Abstract

The continuous proliferation of the global digital wave has increased the contribution of firms’ digital transformation as a vital force propelling economic growth and sustainable development, highlighting the importance of digital transformation and the environment. However, only limited studies focused on how digital transformation influences carbon performance. To fill in this gap, this study investigates the impact of digital transformation on corporate carbon performance using a sample of 2286 Chinese A-share listed firms from 2008 to 2020 and employs the ordinary least squares (OLS) model as the principal research methodology. According to the results, the adoption of digital transformation strategies by firms exhibits a notable capacity to enhance carbon performance, which holds after a series of robustness tests. Green technology innovation and total factor productivity exhibit a partially mediating influence on the relationship between digital transformation and carbon performance. Further analyses reveal that enhanced green management practices and government subsidies have the potential to further amplify this positive effect. However, the impact is diminished by financing constraints and political connections. The findings of this research hold significance for firms striving for sustainable development within the era.

1. Introduction

The frequent occurrence of extreme weather worldwide has significantly affected economic growth and social development. In response to global climate change caused by carbon emissions, countries around the world have been enacting a series of carbon reduction policies [1,2,3]. The global economy is progressively transitioning toward a sustainable and green developmental paradigm. Within this framework, firms encounter a multitude of challenges stemming from climate-related risks amid the progression toward an eco-friendly economic transformation. Concurrently, the advent of climate change and ecological concerns has fundamentally reshaped the concept of corporate social responsibility in the contemporary epoch. Stakeholders, encompassing consumers, suppliers, and regulatory bodies are increasingly demanding that firms take responsibility for their environmental stewardship [4]. Therefore, reducing carbon emissions, practicing prudent resource consumption, and adoption of sustainable business models are not only crucial societal and ethical obligations but also key determinants for fostering firm resilience, ensuring long-term survival, and promoting comprehensive development.

Currently, the global surge of the digital wave has permeated societies. There is an unceasing influx of digital technologies fundamentally altering established corporate production and operational frameworks [5], reshaping human resource management processes [6], and boosting the rapid change of business models [7]. To seize market opportunities and gain first-mover advantages, firms are rapidly promoting digital transformation with cloud computing, big data, artificial intelligence technologies, and other related technologies as the core. The application of digital technology has improved the corporate information environment [8], enhanced the internal resource integration capabilities, and reshaped the production and operation processes [9]. Consequently, enterprises can break through traditional and conventional growth limitations and access novel avenues for development [7,10].

The pursuit of digital transformation and the enhancement of carbon performance have emerged as vitally significant strategic objectives for corporations. By embracing the opportunities catalyzed by digitization, enterprises can reconfigure their operational paradigms, optimize production efficiency [11], and secure a competitive advantage within the market. Digital transformation has evolved beyond mere discretion, evolving into a strategic imperative aligned with the shifting external environment [12]. Impressive carbon performance exceeds being merely a facet of corporate environmental responsibility. It stands as an indispensable element in meeting stakeholders’ expectations and satisfying the market’s green consumption needs [13]. The integration of digital transformation and carbon mitigation engenders effective synergies capable of potentially reshaping the prospective developmental trajectory of enterprises.

This research employs annual reports of Chinese A-share listed firms to measure indicators for corporate digital transformation and estimate the relationship between the degree of digital transformation and carbon performance. This investigation focuses on China for two reasons. First, China has the second largest economy in the world and the largest stock market in Asia, providing ample data support for our research. Second, the Chinese government committed to achieving carbon neutrality and peaking carbon emissions, launching a series of carbon reduction and control policies to foster a comprehensive shift towards a low-carbon economic framework [3]. Under this influence, substantial shifts have occurred in the carbon emission intensity and carbon performance of Chinese listed firms. This provides an ideal test site to analyze the influencing factors of corporate carbon performance. Moreover, the extent and scope of their digital technology implementation manifest notable disparities. These reservoirs of data provide ample source material for investigating the interplay between corporate digital transformation and carbon performance.

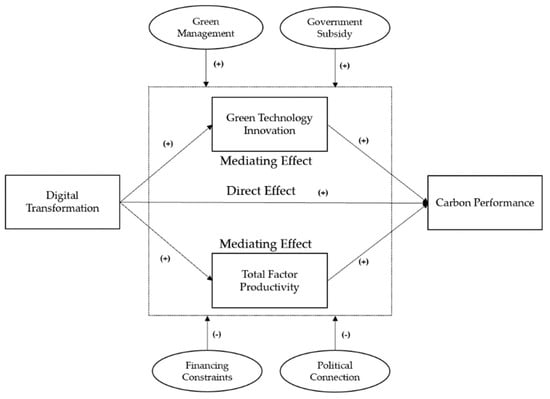

In scrutinizing the nexus between corporate digital transformation and carbon performance, this study collected and analyzed annual reports from Chinese A-share listed firms to extract the frequency of terms associated with digital technology. Formulating metrics denoting digital transformation harmonized them with datasets pertaining to corporate carbon performance, thereby elucidating the causal linkage between these domains. The fundamental regression findings reveal that corporate digital transformation considerably improves carbon performance. Each unit increase in the degree of digital transformation causes a corresponding increase of 0.504 units in carbon performance. This outcome persists in the robustness tests even after a comprehensive array of rigorous testing. Examining the mechanisms reveals that the rise in digital transformation improves carbon performance through two paths: promoting corporate green technology innovation and enhancing total factor productivity. Subsequent examination elucidates that a well-established green management system, lower financing constraints, government subsidies, and non-political connections enhance the positive relationship between digital transformation and carbon performance.

This paper makes a twofold contribution to extant research. Firstly, it augments the investigation into corporate digital transformation, acknowledging digital technology’s emergence as a novel impetus for firm growth and enriching the economic benefits of digital transformation. Previous studies on the economic and social consequences of digital transformation primarily focus on financial performance, production efficiency, innovation capabilities, and social responsibility fulfillment. While some research has explored the relationship between digital transformation and corporate environmental performance, few studies specifically concentrate on carbon performance. Particularly in large emerging economies like China, investigating the constructive role of digital technologies in overall corporate carbon performance holds crucial guidance for a low-carbon transition within the economic system. This paper examines the low-carbon driving effects of corporate digital transformation from the perspective of carbon performance, revealing the significantly beneficial role of digital transformation in corporate carbon performance. Secondly, this research broadens the scope of research concerning factors influencing corporate carbon performance. Different from previous studies that primarily emphasize analysis through internal governance and external market factors, such as executive cognition [14], gender diversity [15], internal carbon pricing [16], and carbon emission trading [1], this paper innovatively departed from the perspective of corporate digital transformation, further scrutinizing the environmental governance effects of digitization. Thirdly, this study advances the analysis of the mechanisms through which digital transformation affects carbon performance, considering dimensions of total factor productivity and green technological innovation. The findings confirm that digital technologies amplify production efficiency and green technology innovation, leading to carbon performance improvement. Fourthly, this research adopts two perspectives: enterprise characteristics and external resource acquisition. From these viewpoints, this study explores the roles and efficacy of digital transformation in enhancing carbon performance, encompassing aspects of green management level, political affiliations, government subsidies, and financing constraints.

2. Literature Review and Hypothesis Development

Carbon performance refers to the performance and effectiveness of a firm or organization in managing and reducing its carbon footprint. The carbon performance of an enterprise not only interfaces with its commitment to social responsibility and sustainable development, but also considerably affects its market competitiveness and long-term growth [17,18]. An increasing number of firms are considering carbon performance as a significant indicator for corporate governance and strategic decision-making. These firms are proactively adopting measures to curtail their carbon emissions throughout operational processes, while concurrently shouldering environmental and social responsibilities, thereby augmenting their sustainable competitive advantage [19].

Regarding the measurement of corporate carbon performance, Hoffmann and Busch [20] underscore that carbon intensity indicators can reflect the differences in carbon emissions among firms. Chapple et al. [1] measured corporate carbon intensity using the ratio of total corporate carbon emissions to every million units of sales, a method subsequently adopted by numerous studies [21,22]. According to the previously outlined methodology, this study employs the carbon intensity indicator to assess corporate carbon performance. Given the dearth of carbon emissions data pertaining to Chinese listed corporations, this research embraces the technique suggested by Shu and Tan [23]. This technique involves computing the aggregate industry-level fossil fuel consumption and subsequently apportioning firm-level carbon emissions data based on operational costs.

Digital transformation is a process that constitutes an entity through combinations of information, computing, communication, and connectivity technologies [24]. Corporate digital transformation refers to the adoption of digital technologies to empower operations management, production processes, innovation activities, and other internal activities, and ultimately to enable digital technologies to drive firms’ development and growth [11].

Recently, prior studies which have assessed the economic effects of corporate digital transformation can be categorized into four groups. The first group focuses on firm characteristics, such as operating efficiency [25], financial performance [26], total factor productivity [27], credit financing [28], and strategic flexibility [29]. The second group addresses investment and financial endeavors, encompassing cash reserves [5], corporate innovation [30], financialization [31], capital structure [32], and financial distress [33]. The third group relies on capital market responses which involve stock crash risk [34], stock volatility [35], and liquidity creation [36]. The fourth group closely associates with stakeholders, covering supply chain innovation [37], knowledge transfer [38], consumer value creation [39], and organization governance [40].

The impact of digital transformation on corporate sustainable development has attracted substantial academic attention. For example, Fang et al. [41] assert that the digitization of firms enhances their Environmental, Social, and Governance (ESG) performance. This achievement is attributed to the reduction of agency costs, the augmentation of goodwill, and the enhancement of environmental performance. Moreover, Zhang and Zhao [42] discern a U-shaped correlation between digital transformation and environmental performance. Their study assessed corporate environmental performance through a composite variable including reductions in resources and emissions, management dedication, and regulatory evaluation. Despite the extensive research conducted on the correlation between digital transformation and corporate environmental performance, the findings are inconsistent, necessitating a more thorough exploration. This paper focuses on investigating the influence of digital transformation on corporate carbon performance. It systematically elucidates the mechanisms through which digital transformation shapes carbon performance, alongside the divergent effects observed under diverse environmental conditions. The primary objective is to meticulously analyze the prospective interrelationship between digital transformation and carbon performance on a micro-level scale.

Digital transformation affords firms an extensive repository of production data and information [8]. Through organizing and analyzing the collected data, firms can accurately identify carbon emission sources and inefficient production links [43]. This analysis enables a precise optimization of energy consumption and resource utilization, enhancing production processes and reducing energy consumption.

Using technologies such as big data, cloud computing, and artificial intelligence, the amalgamation of digital platforms with intelligent devices assists firms in achieving more efficient management of production costs and energy consumption [44]. Concurrently, the real-time monitoring and data analysis of the production process empower firms to swiftly detect anomalies in energy consumption and emissions [45]. Then, prompt interventions can adjust and optimize processes, thereby mitigating the carbon emissions associated with each product unit and enhancing corporate overall carbon performance.

Digital transformation can amplify the efficiency of corporate supply chain management and the resilience of the supply chain [46]. Assisted by digital technologies, shifts in the market and data on customer consumption are rapidly transmitted upstream. Firms can monitor various links in the supply chain in real time by building digital platforms, accurately forecasting customer demand, and promptly adjusting production and logistics arrangements [47,48]. With digital supply chain management, enterprises can curtail inventory expenses and enhance the efficiency of the supply chain, thereby fortifying their competitive stance [49]. This augmentation bolsters corporate carbon performance by optimizing the input–output ratio.

The integration of digital transformation and carbon performance can augment firms’ image of sustainable development and cultivate a positive corporate reputation [50]. In an era characterized by escalating consumer concerns regarding corporate social responsibility and environmental implications, enterprises exhibiting commendable carbon performance are more inclined to secure consumer trust and loyalty. This, in turn, bolsters their sustainable competitive advantages within the market [51,52].

The above analysis shows that digital transformation promotes carbon performance. Therefore, we propose the following hypothesis.

Hypothesis 1.

Corporate digital transformation improves carbon performance.

Digital transformation further enhances a firm’s ability to integrate and utilize resources, driving the growth of total factor productivity [53]. First, digital transformation strengthens the corporate capacity to collect, store, and analyze data. By processing and integrating data from various aspects such as production, sales, and supply chain, firms can identify operational risks, reduce operating costs, and improve human capital and total factor productivity [54]. Secondly, the application of digital technologies augments cross-departmental collaboration and communication, fostering the exchange of information and sharing of resources. This mitigates the emergence of information silos and redundant endeavors, consequently amplifying the efficiency of resource allocation [55] and corporate total factor productivity. This increase in total factor productivity corresponds to an augmented input–output ratio, thereby resulting in amplified value creation per unit of carbon emissions. Consequently, the enhancement of total factor productivity inherently bolsters a firm’s carbon performance. This analysis shows that digitization engenders the augmentation of a firm’s carbon performance by facilitating its total factor productivity, proposing the following hypothesis.

Hypothesis 2.

Corporate digital transformation improves carbon performance by promoting total factor productivity.

According to the resource-based view, the development of firms cannot be separated from the support of production factors. Data elements are increasingly becoming an important source of corporate growth and value creation [56]. Digital transformation breaks the communication and knowledge barriers and provides firms with rich data resources [57]. This provision equips firms to acquire environmental knowledge through interaction with the external milieu, leading to the advancement of green technology innovation [58]. Concurrently, corporate digital transformation facilitates firms in the perpetual augmentation of innovation capital investment [30], thereby furnishing a reinforced material foundation for green technology innovation. Furthermore, the implementation of digital technologies, including virtual experimentation and simulation, expedites the innovation trajectory and engenders a plethora of competitive decarbonization strategies and eco-friendly product blueprints [59,60]. Therefore, digital transformation reshapes the process of green technology innovation and enhances corporate green innovation capabilities. The advancement in green technology innovation reduces the carbon intensity of each unit of product, thereby improving corporate carbon performance. This analysis proposes the following hypothesis.

Hypothesis 3.

Corporate digital transformation improves carbon performance by driving green technology innovation.

To summarize the theoretical analysis above, the conceptual mechanism is shown in Figure 1.

Figure 1.

Mechanism Framework.

3. Research Design

3.1. Sample and Data

The research sample includes A-share listed firms from 2008 to 2020, excluding entities from the financial sector and ST, *ST, and PT classifications. The sample covers 12,401 observations and 2286 distinct firms. A 1% trimming procedure is applied to continuous variables to mitigate the influence of extreme values. The financial data of the firms is sourced from the China Stock Market and Accounting Research Database (CSMAR).

3.1.1. Corporate Digitization

According to previous studies [36,61], this research employs text analysis to construct corporate digital transformation. This analysis entails counting the occurrence of keywords associated with digital transformation, e.g., “big data” and “cloud computing”, within each annual report. The corporate digital transformation degree is measured by the logarithm of the total number of digital keywords plus one in the annual report. The digital keyword dictionary is from [36].

3.1.2. Corporate Carbon Performance

To align the orientation of the indicators with the trajectory of carbon performance alterations, we evaluate corporate carbon performance using the inverse of carbon intensity. Based on previous studies [23,62], carbon performance is quantified as the ratio of operating revenue to carbon dioxide emissions. Initially, this research collected consumption data pertaining to eight distinct fossil fuel categories at the industrial level from the National Bureau of Statistics. Then, it calculated the industry-level carbon dioxide emissions based on the consumption of each fossil fuel. The next step involved extracting the primary operating costs associated with diverse industries from the China Industrial Statistics Yearbook. The industry’s carbon emissions are divided by the industry’s operating costs, and subsequently, the firm’s carbon emissions are measured by multiplying the firm’s operating costs. Ultimately, carbon performance is quantified by dividing the operating revenue by carbon dioxide emissions. Equation (1) represents the calculation process.

3.1.3. Control Variables

According to the previous studies [1,63], this research selects the following control variables: firm size (Size), asset–liability ratio (Lev), revenue growth (Growth), return on assets (ROA), firm value (Tobinq), firm age (Age), proportion of cash and cash equivalents (Cash), concentration of share ownership (Top1), and number of directors (Board). Table 1 defines the research variables.

Table 1.

Definition of Variables.

3.2. Econometric Model

Equation (2) estimates the relationship between corporate digitization transformation and carbon performance using Ordinary Least Squares (OLS).

where i and t show firm and year, respectively, CEE is the dependent variable measured by operating revenue per unit of carbon emissions, DigTran is the explanatory variable representing the level of digital transformation, β1 indicates the influence of digital transformation on carbon performance, Control denotes the firm characteristics, and μ and δ are firm fixed and year fixed effects, respectively. The robust standard errors are clustered at the firm level.

3.3. Descriptive Statistics

Table 2 presents the descriptive statistics of the variables. The mean and standard deviation of CEE are 3.093 and 4.925. The maximum and minimum values of CEE are 22.767 and 0.013, respectively. The difference between them is 22.754, indicating a significant variation in carbon performance and highlighting the importance of the study. The mean value, standard variation, maximum value, and minimum value of DigTran are 0.712, 1.038, 5.525, and 0, respectively. The considerable variation among firms in their level of digital transformation provides an opportunity to explore the connection between digital transformation and carbon performance. The descriptive statistical outcomes of the control variables are generally in alignment with the existing literature.

Table 2.

Descriptive statistics.

4. Results

4.1. Baseline Results: Effect of Corporate Digital Transformation on Carbon Performance

Table 3 reports the regression results of estimating Model 2. Column 1 reports the regression results without the control variables. Considering the robustness of the regression results, control variables have been added to the model whose results are in Column 2. According to the results, the estimated coefficient of DigTran is 0.504, which is positive and statistically significant at 1% level. This result implies that corporate digital transformation has a significant and positive effect on carbon performance. An increase of one unit in DigTran causes an increase of 0.504 units in carbon performance. This result suggests that digital transformation enhances the level of carbon performance.

Table 3.

Results of estimating baseline Models 1 and 2.

4.2. Robust Tests

This study employs several approaches to validate the robustness of the results, including (1) changes in the structure of the carbon performance variable, (2) reevaluation of the measurement of corporate digital transformation, (3) adding the preceding CEE variable to re-examine, (4) subdivision of digital technology categories, and (5) using instrumental variables to mitigate potential endogeneity concerns.

4.2.1. Alternative Measure of Carbon Performance

To mitigate the impact of the construction method of carbon performance variables and a heteroskedasticity problem in regression estimations, we applied the natural logarithm of the carbon performance (lnCEE). Subsequently, we conducted a renewed principal regression analysis. Table 4 represents the results of estimating this regression in Column 1. The results of the regression are consistent with those of baseline regression, which verifies the robustness of the above conclusions.

Table 4.

Robustness test results.

4.2.2. Alternative Measure of Corporate Digital Transformation

In the baseline regression, digital transformation is presented by a digital keyword frequency indicator derived from the firm’s annual report. To enhance the robustness of the results, a modified approach quantifies corporate digital transformation and subsequently re-estimates the baseline regression. According to the methodology outlined by [42], we recalibrate the measurement of digital transformation by considering the ratio of digital intangible assets to total intangible assets to construct the variable DA. Table 4 reports the regression results in Column 2. The coefficient of DA is 1.366, which is positive and statistically significant at 5% level, consistent with the baseline regression results.

4.2.3. Future Phase Carbon Performance

As carbon performance worsens, firms may encounter heightened carbon intensity, leading to increased financing costs that could hinder their digital transformation. This case increases the possibility of potential reverse causation issues. Another important issue is about ensuring the sustainability of the positive impact of digital transformation on corporate carbon performance. To this end, a regression uses the carbon performance index for the upcoming phase whose results are in Column 3 of Table 4. The results show that digital transformation continues to exhibit a noteworthy positive influence on corporate carbon performance, thereby maintaining consistency with the prior findings.

4.2.4. Digital Transformation Segmentation

This research goes further to dissect the structural characteristics of corporate digital transformation. As outlined by [36], a comprehensive analysis reveals that the firm’s digital transformation can be deconstructed into fundamental technological components and pragmatic application layers. The foundational technological layer encompasses a range of diverse digital technologies, while the application layer delineates distinct contexts for deploying these technologies. Furthermore, the foundational technological layer is subcategorized into four distinct indicators: artificial intelligence, blockchain, cloud computing, and big data. We conducted regressions using corporate carbon performance as the dependent variable for each of these sub-indicators. Table 5 reports the regression results. The regression outcomes reveal that both the digital technology indicators and the digital application indicators exhibit substantial and positive effects on corporate carbon performance. Among the four categories of digital technologies considered, excluding blockchain, significant enhancements in corporate carbon performance are observed for big data, cloud computing, and artificial intelligence technologies. Compared to the other three categories, blockchain technology is predominantly employed at the enterprise level for data encryption and information security. Consequently, it does not directly contribute to the enhancement of corporate carbon performance.

Table 5.

Digital transformation segmentation regression results.

4.2.5. Instrumental Variable

To mitigate the potential endogeneity issue, our study employs an instrumental variable approach. According to [8], this research considers the industry-province-year average of digital transformation as an instrumental variable (DigTran_average) and uses 2-Stage Least Squares (2SLS) to examine the robustness of baseline regression results. The F-statistic is 113.46, which is far greater than the critical value of 10. Table 6 represents the results, which suggest that baseline regression results maintain prudence after considering the endogeneity issues.

Table 6.

2SLS regression results.

5. Further Analysis

5.1. Potential Mechanism Examination

Referring to Baron and Kenny [64], this study adopts the mediating effect test method to estimate Models 3 and 4. The promoting effect of digital transformation on carbon performance is studied from two channels of green technology innovation and total factor productivity.

where M represents mediating variables, including green technology innovation (Grepat) and total factor productivity (TFP), and the remaining symbols are defined in previous sections. If γ1 is statistically significant in Model 3, we further examine Model 4. If λ2 is significant, M plays a mediating effect. If λ1 is significant, M partially mediates the effect. If λ1 is insignificant, M fully mediates the effect.

5.1.1. Green Technology Innovation

Green technology innovation is the initial pathway through which corporate digital transformation influences carbon performance. Digital transformation reshapes the process of green innovation within firms, offering more precise and effective green innovation solutions. In this way, digital transformation reduces the costs associated with trial and error and minimizes resource consumption in green technology innovation. Consequently, digital transformation enhances the overall quality and output of green technology innovation within the firm [56,65]. Therefore, digital transformation can considerably foster green technology innovation. The heightened engagement in green technology innovation subsequently leads to a reduction in carbon emissions per unit of production cost, thereby elevating the level of carbon performance. Following prior literature [66], the models add the variable Grepat, quantified by the count of green patent applications plus one in natural logarithm. The data pertaining to green patents are sourced from the Chinese Research Data Service Platform (CNRDS). Columns 1 and 2 in Table 7 present the relevant regression results of the mediation effect test for Grepat. According to Column 1, the coefficient of DigTran is positive and statistically significant at 1% level, suggesting that digital transformation drives green technology innovation. Based on results in Column 2, the coefficients of DigTran and Grepat are positive and statistically significant at 1% level. These findings show that green technology innovation serves as a partial intermediary between digital transformation and carbon performance.

Table 7.

Results of evaluating the mechanism of green technology innovation and total factor productivity.

5.1.2. Total Factor Productivity

Another channel through which digital transformation impacts carbon performance is by enhancing total factor productivity. The adoption of digital technology has bolstered firms’ abilities to monitor production processes and integrate resources. Hence, firms exhibiting heightened levels of digital transformation can attain superior resource utilization and production efficiency. This enhancement in production efficiency results in an improved corporate input–output ratio, thereby ultimately augmenting their carbon performance. In summary, digital transformation empowers firms to streamline their production processes, yielding elevated productivity and carbon performance. Following the approach outlined by [67], we constructed the variable TFP to measure the degree of a firm’s total factor productivity. Table 7 reports the regression estimations in Columns 3 and 4. According to the results, digital transformation bolsters a firm’s total factor productivity, thereby improving carbon performance. Notably, the total factor productivity exerts a partial mediating effect between digital transformation and carbon performance.

5.2. Moderating Effect Analysis

After finding the constructive role of corporate digital transformation in improving carbon performance, this study estimates Model 5 to examine the moderating effect of green management, government subsidy, financing constraints, and political connections.

where K signifies the moderating variables, including the level of green management (GM), government subsidy (Subsidy), financing constraints (FC), and political connection (Politic).

5.2.1. Level of Green Management

A well-established green management system serves as a mechanism to amplify the beneficial impacts of digital transformation on carbon performance. Firstly, a sound green management system facilitates the integration of digital technologies with carbon reduction efforts, thereby fostering carbon consciousness and enhancing a firm’s emission reduction capabilities. The resulting reduction in corporate carbon intensity translates to an enhancement in carbon performance. Secondly, the green management system boosts the resource utilization capability of digital technologies, harnessing managerial expertise to underscore the significance of digital transformation in incorporating eco-friendly resources. This effect prompts firms to allocate resources towards energy-saving and carbon reduction initiatives. Based on the approach of [68], this research uses the “firm’s possession of ISO 14001 certification” to measure the degree of corporate green management. The GM variable is one if the firm holds ISO 14001 certification; otherwise, it is zero. The related regression results are displayed in Columns 1 and 2 of Table 8. The coefficient of DigTran × GM is positive and statistically significant, which verifies that a well-established green management system can enhance the positive impact of digital transformation on carbon performance.

Table 8.

Estimated moderating effect of green management and government subsidy.

5.2.2. Government Subsidy

Government subsidies can enhance firms’ resilience. Access to government subsidies can provide firms with the necessary resources for reducing carbon emissions and implementing green innovation technology. Therefore, we construct the variable Subsidy, which is measured by the ratio of government subsidies to total assets [69]. Columns 3 and 4 in Table 8 display the moderating effect of government subsidies on carbon performance. The coefficients of the interaction between DigTran and Subsidy are significantly positive. This result suggests that government subsidies may amplify the positive influence of digital transformation on carbon performance.

5.2.3. Financing Constraints

Undoubtedly, the progress of digital transformation has enhanced corporate resource utilization efficiency and innovation capabilities. Nevertheless, the efficacy of carbon reduction in firms is still subject to the impact of their capacity to secure external capital. Hence, despite the impetus provided by digital technologies, the external financing environment retains its pivotal role in shaping a firm’s carbon performance. Consequently, financing constraints can exert a significant influence on the implementation of green technology innovation. This research employs the SA index to measure corporate financing constraints and construct variable FC [70]. A higher FC value indicates that the firm is experiencing a more severe level of financial constraints. Table 9 represents the regression results in Columns 1 and 2. The coefficient of DigTran × FC is negative and statistically significant, which proves that financing constraints restrict the positive impact of digital transformation on carbon performance.

Table 9.

Estimated moderating role of financing constraints and political connection.

5.2.4. Political Connection

The interplay between digital transformation and carbon performance can be influenced by political connections. Firms that establish connections with the government can gain access to more preferential policies and lower financing costs [71]. Firms with political affiliations often encounter reduced penalties for environmental violations, potentially leading to diminished governmental oversight of environmental regulations [72]. Consequently, politically affiliated firms often exhibit a reduced inclination to decrease carbon emissions and an increased inclination to apply digital technologies for purposes beyond carbon reduction projects. Following prior literature [41], the model adds the variable Politic, which is one if the firms have political affiliations; otherwise, it is zero. Table 9 represents the moderating role of political connections in Columns 3 and 4. According to the results, the coefficient of DigTran × Politic is negative and statistically significant at 5% level. With the continued advancement of digital transformation, firms with non-political connections will achieve higher carbon performance.

6. Conclusions

This paper examines the relationship between digital transformation and corporate carbon performance. In contrast to prior research, this study concentrates on corporate carbon performance without incorporating other environmental performance factors such as pollutant emissions or green information disclosure. Additionally, the study sample is China, an emerging market, including 12,401 observations from Chinese A-share listed firms. China’s significant industrial output and total merchandise exports underscore its crucial impact on global carbon emission management. Therefore, China is a controversial sample enabling further exploration of the digital technology effects on corporate carbon performance within large emerging economies.

The results show that digital transformation enhances corporate carbon performance. Digital transformation improves corporate carbon performance by increasing total factor productivity and green technology innovation level. Effective green management and government subsidies accelerate the positive association between digital transformation and carbon performance, while financing constraints and political connections may limit it.

This study offers valuable insights for policymakers, firms, and other stakeholders. The utilization of digital technology not only yields positive impacts on corporate operational efficiency and capital market performance but also enhances carbon performance within the realm of sustainable development. Our study holds dual significance, both theoretically and practically, by contributing to the understanding of digital technology applications and their implications for firm sustainable development.

For the government, devising and implementing policies that drive corporate digital transformation can effectively expedite the process of low-carbon transformation and carbon neutrality for committed economies. Simultaneously, governments should emphasize the carbon performance of politically affiliated firms, guiding such entities to elevate their low-carbon awareness, prioritize the development of low-carbon technologies, set carbon reduction targets, and prevent the weakening of carbon reduction effects due to political affiliations. Furthermore, governments can employ measures such as subsidies or credit incentives to fulfill corporate external financing needs, reducing restrictions on resource acquisition from hindering the catalytic role of digital technology in enhancing corporate carbon performance.

Firms can effectively enhance the information process and resource integration advantages of digital technology by improving their green management and efficiency, while refining their internal carbon emission regulation and accounting process. This effect accelerates the process of low-carbon transformation. Firms can also empower their production and innovation processes through digitalization to achieve heightened production efficiency and green innovation capabilities. This improvement, in turn, facilitates a dual advancement in resource allocation competence and green technology innovation level, consequently elevating the overall carbon performance. Ultimately, this advancement leads to sustainable growth in the era of low-carbon economy and digitization.

This paper has specifically explored the impact of corporate digital transformation on carbon performance, disregarding the potential carbon reduction effects of external digital infrastructure. For instance, the increase in broadband network coverage and the application of 5G technology can enhance the communication infrastructure available to enterprises. The upgrading and evolution of these facilities can effectively improve the efficiency of corporate carbon, production, and operation. Moving forward, future studies can shift the perspective to digital infrastructure and investigate how the rising level of digitalization in the external environment can enhance carbon reduction and efficiency gains for enterprises. This perspective will provide new insights into how to promote carbon reduction through digital transformation in businesses.

Author Contributions

Conceptualization, B.G.; methodology, B.G.; software, B.G.; validation, B.G. and X.H.; formal analysis, B.G. and X.H.; investigation, B.G. and X.H.; resources, B.G. and X.H.; data curation, B.G.; writing—original draft preparation, B.G.; writing—review and editing, B.G. and X.H.; visualization, X.H.; supervision, X.H.; project administration, X.H.; funding acquisition, X.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Foundation: Research on the realization path and implementation effect of high quality development of enterprises (21FGLB025); Major projects of the National Society Fund: Research on Chinese government cost system under the guidance of performance management (20&ZD115).

Institution Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Chapple, L.; Clarkson, P.M.; Gold, D.L. The cost of carbon: Capital market effects of the proposed emission trading scheme (ETS). Abacus 2013, 49, 1–33. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, X.; Chen, F. Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Chang. 2021, 168, 120744. [Google Scholar] [CrossRef]

- Pan, A.; Zhang, W.; Shi, X.; Dai, L. Climate policy and low-carbon innovation: Evidence from low-carbon city pilots in China. Energy Econ. 2022, 112, 106129. [Google Scholar] [CrossRef]

- Wei, X.; Wei, Q.; Yang, L. Induced green innovation of suppliers: The “green power” from major customers. Energy Econ. 2023, 124, 106775. [Google Scholar] [CrossRef]

- Zhang, C.; Liu, L. Corporate inventory and cash holdings in digital economy strategy: Evidence from China. Financ. Res. Lett. 2023, 53, 103607. [Google Scholar] [CrossRef]

- Dwivedi, P.; Dwivedi, R.; Yoshikuni, A.C.; Xie, B.; Naik, B. Role of Digitalization in Business Process to Reduce Manpower: A Case of Human Resource Management Process. Int. J. Econ. Bus. Adm. 2023, 11, 66–76. [Google Scholar] [CrossRef] [PubMed]

- Loebbecke, C.; Picot, A. Reflections on societal and business model transformation arising from digitization and big data analytics: A research agenda. J. Strateg. Inf. Syst. 2015, 24, 149–157. [Google Scholar] [CrossRef]

- Wu, K.; Fu, Y.; Kong, D. Does the digital transformation of enterprises affect stock price crash risk? Financ. Res. Lett. 2022, 48, 102888. [Google Scholar] [CrossRef]

- Niu, Y.; Wen, W.; Wang, S.; Li, S. Breaking barriers to innovation: The power of digital transformation. Financ. Res. Lett. 2023, 51, 103457. [Google Scholar] [CrossRef]

- Goldfarb, A.; Tucker, C. Digital economics. J. Econ. Lit. 2019, 57, 3–43. [Google Scholar] [CrossRef]

- Guo, X.; Li, M.; Wang, Y.; Mardani, A. Does digital transformation improve the firm’s performance? From the perspective of digitalization paradox and managerial myopia. J. Bus. Res. 2023, 163, 113868. [Google Scholar] [CrossRef]

- George, G.; Merrill, R.K.; Schillebeeckx, S.J. Digital sustainability and entrepreneurship: How digital innovations are helping tackle climate change and sustainable development. Entrep. Theory Pract. 2021, 45, 999–1027. [Google Scholar] [CrossRef]

- Yang, M.; Chen, H.; Long, R.; Yang, J. How does government regulation shape residents’ green consumption behavior? A multi-agent simulation considering environmental values and social interaction. J. Environ. Manag. 2023, 331, 117231. [Google Scholar] [CrossRef] [PubMed]

- Jiang, Y.; Hu, Y.; Asante, D.; Ampaw, E.M.; Asante, B. The Effects of Executives’ low-carbon cognition on corporate low-carbon performance: A study of managerial discretion in China. J. Clean. Prod. 2022, 357, 132015. [Google Scholar] [CrossRef]

- Benkraiem, R.; Shuwaikh, F.; Lakhal, F.; Guizani, A. Carbon performance and firm value of the World’s most sustainable companies. Econ. Model. 2022, 116, 106002. [Google Scholar] [CrossRef]

- Zhu, B.; Xu, C.; Wang, P.; Zhang, L. How does internal carbon pricing affect corporate environmental performance? J. Bus. Res. 2022, 145, 65–77. [Google Scholar] [CrossRef]

- Adu, D.A.; Flynn, A.; Grey, C. Carbon performance, financial performance and market value: The moderating effect of pay incentives. Bus. Strategy Environ. 2023, 32, 2111–2135. [Google Scholar] [CrossRef]

- Lewandowski, S. Corporate carbon and financial performance: The role of emission reductions. Bus. Strategy Environ. 2017, 26, 1196–1211. [Google Scholar] [CrossRef]

- Olatunji, O.O.; Ayo, O.O.; Akinlabi, S.; Ishola, F.; Madushele, N.; Adedeji, P.A. Competitive advantage of carbon efficient supply chain in manufacturing industry. J. Clean. Prod. 2019, 238, 117937. [Google Scholar] [CrossRef]

- Hoffmann, V.H.; Busch, T. Corporate carbon performance indicators: Carbon intensity, dependency, exposure, and risk. J. Ind. Ecol. 2008, 12, 505–520. [Google Scholar] [CrossRef]

- Cui, J.; Wang, C.; Zhang, J.; Zheng, Y. The effectiveness of China’s regional carbon market pilots in reducing firm emissions. Proc. Natl. Acad. Sci. USA 2021, 118, e2109912118. [Google Scholar] [CrossRef]

- Yu, J.; Shi, X.; Guo, D.; Yang, L. Economic policy uncertainty (EPU) and firm carbon emissions: Evidence using a China provincial EPU index. Energy Econ. 2021, 94, 105071. [Google Scholar] [CrossRef]

- Shu, H.; Tan, W. Does carbon control policy risk affect corporate ESG performance? Econ. Model. 2023, 120, 106148. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. In Managing Digital Transformation; Routledge: London, UK, 2021; pp. 13–66. [Google Scholar]

- Tsou, H.-T.; Chen, J.-S. How does digital technology usage benefit firm performance? Digital transformation strategy and organisational innovation as mediators. Technol. Anal. Strateg. Manag. 2023, 35, 1114–1127. [Google Scholar] [CrossRef]

- Zeng, H.; Ran, H.; Zhou, Q.; Jin, Y.; Cheng, X. The financial effect of firm digitalization: Evidence from China. Technol. Forecast. Soc. Chang. 2022, 183, 121951. [Google Scholar] [CrossRef]

- Cheng, Y.; Zhou, X.; Li, Y. The effect of digital transformation on real economy enterprises’ total factor productivity. Int. Rev. Econ. Financ. 2023, 85, 488–501. [Google Scholar] [CrossRef]

- Zhou, Z.; Li, Z. Corporate digital transformation and trade credit financing. J. Bus. Res. 2023, 160, 113793. [Google Scholar] [CrossRef]

- Yoshikuni, A.C.; Dwivedi, R.; Dultra-de-Lima, R.G.; Parisi, C.; Oyadomari, J.C.T. Role of Emerging Technologies in Accounting Information Systems for Achieving Strategic Flexibility through Decision-Making Performance: An Exploratory Study Based on North American and South American Firms. Glob. J. Flex. Syst. Manag. 2023, 24, 199–218. [Google Scholar] [CrossRef]

- Wen, H.; Zhong, Q.; Lee, C.-C. Digitalization, competition strategy and corporate innovation: Evidence from Chinese manufacturing listed companies. Int. Rev. Financ. Anal. 2022, 82, 102166. [Google Scholar] [CrossRef]

- Wu, K.; Lu, Y. Corporate digital transformation and financialization: Evidence from Chinese listed firms. Financ. Res. Lett. 2023, 57, 104229. [Google Scholar] [CrossRef]

- Niu, Y.; Wang, S.; Wen, W.; Li, S. Does digital transformation speed up dynamic capital structure adjustment? Evidence from China. Pac. Basin Financ. J. 2023, 79, 102016. [Google Scholar] [CrossRef]

- Cui, L.; Wang, Y. Can corporate digital transformation alleviate financial distress? Financ. Res. Lett. 2023, 55, 103983. [Google Scholar] [CrossRef]

- Ai, Y.; Sun, G.; Kong, T. Digital finance and stock price crash risk. Int. Rev. Econ. Financ. 2023, 88, 607–619. [Google Scholar] [CrossRef]

- Liu, S.; Zhao, H.; Kong, G. Enterprise digital transformation, breadth of ownership and stock price volatility. Int. Rev. Financ. Anal. 2023, 89, 102713. [Google Scholar] [CrossRef]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise digital transformation and capital market performance: Empirical evidence from stock liquidity. Manag. World 2021, 37, 130–144. [Google Scholar]

- Lai, K.-h.; Feng, Y.; Zhu, Q. Digital transformation for green supply chain innovation in manufacturing operations. Transp. Res. Part E Logist. Transp. Rev. 2023, 175, 103145. [Google Scholar] [CrossRef]

- Guo, C.; Ke, Y.; Zhang, J. Digital transformation along the supply chain. Pac. Basin Financ. J. 2023, 80, 102088. [Google Scholar] [CrossRef]

- Matarazzo, M.; Penco, L.; Profumo, G.; Quaglia, R. Digital transformation and customer value creation in Made in Italy SMEs: A dynamic capabilities perspective. J. Bus. Res. 2021, 123, 642–656. [Google Scholar] [CrossRef]

- Cordery, C.J.; Goncharenko, G.; Polzer, T.; McConville, D.; Belal, A. NGOs’ performance, governance, and accountability in the era of digital transformation. Br. Account. Rev. 2023, 101239. [Google Scholar] [CrossRef]

- Fang, M.; Nie, H.; Shen, X. Can enterprise digitization improve ESG performance? Econ. Model. 2023, 118, 106101. [Google Scholar] [CrossRef]

- Zhang, W.; Zhao, J. Digital transformation, environmental disclosure, and environmental performance: An examination based on listed companies in heavy-pollution industries in China. Int. Rev. Econ. Financ. 2023, 87, 505–518. [Google Scholar] [CrossRef]

- Ye, F.; Ouyang, Y.; Li, Y. Digital investment and environmental performance: The mediating roles of production efficiency and green innovation. Int. J. Prod. Econ. 2023, 259, 108822. [Google Scholar] [CrossRef]

- Tao, F.; Wang, Y.; Zuo, Y.; Yang, H.; Zhang, M. Internet of Things in product life-cycle energy management. J. Ind. Inf. Integr. 2016, 1, 26–39. [Google Scholar] [CrossRef]

- Junior, J.A.G.; Busso, C.M.; Gobbo, S.C.O.; Carreão, H. Making the links among environmental protection, process safety, and industry 4.0. Process Saf. Environ. Prot. 2018, 117, 372–382. [Google Scholar]

- Hamann-Lohmer, J.; Bendig, M.; Lasch, R. Investigating the impact of digital transformation on relationship and collaboration dynamics in supply chains and manufacturing networks–A multi-case study. Int. J. Prod. Econ. 2023, 262, 108932. [Google Scholar] [CrossRef]

- Power, D.; Singh, P. The e-integration dilemma: The linkages between Internet technology application, trading partner relationships and structural change. J. Oper. Manag. 2007, 25, 1292–1310. [Google Scholar] [CrossRef]

- Li, H.; Fang, Y.; Lim, K.H.; Wang, Y. Platform-based function repertoire, reputation, and sales performance of e-marketplace sellers. MIS Q. 2019, 43, 207–236. [Google Scholar] [CrossRef]

- Nasiri, M.; Ukko, J.; Saunila, M.; Rantala, T. Managing the digital supply chain: The role of smart technologies. Technovation 2020, 96, 102121. [Google Scholar] [CrossRef]

- Rosamartina, S.; Giustina, S.; Angeloantonio, R. Digital reputation and firm performance: The moderating role of firm orientation towards sustainable development goals (SDGs). J. Bus. Res. 2022, 152, 315–325. [Google Scholar] [CrossRef]

- Chang, C.-H. The influence of corporate environmental ethics on competitive advantage: The mediation role of green innovation. J. Bus. Ethics 2011, 104, 361–370. [Google Scholar] [CrossRef]

- Singh, S.K.; Chen, J.; Del Giudice, M.; El-Kassar, A.-N. Environmental ethics, environmental performance, and competitive advantage: Role of environmental training. Technol. Forecast. Soc. Chang. 2019, 146, 203–211. [Google Scholar] [CrossRef]

- Zhang, H.; Don, S. Digital transformation and firms’ total factor productivity: The role of internal control quality. Financ. Res. Lett. 2023, 57, 104231. [Google Scholar] [CrossRef]

- Pan, W.; Xie, T.; Wang, Z.; Ma, L. Digital economy: An innovation driver for total factor productivity. J. Bus. Res. 2022, 139, 303–311. [Google Scholar] [CrossRef]

- Dalenogare, L.S.; Le Dain, M.-A.; Ayala, N.F.; Pezzotta, G.; Frank, A.G. Building digital servitization ecosystems: An analysis of inter-firm collaboration types and social exchange mechanisms among actors. Technovation 2023, 124, 102756. [Google Scholar] [CrossRef]

- Liu, X.; Liu, F.; Ren, X. Firms’ digitalization in manufacturing and the structure and direction of green innovation. J. Environ. Manag. 2023, 335, 117525. [Google Scholar] [CrossRef] [PubMed]

- Peng, Y.; Tao, C. Can digital transformation promote enterprise performance?—From the perspective of public policy and innovation. J. Innov. Knowl. 2022, 7, 100198. [Google Scholar] [CrossRef]

- Naqshbandi, M.M.; Jasimuddin, S.M. The linkage between open innovation, absorptive capacity and managerial ties: A cross-country perspective. J. Innov. Knowl. 2022, 7, 100167. [Google Scholar] [CrossRef]

- Farrington, T.; Alizadeh, A. On the Impact of Digitalization on R&D: R&D practitioners reflect on the range and type of digitalization’s likely effects on R&D management. Res. Technol. Manag. 2017, 60, 24–30. [Google Scholar]

- Ning, J.; Jiang, X.; Luo, J. Relationship between enterprise digitalization and green innovation: A mediated moderation model. J. Innov. Knowl. 2023, 8, 100326. [Google Scholar] [CrossRef]

- Luo, Y.; Cui, H.; Zhong, H.; Wei, C. Business Environment and Enterprise Digital Transformation. Financ. Res. Lett. 2023, 57, 104250. [Google Scholar] [CrossRef]

- Shi, X.; Cao, X.; Hou, Y.; Xu, W. Mixed Ownership Reform and Environmental Sustainable Development—Based on the Perspective of Carbon Performance. Sustainability 2023, 15, 9809. [Google Scholar] [CrossRef]

- Goud, N.N. Corporate governance: Does it matter management of carbon emission performance? An empirical analyses of Indian companies. J. Clean. Prod. 2022, 379, 134485. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef] [PubMed]

- Mubarak, M.F.; Tiwari, S.; Petraite, M.; Mubarik, M.; Raja Mohd Rasi, R.Z. How Industry 4.0 technologies and open innovation can improve green innovation performance? Manag. Environ. Qual. Int. J. 2021, 32, 1007–1022. [Google Scholar] [CrossRef]

- Liao, Z.; Weng, C.; Shen, C. Can public surveillance promote corporate environmental innovation? The mediating role of environmental law enforcement. Sustain. Dev. 2020, 28, 1519–1527. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 70, 317–341. [Google Scholar] [CrossRef]

- Ren, S.; Sun, H.; Zhang, T. Do environmental subsidies spur environmental innovation? Empirical evidence from Chinese listed firms. Technol. Forecast. Soc. Chang. 2021, 173, 121123. [Google Scholar] [CrossRef]

- Wu, A. The signal effect of government R&D subsidies in China: Does ownership matter? Technol. Forecast. Soc. Chang. 2017, 117, 339–345. [Google Scholar]

- Hadlock, C.J.; Pierce, J.R. New evidence on measuring financial constraints: Moving beyond the KZ index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Wang, Y.; Yao, C.; Kang, D. Political connections and firm performance: Evidence from government officials’ site visits. Pac. Basin Financ. J. 2019, 57, 101021. [Google Scholar] [CrossRef]

- Correia, M.M. Political connections and SEC enforcement. J. Account. Econ. 2014, 57, 241–262. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).