Enhancing Coffee Quality in Rwanda: A Cost Benefit Analysis of Government Policies

Abstract

:1. Introduction

Literature Review

2. The CWS Zoning Policy in Rwanda

3. Data and Methodology

3.1. Financial Analysis

3.1.1. Cost Structures of a Washing Station

3.1.2. Total Seasonal Variable Costs

3.1.3. The Total Seasonal Fixed Cost

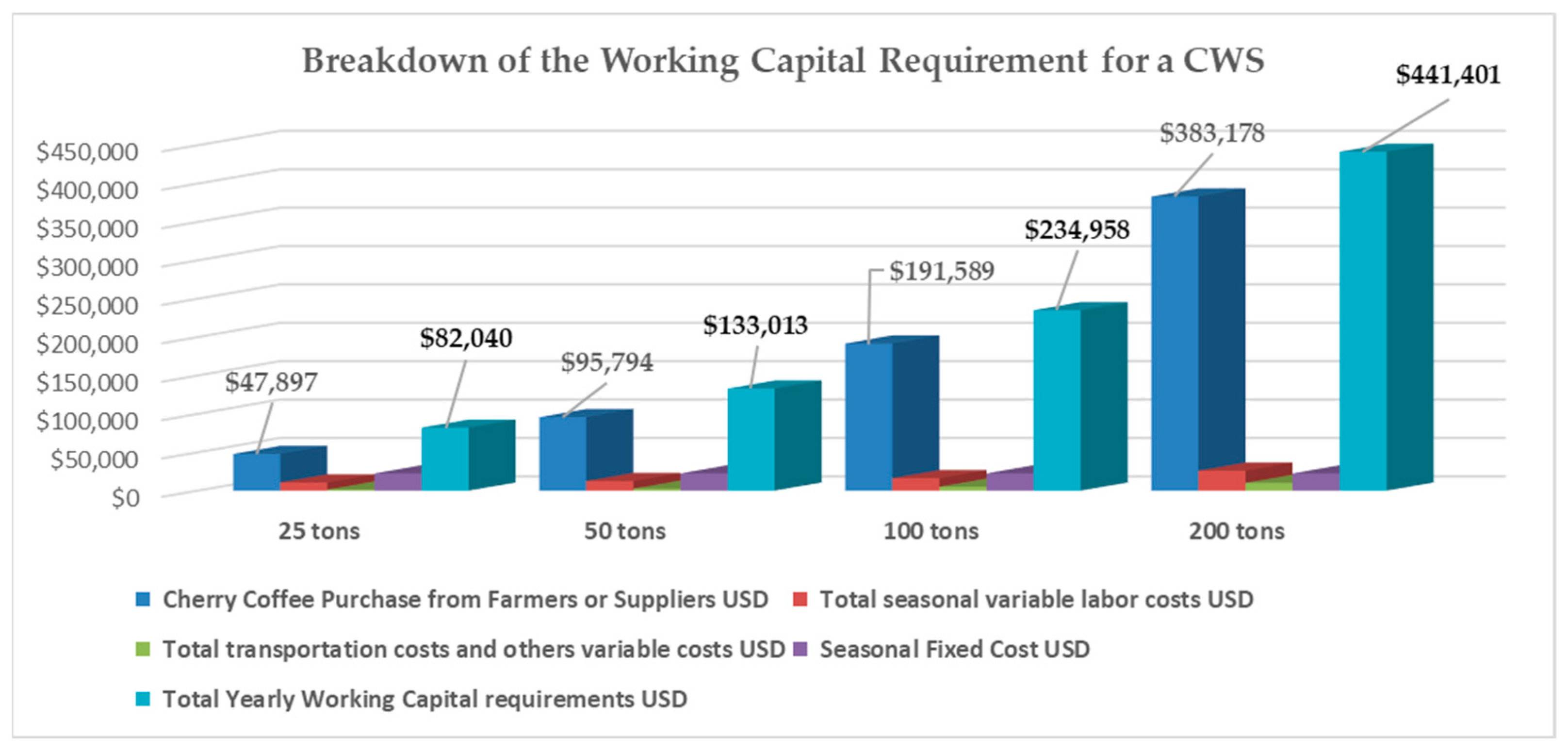

3.1.4. Working Capital

3.1.5. The Total Operating Cost

3.1.6. Present Value of Costs

3.1.7. The PV of Total Processing Cost of Parchment Coffee

3.1.8. The Financial Net Present Value of an Investment in a CWS

3.1.9. Average Variable and Long-Run Costs

| Row | Average Short-Run and Long-Run Unit Processing Costs | 25 Tons | 50 Tons | 100 Tons | 200 Tons |

|---|---|---|---|---|---|

| 1 | Average seasonal variable labor production costs per kg | 0.40 | 0.28 | 0.18 | 0.15 |

| 2 | Average transportation costs and others costs per kg | 0.06 | 0.06 | 0.06 | 0.06 |

| 3 | Average seasonal variable costs per kg | 0.45 | 0.34 | 0.24 | 0.20 |

| 4 | Average seasonal fixed labor costs and others per kg | 1.01 | 0.50 | 0.25 | 0.13 |

| 5 | Average total seasonal costs per kg (r3 + r4) | 1.46 | 0.84 | 0.49 | 0.33 |

| 6 | Average total investment costs per kg | 1.67 | 0.83 | 0.42 | 0.21 |

| 7 | Average total cost of processing/kg of parchment (r7 + r8) | 3.13 | 1.67 | 0.91 | 0.54 |

3.1.10. Producer Surplus and Profit Margins with Regulated Cherry Prices

3.1.11. Equilibrium Cherry Prices in a Competitive Industry

3.1.12. Lost to Farmers as a Result of Government Pricing Policy and Excess Investment in CWS

3.2. Economic Analysis

3.2.1. The Economic Present Values of Total Costs of Processing Parchment

3.2.2. Estimation of Economic Loss to Rwanda from Excess Capacity of Coffee Washing Stations

Rwanda’s Potential Yearly Economic Costs Saving

Total Economics Welfare Loss to Rwanda Due to the Oversupply of CWS

3.2.3. Stakeholder Analysis of Policies Reforms

4. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Items | Quantity | Unit Prices USD 2022 Price Level | Total in USD 2022 Price Level |

|---|---|---|---|

| Land Acquisition | 1 | 4000 | 4000 |

| Capitalized Cost | 1 | 8000 | 8000 |

| Coffee Pulper Machine | 1 | 69,395.3 | 69,395 |

| Generator 10 KW | 1 | 20,000 | 20,000 |

| Moisture Meter | 1 | 1000 | 1000 |

| Loading Scales | 1 | 500 | 500 |

| Dial Scales | 2 | 70 | 140 |

| Drying tables and accessories | 86 | 300 | 25,800 |

| Recycling Pumps | 2 | 5000 | 10,000 |

| Motorcycle | 1 | 5000 | 5000 |

| Total Expenditures Land and Equip | 143,835 | ||

| Construction and Engineering | 56,165 | ||

| Total Initial Investment Cost | 200,000 |

| Seasonal Variable Costs | Seasonal Fixed Costs |

|---|---|

| Cherry transportation cost—farm gate to the CWS | Permanent Workers |

| Washed coffee transportation cost | Station manager |

| Fuel | Agronomist |

| Purchase of bags | Production head |

| Loading and offloading fees | Machine operator |

| Hulling costs | Quality head |

| Insurances | Cashier |

| Electricity | Scale operator |

| Water costs | Accountant and administrative head |

| Materials costs | Security during the season |

| Seasonal Workers | Security for the rest of the year |

| Cherry selection-reception-floatation | Operating Costs |

| Tank—fermentation—grading | Office supplies |

| Drying team | Communication expenses |

| Seasonal variable cost without financing | Printing expenses |

| Mechanic repair and maintenance | |

| Spare parts | |

| Interest on working capital | Advertising |

| Lubricants and greases | |

| Insurances |

| Permanent Labor | Employees for a 200 Outputs Station | Employees for a 100 Outputs Station | Employees for a 50 Outputs Station | Daily Salary Rate in Rwandan Francs 2022 |

|---|---|---|---|---|

| Cherries Selection-Reception-Floatation | 6 | 2 | 2 | 5000 |

| Tank—Fermentation—Grading | 5 | 2 | 2 | 5000 |

| Drying Team | 60 | 40 | 30 | 5000 |

| Permanent Labor | # of Employees | # of Months | Monthly Salary in RwF 2022 |

|---|---|---|---|

| Station manager | 1 | 12 | 630,000 |

| Agronomist | 1 | 12 | 250,000 |

| Production head | 1 | 5 | 310,000 |

| Machine operator | 1 | 3 | 310,000 |

| Quality head | 1 | 3 | 190,000 |

| Cashier | 1 | 3 | 200,000 |

| Scale Operator | 1 | 3 | 190,000 |

| Accountant and administrative head | 1 | 3 | 310,000 |

| Security during the season | 4 | 3 | 180,000 |

| Security for the rest of the year | 2 | 12 | 180,000 |

| Parameters | Definition |

|---|---|

| Financial Analysis | |

| Financial net present value, as of year t = 0 (2022) for a production level of metrics tons of parchment. | |

| Parchment coffee financial selling price per kg | |

| Production scales in metrics tons of parchment (25 tons, 50 tons, 100 tons, 200 tons) at year t | |

| PV of total processing cost of parchment coffee for a production scale of | |

| Total financial variable cost of processing parchment for a season | |

| r | Real financial discount rate |

| The real interest rate on the working capital loan | |

| Total financial seasonal fixed cost of a CWS for a season | |

| Average financial cost of processing a kg of parchment coffee for production scale of | |

| Financial fixed price for 1 kg of cherry set by Government at the beginning of each season | |

| Working capital per season | |

| Average financial cherry cost per kg of parchment coffee produced | |

| The total margin in USD available to the CWS for the purchase of cherry | |

| The interest paid on the working capital excluding on in the interest paid on the cost of cherry purchase | |

| The conversion ratio between cherry coffee and parchment coffee (It is set at 5 kg of cherry = 1 kg of parchment) | |

| Total financial initial capital cost for a washing station | |

| Economic Analysis | |

| EOCK | Economics opportunity cost of capital |

| Economics net present value, as of year t = 0 (2022) | |

| PV of total economic processing cost of parchment coffee | |

| The average economic cost of processing a kg of parchment coffee | |

| The average total long-run economics cost of producing parchment coffee by a coffee washing station producing 100 tons | |

| The average total long-run economics cost of producing parchment coffee by a coffee washing station producing 200 tons | |

| Parchment coffee economic selling price per kg | |

| Total economics variable cost | |

| Total economic seasonal fixed cost | |

| Economics floor price for 1 kg of cherry set by Government at the beginning of each season | |

| PV of total economic cost of processing by 150 CWS each processing 100 tons on average | |

| PV of total economic cost of processing by 300 CWS each processing 50 tons on average | |

| Total economic initial capital cost for a washing station |

References

- Boudreaux, K. Economic Liberalization in Rwanda’s Coffee Sector: A Better Brew for Success. In Yes Africa Can: Success Stories from a Dynamic Continent; Chunan-Pole, P., Angwafo, M., Eds.; The World Bank: Washington, DC, USA, 2011. [Google Scholar]

- Bart, M.; Dereje, M.; Engida, E.; Tamru, S. Tracking the Quality Premium of Certified Coffee: Evidence from Ethiopia. World Dev. 2018, 101, 119–132. [Google Scholar] [CrossRef]

- Tamru, S.; Minten, B. Investing in Wet Mills and Washed Coffee in Ethiopia: Benefits and Constraints; ESSP Working Papers 121; International Food Policy Research Institute (IFPRI): Washington, DC, USA, 2018; Available online: https://ebrary.ifpri.org/digital/collection/p15738coll2/id/132772/rec/110 (accessed on 6 November 2023).

- Mbakop, L.; Jenkins, G.P.; Leung, L.; Sertoglu, K. Traceability, Value, and Trust in the Coffee Market: A Natural Experiment in Ethiopia. Agriculture 2023, 13, 368. [Google Scholar] [CrossRef]

- Minten, B.; Tamru, S.; Kuma, T.; Nyarko, Y. Structure and Performance of Ethiopia’s Coffee Export Sector; ESSP Working Papers 66; International Food Policy Research Institute (IFPRI): Washington, DC, USA, 2014; Available online: https://ebrary.ifpri.org/digital/collection/p15738coll2/id/128188/rec/176 (accessed on 6 November 2023).

- USAID. Assessing USAID’s Investments in Rwanda’s Coffee Sector, Best Practices and Lessons Learned to Consolidate Results and Expands Impacts. 2006. Available online: https://pdf.usaid.gov/pdf_docs/Pnadt522.pdf (accessed on 5 July 2023).

- USAID. Rwanda Bank of Kigali DCA Guarantee. 2009. Available online: https://2012-2017.usaid.gov/sites/default/files/documents/2155/DCA_Rwanda_Report_6_23_10.pdf (accessed on 5 July 2023).

- Easterly, W.; Reshef, A. African Export Successes: Surprises, Stylized Facts and Explanations. NBER Working Paper No. 16597. 2010. Available online: https://www.nber.org/system/files/working_papers/w16597/w16597.pdf (accessed on 6 November 2023).

- National Agricultural Export Development Board. Annual NAEB 2017–2018 Agricultural Export Performance Annual Report 2017–2018. 2018. Available online: https://naeb.gov.rw/fileadmin/Reports-Annual/Annual%20report%202017-2018.pdf (accessed on 1 February 2023).

- National Agricultural Export Development Board. Annual NAEB 2021–2022 Agriculture Export Performance 2021–2022. 2023. Available online: https://naeb.gov.rw/fileadmin/Reports-Annual/ANNUAL_REPORT_2021-2022.pdf (accessed on 1 February 2023).

- Gerard, A.; Clay, D.C.; Claudia Lopez, M. Stakeholder Perceptions on Geographic Zoning in Rwanda’s Coffee Sector Feed the Future Innovation Lab for Food Security Policy Research Brief 42. East Lansing: Michigan State University. 2017. Available online: https://www.canr.msu.edu/fsp/publications/policy-research-briefs/policy_brief_42.pdf (accessed on 4 January 2023).

- Macciavello, R.; Morjaria, A. Coffee Washing Stations in Rwanda Policy Memo. 2015. Available online: https://www.theigc.org/sites/default/files/2015/02/Macciavello-and-Morjaria-2015-Project-Memo.pdf (accessed on 8 February 2023).

- Church, R.A. Understanding and Improving the Price-Quality Relationship in Rwanda’s Coffee Sector. 2018. Available online: https://www.canr.msu.edu/resources/understanding-and-improving-the-price-quality-relationship-in-rwanda-s-coffee-sector (accessed on 1 March 2023).

- Clay, D.C.; Bro, A.S.; Church, R.A.; Bizoza, A.; Ortega, D.L. Determinants of Farmer Investment in Coffee Production: Finding a Path to Sustainable Growth in Rwanda’s Coffee Sector. Feed the Future Innovation Lab for Food Security Research Paper #32. 2016. Available online: http://fsg.afre.msu.edu/fsp/glc/FSP_RP_32_rev.pdf (accessed on 15 March 2023).

- Clay, D.C.; Bizoza, A. The Challenge of Sustainable Growth in Rwanda’s Coffee Sector. 2018. Available online: https://www.canr.msu.edu/fsp/publications/research-papers/fsp%20research%20paper%20100.pdf (accessed on 11 January 2023).

- Behuria, P. The domestic political economy of upgrading in global value chains: How politics shapes pathways for upgrading in Rwanda’s coffee sector. Rev. Int. Political Econ. 2019, 27, 348–376. [Google Scholar] [CrossRef]

- Murekezi, A.K. Profitability Analysis and Strategic Planning of Coffee Processing and Marketing in Rwanda: A Case Study of a Coffee Grower Association. Master’s Thesis, Michigan State University, East Lansing, MI, USA, 2003. Available online: https://ageconsearch.umn.edu/record/11195 (accessed on 23 October 2023). [CrossRef]

- Fritriani, F.; Arifin, B.; Zakaria, W.A.; Ismono, R.H. Sustainable Production of Lampung Robusta Coffee: A Cost-Benefit Analysis. Int. J. Ecol. Dev. 2020, 35, 44–58. [Google Scholar]

- Karim, M.A.; Wijayanti, F.; Sudaryanto, A. Comparative studies of coffee processing methods for decision making in appropriate technology implementation. AIP Conf. Proc. 2019, 2114, 020015. [Google Scholar] [CrossRef]

- Feed the Future Africa Great Lakes Region Coffee Support Program (AGLC) Policy Roundtable (March 2017). Available online: https://www.canr.msu.edu/fsp/outreach/presentations/17.03.02_aglc_y2_zoning_rt_updated.pdf (accessed on 7 May 2023).

- AGRI LOGIC. Value Chain Analysis for the Coffee Sector in Rwanda. 2018. Available online: https://www.cbi.eu/sites/default/files/cbi_vca_rwanda_coffee.pdf (accessed on 14 July 2023).

- Asian Development Bank. Cost-Benefit Analysis for Development: A Practical Guide; Asian Development Bank: Mandaluyong, PH, USA, 2013; Available online: https://www.adb.org/sites/default/files/institutional-document/33788/cost-benefit-analysis-development_0.pdf (accessed on 13 September 2023).

- Boardman, A.E.; Greenberg, D.H.; Vining, A.R.; Weimer, D.L. Cost-Benefit Analysis: Concepts and Practice, 1st ed.; Prentice Hall: Upper Saddle River, NJ, USA, 1996. [Google Scholar]

- Quah, E.; Mishan, E.J. Cost-Benefit Analysis, 5th ed.; Routledge: London, UK, 2007. [Google Scholar]

- Gittinger, J.P. Economic Analysis of Agricultural Projects, 2nd ed.; Johns Hopkins University Press: Baltimore, MD, USA, 1982. [Google Scholar]

- Macchiavello, R.; Morjaria, A. Competition and Relational Contracts in the Rwanda Coffee Chain. Q. J. Econ. 2021, 136, 1089–1143. [Google Scholar] [CrossRef]

- TechnoServe. Coffee Wet Mill Processing Guide. 2022. Available online: https://www.technoserve.org/wp-content/uploads/2022/03/TechnoServe-Wet-Mill-Processing-Guide.pdf (accessed on 14 July 2023).

- Rocco, M.; Ameet, M. Acquisitions, Management, and Efficiency in Rwanda’s Coffee Industry. NBER Working Paper No. 30230. 2022. Available online: https://www.nber.org/system/files/working_papers/w30230/w30230.pdf (accessed on 13 September 2023).

- Guariso, A.; Verpoorten, M. Aid, Trade, and Post-War Recovery of the Rwandan Coffee Sector. J. East. Afr. Stud. 2018, 12, 552–574. [Google Scholar] [CrossRef]

- National Agricultural Export Development Board. Annual NAEB 2018–2019 Annual Report. 2019. Available online: https://naeb.gov.rw/fileadmin/Reports-Annual/ANNUAL%20REPORT%202018-2019.pdf (accessed on 5 April 2023).

- National Agricultural Export Development Board. Annual NAEB 2019–2020 Annual Report. 2019. Available online: https://naeb.gov.rw/fileadmin/Reports-Annual/ANNUAL_REPORT_2019-2020.pdf (accessed on 5 April 2023).

- Miklyaev, M.; Jenkins, G.; Shobowale, D. Sustainability of Agricultural Crop Policies in Rwanda: An Integrated Cost–Benefit Analysis. Sustainability 2021, 13, 48. [Google Scholar] [CrossRef]

- Guariso, A.; Ngabitsinze, C.J.; Verpoorten, M. The Rwandan Coffee Sector: Out of the Ordinary. In L’Afrique des Grands Lacs; Reyntjens, F., Vandeginste, S., et Verpoorten, M., Eds.; Annuaire 2011–2012; L’Harmattan: Paris, France, 2012; pp. 397–426. [Google Scholar]

- Commodity-Specific Economic Conversion Factors Database for the Republic of Rwanda. Available online: https://rwanda-cscf.cri-world.com/ (accessed on 13 September 2023).

- Zhuang, J.; Liang, Z.; Lin, T.; De Guzman, F. Theory and Practice in the Choice of Social Discount Rate for Cost–Benefit Analysis: A Survey. ERD Working Paper. No. 94. ADB. 2007. Available online: https://www.adb.org/sites/default/files/institutional-document/32256/economic-analysis-projects.pdf (accessed on 13 September 2023).

- Ponte, S. The ‘latte revolution’? Regulation, markets and consumption in the global coffee chain. World Dev. 2002, 30, 1099–1122. [Google Scholar] [CrossRef]

- AGLC. Pricing Coffee Cherry to Incentivize Farmers and Improve Quality. Feed the Future Innovation Lab for Food Security Policy Research Brief 43. East Lansing: Michigan State University. 2017. Available online: https://www.canr.msu.edu/fsp/publications/policy-research-briefs/policy_brief_43.pdf (accessed on 5 November 2023).

| Row | Output Production Levels | 25 Tons | 50 Tons | 100 Tons | 200 Tons |

|---|---|---|---|---|---|

| 1 | Cherry coffee purchased from farmers or suppliers USD | 47,897 | 95,794 | 191,589 | 383,178 |

| 2 | Total seasonal variable labor costs USD | 10,579 | 12,403 | 16,051 | 25,900 |

| 3 | Total transportation costs and others variable costs USD | 1252 | 2504 | 5006 | 10,011 |

| 4 | Seasonal Fixed Cost USD | 22,312 | 22,312 | 22,312 | 22,312 |

| 5 | Yearly Working Capital requirements USD (r1 + r2 + r3 + r4) | 82,040 | 133,013 | 234,958 | 441,401 |

| Row | 25 Tons | 50 Tons | 100 Tons | 200 Tons | |

|---|---|---|---|---|---|

| 1 | PV of parchment coffee produced in kg. | 120,050 | 240,099 | 480,199 | 960,397 |

| 2 | PV of total seasonal variable labor. | 47,506 | 67,301 | 87,095 | 140,540 |

| 3 | PV of total transportation costs and others variable costs. | 6796 | 13,586 | 27,165 | 54,323 |

| 4 | PV of total seasonal variable costs (r2 + r3) | 54,302 | 80,887 | 114,260 | 194,863 |

| 5 | PV of total seasonal fixed labor costs and other fixed seasonal costs. | 121,056 | 121,056 | 121,056 | 121,056 |

| 6 | PV of total seasonal costs in USD (r4 + r5) | 175,358 | 201,943 | 235,316 | 315,919 |

| 7 | PV of total investment costs in USD | 200,034 | 200,034 | 200,034 | 200,034 |

| 8 | PV of total cost of processing at CWS in USD (r6 + r7) | 375,392 | 401,977 | 435,350 | 515,953 |

| Row No. | 25 Tons | 50 Tons | 100 Tons | 200 Tons | |

|---|---|---|---|---|---|

| 1 | PV of parchment revenues in USD | 660,275 | 1,320,545 | 2,641,095 | 5,282,184 |

| 2 | PV cherry coffee purchased in USD | 259,902 | 519,804 | 1,039,607 | 2,079,215 |

| 3 | PV of total cost of processing parchment at CWS in USD | 375,392 | 401,977 | 435,350 | 515,953 |

| 4 | Net present value in USD | 24,981 | 398,764 | 1,166,138 | 2,687,016 |

| 5 | Internal rate of return | 14.80% | 34.11% | 57.02% | 81.73% |

| Row | Average Profit per kg | 25 Tons | 50 Tons | 100 Tons | 200 Tons |

|---|---|---|---|---|---|

| 1 | Net export price | 5.5 | 5.5 | 5.5 | 5.5 |

| 2 | Cost of cherry input per kg of parchment if cherry price is 410 RwF/kg | 1.92 | 1.92 | 1.92 | 1.92 |

| 3 | Average total seasonal production costs per kg | 1.46 | 0.84 | 0.49 | 0.33 |

| 4 | Producer surplus (USD/kg) (r1 − r2 − r3) | 2.12 | 2.74 | 3.09 | 3.25 |

| 5 | Average total financial cost of processing a kg of parchment | 3.13 | 1.67 | 0.91 | 0.54 |

| 6 | Profit (USD/kg) of parchment coffee if cherry is 410 RwF/kg (r1 − r2 − r5) | 0.45 | 1.91 | 2.67 | 3.04 |

| Row | Net Export Price (USD per kg) Parchment Coffee | Annual Production | |||

|---|---|---|---|---|---|

| 25 Tons | 50 Tons | 100 Tons | 200 Tons | ||

| 1 | 5.00 | 400 | 713 | 875 | 954 |

| 2 | 5.50 | 507 | 820 | 982 | 1061 |

| 3 | 6.00 | 614 | 927 | 1089 | 1168 |

| 4 | 6.50 | 721 | 1034 | 1196 | 1275 |

| 5 | 7.00 | 828 | 1141 | 1303 | 1382 |

| Row | Net Export Price (USD per kg) Parchment Coffee | Annual Production | |||

|---|---|---|---|---|---|

| 25 Tons | 50 Tons | 100 Tons | 200 Tons | ||

| 1 | 5.00 | 758 | 890 | 965 | 999 |

| 2 | 5.50 | 865 | 997 | 1072 | 1106 |

| 3 | 6.00 | 972 | 1104 | 1179 | 1213 |

| 4 | 6.50 | 1079 | 1211 | 1286 | 1320 |

| 5 | 7.00 | 1186 | 1318 | 1393 | 1427 |

| Col 1 | Col 2 | Col 3 | Col 4 | Col 5 | |

|---|---|---|---|---|---|

| Row | 25 Tons | 50 Tons | 100 Tons | 200 Tons | |

| 1 | Long run of cherry price if parchment price at USD 5.50/kg | 507 | 820 | 982 | 1061 |

| 2 | Fixed cherry price 410 RwF/kg | 410 | 410 | 410 | 410 |

| 3 | Difference per RwF/kg | 97 | 410 | 572 | 651 |

| 4 | Annual loss to coffee growers in million RwF | 7275 | 30,750 | 42,900 | 48,825 |

| 5 | Annual loss to coffee growers in USD | 6,799,065 | 28,738,318 | 40,093,458 | 45,630,841 |

| 6 | PV of aggregate loss over 10 years in USD | 36,893,382 | 155,941,111 | 217,556,865 | 247,604,053 |

| Row | 25 Tons | 50 Tons | 100 Tons | 200 Tons | |

|---|---|---|---|---|---|

| 1 | PV of parchment coffee produced in kg | 120,050 | 240,099 | 480,199 | 960,397 |

| 2 | PV of total seasonal variable labor in USD | 47,506 | 67,301 | 87,095 | 140,540 |

| 3 | PV of total transportation costs and others costs in USD | 5954 | 11,907 | 23,815 | 47,630 |

| 4 | PV of total seasonal variable costs in USD | 53,460 | 79,208 | 110,910 | 188,170 |

| 5 | PV of total seasonal fixed labor costs and others in USD | 105,829 | 105,829 | 105,829 | 105,829 |

| 6 | PV of total seasonal costs (r4 + r5) | 159,289 | 185,037 | 216,739 | 293,999 |

| 7 | PV of total investment costs in USD | 176,479 | 176,479 | 176,479 | 176,479 |

| 8 | PV of total economic cost of processing at CWS in USD (r7 + r8) | 335,768 | 361,516 | 393,218 | 470,478 |

| 9 | Average total long-run economic cost of processing a kg of parchment | 2.80 | 1.51 | 0.82 | 0.49 |

| Row | Col 1 | Col 2 |

|---|---|---|

| 1 | Yearly saving on economic costs to Rwanda from 300 CWS to 150 CWS | USD 9,117,224 |

| 2 | Yearly saving on economic costs to Rwanda from 300 CWS to 75 CWS | USD 13,484,295 |

| Row | Col 1 | Col 2 |

|---|---|---|

| 1 | PV of total economic processing costs of 15,000 tons by 300 CWS | USD 108,454,800 |

| 2 | PV of total economic processing costs of 15,000 tons by 150 CWS | USD 58,982,700 |

| 3 | PV of total economic processing costs of 15,000 tons by 75 CWS | USD 35,285,850 |

| 4 | Economic costs saved if 150 CWS rather than 300 CWS | USD 49,472,100 |

| 5 | Economic costs saved if 75 CWS rather than 300 CWS | USD 73,168,950 |

| Col 1 | Col 2 | Col 3 | Col 4 | Col 5 | |

|---|---|---|---|---|---|

| Row | Rwandan Economy | Farmers | Government | CWS Owners | |

| 1 | Potential annual Impacts USD | −USD 13,484,295 | −USD 45,630,841 | +USD 3,408,228 | +USD 28,738,318 |

| 2 | PV potential impacts over 10 years USD | −USD 73,168,950 | −USD 247,604,053 | +USD 18,493,874 | +USD 155,941,111 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jenkins, G.P.; Mbakop, L.; Miklyaev, M. Enhancing Coffee Quality in Rwanda: A Cost Benefit Analysis of Government Policies. Sustainability 2023, 15, 16513. https://doi.org/10.3390/su152316513

Jenkins GP, Mbakop L, Miklyaev M. Enhancing Coffee Quality in Rwanda: A Cost Benefit Analysis of Government Policies. Sustainability. 2023; 15(23):16513. https://doi.org/10.3390/su152316513

Chicago/Turabian StyleJenkins, Glenn P., Ludovic Mbakop, and Mikhail Miklyaev. 2023. "Enhancing Coffee Quality in Rwanda: A Cost Benefit Analysis of Government Policies" Sustainability 15, no. 23: 16513. https://doi.org/10.3390/su152316513