How Does Environmental Tax Influence the Scale and Efficiency of Green Investment among China’s Heavily Polluting Enterprises?

Abstract

:1. Introduction

2. Institutional Background and Literature Review

2.1. Background of the EPTL Policy

2.2. Literature Review and Hypothesis Development

3. Data and Research Design

3.1. Data and Sample Selection

3.2. Variables

3.2.1. Dependent Variables

- (1)

- Level of green investment

- (2)

- Efficiency of green investment

3.2.2. Variable of Interest

3.2.3. Control Variables

- (1)

- Firm size (Size): This was measured as the logarithm of the firm’s year-end assets, indicating resource endowment and risk tolerance. Larger firms, given their advantages, tend to invest more in environmental protection. They are also more likely to be scrutinized, and thus more attentive to environmental concerns.

- (2)

- Age (Age): This was measured as the natural logarithm of the years since the public listing. Different life cycle stages of a firm influence its investment preferences. We anticipate that firms in mature stages, with well-established governance mechanisms, are more likely to invest in environmental protection due to potential innovation benefits and positive societal responses.

- (3)

- Financial leverage (Lev): This was measured as the total liabilities deflated by the total assets, depicting the company’s risk resistance and its influence on financing and investment decisions. High financial leverage may deter firms from proactively investing in environmental protection to avoid potential losses.

- (4)

- Cashflow Ratio (Cashflow): This was calculated as the net cash flow from annual operating activities divided by the total assets. It reflects the firm’s cash obtainability, which affects the performance assessment and the confidence to increase investment levels, including investment in green initiatives.

- (5)

- Profitability (Roe): This was measured as the ratio of the total net profit to the average total net assets, indicating corporate profitability. A higher value suggests stronger profitability and a greater capacity for green investment.

- (6)

- Growth (TobinQ): This was measured as the ratio of the firm’s market value to its total assets. A higher Tobin’s Q implies better growth prospects, which encourages firms to uphold legal compliance and social responsibility, including green investment.

- (7)

- Shareholding Concentration (Top10): This was measured as the ratio of the total shares held by the top ten shareholders to the total issued shares of the company. It reflects the dispersion of corporate control, affecting corporate decisions, investments, and distributions. A high shareholding concentration may suppress environmental investment due to its inherent high costs and low returns.

- (8)

- Proportion of Independent Directors (Indep): This is the ratio of independent directors to the total board seats and reflects the governance structure of the firm, thereby influencing its investment decisions.

- (9)

- Institutional Investor Shareholding (Inst): This is the proportion of shares held by institutional investors in relation to other shareholders, reflecting market confidence in the company’s operations. The support and advice of institutional investors can also influence corporate investment decisions.

- (10)

- Agency Cost (AC): This was measured by the rate of management expenses. Lower agency costs often reflect serious principal-agent problems, which can impact both the level and efficiency of green investments.

3.2.4. Other Variables

- (1)

- Nature of property rights (Soe): State-owned enterprises were conferred a value of 1, with all others receiving a value of 0.

- (2)

- Regional environmental governance level (EG): The formula we used to measure it was to divide the total investment completed in industrial pollution control in that province in a given year by the added value of the industry in that province. Here, the total investment completed in industrial pollution control refers to the funds used to form fixed assets in the investment of industrial pollution source control and urban environmental infrastructure construction. This includes investment in the control of new and old industrial pollution sources, investment in environmental protection that is concurrent with the project’s construction, and funds invested in urban environmental infrastructure construction.

- (3)

- Financing constraint status (D_fc): Following the methodology of Whited and Wu (2006) and Hadlock and Pierce (2010), we calculated the FC and WW indices [54,55]. Details outlined in Appendix C The absolute values of these indices served as measures of a firm’s financing constraints. A higher index value indicated greater financing constraints. Firms with values above the median were categorized as having high financing constraints and were assigned a value of 1. Those below the median were classified as low financing constraint firms and were assigned a value of 0.

- (4)

- Executive shareholding status (D_Mshare): The executive shareholding ratio was equal to the total number of shares held by executives divided by the total number of outstanding shares. A higher executive shareholding ratio suggested fewer conflicts of interest between managers and shareholders, thereby indicating fewer agency problems within the company. For the firms with an executive shareholding ratio above the median, the executive shareholding statuses were assigned a value of 1, while those below the median were assigned a value of 0.

- (5)

- Agency cost status (D_AC): We used the management expense ratio as a measure of a firm’s agency cost. The ratio was obtained by dividing the management expenses by the total operating revenues. Firms with an agency cost ratio above the median were assigned a value of 1, whereas those below the median were assigned a value of 0. Lower agency costs were correlated with a higher propensity for agency issues.

3.2.5. Descriptive Statistics

3.3. Research Design

4. Empirical Results

4.1. Environmental Tax and Level of Green Investment

4.1.1. Baseline Regression

4.1.2. Robustness Checks

- (1)

- Parallel trends

- (2)

- Concern for endogeneity

- (3)

- Using alternative measures of GI

- (4)

- Accounting for industry-specific policies

4.1.3. Heterogeneity Analysis

- (1)

- Differentiating firms based on the nature of their property rights

- (2)

- Differentiating the firms based on the tightness of their financial constraints

- (3)

- Differentiating firms based on regional environmental governance

4.2. Environmental Tax and Green Investment Efficiency

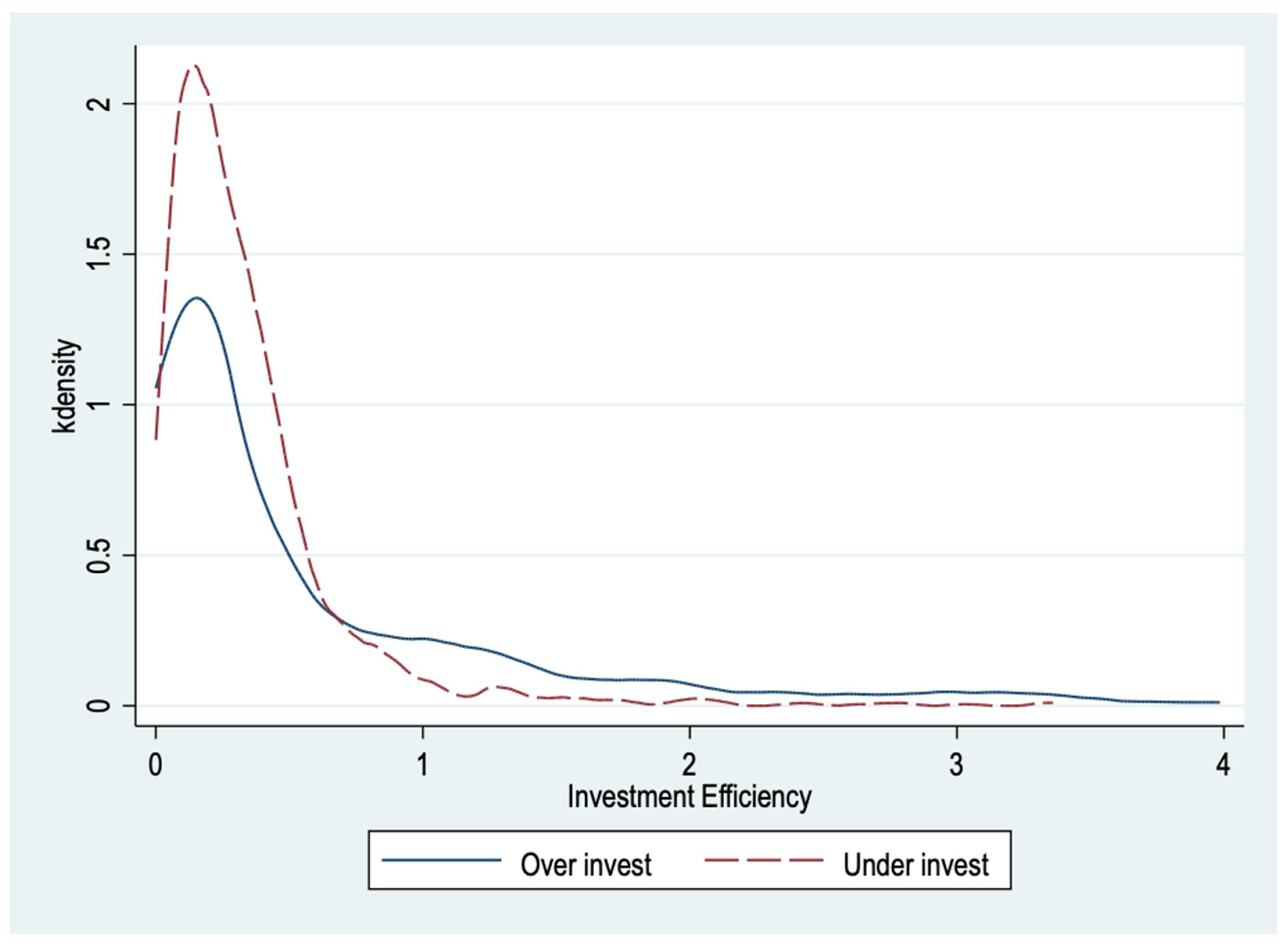

4.2.1. Overinvestment vs. Underinvestment

4.2.2. Parallel Trend Tests

4.2.3. The Role of the Agency Problem

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

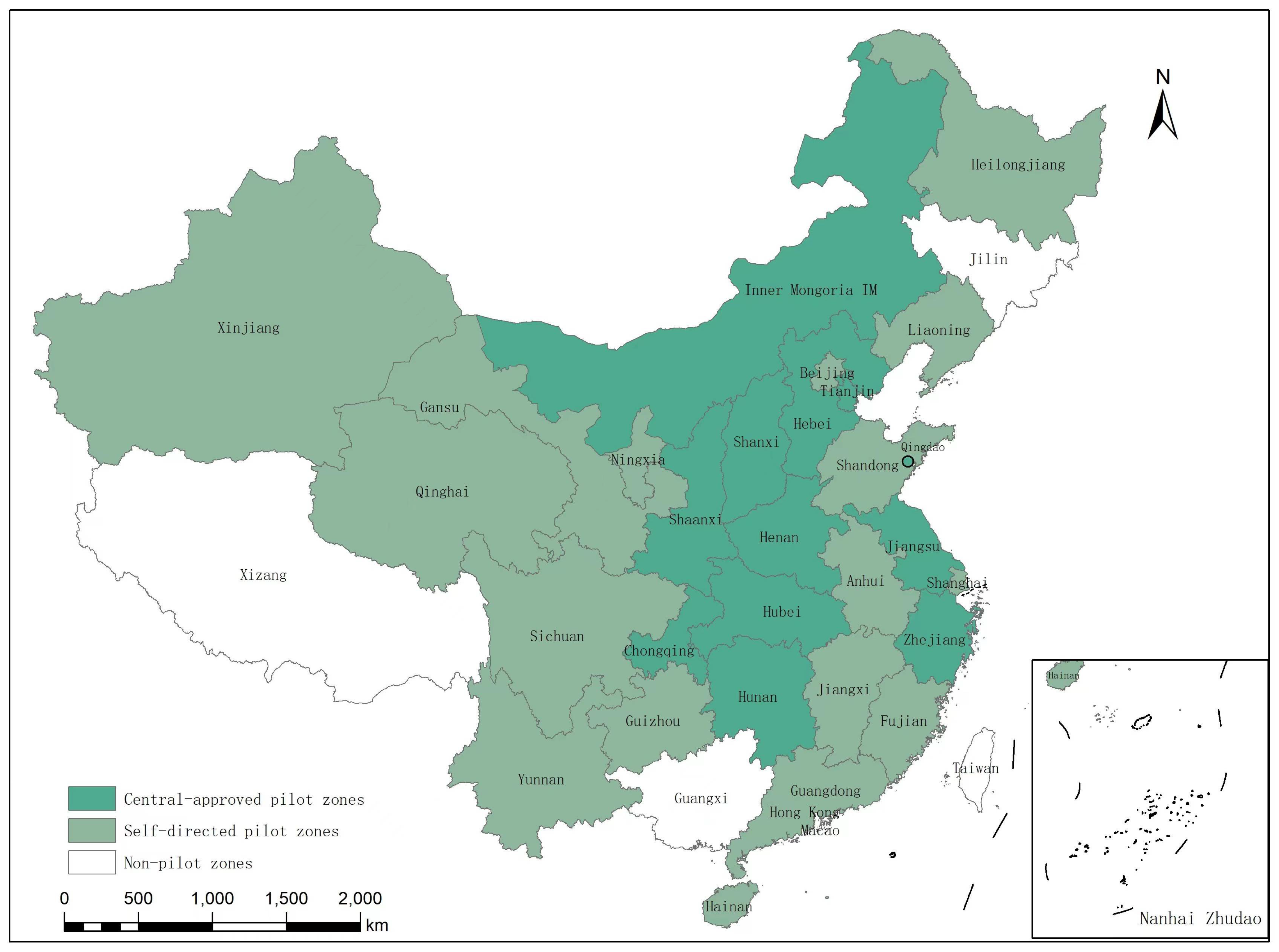

Appendix A. Distribution of Pilot Zones for Emission Trading in China

Appendix B. Tax Rates on Water and Air Pollutants Across the Regions, 2018

| Regions | Tax Rate | ||

|---|---|---|---|

| Water Pollutants (Yuan/Pollution Equivalent) | Air Pollutants (Yuan/Pollution Equivalent) | ||

| Tax burden increases (Treatment group) | Beijing | 14 | 12 |

| Henan, Hunan | 5.6 | 4.8 | |

| Sichuan | 2.8 | 3.9 | |

| Chongqing | 3 | 3.5 | |

| Guizhou, Hainan | 2.8 | 2.4 | |

| Guangxi | 2.8 | 1.8 | |

| Shanxi | 2.1 | 1.8 | |

| Jiangsu | Nanjing: 8.4; others: 5.6 | Nanjing: 8.4; others: 4.8 | |

| Hebei | Tier 1: major pollutants 11.2, others 5.6; Tier 2: major pollutants 7, others 5.6; Tier 3: 5.6 | Tier 1: major pollutants 9.6, others 4.8; Tier 2: major pollutants 6, others 4.8; Tier 3: 4.8 | |

| Shandong | Ammonia nitrogen, COD, five heavy metals 3; others 1.4 | Sulfur dioxide, nitrogen oxides 6; Others 1.2 | |

| Tax burden remains (Control group) | Tianjin | 10 | 10 |

| Shanghai | COD5; Ammonia nitrogen 4.8; others 1.4 | Sulfur dioxide 6.65; nitrogen oxides 7.6; others 1.2 | |

| Guangdong | 2.8 | 1.8 | |

| Yunnan | 1.4 | 1.2 | |

| Hubei | Phosphorus, ammonia nitrogen, COD, five heavy mentals 2.8; others 1.4 | Sulfur dioxide, nitrogen oxides 2.4; others 1.2 | |

| Zhejiang | Five heavy mentals 1.8; others 1.4 | Four heavy mentals 1.8; others 1.4 | |

| Fujian | Phosphorus, ammonia nitrogen, COD, five heavy mentals 1.5; others 1.4 | 1.2 | |

| Heilongjiang, Jilin, Liaoning, Anhui, Gansu, Shaanxi, Jiangxi, Qinghai, Inner Mongolia, Ningxia, Xinjiang, Tibet | 1.4 | 1.2 | |

Appendix C. The Description of the WW and FC Score

- (i)

- We drew upon White and Wu (2006) and constructed the WW index based on the following equation [54].

- (ii)

- We drew upon Hadlock and Pierce (2009) to construct the FC index based on the following equation [55].

References

- Guo, J.J.; Fang, Y.; Yang, Y. Does China’s pollution levy standards reform promote emissions reduction? J. World Econ. 2019, 42, 121–144. [Google Scholar]

- Berman, E.; Bui, L.T.M. Environmental regulation and productivity: Evidence from oil refineries. Rev. Econ. Stat. 2001, 83, 498–510. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Peterson, S.R.; Portney, P.R.; Stavins, R.N. Environmental regulation and the competitiveness of U.S. manufacturing: What does the evidence tell us? J. Econ. Lit. 1995, 33, 132–163. [Google Scholar]

- Soppe, A. Sustainable corporate finance. J. Bus. Ethics 2004, 53, 213–224. [Google Scholar] [CrossRef]

- Iotti, M.; Bonazzi, G. Analysis of the risk of bankruptcy of tomato processing companies operating in the inter-regional interprofessional organization. Sustainability 2018, 10, 947. [Google Scholar] [CrossRef]

- Wen, H.; Deng, W.; Guo, Q. The effects of the environ tax on heavily polluting firms in China. PLoS ONE 2021, 16, e0261342. [Google Scholar] [CrossRef]

- Huang, S.; Lin, H.; Zhou, Y.; Ji, H.; Zhu, N. The influence of the policy of replacing environmental protection fees with taxes on enterprise green innovation—Evidence from China’s heavily polluting industries. Sustainability 2022, 14, 6850. [Google Scholar] [CrossRef]

- Ji, L.; Zeng, T. Environmental “Fee-to-Tax” and heavy pollution enterprises to de-capacity. Sustainability 2022, 14, 5312. [Google Scholar] [CrossRef]

- He, Y.; Zhu, X.; Zheng, H. The influence of environmental protection tax law on total factor productivity: Evidence from listed firms in China. Energy Econ. 2022, 113, 106248. [Google Scholar] [CrossRef]

- Liu, T.; Fang, Y.; Shi, Q.; Ren, L. Research on the effect of the new environmental protection law on the market competitiveness of China’s heavily polluting enterprises. Sustainability 2023, 15, 10311. [Google Scholar] [CrossRef]

- Zheng, Q.; Li, J.; Duan, X. The impact of environmental tax and R&D tax incentives on green innovation. Sustainability 2023, 15, 7303. [Google Scholar]

- Peng, M.; Wei, C.; Jin, Y.; Ran, H. Does the environmental tax reform positively impact corporate environmental performance? Sustainability 2023, 15, 8023. [Google Scholar] [CrossRef]

- Jiang, X.; Li, G.; Fan, X. Environmental protection fee-to-tax and corporate environmental social responsibility: A test based on corporate life cycle theory. Sustainability 2023, 15, 2128. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der Linde, C. Toward a new conception of the environment competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Liao, X.; Shi, X. Public appeal, environmental regulation and green investment: Evidence from China. Energy Policy 2018, 119, 554–562. [Google Scholar] [CrossRef]

- Liu, G.; Yang, Z.; Zhang, F.; Zhang, N. Environmental tax reform and environmental investment: A quasi-natural experiment based on China’s environmental protection tax law. Energy Econ. 2022, 109, 106000. [Google Scholar] [CrossRef]

- Li, G.; Masui, T. Assessing the impacts of China’s environmental tax using a dynamic computable general equilibrium model. J. Clean Prod. 2019, 208, 316–324. [Google Scholar] [CrossRef]

- Albrizio, S.; Kozluk, T.; Zipperer, V. Environmental policies and productivity growth: Evidence across industries and firms. J. Environ. Econ. Manag. 2017, 81, 209–226. [Google Scholar] [CrossRef]

- Bergek, A.; Berggren, C.; KITE Research Group. The impact of environmental policy instruments on innovation: A review of energy and automotive industry studies. Ecol. Econ. 2014, 106, 112–123. [Google Scholar] [CrossRef]

- Shi, X.; Xu, Z. Environmental regulation and firm exports: Evidence from the eleventh five-year plan in China. J. Environ. Econ. Manag. 2018, 89, 187–200. [Google Scholar] [CrossRef]

- Cai, W.; Ye, P. How does environmental regulation influence enterprises’ total factor productivity? A quasi-natural experiment based on China’s new environmental protection law. J. Clean Prod. 2020, 276, 124–125. [Google Scholar] [CrossRef]

- Wang, L.; Ma, P.; Song, Y.; Zhang, M. How does environmental tax affect enterprises’ total factor productivity—Evidence from the reform of environmental fee-to-tax in China. J. Clean Prod. 2023, 413, 137441. [Google Scholar] [CrossRef]

- Gray, W.B.; Shadbegian, R.J. Plant vintage, technology, and environmental regulation. J. Environ. Econ. Manag. 2003, 46, 384–402. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, J.; Xue, Y.; Yang, J. Impact of environmental regulations on green technological innovative behavior: An empirical study in China. J. Clean Prod. 2018, 188, 763–773. [Google Scholar] [CrossRef]

- Yip, C.M. On the labor market consequences of environmental taxes. J. Environ. Econ. Manag. 2018, 89, 136–152. [Google Scholar] [CrossRef]

- Wang, J.; Wang, K.; Shi, X.; Wei, Y.M. Spatial heterogeneity and driving forces of environmental productivity growth in China: Would it help to switch pollutant discharge fees to environmental taxes? J. Clean Prod. 2019, 223, 36–44. [Google Scholar] [CrossRef]

- Kay, D.; Jolley, G.J. Using input–output models to estimate sectoral effects of carbon tax policy: Applications of the NGFS scenarios. Am. J. Econ. Sociol. 2023, 82, 187–222. [Google Scholar] [CrossRef]

- Wang, Q.; Hubacek, K.; Feng, K.; Wei, Y.M.; Liang, Q.M. Distributional effects of carbon taxation. Appl. Energy 2016, 184, 1123–1131. [Google Scholar] [CrossRef]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 996–1014. [Google Scholar] [CrossRef]

- Banerjee, S.B. Managerial perceptions of corporate environmentalism: Interpretations from industry and strategic implications for organizations. J. Manag. Stud. 2001, 38, 489–513. [Google Scholar] [CrossRef]

- Tang, M.F.; Walsh, G.; Lerner, D.; Fitza, M.A.; Li, Q.H. Green innovation, managerial concern and firm performance: An empirical study. Bus. Strategy Environ. 2018, 27, 39–51. [Google Scholar] [CrossRef]

- Gu, Y.; Ho, K.C.; Yan, C.; Gozgor, G. Public environmental concern, CEO turnover, and green investment: Evidence from a quasi-natural experiment in China. Energy Econ. 2021, 100, 105379. [Google Scholar] [CrossRef]

- Chen, Y.; Ma, Y. Does green investment improve energy firm performance? Energy Policy 2021, 153, 112252. [Google Scholar] [CrossRef]

- Hart, S.L.; Ahuja, G. Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Bus. Strategy Environ. 1996, 5, 30–37. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Weche, J.P. Does green corporate investment really crowd out other business investment? Indusial Corp. Chang. 2018, 28, 1279–1295. [Google Scholar]

- Fan, H.; Zivin, J.; Kou, Z.; Liu, X.; Wang, H. Going Green in China: Firms’ Responses to Stricter Environmental Regulations. Natl. Bur. Econ. Res. 2019, 26540. [Google Scholar] [CrossRef]

- Lee, K.-H.; Min, B. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean Prod. 2015, 108, 534–542. [Google Scholar]

- Xu, Q.; Lei, Y.; Ge, J.; Ma, X. Did investment become green in China? Evidence from a sectoral panel analysis from 2003 to 2012. J. Clean Prod. 2017, 156, 500–506. [Google Scholar] [CrossRef]

- Liu, B.L.; Zhao, Z.; Zhang, M.; Zhou, D. Green investment efficiency in the Chinese energy sector: Overinvestment or underinvestment? Energy Policy 2022, 160, 112694. [Google Scholar] [CrossRef]

- Rubashkina, Y.; Galeotti, M.; Verdolini, E. Environmental Regulation and Competitiveness: Empirical Evidence on the Porter Hypothesis from European Manufacturing Sectors. Energy Policy 2015, 83, 288–300. [Google Scholar] [CrossRef]

- Liao, Z. Environmental policy instruments, environmental innovation and the reputation of enterprises. J. Clean Prod. 2018, 171, 1111–1117. [Google Scholar] [CrossRef]

- Zhu, Q.H.; Liu, J.J.; Lai, K.H. Corporate Social Responsibility Practices and Performance Improvement Among Chinese National State-Owned Enterprises. Int. J. Prod. Econ. 2016, 171, 417–426. [Google Scholar] [CrossRef]

- Liu, L.; Zhao, Z.; Zhang, M.; Zhou, C.; Zhou, D. The effects of environmental regulation on outward foreign direct investment’s reverse green technology spillover: Crowding out or facilitation? J. Clean Prod. 2021, 284, 124689. [Google Scholar] [CrossRef]

- Wang, K.; Zhang, H.M.; Tsai, S.B.; Wu, L.D.; Xue, K.K.; Fan, H.J.; Chen, Q. Does a board Chairman’s political connection affect green investment? From a sustainable perspective. Sustainability 2018, 10, 582. [Google Scholar] [CrossRef]

- Zhang, D.; Cao, H.; Zou, P. Exuberance in China’s renewable energy investment: Rationality, capital structure and implications with firm level evidence. Energy Policy 2016, 95, 468–478. [Google Scholar] [CrossRef]

- Yu, X.; Yao, Y.; Zheng, H.; Zhang, L. The role of political connection on overinvestment of Chinese energy firms. Energy Econ. 2020, 85, 104516. [Google Scholar] [CrossRef]

- Jensen, M.C. Agency costs of free cash flow, corporate finance, and takeovers. Am. Econ. Rev. 1986, 76, 323–329. [Google Scholar]

- Biddle, G.C.; Hilary, G. Accounting quality and firm-level capital investment. Account. Rev. 2006, 81, 963–982. [Google Scholar] [CrossRef]

- Biddle, G.C.; Hilary, G.; Verdi, R.S. How does financial reporting quality relate to investment efficiency? J. Account. Econ. 2009, 48, 112–131. [Google Scholar] [CrossRef]

- Benlemlih, M.; Bitar, M. Corporate social responsibility and investment efficiency. J. Bus. Ethics 2018, 48, 647–671. [Google Scholar] [CrossRef]

- Richardson, S. Over-investment of free cash flow. Rev. Account. Stud. 2006, 11, 159–189. [Google Scholar] [CrossRef]

- Wu, H.; Hao, Y.; Weng, J.H. How does energy consumption affect China’s urbanization? New evidence from dynamic threshold panel models. Energy Policy 2019, 127, 24–38. [Google Scholar] [CrossRef]

- Whited, T.M.; Wu, G. Financial constraints risk. Rev. Financ. Stud. 2006, 19, 531–559. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, J.R. New evidence on measuring financial constraints: Moving beyond the KZ index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Jensen, M.; Meckling, W. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Aggarwal, R.K.; Samwick, A.A. Empire-builders and shirkers: Investment, firm performance, and managerial incentives. J. Corp. Financ. 2006, 12, 489–515. [Google Scholar] [CrossRef]

- Darnall, N.; Jolley, G.J.; Ytterhus, B. Understanding the relationship between a facility’s environmental and financial performance. Environ. Policy Corp. Behav. 2007, 213–259. [Google Scholar] [CrossRef]

- Darnall, N.; Jolley, G.J.; Handfield, R. Environmental management systems and green supply chain management: Complements for sustainability? Bus. Strategy Environ. 2008, 17, 30–45. [Google Scholar] [CrossRef]

- Darnall, N.; Henriques, I.; Sadorsky, P. Do environmental management systems improve business performance in an international setting? J. Int. Manag. 2008, 14, 364–376. [Google Scholar] [CrossRef]

| Variable | NO. | Mean | S.D. | 25th Quartile | Median | 75th Quartile |

|---|---|---|---|---|---|---|

| GI | 3193 | 0.2466 | 1.305 | 0.0120 | 0.0453 | 0.1735 |

| GI_2 | 3193 | 0.6826 | 1.499 | 0.0525 | 0.1946 | 0.6289 |

| E_GI | 3193 | 0.4762 | 0.8616 | 0.1212 | 0.2608 | 0.4783 |

| DID | 3193 | 0.0905 | 0.2870 | 0 | 0 | 0 |

| Size | 3193 | 22.668 | 1.303 | 21.730 | 22.467 | 23.517 |

| Age (log) | 3193 | 2.460 | 0.6107 | 2.079 | 2.639 | 2.944 |

| Lev | 3193 | 0.4618 | 0.2023 | 0.3034 | 0.4644 | 0.6146 |

| Cash | 3193 | 0.0614 | 0.0672 | 0.0217 | 0.0600 | 0.0995 |

| ROE | 3193 | 0.0439 | 0.2582 | 0.0198 | 0.0595 | 0.1091 |

| Tobin Q | 3193 | 1.790 | 1.118 | 1.126 | 1.447 | 2.013 |

| Top 10 | 3193 | 0.5737 | 0.1518 | 0.4674 | 0.5765 | 0.6765 |

| Inst | 3193 | 0.4421 | 0.2329 | 0.2740 | 0.4550 | 0.6190 |

| SOE | 3193 | 0.5052 | 0.5000 | 0 | 1 | 1 |

| EG | 3193 | 0.4150 | 0.4928 | 0 | 0 | 1 |

| Agency costs | 3193 | 0.0740 | 0.0587 | 0.0383 | 0.0624 | 0.0948 |

| Mshare | 3193 | 0.0776 | 0.1549 | 0 | 0.0001 | 0.0528 |

| Variable | Green Investment (GI) | ||

|---|---|---|---|

| (1) | (2) | (3) | |

| Post × Treat | 1.008 *** | 0.721 *** | 0.727 *** |

| (0.078) | (0.104) | (0.104) | |

| Size | −0.028 | ||

| (0.027) | |||

| Age | −0.212 *** | ||

| (0.049) | |||

| AC | 1.249 *** | ||

| (0.447) | |||

| Lev | 0.349 ** | ||

| (0.149) | |||

| Cashflow | 0.299 | ||

| (0.361) | |||

| Roe | 0.075 | ||

| (0.095) | |||

| TobinQ | −0.018 | ||

| (0.025) | |||

| Inst | 0.134 | ||

| (0.132) | |||

| Top10 | −0.076 | ||

| (0.203) | |||

| Indep | −0.205 | ||

| (0.451) | |||

| _cons | 0.155 *** | 0.181 *** | 1.143 * |

| (0.024) | (0.024) | (0.613) | |

| Industry FE | Controlled | Controlled | |

| Province FE | Controlled | Controlled | |

| Year FE | Controlled | Controlled | |

| N | 3193 | 3193 | 3193 |

| R2 | 0.049 | 0.103 | 0.113 |

| Variable | Parallel Trend | |

|---|---|---|

| (1) | (2) | |

| Post2018 *Treat | 0.712 *** | |

| (0.167) | ||

| D2012 *Treat | −0.046 | −0.047 |

| (0.193) | (0.193) | |

| D2013 *Treat | −0.025 | −0.025 |

| (0.190) | (0.189) | |

| D2014 *Treat | −0.011 | −0.011 |

| (0.190) | (0.189) | |

| D2015 *Treat | 0.020 | 0.020 |

| (0.192) | (0.191) | |

| D2016 *Treat | −0.022 | −0.023 |

| (0.192) | (0.191) | |

| D2018 *Treat | 0.783 *** | |

| (0.207) | ||

| D2019 *Treat | 1.036 *** | |

| (0.205) | ||

| D2020 *Treat | 0.271 (0.212) | |

| Control variables | Controlled | Controlled |

| Industry FE | Controlled | Controlled |

| Province FE | Controlled | Controlled |

| Year FE | Controlled | Controlled |

| N | 3193 | 3193 |

| R2 | 0.113 | 0.117 |

| PSM–DID | Control for Firm-Fixed Effect | Alternative GI | Consider the Industry-Specific Policies | |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Post *Treat | 0.302 *** | 0.289 *** | 0.670 *** | 0.739 *** |

| (0.101) | (0.102) | (0.118) | (0.103) | |

| Control variables | Controlled | Controlled | Controlled | Controlled |

| Firm fixed effect | Controlled | |||

| Industry *t | Controlled | |||

| Industry * | Controlled | |||

| Industry FE | Controlled | Controlled | Controlled | |

| Province FE | Controlled | Controlled | Controlled | |

| Year FE | Controlled | Controlled | Controlled | |

| N | 3193 | 3193 | 3193 | 3193 |

| R2 | 0.034 | 0.587 | 0.133 | 0.138 |

| Variable | Green Investment | |

|---|---|---|

| (1) SOEs | (2) NSOEs | |

| Post *Treat | 1.101 *** | 0.448 *** |

| (0.186) | (0.97) | |

| Control variables | Controlled | Controlled |

| Industry FE | Controlled | Controlled |

| Province FE | Controlled | Controlled |

| Year FE | Controlled | Controlled |

| N | 1613 | 1580 |

| adj. R2 | 0.190 | 0.123 |

| Based on the FC Scores | Based on the WW Scores | |||

|---|---|---|---|---|

| (1) Higher Financial Constraints | (2) Lower Financial Constraints | (3) Higher Financial Constraints | (4) Lower Financial Constraints | |

| Post *Treat | 0.541 *** | 1.011 *** | 0.374 *** | 0.933 *** |

| (0.119) | (0.178) | (0.087) | (0.199) | |

| Control variables | Controlled | Controlled | Controlled | Controlled |

| Industry FE | Controlled | Controlled | Controlled | Controlled |

| Province FE | Controlled | Controlled | Controlled | Controlled |

| Year FE | Controlled | Controlled | Controlled | Controlled |

| N | 1596 | 1596 | 1444 | 1444 |

| R2 | 0.127 | 0.131 | 0.165 | 0.166 |

| Variable | Green Investment | |

|---|---|---|

| (1) Higher Level of Regional Environmental Governance | (2) Lower Level of Regional Environmental Governance | |

| Post *Treat | 0.448 *** | 1.069 *** |

| (0.096) | (0.188) | |

| Control variables | Controlled | Controlled |

| Industry FE | Controlled | Controlled |

| Province FE | Controlled | Controlled |

| Year FE | Controlled | Controlled |

| N | 1613 | 1580 |

| adj. R2 | 0.190 | 0.123 |

| Variable | Green Investment Efficiency | ||

|---|---|---|---|

| (1) All | (2) Underinvestment | (3) Overinvestment | |

| Post *Treat | 0.240 *** | 0.016 | 0.634 ** |

| (0.086) | (0.047) | (0.255) | |

| Control variables | Controlled | Controlled | Controlled |

| Industry FE | Controlled | Controlled | Controlled |

| Province FE | Controlled | Controlled | Controlled |

| Year FE | Controlled | Controlled | Controlled |

| N | 2119 | 1447 | 672 |

| adj. R2 | 0.139 | 0.233 | 0.242 |

| Variable | Parallel Trend | |

|---|---|---|

| (1) | (2) | |

| Post2018 *Treat | 0.230 * | |

| (0.130) | ||

| D2013 *Treat | −0.057 | −0.058 |

| (0.142) | (0.141) | |

| D2014 *Treat | −0.056 | −0.053 |

| (0.141) | (0.141) | |

| D2015 *Treat | 0.078 | 0.077 |

| (0.142) | (0.142) | |

| D2016 *Treat | −0.008 | −0.009 |

| (0.144) | (0.144) | |

| D2018 *Treat | 0.021 | |

| (0.181) | ||

| D2019 *Treat | 0.134 | |

| (0.157) | ||

| D2020 *Treat | 0.465 *** (0.160) | |

| Control variables | Controlled | Controlled |

| Industry FE | Controlled | Controlled |

| Province FE | Controlled | Controlled |

| Year FE | Controlled | Controlled |

| N | 2119 | 2119 |

| R2 | 0.139 | 0.142 |

| Panel A: Executive Shareholding Ratio | |||

| Variable | Green Investment Efficiency | ||

| (1) All | (2) Firms with a Lower Executive Shareholding Ratio | (3) Firms with a Higher Executive Shareholding Ratio | |

| Post *Treat | 0.400 *** | 0.390 *** | 0.121 |

| (0.113) | (0.137) | (0.116) | |

| Post *Treat *D_AC1 | −0.272 *** | ||

| (0.126) | |||

| Control variables | Controlled | Controlled | Controlled |

| Industry FE | Controlled | Controlled | Controlled |

| Province FE | Controlled | Controlled | Controlled |

| Year FE | Controlled | Controlled | Controlled |

| N | 2119 | 1059 | 1060 |

| R2 | 0.141 | 0.159 | 0.158 |

| Panel B: Agency costs | |||

| Variable | Green investment efficiency | ||

| (1) All | (2) Firms with lower agency costs | (3) Firms with higher agency costs | |

| Post *Treat | 0.339 *** | 0.423 *** | 0.096 |

| (0.098) | (0.134) | (0.112) | |

| Post *Treat *D_AC2 | −0.263 ** | ||

| (0.125) | |||

| Control variables | Controlled | Controlled | Controlled |

| Industry FE | Controlled | Controlled | Controlled |

| Province FE | Controlled | Controlled | Controlled |

| Year FE | Controlled | Controlled | Controlled |

| N | 2119 | 1059 | 1060 |

| R2 | 0.140 | 0.177 | 0.144 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, L.; Tang, Y.; Liu, Y. How Does Environmental Tax Influence the Scale and Efficiency of Green Investment among China’s Heavily Polluting Enterprises? Sustainability 2023, 15, 15021. https://doi.org/10.3390/su152015021

Zhao L, Tang Y, Liu Y. How Does Environmental Tax Influence the Scale and Efficiency of Green Investment among China’s Heavily Polluting Enterprises? Sustainability. 2023; 15(20):15021. https://doi.org/10.3390/su152015021

Chicago/Turabian StyleZhao, Lingxiao, Yunpeng Tang, and Yan Liu. 2023. "How Does Environmental Tax Influence the Scale and Efficiency of Green Investment among China’s Heavily Polluting Enterprises?" Sustainability 15, no. 20: 15021. https://doi.org/10.3390/su152015021

APA StyleZhao, L., Tang, Y., & Liu, Y. (2023). How Does Environmental Tax Influence the Scale and Efficiency of Green Investment among China’s Heavily Polluting Enterprises? Sustainability, 15(20), 15021. https://doi.org/10.3390/su152015021