovation resources to enterprises [

16,

81], achieve economies of scale and scope in R&D-related activities [

43], and improve enterprise R&D efficiency and innovation capabilities [

12].

External knowledge can avoid inefficient, repetitive activities; avoid organizational inertia and capacity rigidity caused by the repeated use of existing knowledge; and generate innovative synergies [

42,

82], thereby reducing the risks introduced by closed innovation and improving the innovation capability of enterprises through breakthroughs [

83,

84]. However, contrasting studies have shown that mergers and acquisitions, as large-scale investments, can occupy a company’s funds and may reduce internal R&D investment in similar technologies. At the same time, post-merger integration activities can also occupy management and other resources [

39]. Therefore, a reduction in enterprise R&D investment affects a company’s future innovation ability and increases the risk of R&D failure, ultimately reducing the company’s innovation level [

57,

85]. The implementation of collaborative efficiency requires the redeployment of resources and may result in meaningless resource waste due to integration failure. Relying on external procurement technology may also lead to loss of internal capabilities [

49] (

Table 6).

8. Discussion

8.1. Construction of Multi-Level Indicators to Measure the Innovation Capability of Enterprises

The differences in research conclusions may be due to differences in measurement methods for enterprise innovation. Due to the complex process of enterprise innovation activities, using a single indicator cannot comprehensively measure the innovation level of the enterprise and cannot reflect the entire process of enterprise innovation. The existing indicator system emphasizes enterprises’ investment in innovation, while neglecting the innovation output after the transforming of R&D resources. In terms of innovation output, excessive emphasis on patent data makes it difficult to measure it more comprehensively and accurately. In addition, the construction of indicators mostly measures the current effectiveness and can only reflect the innovation level the enterprise has already demonstrated. However, enterprise innovation is a continuous activity, and current indicators do not easily reflect the potential technological development capabilities of enterprises. In terms of building enterprise innovation indicators, it is important to build multi-level comprehensive indicators to comprehensively measure the comprehensive innovation ability of enterprises in product lines, services, processes, and systems from the perspectives of process and output.

8.2. Compare the Impact of Technology Mergers and Acquisitions on Corporate Innovation under Different Institutional Environments and Industry Attributes

There is no consensus on whether technology mergers and acquisitions can have a positive promoting effect on enterprise innovation. Most scholars believe that technology mergers and acquisitions will have a certain degree of impact on corporate performance, but there is still no consensus on the direction of the impact. The differences in research conclusions may be due to using different research methods, research samples and indicator measurement methods. Different research samples and data lead to different conclusions. There are significant differences in the institutional environment and corporate governance among different countries and regions, as well as significant differences in openness, inclusivity, and regulatory norms in the stock market, leading to different consequences and research conclusions. It is necessary to compare and study the impact of technology mergers and acquisitions on corporate innovation in institutional environments of different countries and regions. In addition, different industrial characteristics have different demands on the innovation ability of enterprises. Manufacturing enterprises belong to technology-intensive industries, while service enterprises belong to knowledge-intensive industries. The impact of technology mergers and acquisitions on innovation varies among different industries, and research should be conducted based on industry differentiation. With the spread of diversification strategies, more companies are crossing multiple industries. Even within the same industry, the heterogeneity of the environment in which they operate is also strong. The mergers and acquisitions of diversified companies should differ from those of a single industry. Comparative research can be conducted on the impact results.

8.3. Strengthen Research on Equity Characteristics and Enterprise Innovation

At present, the research on its influencing mechanism mainly focuses on factors such as knowledge distance, different types of mergers and acquisitions, and corporate absorptive capacity, but the analysis of corporate equity characteristics is not enough. As an important corporate governance mechanism, the behavior of large shareholders in the process of mergers and acquisitions has attracted much attention. As an important part of the corporate governance mechanism, the holdings of major shareholders have a significant impact on the effectiveness of corporate governance. The shareholding of major shareholders will affect the company’s technology M&A decision. Different ownership concentration will show different M&A motivations. Through M&A support or hollow companies, the relationship between technology M&A and corporate innovation will be further affected. No in-depth research on technology M&A from the perspective of major shareholders.

8.4. Strengthen Research on the Characteristics of Mergers and Acquisitions Transactions and Enterprise Innovation

Affiliated mergers and acquisitions occupy an undeniable position in the mergers and acquisitions market, and the valuation is relatively high, especially when the capital market is underdeveloped and information asymmetry appears. Such M&A characteristics may affect the relationship between technology M&A and corporate innovation. Hence, it is necessary to strengthen research on transaction characteristics in technology mergers and acquisitions and corporate innovation.

8.5. Expand Research on Different Types of Innovation

The current research mainly focuses on the impact of technological mergers and acquisitions on the technological innovation ability of enterprise product production, including a series of processes such as technological invention innovation, production process innovation, internal management innovation, and marketing innovation. With the development of Industry 4.0, new technologies emerge in an endless stream. In the context of the knowledge economy and the development of digital technology, the scope of technology mergers and acquisitions is getting wider and wider. Enterprise management innovation is equally important for enterprises. For example, the innovation of payment technology can speed up the response speed of enterprises to demand, improve the business agility of enterprises, and lead to enterprise innovation. In the future, we should broaden the research on different types of innovative technology mergers and acquisitions.

9. Conclusions

This paper sorts out the relevant theories on the impact of technology mergers and acquisitions on corporate innovation, and summarizes the relevant literature from several aspects such as technology mergers and acquisitions motivation, index measurement, impact consequences, impact mechanism, and path research. The study found that relevant literature mainly uses empirical research methods to explore the impact of technology mergers and acquisitions on corporate innovation, but has not yet formed a unified insight. Given the research results, the conclusions on how external technical resources promote enterprise innovation mainly include two different aspects: positive promotion and negative inhibition. In terms of the impact mechanism, the research is mainly carried out from several aspects such as the institutional environment, corporate governance, technical relevance, technical absorptive capacity, and internal research and development.

This paper believes that relevant research is relatively single and one-sided in measuring innovation indicators, and it is necessary to construct multi-level comprehensive innovation capability measurement indicators based on inputs and outputs, including product lines, services, processes, and systems. From the perspective of the impact mechanism, different systems and industries have different situations. It is necessary to analyze the deep-seated impact mechanism and path of technology mergers and acquisitions on corporate innovation, and compare the impact of technology mergers and acquisitions on corporate innovation under the unique institutional environment and industry attributes. In addition, based on product innovation and service innovation, expand different types of innovation research.

Author Contributions

Conceptualization, L.S.; software, L.S. and K.Y.; validation, K.Y. and H.J.; formal analysis, L.S. and H.J.; investigation, L.S.; resources, L.S. and H.J.; data curation, L.S.; writing—original draft, L.S. and K.Y.; writing—review & editing, L.S. and K.Y.; visualization, H.J.; supervision, L.S. and H.J.; project administration, L.S. and K.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by China National Social Science Fund project: Research on the Causes and Economic Consequences of “High Valuation and High Performance Commitment” in Merger and Reorganization of Listed Companies in China (Grant number: 18BGL066).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aghion, P.; Howitt, P. Endogenous Growth Theory; The MIT Press: Cambridge, MA, USA, 1998; pp. 327–340. [Google Scholar]

- Sears, J.; Hoetker, G. Technological overlap, technological capabilities, and resource recombination in technological acquisitions. Strateg. Manag. J. 2014, 35, 48–67. [Google Scholar] [CrossRef]

- Agrawal, A.; Jaffe, J.F.; Mandelker, G.N. The Post-Merger Performance of Acquiring Firms: A Re-Examination of an Anomaly. J. Financ. 1992, 47, 1605–1621. [Google Scholar] [CrossRef]

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business Press: Boston, MA, USA, 2003. [Google Scholar]

- Christofi, M.; Vrontis, D.; Thrassou, A.; Shams, S.M.R. Triggering technological innovation through cross-border mergers and acquisitions: A micro-foundational perspective. Technol. Forecast. Soc. Chang. 2019, 146, 148–166. [Google Scholar] [CrossRef]

- Lin, B.; Chen, W.; Chu, P. Mergers and Acquisitions Strategies for Industry Leaders, Challengers, and Niche Players: Interaction Effects of Technology Positioning and Industrial Environment. IEEE Trans. Eng. Manag. 2015, 62, 80–88. [Google Scholar] [CrossRef]

- Čirjevskis, A. The Role of Dynamic Capabilities as Drivers of Business Model Innovation in Mergers and Acquisitions of Technology-Advanced Firms. J. Open Innov. Technol. Mark. Complex. 2019, 5, 12. [Google Scholar] [CrossRef]

- Ruckman, K. Technology sourcing acquisitions: What they mean for innovation potential. J. Strategy Manag. 2009, 2, 56–75. [Google Scholar] [CrossRef]

- Jack, H.J.; Xuan, T. Finance and Corporate Innovation: A Survey. Asia-Pac. J. Financ. Stud. 2018, 47, 165–212. [Google Scholar]

- Kogan, L.; Papanikolaou, D.; Seru, A.; Stoffman, N. Technological innovation, resource allocation, and growth. Q. J. Econ. 2017, 132, 665–712. [Google Scholar] [CrossRef]

- Higgins, M.J.; Rodriguez, D. The Outsourcing of R&D through Acquisition in the Pharmaceutical Industry. Soc. Sci. Electron. Publ. 2006, 80, 351–383. [Google Scholar]

- Ahuja, G.; Katila, R. Technological Acquisitions and the Innovation Performance of Acquiring Firms: A Longitudinal Study. Strateg. Manag. J. 2001, 22, 197–220. [Google Scholar] [CrossRef]

- Setiawati, R.; Eve, J.; Syavira, A.; Ricardianto, P.; Nofrisel; Endri, E. The Role of Information Technology in Business Agility: Systematic Literature Review. Qual. Access Success 2022, 23, 144–149. [Google Scholar]

- Najib, M.; Ermawati, W.J.; Fahma, F.; Endri, E.; Suhartanto, D. Fintech in the small food business and its relation with open innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 88. [Google Scholar] [CrossRef]

- Hanelt, A.; Firk, S.; Hilebrandt, B.; Kolbe, L.M. Digital M&A, digital innovation, and firm performance: An empirical investigation. Eur. J. Inf. Syst. 2021, 30, 3–26. [Google Scholar]

- Rossi, M.; Thrassou, A.; Vrontis, D. Biotechnological mergers and acquisitions: Features, trends and new dynamics. J. Res. Mark. Entrep. 2015, 17, 91–109. [Google Scholar]

- Rossi, M.; Yedidia Tarba, S.; Raviv, A. Mergers and acquisitions in the hightech industry: A literature review. Int. J. Organ. Anal. 2013, 21, 66–82. [Google Scholar] [CrossRef]

- Stiebale, J.; Reize, F. The impact of FDI through mergers and acquisitions on innovation in target firms. Int. J. Ind. Organ. 2011, 29, 155–167. [Google Scholar] [CrossRef]

- Webster, J.; Watson, R.T. Analyzing the past to prepare for the future: Writing a literature review. MIS Q. 2002, 26, xiii–xxiii. [Google Scholar]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Cassiman, B.; Colombo, M.G.; Garrone, P.; Veugelers, R. The impact of M&A on the R&D process: An empirical analysis of the role of technological-and market-relatedness. Res. Policy 2005, 34, 195–220. [Google Scholar]

- Ansoff, H.I. Corporate strategy. In Bloomsbury Business Library—Management Library; McGraw-Hill: New York, NY, USA, 1965; Volume 315, p. 25. [Google Scholar]

- Williamson, O.E. Markets and Hierarchies: Analysis and Antitrust Implications: A Study in the Economics of Internal Organization; University of Illinois at Urbana-Champaign’s Academy for Entrepreneurial Leadership Historical Research Reference in Entrepreneurship; Oxford University Press: Oxford, UK, 1975. [Google Scholar]

- Jensen, M.C.; Ruback, R.S. The market for corporate control: The scientific evidence. J. Financ. Econ. 1983, 11, 5–50. [Google Scholar] [CrossRef]

- Grant, M.; Nilsson, F.; Frimanson, L. Merger & Acquisitions as Multitude of Processes: A Review of Qualitative Research. In The Routledge Companion to Mergers and Acquisitions; Informa UK Limited: Colchester, UK, 2015; pp. 287–306. [Google Scholar]

- Fama, E.F.; Jensen, M.C. Separation of Ownership and Control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Organizational forms and investment decisions. J. Financ. Econ. 1985, 14, 101–119. [Google Scholar] [CrossRef]

- Williamson, O.E. Corporate Control and Business Behavior: An Inquiry into the Effects of Organization Form on Enterprise Behavior; Free Press: New York, NY, USA, 1970. [Google Scholar]

- Hall, B.H. The Effect of Takeover Activity on Corporate Research and Development. In Corporate Takeovers: Causes and Consequences; University of Chicago Press: Chicago, IL, USA, 1988; pp. 69–100. [Google Scholar]

- Bena, J.; Kai, L.I. Corporate Innovations and Mergers and Acquisitions. J. Financ. 2014, 69, 1923–1960. [Google Scholar] [CrossRef]

- Nielsen, J.F.; Melicher, R.W. A Financial Analysis of Acquisition and Merger Premiums. J. Financ. Quant. Anal. 1973, 8, 139–148. [Google Scholar] [CrossRef]

- Huang, L.; Shang, L.; Wang, K.; Porter, A.L.; Zhang, Y. Identifying Target for Technology Mergers and Acquisitions Using Patent Information and Semantic Analysis. In Proceedings of the 2015 Portland International Conference on Management of Engineering and Technology (PICMET), Portland, OR, USA, 2–6 August 2015; IEEE: New York, NY, USA, 2015; pp. 2313–2321. [Google Scholar]

- Rhodes-Kropf, M.; Robinson, D.T. The Market for Mergers and the Boundaries of the Firm. J. Financ. 2008, 63, 1169–1211. [Google Scholar] [CrossRef]

- Hagedoorn, J.; Duysters, G. The Effect of Mergers and Acquisitions on the Technological Performance of Companies in a High-tech Environment. Res. Memo. 2000, 14, 67–85. [Google Scholar] [CrossRef][Green Version]

- Ornaghi, C. Mergers and innovation in big pharma. Int. J. Ind. Organ. 2009, 27, 70–79. [Google Scholar] [CrossRef]

- Bloom, N.; Reenen, J.V. Patents, Real Options and Firm Performance. Econ. J. 2010, 112, 97–116. [Google Scholar] [CrossRef]

- Kaneko, K.; Kajikawa, Y. Novelty Score and Technological Relatedness Measurement Using Patent Information in Mergers and Acquisitions: Case Study in the Japanese Electric Motor Industry. Glob. J. Flex. Syst. Manag. 2022, 24, 163–177. [Google Scholar] [CrossRef]

- Vyas, V.; Narayanan, K.; Ramanathan, A. Mergers and acquisitions, technological efforts and exports: A study of pharmaceutical sector in India. Innov. Dev. 2013, 3, 169–186. [Google Scholar] [CrossRef]

- Lvarez, I.; Torrecillas, C. Interactive learning processes and mergers and acquisitions in national systems of innovation. Transnatl. Corp. Rev. 2020, 12, 63–81. [Google Scholar] [CrossRef]

- Phillips, J.G.; Heidrick, T.R.; Potter, I.J. Technology Futures Analysis Methodologies for Sustainable Energy Technologies. Int. J. Innov. Technol. Manag. 2007, 4, 171–190. [Google Scholar] [CrossRef]

- Wu, H.; Qu, Y. How do firms promote green innovation through international mergers and acquisitions: The moderating role of green image and green subsidy. Int. J. Environ. Res. Public Health 2021, 18, 7333. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Y.; Sun, Z.; Sun, M.; Zhou, Y. The effective path of green transformation of heavily polluting enterprises promoted by green merger and acquisition—Qualitative comparative analysis based on fuzzy sets. Environ. Sci. Pollut. Res. 2022, 29, 63277–63293. [Google Scholar] [CrossRef]

- Entezarkheir, M.; Moshiri, S. Innovation spillover and merger decisions. Empir. Econ. 2021, 61, 2419–2448. [Google Scholar] [CrossRef]

- Arvanitis, S.; Stucki, T. Do mergers and acquisitions among small and medium-sized enterprises affect the performance of acquiring firms? Int. Small Bus. J. 2015, 33, 752–773. [Google Scholar] [CrossRef]

- Liang, X.; Li, S.; Luo, P.; Li, Z. Green mergers and acquisitions and green innovation: An empirical study on heavily polluting enterprises. Environ. Sci. Pollut. Res. 2022, 29, 48937–48952. [Google Scholar] [CrossRef]

- Makri, M.; Hitt, M.A.; Lane, P.J. Complementary technologies, knowledge relatedness, and invention outcomes in high technology mergers and acquisitions. Strateg. Manag. J. 2010, 31, 602–628. [Google Scholar] [CrossRef]

- Li, J. Can technology-driven cross-border mergers and acquisitions promote green innovation in emerging market firms? Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 27954–27976. [Google Scholar] [CrossRef] [PubMed]

- Zhao, X. Technological Innovation and Acquisitions. Manag. Sci. 2009, 55, 1170–1183. [Google Scholar] [CrossRef]

- Celik, M.A.; Tian, X.; Wang, W.Y. Acquiring Innovation under Information Frictions. Rev. Financ. Stud. 2022, 35, 4474–4517. [Google Scholar] [CrossRef]

- Hitt, M.A.; Hoskisson, R.E.; Ireland, R.D.; Harrison, J.S. Effects of acquisitions on R&D inputs and outputs. Acad. Manag. J. 1991, 34, 693–706. [Google Scholar]

- Seru, A. Firm boundaries matter: Evidence from conglomerates and R&D activity. J. Financ. Econ. 2014, 111, 381–405. [Google Scholar]

- Giudice, M.D.; Maggioni, V.; Del Giudice, M.; Maggioni, V. Managerial practices and operative directions of knowledge management within inter-firm networks: A global view. J. Knowl. Manag. 2014, 18, 841–846. [Google Scholar] [CrossRef]

- Haucap, J.; Rasch, A.; Stiebale, J. How mergers affect innovation: Theory and evidence. Int. J. Ind. Organ. 2019, 63, 283–325. [Google Scholar] [CrossRef]

- Szücs, F. M&A and R&D: Asymmetric effects on acquirers and targets? Res. Policy 2014, 43, 1264–1273. [Google Scholar]

- Dezi, L.; Battisti, E.; Ferraris, A.; Papa, A.; Janney, D.J.; He, P.L. The link between mergers and acquisitions and innovation. Manag. Res. Rev. 2018, 41, 716–752. [Google Scholar] [CrossRef]

- Colombo, M.G.; Rabbiosi, L. Technological similarity, post-acquisition R&D reorganization, and innovation performance in horizontal acquisitions. Res. Policy 2014, 43, 1039–1054. [Google Scholar]

- Porta, R.; Lopez de Silanes, F.; Shleifer, A. Corporate Ownership around the World. J. Financ. 1999, 54, 471–517. [Google Scholar] [CrossRef]

- Cheng, C.; Yang, M. Enhancing performance of cross-border mergers and acquisitions in developed markets: The role of business ties and technological innovation capability. J. Bus. Res. 2017, 81, 107–117. [Google Scholar] [CrossRef]

- Schneider, M.R.; Schulze-Bentrop, C.; Paunescu, M. Mapping the institutional capital of high-tech firms: A fuzzy-set analysis of capitalist variety and export performance. J. Int. Bus. Stud. 2010, 41, 246–266. [Google Scholar] [CrossRef]

- Shleifer, A.; Vishny, R.W. A survey of corporate governance. J. Financ. 1997, 52, 737–783. [Google Scholar] [CrossRef]

- Brickley, J.A.; Zimmerman, J.L. Corporate governance myths: Comments on Armstrong, Guay, and Weber. J. Account. Econ. 2010, 50, 235–245. [Google Scholar] [CrossRef]

- Ferreira, M.A.; Matos, P. The colors of investors’ money: The role of institutional investors around the world. J. Financ. Econ. 2008, 88, 499–533. [Google Scholar] [CrossRef]

- Sun, Z. In Search of Complementarity in China’s Innovation Strategy through Outward Strategic Mergers and Acquisitions Policy: A Behavioural Additionality Approach. Sci. Technol. Soc. 2018, 23, 107–136. [Google Scholar] [CrossRef]

- Grimpe, C.; Hussinger, K. Resource Complementarity and Value Capture in Firm Acquisitions: The Role of Intellectual Property Rights. Strateg. Manag. J. 2014, 35, 1762–1780. [Google Scholar] [CrossRef]

- Puranam, P.; Singh, H.; Zollo, M. Organizing for Innovation: Managing the Coordination-Autonomy Dilemma in Technology Acquisitions. Acad. Manag. J. 2006, 49, 263–280. [Google Scholar] [CrossRef]

- Schweisfurth, T.G.; Raasch, C. Absorptive capacity for need knowledge: Antecedents and effects for employee innovativeness. Res. Policy 2018, 47, 687–699. [Google Scholar] [CrossRef]

- Prabhu, J.C.; Chandy, R.K.; Ellis, M.E. The impact of acquisitions on innovation: Poison pill, placebo, or tonic? J. Mark. 2005, 69, 114–130. [Google Scholar] [CrossRef]

- Phene, A.; Tallman, S.; Almeida, P. When Do Acquisitions Facilitate Technological Exploration and Exploitation? J. Manag. 2012, 38, 753–783. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. The Net-Enabled Business Innovation Cycle and the Evolution of Dynamic Capabilities. Inf. Syst. Res. 2002, 13, 147–150. [Google Scholar] [CrossRef]

- De Man, A.-P.; Duysters, G. Collaboration and innovation: A review of the effects of mergers, acquisitions and alliances on innovation. Technovation 2005, 25, 1377–1387. [Google Scholar] [CrossRef]

- Huang, P.; Humpheryjenner, M.; Lothian, J.R. Cross-border mergers and acquisitions for innovation. J. Int. Money Financ. 2021, 112, 102320–102345. [Google Scholar] [CrossRef]

- Jo, G.S.; Park, G.; Kang, J. Unravelling the link between technological M&A and innovation performance using the concept of relative absorptive capacity. Asian J. Technol. Innov. 2016, 24, 55–76. [Google Scholar]

- McFadyen, M.A.; Cannella, A.A., Jr. Social Capital and Knowledge Creation: Diminishing Returns of the Number and Strength of Exchange Relationships. Acad. Manag. J. 2004, 45, 735–746. [Google Scholar] [CrossRef]

- Irwin, K.; Gilstrap, C.; Mcdowell, W.; Drnevich, P.; Gorbett, A. How knowledge and uncertainty affect strategic international business investment decisions: Implications for cross-border mergers and acquisitions. J. Bus. Res. 2022, 139, 831–842. [Google Scholar] [CrossRef]

- Tsai, Y.T.; Hsieh, L.F. An innovation knowledge game piloted by merger and acquisition of technological assets: A case study. J. Eng. Technol. Manag. 2006, 23, 248–261. [Google Scholar] [CrossRef]

- Ghosh, A.; Kato, T.; Morita, H. Incremental innovation and competitive pressure in the presence of discrete innovation. J. Econ. Behav. Organ. 2017, 135, 1–14. [Google Scholar] [CrossRef]

- Dierickx, I.; Cool, K. Asset Stock Accumulation and Sustainability of Competitive Advantage. Manag. Sci. 1989, 35, 1504–1511. [Google Scholar] [CrossRef]

- Capron, L.; Mitchell, W. Build, Borrow, or Buy: Solving the Growth Dilemma; Harvard Business Press: Boston, MA, USA, 2012. [Google Scholar]

- Vermeulen, F.; Barkema, H. Learning Through Acquisitions. Acad. Manag. J. 2001, 44, 457–476. [Google Scholar] [CrossRef]

- Lu, Y. The Current Status and Developing Trends of Industry 4.0: A Review. Inf. Syst. Front. 2021, 1–20. [Google Scholar] [CrossRef]

- Xu, L.D.; Lu, Y.; Li, L. Embedding Blockchain Technology Into IoT for Security: A Survey. IEEE Internet Things J. 2021, 8, 10452–10473. [Google Scholar] [CrossRef]

- Cefis, E.; Marsili, O. Crossing the innovation threshold through mergers and acquisitions. Res. Policy 2014, 44, 698–710. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).