A Streamline Sustainable Business Performance Reporting Model by an Integrated FinESG Approach

Abstract

:1. Introduction

2. Literature Review

2.1. ESG Impact on Financial Performance

2.2. Text Analysis and Machine Learning in ESG and Financial Performance Analysis

3. Materials and Methods

3.1. Sample Selection

3.2. Data

3.3. Methodology

4. Results

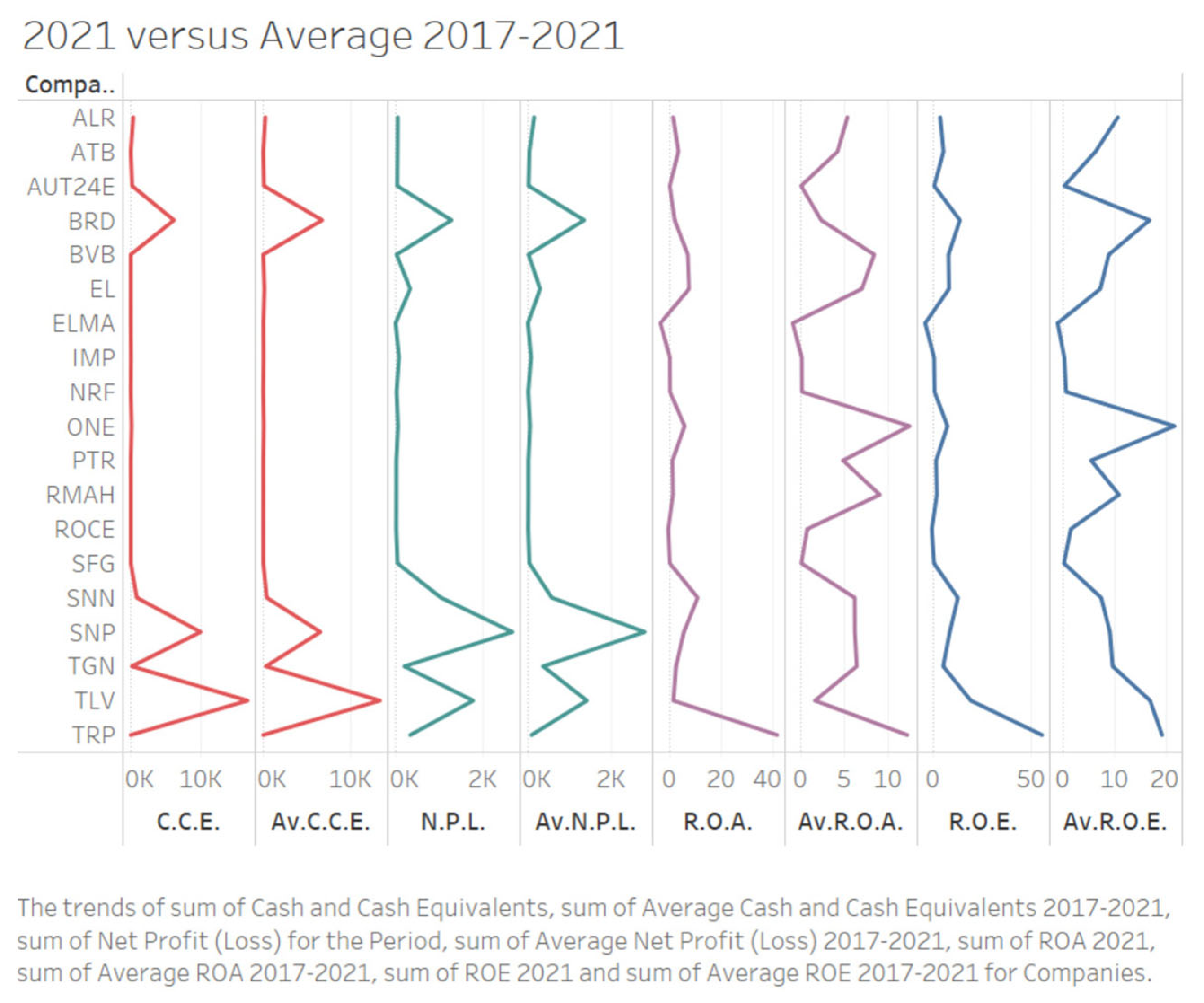

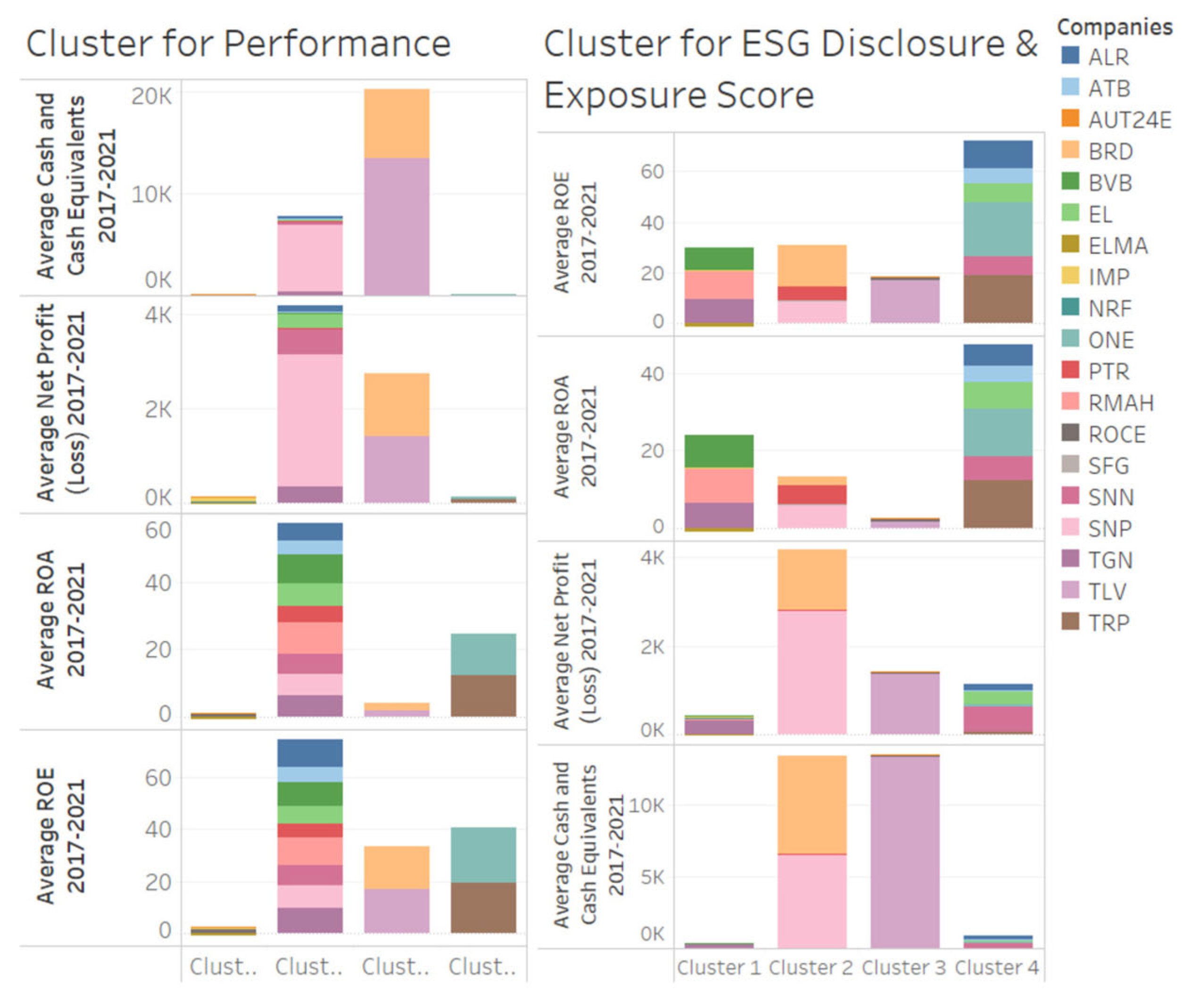

4.1. Analysis and Clustering of the Companies by Size and Financial Performance

4.2. Content Analysis of Sustainability Reports

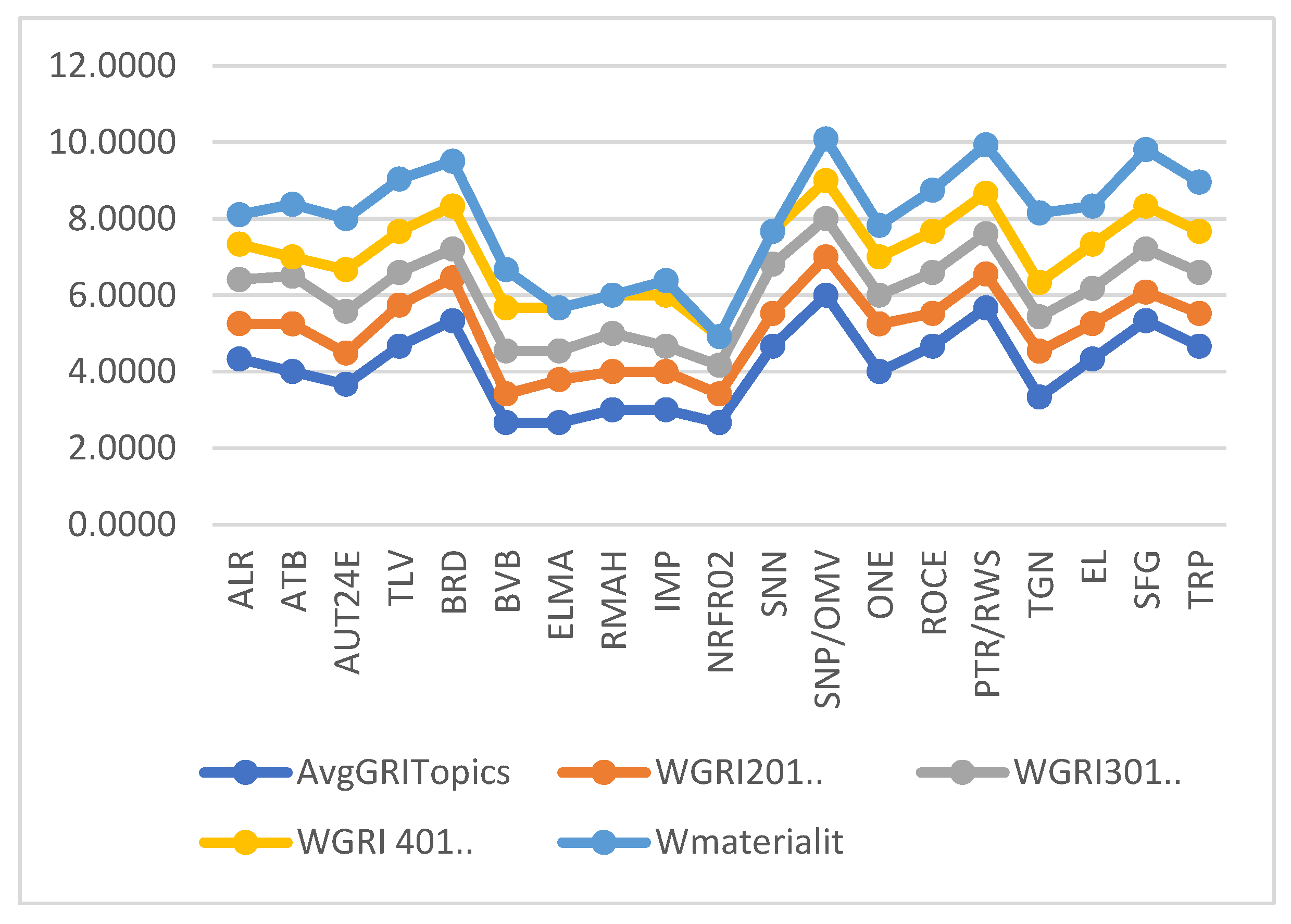

4.2.1. Analysis of Disclosure Scores on GRI Topics and Materiality

4.2.2. Analysis of Average ESG Risk Scores

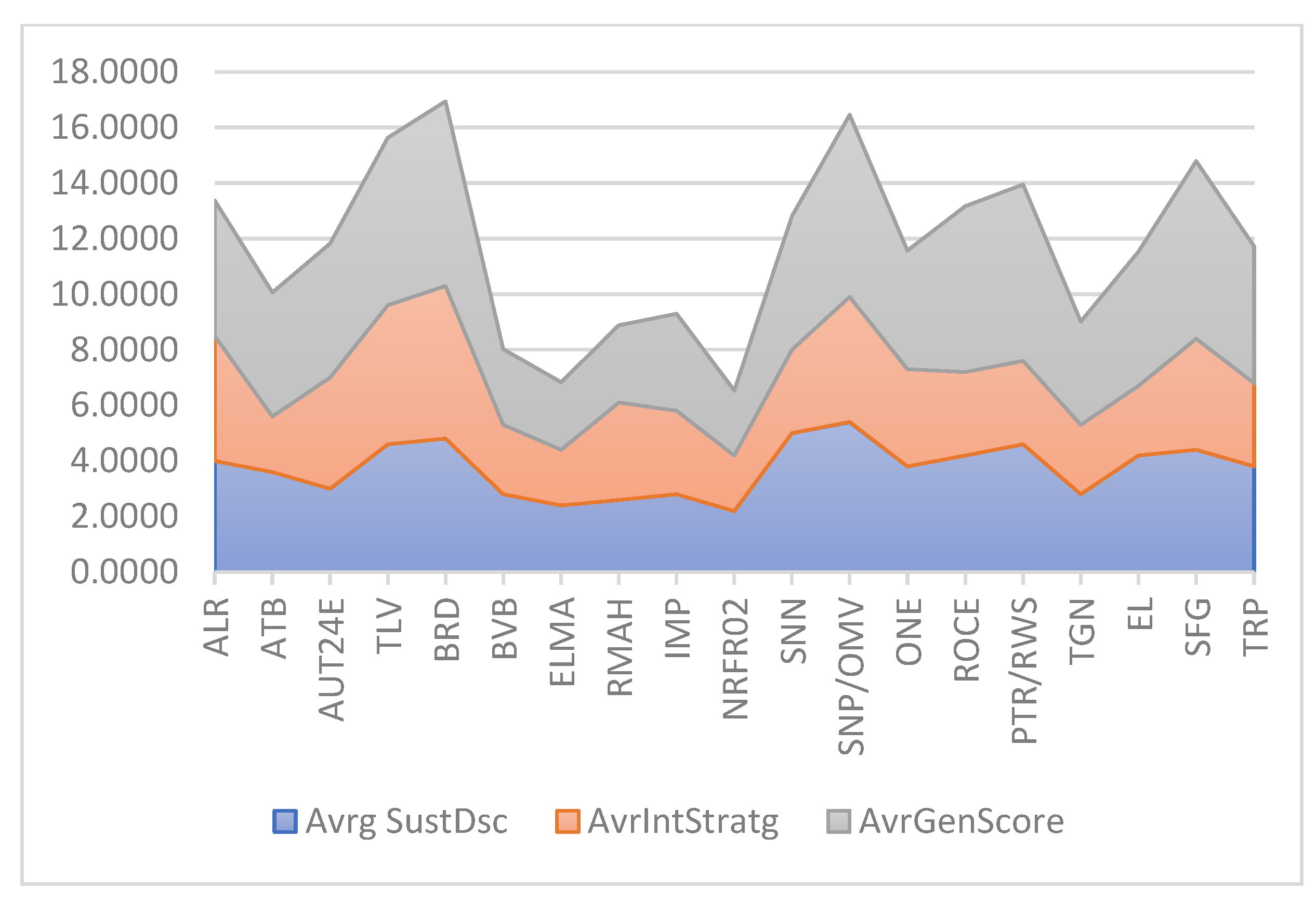

4.2.3. Analysis of Average Disclosure Scores on Integrated Business and Sustainability Strategy

4.2.4. Analysis of Sustainability Average Disclosure Scores

4.2.5. Clustering of Companies by the Overall ESG Disclosure Score, Average ESG Risk Disclosure Score, and the Average ESG Risk Exposure Score

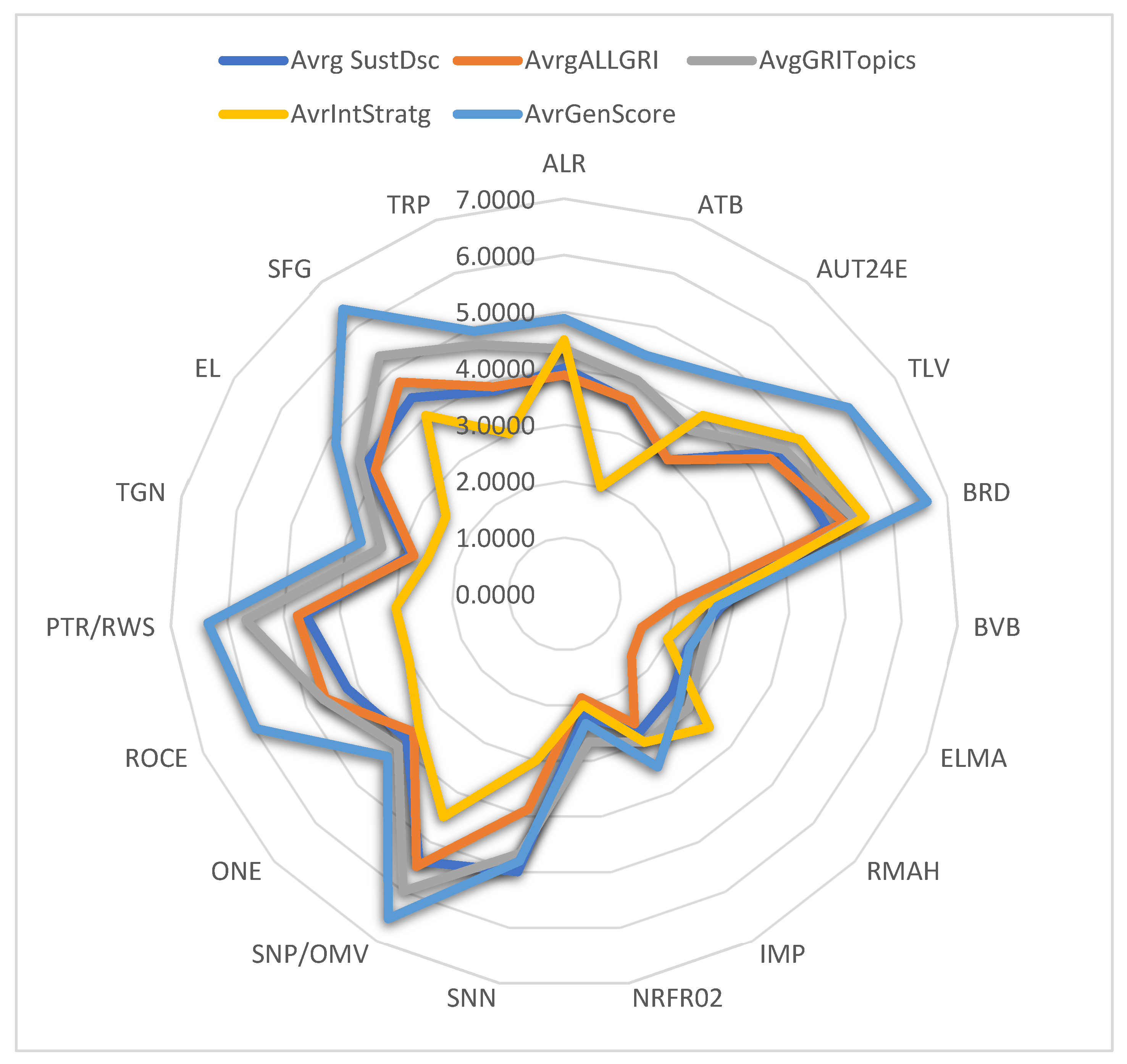

4.2.6. Analysis of Financial and ESG Performance Scores and the Final Ranking of Companies

5. Discussion on the Qualitative Analysis of Sustainability Reports

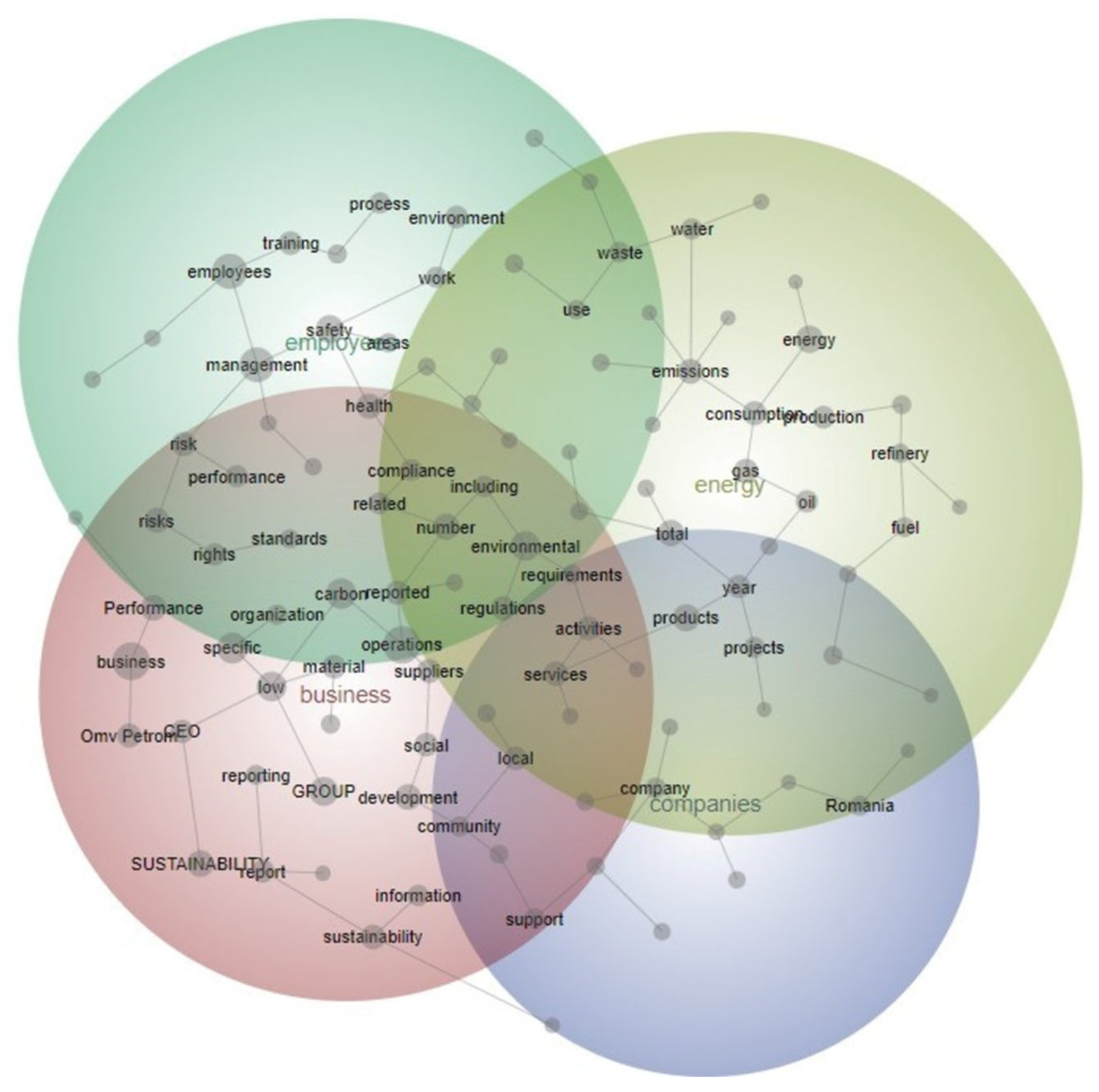

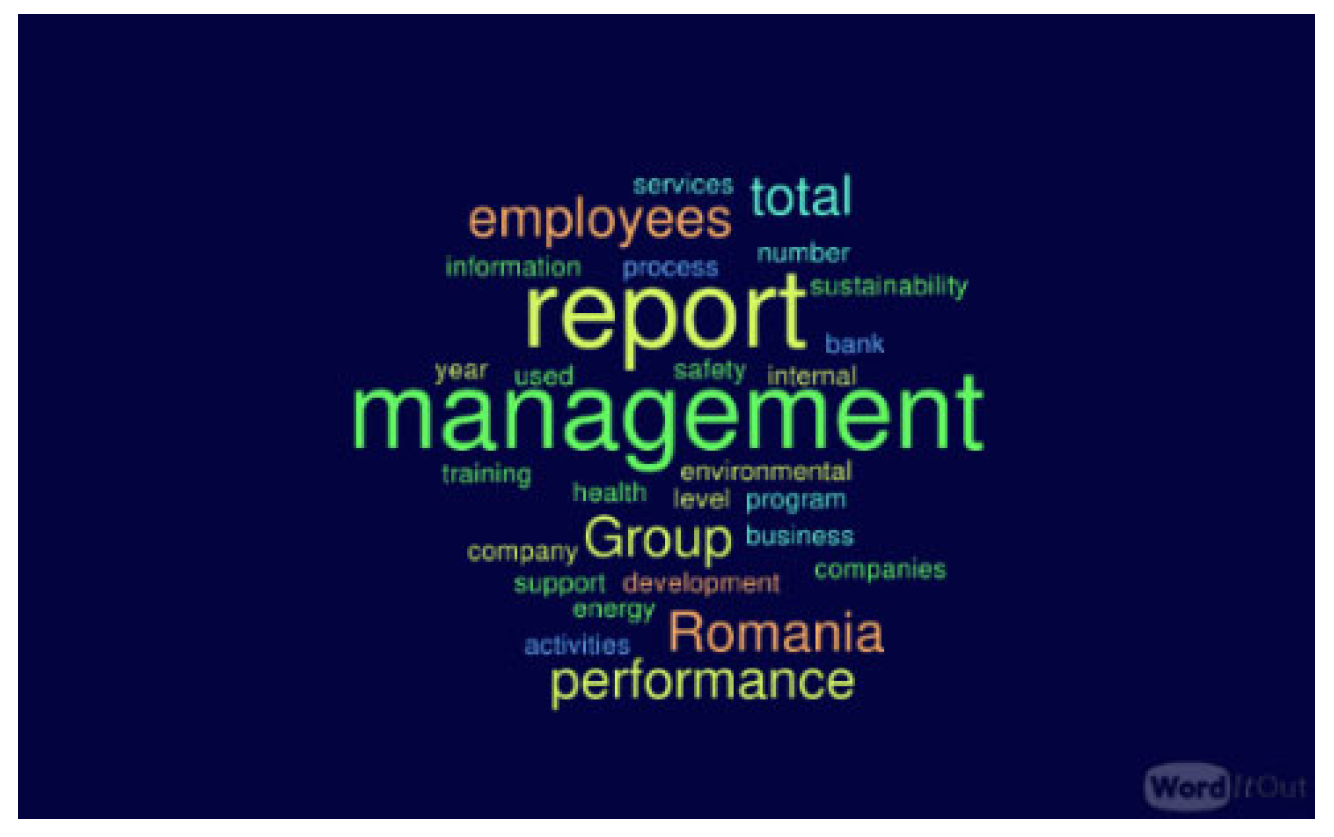

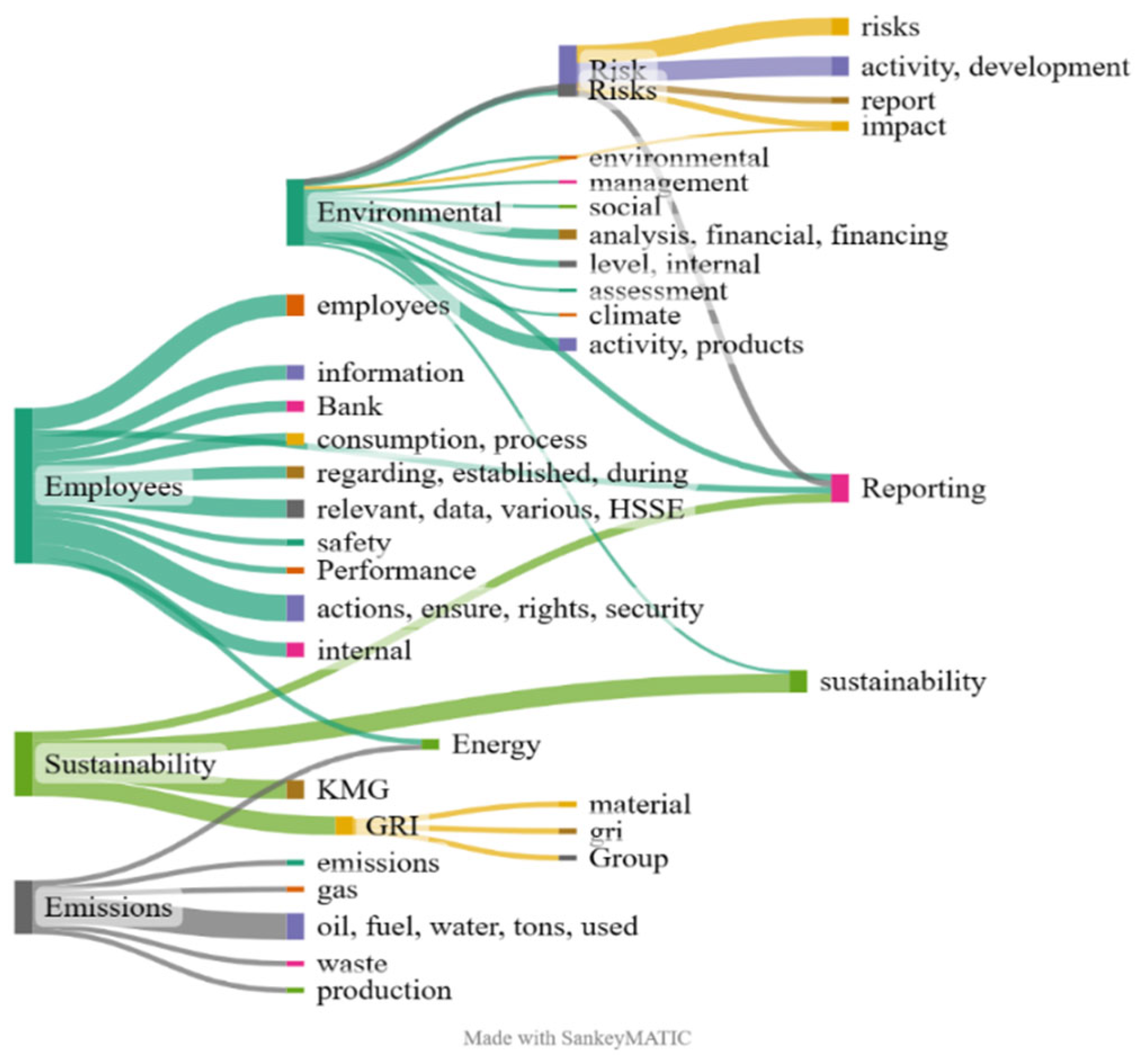

5.1. Concepts and Themes Extraction by Leximancer Exploration

5.2. Major ESG Concepts and Themes Outlined from the Content Analysis of All Sustainability Reports

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Sebrina, N.; Taqwa, S.; Afriyenti, M.; Septiari, D. Analysis of Sustainability Reporting Quality and Corporate Social Responsibility on Companies Listed on the Indonesia Stock Exchange. Cogent Bus. Manag. 2023, 10, 2157975. [Google Scholar] [CrossRef]

- Angin, M.; Taşdemir, B.; Yılmaz, C.A.; Demiralp, G.; Atay, M.; Angin, P.; Dikmener, G. A RoBERTa Approach for Automated Processing of Sustainability Reports. Sustainability 2022, 14, 16139. [Google Scholar] [CrossRef]

- Nitlarp, T.; Kiattisin, S. The Impact Factors of Industry 4.0 on ESG in the Energy Sector. Sustainability 2022, 14, 9198. [Google Scholar] [CrossRef]

- Huang, A.H.; Wang, H.; Yang, Y. FinBERT: A Large Language Model for Extracting Information from Financial Text. Contemp. Account. Res. 2023, 40, 806–841. [Google Scholar] [CrossRef]

- Lee, O.; Joo, H.; Choi, H.; Cheon, M. Proposing an Integrated Approach to Analyzing ESG Data via Machine Learning and Deep Learning Algorithms. Sustainability 2022, 14, 8745. [Google Scholar] [CrossRef]

- Gutierrez-Bustamante, M.; Espinosa-Leal, L. Natural Language Processing Methods for Scoring Sustainability Reports—A Study of Nordic Listed Companies. Sustainability 2022, 14, 9165. [Google Scholar] [CrossRef]

- Wang, J.; Bhowmick, A.; Cevik, M.; Basar, A. Deep Learning Approaches to Classify the Relevance and Sentiment of News Articles to the Economy. In CASCON’20, Proceedings of the 30th Annual International Conference on Computer Science and Software Engineering, Toronto, ON, Canada, 10–13 November 2020; Shaddick, L., Jourdan, G.-V., Onut, V., Ng, T., Eds.; IBM Corp.: Riverton, NJ, USA, 2020; pp. 207–216. [Google Scholar]

- Raman, N.; Bang, G.; Nourbakhsh, A. Mapping ESG Trends by Distant Supervision of Neural Language Models. Mach. Learn. Knowl. Extr. 2020, 2, 453–468. [Google Scholar] [CrossRef]

- Nugent, T.; Stelea, N.; Leidner, J.L. Detecting Environmental, Social and Governance (ESG) Topics Using Domain-Specific Language Models and Data Augmentation. In Flexible Query Answering Systems, Proceedings of the 14th International Conference, FQAS 2021, Bratislava, Slovakia, 19–24 September 2021; Andreasen, T., De Tre, G., Kacprzyk, J., Larse, H.L., Bordigna, G., Zadrozny, S., Eds.; Springer: Berlin, Germany, 2021; Volume 12871, pp. 157–169. [Google Scholar] [CrossRef]

- Sharma, U.; Gupta, A.; Gupta, S.K. The Pertinence of Incorporating ESG Ratings to Make Investment Decisions: A Quantitative Analysis Using Machine Learning. J. Sustain. Financ. Invest. 2022, 1–15. [Google Scholar] [CrossRef]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone: Oxford, UK, 1997. [Google Scholar]

- Jamali, D. Insights into triple bottom line integration from a learning organization perspective. Bus. Process Manag. J. 2006, 12, 809–821. [Google Scholar] [CrossRef]

- Slaper, T.; Hall, T. The Triple Bottom Line: What Is It and How Does It Work? Indiana Univ. Kelley Sch. Bus. 2011, 86, 4–8. [Google Scholar]

- GSSB. Consolidated Set of GRI Sustainability Reporting Standards 2016. GSSB. 2016. Available online: http://www.ekvilib.org/wp-content/uploads/2018/03/GRI-standardi-2016.pdf (accessed on 11 January 2023).

- Chang, R.-D.; Zuo, J.; Zhao, Z.-Y.; Zillante, G.; Gan, X.-L.; Soebarto, V. Evolving theories of sustainability and firms: History, future directions and implications for renewable energy research. Renew. Sustain. Energy Rev. 2017, 72, 48–56. [Google Scholar] [CrossRef]

- Foxon, T.J. A coevolutionary framework for analysing a transition to a sustainable low carbon economy. Ecol. Econ. 2011, 70, 2258–2267. [Google Scholar] [CrossRef]

- Jänicke, M. “Green growth”: From a growing eco-industry to economic sustainability. Energy Policy 2012, 48, 13–21. [Google Scholar] [CrossRef]

- Rotmans, J.; Loorbach, D. Complexity and transition management. J. Ind. Ecol. 2009, 13, 184–196. [Google Scholar] [CrossRef]

- The European Parliament and the Council of the European Union. Directive (EU) 2022/2464 of 14 December 2022 Amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as Regards Corporate Sustainability Reporting; The European Parliament and the Council of the European Union: Brussels, Belgium, 2022; pp. 15–80. Available online: https://eur-lex.europa.eu/legal-content/RO/TXT/PDF/?uri=CELEX:52021PC0189&from=EN/ (accessed on 3 February 2023).

- Ministry of Public Finance. Order of the Minister of Public Finance No. 3456/2018 for Amending and Supplementing Accounting Regulations; Ministry of Public Finance: Bucharest, Romania, 2018; pp. 14–16. Available online: https://static.anaf.ro/static/10/Anaf/legislatie/OMFP_3456_2018.pdf (accessed on 25 January 2023).

- Ministry of Public Finance. Order of the Minister of Public Finance No. 1938/2016 for Amending and Supplementing Accounting Regulations; Ministry of Public Finance: Bucharest, Romania, 2016; pp. 28–32. Available online: https://static.anaf.ro/static/10/Anaf/legislatie/OMFP_1938_2016.pdf (accessed on 25 January 2023).

- Krzysztofik, M.; Düring, N.; Fennema, S.; Scheepens, W. ESG Reporting Guidelines. Bucharest, Romania. 2022. Available online: https://bvb.ro/info/Rapoarte/Ghiduri/ESG_Reporting_Guidelines.pdf (accessed on 19 January 2023).

- Galletta, S.; Mazzù, S.; Naciti, V. A Bibliometric Analysis of ESG Performance in the Banking Industry: From the Current Status to Future Directions. Res. Int. Bus. Finance 2022, 62, 101684. [Google Scholar] [CrossRef]

- Gao, W.; Li, M.; Zou, C. Analysis of the Impact of ESG on Corporate Financial Performance under the Epidemic Based on Static and Dynamic Panel Data. Wirel. Commun. Mob. Comput. 2022, 2022, 6851518. [Google Scholar] [CrossRef]

- Iazzolino, G.; Bruni, M.E.; Veltri, S.; Morea, D.; Baldissarro, G. The Impact of ESG Factors on Financial Efficiency: An Empirical Analysis for the Selection of Sustainable Firm Portfolios. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1917–1927. [Google Scholar] [CrossRef]

- Rahi, A.F.; Akter, R.; Johansson, J. Do Sustainability Practices Influence Financial Performance? Evidence from the Nordic Financial Industry. Account. Res. J. 2022, 35, 292–314. [Google Scholar] [CrossRef]

- Fulton, M.; Kahn, B.M.; Sharples, C. Sustainable Investing: Establishing Long-Term Value and Performance. SSRN Electron. J. 2012, 1–72. [Google Scholar] [CrossRef]

- De Lucia, C.; Pazienza, P.; Bartlett, M. Does Good ESG Lead to Better Financial Performances by Firms? Machine Learning and Logistic Regression Models of Public Enterprises in Europe. Sustainability 2020, 12, 5317. [Google Scholar] [CrossRef]

- Azmi, W.; Hassan, M.K.; Houston, R.; Karim, M.S. ESG Activities and Banking Performance: International Evidence from Emerging Economies. J. Int. Financ. Mark. Inst. Money 2021, 70, 101277. [Google Scholar] [CrossRef]

- Bruna, M.G.; Loprevite, S.; Raucci, D.; Ricca, B.; Rupo, D. Investigating the Marginal Impact of ESG Results on Corporate Financial Performance. Financ. Res. Lett. 2022, 47, 102828. [Google Scholar] [CrossRef]

- Agoraki, M.-E.K.; Giaka, M.; Konstantios, D.; Patsika, V. Firms’ Sustainability, Financial Performance, and Regulatory Dynamics: Evidence from European Firms. J. Int. Money Finance 2023, 131, 102785. [Google Scholar] [CrossRef]

- Barman, A.; Das, R.; De, P.K.; Sana, S.S. Optimal pricing and greening strategy in a competitive green supply chain: Impact of government subsidy and tax policy. Sustainability 2021, 13, 9178. [Google Scholar] [CrossRef]

- Barman, A.; Das, R.; De, P.K.; Dash, J.K. Optimal Pricing, Ordering, and Replenishment Policies in a Multi-Item Inventory System for Deteriorating Items under Time-Varying Backlogging Rate. J. Ind. Integr. Manag. 2022, 7, 235–256. [Google Scholar] [CrossRef]

- Barman, A.; Kumar Chakraborty, A.; Goswami, A.; Banerjee, P.; De, P.K. Pricing and inventory decision in a two-layer supply chain under the Weibull distribution product deterioration: An application of NSGA-II. RAIRO Oper. Res. 2023, 57, 2279–2300. [Google Scholar] [CrossRef]

- Alareeni, B.A.; Hamdan, A. ESG Impact on Performance of US S&P. 500-Listed Firms. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 1409–1428. [Google Scholar] [CrossRef]

- Pacelli, V.; Pampurini, F.; Quaranta, A.G. Environmental, Social and Governance Investing: Does Rating Matter? Bus. Strategy Environ. 2023, 32, 30–41. [Google Scholar] [CrossRef]

- Duque-Grisales, E.; Aguilera-Caracuel, J. Environmental, Social and Governance (ESG) Scores and Financial Performance of Multilatinas: Moderating Effects of Geographic International Diversification and Financial Slack. J. Bus. Ethics 2021, 168, 315–334. [Google Scholar] [CrossRef]

- Li, Z. Treatment and Technology of Domestic Sewage for Improvement of Rural Environment in China-Jiangsu: A Research. Sci. Progress Res. 2021, 1, 305–314. [Google Scholar] [CrossRef]

- Garcia, A.S.; Mendes-Da-Silva, W.; Orsato, R.J. Corporate Sustainability, Capital Markets, and ESG Performance. In Individual Behaviors and Technologies for Financial Innovations; Springer International Publishing: Cham, Switzerland, 2019; pp. 287–309. [Google Scholar] [CrossRef]

- Raghupathi, V.; Ren, J.; Raghupathi, W. Identifying Corporate Sustainability Issues by Analyzing Shareholder Resolutions: A Machine-Learning Text Analytics Approach. Sustainability 2020, 12, 4753. [Google Scholar] [CrossRef]

- Baharudin, B.; Lee, L.H.; Khan, K. A Review of Machine Learning Algorithms for Text-Documents Classification. J. Adv. Inf. Technol. 2010, 1, 4–20. [Google Scholar] [CrossRef]

- Brown, M. Managing Nature–Business as Usual: Resource Extraction Companies and Their Representations of Natural Landscapes. Sustainability 2015, 7, 15900–15922. [Google Scholar] [CrossRef]

- Pennington, J.; Socher, R.; Manning, C. Glove: Global Vectors for Word Representation. In Proceedings of the 2014 Conference on Empirical Methods in Natural Language Processing (EMNLP), Doha, Qatar, 25–29 October 2014; Association for Computational Linguistics: Stroudsburg, PA, USA, 2014; pp. 1532–1543. [Google Scholar] [CrossRef]

- Goel, T.; Jain, P.; Verma, I.; Dey, L.; Paliwal, S.S. Mining Company Sustainability Reports to Aid Financial Decision-Making. In Proceedings of the AAAI-20 KDF—The AAAI-20 Workshop on Knowledge Discovery from Unstructured Data in Financial Service, New York, NY, USA, 7 February 2020. [Google Scholar]

- Margot, V.; Geissler, C.; De Franco, C.; Monnier, B. ESG Investments: Filtering versus Machine Learning Approaches. Appl. Econ. Finance 2021, 8, 1. [Google Scholar] [CrossRef]

- Sustainalytics a Morningstar Company. ESG Risk Ratings-Methodology Abstract Version 2.1; Sustainalytics: Amsterdam, The Netherlands, 2021; Available online: https://connect.sustainalytics.com/hubfs/INV/Methodology/Sustainalytics_ESG%20Ratings_Methodology%20Abstract.pdf (accessed on 16 February 2023).

- Brahma, S.; Nwafor, C.; Boateng, A. Board Gender Diversity and Firm Performance: The UK Evidence. Int. J. Finance Econ. 2021, 26, 5704–5719. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate Social and Financial Performance: A Meta-Analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Wang, C.; Deng, X.; Álvarez-Otero, S.; Sial, M.S.; Comite, U.; Cherian, J.; Oláh, J. Impact of Women and Independent Directors on Corporate Social Responsibility and Financial Performance: Empirical Evidence from an Emerging Economy. Sustainability 2021, 13, 6053. [Google Scholar] [CrossRef]

- Arora, A. Gender Diversity in Boardroom and Its Impact on Firm Performance. J. Manag. Gov. 2022, 26, 735–755. [Google Scholar] [CrossRef]

- Bogdan, V.; Popa, D.-N.; Beleneşi, M. The Complexity of Interaction between Executive Board Gender Diversity and Financial Performance: A Panel Analysis Approach Based on Random Effects. Complexity 2022, 2022, 9559342. [Google Scholar] [CrossRef]

- Li, D.; Zhao, Y.; Sun, Y.; Yin, D. Corporate Environmental Performance, Environmental Information Disclosure, and Financial Performance: Evidence from China. Human. Ecol. Risk Assess. Int. J. 2017, 23, 323–339. [Google Scholar] [CrossRef]

- Deswanto, R.B.; Siregar, S.V. The Associations between Environmental Disclosures with Financial Performance, Environmental Performance, and Firm Value. Soc. Responsib. J. 2018, 14, 180–193. [Google Scholar] [CrossRef]

- Kalash, İ. Environmental Disclosure: Determinants and Effects on Financial Performance? An Empirical Evidence from Turkey. Sosyoekonomi 2020, 28, 95–115. [Google Scholar] [CrossRef]

- Ban, A.I.; Ban, O.I.; Bogdan, V.; Sabau Popa, D.C.; Tuse, D. Performance Evaluation Model of Romanian Manufacturing Listed Companies by Fuzzy AHP and TOPSIS. Technol. Econ. Dev. Econ. 2020, 26, 808–836. [Google Scholar] [CrossRef]

- Smith, A.E.; Humphreys, M.S. Evaluation of Unsupervised Semantic Mapping of Natural Language with Leximancer Concept Mapping. Behav. Res. Methods 2006, 38, 262–279. [Google Scholar] [CrossRef]

- Ciocan, C.C.; Carp, M.; Gerogescu, I. The Determinants of the Financial Reporting Quality: Empirical Evidence for Romania. Audit Financ. J. 2021, 19, 301–319. [Google Scholar] [CrossRef]

- Caratas, M.A.; Stanciu, V. Considerations Regarding Correlated Analysis between Comply or Explain Declaration and Non-Financial Reports. Audit Financ. 2021, 19, 145–155. [Google Scholar] [CrossRef]

- Beleneși, M.; Bogdan, V.; Popa, D.N. Disclosure Dynamics and Non-Financial Reporting Analysis. The Case of Romanian Listed Companies. Sustainability 2021, 13, 4732. [Google Scholar] [CrossRef]

- Hategan, C.-D.; Curea-Pitorac, R.-I.; Hategan, V.-P. Responsible Communication of Romanian Companies for Ensuring Public Health in a COVID-19 Pandemic Context. Int. J. Environ. Res. Public Health 2020, 17, 8526. [Google Scholar] [CrossRef]

- Nechita, E.; Manea, C.L.; Irimescu, A.M.; Nichita, E.-M. The Content Analysis of Reporting on Sustainable Development Goals. Audit Financ. 2020, 18, 831–854. [Google Scholar] [CrossRef]

- Alsmady, A.A. Quality of Financial Reporting, External Audit, Earnings Power and Companies Performance: The Case of Gulf Corporate Council Countries. Res. Glob. 2022, 5, 100093. [Google Scholar] [CrossRef]

- Huian, M. Post M&A Accounting Performance of Romanian Banks. J. East. Eur. Res. Bus. Econ. 2012, 2012, 184557. [Google Scholar] [CrossRef]

- Filip, B.F. Determinants of the Profitability in the Banking Systems of Western European Countries. In Proceedings of the 25th International Business Information Management Association Conference—Innovation Vision 2020: From Regional Development Sustainability to Global Economic Growth; Soliman, K., Ed.; International Business Information Management Association, IBIMA: Amsterdam, The Netherlands, 2015; pp. 443–453. [Google Scholar]

- Tudose, M.B.; Rusu, V.D.; Avasilcai, S. Financial Performance—Determinants and Interdependencies between Measurement Indicators. Bus. Manag. Econ. Eng. 2022, 20, 119–138. [Google Scholar] [CrossRef]

- Dănescu, T.; Popa, M.-A. The Inter-Conditioning between Corporate Governance and Financial Performance. Audit Financ. 2020, 18, 578–584. [Google Scholar] [CrossRef]

- Tiliuţă, B.A.; Diaconu, I.R.; Oanea, D.C. The Impact of Feminine Management on Banks Financial Performance: Evidence from Selected Countries from Europe. Stud. Bus. Econ. 2021, 16, 231–246. [Google Scholar] [CrossRef]

- Movileanu, M.; Danila, R. ESG—Opportunity to Change Strategy? Results of an Opinion Survey Conducted among Listed Companies; PWC: Bucharest, Romania, 2022; Available online: https://www.pwc.ro/en/press-room/press-releases-2022/pwc-romania-report--only-30--of-bvb-listed-companies-have-an-esg.html/ (accessed on 16 February 2023).

- Nirino, N.; Santoro, G.; Miglietta, N.; Quaglia, R. Corporate Controversies and Company’s Financial Performance: Exploring the Moderating Role of ESG Practices. Technol. Forecast. Soc. Change 2021, 162, 120341. [Google Scholar] [CrossRef]

| ESG Data Scoring Scale | ESG Risk Scoring Scale | Exposure to ESG Risk Scoring Scale | ESG Risk Management Scoring Scale |

|---|---|---|---|

| 0 = none | 5 = negligible risk | 5 = negligible exposure | 1 = no performance |

| 1 = very poor | 4 = low risk | 4 = low exposure | 2 = low performance |

| 2 = poor | 3 = medium risk | 3 = medium exposure | 3 = moderate performance |

| 3 = satisfying | 2 = high risk | 2 = high exposure | 4 = good performance |

| 4 = moderate | 1 = severe risk | 1 = severe exposure | 5 = very good performance |

| 5 = good | |||

| 6 = very good | |||

| 7 = excellent |

| Inputs and Summary | Description | Clusters | Number of Items | Average ROE 2017–2021 | Average ROA 2017–2021 | Companies |

|---|---|---|---|---|---|---|

| Variables | Avg. ROE 2017–2021, Avg. ROA 2017–2021 | Cluster 1 | 6 | 0.16157 | 0.0092597 | AUT24E, ELMA, IMP, NRF, ROCE, and SFG |

| Level of detail | Companies | Cluster 2 | 9 | 8.2927 | 6.3993 | ALR, ATB, BVB, EL, PTR, RMAH, SNN, SNP, and TGN |

| Scaling | Normalized | |||||

| Number of clusters | 4 | |||||

| Number of points | 19 | Cluster 3 | 2 | 16.773 | 1.97 | BRD and TLV |

| Between-group Sum of squares | 3.2114 | |||||

| Within-group Sum of squares | 0.1882 | Cluster 4 | 2 | 20.355 | 12.336 | ONE and TRP |

| Total sum of squares | 3.3996 |

| Sustainability Average Scores | Mean | Median | Std. Dev. | Min. | Max. | Skeweness | Ex. Kurtosis |

|---|---|---|---|---|---|---|---|

| AvgSustainDiscSc | 3.74 | 3.80 | 0.96 | 2.20 | 5.40 | −0.048153 | −1.2048 |

| AvgALLGRISc | 3.55 | 3.88 | 1.21 | 1.50 | 5.50 | −0.27412 | −1.0229 |

| AvgGRITopicsSc | 4.14 | 4.33 | 1.05 | 2.67 | 6.00 | 0.038235 | −1.0826 |

| WGRI201 | 0.97 | 0.92 | 0.17 | 0.75 | 1.25 | 0.34585 | −1.0403 |

| WGRI301 | 0.98 | 1.00 | 0.18 | 0.67 | 1.29 | −0.13787 | −1.0977 |

| WGRI401 | 1.01 | 1.07 | 0.18 | 0.50 | 1.33 | −1.2167 | 2.1262 |

| Wmaterialit | 0.91 | 1.08 | 0.57 | 0.00 | 1.82 | −0.56298 | −0.66469 |

| AvgESGRiskSc | 14.30 | 13.00 | 4.70 | 5.33 | 22.70 | 0.20368 | −0.66469 |

| AvgExposRiskSc | 1.42 | 1.14 | 1.31 | 0.00 | 5.33 | 1.4567 | 2.3291 |

| AvgMNriskSc | 16.90 | 19.40 | 7.11 | 4.50 | 27.50 | −0.41918 | −0.96810 |

| AvgIntStratgSc | 3.32 | 3.00 | 1.03 | 2.00 | 5.50 | 0.55078 | −0.62893 |

| AvgGenScore | 4.65 | 4.82 | 1.44 | 2.34 | 6.64 | −0.18804 | −1.1544 |

| Inputs and Summary | Description | Clusters | Number of Items | AvgESG Risk Score | AvgESG Expos Score | AvgGen Score | Companies |

|---|---|---|---|---|---|---|---|

| Variables | AvgGenSc ESGRiskSc ESGExposSc | Cluster 1 | 6 | 9.665 | 0.67378 | 2.9136 | BVB, ELMA, IMP, NRF, RMAH, and TGN |

| Level of detail | Companies | Cluster 2 | 4 | 20.833 | 1.3926 | 6.4814 | BRD, PTR, SFG, and SNP |

| Scaling | Normalized | ||||||

| Number of clusters | 4 | ||||||

| Number of points | 19 | Cluster 3 | 3 | 17.333 | 3.7730 | 5.6031 | AUT24E, ROCE, and TLV |

| Between-group sum of squares | 3.7079 | ||||||

| Within-group sum of squares | 0.70335 | Cluster 4 | 6 | 13.000 | 1.0056 | 4.6943 | ALR, ATB, EL, ONE, SNN, and TRP |

| Total sum of squares | 4.4113 |

| Company | Category by Size | FinP Score | FinP Ranking | ESGGen Score | ESG Ranking | Global Score | FinESG Ranking |

|---|---|---|---|---|---|---|---|

| ALR | C | 1.0107 | 7 | 4.8755 | 8 | 2.1701 | 7 |

| ATB | C | 0.1124 | 12 | 4.4644 | 12 | 1.4180 | 14 |

| AUT24E | E | 0.2246 | 11 | 4.8181 | 10 | 1.6026 | 12 |

| TLV | A | 37.0208 | 1 | 6.0270 | 5 | 27.7226 | 1 |

| BRD | A | 20.3234 | 3 | 6.6415 | 1 | 16.2187 | 3 |

| BVB | E | 0.0807 | 15 | 2.7242 | 27 | 0.8736 | 17 |

| ELMA | D | 0.0299 | 18 | 2.4302 | 18 | 0.7499 | 18 |

| RMAH | E | 0.0945 | 14 | 2.7818 | 16 | 0.9006 | 16 |

| IMP | D | 0.2782 | 10 | 3.4953 | 15 | 1.2432 | 15 |

| NRFR02 | E | 0.0107 | 19 | 2.3363 | 19 | 0.7082 | 19 |

| SNN | B | 2.4726 | 4 | 4.8105 | 11 | 3.1739 | 4 |

| SNP | A | 23.4007 | 2 | 6.5528 | 2 | 18.3462 | 2 |

| ONE | E | 0.3577 | 8 | 4.2643 | 13 | 1.5295 | 13 |

| ROCE | D | 0.0308 | 17 | 5.9643 | 6 | 1.8107 | 10 |

| PTR | E | 0.0611 | 16 | 6.3413 | 4 | 1.9450 | 9 |

| TGN | B | 1.7280 | 5 | 3.7137 | 14 | 2.3237 | 5 |

| EL | C | 1.0901 | 6 | 4.8351 | 9 | 2.2135 | 6 |

| SFG | E | 0.1103 | 13 | 6.3900 | 3 | 1.9942 | 8 |

| TRP | E | 0.2961 | 9 | 4.9161 | 7 | 1.6820 | 11 |

| No | Concepts | Absolute Count | Relative Count | Associated Themes |

|---|---|---|---|---|

| 1 | employees | 4833 | 100% | management, company |

| 2 | management | 4455 | 92% | management, report |

| 3 | business | 3423 | 71% | management, report |

| 4 | company | 3204 | 66% | company, products |

| 5 | report | 2960 | 61% | management, report |

| 6 | products | 2737 | 57% | products |

| 7 | energy | 2652 | 55% | energy |

| 8 | safety | 2650 | 55% | company, management |

| 9 | development | 2529 | 52% | company, products |

| 10 | performance | 2466 | 51% | report, management |

| 11 | environmental | 2370 | 49% | report, management |

| 12 | health | 2351 | 49% | company, management |

| 13 | activities | 2274 | 47% | products, company |

| 14 | sustainability | 2189 | 45% | management, report |

| 15 | group | 2155 | 45% | report, management |

| 16 | risks | 2148 | 44% | management |

| 17 | operations | 2099 | 43% | company, products |

| 18 | training | 2051 | 42% | company, management |

| 19 | risk | 2000 | 41% | company |

| 20 | consumption | 1962 | 41% | energy |

| 21 | environment | 1953 | 40% | products, company |

| 22 | Romania | 1942 | 40% | energy |

| 23 | year | 1906 | 39% | energy |

| 24 | information | 1801 | 37% | management |

| 25 | waste | 1769 | 37% | products, energy |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bogdan, V.; Rus, L.; Gherai, D.S.; Florea, A.G.; Bugnar, N.G. A Streamline Sustainable Business Performance Reporting Model by an Integrated FinESG Approach. Sustainability 2023, 15, 16860. https://doi.org/10.3390/su152416860

Bogdan V, Rus L, Gherai DS, Florea AG, Bugnar NG. A Streamline Sustainable Business Performance Reporting Model by an Integrated FinESG Approach. Sustainability. 2023; 15(24):16860. https://doi.org/10.3390/su152416860

Chicago/Turabian StyleBogdan, Victoria, Luminita Rus, Dana Simona Gherai, Adrian Gheorghe Florea, and Nicoleta Georgeta Bugnar. 2023. "A Streamline Sustainable Business Performance Reporting Model by an Integrated FinESG Approach" Sustainability 15, no. 24: 16860. https://doi.org/10.3390/su152416860