Exploring the Perspective of Bank Employees on the Impact of Green Process Innovation and Perceived Environmental Responsibilities on the Sustainable Performance of the Banking Industry

Abstract

:1. Introduction

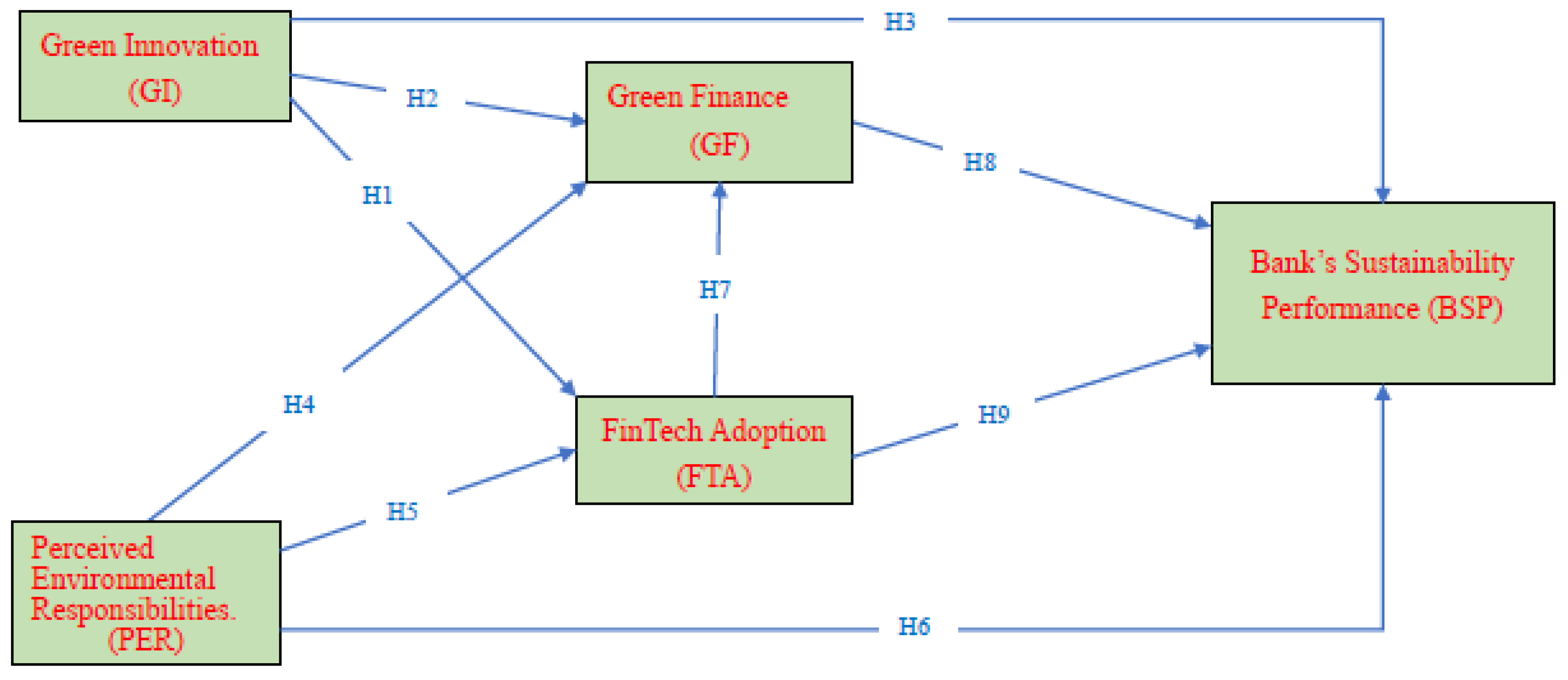

2. Literature Review and Hypotheses

2.1. Theory of Planned Behavior (TPB)

2.2. Green Process Innovation and Fintech Adoption

2.3. Green Process Innovation, Green Finance, and a Bank’s Sustainability Performance

2.4. Perceived Environmental Responsibilities and Green Finance

2.5. Perceived Environmental Responsibilities, Fintech Adoption, and a Bank’s Sustainability Performance

2.6. Fintech Adoption, Green Finance, and a Bank’s Sustainability Performance

3. Research Method

3.1. Questionnaire Design

3.2. Questionnaire Design and Sampling

3.3. Sample Characteristics

3.4. Reliability and Validity Analysis

4. Research Results

4.1. Data Analysis

4.2. Verification of the Hypothesis Results

4.3. Mediation Effect Analysis

5. Conclusions

6. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Guang-Wen, Z.; Siddik, A.B. The effect of Fintech adoption on green finance and environmental performance of banking institutions during the COVID-19 pandemic: The role of green innovation. Environ. Sci. Pollut. Res. Int. 2023, 30, 25959–25971. [Google Scholar] [CrossRef]

- Yan, C.; Siddik, A.B.; Akter, N.; Dong, Q. Factors influencing the adoption intention of using mobile financial service during the COVID-19 pandemic: The role of FinTech. Environ. Sci. Pollut. Res. Int. 2021, 30, 61271–61289. [Google Scholar] [CrossRef]

- Liu, T.L.; Lin, T.T.; Hsu, S.Y. Continuance Usage Intention toward E-Payment during the COVID-19 Pandemic from the Financial Sustainable Development Perspective Using Perceived Usefulness and Electronic Word of Mouth as Mediators. Sustainability 2022, 14, 7775. [Google Scholar] [CrossRef]

- The Financial Brand. Available online: https://reurl.cc/x7AjaN (accessed on 25 July 2023).

- Qi, G.Y.; Shen, L.Y.; Zeng, S.X.; Jorge, O.J. The drivers for contractors’ green innovation: An industry perspective. J. Clean. Prod. 2010, 18, 1358–1365. [Google Scholar] [CrossRef]

- Panwar, N.; Kaushik, S.; Kothari, S. Role of renewable energy sources in environmental protection: A review. Renew. Sustain. Energy Rev. 2011, 15, 1513–1524. [Google Scholar] [CrossRef]

- UNEP. The Financial System We Need: Aligning the Financial System with Sustainable Development. Nairobi: United Nations Environment Programmer. 2015. Available online: https://reurl.cc/lDAj4q (accessed on 25 July 2023).

- Maltais, A.; Nykvist, B. Understanding the role of green bonds in advancing sustainability. J. Sustain. Finance Investig. 2020, 1–20. [Google Scholar] [CrossRef]

- Berensmann, K.; Lindenberg, N. Corporate Social Responsibility, Ethics and Sustainable Prosperity, 1st ed.; World Scientific: Fitchburg, MA, USA, 2019; pp. 305–332. [Google Scholar]

- Furuoka, F. Financial development and energy consumption: Evidence from a heterogeneous panel of Asian countries. Renew. Sust. Energ. Rev. 2015, 52, 430–444. [Google Scholar] [CrossRef]

- Weng, H.H.; Chen, J.S.; Chen, P.C. Effects of green innovation on environmental and corporate performance: A stakeholder perspective. Sustainability 2015, 7, 4997–5026. [Google Scholar] [CrossRef]

- Zhang, B.; Wang, Y. The effect of green finance on energy sustainable development: A case study in China. Emerg. Mark. Financ. Trade 2021, 57, 3435–3454. [Google Scholar] [CrossRef]

- Kammerer, D. The effects of customer benefit and regulation on environmental product innovation: Empirical evidence from appliance manufacturers in germany. Ecol. Econ. 2009, 68, 2285–2295. [Google Scholar] [CrossRef]

- Lin, C.-Y.; Ho, Y.-H. Determinants of green practice adoption for logistics companies in China. J. Bus. Ethics 2011, 98, 67–83. [Google Scholar] [CrossRef]

- Umar, M.; Safi, A. Do green finance and innovation matter for environmental protection? A case of OECD economies. Energy Econ. 2023, 119, 106560. [Google Scholar] [CrossRef]

- Wang, K.; Tsai, S.B.; Du, X.; Bi, D. Internet finance, green finance, and sustainability. Sustainability 2019, 11, 3856. [Google Scholar] [CrossRef]

- Singh, A.K.; Raza, S.A.; Nakonieczny, J.; Shahzad, U. Role of financial inclusion, green innovation, and energy efficiency for environmental performance? Evidence from developed and emerging economies in the lens of sustainable development. Struct. Chang. Econ. Dyn. 2023, 64, 213–224. [Google Scholar]

- Guo, J.; Zhou, Y.; Ali, S.; Shahzad, U.; Cui, L. Exploring the role of green innovation and investment in energy for environmental quality: An empirical appraisal from provincial data of China. J. Environ. Manag. 2021, 292, 112779. [Google Scholar] [CrossRef]

- Álvarez-Herránz, A.; Balsalobre, D.; Cantos, J.M.; Shahbaz, M. Energy innovations-GHG emissions nexus: Fresh empirical evidence from OECD countries. Energy Policy 2017, 101, 90–100. [Google Scholar] [CrossRef]

- Awawdeh, A.E.; Ananzeh, M.; El-khateeb, A.I.; Aljumah, A. Role of green financing and corporate social responsibility (CSR) in technological innovation and corporate environmental performance: A COVID-19 perspective. China Financ. Rev. Int. 2022, 12, 297–316. [Google Scholar] [CrossRef]

- Chen, J.; Siddik, A.B.; Zheng, G.-W.; Masukujjaman, M.; Bekhzod, S. The effect of green banking practices on banks’ environmental performance and green financing: An empirical study. Energies 2022, 15, 1292. [Google Scholar] [CrossRef]

- Xu, H.; Mei, Q.; Shahzad, F.; Liu, S.; Long, X.; Zhang, J. Untangling the impact of green finance on the enterprise green performance: A meta-analytic approach. Sustainability 2020, 12, 9085. [Google Scholar] [CrossRef]

- Muganyi, T.; Yan, L.; Sun, H.P. Green finance, fintech and environmental protection: Evidence from China. Environ. Sci. Ecotechnol. 2021, 7, 100107. [Google Scholar] [CrossRef]

- Ajzen, I. The Theory of Planned Behavior. Organ. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Albayrak, T.; Aksoy, Ş.; Caber, M. The effect of environmental concern and scepticism on green purchase behaviour. Mark. Intell. Plan. 2013, 31, 27–39. [Google Scholar] [CrossRef]

- Zaremohzzabieh, Z.; Ismail, N.; Ahrari, S.; Samah, A.A. The effects of consumer attitude on green purchase intention: A meta-analytic path analysis. J. Bus. Res. 2021, 132, 732–743. [Google Scholar] [CrossRef]

- Barr, S. Strategies for sustainability: Citizens and responsible environmental behaviour. Area 2003, 35, 227–240. [Google Scholar] [CrossRef]

- Kumar, P.; Ghodeswar, B.M. Factors affecting consumers’ green product purchase decisions. Mark. Intell. Plan. 2015, 33, 330–347. [Google Scholar] [CrossRef]

- Dai, P.-F.; Xiong, X.; Liu, Z.; Huynh, T.L.D.; Sun, J. Preventing crash in stock market: The role of economic policy uncertainty during COVID-19. Financ. Innov. 2021, 7, 31. [Google Scholar] [CrossRef] [PubMed]

- Ramelli, S.; Wagner, A.F. Feverish Stock Price Reactions to COVID-19. Rev. Corp. Financ. Stud. 2020, 9, 622–655. [Google Scholar] [CrossRef]

- Almeida, H. Liquidity management during the Covid-19 pandemic. Asia-Pac. J. Financ. Stud. 2021, 50, 7–24. [Google Scholar] [CrossRef]

- Fleisch, E. What is the internet of things? An economic perspective. J. Econ. Financ. 2010, 5, 125–157. [Google Scholar]

- Rogers, E.M. Die Diffusion von Innovationen in der Telekommunikation, 1st ed.; Springer: Berlin/Heidelberg, Germany, 1995; pp. 25–38. [Google Scholar]

- Rogers, E.M. Diffusion of preventive innovations. Addict. Behav. 2002, 27, 989–993. [Google Scholar] [CrossRef]

- Chueca Vergara, C.; Ferruz Agudo, L. Fintech and sustainability: Do they affect each other? Sustainability 2021, 13, 7012. [Google Scholar] [CrossRef]

- Zarrouk, H.; El Ghak, T.; Bakhouche, A. Exploring economic and technological determinants of FinTech startups’ success and growth in the United Arab Emirates. J. Open Innov. Technol. Mark. Complex. 2021, 7, 50. [Google Scholar] [CrossRef]

- Xue, Q.; Bai, C.; Xiao, W. Fintech and corporate green technology innovation: Impacts and mechanisms. MDE Manag. Decis. Econ. 2022, 43, 3898–3914. [Google Scholar] [CrossRef]

- Farboodi, M.; Veldkamp, L. Long-run growth of financial data technology. Am. Econ. Rev. 2020, 110, 2485–2523. [Google Scholar] [CrossRef]

- Hommel, K.; Bican, P.M. Digital entrepreneurship in finance: Fintechs and funding decision criteria. Sustainability 2020, 12, 8035. [Google Scholar] [CrossRef]

- Wang, X. Research on the impact mechanism of green finance on the green innovation performance of China’s manufacturing industry. MDE Manag. Decis. Econ. 2022, 43, 2678–2703. [Google Scholar] [CrossRef]

- Wang, Q.J.; Wang, H.J.; Chang, C.P. Environmental performance, green finance and green innovation: What’s the long-run relationships among variables? Energy Econ. 2022, 110, 106004. [Google Scholar] [CrossRef]

- De Silva, M.; Wang, P.; Kuah, A.T. Why wouldn’t green appeal drive purchase intention? Moderation effects of consumption values in the UK and China. J. Bus. Res. 2021, 122, 713–724. [Google Scholar] [CrossRef]

- Tsarenko, Y.; Ferraro, C.; Sands, S.; McLeod, C. Environmentally conscious consumption: The role of retailers and peers as external influences. J. Retail. Consum. Serv. 2013, 20, 302–310. [Google Scholar] [CrossRef]

- Han, M.S.; Hampson, D.P.; Wang, Y.; Wang, H. Consumer confidence and green purchase intention: An application of the stimulus-organism-response model. J. Retail. Consum. Serv. 2022, 68, 103061. [Google Scholar] [CrossRef]

- Saut, M.; Saing, T. Factors affecting consumer purchase intention towards environmentally friendly products: A case of generation Z studying at universities in Phnom Penh. SN Bus. Econ. 2021, 1, 1–20. [Google Scholar] [CrossRef]

- Kumar, G.A. Framing a model for green buying behavior of Indian consumers: From the lenses of the theory of planned behavior. J. Clean. Prod. 2021, 295, 126487. [Google Scholar] [CrossRef]

- Du, H.; Chen, A.; Li, Y.; Ma, L.; Xing, Q.; Nie, Y. Perceived income inequality increases status seeking among low social class individuals. Asian J. Soc. Psychol. 2022, 25, 52–59. [Google Scholar] [CrossRef]

- Khairunnessa, F.; Vazquez-Brust, D.A.; Yakovleva, N. A review of the recent developments of green banking in Bangladesh. Sustainability 2021, 13, 1904. [Google Scholar] [CrossRef]

- Gu, X.; Qin, L.; Zhang, M. The impact of green finance on the transformation of energy consumption structure: Evidence based on China. Front. Earth Sci. 2023, 10, 1097346. [Google Scholar] [CrossRef]

- Chen, Y.S.; Chang, C.H. Enhance green purchase intentions: The roles of green perceived value, green perceived risk, and green trust. Manag. Decis. 2012, 50, 502–520. [Google Scholar] [CrossRef]

- Sharif, S.P.; Naghavi, N. Online financial trading among young adults: Integrating the theory of planned behavior, technology acceptance model, and theory of flow. Int. J. Hum. Comput. Interact. 2021, 37, 949–962. [Google Scholar] [CrossRef]

- Mazambani, L.; Mutambara, E. Predicting FinTech innovation adoption in South Africa: The case of cryptocurrency. Afr. J. Econ. Manag. 2020, 11, 30–50. [Google Scholar] [CrossRef]

- Huth, W.L.; Mcevoy, D.M.; Morgan, O.A. Controlling an invasive species through consumption: The case of lionfish as an impure public good. Ecol. Econ. 2018, 149, 74–79. [Google Scholar] [CrossRef]

- Chen, M.-F. Impact of fear appeals on pro-environmental behavior and crucial determinants. Int. J. Advert. 2016, 35, 74–92. [Google Scholar] [CrossRef]

- Nassiry, D. The role of fintech in unlocking green finance. In Policy Insights for Developing Countries; ADBI Working Paper, No. 883; Asian Development Bank Institute (ADBI): Tokyo, Japan, 2018. [Google Scholar]

- Kabulova, J.; Stankevičienė, J. Valuation of FinTech Innovation Based on Patent Applications. Sustainability 2020, 12, 10158. [Google Scholar] [CrossRef]

- Moro-Visconti, R.; Cruz Rambaud, S.; López Pascual, J. Sustainability in FinTechs: An Explanation through Business Model Scalability and Market Valuation. Sustainability 2020, 12, 10316. [Google Scholar] [CrossRef]

- Hõbe, L.; Alas, R. A Financial Services Innovation Management Model for Banks. J. Chang. Manag. 2015, 34, 138–154. [Google Scholar]

- Thakor, A.V. Fintech and banking: What do we know? J. Financ. Intermediat. 2020, 41, 100833. [Google Scholar] [CrossRef]

- Firmansyah, E.A.; Masri, M.; Anshari, M.; Besar, M.H.A. Factors affecting fintech adoption: A systematic literature review. FinTech 2022, 2, 21–33. [Google Scholar] [CrossRef]

- Jiao, Z.; Shahid, M.S.; Mirza, N.; Tan, Z. Should the fourth industrial revolution be widespread or confined geographically? A country-level analysis of fintech economies. Technol. Forecast. Soc. Chang. 2021, 163, 120442. [Google Scholar] [CrossRef]

- Deng, X.; Huang, Z.; Cheng, X. FinTech and sustainable development: Evidence from China based on P2P data. Sustainability 2019, 11, 6434. [Google Scholar] [CrossRef]

- Bai, J.; Chen, Z.; Yan, X.; Zhang, Y. Research on the impact of green finance on carbon emissions: Evidence from China. Econ. Res.-Ekon. Istraživanja 2022, 35, 6965–6984. [Google Scholar] [CrossRef]

- Gallego-Losada, M.J.; Montero-Navarro, A.; García-Abajo, E.; Gallego-Losada, R. Digital financial inclusion. Visualizing the academic literature. Res. Int. Bus. Financ. 2023, 64, 101862. [Google Scholar] [CrossRef]

- Zhou, G.; Zhu, J.; Luo, S. The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecol. Econ. 2022, 193, 107308. [Google Scholar] [CrossRef]

- Ren, X.; Shao, Q.; Zhong, R. Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. J. Clean. Prod. 2020, 277, 122844. [Google Scholar] [CrossRef]

- Zheng, G.W.; Siddik, A.B.; Masukujjaman, M.; Fatema, N.; Alam, S.S. Green Finance Development in Bangladesh: The Role of Private Commercial Banks (PCBs). Sustainability 2021, 13, 795. [Google Scholar] [CrossRef]

- Akter, N.; Siddik, A.B.; Mondal, M.S.A. Sustainability Reporting on Green Financing: A Study of Listed Private Sustainability Reporting on Green Financing: A Study of Listed Private Commercial Banks in Bangladesh. J. Bus. Technol. 2018, 7, 14–27. [Google Scholar]

- Ziemba, E. The contribution of ICT adoption to sustainability: Households’ perspective. Inf. Technol. People 2019, 32, 731–753. [Google Scholar] [CrossRef]

- Sinnappan, P.; Rahman, A.A. Antecedents of green purchasing behavior among Malaysian consumers. Int. Bus. Manag. 2011, 5, 129–139. [Google Scholar] [CrossRef]

- Chen, Y.S.; Lai, S.B.; Wen, C.T. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- KPPHGN, M.; Arulrajah, A.A.; Senthilnathan, S. Mediating Role of Employee Green Behaviour Towards Sustainability Performance Of Banks. J. Gov. Regul. 2020, 9, 92–102. [Google Scholar]

- Lo, P.S.; Dwivedi, Y.K.; Tan, G.W.H.; Ooi, K.B.; Aw, E.C.X.; Metri, B. Why do consumers buy impulsively during live streaming? A deep learning-based dual-stage SEM-ANN analysis. J. Bus. Res. 2022, 147, 325–337. [Google Scholar] [CrossRef]

- Mitchell, M. Situational interest: Its multifaceted structure in the secondary school mathematics classroom. J. Educ. Psychol. 1993, 85, 424. [Google Scholar] [CrossRef]

- Jackson, D.L. Revisiting sample size and number of parameter estimates: Some support for the N: Q hypothesis. Struct. Equ. Model. 2003, 10, 128–141. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Structural equation models with unobservable variables and measurement error: Algebra and statistics. J. Mark. Res. 1981, 3, 382–388. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879. [Google Scholar] [CrossRef] [PubMed]

- Dash, G.; Paul, J. CB-SEM vs PLS-SEM methods for research in social sciences and technology forecasting. Technol. Forecast. Soc. Chang. 2021, 173, 121092. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.A. Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: New York, NY, USA, 2021. [Google Scholar]

- Kline, R.B. Principles and Practice of Structural Equation Modeling. Can. Stud. Popul. 2018, 45, 188–195. [Google Scholar] [CrossRef]

- Hoyle, R.H. Structural Equation Modeling: Concepts, Issues, and Applications; Sage: Riverside County, CA, USA, 1995; pp. 1–13. [Google Scholar]

- Boomsma, A. Reporting analyses of covariance structures. Struct. Equ. Model. 2000, 7, 461–483. [Google Scholar] [CrossRef]

- Gefen, D.; Straub, D.; Boudreau, M.C. Structural equation modeling and regression: Guidelines for research practice. Commun. Assoc. Inf. Syst. 2000, 4, 7. [Google Scholar] [CrossRef]

- Doll, W.J.; Xia, W.; Torkzadeh, G. A confirmatory factor analysis of the end-user computing satisfaction instrument. MIS Q. 1994, 18, 453–461. [Google Scholar] [CrossRef]

- Etezadi-Amoli, J.; Farhoomand, A.F. A structural model of end user computing satisfaction and user performance. Inf. Manag. 1996, 30, 65–73. [Google Scholar] [CrossRef]

- Kline, R.B. Software review: Software programs for structural equation modeling: Amos, EQS, and LISREL. J. Psychoeduc. Assess. 1998, 16, 343–364. [Google Scholar] [CrossRef]

- Hayduk, L.A. Structural Equation Modeling with LISREL: Essentials and Advances; The Johns Hopkins University Press: Baltimore, MD, USA, 1987. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef] [PubMed]

- Judd, C.M.; Kenny, D.A. Process analysis: Estimating mediation in treatment evaluations. Eval. Rev. 1981, 5, 602–619. [Google Scholar] [CrossRef]

- Cheung, G.W.; Lau, R.S. Testing Mediation and Suppression Effects of Latent Variables. Organ. Res. Methods 2007, 11, 296–325. [Google Scholar] [CrossRef]

- Efron, B. Bootstrap methods: Another look at the Jackknife. Ann. Stat. 1979, 7, 1–26. [Google Scholar] [CrossRef]

- Hayes, A.F. Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach; Guilford Publications: New York, NY, USA, 2017. [Google Scholar]

- Preacher, K.J.; Rucker, D.D.; Hayes, A.F. Addressing moderated mediation hypotheses: Theory, methods, and prescriptions. Multivar. Behav. Res. 2007, 42, 185–227. [Google Scholar] [CrossRef] [PubMed]

- Hayes, A.F. Beyond Baron and Kenny: Statistical mediation analysis in the new millennium. Commun. Monogr. 2009, 76, 408–420. [Google Scholar] [CrossRef]

- Cheung, M.Y.; Luo, C.; Sia, C.L.; Chen, H. Credibility of electronic word-of-mouth: Informational and normative determinants of on-line consumer recommendations. Int. J. Electron. Commer. 2009, 13, 9–38. [Google Scholar] [CrossRef]

- Lau, R.S.; Cheung, G.W. Estimating and comparing specific mediation effects in complex latent variable models. Organ. Res. Methods 2012, 15, 3–16. [Google Scholar] [CrossRef]

| Variables | Items | Descriptions | Sources |

|---|---|---|---|

| Green financing | GF1 | The amount of money my bank invests in environmental protection projects increases. | [67,68] |

| GF2 | My bank is investing more resources in recycling and recoverable loan products. | ||

| GF3 | My bank increases investment in waste management and green manufacturing projects for businesses. | ||

| GF4 | My bank increases investment in energy-efficiency projects for businesses. | ||

| GF5 | My bank has increased its investment in green industry development. | ||

| GF6 | My bank increases its investment in green marketing. | ||

| Fintech adoption | FTA1 | The adoption of fintech can reduce costs (for example, by reducing the purchase price of goods/services online, eliminating travel expenses, and reducing the cost of online communication instead of telephone or personal communication) | [69] |

| FTA3 | The adoption of financial technology not only provides access to new knowledge and technology but also enhances self-learning and increases information technology literacy. | ||

| FTA4 | Fintech applications can prevent online fraud, reduce information security risks, and improve the safety of financial transactions for individuals and society. | ||

| FTA5 | Financial technology applications are suitable for people living in remote areas, those with disabilities, the elderly, and those with low education levels, so they can obtain convenient financial services. | ||

| FTA6 | Financial technology applications can conserve energy and are also considered environmentally responsible, making them favored by consumers. | ||

| Perceived environmental responsibilities | PER1 | Environmentally aware protection starts with me. | [70] |

| PER2 | Environmental protection is my obligation. | ||

| PER3 | Cultivate environmental awareness from a young age. | ||

| PER4 | Environmental protection in Taiwan is my responsibility. | ||

| PER5 | I do not need to bear the responsibility for environmental protection; that is the responsibility of the Taiwanese government. | ||

| Green process innovation performance | GI1 | My bank chooses to focus on companies that can effectively reduce harmful substance emissions or waste when selecting loan companies. | [71] |

| GI2 | My bank chooses loan companies, mainly companies that can effectively recycle waste and allow emissions and waste to be treated and reused. | ||

| GI3 | My bank can effectively reduce water consumption, electricity, and improve operating procedures. | ||

| GI4 | My bank can effectively reduce the use of paper and electric lights. | ||

| Banks’ sustainability performance | BSP1 | Practicing green banking has significantly increased my bank’s revenue and market share. | [72] |

| BSP2 | Green banking practices have significantly reduced my bank’s operating expenses. | ||

| BSP3 | Green banking practices at my bank significantly improve resource management efficiency. | ||

| BSP4 | Principles of environmental standards influence my bank’s practice of green finance. | ||

| BSP5 | Green banking practices have reduced much of my bank’s energy consumption. | ||

| BSP6 | Green banking practices reduce much of my bank’s paper and other material usage. | ||

| BSP7 | My bank’s image is enhanced through the practice of green finance. | ||

| BSP8 | The practice of green banking enhances the trust of shareholders and other stakeholders in the bank. | ||

| BSP9 | Enhancing environmental responsibility and compliance with social norms and regulations is a crucial step in the practice of green banking. |

| Variables | Particular | Responses | Percentage% |

|---|---|---|---|

| Gender | Male | 156 | 48.00% |

| Female | 169 | 52.00% | |

| Total | 325 | 100.00% | |

| Age | 18–24 year | 25 | 7.69% |

| 25–34 year | 51 | 15.69% | |

| 35–44 year | 82 | 25.23% | |

| 45–54 year | 105 | 32.31% | |

| 55–64 year | 60 | 18.46% | |

| 65 year and over | 2 | 0.62% | |

| Total | 325 | 100.00% | |

| Education | High school or below | 16 | 4.92% |

| Bachelor’s degree | 218 | 67.08% | |

| Master’s | 85 | 26.46% | |

| Ph.D. | 5 | 1.54% | |

| Total | 325 | 100.00% | |

| Working experience | 0–3 years | 46 | 14.15% |

| 3–5 years | 22 | 6.77% | |

| 5–10 years | 40 | 12.31% | |

| Above 10 years | 217 | 66.77% | |

| Total | 100.00% | ||

| Job position | Officer | 197 | 60.62% |

| Principal Officer | 50 | 15.38% | |

| Assistant Manager | 63 | 19.38% | |

| Manager | 15 | 4.62% | |

| Total | 325 | 100.0 | |

| After the outbreak of COVID-19, has there been increased concern about environmental protection issues? | YES | 273 | 84.00 |

| NO | 52 | 16.00 | |

| Total | 325 | 100 | |

| Talent cultivation in green and sustainable finance | YES | 232 | 71.38% |

| Planning stage | 69 | 21.23% | |

| NO | 24 | 7.38% | |

| Total | 325 | 100.00% | |

| Listed (OTC) or non-listed | Listed government bank | 64 | 19.69% |

| Listed non-government Bank | 165 | 50.77% | |

| Non-listed banks | 96 | 29.54% | |

| Total | 325 | 100.00% |

| Construct | Item | Model Parameter Estimates | Item Reliability | Residuals | Convergent Validity | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Unstd. | S.E. | t-Value | p | Std. | SMC | 1-SMC | CR | AVE | ||

| GI 1 | GI1 | 1 | 0.807 | 0.651 | 0.349 | 0.851 | 0.589 | |||

| GI2 | 0.961 | 0.061 | 15.711 | *** 2 | 0.770 | 0.593 | 0.407 | |||

| GI3 | 0.896 | 0.068 | 13.267 | *** | 0.747 | 0.558 | 0.442 | |||

| GI4 | 1.058 | 0.081 | 13.039 | *** | 0.743 | 0.552 | 0.448 | |||

| GF 1 | GF1 | 1 | 0.825 | 0.681 | 0.319 | 0.938 | 0.716 | |||

| GF2 | 0.961 | 0.054 | 17.807 | *** | 0.817 | 0.667 | 0.333 | |||

| GF3 | 1.059 | 0.054 | 19.562 | *** | 0.87 | 0.757 | 0.243 | |||

| GF4 | 0.989 | 0.053 | 18.658 | *** | 0.849 | 0.721 | 0.279 | |||

| GF5 | 0.979 | 0.052 | 18.881 | *** | 0.857 | 0.734 | 0.266 | |||

| GF6 | 0.998 | 0.053 | 18.931 | *** | 0.859 | 0.738 | 0.262 | |||

| PER 1 | PER1 | 1 | 0.676 | 0.457 | 0.543 | 0.781 | 0.439 | |||

| PER2 | 0.95 | 0.096 | 9.859 | *** | 0.601 | 0.361 | 0.639 | |||

| PER3 | 1.407 | 0.116 | 12.126 | *** | 0.812 | 0.659 | 0.341 | |||

| PER4 | 1.397 | 0.117 | 11.909 | *** | 0.801 | 0.642 | 0.358 | |||

| PER5 | 0.3 | 0.066 | 4.556 | *** | 0.273 | 0.075 | 0.925 | |||

| FTA 1 | FTA1 | 1 | 0.653 | 0.426 | 0.574 | 0.839 | 0.51 | |||

| FTA2 | 0.829 | 0.075 | 11.107 | *** | 0.749 | 0.561 | 0.439 | |||

| FTA3 | 0.945 | 0.091 | 10.335 | *** | 0.708 | 0.501 | 0.499 | |||

| FTA4 | 1.05 | 0.096 | 10.945 | *** | 0.753 | 0.567 | 0.433 | |||

| FTA5 | 0.912 | 0.086 | 10.638 | *** | 0.705 | 0.497 | 0.503 | |||

| BSP 1 | BSP1 | 1 | 0.733 | 0.537 | 0.463 | 0.932 | 0.605 | |||

| BSP2 | 1.01 | 0.08 | 12.587 | *** | 0.695 | 0.483 | 0.517 | |||

| BSP3 | 1.065 | 0.076 | 14.08 | *** | 0.774 | 0.599 | 0.401 | |||

| BSP4 | 1.099 | 0.071 | 15.436 | *** | 0.849 | 0.721 | 0.279 | |||

| BSP5 | 1.117 | 0.073 | 15.379 | *** | 0.847 | 0.717 | 0.283 | |||

| BSP6 | 1.128 | 0.08 | 14.126 | *** | 0.787 | 0.619 | 0.381 | |||

| BSP7 | 1.061 | 0.073 | 14.535 | *** | 0.802 | 0.643 | 0.357 | |||

| BSP8 | 0.994 | 0.072 | 13.802 | *** | 0.757 | 0.573 | 0.427 | |||

| BSP9 | 0.952 | 0.071 | 13.474 | *** | 0.743 | 0.552 | 0.448 | |||

| Cronbach’s Alpha | FTA | PER | GI | GF | BSP | |

|---|---|---|---|---|---|---|

| FTA 3 | 0.758 | 0.714 1 | ||||

| PER 3 | 0.789 | 0.571 2 | 0.663 1 | |||

| GI 3 | 0.871 | 0.441 | 0.686 2 | 0.767 1 | ||

| GF 3 | 0.957 | 0.414 | 0.681 | 0.751 2 | 0.846 1 | |

| BSP 3 | 0.968 | 0.483 | 0.626 | 0.710 | 0.736 2 | 0.778 1 |

| Hypothesis Path | B | β | S.E. | C.R. | p Value | Hypothesis | Confirmed (Y/N) | ||

|---|---|---|---|---|---|---|---|---|---|

| FTA 2 | ←- | GI 2 | 0.981 | 0.019 | 0.12 | 0.158 | 0.874 | H1 | N |

| GF 2 | ←- | GI | 0.266 | 0.608 | 0.103 | 5.883 | *** 1 | H2 | Y |

| BSP 2 | ← | GI | 0.392 | 0.341 | 0.099 | 3.434 | *** | H3 | Y |

| GF | ← | PER 2 | 0.597 | 0.403 | 0.154 | 2.612 | ** 1 | H4 | Y |

| FTA | ← | PER | 1.059 | 0.734 | 0.18 | 4.076 | *** | H5 | Y |

| BSP | ← | PER | 0.659 | −0.06 | 0.128 | −0.464 | 0.642 | H6 | N |

| GF | ← | FTA | 1.06 | −0.059 | 0.067 | −0.878 | 0.38 | H7 | N |

| BSP | ← | GF | 0.625 | 0.375 | 0.076 | 4.904 | *** | H8 | Y |

| BSP | ← | FTA | 0.829 | 0.171 | 0.059 | 2.917 | ** | H9 | Y |

| Media Path | Bootstrap 5000 Confidence Interval 2 | |||

|---|---|---|---|---|

| Effect | Bootstrap SE | LLCI | ULCI | |

| Total indirect effect | ||||

| PER1→BSP 1 | 0.2436 | 0.0495 | 0.1505 | 0.3424 |

| The path’s indirect effects | ||||

| PER→FTA 1→BSP | 0.0896 | 0.0376 | 0.0221 | 0.1697 |

| PER→GF1→BSP | 0.1545 | 0.0382 | 0.0824 | 0.2337 |

| PER→FTA→GF→BSP | −0.0005 | 0.0126 | −0.0259 | 0.0251 |

| Direct effect | ||||

| PER→ BSP | 0.0676 | 0.0648 | −0.0599 | 0.1951 |

| Media Path | Bootstrap 5000 Confidence Interval | |||

| Effect | Bootstrap SE | LLCI | ULCI | |

| Total indirect effect | ||||

| GI1→BSP | 0.211 | 0.042 | 0.135 | 0.300 |

| The path’s indirect effects | ||||

| GI→FTA→BSP | 0.012 | 0.013 | −0.008 | 0.044 |

| GI→GF→BSP | 0.199 | 0.044 | 0.119 | 0.293 |

| GI→FTA→GF→BSP | 0.000 | 0.002 | −0.004 | 0.006 |

| Direct effect | ||||

| GI→BSP | 0.261 | 0.050 | 0.163 | 0.359 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, T.-L.; Lin, T.T.; Hsu, S.-Y. Exploring the Perspective of Bank Employees on the Impact of Green Process Innovation and Perceived Environmental Responsibilities on the Sustainable Performance of the Banking Industry. Sustainability 2023, 15, 15925. https://doi.org/10.3390/su152215925

Liu T-L, Lin TT, Hsu S-Y. Exploring the Perspective of Bank Employees on the Impact of Green Process Innovation and Perceived Environmental Responsibilities on the Sustainable Performance of the Banking Industry. Sustainability. 2023; 15(22):15925. https://doi.org/10.3390/su152215925

Chicago/Turabian StyleLiu, Tsai-Ling, Tyrone T. Lin, and Shu-Yen Hsu. 2023. "Exploring the Perspective of Bank Employees on the Impact of Green Process Innovation and Perceived Environmental Responsibilities on the Sustainable Performance of the Banking Industry" Sustainability 15, no. 22: 15925. https://doi.org/10.3390/su152215925

APA StyleLiu, T.-L., Lin, T. T., & Hsu, S.-Y. (2023). Exploring the Perspective of Bank Employees on the Impact of Green Process Innovation and Perceived Environmental Responsibilities on the Sustainable Performance of the Banking Industry. Sustainability, 15(22), 15925. https://doi.org/10.3390/su152215925