Abstract

Because of incomplete information on pre-sold products, consumers face uncertainty about the value of what they have purchased, which leads to a mismatch between supply and demand and a large number of returns. By developing appropriate return policies and effectively managing and handling consumer returns, retailers can not only reduce waste but also ensure better resource utilization, which is essential for sustainable development. In this paper, we analyze the full-refund and full-and-freight-refund policies of retailers and develop a game model based on binary competition for selecting the optimal return policy for the pre-sold products of two retailers. The study shows that when both retailers have low capacity, there is no pre-sale stage. However, when their combined capacity is high and exceeds the demand of non-strategic consumers, equilibrium depends on their combined capacity and the proportion of strategic consumers who choose to keep the pre-purchased product under both return policies. When the number of strategic consumers who retain pre-order products is low under the full-refund policy and both retailers have moderate capacity, equilibrium is achieved when an asymmetric return policy is followed rather than a symmetric return policy. Specifically, when the percentage of strategic consumers who keep their reserved products under the product return strategy is small and the capacity of the two retailers is moderate, the maximum benefit is achieved if one of the retailers adopts the policy of a full refund and the other adopts the policy of a full-and-freight refund. Otherwise, when one retailer adopts the policy of a full refund or a full-and-freight refund, its competitor should adopt the same strategy to gain maximum revenue. The research on retailers’ pre-sale and return strategies in this paper helps to optimize the operational strategies and operational processes of e-retailers, further improve the management and decision making of their joint pre-sale and return strategies, and help optimize retailers’ profits.

1. Introduction

The rapid economic development of modern society has gradually led to many adverse consequences, such as the depletion of natural resources, increased environmental pollution, and the greenhouse effect, which poses a serious threat to the sustainable development of human society. In this context, a “low-carbon wave” has emerged globally. A low-carbon economy relies on science and technology, policies, and market mechanisms to achieve the best economic and social benefits with minimal resource consumption and environmental impact, leading to sustainable development goals of economic and social development and resource conservation and environmental protection. One of the most serious problems facing the e-commerce industry is returns, and according to Accenture e-Research, up to 95% of consumer returns involve non-defective goods. How to develop a reasonable return strategy and how to effectively manage and handle consumer returns have become key issues that e-commerce companies must urgently address. According to a study by the Chinese Consumers Association, the traditional ways in which enterprises handle consumer returns can generally be summarized as remanufacturing, scrapping, and donation. When products with qualified quality and less serious damage are returned, enterprises generally remanufacture or donate them according to the attributes of the products; when poor-quality products are returned, enterprises generally take scrapping measures to deal with them [1]. In this study, based on the requirements of sustainable economic development, products returned by consumers that do not have quality defects are considered without considering the cost of product processing, and the returned products can be resold directly or after simple processing. This will help to establish a low-carbon economy with higher resource utilization and more environmental protection, which is important for enterprises to adapt to future social development.

A low-carbon economy relies on science and technology, policies, and market mechanisms for optimal economic and social benefits with minimal resource consumption and environmental impact, thus achieving sustainable economic and social development, resource conservation, and environmental protection.

The advancement of the Internet has led to more complicated consumer behavior and more waste. Some consumers, for instance, tend to wait for a product’s price to drop before making a purchasing choice. To reduce consumers’ strategic waiting behavior, an increasing number of retailers are embracing the pre-sale approach. Accepting consumer orders before introducing a product allows retailers to not only acquire the sales amount in advance but also increase consumer desire. Pre-sales are frequently accompanied by a price reduction for consumers, who can not only purchase products at a lower price but also avoid the risk of the products going out of stock. When launching new products, online retailers are increasingly adopting pre-sale marketing models [2]. In the pre-sale stage, retailers encourage consumers to pre-order forthcoming new products and guarantee delivery within the standard sales stage. When new products are going to be released, numerous retailers on Taobao and JD.com adopt pre-sales for categories such as digital products, clothes, skincare products, and home appliances. Due to the lack of knowledge regarding pre-sale products, however, consumers face valuation uncertainty while reserving products, and retailers decrease consumers’ purchase risk by offering return policies for pre-sale products. The “insurance” mechanism implied by returns simultaneously minimizes consumer risk and raises their willingness to pay. Some retailers offer a full refund, but the consumer must pay the return freight fee. For instance, when purchasing a piece of clothing from ZARA on Taobao, the consumer can apply for a full refund within seven days of receiving the product but must pay the return freight fee. A survey revealed that 42% of return disputes involved the allocation of return freight costs [3]. Some retailers purchase freight insurance, which entails a full refund for consumers who pre-order products, and the freight costs incurred when the consumer returns an item are covered by the insurance company. One such company on the e-commerce platform is Unilever, which sells products of different brands. Freight insurance reduces negative consumer reviews, rights protection complaints, etc., but also raises the return rate and freight costs. The types of return policies competitive retailers offer as part of their pre-sale policy are important for sustainable development and should be studied.

Because sustainable development is critical, in this paper, we consider a situation where there are strategic consumers and returned products can be re-sold, accordingly construct a Bertrand competition model for two competing retailers with capacity constraints, and solve the equilibrium return strategy of their pre-sold products by the inverse recursive method. In our model, two retailers selling homogeneous products (1) decide on the basis of their capacity whether to set up a pre-sale stage, (2) decide the price of their normal sale stage, and (3) decide the pre-sale capacity, the pre-sale price, and the full-refund return policy or full-and-freight-refund return policy that they should offer for their pre-sale products.

In this paper, we focus on the following three aspects. (1) We analyze the buying behavior of strategic consumers in competitive markets. Most previous studies in the relevant literature have explored the purchasing behavior of consumers only in monopolistic markets, whereas few scholars have analyzed the purchasing utility of consumers in competitive markets when retailers adopt pre-sale strategies. We rationalize the model by taking consumer behavior as the main decision factor for retailers and formulating retailers’ selling strategies by analyzing consumer utility. (2) We explore the choice of return strategy in a retailer’s two-stage sales model in a competitive market where strategic consumers exist. On the basis of the impact of pre-sales on future demand and the proportion of supply in the pre-sales stage, we explore the impact of retailers’ return strategies and the impact of complex consumer behavior on retailers’ profits under different market conditions and different combinations of return strategies. (3) We focus on the impact of the re-salability of returned products in competitive markets on retailers’ pre-sale and return strategies. In addition, by constructing a Bertrand competition model for two retailers, we analyze the following three competitive scenarios: (1) both retailers offer a full refund, (2) both retailers offer a full-and-freight refund, and (3) both retailers offer a full refund and a full-and-freight refund.

According to the study, both retailers do not use the pre-sale stage when the retailer capacity is less than the demand of the non-strategic consumers. However, when the retailer capacity exceeds the demand of non-strategic consumers, the equilibrium results for both retailers are proportional to the percentage of strategic consumers who retain their purchases under the two return policies. In contrast, when the proportion of retention under full refunds and freight refunds is high, equilibrium between both retailers depends on their capacity. In particular, when the capacity of both retailers is low, when one retailer adopts a full-refund return strategy, the other retailer is able to achieve optimal returns by adopting the same return strategy. When the capacity of the two retailers is moderate, when one retailer adopts a full-refund return strategy, the other retailer adopts a full-and-freight-refund return strategy to achieve optimal revenue. When the capacity of the two retailers is high and one retailer adopts a full-and-freight-refund return strategy, then the other retailer adopts the same full-and-freight-refund return strategy to achieve the optimal revenue.

Literature related to this study is mainly separated into two categories: (1) e-commerce pre-sale policies based on sustainable development and (2) product return policies based on sustainable development.

We will begin by looking at the first category of relevant literature for this study. Theoretical scholars have focused on pre-sale policy as a significant means of coordinating operation and marketing. Prasad et al. [4] examined pre-sale pricing and product decision-making concerns when consumers’ product valuations are unclear. Xu et al. [5] studied the optimal one-time order model and second-order model for retailers under pre-sale and out-of-stock conditions. On the basis of consumer risk appetite, Zhao and Stecke [6] considered the two-stage pre-sale dilemma of monopolistic retailers. The above research has analyzed the predictive utility of pre-sale policies under monopoly mode for product proliferation or standard sales stages, and this paper focuses on the effect of competition on the formulation of retailers’ pre-sale policies and the strategic behavior of consumers in the pre-sale stage.

There are fewer studies on multi-retailer pre-sales. Cachon and Feldman [7] examined the impact of retailers’ competition on pre-sale policies. McCardle et al. [8] analyzed the utility of the pre-sale policy when there is a brand competition between two retailers and found that both retailers adopted a pre-sale policy simultaneously as a result of competition. In contrast to McCardle et al. [8], in this paper, we investigate retailers’ pre-sale problems to address the impact of the complicated behaviors of strategic consumers on retailers’ equilibrium and show that retailers tend to pre-sell more products when strategic consumers are involved.

Some studies have also been conducted on strategic consumers in the pre-sale stage. Dana [9] believes that strategic consumers’ demand for pre-sale products depends on pricing and capacity. Shugan and Xie [10] analyzed strategic consumer behavior when retailers have capacity limits during the pre-sale stage and proposed that booking might lower the risk of out-of-stock products for consumers and boost retailer revenues. Yu et al. [11] examined the effect of strategic consumer behavior during the pre-sale stage on retailers’ product pricing. Swinney [12] investigated whether consumers choose pre-sale or standard sales when strategic waiting is involved. Li and Zhang [13] focused on retailers’ pre-sale policies and related price assurance policies where there were strategic consumers and showed that retailers’ strategic choices depend on the relative size of heterogeneous consumer segments. Although the above literature examined the strategic behavior of consumers, it does not address how retailers might reduce the purchasing risks of consumers via a pre-sale policy. In light of the coping policies of actual retailers, this study examines the return policy of pre-sale products to reduce consumer purchase risk.

The second category of relevant literature for this study is research on consumer return behavior. Prior studies have suggested that consumer returns are subject to Poisson’s distribution of purchasing and inventory control policies [14,15] or that consumers’ return behavior depends on product quality [16,17]. As the quality of products has improved, however, many returns no longer involve the return of defective products but rather the return of products because of unclear product use techniques and product and expected differences resulting from the absence of quality issues. Nasery and Popescu [18] studied how retailers adopt pre-sale policies based on consumers’ regret, as well as quality-free return policies for retailers with limited capacity. Mao et al. [19] examined the complicated behavior of strategic consumers and the return of seasonal perishable products when retailers had overcapacity, whereas this study examines the return policy of pre-sold products under the condition of limited retailer capacity.

The majority of the literature on returns has focused on the return form. Chen et al. [20] considered the impact of consumer returns on the product decisions of several decentralized retailers. In their study of returns, Yang and Chang [3] incorporated freight insurance into the newsvendor model. Davis et al. [21] demonstrated that adopting a full-refund policy will boost a retailer’s bottom line when the salvage value of a returned products meets specific parameters. Su [22] examined the impact of some retailers’ refund policies on the supply chain performance in the context of market size and consumer valuation uncertainty. Zhai and Li [23] studied the return processing policies of online retailers. Yang and Ji [24] examined the effect of the return of unsold products, normal resale, and reduced-price resale on retailers’ return policies in the presence of strategic consumer behavior. When retailers have a limited capacity and returned products are available for normal resale, Chu et al. [25] considered the impact of partial refunds on consumer cancellations. On the assumption of a fixed return rate, Vlachos and Dekker [26] studied the storage problem of single-cycle single-product points for various types of returns, including the return of products without quality issues, and provided six solutions.

It is not difficult to conclude that the above research on refund policies mainly aims to investigate the highest suitable return policy for retailers and the associated pricing issues in a monopoly market. There is not much research on a duopoly market. Shulman et al. [27] used an analytical model of bilateral monopoly to investigate the effect of competition on equilibrium prices and benefits. Ferguson et al. [28] studied the supply chain coordination issue when products without quality issues are returned. In this paper, we consider the return of products because of quality-related problems and price differences between various retailers. In a study of the retailer’s pre-sale policy and the return of products without quality issues conducted under the assumption that consumer valuation and product demand are uncertain, Li et al. [29] found that the full-refund return policy and the non-provision return policy of pre-ordered products may result in an irrational distribution of product risk and that the partial-refund policy is the optimal return policy.

Guo [30] studied the pre-sale and return policies of service providers in the duopoly market, focusing on the effect of competition on retailers’ partial-refund policies. Gao discovered that when shifting from a local monopoly to a competitive mechanism, retailers’ interaction behavior may change. This paper, which is closely related to the study by Guo [30], focuses on the return of products that have no quality issues under the supposition of a duopoly and examines the equilibrium between retailers adopting competitive policies. The following are the main differences between the study by Guo [30] and this study: (1) Guo [30] studied service cancellation, whereas this study focuses on product returns. (2) Guo [30] examined the service provider’s zero-refund and partial-refund policies, whereas this paper examines the retailer’s full-refund and full-and-freight-refund policies. (3) According to Guo [30], two service providers in equilibrium adopt identical partial (zero)-refund policies. In this paper, the retailer’s equilibrium is connected to the fraction of strategic consumers who reserve pre-order products and the capacity. When the full-refund approach helps maintain a small number of strategic consumers under the pre-order product and the retailer’s capacity is modest, the retailer’s return policy is an asymmetric policy; otherwise, the equilibrium is symmetrical.

This paper provides an exhaustive overview of the state of research related to retailers’ pre-sales and returns and sorts out the issues of retailers’ pre-sale and return strategy choices. This paper further investigates the case of simultaneous pre-sales, returns, and strategic consumers.

On the basis of a review of the literature: (1) The current research on strategic consumer behavior, pre-sale strategy, and return strategy usually places them in a monopolistic setting, examining only one aspect or two aspects jointly, there being little literature that simultaneously incorporates all three aspects into a model framework and examines their effects on retailers’ strategic choices in a competitive market. (2) Of the literature that has examined both pre-sale strategy and return strategy together, more academic literature has examined retailers’ zero-return policy and partial-return policy, and many scholars’ findings suggest that the partial-return policy is optimal, which is inconsistent with the popular full-refund or full-and-freight-refund policy. Currently, seven-day no-excuse returns and shipping insurance returns are becoming an important trend in online retailing. We will discuss this trend in this paper. In contrast to studies on the problem of consumers returning goods after receiving them in a single sales stage, this paper focuses on the return behavior of consumers who purchase products before the products are released for pre-sale. (3) This paper discusses and models the purchase decisions of consumers and the profits of two retailers under different pre-sale return strategies, obtains the equilibrium revenue and equilibrium strategies of two retailers under different pre-sale return strategies, and finds the optimal pre-sale return strategies of two retailers through comparative analysis, which will supplement the gaps in the research related to retailers’ pre-sale and return, has important guiding significance for practical life, and provides an opportunity for competing retailers to develop optimal pre-sale return strategies in online sales. This will provide a theoretical reference for developing optimal sales strategies for competing retailers in online sales.

2. Materials and Methods

Let us assume that there are two online retailers selling the same products on the market and both adopt the pre-sale stage and the standard sales stage . There are two categories according to whether pre-sale consumers should be targeted: strategic pre-sale consumers (the scale is ), who can either reserve products at the pre-sale stage or wait until the standard sales stage to decide whether to buy, and non-strategic consumers (the scale is ), who do not take priority pre-sales and are identified as consumers who make purchases during the standard sales stages. A consumer who makes a purchase must wait until the standard sales stage before receiving the product.

Since the product has not been released at the pre-sale stage, the strategic consumer does not have or understand the complete product information. Therefore, this paper assumes that the valuation of the product by the strategic consumer in the pre-sale stage is uncertain and evenly distributed on . However, non-strategic consumers in the standard sales stage can collect product information through retailers, online reviews, or other channels, which implies that the valuation of the product by non-strategic consumers in the standard sales stage is certain and private. Non-strategic consumers place a higher value on products, i.e., . The retailer’s capacity is limited, which is . Each consumer may acquire no more than one unit of the product. Both retailers and consumers have the same information structure and are risk-neutral. The model parameters are listed in Table 1.

Table 1.

Parameters and variables.

Suppose two online retailers consider two return policies in the pre-sale stage: the return policy of only providing a full refund (such as clothing products from ZARA on Taobao) or the return policy of purchasing freight insurance and full refund (such as the products of various brands from Unilever on e-commerce platforms). This paper analyzes a scenario in which there is no quality issue with the pre-sold product but the strategic consumer demands a return owing to a variation in the pre-ordered product’s valuation or a mismatch with personal preferences. Under different return policies, the fraction of consumers who reserve their pre-ordered products changes, and the retention rates and under the full-refund and the full-and-freight-refund policies are included, respectively. Products returned by strategic consumers are eligible for resale during the standard sales stage.

It is assumed that non-strategic consumers have a clear preference for retailers during the standard stage (similar to McGill and VanRyzin [31]). Thus, the two retailers in the standard stage are equal to local monopoly retailers, with half of the consumers choosing retailer firmly and the other half choosing retailer strategically. Valuation-determined non-strategic consumers will not apply for returns. Therefore, retailers only offer technical guidance, repair, maintenance, and other after-sales services for products in the standard sales stage. This paper uses the term to represent the revenue of retailer i in the state , , indicating that the two retailers offer a full refund simultaneously, the two retailers offer both full-and-freight refunds, one retailer offers a full refund, and the other offers a full-and-freight refund.

The order of decision-making in the game is as follows: (1) the two retailers develop their own return policies (offer a full refund only or offer a full-and-freight refund); (2) the two retailers develop their own pre-sale prices; (3) the two retailers develop their own standard sales prices; and (4) consumers make purchasing decisions.

2.1. Both Retailers Adopt a Full-Refund Policy Simultaneously

To reduce the uncertainty and purchasing risk of strategic consumers, both retailers simultaneously offer full refunds to strategic consumers who pre-order products. However, consumers who seek refunds are responsible for paying return freight fees . When retailers adopt a full-refund policy, a fraction of consumers will reserve their pre-ordered products. Next, we will use reverse recursion to solve the competitive model of the two retailers.

2.1.1. Standard Sales Stage

Assuming that the total number of consumers in the market is and the fraction of strategic consumers is , the number of strategic consumers is and the number of non-strategic consumers is in the market during the two sales stages. Each of the two retailers in the standard sales stage has its own distinct consumer. The quantity of each product easily available for non-strategic consumers to buy from retailer i during the standard sales stage is . The strategic consumer can purchase the product in two stages and orders number of hypothesized products from retailer i. The fraction of strategic consumers, , who request returns at the standard sales stage due to discrepancies in product pricing is . Therefore, the retailer can sell , which is the standard capacity in the sales stage .

The revenue function of retailer i during the standard sales stage is

In an optimal situation, the retailer should receive the entire consumer surplus. Hence, the optimal standard sales price for retailer i is . The optimal revenue function of retailer i during the standard sales stage is

2.1.2. Pre-Sale Stage

Since the strategic consumer who decides to wait will leave the market because the valuation of the standard sales stage product is higher than expected, which is , the strategic consumer only purchases the product during the pre-sale stage and return is possible. When , the retailer’s capacity is less. As a result, products are offered only during the standard sales stage. When the retailer’s capacity exceeds the demand of non-strategic consumers in the market, i.e., , in order to maximize revenues, retailers tend to pre-sell more products and resell products returned by strategic consumers to non-strategic consumers with high valuations at the standard sales stage. The following condition is satisfied at this time:

Retailer i’s optimal capacity for the pre-sale stage is

Retailer i’s revenue function in the pre-sale stage is

The optimal pre-sale price is as retailer i should get the entire consumer surplus during the pre-sale stage. Retailer i’s optimal revenue function during the pre-sale stage is

When , the two retailers do not interact with one another. As the retailer’s production capacity is higher, the market will be totally covered by the time it reaches . By reducing pre-sale pricing, both retailers compete for strategic consumers in the market.

Retailer i’s optimal revenue function during the pre-sale stage is

The optimal revenue in both sales stages for retailer i is

Principle 1.

When two retailers simultaneously adopt full refunds, their equilibrium revenues are equal and as follows (The proof process is shown in Appendix A):

2.2. Both Retailers Simultaneously Adopt the Full-and-Freight-Refund Strategy

When both retailers offer a full refund in the pre-sale stage, they provide return shipment insurance, , for strategic consumers. After a retailer receives a returned product, the insurance company will refund the consumer for the cost of freight. In this circumstance, retailer i’s return amount is .

When both retailers offer a full-and-freight refund, the fraction of the consumers to reserve their pre-ordered products is . This circumstance is similar to the Bertrand model because both retailers adopt identical return policies. In this case, both retailers must obtain freight insurance for the strategic consumer at the pre-sale stage, according to Equations (1) and (2). The optimal revenue function of retailer i in the standard sales stage is

According to Equations (3) and (4), the optimal pre-sale capacity of the available retailer i is

According to Equations (9) and (10), the optimal revenue function for the available retailer i is

Principle 2.

When both retailers simultaneously adopt full-and-freight refunds, their equilibrium revenues are equal and are as follows (The proof process is shown in Appendix A):

2.3. The Two Retailers Adopt an Asymmetric Return Policy

Asymmetric competition occur when two retailers adopt distinct return policies. This paper assumes that retailer adopts a full refund, i.e., , and retailer adopts a full-and-freight refund, i.e., . In this case, the strategic customers who have reserved the products of retailers and are and , respectively.

According to Equations (3), (4), and (9), the optimal pre-sale capacity of retailers and satisfies the following conditions:

When , i.e., , the number of strategic consumers who order products from the two retailers is smaller than the potential demand of strategic consumers in the market . Therefore, there is an acute shortage of strategic consumers. Similar to the two symmetric competitions, when the competition is asymmetric, the two retailers are equal to monopoly retailers in the pre-sale stage. Specifically, when , according to Equations (8) and (12), the revenue function of retailer can be determined as follows:

According to Equations (11) and (13), when , retailer ’s revenue function is as follows:

When , i.e., , the number of strategic consumers who seek to pre-order products from the two retailers exceeds the market’s potential demand for strategic consumers and the two retailers compete for strategic consumers by lowering the pre-sale prices.

When , the optimal revenue function of retailer is

When , the optimal revenue function of retailer is

Principle 3.

When retailer adopts a full-refund policy, its equilibrium revenues are as follows (The proof process is shown in

Appendix A):

When retailer adopts a full-and-freight-refund policy, its equilibrium revenues are as follows (The proof process is shown in Appendix A):

3. Analysis and Result

Theorem 1.

When, retailer i does not adopt a pre-sale policy. When, retailer i adopts a pre-sale policy and offers a return policy to strategic consumers.

As demonstrated by Theorem 1, the retailer adopts a pre-sale policy depending on its capacity . When , the retailer’s capacity falls short of the market’s non-strategic consumer demand. The two retailers have not yet developed a pre-sale stage. Non-strategic consumers in the standard sales stage place a higher value on the product, and retailers emphasize the demands of non-strategic consumers. Therefore, they only sell products during the standard sales stage. When , the production capacity of the two retailers is higher than the demand of non-strategic consumers but still falls short of meeting all purchase needs. In this case, the retailer gives priority to satisfying the premise of high-valuation consumers in the standard sales stage, adopts a pre-sale policy, and offers return policies to strategic consumers. Because returned products can be resold during the standard sales stage, retailers typically resell products returned by strategic consumers to non-strategic consumers at a high price in order to maximize revenues.

Theorem 2.

When the market is fully covered, competition between two retailers results in one retailer reducing the pre-sale price to increase bookings, whereas the other retailer, i.e., the competitor, raising the pre-sale price to match the remaining market demand.

When the retailer’s capacity is sufficient, the entire market is covered. The number of strategic consumers who want to pre-order products from the two retailers surpasses the market’s potential demand for strategic consumers . To compete for strategic consumers, the two retailers typically offer discounted pre-sale prices. Since and , the capacity of a single retailer to pre-sell is smaller than the needs of strategic consumers in the market; therefore, reducing the pre-sale price will not satisfy all strategic consumers in the market, regardless of the amount by which the price is reduced. At this time, its competitors can set a higher pre-sale price and generate revenues. In particular, when retailer prefers to reduce pre-sale price and increase bookings, strategic consumer demand falls to and retailer , i.e., the competitor, fulfills the remaining strategic consumer demand with higher pre-sale prices. In contrast, the supply by retailers and , respectively, is and . Eventually, competition between the two retailers causes one retailer to meet more demand at a lower pre-sale price, whereas the other retailer satisfies the remaining demand at a higher pre-sale price. Moreover, the revenue of both retailers is identical.

In further analysis, when in the equilibrium of competition between the two retailers through the income matrix of the two retailers under different competitive conditions (see Table 2), this leads to the following conclusions:

Table 2.

Revenue matrix of the two retailers.

Theorem 3.

When, the equilibrium result of the game between the two retailers satisfies the following conditions:

- i.

- When , equilibrium is reached in the game between the two retailers at (full refund, full refund).

- ii.

- When, (a) when , equilibrium is reached in the game between the two retailers at (full refund, full refund); (b) when , equilibrium is reached in the game between the two retailers at (full-and-freight refund, full refund) and (full refund, full-and-freight refund); (c) when , equilibrium is reached in the game between the two retailers at (full-and-freight refund, full-and-freight refund).

Proof of Theorem 3.

When , both retailers simultaneously offer a full refund and the market is fully covered. When , both retailers simultaneously offer a full-and-freight refund and the market is fully covered. When , the two retailers offer an asymmetric refund and the market is fully covered.

- (1)

- When , then

- (2)

- When , then

- (3)

- When , then

□

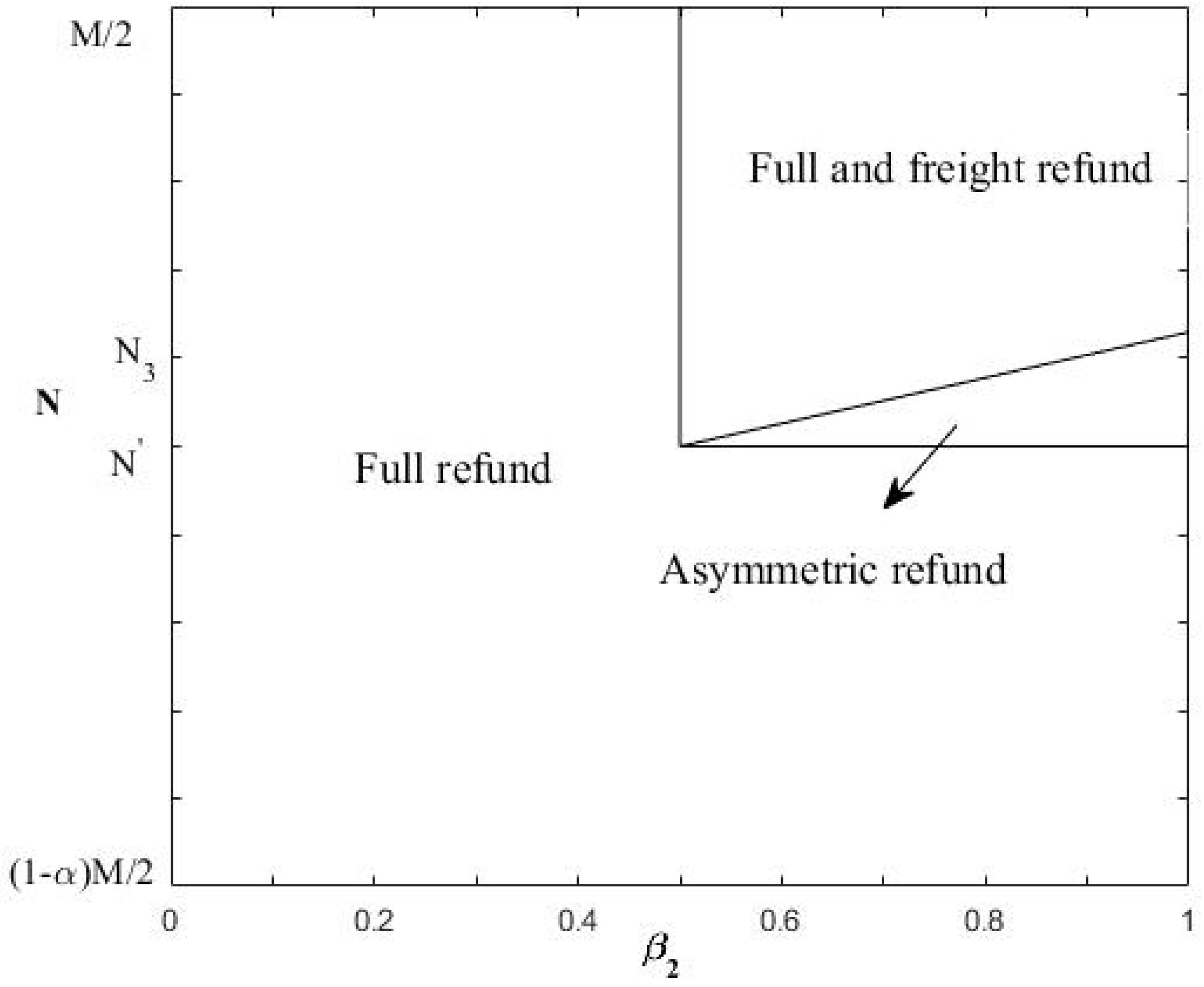

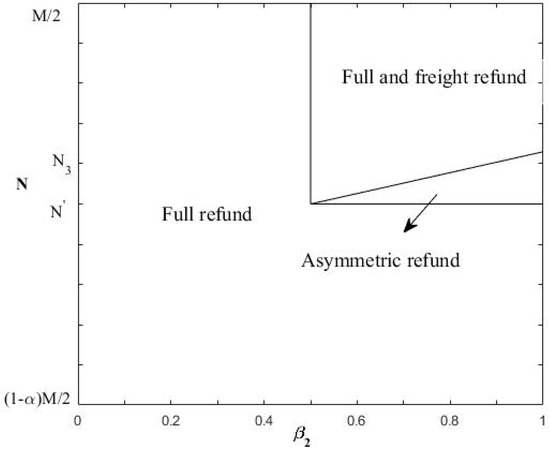

The equilibrium result of the game between the two retailers is affected by the fraction of consumers and and the capacity of the two sets of consumers to reserve their pre-ordered products under the two return policies, according to Theorem 3. As a visual representation of this effect, we present Figure 1, which illustrates the retention ratio under the two return policies at and how retailer capacity affects their equilibrium results.

Figure 1.

Equilibrium refund policies for the two retailers.

As can be seen in Figure 1, when , the retention ratio under the full-refund policy is higher, and at , equilibrium occurs in the game when both retailers simultaneously have a return policy that provides full refunds. This indicates that when strategic consumers are uncertain about the valuation of pre-ordered products and full-and-freight-refund policies induce more returns, two competitive retailers tend to simultaneously adopt return policies that provide full refunds.

When , equilibrium in the game between the two retailers depends on their capacity . Specifically, at , the two retailers have less capacity and equilibrium occurs in the game when both retailers simultaneously adopt a return policy that provides a full refund. In reality, when retailers have less capacity, even if better service is conducive to reducing consumer returns, two competitive retailers that provide full-refund policies for strategic consumers are still conducive to obtaining optimal revenue. When the capacity of the two retailers is moderate, at , equilibrium in the game occurs when both adopt an asymmetrical-refund policy. Correspondingly, if the retailer’s production capacity is moderate and the provision of a full-and-freight refund is conducive to persuading strategic consumers to reserve their pre-orders, offering different refund policies is the optimal method for both retailers. When , the two retailers have a higher capacity and equilibrium occurs in the game when both retailers offer a full-and-freight refund. Providing a full-and-freight refund for strategic consumers will not only reduce the return behavior but also assist retailers in obtaining greater revenue.

On the basis of the revenue function of the two retailers, the following can be concluded regarding the relationship between the revenues of the two retailers in different competitive states and their production capacity and the fraction of strategic consumers and who reserve pre-ordered products under the two refund policies when the market is totally covered:

Theorem 4.

When is sufficiently high and the market is totally covered, the competition between the two retailers will negatively affect their revenues.

As capacity increases, Theorem 4 demonstrates that competition between the two retailers selling identical products intensifies and the two retailers continue to cut their pre-sale prices in order to compete for consumers. In addition, when the market is fully covered, competition among retailers has a negative impact on their revenues, as seen in Figure 1. This is because, when the retailer’s capacity is sufficient, competition induces the retailer to pre-sell more products, which intensifies price competition during the pre-sale stage. Considering the pre-sale return behavior of the strategic consumer, the retailer sets a lower pre-sale price in order to increase bookings or sets a higher pre-sale price to satisfy the remaining consumers in the market, which results in a decline in revenue as production capacity increases.

Theorem 5.

When the market is completely covered, the following conditions apply to the revenues of the two retailers:

- i.

- When, i.e.,, the two retailers simultaneously adopt a full-refund policy and their revenues rise with.

- ii.

- When, i.e. ,, the two retailers simultaneously adopt a full-and-freight-refund policy and their revenues rise with.

- iii.

- When, the two retailers adopt an asymmetric return policy. Whenand, the revenue of the retailers adopting the full-refund policy decreases withand increases with. Whenand, the revenue of the retailer adopting the full-and-freight-refund policy increases withand.

Proof of Theorem 5.

The condition of first order for solving for Equation (9) is:

The condition of first order for solving for Equation (13) is:

The condition of first order for solving for Equations (20) and (21) is:

□

According to Theorem 5, when the market is fully covered, the revenues of the two retailers are proportional to the fraction of strategic consumers who have pre-ordered the product. As shown by the revenue function of the retailer, the revenues of the two retailers with the same return policy are only related to the retention ratio or . When the two retailers simultaneously adopt a full-refund policy or a full-and-freight-refund policy, the retention ratios and under that the refund policy are positively correlated with the retailer’s optimal pre-sale capacity, so the retailer’s revenue rises with or . When retailers adopt distinct return policies, their revenues are impacted by both retention ratios and . Specifically, the revenue of the retailer offering a full refund decreases with and increases with . This is because an increase in leads to a decrease in the retailer’s optimal pre-sale capacity during the pre-sale stage whereas is positively correlated with the retailer’s pre-sale price. Revenues for retailers that offer full-and-freight refunds increase with and because the consumer demand from retailers increases as and are strongly connected with the fraction of strategic consumers where retailers offer full-and-freight refunds to retain their pre-ordered products. Therefore, the retailer’s revenue increases with and .

4. Extensions

The fundamental model of this paper assumes that the needs of non-strategic consumers are fully negatively associated with retailer i’s match. In other words, if the product of retailer fits consumer needs, then retailer cannot be compliant, and vice versa. In this section, this assumption is loosened to accommodate for scenarios in which non-strategic consumer preferences are uncertain.

is evenly distributed among retailers, where and . Thus, there are four consumer segments with a consumption utility of during the standard sales stage. When retailer i adopts a full-and-freight-refund policy, it has to meet the optimal pre-sale capacity ; when retailer i adopts a full-refund policy, it has to meet the optimal pre-sale capacity . As may be seen, . (The proof process is shown in Appendix A).

Analyzing the revenue functions of the two retailers at this time reveals that when non-strategic consumer preferences are uncertain, retailers tend to pre-sell more products, which leads to a rise in pre-sale revenues and a fall in standard sales revenues. Similarly, the relationship between the revenues of the two retailers under different competitive conditions and their production capacity and the fraction of consumers and of their pre-order retention policies under the two return policies is consistent with the conclusions of Theorems 4 and 5. When , the revenues of both retailers are simultaneously subject to a full-refund policy. When , with the increase in retailer capacity , equilibrium is achieved when the two retailers simultaneously adopt a return policy of full refund, an asymmetric-return policy, and a return policy of full-and-freight refund, in accordance with the result of Theorem 3.

5. Conclusions

On the one hand, technological advances have given rise to complex behaviors of strategic consumers, exacerbating the risk of supply–demand mismatches that are detrimental to sustainable economic development, while harming the interests of retailers. On the other hand, the selection of an appropriate pre-sale return policy, as well as the appropriate handling of returned products, is crucial for retailers, not only to help them achieve optimal returns, but also as an important reflection of their active social responsibility to promote sustainable development. Therefore, this study aimed to examine the competitive return offers on pre-sale products by duopoly retailers in the absence of returns based on quality issues; analyze three competitive states of duopoly retailers under pre-sale policies, namely, (1) duopoly retailers both following the full-refund policy, (2) duopoly retailers both using the full-and-freight-refund strategies, and (3) one retailer giving full refunds and the other retailer using the full-and-freight-refund policy; and analyze the duopoly retailer’s equilibrium strategy.

In this study, two retailers adopted a pre-sale policy and offered a return policy only when their capacity was higher than the demand of non-strategic consumers. The competition between the two retailers rose with the increase in capacity. When capacity was sufficient and the market was fully covered, both retailers tended to lower their pre-sale prices to compete on behalf of consumers. Eventually, one retailer chose to lower the pre-sale price to increase bookings, at which point, the other retailer could maximize revenue only by setting a higher pre-sale price to meet the remaining market demand.

By comparing the revenue functions of the two retailers, this study concludes that both the proportion of strategic consumers who book pre-order products and the retailers’ capabilities affect their equilibrium revenue and equilibrium strategies. Equilibrium revenue is such that the revenue of two retailers with the same return policy increases with their retention rate, but the revenue of two retailers with different return policies is influenced by the intersection of their retention rates. When the percentage of strategic consumers who retain pre-order products under a full-refund policy is minimal and the retailer has moderate capacity, its equilibrium refund policy is asymmetric; otherwise, it is symmetric. When the proportion of strategic consumers retaining pre-order products under full refund is the smallest, and if one retailer adopts a full-refund approach, the other retailer should adopt the full-and-freight-refund approach to achieve the optimal benefit. Otherwise, it should adopt the same return policy as its competitor to achieve the optimal benefit. Overall, in this paper, for retailers whose products are sold in two sales phases, on the basis of the competitive market environment, we have designed a reasonable return scheme based on the choice of pre-sale and return policies, combined with a diversified real-world environment, to provide practical guidance for the development of enterprises that is conducive to improving the efficiency of matching supply and demand and is of great significance to the development of the e-commerce industry.

In addition to the limitations arising from the complexity of the actual situation, based on the requirements of sustainable economic development, this study can be expanded in the following ways: (1) This study does not discuss the logistics and distribution problems in the pre-sale and return model. However, the massive resource waste and environmental pollution problems in logistics distribution cannot be ignored. Therefore, the pre-sale inventory allocation problem and the path optimization problem based on pre-sale order information in retail e-commerce platforms can be a direction for future research. (2) The problem of uncertainty in both sales stages is a future research direction. In this paper, we assume that consumers face uncertainty in product valuation during the pre-sale phase, and in the normal sales phase, all uncertainty disappears completely. However, in future research, it can be assumed that uncertainty exists simultaneously in both periods and that the risk of uncertainty decreases over time. This situation would lead to more complex consumer behavior and more wasted resources. (3) Empirical research on consumer returns under the pre-sale policy is also an important direction for future research, and real data will help solve the waste problem caused by the mismatch between supply and demand.

Author Contributions

Conceptualization and methodology, D.W. and X.L.; validation, D.W. and X.L.; function analysis, D.W. and X.L.; writing—review and editing, D.W. and X.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Natural Science Foundation of Zhejiang Province (No. LQ21G010003) and the Pre-research Fund Project of Zhejiang University of Technology (NO. SKY-ZX-20210205).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data sharing is not applicable.

Acknowledgments

The authors are grateful for many experts’ guidance.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Proof of Principle 1.

When , ; when and , are satisfied at this point, then, ; when , i.e., , then, .

When condition is satisfied, equilibrium is reached between the two retailers and both retailers receive the same revenues. □

Proof of Principle 3.

Because , the market is fully covered and both retailers compete for consumers by reducing the pre-sale price. When the pre-sale price of retailer is higher than that of retailer , assuming that retailer sets a lower pre-sale price, of , the obtained strategic consumer demand is the optimal pre-sale capacity of its pre-sale stage and the competitor retailer sets a higher price in the pre-sale stage , obtaining the full consumer surplus and the strategic consumer demand for its competitors’ surplus:

When , the two retailers have the same revenue and reach equilibrium.

Then,

When retailer ’s pre-sale price is higher than that of retailer , retailer will be given the order.

When , the two retailers have the same revenue and reach equilibrium.

Then,

□

Proof of Extensions.

When both retailers simultaneously offer full refunds, the consumer demands from both retailers throughout the standard sales stage are represented by .

When both retailers offer full-and-freight refunds, the demands from both retailers throughout the standard sales stage are represented by .

When the two retailers simultaneously adopt a full-refund policy, their equilibrium revenues are equal and as follows:

When both retailers adopt a full-and-freight-refund policy, their equilibrium revenues are equal and are as follows:

When retailer adopts a full-refund policy, its equilibrium revenue is as follows:

When retailer adopts a full-and-freight-refund policy, its revenue is as follows:

□

References

- China Consumers Association. Available online: https://cca.org.cn/ (accessed on 30 December 2022.).

- Chu, Y.L.; Zhang, H. Optimal Preorder Strategy with Endogenous Information Control. Manag. Sci. 2011, 57, 1055–1077. [Google Scholar] [CrossRef]

- Yang, L.; Chang, N. Research on Supply Chain Operation Decision Considering Return Freight Insurance. J. Syst. Eng. 2018, 33, 116–124. [Google Scholar]

- Prasad, A.; Stecke, K.E.; Zhao, X.Y. Advance Selling by a Newsvendor Retailer. Prod. Oper. Manag. 2011, 20, 129–142. [Google Scholar] [CrossRef]

- Xu, H.X.; Zhang, J.L.; Gong, Y.M.; Wu, X. Research on Ordering Strategy of Network Pre-sale Products. J. Syst. Eng. 2017, 32, 843–854. [Google Scholar]

- Zhao, X.; Stecke, K.E. Pre-orders for New To-be-Released Products Considering Consumer Loss Aversion. Prod. Oper. Manag. 2010, 19, 198–215. [Google Scholar] [CrossRef]

- Cachon, G.P.; Feldman, P. Is Advance Selling Desirable with Competition. Mark. Sci. 2017, 36, 214–231. [Google Scholar] [CrossRef]

- McCardle, K.; Rajaram, K.; Tang, C.S. Advance Booking Discount Programs under Retail Competition. Manag. Sci. 2004, 50, 701–708. [Google Scholar] [CrossRef]

- Dana, J.D. Advance-Purchase Discounts and Price Discrimination in Competitive Markets. J. Political Econ. 1998, 106, 395–422. [Google Scholar] [CrossRef]

- Shugan, S.M.; Xie, J. Advance Selling as a Competitive Marketing Tool. Int. J. Res. Mark. 2005, 22, 351–373. [Google Scholar] [CrossRef]

- Yu, Y.G.; Liu, J.; Han, X.Y.; Chen, C. Optimal Decisions for Sellers Considering Valuation Bias and Strategic Consumer Reaction. Eur. J. Oper. Res. 2016, 259, 599–613. [Google Scholar] [CrossRef]

- Swinney, R. Selling to Strategic Consumers When Product Value is Uncertain: The value of matching supply and demand. Manag. Sci. 2011, 57, 1737–1751. [Google Scholar] [CrossRef]

- Li, C.H.; Zhang, F.Q. Advance Demand Information, Price Discrimination, and Pre-order Policies. Manuf. Serv. Oper. Manag. 2013, 15, 57–71. [Google Scholar] [CrossRef]

- Kelle, P.; Silver, E. Purchasing Policy of New Containers Considering the Random Returns of Previously Issued Containers. IIE Trans. 1989, 21, 349–354. [Google Scholar] [CrossRef]

- Fleischmann, M.; Kuik, R.; Dekker, R. Controlling Inventories with Stochastic Item Returns: A Basic Mode. Eur. J. Oper. Res. 2002, 138, 63–75. [Google Scholar] [CrossRef]

- Ketzenberg, M.E.; Zuidwijk, R.A. Optimal Pricing, Ordering, and Return Policies for Consumer Goods. Prod. Oper. Manag. 2009, 18, 344–360. [Google Scholar] [CrossRef]

- Huang, Z.S.; Nie, J.J.; Zhao, Y.X. Competitive Money-Back Guarantee Strategy Based on Bounded Rational Consumers. Manag. Sci. China 2016, 24, 116–123. [Google Scholar]

- Nasiry, J.; Popescu, I. Advance Selling When Consumers Regret. Manag. Sci. 2012, 58, 1160–1177. [Google Scholar] [CrossRef]

- Mao, Z.F.; Liu, W.W.; Li, H. Research on Joint Decision of Pre-sale and Repurchase of Seasonal Perishable Products. J. Manag. Sci. 2016, 19, 74–84. [Google Scholar]

- Chen, J.X.; Wang, G.H.; Lian, L. Multi-retailer Inventory Game Affecting Consumer Returns. J. Syst. Eng. 2013, 28, 101–108. [Google Scholar]

- Davis, S.; Gerstner, E.; Hagerty, M. Money-back Guarantees in Retailing: Matching Products to Consumer Tasters. J. Retail. 1995, 71, 7–22. [Google Scholar] [CrossRef]

- Su, X.M. Consumer Returns Policies and Supply Chain Performance. Manuf. Serv. Oper. Manag. 2009, 11, 596–612. [Google Scholar] [CrossRef]

- Zhai, C.J.; Li, Y.J. Research on Online Retailer’s Return Strategy under B2C Mode. J. Manag. Eng. 2011, 25, 62–68. [Google Scholar]

- Yang, G.Y.; Ji, G.J. Research on Return Strategy of Strategic Consumers. J. Manag. Sci. 2014, 17, 23–33+94. [Google Scholar]

- Chu, W.; Gerstner, E.; Hess, J.D. Managing Dissatisfaction: How to Decrease Customer Opportunism by Partial Refunds. J. Serv. Res. 1998, 1, 140–155. [Google Scholar] [CrossRef]

- Vlachos, D.; Dekker, R. Return Handling Options and Order Quantities for Single Period Products. Eur. J. Oper. Res. 2003, 151, 38–52. [Google Scholar] [CrossRef]

- Shulman, J.D.; Coughlan, A.T.; Savaskan, R.C. Optimal Reverse Channel Structure for Consumer Product Returns. Mark. Sci. 2010, 29, 1071–1085. [Google Scholar] [CrossRef]

- Ferguson, M.; Guide, V.D.R.; Souza, G.C. Supply Chain Coordination for False Failure Returns. Manuf. Serv. Oper. Manag. 2006, 8, 376–393. [Google Scholar] [CrossRef]

- Li, Y.J.; Xu, L.; Yang, X.L. Product Pre-sale, Return policy and Consumer Defect-free Return Behavior. Nankai Manag. Rev. 2012, 15, 105–113. [Google Scholar]

- Guo, L. Service Cancellation and Competitive Refund Policy. Mark. Sci. 2009, 28, 901–917. [Google Scholar] [CrossRef]

- McGill, J.I.; VanRyzin, G.J. Revenue Management: Research Overview and Prospects. Transp. Sci. 1999, 33, 233–256. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).