The Dynamic Relationship between Carbon Emissions, Financial Development, and Renewable Energy: A Study of the N-5 Asian Countries

Abstract

:1. Introduction

2. Literature Review

2.1. Association amongst Carbon Emissions and Financial Development

2.2. Energy Consumption and CO2 Emissions

2.3. CO2 Emissions and Moderating Impact of Globalisation

2.4. CO2 Emission and Moderating Impact of Institutional Quality

3. Methodology

3.1. Data

3.2. Variables Description

3.3. Model and Specification

3.4. Empirical Estimation

4. Empirical Results and Discussion

Implications of Results

5. Concluding Remarks

5.1. Conclusions

5.2. Implications for Sustainable Development

5.3. Limitations and Future Considerations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aye, G.C.; Edoja, P.E. Effect of economic growth on CO2 emission in developing countries: Evidence from a dynamic panel threshold model. Cogent Econ. Financ. 2017, 5, 1379239. [Google Scholar] [CrossRef]

- Shahsavari, A.; Akbari, M. Potential of solar energy in developing countries for reducing energy-related emissions. Renew. Sustain. Energy Rev. 2018, 90, 275–291. [Google Scholar] [CrossRef]

- Aleluia, J.; Tharakan, P.; Chikkatur, A.; Shrimali, G.; Chen, X. Accelerating a clean energy transition in Southeast Asia: Role of governments and public policy. Renew. Sustain. Energy Rev. 2022, 159, 112226. [Google Scholar] [CrossRef]

- Tian, J.; Yu, L.; Xue, R.; Zhuang, S.; Shan, Y. Global low-carbon energy transition in the post-COVID-19 era. Appl. Energy 2022, 307, 118205. [Google Scholar] [CrossRef] [PubMed]

- Burke, P.J.; Widnyana, J.; Anjum, Z.; Aisbett, E.; Resosudarmo, B.; Baldwin, K.G. Overcoming barriers to solar and wind energy adoption in two Asian giants: India and Indonesia. Energy Policy 2019, 132, 1216–1228. [Google Scholar] [CrossRef]

- Hung, N.T. Green investment, financial development, digitalization and economic sustainability in Vietnam: Evidence from a quantile-on-quantile regression and wavelet coherence. Technol. Forecast. Soc. Chang. 2023, 186, 122185. [Google Scholar] [CrossRef]

- Karuppiah, K.; Sankaranarayanan, B.; Ali, S.M.; Jabbour, C.J.C.; Bhalaji, R. Inhibitors to circular economy practices in the leather industry using an integrated approach: Implications for sustainable development goals in emerging economies. Sustain. Prod. Consum. 2021, 27, 1554–1568. [Google Scholar] [CrossRef]

- Sharif, A.; Mishra, S.; Sinha, A.; Jiao, Z.; Shahbaz, M.; Afshan, S. The renewable energy consumption-environmental degradation nexus in Top-10 polluted countries: Fresh insights from quantile-on-quantile regression approach. Renew. Energy 2020, 150, 670–690. [Google Scholar] [CrossRef]

- Nedopil, C.; Wang, Y.; Xie, W.; DeBoer, D.; Liu, S.; Chen, X.; Li, Y.; Zhu, Y.; Lan, Y.; Zhao, H. Green Development Guidance for BRI Projects Baseline Study Report; International Belt and Road Initiative Green Development Coalition (BRIGC): Beijing, China, 2020. [Google Scholar]

- Yin, W. Integrating Sustainable Development Goals into the Belt and Road Initiative: Would it be a new model for green and sustainable investment? Sustainability 2019, 11, 6991. [Google Scholar] [CrossRef]

- Hannah, R.; Max, R.; Pablo, R. CO2 and Greenhouse Gas Emissions. 2020. Available online: https://ourworldindata.org/greenhouse-gas-emissions#annual-greenhouse-gas-emissions-how-much-do-we-emit-each-year (accessed on 19 July 2023).

- Park, D.; Shin, K. Economic growth, financial development, and income inequality. Emerg. Mark. Financ. Trade 2017, 53, 2794–2825. [Google Scholar] [CrossRef]

- Zaman, R.; Brudermann, T. Energy governance in the context of energy service security: A qualitative assessment of the electricity system in Bangladesh. Appl. Energy 2018, 223, 443–456. [Google Scholar] [CrossRef]

- Wangzhou, K.; Wen, J.J.; Wang, Z.; Wang, H.; Hao, C.; Andlib, Z. Revealing the nexus between tourism development and CO2 emissions in Asia: Does asymmetry matter? Environ. Sci. Pollut. Res. 2022, 29, 79016–79024. [Google Scholar] [CrossRef] [PubMed]

- Asian Development Bank. Energy in Asia and the Pacific, Asian Development Bank. 2022. Available online: https://www.adb.org/what-wedo/topics/energy#:~:text=Fossil%20fuels%20account%20for%2075,than%20half%20of%20global%20consumption (accessed on 19 July 2023).

- Sun, Y.; Razzaq, A.; Sun, H.; Irfan, M. The asymmetric influence of renewable energy and green innovation on carbon neutrality in China: Analysis from non-linear ARDL model. Renew. Energy 2022, 193, 334–343. [Google Scholar] [CrossRef]

- Fang, W.; Liu, Z.; Putra, A.R.S. Role of research and development in green economic growth through renewable energy development: Empirical evidence from South Asia. Renew. Energy 2022, 194, 1142–1152. [Google Scholar] [CrossRef]

- Sheraz, M.; Deyi, X.; Sinha, A.; Mumtaz, M.Z.; Fatima, N. The dynamic nexus among financial development, renewable energy and carbon emissions: Moderating roles of globalization and institutional quality across BRI countries. J. Clean. Prod. 2022, 343, 130995. [Google Scholar] [CrossRef]

- Rehman, A.; Alam, M.M.; Ozturk, I.; Alvarado, R.; Murshed, M.; Işık, C.; Ma, H. Globalization and renewable energy use: How are they contributing to upsurge the CO2 emissions? A global perspective. Environ. Sci. Pollut. Res. 2023, 30, 9699–9712. [Google Scholar] [CrossRef]

- Khan, H.; Weili, L.; Khan, I. Institutional quality, financial development and the influence of environmental factors on carbon emissions: Evidence from a global perspective. Environ. Sci. Pollut. Res. 2022, 29, 1–13. [Google Scholar] [CrossRef]

- Salahuddin, M.; Alam, K.; Ozturk, I.; Sohag, K. The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew. Sustain. Energy Rev. 2018, 81, 2002–2010. [Google Scholar] [CrossRef]

- Zafar, M.W.; Saud, S.; Hou, F. The impact of globalization and financial development on environmental quality: Evidence from selected countries in the Organization for Economic Co-operation and Development (OECD). Environ. Sci. Pollut. Res. 2019, 26, 13246–13262. [Google Scholar] [CrossRef]

- Asumadu-Sarkodie, S.; Owusu, P.A. A multivariate analysis of carbon dioxide emissions, electricity consumption, economic growth, financial development, industrialization, and urbanization in Senegal. Energy Sources Part B Econ. Plan. Policy 2017, 12, 77–84. [Google Scholar] [CrossRef]

- Khan, M.T.I.; Yaseen, M.R.; Ali, Q. Dynamic relationship between financial development, energy consumption, trade and greenhouse gas: Comparison of upper middle income countries from Asia, Europe, Africa and America. J. Clean. Prod. 2017, 161, 567–580. [Google Scholar] [CrossRef]

- Majeed, M.T.; Tauqir, A. Effects of urbanization, industrialization, economic growth, energy consumption, financial development on carbon emissions: An extended STIRPAT model for heterogeneous income groups. Pak. J. Commer. Soc. Sci. 2020, 14, 652–681. [Google Scholar]

- Ahmad, M.; Khan, Z.; Rahman, Z.U.; Khan, S. Does financial development asymmetrically affect CO2 emissions in China? An application of the nonlinear autoregressive distributed lag (NARDL) model. Carbon Manag. 2018, 9, 631–644. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nasir, M.A.; Hille, E.; Mahalik, M.K. UK’s net-zero carbon emissions target: Investigating the potential role of economic growth, financial development, and R&D expenditures based on historical data (1870–2017). Technol. Forecast. Soc. Chang. 2020, 161, 120255. [Google Scholar]

- Bibi, F.; Jamil, M. Testing environment Kuznets curve (EKC) hypothesis in different regions. Environ. Sci. Pollut. Res. 2021, 28, 13581–13594. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Churchill, S.A.; Paramati, S.R. The dynamic impact of renewable energy and institutions on economic output and CO2 emissions across regions. Renew. Energy 2017, 111, 157–167. [Google Scholar] [CrossRef]

- Raza, S.A.; Shah, N.; Khan, K.A. Residential energy environmental Kuznets curve in emerging economies: The role of economic growth, renewable energy consumption, and financial development. Environ. Sci. Pollut. Res. 2020, 27, 5620–5629. [Google Scholar] [CrossRef]

- Zhang, J.; Ahmad, M.; Muhammad, T.; Syed, F.; Hong, X.; Khan, M. The Impact of the Financial Industry and Globalization on Environmental Quality. Sustainability 2023, 15, 1705. [Google Scholar] [CrossRef]

- Zhang, B.; Wang, B.; Wang, Z. Role of renewable energy and non-renewable energy consumption on EKC: Evidence from Pakistan. J. Clean. Prod. 2017, 156, 855–864. [Google Scholar]

- Murshed, M.; Apergis, N.; Alam, S.; Khan, U.; Mahmud, S. The impacts of renewable energy, financial inclusivity, globalization, economic growth, and urbanization on carbon productivity: Evidence from net moderation and mediation effects of energy efficiency gains. Renew. Energy 2022, 196, 824–838. [Google Scholar] [CrossRef]

- Sheraz, M.; Deyi, X.; Ahmed, J.; Ullah, S.; Ullah, A. Moderating the effect of globalization on financial development, energy consumption, human capital, and carbon emissions: Evidence from G20 countries. Environ. Sci. Pollut. Res. 2021, 28, 35126–35144. [Google Scholar] [CrossRef]

- Qayyum, M.; Ali, M.; Nizamani, M.M.; Li, S.; Yu, Y.; Jahanger, A. Nexus between financial development, renewable energy consumption, technological innovations, and CO2 emissions: The case of India. Energies 2021, 14, 4505. [Google Scholar] [CrossRef]

- Dilanchiev, A.; Nuta, F.; Khan, I.; Khan, H. Urbanization, renewable energy production, and carbon dioxide emission in BSEC member states: Implications for climate change mitigation and energy markets. Environ. Sci. Pollut. Res. 2023, 30, 67338–67350. [Google Scholar] [CrossRef] [PubMed]

- Balsalobre-Lorente, D.; Shahbaz, M.; Murshed, M.; Nuta, F.M. Environmental impact of globalization: The case of central and Eastern European emerging economies. J. Environ. Manag. 2023, 341, 118018. [Google Scholar] [CrossRef]

- Shahbaz, M.; Mallick, H.; Mahalik, M.K.; Loganathan, N. Does globalization impede environmental quality in India? Ecol. Indicat. 2015, 52, 379–393. [Google Scholar] [CrossRef]

- Shahbaz, M.; Solarin, S.A.; Ozturk, I. Environmental Kuznets Curve hypothesis and the role of globalization in selected African countries. Ecol. Indic. 2016, 67, 623–636. [Google Scholar] [CrossRef]

- Voegtlin, C.; Scherer, A.G. Responsible innovation and the innovation of responsibility: Governing sustainable development in a globalized world. J. Bus. Ethics 2017, 143, 227–243. [Google Scholar] [CrossRef]

- Salman, M.; Long, X.; Dauda, L.; Mensah, C.N. The impact of institutional quality on economic growth and carbon emissions: Evidence from Indonesia, South Korea and Thailand. J. Clean. Prod. 2019, 241, 118331. [Google Scholar] [CrossRef]

- Yuan, B.; Li, C.; Yin, H.; Zeng, M. Green innovation and China’s CO2 emissions–the moderating effect of institutional quality. J. Environ. Plan. Manag. 2022, 65, 877–906. [Google Scholar] [CrossRef]

- Bano, S.; Zhao, Y.; Ahmad, A.; Wang, S.; Liu, Y. Identifying the impacts of human capital on carbon emissions in Pakistan. J. Clean. Prod. 2018, 183, 1082–1092. [Google Scholar] [CrossRef]

- Zakaria, M.; Bibi, S. Financial development and environment in South Asia: The role of institutional quality. Environ. Sci. Pollut. Res. 2019, 26, 7926–7937. [Google Scholar] [CrossRef] [PubMed]

- Ahmed, Z.; Asghar, M.M.; Malik, M.N.; Nawaz, K. Moving towards a sustainable environment: The dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Resour. Policy 2020, 67, 101677. [Google Scholar] [CrossRef]

- Hassan, S.T.; Xia, E.; Khan, N.H.; Shah, S.M.A. Economic growth, natural resources, and ecological footprints: Evidence from Pakistan. Environ. Sci. Pollut. Res. 2019, 26, 2929–2938. [Google Scholar] [CrossRef] [PubMed]

- Haini, H. Examining the impact of ICT, human capital and carbon emissions: Evidence from the ASEAN economies. Int. Econ. 2021, 166, 116–125. [Google Scholar] [CrossRef]

- Miller, N.C.; Kumar, S.; Pearce, K.L.; Baldock, K.L. The outcomes of nature-based learning for primary school aged children: A systematic review of quantitative research. Environ. Educ. Res. 2021, 27, 1115–1140. [Google Scholar] [CrossRef]

- Pesaran, M.H. General diagnostic tests for cross-sectional dependence in panels. Empir. Econ. 2021, 60, 13–50. [Google Scholar] [CrossRef]

- Alhodiry, A.; Rjoub, H.; Samour, A. Impact of oil prices, the US interest rates on Turkey’s real estate market. New evidence from combined co-integration and bootstrap ARDL tests. PLoS ONE 2021, 16, e0242672. [Google Scholar] [CrossRef]

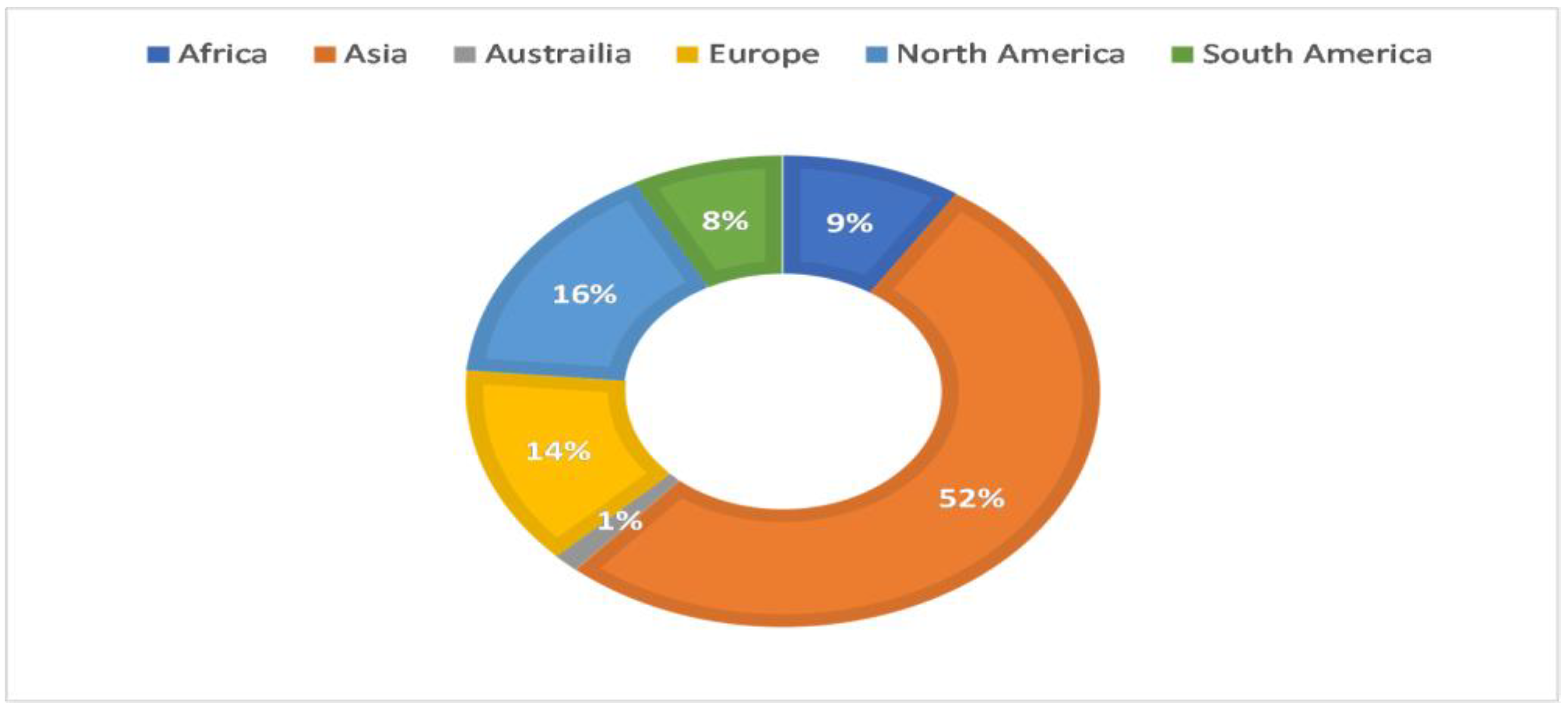

| Continents | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Africa | 4,724,591,000 | 4,883,026,400 | 4,862,142,500 | 4,771,323,000 | 4,751,794,700 | 4,656,470,000 | 4,698,851,300 | 4,742,433,300 | 4,683,634,000 | 4,719,213,600 | 4,640,355,300 |

| Asia | 23,501,705,000 | 25,112,080,000 | 25,835,897,000 | 26,092,777,000 | 27,001,670,000 | 27,731,263,000 | 27,087,560,000 | 27,633,859,000 | 28,251,386,000 | 29,153,006,000 | 2,867,336,800 |

| Australia | 811,251,000 | 826,610,200 | 777,676,000 | 675,925,570 | 665,306,560 | 650,599,200 | 646,500,160 | 680,855,550 | 658,960,260 | 623,561,300 | 602,731,650 |

| Europe | 7,467,774,000 | 7,399,134,000 | 7,359,351,300 | 7,226,138,000 | 6,950,991,000 | 6,989,548,000 | 7,031,311,400 | 7,091,462,000 | 7,084,059,600 | 6,916,850,700 | 6,486,574,000 |

| North America | 8,417,333,000 | 8,288,974,300 | 8,108,574,000 | 8,245,462,500 | 8,380,942,300 | 8,275,196,000 | 8,170,190,000 | 8,112,087,600 | 8,320,786,000 | 8,221,015,000 | 7,507,261,400 |

| South America | 4,153,206,800 | 4,121,616,000 | 4,234,718,500 | 4,239,712,800 | 4,161,550,300 | 4,071,219,000 | 3,889,702,400 | 3,783,899,400 | 3,658,345,500 | 3,800,535,000 | 3,601,995,300 |

| Variables | Data Source | Description of Variables |

|---|---|---|

| Dependent Variable | ||

| Carbon Emission | WDI, World Bank | CO2 emission |

| Independent Variables | ||

| Financial Development | World Development Indicators | Accessibility to banks |

| Renewable Energy | World Development Indicators | Renewable energy consumption |

| Globalisation | Economy Website of Global Economic Barometer (KOF) | Consisting of sub-indices of economic, social, and political, |

| Institution Quality | World Development Indicators | Comprises sub-indices, control of corruption, regulatory quality, voice and accountability, rule of law, government effectiveness absence of political stability, and terrorism |

| Test | Statistic | d.f. | Prob. |

|---|---|---|---|

| Breusch–Pagan LM | 18.77906 | 10 | 0.0432 |

| Pesaran-scaled LM | 1.963055 | 0.0495 | |

| Pesaran CD | 0.022448 | 0.9822 |

| Level | First Difference | |||

|---|---|---|---|---|

| Variables | t-Statistics | p-Value | t-Statistics | p-Value |

| Carbon Emission | 16.8592 | 0.0775 | 19.6494 | 0.0327 |

| Financial Development | 7.43433 | 0.6839 | 14.7845 | 0.1401 |

| Globalisation | 7.90039 | 0.6386 | 31.5005 | 0.0005 |

| Institution Quality | 8.57044 | 0.5733 | 22.1115 | 0.0145 |

| Renewable Energy | 13.7155 | 0.1864 | 10.8251 | 0.3713 |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| Financial Development | −0.056159 | 0.085746 | −0.654948 | 0.5152 |

| Renewable Energy | −0.098386 | 0.058217 | −1.689761 | 0.0986 |

| Institutional Quality | 2.274171 | 1.006059 | 2.260484 | 0.0292 |

| Globalisation | −0.030843 | 0.061063 | −0.505075 | 0.6162 |

| Model 1 | Model 2 | Model 3 | ||||

| Long Run Equation | ||||||

| Coefficient | p Value | Coefficient | p Value | Coefficient | p Value | |

| Renewable Energy | −0.207 *** | 0.000 | ||||

| Financial Development | 0.153 *** | 0.095 | ||||

| Globalisation | 0.095 *** | 0.000 | ||||

| Institution Quality | 0.115 | 0.8259 | ||||

| Renewable Energy *Globalisation | 0.001 *** | 0.000 | −0.008 *** | 0.000 | ||

| Financial Development * Globalisation | 0.001 *** | 0.011 | 0.015 *** | 0.000 | ||

| Renewable Energy * Institutional Quality | −1.92 *** | 0.000 | ||||

| Financial Development * Institutional Quality | −0.593 *** | 0.000 | ||||

| Short Term Equation | ||||||

| Coefficient | p Value | Coefficient | p Value | Coefficient | p Value | |

| D (Renewable Energy) | −0.339 ** | 0.0369 | ||||

| D (Financial Development) | −0.169 | 0.3832 | ||||

| D (Globalisation) | 0.003 | 0.9298 | ||||

| D (Institution Quality) | 1.066 | 0.1807 | ||||

| D (Renewable Energy * Globalisation) | −0.004 ** | 0.0387 | −0.010 | 0.147 | ||

| D (Financial Development * Globalisation) | −0.001 | 0.6992 | 0.005 | 0.3515 | ||

| D (Renewable Energy * Institutional Quality) | −0.435 | 0.6345 | ||||

| D (Financial Development * Institutional Quality) | 1.070 | 0.3938 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, X.; Dai, W.; Muhammad, T.; Zhang, T. The Dynamic Relationship between Carbon Emissions, Financial Development, and Renewable Energy: A Study of the N-5 Asian Countries. Sustainability 2023, 15, 13888. https://doi.org/10.3390/su151813888

Xu X, Dai W, Muhammad T, Zhang T. The Dynamic Relationship between Carbon Emissions, Financial Development, and Renewable Energy: A Study of the N-5 Asian Countries. Sustainability. 2023; 15(18):13888. https://doi.org/10.3390/su151813888

Chicago/Turabian StyleXu, Xu, Wensheng Dai, Tufail Muhammad, and Tao Zhang. 2023. "The Dynamic Relationship between Carbon Emissions, Financial Development, and Renewable Energy: A Study of the N-5 Asian Countries" Sustainability 15, no. 18: 13888. https://doi.org/10.3390/su151813888