Equitable Global Value Chain and Production Network as a Driver for Enhanced Sustainability in Developing Economies

Abstract

:1. Introduction

2. Literature Review

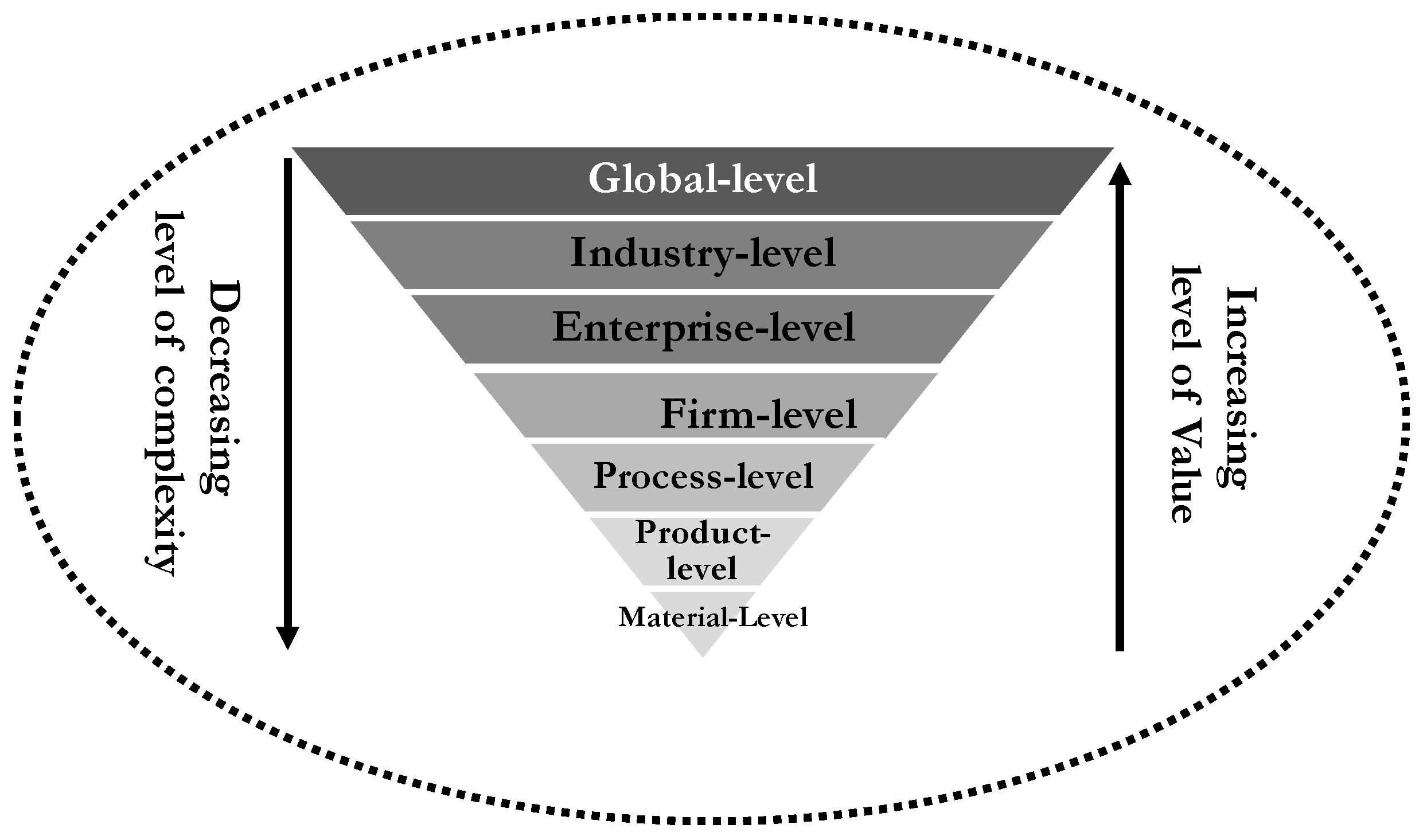

3. Conceptual GVC Model

4. Research Methodology

4.1. Methodological Framework for GVC Analysis

4.2. Multi-Regional Perspective of Value Added Activities

4.3. Assessments of MRIO-Based Value Added Effects of the Industrial Supply Chain

4.3.1. Industrial Value Added Intensities

4.3.2. Total Value Added as a Result of Final Demand

4.4. Data Source

5. Results and Discussion

5.1. Value Addition as a Measure for Socio-Economic Sustainability

5.1.1. Measuring Capital Value Addition between UK (Global North) and Listed Global South Countries

5.1.2. Measuring Labour Value Addition between the UK (Global North) and Listed African Countries (Global South)

5.1.3. Similarity in Embodied Net Capital and Labour Value Added Flows

5.2. Discussion and Research Implications

5.3. Limitations and Future Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| No. | Disaggregated Sectors | Economic Markets | 3 Sector Theory |

|---|---|---|---|

| 1 | Paddy rice | 1: Agriculture | Primary Industries |

| 2 | Wheat | ||

| 3 | Cereal grains nec | ||

| 4 | Vegetables; fruit; nuts | ||

| 5 | Oil seeds | ||

| 6 | Sugar cane; sugar beet | ||

| 7 | Plant-based fibers | ||

| 8 | Crops nec | ||

| 9 | Bovine cattle; sheep and goats; horses | ||

| 10 | Animal products nec | ||

| 11 | Raw milk | ||

| 12 | Wool; silk-worm cocoons | ||

| 13 | Forestry | 2: Forestry | |

| 14 | Fishing | 3: Fishing | |

| 15 | Coal | 4: Mining | |

| 16 | Oil | ||

| 17 | Gas | ||

| 18 | Minerals nec | ||

| 19 | Bovine meat products | 5: Food | Secondary Industries |

| 20 | Meat products nec | ||

| 21 | Vegetable oils and fats | ||

| 22 | Dairy products | ||

| 23 | Processed rice | ||

| 24 | Sugar | ||

| 25 | Food products nec | ||

| 26 | Beverages and tobacco products | ||

| 27 | Textiles | 6: Textiles | |

| 28 | Wearing apparel | ||

| 29 | Leather products | ||

| 30 | Wood products | 7: Wood and Paper | |

| 31 | Paper products; publishing | ||

| 32 | Petroleum; coal products | 8: Fuel | |

| 33 | Chemical; rubber; plastic products | 9: Chemical | |

| 34 | Mineral products nec | 10: Mineral | |

| 35 | Ferrous metals | 11: Metal | |

| 36 | Metals nec | ||

| 37 | Metal products | ||

| 38 | Motor vehicles and parts | 12: Equipm’ts | |

| 39 | Transport equipment nec | ||

| 40 | Electronic equipment | ||

| 41 | Machinery and equipment nec | ||

| 42 | Manufactures nec | ||

| 43 | Electricity | 13: Utilities | |

| 44 | Gas manufacture; distribution | ||

| 45 | Water | ||

| 46 | Construction | 14: Construction | |

| 47 | Trade | 15: Trade | Tertiary Industries |

| 48 | Transport nec | 16: Transport | |

| 49 | Water transport | ||

| 50 | Air transport | ||

| 51 | Communication | ||

| 52 | Financial services nec | 17: Business Services | |

| 53 | Insurance | ||

| 54 | Business services nec | ||

| 55 | Recreational and other services | ||

| 56 | Public Administration; Defense; Education; Health | ||

| 57 | Dwellings | 18: Personal Services |

Appendix B

References

- Gereffi, G.; Humphrey, J.; Sturgeon, T. The governance of global value chains. Rev. Int. Political Econ. 2005, 121, 78–104. [Google Scholar] [CrossRef]

- Yeung, H.W.-C.; Coe, N. Toward a Dynamic Theory of Global Production Networks. Econ. Geogr. 2015, 911, 29–58. [Google Scholar] [CrossRef]

- Humphrey, J.; Schmitz, H. How does insertion in global value chains affect upgrading in industrial clusters? Reg. Stud. 2002, 369, 1017–1027. [Google Scholar] [CrossRef]

- Acquaye, A.A.; Yamoah, F.A.; Feng, K. An integrated environmental and fairtrade labelling scheme for product supply chains. Int. J. Prod. Econ. 2015, 164, 472–483. [Google Scholar] [CrossRef]

- Taglioni, D.; Winkler, D. Making Global Value Chains Work for Development; The World Bank: Washington, DC, USA, 2016. [Google Scholar]

- Hopkins, T.K.; Wallerstein, I. Commodity chains: Construct and research. In Commodity Chains and Global Capitalism; Gereffi, G., Korzeniewicz, M., Eds.; Greenwood Press: Westport, Connecticut, 1994; Volume 17. [Google Scholar]

- Barrientos, S.; Knorringa, P.; Evers, B.; Visser, M.; Opondo, M. Shifting regional dynamics of global value chains: Implications for economic and social upgrading in African horticulture. Environ. Plan. A Econ. Space 2016, 48, 1266–1283. [Google Scholar] [CrossRef]

- OECD. Interconnected Econ.: Benefiting Glob. Value Chains; OECD Publishing: Washington, DC, USA, 2013. [Google Scholar]

- Galar, M. Competing within global value chains. ECFIN Econ. Brief 2012, 17, 1–12. [Google Scholar]

- Dunning, J.H. Reappraising the Eclectic Paradigm in an Age of Alliance Capitalism. In The Eclectic Paradigm: A Framework for Synthesizing and Comparing Theories of International Business from Different Disciplines or Perspectives; Cantwell, J., Ed.; Palgrave Macmillan: London, UK, 2015; pp. 111–142. [Google Scholar]

- Kano, L. Global value chain governance: A relational perspective. J. Int. Bus. Stud. 2018, 496, 684–705. [Google Scholar] [CrossRef]

- Pavlínek, P. Global Production Networks, Foreign Direct Investment, and Supplier Linkages in the Integrated Peripheries of the Automotive Industry. Econ. Geogr. 2018, 942, 141–165. [Google Scholar] [CrossRef]

- Moran, D.D.; Lenzen, M.; Kanemoto, K.; Geschke, A. Does ecologically unequal exchange occur? Ecol. Econ. 2013, 890, 177–186. [Google Scholar] [CrossRef]

- Oppon, E.; Acquaye, A.; Ibn-Mohammed, T.; Koh, L. Modelling Multi-regional Ecological Exchanges: The Case of UK and Africa. Ecol. Econ. 2018, 147, 422–435. [Google Scholar] [CrossRef]

- Dallas, M.; Ponte, S.; Sturgeon, T. A Typology of Power in Global Value Chains; Copenhagen Business School, Working paper in Business and Politics; Copenhagen Business School: Copenhagen, Denmark, 2017; Volume 91. [Google Scholar]

- Turkina, E.; Van Assche, A.; Kali, R. Structure and evolution of global cluster networks: Evidence from the aerospace industry. J. Econ. Geogr. 2016, 166, 1211–1234. [Google Scholar] [CrossRef]

- Gereffi, G.; Lee, J. Economic and social upgrading in global value chains and industrial clusters: Why governance matters. J. Bus. Ethics 2016, 1331, 25–38. [Google Scholar] [CrossRef]

- Pietrobelli, C.; Rabellotti, R. Global value chains meet innovation systems: Are there learning opportunities for developing countries? World Dev. 2011, 397, 1261–1269. [Google Scholar] [CrossRef]

- Humphrey, J.; Schmitz, H. Inter-firm relationships in global value chains: Trends in chain governance and their policy implications. Int. J. Technol. Learn. Innov. Dev. 2008, 13, 258–282. [Google Scholar] [CrossRef]

- Saliola, F.; Zanfei, A. Multinational firms, global value chains and the organization of knowledge transfer. Res. Policy 2009, 382, 369–381. [Google Scholar] [CrossRef]

- Manioudis, Manolis, and Giorgos Meramveliotakis. Broad Strokes Towards a Grand Theory in the Analysis of Sustainable Development: A Return to the Classical Political Economy. New Political Econ. 2022, 27, 866–878. [Google Scholar] [CrossRef]

- Tomislav, K. The concept of sustainable development: From its beginning to the contemporary issues. Zagreb Int. Rev. Econ. Bus. 2018, 21, 67–94. [Google Scholar]

- Guschanski, A.; Onaran, Ö. Global Value Chain Participation and the Labour Share: Industry-level Evidence from Emerging Economies. Dev. Change 2023, 54, 31–63. [Google Scholar] [CrossRef]

- Garhart, R. Frontiers of Input-Output Analysis. Econ. Geogr. 1991, 671, 84–86. [Google Scholar] [CrossRef]

- Miller, R.E.; Blair, P.D. Input-Output Analysis: Foundations and Extensions; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Bridge, G.; Bradshaw, M. Making a global gas market: Territoriality and production networks in liquefied natural gas. Econ. Geogr. 2017, 933, 215–240. [Google Scholar] [CrossRef]

- Lee, E.; Yi, K.M. Global Value Chains and Inequality with Endogenous Labor Supply. J. Int. Econ. 2018, 115, 223–241. [Google Scholar] [CrossRef]

- Neilson, J.; Pritchard, B.; Fold, N.; Dwiartama, A. Lead firms in the cocoa–chocolate global production network: An assessment of the deductive capabilities of GPN 2.0. Econ. Geogr. 2018, 94, 400–424. [Google Scholar] [CrossRef]

- Kogut, B. Designing global strategies: Comparative and competitive value added chains. Sloan Manag. Rev. 1985, 26, 15. [Google Scholar]

- The Global Value Chains Initiative. Concepts and Tools. 2016. Available online: https://globalvaluechains.org/concept-tools (accessed on 1 August 2016).

- Tukker, A.; Dietzenbacher, E. Global multiregional input–output frameworks: An introduction and outlook. Econ. Syst. Res. 2013, 251, 1–19. [Google Scholar] [CrossRef]

- Timmer, M.P.; Erumban, A.A.; Los, B.; Stehrer, R.; de Vries, G.J. Slicing up global value chains. J. Econ. Perspect. 2014, 28, 99–118. [Google Scholar] [CrossRef]

- Klein, O.; Pachura, P. Tamásy Ch.Globalizing production networks. Pol. J. Manag. Stud. 2016, 13, 81–89. [Google Scholar]

- OECD. Global Value Chains. 2016. Available online: http://www.oecd.org/sti/ind/global-value-chains.htm (accessed on 1 August 2016).

- Cuervo-Cazurra, A.; Pananond, P. The rise of emerging market lead firms in global value chains. J. Bus. Res. 2023, 154, 113327. [Google Scholar] [CrossRef]

- Elms, D.K.; Low, P. Global Value Chains in a Changing World; World Trade Organization: Geneva, Switzerland, 2013. [Google Scholar]

- Gereffi, G.; Fernandez-Stark, K. Global value chain analysis: A primer. In Center on Globalization, Governance & Competitiveness CGGC; Duke University: Durham, NC, USA, 2011. [Google Scholar]

- Yawson, D.E.; Yamoah, F.A. Review of strategic agility: A holistic framework for fresh produce supply chain disruptions. Sustainability 2022, 14, 14977. [Google Scholar] [CrossRef]

- UNCTAD. Global Value Chains: Investment and Trade for Development; World Investment Report; UNCTAD: Geneva, Switzerland, 2013. [Google Scholar]

- Acquaye, A.; Feng, K.; Oppon, E.; Salhi, S.; Ibn-Mohammed, T.; Genovese, A.; Hubacek, K. Measuring the environmental sustainability performance of global supply chains: A multi-regional input-output analysis for carbon, sulphur oxide and water footprints. J. Environ. Manag. 2017, 187, 571–585. [Google Scholar] [CrossRef]

- Sturgeon, T.J. How Do We Define Value Chains and Production Networks? IDS Bull. 2001, 323, 9–18. [Google Scholar] [CrossRef]

- Acquaye, A.; Ibn-Mohammed, T.; Genovese, A.; Afrifa, G.A.; Yamoah, F.A.; Oppon, E. A quantitative model for environmentally sustainable supply chain performance measurement. Eur. J. Oper. Res. 2018, 269, 188–205. [Google Scholar] [CrossRef]

- Antràs, P.; Chor, D. Global value chains. Handb. Int. Econ. 2022, 5, 297–376. [Google Scholar]

- Bi, K.; Huang, P.; Ye, H. Risk identification, evaluation and response of low-carbon technological innovation under the global value chain: A case of the Chinese manufacturing industry. Technol. Forecast. Soc. Change 2015, 100, 238–248. [Google Scholar] [CrossRef]

- Kiamehr, M. Paths of technological capability building in complex capital goods: The case of hydroelectricity generation systems in Iran. Technol. Forecast. Soc. Change 2017, 122, 215–230. [Google Scholar] [CrossRef]

- Pietrobelli, C.; Puppato, F. Technology foresight and industrial strategy. Technol. Forecast. Soc. Change 2016, 110, 117–125. [Google Scholar] [CrossRef]

- Bi, K.; Huang, P.; Wang, X. Innovation performance and influencing factors of low-carbon technological innovation under the global value chain: A case of Chinese manufacturing industry. Technol. Forecast. Soc. Change 2016, 111, 275–284. [Google Scholar] [CrossRef]

- Zhang, F.; Gallagher, K.S. Innovation and technology transfer through global value chains: Evidence from China’s PV industry. Energy Policy 2016, 94, 191–203. [Google Scholar] [CrossRef]

- Vellema, S.; Van Wijk, J. Partnerships intervening in global food chains: The emergence of co-creation in standard-setting and certification. J. Clean. Prod. 2015, 107, 105–113. [Google Scholar] [CrossRef]

- Adolf, S.; Bush, S.R.; Vellema, S. Reinserting state agency in global value chains: The case of MSC certified skipjack tuna. Fish. Res. 2016, 182, 79–87. [Google Scholar] [CrossRef]

- Luppes, M.; Nielsen, P.B. Global Value Chains in Official Business Statistics. 2015. Available online: https://unstats.un.org/unsd/trade/events/2016/newyork-egm/documents/background/Luppes%20and%20Nielsen%20-%202015%20-%20Global%20Value%20Chains%20in%20official%20business%20statistics.pdf (accessed on 30 August 2023).

- Jara, A.; Escaith, H. Global value chains, international trade statistics and policymaking in a flattening world. World Econ. 2012, 13, 19–38. [Google Scholar]

- Armando, E.; Azevedo, A.C.; Fischmann, A.A.; Pereira, C.E.C. Business Strategy and Upgrading in Global Value Chains: A Multiple Case Study in Information Technology Firms of Brazilian Origin. RAI 2016, 13, 39–47. [Google Scholar] [CrossRef]

- Said-Allsopp, M.; Tallontire, A. Pathways to empowerment? Dynamics of women’s participation in Global Value Chains. J. Clean. Prod. 2015, 107, 114–121. [Google Scholar] [CrossRef]

- Yamoah, F.A.; Yawson, D.E. Promoting global well-being through fairtrade food: The role of international exposure. Int. Food Agribus. Manag. Rev. 2023, 26, 243–265. [Google Scholar] [CrossRef]

- Harnesk, D.; Brogaard, S.; Peck, P. Regulating a global value chain with the European Union’s sustainability criteria–experiences from the Swedish liquid transport biofuel sector. J. Clean. Prod. 2017, 153, 580–591. [Google Scholar] [CrossRef]

- Utrilla-Catalan, R.; Rodríguez-Rivero, R.; Narvaez, V.; Díaz-Barcos, V.; Blanco, M.; Galeano, J. Growing inequality in the coffee global value chain: A complex network assessment. Sustainability 2022, 14, 672. [Google Scholar] [CrossRef]

- Szymczak, S.; Wolszczak-Derlacz, J. Global value chains and labour markets–simultaneous analysis of wages and employment. Econ. Syst. Res. 2022, 34, 69–96. [Google Scholar] [CrossRef]

- Damali, U.; Miller, J.L.; Fredendall, L.D.; Moore, D.; Dye, C.J. Co-creating value using customer training and education in a healthcare service design. J. Oper. Manag. 2016, 47–48, 80–97. [Google Scholar] [CrossRef]

- Tsai, J.Y.; Raghu, T.S.; Shao, B.B.M. Information systems and technology sourcing strategies of e-Retailers for value chain enablement. J. Oper. Manag. 2013, 316, 345–362. [Google Scholar] [CrossRef]

- Radhakrishnan, A.; Zu, X.; Grover, V. A process-oriented perspective on differential business value creation by information technology: An empirical investigation. Omega 2008, 366, 1105–1125. [Google Scholar] [CrossRef]

- Harrison, J. Trade Agreements and Sustainability: Exploring the Potential of Global Value Chain (GVC) Obligations. J. Int. Econ. Law 2022, 26, 199–215. [Google Scholar] [CrossRef]

- Harris, J.M. Basic Principles of Sustainable Development; Dimensions of Sustainable Development; Seidler, R., Bawa, K.S., Eds.; 2000; Volume 1, pp. 21–41. Available online: https://sites.tufts.edu/gdae/files/2019/10/00-04Harris-BasicPrinciplesSD.pdf (accessed on 20 August 2023).

- Hart, S.L.; Milstein, M.B. Creating sustainable value. Acad. Manag. Perspect. 2003, 172, 56–67. [Google Scholar] [CrossRef]

- Tseng, M.-L.; Tan, K.H.; Geng, Y.; Govindan, K. Sustainable consumption and production in emerging markets. Int. J. Prod. Econ. 2016, 181, 257–261. [Google Scholar] [CrossRef]

- Husted, B.W.; Allen, D.B. Corporate social strategy. In Stakeholder Engagement and Competitive Advantage; Cambridge University Press: New York, NY, USA, 2011. [Google Scholar]

- Garvare, R.; Johansson, P. Management for sustainability—A stakeholder theory. Total Qual. Manag. 2010, 217, 737–744. [Google Scholar] [CrossRef]

- Lee, M.D.P. A review of the theories of corporate social responsibility: Its evolutionary path and the road ahead. Int. J. Manag. Rev. 2008, 101, 53–73. [Google Scholar] [CrossRef]

- Tilt, C.A. Environmental Policies of Major Companies: Australian Evidence. Br. Acc. Rev. 1997, 294, 367–394. [Google Scholar] [CrossRef]

- Del Prete, D.; Rungi, A. Organizing the Global Value Chain: A firm-level test. J. Int. Econ. 2017, 109, 16–30. [Google Scholar] [CrossRef]

- Leontief, W.W. Quantitative input and output relations in the economic systems of the United States. Rev. Econ. Stat. 1936, 18, 105–125. [Google Scholar] [CrossRef]

- Genovese, A.; Acquaye, A.A.; Figueroa, A.; Koh, S.C.L. Sustainable supply chain management and the transition towards a circular economy: Evidence and some applications. Omega 2017, 66, 344–357. [Google Scholar] [CrossRef]

- Prell, C.; Feng, K.; Sun, L.; Geores, M.; Hubacek, K. The Economic Gains and Environmental Losses of US Consumption: A World-Systems and Input-Output Approach. Soc. Forces 2014, 931, 405–428. [Google Scholar] [CrossRef]

- Koh, S.L.; Genovese, A.; Acquaye, A.A.; Barratt, P.; Rana, N.; Kuylenstierna, J.; Gibbs, D. Decarbonising product supply chains: Design and development of an integrated evidence-based decision support system–the supply chain environmental analysis tool SCEnAT. Int. J. Prod. Res. 2013, 517, 2092–2109. [Google Scholar] [CrossRef]

- Johnson, R.C.; Noguera, G. Accounting for intermediates: Production sharing and trade in value added. J. Int. Econ. 2012, 86, 224–236. [Google Scholar] [CrossRef]

- Aichele, R.; Inga, H. Where Is the Value Added? Trade Liberalization and Production Networks. J. Int. Econ. 2018, 115, 130–144. [Google Scholar] [CrossRef]

- Acquaye, A.; Genovese, A.; Barrett, J.; Koh, S.C.L. Benchmarking Carbon Emissions Performance in Supply Chains. Supply Chain Manag. Int. J. 2014, 19, 306–321. [Google Scholar] [CrossRef]

- Sundarakani, B.; de Souza, R.; Goh, M.; Van Over, D.; Manikandan, S.; Koh, S.L. A sustainable green supply chain for globally integrated networks. Enterprise networks and logistics for agile manufacturing. In Enterprise Network Logistics for Agile Manufacturing; Wang, L., Koh, S.C.L., Eds.; Springer: London, UK, 2010; pp. 191–206. [Google Scholar]

- Office of National Statistics. Measuring the Economic Impact of an Intervention or Investment Paper One: Context & Rationale; Office of National Statistics: London, UK, 2010.

- Jakob, M.; Steckel, J.C.; Edenhofer, O. Consumption-Versus Production-Based Emission Policies. Annu. Rev. Resour. Econ. 2014, 6, 297–318. [Google Scholar] [CrossRef]

- Ibn-Mohammed, T.; Greenough, R.; Taylor, S.; Ozawa-Meida, L.; Acquaye, A. Integrating economic considerations with operational and embodied emissions into a decision support system for the optimal ranking of building retrofit options. Build. Environ. 2014, 72, 82–101. [Google Scholar] [CrossRef]

- Davis, S.J.; Caldeira, K. Consumption-based accounting of CO2 emissions. Proc. Natl. Acad. Sci. USA 2010, 10712, 5687–5692. [Google Scholar] [CrossRef]

- West, G.R.; Jackson, R.W. Simulating Impacts on Regional Economies: A Modelling Alternative. In Hospitality Travel and Tourism: Concepts, Methodologies, Tools and Applications; Information Resources Management Association, Ed.; IGI Global: Hershey, PA, USA, 2015; pp. 1064–1083. [Google Scholar]

- GTAP. GTAP Version 9 Data Base; Purdue University: West Lafayette, IN, USA, 2015. [Google Scholar]

- Gereffi, G.; Humphrey, J.; Kaplinsky, R.; Sturgeon, T.J. Introduction: Globalisation, Value Chains and Development. IDS Bull. 2001, 323, 1–8. [Google Scholar] [CrossRef]

- Arrow, K.J.; Chenery, H.B.; Minhas, B.S.; Solow, R.M. Capital-labor substitution and economic efficiency. Rev. Econ. Stat. 1961, 43, 225–250. [Google Scholar] [CrossRef]

- Shapiro, M.D. The dynamic demand for capital and labor. Q. J. Econ. 1986, 101, 513–542. [Google Scholar] [CrossRef]

- World Bank. 2014 World Development Indicators—The World Bank; World Bank: Washington, DC, USA, 2014. [Google Scholar]

- Figge, F.; Hahn, T. Sustainable value added—Measuring corporate contributions to sustainability beyond eco-efficiency. Ecol. Econ. 2004, 482, 173–187. [Google Scholar] [CrossRef]

- Atkinson, G. Measuring Corporate Sustainability. J. Environ. Plan. Manag. 2000, 432, 235–252. [Google Scholar] [CrossRef]

- World Business Council for Sustainable Development. Measuring Socio-Economic Impact: A Guide for Business; World Business Council for Sustainable Development: Conches-Geneva, Switzerland, 2013. [Google Scholar]

- Rosenberg, N. Capital goods, technology, and economic growth. Oxf. Econ. Pap. 1963, 15, 217–227. [Google Scholar] [CrossRef]

- Wacker, J.G.; Yang, C.-L.; Sheu, C. Productivity of production labor, non-production labor, and capital: An international study. Int. J. Prod. Econ. 2006, 1032, 863–872. [Google Scholar] [CrossRef]

- Eaton, J.; Kortum, S. Trade in capital goods. Eur. Econ. Rev. 2001, 457, 1195–1235. [Google Scholar] [CrossRef]

- Appiah, M.; Blay, D.; Damnyag, L.; Dwomoh, F.; Pappinen, A.; Luukkanen, O. Dependence on forest resources and tropical deforestation in Ghana. Environ. Dev. Sustain. 2009, 113, 471–487. [Google Scholar] [CrossRef]

- Demeter, K.; Chikán, A.; Matyusz, Z. Labour productivity change: Drivers, business impact and macroeconomic moderators. Int. J. Prod. Econ. 2011, 1311, 215–223. [Google Scholar] [CrossRef]

- Hauke, J.; Kossowski, T. Comparison of values of Pearson’s and Spearman’s correlation coefficients on the same sets of data. Quaest. Geogr. 2011, 302, 87–93. [Google Scholar] [CrossRef]

- Osei, M.B.; Papadopoulos, T.; Acquaye, A.; Stamati, T. Improving sustainable supply chain performance through organisational culture: A competing values framework approach. J. Purch. Supply Manag. 2023, 29, 100821. [Google Scholar] [CrossRef]

- Kannan, D. Role of multiple stakeholders and the critical success factor theory for the sustainable supplier selection process. Int. J. Prod. Econ. 2018, 195, 391–418. [Google Scholar] [CrossRef]

- Nudurupati, S.S.; Bhattacharya, A.; Lascelles, D.; Caton, N. Strategic sourcing with multi-stakeholders through value co-creation: An evidence from global health care company. Int. J. Prod. Econ. 2015, 166, 248–257. [Google Scholar] [CrossRef]

- Daugherty, P.J. Review of Logistics and Supply Chain Relationship Literature and Suggested Research Agenda. Int. J. Phys. Distrib. Logist. Manag. 2011, 41, 16–31. [Google Scholar] [CrossRef]

- Lund-Thomsen, P.; Nadvi, K. Global value chains, local collective action and corporate social responsibility: A review of empirical evidence. Bus. Strategy Environ. 2010, 19, 1–13. [Google Scholar] [CrossRef]

- Gibbon, P. Commodities, Donors, Value-Chain Analysis and Upgrading; International Centre for Trade and Sustainable Development ICTSD: Geneva, Switzerland, 2004. [Google Scholar]

- Talbot, J.M. Tropical commodity chains, forward integration strategies and international inequality: Coffee, cocoa and tea. Rev. Int. Political Econ. 2002, 94, 701–734. [Google Scholar] [CrossRef]

- Cramer, C. Can Africa industrialize by processing primary commodities? The case of Mozambican cashew nuts. World Dev. 1999, 277, 1247–1266. [Google Scholar] [CrossRef]

- Hörisch, J.; Freeman, R.E.; Schaltegger, S. Applying stakeholder theory in sustainability management: Links, similarities, dissimilarities, and a conceptual framework. Organ. Environ. 2014, 27, 328–346. [Google Scholar] [CrossRef]

- African Development Bank. African Economic Outlook 2018; African Development Bank: Abidjan, Côte d’Ivoire, 2018. [Google Scholar]

- The Economist, Logistics in Africa: Network Effects. 2008. Available online: https://www.economist.com/business/2008/10/16/network-effects (accessed on 11 March 2023).

- The Economist. A road to somewhere. Afr. Infrastruct. 2011, 400, 44. [Google Scholar]

- Acquaye, A.; Duffy, A.P.; Biswajit, B. Development of a Construction Sub-Sector Embodied Energy Hybrid Analysis. 2008. Working Papers. 1. Available online: https://arrow.tudublin.ie/dubenwp/1 (accessed on 1 August 2023).

- Lenzen, M.; Moran, D.; Kanemoto, K.; Geschke, A. Building Eora: A Global Multi-Region Input–Output Database at High Country and Sector Resolution. Econ. Syst. Res. 2013, 251, 20–49. [Google Scholar] [CrossRef]

| No. | Sector | Cameroon | Cote d’Ivoire | Ghana | Nigeria | Senegal |

|---|---|---|---|---|---|---|

| 1 | Agriculture | −0.9020 | −17.1507 | −35.6847 | −16.9796 | −5.9705 |

| 2 | Forestry | −3.3824 | −0.0586 | −0.6019 | −0.5296 | −1.0451 |

| 3 | Fishing | −0.0170 | −0.0375 | −0.0660 | 0.3112 | −0.1520 |

| 4 | Mining | −10.2902 | 3.9398 | 31.3800 | −1764.422 | 51.4396 |

| 5 | Food | 0.1583 | −0.2856 | 1.9688 | 17.4671 | −1.7908 |

| 6 | Textiles | −0.4352 | −0.0009 | 0.6069 | −0.1320 | −0.8282 |

| 7 | Wood & Paper | −3.0767 | −0.5964 | 8.1312 | 23.8089 | 0.3603 |

| 8 | Fuels | −0.1747 | 0.0343 | 1.0522 | 1.7127 | 2.4728 |

| 9 | Chemicals | 1.9203 | −3.0658 | 14.1836 | 31.1158 | −1.0329 |

| 10 | Minerals | 0.1893 | 0.1235 | 1.1020 | 2.4050 | −1.1437 |

| 11 | Metals | −0.1611 | −0.7165 | 0.6958 | 13.3638 | −2.2104 |

| 12 | Equipment | 5.3592 | 5.9189 | 44.6416 | −30.8647 | 3.2761 |

| 13 | Utilities | 1.5914 | 1.1156 | 9.9708 | 31.3353 | 2.3129 |

| 14 | Construction | 0.7686 | 0.8375 | 1.9052 | 10.1693 | 1.3502 |

| 15 | Trade | −6.3422 | −6.5627 | −0.3439 | 35.4656 | −10.7853 |

| 16 | Transport & Communication | −6.0648 | 2.6709 | −17.5704 | 54.8815 | −8.5854 |

| 17 | Business Services | 13.8444 | 18.8181 | 35.4745 | 380.3386 | −5.1901 |

| 18 | Personal Services | 0.0617 | 0.0684 | −3.5692 | 0.9432 | 0.0624 |

| No. | Sector | Cameroon | Cote d’Ivoire | Ghana | Nigeria | Senegal |

|---|---|---|---|---|---|---|

| 1 | Agriculture | −4.4295 | −77.3580 | −161.4305 | −78.8000 | −26.9597 |

| 2 | Forestry | −3.6114 | −0.7981 | −2.1577 | −1.6949 | −0.1227 |

| 3 | Fishing | −0.0692 | −0.5603 | −1.0959 | −0.5072 | −0.2964 |

| 4 | Mining | −2.7883 | −4.3017 | 1.9490 | 4.3718 | 2.6071 |

| 5 | Food | 1.1867 | 0.7716 | −12.7793 | 26.1871 | 0.4684 |

| 6 | Textiles | −0.3238 | 0.3666 | 2.7149 | 21.9976 | 0.6265 |

| 7 | Wood & Paper | 0.3237 | −1.4710 | 19.7587 | 63.0069 | 2.1727 |

| 8 | Fuels | 0.4442 | −0.3482 | 6.3508 | 13.6782 | 11.1756 |

| 9 | Chemicals | 6.6183 | −2.9950 | 38.3041 | 111.5621 | 4.4453 |

| 10 | Minerals | 0.9633 | 0.1636 | 3.1430 | 10.1598 | 0.0146 |

| 11 | Metals | 4.6990 | 1.5550 | 31.0142 | 98.4242 | 3.5994 |

| 12 | Equipment | 17.0553 | 15.6558 | 124.2734 | 362.4803 | 13.9017 |

| 13 | Utilities | 0.6602 | −0.6576 | 4.6704 | 15.1441 | 1.3971 |

| 14 | Construction | 0.7857 | 0.9034 | 1.7392 | 13.7729 | 1.7800 |

| 15 | Trade | −6.3294 | −14.1440 | −16.0538 | 33.1424 | 2.3168 |

| 16 | Transport & Communication | −0.4041 | 2.9072 | −45.8513 | 95.3580 | −4.5657 |

| 17 | Business Services | 16.4288 | 7.9306 | 66.0936 | 696.1532 | 28.0586 |

| 18 | Personal Services | 0.0005 | 0.0006 | −4.1382 | 0.0080 | 0.0005 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Acquaye, A.A.; Yamoah, F.A.; Ibn-Mohammed, T.; Quaye, E.; Yawson, D.E. Equitable Global Value Chain and Production Network as a Driver for Enhanced Sustainability in Developing Economies. Sustainability 2023, 15, 14550. https://doi.org/10.3390/su151914550

Acquaye AA, Yamoah FA, Ibn-Mohammed T, Quaye E, Yawson DE. Equitable Global Value Chain and Production Network as a Driver for Enhanced Sustainability in Developing Economies. Sustainability. 2023; 15(19):14550. https://doi.org/10.3390/su151914550

Chicago/Turabian StyleAcquaye, Adolf Akwei, Fred Amofa Yamoah, Taofeeq Ibn-Mohammed, Enoch Quaye, and David Eshun Yawson. 2023. "Equitable Global Value Chain and Production Network as a Driver for Enhanced Sustainability in Developing Economies" Sustainability 15, no. 19: 14550. https://doi.org/10.3390/su151914550

APA StyleAcquaye, A. A., Yamoah, F. A., Ibn-Mohammed, T., Quaye, E., & Yawson, D. E. (2023). Equitable Global Value Chain and Production Network as a Driver for Enhanced Sustainability in Developing Economies. Sustainability, 15(19), 14550. https://doi.org/10.3390/su151914550