An Innovative Approach for Energy Transition in China? Chinese National Hydrogen Policies from 2001 to 2020

Abstract

1. Introduction

2. Current Debates

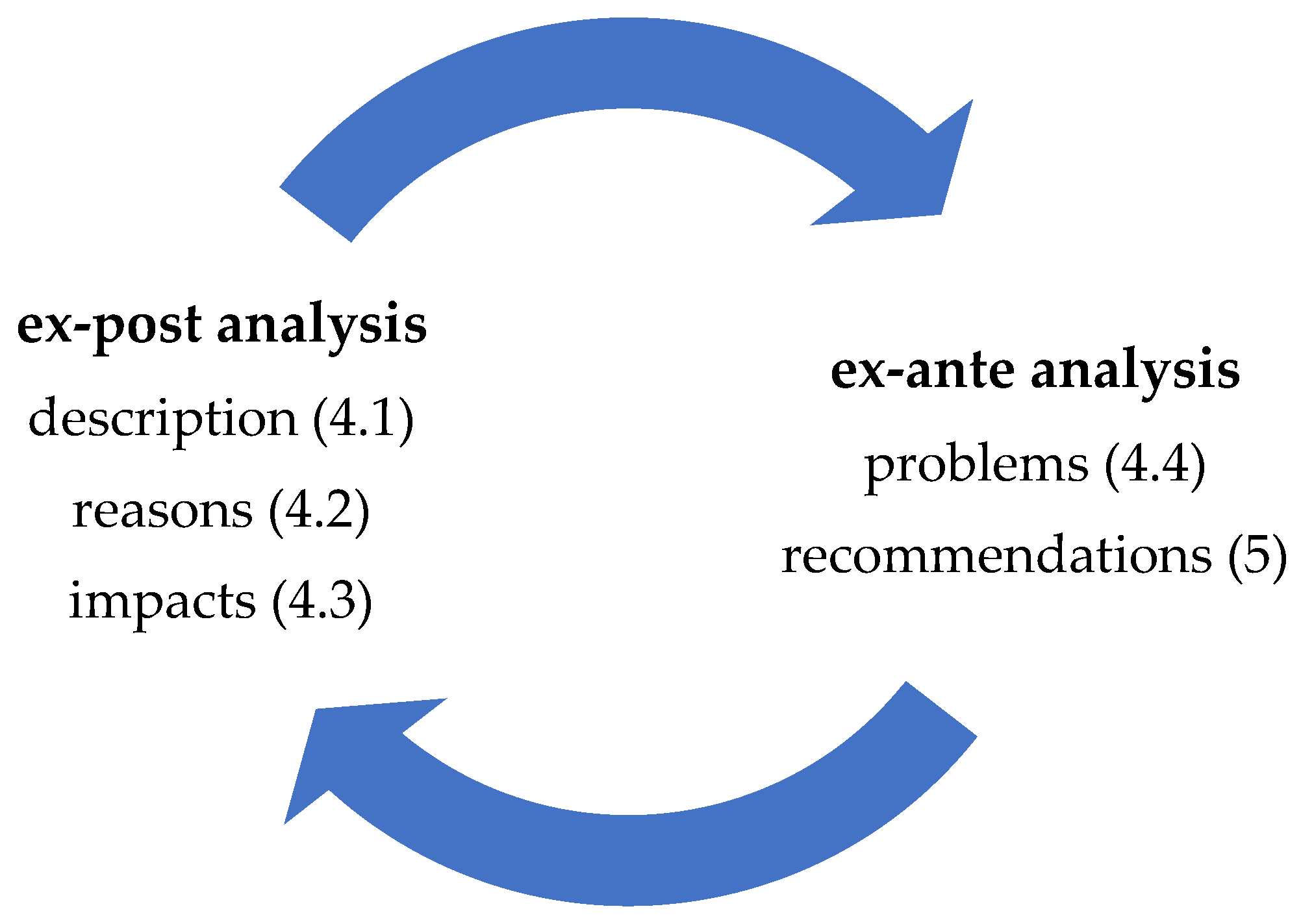

3. Conceptual Framework and Methodology

3.1. Conceptual Framework

3.2. Methodology

4. Discussion

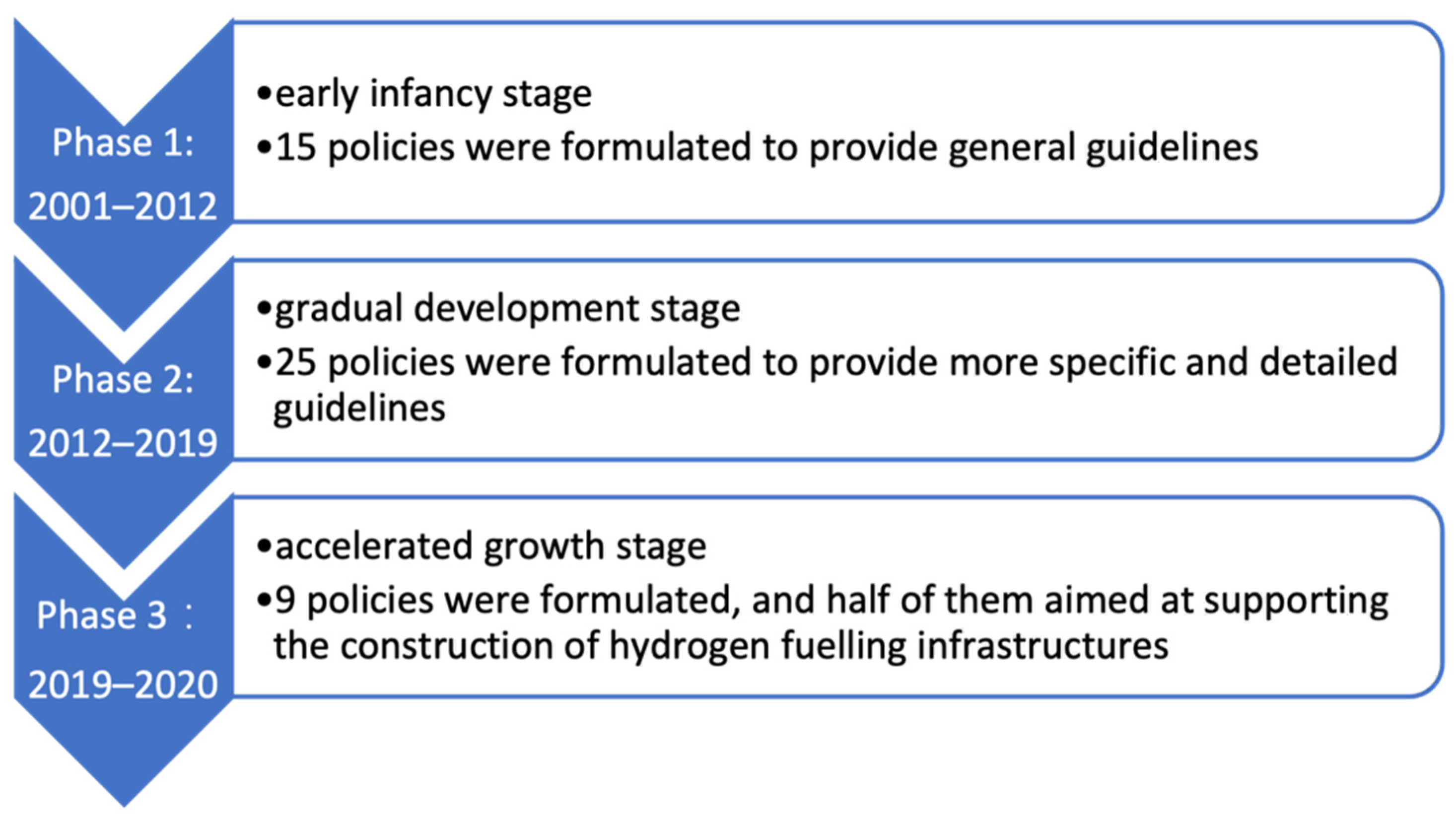

4.1. Description of Chinese National Hydrogen Policies from 2001 to 2020

4.2. Reasons for the Chinese National Government’s Efforts towards Formulating Hydrogen Policies

4.3. Impacts

4.4. Problems

4.4.1. Problem 1: The Lack of Regulations for the Industry Threshold

4.4.2. Problem 2: The Lack of a Holistic Plan

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| BRI | Belt and Road Initiative |

| CATRC | China Automotive Technology and Research Center |

| CREC | China Railway Group Limited |

| H-FCV | Hydrogen Fuel Cell Vehicles |

| MEE | Ministry of Ecology and Environment, PRC |

| MIIT | Ministry of Industry and Information Technology, PRC |

| MoF | Ministry of Finance, PRC |

| Mofcom | Ministry of Commerce, PRC |

| MoS | Ministry of Supervision, PRC |

| MoST | Ministry of Science and Technology, PRC |

| MoT | Ministry of Transport |

| MPS | Ministry of Public Security, PRC |

| NDRC | National Development and Reform Commission, PRC |

| NEA | National Energy Administration |

| NRA | National Railway Administration |

| SAMR | State Administration for Market Regulation |

| SC | State Council, PRC |

| SPC | State Planning Commission, PRC |

Appendix A

| No. | Issued Date | Issuing Departments | Title of the Policy | Key Points |

|---|---|---|---|---|

| Phase I: An Early Infancy Stage | ||||

| 1. ** [90] | 14 November 2001 | SPC, MoST | Guide to Key Development Areas of High Technology Industrialisation at Present |

|

| 2. [91] | 2 August 2002 | MoST | Outline of Sustainable Development of Science and Technology (2001–2010) |

|

| 3. * [49] | 21 May 2004 | NDRC | Policy on Development of Automotive Industry |

|

| 4. * [92] | 2 December 2005 | NDRC | Directory Catalogue on Readjustment of Industrial Structure (Version 2005) |

|

| 5. * [93] | 25 December 2005 | NDRC, Ministry of Construction, PRC, MPS, MoF, MoS, State Environmental Protection Administration | Opinions on Development of Energy-Efficient and Low-Emission Vehicles |

|

| 6. ** [94] | 30 December 2005 | SC | Outline of the National Medium- and Long-Term Program for Science and Technology Development (2006–2020) |

|

| 7. ** [36] | 14 May 2006 | MoST | National 11th Five-Year Plan for Science and Technology Development |

|

| 8. ** [59] | 3 June 2007 | NDRC | China’s National Climate Change Programme |

|

| 9. * [95] | 31 October 2007 | NDRC, Mofcom | Catalogue of Industries for Guiding Foreign Investment (2007 Revision) |

|

| 10. * [70] | 20 March 2009 | SC | Plan on Restructuring and Revitalisation of Auto Industry |

|

| 11. * [50] | 10 October 2010 | SC | Decision on Accelerating the Development of Strategic Emerging Industries |

|

| 12. ** [37] | 13 July 2011 | MoST | National 12th Five-Year Plan for Science and Technology Development |

|

| 13. [96] | 24 December 2011 | NDRC, Mofcom | Catalogue of Industries for Guiding Foreign Investment (2011 Revision) |

|

| 14. * [97] | 30 December 2011 | SC | Industrial Transformation and Upgrade Plan (2011–2015) |

|

| 15. * [38] | 27 March 2012 | MoST | 12th Five-Year Plan for Science and Technology Development of Electric Vehicles |

|

| Phase II: A Gradual Development Stage | ||||

| 16. * [39] | 28 June 2012 | SC | Plan for the Development of the Energy-Saving and New Energy Automobile Industry (2012–2020) |

|

| 17. * [53] | 9 July 2012 | SC | 12th Five-Year Plan for National Strategic Emerging Industries |

|

| 18. [98] | 23 January 2013 | SC | The Circular Economy Development Strategy and Near-Term Action Plan |

|

| 19. ** [99] | 7 June 2014 | General Office of the State Council, PRC | Action Plan for Energy Development Strategy |

|

| 20. * [40] | 14 July 2014 | General Office of the State Council, PRC | Guide to Accelerate Promotion and Application of New Energy Vehicles |

|

| 21. ** [100] | 18 November 2014 | MoF, MoST, MIIT, NDRC | Notice of Reward for New Energy Vehicle Charging Infrastructure |

|

| 22. * [101] | 22 April 2015 | MoF, MoST, MIIT, NDRC | Notice of Financial Support for Promotion and Application of New Energy Vehicles (2016–2020) |

|

| 23. * [102] | 19 May 2015 | Central Committee of the Communist Party of China, SC | Made in China 2025 |

|

| 24. [103] | 10 March 2015 | NDRC, Mofcom | Catalogue of Industries for Guiding Foreign Investment (2015 Revision) |

|

| 25. ** [86] | 17 December 2015 | General Office of the State Council, PRC | Plan for National Standardisation System Construction |

|

| 26. [52] | 24 February 2016 | NDRC, NEA, MIIT | Guiding Opinions on Promoting Internet Plus Smart Energy Development |

|

| 27. ** [61] | 7 April 2016 | NDRC, NEA | Action Plan for the Energy Technology Revolution Innovation (2016–2030) |

|

| 28. ** [63] | 19 May 2016 | Central Committee of the Communist Party of China, SC | Outline of the National Strategy of Innovation-Driven Development |

|

| 29. ** [104] | 28 July 2016 | SC | 13th Five-Year Plan for Science, Technology and Innovation |

|

| 30. ** [41] | 29 November 2016 | SC | 13th Five-Year Plan for Strategic Emerging Industries Development |

|

| 31. ** [62] | 6 December 2016 | NDRC, NEA | 13th Five-Year Plan for Energy Development |

|

| 32. ** [105] | 29 December 2016 | NDRC, NEA | Energy Supply and Consumption Revolution Strategy (2016–2030) |

|

| 33. * [106] | 29 December 2016 | MoF, MoST, MIIT, NDRC | Notice of Adjusting the Policies on Government Subsidies for Promotion and Application of New Energy Vehicles |

|

| 34. * [68] | 6 April 2017 | MIIT, NDRC, MoST | Mid- to Long-Term Development Plan for the Automotive Industry |

|

| 35. * [87] | 2 May 2017 | MoST, MoT | 13th Five-Year Special Plan for Science and Technology Innovation in the Transportation Sector |

|

| 36. * [107] | 28 June 2017 | NDRC, Mofcom | Catalogue of Industries for Guiding Foreign Investment (2017 Revision) |

|

| 37. [42] | 8 November 2017 | NDRC, NEA | Implementation of a Solution to Water, Wind and Light Abandonment |

|

| 38. * [108] | 12 February 2018 | MoF, MIIT, MoST, NDRC | Notice of Adjusting and Improving the Financial Subsidy Policies for Promotion and Application of New Energy Vehicles |

|

| 39. [109] | 28 February 2018 | NDRC, NEA | Guiding Opinions on Improving the Electricity System’s Adjustment Capabilities |

|

| 40. * [110] | 30 December 2018 | MEE, NDRC, MIIT, MPS, MoF, MoT, Mofcom, SAMR, NEA, NRA, CREC | Action Plan for Diesel Truck Emissions Control |

|

| Phase III: An Accelerated Growth Stage | ||||

| 41. ** [45] | 26 March 2019 | MoF, MIIT, MoST, NDRC | Notice on Further Improving the Financial Subsidy Policies for the Promotion and Application of New Energy Vehicles |

|

| 42. * [47] | 30 June 2019 | NDRC, Mofcom | Catalogue of Industries for Guiding Foreign Investment (2019 Revision) |

|

| 43. ** [111] | 19 September 2019 | Central Committee of the Communist Party of China, SC | Outline on Building China’s Strength in Transport |

|

| 44. * [58] | 30 October 2019 | NDRC | Catalogue for Guiding Industry Restructuring (2019 Version) |

|

| 45. * [51] | 23 April 2020 | MoF, MIIT, MoST, NDRC | Notice of Improving the Financial Subsidy Policies for the Promotion and Application of New Energy Vehicles |

|

| 46. * [48] | 29 May 2020 | MoT | Outline on Developing Inland Waterway Transport |

|

| 47. * [46] | 16 September 2020 | MoF, MIIT, MoST, NDRC, NEA | Notice of the Pilot Application of Fuel Cell Vehicles |

|

| 48. * [44] | 20 October 2020 | General Office of the State Council, PRC | New Energy Vehicle Industry Development Plan (2021–2035) |

|

| 49. * [112] | 27 December 2020 | NDRC, Mofcom | Catalogue of Industries for Encouraging Foreign Investment (2020 Version) |

|

References

- Xinhua. Xi Focus: Xi Announces China Aims to Achieve Carbon Neutrality before 2060. 22 September 2020. Available online: http://www.xinhuanet.com/english/2020-09/23/c_139388764.htm (accessed on 28 July 2022).

- State Council, PRC. Working Guidance for Carbon Dioxide Peaking and Carbon Neutrality in Full and Faithful Implementation of the New Development Philosophy. 24 October 2021. Available online: http://english.www.gov.cn/policies/latestreleases/202110/25/content_WS61760047c6d0df57f98e3c21.html (accessed on 28 July 2022).

- International Renewable Energy Agency. Hydrogen: A Renewable Energy Perspective; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- Balat, H.; Kirtay, E. Hydrogen from biomass—Present scenario and future prospects. J. Hydrogen Energy 2010, 35, 7416–7426. [Google Scholar] [CrossRef]

- Joosse, T. ‘The Hydrogen Olympics’ Lit a Torch for the Clean Fuel’s Futur. Scientific America. 30 July 2021. Available online: https://www.scientificamerica.com/article/the-hydrogen-olympics-lit-a-torch-for-the-clean-fuels-future1/ (accessed on 28 July 2022).

- Hydrogen and Fuel Cell Strategy Counci. The Strategic Road Map for Hydrogen and Fuel Cells—Industry-Academia-Government Action Plan to Realize a “Hydrogen Society”. 12 March 2019. Available online: https://www.hydrogenenergysupplychai.com/wp-content/uploads/2021/07/0312_002b.pdf (accessed on 28 July 2022).

- Pan, X.; Lv, H.; Zhou, W.; Ma, J.; Gao, D. Design and operation of the hydrogen supply chain for fuel-cell vehicles in Expo Shanghai 2010. World Electr. Veh. J. 2010, 4, 671–676. [Google Scholar] [CrossRef]

- Nakano, J. China’s Hydrogen Industrial Strategy. Centre for Strategic & International Studies. 3 February 2022. Available online: https://www.csis.org/analysis/chinas-hydrogen-industrial-strategy/ (accessed on 9 December 2022).

- Yuan, K.; Lin, W. Hydrogen in China: Policy, program and progress. Int. J. Hydrogen Energy 2010, 35, 3110–3113. [Google Scholar] [CrossRef]

- Ren, J.; Gao, S.; Tan, S.; Dong, L. Hydrogen economy in China: Strengths–weaknesses–opportunities– threats analysis and strategies prioritization. Renew. Sustain. Energy Rev. 2014, 41, 1230–1243. [Google Scholar] [CrossRef]

- Xu, X.; Xu, B.; Dong, J.; Liu, X. Near-term analysis of a roll-out strategy to introduce fuel cell vehicles and hydrogen stations in Shenzhen China. Appl. Energy 2017, 196, 229–237. [Google Scholar] [CrossRef]

- Liu, Z.; Kendall, K.; Yan, X. China Progress on Renewable Energy Vehicles: Fuel Cells, Hydrogen and Battery Hybrid Vehicles. Energies 2018, 12, 54. [Google Scholar] [CrossRef]

- Ren, L.; Zhou, S.; Qu, X. Life-cycle energy consumption and greenhouse-gas emissions of hydrogen supply chains for fuel-cell vehicles in China. Energy 2020, 209, 118482. [Google Scholar] [CrossRef]

- Blasio, N.D.; Pflugmann, F. Is China’s Hydrogen Economy Coming? Belfer Center. 2020. Available online: https://www.belfercenter.org/sites/default/files/files/publication/Is%20China%27s%20Hydrogen%20Economy%20Coming%207.28.20.pdf (accessed on 28 July 2022).

- Yue, M.; Wang, C.N. Hydrogen: China’s Progress and Opportunities for a Green Belt and Road Initiative. Green Belt and Road Initiative Center. 27 September 2020. Available online: https://green-br.org/hydrogen-chinas-progress-and-opportunities-for-a-green-belt-and-road-initiative (accessed on 28 July 2022).

- Bockris, J.O.M. A Hydrogen Economy. Science 1972, 176, 1323. [Google Scholar] [CrossRef] [PubMed]

- Brandon, N.P.; Kurban, Z. Clean energy and the hydrogen economy. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2017, 375, 20160400. [Google Scholar] [CrossRef] [PubMed]

- Abe, J.O.; Popoola, A.P.I.; Ajenifuja, E.; Popoola, O.M. Hydrogen energy, economy and storage: Review and recommendation. Int. J. Hydrogen Energy 2019, 44, 15072–15086. [Google Scholar] [CrossRef]

- International Energy Agency. The Future of Hydrogen: Seizing Today’s Opportunities. 2020. Available online: https://iea.blob.cor.windows.net/assets/9e3a3493-b9a6-4b7d-b499-7ca48e357561/The_Future_of_Hydroge.pdf (accessed on 28 July 2022).

- Moliner, R.; Lázaro, M.J.; Suelves, I. Analysis of the strategies for bridging the gap towards the Hydrogen Economy. Int. J. Hydrogen Energy 2016, 41, 19500–19508. [Google Scholar] [CrossRef]

- Chapman, A.; Itaoka, K.; Hirose, K.; Davidson, F.T.; Nagasawa, K.; Lloyd, A.C.; Webber, M.E.; Kurban, Z.; Managi, S.; Tamaki, T.; et al. A review of four case studies assessing the potential for hydrogen penetration of the future energy system. Int. J. Hydrogen Energy 2019, 44, 6371–6382. [Google Scholar] [CrossRef]

- Parra, D.; Valverde, L.; Pino, F.J.; Patel, M.K. A review on the role, cost and value of hydrogen energy systems for deep decarbonisation. Renew. Sustain. Energy Rev. 2019, 101, 279–294. [Google Scholar] [CrossRef]

- Verheul, B. Overview of Hydrogen and Fuel Cell Developments in China; Holland Innovation Network China: Shanghai, China, 2019. [Google Scholar]

- Tu, K.J. Prospects of a Hydrogen Economy with Chinese Characteristics; Ifri, Études de l’Ifr: Paris, France, 2020. [Google Scholar]

- Blasio, N.D.; Pflugmann, F. China: The Renewable Hydrogen Superpower? Belfer Center. May 2021. Available online: https://www.belfercenter.org/publication/china-renewable-hydrogen-superpower (accessed on 28 July 2022).

- Chai, S.; Zhang, G.; Li, G.; Zhang, Y. Industrial hydrogen production technology and development status in China: A review. Clean Technol. Environ. Policy 2021, 23, 1931–1946. [Google Scholar] [CrossRef]

- Bai, Y.; Liu, Y.; Wen, S.; Jia, D. China’s hydrogen roadmap: 4 things to know. Nikkei Asia. 21 June 2021. Available online: https://asia.nikke.com/Spotlight/Caixin/China-s-hydrogen-roadmap-4-things-to-know (accessed on 28 July 2022).

- China Hydrogen Alliance. Zhongguo Qingnnegyuan Ji Ranliao Dianchi Chanye Baipishu (White Paper on Hydrogen and Fuel Cell Industry in China). 2019. Available online: http://zg-kg.com/files/《中国氢能源及燃料电池产业白皮书》.pdf (accessed on 28 July 2022).

- Dunn, W.N. Public Policy Analysis: An Integrated Approach, 6th ed; Routledg: New York, NY, USA, 2018. [Google Scholar]

- Einbinder, S.D. Policy Analysis. In The Handbook of Social Work Research Methods, 2nd ed; Thyer, B.A., Ed.; SAGE Publication Inc.: Thousand Oaks, CA, USA, 2010; pp. 941–983. [Google Scholar]

- Dye, T.R. Understanding Public Policy, 15th ed; Pearso: Boston, MA, USA, 2017. [Google Scholar]

- Williams, J. Reviewed Work(s): Policy Analysis: What Governments Do, Why They Do It, and What Difference It Makes by Thomas R. Dye. Am. Political Sci. Rev. 1978, 72, 635–636. [Google Scholar] [CrossRef]

- Fischer, F.; Miller, G.J.; Sidney, M.S. (Eds.) Handbook of Public Policy Analysis: Theory, Politics, and Methods; Taylor & Francis Group: Boca Raton, FL, USA, 2007. [Google Scholar]

- European Training Foundation. Guide to Policy Analysis; European Training Foundatio: Turin, Italy, 2018.

- Jann, W.; Wegrich, K. Theories of the Policy Cycle. In Handbook of Public Policy Analysis: Theory, Politics, and Methods; Fischer, F., Miller, G.J., Sidney, M.S., Eds.; Taylor & Francis Group: Boca Raton, FL, USA, 2017; pp. 43–62. [Google Scholar]

- Ministry of Science and Technology, PRC. Guojia “Shiyiwu” Kexue Jishu Fazhan Guihua (National 11th Five-Year Plan for Science and Technology Development). 14 May 2006. Available online: https://most.gov.cn/xxgk/xinxifenlei/fdzdgknr/gjkjgh/200811/t20081129_65773.html (accessed on 28 July 2022).

- Ministry of Science and Technology, PRC. Guojia “Shierwu” Kexue He Jishu Fazhan Guihua (National 12th Five-Year Plan for Science and Technology Development). 13 July 2011. Available online: http://www.most.gov.cn/xxgk/xinxifenlei/fdzdgknr/qtwj/qtwj2011/201107/t20110713_88228.html (accessed on 28 July 2022).

- Ministry of Science and Technology, PRC. Diandong Qiche Keji Fazhan “Shierwu” Zhuanxiang Guihua (12th Five-Year Plan for Science and Technology Development of Electric Vehicles). 27 March 2012. Available online: http://www.gov.cn/zwgk/2012-04/20/content_2118595.htm (accessed on 28 July 2022).

- State Council, PRC. Jieneng Yu Xinnengyuan Qiche Chanye Fazhan Guihua (2012–2020nian) (Plan for the Development of the Energy-Saving and New Energy Automobile Industry (2012–2020)). 28 June 2012. Available online: http://www.gov.cn/gongbao/content/2012/content_2182749.htm (accessed on 28 July 2022).

- General Office of the State Council, PRC. Guanyu Jiakuai Xinnengyuan Qiche Tuiguang Yingyong De Zhidao Yijian (Guide to Accelerate Promotion and Application of New Energy Vehicles). 14 July 2014. Available online: http://www.gov.cn/zhengce/content/2014-07/21/content_8936.htm (accessed on 28 July 2022).

- State Council, PRC. “Shisanwu” Guojia Zhanlue Xinxing Chanye Fazhan Guihua (13th Five-Year Plan for Strategic Emerging Industries Development). 29 November 2016. Available online: http://www.gov.cn/gongbao/content/2017/content_5157170.htm (accessed on 28 July 2022).

- National Development and Reform Commission, PRC; National Energy Administration. Jiejue Qishui Qifeng Qiguang Wenti Shishi Fangan (Implementation of a Solution to Water, Wind and Light Abandonment). 8 November 2017. Available online: http://www.gov.cn/xinwen/2017-11/14/5239536/files/79efc0156c52423c909442dcb732d3f6.pdf (accessed on 28 July 2022).

- Li, K. Zheng Fu Bao Gao (Report on the Work of the Government) Xinhuanet, 16 March 2019. Available online: http://english.www.gov.cn/premier/speeches/2019/03/16/content_281476565265580.htm (accessed on 28 July 2022).

- General Office of the State Council, PRC. Xinnengyuan Qiche Chanye Fazhan Guihua (2021–2035nian) (New Energy Vehicle Industry Development Plan (2021–2035)). 20 October 2020. Available online: http://www.gov.cn/gongbao/content/2020/content_5560291.htm (accessed on 28 July 2022).

- Ministry of Finance, PRC; Ministry of Industry and Information, PRC; Ministry of Science and Technology, PRC; National Development and Reform Commission, PRC. Guanyu Jinyibu Wanshan Xinnengyuan Qiche Tuiguang Yingyong Caizheng Butie Zhengce de Tongzhi (Notice on Further Improving the Financial Subsidy Policies for the Promotion and Application of New Energy Vehicles). 26 March 2019. Available online: http://www.gov.cn/zhengce/zhengceku/2019-10/14/content_5439544.htm (accessed on 28 July 2022).

- Ministry of Finance, PRC; Ministry of Industry and Information Technology, PRC; Ministry of Science and Technology, PRC; National Development and Reform Commission, PRC; National Energy Administration. Guanyu Kaizhan Ranliao Dianchi Qiche Shifan Yingyong de Tongzhi (Notice of the Pilot Application of Fuel Cell Vehicles). 16 September 2020. Available online: http://www.gov.cn/zhengce/zhengceku/2020-09/21/content_5545221.htm (accessed on 28 July 2022).

- National Development and Reform Commission, PRC; Ministry of Commerce, PRC. Waishang Touzi Chanye Zhidao Mulu (2019nian Ban) (Catalogue of Industries for Guiding Foreign Investment (2019 Revision)). 30 June 2019. Available online: http://www.gov.cn/gongbao/content/2019/content_5433724.htm (accessed on 28 July 2022).

- Ministry of Transport, PRC. Neihe Hangyun Fazhan Gangyao (Outline on Developing Inland Waterway Transport). 29 May 2020. Available online: http://www.gov.cn/zhengce/zhengceku/2020-06/04/content_5517185.htm (accessed on 28 July 2022).

- National Development and Reform Commission, PRC. Qiche Chanye Fazhan Zhengce (Policy on Development of Automotive Industry). 21 May 2004. Available online: http://www.gov.cn/gongbao/content/2005/content_63336.htm (accessed on 28 July 2022).

- State Council, PRC. Guowuyuan Guanyu Jiakuai Peiyu He Fazhan Zhanluexing Xinxing Chanye De Jueding (Decision on Accelerating the Development of Strategic Emerging Industries). 10 October 2010. Available online: http://www.gov.cn/zwgk/2010-10/18/content_1724848.htm (accessed on 28 July 2022).

- Ministry of Finance, PRC; Ministry of Industry and Information Technology, PRC; Ministry of Science and Technology, PRC; National Development and Reform Commission, PRC. Guanyu Wanshan Xinnengyuan Qiche Tuiguang Yingyong Caizheng Butie Zhengce De Tongzhi (Notice of Improving the Financial Subsidy Policies for the Promotion and Application of New Energy Vehicles). 23 April 2020. Available online: http://www.gov.cn/zhengce/zhengceku/2020-04/23/content_5505502.htm (accessed on 28 July 2022).

- National Development and Reform Commission, PRC; National Energy Administration; Ministry of Industry and Information Technology, PRC. Guanyu Tuijin “Hulianwang Jia” Zhihui Nengyuan Fazhan De Zhidao Yijian (Guiding Opinions on Promoting Internet Plus Smart Energy Development). 24 February 2016. Available online: http://www.gov.cn/gongbao/content/2016/content_5082989.htm (accessed on 28 July 2022).

- State Council, PRC. “Shierwu” Guojia Zhanluexing Xinxing Chanye Fazhan Guihua (12th Five-Year Plan for National Strategic Emerging Industries). 9 July 2012. Available online: http://www.gov.cn/gongbao/content/2012/content_2192397.htm (accessed on 28 July 2022).

- Li, F. 2020 Marks End of Support for Fuel Cell Cars. China Daily. 14 October 2019. Available online: https://globa.chinadaily.com.cn/a/201910/14/WS5da406a7a310cf3e355705d5.html (accessed on 28 July 2022).

- Xi, J. Revolutionize Energy Production and Consumption. Qiushi Journal. 13 June 2014. Available online: http://e.qstheory.cn/2020-10/30/c_555142.htm (accessed on 28 July 2022).

- BP p.c. Statistical Review of World Energy 2020; BP, p.c.: London, UK, 2020. [Google Scholar]

- ChinaEV100. Zhongguo Qingneng Chanye Fazhan Baogao 2020 (Report on the Development of Hydrogen Industry in China). Available online: http://www.ev100plus.com/report/ (accessed on 28 July 2022).

- National Development; Reform Commission, PRC. Chanye Jiegou Tiaozheng Zhidao Mulu (2019nian Ben) (Catalogue for Guiding Industry Restructuring (2019 Version)). 30 October 2019. Available online: http://www.gov.cn/gongbao/content/2020/content_5467513.htm (accessed on 28 July 2022).

- National Development and Reform Commission, PRC. Zhongguo Yingdui Qihou Bianhua Guojia Fangan (China’s National Climate Change Programme). 3 June 2007. Available online: http://www.gov.cn/zhengce/content/2008-03/28/content_5743.htm (accessed on 28 July 2022).

- The Research Team from China Center for International Economic Exchanges. Zhongguo Qingneng Chanye Zhengce Yanjiu (Research on China’s Hydrogen Industry Policy); SSAP: Beijing, China, 2020. [Google Scholar]

- National Development and Reform Commission, PRC; National Energy Administration. Nengyuan Jishu Geming Chuanxin Xingdong Jihua (2016–2030nian) (Action Plan for the Energy Technology Revolution Innovation (2016–2030)). 7 April 2016. Available online: http://www.gov.cn/xinwen/2016-06/01/5078628/files/d30fbe1ca23e45f3a8de7e6c563c9ec6.pdf (accessed on 28 July 2022).

- National Development and Reform Commission, PRC; National Energy Administration. Nengyuan Fazhan “Shisanwu” Guihua (13th Five-Year Plan for Energy Development). 6 December 2016. Available online: http://www.nea.gov.cn/135989417_14846217874961.pdf (accessed on 28 July 2022).

- Central Committee of the Communist Party of China; State Council, PRC. Guojia Chuangxin Qudong Fazhan Zhanlue Gangyao (Outline of the National Strategy of Innovation-Driven Development). 19 May 2016. Available online: http://www.gov.cn/xinwen/2016-05/19/content_5074812.htm (accessed on 28 July 2021).

- Xi, J. Rang Gongchengkeji Zaofu Renlei, Chuangzao Weilai (Let Engineering Science and Technology Create a Better Future for Humankind). 3 June 2014. Available online: http://www.icest2014.ca.cn/down/Xispeech.pdf (accessed on 28 July 2022).

- Jensterle, M.; Narita, J.; Piria, R.; Samadi, S.; Prantner, M.; Crone, K.; Siegemund, S.; Kan, S.; Matsumoto, T.; Shibata, Y.; et al. The Role of Clean Hydrogen in the Future Energy Systems of Japan and Germany; Adelph: Berlin, Germany, 2019. [Google Scholar]

- Dong, Y. Zhongguo Qiche Dongli Dianchi ji Qingranliao Dianchi Chanye Fazhan Niandu Baogao 2019–2020nian (China Automotive Power Battery and Hydrogen Fuel Battery Industries Development Annual Report from 2019 to 2020); CMPBOOK: Beijing, China, 2020. [Google Scholar]

- Wang, B. Online Regular Press Conference of the Ministry of Commerce (2 April 2020). Available online: http://english.mofcom.gov.cn/article/newsrelease/press/202004/20200402953617.shtml (accessed on 28 July 2022).

- Ministry of Industry and Information Technology, PRC; National Development and Reform Commission, PRC; Ministry of Science and Technology, PRC. Qiche Zhongchangqi Fazhan Guihua (Mid- to Long-Term Development Plan for the Automotive Industry). 6 April 2017. Available online: http://www.gov.cn/gongbao/content/2017/content_5230289.htm (accessed on 28 July 2022).

- Ministry of Ecology and Environment PRC; National Bureau of Statistics, and Ministry of Agriculture and Rural Affairs, PRC. Dierci Quanguo Wuyuanyuan Pucha Gongbao (Report on the Second National Survey of Pollution Sources). 9 June 2020. Available online: http://www.me.gov.cn/xxgk2018/xxgk/xxgk01/202006/t20200610_783547.html (accessed on 28 July 2022).

- State Council, PRC. Qiche Chanye Tiaozheng he Zhenxing Guihua (Plan on Restructuring and Revitalisation of Auto Industry). 20 March 2009. Available online: http://www.gov.cn/zwgk/2009-03/20/content_1264324.htm (accessed on 28 July 2022).

- Phillips, S. Amid Global Push to Reduce Carbon Emissions, Japan Looks Past Battery-Powered Electric Cars and Envisions a Hydrogen Society. StateImpact Pennsylvania. 14 March 2019. Available online: https://stateimpact.npr.org/pennsylvania/2019/03/14/for-electric-vehicles-japan-bets-on-hydrogen/ (accessed on 28 July 2022).

- Ministry of Science and Technology, PRC. “Kezaisheng Nengyuan yu Qingneng Jishu” Zhongdian Zhuanxiang 2018niandu Xiangmu Shenbao Zhinan (Guide to the Application of Key Projects about Renewable Energy and Hydrogen Technologies in 2018). Available online: http://kjt.huna.gov.cn/xxgk/tzgg/kjbtzgg/201808/9898921/files/17399d349ff64d1f977e463f5594d1ff.pdf (accessed on 28 July 2022).

- China Automotive Technology and Research Center Co., Ltd. Zhongguo Cheyong Qingneng Chanye Fazhan Baogao (2018) (Annual Report on the Development of Automotive Hydrogen Industry in China); SSAP: Beijing, China, 2018. [Google Scholar]

- Ministry of Science and Technology, PRC. “Kezaisheng Nengyuan yu Qingneng Jishu” Zhongdian Zhuanxiang 2019niandu Xiangmu Shenbao Zhinan (Guide to the Application of Key Projects about Renewable Energy and Hydrogen Technologies in 2019). 12 June 2019. Available online: http://www.gov.cn/zhengce/zhengceku/2019-10/16/content_5440442.htm (accessed on 28 July 2022).

- Ministry of Science and Technology, PRC. “Kezaisheng Nengyuan yu Qingneng Jishu” Zhongdian Zhuanxiang 2020niandu Xiangmu Shenbao Zhinan (Guide to the Application of Key Projects about Renewable Energy and Hydrogen Technologies in 2020. 23 March 2020. Available online: https://fuwu.most.gov.cn/u/cms/zwpt/202003/23191758j1th.pdf (accessed on 28 July 2022).

- China Society of Automotive Engineers. Shijie Qingneng yu Ranliao Dianchi Qiche Chanye Fazhan Baogao 2019 (Annual Report on Global Hydrogen Fuel Cell Vehicle 2019); CMPBOOK: Beijing, China, 2019. [Google Scholar]

- Sinopec Group. Corporate Social Responsibility Report 2019; Petrochemical Corporation: Beijing, China, 2020. [Google Scholar]

- Research and Markets. Global and China Fuel Cell Industry Report 2020: China is Close to Its Leading Peers in Fuel Cell System and Engine. Intrado GlobeNewswire. 2 October 2020. Available online: https://www.globenewswir.com/news-release/2020/10/02/2102783/0/en/Global-and-China-Fuel-Cell-Industry-Report-2020-China-is-Close-to-It-s-Leading-Peers-in-Fuel-Cell-System-and-Engin.html (accessed on 28 July 2022).

- Ahsan, N.; Rashid, A.A.; Zaidi, A.A.; Imran, R.; Qadir, S.A. Performance analysis of hydrogen fuel cell with two-stage turbo compressor for automotive applications. Energy Rep. 2021, 7, 2635–2646. [Google Scholar] [CrossRef]

- Meng, X.; Gu, A.; Wu, X.; Zhou, L.; Zhou, J.; Liu, B.; Mao, Z. Status quo of China hydrogen strategy in the field of transportation and international comparisons. Int. J. Hydrog. Energy 2021, 46, 28887–28899. [Google Scholar] [CrossRef]

- China Association of Automobile Manufacturers. 2018nian Qiche Gongye Jingji Yunxing Qingkuang (Economic Performance of Automobile Industry in 2018). 14 January 2019. Available online: http://www.caam.org.cn/search/con_5221202.html (accessed on 28 July 2022).

- China Association of Automobile Manufacturers. 2019nian Qiche Gongye Jingji Yunxing Qingkuang (Economic Performance of Automobile Industry in 2019). 13 January 2020. Available online: http://www.caam.org.cn/search/con_5228367.html (accessed on 28 July 2022).

- China Association of Automobile Manufacturers. 2020nian 11yue Qiche Gongye Jingji Yunxing Qingkuang Jianxi (Brief Analysis of Economic Performance of Automobile Industry in November 2020). 14 December 2020. Available online: http://www.caam.org.cn/chn/4/cate_38/con_5232638.html (accessed on 28 July 2022).

- China Association of Automobile Manufacturers. 2020nian Qiche Gongye Jingji Yunxing Qingkuang (Economic Performance of Automobile Industry in 2020). 13 January 2021. Available online: http://www.caam.org.cn/chn/4/cate_38/con_5232916.html (accessed on 28 July 2022).

- Wang, F. China Has Built 104 Hydrogen Fueling Stations Ranking Second Globally. EqualOcean. 4 December 2020. Available online: https://equalocea.com/news/2020120415213 (accessed on 28 July 2022).

- General Office of the State Council, PRC. Guojia Biaozhunhua Tixi Jianshe Fazhan Guihua (2016–2020 Nian) (Plan for National Standardisation System Construction (2016–2020)). 17 December 2015. Available online: http://www.gov.cn/zhengce/content/2015-12/30/content_10523.htm (accessed on 28 July 2022).

- Ministry of Science and Technology, PRC; Ministry of Transport, PRC. “Shisanwu” Jiaotong Lingyu Keji Chuangxin Zhuanxiang Guihua (13th Five-Year Special Plan for Science and Technology Innovation in the Transportation Sector). 2 May 2017. Available online: https://www.most.gov.cn/xxgk/xinxifenlei/fdzdgknr/fgzc/gfxwj/gfxwj2017/201706/t20170601_133311.html (accessed on 28 July 2022).

- Zheng, L. Qingneng Fazhan Xian “Xuhuo”, Yejie Huyu Dingceng Sheji (The Development of Hydrogen Energy is “fake” and Top-Level Design is Urged). China Energy News. 28 May 2020. Available online: https://baijiahao.baidu.com/s?id=1667918101556564320&wfr=spider&for=pc (accessed on 28 July 2022).

- National Development and Reform Commission, PRC; Ministry of Foreign Affairs, PRC; Ministry of Commerce, PRC. Tuidong Gongjian Sichouzhilu Jingjidai he 21shiji Haishang Sichouzhilu de Yuanjing yu Xingdong (Vision and Actions on Jointly Building Silk Road Economic Belt and 21st-Century Maritime Silk Road). 28 March 2015. Available online: https://www.ndrc.gov.cn/xwdt/xwfb/201503/t20150328_956036.html (accessed on 28 July 2022).

- State Planning Commission, PRC; Ministry of Science and Technology, PRC. Dangqian Youxian Fazhan de Gaojishu Chanyehua Zhongdian Lingyu Zhinan (Guide to Key Development Areas of High Technology Industrialisation at Present). 14 November 2001. Available online: http://www.gov.cn/gongbao/content/2002/content_61654.htm (accessed on 28 July 2022).

- Ministry of Science and Technology, PRC. Kechixu Fazhan Keji Gang Yao (2001–2010 Nian) (Outline of Sustainable Development of Science and Technology (2001–2010)). 2 August 2002. Available online: http://www.gov.cn/gongbao/content/2003/content_62625.htm (accessed on 28 July 2022).

- National Development and Reform Commission, PRC. Chanye Jiegou Tiaozhneg Zhidao Mulu (2005 Nian Ben) (Directory Catalogue on Readjustment of Industrial Structure (2005 Version)). 2 December 2005. Available online: http://www.gov.cn/gongbao/content/2006/content_169943.htm (accessed on 28 July 2022).

- National Development and Reform Commission, PRC; Ministry of Construction, PRC; Ministry of Public Security, PRC; Ministry of Finance, PRC; Ministry of Supervision, PRC; State Environmental Protection Administration. Guanyu Guli Fazhan Jieneng Huanbaoxing Xiao Pailiang Qiche de Yijian (Opinions on Development of Energy-Efficient and Low-Emission Vehicles). 25 December 2005. Available online: http://www.gov.cn/gongbao/content/2006/content_212067.htm (accessed on 28 July 2022).

- State Council, PRC. Guojia Zhongchangqi Kexue he Jishu Fazhan Guihua Gangyao (2006–2020 Nian) (Outline of the National Medium- and Long-Term Program for Science and Technology Development (2006–2020)). 30 December 2005. Available online: http://www.gov.cn/gongbao/content/2006/content_240244.htm (accessed on 28 July 2022).

- National Development and Reform Commission, PRC; Ministry of Commerce, PRC. Waishang Touzi Chanye Zhidao Mulu (2007 Nian Xiuding) (Catalogue of Industries for Guiding Foreign Investment (2007 Revision)). 31 October 2007. Available online: http://www.gov.cn/gongbao/content/2008/content_1018951.htm (accessed on 28 July 2022).

- National Development and Reform Commission, PRC; Ministry of Commerce, PRC. Waishang Touzi Chanye Zhidao Mulu (2011 Nian Xiuding) (Catalogue of Industries for Guiding Foreign Investment (2011 Revision)). 24 December 2011. Available online: http://www.gov.cn/gongbao/content/2012/content_2144287.htm (accessed on 28 July 2022).

- State Council, PRC. Gongye Zhuanxing Shengji Guihua (2011–2015 Nian) (Industrial Transformation and Upgrade Plan (2011–2015)). 30 December 2011. Available online: http://www.gov.cn/zhengce/zhengceku/2012-01/19/content_3655.htm (accessed on 28 July 2022).

- State Council, PRC. Xunhuan Jingji Fazhan Zhanlue ji Jinqi Xingdong Jihua (The Circular Economy Development Strategy and Near-Term Action Plan). 23 January 2013. Available online: http://www.gov.cn/gongbao/content/2013/content_2339517.htm (accessed on 28 July 2022).

- General Office of the State Council, PRC. Nengyuan Fazhan Zhanlue Xingdong Jihua (2014–2020 Nian) (Action Plan for Energy Development Strategy (2014–2020)). 7 June 2014. Available online: http://www.gov.cn/gongbao/content/2014/content_2781468.htm (accessed on 28 July 2022).

- Ministry of Finance, PRC; Ministry of Science and Technology, PRC; Ministry of Industry and Information Technology, PRC; National Development and Reform Commission, PRC. Guanyu Xinnengyuan Qiche Chongdian Sheshi Jianshe Jiangli de Tongzhi (Notice of Reward for New Energy Vehicle Charging Infrastructure). 18 November 2014. Available online: https://www.miit.gov.cn/ztzl/lszt/2015nqggyhxxhgzhy/2014ztrd/zcwj/art/2020/art_7c69f915abc348b2a1750487f1374c83.html (accessed on 28 July 2022).

- Ministry of Finance, PRC; Ministry of Science and Technology, PRC; Ministry of Industry and Information Technology, PRC; National Development and Reform Commission, PRC. Guanyu 2016–2020 Nian Xinnengyuan Qiche Tuiguang Yingyong Caizheng Zhichi Zhengce de Tongzhi (Notice of Financial Support for Promotion and Application of New Energy Vehicles (2016–2020)). 22 April 2015. Available online: http://www.gov.cn/xinwen/2015-04/29/content_2855040.htm (accessed on 28 July 2022).

- Central Committee of the Communist Party of China; State Council, PRC. Zhongguo Zhizao 2025 (Made in China 2025). 19 May 2015. Available online: http://www.gov.cn/zhengce/content/2015-05/19/content_9784.htm (accessed on 28 July 2021).

- National Development and Reform Commission, PRC; Ministry of Commerce, PRC. Waishang Touzi Chanye Zhidao Mulu (2015 Nian Xiuding) (Catalogue of Industries for Guiding Foreign Investment (2015 Revision)). 10 March 2015. Available online: http://www.gov.cn/gongbao/content/2015/content_2864060.htm (accessed on 28 July 2022).

- State Council, PRC. “Shisanwu” Wujia Keji Chuangxin Guihua (13th Five-Year Plan for Science, Technology and Innovation). 28 July 2016. Available online: http://www.gov.cn/zhengce/content/2016-08/08/content_5098072.htm (accessed on 28 July 2022).

- National Development and Reform Commission, PRC; National Energy Administration. Nengyuan Shengchan he Xiaofei Geming Zhanlue (2016–2030 Nian) (Energy Supply and Consumption Revolution Strategy (2016–2030)). 29 December 2016. Available online: http://www.gov.cn/xinwen/2017-04/25/5230568/files/286514af354e41578c57ca38d5c4935b.pdf (accessed on 28 July 2022).

- Ministry of Finance, PRC; Ministry of Science and Technology, PRC; Ministry of Industry and Information Technology, PRC; National Development and Reform Commission, PRC. Guanyu Tiaozheng Xinnengyuan Qiche Tuiguang Yingyong Caizheng Butie Zhengce de Tongzhi (Notice of Adjusting the Policies on Government Subsidies for Promotion and Application of New Energy Vehicles). 29 December 2016. Available online: http://www.gov.cn/xinwen/2016-12/30/content_5154971.htm#1 (accessed on 28 July 2022).

- National Development and Reform Commission, PRC; Ministry of Commerce, PRC. Waishang Touzi Chanye Zhidao Mulu (2017 Nian Xiuding) (Catalogue of Industries for Guiding Foreign Investment (2017 Revision)). 28 June 2017. Available online: http://www.gov.cn/gongbao/content/2017/content_5237697.htm (accessed on 28 July 2022).

- Ministry of Finance, PRC; Ministry of Industry and Information Technology, PRC; Ministry of Science and Technology, PRC; National Development and Reform Commission, PRC. Guanyu Tiaozheng Wanshan Xinnengyuan Qiche Tuiguang Yingyong Caizheng Butie Zhengce de Tongzhi (Notice of Adjusting and Improving the Financial Subsidy Policies for Promotion and Application of New Energy Vehicles). 12 February 2018. Available online: http://www.miitcfc.cn/n73563/n73620/c1206074/part/1206093.pdf (accessed on 28 July 2022).

- National Development and Reform Commission, PRC; National Energy Administration. Guanyu Tisheng Dianli Xitong Tioajie Nengli de Zhidao Yijian (Guiding Opinions on Improving the Electricity System’s Adjustment Capabilities). 28 February 2018. Available online: http://www.gov.cn/zhengce/zhengceku/2019-09/29/content_5434855.htm (accessed on 28 July 2022).

- Ministry of Ecology and Environment, PRC; National Development and Reform Commission, PRC; Ministry of Industry and Information Technology, PRC; Ministry of Public Security, PRC; Ministry of Finance, PRC; Ministry of Transport, PRC; Ministry of Commerce, PRC; State Administration for Market Regulation; National Energy Administration; National Railway Administration; et al. Chaiyou Huoche Wuran Zhili Gongjianzhan Xingdong Jihua (Action Plan for Diesel Truck Emissions Control). 30 December 2018. Available online: http://www.gov.cn/gongbao/content/2019/content_5389334.htm (accessed on 28 July 2022).

- Central Committee of the Communist Party of China; State Council, PRC. Jiaotong Qiangguo Jianshe Gangyao (Outline on Building China’s Strength in Transport). 19 September 2019. Available online: http://www.gov.cn/gongbao/content/2019/content_5437132.htm (accessed on 28 July 2021).

- National Development and Reform Commission; PRC; Ministry of Commerce. Guli Waishang Touzi Chanye Mulu (2020 Nian Ban) (Catalogue of Industries for Encouraging Foreign Investment (2020 Version)). 27 December 2020. Available online: http://www.gov.cn/gongbao/content/2021/content_5587654.htm (accessed on 28 July 2022).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yuan, Y.; Tan-Mullins, M. An Innovative Approach for Energy Transition in China? Chinese National Hydrogen Policies from 2001 to 2020. Sustainability 2023, 15, 1265. https://doi.org/10.3390/su15021265

Yuan Y, Tan-Mullins M. An Innovative Approach for Energy Transition in China? Chinese National Hydrogen Policies from 2001 to 2020. Sustainability. 2023; 15(2):1265. https://doi.org/10.3390/su15021265

Chicago/Turabian StyleYuan, Yiqi, and May Tan-Mullins. 2023. "An Innovative Approach for Energy Transition in China? Chinese National Hydrogen Policies from 2001 to 2020" Sustainability 15, no. 2: 1265. https://doi.org/10.3390/su15021265

APA StyleYuan, Y., & Tan-Mullins, M. (2023). An Innovative Approach for Energy Transition in China? Chinese National Hydrogen Policies from 2001 to 2020. Sustainability, 15(2), 1265. https://doi.org/10.3390/su15021265