Inter-Industry Transfer of Intermediate Virtual Water Scarcity Risk: The Case of China

Abstract

:1. Introduction

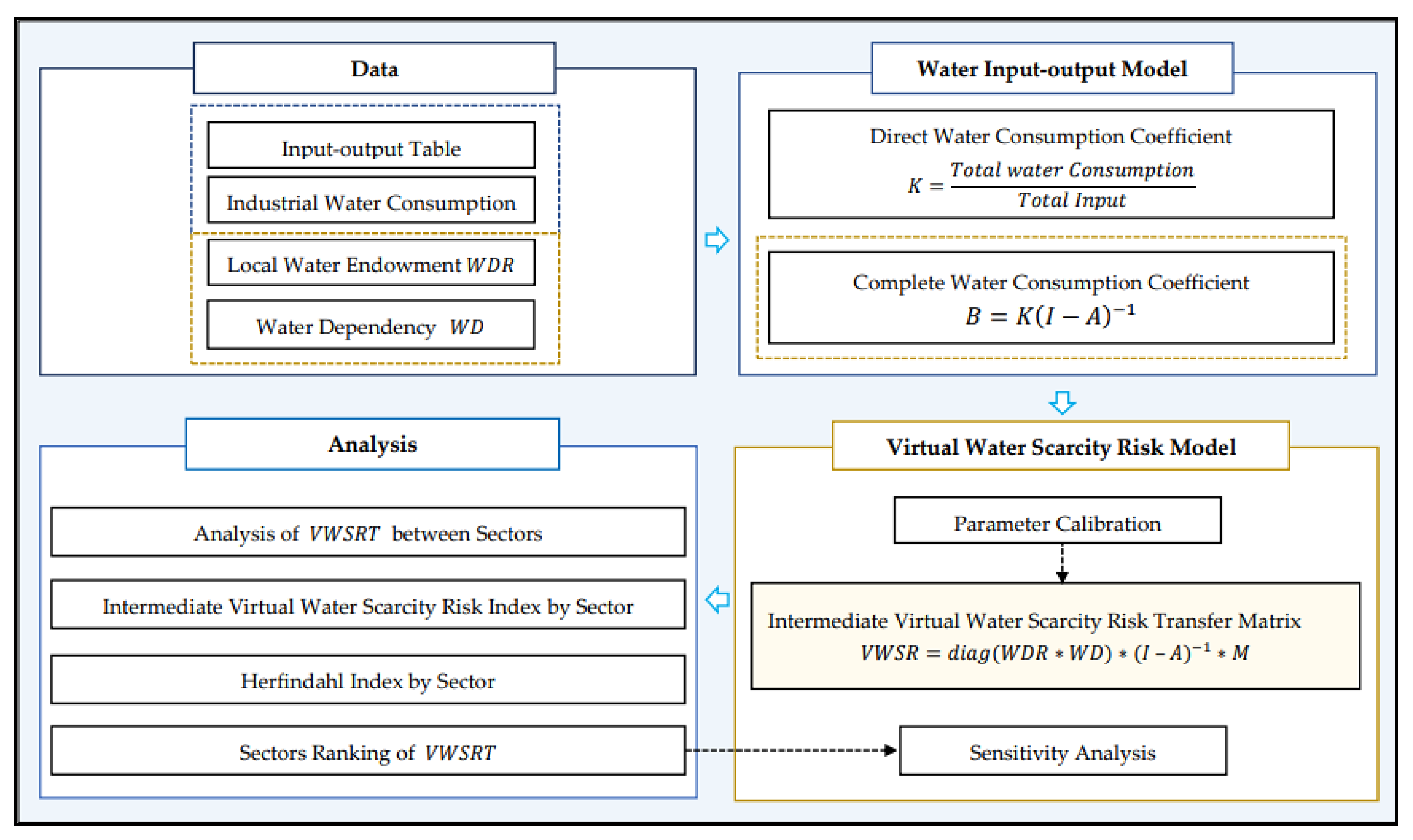

2. Methods and Data

2.1. Data

2.2. Industry Classification

2.3. Methods

2.3.1. Water Input–Output Model

- (i)

- Water-use Coefficient

- (ii)

- Calculation of Inter-sector Virtual Water Transfer

2.3.2. Virtual Water Scarcity Risk Model

- (i)

- Quantification of Water Scarcity Risk

- (ii)

- Virtual Water Scarcity Risk Transfer

- (iii)

- Intermediate Virtual Water Scarcity Risk Transfer Index

- (iv) Herfindahl Index

2.4. Flow Chart

3. Results

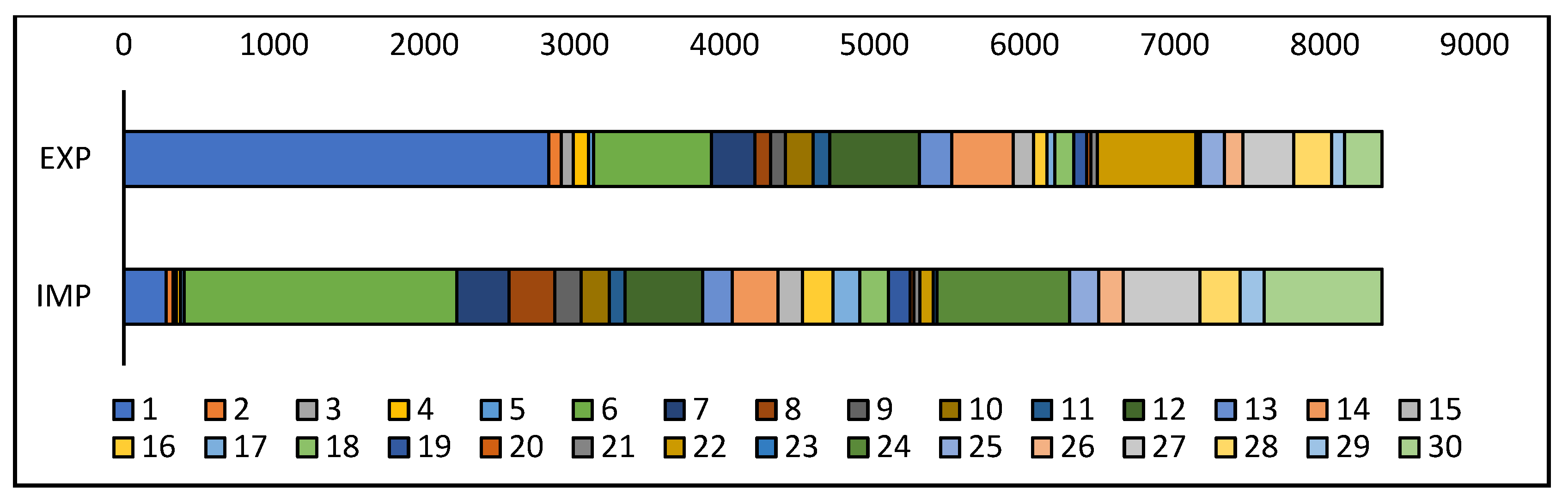

3.1. Virtual Water Trade of Sectors in China

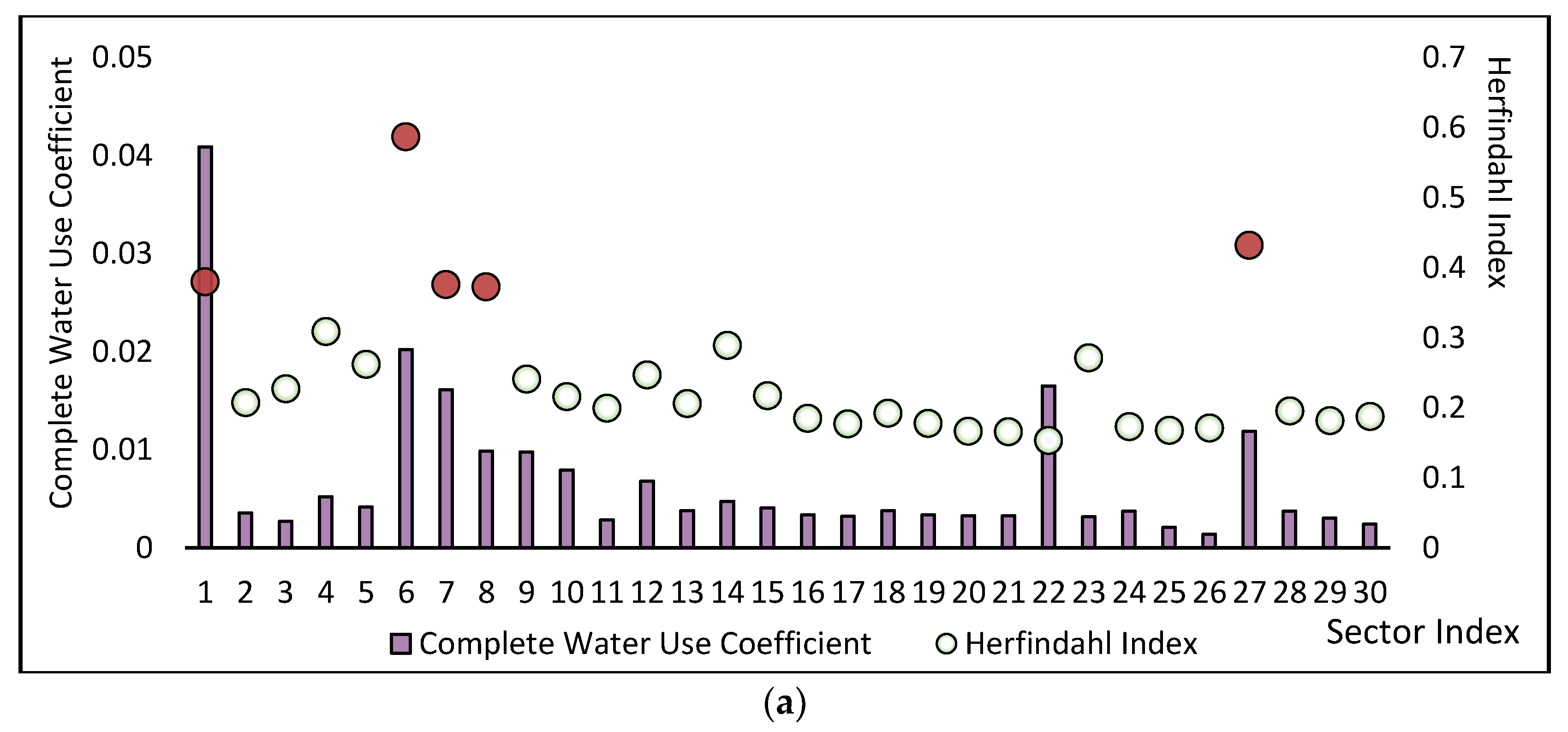

3.1.1. Water-use Coefficient

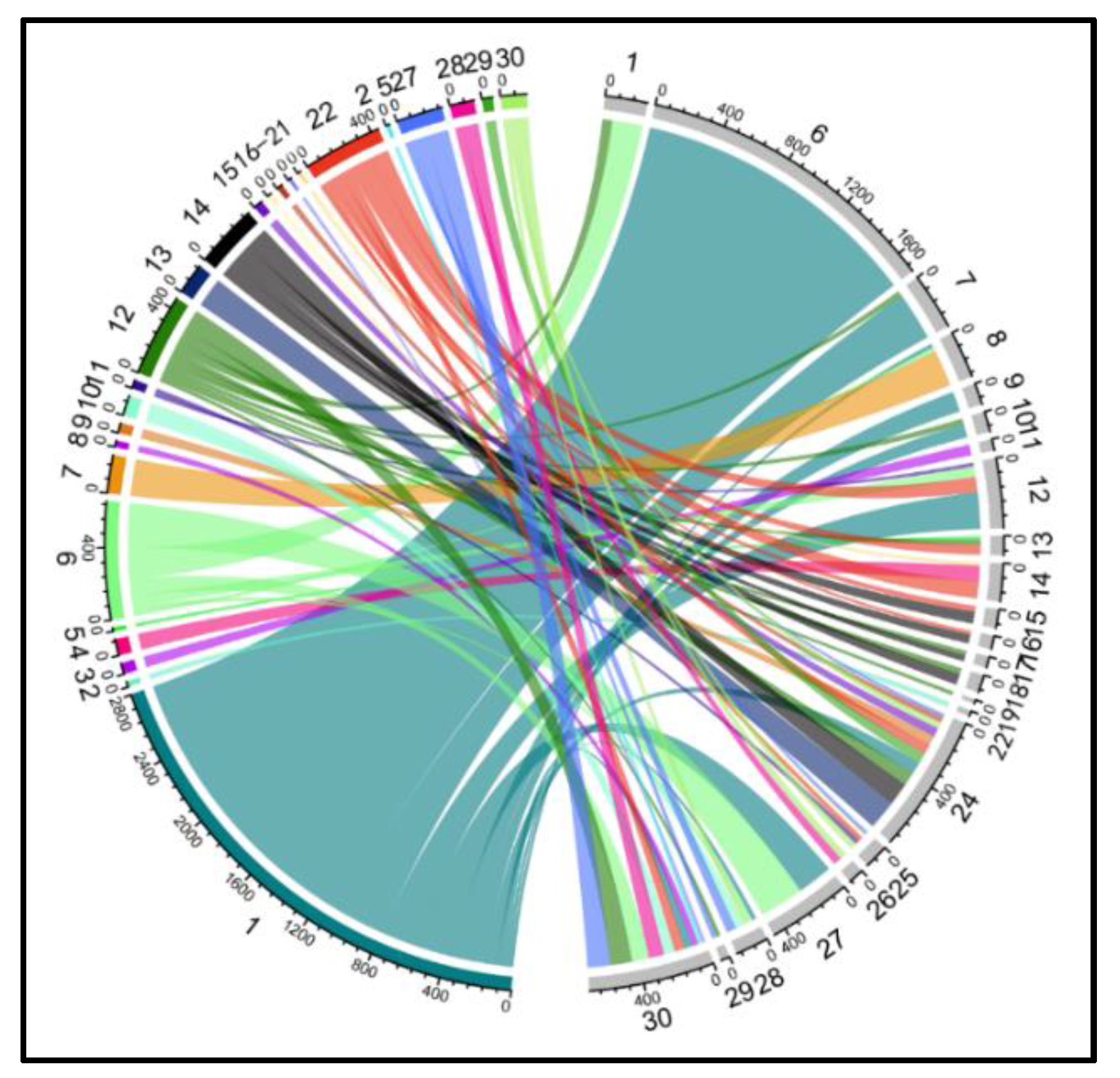

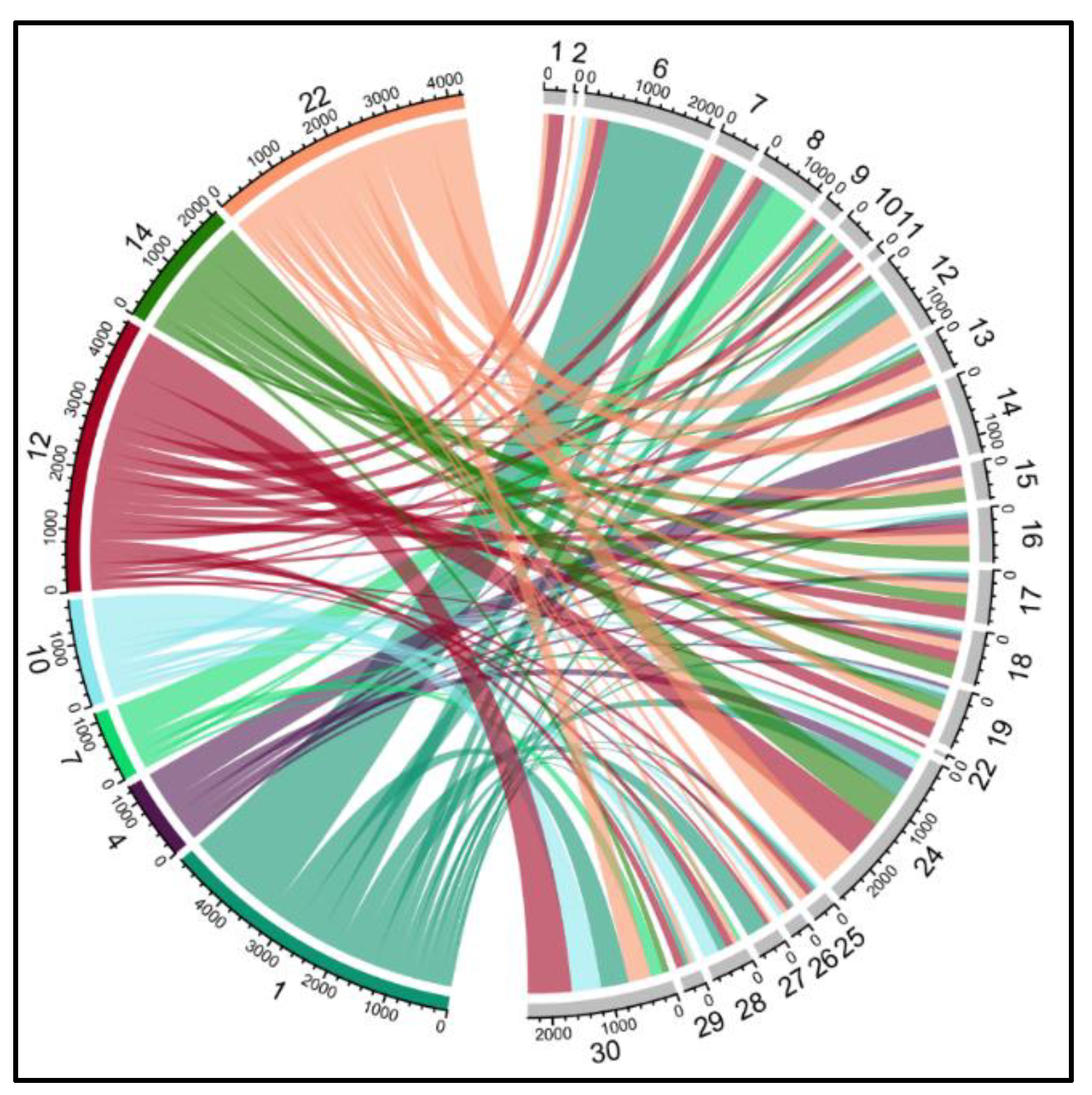

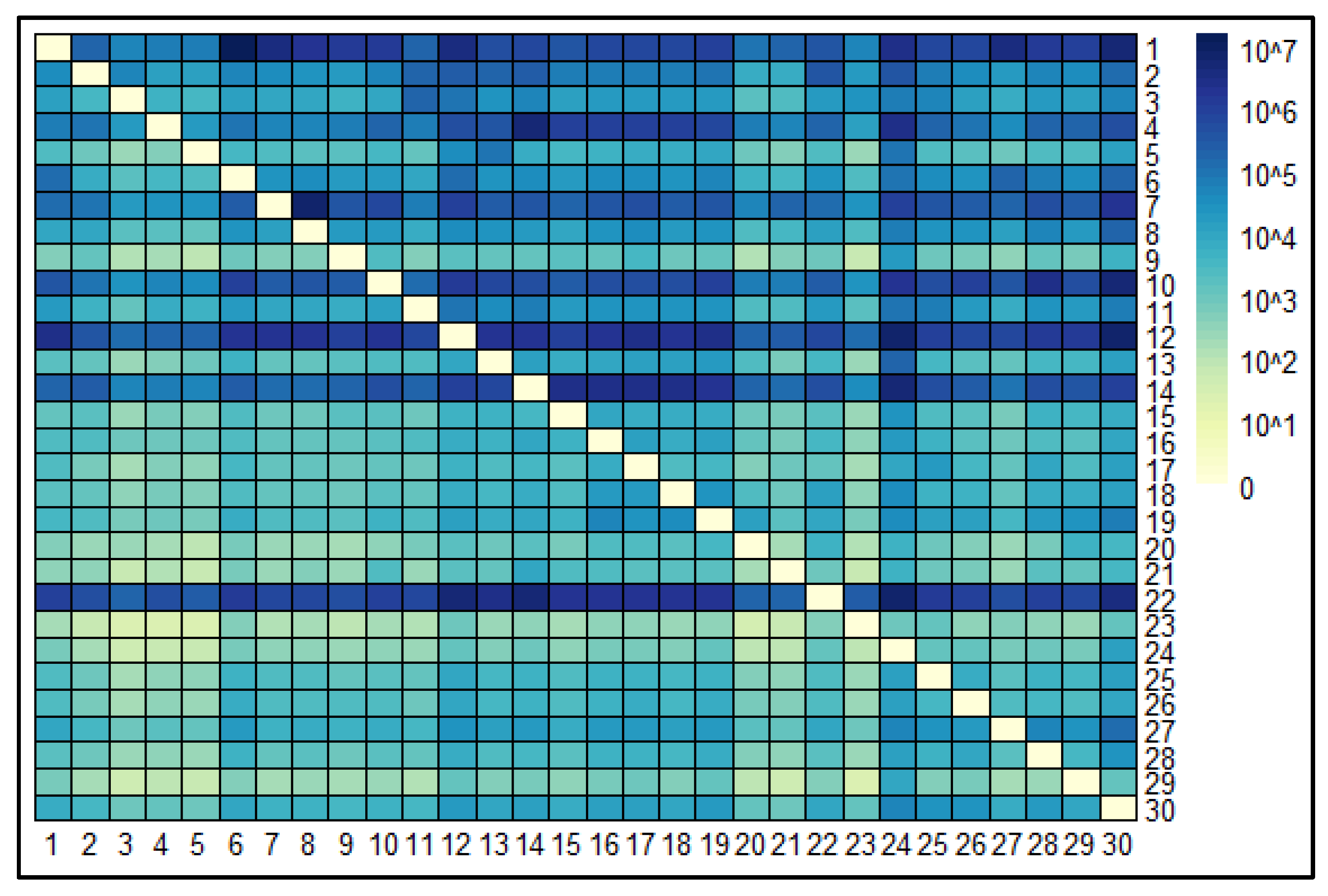

3.1.2. Intermediate Virtual Water Transfer between Sectors

3.2. Virtual Water Scarcity Risk Transfer of sectors in China

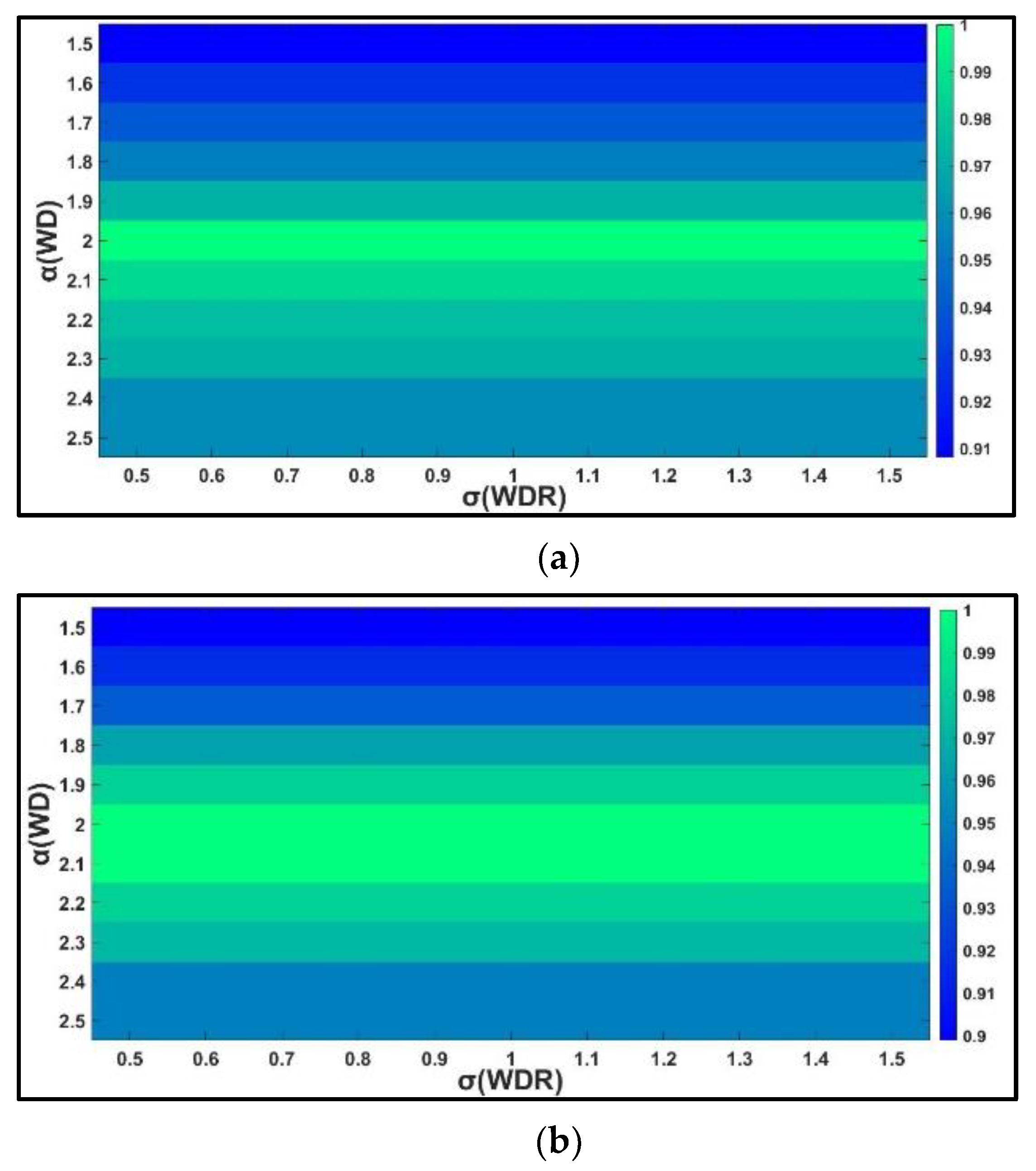

3.2.1. Parameter Calibration

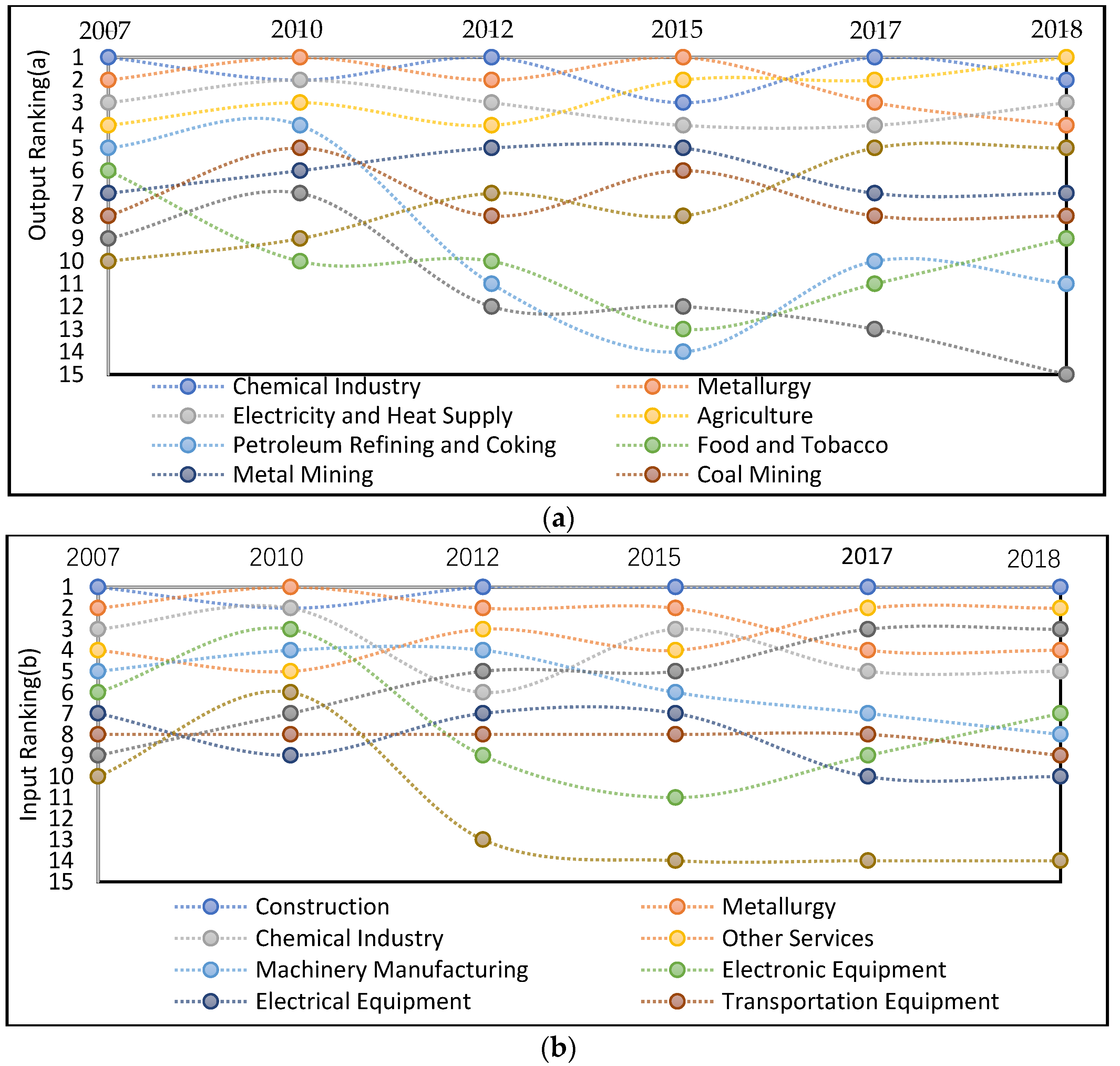

3.2.2. Sectors’ Ranking of Intermediate Virtual Water Scarcity Risk Transfer

3.2.3. Sensitivity Analysis

3.2.4. Intermediate Virtual Water Scarcity Risk Transfer between Sectors

3.2.5. Intermediate Virtual Water Scarcity Risk Index by Sector

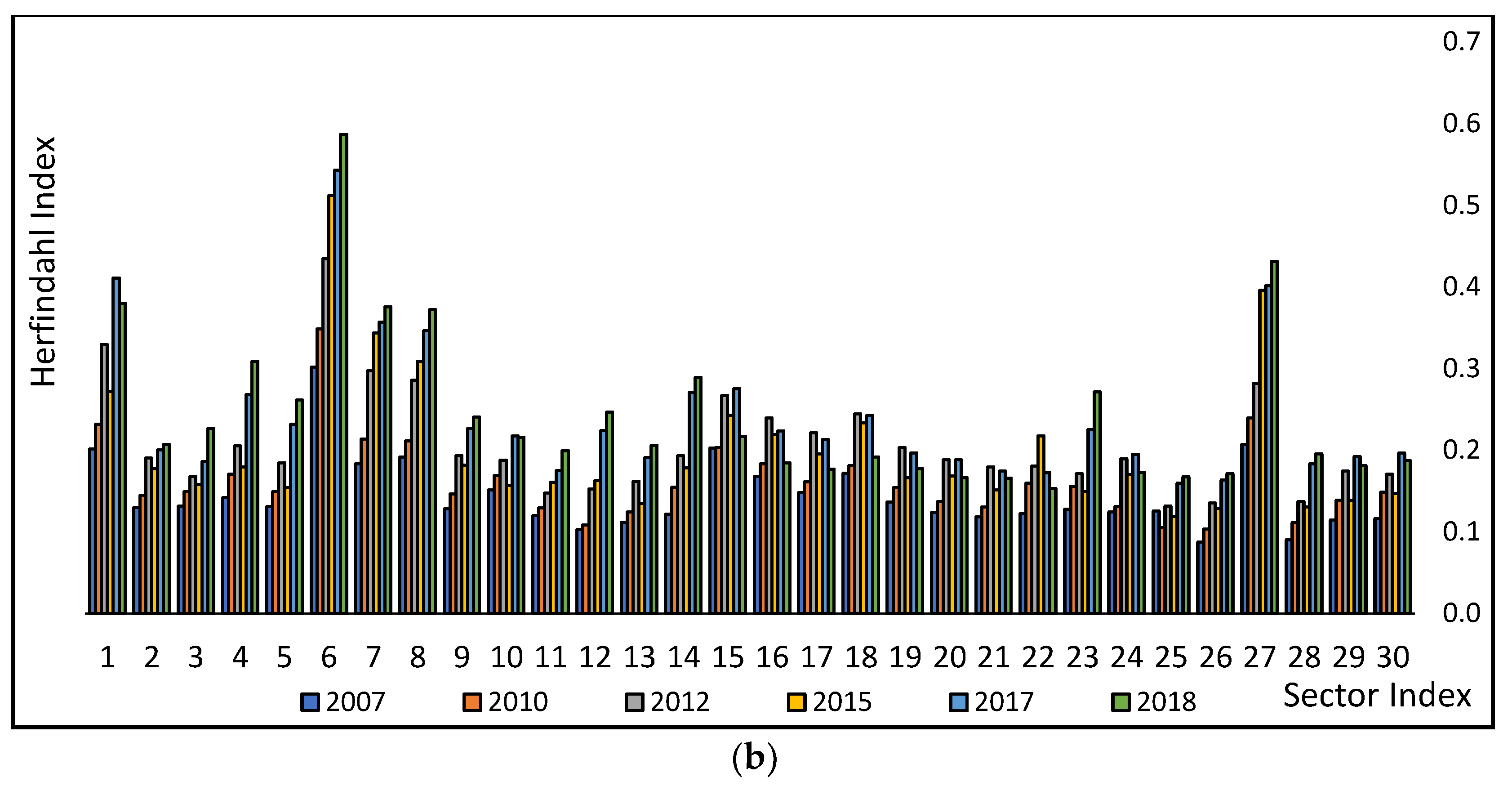

3.2.6. Herfindahl Index by Sector

4. Discussion

- (i)

- The water input–output model has some limitations from the perspective of economics since it assumes economies or diseconomies of scale and does not incorporate supply constraints. However, it can reveal water utilization in economic input–output, and is a beneficial way for studying virtual water trade and water footprint. The former studies have provided extensive ideas for world water security [42,43,44,45]. This paper based on the water input–output model draws conclusions of reference significance in the rational allocation of water resources.

- (ii)

- The virtual water scarcity risk output decides mainly on the dependence of each sector on physical water, and the virtual water scarcity risk input mainly depends on the necessary degree of direct water used in the production of upstream sectors closely related. Therefore, the upstream sectors with high water consumption will output more risk, and the midstream industry with indispensable input demand for products of these upstream exporters will input a large amount of virtual water scarcity risks. However, the risk output by some midstream sectors is low since they consume water through intermediate inputs instead of physical water. Similarly, the downstream sectors have less risk input.

- (iii)

- According to the sensitivity analysis, the input ranking of virtual water scarcity risk is more robust. This is due to the fact that the parameter taken will directly affect a particular significantly; however, virtual water scarcity risk input comes from multiple sectors. The virtual water scarcity risk output occurs when the production is completed in the source sector, and is only transferred into the downstream sector after the intermediate input process. A complex trade system reduces the impact of parameter changes. Nevertheless, the Kendall index for both rankings is above 0.9, indicating that our calculations are credible and informative.

- (iv)

- The virtual water scarcity risk for each sector in the paper does not respond to absolute values due to the calculation results being subject to parameter variation. and do not have statistical data; they need to be extrapolated from the related variables and measured in relative terms. Therefore, is also measured in relative terms. For the virtual water scarcity risk, this paper focuses only on the ranking, proportion and other relative quantities of sectors, which can also provide reference significance.

- (v)

- The intermediate virtual water scarcity risk index evaluates the level of virtual water scarcity risk input or output in a certain sector compared to the industry-wide average for the current year, focusing on the volume of risk, which can be evaluated to find the sectors with especially high virtual water scarcity risk. The Herfindahl index describes the concentration degree of input sources from upstream of a certain sector, focusing on the low resistance to water scarcity caused by simple input relations. This simplicity prevents HI from accurately assessing competitive or monopolistic market conditions. However, only from the perspective of virtual water, introducing it to evaluate can still intuitively reflect the sectors with high input concentration and which are, thus, vulnerable to water shortage [11,12,22,46].

5. Conclusions

- (i)

- China’s virtual water and water scarcity risk are mainly transferred through the secondary industry. The secondary industry accounted for 51.8% of the output and 71.8% of the input in the intermediate virtual water transfer in 2018. In the intermediate virtual water scarcity risk transfer, the output of the secondary industry accounts for 77.0%, and the input accounts for 74.7%.

- (ii)

- In terms of intermediate virtual water scarcity risk output, the agriculture, chemical industry, metallurgy, and electricity and heat supply sectors always ranked in the top four from 2017 to 2018. These industries are the origin of virtual water scarcity risk in China’s supply chain and have a long-term high degree of dependence on direct water use. Once they face reduction in production in case of water scarcity, a huge impact will be introduced to the whole economic system. In terms of intermediate virtual water scarcity risk input, the construction, metallurgy, and other services sectors were stable within the top four from 2007 to 2018, all of which have high reliance on specific production factors. Meanwhile, they are the downstream sectors of the main output sectors; therefore, these have a higher intermediate virtual water scarcity risk input.

- (iii)

- Compared with the output, the peak value of ratio of virtual water scarcity risk input to industry gross product is lower, and the variance is smaller. The virtual water scarcity risk transmitted from upstream is significantly dispersed after the intermediate input process. This indicates that the rich import relationships are conducive to reducing the risk transmitted by upstream water shortages; thus, it is necessary to promote balanced market development and close production linkages among various sectors.

- (iv)

- Although the water-use efficiency of all sectors in China increased steadily from 2007 to 2008, the overall input concentration of virtual water scarcity risk showed a rising trend, reflecting the gradual increase in the vulnerability of the industrial chain to water shortage. While focusing on economic development, attention should also be paid to industrial restructuring to ensure the sustainable utilization of resources and enhance economic resilience. After the industrial structure reform policies established in 2017, the Herfindahl index was still increasing in certain sectors, notably the food and tobacco, non-metallic mining, oil and gas, and metal mining, metal mining, gas water supply, and restaurant and accommodation sectors, etc. In 2018, the Herfindahl index values for the food and tobacco, agriculture, apparel leather, woodworking and furniture, and restaurant and accommodation sectors were still significantly higher than those of other sectors. Additional efforts are needed to reduce the water dependence of these industries and their upstream industries.

- (v)

- Despite water-use efficiency suggesting water resources should be prioritized to meet the water needs of service and industrial sectors with higher economic efficiency, water allocation should not take this as a one-sided standard. From the perspective of intermediate inputs for industry production, the water needs of major virtual water scarcity risk output sectors such as agriculture, chemical industry, and electricity and heat supply should be satisfied. This is to avoid the chain economic loss occurring in downstream sectors due to their reduced production once impacted by water scarcity.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Oki, T.; Kanae, S. Global Hydrological Cycles and World Water Resources. Science 2006, 313, 1068–1072. [Google Scholar] [CrossRef] [PubMed]

- World Economic Forum. Global Risks 2017; World Economic Forum: Cologny, Switzerland, 2017. [Google Scholar]

- Zhao, D.; Liu, J.; Yang, H.; Sun, L.; Varis, O. Socioeconomic drivers of provincial-level changes in the blue and green water footprints in China. Resour. Conserv. Recycl. 2021, 175, 105834. [Google Scholar] [CrossRef]

- Gleick, P.H.; Cooley, H. Freshwater Scarcity. Annu. Rev. Environ. Resour. 2021, 46, 319–348. [Google Scholar] [CrossRef]

- Alexoaei, A.P.; Cojanu, V.; Coman, C.-I. On Sustainable Consumption: The Implications of Trade in Virtual Water for the EU’s Food Security. Sustainability 2021, 13, 11952. [Google Scholar] [CrossRef]

- Huang, H.; Jiang, S.; Gao, X.; Zhao, Y.; Lin, L.; Wang, J.; Han, X. The Temporal Evolution of Physical Water Consumption and Virtual Water Flow in Beijing, China. Sustainability 2022, 14, 9596. [Google Scholar] [CrossRef]

- Orr, S.; Cartwright, A. Water scarcity risks: Experience of the private sector. In Re-thinking Water and Food Security; CRC Press: Boca Raton, FL, USA, 2010. [Google Scholar]

- Falkenmark, M. Growing water scarcity in agriculture: Future challenge to global water security. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2013, 371, 20120410. [Google Scholar] [CrossRef]

- Lenzen, M.; Moran, D.; Bhaduri, A.; Kanemoto, K.; Bekchanov, M.; Geschke, A.; Foran, B. International trade of scarce water. Ecol. Econ. 2013, 94, 78–85. [Google Scholar] [CrossRef]

- Vörösmarty, C.J.; Hoekstra, A.Y.; Bunn, S.E.; Conway, D.; Gupta, J. Fresh water goes global. Science 2015, 349, 478–479. [Google Scholar] [CrossRef]

- Zhao, H.; Qu, S.; Liu, Y.; Guo, S.; Zhao, H.; Chiu, A.C.F.; Liang, S.; Zou, J.-P.; Xu, M. Virtual water scarcity risk in China. Resour. Conserv. Recycl. 2020, 160, 104886. [Google Scholar] [CrossRef]

- Qu, S.; Liang, S.; Konar, M.; Zhu, Z.; Chiu, A.S.F.; Jia, X.; Xu, M. Virtual Water Scarcity Risk to the Global Trade System. Environ. Sci. Technol. 2018, 52, 673–683. [Google Scholar] [CrossRef]

- Gain, A.K.; Giupponi, C. A dynamic assessment of water scarcity risk in the Lower Brahmaputra River Basin: An integrated approach. Ecol. Indic. 2015, 48, 120–131. [Google Scholar] [CrossRef]

- United Nations Development Programme. Human Development Report 2006; Human Development Report Office: New York, NY, USA, 2006. [Google Scholar]

- Hoekstra, A.Y. Water scarcity challenges to business. Nat. Clim. Change 2014, 4, 318–320. [Google Scholar] [CrossRef]

- Schyns, J.F.; Hamaideh, A.; Hoekstra, A.Y.; Mekonnen, M.M.; Schyns, M. Mitigating the Risk of Extreme Water Scarcity and Dependency: The Case of Jordan. Water 2015, 7, 5705–5730. [Google Scholar] [CrossRef]

- DeNicola, E.; Aburizaiza, O.S.; Siddique, A.; Khwaja, H.; Carpenter, D.O. Climate Change and Water Scarcity: The Case of Saudi Arabia. Ann. Glob. Health 2015, 81, 342–353. [Google Scholar] [CrossRef]

- Hoekstra, A.Y.; Mekonnen, M.M. Imported water risk: The case of the UK. Environ. Res. Lett. 2016, 11, 055002. [Google Scholar] [CrossRef]

- Rushforth, R.R.; Ruddell, B.L. The vulnerability and resilience of a city’s water footprint: The case of Flagstaff, Arizona, USA. Water Resour. Res. 2016, 52, 2698–2714. [Google Scholar] [CrossRef]

- Chini, C.M.; Konar, M.; Stillwell, A.S. Direct and indirect urban water footprints of the United States. Water Resour. Res. 2017, 53, 316–327. [Google Scholar] [CrossRef]

- Djehdian, L.A.; Chini, C.M.; Marston, L.; Konar, M.; Stillwell, A.S. Exposure of urban food–energy–water (FEW) systems to water scarcity. Sustain. Cities Soc. 2019, 50, 101621. [Google Scholar] [CrossRef]

- Zhao, H.; Qu, S.; Guo, S.; Zhao, H.; Liang, S.; Xu, M. Virtual water scarcity risk to global trade under climate change. J. Clean. Prod. 2019, 230, 1013–1026. [Google Scholar] [CrossRef]

- Cao, T.; Wang, S.; Chen, B. Water shortage risk transferred through interprovincial trade in Northeast China. Energy Procedia 2019, 158, 3865–3871. [Google Scholar] [CrossRef]

- Yao, X.; Tang, X.; Farnoosh, A.; Feng, C. Quantifying virtual water scarcity risk transfers of energy system in China. Environ. Econ. Policy Stud. 2021, 23, 945–969. [Google Scholar] [CrossRef]

- Wang, L.; Li, Y.; Liang, S.; Xu, M.; Qu, S. Trade-related water scarcity risk under the Belt and Road Initiative. Sci. Total Environ. 2021, 801, 149781. [Google Scholar] [CrossRef] [PubMed]

- Markusen, J.R. Trade in Producer Services and in Other Specialized Intermediate Inputs. Am. Econ. Rev. 1989, 79, 85–95. [Google Scholar]

- Liu, X.; Du, H.; Zhang, Z.; Crittenden, J.C.; Lahr, M.L.; Moreno-Cruz, J.; Guan, D.; Mi, Z.; Zuo, J. Can virtual water trade save water resources? Water Res. 2019, 163, 114848. [Google Scholar] [CrossRef] [PubMed]

- Wu, X.D.; Guo, J.L.; Li, C.H.; Shao, L.; Han, M.Y.; Chen, G.Q. Global socio-hydrology: An overview of virtual water use by the world economy from source of exploitation to sink of final consumption. J. Hydrol. 2019, 573, 794–810. [Google Scholar] [CrossRef]

- National Bureau of Statistics of China. China Statistical Yearbook 2018; National Bureau of Statistics of China: Beijing, China, 2018.

- National Bureau of Statistics of China. China Statistical Yearbook 2010; National Bureau of Statistics of China: Beijing, China, 2010.

- National Bureau of Statistics of China. China Statistical Yearbook 2007; National Bureau of Statistics of China: Beijing, China, 2007.

- National Bureau of Statistics of China. China Statistical Yearbook 2012; National Bureau of Statistics of China: Beijing, China, 2012.

- China Statistical Yearbook 2015; National Bureau of Statistics of China: Beijing, China, 2015.

- National Bureau of Statistics of China. China Statistical Yearbook 2017; National Bureau of Statistics of China: Beijing, China, 2017.

- China Statistical Press. China Economic Census Yearbook; China Statistical Press: Beijing, China, 2008. [Google Scholar]

- Standardization Administration of China. General Administration of Quality Supervision, Inspection and Quarantine of the People’s Republic of China, Industrial Classification for National Economic Activities; Standardization Administration of China: Beijing, China, 2017. [Google Scholar]

- Hubacek, K.; Sun, L. Economic and Societal Changes in China and their Effects on Water Use A Scenario Analysis. J. Ind. Ecol. 2008, 9, 187–200. [Google Scholar] [CrossRef]

- Guan, D.; Hubacek, K. Assessment of regional trade and virtual water flows in China. Ecol. Econ. 2007, 61, 159–170. [Google Scholar] [CrossRef]

- Leontief, W. Input-Output Economics; Oxford University Press: Oxford, UK, 1986; Available online: https://books.google.com.hk/books?id=HMnQCwAAQBAJ (accessed on 29 December 2022).

- Ghosh, A. Input-Output Approach in an Allocation System. Economica 1958, 25, 58–64. [Google Scholar] [CrossRef]

- Zhang, H. Supply-side Structural Reform: New Practice under the “New Normal”. China Today, 31 July 2017. [Google Scholar]

- Lenzen, M.; Foran, B. An input–output analysis of Australian water usage. Water Policy 2001, 3, 321–340. [Google Scholar] [CrossRef]

- Zhao, X.; Chen, B.; Yang, Z.F. National water footprint in an input-output framework—A case study of China 2002. Ecol. Model. 2009, 220, 245–253. [Google Scholar] [CrossRef]

- Velázquez, E. An input-output model of water consumption: Analysing intersectoral water relationships in Andalusia. Ecol. Econ. 2006, 56, 226–240. [Google Scholar] [CrossRef]

- Duarte, R.; Sánchez-Chóliz, J.; Bielsa, J. Water use in the Spanish economy: An input-output approach. Ecol. Econ. 2002, 43, 71–85. [Google Scholar] [CrossRef]

- Sonderegger, T.; Pfister, S.; Hellweg, S. Criticality of Water: Aligning Water and Mineral Resources Assessment. Environ. Sci. Technol. 2015, 49, 12315–12323. [Google Scholar] [CrossRef]

| Industry | Digital Index | Sector Abbreviations in Text |

|---|---|---|

| Primary Industry | 1 | Agriculture |

| Secondary Industry | 2 | Coal Mining |

| 3 | Oil and Gas | |

| 4 | Metal Mining | |

| 5 | Non-metallic Mining | |

| 6 | Food and Tobacco | |

| 7 | Textile | |

| 8 | Apparel Leather | |

| 9 | Woodworking and Furniture | |

| 10 | Paper Printing and Stationery | |

| 11 | Petroleum Refining and Coking | |

| 12 | Chemical Industry | |

| 13 | Non-metallic Products | |

| 14 | Metallurgy | |

| 15 | Metallic Products | |

| 16 | Machinery Manufacturing | |

| 17 | Transportation Equipment | |

| 18 | Electrical Equipment | |

| 19 | Electronic Equipment | |

| 20 | Instruments and Meters | |

| 21 | Other Manufacturing | |

| 22 | Electricity and Heat Supply | |

| 23 | Gas Water Supply | |

| 24 | Construction | |

| Tertiary Industry | 25 | Transportation and Post |

| 26 | Wholesale and Retail | |

| 27 | Restaurant and Accommodation | |

| 28 | Leasing and Business Services | |

| 29 | Scientific Research | |

| 30 | Other Services |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ning, X.; Zhang, Y.; Xu, H.; Dong, W.; Song, Y.; Zhang, L. Inter-Industry Transfer of Intermediate Virtual Water Scarcity Risk: The Case of China. Sustainability 2023, 15, 2658. https://doi.org/10.3390/su15032658

Ning X, Zhang Y, Xu H, Dong W, Song Y, Zhang L. Inter-Industry Transfer of Intermediate Virtual Water Scarcity Risk: The Case of China. Sustainability. 2023; 15(3):2658. https://doi.org/10.3390/su15032658

Chicago/Turabian StyleNing, Xin’er, Yanjun Zhang, Hongbo Xu, Wenxun Dong, Yuanxin Song, and Liping Zhang. 2023. "Inter-Industry Transfer of Intermediate Virtual Water Scarcity Risk: The Case of China" Sustainability 15, no. 3: 2658. https://doi.org/10.3390/su15032658

APA StyleNing, X., Zhang, Y., Xu, H., Dong, W., Song, Y., & Zhang, L. (2023). Inter-Industry Transfer of Intermediate Virtual Water Scarcity Risk: The Case of China. Sustainability, 15(3), 2658. https://doi.org/10.3390/su15032658