Efficiency in the Last Mile of Autonomous Ground Vehicles with Lockers: From Conventional to Renewable Energy Transport

Abstract

:1. Introduction

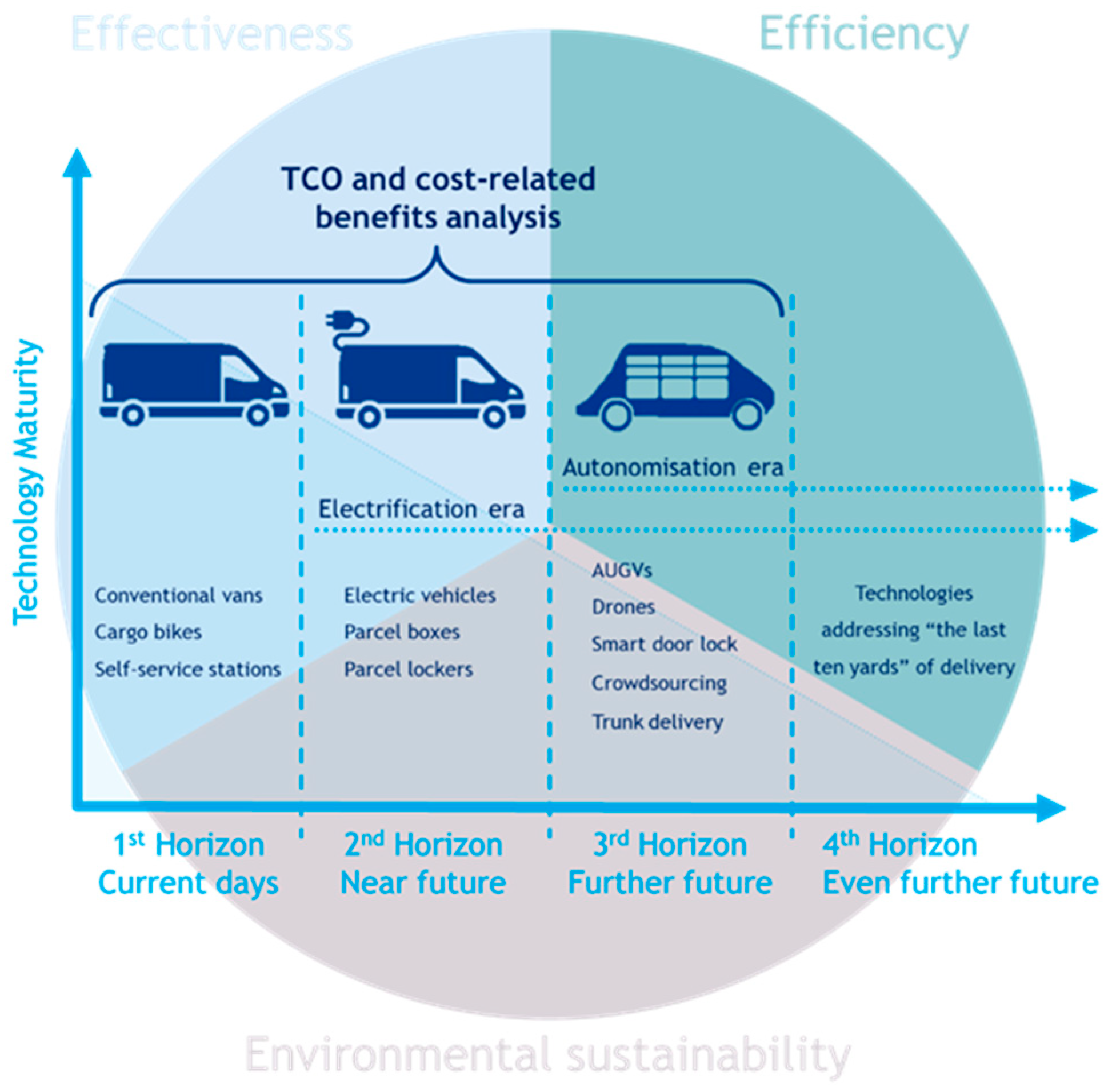

2. Literature Review

2.1. Efficiency in Last-Mile Logistics

2.2. Traditional Delivery Mode Optimization and Innovations

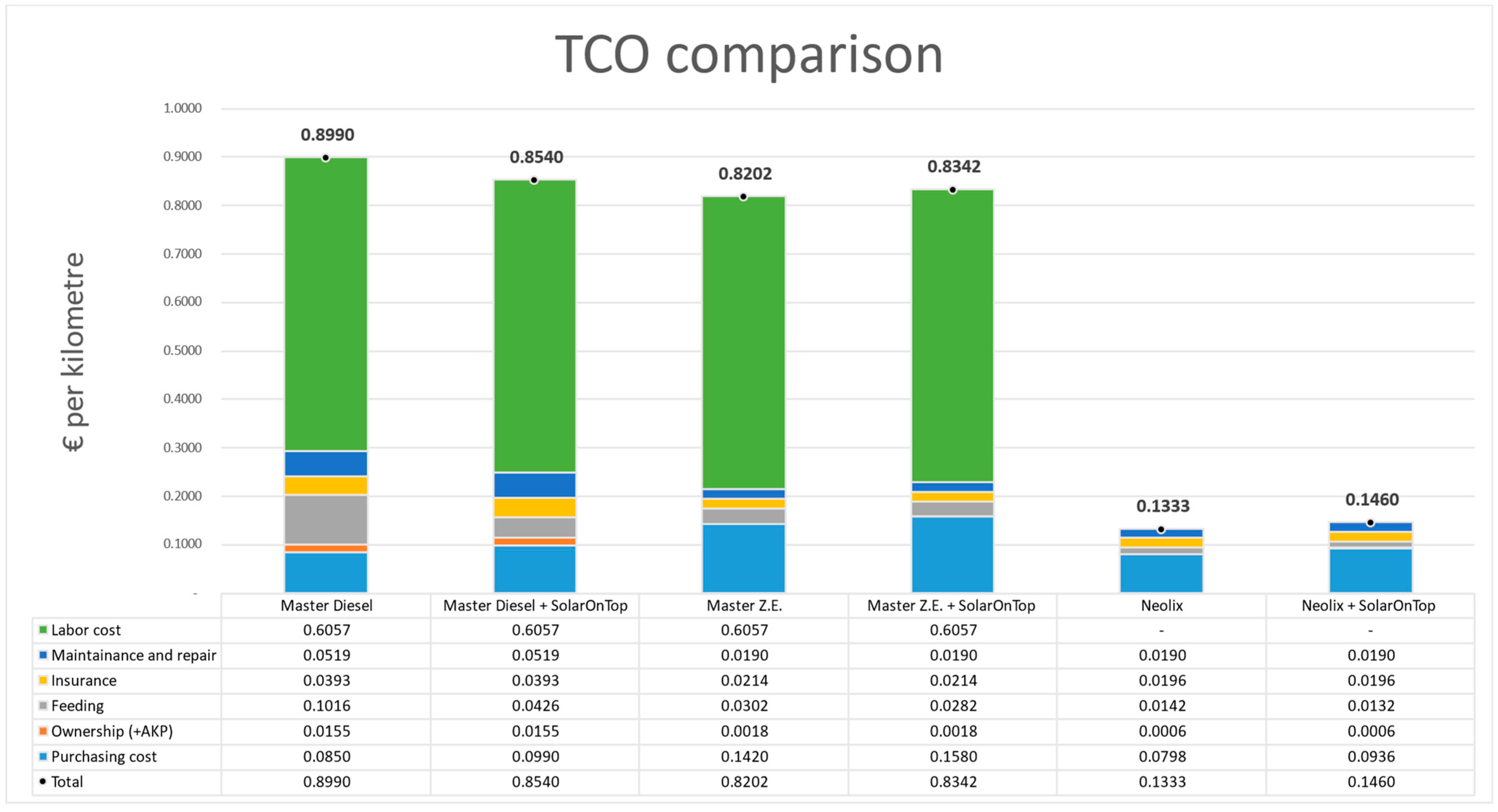

2.3. Total Cost of Ownership Analysis and Cost-Related Benefits

3. Methodology

- PV = Present value;

- T = Time (expressed as number of years).

3.1. TCO Calculation

3.1.1. Vehicle Characteristics

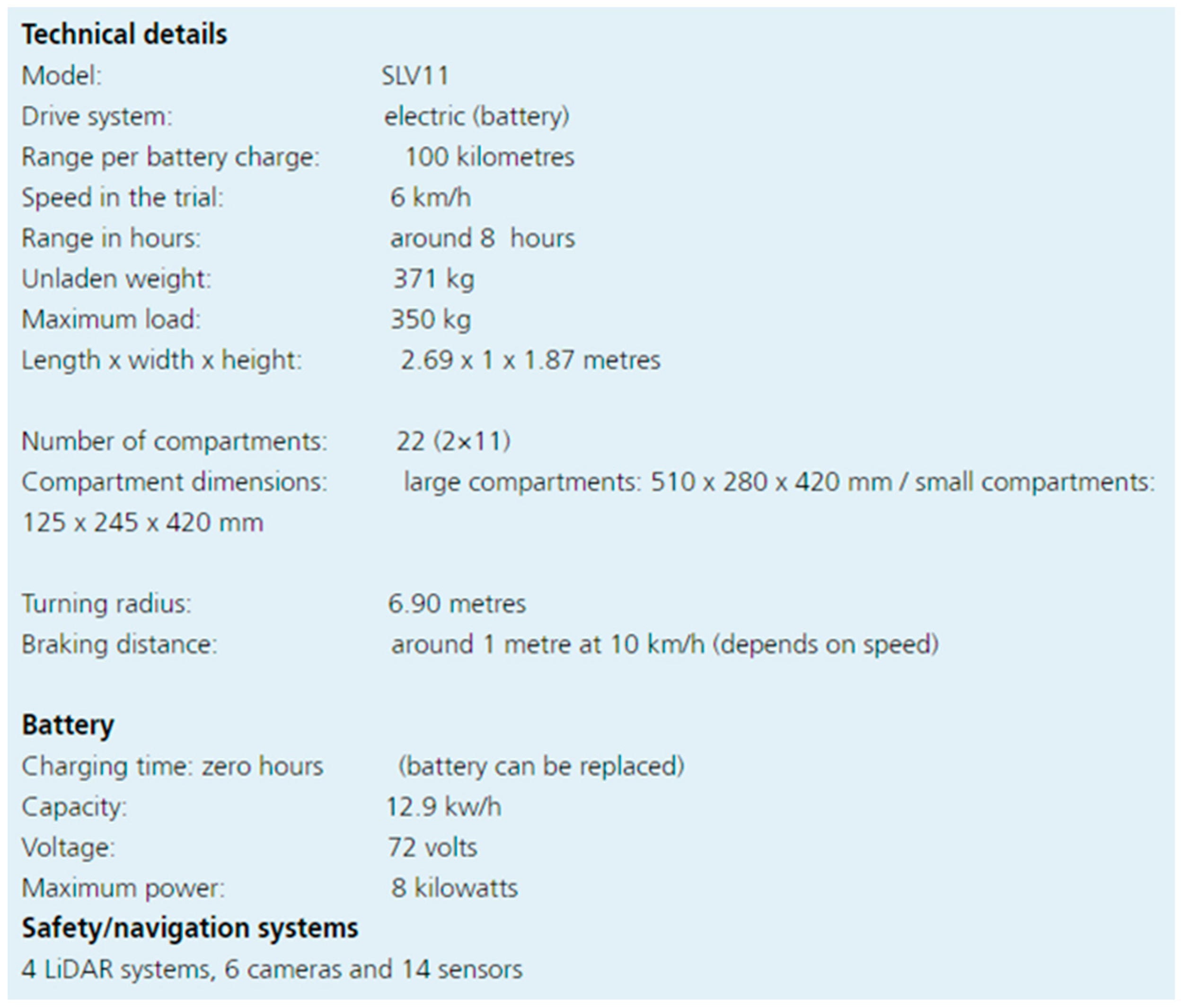

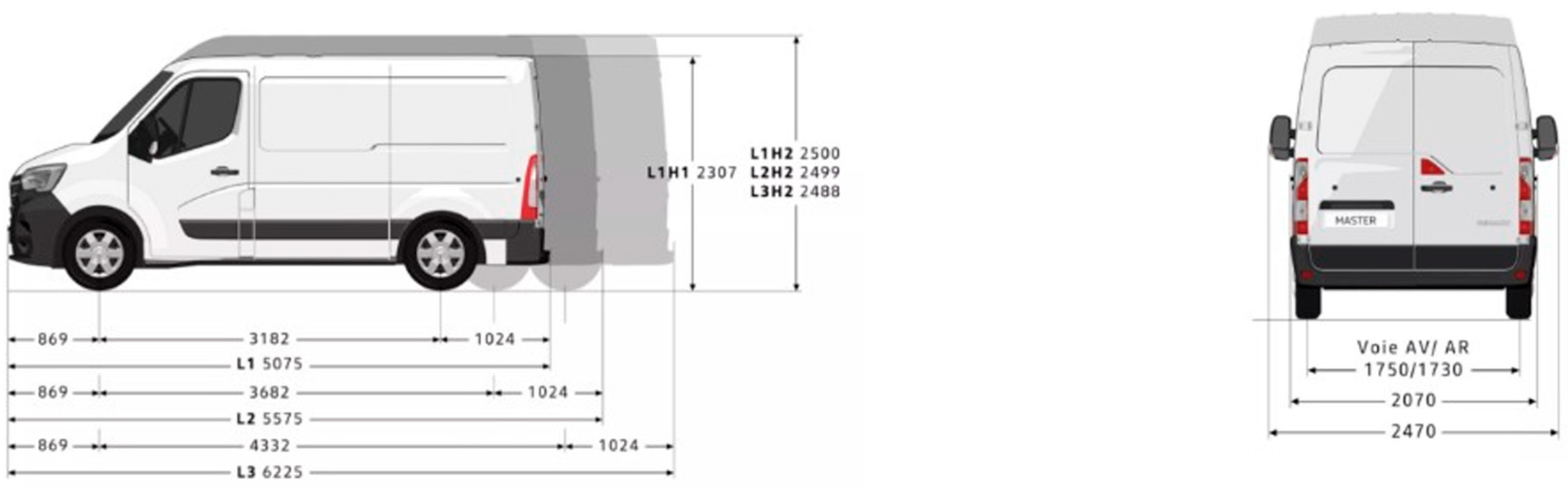

- Vehicle overview: Vehicle type largely affects the remaining variables, and therefore requires a primary outline. PostNL, the main parcel delivery service provider in the Netherlands [72], made a deal with Renault group on the purchase of light commercial electric vehicles, Master Z.E (L3H2) [73], as a part of its plan for emission-free LMD by 2030 [74]. The same model exists in a version with the diesel engine, which provides a convenient comparison basis within a research’s conceptual framework. The autonomous ground vehicle (AGV) with lockers, namely Neolix, which McKinsey judges as a promising development for replacing some of the current urban delivery modes [17], was selected as the future delivery option. Neolix was deployed in China by tech and logistics giants such as Huawei, Alibaba, Meituan-Dianping, and JD [75], who collaborated in a trial with Swiss Post in Europe [76], and piloted autonomous deliveries for e-commerce startup Noon.com in the Middle East [77]. Table 1 includes the overview of the information that will later be needed to define various main segments of cost–benefit analysis. Purchasing price and curb weight are used to assess eligibility for subsidies as well as define the exact rate of various ownership costs for our analysis. Motor type data, together with vehicle fuel consumption, are used in calculations to determine the fuel efficiency impact (cost savings) provided by SolarOnTop (SOT) technology. Payload, maximum speed, and maximum range serve as input to calculate benefit or maximum daily delivery volumes per vehicle. The starting price, which assumes the inclusion of battery cost, and an overview of the vehicles can be found in Table 1, whereas the rest of the descriptive information, retrieved from Renault.nl [78], Neolix.ai [79], and the department of road transport-RDW [80], can be found in Appendix B.

- 2.

- Solar panels: Current technology maturity does not allow for commercial vehicles running entirely on solar power, yet there are few examples of solar panels providing fuel savings and extending a vehicle’s battery life [82,83]. Dutch company IM Efficiency has developed the SolarOnTop (SOT) product, providing trucks with clean electricity generated by solar panels otherwise generated by the alternator [84], reducing the load on the engine and hence fuel consumption, thus preventing the costly idling hours. All SOT-related information was obtained during an informal interview with a company representative. The SOT price is determined separately for each vehicle.

- 3.

- Depreciation rate: According to Dutch law, the depreciation rate for delivery vans is 100% after five years [85]. Due to the lack of similar information concerning the ADRs, the same depreciation rule will be applied to the AGV with lockers, considering the residual value of EUR 0 in all cases (see Table 1).

- 4.

- Vehicle-related costs, fees and taxes: Upon purchase, a vehicle owner is automatically responsible for registration, insurance, APK (Algemene Periodieke Keuring), and motor vehicle tax (see Appendix A).

- 5.

- Vehicle-related costs, subsidies and indirect initiatives: According to the Netherlands Enterprise Agency–RVO [86], there is a list of financial support for businesses driving electric with a minimum reliability level of 2+ where ‘RVO services’ authorization is assumed in order to receive these subsidies. Allowances are applied to corresponding purchase costs and can be combined except for the MIA and EIA combination. Those able to be applied to this research are presented in detail in Appendix A.

3.1.2. Ownership Period

3.1.3. Travel Data

3.1.4. Labour Costs

3.2. Benefits Calculation

3.2.1. Capacity Occupation and Reliability

3.2.2. Fuel Efficiency

3.3. Travel Time: Total Operational Time Increase

4. Data Analysis and Results

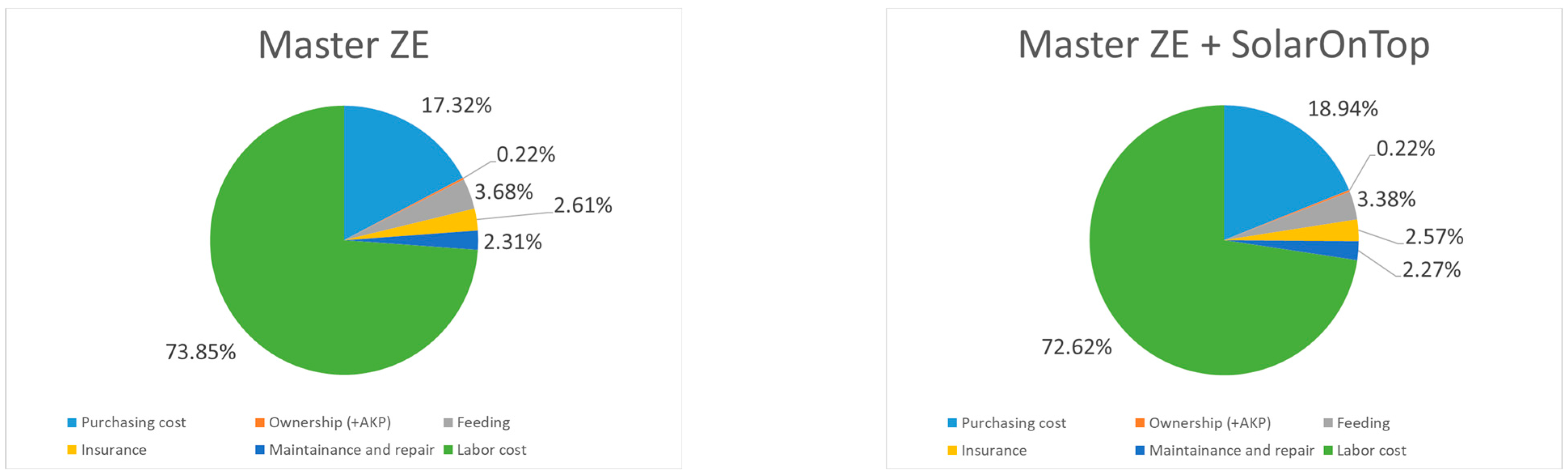

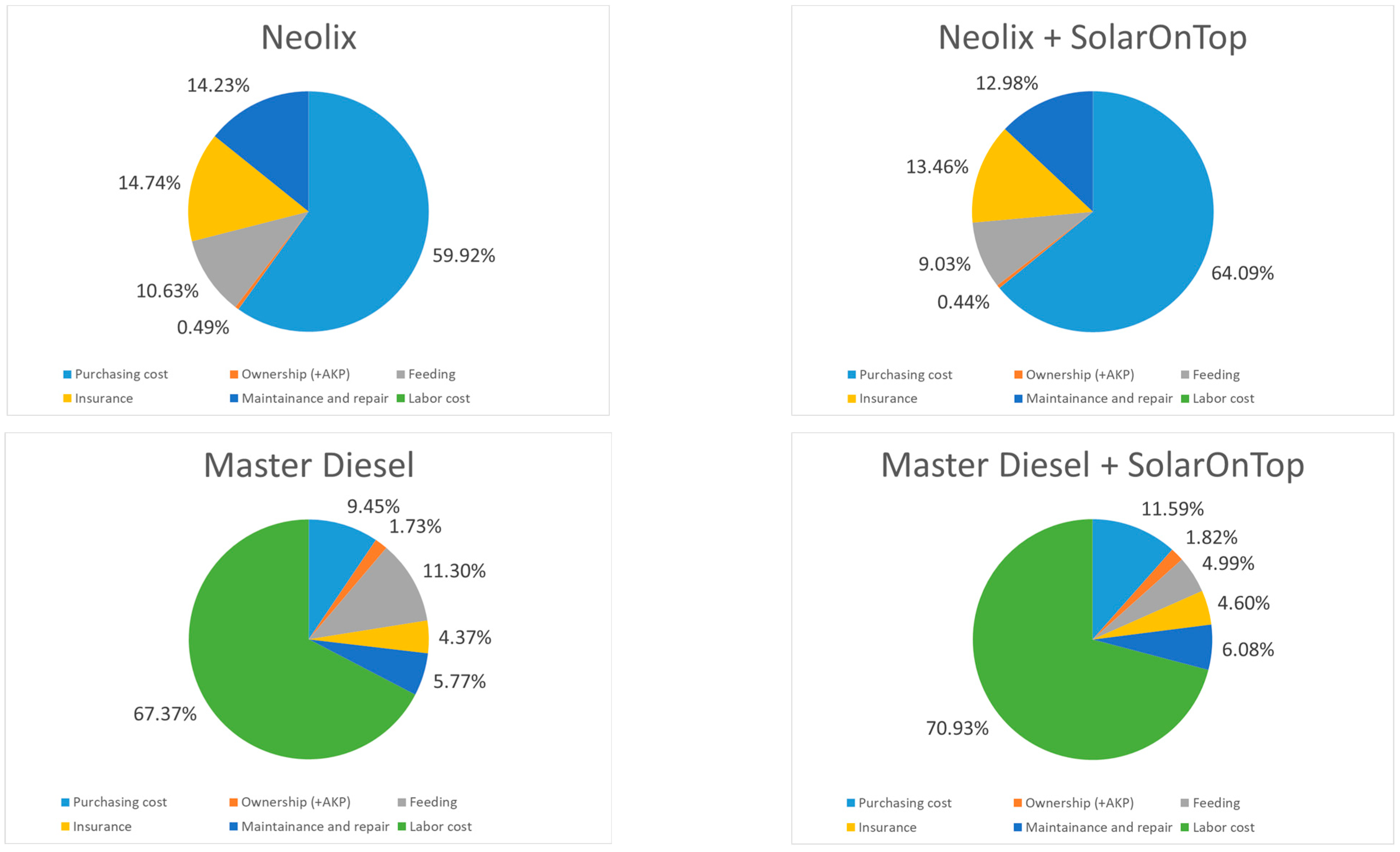

4.1. TCO Analysis

4.2. Benefit Analysis

4.3. Sensitivity Analysis

5. Conclusions

- Purchasing cost was another significant element, proving that technological deployment highly relies on economic feasibility and practicality. Thus, electric vehicles, while still being more expensive than diesel ones, even with governmental subsidies (EUR 26,520.95 versus EUR 44,318.75), over an ownership period of 8 years will be cheaper to retain (EUR 25,5894.2 versus EUR 28,0501.96), encouraging an ongoing shift towards electrification. On the contrary, AGVs with lockers, Neolix in this study, despite the lowest purchasing and TCO costs (EUR 24,910.75 and EUR 41,574.82), make autonomy an expensive option, questioning its practicality, as the AG’s load capacity is 6 times smaller than a delivery van.

- Regarding fuel efficiency, the effect of the auxiliary tool, SOT, on vehicles’ feeding costs was considered, discovering a significant difference in savings capabilities for diesel versus electric vehicles benefiting the former while the cumulative TCO period savings for the latter were not even enough to overcome initial technological investment. Although SOT technology did not bring significant fuel savings for electric vehicles, it still represents interest from a sustainability perspective, being a source of green energy that can otherwise supplement standard charging from a grid or support a cooling system for food delivery.

- Total operational time increase, capacity occupation and reliability benefits affect the total number of parcels delivered, representing the income constituent often neglected in economic assessments. Under the conditions of the maximum capacity of 220 parcels and 39 parcels of 12 L for a delivery van and Neolix, respectively, even with an increase in possible delivery time to 07:00–01:00 as opposed to the traditional 08:00–21:30 range, an AGV is not able to deliver more parcels than a van. Therefore, in sensitivity analysis, factors like average parcel volume and delivery area density were examined, to find out the factors’ break-even values when an AGV becomes more profitable than the delivery van. It was discovered that Neolix should be used for parcels with a volume of less than 9.06 L, or in areas of parcel density as high as 0.62 km per parcel, to provide competitive performance results within urban delivery contexts.

- Presumably useful for the practitioners interested in the feasibility of autonomous vehicles for LMD operations, the conducted research proves AGVs are a potentially successful future project considering mandatory urban delivery conditions, high parcel demand density and sufficiently developed infrastructure, that would facilitate the deployment of AGVs similar to cargo bikes. Considering the theoretical implications, this study offers a framework allowing for a monetary-based comparison of vehicles used in LMD, within a multidimensional context of environmental sustainability, effectiveness and efficiency. Furthermore, this paper determines the AGV with lockers as a separate class of innovative solutions along the LMD technological transformation process and makes an academic contribution by investigating its competitiveness as a substitute to the ICEVs and eVs.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Input Information for a TCO on a Transport Vehicle

- VEHICLE-RELATED COSTS, SUBSIDIES AND INDIRECT INITIATIVES

- PV = Present value;

- T = Time (expressed as number of years).

Appendix B. Vehicle’ Descriptive Information

Appendix C. Purchasing and Annual Ownership (+APK) Costs Calculations

| Price Segments/Vehicle | Master Diesel | Master Diesel + SolarOnTop | Master Z.E. | Master Z.E. + SolarOnTop | Neolix | Neolix + SolarOnTop |

|---|---|---|---|---|---|---|

| Price of vehicle excl. VAT/BPM | 31,940.00 | 31,940.00 | 58,700.00 | 58,700.00 | 30,000.00 | 30,000.00 |

| Price of SolarOnTop | 5350.00 | 5350.00 | 5250.00 | |||

| Vehicle related capital costs | ||||||

| Registration fee | 10.75 | 10.75 | 10.75 | 10.75 | 10.75 | 10.75 |

| BPM 37.7% (+273) | ||||||

| Total | 31,950.75 | 37,300.75 | 58,710.75 | 64,060.75 | 30,010.75 | 32,260.75 |

| Subsidies and Indirect initiatives | ||||||

| MIA 36% (9%) | − | − | 21,132.00 | 21,132.00 | ||

| KIA 28% (5.5%) | 8943.20 | 10,441.20 | 16,436.00 | 17,934.00 | 8400.00 | 9870.00 |

| EIA 45.5.% (11%) | − | 2434.25 | − | − | − | 2388.75 |

| Net benefit at 25% nominal tax | 2235.80 | 3218.86 | 9392.00 | 9766.50 | 2100.00 | 3064.69 |

| SEBA | 3194.00 | 3194.00 | 5000.00 | 5000.00 | 3000.00 | 3000.00 |

| Total subsidies | 5429.80 | 6412.86 | 14,392.00 | 14,766.50 | 5100.00 | 6064.69 |

| Total purchasing price | 26,520.95 | 30,887.89 | 44,318.75 | 49,294.25 | 24,910.75 | 29,196.06 |

| Year | Master Diesel | Master Diesel + SolarOnTop | Master Z.E. | Master Z.E. + SolarOnTop | Neolix | Neolix + SolarOnTop | |

|---|---|---|---|---|---|---|---|

| 2021 | 1 | 567.72 | 567.72 | ||||

| 2022 | 2 | 567.43 | 567.43 | ||||

| 2023 | 3 | 619.07 | 619.07 | ||||

| 2024 | 4 | 618.76 | 618.76 | 44.91 | 44.91 | 34.93 | 34.93 |

| 2025 | 5 | 618.45 | 618.45 | 33.67 | 33.67 | 7.48 | 7.48 |

| 2026 | 6 | 618.14 | 618.14 | 179.46 | 179.46 | 64.81 | 64.81 |

| 2027 | 7 | 617.83 | 617.83 | 134.53 | 134.53 | 29.90 | 29.90 |

| 2028 | 8 | 617.53 | 617.53 | 179.28 | 179.28 | 64.74 | 64.74 |

| Total 8 years | 4844.94 | 4844.94 | 571.85 | 571.85 | 201.85 | 201.85 | |

References

- Islam, A.H.M.R.; Selvadurai, N.; Town, G. Wireless Broadband Technologies for Regional and Rural Australia: A Last-mile Perspective. Aust. J. Telecommun. 2008, 58, 1. [Google Scholar] [CrossRef]

- Macharis, C.; Melo, S. City Distribution and Urban Freight Transport: Multiple Perspectives; Edward Elgar Publishing: Chottham, UK, 2011; pp. 45–60. [Google Scholar]

- Olsson, J.; Hellström, D.; Pålsson, H. Framework of Last Mile Logistics Research: A Systematic Review of the Literature. Sustainability 2019, 11, 7131. [Google Scholar] [CrossRef]

- Savelsbergh, M.; Van Woensel, T. 50th Anniversary Invited Article—City Logistics: Challenges and Opportunities. Transp. Sci. 2016, 50, 579–590. [Google Scholar] [CrossRef]

- The COVID-19 Recovery Will Be Digital: A Plan for the First 90 Days. Available online: https://www.mckinsey.de/~/media/McKinsey/Business%20Functions/McKinsey%20Digital/Our%20Insights/The%20COVID%2019%20recovery%20will%20be%20digital%20A%20plan%20for%20the%20first%2090%20days/The-COVID-19-recovery-will-be-digital-A-plan-for-the-first-90-days-vF.pdf (accessed on 9 May 2021).

- Retail Sales by Channel Worldwide. 2020. Available online: https://www.statista.com/statistics/1095969/retail-sales-by-channel-worldwide/ (accessed on 9 May 2021).

- The Satisfaction Death Valley That Awaits Online Retailers. Available online: https://www.withbond.com/blog/the-satisfaction-death-valley-that-awaits-online-retailers-in-2020/ (accessed on 9 May 2021).

- Yaman, H.; Karasan, O.E.; Kara, B.Y. Release Time Scheduling and Hub Location for Next-day Delivery. Oper. Res. 2012, 60, 906–917. [Google Scholar] [CrossRef]

- 68% of the World Population Projected to Live in Urban Areas by 2050, Says UN|UN DESA. Available online: https://www.un.org/development/desa/en/news/population/2018-revision-of-world-urbanization-prospects.html#:~:text=News-,68%25%20of%20the%20world%20population%20projected%20to%20live%20in,areas%20by%202050%2C%20says%20UN&text=Today%2C%2055%25%20of%20the%20worl’’s,increase%20to%2068%25%20by%202050.&text=In%20contrast%2C%20Africa%20remains%20mostly,population%20living%20in%20urban%20areas (accessed on 9 May 2021).

- Bretzke, W.-R. Global Urbanization: A Major Challenge for Logistics. Log. Res. 2013, 6, 57–62. [Google Scholar] [CrossRef]

- Urban World: Mapping the Economic Power of Cities. Available online: https://www.mckinsey.com/featured-insights/urbanization/urban-world-mapping-the-economic-power-of-cities (accessed on 10 May 2021).

- Blanco, E.E.; Fransoo, J.J. Reaching 50 Million Nanostores: Retail Distribution in Emerging Megacities; Independent Publishing Platform: Columbia, SC, USA, 2017. [Google Scholar]

- Otto, A.; Boysen, N.; Scholl, A.; Walter, R. Ergonomic Workplace Design in the Fast Pick Area. OR Spectr. 2017, 39, 945–975. [Google Scholar] [CrossRef]

- Greenhouse Gas Emission Trends and Projections in Europe 2009. Available online: https://www.eea.europa.eu/publications/eea_report_2009_9 (accessed on 3 May 2021).

- Apply for Electric Vehicles in HOV Lanes on, B.C. Highways—Province of British Columbia. Available online: https://www2.gov.bc.ca/gov/content/transportation/driving-and-cycling/traveller-information/routes-and-driving-conditions/hov-lanes/electric (accessed on 9 May 2021).

- Zhang, Y.; Sun, L.; Hu, X.; Hu, X.; Zhao, C. Order Consolidation for the Last-mile Split Delivery in Online Retailing. Transp. Res. Part E Logist. Transp. Rev. 2019, 122, 309–327. [Google Scholar] [CrossRef]

- Parcel Delivery. The Future of Last Mile. Available online: https://www.bringg.com/wp-content/uploads/2016/10/Parcel_delivery_The_future_of_last_mile-1.pdf (accessed on 23 September 2023).

- Fehling, C.; Saraceni, A. Technical and Legal Critical Success Factors: Feasibility of Drones & AGV in the Last-Mile-Delivery. Res. Transp. Bus. Manag. 2023, 50, 101029. [Google Scholar] [CrossRef]

- Ensafian, H.; Zare Andaryan, A.; Bell, M.G.H.; Glenn Geers, D.; Kilby, P.; Li, J. Cost-optimal deployment of autonomous mobile lockers co-operating with couriers for Simultaneous Pickup and Delivery Operations. Transp. Res. C Emerg. Technol. 2023, 146, 103958. [Google Scholar] [CrossRef]

- Maestro, J.A.; Rodriguez, S.; Casado, R.; Prieto, J.; Corchado, J.M. Comparison of Efficient Planning and Optimization Methods of Last Mile Delivery Resources. In Broadband Communications, Networks, and Systems Proceedings of the 11th EAI International Conference, BROADNETS 2020, Qingdao, China, 11–12 December 2020; Springer International Publishing: Cham, Switzerland, 2021; pp. 163–173. [Google Scholar] [CrossRef]

- Tiwapat, N.; Pomsing, C.; Jomthong, P. Last Mile Delivery: Modes, Efficiencies, Sustainability, and Trends. In Proceedings of the 3Rd IEEE International Conference On Intelligent Transportation Engineering (ICITE), Singapore, 3–5 September 2018. [Google Scholar]

- Ongel, A.; Loewer, E.; Roemer, F.; Sethuraman, G.; Chang, F.; Lienkamp, M. Economic Assessment of Autonomous Electric Microtransit Vehicles. Sustainability 2019, 11, 648. [Google Scholar] [CrossRef]

- Ranieri, L.; Digiesi, S.; Silvestri, B.; Roccotelli, M. A Review of Last Mile Logistics Innovations in an Externalities Cost Reduction Vision. Sustainability 2018, 10, 782. [Google Scholar] [CrossRef]

- Pani, A.; Mishra, S.; Golias, M.M.; Figliozzi, M.A. Evaluating Public Acceptance of Autonomous Delivery Robots during COVID-19 Pandemic. Transp. Res. Part D Transp. Environ. 2020, 89, 102600. [Google Scholar] [CrossRef]

- Figliozzi, M.A. Carbon Emissions Reductions in Last Mile and Grocery Deliveries Utilizing Air and Ground Autonomous Vehicles. Transp. Res. Part D Transp. Environ. 2020, 85, 102443. [Google Scholar] [CrossRef] [PubMed]

- Reed, S.; Campbell, A.M.; Thomas, B.W. Impact of Autonomous Vehicle Assisted Last-Mile Delivery in Urban to Rural Settings. Transp. Sci. 2022, 56, 1530–1548. [Google Scholar] [CrossRef]

- Mangiaracina, R.; Perego, A.; Seghezzi, A.; Tumino, A. Innovative Solutions to Increase Last-mile Delivery Efficiency in B2C E-commerce: A Literature Review. Int. J. Phys. Distrib. 2019, 49, 901–920. [Google Scholar] [CrossRef]

- Digiesi, S.; Fanti, M.P.; Mummolo, G.; Silvestri, B. Externalities Reduction Strategies in Last Mile Logistics: A Review. In Proceedings of the International Conference on Service Operations and Logistics, and Informatics (SOLI), Bari, Italy, 18–20 September 2017. [Google Scholar]

- Gevaers, R.; Voorde, E.V.; Vanelslander, T. Characteristics and Typology of Last-mile Logistics from an Innovation Perspective in an Urban Context. In City Distribution and Urban Freight Transport: Multiple Perspectives; Edward Elgar Publishing: Drottham, UK, 2011; pp. 56–71. [Google Scholar]

- Onghena, E. Integrators in a Changing World. In Critical Issues in Air Transport Economics and Business, 1st ed.; Routledge: London, UK, 2008. [Google Scholar]

- Jacobs, K.; Warner, S.; Rietra, M.; Mazza, L.; Buvat, J.; Khadikar, A.; Cherian, S.; Khemka, Y. The Last-Mile Delivery Challenge; Capgemini Research Institute: Paris, France, 2019. [Google Scholar]

- Slabinac, M. The 15th International Scientific Conference Business Logistics in Modern Management. In Proceedings of the Innovative Solutions for A “Last-Mile” Delivery—A European Experience, Osijek, Croatia, 15 October 2015. [Google Scholar]

- Visser, J.; Nemoto, T.; Browne, M. Home Delivery and the Impacts on Urban Freight Transport: A Review. Procedia Soc. Behav. 2014, 125, 15–27. [Google Scholar] [CrossRef]

- Allen, J.; Thorne, G.; Browne, M. Good Practice Guide on Urban Freight Transport; BESTUFS, University of Westminster: London, UK, 2007. [Google Scholar]

- Savelsbergh, M.W.; Goetschalckx, M. A Comparison of the Efficiency of Fixed Versus Variable Vehi. J. Bus. Logist. 1995, 16, 163. [Google Scholar]

- Punakivi, M.; Saranen, J. Identifying the Success Factors in E-grocery Home Delivery. Int. J. Retail. Distrib. 2001, 29, 156–163. [Google Scholar] [CrossRef]

- Chen, H.K.; Hsueh, C.F.; Chang, M.S. The Real-time Time-dependent Vehicle Routing Problem. Transp. Res. E-Log. 2006, 42, 383–408. [Google Scholar] [CrossRef]

- Boyer, K.K.; Frohlich, M.T.; Hult, G.T.M. Extending the Supply Chain: How Cutting-Edge Companies Bridge the Critical Last Mile into Customer’ Homes; AMACOM: New York, NY, USA, 2004. [Google Scholar]

- Solomon, M.M. Algorithms for the Vehicle Routing and Scheduling Problems with Time Window Constraints. Oper. Res. 1987, 35, 254–265. [Google Scholar] [CrossRef]

- Kin, B.; Ambra, T.; Verlinde, S.; Macharis, C. Tackling Fragmented Last Mile Deliveries to Nanostores by Utilizing Spare Transportation Capacity-a Simulation Study. Sustainability 2018, 10, 653. [Google Scholar] [CrossRef]

- Lin, C.-C.; Yu, C.-S. A Heuristic Algorithm for the Three-dimensional Container Packing Problem with Zero Unloading Cost Constraint. In Proceedings of the 2006 IEEE International Conference on Systems, Man and Cybernetics, Taipei, Taiwan, 8–11 October 2006. [Google Scholar]

- Rojas Viloria, D.; Solano-Charris, E.L.; Muñoz-Villamizar, A.; Montoya-Torres, J.R. Unmanned Aerial Vehicles/drones in Vehicle Routing Problems: A Literature Review. Int. Trans. Oper. Res. 2021, 28, 1626–1657. [Google Scholar] [CrossRef]

- Orenstein, I.; Raviv, T.; Sadan, E. Flexible Parcel Delivery to Automated Parcel Lockers: Models, Solution Methods and Analysis. EURO J. Transp. Logist. 2019, 8, 683–711. [Google Scholar] [CrossRef]

- Reck, D.J.; Axhausen, K.W. Subsidized Ridesourcing for the First/last Mile: How Valuable for Whom? Eur. J. Transp. Infrastruct. 2020, 20, 59–77. [Google Scholar] [CrossRef]

- Wang, X.; Zhan, L.; Ruan, J.; Zhang, J. How to Choose “last Mile” Delivery Modes for E-fulfillment. Math. Probl. Eng. 2014, 2014, 417129. [Google Scholar] [CrossRef]

- Molin, E.; Kosicki, M.; van Duin, R. Consumer Preferences for Parcel Delivery Methods: The Potential of Parcel Locker Use in the Netherlands. Eur. J. Transp. Infrastruct. 2022, 22, 183–200. [Google Scholar] [CrossRef]

- Simoni, M.D.; Marcucci, E.; Gatta, V.; Claudel, C. Potential Last-mile Impacts of Crowdshipping Services: A Simulation-based Evaluation. Transp. J. 2020, 47, 1933–1954. [Google Scholar] [CrossRef]

- Amore, M.D. Innovation Disclosure in Times of Uncertainty. J. Econ. Manag. 2020, 29, 792–815. [Google Scholar] [CrossRef]

- Bonilla, C.A.; Gutierrez Cubillos, P. The Effects of Ambiguity on Entrepreneurship. J. Econ. Manag. 2021, 30, 63–80. [Google Scholar] [CrossRef]

- Stucki, T.; Wochner, D. Technological and Organizational Capital: Where Complementarities Exist. J. Econ. Manag. Strategy 2018, 28, 458–487. [Google Scholar] [CrossRef]

- Boysen, N.; Fedtke, S.; Schwerdfeger, S. Last-mile Delivery Concepts: A Survey from an Operational Research Perspective. OR Spectr. 2020, 43, 1–58. [Google Scholar] [CrossRef]

- Schröder, J.; Heid, B.; Neuhaus, F.; Kässer, M.; Klink, C.; Tatomir, S. Fast Forwarding Last-Mile Delivery—Implications for the Ecosystem; McKinsey & Company. Available online: https://www.mckinsey.com/~/media/mckinsey/industries/travel%20logistics%20and%20infrastructure/our%20insights/technology%20delivered%20implications%20for%20cost%20customers%20and%20competition%20in%20the%20last%20mile%20ecosystem/fast-forwarding-last-mile-delivery-implications-for-the-ecosystem.pdf (accessed on 10 May 2021).

- Dobbins, A.; Nerini, F.F.; Deane, P.; Pye, S. Strengthening the EU Response to Energy Poverty. Nat. Energy 2019, 4, 2–5. [Google Scholar] [CrossRef]

- Shivakumar, A.; Dobbins, A.; Fahl, U.; Singh, A. Drivers of Renewable Energy Deployment in the Eu: An Analysis of Past Trends and Projections. Energy Strategy Rev. 2019, 26, 100402. [Google Scholar] [CrossRef]

- Lebeau, P. Towards the Electrification of City Logistic; Vrije Universiteit Brussel: Brussel, Belgium, 2016. [Google Scholar]

- Infographic: Can Falling Battery Prices Power EV Breakthrough? Available online: https://www.statista.com/chart/7713/electric-car-battery-prices/ (accessed on 10 May 2021).

- de Rus, G.; Socorro, M.P.; Valido, J.; Campos, J. Cost-benefit Analysis of Transport Projects: Theoretical Framework and Practical Rules. Transp. Policy 2022, 123, 25–39. [Google Scholar] [CrossRef]

- Taefi, T.T. Viability of Electric Vehicles in Combined Day and Night Delivery: A Total Cost of Ownership Example in Germany. Eur. J. Transp. Infrastruct. 2016, 16, 4. [Google Scholar] [CrossRef]

- Requia, W.J.; Mohamed, M.; Higgins, C.D.; Arain, A.; Ferguson, M. How Clean Are Electric Vehicles? Evidence-based Review of the Effects of Electric Mobility on Air Pollutants, Greenhouse Gas Emissions and Human Health. Atmos. Environ. 2018, 185, 64–77. [Google Scholar] [CrossRef]

- Kumar, R.R.; Alok, K. Adoption of Electric Vehicle: A Literature Review and Prospects for Sustainability. J. Clean. Prod. 2020, 253, 119911. [Google Scholar] [CrossRef]

- Siragusa, C.; Tumino, A.; Mangiaracina, R.; Perego, A. Electric Vehicles Performing Last-mile Delivery in B2C E-commerce: An Economic and Environmental Assessment. Int. J. Sustain. Transp. 2020, 16, 22–33. [Google Scholar] [CrossRef]

- Kumar, D.; Kalghatgi, G.; Agarwal, A.K. Comparison of Economic Viability of Electric and Internal Combustion Engine Vehicles Based on Total Cost of Ownership Analysis; Upadhyay, R.K., Sharma, S.K., Kumar, V., Valera, H., Eds.; Springer: Singapore, 2023; pp. 455–489. [Google Scholar] [CrossRef]

- Glitman, K.; Farnsworth, D.; Hildermeier, J. The Role of Electric Vehicles in a Decarbonized Economy: Supporting a Reliable, Affordable and Efficient Electric System. Electr. J. 2019, 32, 106623. [Google Scholar] [CrossRef]

- Desreveaux, A.; Hittinger, E.; Bouscayrol, A.; Castex, E.; Sirbu, G.M. Techno-economic Comparison of Total Cost of Ownership of Electric and Diesel Vehicles. IEEE Access 2020, 8, 195752–195762. [Google Scholar] [CrossRef]

- Lebeau, P.; Macharis, C.; Van Mierlo, J. How to Improve the Total Cost of Ownership of Electric Vehicles: An Analysis of the Light Commercial Vehicle Segment. World Electr. 2019, 10, 90. [Google Scholar] [CrossRef]

- Wadud, Z. Fully Automated Vehicles: A Cost of Ownership Analysis to Inform Early Adoption. Transp. Res. Part A Policy Pract. 2017, 101, 163–176. [Google Scholar] [CrossRef]

- Wadud, Z.; Anable, J. Automated Vehicles: Automatically Low Carbon? Low Carbon Vehicle Partnership and Institution of Mechanical Engineering: London, UK, 2016. [Google Scholar]

- Wadud, Z.; MacKenzie, D.; Leiby, P. Help or Hindrance? the Travel, Energy and Carbon Impacts of Highly Automated Vehicles. Transp. Res. 2016, 86, 1–18. [Google Scholar] [CrossRef]

- Driverless Cars Will Shave ‘‘£26” off Insurance Premiums in Five Years. Available online: https://www.telegraph.co.uk/finance/personalfinance/insurance/motorinsurance/11623218/Driverless-cars-will-shave-265-off-insurance-premiums-in-five-years.html (accessed on 10 May 2021).

- A Scenario: The End of Auto Insurance. Available online: https://www.celent.com/insights/121822340 (accessed on 10 May 2021).

- Life Cycle Cost Analysis Handbook. State of Alaska, Department of Education & Early Development. Available online: https://education.alaska.gov/facilities/publications/LCCAHandbook.pdf (accessed on 10 May 2021).

- Marktstudie Last Mile Pakketbezorging. Available online: https://www.acm.nl/sites/default/files/documents/2020-05/marktstudie-last-mile-pakketbezorging.pdf (accessed on 31 May 2021).

- Renault Case Elektrisch Rijden: PostNL. Available online: https://electric.renault.nl/nl/case-postnl (accessed on 31 May 2021).

- Operational Deep-Dive Parcels. Available online: https://www.postnl.nl/Images/parcels-operational-deep-dive_tcm10-149463.pdf (accessed on 31 May 2021).

- Neolix Raises $29 Million to Mass-Produce Autonomous Delivery Shuttles. Available online: https://venturebeat.com/2020/03/11/neolix-raises-29-million-to-mass-produce-autonomous-delivery-shuttles/ (accessed on 31 May 2021).

- Dérobert, N. Self-Driving Shuttle Bus Delivers Meals on EPFL Campus—Post Medien. Available online: https://post-medien.ch/en/self-driving-shuttle-bus-delivers-meals-on-epfl-campus/ (accessed on 31 May 2021).

- Chinese Self-Driving Cars Ready to Roll Abroad. Available online: https://global.chinadaily.com.cn/a/202010/12/WS5f83a900a31024ad0ba7df6e.html (accessed on 31 May 2021).

- Master E-Tech Electric–- Dimensions & Specifications—Renault UK. Available online: https://business.renault.co.uk/electric-vehicle-range/master-ze/specifications.html?bodyTypeCode=PT1261_panel_van (accessed on 11 August 2021).

- 新石器无人车官网-全球领先的无人车暨服务提供商 (Neolithic Unmanned Vehicle Official Website-The World’s Leading Unmanned Vehicle and Service Provider). Available online: http://www.neolix.ai/ (accessed on 31 May 2021).

- OVI: RDW Kentekencheck. Available online: https://ovi.rdw.nl/default.aspx (accessed on 31 May 2021).

- Delivery by Robot Soon to be Reality in China as Startup Neolix Begins Mass Production of “Robovan”. Available online: https://www.japantimes.co.jp/news/2019/05/28/business/corporate-business/delivery-robot-soon-reality-china-startup-begins-mass-production-robovans/ (accessed on 31 May 2021).

- Srivastava, S.; Karthikeyan, S.; Arumugam, P.; Kumar, A.; Thanigaivel, G. Design, Development and Experimental Investi-gation on the Effect of HVAC Power Consumption in Electric Vehicle Integrated with Thin Film Solar PV Panels. SAE Tech. Pap. 2021, 1–9. [Google Scholar] [CrossRef]

- Angamarca-Avendaño, D.; Saquicela-Moncayo, J.; Capa-Carrillo, B.; Cobos-Torres, J. Charge Equalization System for an Electric Vehicle with a Solar Panel. Energies 2023, 16, 3360. [Google Scholar] [CrossRef]

- SolarOnTop—The Future Is on the Roof|IM Efficiency. Available online: https://imefficiency.com/solarontop (accessed on 31 May 2021).

- Depreciation Based on Fixed Depreciation Table. Available online: https://www.belastingdienst.nl/wps/wcm/connect/bldcontenten/belastingdienst/individuals/cars/bpm/calculate_and_pay_bpm/depreciation_with_a_price_list_a_valuation_report_or_a_fixed_depreciation_table/depreciation-based-on-fixed-depreciation-table (accessed on 31 May 2021).

- Financiële Ondersteuning Elektrisch Rijden|RVO.nl|Rijksdienst. Available online: https://www.rvo.nl/onderwerpen/duurzaam-ondernemen/energie-en-milieu-innovaties/elektrisch-rijden/financiele-ondersteuning (accessed on 31 May 2021).

- Dablanc, L. Goods Transport in Large European Cities: Difficult to Organize, Difficult to Modernize. Transp. Res. Part A Policy Pract. 2007, 41, 280–285. [Google Scholar] [CrossRef]

- Users and Deployment of Delivery Vans in The Netherlands. Available online: https://topsectorlogistiek.nl/wptop/wp-content/uploads/2017/04/20170516-Users-and-deployment-of-delivery-vans-bericht-42-ENG.pdf (accessed on 31 May 2021).

- Lebeau, P.; Macharis, C.; Van Mierlo, J.; Lebeau, K. Electrifying Light Commercial Vehicles for City Logistics? A Total Cost of Ownership Analysis. Eur. J. Transp. Infrastruct. Res. 2015, 15, 551–569. [Google Scholar] [CrossRef]

- Netherlands Average Long-Term Government Bond|Moody’s Analytics. Available online: https://www.economy.com/netherlands/average-long-term-government-bond (accessed on 31 May 2021).

- Netherlands Long Term Interest Rate. Available online: https://ycharts.com/indicators/netherlands_long_term_interest_rates (accessed on 31 May 2021).

- Standaard Bedrijfsindeling—English. Available online: https://www.cbs.nl/-/media/_pdf/2017/31/sbi%202008%20versie%202017%20engels.pdf (accessed on 31 May 2021).

- Outlook Pakketmarkt en Thuisleveringen. Available online: https://topsectorlogistiek.nl/wptop/wp-content/uploads/2021/02/Outlook-Pakketmarkt-en-Thuisleveringen.pdf (accessed on 31 May 2021).

- Salaris Voor Bezorger (m/v) in Nederland. Available online: https://nl.indeed.com/career/bezorger/salaries (accessed on 31 May 2021).

- Vacatures in de Postbezorging & Sortering. Available online: https://www.postnl.nl/over-postnl/werkenbij/vacatures-in-de-postbezorging-sortering/pakketbezorger-tilburg-5048-ad-1.html?zipcode=&distance=50&page=2&functionType=017|021 (accessed on 31 May 2021).

- Slimme Rittenplanning Ondersteunt Duurzame Fietslogistiek van PostNL|Transport & Logistiek. Available online: https://transportlogistiek.nl/branche/bedrijf-ondernemer/slimme-rittenplanning-ondersteunt-duurzame-fietslogistiek-postnl/ (accessed on 11 July 2021).

- Thuisbezorging E-Commerce Wordt ‘Duurder’ Door Sterke Stijging Grote Pakketten. Available online: https://www.logistiek.nl/distributie/nieuws/2020/05/thuisbezorging-e-commerce-wordt-duurder-door-sterke-stijging-grote-pakketten-101173491 (accessed on 31 May 2021).

- Cross-Border Delivery: Average Package Weight|Statista. Available online: https://www.statista.com/statistics/974065/cross-border-delivery-package-weight-worldwide/ (accessed on 31 May 2021).

- Tarieven logistiek via bol.com. Available online: https://partnerplatform.bol.com/nl/hulp-nodig/logistiek-via-bol-com/tarieven-logistiek-via-bol-com/ (accessed on 6 July 2021).

- What Are The Delivery Days? Available online: https://www.postnl.nl/en/customer-service/delivery-days-and-times/what-are-the-delivery-days/ (accessed on 31 May 2021).

- A Simulation Study on Standardized Containers and the Interplay between Routing Efficiency and Material Handling. Available online: https://feb.studenttheses.ub.rug.nl/24273/1/Msc_Thesis_S2520559.pdf (accessed on 6 July 2021).

- Improving Alternator Efficiency Measurably Reduces Fuel Costs. Available online: https://www.delcoremy.com/documents/high-efficiency-white-paper.aspx (accessed on 20 June 2021).

- Fietskoerier Vacatures. Available online: https://www.postnl.nl/over-postnl/werkenbij/vacatures-in-de-postbezorging-sortering/?searchterm=&zipcode=&distance=10&functionType=030 (accessed on 6 July 2021).

- What Time Will My Package Be Delivered? Available online: https://www.postnl.be/en/contact/receiving-your-parcel/delivery-time/ (accessed on 6 July 2021).

- Kenteken Auto Overschrijven|RDW. Available online: https://www.rdw.nl/particulier/voertuigen/auto/kopen-en-verkopen/kenteken-overschrijven (accessed on 31 May 2021).

- Bestelauto die Vanaf 1 Juli 2005 in Gebruik Is Genomen. Available online: https://www.belastingdienst.nl/wps/wcm/connect/bldcontentnl/belastingdienst/prive/auto_en_vervoer/belastingen_op_auto_en_motor/bpm/voor_welke_motorrijtuigen_betaal_ik_bpm/bestelauto_die_vanaf_1_juli_2005_in_gebruik_is_genomen (accessed on 11 August 2021).

- Bpm-Tarief Personenauto. Available online: https://www.belastingdienst.nl/wps/wcm/connect/bldcontentnl/belastingdienst/prive/auto_en_vervoer/belastingen_op_auto_en_motor/bpm/bpm_berekenen_en_betalen/bpm_tarief/bpm-tarief-personenauto (accessed on 11 August 2021).

- Motorrijtuigenbelasting Berekenen. Available online: https://www.belastingdienst.nl/wps/wcm/connect/nl/auto-en-vervoer/content/hulpmiddel-motorrijtuigenbelasting-berekenen (accessed on 31 May 2021).

- Kleinschaligheidsinvesteringsaftrek 2021. Available online: https://www.belastingdienst.nl/wps/wcm/connect/bldcontentnl/belastingdienst/zakelijk/winst/inkomstenbelasting/veranderingen-actueel-jaar/investeringsaftrek-2021/kleinschaligheidsinvesteringsaftrek-2021 (accessed on 31 May 2021).

- Subsidieregeling Emissieloze Bedrijfsauto’s (SEBA)|RVO.nl|Rijksdienst. Available online: https://www.rvo.nl/subsidie-en-financieringswijzer/seba (accessed on 31 May 2021).

- Positieve Lijst Bij de Milieulijst 2021 Waterstof of Elektrische Voertuigen G 3101, F 3109, E 3110 en E 3114. Available online: https://www.rvo.nl/sites/default/files/2021/04/Waterstof-of-elektrische-voertuigen-voor-zakelijk-gebruik-28april2021.pdf (accessed on 31 May 2021).

- Energie-Investeringsaftrek (EIA) Voor Ondernemers|RVO.nl|Rijksdienst. Available online: https://www.rvo.nl/subsidie-en-financieringswijzer/energie-investeringsaftrek/ondernemers (accessed on 31 May 2021).

- Electricity Prices for Non-Household Consumers—Bi-Annual Data (from 2007 Onwards). Available online: https://ec.europa.eu/eurostat/databrowser/view/nrg_pc_205/default/table?lang=en (accessed on 31 May 2021).

- APK-Auto Dijk. Available online: https://www.autodijk.nl/apk/ (accessed on 31 May 2021).

- Actuele Brandstofprijzen, Zoals de Benzineprijs en Dieselprijs. Available online: https://www.unitedconsumers.com/tanken/informatie/brandstof-prijzen.asp (accessed on 31 May 2021).

- Self Driving Car Insurance: What You Need To Know. Available online: https://www.caranddriver.com/car-insurance/a35950852/self-driving-car-insurance/ (accessed on 11 July 2021).

- Magri, A.; Farrugia, A.; Valletta, F.; Grima, S. An Analysis of the Risk Factors Determining Motor Insurance Premium in a Small Island State: The Case of Malta. Int. J. Financ. Insur. Risk Manag. 2019, 9, 63–85. [Google Scholar]

- Bian, Y.; Yang, C.; Zhao, J.L.; Liang, L. Good Drivers Pay Less: A Study of Usage-based Vehicle Insurance Models. Transp. Res. 2018, 107, 20–34. [Google Scholar] [CrossRef]

- Huang, W.-D.; Zhang, Y.-H.P. Energy Efficiency Analysis: Biomass-to-wheel Efficiency Related with Biofuels Production, Fuel Distribution, and Powertrain Systems. PLoS ONE 2011, 6, e22113. [Google Scholar] [CrossRef]

- PostNL Vervangt Stint voor Bakfiets en Dieselbestelauto—Logistiek. Available online: https://www.logistiek.nl/distributie/nieuws/2018/10/postnl-vervangt-stint-voor-bakfiets-en-dieselbestelauto-101165300 (accessed on 6 July 2021).

- Meer Informatie over de Stint—PDF Gratis Download. Available online: https://docplayer.nl/12666947-Meer-informatie-over-de-stint.html (accessed on 6 July 2021).

- Ook Pakjesvervoerders Halen ‘Bolderkar’ Stint van de Weg. Available online: https://www.flows.be/nl/transport/ook-pakjesvervoerders-halen-bolderkar-stint-van-de-weg (accessed on 6 July 2021).

- Greibe, P.; Buch, T.S. Capacity and Behaviour on One-way Cycle Tracks of Different Widths. Transp. Res. Procedia 2016, 15, 122–136. [Google Scholar] [CrossRef]

- Gruber, J.; Kihm, A.; Lenz, B. A New Vehicle for Urban Freight? an Ex-ante Evaluation of Electric Cargo Bikes in Courier Services. Res. Transp. Bus. Manag. 2014, 11, 53–62. [Google Scholar] [CrossRef]

- Rolling Emissions-Free through Rotterdam. Available online: https://www.dhl.com/global-en/spotlight/sustainability/carbon-neutral-delivery.html (accessed on 6 July 2021).

- Ga Aan de Slag Als Fietskoerier bij DHL Express in Utrech. Available online: https://www.youngcapital.nl/vacatures/1410846-ga-aan-de-slag-als-fietskoerier-bij-dhl-express-in-utrecht (accessed on 6 July 2021).

- Tariefbeoordeling Verordening Grensoverschrijdend Pakketvervoer. Available online: https://www.acm.nl/sites/default/files/documents/2020-08/tariefbeoordeling-grensoverschrijdend-pakketvervoer-2019.pdf (accessed on 11 July 2021).

- Rates for Mail and Parcels. Available online: https://www.postnl.nl/Images/tarievenfolder-2021-en-web_tcm10-194354.pdf?version=1 (accessed on 31 May 2021).

- New Agreements on Urban Deliveries Without CO2 Emission. Available online: https://www.government.nl/latest/news/2021/02/11/new-agreements-on-urban-deliveries-without-co2-emission (accessed on 9 August 2021).

- Automobile Insurance in the Era of Autonomous Vehicles. Available online: https://assets.kpmg/content/dam/kpmg/pdf/2016/05/kpmg-automobile-insurance-in-era-autonomous.pdf (accessed on 31 May 2021).

- DHL: Bakfiets Sneller dan Bestelbus. Available online: https://www.fietsersbond.nl/nieuws/bakfiets-sneller-dan-bestelbus/ (accessed on 11 July 2021).

- Jonker, D.; Zschocke, K. The Average Parcel Size in E-Commerce Shipments—A Variable in Coping with Congestion in Carrier Networks? Available online: https://www.kennisdclogistiek.nl/ (accessed on 11 July 2021).

- Bol.com Removes Parcel Packaging from 7 Million Items. Available online: https://internetretailing.net/operations-and-logistics/operations-and-logistics/bolcom-removes-parcel-packaging-from-7-million-items-21553 (accessed on 11 July 2021).

- Apparel and General Merchandise Guideline—Order Consolidation. Available online: https://www.gs1us.org/DesktopModules/Bring2mind/DMX/Download.aspx?Command=Core_Download&EntryId=1642&language=en-US&PortalId=0&TabId=134 (accessed on 11 July 2021).

- Levinson, J.; Askeland, J.; Becker, J.; Dolson, J.; Held, D.; Kammel, S.; Kolter, J.Z.; Langer, D.; Pink, O.; Pratt, V.R. Towards Fully Autonomous Driving: Systems and Algorithms. In Proceedings of the IEEE Intelligent Vehicles Symposium (IV), Aachen, Germany, 5 June 2011. [Google Scholar]

- Marouf, M.; Pollard, E.; Nashashibi, F. Automatic Parallel Parking and Platooning to Redistribute Electric Vehicles in a Car-sharing Application. In Proceedings of the IEEE Intelligent Vehicles Symposium Proceedings, Dearborn, MI, USA, 8 June 2014. [Google Scholar]

- Fleet Electrifi cation Roadmap Revolutionizing Transportation and Achieving Energy Security. Available online: https://www.electrificationcoalition.org/wp-content/uploads/2018/07/EC-Fleet-Roadmap-screen.pdf (accessed on 10 May 2021).

- Bpm-Tarief. Available online: https://www.belastingdienst.nl/wps/wcm/connect/bldcontentnl/belastingdienst/prive/auto_en_vervoer/belastingen_op_auto_en_motor/bpm/bpm_berekenen_en_betalen/bpm_tarief/bpm-tarief (accessed on 31 May 2021).

- Grijs kenteken—Qilo. Available online: https://www.nmanet.nl/grijs-kenteken/ (accessed on 31 May 2021).

- Eisen aan een Bestelauto. Available online: https://www.belastingdienst.nl/wps/wcm/connect/bldcontentnl/belastingdienst/prive/auto_en_vervoer/belastingen_op_auto_en_motor/bpm/voor_welke_motorrijtuigen_betaal_ik_bpm/eisen_aan_een_bestelauto#Bestelauto_dubbele_cabine (accessed on 11 August 2021).

- Wanneer en Hoe Vaak APK Keuren. Available online: https://www.rdw.nl/particulier/voertuigen/auto/apk/wanneer-en-hoe-vaak-apk-keuren (accessed on 31 May 2021).

- Waarom een APK Keuring? Available online: https://www.profile.nl/apk (accessed on 31 May 2021).

- APK-Keuring bij Profile Car & Tyreservice Zierikzee en Middelharnis. Available online: https://www.rinusroon.nl/rinus-roon-goed-voor-uw-auto/apk-keuring/ (accessed on 31 May 2021).

- VAT Tariffs. Available online: https://www.belastingdienst.nl/wps/wcm/connect/bldcontenten/belastingdienst/business/vat/vat_in_the_netherlands/calculating_vat/vat_tariffs (accessed on 31 May 2021).

- Btw Aftrekken Over een Auto die u Zakelijk en Privé Gebruikt? Available online: https://www.belastingdienst.nl/wps/wcm/connect/bldcontentnl/belastingdienst/zakelijk/btw/btw_aftrekken/btw_en_de_auto/btw_en_de_auto (accessed on 31 May 2021).

- EU: Vehicle Definitions|Transport Policy. Available online: https://www.transportpolicy.net/standard/eu-vehicle-definitions/ (accessed on 11 August 2021).

- Lichte Elektrische Bestelauto|RVO.nl|Rijksdienst. Available online: https://www.rvo.nl/subsidies-regelingen/milieulijst-en-energielijst/miavamil/lichte-elektrische-bestelauto-0 (accessed on 31 May 2021).

- Geen Recht op Investeringsaftrek. Available online: https://www.belastingdienst.nl/wps/wcm/connect/bldcontentnl/belastingdienst/zakelijk/winst/inkomstenbelasting/inkomstenbelasting_voor_ondernemers/investeringsaftrek_en_desinvesteringsbijtelling/geen_recht_op_investeringsaftrek (accessed on 31 May 2021).

- Zonnepanelen of—Folie Voor Elektriciteitsopwekking op Transportmiddelen [W]|RVO.nl|Rijksdienst. Available online: https://www.rvo.nl/subsidies-regelingen/milieulijst-en-energielijst/eia/zonnepanelen-%E2%80%93folie-voor-elektriciteitsopwekking-op-transportmiddelen-w-0 (accessed on 31 May 2021).

- Zakelijke Autoverzekering—Wat Zijn de Voordelen?|Autoverzekering.nl. Available online: https://www.autoverzekering.nl/zakelijk/ (accessed on 31 May 2021).

- Analyse van de Nederlandse Verzekeringsmarkt 2019. Available online: https://assets.kpmg/content/dam/kpmg/nl/pdf/2021/sectoren/analyse-nederlandse-verzekeringsmarkt-2019.pdf (accessed on 31 May 2021).

- Bedrijfsautoverzekering. Available online: https://www.averoachmea.nl/bedrijfsverzekeringen/autoverzekering (accessed on 31 May 2021).

- Davis, B.; Figliozzi, M.A. A Methodology to Evaluate the Competitiveness of Electric Delivery Trucks. Transp. Res. E-Log. 2013, 49, 8–23. [Google Scholar] [CrossRef]

- De Renault Trucks Master, Z.E. Is de Schoonste Speler in ons Team van Professionals. Available online: https://www.renaulttrucksonline.nl/page/renault_trucks_master_ze (accessed on 31 May 2021).

- What Can 6000 Electric Vehicles Tell Us About EV Battery Health? Available online: https://www.geotab.com/blog/ev-battery-health/ (accessed on 6 July 2021).

- What Is the Lifespan of an Electric Car Battery? Available online: https://easyelectriclife.groupe.renault.com/en/day-to-day/charging/what-is-the-lifespan-of-an-electric-car-battery/ (accessed on 6 July 2021).

- Vrachtwagentol in Nederland. Available online: https://web.uta.com/nl/toll/tolls-in-europe-55ma/Netherlands (accessed on 31 May 2021).

- Veelgestelde Vragen|Milieuzones in Nederland. Available online: https://www.milieuzones.nl/veelgestelde-vragen (accessed on 31 May 2021).

- Saraceni, A.; Oleko, R.; Guan, L.; Bagaria, A.; Quintens, L. Autonomization and Digitalization: Index of Last Mile 4.0 Inclusive Transition. In Advances in Production Management Systems. Smart Manufacturing and Logistics Systems: Turning Ideas into APMS 2022, Proceedings of the IFIP Advances in Information and Communication Technology, Gyeongju, South Korea, 25–29 September 2022; Action Kim, D.Y., von Cieminski, G., Romero, D., Eds.; Springer: Cham, Switzerland, 2022; p. 663. [Google Scholar] [CrossRef]

| |||||||

|---|---|---|---|---|---|---|---|

| Vehicle Name | Motor Type | Curb Weight (kg) | Max. Speed (km/h) | Purchase Price (EUR, excl. VAT) | Max. Range (km) | Fuel Consumption (l/100 km or kWh/100 km | |

| Renault Master Diesel | 2.3 L diesel engine | 13.0 | 2066 | 148 | 31,940 | 1200 | 6.7 |

| Renault Master Z.E. | 5.7 kW BEV with 33 kWh battery | 13.0 | 2050 | 100 | 58,700 | 120 | 27.5 |

| Neolix Express | BEV with swappable 12.9 kWh battery | 2.4 | 371 | 50 | 30,000 | 100 | 12.9 |

| Vehicle Name | Area Suitable for SOT Installment (m2) | Annual Energy Generated (kWh) | Annual Fuel Savings (L) |

|---|---|---|---|

| Renault Master Diesel | 6.88 | - | 998.73 |

| Renault Master Z.E. | 6.88 | 692.50 | - |

| Neolix Express | 3.25 | 346.25 | - |

| Cost Segments/Vehicle | Master Diesel | Master Diesel + SolarOnTop | Master Z.E. | Master Z.E. + SolarOnTop | Neolix | Neolix + SolarOnTop |

|---|---|---|---|---|---|---|

| Purchasing Costs(EUR) | ||||||

| Purchasing cost (EUR) | 31,940.00 | 37,290.00 | 58,700.00 | 64,050.00 | 30,000.00 | 352,500.00 |

| Subsidies and Indirect initiatives (EUR) | 5429.80 | 6412.86 | 14,392.00 | 14,766.50 | 5100.00 | 6064.69 |

| Ownership (+AKP)(EUR) | ||||||

| Registration fee (EUR) | 10.75 | 10.75 | 10.75 | 10.75 | 10.75 | 10.75 |

| BPM tax (EUR) | − | − | − | − | − | − |

| Road tax (EUR) (for 3 months) | 142 | 142 | 135 (from 2026) | 135 (from 2026) | 30 (from 2026) | 20 (from 2026) |

| APK inspection (EUR) (schedule pattern) | 52 (3-1-1) | 52 (3-1-1) | 45 (4-2-2-1) | 45 (4-2-2-1) | 35 (4-2-2-1) | 35 (4-2-2-1) |

| Feeding cost(EUR/L,EUR/kWh) | 1.52 | 1.52 | 0.11 | 0.11 | 0.11 | 0.11 |

| Insurance cost(EUR/month) | 128.03 | 128.03 | 69.84 | 69.84 | 64.00 | 64.00 |

| Maintenance and repair(EUR/km) | 0.052 | 0.052 | 0.019 | 0.019 | 0.019 | 0.019 |

| Battery cost (EUR) | - | - | - | - | - | - |

| Road toll (EUR) | - | - | - | - | - | - |

| Labour cost(EUR/month) | 1973.00 | 1973.00 | 1973.00 | 1973.00 | - | - |

| TCO for 8 years (EUR) | 280,501.96 | 266,450.62 | 255,894.20 | 260,261.67 | 41,574.82 | 45,566.12 |

| Renault Master | Neolix | Neolix Delivery Performance | ||

|---|---|---|---|---|

| 220 | 39 | Load capacity in units | ||

| 08:00–21:30 | 07:00–01:00 | Working hours | 16 | Vehicle speed in km/h |

| 13.5 | 18 | 0.83 | Vehicle km per unit | |

| 6 | 7 | Working days per week | 39 | Load capacity in units |

| 302 | 354 | Working days per year | 32.37 | Delivery cycle millage |

| 440 | 351 | Maximum delivery volume per day | 2 | Delivery cycle duration in hours |

| 2640 | 2457 | Maximum delivery volume per week | 9 | Number of cycles per days |

| 132,880 | 124,254 | Maximum delivery volume per year | 351 | Maximum delivery volume per day |

| Renault Master Diesel | Renault Master Z.E. | Neolix | |

|---|---|---|---|

| 132,880 | 132,880 | 124,254 | Delivery volume per year (units) |

| 78,000 | 78,000 | 103,131 | Delivery kilometer per year (km) |

| 1.70 | 1.70 | 1.20 | Parcels per kilometer delivered (units) |

| 7.00 | 7.00 | 7.00 | Income per parcel delivered (EUR) |

| 11.93 | 11.93 | 8.43 | Income benefit per kilometer (EUR) |

| 0.90 | 0.96 | 0.13 | Cost per kilometer (EUR) |

| 11.03 | 10.96 | 8.30 | Revenue/Loss per kilometer (EUR) |

| Vehicle Name | Ownership (+AKP) | Purchasing Cost | Feeding | Maintenance and Repair | Labor Cost | Insurance | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20% | 30% | 40% | 10% | 20% | 30% | 10% | 20% | 30% | 10% | 20% | 30% | 10% | 20% | 30% | 50% | 100% | 150% | |

| Renault Master Diesel | 0.4% | 0.5% | 0.7% | 1.0% | 2.0% | 3.0% | 4.0% | 5.0% | 6.0% | 3.0% | 4.0% | 5.0% | 10.0% | 16.0% | 23.0% | 2.0% | 4.0% | 7.0% |

| Renault Master Z.E. | 0.04% | 0.06% | 0.09% | 2.0% | 3.0% | 5.0% | 0.4% | 0.7% | 1.0% | 0.2% | 0.5% | 0.7% | 7.0% | 15.0% | 22.0% | 1.0% | 3.0% | 4.0% |

| Neolix Express | 0.006% | 0.01% | 0.2% | 6.0% | 12.0% | 18.0% | 1.0% | 2.0% | 3.0% | 1.0% | 3.0% | 4.0% | 0.0% | 0.0% | 0.0% | 7.0% | 15.0% | 22.0% |

| Renault Master Diesel | Renault Master Z.E. | Neolix | Neolix Scenario 1 | Neolix Scenario 2 | |

|---|---|---|---|---|---|

| 132,880 | 132,880 | 124,254 | 149,742 | 210,276 | Delivery volume per year (units) |

| 78,000 | 78,000 | 103,131 | 103,131 | 103,131 | Delivery kilometer per year (km) |

| 1.70 | 1.70 | 1.20 | 1.45 | 2.04 | Parcels per kilometer delivered (units) |

| 7.00 | 7.00 | 7.00 | 7.00 | 5.94 | Income per parcel delivered (EUR) |

| 11.93 | 11.93 | 8.43 | 10.16 | 12.11 | Income benefit per kilometer (EUR) |

| 0.90 | 0.96 | 0.13 | 0.13 | 0.13 | Cost per kilometer (EUR) |

| 11.03 | 10.96 | 8.30 | 10.03 | 11.98 | Revenue/Loss per kilometer (EUR) |

| Renault Master Diesel | Renault Master Z.E. | Neolix | Neolix Scenario 1 | Neolix Scenario 2 | |

|---|---|---|---|---|---|

| 132,880 | 132,880 | 124,254 | 124,254 | 124,254 | Delivery volume per year (units) |

| 78,000 | 78,000 | 103,131 | 85.942 | 79,331 | Delivery kilometre per year (km) |

| 1.70 | 1.70 | 1.20 | 1.45 | 1.57 | Parcels per kilometre delivered (units) |

| 7.00 | 7.00 | 7.00 | 7.00 | 7.00 | Income per parcel delivered (EUR) |

| 11.93 | 11.93 | 8.43 | 10.12 | 10.96 | Income benefit per kilometre (EUR) |

| 0.90 | 0.96 | 0.13 | 0.13 | 0.13 | Cost per kilometre (EUR) |

| 11.03 | 10.96 | 8.30 | 9.99 | 10.83 | Revenue/Loss per kilometre (EUR) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Levkovych, O.; Saraceni, A. Efficiency in the Last Mile of Autonomous Ground Vehicles with Lockers: From Conventional to Renewable Energy Transport. Sustainability 2023, 15, 16219. https://doi.org/10.3390/su152316219

Levkovych O, Saraceni A. Efficiency in the Last Mile of Autonomous Ground Vehicles with Lockers: From Conventional to Renewable Energy Transport. Sustainability. 2023; 15(23):16219. https://doi.org/10.3390/su152316219

Chicago/Turabian StyleLevkovych, Olga, and Adriana Saraceni. 2023. "Efficiency in the Last Mile of Autonomous Ground Vehicles with Lockers: From Conventional to Renewable Energy Transport" Sustainability 15, no. 23: 16219. https://doi.org/10.3390/su152316219

APA StyleLevkovych, O., & Saraceni, A. (2023). Efficiency in the Last Mile of Autonomous Ground Vehicles with Lockers: From Conventional to Renewable Energy Transport. Sustainability, 15(23), 16219. https://doi.org/10.3390/su152316219