When CSR Matters: The Moderating Effect of Industrial Growth Rate on the Relationship between CSR and Firm Performance

Abstract

:1. Introduction

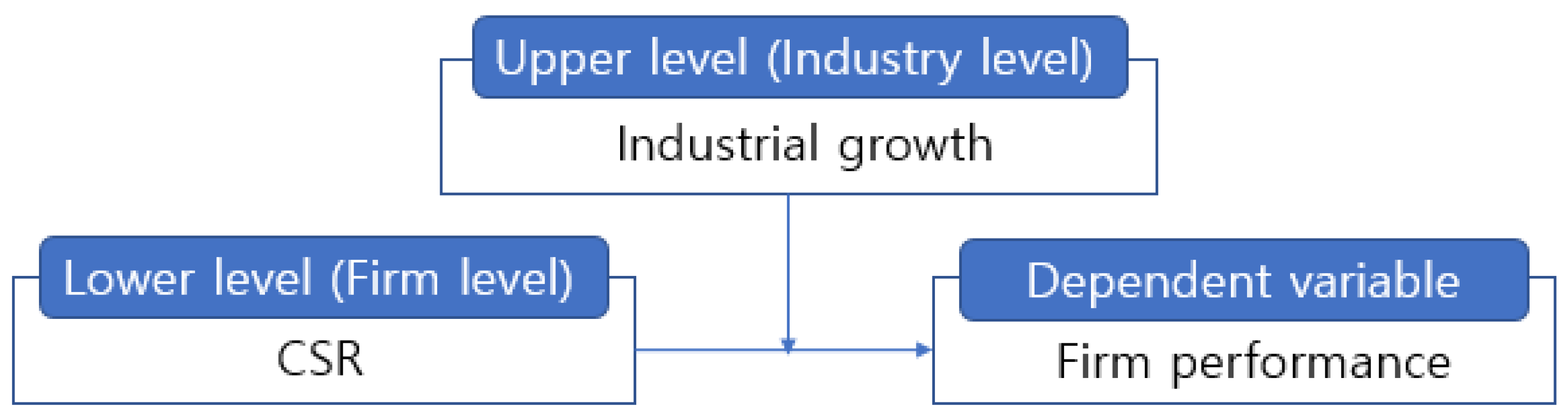

2. Literature Review and Hypotheses Development

2.1. CSR and Firm Performance

2.2. CSR According to Industry Growth

3. Materials and Methods

3.1. Independent Variable

3.2. Dependent Variable

3.3. Control Variable

3.4. Data

3.5. Analysis Method

| Model 1 (Firm level): TOBIN’s Qij = β0j + β1j × (CSRij) + rij |

| Model 2 (Industry level): β0j = γ00 + γ01 × (GROWTHj) + u0j β1j = γ10 + γ11 × (GROWTHj) + u1j |

| Mixed Model: TOBIN’s Qij = γ00 + γ01 × GROWTHj + γ10 × CSRij + γ11 × GROWTHj × CSRij + u0j + u1j × CSRij + rij |

4. Research Analysis Result

4.1. Extract the CSR Variables

4.2. Descriptive Statistics and Correlation Analysis

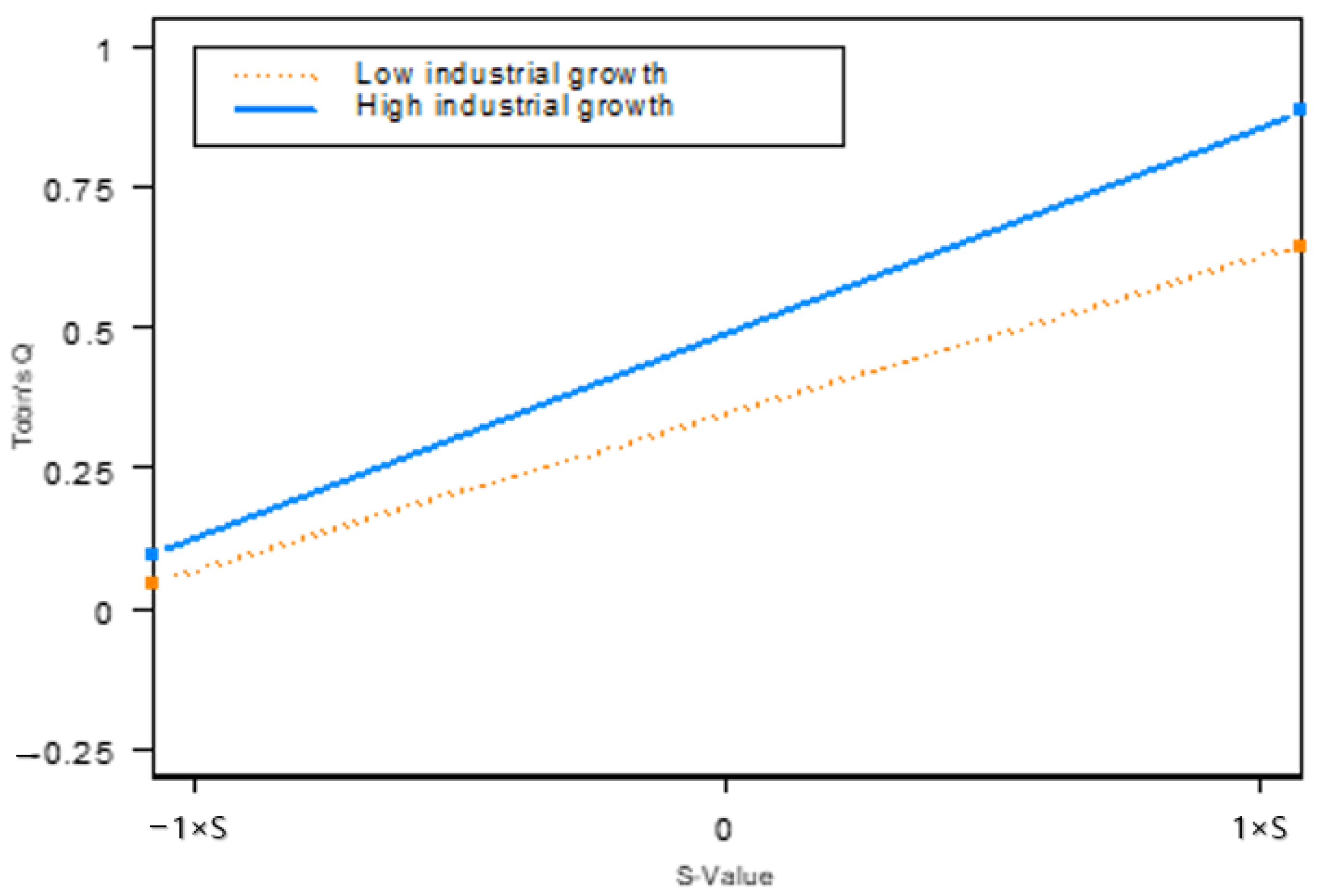

4.3. Regression Analysis Results

4.4. Further Analysis (t-Test Analysis)

5. Discussion

6. Conclusions

6.1. Implications

6.2. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Chakraborty, I.; Maity, P. COVID-19 outbreak: Migration, effects on society, global environment and prevention. Sci. Total Environ. 2020, 728, 138882. [Google Scholar] [CrossRef]

- Zhou, Y.R. Vaccine nationalism: Contested relationships between COVID-19 and globalization. Globalizations 2022, 19, 450–465. [Google Scholar] [CrossRef]

- Hakovirta, M.; Denuwara, N. How COVID-19 redefines the concept of sustainability. Sustainability 2020, 12, 3727. [Google Scholar] [CrossRef]

- Roundtable, B.B. Statement on the Purpose of a Corporation. Available online: https://www.businessroundtable.org/business-roundtable-redefines-the-purpose-of-a-corporation-to-promote-an-economy-that-serves-all-americans (accessed on 5 April 2023).

- Forum, W.E. Recap of Davos 2020. Available online: https://www.weforum.org/events/world-economic-forum-annual-meeting-2020 (accessed on 13 November 2022).

- Hemmert, M. The Korean innovation system: From industrial catch-up to technological leadership? In Innovation and Technology in Korea: Challenges of a Newly Advanced Economy; Physica-Verlag HD: Heidelberg, Germany, 2007; pp. 11–32. [Google Scholar]

- van Niekerk, A.J. Inclusive economic sustainability: SDGs and global inequality. Sustainability 2020, 12, 5427. [Google Scholar] [CrossRef]

- Kim, Y. Hell Joseon: Polarization and social contention in a neo-liberal age. In Korea’s Quest for Economic Democratization: Globalization, Polarization and Contention; Palgrave Macmillan: Cham, Switzerland, 2018; pp. 1–20. [Google Scholar]

- Khuong, M.N.; Truong An, N.K.; Thanh Hang, T.T. Stakeholders and Corporate Social Responsibility (CSR) programme as key sustainable development strategies to promote corporate reputation—Evidence from vietnam. Cogent Bus. Manag. 2021, 8, 1917333. [Google Scholar] [CrossRef]

- Ullah, Z.; Ahmad, N.; Nazim, Z.; Ramzan, M. Impact of CSR on corporate reputation, customer loyalty and organizational performance. Gov. Manag. Rev. 2020, 5, 195–210. [Google Scholar]

- Loosemore, M.; Lim, B.T.H. Linking corporate social responsibility and organizational performance in the construction industry. Constr. Manag. Econ. 2017, 35, 90–105. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Boubaker, S.; Cellier, A.; Manita, R.; Saeed, A. Does corporate social responsibility reduce financial distress risk? Econ. Model. 2020, 91, 835–851. [Google Scholar] [CrossRef]

- Gregory, A.; Whittaker, J.; Yan, X. Corporate social performance, competitive advantage, earnings persistence and firm value. J. Bus. Financ. Account. 2016, 43, 3–30. [Google Scholar] [CrossRef]

- Scholtens, B. A note on the interaction between corporate social responsibility and financial performance. Ecol. Econ. 2008, 68, 46–55. [Google Scholar] [CrossRef]

- Tsoutsoura, M. Corporate social responsibility and financial performance. UC Berkeley Work. Pap. Ser. 2004. Available online: https://escholarship.org/uc/item/111799p2 (accessed on 5 April 2023).

- Surroca, J.; Tribó, J.A. Managerial entrenchment and corporate social performance. J. Bus. Financ. Account. 2008, 35, 748–789. [Google Scholar] [CrossRef]

- Nguyen, C.T.; Nguyen, L.T.; Nguyen, N.Q. Corporate social responsibility and financial performance: The case in Vietnam. Cogent Econ. Financ. 2022, 10, 2075600. [Google Scholar] [CrossRef]

- Hashim, F.; Ries, E.A.; Huai, N.T. Corporate Social Responsibility and Financial Performance: The Case of ASEAN Telecommunications Companies. KnE Soc. Sci. 2019, 892–913. [Google Scholar] [CrossRef]

- Iqbal, N.; Ahmad, N.; Basheer, N.A.; Nadeem, M. Impact of corporate social responsibility on financial performance of corporations: Evidence from Pakistan. Int. J. Learn. Dev. 2012, 2, 107–118. [Google Scholar] [CrossRef]

- Carroll, A.B. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Barauskaite, G.; Streimikiene, D. Corporate social responsibility and financial performance of companies: The puzzle of concepts, definitions and assessment methods. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 278–287. [Google Scholar] [CrossRef]

- Ramlall, S. Corporate social responsibility in post-apartheid South Africa. Soc. Responsib. J. 2012, 8, 270–288. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.; Mishra, D.R. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Goss, A.; Roberts, G.S. The impact of corporate social responsibility on the cost of bank loans. J. Bank. Financ. 2011, 35, 1794–1810. [Google Scholar] [CrossRef]

- Barnea, A.; Rubin, A. Corporate social responsibility as a conflict between shareholders. J. Bus. Ethics 2010, 97, 71–86. [Google Scholar] [CrossRef]

- Brammer, S.; Brooks, C.; Pavelin, S. Corporate social performance and stock returns: UK evidence from disaggregate measures. Financ. Manag. 2006, 35, 97–116. [Google Scholar] [CrossRef]

- Hou, T.C.T. The relationship between corporate social responsibility and sustainable financial performance: Firm-level evidence from Taiwan. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 19–28. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. The competitive advantage of corporate philanthropy. Harv. Bus. Rev. 2002, 80, 56–68. [Google Scholar]

- Chung, C.Y.; Jung, S.; Young, J. Do CSR activities increase firm value? Evidence from the Korean market. Sustainability 2018, 10, 3164. [Google Scholar] [CrossRef]

- Korten, D.C. When corporations rule the world. Eur. Bus. Rev. 1998, 98, 99–103. [Google Scholar] [CrossRef]

- Sandberg, H.; Alnoor, A.; Tiberius, V. Environmental, social, and governance ratings and financial performance: Evidence from the European food industry. Bus. Strategy Environ. 2023, 32, 2471–2489. [Google Scholar] [CrossRef]

- Morrison, W.M. China’s Economic Conditions; DIANE Publishing: Collingdale, PA, USA, 2009. [Google Scholar]

- Lin, L.-W. Corporate social responsibility in China: Window dressing or structural change. Berkeley J. Int’l L. 2010, 28, 64. [Google Scholar]

- Sullivan, L.R. Tackling the Environment: Xi Jinping and the Pursuit of a ‘Beautiful China’. J. Environ. Assess. Policy Manag. 2023, 25, 2350005. [Google Scholar] [CrossRef]

- Russo, M.V.; Fouts, P.A. A resource-based perspective on corporate environmental performance and profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar] [CrossRef]

- Hofer, C. Toward a contingency theory of business strategy. Acad. Manag. J. 1975, 18, 784–810. [Google Scholar] [CrossRef]

- Burns, T.; Stalker, G.M. Innovation, market orientation, and organizational learning: An integration and empirical examination. J. Mark. 1961, 62, 42–54. [Google Scholar]

- Hou, C.-E.; Lu, W.-M.; Hung, S.-W. Does CSR matter? Influence of corporate social responsibility on corporate performance in the creative industry. Ann. Oper. Res. 2019, 278, 255–279. [Google Scholar] [CrossRef]

- Jeong, Y.U.; Kang, W.G.; Ryu, J.H. Study for Market Forecast of Unmanned Vehicle. Trans. KSME 2015, 1772–1777. [Google Scholar]

- Chung, K.H.; Pruitt, S.W. A simple approximation of Tobin’s q. Financ. Manag. 1994, 23, 70–74. [Google Scholar] [CrossRef]

- Alajlani, S.E.; Posecion, O.T. Measuring market valuation of Amman stock exchange industrial sectors: Tobin’s Q ratio as investors’ market performance indicator. Res. J. Financ. Account. 2018, 9, 77–84. [Google Scholar]

- Jinji, N.; Zhang, X.; Haruna, S. Does a firm with higher Tobin’sq prefer foreign direct investment to foreign outsourcing? N. Am. J. Econ. Financ. 2019, 50, 101044. [Google Scholar] [CrossRef]

- Pratheepan, T. A Panel Data Analysis of Profitability Determinants: Empirical Results from Sri Lankan Manufacturing Companies. Int. J. Econ. Commer. Manag. 2014, 2, 1–9. [Google Scholar]

- Činčalová, S.; Hedija, V. Firm characteristics and corporate social responsibility: The case of Czech transportation and storage industry. Sustainability 2020, 12, 1992. [Google Scholar] [CrossRef]

- Oh, W.Y.; Chang, Y.K.; Martynov, A. The effect of ownership structure on corporate social responsibility: Empirical evidence from Korea. J. Bus. Ethics 2011, 104, 283–297. [Google Scholar] [CrossRef]

- ISO 26000:2010; Guidance on Social Responsibility. ISO: London, UK, 2010. Available online: https://www.iso.org/standard/42546.html (accessed on 1 February 2021).

- Dudek, M.; Bashynska, I.; Filyppova, S.; Yermak, S.; Cichoń, D. Methodology for assessment of inclusive social responsibility of the energy industry enterprises. J. Clean. Prod. 2023, 394, 136317. [Google Scholar] [CrossRef]

- GRI. GRI Standards English Language. Available online: https://www.globalreporting.org/how-to-use-the-gri-standards/gri-standards-english-language (accessed on 1 February 2021).

- Heck, R.H.; Thomas, S.L. An Introduction to Multilevel Modeling Techniques: MLM and SEM Approaches Using Mplus; Routledge: London, UK, 2015. [Google Scholar]

- Bosker, R.; Snijders, T.A. Multilevel analysis: An introduction to basic and advanced multilevel modeling. In Multilevel Analysis; SAGE Publications Ltd.: London, UK, 2011; pp. 1–368. [Google Scholar]

- Heck, R.H.; Thomas, S.L.; Tabata, L.N. Multilevel and Longitudinal Modeling with IBM SPSS; Routledge: London, UK, 2013. [Google Scholar]

- Day, G.S.; Nedungadi, P. Managerial representations of competitive advantage. J. Mark. 1994, 58, 31–44. [Google Scholar] [CrossRef]

| Firm-Level Variance | Industry-Level Variance | ICC |

|---|---|---|

| 0.82 | 0.23 | 0.22 |

| Item | Factor |

|---|---|

| Volunteer hours | 0.659 |

| Continuous years of service | 0.755 |

| Union coverage rate | 0.738 |

| Disability employment rate | 0.585 |

| Return to work rate after parental leave | 0.531 |

| Variable | Mean | SD | Minimum | Maximum |

|---|---|---|---|---|

| Training hours | 67 | 42 | 3 | 323 |

| Contribute cost | 20,740,000 | 56,540,000 | 4,000,000 | 536,000,000 |

| Volunteer hours | 7 | 6 | 0 | 46 |

| Resignation rate (%) | 0.06 | 0.06 | 0.00 | 0.50 |

| Continuous years of service | 11 | 4 | 1 | 22 |

| Union coverage rate (%) | 0.52 | 0.32 | 0.00 | 1.00 |

| New employee recruitment rate (%) | 0.12 | 0.10 | 0.00 | 0.53 |

| Disability employment rate (%) | 0.02 | 0.01 | 0.00 | 0.07 |

| Employment growth rate (%) | 0.01 | 0.00 | 0.00 | 0.05 |

| Return to work rate after parental leave | 0.86 | 0.19 | 0.00 | 1.00 |

| Industrial growth(%) | 0.01 | 0.04 | −0.09 | 0.06 |

| Asset(log) | 16 | 1 | 11 | 19 |

| Employee | 11,600 | 9200 | 169 | 310,000 |

| Foreign Equity(%) | 0.24 | 0.16 | 0.00 | 0.65 |

| Tobin’s Q | 1.12 | 1.01 | 0.07 | 6.74 |

| Variable | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| 1 | 1 | |||||

| 2 | −0.102 | 1 | ||||

| 3 | 0.150 ** | 0.502 *** | 1 | |||

| 4 | 0.071 | 0.492 ** | 0.397 *** | 1 | ||

| 5 | −0.074 | 0.349 *** | 0.076 | 0.098 * | 1 | |

| 6 | 0.394 ** | −0.192 | 0.004 | 0.374 *** | 0.401 *** | 1 |

| Dependent Variable | Null Model | Model 1 | Model 2 | Model 3 |

|---|---|---|---|---|

| Constant | 0.135 (6.521 ***) | 0.392 (4.589 ***) | 0.355 (3.229 ***) | 0.344 (4.002 ***) |

| Asset(log) | −0.325 (−7.448 ***) | −0.311 (−7.223 ***) | −0.310 (−7.220 ***) | |

| Employee | 0.004 (1.236) | 0.003 (1.191) | 0.003 (1.184) | |

| Foreign Equity | 0.036 (12.221 ***) | 0.036 (12.209 ***) | 0.033 (10.828 ***) | |

| CSR | 0 | 0.365 (8.767 ***) | 0.325(7.854 ***) | 0.278(6.477 ***) |

| Industry growth | 0.161 (2.005 *) | 0.146 (1.984 *) | ||

| Industry growth × CSR | 0.088 (3.211 **) | |||

| σ2 | 0.82289 | 0.52766 | 0.53004 | 0.53080 |

| τ | 0.23206 | 0.16845 | 0.17212 | 0.17004 |

| Deviance | 1794.06 | 1214.28 | 1210.33 | 1199.41 |

| Industry Growth | Mean | SD | t | p | |

|---|---|---|---|---|---|

| CSR | High | 0.20 | 0.99 | 5.787 | 0.000 |

| Low | −0.23 | 0.96 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chang, Y.J.; Yoo, J.W. When CSR Matters: The Moderating Effect of Industrial Growth Rate on the Relationship between CSR and Firm Performance. Sustainability 2023, 15, 13677. https://doi.org/10.3390/su151813677

Chang YJ, Yoo JW. When CSR Matters: The Moderating Effect of Industrial Growth Rate on the Relationship between CSR and Firm Performance. Sustainability. 2023; 15(18):13677. https://doi.org/10.3390/su151813677

Chicago/Turabian StyleChang, Yu Jin, and Jae Wook Yoo. 2023. "When CSR Matters: The Moderating Effect of Industrial Growth Rate on the Relationship between CSR and Firm Performance" Sustainability 15, no. 18: 13677. https://doi.org/10.3390/su151813677

APA StyleChang, Y. J., & Yoo, J. W. (2023). When CSR Matters: The Moderating Effect of Industrial Growth Rate on the Relationship between CSR and Firm Performance. Sustainability, 15(18), 13677. https://doi.org/10.3390/su151813677