A Detailed Examination of China’s Clean Energy Mineral Consumption: Footprints, Trends, and Drivers

Abstract

1. Introduction

2. Literature Review

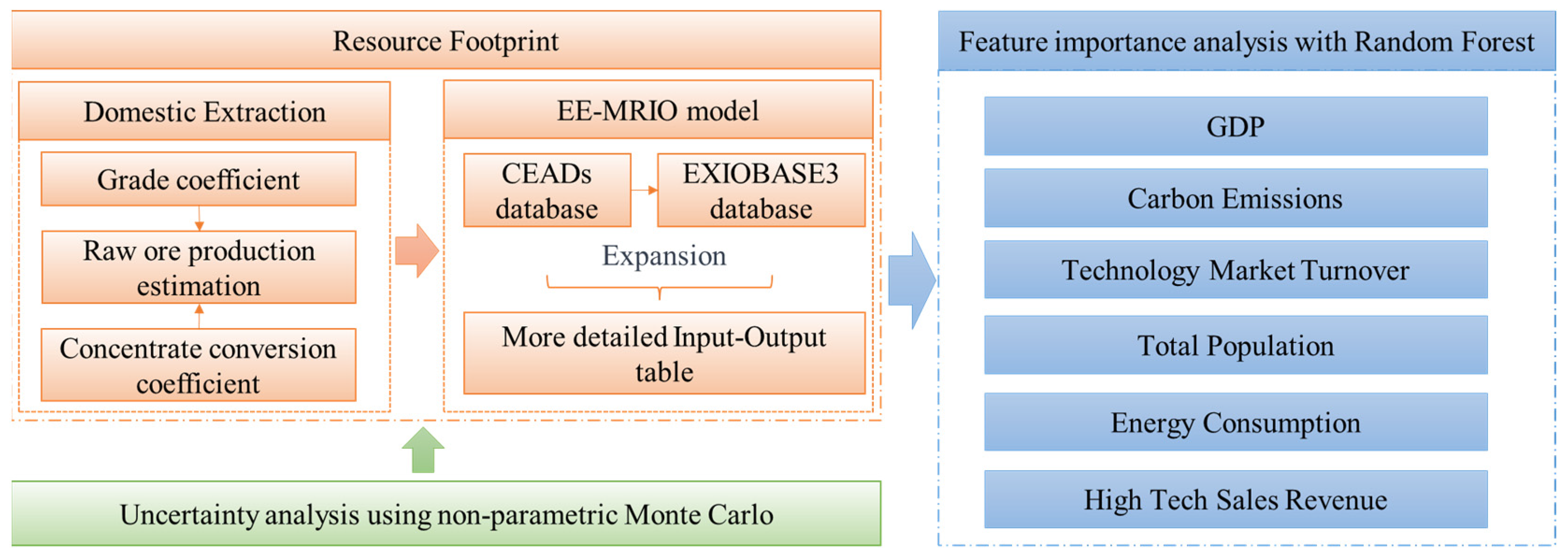

3. Methodology

3.1. Estimation of Raw Mining Capacity of Clean Energy Minerals

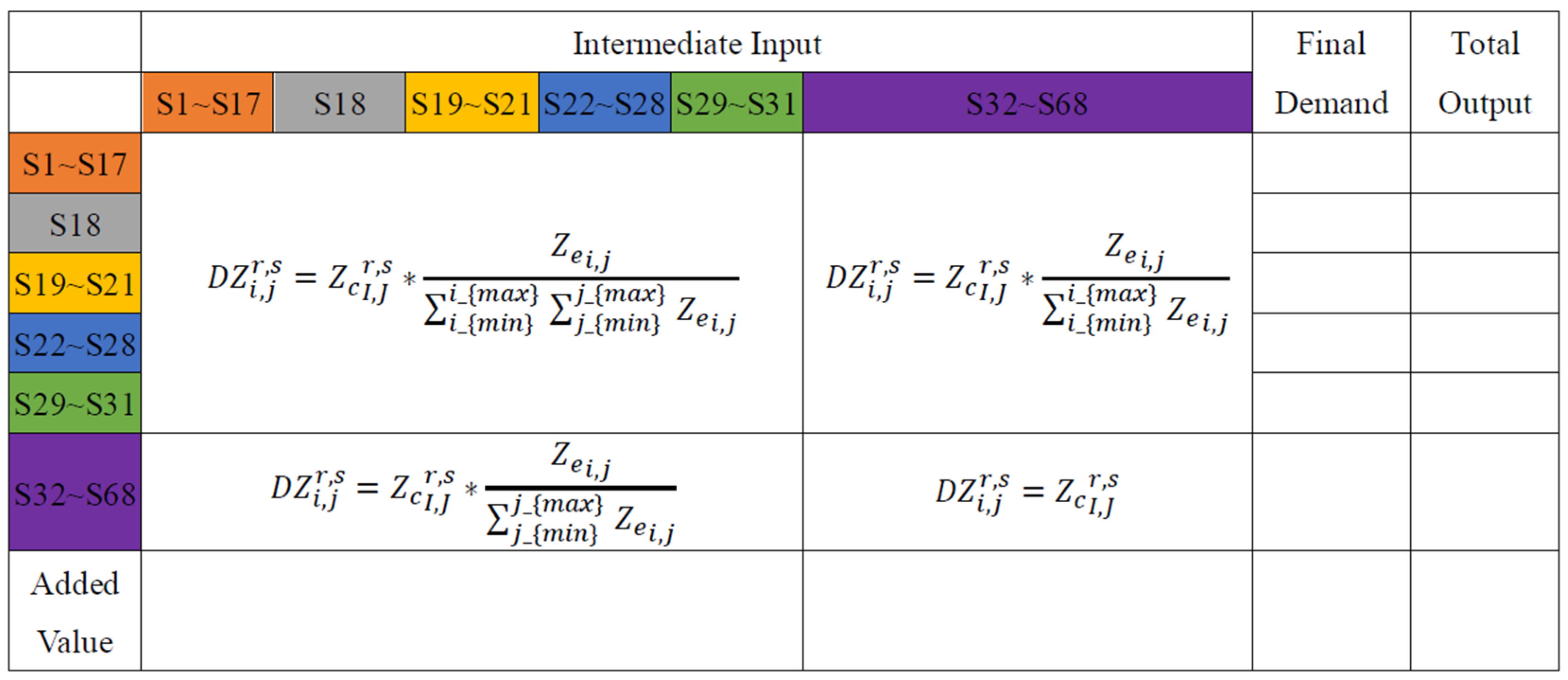

3.2. EE-MRIO Model

3.3. Non-Parametric Monte Carlo Methods

3.4. Random Forest Regression

3.4.1. Random Forest Regression Method

3.4.2. Feature Selection

- (1)

- Economic Development: represented by a region’s GDP, indicating its economic strength and the potential demand for clean energy resources;

- (2)

- Industrial Structure: captured by the revenue from new product sales in high-tech industries, reflecting a shift towards knowledge and technology-intensive industries;

- (3)

- Environmental Quality: measured by total carbon emissions, suggesting how environmental conditions might impact resource use efficiency;

- (4)

- Population Size: indicated by the total population, representing basic resource demand;

- (5)

- Energy Consumption: denoted by a region’s total energy consumption, reflecting demand for clean energy resources;

- (6)

- Technological Innovation: represented by a region’s technology market turnover, showcasing the impact of innovation on resource efficiency.

3.5. Data Source

4. Results

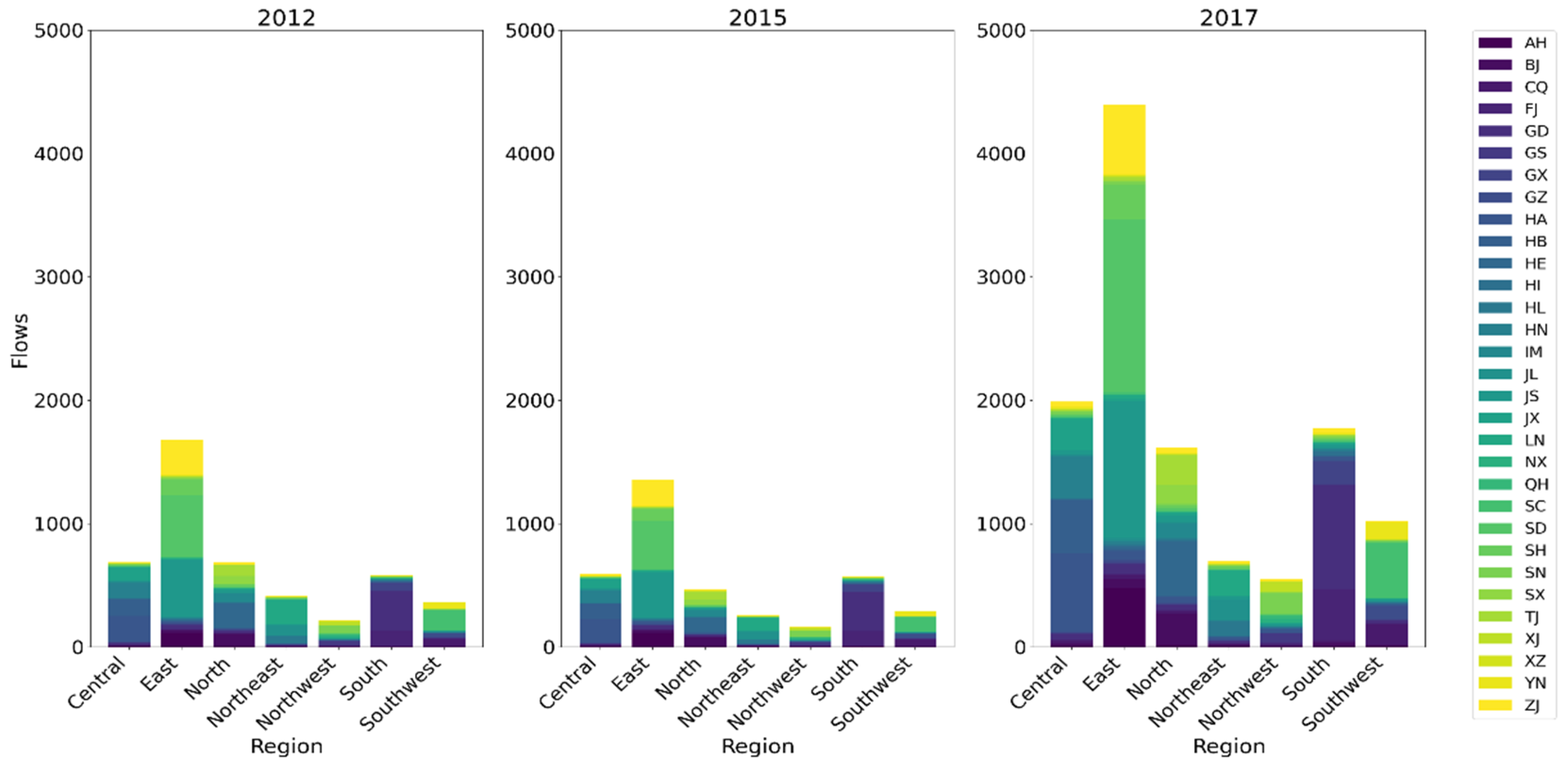

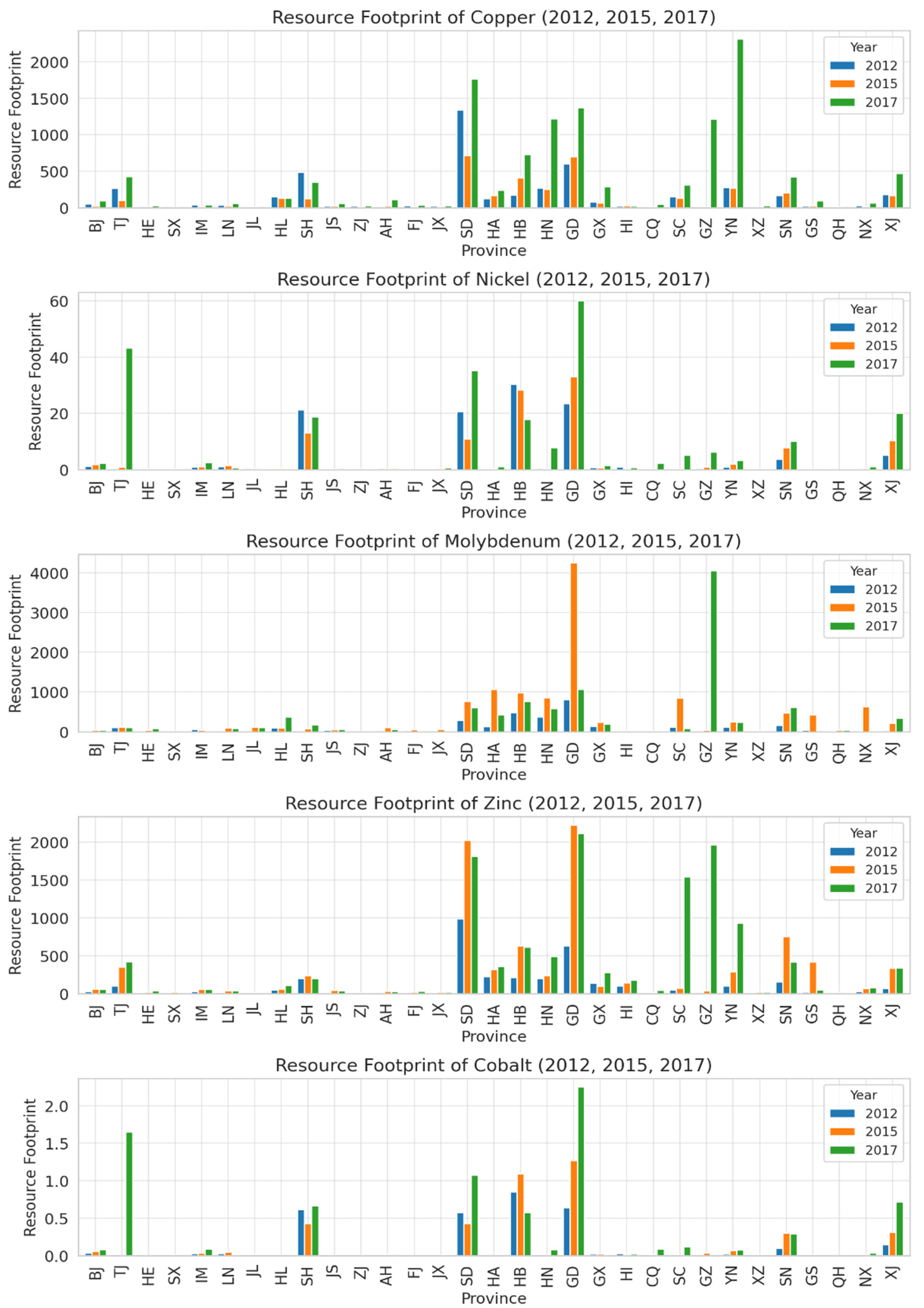

4.1. Interpretation of Resource Footprint Results

4.2. Uncertainty Analysis Using the Non-Parametric Monte Carlo

4.3. Random Forest Regression Results

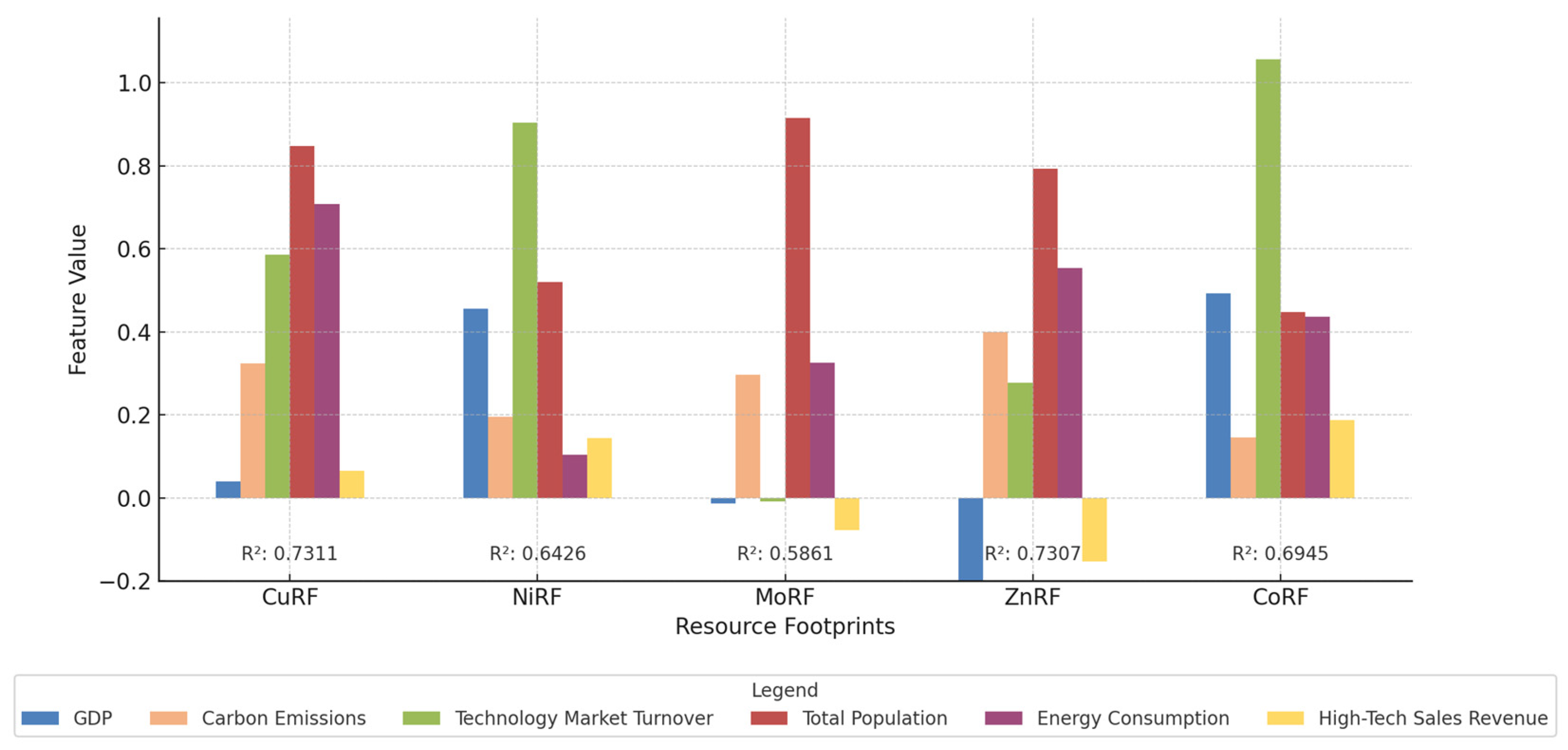

4.3.1. Model Results

4.3.2. Robustness Testing

5. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| Abbreviation | Full Name | Abbreviation | Full Name |

| EE-MRIO | Environmentally Extended Multi-Regional Input–Output | HL | Heilongjiang |

| RF | Resource Footprint | SH | Shanghai |

| CEADS | China Emission Accounts and Datasets | JS | Jiangsu |

| GDP | Gross Domestic Product | ZJ | Zhejiang |

| Cu | Copper | AH | Anhui |

| Ni | Nickel | FJ | Fujian |

| Mo | Molybdenum | JX | Jiangxi |

| Zn | Zinc | SD | Shandong |

| Co | Cobalt | HA | Henan |

| CV | Coefficient of Variation | HB | Hubei |

| NT | Number of Trees | HN | Hunan |

| MLS | Minimum Leaf Size | GD | Guangdong |

| MNS | Maximum Number of Splits | GX | Guangxi |

| NVS | Number of Variables to Sample | HI | Hannan |

| MSE | Mean Squared Error | CQ | Chongqing |

| MAE | Mean Absolute Error | SC | Sichuan |

| RMSE | Root Mean Squared Error | GZ | Guizhou |

| R2 | Coefficient of Determination | YN | Yunnan |

| BJ | Beijing | XZ | Tibet |

| TJ | Tianjin | SN | Shanxi |

| HE | Hebei | GS | Gansu |

| SX | Shanxi | QH | Qinghai |

| IM | Inner Mongolia | NX | Ningxia |

| LN | Liaoning | XJ | Xinjiang |

References

- Islam, M.M.; Irfan, M.; Shahbaz, M.; Vo, X.V. Renewable and Non-Renewable Energy Consumption in Bangladesh: The Relative Influencing Profiles of Economic Factors, Urbanization, Physical Infrastructure and Institutional Quality. Renew. Energy 2022, 184, 1130–1149. [Google Scholar] [CrossRef]

- Dou, S.; Xu, D.; Zhu, Y.; Keenan, R. Critical Mineral Sustainable Supply: Challenges and Governance. Futures 2023, 146, 103101. [Google Scholar] [CrossRef]

- Vivoda, V. Friend-Shoring and Critical Minerals: Exploring the Role of the Minerals Security Partnership. Energy Res. Soc. Sci. 2023, 100, 103085. [Google Scholar] [CrossRef]

- World Bank. Climate-Smart Mining: Minerals for Climate Action. 2018. Available online: https://www.worldbank.org/en/topic/extractiveindustries/brief/climate-smart-mining-minerals-for-climate-action (accessed on 10 March 2023).

- Raimi, D.; Campbell, E.; Newell, R.; Prest, B.; Villanueva, S.; Wingenroth, J. Global Energy Outlook 2022: Turning Points and Tension in the Energy Transition; Resources for the Future: Washington, DC, USA, 2022. [Google Scholar]

- Purdy, C.; Castillo, R. China’s Role in Supplying Critical Minerals for the Global Energy Transition. 2022. Available online: https://www.brookings.edu/wp-content/uploads/2022/08/LTRC_ChinaSupplyChain.pdf (accessed on 15 June 2023).

- Franks, D.M.; Keenan, J.; Hailu, D. Mineral Security Essential to Achieving the Sustainable Development Goals. Nat. Sustain. 2023, 6, 21–27. [Google Scholar] [CrossRef]

- Calvo, G.; Valero, A. Strategic Mineral Resources: Availability and Future Estimations for the Renewable Energy Sector. Environ. Dev. 2022, 41, 100640. [Google Scholar] [CrossRef]

- Fang, C.; Cheng, J.; Zhu, Y.; Chen, J.; Peng, X. Green Total Factor Productivity of Extractive Industries in China: An Explanation from Technology Heterogeneity. Resour. Policy 2021, 70, 101933. [Google Scholar] [CrossRef]

- Hayes, S.M.; McCullough, E.A. Critical Minerals: A Review of Elemental Trends in Comprehensive Criticality Studies. Resour. Policy 2018, 59, 192–199. [Google Scholar] [CrossRef]

- Watari, T.; Nansai, K.; Nakajima, K. Review of Critical Metal Dynamics to 2050 for 48 Elements. Resour. Conserv. Recycl. 2020, 155, 104669. [Google Scholar] [CrossRef]

- Islam, M.M.; Sohag, K.; Alam, M.M. Mineral Import Demand and Clean Energy Transitions in the Top Mineral-Importing Countries. Resour. Policy 2022, 78, 102893. [Google Scholar] [CrossRef]

- Yi, J.; Dai, S.; Cheng, J.; Wu, Q.; Liu, K. Production Quota Policy in China: Implications for Sustainable Supply Capacity of Critical Minerals. Resour. Policy 2021, 72, 102046. [Google Scholar] [CrossRef]

- Ladislaw, S.; Zindler, E.; Tsafos, N.; Goldie-Scot, L.; Carey, L.; Lezcano, P.; Nakano, J.; Chase, J. Industrial Policy, Trade, and Clean Energy Supply Chains; Center for Strategic and International Studies (CSIS): Washington, DC, USA; BloombergNEF: New York, NY, USA, 2021. [Google Scholar]

- Cox, B.; Innis, S.; Kunz, N.C.; Steen, J. The Mining Industry as a Net Beneficiary of a Global Tax on Carbon Emissions. Commun. Earth Environ. 2022, 3, 17. [Google Scholar] [CrossRef]

- Economy-Wide Material Flow Accounts and Derived Indicators—A Methodological Guide (PDF). 2001. Available online: https://ec.europa.eu/eurostat/web/products-manuals-and-guidelines/-/ks-34-00-536 (accessed on 15 November 2022).

- Zhang, Y.; Ji, Y.; Xu, H.; Yang, Y.; Tian, L. Life Cycle Assessment of Valuable Metal Extraction from Copper Pyrometallurgical Solid Waste. Resour. Conserv. Recycl. 2023, 191, 106875. [Google Scholar] [CrossRef]

- Wang, H.; Hashimoto, S.; Moriguchi, Y.; Yue, Q.; Lu, Z. Resource Use in Growing China. J. Ind. Ecol. 2012, 16, 481–492. [Google Scholar] [CrossRef]

- Zeng, X.; Ali, S.H.; Tian, J.; Li, J. Mapping Anthropogenic Mineral Generation in China and Its Implications for a Circular Economy. Nat. Commun. 2020, 11, 1544. [Google Scholar] [CrossRef] [PubMed]

- Wood, R.; Stadler, K.; Simas, M.; Bulavskaya, T.; Giljum, S.; Lutter, S.; Tukker, A. Growth in Environmental Footprints and Environmental Impacts Embodied in Trade: Resource Efficiency Indicators from EXIOBASE3. J. Ind. Ecol. 2018, 22, 553–564. [Google Scholar] [CrossRef]

- Ahmed, Z.; Asghar, M.M.; Malik, M.N.; Nawaz, K. Moving towards a Sustainable Environment: The Dynamic Linkage between Natural Resources, Human Capital, Urbanization, Economic Growth, and Ecological Footprint in China. Resour. Policy 2020, 67, 101677. [Google Scholar] [CrossRef]

- Yilanci, V.; Pata, U.K. Investigating the EKC Hypothesis for China: The Role of Economic Complexity on Ecological Footprint. Environ. Sci. Pollut. Res. 2020, 27, 32683–32694. [Google Scholar] [CrossRef]

- Akalin, G.; Erdogan, S.; Sarkodie, S.A. Do Dependence on Fossil Fuels and Corruption Spur Ecological Footprint? Environ. Impact Assess. Rev. 2021, 90, 106641. [Google Scholar] [CrossRef]

- Abbood, K.; Meszaros, F. Carbon Footprint Analysis of the Freight Transport Sector Using a Multi-Region Input–Output Model (MRIO) from 2000 to 2014: Evidence from Industrial Countries. Sustainability 2023, 15, 7787. [Google Scholar] [CrossRef]

- Huang, Y.; Huang, D. Decoupling Economic Growth from Embodied Water–Energy–Food Consumption Based on a Modified MRIO Model: A Case Study of the Yangtze River Delta Region in China. Sustainability 2023, 15, 10779. [Google Scholar] [CrossRef]

- Long, Y.; Chen, G.; Wang, Y. Carbon Footprint of Residents’ Online Consumption in China. Environ. Impact Assess. Rev. 2023, 103, 107228. [Google Scholar] [CrossRef]

- Lenzen, M.; Geschke, A.; West, J.; Fry, J.; Malik, A.; Giljum, S.; Milà i Canals, L.; Piñero, P.; Lutter, S.; Wiedmann, T.; et al. Implementing the Material Footprint to Measure Progress towards Sustainable Development Goals 8 and 12. Nat. Sustain. 2022, 5, 157–166. [Google Scholar] [CrossRef]

- Tukker, A.; de Koning, A.; Owen, A.; Lutter, S.; Bruckner, M.; Giljum, S.; Stadler, K.; Wood, R.; Hoekstra, R. Towards Robust, Authoritative Assessments of Environmental Impacts Embodied in Trade: Current State and Recommendations. J. Ind. Ecol. 2018, 22, 585–598. [Google Scholar] [CrossRef]

- Jiang, M.; Behrens, P.; Wang, T.; Tang, Z.; Yu, Y.; Chen, D.; Liu, L.; Ren, Z.; Zhou, W.; Zhu, S.; et al. Provincial and Sector-Level Material Footprints in China. Proc. Natl. Acad. Sci. USA 2019, 116, 26484–26490. [Google Scholar] [CrossRef] [PubMed]

- Wang, H.; Tian, X.; Tanikawa, H.; Chang, M.; Hashimoto, S.; Moriguchi, Y.; Lu, Z. Exploring China’s Materialization Process with Economic Transition: Analysis of Raw Material Consumption and Its Socioeconomic Drivers. Environ. Sci. Technol. 2014, 48, 5025–5032. [Google Scholar] [CrossRef]

- Wiedmann, T.O.; Schandl, H.; Lenzen, M.; Moran, D.; Suh, S.; West, J.; Kanemoto, K. The Material Footprint of Nations. Proc. Natl. Acad. Sci. USA 2015, 112, 6271–6276. [Google Scholar] [CrossRef] [PubMed]

- Tukker, A.; Bulavskaya, T.; Giljum, S.; Koning, A.; Lutter, F.S.; Simas, M.; Stadler, K.; Wood, R. The Global Resource Footprint of Nations: Carbon, Water, Land and Materials Embodied in Trade and Final Consumption Calculated with EXIOBASE 2.1; TNO: Delft, The Netherlands, 2014. [Google Scholar]

- Li, M.; Meng, B.; Gao, Y.; Guilhoto, J.J.M.; Wang, K.; Geng, Y. Material Footprints in Global Value Chains with Consideration of Multinational Enterprises. Resour. Conserv. Recycl. 2023, 190, 106828. [Google Scholar] [CrossRef]

- Platon, V.; Pavelescu, F.M.; Surugiu, M.; Frone, S.; Mazilescu, R.; Constantinescu, A.; Popa, F. Influence of Eco-Innovation and Recycling on Raw Material Consumption; Econometric Approach in the Case of the European Union. Sustainability 2023, 15, 3996. [Google Scholar] [CrossRef]

- Jiang, M.; Liu, L.; Behrens, P.; Wang, T.; Tang, Z.; Chen, D.; Yu, Y.; Ren, Z.; Zhu, S.; Tukker, A.; et al. Improving Subnational Input–Output Analyses Using Regional Trade Data: A Case-Study and Comparison. Environ. Sci. Technol. 2020, 54, 12732–12741. [Google Scholar] [CrossRef]

- Zhou, Y.; Li, J.; Wang, G.; Chen, S.; Xing, W.; Li, T. Assessing the Short-to Medium-Term Supply Risks of Clean Energy Minerals for China. J. Clean. Prod. 2019, 215, 217–225. [Google Scholar] [CrossRef]

- Baz, K.; Cheng, J.; Xu, D.; Abbas, K.; Ali, I.; Ali, H.; Fang, C. Asymmetric Impact of Fossil Fuel and Renewable Energy Consumption on Economic Growth: A Nonlinear Technique. Energy 2021, 226, 120357. [Google Scholar] [CrossRef]

- Koçak, E.; Şarkgüneşi, A. The Renewable Energy and Economic Growth Nexus in Black Sea and Balkan Countries. Energy Policy 2017, 100, 51–57. [Google Scholar] [CrossRef]

- Guliyev, H.; Mustafayev, E. Predicting the Changes in the WTI Crude Oil Price Dynamics Using Machine Learning Models. Resour. Policy 2022, 77, 102664. [Google Scholar] [CrossRef]

- Ahmad, T.; Chen, H. Nonlinear Autoregressive and Random Forest Approaches to Forecasting Electricity Load for Utility Energy Management Systems. Sustain. Cities Soc. 2019, 45, 460–473. [Google Scholar] [CrossRef]

- Tang, Z.; Mei, Z.; Liu, W.; Xia, Y. Identification of the Key Factors Affecting Chinese Carbon Intensity and Their Historical Trends Using Random Forest Algorithm. J. Geogr. Sci. 2020, 30, 743–756. [Google Scholar] [CrossRef]

- Tao, M.; Zhang, T.; Xie, X.; Liang, X. Water Footprint Modeling and Forecasting of Cassava Based on Different Artificial Intelligence Algorithms in Guangxi, China. J. Clean. Prod. 2023, 382, 135238. [Google Scholar] [CrossRef]

- Cutler, D.R.; Edwards, T.C., Jr.; Beard, K.H.; Cutler, A.; Hess, K.T.; Gibson, J.; Lawler, J.J. Random Forests for Classification in Ecology. Ecology 2007, 88, 2783–2792. [Google Scholar] [CrossRef]

- Ma, J.; Cheng, J.C.P. Identifying the Influential Features on the Regional Energy Use Intensity of Residential Buildings Based on Random Forests. Appl. Energy 2016, 183, 193–201. [Google Scholar] [CrossRef]

- Ahmad, M.W.; Reynolds, J.; Rezgui, Y. Predictive Modelling for Solar Thermal Energy Systems: A Comparison of Support Vector Regression, Random Forest, Extra Trees and Regression Trees. J. Clean. Prod. 2018, 203, 810–821. [Google Scholar] [CrossRef]

- Croft, S.; West, C.; Green, J. Capturing the Heterogeneity of Sub-National Production in Global Trade Flows. J. Clean. Prod. 2018, 203, 1106–1118. [Google Scholar] [CrossRef]

- Michaels, K.C. The Role of Critical Minerals in Clean Energy Transitions. Available online: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions (accessed on 10 December 2022).

- Södersten, C.-J.; Wood, R.; Wiedmann, T. The Capital Load of Global Material Footprints. Resour. Conserv. Recycl. 2020, 158, 104811. [Google Scholar] [CrossRef]

- Liu, L.; Schandl, H.; West, J.; Jiang, M.; Ren, Z.; Chen, D.; Zhu, B. Copper Ore Material Footprints and Transfers Embodied in Domestic and International Trade of Provinces in China. J. Ind. Ecol. 2022, 26, 1423–1436. [Google Scholar] [CrossRef]

- Dominicy, Y.; Veredas, D. The Method of Simulated Quantiles. J. Econom. 2013, 172, 235–247. [Google Scholar] [CrossRef][Green Version]

- Li, Y.; Zou, C.; Berecibar, M.; Nanini-Maury, E.; Chan, J.C.-W.; van den Bossche, P.; Van Mierlo, J.; Omar, N. Random Forest Regression for Online Capacity Estimation of Lithium-Ion Batteries. Appl. Energy 2018, 232, 197–210. [Google Scholar] [CrossRef]

- Breiman, L. Random Forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Snoek, J.; Larochelle, H.; Adams, R.P. Practical Bayesian Optimization of Machine Learning Algorithms. In Advances in Neural Information Processing Systems; Curran Associates, Inc.: New York, NY, USA, 2012; Volume 25. [Google Scholar]

- Mullainathan, S.; Spiess, J. Machine Learning: An Applied Econometric Approach. J. Econ. Perspect. 2017, 31, 87–106. [Google Scholar] [CrossRef]

- Jiang, W.; Sun, Y. Which Is the More Important Factor of Carbon Emission, Coal Consumption or Industrial Structure? Energy Policy 2023, 176, 113508. [Google Scholar] [CrossRef]

- Zheng, H.; Bai, Y.; Wei, W.; Meng, J.; Zhang, Z.; Song, M.; Guan, D. Chinese Provincial Multi-Regional Input-Output Database for 2012, 2015, and 2017. Sci. Data 2021, 8, 244. [Google Scholar] [CrossRef]

- Stadler, K.; Wood, R.; Bulavskaya, T.; Södersten, C.-J.; Simas, M.; Schmidt, S.; Usubiaga, A.; Acosta-Fernández, J.; Kuenen, J.; Bruckner, M.; et al. EXIOBASE 3, Version 3.8.2; Zenodo. 2021. Available online: https://zenodo.org/records/5589597#.ZAX2yD1By3A (accessed on 13 November 2022).

- Zeng, X.; Zheng, H.; Gong, R.; Eheliyagoda, D.; Zeng, X. Uncovering the Evolution of Substance Flow Analysis of Nickel in China. Resour. Conserv. Recycl. 2018, 135, 210–215. [Google Scholar] [CrossRef]

- Bai, Y.; Zhang, T.; Zhai, Y.; Jia, Y.; Ren, K.; Hong, J. Strategies for Improving the Environmental Performance of Nickel Production in China: Insight into a Life Cycle Assessment. J. Environ. Manag. 2022, 312, 114949. [Google Scholar] [CrossRef]

- Xu, G.; Geng, M.; Schwarz, P.; Dong, H.; Gong, Y.; Yang, H.; Thomas, M. The Effect of Industrial Relocations to Central and Western China on Urban Construction Land Expansion. J. Land Use Sci. 2021, 16, 339–357. [Google Scholar] [CrossRef]

- Li, Q.; Zeng, F.; Liu, S.; Yang, M.; Xu, F. The Effects of China’s Sustainable Development Policy for Resource-Based Cities on Local Industrial Transformation. Resour. Policy 2021, 71, 101940. [Google Scholar] [CrossRef]

- Jia, H.; Li, T.; Wang, A.; Liu, G.; Guo, X. Decoupling Analysis of Economic Growth and Mineral Resources Consumption in China from 1992 to 2017: A Comparison between Tonnage and Exergy Perspective. Resour. Policy 2021, 74, 102448. [Google Scholar] [CrossRef]

| Original Sector in CEADs | Allocated Sector | No. |

|---|---|---|

| Agriculture, Forestry, Animal Husbandry and Fishery | Cultivation of paddy rice | S1 |

| Cultivation of wheat | S2 | |

| Cultivation of cereal grains n.e.c. | S3 | |

| Cultivation of vegetables, fruit, nuts | S4 | |

| Cultivation of oil seeds | S5 | |

| Cultivation of sugar cane, sugar beet | S6 | |

| Cultivation of plant-based fibers | S7 | |

| Cultivation of crops n.e.c. | S8 | |

| Cattle farming | S9 | |

| Pigs farming | S10 | |

| Poultry farming | S11 | |

| Meat animals n.e.c. | S12 | |

| Animal products n.e.c. | S13 | |

| Raw milk | S14 | |

| Wool, silk-worm cocoons | S15 | |

| Manure treatment (conventional), storage and land application | S15 | |

| Manure treatment (biogas), storage and land application | S15 | |

| Forestry, logging, and related service activities | S16 | |

| Fishing, operating of fish hatcheries and fish farms; service activities incidental to fishing | S17 | |

| Mining and washing of coal | Mining of coal and lignite; extraction of peat | S18 |

| Extraction of petroleum and natural gas | Extraction of crude petroleum and services related to crude oil extraction, excluding surveying | S19 |

| Extraction of natural gas and services related to natural gas extraction, excluding surveying | S20 | |

| Extraction, liquefaction, and regasification of other petroleum and gaseous materials | S19 | |

| Mining and processing of metal ores | Mining of uranium and thorium ores | S21 |

| Mining of iron ores | S22 | |

| Mining of copper ores and concentrates | S23 | |

| Mining of nickel ores and concentrates | S24 | |

| Mining of aluminum ores and concentrates | S25 | |

| Mining of precious metal ores and concentrates | S26 | |

| Mining of lead, zinc and tin ores and concentrates | S27 | |

| Mining of other non-ferrous metal ores and concentrates | S28 | |

| Mining and processing of nonmetal and other ores | Quarrying of stone | S29 |

| Quarrying of sand and clay | S30 | |

| Mining of chemical and fertilizer minerals, production of salt, other mining and quarrying n.e.c. | S31 |

| Sector No. | 2012 and 2015 | 2017 |

|---|---|---|

| S32 | Food and tobacco processing | Food and tobacco processing |

| S33 | Textile industry | Textile industry |

| S34 | Manufacture of leather, fur, feather, and related products | Manufacture of leather, fur, feather, and related products |

| S35 | Processing of timber and furniture | Processing of timber and furniture |

| S36 | Manufacture of paper, printing and articles for culture, education, and sport activity | Manufacture of paper, printing and articles for culture, education, and sport activity |

| S37 | Processing of petroleum, coking, processing of nuclear fuel | Processing of petroleum, coking, processing of nuclear fuel |

| S38 | Manufacture of chemical products | Manufacture of chemical products |

| S39 | Manuf. of non-metallic mineral products | Manuf. of non-metallic mineral products |

| S40 | Smelting and processing of metals | Smelting and processing of metals |

| S41 | Manufacture of metal products | Manufacture of metal products |

| S42 | Manufacture of general purpose machinery | Manufacture of general purpose machinery |

| S43 | Manufacture of special purpose machinery | Manufacture of special purpose machinery |

| S44 | Manufacture of transport equipment | Manufacture of transport equipment |

| S45 | Manufacture of electrical machinery and equipment | Manufacture of electrical machinery and equipment |

| S46 | Manufacture of communication equipment, computers, and other electronic equipment | Manufacture of communication equipment, computers, and other electronic equipment |

| S47 | Manufacture of measuring instruments | Manufacture of measuring instruments |

| S48 | Other manufacturing | Other manufacturing and waste resources |

| S49 | Comprehensive use of waste resources | Repair of metal products, machinery, and equipment |

| S50 | Repair of metal products, machinery, and equipment | Production and distribution of electric power and heat power |

| S51 | Production and distribution of electric power and heat power | Production and distribution of gas |

| S52 | Production and distribution of gas | Production and distribution of tap water |

| S53 | Production and distribution of tap water | Construction |

| S54 | Construction | Wholesale and retail trades |

| S55 | Wholesale and retail trades | Transport, storage, and postal services |

| S56 | Transport, storage, and postal services | Accommodation and catering |

| S57 | Accommodation and catering | Information transfer, software, and information technology services |

| S58 | Information transfer, software, and information technology services | Finance |

| S59 | Finance | Real estate |

| S60 | Real estate | Leasing and commercial services |

| S61 | Leasing and commercial services | Scientific research |

| S62 | Scientific research and polytechnic services | Polytechnic services |

| S63 | Administration of water, environment, and public facilities | Administration of water, environment, and public facilities |

| S64 | Resident, repair, and other services | Resident, repair, and other services |

| S65 | Education | Education |

| S66 | Healthcare and social work | Healthcare and social work |

| S67 | Culture, sports, and entertainment | Culture, sports, and entertainment |

| S68 | Public administration, social insurance, and social organizations | Public administration, social insurance, and social organizations |

| Resource Footprint | 2012 | 2015 | 2017 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Median | Confidence Interval | Median | Confidence Interval | Median | Confidence Interval | ||||

| Copper | 4539.58 | 4199.79 | 5381.54 | 3740.10 | 3458.79 | 4433.82 | 12,383.90 | 11,458.91 | 14,682.85 |

| Nickel | 111.92 | 93.85 | 133.50 | 116.57 | 97.69 | 137.72 | 268.10 | 224.22 | 315.44 |

| Molybdenum | 3290.58 | 3015.15 | 4360.21 | 12,206.80 | 11,172.97 | 16,170.02 | 9462.48 | 8668.04 | 12,536.97 |

| Zinc | 4950.10 | 4203.10 | 6079.27 | 8933.82 | 7570.52 | 10,954.28 | 12,246.75 | 10,391.88 | 15,036.14 |

| RF | NT | MLS | MNS | NVS |

|---|---|---|---|---|

| Copper | 90 | 2 | 10 | 6 |

| Nickel | 30 | 1 | 9 | 6 |

| Molybdenum | 35 | 3 | 9 | 5 |

| Zinc | 87 | 1 | 10 | 6 |

| Cobalt | 62 | 4 | 10 | 5 |

| Mean | CuRF | NiRF | MoRF | ZnRF | CoRF |

|---|---|---|---|---|---|

| R2 | 0.6917 | 0.6080 | 0.5240 | 0.6774 | 0.5964 |

| MAE | 0.6925 | 1.0550 | 0.8471 | 0.7337 | 1.3291 |

| MSE | 0.7069 | 1.6378 | 1.0450 | 0.8037 | 2.7038 |

| RMSE | 0.8387 | 1.2741 | 1.0188 | 0.8942 | 1.6373 |

| GDP | 0.0854 | 0.3052 | 0.0887 | 0.0183 | 0.3828 |

| Carbon Emissions | 0.3974 | 0.1401 | 0.3542 | 0.2899 | 0.1268 |

| Technology Market Turnover | 0.3286 | 0.8548 | 0.0713 | 0.4009 | 0.8893 |

| Total Population | 0.7594 | 0.4482 | 0.5885 | 0.8759 | 0.2641 |

| Energy Consumption | 0.6549 | 0.2601 | 0.3140 | 0.4309 | 0.2107 |

| High-Tech Sales Revenue | 0.1100 | 0.0116 | 0.0361 | 0.0574 | 0.1896 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fang, C.; Cheng, J.; You, Z.; Chen, J.; Peng, J. A Detailed Examination of China’s Clean Energy Mineral Consumption: Footprints, Trends, and Drivers. Sustainability 2023, 15, 16255. https://doi.org/10.3390/su152316255

Fang C, Cheng J, You Z, Chen J, Peng J. A Detailed Examination of China’s Clean Energy Mineral Consumption: Footprints, Trends, and Drivers. Sustainability. 2023; 15(23):16255. https://doi.org/10.3390/su152316255

Chicago/Turabian StyleFang, Chuandi, Jinhua Cheng, Zhe You, Jiahao Chen, and Jing Peng. 2023. "A Detailed Examination of China’s Clean Energy Mineral Consumption: Footprints, Trends, and Drivers" Sustainability 15, no. 23: 16255. https://doi.org/10.3390/su152316255

APA StyleFang, C., Cheng, J., You, Z., Chen, J., & Peng, J. (2023). A Detailed Examination of China’s Clean Energy Mineral Consumption: Footprints, Trends, and Drivers. Sustainability, 15(23), 16255. https://doi.org/10.3390/su152316255