Socio-Economic Factors Affecting ESG Reporting Call for Globally Agreed Standards

Abstract

:1. Introduction

2. Literature Review

- What is the global trend for the environmental, social, governance, and the overall ESG indices over the years?

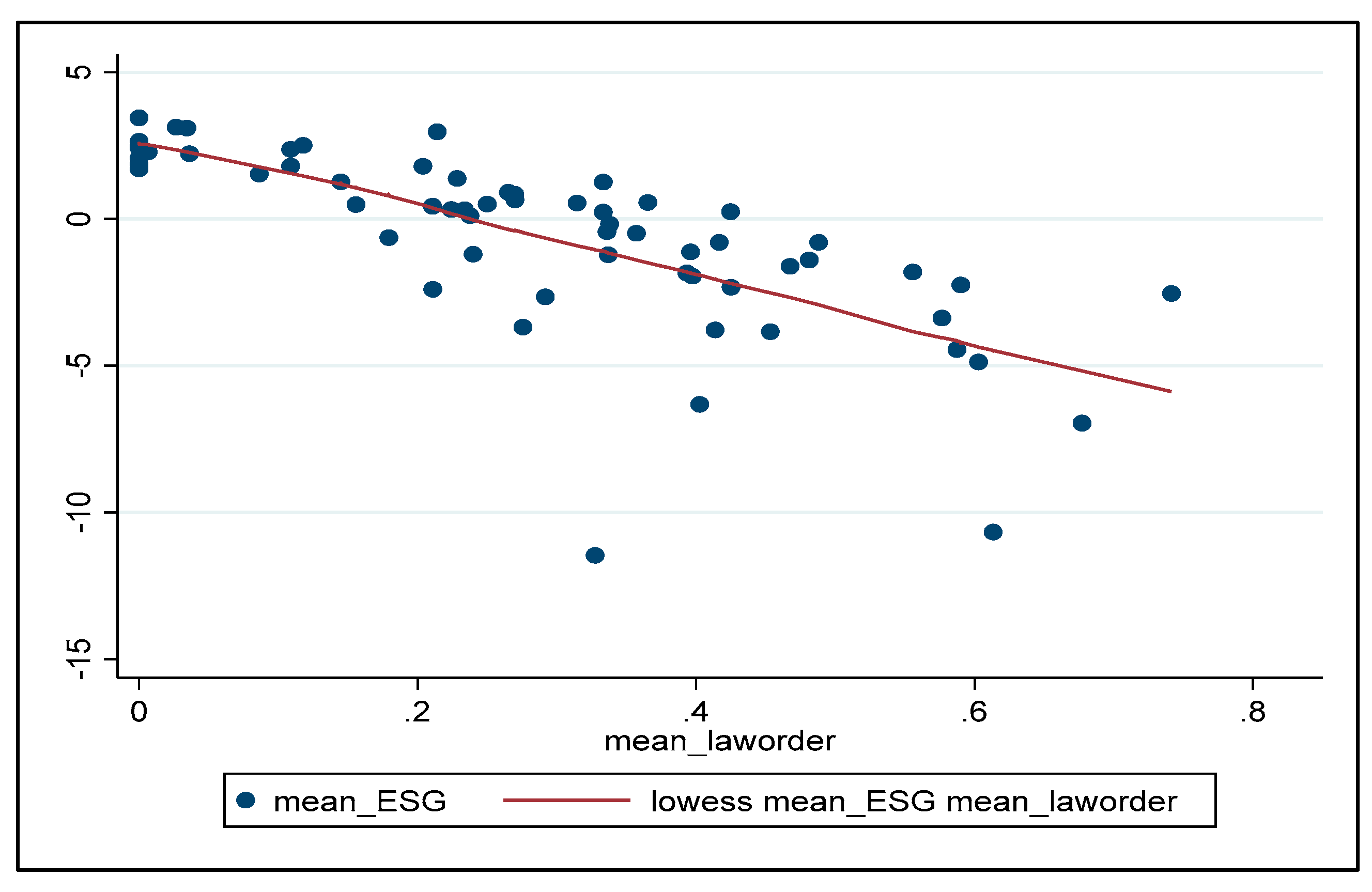

- What is the impact of the political and economic institutions, such as corruption, civil disorder and war, economic and financial risk, ethnic and religious tensions, foreign pressures, law and order, and military in politics on the ESG index?

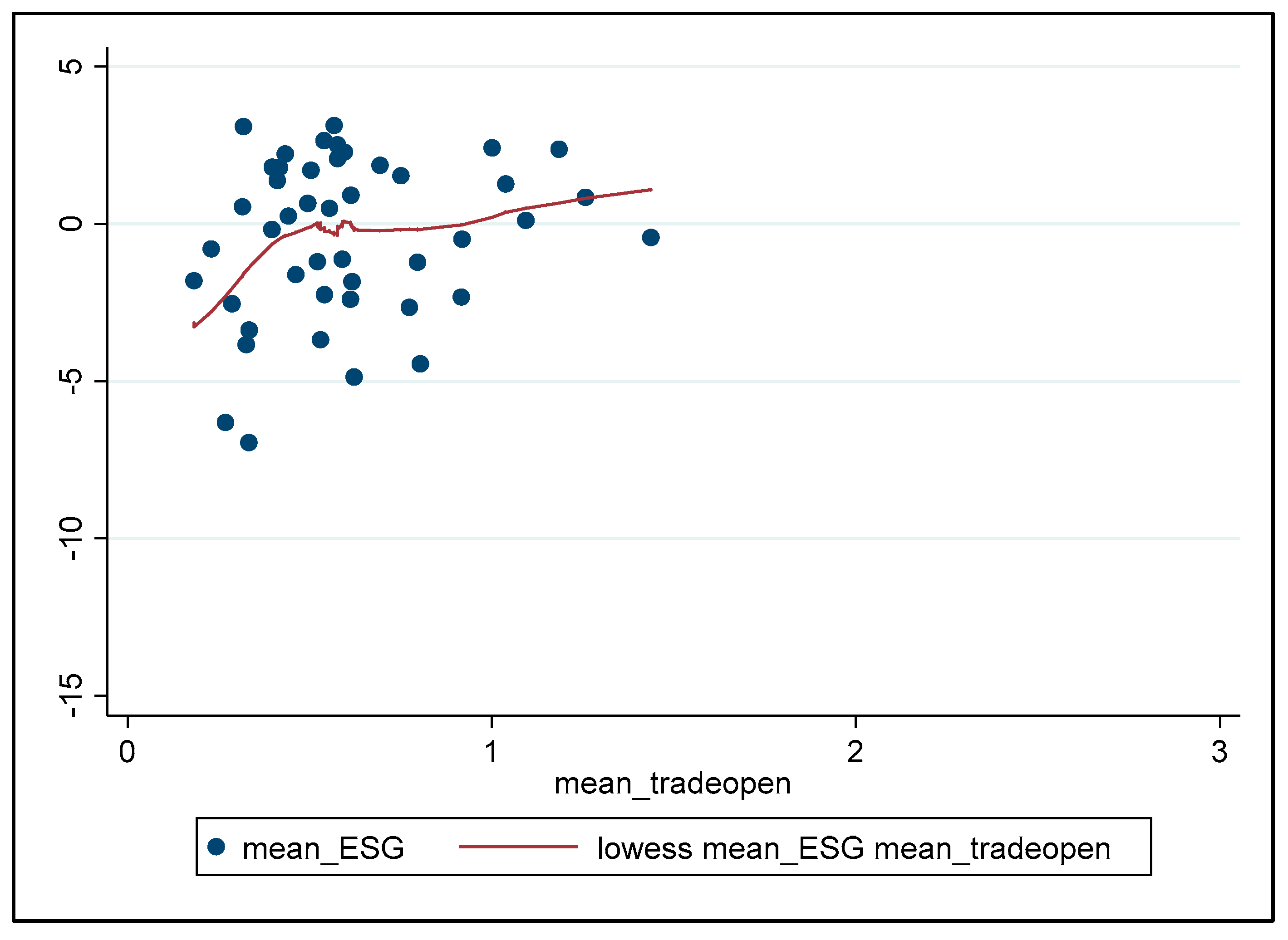

- How macroeconomic factors such as GDP per capita, inflation, and trade openness affect the ESG index?

- Has the presence of political and economic shocks (structural breaks) changed the impact of political and economic institutions and macroeconomic variables on the ESG index?

3. Methodology and Data Description

4. Empirical Results

5. Discussion

6. Policy Implications and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Description |

|---|---|

| Environment | Emissions and pollution: CO2 emissions (metric tons per capita), methane emissions (metric tons of CO2 equivalent per capita), nitrous oxide emissions (metric tons of CO2 equivalent per capita). Energy use: Energy intensity level of primary energy (MJ/$2011 PPP GDP), electricity production from coal sources (% of total), fossil fuel energy consumption (% of total), Eenergy use (kg of oil equivalent per capita), renewable electricity output (% of total electricity output), renewable energy consumption (% of total final energy consumption). All variables apart from renewable electricity output and renewable energy consumption have been rescaled between 0 and 1, with high scores indicating strong environmental performance. Source: www.refinitiv.com Data access is restricted to subscribers |

| Social | Access to services: Access to clean fuels and technologies for cooking (% of population), access to electricity (% of population), people using safely managed sanitation services (% of population). Demography: Life expectancy at birth, total (years), fertility rate, total (births per woman). Education and skills: School enrolment—primary (% gross), government expenditure on education—total (% of government expenditure). Source: www.refinitiv.com Data access is restricted to subscribers |

| Governance | Economic environment and innovation: Individuals using the internet (% of population), scientific and technical journal articles, patent applications—residents. Gender: School enrolment—primary and secondary (gross)—gender parity index (GPI), proportion of seats held by women in national parliaments (%), ratio of female to male labor force participation rate (%) (modeled ILO estimate). Source: www.refinitiv.com Data access is restricted to subscribers |

| Corruption | A measure of corruption within the political system that is a threat to foreign investment by distorting the economic and financial environment, reducing the efficiency of government and business by enabling people to assume positions of power through patronage rather than ability, and introducing inherent instability into the political process. Between 0 (high corruption) and 6 (low corruption). Rescaled between 0 (very clean) and 1 (highly corrupt). Source: International Country Risk Guide (ICRG). https://epub.prsgroup.com/products/icrg-historical-data. Data access is restricted to subscribers. |

| Civil disorder | “The potential risk to governance or investment from mass protest, such as anti-government demonstrations, strikes, etc. Between 0 (high risk) and 4 (low risk).” Rescaled between 0 (low risk) and 1 (high risk). Source: International Country Risk Guide (ICRG). https://epub.prsgroup.com/products/icrg-historical-data. Data access is restricted to subscribers. |

| Civil war | The actual or potential risk of civil war (where a rebel force, which holds territory, is in armed conflict with the security forces of the government, and where both forces are citizens of the state in which the conflict occurs). Between 0 (high risk) and 4 (low risk). Rescaled between 0 (low risk) and 1 (high risk). Source: International Country Risk Guide (ICRG). https://epub.prsgroup.com/products/icrg-historical-data. Data access is restricted to subscribers. |

| Economic risk rating | A means of assessing a country’s current economic strengths and weaknesses. In general, where strengths outweigh weaknesses, a country will show low risk, and where weaknesses outweigh strengths, the economic risk will be high. To ensure comparability between countries, risk components are based on accepted ratios between the measured data within the national economic/financial structure, and then the ratios are compared, not the data. Risk points are assessed for each of the component factors of GDP per head of population, real annual GDP growth, annual inflation rate, budget balance as a percentage of GDP, and current account balance as a percentage of GDP. Risk ratings range from a high of 50 (least risk) to a low of 0 (highest risk), though lowest de facto ratings are generally near 15. Rescaled between 0 (low risk) and 1 (high risk). Source: International Country Risk Guide (ICRG). https://epub.prsgroup.com/products/icrg-historical-data. Data access is restricted to subscribers. |

| Financial risk rating | A means of assessing a country’s ability to pay its way by financing its official, commercial, and trade debt obligations. To ensure comparability between countries, risk components are based on accepted ratios between the measured data within the national economic/financial structure, and then the ratios are compared, not the data. Risk points are assessed for each of the component factors of foreign debt as a percentage of GDP, foreign debt service as a percentage of exports of goods and services (XGS), current account as a percentage of XGS, net liquidity as months of import cover, and exchange rate stability. Risk ratings range from a high of 50 (least risk) to a low of 0 (highest risk), though lowest de facto ratings are generally near 20. Rescaled between 0 (low risk) and 1 (high risk). Source: International Country Risk Guide (ICRG). https://epub.prsgroup.com/products/icrg-historical-data. Data access is restricted to subscribers. |

| Ethnic tensions | A measure of the degree of tension attributable to racial, national, or language divisions. Between 0 and 6. Lower ratings near 0 (higher risk) are given to countries where tensions are high because opposing groups are intolerant and unwilling to compromise. Higher ratings, near 6, are given to countries where tensions are minimal, even though such differences may still exist. Rescaled between 0 (low risk) and 1 (high risk). Source: International Country Risk Guide (ICRG). https://epub.prsgroup.com/products/icrg-historical-data. Data access is restricted to subscribers. |

| Religious tensions | A measure of religious tensions arising from the domination of society and/or governance by a single religious group—or a desire to dominate—in a way that replaces civil law by religious law, excludes other religions from the political/social processes, suppresses religious freedom or expressions of religious identity. The risks involved range from inexperienced people imposing inappropriate policies to civil dissent or civil war. Between 0 (high tensions) and 6 (low tensions). Rescaled between 0 (low tensions) and 1 (high tensions). Source: International Country Risk Guide (ICRG). https://epub.prsgroup.com/products/icrg-historical-data. Data access is restricted to subscribers. |

| Foreign pressures | Actual or potential risk posed by pressures brought to bear on the government by one or more foreign states to force a change of policy. Such pressures can range from diplomatic pressures, through suspension of aid and/or credits, to outright sanctions. Between 0 (high risk) and 4 (low risk). Rescaled between 0 (low risk) and 1 (high risk). Source: International Country Risk Guide (ICRG). https://epub.prsgroup.com/products/icrg-historical-data. Data access is restricted to subscribers. |

| Law and order | Two measures comprising one risk component. Each sub-component equals half of the total. The “law” sub-component assesses the strength and impartiality of the legal system, and the “order” sub-component assesses popular observance of the law. Between 0 (high risk) and 6 (low risk). Rescaled between 0 (low risk) and 1 (high risk). Source: International Country Risk Guide (ICRG). https://epub.prsgroup.com/products/icrg-historical-data. Data access is restricted to subscribers. |

| Military in politics | A measure of the military’s involvement in politics. Since the military is not elected, involvement, even at a peripheral level, diminishes democratic accountability. Military involvement might stem from an external or internal threat, be symptomatic of underlying difficulties, or be a full-scale military takeover. Over the long term, a system of military government will almost certainly diminish effective governmental functioning, become corrupt, and create an uneasy environment for foreign businesses. Between 0 and 6. Overall, lower risk ratings (0) indicate a greater degree of military participation in politics. Rescaled between 0 (low participation) and 1 (high participation). Source: International Country Risk Guide (ICRG). https://epub.prsgroup.com/products/icrg-historical-data. Data access is restricted to subscribers. |

| Real per capita GDP | Ratio of real GDP to population. Source: International Country Risk Guide (ICRG). https://epub.prsgroup.com/products/icrg-historical-data. Data access is restricted to subscribers. |

| Inflation | Annual average percent change in the consumer price index. Source: International Country Risk Guide (ICRG). https://epub.prsgroup.com/products/icrg-historical-data. Data access is restricted to subscribers. |

| Trade openness | Trade is the sum of exports and imports of goods and services measured as a share of gross domestic product. Source: International Country Risk Guide (ICRG). https://epub.prsgroup.com/products/icrg-historical-data. Data access is restricted to subscribers. |

| Albania | Egypt | Lebanon | Russia |

| Algeria | El Salvador | Liberia | Saudi Arabia |

| Angola | Estonia | Libya | Senegal |

| Argentina | Ethiopia | Lithuania | Serbia |

| Armenia | Finland | Luxembourg | Sierra Leone |

| Australia | France | Madagascar | Singapore |

| Austria | Gabon | Malawi | Slovakia |

| Azerbaijan | Gambia | Malaysia | Slovenia |

| Bahamas | Germany | Mali | Somalia |

| Bahrain | Ghana | Malta | South Africa |

| Bangladesh | Greece | Mexico | Spain |

| Belarus | Guatemala | Moldova | Sri Lanka |

| Belgium | Guinea | Mongolia | Sudan |

| Bolivia | Guinea-Bissau | Serbia-Montenegro | Suriname |

| Botswana | Guyana | Morocco | Sweden |

| Brazil | Haiti | Mozambique | Switzerland |

| Brunei | Honduras | Myanmar | Syria |

| Bulgaria | Hungary | Namibia | Tanzania |

| Burkina Faso | Iceland | Netherlands | Thailand |

| Cameroon | India | New Zealand | Togo |

| Canada | Indonesia | Nicaragua | Trinidad and Tobago |

| Chile | Iran | Niger | Tunisia |

| China | Iraq | Nigeria | Turkey |

| Colombia | Ireland | Norway | Uganda |

| Congo, DR | Israel | Oman | Ukraine |

| Congo | Italy | Pakistan | UAE |

| Costa Rica | Jamaica | Panama | United Kingdom |

| Côte d’Ivoire | Japan | Papua New Guinea | United States |

| Croatia | Jordan | Paraguay | Uruguay |

| Cuba | Kazakhstan | Peru | Venezuela |

| Cyprus | Kenya | Philippines | Vietnam |

| Czech Republic | Korea, DPR | Poland | Yemen |

| Denmark | Korea South | Portugal | Zambia |

| Dominican Republic | Kuwait | Qatar | Zimbabwe |

| Ecuador | Latvia | Romania |

| Variable | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|

| Environment | ||||

| CO2 emissions (metric tons per capita) | 0.8946 | 0.1264 | 0.0000 | 1.0000 |

| Methane emissions (metric tons of CO2 equivalent per capita) | 0.9531 | 0.0768 | 0.0000 | 1.0000 |

| Nitrous oxide emissions (metric tons of CO2 equivalent per capita) | 0.8820 | 0.1281 | 0.0000 | 1.0000 |

| Energy intensity level of primary energy (MJ/$2011 PPP GDP) | 0.8747 | 0.1018 | 0.0000 | 1.0000 |

| Electricity production from coal sources (% of total) | 0.8310 | 0.2598 | 0.0000 | 1.0000 |

| Renewable electricity output (% of total electricity output) | 32.7090 | 33.2441 | 0.0000 | 100.000 |

| Renewable energy consumption (% of total final energy consumption) | 32.7392 | 30.9661 | 0.0000 | 98.3429 |

| Fossil fuel energy consumption (% of total) | 0.3225 | 0.2851 | 0.0000 | 1.0000 |

| Energy use (kg of oil equivalent per capita) | 0.8873 | 0.1286 | 0.0000 | 1.0000 |

| Social | ||||

| Access to clean fuels and technologies for cooking (% of population) | 66.0924 | 37.7077 | 0.1500 | 100.0000 |

| Access to electricity (% of population) | 80.6326 | 29.8364 | 0.5339 | 100.0000 |

| People using safely managed sanitation services (% of population) | 55.3169 | 29.6689 | 2.1169 | 100.0000 |

| Life expectancy at birth, total (years) | 68.4627 | 9.8090 | 37.0830 | 84.3563 |

| Fertility rate, total (births per woman) | 3.1969 | 1.7615 | 0.9180 | 8.8640 |

| School enrolment—primary (% gross) | 99.3100 | 16.9754 | 14.4150 | 165.6450 |

| Government expenditure on education—total (% of government expenditure) | 14.4206 | 4.8680 | 0.0000 | 47.2787 |

| Governance | ||||

| Individuals using the internet (% of population) | 24.4633 | 30.3331 | 0.0000 | 100.0000 |

| Scientific and technical journal articles | 12,780.35 | 45,012.21 | 0.0000 | 528,263.00 |

| Patent applications—residents | 12,086.3100 | 68,421.9500 | 1.0000 | 1,400,000 |

| School enrolment—primary and secondary (gross)—gender parity index (GPI) | 0.9622 | 0.1094 | 0.4121 | 1.2435 |

| Proportion of seats held by women in national parliaments (%) | 18.1828 | 11.2452 | 0.0000 | 53.2231 |

| Ratio of female to male labor force participation rate (%) (modeled ILO estimate) | 67.7976 | 20.6990 | 8.5504 | 107.9940 |

| Economic and political institutions | ||||

| Corruption | 0.5157 | 0.2208 | 0.0000 | 1.0000 |

| Civil disorder | 0.3317 | 0.1447 | 0.0000 | 0.8750 |

| Civil war | 0.0965 | 0.1583 | 0.0000 | 1.0000 |

| Economic risk rating | 0.3261 | 0.1381 | 0.0000 | 1.0000 |

| Financial risk rating | 0.3021 | 0.1649 | 0.0000 | 0.9300 |

| Ethnic tensions | 0.3443 | 0.2315 | 0.0000 | 1.0000 |

| Religious tensions | 0.2424 | 0.2216 | 0.0000 | 1.0000 |

| Foreign pressures | 0.2846 | 0.1688 | 0.0000 | 1.0000 |

| Law and order | 0.3937 | 0.2392 | 0.0000 | 1.0000 |

| Military in politics | 0.3799 | 0.2996 | 0.0000 | 1.0000 |

| Macroeconomic variables | ||||

| Real per capita GDP | 11,898.3000 | 16,043.5800 | 63.0000 | 100,631.0000 |

| Inflation | 24.8030 | 101.8954 | −0.7000 | 900.0000 |

| Trade openness | 0.6287 | 0.3856 | 0.0400 | 4.2391 |

| Variable | Level | Growth Rate | ||

|---|---|---|---|---|

| Statistic | Estimated Breaks | Statistic | Estimated Breaks | |

| Environment | ||||

| CO2 emissions (metric tons per capita) | −9.9661 | 1991, 2006 | −69.6696 | 1987, 1990 |

| Methane emissions (metric tons of CO2 equivalent per capita) | −26.7112 | 1988, 1991 | −131.1719 | 1987, 1990 |

| Nitrous oxide emissions (metric tons of CO2 equivalent per capita) | −26.6511 | 1991, 1993 | −81.3295 | 1986, 2017 |

| Energy intensity level of primary energy (MJ/$2011 PPP GDP) | 4.5898 | 1986, 1999 | −39.4348 | 1987, 1991 |

| Electricity production from coal sources (% of total) | 0.1441 | 1991, 2000 | −55.5580 | 2014, 2016 |

| Fossil fuel energy consumption (% of total) | 4.0953 | 1991, 2001 | −62.9663 | 2014, 2016 |

| Energy use (kg of oil equivalent per capita) | 12.0292 | 2014, 2016 | −51.9082 | 2014, 2016 |

| Renewable electricity output (% of total electricity output) | −10.3201 | 2010, 2012 | −54.9086 | 2009, 2011 |

| Renewable energy consumption (% of total final energy consumption) | −1.0606 | 1994, 1998 | −55.5454 | 1986, 2011 |

| Social | ||||

| Access to clean fuels and technologies for cooking (% of population) | −22.4973 | 1989, 1997 | −68.5877 | 1996, 1999 |

| Access to electricity (% of population) | 13.1774 | 2010, 2012 | −68.6941 | 1986, 2011 |

| People using safely managed sanitation services (% of population) | 11.8600 | 1986, 1990 | −4.7184 | 1991, 2000 |

| Life expectancy at birth, total (years) | 7.1493 | 1992, 2002 | −29.9059 | 1993, 2006 |

| Fertility rate, total (births per woman) | −4.2957 | 1986, 1988 | −30.1373 | 1986, 2017 |

| School enrolment—primary (% gross) | 1.6625 | 1986, 1991 | −51.4022 | 2015, 2017 |

| Government expenditure on education—total (% of government expenditure) | −0.1332 | 1988, 1992 | −38.7287 | 1986, 1988 |

| Governance | ||||

| Individuals using the internet (% of population) | −6.3405 | 2011, 2016 | −37.2460 | 1986, 1988 |

| Scientific and technical journal articles | 3.3740 | 1988, 2000 | −19.1604 | 1986, 2000 |

| Patent applications—residents | −23.8476 | 2003, 2009 | −65.9574 | 2010, 2014 |

| School enrolment—primary and secondary (gross)—gender parity index (GPI) | 8.5208 | 1986, 1993 | −43.6542 | 1986, 2017 |

| Proportion of seats held by women in national parliaments (%) | −2.5575 | 1986, 1988 | −36.9545 | 1986, 1988 |

| Ratio of female to male labor force participation rate (%) (modeled ILO estimate) | 0.0735 | 1997, 2008 | −50.9640 | 1986, 2011 |

| Economic and political institutions | ||||

| Corruption | −11.8243 | 1986, 1991 | −51.4198 | 1986, 1988 |

| Civil disorder | −7.7802 | 1988, 1990 | −26.3981 | 1986, 1988 |

| Civil war | −3.1789 | 1989, 2001 | −22.0032 | 1998, 2000 |

| Economic risk rating | −10.0200 | 1988, 1986 | −61.8362 | 1986, 1988 |

| Financial risk rating | −6.3035 | 1986, 2018 | −61.3741 | 1986, 1988 |

| Ethnic tensions | −8.0902 | 1986, 1991 | −49.4234 | 1986, 1988 |

| Religious tensions | −3.9687 | 1986, 1988 | −47.1659 | 1986, 1988 |

| Foreign pressures | −2.1587 | 1999, 2001 | −22.6034 | 1998, 2000 |

| Law and order | −15.0105 | 1986, 1990 | −49.6440 | 1986, 1988 |

| Military in politics | −3.3038 | 1986, 1991 | −52.1251 | 1986, 1988 |

| Macroeconomic variables | ||||

| Real per capita GDP | −10.3820 | 1999, 2005 | −47.9315 | 2008, 2011 |

| Inflation | −18.2139 | 1988, 1994 | −55.2454 | 1989, 1992 |

| Trade openness | −27.6053 | 1987, 1998 | −68.5363 | 1987, 1989 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) | ESG | 1 | |||||||||||||

| (2) | Corruption | −0.6484 * | 1 | ||||||||||||

| (3) | Civil disorder | −0.5520 * | 0.5133 * | 1 | |||||||||||

| (4) | Civil war | −0.3565 * | 0.4118 * | 0.3469 * | 1 | ||||||||||

| (5) | Economic risk rating | −0.3966 * | 0.3433 * | 0.4640 * | 0.3907 * | 1 | |||||||||

| (6) | Financial risk rating | −0.0079 | 0.2703 * | 0.1759 * | 0.1688 * | 0.6940 * | 1 | ||||||||

| (7) | Ethnic tensions | −0.1468 | 0.3357 * | 0.2675 * | 0.4241 * | 0.2849 * | 0.3542 * | 1 | |||||||

| (8) | Religious tensions | −0.2861 * | 0.3343 * | 0.2637 * | 0.4559 * | 0.1372 * | 0.1777 * | 0.4081 * | 1 | ||||||

| (9) | Foreign pressures | −0.1295 | 0.3541 * | 0.2863 * | 0.4418 * | 0.3085 * | 0.1394 * | 0.1863 * | 0.2196 * | 1 | |||||

| (10) | Law and order | −0.6395 * | 0.6322 * | 0.5801 * | 0.3753 * | 0.5059 * | 0.4859 * | 0.4893 * | 0.3269 * | 0.2565 * | 1 | ||||

| (11) | Military in politics | −0.6712 * | 0.5894 * | 0.4764 * | 0.6033 * | 0.4734 * | 0.4591 * | 0.4149 * | 0.4143 * | 0.4658 * | 0.6459 * | 1 | |||

| (12) | Real per capita GDP | 0.7185 * | −0.6037 * | −0.5320 * | −0.3295 * | −0.5171 * | −0.3091 * | −0.2435 * | −0.2345 * | −0.2510 * | −0.6145 * | −0.5390 * | 1 | ||

| (13) | Inflation | −0.3120 * | 0.0730 * | 0.0894 * | 0.1802 * | 0.3647 * | 0.2939 * | 0.0795 * | 0.0111 | 0.1836 * | 0.1720 * | 0.1560 * | −0.1305 * | 1 | |

| (14) | Trade openness | 0.1324 | −0.023 | −0.2247 * | −0.1713 * | −0.2336 * | −0.1357 * | −0.1078 * | −0.0741 * | −0.1607 * | −0.1265 * | −0.2130 * | 0.1219 * | 0.0014 | 1 |

| Variable | ESG | Environment | Social | Governance | Bai and Perron Critical Values | ||

|---|---|---|---|---|---|---|---|

| Test Statistic | 1% | 5% | 10% | ||||

| F(1|0) | 32.43 | 22.25 | 35.35 | 30.04 | 12.29 | 8.58 | 7.04 |

| F(2|1) | 6.88 | 6.51 | 21.72 | 25.62 | 13.89 | 10.13 | 8.51 |

| F(3|2) | 2.75 | 6.32 | 6.97 | 7.45 | 14.80 | 11.14 | 9.41 |

| F(4|3) | 1.70 | 3.14 | 2.86 | 6.83 | 15.28 | 11.83 | 10.04 |

| F(5|4) | 0.68 | 1.29 | 1.96 | 2.56 | 15.76 | 12.25 | 10.58 |

| Breakpoints estimation | |||||||

| Estimated Breakpoints | ESG | Environment | Social | Governance | |||

| 2010 | 2010 | 2004, 2010 | 2010, 2015 | ||||

| SSR | 213.39 | 198.84 | 259.29 | 299.75 | |||

| [95% Conf. Interval] | [2008, 2012] | [2008, 2012] | [2003, 2005] [2008, 2012] | [2008, 2012] [2013, 2017] | |||

| Variable | Full Sample | Before 2010 | After 2010 |

|---|---|---|---|

| (1) | (2) | (3) | |

| Economic and political institutions | |||

| Corruption | −0.6943 ** (0.3312) | −1.0346 *** (0.3122) | 0.7974 (0.5003) |

| Civil disorder | 0.3769 (0.2370) | −0.2651 (0.2589) | −0.1527 (0.2948) |

| Civil war | −0.4461 (0.4268) | −0.6528 (0.4725) | 0.3576 (0.4010) |

| Economic risk rating | 0.5779 (0.4773) | 0.4469 (0.4956) | −0.2894 (0.5360) |

| Financial risk rating | −2.0347 *** (0.4787) | −1.6884 *** (0.5473) | −1.6525 *** (0.5499) |

| Ethnic tensions | −0.3245 (0.4971) | −0.8268 * (0.4829) | −1.3680 (0.8744) |

| Religious tensions | 0.0476 (0.3649) | −0.0667 (0.3473) | 0.8772 (0.8869) |

| Foreign pressures | −0.9994 *** (0.2789) | −1.0527 *** (0.2773) | −0.2644 (0.6395) |

| Law and order | −0.0950 (0.4075) | −0.8699 ** (0.4103) | −1.4464 (0.9298) |

| Military in politics | −0.1393 (0.4965) | −1.5020 *** (0.5177) | −0.1834 (0.8767) |

| Macroeconomic variables | |||

| Real per capita GDP | 0.0192 *** (0.0026) | 0.0198 *** (0.0034) | 0.0221 *** (0.0066) |

| Inflation | −0.0272 *** 0.0065 | −0.0085 (0.0063) | −0.0075 (0.0102) |

| Trade openness | 0.8941 *** 0.2502 | 0.8825 *** (0.2880) | −0.3760 (0.3570) |

| Constant | −0.7437 ** 0.3682 | −0.5346 (0.3677) | 0.5386 (0.6246) |

| Adjusted R-squared | 0.4715 | 0.6757 | 0.5541 |

| Observations | 830 | ||

| Variable | Full Sample | Before 2010 | After 2010 |

|---|---|---|---|

| (1) | (2) | (3) | |

| Economic and political institutions | |||

| Corruption | −0.3247 *** (0.0926) | −0.2542 *** (0.0894) | −0.1848 (0.2348) |

| Civil disorder | −0.1888 *** (0.0644) | 0.0373 (0.0675) | −0.0569 (0.1348) |

| Civil war | −0.0252 (0.0784) | −0.0225 (0.0792) | 0.1729 (0.1756) |

| Economic risk rating | 0.0442 (0.1230) | 0.2049 (0.1326) | −0.4284 ** (0.2051) |

| Financial risk rating | −1.3072 *** (0.1133) | −0.8483 *** (0.1249) | −0.5224 ** (0.2568) |

| Ethnic tensions | 0.1344 (0.0924) | 0.0950 (0.0847) | −1.1254 ** (0.5373 |

| Religious tensions | −0.1675 * (0.0923) | −0.1875 ** (0.0871) | −0.4859 (0.3496) |

| Foreign pressures | −0.0377 (0.0660) | −0.1144 * (0.0669) | 0.1670 (0.1811) |

| Law and order | −0.4086 *** (0.1193) | −0.2297 ** (0.1152) | −0.9751 *** (0.3719) |

| Military in politics | 0.0828 (0.1106) | −0.1792 (0.1114) | −1.4320 *** (0.3830) |

| Macroeconomic variables | |||

| Real per capita GDP | 0.0104 *** (0.0009) | 0.0065 *** (0.0013) | 0.0026 (0.0035) |

| Inflation | −0.0003 * (0.0002) | −0.0005 *** (0.0002) | −0.0018 (0.0037) |

| Trade openness | 0.1065 * (0.0564) | −0.0919 (0.0622) | −0.0378 (0.1199) |

| Constant | −0.7955 (0.1591) | −0.5454 *** (0.1608) | −1.1613 (0.3147) |

| Adjusted R-squared | 0.4628 | 0.5631 | 0.5572 |

| Observations | 1345 | ||

| Variable | Full Sample | Before 2004 | After 2004 and before 2010 | After 2010 |

| (1) | (2) | (3) | (4) | |

| Economic and political institutions | ||||

| Corruption | −0.3912 *** (0.1444) | −0.0364 *** (0.0142) | −0.8467 *** (0.2364) | −0.3554 (0.2741) |

| Civil disorder | −0.4574 *** (0.0976) | 0.1638 (0.1197) | −0.4499 *** (0.1382) | −0.5417 *** (0.1830) |

| Civil war | −0.1905 (0.1685) | −0.1104 (0.2394) | −0.2853 (0.2518) | −0.3159 (0.2492) |

| Economic risk rating | 0.0092 (0.1786) | −0.6260 (0.5065) | 0.3164 (0.2054) | −0.0831 (0.2304) |

| Financial risk rating | −0.6258 *** (0.1873) | −0.2663 (0.4145) | −0.2671 (0.2618) | −0.5720 ** (0.2803) |

| Ethnic tensions | −0.4633 ** (0.1962) | −0.1611 (0.2403) | −0.8631 ** (0.3832) | −2.5465 *** (0.5750) |

| Religious tensions | 0.1434 (0.1462) | −0.4383 * (0.2531) | −0.5250 ** (0.2475) | 0.6201 (0.5267) |

| Foreign pressures | −0.3038 *** (0.1180) | 0.1466 (0.1481) | −0.3770 ** (0.1623) | 0.1374 (0.3895) |

| Law and order | −0.0138 (0.1694) | 0.0324 (0.1591) | −0.3992 * (0.2409) | −2.1465 *** (0.5337) |

| Military in politics | 0.0435 (0.2111) | −0.8656 ** (0.3629) | −1.1190 *** (0.3168) | −0.9050 ** (0.3805) |

| Macroeconomic variables | ||||

| Real per capita GDP | 0.0070 *** (0.0011) | 0.0069 * (0.0039) | 0.0032 * (0.0018) | 0.0020 (0.0031) |

| Inflation | −0.0004 (0.0007) | 0.0015 (0.0036) | 0.0026 (0.0028) | −0.0006 (0.0005) |

| Trade openness | −0.0034 (0.0985) | 0.1690 (0.2073) | 0.2258 * (0.1266) | 0.7809 *** (0.1784) |

| Constant | 0.4010 ** (0.1927) | 0.7206 ** (0.2819) | 1.5804 *** (0.2378) | 2.5180 *** (0.3358) |

| Adjusted R-squared | 0.5918 | 0.6183 | 0.6521 | 0.6725 |

| Observations | 870 | |||

| Variable | Full Sample | Before 2010 | After 2010 and before 2015 | After 2015 |

| (1) | (2) | (3) | (4) | |

| Economic and political institutions | ||||

| Corruption | −0.8563 *** (0.2624) | −0.6286 *** (0.1814) | 0.7251 (0.6315) | 0.0525 (0.7534) |

| Civil disorder | −0.7149 *** (0.2078) | −0.2111 (0.1616) | 0.0584 (0.3201) | −0.4811 (0.4503) |

| Civil war | −1.1385 *** (0.2776) | 0.0959 (0.2052) | −0.9367 ** (0.4567) | −0.2761 (0.6522) |

| Economic risk rating | 0.3440 (0.3958) | −0.8047 ** (0.3507) | −1.2037 * (0.6907) | −0.9712 (0.8724) |

| Financial risk rating | −1.6486 *** (0.4189) | −1.4828 *** (0.3813) | −1.1777 * (0.6317) | −1.2274 (0.8530) |

| Ethnic tensions | 0.4079 (0.3586) | −0.0030 (0.2683) | −1.2046 (0.7635) | −0.0913 (0.8695) |

| Religious tensions | −0.3511 (0.3160) | −0.0878 (0.2202) | 0.9342 (0.7714) | −1.6536 * (0.8756) |

| Foreign pressures | 0.3668 (0.2283) | −0.6019 *** (0.1633) | −0.4682 (0.4797) | 0.4729 (0.6961) |

| Law and order | −1.3463 *** (0.3114) | −0.2856 (0.2487) | 0.6477 (0.6883) | 0.3547 (0.8953) |

| Military in politics | −0.8036 ** (0.3167) | −0.4870 ** (0.2325) | −1.7164 ** (0.7716) | −0.1432 (0.9791) |

| Macroeconomic variables | ||||

| Real per capita GDP | 0.0415 *** (0.0027) | 0.0321 *** (0.0028) | 0.0373 *** (0.0077) | 0.0242 *** (0.0076) |

| Inflation | −0.0201 *** (0.0046) | −0.0073 ** (0.0031) | −0.0038 (0.0066) | 0.0127 (0.0108) |

| Trade openness | 0.3333 * (0.1767) | 0.6310 *** (0.1812) | −1.1070 (0.3537) | −0.0799 (0.3724) |

| Constant | −0.4030 (0.2676) | −0.6062 *** (0.2228) | 0.5158 (0.6144) | 1.0750 * (0.6192) |

| Adjusted R-squared | 0.4389 | 0.5536 | 0.5762 | 0.5492 |

| Observations | 1112 | |||

References

- Steenkamp, J.B.E. The Role of National Culture in International Marketing Research. Int. Mark. Rev. 2001, 18, 30–44. [Google Scholar] [CrossRef]

- Landi, G.C.; Iandolo, F.; Renzi, A.; Rey, A. Embedding Sustainability in Risk Management: The Impact of Environmental, Social, and Governance Ratings on Corporate Financial Risk. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1096–1107. [Google Scholar] [CrossRef]

- Zhang, W.; He, X.; Hamori, S. Volatility Spillover and Investment Strategies among Sustainability-related Financial Indexes: Evidence from the DCC-GARCH-based Dynamic Connectedness and DCC-GARCH t-copula approach. Int. Rev. Financ. Anal. 2022, 83, 102223. [Google Scholar] [CrossRef]

- Pelos, M.E.; Schmergel, C.E. Board Oversight in ESG-Evolving Trends in the Era of Increasing Disclosure Requirements. Environ. Law Rev. 2022, 52, 10637–10640. [Google Scholar]

- Sulkowski, A.; Jebe, R. Evolving ESG Reporting Governance, Regime Theory, and Proactive Law: Predictions and Strategies. Am. Bus. Law J. 2022, 59, 449–503. [Google Scholar] [CrossRef]

- Elkington, J. Towards the Sustainable Corporation: Win-Win-Win Business Strategies for Sustainable Development. Calif. Manag. Rev. 1994, 36, 90–100. [Google Scholar] [CrossRef]

- Chang, K.; Kim, I.; Li, Y. The Heterogeneous Impact of Corporate Social Responsibility Activities that Target Different Stakeholders. J. Bus. Ethics 2014, 125, 211–234. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The Impact of a Corporate Culture of Sustainability on Corporate Behavior and Performance; National Bureau of Economic Research: Cambridge, MA, USA, 2012; Volume 17950, pp. 113–127. [Google Scholar]

- Bassen, A.; Senkl, D. ESG-environmental, social, governance issues. Betriebswirtschaft 2011, 71, 506. [Google Scholar]

- Meier, S.; Cassar, L. Stop Talking about How CSR Helps Your Bottom Line. Harvard Business Review 31. 2018. Available online: https://hbr.org/2018/01/stop-talking-about-how-csr-helps-your-bottom-line (accessed on 25 April 2023).

- Boerner, H. Sustainability Reports Published in 2020, G&A Institute. 2021. Available online: https://www.ga-institute.com/2021-sustainability-reporting-in-focus.html (accessed on 25 April 2023).

- Daugaard, D.; Ding, A. Global Drivers for ESG Performance: The Body of Knowledge. Sustainability 2022, 14, 2322. [Google Scholar] [CrossRef]

- Hossain, M.; Reaz, M. The determinants and characteristics of voluntary disclosure by Indian banking companies. Corp. Soc. Responsib. Environ. Manag. 2007, 14, 274–288. [Google Scholar] [CrossRef]

- Baldini, M.; Dal Maso, L.; Liberatore, G.; Mazzi, F.; Terzani, S. Role of Country- and Firm-Level Determinants in Environmental, Social, and Governance Disclosure. J. Bus. Ethics 2018, 150, 79–98. [Google Scholar] [CrossRef]

- Moura-Leite, R.C.; Padgett, R.C.; Galan, J.I. Is Social Responsibility driven by industry or firm-specific factors? Manag. Decis. 2012, 50, 1200–1221. [Google Scholar] [CrossRef]

- Short, J.L.; Toffel, M.W.; Hugill, A.R. Monitoring Global Supply Chains. Strateg. Manag. J. 2016, 37, 1878–1897. [Google Scholar] [CrossRef]

- Eliwa, Y.; Aboud, A.; Saleh, A. ESG Practices and the Cost of Debt: Evidence from EU countries. Crit. Perspect. Account. 2019, 79, 102097. [Google Scholar] [CrossRef]

- Campbell, J.L. Why Would Corporations Behave in Socially Responsible Ways? An Institutional Theory of corporate social responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- Abdul Rahman, R.; Alsayegh, M.F. Determinants of Corporate Environment, Social and Governance (ESG) Reporting among Asian Firms. J. Risk Financ. Manag. 2021, 14, 167. [Google Scholar] [CrossRef]

- Li, T.-T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research Progress and Future Prospects. Sustainability 2022, 13, 11663. [Google Scholar] [CrossRef]

- Anita, M.; Shveta, S.; Surendra, Y.S.; Arvind, M. When do ESG Controversies Reduce Firm Value in India? Glob. Financ. J. 2023, 55, 100809. [Google Scholar] [CrossRef]

- Coombs, W.T.; Holladay, S.J. Communication and Attributions in a Crisis: An experimental Study in Crisis Communication. J. Public Relat. Res. 1996, 8, 279–295. [Google Scholar] [CrossRef]

- Fatemi, A.; Fooladi, I.J.; Wheeler, D. The Relative Valuation of Socially Responsible Firms: An Exploratory Study. In Finance for a Better World: The Shift towards Sustainability; de Bettingnies, H.-C., L’epineux, F., Eds.; Palgrave Macmillan: London, UK, 2009; pp. 140–167. [Google Scholar]

- Barreto, I.; Baden-Fuller, C. To Conform or to Perform? Mimetic Behaviour, Legitimacy-Based Groups and Performance Consequences. J. Manag. 2006, 43, 1559–1581. [Google Scholar] [CrossRef]

- Boufounou, P.; Moustairas, I.; Toudas, K.; Malesios, C. ESGs and Customer Choice: Some Empirical Evidence. Circ. Econ. Sustain. 2023. [Google Scholar] [CrossRef] [PubMed]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate Social Responsibility and Access to Finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Radhakrishnan, S.; Tsang, A.; Yang, Y.G. Nonfinancial Disclosure and Analyst Forecast Accuracy: International Evidence on Corporate Social Responsibility Disclosure. Account. Rev. 2012, 87, 723–759. [Google Scholar] [CrossRef]

- Attig, N.; El Ghoul, S.; Guedhami, O.; Suh, J. Corporate Social Responsibility and Credit Ratings. J. Bus. Ethics 2013, 117, 679–694. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.; Mishra, D.R. Does Corporate Social Responsibility Affect the Cost of Capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Albinger, H.S.; Freeman, S.J. Corporate Social Performance and Attractiveness as an Employer to Different Job Seeking Populations. J. Bus. Ethics 2000, 28, 243–253. [Google Scholar] [CrossRef]

- Sciarelli, M.; Cosimato, S.; Landi, G.; Iandolo, F. Socially Responsible Investment Strategies for the Transition towards Sustainable Development: The Importance of Integrating and Communicating ESG. TQM J. 2021, 33, 39–56. [Google Scholar] [CrossRef]

- Sciarelli, M.; Tani, M.; Landi, G.; Turriziani, L. CSR Perception and Financial Performance: Evidences from Italian and UK Asset Management Companies. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 841–851. [Google Scholar] [CrossRef]

- Palazzo, G.; Richter, U. CSR Business as Usual? The Case of the Tobacco Industry. J. Bus. Ethics 2005, 61, 387–401. [Google Scholar] [CrossRef]

- Jin, L.; Myers, S. R2 around the world: New theory and new tests. J. Financ. Econ. 2006, 79, 257–292. [Google Scholar] [CrossRef]

- El Khoury, R.; Nasrallah, N.; Alareeni, B. The Determinants of ESG in the Banking Sector of MENA region: A Trend or Necessity? Compet. Rev. Int. Bus. J. 2023, 33, 7–29. [Google Scholar] [CrossRef]

- Rezaee, Z.; Homayoun, S.; Poursoleyman, E.; Rezaee, N. Comparative Analysis of Environmental, Social, and Governance Disclosures. Glob. Financ. J. 2023, 55, 100804. [Google Scholar] [CrossRef]

- Grewal, J.; Hauptmann, C.; Serafeim, G. Material sustainability information and stock price informativeness. J. Bus. Ethics 2020, 171, 513–544. [Google Scholar] [CrossRef]

- Grewal, J.; Riedl, E.J.; Serafeim, G. Market reaction to mandatory nonfinancial disclosure. Manag. Sci. 2019, 65, 2947–3448. [Google Scholar] [CrossRef]

- Ioannou, I.; Serafeim, G. The consequences of mandatory corporate sustainability reporting. In The Oxford Handbook of Corporate Social Responsibility: Psychological and Organizational Perspectives; Oxford University Press: Oxford, UK, 2019; pp. 452–489. [Google Scholar]

- Alareeni, B.A.; Hamdan, A. ESG Impact on Performance of US S&P 500-listed firms. Corp. Gov. 2020, 20, 1409–1428. [Google Scholar]

- Santamaria, R.; Paolone, F.; Cucari, N.; Dezi, L. Non-financial Strategy Disclosure and Environmental, Social and Governance Score: Insight from a Configurational Approach. Bus. Strategy Environ. 2021, 30, 1993–2007. [Google Scholar] [CrossRef]

- European Parliament and the Council of the European Union. Directive (EU) 2022/2464 of the European Parliament and of the Council amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as Regards Corporate Sustainability Reporting. Off. J. Eur. Union 2022, 322, 15–80. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32022L2464 (accessed on 28 August 2023).

- Fiechter, P.; Hitz, J.M.; Lehmann, N. Real Effects of a Widespread ESG Reporting Mandate: Evidence from the European Union’s ESG directive. J. Account. Res. 2022, 60, 1499–1549. [Google Scholar] [CrossRef]

- European Union (EU). Directive 2014/95/EU. Directive 2014/95/EU of the European Parliament and of the Council Amending Directive 2013/34/EU as Regards Disclosure of Non-Financial and Diversity Information by Certain Large Undertakings and Groups. 2022. Available online: https://eur-lex.europa.eu/legal-content/ (accessed on 25 April 2023).

- Christensen, D.M.; Serafeim, G.; Sikochi, A. Why is Corporate Virtue in the Eye of the Beholder? The Case of ESG ratings. Account. Rev. 2022, 97, 147–175. [Google Scholar] [CrossRef]

- Lu, H.; Peng, Q.; Shin, J.E.; Yu, L. Migration of Global Supply Chains: A Real Effect of Mandatory ESG Disclosure; Working paper; University of Toronto: Toronto, ON, USA, 2022. [Google Scholar]

- Zhang, Q.; Ding, R.; Chen, D.; Zhang, X. The Effects of Mandatory ESG Disclosure on Price Discovery Efficiency around the World; Working paper; University of Sussex Business School: Brighton, UK, 2022; Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4308420 (accessed on 25 April 2023).

- Mbanyele, B.; Huang, H.; Li, Y.; Muchenje, H.; Wang, F. Corporate Social Responsibility and Green Innovation: Evidence from Mandatory CSR disclosure laws. Econ. Lett. 2022, 21, 110322. [Google Scholar] [CrossRef]

- Krueger, P.; Sauter, Z.; Yongjun Tang, D.; Zhong, R. The Effects of Mandatory ESG Disclosure around the World; Research Paper Series N 21-44; Swiss Finance Institute: Zürich, Switzerland, 2023. [Google Scholar]

- Bai, X.; Han, J.; Ma, Y.; Zhang, W. ESG Performance, Institutional Investors’ Preference and Financing Constraints: Empirical Evidence from China. Borsa Istanbul Review. 2022. Available online: https://www.elsevier.com/journals/borsa-istanbul-review/2214-8450 (accessed on 25 April 2023).

- Sun, Y.; Xu, C.; Ding, R.; Cao, Y. Does Innovation in Environmental, Social, and Governance Disclosures Pay off in China? An Integrated Reporting Perspective, Borsa Istanbul Review. 2023. Available online: https://www.elsevier.com/journals/borsa-istanbul-review/2214-8450g (accessed on 26 January 2023).

- Bischoff, B. Anti-ESG Legislation in the USA: Emerging Risk for Financial Institutions? 2022. Available online: https://www.ecofact.com/blog/anti-esg-legislation-in-the-usa-emerging-risk-for-financial-institutions/ (accessed on 26 January 2023).

- Sorkin, A.R.; Giang, V.; Gandel, S.; Warner, B.; de la Merced, M.J.; Hirsch, L.; Livni, E. BlackRock Seeks to Defend Its Reputation Over E.S.G. Fight The World’s Largest Money Manager Fired off a Letter to Attorneys General in 19 States Rebutting Claims about Its Position on Climate-Minded Investing. The New York Times. 2022/09/08. Available online: https://www.nytimes.com/2022/09/08/business/dealbook/blackrock-texas-defend-reputation-esg-fight.html (accessed on 26 January 2023).

- Smart, T. The New Front of the Culture Wars for GOP Governors: ESG Investing, Florida’s Ron DeSantis is the Latest GOP Governor to Take on ‘Woke’ Wall Street. 13 September 2022. Available online: https://www.usnews.com/news/politics/articles/2022-09-13/the-new-front-of-the-culture-wars-for-gop-governors-esg-investing (accessed on 29 January 2023).

- Ramírez-Orellana, A.; Martínez-Victoria, M.C.; García-Amate, A.; Rojo-Ramírez, A.A. Is the Corporate Financial Strategy in the Oil and Gas Sector Affected by ESG Dimensions? Resour. Policy 2023, 81, 103303. [Google Scholar] [CrossRef]

- International Energy Agency. World Energy Outlook 2021. 2021. Available online: https://www.eia.gov/pressroom/presentations/AEO2021_Release_Presentation.pdf (accessed on 25 April 2023).

- Shiu, Y.M.; Yang, S.L. Does Engagement in Corporate Social Responsibility Provide Strategic Insurance-like Effects? Strateg. Manag. J. 2017, 38, 455–470. [Google Scholar] [CrossRef]

- Godfrey, P.C. The Relationship Between Corporate Philanthropy and Shareholder Wealth: A Risk Management Perspective. Acad. Manag. Rev. 2005, 30, 777–798. [Google Scholar] [CrossRef]

- Minor, D.; Morgan, J. CSR as Reputation Insurance: Primum non-nocere. Calif. Manag. Rev. 2011, 53, 40–59. [Google Scholar] [CrossRef]

- Aono, K.; Okimoto, T. When Does the Japan Empowering Women Index Outperform its Parent and the ESG Select Leaders Indexes? Int. Rev. Financ. Anal. 2023, 85, 102428. [Google Scholar] [CrossRef]

- Ellouze, D. The Role of Customers and Employees in the Buffer Effect of Corporate Social Responsibility in Times of Crisis. Manag. Financ. 2020, 46, 955–975. [Google Scholar] [CrossRef]

- Lins, K.V.; Servaes, H.; Tamayo, A. Social Capital, Trust, and Firm Performance: The Value of Corporate Social Responsibility During the Financial Crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar] [CrossRef]

- Zhang, L.; Shan, Y.G.; Chang, M. Can CSR Disclosure Protect Firm Reputation During Financial Restatements? J. Bus. Ethics 2021, 173, 157–184. [Google Scholar] [CrossRef]

- Guimarães, T.M.; Malaquias, R.D. Performance of Equity Mutual Funds considering ESG investments, Financial Constraints, and the COVID-19 Pandemic. Braz. Bus. Rev. 2023, 20, 18–37. [Google Scholar] [CrossRef]

- Becchetti, L.; Ciciretti, R.; Dalò, A.; Herzel, S. Socially Responsible and Conventional Investment Funds: Performance Comparison and the Global Financial Crisis. J. Appl. Econ. 2015, 47, 2541–2562. [Google Scholar] [CrossRef]

- Nofsinger, J.; Varma, A. Socially Responsible Funds and Market Crises. J. Bank. Financ. 2014, 48, 180–193. [Google Scholar] [CrossRef]

- Cai, Y.; Jo, H.; Pan, C. Doing Well While Doing Bad? CSR in Controversial Industry Sectors. J. Bus. Ethics 2012, 108, 467–480. [Google Scholar] [CrossRef]

- Yuan, X.; Li, Z.; Xu, J.; Li, S. ESG Disclosure and Corporate Financial Irregularities—Evidence from Chinese listed firms. J. Clean. Prod. 2022, 332, 129992. [Google Scholar] [CrossRef]

- Liu, L.; Xu, Y.; Rao, P.; Chen, Y. The Contagion Effects of Irregularities Within Business Groups. J. Financ. Res. 2019, 468, 113–131. [Google Scholar]

- Ye, K.; Cao, F.; Wang, H. Can Internal Control Information Disclosure Reduce Stock Price Crash Risk? J. Financ. Res. 2015, 416, 192–206. [Google Scholar]

- Fombrun, C.; Shanley, M. What’s in a Name? Reputation Building and Corporate Strategy. Acad. Manag. J. 1990, 33, 233–258. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, L.; Jin, S. Environmental Performance, Social Responsibility and Corporate Governance (ESG) Ratings and Financial Risk. Environ. Eng. Manag. J. 2022, 21, 857–868. Available online: http://www.eemj.eu (accessed on 25 April 2023).

- Orlitzky, M.; Benjamin, J.D. Corporate Social Performance and Firm Risk: A Meta-Analytic Review. Bus. Soc. 2001, 40, 369–396. [Google Scholar] [CrossRef]

- La Torre, M.; Mango, F.; Cafaro, A.; Leo, S. Does the ESG Index Affect Stock Return? Evidence, from the Eurostoxx50. Sustainability 2020, 12, 6387. [Google Scholar] [CrossRef]

- Champagne, C.; Coggins, F.; Sodjahin, A. Can extra-financial ratings serve as an indicator of ESG risk? Glob. Financ. J. 2022, 54, 100638. [Google Scholar] [CrossRef]

- Sabbaghi, O. The Impact of News on the Volatility of ESG firms. Glob. Financ. J. 2022, 51, 100570. [Google Scholar] [CrossRef]

- Kanouse, D.E.; Hansen, L.R., Jr. Negativity in evaluations. In Attribution: Perceiving the Causes of Behavior; Jones, E.E., Kanouse, D.E., Kelley, H.H., Nisbett, R.E., Valin, S., Weiner, B., Eds.; General Learning Press: Morristown, NJ, USA, 1971; pp. 47–62. [Google Scholar]

- Peeters, G. The Positive-Negative Asymmetry: On Cognitive Consistency and Positivity Bias. Eur. J. Soc. Psychol. 1971, 1, 455–474. [Google Scholar] [CrossRef]

- Peeters, G.; Czapinski, J. Positive-negative Asymmetry in Evaluations: The Distinction between Affective and Informational Negativity Effects. Eur. Rev. Soc. Psychol. 1990, 1, 33–60. [Google Scholar] [CrossRef]

- Akhtar, S.; Faff, R.; Oliver, B.; Subrahmanyam, A. The Power of Bad: The Negativity Bias in Australian Consumer Sentiment Announcements on Stock Returns. J. Bank. Financ. 2011, 35, 1239–1249. [Google Scholar] [CrossRef]

- Ioannou, I.; Serafeim, G. What drives corporate social performance? The role of nation-level institutions. J. Int. Bus. Stud. 2012, 43, 834–864. [Google Scholar] [CrossRef]

- Hoang, K. Silent but deadly: Political corruption and voluntary ESG disclosure in the United States. Manag. Decis. Econ. 2022, 43, 2775–2793. [Google Scholar] [CrossRef]

- Malesky, E.J.; Nguyen, T.V.; Bach, T.N.; Ho, B.D. The Effect of Market Competition on Bribery in Emerging Economies: An Empirical Analysis of Vietnamese Firms. World Dev. 2020, 131, 104957. [Google Scholar] [CrossRef]

- Houqe, M.; Monem, R. IFRS Adoption, Extent of Disclosure, and Perceived Corruption: A cross–country study. Int. J. Account. 2016, 51, 363–378. [Google Scholar] [CrossRef]

- Agyei-Mensah, B.K.; Buertey, S. The Effect of Corruption And Culture On Corporate Social Performance: An Empirical Study. Soc. Responsib. J. 2019, 15, 1071–1086. [Google Scholar] [CrossRef]

- Quinson, T. Bank of America: Food Shocks Will Destabilise ESG. 21 May 2022. Available online: https://quota.media/food-shocks-will-also-destabilise-esg/ (accessed on 30 January 2023).

- Quinson, T. Food Shocks Will Also Destabilize the ESG World. 18 May 2022. Available online: https://www.bloomberg.com/news/articles/2022-05-18/food-shocks-will-also-destabilize-the-esg-world-green-insight?leadSource=uverify%20wall (accessed on 30 January 2023).

- Investment Officer. Goldman Sachs: ESG Implications of Russia-Ukraine Conflict. 2022. Available online: https://www.investmentofficer.nl/partners/goldman-sachs-asset-management/goldman-sachs-esg-implications-russia-ukraine-conflict-0 (accessed on 30 January 2023).

- Engler, H.U.S. Social Unrest Presents Opportunities for Firms to Enhance ESG Credentials, Bolster Ties with other Stakeholders Financial Regulatory Forum. 9 June 2020. Available online: https://jp.reuters.com/article/bc-finreg-social-unrest-esg-enhance-cred-idUSKBN23C2T8 (accessed on 30 January 2023).

- Granger, C.W.J.; Newbold, P. Spurious regressions in econometrics. J. Econom. 1974, 2, 111–120. [Google Scholar] [CrossRef]

- Karavias, Y.; Tzavalis, E. Testing for unit roots in short panels allowing for a structural break. Comput. Stat. Data Anal. 2014, 76, 391–407. [Google Scholar] [CrossRef]

- Perron, P. The Great Crash, the Oil Price Shock, and the Unit Root Hypothesis. Econometrica 1989, 57, 1361–1401. [Google Scholar] [CrossRef]

- Karavias, Y.; Narayan, P.K.; Westerlund, J. Structural Breaks in Interactive Effects Panels and the Stock Market Reaction to COVID-19. J. Bus. Econ. Stat. 2022, 41, 653–666. [Google Scholar] [CrossRef]

- Wooldridge, J. Multiplicative Panel Data Models without the Strict Exogeneity Assumption. Econom. Theory 1997, 13, 667–678. [Google Scholar] [CrossRef]

- Abdallah, W.; Goergen, M.; O’Sullivan, S.N. Endogeneity: How Failure to Correct for it can Cause Wrong Inferences and Some Remedies. Br. J. Manag. 2015, 26, 791–804. [Google Scholar] [CrossRef]

- Bai, B.; Perron, P. Estimating and Testing Linear Models with Multiple Structural Changes. Econometrica 1998, 66, 47–78. [Google Scholar] [CrossRef]

- Ditzen, J.; Karavias, Y.; Westerlund, J. Testing for Multiple Structural Breaks in Panel Data. arXiv 2021. Available online: https://arxiv.org/pdf/2110.14550.pdf (accessed on 25 April 2023).

- Capelle-Blancard, G.; Crifo, P.; Oueghlissi, R.; Scholtens, B. Environmental, Social and Governance (ESG) Performance and Sovereign Bond Spreads: An Empirical Analysis of OECD Countries; Working Paper; Université de Paris Ouest Nanterre La Défense: Nanterre, France, 2017; Volume 2017, pp. 1–56. [Google Scholar]

- Nicoletti, G.; Scarpetta, S.; Boylaud, O. Summary Indicators of Product and Market Regulation with an Extension to Employment Protection Legislation. 2000. Available online: www.oecd.org/eco/eco (accessed on 25 April 2023).

- Tabachnick, B.G.; Fidell, L.S. Using Multivariate Statistics, 5th ed.; Pearson Education: Boston, MA, USA, 2007. [Google Scholar]

- Chan, F.H.; Frey, B.; Skali, A.; Torgler, B. Political Entrenchment and GDP Misreporting; CREMA Working Paper Series 2019–02; Center for Research in Economics, Management and the Arts (CREMA): Zurich, Switzerland, 2019. [Google Scholar]

- Abed, G.; Gupta, S. Governance, Corruption, and Economic Performance; International Monetary Fund: Washington, DC, USA, 2003. [Google Scholar]

- Durlauf, S.; Kourtellos, A.; Tan, C.M. Are any growth theories robust. Econ. J. 2008, 118, 329–346. [Google Scholar] [CrossRef]

- Krambia-Kapardis, M.; Stylianou, I.; Dimitriou, S. Nonlinear nexus between corruption and tourism arrivals: A global analysis. Empir. Econ. J. 2022, 63, 1997–2024. [Google Scholar] [CrossRef]

- Yadav, V.; Mukherjee, B. The Politics of Corruption in Dictatorships; Cambridge University Press: New York, NY, USA, 2016. [Google Scholar]

- Galbreath, J. ESG in Focus: The Australian Evidence. J. Bus. Ethics 2013, 118, 529–541. [Google Scholar] [CrossRef]

- Nicholson, G.; Kiel, G.; Kiel-Chisholm, S. The Contribution of Social Norms to the Global Financial Crisis: A Systemic Actor Focused Model and Proposal for Regulatory Change. Corp. Gov. Int. Rev. 2011, 19, 471–488. [Google Scholar] [CrossRef]

- Schapiro, M. SEC Issues Interpretive Guidance on Disclosure Related to Business or Legal Developments Regarding Climate Change. 2010. Available online: https://www.sec.gov/news/speech/2010/spch012710mls-climate.htm (accessed on 25 April 2023).

- Krambia-Kapardis, M. Corporate Fraud and Corruption: A Holistic Approach to Preventing Financial Crisis; Palgrave Macmillan: New York, NY, USA, 2016. [Google Scholar]

- Adams, S.; Simnett, R. Integrated Reporting: An opportunity for Australia’s Not for Profit Sector. Aust. Account. Rev. 2011, 21, 292–301. [Google Scholar] [CrossRef]

- Aljazeera. G20 Environment Meeting Ends without Agreement on Climate Crisis. 2023. Available online: https://www.aljazeera.com/news/2023/7/28/g20-environment-meeting-ends-without-agreement-on-climate-crisis (accessed on 11 September 2023).

- Camilleri, M.A. Walking the talk about corporate social responsibility communication: An elaboration likelihood model perspective. Bus. Ethics Environ. Responsib. 2022, 31, 649–661. [Google Scholar] [CrossRef]

- Arvidsson, S.; Dumay, J. Corporate ESG reporting quantity, quality and performance: Where to now for environmental policy and practice? Bus. Strategy Environ. 2022, 31, 1091–1110. [Google Scholar] [CrossRef]

- McGarry, C.; Connellan, C.; MacLennan, J.; Pullins, T.; Gez, M.; Hublet, A.; De Catelle, W. The Global ESG Regulatory Framework Toughens up. 2022. Available online: https://www.whitecase.com/insight-alert/global-esg-regulatory-framework-toughens (accessed on 28 August 2023).

- Camilleri, M.A. Theoretical insights on integrated reporting: The inclusion of non-financial capitals in corporate disclosures. Corp. Commun. Int. J. 2018, 23, 567–581. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Krambia-Kapardis, M.; Savva, C.S.; Stylianou, I. Socio-Economic Factors Affecting ESG Reporting Call for Globally Agreed Standards. Sustainability 2023, 15, 14927. https://doi.org/10.3390/su152014927

Krambia-Kapardis M, Savva CS, Stylianou I. Socio-Economic Factors Affecting ESG Reporting Call for Globally Agreed Standards. Sustainability. 2023; 15(20):14927. https://doi.org/10.3390/su152014927

Chicago/Turabian StyleKrambia-Kapardis, Maria, Christos S. Savva, and Ioanna Stylianou. 2023. "Socio-Economic Factors Affecting ESG Reporting Call for Globally Agreed Standards" Sustainability 15, no. 20: 14927. https://doi.org/10.3390/su152014927

APA StyleKrambia-Kapardis, M., Savva, C. S., & Stylianou, I. (2023). Socio-Economic Factors Affecting ESG Reporting Call for Globally Agreed Standards. Sustainability, 15(20), 14927. https://doi.org/10.3390/su152014927