Iron Ore Price Prediction Based on Multiple Linear Regression Model

Abstract

1. Introduction

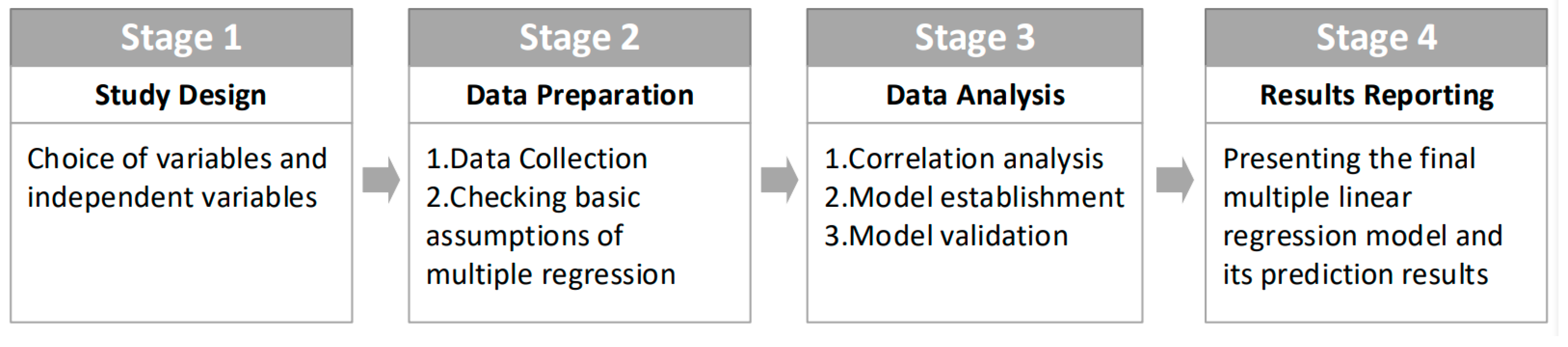

2. Methods

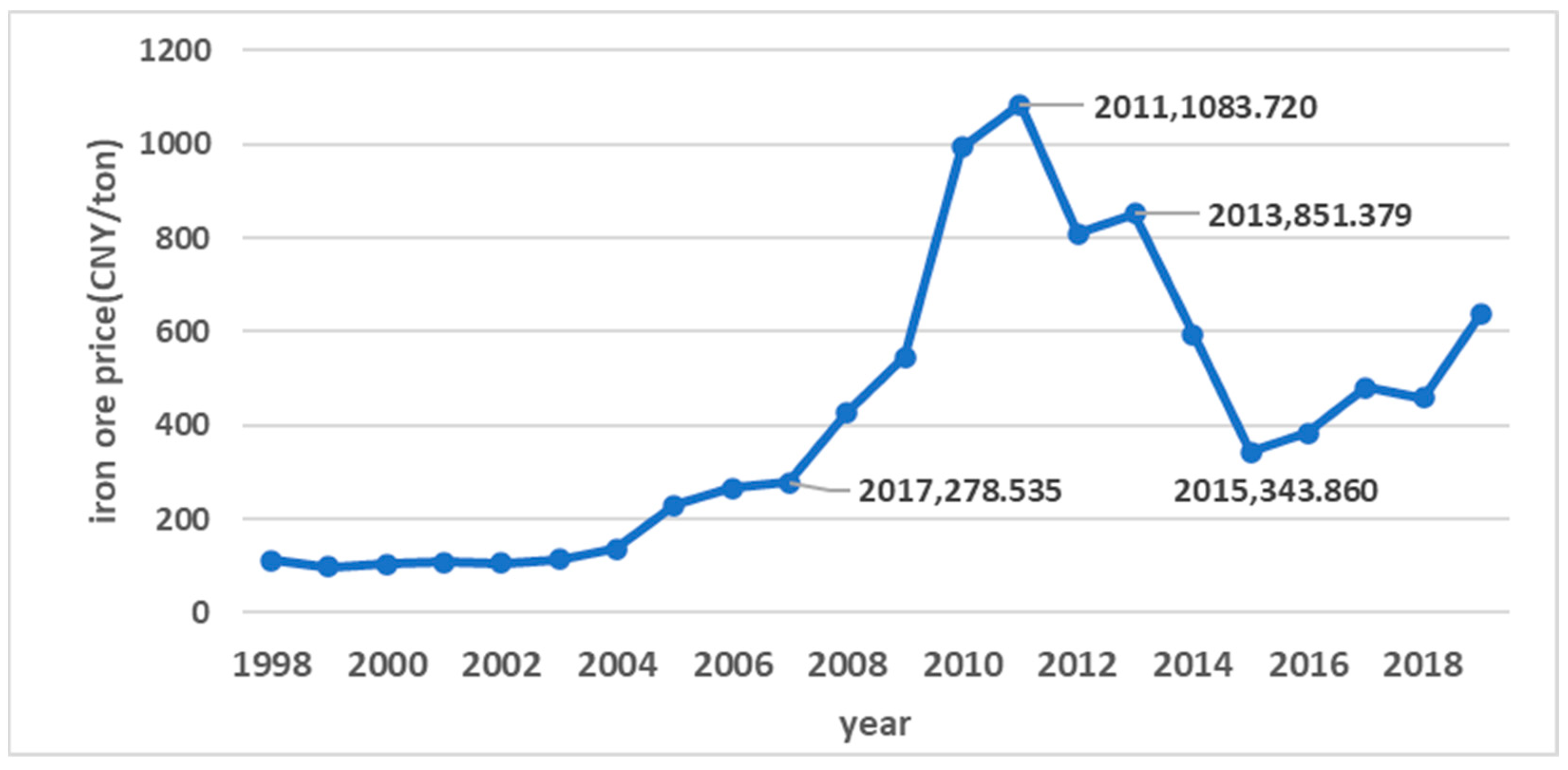

2.1. Influencing Factors of Iron Ore Prices

2.2. Data Preparation

2.3. Multiple Linear Regression Model

3. Results

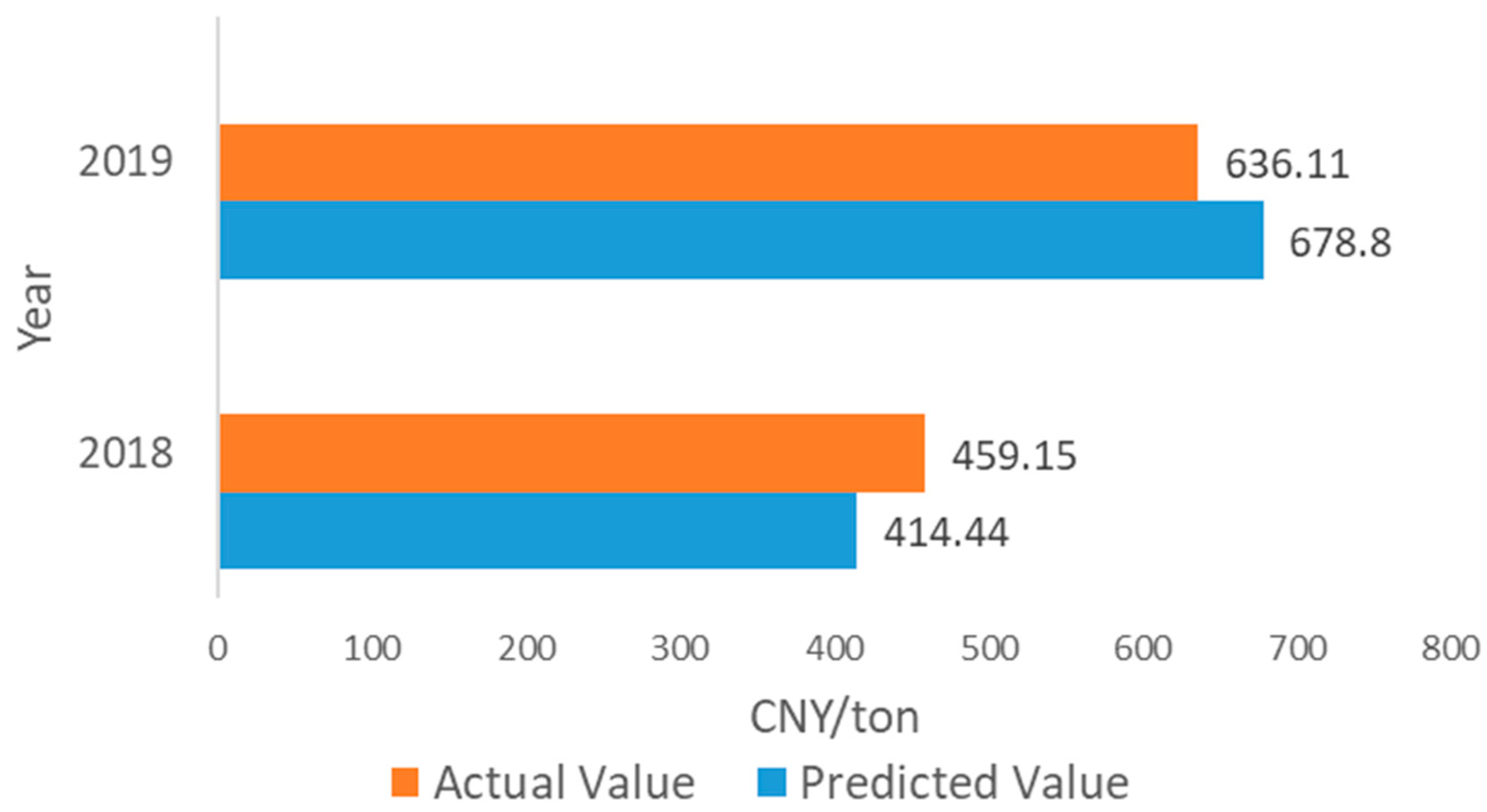

3.1. Accuracy Evaluation

3.2. Forecasting Experiments

3.2.1. Independent Variable Prediction

3.2.2. Prediction Results

4. Discussion

5. Conclusions

- (1)

- In this paper, correlation analysis was used in the influencing factors of the price of iron ore. Then, we identified various factors that are highly correlated with iron ore prices, including not only fundamental factors (supply and demand) but also non-fundamental factors such as GNI, GDP, Tariff, Fixed-Asset Investment, Steel Production, Waste Steel Consumption, Raw Iron Ore Output, and the Production Cost of Iron Concentrate. In addition, we further illustrated that the price of iron ore is the result of many factors.

- (2)

- The proposed model can be easily applied in forecasting the price of iron ore with a high degree of precision. Its effectiveness was validated through a prediction test for 2018 and 2019. The predicted iron ore prices in the next five years (2020–2024) are, respectively, 750.74 CNY/ton, 785.46 CNY/ton, 808.12 CNY/ton, 821.47CNY/ton, and 826.55 CNY/ton with an average annual growth rate of 5.51%. A detailed procedure for constructing multiple regression modeling has been presented, ensuring its application in any price prediction system. The predicted price has deviated slightly from the actual price, potentially due to the impact of COVID-19.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Mishra, D.P.; Swain, S.K. Global trends in reserves, production and utilization of iron ore and its sustainability with special emphasis to India. J. Mines Met. Fuels 2020, 68, 11–18. [Google Scholar]

- Astier, J. Evolution of iron ore prices. Miner. Econ. 2015, 28, 3–9. [Google Scholar] [CrossRef]

- Upadhyay, R.K. Iron Ore Resources: Their Conservation, Value addition and Impact on Iron and Steel Industry. Tata Search 2008, 1, 197–205. [Google Scholar]

- Wang, L.; Lai, M.; Zhang, B. The transmission effects of iron ore price shocks on China’s economy and industries: A CGE approach. Int. J. Trade Glob. Mark. 2007, 1, 23–43. [Google Scholar] [CrossRef]

- Su, C.W.; Wang, K.H.; Chang, H.L.; Peculea, A.D. Do iron ore price bubbles occur? Resour. Policy 2017, 53, 340–346. [Google Scholar] [CrossRef]

- Wu, J.; Yang, J.; Ma, L.; Shen, X. A system analysis of the development strategy of iron ore in China. Resour. Policy 2016, 48, 32–40. [Google Scholar] [CrossRef]

- Li, H.; Zhang, Z.; Li, L.; Zhang, Z.; Chen, J.; Yao, T. Types and general characteristics of the BIF-related iron deposits in China. Ore Geol. Rev. 2014, 57, 264–287. [Google Scholar] [CrossRef]

- Sari, R.; Hammoudeh, S.; Soytas, U. Dynamics of oil price, precious metal prices, and exchange rate. Energy Econ. 2010, 32, 351–362. [Google Scholar] [CrossRef]

- Pustov, A.; Malanichev, A.; Khobotilov, I. Long-term iron ore price modeling: Marginal costs vs. incentive price. Resour. Policy 2013, 38, 558–567. [Google Scholar] [CrossRef]

- Morandi, M.I.W.M.; Rodrigues, L.H.; Lacerda, D.P. Foreseeing iron ore prices using system thinking and scenario planning. Syst. Pract. Action Res. 2014, 27, 287–306. [Google Scholar] [CrossRef]

- Moghaddam, M.R.; Manjezi, M.; Danesh, A.H.M.; Kakha, G. Prediction of monthly price of iron ore by using artificial neural network. Indian J. Sci. Res. 2014, 7, 1200–1204. [Google Scholar]

- Mobtaker, M.M.; Osanloo, M. Chaos in iron ore price prediction. In Proceedings of the Southern African Institute of Mining and Metallurgy MPES 2015—Smart Innovation in Mining, Johannesburg, South Africa, 9–11 November 2015. [Google Scholar]

- Weng, F.; Hou, M.; Zhang, T.; Yang, Y.; Wang, Z.; Sun, H.; Luo, J. Application of regularized extreme learning machine based on BIC criterion and genetic algorithm in iron ore price forecasting. In Proceedings of the 3rd International Conference on Modelling, Simulation and Applied Mathematics, Shanghai, China, 22–23 July 2018. [Google Scholar]

- Ramos, A.L.; Mazzinghy, D.B.; Barbosa, V.D.S.B.; Oliveira, M.M.; Silva, G.R.D. Evaluation of an iron ore price forecast using a geometric Brownian motion model. REM-Int. Eng. J. 2019, 72, 9–15. [Google Scholar] [CrossRef][Green Version]

- Wang, W.M.; Wang, W.K.; Du, D. Application of Grey Prediction Model GM (1.1) for Forecasting Hydrology Kas an example of Manasi river. Ground Water 2007, 2007, 10–12. [Google Scholar]

- Zhao, M.; Zhao, D.; Jiang, Z.; Cui, D.; Li, J.; Shi, X. The gray prediction GM (1, 1) model in traffic forecast application. Math. Model. Eng. Probl. 2015, 2, 17–22. [Google Scholar] [CrossRef]

- Lv, J.; Tang, W.; Hosseinzadeh, H. Developed multiple-layer perceptron neural network based on developed search and rescue optimizer to predict iron ore price volatility: A case study. ISA Trans. 2022, 130, 420–432. [Google Scholar] [CrossRef] [PubMed]

- Guo, L. Analysis of Factors Affecting Iron Ore Price and Research on Price Prediction. Master’s Thesis, Xi’an University of Architecture and Technology, Xi’an, China, 2008. (In Chinese). [Google Scholar]

- Daut, M.A.M.; Hassan, M.Y.; Abdullah, H.; Rahman, H.A.; Abdullah, M.P.; Hussin, F. Building electrical energy consumption forecasting analysis using conventional and artificial intelligence methods: A review. Renew. Sustain. Energy Rev. 2017, 70, 1108–1118. [Google Scholar] [CrossRef]

- Escribano, A.; Granger, C.W.J. Investigating the relationship between gold and silver prices. J. Forecast. 1998, 17, 81–107. [Google Scholar] [CrossRef]

- Kearney, A.A.; Lombra, R.E. Gold and platinum: Toward solving the price puzzle. Q. Rev. Econ. Financ. 2009, 49, 884–892. [Google Scholar] [CrossRef]

- Zhu, Y.H. Research on the Relationship between the Cost of New Shipbuilding Materials and Changes in International Iron Ore Prices. Master’s Thesis, Shanghai Jiao Tong University, Shanghai, China, 2015. (In Chinese). [Google Scholar]

- Gu, X.W.; Wang, Z.K.; Xu, X.C.; Huang, X.H.; Wang, Q. Linear regression prediction of iron ore price considering multiple factors. Nonferrous Met. (Min. Part) 2017, 69, 98–103. (In Chinese) [Google Scholar]

- Wårell, L. An analysis of iron ore prices during the latest commodity boom. Miner. Econ. 2018, 31, 203–216. [Google Scholar] [CrossRef]

- Omundsen, J. Forecasting the Price of Iron Ore. 2019. Available online: https://core.ac.uk/download/pdf/286812523.pdf (accessed on 19 October 2023).

- Yan, X.D.; Yan, J.; Wang, Y.W.; Cui, J.H. The Impact of Tariff Policy Adjustment on the Development of China’s Steel Industry. Modern Industrial Economy and Informationization. 2022, 12, 16–19+39. (In Chinese) [Google Scholar]

- Li, D.; Moghaddam, M.R.; Monjezi, M.; Jahed Armaghani, D.; Mehrdanesh, A. Development of a group method of data handling technique to forecast iron ore price. Appl. Sci. 2020, 10, 2364. [Google Scholar] [CrossRef]

- Liu, Y.; Li, H.; Guan, J.; Liu, X.; Guan, Q.; Sun, Q. Influence of different factors on prices of upstream, middle and downstream products in China’s whole steel industry chain: Based on Adaptive Neural Fuzzy Inference System. Resour. Policy 2019, 60, 134–142. [Google Scholar] [CrossRef]

- Kutner, M.H.; Nachtsheim, C.J.; Neter, J.; Li, W. Applied Linear Statistical Models; McGraw-Hill Irwin: Boston, MA, USA, 2005. [Google Scholar]

- Huang, B.; Li, Y.; Liu, Y.; Hu, X.; Zhao, W.; Cherubini, F. A simplified multi-model statistical approach for predicting the effects of forest management on land surface temperature in Fennoscandia. Agric. For. Meteorol. 2023, 332, 109362. [Google Scholar] [CrossRef]

- Wu, P.; Qiu, S.P. Macroeconomic development prediction based on optimized multi-dimensional grey model. Stat. Decis. 2020, 36, 42–45. (In Chinese) [Google Scholar]

- Gan, Y.; Griffin, W.M. Analysis of life-cycle GHG emissions for iron ore mining and processing in China—Uncertainty and trends. Resour. Policy 2018, 58, 90–96. [Google Scholar] [CrossRef]

- Akbary, P.; Ghiasi, M.; Pourkheranjani, M.R.R.; Alipour, H.; Ghadimi, N. Extracting appropriate nodal marginal prices for all types of committed reserve. Comput. Econ. 2019, 53, 1–26. [Google Scholar] [CrossRef]

- Zhang, Q.; Wang, Y.; Zhang, W.; Xu, J. Energy and resource conservation and air pollution abatement in China’s iron and steel industry. Resour. Conserv. Recycl. 2019, 147, 67–84. [Google Scholar] [CrossRef]

- Yan, L. Research on China’s Macroscopic Countermeasures against Iron Ore Price Fluctuation. Master’s Thesis, China University of Geosciences, Beijing, China, 2009. (In Chinese). [Google Scholar]

- Lima, G.A.C.; Suslick, S.B. Estimativa da volatilidade de projetos de bens minerais. Rev. Esc. Minas 2006, 59, 37–46. [Google Scholar] [CrossRef]

- Yan, X.; Su, X. Linear Regression Analysis: Theory and Computing; World Scientific: Singapore, 2009. [Google Scholar]

| Index | GNI | GDP | Tariff | Fixed Investment | Steel Output | Waste Steel Consumption | The Raw Ore Output of Iron Ore | Production Cost |

|---|---|---|---|---|---|---|---|---|

| Correlation Coefficient | 0.75 | 0.76 | 0.85 | 0.72 | 0.77 | 0.61 | 0.84 | 0.84 |

| Year | GNI (Billion CNY) | GPD (Billion CNY) | Tariff (Billion CNY) | Fixed Investment (Billion CNY) | Steel Output (Million Ton) | Waste Steel Consumption (Million Ton) | The Raw Ore Output of Iron Ore (Million Ton) | Production Cost of Iron Fine Powder (CNY/Ton) |

|---|---|---|---|---|---|---|---|---|

| 1998 | 8380.0 | 6830.0 | 31.3 | 2840.0 | 107.0 | 27.5 | 206.0 | 260.0 |

| 1999 | 8940.0 | 7200.0 | 56.2 | 2990.0 | 121.0 | 26.7 | 209.0 | 285.0 |

| 2000 | 9910.0 | 7910.0 | 75.0 | 3290.0 | 131.0 | 29.2 | 224.0 | 290.0 |

| 2001 | 10,900.0 | 8690.0 | 84.1 | 3720.0 | 161.0 | 34.4 | 217.0 | 352.0 |

| 2002 | 12,000.0 | 9480.0 | 70.4 | 4350.0 | 193.0 | 39.2 | 231.0 | 320.0 |

| 2003 | 13,700.0 | 10,600.0 | 92.3 | 5560.0 | 241.0 | 48.2 | 261.0 | 345.0 |

| 2004 | 16,100.0 | 12,500.0 | 104.0 | 7050.0 | 320.0 | 54.3 | 310.0 | 404.0 |

| 2005 | 18,600.0 | 14,300.0 | 107.0 | 8880.0 | 378.0 | 60.0 | 420.0 | 468.0 |

| 2006 | 21,900.0 | 16,700.0 | 114.0 | 11,000.0 | 469.0 | 67.2 | 588.0 | 502.0 |

| 2007 | 27,100.0 | 20,400.0 | 143.0 | 13,700.0 | 566.0 | 68.5 | 707.0 | 525.0 |

| 2008 | 32,100.0 | 24,000.0 | 177.0 | 17,300.0 | 605.0 | 72.0 | 824.0 | 624.0 |

| 2009 | 34,800.0 | 26,100.0 | 148.0 | 22,500.0 | 694.0 | 83.1 | 880.0 | 563.0 |

| 2010 | 41,000.0 | 30,700.0 | 203.0 | 25,200.0 | 803.0 | 86.7 | 1070.0 | 589.0 |

| 2011 | 48,300.0 | 36,200.0 | 256.0 | 31,100.0 | 886.0 | 91.0 | 1330.0 | 615.0 |

| 2012 | 8380.0 | 6830.0 | 31.3 | 2840.0 | 107.0 | 27.5 | 206.0 | 260.0 |

| 2013 | 8940.0 | 7200.0 | 56.2 | 2990.0 | 121.0 | 26.7 | 209.0 | 285.0 |

| 2014 | 9910.0 | 7910.0 | 75.0 | 3290.0 | 131.0 | 29.2 | 224.0 | 290.0 |

| 2015 | 10,900.0 | 8690.0 | 84.1 | 3720.0 | 161.0 | 34.4 | 217.0 | 352.0 |

| 2016 | 12,000.0 | 9480.0 | 70.4 | 4350.0 | 193.0 | 39.2 | 231.0 | 320.0 |

| 2017 | 13,700.0 | 10,600.0 | 92.3 | 5560.0 | 241.0 | 48.2 | 261.0 | 345.0 |

| 2018 | 16,100.0 | 12,500.0 | 104.0 | 7050.0 | 320.0 | 54.3 | 310.0 | 404.0 |

| 2019 | 18,600.0 | 14,300.0 | 107.0 | 8880.0 | 378.0 | 60.0 | 420.0 | 468.0 |

| Coefficients | Regressed Value |

|---|---|

| −488.81 | |

| −0.038683 | |

| 0.059416 | |

| 0.12591 | |

| −0.0042319 | |

| 0.00021895 | |

| −0.027253 | |

| 0.0032307 | |

| −0.740260 |

| Year | Predicted Value | Actual Value | Error |

|---|---|---|---|

| 2018 | 414.44 | 459.15 | −9.74% |

| 2019 | 678.80 | 636.11 | 6.71% |

| Independent Variable | GNI | GDP | Tariff | Fixed Investment | Steel Output | Waste Steel Consumption | The Raw Ore Output of Iron Ore | Production Cost |

|---|---|---|---|---|---|---|---|---|

| Annual growth rate | 7% | 7% | * | 9.5% | 7% | 3% | 2% | 4% |

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| GNI (billion CNY) | 106,000 | 113,000 | 121,000 | 130,000 | 139,000 |

| GDP (billion CNY) | 7570 | 8100 | 8670 | 9280 | 9930 |

| Tariff (billion CNY) | 332 | 349 | 359 | 366 | 372 |

| Fixed Investment (billion CNY) | 61,400 | 67,200 | 73,600 | 80,600 | 88,300 |

| Steel Output (million tons) | 1290 | 1380 | 1480 | 1580 | 1690 |

| Waste Steel Consumption (million tons) | 227 | 233 | 240 | 248 | 255 |

| The raw ore output of iron ore (million tons) | 861 | 878 | 896 | 914 | 932 |

| Production cost of iron fine powder (CNY/ton) | 473 | 492 | 511 | 532 | 553 |

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Prediction of iron ore prices (CNY/ton) | 750.74 | 785.46 | 808.12 | 821.47 | 826.55 |

| Growth rate (%) | 18.02 | 4.42 | 2.88 | 1.63 | 0.62 |

| Iron ore prices (CNY/ton) | 750.74 | 1239 | 838.56 | 820.80 | / |

| Variables | Correlation Coefficient |

|---|---|

| GNI (billion CNY) | 0.944 |

| GDP (billion CNY) | 0.944 |

| Tariff (billion CNY) | 0.996 |

| Fixed Investment (billion CNY) | 0.938 |

| Steel Output (million tons) | 0.943 |

| Waste Steel Consumption (million tons) | 0.950 |

| The raw ore output of iron ore (million tons) | 0.952 |

| Production cost of iron fine powder (CNY/ton) | 0.948 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Guo, Z.; Zhang, Y.; Hu, X.; Xiao, J. Iron Ore Price Prediction Based on Multiple Linear Regression Model. Sustainability 2023, 15, 15864. https://doi.org/10.3390/su152215864

Wang Y, Guo Z, Zhang Y, Hu X, Xiao J. Iron Ore Price Prediction Based on Multiple Linear Regression Model. Sustainability. 2023; 15(22):15864. https://doi.org/10.3390/su152215864

Chicago/Turabian StyleWang, Yanyi, Zhenwei Guo, Yunrui Zhang, Xiangping Hu, and Jianping Xiao. 2023. "Iron Ore Price Prediction Based on Multiple Linear Regression Model" Sustainability 15, no. 22: 15864. https://doi.org/10.3390/su152215864

APA StyleWang, Y., Guo, Z., Zhang, Y., Hu, X., & Xiao, J. (2023). Iron Ore Price Prediction Based on Multiple Linear Regression Model. Sustainability, 15(22), 15864. https://doi.org/10.3390/su152215864