Optimizing Green Strategy for Retired Electric Vehicle Battery Recycling: An Evolutionary Game Theory Approach

Abstract

:1. Introduction

2. Literature Review

2.1. Power Battery Recycling Model

2.2. Research on Government Subsidies for Power Battery Recycling

2.3. Green CLSC Carbon Policy

2.4. Evolutionary Game Theory

3. Methods

3.1. Model Descriptions

3.2. Model Assumptions

4. Results

4.1. Replication Dynamic Equations

4.2. Manufacturer ESS Stability Analysis

4.3. Recycler ESS Stability Analysis

4.4. Government ESS Stability Analysis

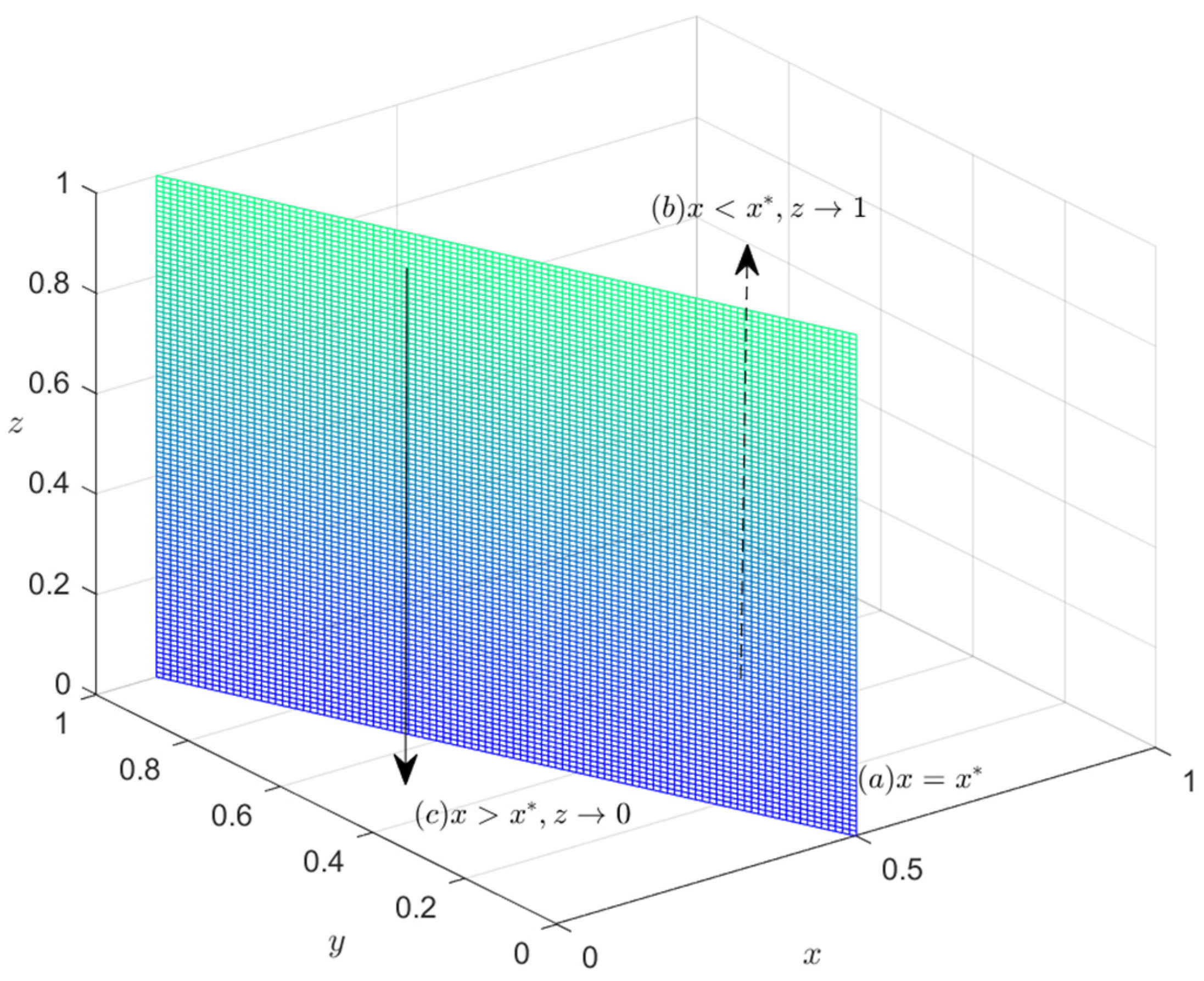

4.5. Stability Analysis of the System ESS

5. Simulation Analysis

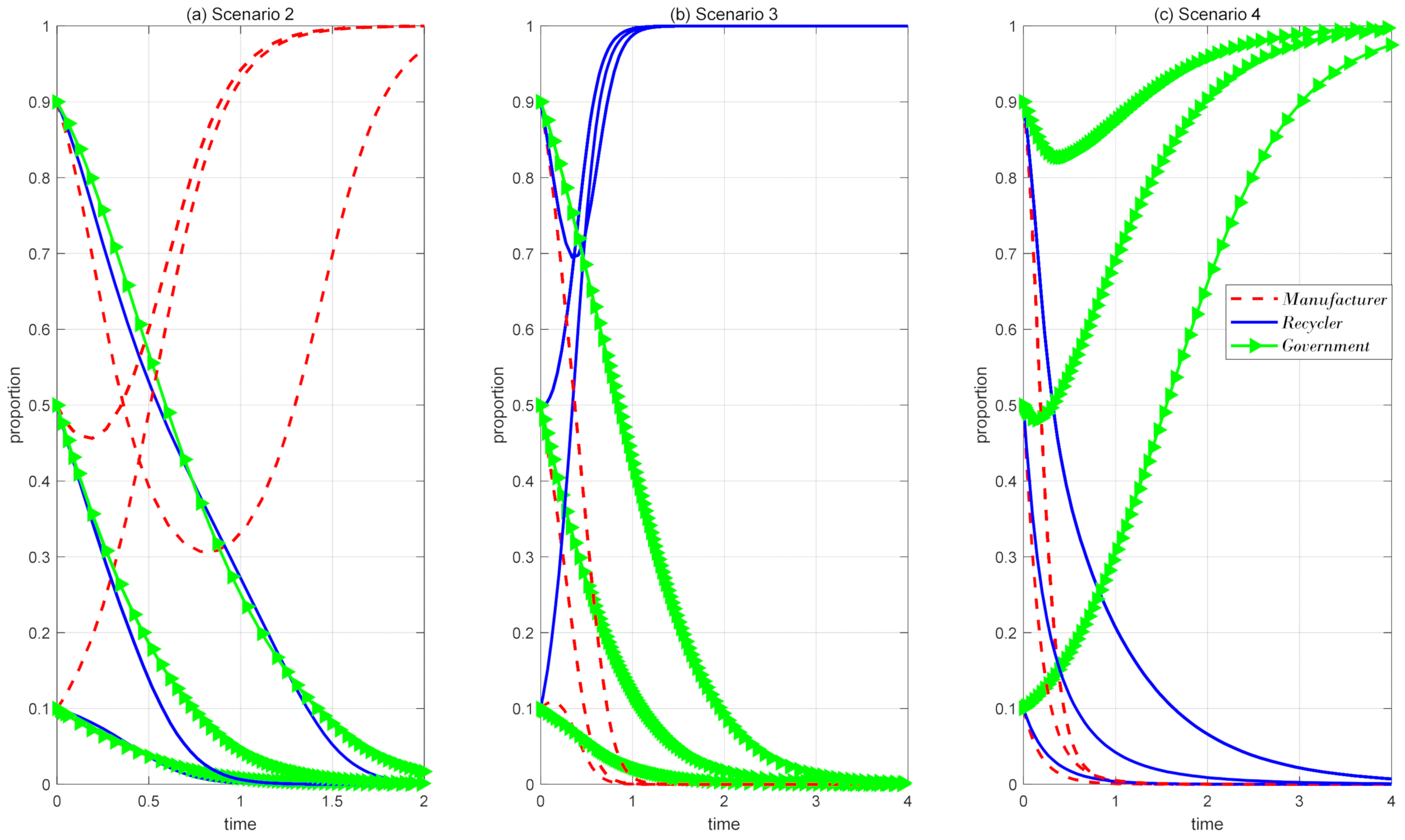

5.1. Analysis of Each Period

5.2. Sensitivity Analysis

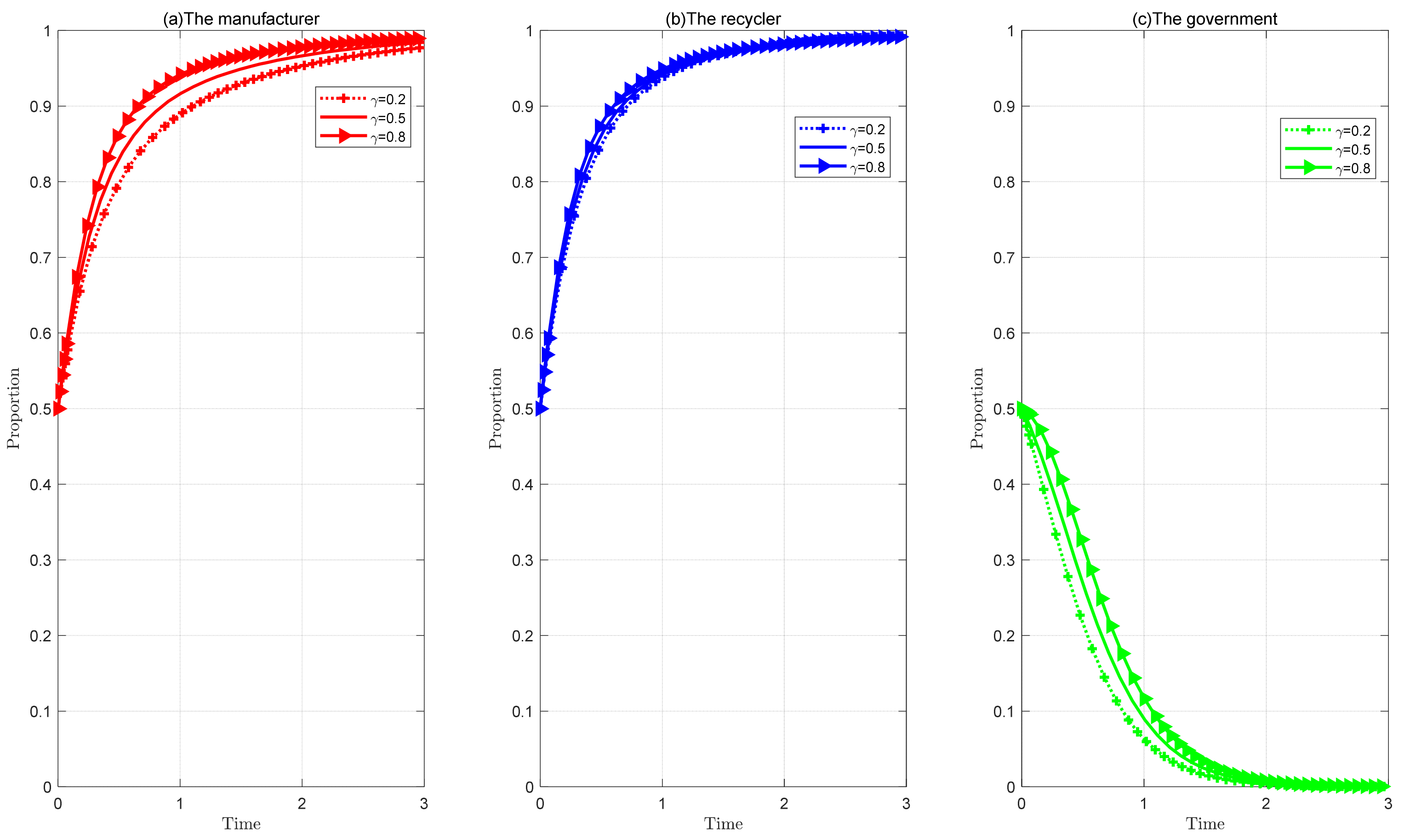

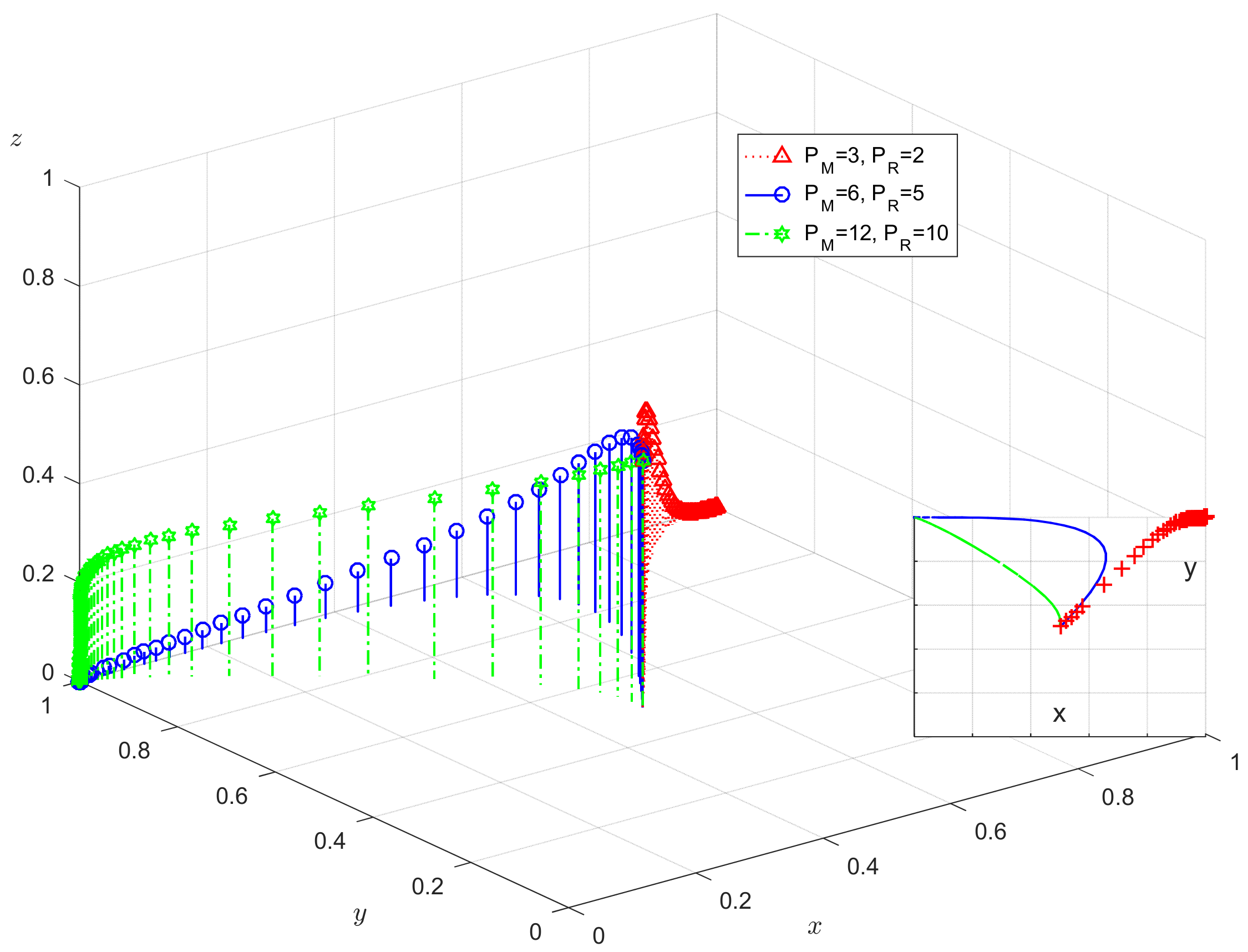

5.2.1. Impact of Subsidy Coefficient

5.2.2. Impact of Tax Rate

5.2.3. Impact of Synergy Benefits Base

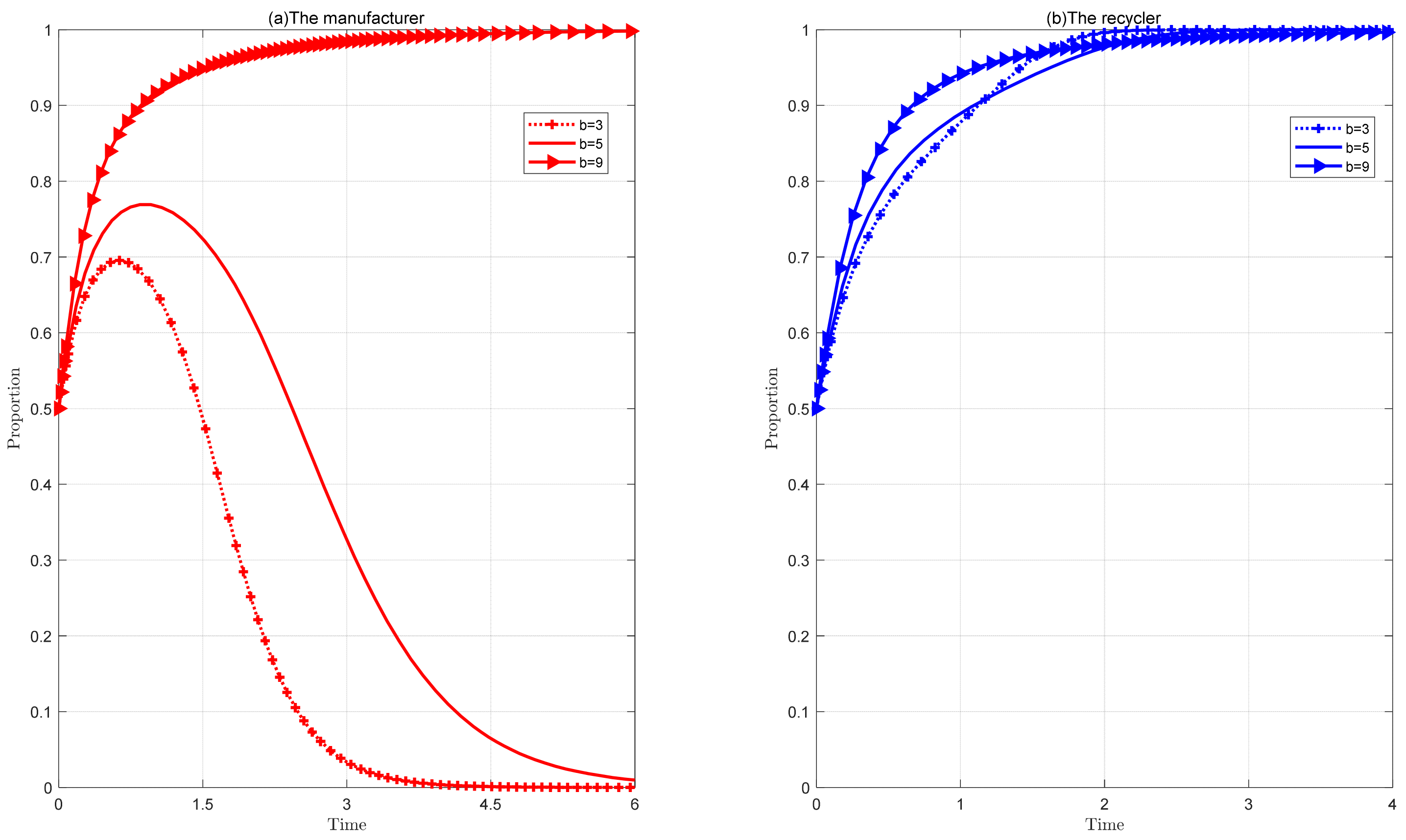

5.2.4. Impact of Free-Rider Benefits

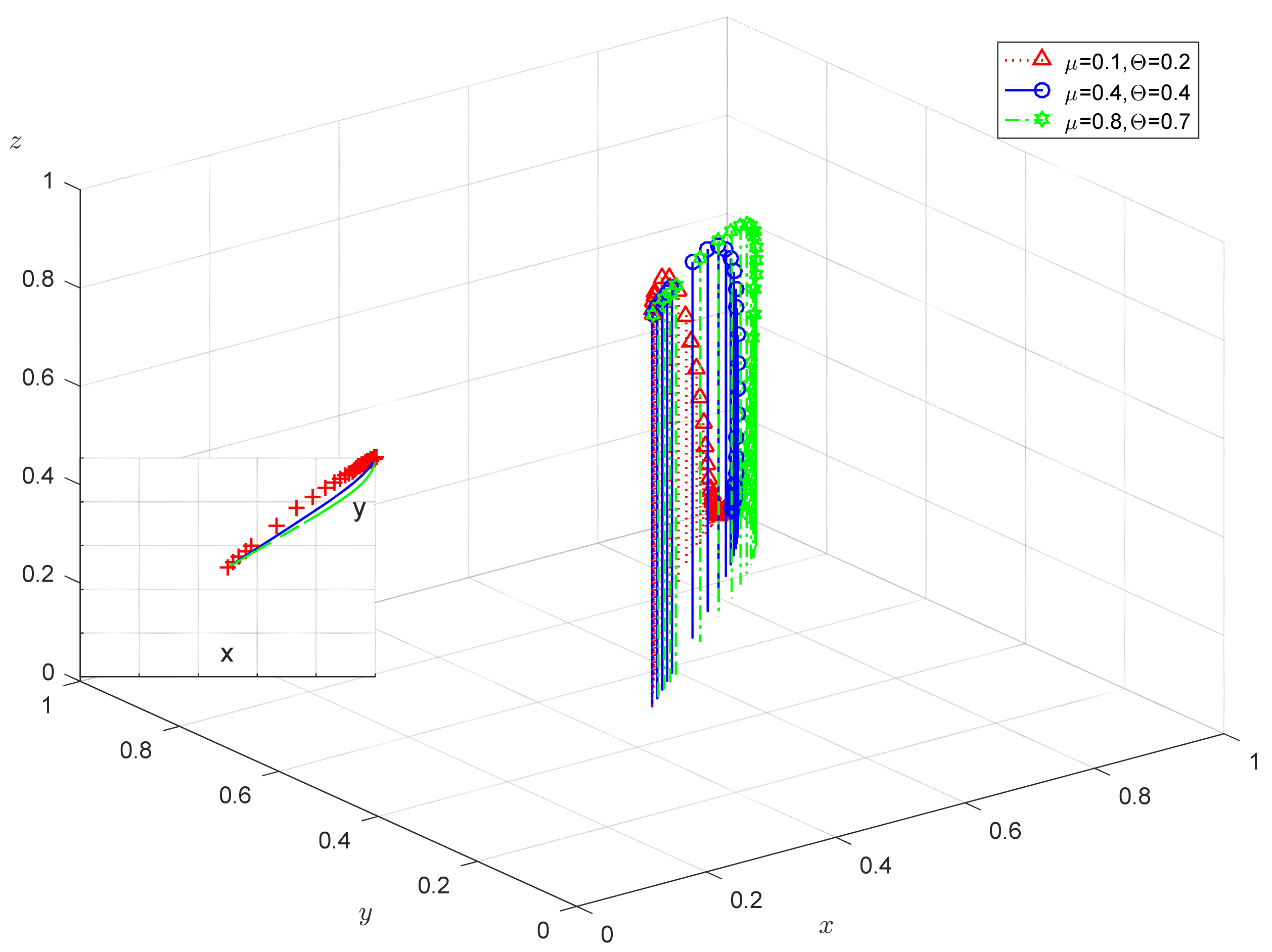

5.2.5. Impacts of Green Costs

5.2.6. Impact of Benefits Increases Coefficient from Green Investments

6. Discussion and Policy Implications

6.1. Discussion

6.2. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kazancoglu, Y.; Ozbiltekin-Pala, M.; Ozkan-Ozen, Y.D. Prediction and evaluation of greenhouse gas emissions for sustainable road transport within Europe. Sustain. Cities Soc. 2021, 70, 102924. [Google Scholar] [CrossRef]

- Way, R.; Ives, M.C.; Mealy, P.; Farmer, J.D. Empirically grounded technology forecasts and the energy transition. Joule 2022, 6, 2057–2082. [Google Scholar] [CrossRef]

- Zhang, H.; Zhu, K.; Hang, Z.; Zhou, D.; Zhou, Y.; Xu, Z. Waste battery-to-reutilization decisions under government subsidies: An evolutionary game approach. Energy 2022, 259, 124835. [Google Scholar] [CrossRef]

- Neumann, J.; Petranikova, M.; Meeus, M.; Gamarra, J.D.; Younesi, R.; Winter, M.; Nowak, S. Recycling of lithium-ion batteries—Current state of the art, circular economy, and next generation recycling. Adv. Energy Mater. 2022, 12, 2102917. [Google Scholar] [CrossRef]

- Li, J.; Li, L.; Yang, R.; Jiao, J. Assessment of the lifecycle carbon emission and energy consumption of lithium-ion power batteries recycling: A systematic review and meta-analysis. J. Energy Storage 2023, 65, 107306. [Google Scholar] [CrossRef]

- Wang, L.; Zhu, S.; Evans, S.; Zhang, Z.; Xia, X.; Guo, Y. Automobile recycling for remanufacturing in China: A systematic review on recycling legislations, models and methods. Sustain. Prod. Consum. 2023, 36, 369–385. [Google Scholar] [CrossRef]

- He, L.; Sun, B. Exploring the EPR system for power battery recycling from a supply-side perspective: An evolutionary game analysis. Waste Manag. 2022, 140, 204–212. [Google Scholar] [CrossRef]

- Azadnia, A.H.; Onofrei, G.; Ghadimi, P. Electric vehicles lithium-ion batteries reverse logistics implementation barriers analysis: A TISM-MICMAC approach. Resour. Conserv. Recycl. 2021, 174, 105751. [Google Scholar] [CrossRef]

- MIIT. The Interim Measures for the Administration of Recycling and Utilization of New Energy Vehicles Power Battery. 2018. Available online: https://www.gov.cn/xinwen/2018-02/26/content_5268875.htm (accessed on 25 May 2023).

- Zhang, M.; Kong, Z. A tripartite evolutionary game model of emergency supplies joint reserve among the government, enterprise and society. Comput. Ind. Eng. 2022, 169, 108132. [Google Scholar] [CrossRef]

- Wang, S.; Xu, Y. Complex Network-Based Evolutionary Game for Knowledge Transfer of Social E-Commerce Platform Enterprise’s Operation Team under Strategy Imitation Preferences. Sustainability 2022, 14, 15383. [Google Scholar] [CrossRef]

- Liu, C.; Song, Y.; Wang, W.; Shi, X. The governance of manufacturers’ greenwashing behaviors: A tripartite evolutionary game analysis of electric vehicles. Appl. Energy 2023, 333, 120498. [Google Scholar] [CrossRef]

- Lin, Y.; Yu, Z.; Wang, Y.; Goh, M. Performance evaluation of regulatory schemes for retired electric vehicle battery recycling within dual-recycle channels. J. Environ. Manag. 2023, 332, 117354. [Google Scholar] [CrossRef] [PubMed]

- Zheng, B.; Wen, K.; Jin, L.; Hong, X. Alliance or cost-sharing? Recycling cooperation mode selection in a closed-loop supply chain. Sustain. Prod. Consum. 2022, 32, 942–955. [Google Scholar] [CrossRef]

- Harper, G.; Sommerville, R.; Kendrick, E.; Driscoll, L.; Slater, P.; Stolkin, R.; Walton, A.; Christensen, P.; Heidrich, O.; Lambert, S.; et al. Recycling lithium-ion batteries from electric vehicles. Nature 2019, 575, 75–86. [Google Scholar] [CrossRef]

- Chinen, K.; Matsumoto, M.; Tong, P.; Han, Y.S.; Niu, K.-H.J. Electric Vehicle Owners’ Perception of Remanufactured Batteries: An Empirical Study in China. Sustainability 2022, 14, 10846. [Google Scholar] [CrossRef]

- Rajaeifar, M.A.; Ghadimi, P.; Raugei, M.; Wu, Y.; Heidrich, O. Challenges and recent developments in supply and value chains of electric vehicle batteries: A sustainability perspective. Resour. Conserv. Recycl. 2022, 180, 106144. [Google Scholar] [CrossRef]

- Qiao, D.; Wang, G.; Gao, T.; Wen, B.; Dai, T. Potential impact of the end-of-life batteries recycling of electric vehicles on lithium demand in China: 2010–2050. Sci Total Env. 2021, 764, 142835. [Google Scholar] [CrossRef]

- Xu, X.; Hu, W.; Liu, W.; Wang, D.; Huang, Q.; Chen, Z. Study on the economic benefits of retired electric vehicle batteries participating in the electricity markets. J. Clean. Prod. 2021, 286, 125414. [Google Scholar] [CrossRef]

- Mirzaei Omrani, M.; Jannesari, H. Economic and environmental assessment of reusing electric vehicle lithium-ion batteries for load leveling in the residential, industrial and photovoltaic power plants sectors. Renew. Sustain. Energy Rev. 2019, 116, 109413. [Google Scholar] [CrossRef]

- Skeete, J.-P.; Wells, P.; Dong, X.; Heidrich, O.; Harper, G. Beyond the EVent horizon: Battery waste, recycling, and sustainability in the United Kingdom electric vehicle transition. Energy Res. Soc. Sci. 2020, 69, 101581. [Google Scholar] [CrossRef]

- Miao, Y.; Liu, L.; Zhang, Y.; Tan, Q.; Li, J. An overview of global power lithium-ion batteries and associated critical metal recycling. J. Hazard. Mater. 2022, 425, 127900. [Google Scholar] [CrossRef]

- Jung, J.C.-Y.; Sui, P.-C.; Zhang, J. A review of recycling spent lithium-ion battery cathode materials using hydrometallurgical treatments. J. Energy Storage 2021, 35, 102217. [Google Scholar] [CrossRef]

- Zhang, C.; Tian, Y.-X.; Han, M.-H. Recycling mode selection and carbon emission reduction decisions for a multi-channel closed-loop supply chain of electric vehicle power battery under cap-and-trade policy. J. Clean. Prod. 2022, 375, 134060. [Google Scholar] [CrossRef]

- Yu, W.; Guo, Y.; Shang, Z.; Zhang, Y.; Xu, S. A review on comprehensive recycling of spent power lithium-ion battery in China. Etransportation 2022, 11, 100155. [Google Scholar] [CrossRef]

- Zhao, S.; Ma, C. Research on the coordination of the power battery echelon utilization supply chain considering recycling outsourcing. J. Clean. Prod. 2022, 358, 131922. [Google Scholar] [CrossRef]

- Sun, Q.; Chen, H.; Long, R.; Li, Q.; Huang, H. Comparative evaluation for recycling waste power batteries with different collection modes based on Stackelberg game. J. Environ. Manag. 2022, 312, 114892. [Google Scholar] [CrossRef]

- Kong, J.; Chua, G.A.; Yang, F. Firms’ cooperation on recycling investments in a three-echelon reverse supply chain. Int. J. Prod. Econ. 2023, 263, 108959. [Google Scholar] [CrossRef]

- De, M.; Giri, B. Modelling a closed-loop supply chain with a heterogeneous fleet under carbon emission reduction policy. Transp. Res. Part E Logist. Transp. Rev. 2020, 133, 101813. [Google Scholar] [CrossRef]

- Mondal, C.; Giri, B.C. Retailers’ competition and cooperation in a closed-loop green supply chain under governmental intervention and cap-and-trade policy. Oper. Res. 2022, 22, 859–894. [Google Scholar] [CrossRef]

- Jiao, J.; Pan, Z.; Li, J. Effect of carbon trading scheme and technological advancement on the decision-making of power battery closed-loop supply chain. Environ. Sci. Pollut. Res. 2023, 30, 14770–14791. [Google Scholar] [CrossRef]

- Li, S.; Sun, Q. Evolutionary game analysis of WEEE recycling tripartite stakeholders under variable subsidies and processing fees. Env. Sci. Pollut. Res. Int. 2023, 30, 11584–11599. [Google Scholar] [CrossRef] [PubMed]

- Jiao, J.; Chen, Y.; Li, J.; Yang, S. Carbon reduction behavior of waste power battery recycling enterprises considering learning effects. J. Environ. Manag. 2023, 341, 118084. [Google Scholar] [CrossRef] [PubMed]

- Gu, X.; Zhou, L.; Huang, H.; Shi, X.; Ieromonachou, P. Electric vehicle battery secondary use under government subsidy: A closed-loop supply chain perspective. Int. J. Prod. Econ. 2021, 234, 108035. [Google Scholar] [CrossRef]

- Gong, Y.; Chen, M.; Wang, Z.; Zhan, J. With or without deposit-refund system for a network platform-led electronic closed-loop supply chain. J. Clean. Prod. 2021, 281, 125356. [Google Scholar] [CrossRef]

- Zhang, M.; Wu, W.; Song, Y. Study on the impact of government policies on power battery recycling under different recycling models. J. Clean. Prod. 2023, 413, 137492. [Google Scholar] [CrossRef]

- Li, Z.; Zhong, X.; Xu, X. The mechanism of retired power batteries recycling through blockchain token incentives. J. Clean. Prod. 2023, 415, 137560. [Google Scholar] [CrossRef]

- Zheng, Y.; Xu, Y.; Qiu, Z. Blockchain Traceability Adoption in Agricultural Supply Chain Coordination: An Evolutionary Game Analysis. Agriculture 2023, 13, 184. [Google Scholar] [CrossRef]

- Li, X.; Du, J.; Liu, P.; Wang, C.; Hu, X.; Ghadimi, P. Optimal choice of power battery joint recycling strategy for electric vehicle manufacturers under a deposit-refund system. Int. J. Prod. Res. 2023, 61, 7281–7301. [Google Scholar] [CrossRef]

- Wang, Z.; Chen, B.; Li, B.; Cheng, Y. Rate, tax, or hybrid: A comparison of recycling systems in the electronic industry. Sustain. Prod. Consum. 2023, 39, 93–108. [Google Scholar] [CrossRef]

- Meng, Q.; Li, M.; Liu, W.; Li, Z.; Zhang, J. Pricing policies of dual-channel green supply chain: Considering government subsidies and consumers’ dual preferences. Sustain. Prod. Consum. 2021, 26, 1021–1030. [Google Scholar] [CrossRef]

- Xu, N.; Xu, Y. Research on Tacit Knowledge Dissemination of Automobile Consumers’ Low-Carbon Purchase Intention. Sustainability 2022, 14, 10097. [Google Scholar] [CrossRef]

- Nersesian, L.; Hafezalkotob, A.; Reza-Gharehbagh, R. Alternative governmental carbon policies on populations of green and non-green supply chains in a competitive market. Environ. Dev. Sustain. 2023, 25, 4139–4172. [Google Scholar] [CrossRef]

- Zhang, X.; Guo, X.; Zhang, X. Collaborative strategy within China’s emission trading scheme: Evidence from a tripartite evolutionary game model. J. Clean. Prod. 2023, 382, 135255. [Google Scholar] [CrossRef]

- Zhang, C.; Chen, Y.-X.; Tian, Y.-X. Collection and recycling decisions for electric vehicle end-of-life power batteries in the context of carbon emissions reduction. Comput. Ind. Eng. 2023, 175, 108869. [Google Scholar] [CrossRef]

- Yan, J. Personal sustained cooperation based on networked evolutionary game theory. Sci. Rep. 2023, 13, 9125. [Google Scholar] [CrossRef] [PubMed]

- Traulsen, A.; Glynatsi, N.E. The future of theoretical evolutionary game theory. Philos. Trans. R. Soc. B 2023, 378, 20210508. [Google Scholar] [CrossRef]

- Wan, X.; Liu, J.; Zhao, S. Evolutionary game study on the governance and development of online car-hailing based on blockchain technology. Sci. Rep. 2022, 12, 9388. [Google Scholar] [CrossRef]

- Yuan, Y.; Du, L.; Luo, L.; Cui, L. Allocation strategy of medical supplies during a public health emergency: A tripartite evolutionary game perspective. Sci. Rep. 2023, 13, 9571. [Google Scholar] [CrossRef]

- Zhang, Z.; Zhang, G.; Hu, Y.; Jiang, Y.; Zhou, C.; Ma, J. The evolutionary mechanism of haze collaborative governance: Novel evidence from a tripartite evolutionary game model and a case study in China. Humanit. Soc. Sci. Commun. 2023, 10, 69. [Google Scholar] [CrossRef]

- Sasikumar, P.; Haq, A.N. Integration of closed loop distribution supply chain network and 3PRLP selection for the case of battery recycling. Int. J. Prod. Res. 2011, 49, 3363–3385. [Google Scholar] [CrossRef]

- Wang, F.; Xu, Y. Evolutionary Game Analysis of the Quality of Agricultural Products in Supply Chain. Agriculture 2022, 12, 1575. [Google Scholar] [CrossRef]

- Gao, W.; Guo, W.; Zhou, S.; Wu, S.; Yang, Z. The evolution of the relationship among stakeholders in port integration: Evidence from tripartite evolutionary game analysis. Ocean Coast. Manag. 2023, 240, 106628. [Google Scholar] [CrossRef]

| Parameter | Description |

|---|---|

| Manufacturer’s usual benefits | |

| Recycler’s usual benefits | |

| Manufacturer’s GI costs | |

| Recycler’s GI costs | |

| The cost of GR for governments | |

| Additional benefits to manufacturers from investments by recyclers | |

| Additional benefits to recyclers from GI by manufacturers | |

| Manufacturer’s excess carbon emissions | |

| Recycler’s excess carbon emissions | |

| Carbon tax rates | |

| Subsidy intensity of government subsidies for GI | |

| Benefits increase coefficient of manufacturers choosing GI | |

| Benefits increase coefficient of recyclers choosing GI | |

| Green benefits of GI for governments | |

| Government pollution management unit costs | |

| Synergy benefits base | |

| Distribution coefficient | |

| Coefficient of synergy |

| Governments | GR | NR | ||

|---|---|---|---|---|

| Recyclers | GI | NI | GI | NI |

| Manufacturers | ||||

| GI | ||||

| NI | ||||

| Equilibrium Points | Eigenvalues | ||

|---|---|---|---|

| Equilibrium Points | Stability Condition | Green Invest Development Period |

|---|---|---|

| Early period | ||

| Transition period | ||

| Transition period | ||

| Transition period | ||

| Mature period |

| Conditions | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Scenario 1 | 22 | 0.3 | 8 | 0.1 | 10 | 20 | 0.2 | 6 | 8 | 0.5 | 4 | 3 | 2 | 5 |

| Scenario 2 | 22 | 0.5 | 8 | 0.3 | 8 | 20 | 0.2 | 6 | 6 | 0.5 | 4 | 3 | 4 | 5 |

| Scenario 3 | 22 | 0.4 | 8 | 0.2 | 6 | 20 | 0.6 | 5 | 8 | 0.5 | 4 | 3 | 4 | 4 |

| Scenario 4 | 20 | 0.2 | 10 | 0.1 | 10 | 18 | 0.2 | 8 | 8 | 0.5 | 6 | 5 | 4 | 4 |

| Scenario 5 | 26 | 0.3 | 4 | 0.8 | 3 | 24 | 0.4 | 4 | 3 | 0.5 | 4 | 3 | 9 | 3 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zheng, Y.; Xu, Y. Optimizing Green Strategy for Retired Electric Vehicle Battery Recycling: An Evolutionary Game Theory Approach. Sustainability 2023, 15, 15464. https://doi.org/10.3390/su152115464

Zheng Y, Xu Y. Optimizing Green Strategy for Retired Electric Vehicle Battery Recycling: An Evolutionary Game Theory Approach. Sustainability. 2023; 15(21):15464. https://doi.org/10.3390/su152115464

Chicago/Turabian StyleZheng, Yi, and Yaoqun Xu. 2023. "Optimizing Green Strategy for Retired Electric Vehicle Battery Recycling: An Evolutionary Game Theory Approach" Sustainability 15, no. 21: 15464. https://doi.org/10.3390/su152115464