Economic Evaluation and Technoeconomic Resilience Analysis of Two Routes for Hydrogen Production via Indirect Gasification in North Colombia

Abstract

:1. Introduction

2. Materials and Methods

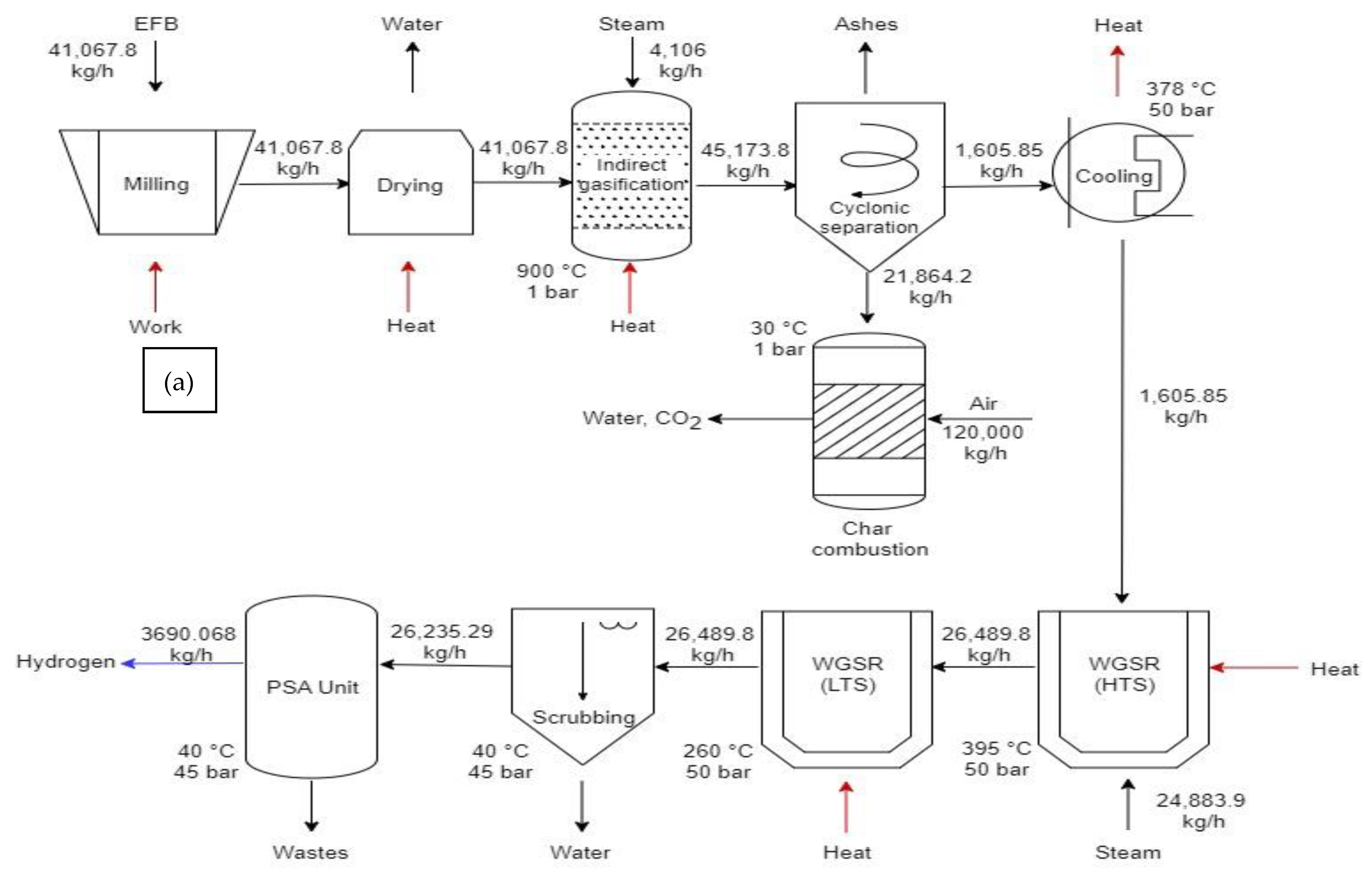

2.1. Description of the Processes

Hydrogen Production by Direct Gasification Combined with Pressure Swing Adsorption (Route 1) or Selexol-Based Adsorption (Route 2)

2.2. Economic Evaluation

2.3. Technoeconomic Resilience Analysis

3. Results and Discussion

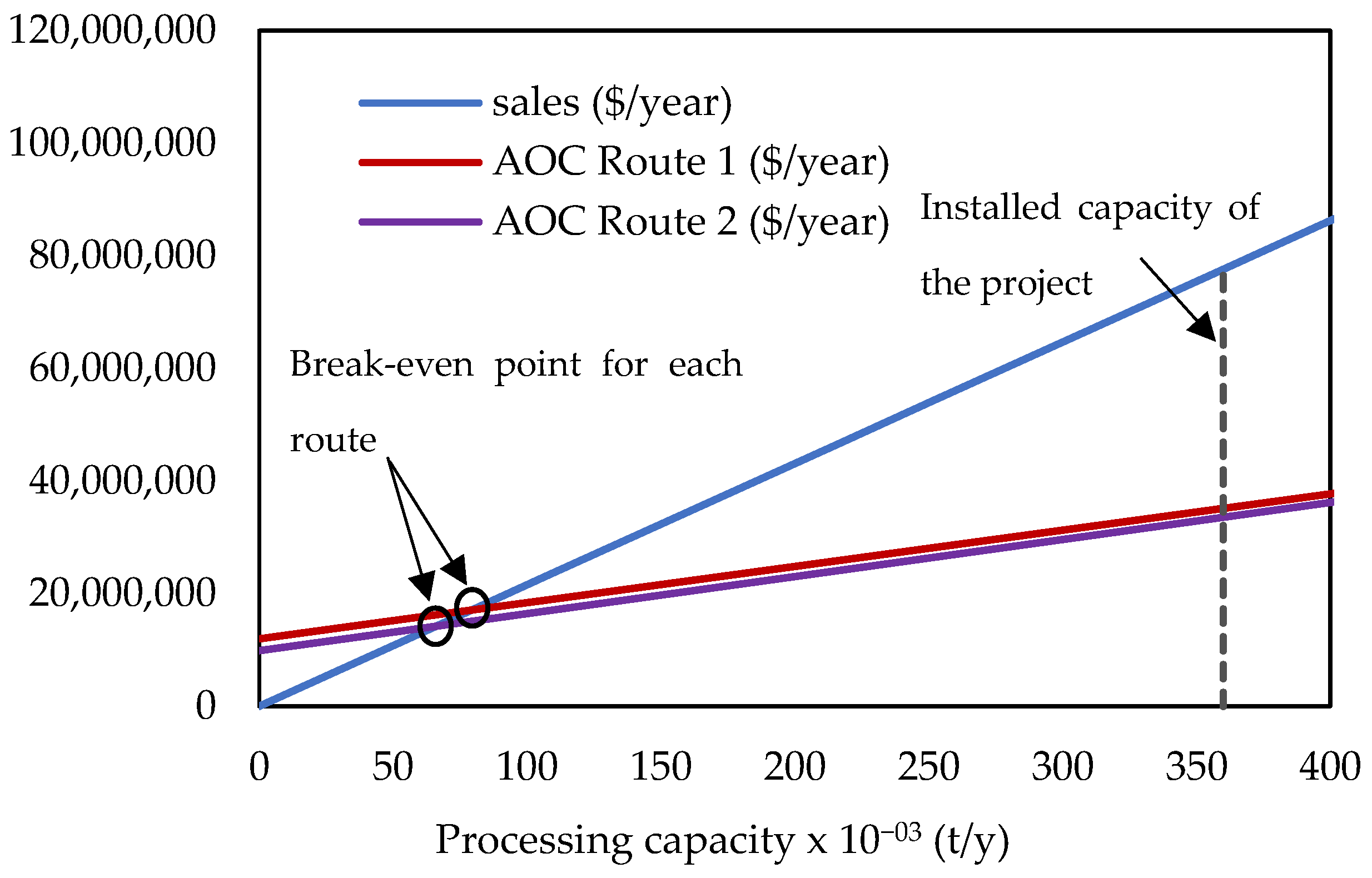

3.1. Economic Assessment

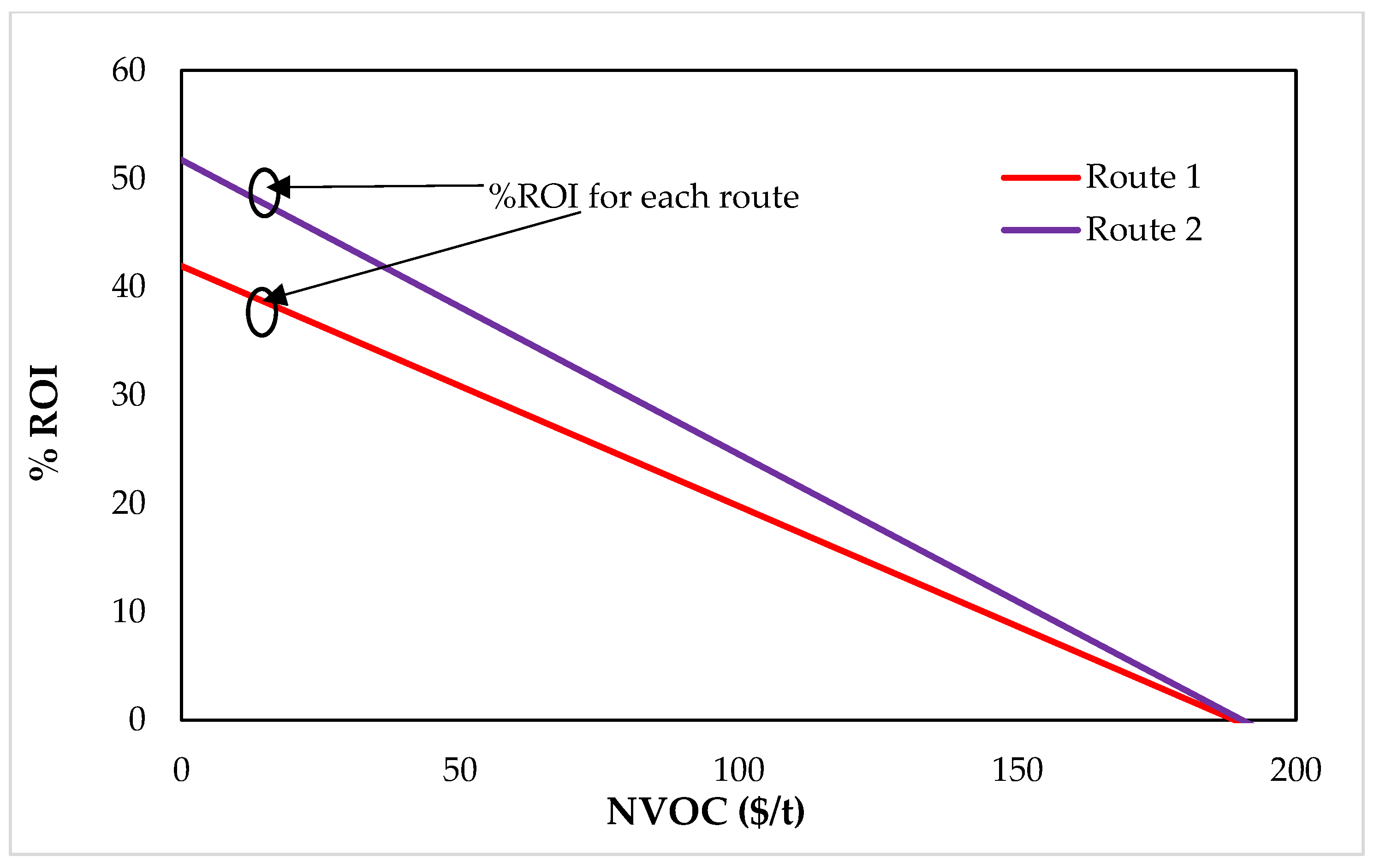

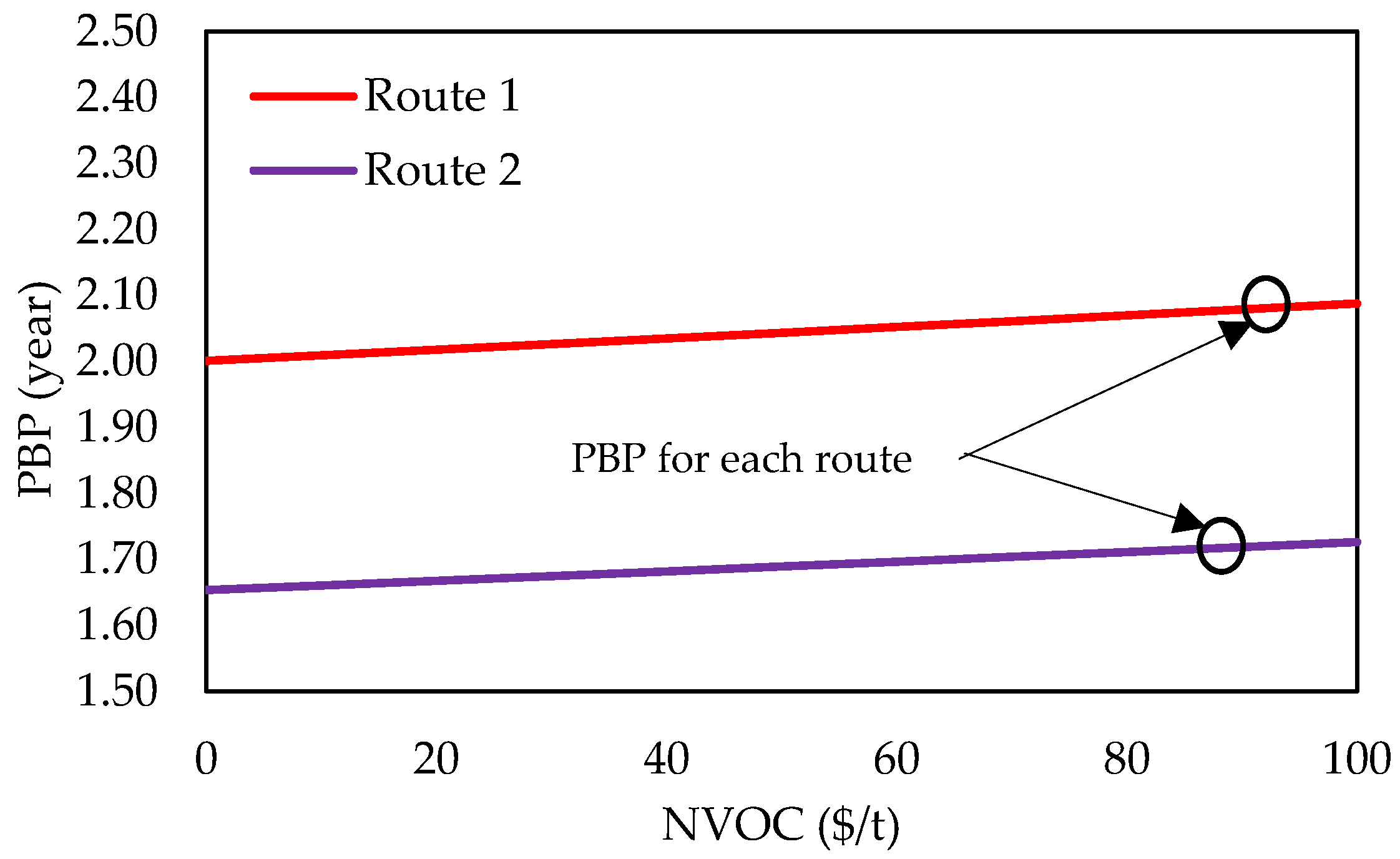

3.2. Technoeconomic Resilience Analysis

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Nomenclature

| Symbols | |

| Mass flow of raw material (t/y) | |

| Ratio between the quantity of product i obtained per unit of raw material | |

| Efficiency on-stream (%) | |

| Abbreviations | |

| ACF | Net profit for year n (USD) |

| ACR | Annual cost/benefit ratio |

| AFC | Annualized fixed costs (USD/y) |

| AOC | Annualized operating costs (USD/y) |

| BEP | Break-even point |

| C | Operating costs (USD) |

| CCF | Cumulative cash flow (1/y) |

| DFCI | Direct fixed capital investment (USD) |

| DPC | Direct production costs (USD/y) |

| DGP | Gross profit (depreciation included) (USD MM/y) |

| EP | Economic potentials |

| FCH | Fixed charges (USD/y) |

| FCI | Fixed capital investment (USD) |

| FCI0 | Initial value of depreciable fixed capital investment (USD) |

| FCIs | Salvage value of fixed capital investment (USD) |

| FOB | Free on board |

| GE | General expenses (USD/y) |

| GH | Gaseous hydrocarbons |

| HTS | High-temperature stage |

| I | Inflation rate (%) |

| Itr | Tax rate set by the government for income derived from the process (%) |

| IFCI | Indirect fixed capital investment (USD) |

| LH | Liquid hydrocarbons |

| LTS | Low-temperature stage |

| MR | Maintenance and repairs |

| N | Years |

| NOC | Normalized operating costs (USD/y) |

| NPV | Net present value (USD MM) |

| NVOC | Normalized variable operating cost (USD/t-rm) |

| OL | Operating labor |

| PAT | Profit after taxes (USD/y) |

| PBP | Payback period (y) |

| POH | Plant overhead (USD/y) |

| PSA | Pressure swing adsorption |

| RM | Raw material |

| ROI | Return on investment (%) |

| SUC | Start-up costs |

| TAC | Total annualized process costs (USD/y) |

| TCI | Total capital investment (USD) |

| U | Utilities |

| WCI | Work capital investment (USD) |

| WGS | Water gas shift |

References

- Okolie, J.A.; Patra, B.R.; Mukherjee, A.; Nanda, S.; Dalai, A.K.; Kozinski, J.A. Futuristic applications of hydrogen in energy, biorefining, aerospace, pharmaceuticals and metallurgy. Int. J. Hydrogen Energy 2021, 46, 8885–8905. [Google Scholar] [CrossRef]

- Berry, G.D.; Aceves, S.M. La Economía del Hidrógeno como Solución al Problema de la Estabilización del Clima Mundial. Acta Univ. 2006, 16, 5–14. [Google Scholar] [CrossRef]

- Brijaldo, M.H.; Castillo, C.; Pérez, G. Principales Rutas en la Producción de Hidrógeno. Ing. Y Compet. 2021, 23, e30211155. [Google Scholar] [CrossRef]

- Lamb, J.J.; Hillestad, M.; Rytter, E.; Bock, R.; Nordgård, A.S.R.; Lien, K.M.; Burheim, O.S.; Pollet, B.G. Traditional Routes for Hydrogen Production and Carbon Conversion. In Hydrogen, Biomass and Bioenergy; Academic Press: Cambridge, MA, USA, 2020; pp. 21–53. [Google Scholar] [CrossRef]

- Penner, S.S. Steps toward the hydrogen economy. Energy 2006, 31, 33–43. [Google Scholar] [CrossRef]

- Mansilla, C.; Bourasseau, C.; Cany, C.; Guinot, B.; Le Duigou, A.; Lucchese, P. Hydrogen Applications: Overview of the Key Economic Issues and Perspectives. In Hydrogen Supply Chain: Design, Deployment and Operation; Academic Press: Cambridge, MA, USA, 2018; pp. 271–292. [Google Scholar] [CrossRef]

- Heidenreich, S.; Foscolo, P.U. New concepts in biomass gasification. Prog. Energy Combust. Sci. 2015, 46, 72–95. [Google Scholar] [CrossRef]

- Ministerio de Ambiente y Energtía-Minenergia Colombia’s Hydrogen Roadmap (In Spanish). August 2021. Available online: https://www.minenergia.gov.co/es/servicio-al-ciudadano/foros/hoja-de-ruta-del-hidrógeno-en-colombia/ (accessed on 3 June 2021).

- Revista, R. Colombia will have the Fourth Lowest Green Hydrogen Price in the World by 2050 (In Spanish). Rev. Sem. 2022. Available online: https://www.semana.com/economia/macroeconomia/articulo/colombia-tendra-el-cuarto-precio-mas-bajo-de-hidrogeno-verde-en-el-mundo-en-2050/202208/ (accessed on 3 June 2023).

- González-Delgado, Á.D.; Moreno-Sader, K.A.; Martínez-Consuegra, J.D. Sustainable Biorefining of shrimp: Developments from Computer Aided Process Engineering; Corporación Universitaria Minuto de Dios–UNIMINUTO: Bogotá, Colombia, 2022; (In Spanish). [Google Scholar] [CrossRef]

- Gondal, I.A.; Masood, S.A.; Khan, R. Green hydrogen production potential for developing a hydrogen economy in Pakistan. Int. J. Hydrogen Energy 2018, 43, 6011–6039. [Google Scholar] [CrossRef]

- Hamedani, S.R.; Villarini, M.; Colantoni, A.; Moretti, M.; Bocci, E. Life Cycle Performance of Hydrogen Production via Agro-Industrial Residue Gasification—A Small Scale Power Plant Study. Energies 2018, 11, 675. [Google Scholar] [CrossRef]

- Spath, P.; Aden, A.; Eggeman, T.; Ringer, M.; Wallace, B.; Jechura, J. Biomass to Hydrogen Production Detailed Design and Economics Utilizing the Battelle Columbus Laboratory Indirectly-Heated Gasifier; National Renewable Energy Laboratory (NREL): Springfield, QLD, Australia, 2005. Available online: http://www.osti.gov/bridge (accessed on 23 August 2023).

- El-Halwagi, M.M. A return on investment metric for incorporating sustainability in process integration and improvement projects. Clean Technol. Environ. Policy 2016, 19, 611–617. [Google Scholar] [CrossRef]

- Peters, M.; Timmerhaus, K.D.; West, R. Plant Design and Economics for Chemical Engineers, 5th ed.; McGraw-Hill Education: New York, NY, USA, 2003. [Google Scholar]

- El-Halwagi, M.M. Sustainable Design through Process Integration: Fundamentals and Applications to Industrial Pollution Prevention, Resource Conservation, and Profitability Enhancement, 2nd ed.; Butterworth-Heinemann: Oxford, UK, 2017. [Google Scholar]

- Jha, S.; Nanda, S.; Acharya, B.; Dalai, A.K. A Review of Thermochemical Conversion of Waste Biomass to Biofuels. Energies 2022, 15, 6352. [Google Scholar] [CrossRef]

- Heidenreich, S.; Müller, M.; Foscolo, P.U. Advanced Biomass Gasification and Product Flexibility; Elsevier: Amsterdam, The Netherlands, 2016; Available online: http://www.sciencedirect.com:5070/book/9780128042960/advanced-biomass-gasification (accessed on 3 November 2023).

- Mohammed, M.A.A.; Salmiaton, A.; Wan Azlina, W.A.K.G.; Mohammad Amran, M.S.; Fakhru’L-Razi, A. Air gasification of empty fruit bunch for hydrogen-rich gas production in a fluidized-bed reactor. Energy Convers. Manag. 2011, 52, 1555–1561. [Google Scholar] [CrossRef]

- D’Orazio, A.; Rapagnà, S.; Foscolo, P.U.; Gallucci, K.; Nacken, M.; Heidenreich, S.; Di Carlo, A.; Dell’Era, A. Gas conditioning in H2 rich syngas production by biomass steam gasification: Experimental comparison between three innovative ceramic filter candles. Int. J. Hydrogen Energy 2015, 40, 7282–7290. [Google Scholar] [CrossRef]

- Rauch, R.; Hrbek, J.; Hofbauer, H. Biomass gasification for synthesis gas production and applications of the syngas. Wiley Interdiscip. Rev. Energy Environ. 2014, 3, 343–362. [Google Scholar] [CrossRef]

- Cheng, Y.W.; Lee, Z.S.; Chong, C.C.; Khan, M.R.; Cheng, C.K.; Ng, K.H.; Hossain, S.S. Hydrogen-rich syngas production via steam reforming of palm oil mill effluent (POME)–A thermodynamics analysis. Int. J. Hydrogen Energy 2019, 44, 20711–20724. [Google Scholar] [CrossRef]

- Arregi, A.; Amutio, M.; Lopez, G.; Bilbao, J.; Olazar, M. Evaluation of thermochemical routes for hydrogen production from biomass: A review. Energy Convers. Manag. 2018, 165, 696–719. [Google Scholar] [CrossRef]

- Barisano, D.; Canneto, G.; Nanna, F.; Villone, A.; Fanelli, E.; Freda, C.; Grieco, M.; Lotierz, A.; Cornacchia, G.; Braccio, G.; et al. Investigation of an Intensified Thermo-Chemical Experimental Set-Up for Hydrogen Production from Biomass: Gasification Process Integrated to a Portable Purification System—Part II. Energies 2022, 15, 4580. [Google Scholar] [CrossRef]

- Marcantonio, V.; Bocci, E.; Monarca, D. Development of a Chemical Quasi-Equilibrium Model of Biomass Waste Gasification in a Fluidized-Bed Reactor by Using Aspen Plus. Energies 2019, 13, 53. [Google Scholar] [CrossRef]

- Barisano, D.; Canneto, G.; Nanna, F.; Alvino, E.; Pinto, G.; Villone, A.; Carnevale, M.; Valerio, V.; Battafarano, A.; Braccio, G. Steam/oxygen biomass gasification at pilot scale in an internally circulating bubbling fluidized bed reactor. Fuel Process. Technol. 2016, 141, 74–81. [Google Scholar] [CrossRef]

- Keskin, T.; Arslan, K.; Nalakth Abubackar, H.; Vural, C.; Eroglu, D.; Karaalp, D.; Yanik, J.; Ozdemir, G.; Azbar, N. Determining the effect of trace elements on biohydrogen production from fruit and vegetable wastes. Int. J. Hydrogen Energy 2018, 43, 10666–10677. [Google Scholar] [CrossRef]

- Motta, I.L.; Miranda, N.T.; Maciel Filho, R.; Wolf Maciel, M.R. Biomass gasification in fluidized beds: A review of biomass moisture content and operating pressure effects. Renew. Sustain. Energy Rev. 2018, 94, 998–1023. [Google Scholar] [CrossRef]

- Barisano, D.; Canneto, G.; Nanna, F.; Villone, A.; Fanelli, E.; Freda, C.; Grieco, M.; Cornacchia, G.; Braccio, G.; Marcantonio, V.; et al. Investigation of an Intensified Thermo-Chemical Experimental Set-Up for Hydrogen Production from Biomass: Gasification Process Performance—Part I. Processes 2021, 9, 1104. [Google Scholar] [CrossRef]

- Tuna, C.E.; Silveira, J.L.; da Silva, M.E.; Boloy, R.M.; Braga, L.B.; Pérez, N.P. Biogas steam reformer for hydrogen production: Evaluation of the reformer prototype and catalysts. Int. J. Hydrogen Energy 2018, 43, 2108–2120. [Google Scholar] [CrossRef]

- Pacheco-Pérez, K.; Baia-Olivares, M.; Meza-González, D.; González-Delgado, A.D. Exergy analysis of hydrogen production from palm oil solid wastes using indirect gasification. Indian J. Sci. Technol. 2018, 11, 1–6. [Google Scholar] [CrossRef]

- Salkuyeh, Y.K.; Saville, B.A.; MacLean, H.L. Techno-economic analysis and life cycle assessment of hydrogen production from different biomass gasification processes. Int. J. Hydrogen Energy 2018, 43, 9514–9528. [Google Scholar] [CrossRef]

- Li, G.; Wang, S.; Zhao, J.; Qi, H.; Ma, Z.; Cui, P.; Zhu, Z.; Gao, J.; Wang, Y. Life cycle assessment and techno-economic analysis of biomass-to-hydrogen production with methane tri-reforming. Energy 2020, 199, 117488. [Google Scholar] [CrossRef]

- Ma, Z.; Liu, X.; Li, G.; Qiu, X.; Yao, D.; Zhu, Z.; Wang, Y.; Gao, J.; Cui, P. Energy consumption, environmental performance, and techno-economic feasibility analysis of the biomass-to-hydrogen process with and without carbon capture and storage. J. Environ. Chem. Eng. 2021, 9, 106752. [Google Scholar] [CrossRef]

- Yukesh Kannah, R.; Kavitha, S.; Preethi; Parthiba Karthikeyan, O.; Kumar, G.; Dai-Viet, N.V.; Rajesh Banu, J. Techno-economic assessment of various hydrogen production methods–A review. Bioresour. Technol. 2021, 319, 124175. [Google Scholar] [CrossRef]

- Cook, B.; Hagen, C. Techno-economic analysis of biomass gasification for hydrogen production in three US-based case studies. Int. J. Hydrogen Energy 2023, in press, corrected proof. [Google Scholar] [CrossRef]

- Meramo-Hurtado, S.I.; González-Delgado, Á.; Rehmann, L.; Quinones-Bolanos, E.; Mehvar, M. Comparative analysis of biorefinery designs based on acetone-butanol-ethanol fermentation under exergetic, techno-economic, and sensitivity analyses towards a sustainability perspective. J. Clean. Prod. 2021, 298, 126761. [Google Scholar] [CrossRef]

| Item | Value |

|---|---|

| Processing capacity (t/year) | 360.000 |

| Main product flow (t/year) | 19.080 |

| Raw material cost (USD/t) | 50 |

| Final product cost (USD/kg) | 4 |

| Plant life (years) | 15 |

| Salvage value | 10% of depreciable FCI |

| Construction time | 3 years |

| Location | Colombia |

| Tax rate | 39% |

| Discount rate | 8% |

| Capacity operated | 50% the first year, 70% the second year, 100% from the third year onwards |

| Subsidies (USD/year) | 0 |

| Process type | New and unproven process |

| Process control | Digital |

| Type of project | Plant on unconstructed land |

| Type of soil | Soft clay |

| Contingency percentage (%) | 20 |

| Tank design code | ASME |

| Vessel diameter specification | Internal diameter |

| Operator hour cost (USD/h) | 20 |

| Supervisor hourly cost (USD/h) | 35 |

| Salaries per year | 15 |

| Utilities | Gas, water, steam, electricity |

| Process fluids | Solid–liquid–gas |

| Depreciation method | Linear |

| Equipment | Power (kW) | Energy Cost (USD/Year) | Modular Cost (USD) | Number of Equipment | |

|---|---|---|---|---|---|

| Route | |||||

| 1 | 2 | ||||

| Rotary dryer | 130 | 150,909 | 42,155 | 1 | 1 |

| Hammer mill | 250 | 290,210 | 12,800 | 1 | 1 |

| O2 compressor | 100 | 116,084 | 23,134 | 1 | 1 |

| Gasifier | 5000 | 5,804,196 | 2,988,224 | 1 | 1 |

| Air compressor | 85 | 98,671 | 173,134 | 1 | 1 |

| Cyclone | 80 | 92,867 | 103,422 | 1 | 1 |

| Syngas clean heat exchanger | 210 | 243,776 | 122,582 | 1 | 1 |

| RadFrac tower | 100 | 116,084 | 871,390 | 1 | 1 |

| Pump | 75 | 87,063 | 3450 | 1 | 1 |

| Shift reactor | 3500 | 4,062,937 | 3,650,873 | 1 | 1 |

| Steam compressor | 350 | 406,294 | 64,407 | 1 | 1 |

| LTS outlet heat exchanger | 175 | 203,147 | 143,933 | 1 | 1 |

| Flash drum | 90 | 104,476 | 72,352 | 1 | 2 |

| PSA tower | 2500 | 2,902,098 | 4,659,540 | 1 | 0 |

| Absorption tower | 2820 | 3,273,566 | 1,572,153 | 0 | 1 |

| CO2 compressor | 103 | 119,799 | 68,342 | 0 | 1 |

| Cooling exchangers | 372 | 431,832 | 241,930 | 0 | 2 |

| Total Product Cost (TPC) | Total (USD/y) | |

|---|---|---|

| Route 1 | Route 2 | |

| Raw materials | 18,000,000 | 18,000,000 |

| Utilities (U) | 532,224 | 957,600 |

| Maintenance and repairs (MR) | 2,911,964 | 2,376,644 |

| Operating supplies | 145,598 | 118,832 |

| Operating labor (OL) | 257,400 | |

| Direct supervision and clerical labor | 38,610 | |

| Laboratory charges | 25,740 | |

| Patents and royalties | 0 | |

| Direct production cost (DPC) | 21,911,536 | 21,774,826 |

| Depreciation (D) | 4,076,750 | 3,327,301 |

| Local taxes | 1,164,785 | 950,657 |

| Insurance | 232,957 | 190,131 |

| Interest/rent | 582,392 | 475,329 |

| Fixed charges (FCH) | 6,056,885 | 4,943,419 |

| Plant overhead (POH) | 154,440 | |

| Total manufacturing cost (TMC) | 28,122,862 | 26,872,685 |

| General expenses (GE) | 7,030,715 | 6,718,171 |

| Total product cost (TPC) | 35,153,578 | 33,590,856 |

| Capital Costs | Route 1 | Route 2 |

|---|---|---|

| Cost of equipment | 14,894,959 | 12,156,745 |

| Equipment purchased (installed) | 2,978,992 | 2,431,349 |

| Instrumentation (installed) | 1,191,597 | 972,540 |

| Piping (installed) | 2,978,992 | 2,431,349 |

| Electrical network (installed) | 1,936,345 | 1,580,377 |

| Buildings (including services) | 5,957,983 | 4,862,698 |

| Services (installed) | 4,468,488 | 3,647,024 |

| Total DFCI | 34,407,354 | 28,082,082 |

| Land | 893,698 | 729,405 |

| Land improvements | 5,957,983 | 4,862,698 |

| Engineering and supervision | 4,766,387 | 3,890,159 |

| Equipment (R&D) | 1,489,496 | 1,215,675 |

| Construction costs | 5,064,286 | 4,133,293 |

| Legal expenses | 148,950 | 121,567 |

| Contractors’ fees | 1,042,647 | 850,972 |

| Contingency | 4,468,488 | 3,647,024 |

| Total IFCI | 23,831,934 | 19,450,793 |

| Fixed capital investment (FCI) | 58,239,288 | 47,532,874 |

| Working capital (WCI) | 34,943,573 | 28,519,725 |

| Start-up (SUC) | 5,823,929 | 4,753,287 |

| Total capital investment (TCI) | 99,006,790 | 80,805,887 |

| Salvage value FCI | 5,823,929 | 4,753,287 |

| Annualized fixed costs (AFC; USD/y) | 3,494,357 | 2,851,972 |

| Indicator | Route 1 | Route 2 |

|---|---|---|

| Gross profit (depreciation not included) (GP) | 43,044,814 | 43,204,472 |

| Gross profit (depreciation included) (DGP) | 47,121,564 | 46,531,773 |

| Profit after tax (PAT) | 28,744,154 | 28,384,382 |

| Profitability (gross income) | 77,616,000 | 77,616,000 |

| EP1 [USD/year] | 59,616,000 | 58,320,000 |

| EP2 [USD/year] | 59,083,776 | 57,362,400 |

| EP3 [USD/year] | 42,462,421 | 42,729,143 |

| Cumulative cash flow (CCF) (1/y) | 0.43 | 0.53 |

| Return on investment (% ROI) | 29 | 35 |

| Net present value (NPV; USD MM) | 492.73 | 587.33 |

| Annual cost/benefit ratio | 57.57 | 68.62 |

| Normalized variable operating costs (NVOC; USD/t-rm) | 80.82 | 79.58 |

| Annualized total operating costs (AOC; USD/year) | 35,153,578 | 33,590,856 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

González-Delgado, Á.D.; Vargas-Mira, A.; Zuluaga-García, C. Economic Evaluation and Technoeconomic Resilience Analysis of Two Routes for Hydrogen Production via Indirect Gasification in North Colombia. Sustainability 2023, 15, 16371. https://doi.org/10.3390/su152316371

González-Delgado ÁD, Vargas-Mira A, Zuluaga-García C. Economic Evaluation and Technoeconomic Resilience Analysis of Two Routes for Hydrogen Production via Indirect Gasification in North Colombia. Sustainability. 2023; 15(23):16371. https://doi.org/10.3390/su152316371

Chicago/Turabian StyleGonzález-Delgado, Ángel Darío, Alexander Vargas-Mira, and Carlos Zuluaga-García. 2023. "Economic Evaluation and Technoeconomic Resilience Analysis of Two Routes for Hydrogen Production via Indirect Gasification in North Colombia" Sustainability 15, no. 23: 16371. https://doi.org/10.3390/su152316371

APA StyleGonzález-Delgado, Á. D., Vargas-Mira, A., & Zuluaga-García, C. (2023). Economic Evaluation and Technoeconomic Resilience Analysis of Two Routes for Hydrogen Production via Indirect Gasification in North Colombia. Sustainability, 15(23), 16371. https://doi.org/10.3390/su152316371