Corporate Social Responsibility as the Pathway to Sustainable Banking: A Systematic Literature Review

Abstract

1. Introduction

- RQ1. Which theories are applied in sustainable banking and CSR-related studies?

- RQ2. What are the dimensions of CSR practices for sustainable banking?

2. Methodology

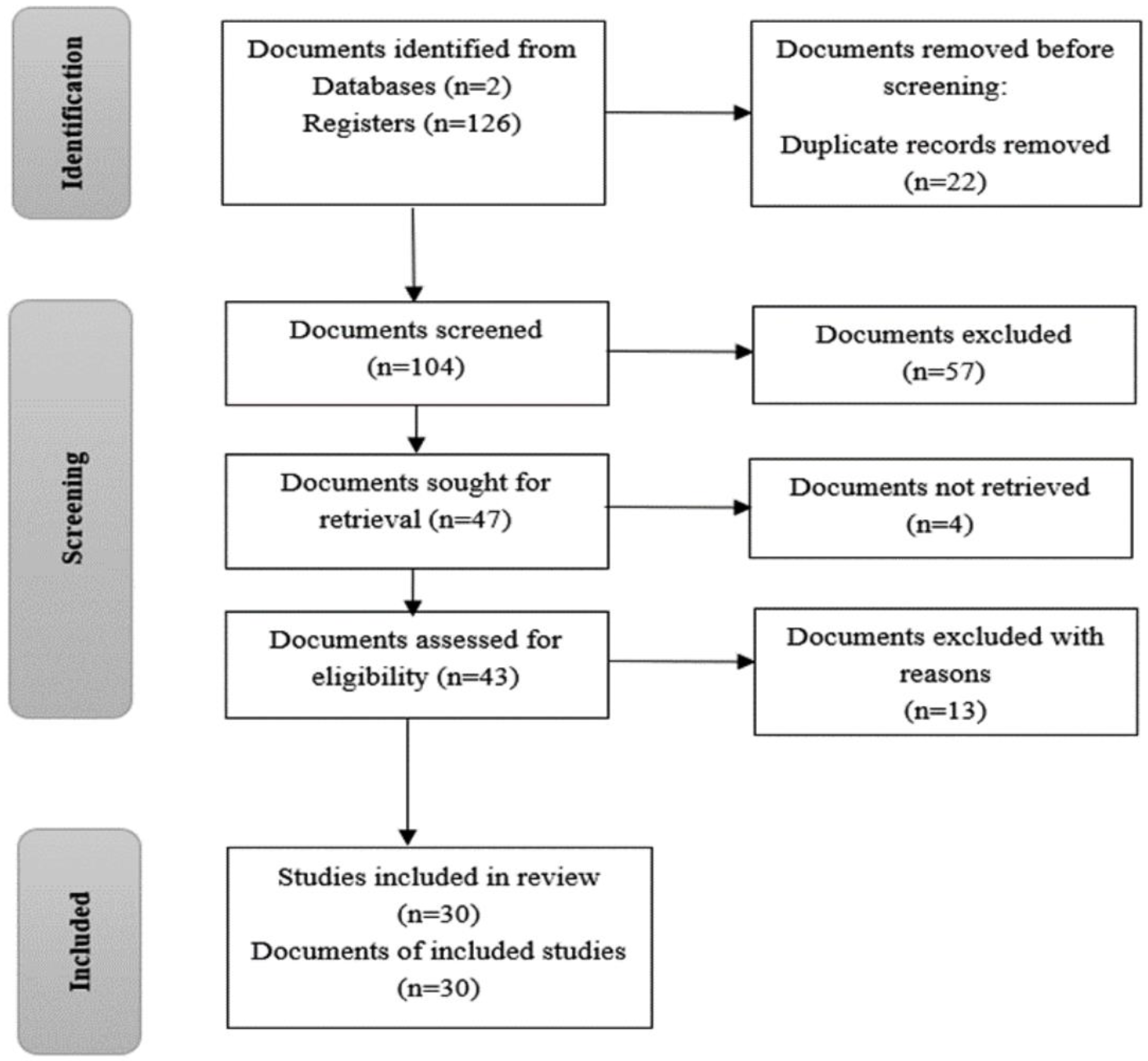

2.1. Sample Selection

2.2. Refining Criteria

2.3. Searching Process of Literature

3. Findings and Interpretations

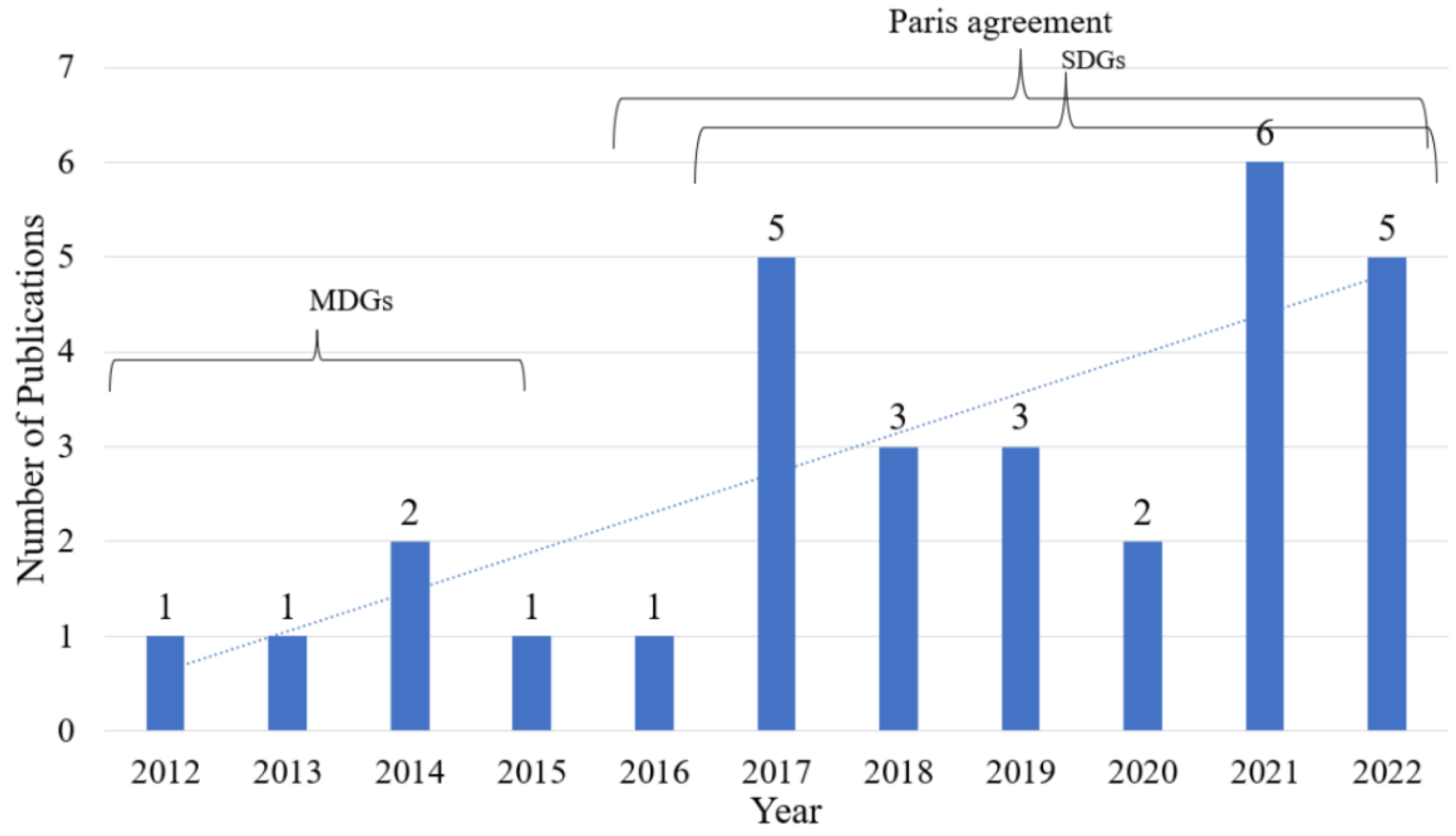

3.1. Publication Trends in CSR and Sustainable Banking

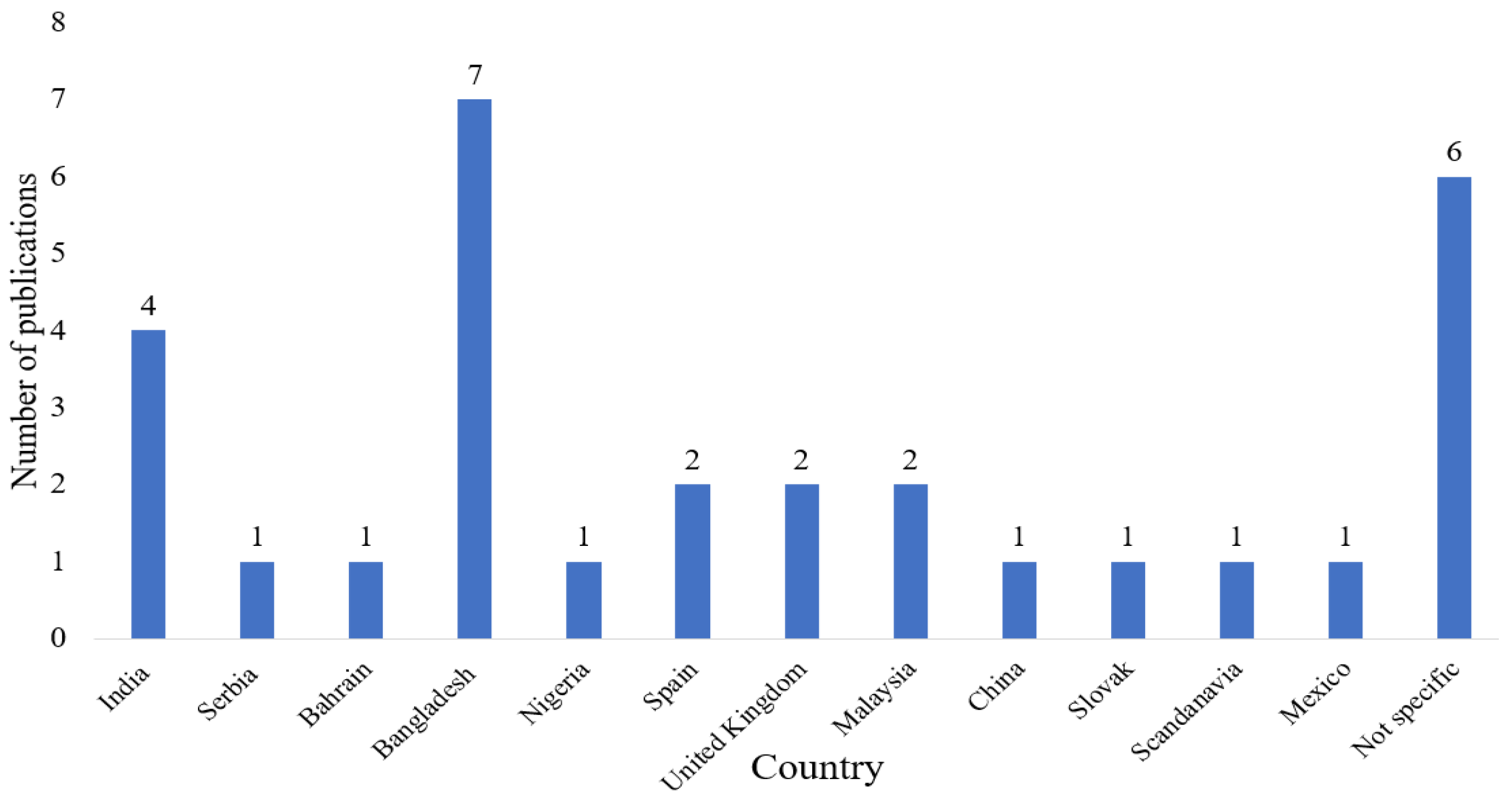

3.2. Country Contexts of CSR and Sustainable Banking

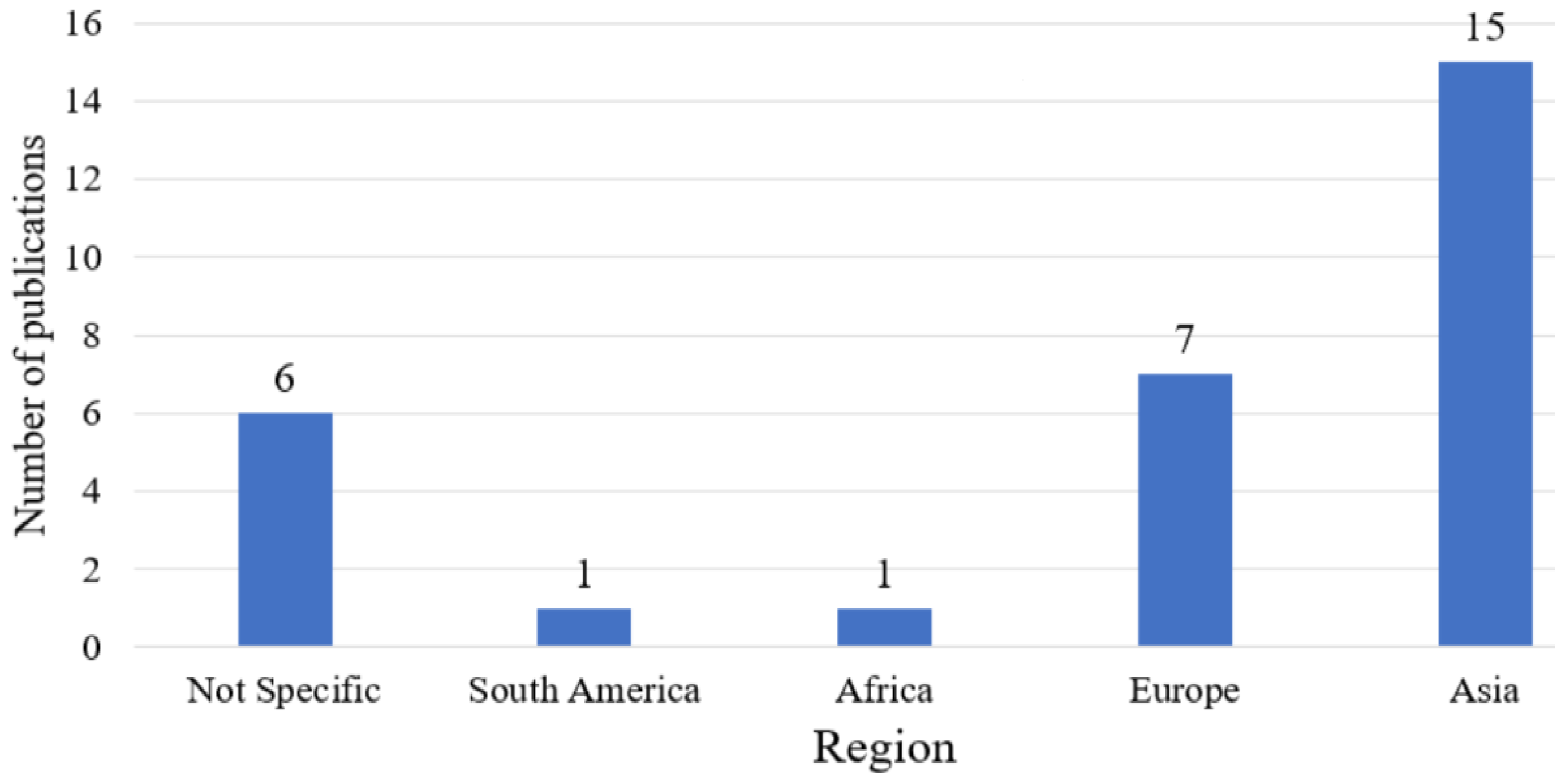

3.3. Regional Contexts of CSR and Sustainable Banking

3.4. Underlying Theories in CSR and Sustainable Banking

3.5. CSR Dimensions for Sustainable Banking

4. Discussion

4.1. Publication Trends

4.2. Context of the Countries and Regions

4.3. Theories Applied in CSR and Sustainable Banking

4.4. CSR Dimensions for Sustainable Banking

4.4.1. CSR Dimensions Connected with the Society

4.4.2. CSR Dimensions Connected with the Environment

4.4.3. CSR Dimensions Integrated with the Society and Environment

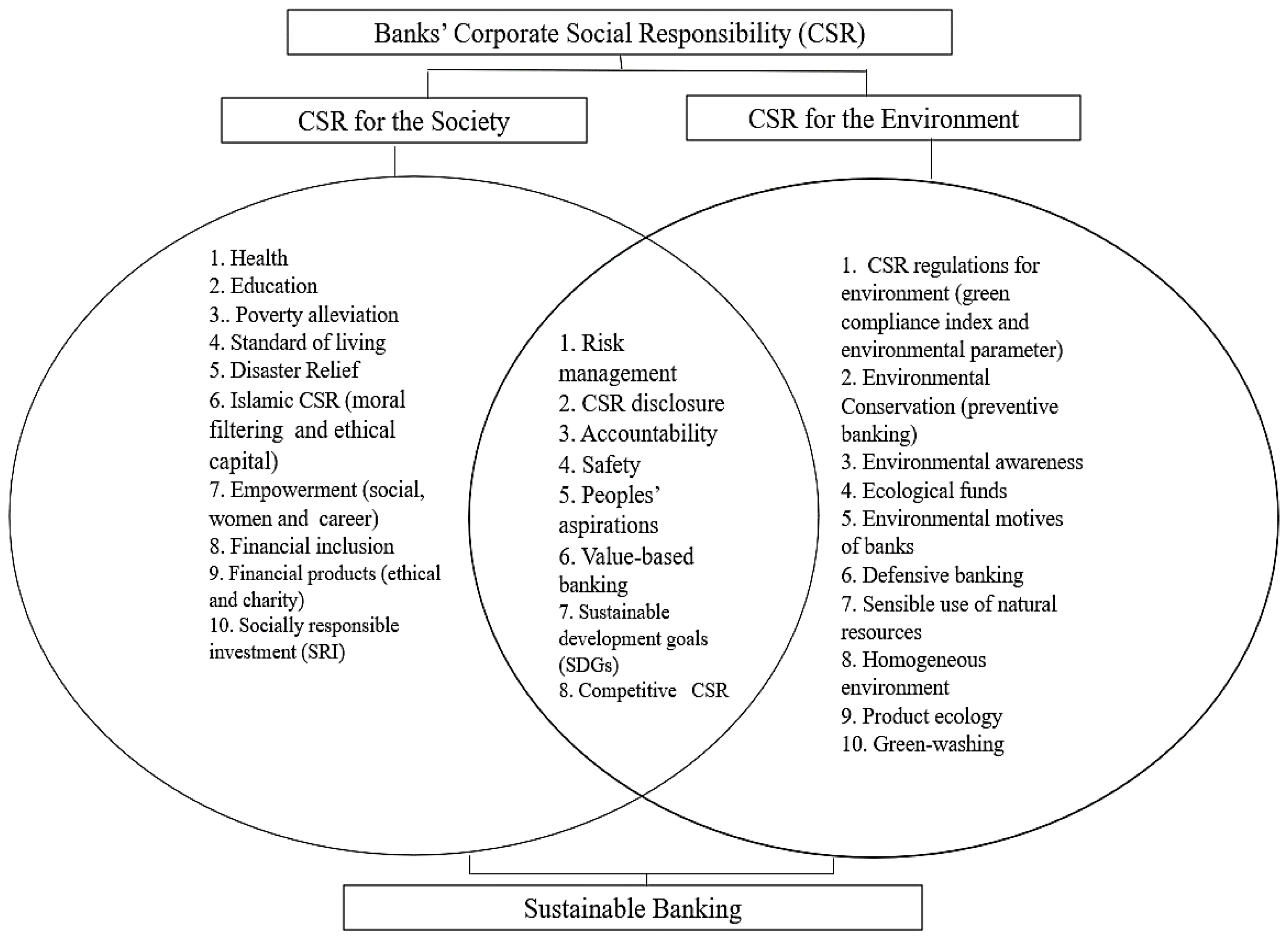

5. The Proposed Model of Sustainable Banking Based on the CSR Dimensions

6. Mapping the Theories with the CSR Dimensions in Connection with Sustainable Banking

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Desalegn, G.; Tangl, A. Enhancing Green Finance for Inclusive Green Growth: A Systematic Approach. Sustainability 2022, 14, 7416. [Google Scholar] [CrossRef]

- Tan, L.H.; Chew, B.C.; Hamid, S.R. A holistic perspective on sustainable banking operating system drivers: A case study of Maybank group. Qual. Res. Financ. Mark. 2017, 9, 240–262. [Google Scholar] [CrossRef]

- Nizam, E.; Ng, A.; Dewandaru, G.; Nagayev, R.; Nkoba, M.A. The impact of social and environmental sustainability on financial performance: A global analysis of the banking sector. J. Multinatl. Financ. Manag. 2019, 49, 35–53. [Google Scholar] [CrossRef]

- Kumar, K.; Prakash, A. Examination of sustainability reporting practices in Indian banking sector. Asian J. Sustain. Soc. Responsib. 2019, 4, 2. [Google Scholar] [CrossRef]

- Nájera-Sánchez, J.J. A systematic review of sustainable banking through a co-word analysis. Sustainability 2020, 12, 278. [Google Scholar] [CrossRef]

- Kumar, K.; Prakash, A. Developing a framework for assessing sustainable banking performance of the Indian banking sector. Soc. Responsib. J. 2019, 15, 689–709. [Google Scholar] [CrossRef]

- Saeudy, M.; Atkins, J.; Barone, E.A.V. Interpreting banks’ sustainability initiatives as reputational risk management and mechanisms for coping, re-embedding and rebuilding societal trust. Qual. Res. Financ. Mark. 2022, 14, 169–188. [Google Scholar] [CrossRef]

- Forcadell, F.J.; Aracil, E.; Úbeda, F. The Impact of Corporate Sustainability and Digitalization on International Banks’ Performance. Glob. Policy 2020, 11, 18–27. [Google Scholar] [CrossRef]

- Abu Al-Haija, E.; Kolsi, M.C.; Kolsi, M.C.C. Corporate social responsibility in Islamic banks: To which extent does Abu Dhabi Islamic bank comply with the global reporting initiative standards? J. Islam. Account. Bus. Res. 2021, 12, 1200–1223. [Google Scholar] [CrossRef]

- Bose, S.; Khan, H.Z.; Monem, R.M. Does Green Banking Performance Pay Off? Evidence from a Unique Regulatory Setting in Bangladesh Running. Corp. Gov. An Int. Rev. 2021, 29, 162–187. [Google Scholar] [CrossRef]

- Weber, O.; Chowdury, R.K. Corporate Sustainability in Bangladeshi Banks: Proactive or Reactive Ethical Behavior ? Sustainability 2020, 12, 7999. [Google Scholar] [CrossRef]

- Zhixia, C.; Hossen, M.M.; Mareumuzafary, S.S.; Begum, M. Green Banking for Environmental Sustainability-Present Status and Future Agenda: Experience from Bangladesh. Asian Econ. Financ. Rev. 2018, 8, 571–585. [Google Scholar] [CrossRef]

- Sharma, M.; Choubey, A. Green banking initiatives: A qualitative study on Indian banking sector. Environ. Dev. Sustain. 2022, 24, 293–319. [Google Scholar] [CrossRef] [PubMed]

- Nosratabadi, S.; Pinter, G.; Mosavi, A.; Semperger, S. Sustainable banking; Evaluation of the European business models. Sustainability 2020, 12, 2314. [Google Scholar] [CrossRef]

- Aracil, E. Corporate social responsibility of Islamic and conventional banks: The influence of institutions in emerging countries. Int. J. Emerg. Mark. 2019, 14, 582–600. [Google Scholar] [CrossRef]

- Méndez-Suárez, M.; Monfort, A.; Gallardo, F. Sustainable banking: New forms of investing under the umbrella of the 2030 agenda. Sustainability 2020, 12, 2096. [Google Scholar] [CrossRef]

- Mera, A.C. Socially responsible investment: An analysis of the structure of preferences of savers. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 1423–1434. [Google Scholar] [CrossRef]

- Khan, H.Z.; Bose, S.; Sheehy, B.; Quazi, A. Green banking disclosure, firm value and the moderating role of a contextual factor: Evidence from a distinctive regulatory setting. Bus. Strateg. Environ. 2021, 30, 3651–3670. [Google Scholar] [CrossRef]

- Athari, S.A.; Adaoglu, C.; Bektas, E. Investor protection and dividend policy: The case of Islamic and conventional banks. Emerg. Mark. Rev. 2016, 27, 100–117. [Google Scholar] [CrossRef]

- Athari, S.A. Examining the Impacts of Environmental Characteristics on Shariah-Based Bank’s Capital Holdings: Role of Country Risk and Governance Quality. Econ. Financ. Lett. 2022, 9, 99–109. [Google Scholar] [CrossRef]

- Athari, S.A.; Bahreini, M. The impact of external governance and regulatory settings on the profitability of Islamic banks: Evidence from Arab markets. Int. J. Financ. Econ. 2021. [Google Scholar] [CrossRef]

- Athari, S.A. Financial Inclusion, Political Risk, and Banking Sector Stability: Evidence from Different Geographical Regions. Econ. Bull. 2022, 42, 99–108. [Google Scholar]

- Úbeda, F.; Forcadell, F.J.; Aracil, E.; Mendez, A. How sustainable banking fosters the SDG 10 in weak institutional environments. J. Bus. Res. 2022, 146, 277–287. [Google Scholar] [CrossRef]

- Asim, S.; Bukhari, A.; Hashim, F.; Amran, A. Bin Green Banking and Islam: Two sides of the same coin. J. Islam. Mark. 2020, 11, 977–1000. [Google Scholar] [CrossRef]

- Mir, A.A.; Bhat, A.A. Green banking and sustainability—A review. Arab Gulf J. Sci. Res. 2022, 40, 247–263. [Google Scholar] [CrossRef]

- Rouf, M.A.; Siddique, M.N.-E.-A. Theories applied in corporate voluntary disclosure: A literature review. J. Entrep. Public Policy 2022. [Google Scholar] [CrossRef]

- Belas, J. Social responsibility and ethics in the banking business: Myth or reality? A case study from the Slovak Republic. Econ. Ann. 2012, 57, 115–137. [Google Scholar] [CrossRef]

- Carroll, A.B. Corporate Social Responsibility (CSR) and Corporate Social Performance (CSP). In SAGE Brief Guide to Marketing Ethics; SAGE Publication, Inc.: Thousand Oaks, CA, USA, 2012; pp. 51–67. [Google Scholar] [CrossRef]

- Carroll, A.B. Corporate Social Responsibility: Perspectives on the CSR Construct’s Development and Future. Bus. Soc. 2021, 60, 1258–1278. [Google Scholar] [CrossRef]

- Sethi, S.P. Dimensions of Corporate Social Performance: An Analytical Framework. Calif. Manage. Rev. 1975, 17, 58–64. [Google Scholar] [CrossRef]

- Bowen, H.R. Social Responsibility of the Businessman; Harper: New York, NY, USA, 1953; pp. 1–20. [Google Scholar]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G. Academia and Clinic Annals of Internal Medicine Preferred Reporting Items for Systematic Reviews and Meta-Analyses: The PRISMA Statement. Ann. Intern. Med. 2009, 151, 264–269. [Google Scholar]

- Neitzert, F.; Petras, M. Corporate Social Responsibility and Bank Risk; Springer: Berlin/Heidelberg, Germany, 2022; Volume 92, ISBN 0123456789. [Google Scholar]

- Becchetti, L.; Palestini, A.; Solferino, N.; Tessitore, M.E. The socially responsible choice in a duopolistic market: A dynamic model of “ethical product” differentiation. Econ. Model. 2014, 43, 114–123. [Google Scholar] [CrossRef]

- Barigozzi, F.; Tedeschi, P. On the credibility of ethical banking. J. Econ. Behav. Organ. 2019, 166, 381–402. [Google Scholar] [CrossRef]

- Adu, D.A. Sustainable banking initiatives, environmental disclosure and financial performance: The moderating impact of corporate governance mechanisms. Bus. Strateg. Environ. 2022, 31, 2365–2399. [Google Scholar] [CrossRef]

- Ali, A.; Mohammed, S.; Mansor, F. Value- based Islamic banking and reporting in Bahrain. Int. J. Ethics Syst. 2021, 37, 644–663. [Google Scholar] [CrossRef]

- Mogaji, E.; Hinson, R.E.; Nwoba, A.C. Corporate social responsibility for women’ s empowerment: A study on Nigerian banks. Int. J. Bank Mark. 2021, 39, 516–540. [Google Scholar] [CrossRef]

- Levanchuk, V. The China Development Bank and Sustainable Development. Int. Organ. Res. J. 2016, 11, 68–76. [Google Scholar] [CrossRef]

- Paulet, E.; Relano, F. From CSR rhetoric to real business practice: Ethical banking in Scandinavia. Int. J. Bus. Gov. Ethics 2012, 7, 350–364. [Google Scholar] [CrossRef]

- Forcadell, F.J.; Aracil, E. Sustainable banking in Latin American developing countries: Leading to (mutual) prosperity. Bus. Ethics 2017, 26, 382–395. [Google Scholar] [CrossRef]

- Costa-climent, R.; Martínez-climent, C.; Costa-climent, R.; Martínez-climent, C. Sustainable profitability of ethical and conventional banking. Contemp. Econ. 2018, 12, 519–530. [Google Scholar] [CrossRef]

- Ahmed, A.; El-belihy, A. An Investigation of the Disclosure of Corporate Social Responsibility in UK Islamic Banks. Acad. Account. Financ. Stud. J. 2017, 21, 1–31. [Google Scholar]

- Nor, S.M.; Hashim, N.A. CSR and Sustainability of Islamic Banking: The Bankers View (CSR dan Kemampanan Perbankan Islam: Pandangan Pegawai Bank). J. Pengur. 2015, 45, 73–81. [Google Scholar]

- Islam, M.A.; Yousuf, S.; Hossain, K.F.; Islam, M.R. Green financing in Bangladesh: Challenges and opportunities—A descriptive approach. Int. J. Green Econ. 2014, 8, 74–91. [Google Scholar] [CrossRef]

- Khan, H.Z.; Bose, S.; Mollik, A.T.; Harun, H. “Green washing” or “authentic effort”? An empirical investigation of the quality of sustainability reporting by banks. Account. Audit. Account. J. 2021, 34, 338–369. [Google Scholar] [CrossRef]

- Bose, S.; Khan, H.Z.; Rashid, A.; Islam, S. What drives green banking disclosure ? An institutional and corporate governance perspective. Asia Pac. J. Manag. 2018, 35, 501–527. [Google Scholar] [CrossRef]

- Sharmeen, K.; Hasan, R. Underpinning the benefits of green banking: A comparative study between Islamic and conventional banks in Bangladesh. Thunderbird Int. Bus. Rev. 2019, 61, 735–744. [Google Scholar] [CrossRef]

- Kumar, K.; Prakash, A.; Khan, W. Integrating the notion of sustainable development in banking: Analysing historical and conceptual framework. Indian J. Econ. Dev. 2020, 16, 449–458. [Google Scholar] [CrossRef]

- Raut, R.; Naoufel, C.; Kharat, M. Sustainability in The Banking Industry: A Strategic Multi-Criterion Analysis. Bus. Strateg. Environ. 2017, 26, 550–568. [Google Scholar] [CrossRef]

- Hanic, A.; Jovanovic, O. Environmental disclosure practice in the Serbian banking sector. Management 2021, 26, 115–144. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman: London, UK, 1984. [Google Scholar]

- Meyer, J.W.; Rowan, B. Institutionalized Organizations: Formal Structure as Myth and Ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef]

- Dowling, J.; Pfeffer, J. Pacific Sociological Association Organizational Legitimacy: Social Values and Organizational Behavior. Source Pacific Sociol. Rev. 1975, 18, 122–136. [Google Scholar] [CrossRef]

| Sustainable Banking Approaches | Description |

|---|---|

| Approach 1 | CSR needs to be considered as the path to sustainable banking. |

| Approach 2 | Banks should take effective initiatives that will directly contribute to decreasing the environmentally harmful effects, lessening carbon emissions and climate protection. |

| Approach 3 | Banks need to offer products and services through a value proposition that ensures sustainable development. |

| Scope | Operational Definition |

|---|---|

| Sustainable banking | Banking operations considering the internal and external environmental and social sustainability as conscious members of the society may be termed sustainable banking [25]. |

| Green banking | The banking activities that make the planet more liveable by preventing environmental deterioration through effective banking initiatives can be denoted as green banking [25]. |

| Ethical banking | Ethical banking is the banking operation to achieve economic benefits by ensuring social goals relevant to socio-economic systems and exemplary life of people [27]. |

| Scope | Operational Definition |

|---|---|

| Corporate social responsibility | Corporate social responsibility (CSR) is the management-related concept through which companies integrate environmental and social issues in the operation of business and connection with the stakeholders [28,29]. |

| Corporate social performance | Corporate social performance is the principles and outcomes of businesses’ voluntary actions for building a relationship with the people, community and planet, including a social obligation, responsibilities and responsiveness [30]. |

| Social responsibility | The obligations of the business to formulate policies to follow the guidelines of practices required for the wellbeing of society are termed social responsibility [31]. |

| Source | Theory | Objective |

|---|---|---|

| [33] | Risk management theory | To analyze the effect of CSR practices on bank risk and determinants of risk-reducing CSR to implement sustainable banking. |

| [51] | Legitimacy theory | To investigate the relationship between CSR practices and the sustainable financial performance of banks. |

| [10] | Slack resources theory | To assess the impact of the green performance of banks on financial performance and the influence of political factors. |

| [24] | Theory of self-congruity | To propose the application of Islamic principles to build emotional involvement with Muslim consumers with green banking practices and adoption. |

| [38] | Stakeholder theory | To examine how the banks can empower women through their CSR practices. |

| [48] | Legitimacy theory | To compare the environmental motives and environmental performance of Islamic and conventional banks. |

| [2] | Organizational change theory | To explore the rationales and motivational factors that lead the banks to become sustainable banks from conventional banks. |

| [39] | Mercantilist theory | To examine how does China Development Bank determine the social and environmental policies independently from the government. |

| [45] | Economic theory | To explore the challenges and opportunities connected with green banking. |

| [27] | Economic theory and sociological theory | To examine the social context of banking based on the different aspects of CSR. |

| [40] | Social welfare theory and stakeholder theory | To examine the actual CSR practices and the communicated CSR information of banks. |

| [46] | Institutional theory and legitimacy theory | To investigate the impact of CSR guidelines, social performance and Global Reporting Initiative (GRI) guidelines on banks’ quality of sustainable reporting (QSR). |

| [7] | Risk society theory | To explore how to manage reputational risk and build social trust through sustainable banking. |

| [47] | Institutional theory | To investigate the impact of regulator guidance on green banking disclosure of banks. |

| [36] | Agency theory, stakeholder theory and resource dependence theory | To investigate the impact of corporate governance on sustainable banking from the perspective of CSR. |

| [18] | Stakeholder theory | To investigate the impact of green banking and CSR disclosure on the sustainable performance of banks. |

| [41] | Institutional theory | To investigate the CSR approaches used by the banks and how CSR can improve the level of sustainable banking initiatives through education and financial inclusion. |

| Source | Key Dimensions | Major Findings |

|---|---|---|

| [33] | Environmental activity, social activity, governance activity, social risk, environmental risk and sustainability risk | CSR reduces the banks’ sustainability risks. |

| [13] | Green CSR, green products and green trust | Green banking initiatives in the form of green products and green CSR play a positive role to restore the green trust of the banks’ customers. |

| [51] | CSR disclosure and environmental disclosure index (EDI) | A limited number of banks in Serbia concentrate on the efficient use of water, energy and paper, but the sustainability practices among the banks are increasing. |

| [37] | Value-based banking, sustainable and responsible investment banking, Islamic principles of CSR, social impact performance | Banks are supposed to consider ethical and social investment and community development as the foremost objectives in Islamic banking. |

| [10] | CSR regulatory setting and green banking disclosure | CSR and Green banking are the catalysts for the transition to an economy of low carbon by imposing some rules in financing businesses. |

| [24] | Islamic CSR, Environmental social governance and Islamic principles of CSR | The ideology of Muslim green consumers is fostered by the congruence of green banking and Islamic principles connected with Islamic CSR. |

| [49] | Equator principles, sustainability principles and CSR guidelines, | Different organizations like UNEP FI, UNGC, IFC, GRI, and ISO promote the sustainability guidelines and implementation of sustainable banking through social and environmental initiatives by banks and financial institutions. |

| [38] | Female empowerment, women’s participation in financial activities (financial inclusion) | Female empowerment in the form of participation in healthcare, financial, social and career-related activities ensure sustainable banking. |

| [17] | Ethical financial products, charity financial products and socially responsible investments, ethical bank | A good breeding ground exists for ethical banking to establish sustainability in financial sectors. |

| [48] | Environmental motives, environmental codes and green compliance index, green banking | Green compliance ensures the banks’ accountability, profitability and reputation. |

| [42] | People’s social aspirations and people’s environmental aspirations | A socially responsible bank is concerned with shareholders, employees, suppliers, customers, society and the environment. Meeting the stakeholders’ expectations is a sustainable bank’s primary objective. |

| [12] | Environmental sustainability and environmental risk management | Banks get greater legitimacy and acceptance through CSR practices. |

| [43] | Islamic CSR, social justice, social accountability, moral filtering, social trust | Communication of Islamic CSR activities enhances the image of the banks about sustainability. |

| [50] | Internal CSR, customer relationship management, environment-friendly management and financial stability | Environment-friendly management and CSR are critical factors for sustainable banking performance. |

| [2] | Defensive banking, preventive banking, offensive banking and sustainable banking motivation | CSR inarguably is a strategic tool to enhance the image of a bank as a socially responsible bank. |

| [39] | Equator principles, environmental impact assessment (EIA), sustainable environment, sustainable society and green credit | Chinese Development Bank is active in implementing the strategy to establish sustainable banking through sustainable development of the economy, environment and society by following the rules of the regulatory authority of China. |

| [44] | Social progress, environmental protection, sensible use of natural resources, employment stability, Islamic moral economy and social banking | Islamic banks should focus on CSR activities that fulfill social needs and sustainable development rather than just taking tax benefits from the government. |

| [45] | Environmental parameters, homogeneous environment and product ecology | The major challenges of green banking are establishing environmental parameters, a homogeneous environment and policy formulation. |

| [34] | CSR as ethical capital and CSR competition | Companies can switch from price competition to CSR competition through social and consumer welfare to leverage the maximum benefit. |

| [27] | Social aspects of banks and moral attitude of bankers | CSR as an ethical self-regulatory tool is effective in the banking sector. Banks’ profit is compatible if the social value is added to banks’ activities. |

| [40] | CSR as a real accounting and green-washing | Conventional banks concentrate on profit maximization, whereas ethical banks focus mainly on human, society and the environment. |

| [46] | Humanitarian relief, disaster relief, health, education, environment, CSR reporting | There is a substantial impact of CSR guidelines, social performance and Global Reporting Initiative (GRI) guidelines on the quality of sustainable reporting (QSR) of banks. |

| [7] | Recycling, waste reduction and climate change response | Internal sustainability initiatives of bank employees can cope with the climate change risk and manage the bank’s reputation effectively. |

| [35] | Employee-friendly management, environment-friendly management and respect for the community | Socially responsible entrepreneurs are motivated to deal with ethical banks’ ethical and responsible projects. |

| [47] | Needs-based CSR | Issuance of regulatory guidance for green initiatives and CSR practices by the central bank positively impacts green banking practices and disclosures of scheduled banks. |

| [36] | Environment, health, social safety and community involvement | Corporate governance and CSR practices improve sustainable banking performance. |

| [18] | Social impact on environmental degradation | Green banking activities and disclosure positively impact banks’ value to the stakeholders. |

| [41] | Education, financial inclusion, poverty alleviation and pollution control | CSR of banks has a role in alleviating poverty, improving education, social wellbeing and mutual prosperity of society and banks. |

| [23] | Inequality reduction and sustainable development goal 10 (SDG 10) | Sustainable banking reduces income inequality and fosters SDG 10. |

| [6] | Financial inclusion, energy efficiency, environmental management and green products | As sustainable banking practices, some banks focus more on addressing social issues like financial inclusions rather than on environmental issues like energy efficiency, environmental management and green products. |

| Topics | Major Findings |

|---|---|

| Publication trends | The result showed that the publications of CSR and sustainable banking related studies increased rapidly after declaration of the Paris agreement and sustainable development goals in 2015 and 2016, respectively. |

| Country and regional contexts of publications | Researchers focused more on the contexts of European and Asian countries in CSR and sustainable banking related studies. In Asia, majority researchers investigated CSR and sustainable banking based on the contexts of India and Bangladesh. |

| Theories in CSR and sustainable banking | The study revealed 14 theories from the sample studies on CSR and sustainable banking. Majority researchers used stakeholder, institutional and legitimacy theories. There is great opportunity of applying risk management and organizational change theories in sustainable banking related studies. |

| CSR dimensions in sustainable banking | The study identified 28 CSR dimensions connected with sustainable banking analyzing 30 articles. Among those dimensions, 10 address social issues, 10 environmental and 8 both social and environmental issues. Researchers need to focus more on CSR dimensions that address both social and environmental issues like SDGs. |

| Theory | CSR Dimensions | |

|---|---|---|

| Primary theory | Stakeholder theory | Health, education, poverty alleviation, the standard of living. Female empowerment, employment, greenwashing, CSR disclosure, financial inclusion, CSR disclosure, Sustainable development goals (SDGs), peoples’ aspirations for society and environment, accountability, safety. |

| Institutional theory | Ecological funds, environmental motives of banks, environmental conservation, green compliance index and accountability. | |

| Legitimacy theory | CSR disclosure, environmental conservation, green compliance index, preventive banking for the environment and accountability. | |

| Secondary theory | Risk management theory | Social and environmental risk management, social and environmental sustainability, sustainability and safety. |

| Slack resources theory | CSR disclosure, regulatory CSR for the environment and sensible use of natural resources. | |

| Theory of self-congruity | Environmental conservation, environmental awareness, environmental motives and Islamic CSR. | |

| Organizational change theory | Defensive and preventive banking for the environment, socially responsible investment (SRI), value-based banking. | |

| Mercantilist theory | Sustainable environment and society. | |

| Economic theory | Environmental parameters, homogeneous environment, product ecology and competitive CSR. | |

| Sociological theory | CSR as ethical capital, moral filtering, Islamic CSR, Ethical capital, ethical financial products and value-based banking. | |

| Social welfare theory | Green-washing, poverty alleviation, Islamic CSR, socially responsible investment (SRI) and charity financial product. | |

| Risk society theory | Defensive banking, preventive banking, homogeneous environment and product ecology. | |

| Agency theory | CSR disclosure, green compliance index, greenwashing, homogeneous environment and product ecology. | |

| Resource dependence theory | Sensible use of natural resources and competitive CSR. | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Siddique, M.N.-E.-A.; Nor, S.M.; Senik, Z.C.; Omar, N.A. Corporate Social Responsibility as the Pathway to Sustainable Banking: A Systematic Literature Review. Sustainability 2023, 15, 1807. https://doi.org/10.3390/su15031807

Siddique MN-E-A, Nor SM, Senik ZC, Omar NA. Corporate Social Responsibility as the Pathway to Sustainable Banking: A Systematic Literature Review. Sustainability. 2023; 15(3):1807. https://doi.org/10.3390/su15031807

Chicago/Turabian StyleSiddique, Md. Nur-E-Alam, Shifa Mohd Nor, Zizah Che Senik, and Nor Asiah Omar. 2023. "Corporate Social Responsibility as the Pathway to Sustainable Banking: A Systematic Literature Review" Sustainability 15, no. 3: 1807. https://doi.org/10.3390/su15031807

APA StyleSiddique, M. N.-E.-A., Nor, S. M., Senik, Z. C., & Omar, N. A. (2023). Corporate Social Responsibility as the Pathway to Sustainable Banking: A Systematic Literature Review. Sustainability, 15(3), 1807. https://doi.org/10.3390/su15031807