Decarbonization in the Automotive Sector: A Holistic Status Quo Analysis of Original Equipment Manufacturer Strategies and Carbon Management Activities

Abstract

:1. Introduction

2. Materials and Method

2.1. Theoretical Framework

2.1.1. Corporate Decarbonization in the Automotive Industry

2.1.2. Decarbonization Communication and Implementation

2.2. Methods

2.2.1. Sampling

2.2.2. Sustainability Reports and Other Sources of Information

2.2.3. Method of Analysis

| Categories | Criteria | Aspects of Evaluation |

|---|---|---|

| Decarbonization strategy | Sustainability reporting | Existence of sustainability report/joint report/environmental, social und governance (ESG) report or corporate social responsibility (CSR) report |

| Implementation within the company | Environmental management/policy: decarbonization vision, strategy, (goal and target) Integration: steering committees, responsibility tools: environmental management system (EMS) and ISO 14001 [89] | |

| Management control | Key facts and data/assessment and indicators: Global Reporting Initiative (GRI), key figures, life cycle assessment, key performance indicators, supplier decarbonization engagement, scorecard | |

| Carbon reporting | Reporting practice | Existence of carbon reporting |

| Reporting scope | Reporting of direct (scope 1 and 2) emissions, reporting of indirect (scope 3) emissions, reported scope 3 categories | |

| Calculation standard | Standard(s) used for scope 1–3 emission calculations | |

| Carbon reduction targets | Target setting | Existence of carbon reduction targets |

| Target characteristic | Absolute target (incl. carbon neutrality target), relative target | |

| SBTi certification | Target certification by SBTi | |

| Target ambition | Ambition level | |

| Scope | Scope 1 and 2, scope 3, scope 3 categories | |

| Timeframe | Base year, target year | |

| Transparency | Availability of base year data | |

| Carbon reduction measures | Scope of reduction measures | Reduction measures in scope 1 and 2, scope 3, scope 3 categories |

| Form of reduction measures | Individual reduction measures according to frequency |

3. Results

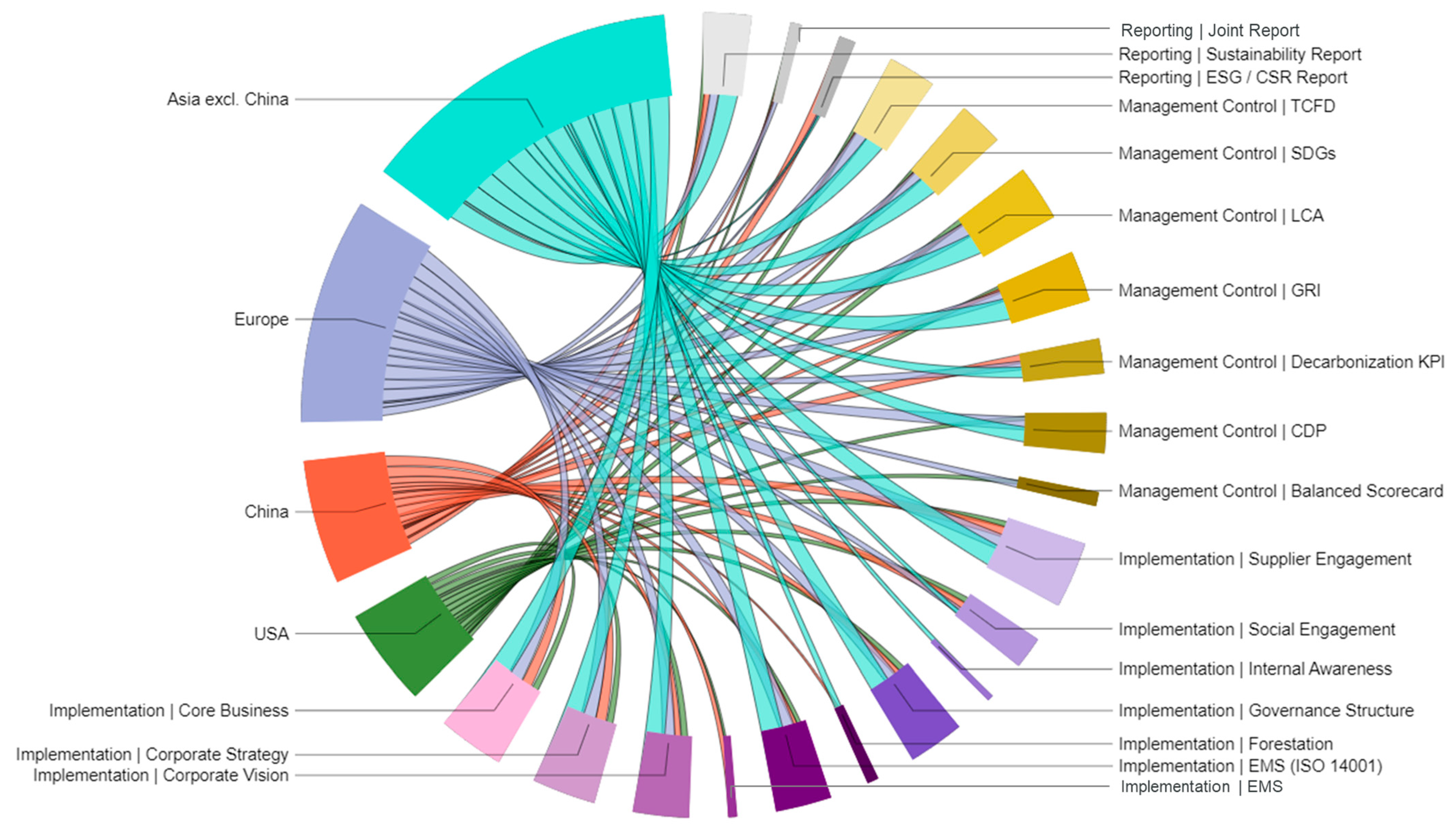

3.1. Comparison of Decarbonization Strategies

3.2. Carbon Reporting in the Automotive Industry

3.3. Carbon Reduction Targets

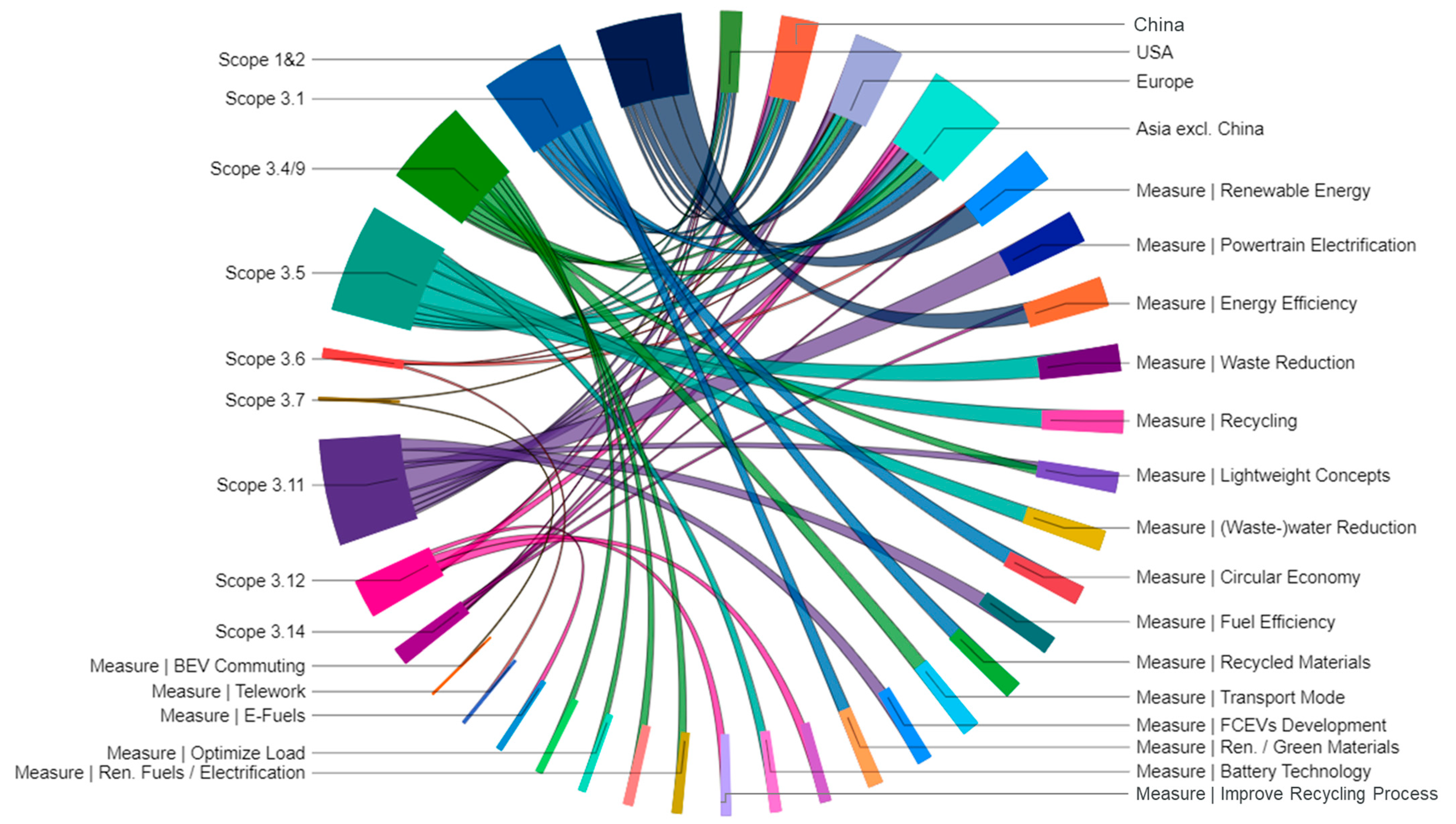

3.4. Comparison of Carbon Reduction Measures

4. Discussion

4.1. Decarbonization Strategies

4.2. Carbon Reporting

4.3. Carbon Reduction Targets

4.4. Carbon Reduction Measures

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

References

- Li, B.; Gasser, T.; Ciais, P.; Piao, S.; Tao, S.; Balkanski, Y.; Hauglustaine, D.; Boisier, J.-P.; Chen, Z.; Huang, M.; et al. The Contribution of China’s Emissions to Global Climate Forcing. Nature 2016, 531, 357–361. [Google Scholar] [CrossRef] [PubMed]

- United Nations. Adoption of the Paris Agreement—Framework Convention on Climate Change. In Proceedings of the 21st Conference of the Parties, Paris, France, 30 November–11 December 2015. [Google Scholar]

- Masson-Delmotte, V.; Pörtner, H.-O.; Skea, J.; Zhai, P.; Roberts, D.; Shukla, P.R.; Pirani, A.; Pidcock, R.; Chen, Y.; Lonnoy, E.; et al. Global Warming of 1.5 °C. An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; Cambridge University Press: Cambridge, UK, 2018; p. 630. [Google Scholar]

- International Energy Agency Transport. Improving the Sustainability of Passenger and Freight Transport. Available online: https://www.iea.org/topics/transport (accessed on 28 October 2022).

- International Energy Agency. Transport: Tracking Progress 2022. Available online: https://www.iea.org/reports/transport (accessed on 28 October 2022).

- Volkswagen AG. Sustainability at Volkswagen Group. In Proceedings of the ESG SRI Conference2020, Virtual, 17–19 November 2020. [Google Scholar]

- Neef, M.A. Carbon Budget Compliance: A Life-Cycle-Based Model for Carbon Emissions of Automotive Original Equipment Manufacturers; Verein zur Förderung des Institutes IWAR der Technischen Universität Darmstadt: Darmstadt, Germany, 2020. [Google Scholar]

- Mathews, M.R. Twenty-five Years of Social and Environmental Accounting Research: Is There a Silver Jubilee to Celebrate? Account. Audit. Account. J. 1997, 10, 481–531. [Google Scholar] [CrossRef]

- Haffar, M.; Searcy, C. Target-Setting for Ecological Resilience: Are Companies Setting Environmental Sustainability Targets in Line with Planetary Thresholds? Bus. Strat. Environ. 2018, 27, 1079–1092. [Google Scholar] [CrossRef]

- Bjørn, A.; Bey, N.; Georg, S.; Røpke, I.; Hauschild, M.Z. Is Earth Recognized as a Finite System in Corporate Responsibility Reporting? J. Clean. Prod. 2017, 163, 106–117. [Google Scholar] [CrossRef]

- Margolick, M.; Russell, D. Corporate Greenhouse Gas Reduction Targets; Global Change Strategies International Inc.: Ottawa, ON, Canada, 2001. [Google Scholar]

- Rietbergen, M.G.; van Rheede, A.; Blok, K. The Target-Setting Process in the CO2 Performance Ladder: Does It Lead to Ambitious Goals for Carbon Dioxide Emission Reduction? J. Clean. Prod. 2015, 103, 549–561. [Google Scholar] [CrossRef]

- Bjørn, A.; Lloyd, S.; Matthews, D. From the Paris Agreement to Corporate Climate Commitments: Evaluation of Seven Methods for Setting ‘Science-Based’ Emission Targets. Environ. Res. Lett. 2021, 16, 054019. [Google Scholar] [CrossRef]

- SBTi. Transport Science-Based Target Setting Guidance; SBTi, 2017. [Google Scholar]

- Busch, T.; Schwarzkopf, J. Carbon Management Strategies—A Quest for Corporate Competitiveness. Prog. Ind. Ecol. 2013, 8, 4–29. [Google Scholar] [CrossRef]

- Sukitsch, M.; Engert, S.; Baumgartner, R. The Implementation of Corporate Sustainability in the European Automotive Industry: An Analysis of Sustainability Reports. Sustainability 2015, 7, 11504–11531. [Google Scholar] [CrossRef]

- Damert, M.; Paul, A.; Baumgartner, R.J. Exploring the Determinants and Long-Term Performance Outcomes of Corporate Carbon Strategies. J. Clean. Prod. 2017, 160, 123–138. [Google Scholar] [CrossRef]

- Shinkle, G.A.; Spencer, J.W. The Social Construction of Global Corporate Citizenship: Sustainability Reports of Automotive Corporations. J. World Bus. 2012, 47, 123–133. [Google Scholar] [CrossRef]

- Thun, J.-H.; Müller, A. An Empirical Analysis of Green Supply Chain Management in the German Automotive Industry. Bus. Strat. Environ. 2009, 19, 119–132. [Google Scholar] [CrossRef]

- Regulation (EU) 2019/631 of the European Parliament and of the Council of 17 April 2019 Setting CO2 Emission Performance Standards for New Passenger Cars and for New Light Commercial Vehicles, and Repealing Regulations (EC) No 443/2009 and (EU) No 510/2011. Off. J. Eur. Union 2019, L 111, 13–53.

- Schmid, M. Challenges to the European Automotive Industry in Securing Critical Raw Materials for Electric Mobility: The Case of Rare Earths. MinMag 2020, 84, 5–17. [Google Scholar] [CrossRef]

- Stechemesser, K.; Guenther, E. Carbon Accounting: A Systematic Literature Review. J. Clean. Prod. 2012, 36, 17–38. [Google Scholar] [CrossRef]

- World Business Council for Sustainable Development; World Resources Institute. The Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard; World Business Council for Sustainable Development; World Resources Institute: Geneva, Switzerland; Washington, DC, USA, 2004; ISBN 1-56973-568-9. [Google Scholar]

- World Business Council for Sustainable Development; World Resources Institute. The Greenhouse Gas Protocol: Corporate Value Chain (Scope 3) Accounting and Reporting Standard; World Business Council for Sustainable Development; World Resources Institute: Geneva, Switzerland; Washington, DC, USA, 2011; ISBN 978-1-56973-772-9. [Google Scholar]

- Fugger, T.; Poligkeit, J.; Herrmann, C. Integration of Coupled Sectors Decarbonization Pathways across the Value Chain into Corporate Carbon Management Processes. Procedia CIRP 2023, 16, 1–6. [Google Scholar] [CrossRef]

- SBTi. Science Based Targets: Companies Taking Action. Available online: https://sciencebasedtargets.org/companies-taking-action (accessed on 23 October 2022).

- International Organization of Motor Vehicle Manufacturers Global Sales Statistics 2019–2022. Sales Statistics. Available online: www.oica.net (accessed on 31 August 2023).

- BAIC Motor Corporation Limited. 2020 Annual Report; Beijing Automotive Group: Beijing, China, 2021. [Google Scholar]

- BMW Group. BMW Group Bericht 2020; BMW Group: Munich, Germany, 2021. [Google Scholar]

- Changan Automobile Company Limited. 2020 Annual Report; Changan Automobile Company Limited: Chongqing, China, 2021. [Google Scholar]

- Chery Automobile Company Limited. Chery Automobile Grew 8.6% against the Trend in 2020, and Its Total Sales Reached 449,000 Units. Available online: https://www.chery.cn/BrandShow/News?newsid=6020708e-4069-4646-8101-649b02e96d92 (accessed on 18 July 2022).

- China FAW Group Corporation Limited. FAW’s First-Half Sales Up 2.3% YoY to 1,630,923 Units. Available online: http://www.faw.com/fawen/xwzt/xwbd/5264023/index.html (accessed on 29 December 2022).

- China FAW Group Corporation Limited. Financial Data. Available online: http://www.faw.com/fawen/gyjt36/jtgl59/jysj87/index.html (accessed on 29 December 2022).

- Dongfeng Motor Group Company Limited. 2020 Annual Report; Dongfeng Motor Group Company Limited: Wuhan, China, 2021. [Google Scholar]

- Ford Motor Company. Annual Report; Ford Motor Company: Dearborn, MI, USA, 2021. [Google Scholar]

- Ford Motor Company. Climate Change 2021; Ford Motor Company: Dearborn, MI, USA, 2021. [Google Scholar]

- General Motors Company. 2020 Sustainability Report: Driving Sustainable Value; General Motors Company: Detroit, MI, USA, 2021. [Google Scholar]

- Great Wall Motor Company Limited. Annual Report 2020; Great Wall Motor Company Limited: Baoding, China, 2021. [Google Scholar]

- Guangzhou Automobile Group Company Limited. Environmental, Social and Governance Report 2020; Guangzhou Automobile Group Company Limited: Guangzhou, China, 2021. [Google Scholar]

- Honda Motor Company Limited. Consolidated Financial Summary for the Fiscal 4th Quarter and the Fiscal Year Ended March 31, 2020. Available online: https://global.honda/newsroom/news/2020/c200512eng.html (accessed on 29 December 2022).

- Honda Motor Company Limited. Consolidated Financial Summary for the Fiscal 3rd Quarter Ended December 31, 2020 and Forecasts for the Fiscal Year Ending March 31, 2021. Available online: https://global.honda/newsroom/news/2021/c210209eng.html (accessed on 29 December 2022).

- Hyundai Motor Company. 2021 Sustainability Report: Road to Sustainability; Hyundai Motor Company: Seoul, Republic of Korea, 2021. [Google Scholar]

- Jaguar Land Rover. Jaguar Land Rover Retail Sales Continue to Recover in Quarter Ending December 2020 with China Sales Growing Year-on-Year; Tata Group: Coventry, UK, 2021. [Google Scholar]

- Kia Corporation. MOVE: Kia Sustainability Magazine 2021; Kia Corporation: Seoul, Republic of Korea, 2021. [Google Scholar]

- Mazda Motor Corporation. Mazda Production and Sales Results for December 2020 and for January through December 2020 (Flash Report); Mazda Motor Corporation: Hiroshima, Japan, 2021. [Google Scholar]

- Mercedes-Benz Group AG. Geschäftsbericht 2020; Mercedes-Benz Group AG: Stuttgart, Germany, 2021. [Google Scholar]

- Mitsubishi Motors Corporation. Production, Sales and Export Data. Available online: https://www.mitsubishi-motors.com/en/investors/finance_result/result.html (accessed on 27 December 2022).

- Mitsubishi Motors Corporation. Sustainability Report 2021; Mitsubishi Motors Corporation: Minato, Japan, 2021. [Google Scholar]

- Nissan Motor Corporation Limited. Nissan Production, Sales and Exports for December and 2020; Nissan Motor Corporation Limited: Yokohama, Japan, 2021. [Google Scholar]

- Nissan Motor Corporation Limited. Sustainability Report 2021; Nissan Motor Co., Ltd.: Yokohama, Japan, 2021. [Google Scholar]

- Renault Group. Monthly Sales. Available online: https://www.renaultgroup.com/en/finance-2/financial-information/key-figures/monthly-sales/ (accessed on 1 November 2021).

- SAIC Motor Corporation Limited. Annual Report 2020; SAIC Motor Corporation Limited: Shanghai, China, 2021. [Google Scholar]

- Stellantis, N.V. 2020 Corporate Social Responsibility Report: Peugeot S.A. Scope; Stellantis N.V.: Hoofddorp, The Netherlands, 2021. [Google Scholar]

- Stellantis, N.V. 2020 Sustainability Report: FCA N.V. Scope; Stellantis N.V.: Hoofddorp, The Netherlands, 2021. [Google Scholar]

- Subaru Corporation. Global Sales Results. Available online: https://www.subaru.co.jp/en/ir/finance/performance.html (accessed on 2 April 2023).

- Suzuki Motor Corporation. Automobile Monthly Results of Production, Sales & Exports. Available online: https://www.globalsuzuki.com/ir/library/data/ (accessed on 10 April 2022).

- Tata Motors Limited. TML Volumes—Flash Figures. Available online: https://www.tatamotors.com/investors/volumes/ (accessed on 27 November 2021).

- Tesla Incorporated. Q4 and FY2020 Update; Tesla Incorporated: Austin, TX, USA, 2021. [Google Scholar]

- Toyota Motor Corporation. Toyota Global Sales, Production, and Export Data. Available online: https://global.toyota/pages/global_toyota/company/profile/production-sales-figures/production_sales_figures_en.xls (accessed on 15 November 2021).

- Volkswagen Group. Die Zukunft in der Hand—Geschäftsbericht 2020; Volkswagen Group: Wolfsburg, Germany, 2021. [Google Scholar]

- Volvo Car Group. Sustainability Management and Governance; Volvo Car Group: Gothenburg, Sweden, 2021. [Google Scholar]

- Zhejiang Geely Holding Group Company Limited. Geely Auto 2020 Sales Reach 1.32 Million Units. Available online: http://global.geely.com/media-center/news/geely-auto-2020-sales-reach-1-32-million-units/ (accessed on 28 October 2022).

- Chery Automobile Company Limited. Environmental Information 2021; Chery Automobile Company Limited: Wuhu, China, 2022. [Google Scholar]

- China FAW Group Corporation Limited. 2021 Sustainable Development Report; China FAW Group Corporation Limited: Changchun, China, 2022. [Google Scholar]

- Dongfeng Motor Group Company Limited. 2020 Environmental, Social and Governance Report; Dongfeng Motor Group Company Limited: Wuhan, China, 2021. [Google Scholar]

- Ford Motor Company. Integrated Sustainability and Financial Report 2021; Ford Motor Company: Dearborn, MI, USA, 2021. [Google Scholar]

- General Motors Company. Climate Change 2021; General Motors Company: Detroit, MI, USA, 2021. [Google Scholar]

- Great Wall Motor Company Limited. Corporate, Social and Responsibility Report 2020; Great Wall Motor Company Limited: Baoding, China, 2021. [Google Scholar]

- Honda Motor Company Limited. Honda Sustainability Report 2021; Honda Motor Copmany Limited: Minato, Japan, 2021. [Google Scholar]

- Kia Corporation. ESG Special Report 2021; Kia Motors Corporation: Seoul, Republic of Korea, 2021. [Google Scholar]

- Mazda Motor Corporation. Sustainability Report 2020: In-Depth Version; Mazda Motor Corporation: Hiroshima, Japan, 2020. [Google Scholar]

- Mazda Motor Corporation. Sustainability Report 2021: In-Depth Version; Mazda Motor Corporation: Hiroshima, Japan, 2022. [Google Scholar]

- Mercedes-Benz Group AG. Nachhaltigkeitsbericht 2020; Mercedes-Benz Group AG: Stuttgart, Germany, 2021. [Google Scholar]

- Renault Group. Climate Report: On the Road to Carbon Neutrality; Renault Group: Boulogne-Billancourt, France, 2021. [Google Scholar]

- SAIC Motor Corporation Limited. Social Responsibility Report 2020; SAIC Motor Corporation Limited: Shanghai, China, 2021. [Google Scholar]

- Subaru Corporation. Sustainability Report 2021; Subaru Corporation: Shibuya, Japan, 2021. [Google Scholar]

- Suzuki Motor Corporation. Integrated Report 2021; Suzuki K.K.: Hamamatsu, Japan, 2022. [Google Scholar]

- Suzuki Motor Corporation. Sustainability Report 2021; Suzuki K.K.: Hamamatsu, Japan, 2022. [Google Scholar]

- Tata Motors Group. 76th Integrated Annual Report 2020–2021; Tata Group: Mumbai, India, 2021. [Google Scholar]

- Tata Motors Group. Annual CSR Report 2020–2021; Tata Group: Mumbai, India, 2021. [Google Scholar]

- Tesla Incorporated. Impact Report 2020; Tesla Incorporated: Austin, TX, USA, 2021. [Google Scholar]

- Toyota Motor Corporation. Sustainability Data Book; Toyota Motor Corporation: Toyota, Japan, 2021. [Google Scholar]

- Volkswagen Group. Nachhaltigkeitsbericht 2020; Volkswagen Group: Wolfsburg, Germany, 2021. [Google Scholar]

- Volvo Car Group. Annual Report 2020; Volvo Car Group: Gothenburg, Sweden, 2021. [Google Scholar]

- Zhejiang Geely Holding Group Company Limited. Annual Report 2020; Zhejiang Geely Holding Group Company Limited: Hangzhou, China, 2021. [Google Scholar]

- Zhejiang Geely Holding Group Company Limited. 2020 Environmental, Social and Governance Report; Zhejiang Geely Holding Group Company Limited: Hangzhou, China, 2021. [Google Scholar]

- Busch, T.; Lewandowski, S. Corporate Carbon and Financial Performance a Meta-Analysis. J. Ind. Ecol. 2018, 22, 745–759. [Google Scholar] [CrossRef]

- World Business Council for Sustainable Development; World Resources Institute. The Greenhouse Gas Protocol; World Resources Institute and World Business Council for Sustainable Development: Washington, DC, USA, 2004. [Google Scholar]

- ISO 14001:2015; Environmental Management Systems—Requirements with Guidance for Use. International Organization for Standardization: Geneva, Switzerland, 2015.

- ISO 14040:2006; Environmental Management—Life Cycle Assessment—Principles and Framework. International Organization for Standardization: Geneva, Switzerland, 2006.

- ISO 14044:2006; Environmental Management—Life Cycle Assessment—Requirements and Guidelines. International Organization for Standardization: Geneva, Switzerland, 2006.

- EN 16258:2012; Methodology for Calculation and Declaration of Energy Consumption and GHG Emissions of Transport Services (Freight and Passengers). European Committee for Standardization: Brussels, Belgium, 2012.

- Brammer, S.; Jackson, G.; Matten, D. Corporate Social Responsibility and Institutional Theory: New Perspectives on Private Governance. Socio-Econ. Rev. 2012, 10, 3–28. [Google Scholar] [CrossRef]

- Consolidated Set of the GRI Standards; GRI Standards: Amsterdam, The Netherlands, 2023; ISBN 978-90-8866-133-4.

- Task Force on Climate-Related Financial Disclosures Guidance on Metrics, Targets, and Transition Plans; TCFD: Basel, Switzerland, 2021.

- European Parliament; European Council. Directive 2000/53/EC of the European Parliament and of the Council of 18 September 2000 on End-of Life Vehicles; European Council: Brussels, Belgium, 2000; pp. 34–43.

- CATARC. LCA Research Progress of CATARC; China Automotive Technology and Research Center Co., Ltd.: Tianjin, China, 2022. [Google Scholar]

- Petavratzi, E.; Gunn, G. Decarbonising the Automotive Sector: A Primary Raw Material Perspective on Targets and Timescales. Min. Econ 2022, 36, 545–561. [Google Scholar] [CrossRef]

- European Council Council and Parliament. Reach Provisional Deal on Renewable Energy Directive. Available online: https://www.consilium.europa.eu/en/press/press-releases/2023/03/30/council-and-parliament-reach-provisional-deal-on-renewable-energy-directive/#:~:text=The%20Council%20and%20the%20Parliament,contribute%20to%20this%20common%20target (accessed on 15 August 2023).

- Patel, A.; Singh, S. Implementing Circular Economy Strategies in the Automobile Industry—A Step toward Creating Sustainable Automobiles. BIJ 2023, 30, 2225–2233. [Google Scholar] [CrossRef]

- Grenz, J.; Ostermann, M.; Käsewieter, K.; Cerdas, F.; Marten, T.; Herrmann, C.; Tröster, T. Integrating Prospective LCA in the Development of Automotive Components. Sustainability 2023, 15, 10041. [Google Scholar] [CrossRef]

- Muslemani, H.; Liang, X.; Kaesehage, K.; Ascui, F.; Wilson, J. Opportunities and Challenges for Decarbonizing Steel Production by Creating Markets for ‘Green Steel’ Products. J. Clean. Prod. 2021, 315, 128127. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Poligkeit, J.; Fugger, T.; Herrmann, C. Decarbonization in the Automotive Sector: A Holistic Status Quo Analysis of Original Equipment Manufacturer Strategies and Carbon Management Activities. Sustainability 2023, 15, 15753. https://doi.org/10.3390/su152215753

Poligkeit J, Fugger T, Herrmann C. Decarbonization in the Automotive Sector: A Holistic Status Quo Analysis of Original Equipment Manufacturer Strategies and Carbon Management Activities. Sustainability. 2023; 15(22):15753. https://doi.org/10.3390/su152215753

Chicago/Turabian StylePoligkeit, Joseph, Thomas Fugger, and Christoph Herrmann. 2023. "Decarbonization in the Automotive Sector: A Holistic Status Quo Analysis of Original Equipment Manufacturer Strategies and Carbon Management Activities" Sustainability 15, no. 22: 15753. https://doi.org/10.3390/su152215753