Development of Bioplastics from Cassava toward the Sustainability of Cassava Value Chain in Thailand

Abstract

:1. Introduction

2. Background

2.1. Cassava Sector in Thailand

2.2. Bioplastic Industry

2.3. Reviews of Bioplastics from Cassava

3. Materials and Methods

4. Results

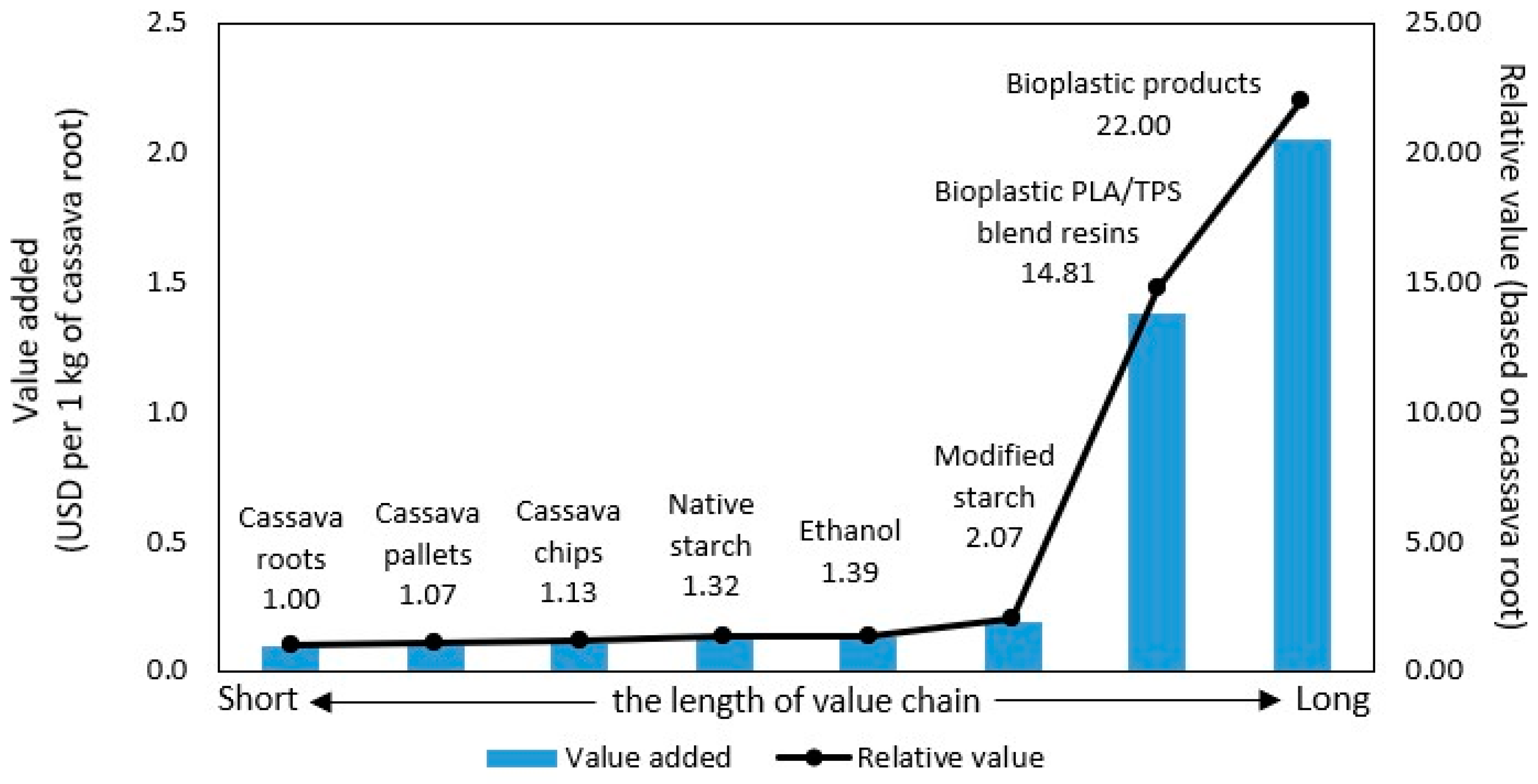

4.1. Cassava-Based Bioplastic Value Chain Analysis

- Bio-resin producers—the process of bio-resin production starts from starch from agricultural products (e.g., corn, cassava, rice, and sugar cane). Starch is then converted to sugar and processed via fermentation and polymerization to produce bioplastic resins (e.g., PBS and PLA). Two major bioplastic resin manufacturers in Thailand are PTT MCC Biochem Company Limited and Total-Corbion. PTT MCC possesses the first biobased PBS plant in the world with a total production of 20,000 T per year, while Total-Corbion, headquartered in the Netherlands, produces PLA with a total capacity of 75,000 T per year. Other companies import bio-resins (e.g., PBAT) for bioplastic compounding and converting. In addition, starch can be directly converted into bio-resins called “TPS” by plasticization with plasticizers under the application of heat and shear [40]. Ingredion (Thailand) Company Limited, Siam Modified Starch Company Limited (SMS), Thai wah Public Company Limited, and Mitrphol Biotech Company Limited are major TPS manufacturers and suppliers in Thailand. The SMS company offers modified tapioca starch for its use in various industries, including foods and non-foods (e.g., paper, health care, and textiles). SMS innovates cassava starch for “TAPIOPLAST” bioplastics, which are composed of 30–50% TPS blended with PBAT or PLA. The main businesses of Thai wah are divided into tapioca starch and starch-related products, food products, and biodegradable products. Thai wah offer “ROSECO”, which is a thermoplastic starch (TPS) resin made from tapioca, which can be applied to single-use plastics, bags, and agricultural goods. Mitrphol Biotech is a new player in bioplastic products made from cassava and sugar under “Planex” biodegradable plastic products and “Canex” compostable food packaging.

- Bioplastic compounders—the process of compounding starts from the blending of bio-resins with other substances, such as plastics, functional additives, and fillers (biomass or cassava starch), to create plastic compounds. For example, TPS resins are blended with other plastics (e.g., PLA, PBAT) in the presence of additives before being converting into bioplastic products.

- Converters—the process of bioplastic conversion involves the forming of bioplastic products, including post-processing, to obtain finished goods (e.g., films, sheets, bags, boxes, packaging, tableware, toys, and electronic parts). Plastic processors or convertors account for 71% of all plastic manufacturers in Thailand. Converting bioplastic products is successfully achieved using the same or slightly modified machines as conventional plastics. Although local plastic converters can adapt and process bioplastic products, some barriers, including the processing conditions, properties of bio-resin, and the efficiency of the machines, need to be studied further. Converting processes include blow molding, injection molding, extrusion, and thermoforming. Injection molding is the major converting process for bioplastics.

- Distributors—bioplastic products are packed for distribution and distributed to wholesalers and HORECA (hotels, retailers, and cafe-catering), which may involve marketing activities, services, and connections to end-users. Note that not all businesses are willing to shift from petroleum-based plastics to bioplastics from cassava. Most of the additional costs of bioplastics will be incurred by green businesses and might be passed onto customers.

- Users or Consumers—major users include green businesses and end consumers who are concerned about environmental impacts. Bioplastic products are often produced and suitable for short-term and single-use applications such as rigid or flexible packaging, bio waste bags, and agricultural-related products. However, bioplastic applications are developed for long-term use in several sectors such as electronic parts, construction, automotive, and transportation.

4.2. Consumer Acceptance of Bioplastics from Cassava

4.2.1. Descriptive Statistics of Sample

4.2.2. Segmentation among Green Consumers

4.2.3. Consumer Acceptance of Bioplastic Products

4.3. Challenges and Opportunities in Moving toward the Bioplastic Industry

5. Discussion

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Food and Agriculture Organization of the United Nations (FAO). FAOSTAT: Crops and Livestock Products. 2019. Available online: https://www.fao.org/faostat/en/#data/QCL (accessed on 15 April 2023).

- Sowcharoensuk, C. Industry Outlook 2023–2025: Cassava Industry; Krungsri Research. 2023. Available online: https://www.krungsri.com/en/research/industry/industry-outlook/agriculture/cassava/io/cassava-2023-2025 (accessed on 25 June 2023).

- Chancharoenchai, K.; Saraithong, W. Sustainable Development of Cassava Value Chain through the Promotion of Locally Sourced Chips. Sustainability 2022, 14, 14521. [Google Scholar] [CrossRef]

- Office of Agricultural Economics (OAE). Information on Agricultural Economic Commodities 2022; Ministry of Agriculture and Cooperatives: Bangkok, Thailand, 2023. Available online: https://www.oae.go.th/assets/portals/1/files/jounal/2566/commodity2565.pdf (accessed on 3 June 2023).

- Office of Agricultural Economics (OAE). Agricultural Statistics of Thailand 2022; Ministry of Agriculture and Cooperatives: Bangkok, Thailand, 2023. Available online: https://www.oae.go.th/assets/portals/1/files/jounal/2566/yearbook2565.pdf (accessed on 10 June 2023).

- Kaplinsky, R.; Terheggen, A.; Tijaja, J. China as a final market: The Gabon timber and Thai cassava value chains. World Dev. 2011, 39, 1177–1190. [Google Scholar] [CrossRef]

- Arthey, T.; Orawan Srisompun, O.; Zimmer, Y. Cassava Production and Processing in Thailand: A Value Chain Analysis Commissioned by FAO; Agri Benchmark. 2018. Available online: http://www.agribenchmark.org/fileadmin/Dateiablage/B-Cash-Crop/Reports/CassavaReportFinal-181030.pdf (accessed on 12 September 2023).

- Office of the National Economic and Social Development Council (NESDC). National Strategy (2018–2037); Office of the National Economic and Social Development Council, Office of the Prime Minister: Bangkok, Thailand, 2018. Available online: http://nscr.nesdc.go.th/wp-content/uploads/2019/10/National-Strategy-Eng-Final-25-OCT-2019.pdf (accessed on 29 April 2023).

- Barros, M.V.; Salvador, R.; do Prado, G.F.; de Francisco, A.C.; Piekarski, C.M. Circular economy as a driver to sustainable businesses. Clean. Environ. Syst. 2021, 2, 100006. [Google Scholar] [CrossRef]

- Lavelli, V. Circular food supply chains–Impact on value addition and safety. Trends Food Sci. Technol. 2021, 114, 323–332. [Google Scholar] [CrossRef]

- Bank of Thailand. Daily Foreign Exchange Rates; Bank of Thailand. 2023. Available online: https://www.bot.or.th/en/statistics/exchange-rate.html (accessed on 16 September 2023).

- Pannakkong, W.; Parthanadee, P.; Buddhakulsomsiri, J. Impacts of harvesting age and pricing schemes on economic sustainability of cassava farmers in Thailand under market uncertainty. Sustainability 2022, 14, 7768. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Advantage: Creating and Sustaining Superior Performance; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Kaplinsky, R.; Morris, M. A Handbook for Value Chain Research; University of Sussex, Institute of Development Studies: Brighton, UK, 2000; Volume 113. [Google Scholar]

- Darko-Koomson, S.; Aidoo, R.; Abdoulaye, T. Analysis of cassava value chain in Ghana: Implications for upgrading smallholder supply systems. J. Agribus. Dev. Emerg. Econ. 2020, 10, 217–235. [Google Scholar] [CrossRef]

- Kaplinsky, R.; Tijaja, J.; Terheggen, A. What Happens When the Market Shifts to China? The Gabon Timber and Thai Cassava Value Chain; World Bank: Washington, DC, USA, 2010; pp. 303–334. [Google Scholar]

- ASEAN Food Security Information System. The Study of Cassava Supply Chain in Kanchanaburi Thailand; Office of Agricultural Economics, Ministry of Agriculture and Cooperatives: Bangkok, Thailand, 2019. Available online: https://aptfsis.org/uploads/normal/ISFAS%20Project%20in%20Thailand/The%20Study%20of%20Cassava%20Supply%20Chain%20in%20Kanchanaburi%20Thailand.pdf (accessed on 12 September 2023).

- Howeler, R.H. Agronomic practices for sustainable cassava production in Asia. In Cassava Research and Development in Asia, Proceedings of the Seventh Regional Workshop; Bangkok, Thailand, 28 October–1 November 2002, Centro Internacional de Agricultura Tropical (CIAT), Cassava Office for Asia: Bangkok, Thailand; pp. 288–314.

- Kansup, J.; Amawan, S.; Wongtiem, P.; Sawwa, A.; Ngorian, S.; Narkprasert, D.; Hansethasuk, J. Marker-assisted selection for resistance to cassava mosaic disease in Manihot esculenta Crantz. Thai Agric. Res. J. 2020, 38, 68–79. (In Thai) [Google Scholar]

- Office of Industrial Economics (OIE). Industry Statistics 2023; Office of Industrial Economics, Ministry of Industry: Bangkok, Thailand, 2023. Available online: https://www.oie.go.th/ (accessed on 29 April 2023).

- Pollution Control Department. Action Plan on Plastic Waste Management Phase II (2023–2027); Ministry of Natural Resources and Environment. 2023. Available online: https://www.pcd.go.th/publication/28484 (accessed on 25 April 2023).

- European Commission. Directorate-General for Environment. Relevance of Biodegradable and Compostable Consumer Plastic Products and Packaging in a Circular Economy; Office of the European Union: Luxembourg, 2020; Available online: https://op.europa.eu/en/publication-detail/-/publication/3fde3279-77af-11ea-a07e-01aa75ed71a1/language-en (accessed on 10 April 2023).

- Khanunthong, A. Industry Outlook 2021–2023: Plastics; Krungsri Research. 2021. Available online: https://www.krungsri.com/en/research/industry/industry-outlook/petrochemicals/plastics/io/io-plastics-21 (accessed on 2 May 2023).

- National Science and Technology Development Agency (NSTDA). BCG-Action-Plan-2564–2570; Ministry of Higher Education, Science, Research and Innovation, 2021. Available online: https://waa.inter.nstda.or.th/stks/pub/bcg/20211228-BCG-Action-Plan-2564-2570.pdf (accessed on 29 April 2023).

- Thailand Board of Investment (BOI). Thailand’s Bioplastics Industry; Office of the Prime Minister, 2017. Available online: https://www.boi.go.th/upload/content/BOI-brochure%202017-bioplastics-20171114_19753.pdf (accessed on 15 March 2023).

- Petnamsin, C.; Termvejsayanon, N.; Sriroth, K. Effect of Particle Size on Physical Properties and Biodegradability of Cassava Starch/Polymer Blend. Kasetsart J. (Nat. Sci.) 2000, 34, 254–261. [Google Scholar]

- Tanrattanakul, V.; Panwiriyarat, W. Compatibilization of low-density polyethylene/cassava starch blends by potassium persulfate and benzoyl peroxide. J. Appl. Polym. Sci. 2009, 114, 742–753. [Google Scholar] [CrossRef]

- Thitisomboon, W.; Opaprakasit, P.; Jaikaew, N.; Boonyarattanakalin, S. Characterizations of modified cassava starch with long chain fatty acid chlorides obtained from esterification under low reaction temperature and its PLA blending. J. Macromol. Sci. Part A 2018, 55, 253–259. [Google Scholar] [CrossRef]

- Srisuwan, Y.; Baimark, Y. Improvement in Thermal Stability of Flexible Poly(L-lactide)-b-poly(ethylene glycol)-b-poly(L-lactide) Bioplastic by Blending with Native Cassava Starch. Polymers 2022, 14, 3186. [Google Scholar] [CrossRef] [PubMed]

- Kangwanwatthanasiri, P.; Suppakarn, N.; Ruksakulpiwat, C.; Yupaporn, R. Biocomposites from Cassava Pulp/Polylactic Acid/Poly(butylene Succinate). Adv. Mater. Res. 2013, 747, 367–370. [Google Scholar] [CrossRef]

- Nithikarnjanatharn, J.; Samsalee, N. Effect of cassava pulp on Physical, Mechanical, and biodegradable properties of Poly(Butylene-Succinate)-Based biocomposites. Alex. Eng. J. 2022, 61, 10171–10181. [Google Scholar] [CrossRef]

- Suttiruengwong, S.; Sotho, K.; Seadan, M. Effect of Glycerol and Reactive Compatibilizers on Poly(butylene succinate)/Starch Blends. J. Renew. Mater. 2014, 2, 85–92. [Google Scholar] [CrossRef]

- Lopattananon, N.; Thongpin, C.; Sombatsompop, N. Bioplastics from Blends of Cassava and Rice Flours: The Effect of Blend Composition. Intern. Polym. Process. 2012, 27, 334–340. [Google Scholar] [CrossRef]

- Thipmanee, R.; Lukubira, S.; Ogale, A.A.; Sane, A. Enhancing distributive mixing of immiscible polyethylene/thermoplastic starch blend through zeolite ZSM-5 compounding sequence. Carbohydr. Polym. 2016, 136, 812–819. [Google Scholar] [CrossRef]

- Katanyoota, P.; Jariyasakoolroj, P.; Sane, A. Mechanical and barrier properties of simultaneous biaxially stretched polylactic acid/thermoplastic starch/poly(butylene adipate-co-terephthalate) films. Polym. Bull. 2022, 80, 5219–5237. [Google Scholar] [CrossRef]

- Yimnak, K.; Thipmanee, R.; Sane, A. Poly(butylene adipate-co-terephthalate)/thermoplastic starch/zeolite 5A films: Effects of compounding sequence and plasticizer content. Int. J. Biol. Macromol. 2020, 164, 1037–1045. [Google Scholar] [CrossRef]

- Garalde, R.A.; Thipmanee, R.; Jariyasakoolroj, P.; Sane, A. The effects of blend ratio and storage time on thermoplastic starch/poly(butylene adipate-co-terephthalate) films. Heliyon 2019, 5, e01251. [Google Scholar] [CrossRef]

- Jariyasakoolroj, P.; Chirachanchai, S. In Situ Chemical Modification of Thermoplastic Starch with Poly(L-lactide) and Poly(butylene succinate) for an Effectively Miscible Ternary Blend. Polymers 2022, 14, 825. [Google Scholar] [CrossRef] [PubMed]

- Jariyasakoolroj, P.; Tashiro, K.; Chinsirikul, W.; Kerddonfag, N.; Chirachanchai, S. Microstructural Analyses of Biaxially Oriented Polylactide/Modified Thermoplastic Starch Film with Drastic Improvement in Toughness. Macromol. Mater. Eng. 2019, 304, 1900340. [Google Scholar] [CrossRef]

- Dang, K.M.; Yoksan, R. Development of thermoplastic starch blown film by incorporating plasticized chitosan. Carbohydr. Polym. 2015, 115, 575–581. [Google Scholar] [CrossRef] [PubMed]

- Khanoonkon, N.; Yoksan, R.; Ogale, A.A. Effect of stearic acid-grafted starch compatibilizer on properties of linear low density polyethylene/thermoplastic starch blown film. Carbohydr. Polym. 2016, 137, 165–173. [Google Scholar] [CrossRef] [PubMed]

- Yoksan, R.; Boontanimitr, A.; Klompong, N.; Phothongsurakun, T. Poly(lactic acid)/thermoplastic cassava starch blends filled with duckweed biomass. Int. J. Biol. Macromol. 2022, 203, 369–378. [Google Scholar] [CrossRef] [PubMed]

- Yoksan, R.; Dang, K.M. The effect of polyethylene glycol sorbitan monostearate on the morphological characteristics and performance of thermoplastic starch/biodegradable polyester blend films. Int. J. Biol. Macromol. 2023, 231, 123332. [Google Scholar] [CrossRef] [PubMed]

- Chotiprayon, P.; Chaisawad, B.; Yoksan, R. Thermoplastic cassava starch/poly(lactic acid) blend reinforced with coir fibres. Int. J. Biol. Macromol. 2020, 156, 960–968. [Google Scholar] [CrossRef]

- Dang, K.M.; Yoksan, R. Thermoplastic starch blown films with improved mechanical and barrier properties. Int. J. Biol. Macromol. 2021, 188, 290–299. [Google Scholar] [CrossRef]

- Jullanun, P.; Yoksan, R. Morphological characteristics and properties of TPS/PLA/cassava pulp biocomposites. Polym. Test. 2020, 88, 106522. [Google Scholar] [CrossRef]

- Wongphan, P.; Panrong, T.; Harnkarnsujarit, N. Effect of different modified starches on physical, morphological, thermomechanical, barrier and biodegradation properties of cassava starch and polybutylene adipate terephthalate blend film. Food Packag. Shelf Life 2022, 32, 100844. [Google Scholar] [CrossRef]

- Wongphan, P.; Nerin, C.; Harnkarnsujarit, N. Enhanced compatibility and functionality of thermoplastic cassava starch blended PBAT blown films with erythorbate and nitrite. Food Chem. 2023, 420, 136107. [Google Scholar] [CrossRef]

- Phothisarattana, D.; Harnkarnsujarit, N. Migration, aggregations and thermal degradation behaviors of TiO2 and ZnO incorporated PBAT/TPS nanocomposite blown films. Food Packag. Shelf Life 2022, 33, 100901. [Google Scholar] [CrossRef]

- Katekhong, W.; Wongphan, P.; Klinmalai, P.; Harnkarnsujarit, N. Thermoplastic starch blown films functionalized by plasticized nitrite blended with PBAT for superior oxygen barrier and active biodegradable meat packaging. Food Chem. 2022, 374, 131709. [Google Scholar] [CrossRef] [PubMed]

- Phiriyawirut, M.; Duangsuwan, T.; Uenghuab, N.; Meena, C. Effect of Octenyl Succinate Starch on Properties of Tapioca Thermoplastic Starch Blends. Key Eng. Mater. 2017, 751, 290–295. [Google Scholar] [CrossRef]

- Pichaiyut, S.; Uttaro, C.; Ritthikan, K.; Nakason, C. Biodegradable thermoplastic natural rubber based on natural rubber and thermoplastic starch blends. J. Polym. Res. 2022, 30, 23. [Google Scholar] [CrossRef]

- Prachayawarakorn, J.; Chaiwatyothin, S.; Mueangta, S.; Hanchana, A. Effect of jute and kapok fibers on properties of thermoplastic cassava starch composites. Mater. Des. 2013, 47, 309–315. [Google Scholar] [CrossRef]

- Wattanakornsiri, A.; Pachana, K.; Kaewpirom, S.; Traina, M.; Migliaresi, C. Preparation and Properties of Green Composites Based on Tapioca Starch and Differently Recycled Paper Cellulose Fibers. J. Polym. Environ. 2012, 20, 801–809. [Google Scholar] [CrossRef]

- Promsorn, J.; Harnkarnsujarit, N. Oxygen absorbing food packaging made by extrusion compounding of thermoplastic cassava starch with gallic acid. Food Control 2022, 142, 109273. [Google Scholar] [CrossRef]

- Promsorn, J.; Harnkarnsujarit, N. Pyrogallol loaded thermoplastic cassava starch based films as bio-based oxygen scavengers. Ind. Crops Prod. 2022, 186, 115226. [Google Scholar] [CrossRef]

- Saepoo, T.; Sarak, S.; Mayakun, J.; Eksomtramage, T.; Kaewtatip, K. Thermoplastic starch composite with oil palm mesocarp fiber waste and its application as biodegradable seeding pot. Carbohydr. Polym. 2023, 299, 120221. [Google Scholar] [CrossRef] [PubMed]

- Boonsuk, P.; Sukolrat, A.; Bourkaew, S.; Kaewtatip, K.; Chantarak, S.; Kelarakis, A.; Chaibundit, C. Structure-properties relationships in alkaline treated rice husk reinforced thermoplastic cassava starch biocomposites. Int. J. Biol. Macromol. 2021, 167, 130–140. [Google Scholar] [CrossRef]

- Kaewtatip, K.; Thongmee, J. Preparation of thermoplastic starch/treated bagasse fiber composites. Starch Stärke 2014, 66, 724–728. [Google Scholar] [CrossRef]

- Fearne, A.; Martinez, M.G.; Dent, B. Dimensions of sustainable value chains: Implications for value chain analysis. Supply Chain Manag. Int. J. 2012, 17, 575–581. [Google Scholar] [CrossRef]

- Porter, M.E. What Is Strategy? Harvard Business Review, November–December 1996. Available online: https://hbr.org/1996/11/what-is-strategy (accessed on 30 June 2023).

- Samuelson, P.; Nordhaus, W. Economics, 19th ed.; McGraw Hill: New York, NY, USA, 2009. [Google Scholar]

- Cochran, W.G. Sampling Techniques, 3rd ed.; John Wiley & Sons: New York, NY, USA, 1977. [Google Scholar]

- Susanty, A.; Akshinta, P.Y.; Ulkhaq, M.M.; Puspitasari, N.B. Analysis of the tendency of transition between segments of green consumer behavior with a Markov chain approach. J. Model. Manag. 2022, 17, 1177–1212. [Google Scholar] [CrossRef]

- Chiu, T.; Fang, D.; Chen, J.; Wang, Y.; Jeris, C. A robust and scalable clustering algorithm for mixed type attributes in large database environment. In Proceedings of the Seventh ACM SIGKDD International Conference on Knowledge Discovery and Data Mining—KDD ’01, San Francisco, CA, USA, 26–29 August 2001; ACM Press: New York, NY, USA, 2001; pp. 263–268. [Google Scholar]

- Bacher, J.; Wenzig, K.; Vogler, M. SPSS Twostep Cluster—A First Evaluation; Universität Erlangen-Nürnberg: Erlangen, Germany, 2004; pp. 1–20. [Google Scholar]

- IBM. TwoStep Cluster Analysis. IBM SPSS Statistics Information Center: IBM Corporation. 2021. Available online: https://www.ibm.com/docs/en/spss-statistics/25.0.0?topic=features-twostep-cluster-analysis (accessed on 30 June 2023).

- Norusis, M. SPSS 15.0 Advanced Statistical Procedures Companion; Prentice Hall Press: Hoboken, NJ, USA, 2007. [Google Scholar]

- Harantová, V.; Mazanec, J.; Štefancová, V.; Mašek, J.; Foltýnová, H.B. Two-step cluster analysis of passenger mobility segmentation during the COVID-19 pandemic. Mathematics 2023, 11, 583. [Google Scholar] [CrossRef]

- European Commission. Directorate-General for Environment. Biobased Plastic—Sustainable Sourcing and Content: Final Report; Office of the European Union. 2022. Available online: https://data.europa.eu/doi/10.2779/668096 (accessed on 20 April 2023).

- Thai Tapioca Trade Association (TTTA). Prices 2023. Available online: https://ttta-tapioca.org (accessed on 3 June 2023).

- Isroi, I.; Supeni, G.; Eris, D.D.; Cahyaningtyas, A.A. Biodegradability of Cassava Edible Bioplastics in Landfill Soil and Plantation Soil. J. Kim. Dan Kemasan 2018, 40, 129–140. [Google Scholar] [CrossRef]

| Criteria Factor | Factor Detail |

|---|---|

| Environmentally friendly buying behavior | I always think about the environmental impacts of packaging before making purchase decisions |

| I frequently use biodegradable products when ordering take away | |

| Environmental activism | I support a shop that carries out environmental activities |

| I think reducing plastic use can positively influence others | |

| I think protecting and preserving the environment should start with myself | |

| Resource-saving | I think biodegradable products can reduce environmental problems in the long-term |

| I attempt to decrease the number of plastics that are not necessary | |

| I favor the substitution of single-use plastic packaging with biodegradable products | |

| Economic factor | I am willing to pay more for green products |

| Skepticism toward environmental claims | I believe that understanding the benefits of green products is important |

| Age | Age of participants (years old) |

| Income | Monthly income per individual (USD per month) |

| Education | Levels of education |

| Plastic Resin Type 1 | Price Range (USD/kg) | Relative Price 3 |

|---|---|---|

| Conventional plastics (PP, PE) | 1.39–1.67 | 100 |

| Bioplastic PBS | 6.12–6.40 | 409.1 |

| Bioplastic PLA | 2.78–3.62 | 209.1 |

| Bioplastic TPS blend | 2.23–3.62 | 190.9 |

| Bioplastic PLA/TPS blend 2 | 2.23–2.50 | 154.5 |

| Characteristics | Profile Details | Percentage (n = 915) |

|---|---|---|

| Gender | Female | 519 (56.8%) |

| Age | 18–20 years old | 31 (3.4%) |

| 21–37 years old | 376 (41.1%) | |

| 38–53 years old | 353 (38.6%) | |

| Greater than 54 years old | 155 (16.9%) | |

| Education | High school certificate diploma or below | 109 (12.0%) |

| Bachelor’s degree | 474 (52.3%) | |

| Master’s degree or higher | 323 (35.7%) | |

| Average income per month (USD) | Less than 557 | 199 (22.4%) |

| 557–1113 | 208 (23.4%) | |

| Greater than 1113 | 480 (54.1%) | |

| Behavior when buying takeaway food and choices on plastic cutlery (spoons, forks, and knives) | Use plastic cutlery for consumption and throw it into the bin | 566 (61.9%) |

| Use plastic cutlery for consumption, clean it, and keep it for the next time | 115 (12.6%) | |

| Do not use plastic cutlery for consumption, but keep it for next time | 121 (13.2%) | |

| Do not receive plastic cutlery | 113 (12.3%) |

| Criteria Factors | Clusters (n = 915) | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| 13.70% | 21.80% | 19.20% | 15.90% | 29.40% | |

| I support a shop that carries out environmental activities | 3.34 | 3.98 | 4.82 | 4.61 | 4.64 |

| I believe that understanding the benefits of green products is important | 3.28 | 3.93 | 4.83 | 4.52 | 4.61 |

| I think reducing plastic use can positively influence others | 3.23 | 3.94 | 4.75 | 4.54 | 4.59 |

| I think protecting and preserving the environment should start with myself | 3.64 | 4.18 | 4.91 | 4.61 | 4.77 |

| I think biodegradable products can reduce environmental problems in the long-term | 3.29 | 3.99 | 4.62 | 4.53 | 4.53 |

| I attempt to decrease the number of plastics that are not necessary | 3.08 | 3.67 | 4.37 | 4.25 | 4.38 |

| I think biodegradable products should be substituted single-use plastic packaging | 3.37 | 4.00 | 4.54 | 4.49 | 4.47 |

| I am willing to pay more for green products | 2.78 | 3.23 | 3.86 | 4.01 | 4.01 |

| I always think about the environmental impacts of packaging before making purchase decisions | 2.72 | 3.11 | 3.77 | 4.01 | 3.84 |

| I frequently use biodegradable products when ordering takeaway | 2.92 | 3.49 | 4.33 | 3.81 | 4.15 |

| Age (years old) 1 | 18–54 and over | 18–37 | 18–37 | >54 | 38–54 |

| Income: Less than 557 USD | 28.3% | 32.5% | 37.9% | 12.1% | 7.4% |

| 557–1113 USD | 24.2% | 28.3% | 26.0% | 19.3% | 20.2% |

| Greater than 1113 USD | 47.5% | 39.3% | 36.1% | 68.6% | 72.5% |

| Education: High school certificate diploma or below | 23.3% | 13.6% | 3.6% | 15.0% | 7.0% |

| Bachelor’s degree | 46.7% | 56.5% | 75.7% | 45.0% | 39.9% |

| Master’s degree or higher | 30.0% | 29.8% | 20.7% | 40.0% | 53.1% |

| Preference for Bioplastic Products from Cassava | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| 13.70% | 21.80% | 19.20% | 15.90% | 29.40% | |

| Additional willingness to pay (mean) (USD) | 0.38 | 0.42 | 0.51 | 0.37 | 0.44 |

| Intention to buy: | |||||

| Buy | 11.7% | 17.3% | 36.1% | 47.1% | 43.0% |

| Possibly buy | 39.2% | 52.4% | 53.8% | 38.4% | 45.7% |

| Do not buy | 49.2% | 30.4% | 10.1% | 14.5% | 11.2% |

| Reasons for not buying bioplastic from cassava: | |||||

| Not satisfied with physical properties (e.g., heat resistance, hardness) | 10 | 16 | 15 | 9 | 10 |

| Do not use any plastic cutleries and prefer other materials (e.g., stainless) | 5 | 2 | 2 | 8 | 9 |

| Do not respond well to the additional price of bioplastics compared with commercial plastics | 10 | 4 | 6 | 3 | 3 |

| Not sure about the biodegradation process of bioplastics from cassava | 6 | 4 | 4 | 0 | 5 |

| Do not trust in the food safety of bioplastics from cassava | 4 | 6 | 0 | 0 | 4 |

| Are not familiar with bioplastics from cassava and do not know where to buy them | 3 | 5 | 2 | 4 | 3 |

| Total (%) | 38 | 37 | 29 | 24 | 34 |

| Value Chain Actors | Opportunities | Challenges |

|---|---|---|

| Bio-plastic compounders and converters (2 stakeholders) |

|

|

| Cassava industries (4 stakeholders) |

|

|

| Retailers and restaurants (5 stakeholders) |

|

|

| Government agency (1 stakeholder) |

|

|

| Authors’ reviews |

|

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lilavanichakul, A.; Yoksan, R. Development of Bioplastics from Cassava toward the Sustainability of Cassava Value Chain in Thailand. Sustainability 2023, 15, 14713. https://doi.org/10.3390/su152014713

Lilavanichakul A, Yoksan R. Development of Bioplastics from Cassava toward the Sustainability of Cassava Value Chain in Thailand. Sustainability. 2023; 15(20):14713. https://doi.org/10.3390/su152014713

Chicago/Turabian StyleLilavanichakul, Apichaya, and Rangrong Yoksan. 2023. "Development of Bioplastics from Cassava toward the Sustainability of Cassava Value Chain in Thailand" Sustainability 15, no. 20: 14713. https://doi.org/10.3390/su152014713

APA StyleLilavanichakul, A., & Yoksan, R. (2023). Development of Bioplastics from Cassava toward the Sustainability of Cassava Value Chain in Thailand. Sustainability, 15(20), 14713. https://doi.org/10.3390/su152014713