Scaling Up Banking Performance for the Realisation of Specific Sustainable Development Goals: The Interplay of Digitalisation and Training in the Transformation Journey

Abstract

1. Introduction

Need for the Study

2. Literature Evaluation and Hypotheses Development

Theoretical Lens and Hypotheses Development

3. Materials and Methods

3.1. Data and Sample

3.2. Measures

3.3. Research Methods

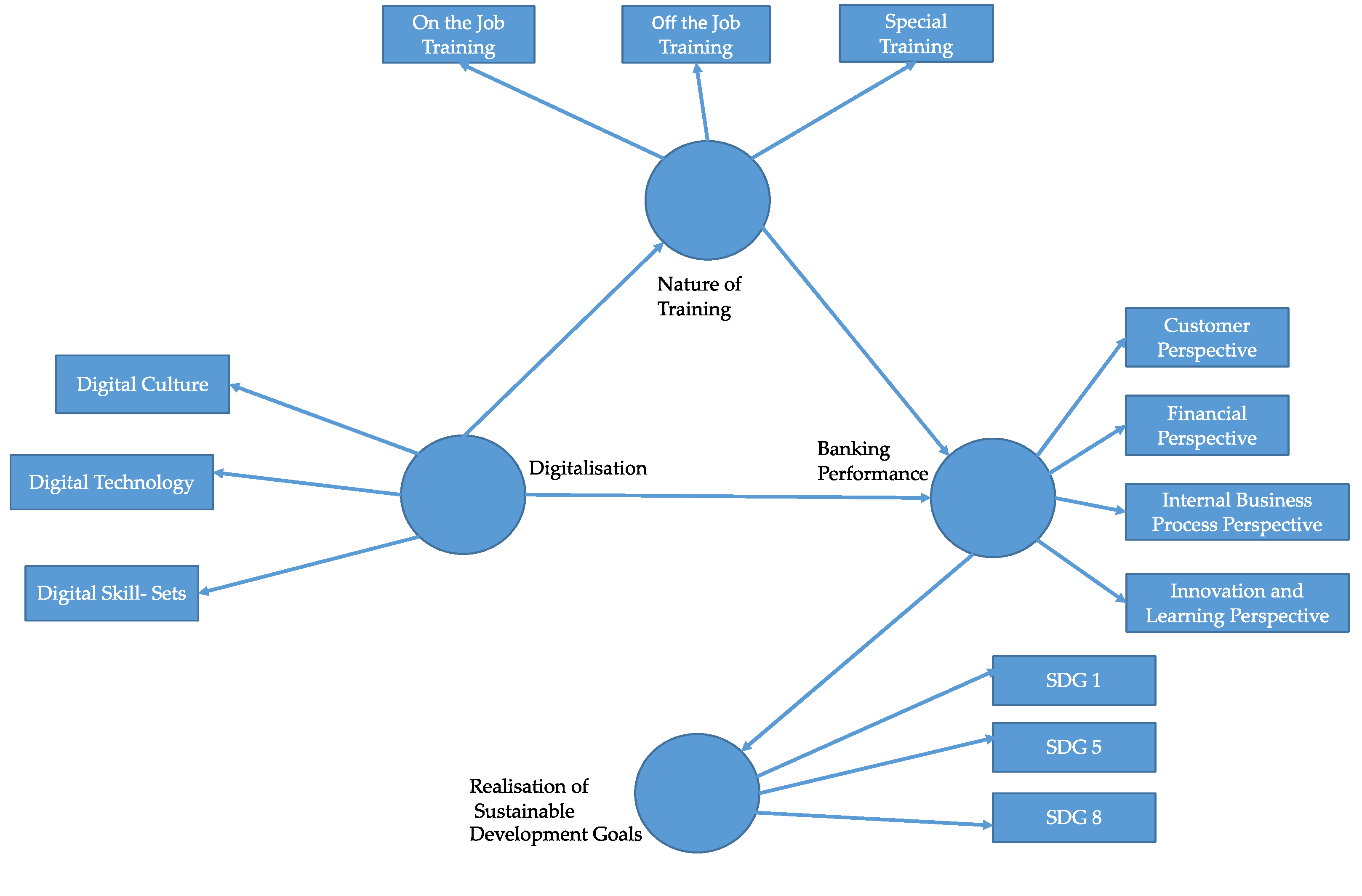

3.4. Conceptual Model

4. Analysis and Findings

4.1. Measurement Model

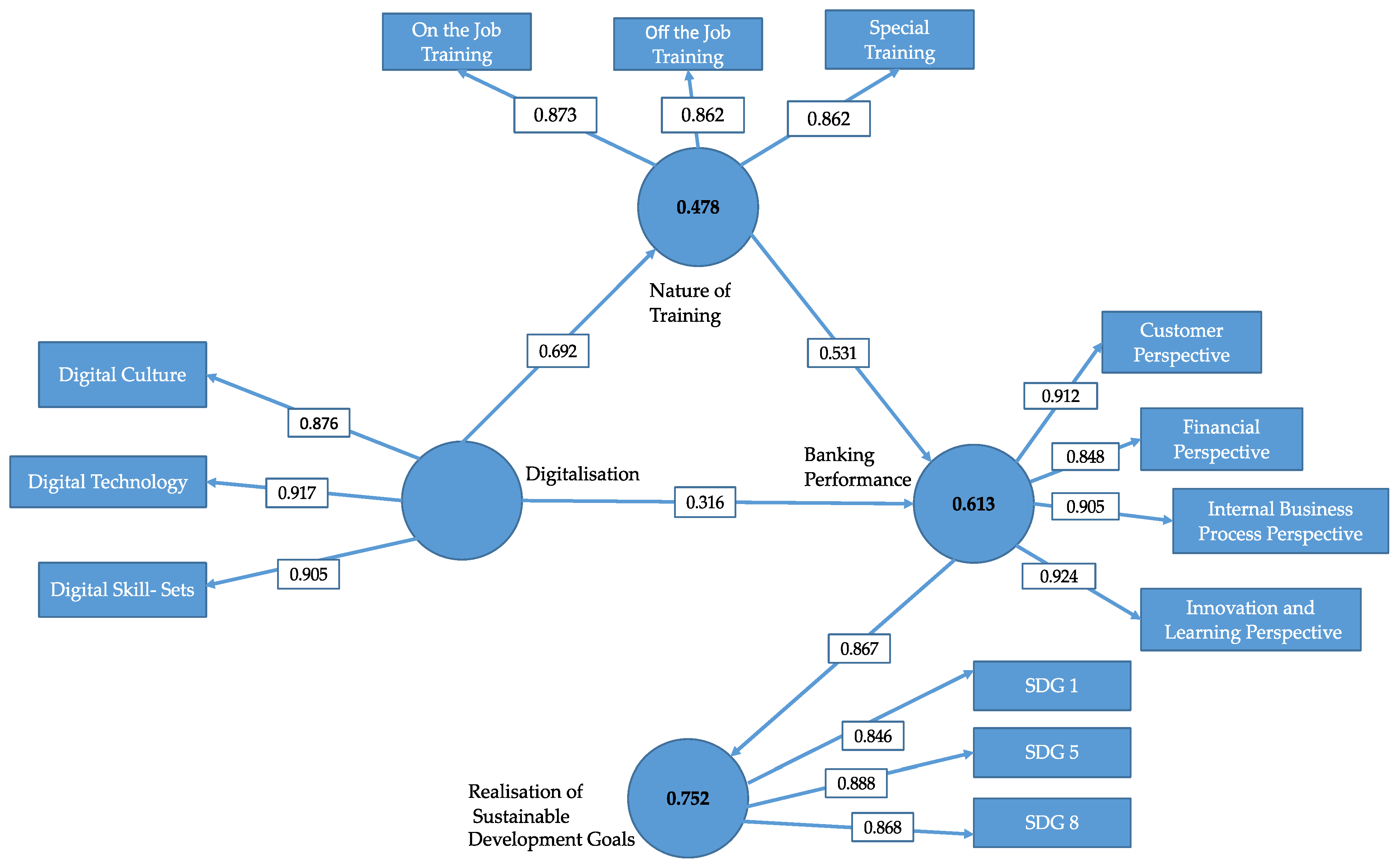

4.2. Structural Model: Path Analysis

5. Discussion and Conclusions

6. Implications

6.1. Theoretical Implication

6.2. Practical Implications

7. Limitations and Future Directions of Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ntarmah, A.H.; Kong, Y.; Kobina, M. Banking system stability and economic sustainability: A panel data analysis of the effect of banking system stability on sustainability of some selected developing countries. Quant. Financ. Econ. 2019, 3, 709–738. [Google Scholar] [CrossRef]

- Taiminen, H.M.; Karjaluoto, H. The usage of digital marketing channels in SMEs. J. Small Bus. Enterp. Dev. 2015, 22, 633–651. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2020, 18, 329–340. [Google Scholar] [CrossRef]

- Zuo, L.; Strauss, J.; Zuo, L. The Digitalisation transformation of commercial banks and its impact on sustainable efficiency improvements through investment in science and technology. Sustainability 2021, 13, 11028. [Google Scholar] [CrossRef]

- Deuze, M. Participation, remediation, bricolage: Considering principal components of a digital culture. Inf. Soc. 2006, 22, 63–75. [Google Scholar] [CrossRef]

- Muniroh, M.; Hamidah, H.; Abdullah, T. Managerial implications on the relation of digital leadership, digital culture, organizational learning, and innovation of the employee performance (case study of PT. Telkom digital and next business department). Manag. Entrep. Trends Dev. 2022, 1, 58–75. [Google Scholar] [CrossRef]

- Khan, I.U. How does culture influence digital banking? A comparative study based on the unified model. Technol. Soc. 2022, 68, 101822. [Google Scholar] [CrossRef]

- Peng, B. Digital leadership: State governance in the era of digital technology. Cult. Sci. 2022, 5, 210–225. [Google Scholar] [CrossRef]

- Khin, S.; Ho, T.C. Digital technology, digital capability and organizational performance: A mediating role of digital innovation. Int. J. Innov. Sci. 2018, 11, 177–195. [Google Scholar] [CrossRef]

- Mazurchenko, A.; Zelenka, M.; Maršíková, K. Demand for Employees’ digital Skills in the Context of Banking 4.0. Ekon. Manag. 2022, 25, 41–58. [Google Scholar] [CrossRef]

- Teichert, R. Digital transformation maturity: A systematic review of literature. In Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis; Mendel University Press: Brno, Czech Republic, 2019; Volume 67, pp. 1673–1687. [Google Scholar]

- Dikshit, A.; Jain, T.K. Training and Skill Development for Employee Retention and Performance Enhancement in Banks. 2017. Available online: https://www.researchgate.net/profile/Trilok-Jain/publication/324667619_Training_and_Skill_Development_for_Employee_Retention_and_Performance_Enhancement_in_Banks/links/5c627c7b92851c48a9cd7af5/Training-and-Skill-Development-for-Employee-Retention-and-Performance-Enhancement-in-Banks.pdf (accessed on 22 June 2023).

- Rowland, C.A.; Hall, R.D.; Altarawneh, I. Training and development: Challenges of strategy and managing performance in Jordanian banking. EuroMed J. Bus. 2017, 12, 36–51. [Google Scholar] [CrossRef]

- Amos, K.J.; Natamba, B. The impact of training and development on job performance in Ugandan banking sector. J. Innov. Sustain. RISUS 2015, 6, 65–67. [Google Scholar] [CrossRef][Green Version]

- Diener, F.; Špaček, M. Digital transformation in banking: A managerial perspective on barriers to change. Sustainability 2021, 13, 2032. [Google Scholar] [CrossRef]

- Chauhan, S.; Akhtar, A.; Gupta, A. Customer experience in digital banking: A review and future research directions. Int. J. Qual. Serv. Sci. 2022, 14, 311–348. [Google Scholar] [CrossRef]

- Firdous, S.; Farooqi, R. Impact of internet banking service quality on customer satisfaction. J. Internet Bank. Commer. 2017, 22, 1–17. [Google Scholar]

- Davis, F.D.; Bagozzi, R.P.; Warshaw, P.R. User acceptance of computer technology: A comparison of two theoretical models. Manag. Sci. 1989, 35, 982–1003. [Google Scholar] [CrossRef]

- Ajzen, I. The theory of planned behavior. Organ. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Alnemer, H.A. Determinants of digital banking adoption in the Kingdom of Saudi Arabia: A technology acceptance model approach. Digit. Bus. 2022, 2, 100037. [Google Scholar] [CrossRef]

- Jena, R.K. Examining the factors affecting the adoption of blockchain technology in the banking sector: An extended UTAUT model. Int. J. Financ. Stud. 2022, 10, 90. [Google Scholar] [CrossRef]

- Jiang, G.; Liu, F.; Liu, W.; Liu, S.; Chen, Y.; Xu, D. Effects of information quality on information adoption on social media review platforms: Moderating role of perceived risk. Data Sci. Manag. 2021, 1, 13–22. [Google Scholar] [CrossRef]

- Yan, Y.; Jeon, B.N.; Wu, J. The impact of the COVID-19 pandemic on bank systemic risk: Some cross-country evidence. China Financ. Rev. Int. 2023, 13, 388–409. [Google Scholar] [CrossRef]

- Kumar, P.; Islam, M.A.; Pillai, R.; Sharif, T. Analysing the behavioural, psychological, and demographic determinants of financial decision making of household investors. Heliyon 2023, 9, 2405–8440. [Google Scholar] [CrossRef] [PubMed]

- Chen, M.; Li, N.; Zheng, L.; Huang, D.; Wu, B. Dynamic correlation of market connectivity, risk spillover and abnormal volatility in stock price. Phys. A Stat. Mech. Its Appl. 2022, 587, 126506. [Google Scholar] [CrossRef]

- Forcadell, F.J.; Aracil, E.; Ubeda, F. Using reputation for corporate sustainability to tackle banks Digitalisation challenges. Bus. Strategy Environ. 2020, 29, 2181–2193. [Google Scholar] [CrossRef]

- Bahl, K.; Kiran, R.; Sharma, A. Impact of Drivers of Change (Digitalisation, Demonetization, and Consolidation of Banks) with Mediating Role of Nature of Training and Job Enrichment on the Banking Performance. SAGE Open 2022, 12, 21582440221097393. [Google Scholar] [CrossRef]

- Lumunon, D.F.; Massie, J.D.; Trang, I. The effect of training, digital transformation, and work motivation on employee performance during the COVID-19 period: A study on culinary UMKM employees in Manado city. Cent. Asian J. Lit. Philos. Cult. 2021, 2, 22–37. [Google Scholar]

- Shah, K.U.; Arjoon, S.; Rambocas, M. Aligning corporate social responsibility with green economy development pathways in developing countries. Sustain. Dev. 2016, 24, 237–253. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Goran, J.; La Berge, L.; Srinivasan, R. Culture for a digital age. McKinsey Q. 2017, 3, 56–67. [Google Scholar]

- Brohman, M.K.; Copeland, D.G. Riverbank Financial: Changing the role of information technology. J. Inf. Technol. 1999, 14, 287–293. [Google Scholar] [CrossRef]

- Berghaus, S.; Back, A. Stages in Digital Business Transformation: Results of an Empirical Maturity Study. In Proceedings of the MCIS 2016 Proceedings, Paphos, Cyprus, 4–6 September 2016; Volume 22. Available online: http://aisel.aisnet.org/mcis2016/22 (accessed on 14 May 2023).

- Ikegami, H.; Iijima, J. Unwrapping Efforts and Difficulties of Enterprises for Digital Transformation. In Digital Business Transformation; Agrifoglio, R., Lamboglia, R., Mancini, D., Ricciardi, F., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 237–250. [Google Scholar]

- Geoffrion, A.M.; Krishnan, R. E-business and management science: Mutual impacts (Part 2 of 2). Manag. Sci. 2003, 49, 1445–1456. [Google Scholar] [CrossRef]

- Sibanda, W.; Ndiweni, E.; Boulkeroua, M.; Echchabi, A.; Ndlovu, T. Digital technology disruption on bank business models. Int. J. Bus. Perform. Manag. 2020, 21, 184–213. [Google Scholar] [CrossRef]

- Kitsios, F.; Giatsidis, I.; Kamariotou, M. Digital Transformation and Strategy in the Banking Sector: Evaluating the Acceptance Rate of E-Services. J. Open Innov. Technol. Mark. Complex. 2021, 7, 204. [Google Scholar] [CrossRef]

- Currie, W.L.; Willcocks, L. The New Branch Columbus project at Royal Bank of Scotland: The implementation of large-scale business process re-engineering. J. Strateg. Inf. Syst. 1996, 5, 213–236. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. The Balanced Scorecard: Measures that Drive Performance. Harv. Bus. Rev. 1992, 70, 71–79. [Google Scholar]

- Van Laar, E.; van Deursen, A.J.; van Dijk, J.A.; de Haan, J. Determinants of 21st-century digital skills: A large-scale survey among working professionals. Comput. Hum. Behav. 2019, 100, 93–104. [Google Scholar] [CrossRef]

- Nath, R.; Bhal, K.T.; Kapoor, G.T. Factors influencing IT adoption by bank employees: An extended TAM approach. Vikalpa 2013, 38, 83–96. [Google Scholar] [CrossRef]

- Pandey, A.; Kiran, R.; Sharma, R.K. Investigating the Impact of Financial Inclusion Drivers, Financial Literacy and Financial Initiatives in Fostering Sustainable Growth in North India. Sustainability 2022, 14, 11061. [Google Scholar] [CrossRef]

- Shetty, M.D.; Nikhitha, M.K. Impact of Information Technology on the Banking Sector in Developing Countries. Int. J. Manag. Technol. Soc. Sci. 2022, 7, 635–645. [Google Scholar]

- Sloboda, L.; Dunas, N.; Limański, A. Contemporary challenges and risks of retail banking development in Ukraine. Banks Bank Syst. 2018, 13, 88–97. [Google Scholar] [CrossRef]

- Do, T.D.; Pham, H.A.T.; Thalassinos, E.I.; Le, H.A. Thalassinos and Hoang Anh Le the Impact of Digital Transformation on Performance: Evidence from Vietnamese Commercial Banks. J. Risk Financ. Manag. 2022, 15, 21. [Google Scholar] [CrossRef]

- Starnawska, S.E. Sustainability in the banking industry through technological transformation. In The Palgrave Handbook of Corporate Sustainability in the Digital Era; Palgrave Macmillan: Cham, Switzerland, 2021; pp. 429–453. [Google Scholar]

- Tsekeris, C. Surviving and thriving in the Fourth Industrial Revolution: Digital skills for education and society. Homo Virtualis 2019, 2, 34–42. [Google Scholar] [CrossRef]

- Meena, R.; Ganesan, P. Impact of Digital disruption on human capital of banking sector. Int. J. Anal. Exp. Modal Anal. 2019, 11, 629–636. [Google Scholar]

- Subramony, M. A meta-analytic investigation of the relationship between HRM bundles and firm performance. Hum. Resour. Manag. 2009, 48, 745–768. [Google Scholar] [CrossRef]

- Armstrong, M. Handbook of Human Resource Management Practice, 13th ed.; Kogan Page Limited: London, UK, 2014. [Google Scholar]

- Afroz, N.N. Effects of Training on Employee Performance: A Study on Banking Sector, Tangail Bangladesh. Glob. J. Econ. Bus. 2018, 427, 111–124. [Google Scholar] [CrossRef]

- Garavan, T.; McCarthy, A.; Lai, Y.; Murphy, K.; Sheehan, M.; Carbery, R. Training and organisational performance: A meta-analysis of temporal, institutional and organisational context moderators. Hum. Resour. Manag. J. 2020, 31, 93–119. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Becker, G.M.; DeGroot, M.H.; Marschak, J. Measuring utility by a single-response sequential method. Behav. Sci. 1964, 9, 226–232. [Google Scholar] [CrossRef]

- Aragon, I.B.; Valle, R.S. Does training managers pay off? Int. J. Hum. Resour. Manag. 2013, 24, 1671–1684. [Google Scholar] [CrossRef]

- Riley, S.M.; Michael, S.C.; Mahoney, J.T. Human capital matters: Market valuation of firm investments in training and the role of complementary assets. Strateg. Manag. J. 2017, 38, 1895–1914. [Google Scholar] [CrossRef]

- Raut, R.; Cheikhrouhou, N.; Kharat, M. Sustainability in the banking industry: A strategic multi-criterion analysis. Bus. Strategy Environ. 2017, 26, 550–568. [Google Scholar] [CrossRef]

- Goyal, L.; Kiran, R.; Bose, S.C. Examining the intricacies of organizational and attitudinal factors with leadership style and performance measures: A family business perspective. Curr. Psychology 2022. ahead of print. [Google Scholar] [CrossRef]

- Marinovic Matovic, I.; Lazarevic, A.; Vemic Djurkovic, J. Impact of gender and other demographic parameters on managers’ motivation. Curr. Psychol. 2023, 42, 13346–13357. [Google Scholar] [CrossRef]

- Karim, K.; Ilyas, G.B.; Umar, Z.A.; Tajibu, M.J.; Junaidi, J. Consumers’ awareness and loyalty in Indonesia banking sector: Does emotional bonding effect matters? J. Islamic Mark. 2022. ahead of print. [Google Scholar] [CrossRef]

- Gupta, A.K.; Maheshwari, M.; Sharma, S. Performance Evaluation Using Balanced Scorecard Model in Banking Industry: A Case Study of HDFC Bank. Pac. Bus. Rev. Int. 2018, 10, 64–78. [Google Scholar]

- Jain, N.K.; Kamboj, S.; Kumar, V.; Rahman, Z. Examining consumer-brand relationships on social media platforms. Mark. Intell. Plan. 2018, 36, 63–78. [Google Scholar] [CrossRef]

- Kumbhar, V.M. Factors Affecting on Customers’ Satisfaction: An Empirical Investigation of Atm Service. Int. J. Bus. Econ. 2011, 2, 144–156. Available online: https://www.skirec.com144 (accessed on 11 June 2023).

- Ozkan, M.; Cek, K.; Eyupoglu, S.Z. Sustainable Development and Customer Satisfaction and Loyalty in North Cyprus: The Mediating Effect of Customer Identification. Sustainability 2022, 14, 5196. [Google Scholar] [CrossRef]

- Cavus, N.; Mohammed, Y.B.; Yakubu, M.N. An artificial intelligence-based model for prediction of parameters affecting sustainable growth of mobile banking apps. Sustainability 2021, 13, 6206. [Google Scholar] [CrossRef]

- Engidaw, A.E. Exploring internal business factors and their impact on firm performance: Small business perspective in Ethiopia. J. Innov. Entrep. 2021, 10, 25. [Google Scholar] [CrossRef]

- Tibbs, C.Y.; Langat, L.K. Internal process, learning perspective of balance scorecard and organisational performance. Int. J. Econ. Commer. Manag. 2016, 4, 458–474. [Google Scholar]

- Tabouli, E.M.; Habtoor, N.A.; Nashief, M. The impact of human resources management on employee performance: Organizational commitment mediator variable. Asian Soc. Sci. 2016, 12, 176–192. [Google Scholar] [CrossRef]

- Kefe, I. The Determination of Performance Measures by using a Balanced Scorecard Framework. Found. Manag. 2019, 11, 43–57. [Google Scholar] [CrossRef]

- Narayanamma, P.L.; Lalitha, K. Balanced Scorecard-The Learning & Growth Perspective. Aweshkar Res. J. 2016, 21, 59–67. [Google Scholar]

- Chahal, H.; Bakshi, P. Measurement of Intellectual Capital in the Indian Banking Sector. Vikalpa 2016, 41, 61–73. [Google Scholar] [CrossRef]

- Pousttchi, K.; Dehnert, M. Exploring the Digitalisation impact on consumer decision-making in retail banking. Electron. Mark. 2018, 28, 265–286. [Google Scholar] [CrossRef]

- Losada-Otálora, M.; Alkire, L. Investigating the transformative impact of bank transparency on consumers’ financial well-being. Int. J. Bank Mark. 2019, 37, 1062–1079. [Google Scholar] [CrossRef]

- Malik, G.; Prakash, A. The impact of new private sector banks on old private sector banks in India. Asia Pac. Bus. Rev. 2008, 4, 64–73. [Google Scholar] [CrossRef]

- Shamshad, M.; Sarim, M.; Akhtar, A.; Tabash, M.I. Identifying critical success factors for sustainable growth of Indian banking sector using interpretive structural modelling (ISM). Int. J. Soc. Econ. 2018, 45, 1189–1204. [Google Scholar] [CrossRef]

- Kumar, K.; Prakash, A. Managing sustainability in banking: Extent of sustainable banking adaptations of banking sector in India. Environment. Dev. Sustain. 2020, 22, 5199–5217. [Google Scholar] [CrossRef]

- India CSR. 2019. Women Represent 24.34% in SBI Total Workforce. Available online: https://indiacsr.in/women-represent-24-34-in-sbis-total-workforce/ (accessed on 21 June 2023).

- Kumar, K.; Prakash, A. Developing a framework for assessing sustainable banking performance of the Indian banking sector. Soc. Responsib. J. 2019, 15, 689–709. [Google Scholar] [CrossRef]

- Aras, G.; Tezcan, N.; Furtuna, O.K. Multidimensional comprehensive corporate sustainability performance evaluation model: Evidence from an emerging market banking sector. J. Clean. Prod. 2018, 185, 600–609. [Google Scholar] [CrossRef]

- Nizam, E.; Dewandaru, G.; Nagayev, R. The Impact of Social and Environmental Sustainability on Financial Performance: A Global Analysis of the Banking Sector. J. Multinatl. Financ. Manag. 2019, 49, 35–53. [Google Scholar] [CrossRef]

- Galletta, S.; Mazzù, S.; Naciti, V.; Vermiglio, C. Gender diversity and sustainability performance in the banking industry. Corp. Soc. Responsib. Environ. Manag. 2021, 29, 161–174. [Google Scholar] [CrossRef]

- Ringle, C.; Da Silva, D.; Bido, D. Structural Equation Modeling with the Smartpls. Braz. J. Mark. 2015, 13, 56–73. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Treating unobserved heterogeneity in PLS-SEM: A multi-method approach. In Partial Least Squares Path Modeling: Basic Concepts, Methodological Issues and Applications; Partial Least Squares Path Modeling; Latan, H., Noonan, R., Eds.; Springer International Publishing: Cham, Switzerland, 2017; pp. 197–217. [Google Scholar] [CrossRef]

- Guenther, P.; Guenther, M.; Ringle, C.M.; Zaefarian, G.; Cartwright, S. Improving PLS-SEM use for business marketing research. Ind. Mark. Manag. 2023, 111, 127–142. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Podsakoff, N.P. Sources of method bias in social science research and recommendations on how to control it. Annu. Rev. Psychol. 2012, 63, 539–569. [Google Scholar] [CrossRef]

- Ramos, D.L.; Chen, S.; Rabeeu, A.; Abdul Rahim, A.B. Does SDG Coverage influence firm performance? Sustainability 2022, 14, 4870. [Google Scholar] [CrossRef]

- Nunnally, J.C. Psychometric theory-25 years ago and now. Educ. Res. 1975, 4, 7–21. [Google Scholar]

- Brown, T.A.; Moore, M.T. Confirmatory factor analysis. Handb. Struct. Equ. Model. 2012, 361, 379. [Google Scholar]

- Fornell, C.; Larcker, D.F. Structural equation models with unobservable variables and measurement error: Algebra and statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Henseler, J.; Dijkstra, T.K.; Sarstedt, M.; Ringle, C.M.; Diamantopoulos, A.; Straub, D.W.; Calantone, R.J. Common beliefs and reality about PLS: Comments on Rönkkö and Evermann (2013). Organ. Res. Methods 2014, 17, 182–209. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Zhao, X.; Lynch, J.G., Jr.; Chen, Q. Reconsidering Baron and Kenny: Myths and truths about mediation analysis. J. Consum. Res. 2010, 37, 197–206. [Google Scholar] [CrossRef]

- Saraf, P.K.; Saha, S.; Anand, A. Supportive culture and job involvement in public sector: The mediating role of participation in decision making and organizational learning. Int. J. Public Sect. Manag. 2022, 35, 549–567. [Google Scholar] [CrossRef]

- Anand, G. Corporate excellence through governance and employee engagement: A brief analysis. J. Commer. Manag. Thought 2017, 8, 554–562. [Google Scholar] [CrossRef]

- Fekete, A.; Rhyner, J. Sustainable Digital Transformation of Disaster Risk-Integrating New Types of Digital Social Vulnerability and Interdependencies with Critical Infrastructure. Sustainability 2020, 12, 9324. [Google Scholar] [CrossRef]

- Hayes, A.F. Partial, conditional, and moderated moderated mediation: Quantification, inference, and interpretation. Commun. Monogr. 2018, 85, 4–40. [Google Scholar] [CrossRef]

- Yimam, M.H. Impact of training on employees performance: A case study of Bahir Dar university, Ethiopia. Cogent Educ. 2022, 9, 2107301. [Google Scholar] [CrossRef]

- Sam, J.S.; Chakraborty, A.; Srinivasan, J. Cashlessness in India: Vision, policy and practices. Telecommun. Policy 2021, 45, 102169. [Google Scholar] [CrossRef]

| Participants | Public Sector Banks | Private Sector Banks | Foreign Sector Banks | Total |

|---|---|---|---|---|

| Total Responses | 189 | 191 | 22 | 402 |

| Gender | ||||

| Males | 107 | 111 | 15 | 233 (57.96%) |

| Females | 82 | 80 | 7 | 169 (42.04%) |

| Levels | ||||

| Managerial Level | 101 | 96 | 17 | 214 (53.23%) |

| Non-Managerial Level | 88 | 95 | 5 | 188 (46.76%) |

| Type of Training | ||||

| On the Job | 75 | 78 | 13 | 166 (41.29%) |

| Off the Job | 42 | 38 | 4 | 84 (20.89%) |

| Special | 72 | 75 | 5 | 152 (37.81%) |

| Wave 1 (n1 = 200) February 2022–July 2022 | Wave 2 (n2 = 202) November 2022–January 2023 | |||

|---|---|---|---|---|

| Construct | Mean | Standard Deviation | Mean | Standard Deviation |

| Digitalisation | ||||

| Digital Culture | 4.123 | 1.049 | 4.115 | 1.161 |

| Digital Skill-Sets | 4.176 | 0.889 | 4.368 | 0.912 |

| Digital Technology | 4.031 | 0.820 | 4.025 | 0.896 |

| Nature of Training | ||||

| On the Job Training | 4.023 | 0.849 | 4.111 | 0.829 |

| Off the Job Training | 4.016 | 0.869 | 4.201 | 0.878 |

| Special Training | 3.431 | 0.820 | 3.331 | 0.802 |

| Banking Performance | ||||

| Financial Perspective | 4.331 | 0.878 | 4.345 | 0.876 |

| Customer Perspective | 4.014 | 0.844 | 4.002 | 0.847 |

| Internal Business Process Perspective | 3.908 | 0.850 | 3.906 | 0.869 |

| Innovative and Learning Perspective | 4.001 | 0.877 | 4.103 | 0.856 |

| Sustainable Growth | ||||

| SDG1 | 4.009 | 0.811 | 4.048 | 0.861 |

| SDG5 | 3.953 | 0.862 | 4.055 | 0.922 |

| SDG8 | 4.014 | 0.857 | 4.025 | 0.916 |

| Scale | Supporting References | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Digitalisation | |||||||||||||||

| Digital Culture | |||||||||||||||

| [9,27,35,37,49] | ||||||||||||||

| Digital Skillsets | |||||||||||||||

| [6,8,9,34] | ||||||||||||||

| Digital Technology | |||||||||||||||

| [10,11,48,49] | ||||||||||||||

| Nature of Training | On the Job Training | Off the Job Training | Special Training | ||||||||||||

| 1 | 2 | 3 | 4 | 5 | 1 | 2 | 3 | 4 | 5 | 1 | 2 | 3 | 4 | 5 | |

| [50,51,52,53,54,55,56] | ||||||||||||||

| Banking Performance: | |||||||||||||||

| Internal Business Processes | |||||||||||||||

| [40,58,59,60] | ||||||||||||||

| Internal Business Processes | |||||||||||||||

| [40,61,62,63,64,65] | ||||||||||||||

| Financial Performance | |||||||||||||||

| [40,68,69,70,71] | ||||||||||||||

| Innovation and learning perspective | |||||||||||||||

| [40,72] | ||||||||||||||

| Realisation of Specific SDGs (SDG1, SDG5, SDG8) | |||||||||||||||

| [47,76,77,78,79] | ||||||||||||||

| Cronbach’s Alpha | rho_A | Composite Reliability | Average Variance Extracted (AVE) | |

|---|---|---|---|---|

| Banking performance | 0.920 | 0.926 | 0.943 | 0.806 |

| Digitalisation | 0.882 | 0.885 | 0.927 | 0.809 |

| Nature of Training | 0.835 | 0.851 | 0.900 | 0.749 |

| Realisation of specific SDGs | 0.835 | 0.835 | 0.901 | 0.752 |

| Fornell Larker Criteria | ||||

| Banking Performance | Digitalisation | Nature of Training | Realisation of Specific SDGs | |

| Banking Performance | 0.898 | |||

| Digitalisation | 0.683 | 0.900 | ||

| Nature of Training | 0.749 | 0.692 | 0.866 | |

| Realisation of specific SDGs | 0.856 | 0.583 | 0.629 | 0.867 |

| HTMT Ratio | ||||

| Banking Performance | ||||

| Digitalisation | 0.756 | |||

| Nature of Training | 0.845 | 0.785 | ||

| Realisation of specific SDGs | 0.812 | 0.679 | 0.738 | |

| Outer VIF | |||||||

| Constructs | VIF | Constructs | VIF | Constructs | VIF | Constructs | VIF |

| Digital Culture | 2.194 | OFFJT | 2.252 | FP | 2.317 | SDG1 | 1.761 |

| Digital Skill-Sets | 2.628 | ONJT | 2.316 | IBP | 3.483 | SDG5 | 2.191 |

| Digital Technology | 2.766 | SPT | 2.764 | CP | 2.446 | SDG8 | 2.013 |

| Inner VIF | |||||||

| Banking Performance | Digitalisation | Nature of Training | Realisation of Specific SDGs | ||||

| Banking Performance | 1.000 | ||||||

| Digitalisation | 1.917 | 1.000 | |||||

| Nature of Training | 1.917 | ||||||

| Realisation of specific SDGs | |||||||

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | p-Values | |

|---|---|---|---|---|---|

| Digital Culture ← Digitalisation | 0.876 | 0.880 | 0.056 | 15.549 | 0.000 *** |

| Digital Skill-Sets ← Digitalisation | 0.905 | 0.907 | 0.012 | 73.041 | 0.000 *** |

| Digital Technology ← Digitalisation | 0.917 | 0.919 | 0.010 | 91.254 | 0.000 *** |

| ONJT ← Nature of _Training | 0.873 | 0.872 | 0.016 | 54.598 | 0.000 *** |

| OFFJT ← Nature of _Training | 0.862 | 0.861 | 0.017 | 51.649 | 0.000 *** |

| SPTG ← Nature of _Training | 0.862 | 0.862 | 0.012 | 69.921 | 0.000 *** |

| FP ← Banking Performance | 0.848 | 0.847 | 0.023 | 37.572 | 0.000 *** |

| CP ← Banking Performance | 0.912 | 0.912 | 0.012 | 77.449 | 0.000 *** |

| IBP ← Banking Performance | 0.905 | 0.905 | 0.011 | 83.758 | 0.000 *** |

| I&LP← Banking Performance | 0.924 | 0.925 | 0.009 | 100.100 | 0.000 *** |

| SDG1 ← Realisation of specific SDGs | 0.846 | 0.845 | 0.021 | 41.160 | 0.000 *** |

| SDG5 ← Realisation of specific SDGs | 0.888 | 0.887 | 0.014 | 64.057 | 0.000 *** |

| SGP8 ← Realisation of specific SDGs | 0.868 | 0.867 | 0.016 | 54.563 | 0.000 *** |

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T-Statistics (|O/STDEV|) | p-Values | f2 | |

|---|---|---|---|---|---|---|

| H1: Digitalisation → nature of training | 0.692 | 0.694 | 0.028 | 24.362 | 0.000 *** | 0.917 (L) |

| H2: Digitalisation → banking performance | 0.316 | 0.321 | 0.058 | 5.411 | 0.000 *** | 0.153 (M) |

| H3: Nature of training → banking performance | 0.531 | 0.526 | 0.051 | 10.448 | 0.000 *** | 0.380 (L) |

| H4: Banking performance → realisation of specific sustainable development goals (SDG1, SDG5, and SDG8). | 0.867 | 0.868 | 0.014 | 61.303 | 0.000 *** | 3.038 (L) |

| Mediation/Indirect Effect | ||||||

| H5: Digitalisation → nature of training → banking performance | 0.367 | 0.365 | 0.036 | 10.079 | 0.000 *** | |

| H6: Digitalisation → banking performance → realisation of specific sustainable development goals (SDG1, SDG5, and SDG8). | 0.274 | 0.279 | 0.051 | 5.387 | 0.000 *** | |

| H7: Nature of training → banking performance → realisation of specific sustainable development goals (SDG1, SDG5, and SDG8). | 0.460 | 0.457 | 0.045 | 10.127 | 0.000 *** | |

| H8: Digitalisation → nature of training → banking performance → realisation of specific sustainable development goals (SDG1, SDG5, and SDG8). | 0.318 | 0.317 | 0.033 | 9.685 | 0.000 *** | |

| R-Square | Adj. R-Square | |||||

| Nature of Training | 0.478 | 0.477 | ||||

| Banking Performance | 0.613 | 0.611 | ||||

| Realisation of specific SDGs (SDG1, SDG5 and SDG8) | 0.752 | 0.752 | ||||

| Hypotheses | β-Values/R2 | p-Values | Status |

|---|---|---|---|

| H1: Digitalisation → nature of Training | β-value 0.692 | 0.000 *** | Supported |

| H2: Digitalisation → banking performance | β-value 0.316 | 0.000 *** | Supported |

| H3: Nature of training → banking performance | β-value 0.531 | 0.000 *** | Supported |

| H4: Banking performance → realisation of specific sustainable development goals (SDG1, SDG5 and SDG8). | β-value 0.867 | 0.000 *** | Supported |

| Indirect Effect | |||

| H5: (H1 × H3): Digitalisation → nature of training → banking performance | β-value 0.361 | 0.000 *** | Supported |

| H6: (H3 × H4): Digitalisation → banking performance → realisation of specific sustainable development goals (SDG1, SDG5 and SDG8). | β-value 0.274 | 0.000 *** | Supported |

| H7: (H2 × H4): Nature of training → banking performance → realisation of specific Sustainable development goals (SDG1, SDG5 and SDG8). | β-value 0.460 | 0.000 *** | Supported |

| H8: (H1 × H3 × H4): Digitalisation → nature of training → banking performance → realisation of specific sustainable development goals (SDG1, SDG5 and SDG8). | β-value 0.318 | 0.000 *** | Supported |

| R2: 0.752 | Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bahl, K.; Kiran, R.; Sharma, A. Scaling Up Banking Performance for the Realisation of Specific Sustainable Development Goals: The Interplay of Digitalisation and Training in the Transformation Journey. Sustainability 2023, 15, 13798. https://doi.org/10.3390/su151813798

Bahl K, Kiran R, Sharma A. Scaling Up Banking Performance for the Realisation of Specific Sustainable Development Goals: The Interplay of Digitalisation and Training in the Transformation Journey. Sustainability. 2023; 15(18):13798. https://doi.org/10.3390/su151813798

Chicago/Turabian StyleBahl, Kayenaat, Ravi Kiran, and Anupam Sharma. 2023. "Scaling Up Banking Performance for the Realisation of Specific Sustainable Development Goals: The Interplay of Digitalisation and Training in the Transformation Journey" Sustainability 15, no. 18: 13798. https://doi.org/10.3390/su151813798

APA StyleBahl, K., Kiran, R., & Sharma, A. (2023). Scaling Up Banking Performance for the Realisation of Specific Sustainable Development Goals: The Interplay of Digitalisation and Training in the Transformation Journey. Sustainability, 15(18), 13798. https://doi.org/10.3390/su151813798