1. Introduction

The term “sustainability” is widely used in contemporary society. Sustainability has always played an important role in the evolution of human thought and has been associated with various issues of unquestionable interest. In the environmental and economic sciences, the term sustainability involves the condition of a development able to ensure the satisfaction of the needs of the present generation, without compromising the possibility of future generations realizing their own. At present, the issue of sustainability is important in various fields of research and applications, from environmental problems to business ones [

1].

Therefore, the reflections on sustainability are linked with those on the environment, society, and business management, often in the opposite way. In fact, companies are often accused of putting profit first by relegating the component of sustainability to the background. However, this bias does not typically correspond to reality, especially since, in today’s corporate realities, the values of profit and sustainability frequently go hand in hand [

2,

3,

4]. Companies should not be considered only as production systems, but also as operators who play a role in a social environment and interact continuously with it, creating knowledge, trust, and reputation. Successful companies increasingly seek to pursue so-called “business ethics”, combining the search for profit with the “values” of sustainability [

5]. The traditional paradigm of the company becomes reversed: The pursuit of sustainability is essential for the company’s economic success, which is perceived with greater credibility, reliability, and fairness. This is particularly important since the specific behaviors of managers and collaborators not only affect the performance of individuals, but also play a fundamental role in determining the achievement of good results by the company as a whole [

6,

7].

In this scenario, the literature and the recent financial and pandemic crises have emphasized how business ethics is closely linked to sustainability [

5,

8]. In particular, the role of corporate governance in the prevention of fraud was examined to allow corporate sustainability [

9]. Corporate governance is known as a set of rules, systems, processes, and practices that are applied to control and manage the operation of a company. Corporate governance identifies who has responsibility and who makes decisions, ensuring that companies have appropriate decision-making processes and controls, and that the interests of stakeholders are balanced. Corporate governance plays a leading role in management and has many tasks and responsibilities [

10]. Some responsibilities include evaluating the company’s performance, setting suitable management strategies, and monitoring and preventing fraud inside the organization. The recent literature has focused on the last aspect, exploring the linkages between corporate governance and corporate fraud [

11,

12,

13,

14,

15,

16,

17,

18,

19]. Fraudulent behavior is configured as a “negative” human behavior, as it refers to tricks or deceptions in order to mislead other people and thus obtain illicit advantages.

Sustainable corporate governance can be translated as a company’s commitment to a responsible business model, the aim of which is to ensure sustainable development that is strongly attentive to the health of the planet and to people’s social and economic well-being. Corporate fraud could hinder corporate sustainability goals. Ethical values and integrity could prevent fraud by promoting the achievement of companies’ sustainability objectives. To remove fraudulent behavior, rules of conduct, formal recommendations, or the implementation of business ethics programs are often not enough. In fact, corporate governance directives do not always have a positive effect on the ethical behavior of employees. This is due to the fact that the practical behavior—the good example—of governance seems, in many cases, to have a considerably more significant effect than the words spoken by executives or written in operational manuals [

20,

21]. In this sense, corporate ethics linked to governance has been analyzed in recent years through the so-called tone at the top. The tone at the top contemplates the ethical atmosphere created in the workplace by the actual behavior of corporate governance. Therefore, the relationship between tone at the top and corporate fraud has received significant attention in recent years. The top management has the responsibility to define the right “tone at the top” and demonstrate commitment with behavior and actions in order to build a better working world. Whatever the tone at the top model set by the management, it will inevitably have effects on the company’s employees and on the sustainability of corporate governance [

22,

23,

24,

25].

These linkages between corporate governance, sustainability, and fraud have been raised in the literature, but although there are some studies that have tried to address the topic, the research field requires further investigation. To the best of our knowledge, in fact, there does not yet seem to be a generally accepted theory that considers the aspects related to the sustainability of corporate governance connected to the tone at the top matters in fraud prevention. Therefore, this study aims to help fill this gap by providing a critical systematic literature review, based on studies that have considered the issue of sustainability with the characteristics of corporate governance and, in particular, with the aspects of tone at the top using text network analysis.

This paper contributes to the following three main streams of the literature: By reviewing the impact of corporate governance on sustainability and fraud prevention; by proposing the concept of tone at the top as one of the main drivers of corporate governance sustainability; by exploring what has been conducted to date by scholars and what issues still need to be investigated through a text network analysis approach. We contribute to the corporate governance field from both theoretical and practical perspectives by offering a systematic analysis on the elements that corporate governance must have to be sustainable and avoid fraud. A comprehensive overview of sustainable corporate governance is needed to find the best practices of corporate governance for fraud prevention and to explore future research topics in this field.

In this framework, the tone at the top linked to the ethical behavior of top management could play a crucial role. The identification of the main contributions on the topic of “sustainability, corporate governance and corporate fraud”, in a broad sense, represents a first step in the critical evaluation of the literature that has studied these topics in depth. In this regard, a search was conducted with reference to the Scopus database using a text network analysis. Therefore, the main purpose of this study is to systemically analyze, through text network analysis, research trends in sustainable corporate governance, identifying the so-called tone at the top as a crucial element to avoid fraud. Indeed, as the nature of fraud becomes progressively more complex, especially with the COVID-19 pandemic, it is now more important than ever that businesses develop robust fraud prevention programs.

The remainder of this paper is organized as follows:

Section 2 specifically presents the theoretical background.

Section 3 describes the research design and methods adopted to conduct the bibliographic research.

Section 4 discusses the results. Finally,

Section 5 presents the conclusions, limitations, and future research directions.

2. Literature Review

Corporate governance plays a crucial role in preventing fraud and maintaining company stability. Theoretical and empirical studies have recently explored how corporate governance behaviors affect corporate fraud [

18,

26,

27,

28,

29,

30,

31,

32,

33]. Fraud can be identified as a conduct aimed at abusing the trust of others by deviating from the general principle of good faith, but also simply as a human behavior aimed at causing damage to third parties and evading the legal rules of the legal system. Corporate fraud can also be defined as a deliberate falsification of a company’s financial report or the non-financial disclosure and business activities of management, employees, or third parties with the intention to misrepresent the public and obtain gains over others [

32,

34].

Previous findings stressed that poor corporate governance would increase the frequency of fraud in a company. Several studies have shown that this is particularly important for companies in the banking sector. In particular, bank frauds have more significant costs since a bank has a “special” role in the economic system, helping other firms and facilitating better governance through effective resource allocation [

19,

33,

35,

36]. Therefore, policymakers and regulators around the world have made a great effort to prevent fraud. However, this is insufficient to avoid major corporate fraud, which is due to the fact that the practical behavior—the good example—of governance seems, in many cases, to have a considerably more significant effect than the formal rules and good words spoken by executives or written in ethical operational manuals. In this sense, corporate ethics linked to governance has been analyzed in recent years through the so-called tone at the top. The tone at the top contemplates the ethical atmosphere created in the workplace by the actual behavior of corporate governance [

20,

21].

Therefore, understanding the corporate fraud phenomenon is crucial for analyzing the motivating factors to commit corporate fraud, in order to implement preventive measures. The fraud triangle theory by Donald Cressey [

37] explains that fraud is typically carried out for specific reasons, which can be shaped by a wide range of situations. Donald R. Cressey’s theory, still valid today in some revised versions [

38,

39], allows us to explain the reasons that typically lie at the basis of a fraud. Cressey’s theory considers that, generally, every fraud appears to be characterized by at least three fundamental elements: Pressure, opportunity, and rationalization.

Rationalization is deeply connected to the ethical climate and corporate sustainability. Rationalization presents the justification used by the individual who commits the fraud. This is not only a mere ex post justification with respect to the event, but it also represents the founding element of the generation of the fraudulent act. In fact, the individual needs a reason, such as to make the fraud acceptable to themself, before committing the fraudulent action. If the individual does not find a reason that makes it acceptable, they will unlikely undertake the fraudulent action [

40]. Typically, the subject tends to minimize the fraudulent event to consider it tolerable with respect to its principles of honesty and fairness. There are different types of rationalization, which tend to transform the illegal act into a less noteworthy action. For example, there is a tendency to consider the dishonest act as compensation for the injustices suffered, to minimize the extent of the fraud by making generalizations with respect to a similar behavior carried out by other employees of the company: “In the company there are major crimes, everyone does in the same way, it is the only way to obtain a certain thing” [

41,

42].

In this sense, the rationalization of fraud is closely linked to tone at the top. Tone at the top contemplates the ethical atmosphere created in the workplace by the behavior of corporate governance. Given that it is a determining factor in the probability of engaging in fraudulent behaviors, and considering that rationalization depends significantly on the corporate ethical climate, it can be considered that tone at the top plays a primary role in reducing the risk of fraud and illegal behavior [

20,

22,

43]. Fraud perpetrated by management or employees is a problem that threatens the long-term success of any company and its sustainability. Fraud can occur due to misappropriation of resources and financial fraud. In both cases, it cheats the owners and the public of the necessary financial information that is reliable and essential for effective decision making. Fraud is difficult to uncover often since scammers know the system inside and out and its vulnerabilities. The directives and behaviors of the managers influence the ethical principles that the company intends to pursue and the actions performed by the employees. In this framework, the tone at the top—the practical behavior (the good example)—of top management can play a very important role in corporate governance sustainability [

44,

45,

46].

The original discussion regarding tone at the top dates to the financial report of the National Commission on Fraudulent Financial Reporting (The Treadway Commission) in 1987. The Commission identifies tone at the top as one of the key elements that “contributes to the integrity of the financial reporting process” and as essential in “preventing fraudulent financial reporting”. Throughout the years, the relationship between tone at the top and fraud has been emphasized by other authorities. The Association of Certified Fraud Examiners asserts that when top management is not focused on ethics, the employees are more inclined to commit fraud since they feel that ethics is not a priority [

47]. The Institute of Internal Auditors also states that tone at the top may lead to fraud when employees are afraid to be reproached or fired [

48]. The literature provides some evidence on the relationship between tone at the top and fraud in corporations. Law [

49], analyzing survey responses and carrying out semi-structured interviews of Hong Kong CFOs, found that an ethical and moral tone at the top is among the most important factors associated with the absence of fraud, along with the audit committee effectiveness, internal audit effectiveness, and ethical guidelines and policies. D’Aquila [

50] analyzed the relationship between the control environment and financial report decision-making. Through a survey of certified public accountants, the author found that tone at the top—which encourages ethical decisions—is of predominant importance to reliable financial reporting. Albrecht et al. [

12] stress that, to prevent fraud, the top management should set an ethical tone at the top. Abri et al. [

14] studied how corporate governance impacts financial statement fraud. Their study surveyed employees, senior managers, and intern-related parties of companies in Tanzania. They found that several variables, including tone at the top, policies and ethical guidance, and the corporate culture have a direct impact on financial statement fraud. Soltani [

11] studied six American and European corporate scandals to analyze the major causes of financial corporate fraud. The author found both differences (as internal and context differences) and similarities. Among the latter, he found a lack of ethical tone at the top policy within the corporation, ineffective boards, inefficient corporate governance and internal control, accounting irregularities, failure of external auditors, dominant CEOs, greed, and a desire for power. Suh and Shim [

51] analyzed the relationship between the diverse element of ethical culture and the anti-fraud strategy in small and medium-sized depositary financial institutions in South Korea. The authors found that when the employees consider the level of tone at the top, the workplace integrity, and the ethics training elevated—which are the core elements of ethical corporate culture—they are likely to positively evaluate the anti-fraud strategy of the company. Moreover, their study revealed that when employees highly assess the tone at the top and the ethics training, they are inclined to positively regard the company’s whistleblowing policy—that is, the disclosure by members of the organization of illegal practices.

Rose et al. [

52] studied how tone at the top impacts the decision of financial executives to misreport income. The findings showed that the willingness to misreport income is greater when the tone at the top is positive, compared to when the tone at the top is negative. However, the authors also analyzed the impact of tone at the top on external auditors’ perception of the probability of misreporting income by financial executives, under different tones. They found that auditors increase the fraud risk assessment when the tone is negative, which is in contradiction to the previous finding. Their study demonstrates the uncertain relationship between tone at the top and the auditors’ fraud risk assessment. Auditors are most often required to assess the tone at the top [

53]; the American Institute of Certified Public Accountants identifies aggressive tone at the top by management as a key factor for risk fraud. Wang and Fargher [

54] confirm the last theory. The authors studied the effect of the quality of tone at the top on the fraud risk assessment by internal auditors. They found that the fraud risk assessment by internal auditors is higher when the tone at the top is poor, compared to when the tone at the top is good. This suggests that poor tone at the top is considered a signal of potential fraud by internal auditors. Schmidt [

55] studied the importance of auditors’ mental representation of the tone of the top. The author shows that a positive mental representation has a favorable influence on audit judgment on the control environment and fraud risk assessment. However, Julian et al. [

56] did not confirm the previous findings. The authors analyzed the effect of tone at the top on fraud risk assessment, surveying mature internal auditors in Indonesia, and did not find a significant relationship between tone at the top and fraud risk judgment. This suggests that the link between tone at the top and fraud risk assessment is not always straightforward.

The tone set by the governance and its relationship with fraud is relevant to every organization. Klaus [

57] interviewed 29 professionals who have worked in military hospitals in Brazil to assess the potential fraud and corruption that may derive from a weak tone at the top. The author discovered that a weak tone at the top may have permitted several violations to take place, including financial disclosure violations and fraud, bribery, falsification and misrepresentation of financial records, abuse of position, stealing, theft, or related fraud. Harris et al. [

58] studied the relationship between governance and asset diversion in public charities. Asset diversion is a type of fraud corresponding to asset misappropriation. They found that an ethical tone at the top is negatively related to the probability of asset diversion.

3. Research Design and Methods

This section defines the research protocol and criteria to develop our systematic analysis. The search for contributions was carried out through the Scopus database, which represents one of the main tools for bibliographic research in the international scene. It was chosen to consider contributions in all scientific disciplines, and in order to perform useful comparisons and intercept any points of contact between different scientific disciplines. Scopus is regularly used in research trend analysis, since it is the major abstract and citation database in the field of management and social science, and offers complete functions to synthesize bibliometric data [

17]. The research was limited only to scientific articles, excluding conference proceedings or other contributions that have not yet received formal scientific recognition or a refereeing process. No restrictions were placed on the period of time from 1990 to 2021. The research protocol was based on “Article title, Abstract, Keywords”, adopting the Boolean operator (AND) for connection. We analyze keyword in quotation marks to consider the multi-word units as the single keyword. Moreover, we count the keyword if this belongs to a multi-word unit. The research methodology adopted was a systematic literature review by searching for parameters and filters, as described in

Table 1.

Network analysis represents a useful tool for analyzing the linkages between corporate governance and fraud [

59,

60,

61]. A network is composed of a series of nodes that quantify the existence of relationships and describe the different types of connections between the units. In its basic form, a network is a set of points linked together in pairs of lines. These points are so-called vertices or nodes, and the lines are called links or arcs. The literature on the subject has shown how grouping models within networks is associated with a very wide range of analyses. This often allows for the derivation of new interpretations of the available data. A growing number of studies have begun to apply networks to represent the relationships between words [

62,

63,

64]. For example, it is possible to represent a corpus of documents in the form of a network in which each node represents a document. The strength of the links between the nodes represents the similarities between the words used in the documents considered. Furthermore, it is possible to create a textual network in which the single words represent the nodes and the links between them describe the regularity with which these words appear in different documents. In text network analysis, the notions of occurrences and co-occurrences are crucial. Occurrences are quantities resulting from counting the number of times (frequencies) in which a lexical unit (LU) occurs within the textual corpus or a context unit. Co-occurrences are quantities resulting from counting the number of times in which two or more lexical units are simultaneously present within the same elementary contexts. In co-occurrence analysis, the so-called relatedness of items (the relationships between the objects of study) is determined based on the number of documents in which the items (the objects—the keywords) appear together [

17,

65]. The graphical representation of the co-occurrence networks allows the analyzed words to be visualized and inferences on their relationships to be drawn.

To identify the main links between corporate governance and fraud that have been most investigated by the literature, a keyword-based network analysis was conducted. The analysis was developed with VOSviewer software [

66,

67]. This software is a suitable and reliable tool for building and visualizing networks and clusters derived from bibliometric analysis. Networks elaborated on the basis of the keywords of the contributions considered in this work are presented below. The method chosen to proceed with the analysis is the so-called “complete counting method”, which gives the same weight to each co-occurrence link between the keywords without the use of fractional units.

4. Results

The Scopus database tracked 492 contributions for the search criterion CGF (Corporate Governance and Fraud), 21 contributions for the search criterion SCGF (Sustainable Corporate Governance and Fraud), and 22 contributions for the search criterion TATTF (Tone at the Top and Fraud).

Figure 1 shows the evolution of the number of contributions on the three approaches, showing an increasing trend over time with a notable increase since the beginning of the 2000s for the criterion “Corporate Governance and Fraud”. The bibliometric analysis of the data tracks the evolution of the topics over time, offers a network map of the main keywords adopting the VOSviewer software, and classifies the countries of publication and representation by subject.

Since 2000, contributions on the subject have been increasingly present in the business-economic debate. Regarding the journals that have published the largest number of contributions on the subject, the Journal of Financial Crime and Journal of Business Ethics are certainly noteworthy. These journals have collected over fifty scientific articles on the subject with the publication of case studies, empirical analyses, and analytical models.

The bibliometric analysis indicated that the topic of corporate governance related to fraud has been evolving in recent decades. However, the consideration of “sustainable development” in the field of corporate governance related to fraud represents a recent body of literature. Studies on sustainable corporate governance and tone at the top related to fraud start in the recent period 2011–2021. The trend shows that studies in this field are increasing, and that the evolution of research on sustainable corporate governance is extremely relevant to preventing corporate fraud.

The growing interest in the topic is also evidenced by the analysis of the number of article citations. Citation analysis uses citations from scientific productions to establish connections to other scientific works. The number of citations of the identified articles has significantly increased in the last 10 years, from a total of 392 in 2010 to a total of 1767 in 2021. In recent years, studies on the sustainability of corporate governance have begun to receive citations, testifying to the growing interest in the matter.

Figure 2 shows the citation trend on a logarithmic scale.

Figure 3 highlights the number of authors of scientific contributions in relation to the nationality of the university of origin, considering the top 12 countries. It is important to note how the Anglo-Saxon countries and China take a primary position. In particular, in the United States, studies on “Corporate Governance and Fraud” have very high relevance. Therefore, the country with the highest percentage of articles in relation to the portfolio is the United States at 28.9% (n = 142), followed by China with a representation of 12% (n = 59), and the United Kingdom with 8.10% (n = 40). Fourth and fifth in the ranking are Malaysia and India, each with a percentage of 6.40% (n = 31), with the other countries contributing a lower percentage of authors conducting research on the topic.

However, it is necessary to take into account the different sizes of the countries and the number of universities.

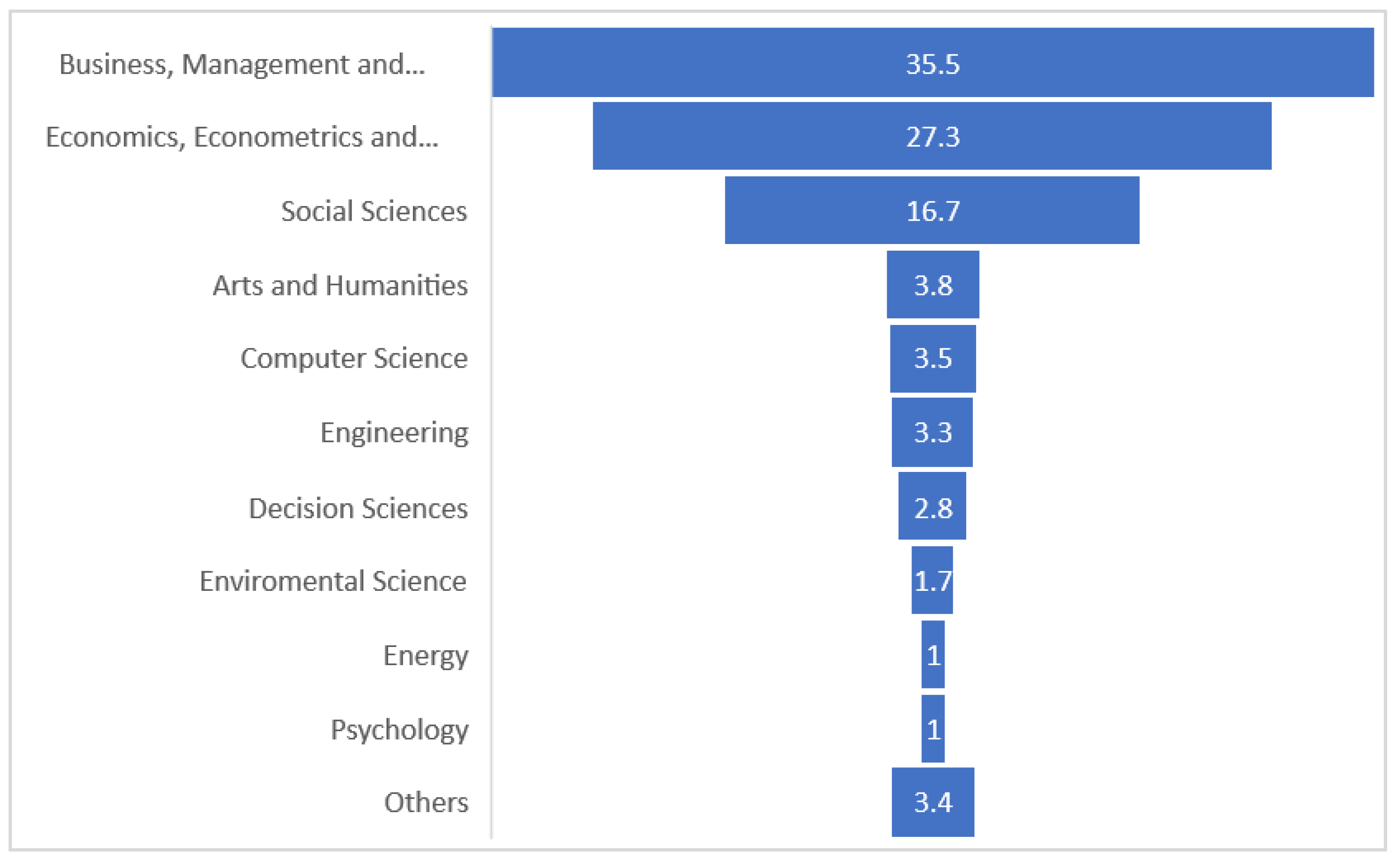

The topic addressed is rather transversal and involves various scientific disciplines. However, as can be seen in

Figure 4, the predominant area is linked to the economy, which, overall, represents 62.8% of the total contributions in the sample considered. Within the economic area, contributions related to the topic “Business, Management and Accounting” represent the majority, with 35.5% of the total. Even in the study of social sciences, the topics considered play an important role, and the contributions account for 16.7%. The contributions regarding the human sciences “Arts and Humanities” account for 3.8%, while there are disparate contributions involving different topics, which together account for only over 16% of the total contributions on the topic.

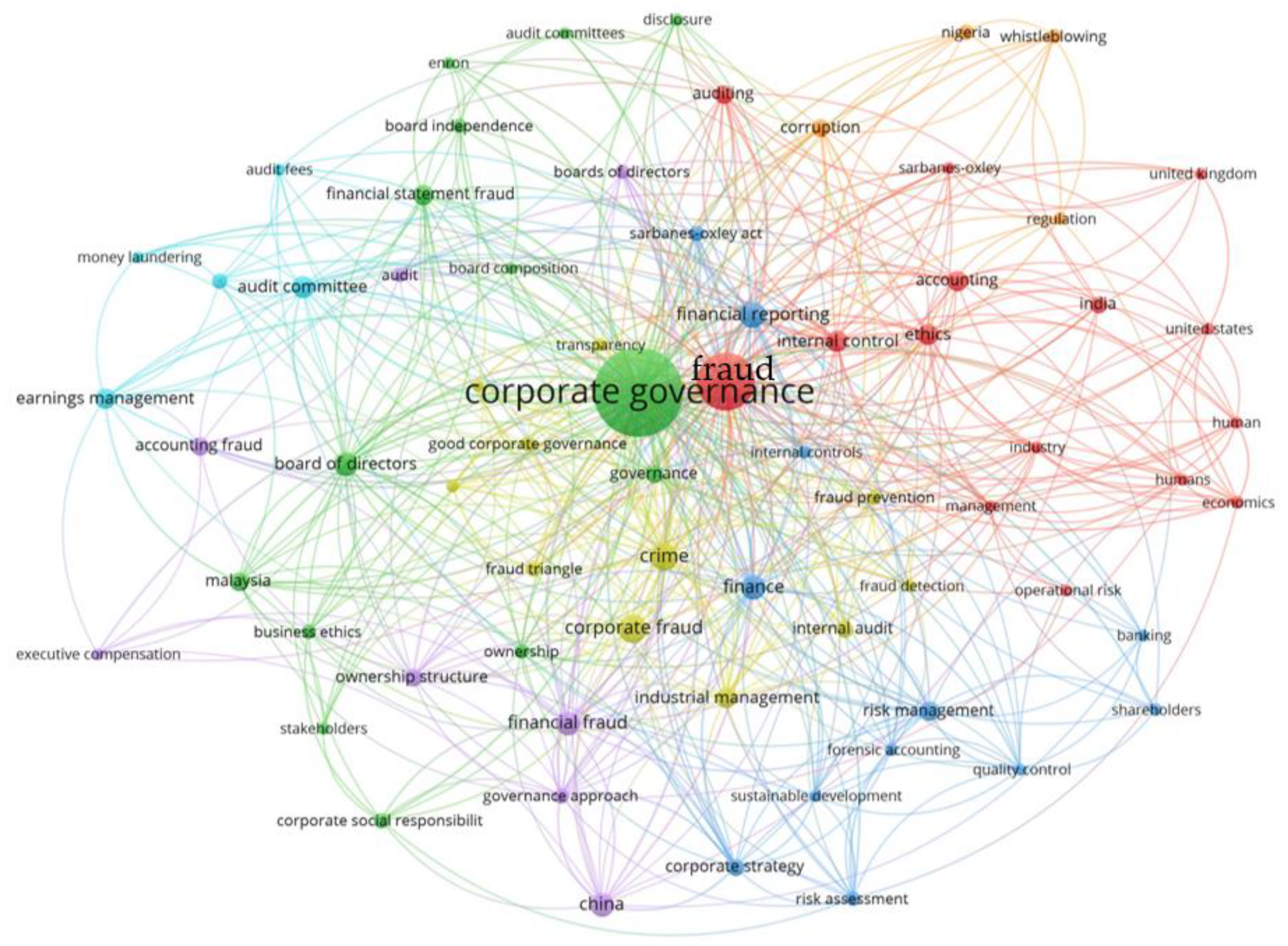

Figure 5 shows how the topics of corporate governance and fraud are at the center of the network, which are the main aspects of management with corporate governance interfaces. The nodes of

Figure 5 are represented by the most recurring keywords found in the contributions considered. The first area of interactions certainly concerns fraud, with particular attention to internal controls and ethics. In this direction, an important role is certainly the sustainable development closely linked to ethical issues and corporate social responsibility. Other important topics are financial statement fraud, but also aspects related to strategic management and risk management.

Table 2 identifies the most relevant keywords within the 492 contributions analyzed through the analysis of co-occurrences. The network analysis allows for a comparison of the importance of individual nodes. A unit of measurement of considerable interest is represented by the so-called “centrality” or “total link strength”. The concept of the centrality of a node, in fact, concerns the importance of the role that node plays within the network. However, the term “importance” can have a large number of meanings, and, from this observation, various measures of centrality can be defined in network analysis. Among these, certainly a prominent function corresponds to the number of connections of a node; namely, the greater the number of connections of a node, the more important that node is.

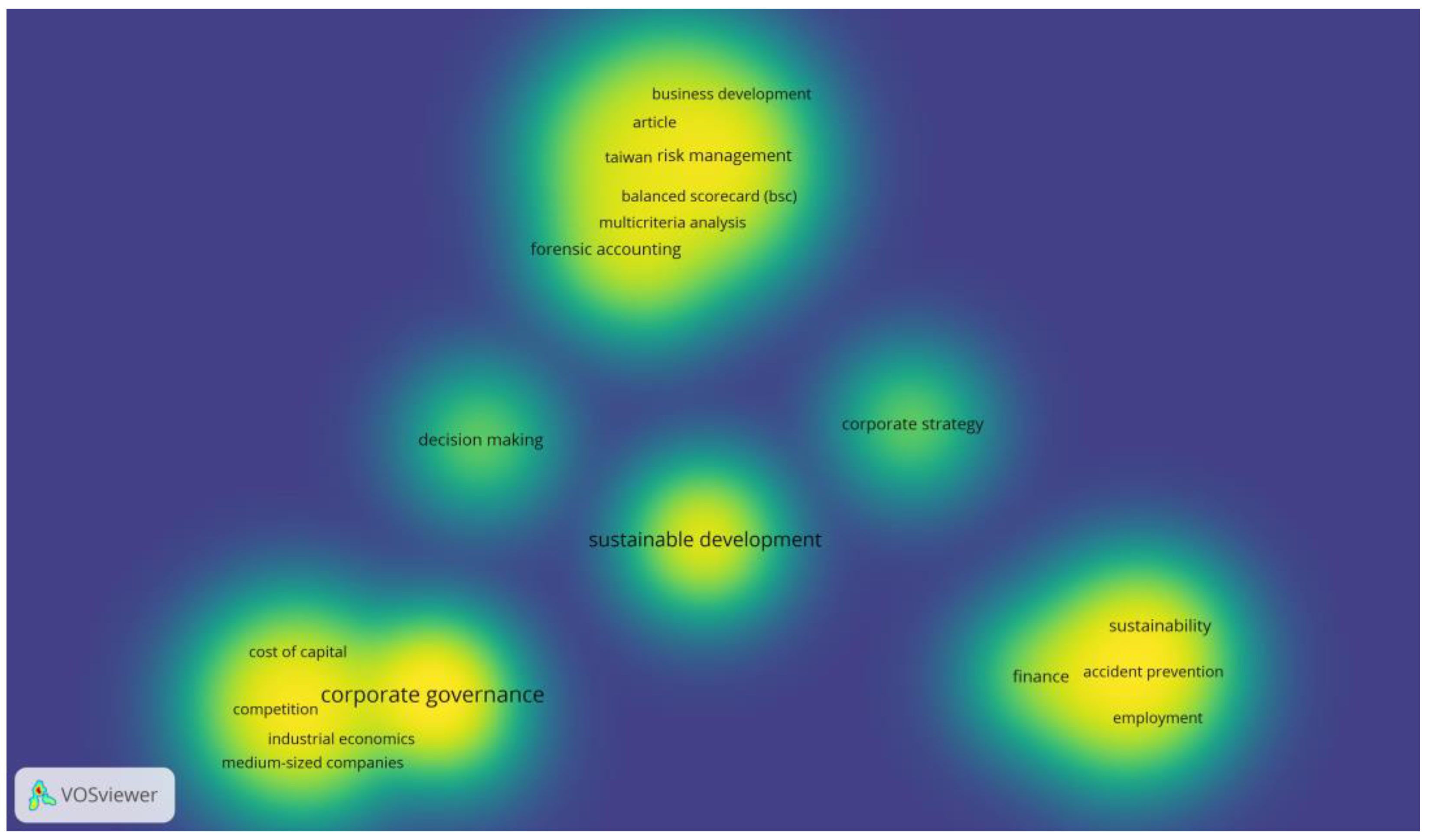

The network density analysis identified the clusters of groups of keywords that contribute most frequently to the subject researched, highlighting the connections among the topics. In the network density analysis in

Figure 6, “the larger the number of items in the neighborhood of a point and the higher the weights of the neighboring items, the closer the color of the point is to yellow. The other way around, the smaller the number of items in the neighborhood of a point and the lower the weights of the neighboring items, the closer the color of the point is to blue” [

67]. It can be noted that the combination of sustainability development and corporate governance in fraud prevention does not have many connections demonstrated by the literature. Sustainability shows no links with other clusters in the network.

The “tone at the top” affects the autonomy of work and the organizational–professional territory. Each of these variables directly or indirectly affects job satisfaction. A “tone at the top” that emphasizes the effectiveness of the audit not only improves the quality of today’s audits, but also has a long-term effect on the culture of audit firms by improving job satisfaction [

68,

69,

70]. “Tone at the top” perceptions and audit committee quality are positively associated with earnings quality and sustainable corporate governance. There is a close relationship between good corporate governance and sustainability. Corporate governance could improve the public’s faith and confidence in corporate leaders. Sustainability takes into account a robust interest for the future. It is in a corporation’s best interest to manage social responsibility since this will guarantee sustainability [

71,

72,

73]. Corporate governance that promotes sustainability creates sustainable values and assists companies in realizing long-term benefits, including reducing risk, and attracting new investors and shareholders. Corporate sustainability improves the principles of good corporate governance. Therefore, companies will support their efforts with transparency and public disclosure. Transparency efforts will provide information regarding the relationship between corporate governance and greater sustainability. The more stakeholders are informed on the connection between corporate governance and sustainability, the stronger that relationship will be over time [

9,

74]. How does the relationship between corporate governance and sustainability play out in practice? Setting an appropriate tone at the top could be the key to supporting the link between corporate governance and sustainability. Indeed, as suggested by the recent literature discussed in

Section 2, the tone at the top appears to be strongly connected to fraud prevention and could represent a useful tool in the sustainability of corporate governance (

Figure 7).

5. Conclusions

In this paper, a systematic literature review was conducted to derive a framework regarding sustainable corporate governance to prevent fraud through the tone at the top perspective. Therefore, a text network analysis based on the Scopus database was performed. The main results show that the relationship between corporate governance sustainability and corporate fraud is very close. This confirms the growing interest in the topic, reinforcing earlier findings by Naciti et al. [

9], Kavadis and Thomsen [

73], and Nguyen [

33] regarding the factors that have led companies to increase their attention on sustainability practices and how the corporate governance literature that considers sustainability has developed.

In the relationship between corporate social sustainability and corporate fraud, the so-called tone at the top could play a crucial role. The recent literature investigates the utility of considering the tone at the top to prevent corporate fraud [

20,

22,

43], calling for thinking about it as an additional tool in the organization of corporate governance. Indeed, the directives of the executives influence the ethical principles that the company intends to pursue and the actions performed by the employees. However, directives and what is said by corporate governance members do not always have a positive impact on the ethical behavior of employees. In fact, the practical behavior—the good example—of governance seems to have a considerably more significant effect than the words spoken by executives or recorded in written form in internal company operating manuals [

20,

21]. In this sense, corporate ethics linked to governance has been compared in recent years to the concept of tone at the top—the example must come from top management. If the tone set by governance supports ethics and integrity through good example, employees will be more inclined to follow these same values.

Conversely, if corporate governance does not follow any ethical principles but appears to be primarily focused on profits, employees will be more likely to commit fraud since they believe that ethical conduct is not a priority for the organization they work for, and corporate sustainability suffers. Employees do what they see their superiors do, they closely follow the actions of their bosses and follow suit. In light of this, organizations that are structurally similar in terms of size and organization often seem to have significant differences in terms of the number of frauds suffered. Studies have shown that, in organizations where, other things being equal, there are higher rates of fraud and other ethics and integrity issues, there is often a negative tone at the top, with senior executives who show a clear disregard for business ethics [

46,

52]. A negative tone makes employees reach out more often to evaluate the wrong decision and to take the less ethical and, generally, easier path. In this framework, the negative actions implemented appear easier to justify and rationalize since that type of behavior appears generalized within the organization. Conversely, a positive tone at the top promotes a virtuous culture that maximizes the likelihood that employees will choose to maintain high ethical integrity, with positive effects on corporate sustainability.

The content analysis in this paper allowed for the identification of the growing interest of the literature in the linkages among corporate governance, sustainability, and fraud. This paper adds insight into the potential role of tone at the top in mitigating corporate fraud behavior and, consequently, acting as a pivotal point to achieve sustainable corporate governance. From the contributions analyzed, several lines of study emerge in the relationship between the ethics and “tone” of corporate governance. In fact, this combination appears to be of fundamental importance for supporting corporate sustainability in the fraud prevention and anti-fraud behaviors implemented by employees. Furthermore, the role of tone at the top in corporate governance seems to play a potential leading role in the correct preparation of accounting procedures, and in the reliability of financial statements and financial reports. In addition, no less important is the positive influence that a high tone at the top can have on the processes of the correct preparation of accounting procedures, on the reliability of the financial statements, and on the auditing processes, with undoubted advantages in terms of efficiency, cost savings, and corporate sustainability. The results of this study are able to help managers of companies to effectively plan their corporate governance structure to face and prevent corporate fraud and thus strengthen the sustainability of current and future company activities. The main limitations of the study can be identified as the types of papers considered and the exclusion of contributions, such as book chapters, proceedings, and those not included in the Scopus database. Second, although we used a systematic method, there might be potential bias in the paper selection, with the risk of exclusion of important articles in the analysis. Finally, there is a lack of statistical tests to identify the strength of the linkages between the sustainability degree of corporate governance, fraud, and tone at the top. Nevertheless, this offers an opportunity and inspiration for future research using statistical analyses to verify the results proposed in the analysis and to plan strategic policies for the implementation of sustainable corporate governance. This exploratory bibliographic survey sets the basis for future empirical analysis on the relationship between tone at the top, sustainability, and fraud, even within specific company case studies.