Abstract

The industrial sector is now undergoing digital revolution and upgrade, and it is of strategic significance to study how enterprise digitalization affects enterprise innovation. This paper develops a theoretical model of how digital transformation affects innovation in manufacturing enterprises, based on the resource-based view, network-embeddedness theory, and resource-complementarity theory. It then tests the mechanism and boundary conditions of the model, using data from a World Bank survey of Chinese enterprises. The study reveals how the degree of e-commerce embeddedness might partially mediate the effect of digital transformation on the innovation of manufacturing companies. Managerial human capital positively moderates the effect of digital transformation on manufacturing enterprises’ independent-R&D investment and product-innovation output. Employee human capital significantly and positively moderates the effect of digital transformation on manufacturing enterprises’ product-innovation output, while negatively moderating the effect of digital transformation on manufacturing enterprises’ cooperative-R&D investment. The conclusions can expand the relevant theoretical research on digital transformation and enterprise innovation, and also provide practical enlightenment for the digital transformation and upgrading of manufacturing enterprises.

1. Introduction

The rapid economic growth in China as a result of the reform and opening up has drawn the attention of the international community, with the manufacturing industry playing a critical role. On the one hand, data from China’s National Bureau of Statistics show that in 2022, China’s industrial added value accounted for about 33.2% of the total GDP in the same period, among which the added value of manufacturing accounted for about 27.7% of the total GDP in the same period. In the face of adverse factors such as the COVID-19 pandemic, China’s manufacturing sector has shown strong resilience and vitality; on the other hand, as China enters a new stage of development it faces profound and complex changes in its domestic and international-development environments. It has become the mission of the time to promote further innovation and upgrade the manufacturing industry. According to the 14th “Five-Year Plan”, it is clearly stated that China will further implement the strategy of building a strong manufacturing country, developing digital economies, integrating them with their real economies, and helping traditional industries transform and upgrade by leveraging digital technologies.

At present, some achievements have been made in the research of enterprises using information technology for digital transformation. For example, some scholars believe that the application of information technology can bring sustainable competitive advantages to enterprises from a resource-based perspective, thereby improving enterprise performance [1,2]. Based on the theory of resource complementarity, Wang et al. [3] proposed that the accessibility and heterogeneity of IT software and hardware are low, and easily imitated by competitors. Therefore, the value of IT investment depends on the support of IT complementary resources; the matching or combination of IT investment and complementary resources can bring a significant impact on enterprise performance. However, existing research has also found that the return on investment of enterprise-information systems is not stable, and that even, in some cases, the use of information technology not only fails to empower enterprises, but also brings counterproductive effects [4]. In these existing studies, digitalization has mainly been examined as a driver of business performance, with little attention paid to the unique behavior of innovation. Compared with the short-term behavior of improving corporate performance, the innovation ability of a company can often determine the long-term competitiveness of the company, and can also provide a long-term perspective for enterprises to evaluate the return rate of digital transformation. Therefore, studying the impact of digital transformation on enterprise innovation rather than general enterprise performance can help to further focus on the problem. Focused research has positive significance for the in-depth understanding of digitalization and enterprise innovation and also helps to provide more targeted opinions and suggestions for enterprises’ innovative practices.

With the urgent need to transform and upgrade, this paper focuses on manufacturing companies, to examine how digital transformation affects their innovation. Specifically, this paper firstly analyzes the impact mechanism and boundary conditions of digitalization on manufacturing enterprise innovation from a theoretical perspective; secondly, using the World Bank survey data, it conducts an empirical study on the relationship between enterprise digital transformation and enterprise innovation behavior at the micro level; finally, by using the instrumental variable, endogeneity problems in the research model can be addressed, while the robustness test improves the reliability of the research conclusions. At the same time, countermeasures and suggestions are provided for enterprise practice, according to the research conclusions.

2. Theoretical Analysis and Hypothesis Development

2.1. Literature Review on Digitization Transformation and Enterprise Innovation

Several academic studies have investigated how digital transformation impacts enterprise innovation. Some scholars have conducted relevant researches and discussions on enterprise-technology innovation, product innovation, organizational innovation, business-model innovation, innovation ecosystems, and other aspects, from the perspective of digital transformation: (1) Technological innovation: digital transformation is considered an important factor in enterprise green-technology innovation, as discussed by Xue et al. [5]. According to the study, enterprise green-technology innovation was significantly enhanced by digital transformation [5]; Zhou et al. [6] adopted the case-study method to explore how digital transformation promotes the innovation of enterprise mass-customization technology, and refined the process model of digital transformation affecting enterprise mass-customization technology. Agricultural enterprises were found to have a complicated relationship between the quantity and the quality of innovation, due to digital transformation, according to Liu et al. [7]. (2) Product innovation Through case studies, Hilbolling et al. [8] discussed how enterprises implement a digital-platform strategy to promote open innovation in the digital economy; Zhan et al. [9] put forward the idea that enterprise digitization can accelerate the innovation process, strengthen customer contact and build an innovation ecosystem, which can help enterprises develop products at a faster speed and lower cost. (3) Organizational innovation. Svahn et al. [10] discussed how established enterprises embrace digital innovation in competition, and the organizational changes brought about by digital technology through case studies. AlNuaimi et al. [11] studied the impact of digital transformation on organizational agility through a questionnaire survey, and concluded that digital-transformation leadership improved the organizational agility of enterprises; Li et al. [12] believed that e-commerce was crucial to organizational agility. (4) Business model innovation. Haaker et al. [13] analyzed how to use the Internet of Things for business-model innovation in digital transformation through case studies. Based on the perspective of digital capability, Gao et al. [14] studied how entrepreneurship in the era of digital economy affects enterprises’ sustainable-business-model innovation. (5) Innovation ecosystem. Su et al. [15] found that well-known enterprises such as Google and Microsoft build a large-scale innovation ecosystem among multiple platforms by virtue of their strong digital-technology capabilities and resource advantages; using a multi-agent model constructed by Yang et al. [16], it was shown that enterprise digital transformation affected innovation ecosystems differently, depending on market size.

Through analysis, it is found that the academic community focuses on enterprise innovation in the context of digitization from the following perspectives: (1) Causing inferences about how digital transformation impacts enterprise innovation and determining if that impact is significant [5,7,17,18,19,20]; (2) Investigating the mechanism that drives digital transformation in enterprise innovation and analyzing how digital transformation impacts innovation in enterprises [5,7,17,21]; (3) Studying the boundary conditions of digital transformation affecting enterprise innovation. In other words, enterprises regard digitalization as a kind of resource that needs other complementary resources to be matched and combined, in order to play a better role; they can then study the effect of the interaction between digital transformation and complementary resources on the innovation capacity of enterprises [11,20,22,23].

These studies have achieved fruitful results, but there are still some shortcomings. For example, the researchers did not focus on the industry level [5,17,23]; digital transformation was studied only in relation to enterprise innovation, without detailed demonstration of the mechanism, or the mechanism was not clear [8,10]; and the impact of enterprises’ other resources was not considered [16].

In view of this, according to the existing literature, this paper regards the digital transformation of enterprises as an important resource [24] and an important supporting force for enterprise innovation. In the digital era, the links between enterprises are increasingly close [25]. Joining an ecosystem composed of multiple enterprises has a crucial impact on enterprise innovation. Does the digital-transformation process increase the degree of enterprise-network embedding and then transmit the benefits that will be achieved from digital transformation to the enterprises’ innovation process? Furthermore, human capital is also an important supplementary resource for enterprises [3,26]. How does it play a role in digitization and an enterprise’s ability to innovate in the manufacturing industry? This is the exact content of this article to be studied.

Therefore, we comprehensively use related theories such as the resource-based view, network-embeddedness theory, and enterprise-resource-complementarity theory to study the causal relationship, mechanism, and boundary conditions of how digital transformation affects manufacturing-enterprise innovation. Compared with many studies that do not emphasize industrial background [5,17,23], we focus on manufacturing enterprises, which has a positive significance for an in-depth understanding of how digital transformation affects enterprise innovation and also helps to provide more targeted opinions and suggestions for the innovation practices of enterprises.

2.2. Hypothesis Development

2.2.1. Digital Transformation and Manufacturing-Enterprise Innovation, Based on a Resource-Based View

Resource-based view (RBV)-theory holds that when an enterprise’s resources meet the VRIN framework, that is when enterprise resources are valuable, rare, imperfectly imitable, and non-substitutable, enterprises can obtain sustainable competitiveness [27]. According to the resource-based theory, although the hardware and software systems of an enterprise’s digital investment are easily to imitated and followed up by competitors, in the process of applying digital technology, the digital-application capability formed by the close combination of digital technology with enterprise strategy, marketing, human resources, operations, and business processes is constantly improved. Enterprises enhance their digital capability by investing in information technology. This capability is the knowledge, experience, and skills that enterprises accumulate continuously in the process of digital transformation, and it can be deeply integrated with enterprise development and the organizational culture, which improves the non-replicability and non-substitutability of enterprise resources, increases the imitation cost of competitors, and thus can become the source of long-term competitive advantage for enterprises. Previous studies have shown that information-technology investment is helpful to enhance the ability of enterprises to manage innovative knowledge, thereby enabling the key links of enterprise innovation, such as R&D-investment management, market-opportunity identification, dynamic-innovation capability, new product design, and process optimization [17,28]. In addition, digitalization can provide more convenient communication channels for external partners, making information sharing within and between enterprises more efficient, and thus becoming a key factor in promoting cooperative R&D [17,22,29]. Based on this, we propose hypothesis 1:

H1.

Digital transformation can significantly improve the innovation performance of manufacturing enterprises.

H1a.

Digital transformation can significantly increase the independent R&D investment of manufacturing enterprises.

H1b.

Digital transformation can significantly improve the cooperative R&D investment of manufacturing enterprises.

H1c.

Digital transformation can significantly improve the product-innovation output of manufacturing enterprises.

H1d.

Digital transformation can significantly improve the process-innovation output of manufacturing enterprises.

2.2.2. The Mediating Role of E-Commerce Embeddedness, Based on the Network-Embeddedness Theory

At present, the digital transformation of the manufacturing industry has become the general trend, and the further in-depth integration of traditional manufacturing enterprises and e-commerce has assumed a significant role in their transformation and upgrading. It has been argued by some scholars that e-commerce provides enterprises with more abundant information about consumer preferences, and enterprises can make full use of consumer data to conduct precise R&D and innovation in a market-oriented way [19]; others hold that when market competition intensifies, the market information acquired by enterprises will gradually become overloaded, which makes it more difficult and less efficient for enterprises to innovate through the collection of market information, thereby inhibiting enterprise innovation. That is, competition intensity negatively moderates the influence of market information on enterprise innovation [30]. In this case, can e-commerce promote enterprise innovation? Some studies have attempted to answer this question from the perspective of embeddedness theory.

Embeddedness theory is an important core theory in the research of new economic sociology. Since Polanyi first proposed it in 1944, it has been continuously developed and gradually applied in various fields, and has now formed a relatively complete theoretical system. According to different perspectives, network embeddedness can be divided into different dimensions. In the field of management, network embeddedness is often divided into “structural embeddedness” and “relational embeddedness” [31]. Structural embeddedness refers to the competitive advantages brought about by the network location of an enterprise, such as reducing the cost of information search and enriching access to resources. Relational embeddedness emphasizes the comparative advantages brought about by the network relationships embedded in enterprises, such as the strong and weak relationships in the network, to improve organizational performance [31,32]. Zhang et al. [32] used meta-analysis to study the relationship between network embeddedness and enterprise-innovation performance. The research shows that both network relational embeddedness and network structural embeddedness have a significant positive impact on enterprise innovation. From the standpoint of knowledge management, Cong et al. [25] developed a conceptual model showing that multiple-network embeddedness influences enterprises’ performance in terms of technological innovation as a whole. Based on the findings of the research, enterprises with embedded relationships, embedded structures, and embedded resources are able to improve their knowledge-management capabilities. As a result, it contributes significantly to the performance of technological innovation. Zhang et al. [19] applied the embeddedness theory in the e-commerce scenario and proposed the concept of embeddedness degree of e-commerce, arguing that traditional manufacturing enterprises are embedded to varying degrees in the electronic-commerce trading network in the context of digital transformation. The results show that the degree of e-commerce embeddedness has a significant positive impact on the R&D investment and output of enterprises. In short, digital transformation improves enterprises’ degree of e-commerce embeddedness, which further promotes enterprises’ innovation. In light of this, hypothesis 2 is proposed.

H2.

The impact of e-commerce-embeddedness degree mediating digital transformation on manufacturing enterprises’ innovation.

H2a.

The degree of e-commerce embeddedness plays a mediating role in the impact of digital transformation on independent R&D investment of manufacturing enterprises.

H2b.

The degree of e-commerce embeddedness plays a mediating role in the impact of digital transformation on collaborative-R&D investment of manufacturing enterprises.

H2c.

The degree of e-commerce embeddedness plays a mediating role in the impact of digital transformation on the product-innovation output of manufacturing enterprises.

H2d.

The degree of e-commerce embeddedness plays a mediating role in the impact of digital transformation on the process-innovation output of manufacturing enterprises.

2.2.3. The Moderating Role of Human Capital, Based on the Theory of Enterprise-Resource Complementarity

The complementary theory holds that there are complementary effects among various resources of an enterprise. According to the theory of enterprise-resource complementarity, some scholars believe that digital-technology investment makes it difficult to create sustainable competitive advantages for enterprises, due to its high imitativeness. Only by combining digital technology with other key resources of the organization to form the matching and combination of enterprise resources, can enterprises maintain the uniqueness and non-imitativeness of enterprise resources, which can bring sustainable competitive advantages to the enterprises [3]. In an inverted-U-shaped relationship between R&D and enterprise innovation, Ravichandran et al. [23] found that digital technology alleviates the diminishing returns of R&D investment. According to Wang et al. [3], R&D is an extremely valuable complementary resource of digital technology for enterprises, and it plays a positive moderating effect on the performance of enterprises through digital investments. Wang et al. [18] studied the impact of digitalization and human capital on enterprise innovation, and found that human capital played a positive moderating role in the impact of digitalization on enterprise innovation. On this basis, this paper holds that, as an important enterprise resource, the combination and matching of human capital with digital transformation can produce a higher performance for enterprise innovation. Based on this, we put forward hypothesis 3:

H3.

Manufacturing enterprises’ innovation performance is moderated by human capital in the context of digital transformation.

H3a.

Managerial human capital plays a positive moderating role in the impact of digital transformation on the innovation performance of manufacturing enterprises.

H3b.

Employee human capital plays a positive moderating role in the impact of digital transformation on the innovation performance of manufacturing enterprises.

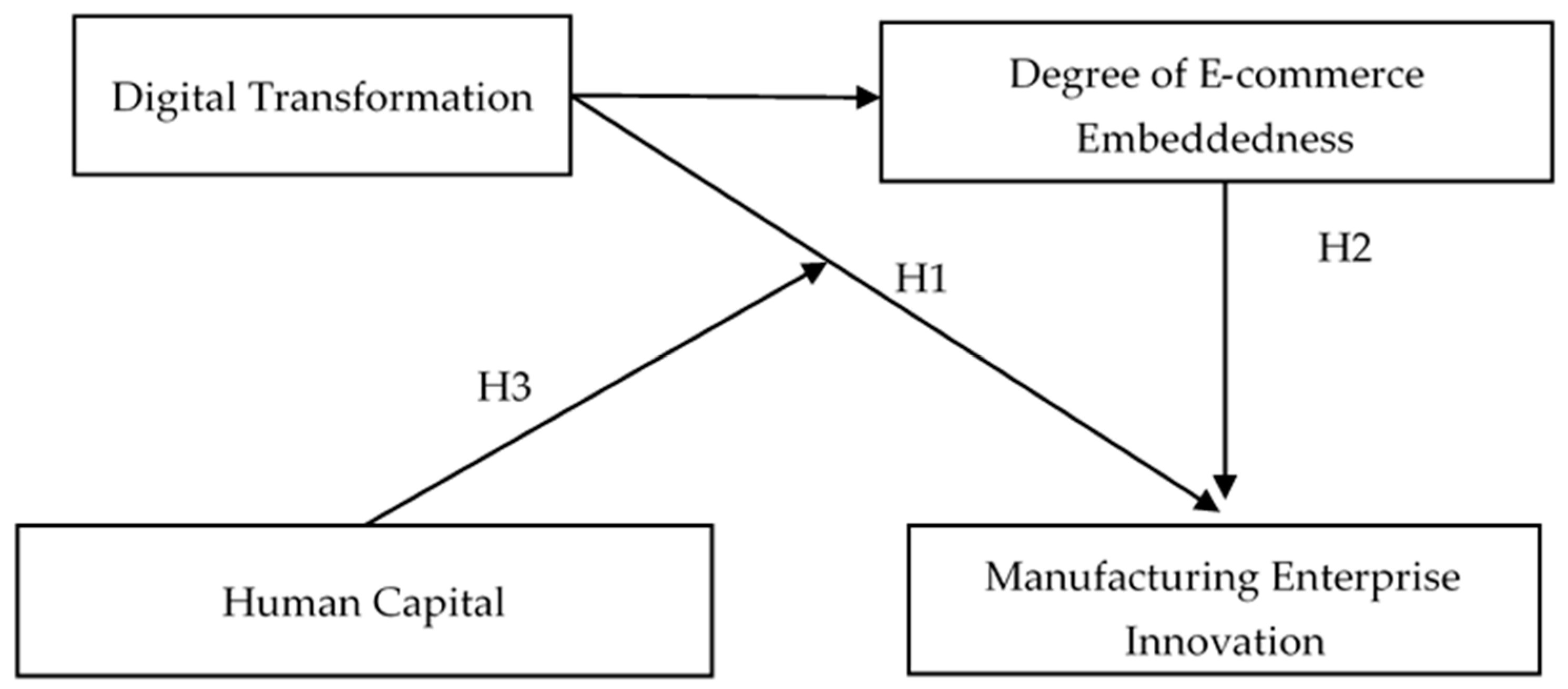

In summary, the paper’s conceptual model is based on the three research assumptions outlined above, which can be seen in Figure 1.

Figure 1.

Conceptual model.

3. Research Design

3.1. Model Construction

In order to verify the impact of digital transformation on manufacturing-enterprise innovation (H1), we construct the following model:

In Equation model (1) to Equation model (4), the explained variables RD_interi, RD_cooperi, innov_prodi, and innov_proci represent the independent-R&D investment, cooperative-R&D investment, product-innovation output, and process-innovation output of enterprise i, respectively, and the core explanatory variable Digitali represents the degree of digital transformation of enterprise i, controli represents the control variables, and μi is the random-error term. At the same time, in order to control the differences brought by regions and industries to enterprise-innovation activities, we add industry and region fixed effects to the model, which are represented by δI and ηc, respectively.

Using the following mediating-analysis model, we investigate the mechanism of digital transformation on manufacturing-enterprise innovation (H2).

In Equation model (5) to Equation model (7), innovationi was used to measure enterprise innovation, including four dimensions (RD_interi, RD_cooperi, innov_prodi, and innov_proci), and ecommer_embedi was used to measure the degree of e-commerce embeddedness, which was a mediating variable.

Meanwhile, as a further check of the moderating effect of human capital on digital transformation’s influence on manufacturing-enterprise innovation (H3), the following moderating-analysis model is constructed:

In Equation model (8) and Equation model (9), manager_capi and employee_capi represent the managerial human capital and employee human capital, respectively, of enterprise i, which are moderating variables of the model. We judge the moderating effect of human capital through the interaction between digital transformation and two types of human capital. To ensure the moderating-effect characteristics are as accurate as possible, we centralize the moderating variables and their interaction items with digital transformation. At the same time, the model also controls the industry and city fixed effects.

3.2. Variables Selection and Measurement

3.2.1. Explained Variable: Manufacturing-Enterprise Innovation

At present, there are two main types of measurement indicators for manufacturing-enterprise innovation in academia: one is the input of innovation, such as research and development investment (R&D)-data; the other is the output of innovation, such as the number of patents, new product sales, and so on. Referring to the practice of Wang and Zhang [18], to evaluate manufacturing enterprises’ innovation, we take into account two dimensions: R&D investments and innovation outputs. Among them, innovation output includes product-innovation output and process-innovation output. Meanwhile, according to Zhou et al. [33], R&D investments can be classified as independent or cooperative. The measurement methods are as follows:

Independent-R&D investment (RD_inter): question CNO.3 of the questionnaire asks, “over the past three years, has the company conducted internal research and development?”, CNO.4 asks about the company’s average annual investment in internal R&D activities in the past three years. Due to the large lack of data in the database on the annual average-internal-R&D investment of enterprises, we recorded the annual average-internal-R&D investment of these enterprises as 0, according to the data of no internal-R&D behavior, in question CNO.3. Finally, the natural logarithm of the supplemented annual average-internal-R&D investment of enterprises was calculated by adding 1. Cooperative-R&D investment (RD_cooper): question CNO.5 of the questionnaire asks whether an enterprise has had any cooperative-R&D behavior in the past three years, and question CNO.6 asks about the average annual investment in cooperative-R&D activities over the past three years. Similarly, according to the data in question, where CNO.5 answers indicate no cooperative-R&D behavior, the average annual cooperative-R&D investment of these enterprises is recorded as 0. Finally, the natural logarithm is calculated by adding 1 to the total annual cooperative-R&D investment of the supplementary enterprises. Product-innovation output (innov_prod): the questionnaire CNO.14 asks what kinds of innovative activities the enterprise has undertaken in the past three years. Among them, CNo14e (introducing new products or services) and CNo14f (adding new functions to existing products or services) are relevant to product innovation. If the enterprise engages in any of the innovation activities, the product-innovation output (innov_prod) is denoted as 1; otherwise, it is denoted as 0. Process-innovation output (innov_proc): questions CNo14a (introducing new technology to improve the process), CNo14b (introducing new quality-control procedures), CNo14c (introducing new management/administrative procedures), CNo14d (providing technical training for employees), CNo14g (taking measures to reduce production costs), and CNo14h (taking measures to improve production flexibility) are related to process innovation. If an enterprise engages in any of these innovative activities, the process-innovation output (innov_proc) is recorded as 1; otherwise, it is recorded as 0.

3.2.2. Explaining Variable: Digital Transformation

The questionnaire CNO.7 asks about the average annual expenditure of enterprises in the following categories over the past three years. The sub-question CNo7a (computers and other information-processing equipment, such as printers, terminals, opto-magnetic readers, RFID, operating system, and software) is related to enterprises’ digital investment. Since there are enterprises with zero investment in digital technology in the original data, we add 1 to the digital-technology investment of all enterprises, and the explanatory variable is measured by its natural logarithm, namely enterprise digital transformation. Considering the hysteresis effect of investment, digital transformation chooses to use the average expenditure of the past three years instead of the current year’s expenditure in the measurement method, which is conducive to removing the time effect and alleviating the synchronization problem of digital transformation on the explained variables.

3.2.3. Mediating Variable: Degree of E-Commerce Embeddedness

Through the literature analysis, it is found that the measurement of network embeddedness in academia is mainly divided into two categories: network structural embeddedness and network relational embeddedness. Chi et al. [34] believe that the application degree of digital assets (hardware, software) in the process of internal and external business operations reflects the embedded level of enterprise information technology. Zhang et al. [19] used procurement data to measure the e-commerce embeddedness between enterprises and upstream suppliers, and sales data to measure the e-commerce embeddedness between enterprises and downstream consumers. The questionnaire CNO11 asks, by means of a scale, to what extent ICT (computers, the Internet and software) is used to support the enterprise’s key business activities in the following business processes, of which the business processes (sub-items CNo11a–CNo11e) include partnerships, enhancement of products and services, production and operations, marketing and customer relations. The questionnaire designed five different application levels of e-commerce embedding, ranging from “never use” to “always use”, with a value of 1 to 5. Referring to the existing studies, this paper takes the arithmetic average of enterprises’ scores in sub-questions as the proxy variable of e-commerce embeddedness.

3.2.4. Moderating Variable: Human Capital

Human capital is an important resource of an enterprise, and only excellent talents can lead the enterprise to achieve continuous breakthroughs. Giving full play to the role of talents can enhance the absorptive capacity of enterprises and further promote the innovation and development of enterprises. Referring to the practice of Wang and Zhang [18], we divide the human capital of enterprises into managerial human capital (manager_cap) and employee human capital (employee_cap). Among them, the managerial human capital is expressed by the data from question B.7 of the questionnaire (the actual working years of senior managers), and the employee human capital is expressed from the data of question l9a of the questionnaire (years of education of employees).

3.2.5. Control Variables

Referring to the practice of existing research [18,29,33], we set the following control variables: (1) Enterprise size (size). As a proxy variable for measuring enterprise size, we take the number of employees logarithmically, and the corresponding questionnaire question was L.1 (how many permanent full-time employees does the enterprise have?). (2) The age of the enterprise (age). Questionnaire B.6b asks about the registration year of the enterprise. We use the survey time minus the year of enterprise registration to represent the age of the enterprise. (3) Whether to export (export). Questionnaire E.1 asks which market the company mainly sells its products in. It is recorded as 0 if the product is not exported (only the local market and domestic market are selected), and 1 if the product is exported (the international market is selected). (4) Market competition (competition). Questionnaire E.30 asks the extent to which competitors’ actions have hindered the current operation of the company, and the levels from “no obstacle” to “very serious obstacle” are represented by 0 to 4. We adopt this scale to measure the enterprise’s market-competition environment. (5) Gender of senior executives (gender). According to question B.7a, if the executive is male it is written as 1, and if the executive is female it is written as 0. (6) Financing position (finance). The financing situation of an enterprise will affect its operation and future development. Questionnaire K.30 asks to what extent financing channels are an obstacle to the current operation of the organization. The scale ranges from “no obstacle” to “very serious obstacle”, and is divided into five levels, with values ranging from 0 to 4. We use the scale scores to measure the financing situation of enterprises.

3.3. Data Sources and Descriptive Statistics

The data used in this study comes from the World Bank’s Business Survey Database, which consists of the Bank’s global-survey data on enterprises. The main purpose of this database is to evaluate the business environment in the place where the enterprises are located. As of November 2022, the World Bank’s Enterprise Survey Database provides survey data of 180,000 enterprises in 154 countries (regions). These data provide an objective description of enterprises’ operating status, innovation environment, government–enterprise relationship, and other aspects, from different dimensions. They are of great reference value to enterprise managers, policymakers, and researchers. The World Bank survey data of Chinese enterprises involved 2848 enterprises in 25 cities in China, including manufacturing and service industries. The feature of this survey is that it contains a large number of questions about enterprise innovation and innovation methods, which is more in keeping with the research theme of this paper. The World Bank surveyed 2848 enterprises in China using the stratified-sampling method, including 2700 private enterprises and 148 state-owned enterprises, and 1727 manufacturing enterprises and 1121 service enterprises. The surveyed enterprises were distributed in 25 cities, including Beijing, Shanghai, Shenzhen, Shijiazhuang, Zhengzhou, Hefei, and Chengdu, covering the eastern, central, and western regions of China. The samples are universal and representative.

On this basis, we screened the data according to the research needs. First of all, question A4 (enterprise industry) in the questionnaire classifies the industry to which the enterprise belongs in detail, and the state-owned enterprise data does not provide detailed secondary-industry classification information. Therefore, we deleted the data of 148 state-owned enterprises and retained 2700 private enterprises’ data. Secondly, this paper mainly studies the impact of digital transformation on the innovation of manufacturing enterprises. Therefore, in accordance with the A4 question of the questionnaire, the data from retail and other service enterprises were deleted. Finally, we obtained a sample of 1692 manufacturing enterprises. Meanwhile, in this paper, missing values are processed for the data that answered “don’t know” or “don’t answer” in the database. A descriptive analysis of the main variables is presented in Table 1.

Table 1.

Major variables and descriptive statistics.

4. Empirical Results and Analysis

4.1. Main Regression Results and Analysis

To reduce the impact of heteroscedasticity, robust standard errors are used in all regression models in this paper. Among them, model 1 and model 2 adopt the OLS-regression model, and model 3 and model 4 choose to use the probit-regression model, because the explained variables are 0–1 variables. The regression results are shown in Table 2:

Table 2.

The regression results of digital transformation on manufacturing enterprises’ innovation.

Columns (m1) and (m2) show the regression results for models 1 and 2. Based on the data, digital transformation positively promotes independent R&D (RD_inter) at a significance level of 1%, as well as positively promoting collaborative R&D (RD_cooper) at a 5% significance level. Specifically, for every 1 unit increase in digital-transformation investment, enterprises’ independent-R&D investment increases by 0.456 units, and cooperative-R&D investment increases by 0.194 units. The regression results of model 2 and model 3 are shown in columns (m3) and (m4). Since the probit model is not a linear-regression model, its equation coefficients cannot be explained in an economic sense as with the OLS-regression coefficients, so it is usually more practical to use the mean marginal effect of explanatory variables. Through calculation, the average marginal effects of model 3 and model 4 are 0.031 and 0.044, respectively, which means that for every 1-unit increase in digital investment, the probability of product-innovation output (Innov_prod) increasing by 3.1%, and process-innovation output (innov_proc) increasing by 4.4%, increase in chance. Hypothesis 1 of this paper has been verified.

Despite inconsistent results for the control variables, we find that: (1) Enterprise size affects enterprise R&D investment and innovation output significantly, at the 1% level. Compared with small enterprises, large enterprises not only have the advantages of economies of scale but also have better resources, platforms, and more partners, which further enhances the digital-transformation influence on enterprise innovation [20,35]. (2) The enterprise exports have a significant positive impact on the internal-R&D investment, cooperative-R&D investment, and product-innovation output. This indicates that Chinese manufacturing enterprises have an export–learning effect. Entering the international market can help enterprises learn and absorb foreign advanced-production technology and management experience, and provide more resources and opportunities for enterprises to innovate [36]. Therefore, exports positively affect the innovation of Chinese manufacturing enterprises. (3) A significant positive impact of finance status on enterprise innovation can be observed at a level of 1%. This shows that financing constraints have an anti-driving effect on enterprise-innovation behavior. Existing studies have also shown that enterprises constrained by financing will choose their innovation strategies more carefully, reduce long-term R&D investment and choose short-term R&D projects with higher returns, so as to avoid the impact brought by external environmental uncertainties, improve the utilization efficiency of existing innovation resources, and thus improve the quantity and quality of innovation [37]. (4) Market competition has a significant negative impact on the output of enterprise-process innovation, which may be caused by the fierce market competition among competitors, which reduces the cooperation between enterprises and causes enterprises to mobilize more resources to participate in the competition, thus crowding out the input of innovation resources, and then negatively affecting the output of innovation achievements. Manufacturing enterprises’ innovation is negatively impacted by other control variables, such as enterprise age and the gender of senior executives. However, they are not significant.

4.2. Robustness Check

In view of the possible endogenous problems in the research process and the robustness of the explanatory power of the indicators, we conducted a robustness test on the model. Firstly, the instrumental-variables method was used to alleviate the endogenous problems in the research, and then the model was tested by subsamples. The test results all show the robustness of the research conclusions.

4.2.1. Treatment of Endogenous Problems

The research model in this paper may cause endogeneity problems, due to missing variables, two-way causality, and other factors, which will affect the reliability of the research conclusions. The instrumental-variables method is one of the most widely used methods to correct endogeneity problems [38]. Therefore, in order to improve the credibility and robustness of the research conclusions, this study constructed instrumental variables to solve the endogenous problem of the model. The selection of instrumental variables should follow two principles: first, instrumental variables should be related to endogenous-explanatory variables, namely, the correlation principle; second, instrumental variables should be independent of perturbation terms (not directly related to explained variables), that is, the principle of orthogonality [29]. Therefore, for the purpose of this paper, an ideal instrumental variable is one that has an impact on digital transformation but has no impact on manufacturing-enterprise innovation. The instrumental variable selected in this study comes from the question C.22b (whether the enterprise uses the self-built website at present) in the questionnaire. If the enterprise uses the self-built website, it is denoted as 1; if the enterprise does not use the self-built website, it is denoted as 0. On the one hand, if an enterprise uses a self-built website, it will inevitably increase its investment in computers, software systems, servers, and other information-technology software and hardware, thus directly driving the increase in enterprise digital investment; that is, the instrumental variable has an impact on the digital transformation of endogenous explanatory variables. On the other hand, whether an enterprise uses a self-built website has almost no direct influence on enterprise innovation, that is, the instrumental variable has no direct influence on the explained variables. Therefore, it is appropriate to choose whether enterprises use self-built websites, as an instrumental variable. The 2SLS model and IVProbit model were used for the regression of the instrumental-variables method. In Table 3, regression results and test results for the instrumental variable are presented in detail. Firstly, in the DWH test of model 1 and model 2, chi-square statistics and F-statistics are both significant at the level of 0.01, indicating that the null hypothesis that there is no endogenous explanatory variable is rejected. Secondly, the Kleibergen–Paap rk-LM statistics of model 1 and model 2 are significant at the 1% level, indicating that the model passes the unrecognized test of the instrumental variable. Further, the Kleibergen–Paap rk-Wald-F statistics of model 1 and model 2 are significant at the 1% level, and the AR statistics of model 3 and model 4 are significant at the 0.01 level, indicating that there is a correlation between the endogenous variable and instrumental variable. Finally, both model 3 and model 4 passed the Wald-exogeneity test. Therefore, the selection of instrumental variable is appropriate. On the other hand, according to the instrumental-variable regression results, digital transformation significantly affects independent-R&D investment, cooperative-R&D investment, product-innovation generation, and process-innovation output at the 1% level. Therefore, after considering the endogeneity problem, hypothesis 1 of this paper has also been verified.

Table 3.

Instrumental-variable regression results of digital transformation and manufacturing-enterprise innovation.

4.2.2. Sub-Sample Test

The explained variable in this article, manufacturing-enterprise innovation, adopts four different dimensions (independent-R&D investment, cooperative-R&D investment, product-innovation output, process-innovation output) as measurement methods, and uses OLS and probit models to perform regression respectively. The main regression coefficients are all significant, which reflects the robustness of the research conclusions, to a certain extent. In order to further improve the robustness of the conclusion, we chose to eliminate the special samples that may affect the conclusion. As first-tier cities such as Beijing, Shanghai, Shenzhen, and Guangzhou are economically developed, enterprises in these areas are highly innovative. Therefore, in order to ensure that the research conclusions were not affected, enterprises in these areas were excluded from this paper. Table 4 shows the regression coefficients of independent variables for the subsamples, which are all significant, indicating that the research conclusion passes the robustness test.

Table 4.

Sub-sample test results.

4.3. Mechanism Analysis

In accordance with the literature analysis, we constructed a mediation model through Equations (5)–(7) to verify the mechanism of digital transformation on manufacturing-enterprise innovation. The regression results of the mediation effect are shown in Table 5. In this paper, Wen and Ye [39] are referred to, to test the mediation effect. Firstly, the coefficient α1 of Equation (5) is checked. According to Table 2, a significant impact on the innovation capabilities of manufacturing enterprises can be attributed to digital transformation, so it is the mediation effect that supports the thesis. Secondly, from the analysis shown in Table 5, it is evident that the coefficient β1 of Equation (6) and the coefficient γ2 of Equation (7) are both significant, indicating that the indirect mediating effect of the e-commerce-embedment degree on digital transformation and manufacturing-enterprise innovation is significant. The third step is to test the coefficient γ1 of Equation (7). It can be seen from the table that the coefficients are significant at the 1% level, so the direct effect of the model is significant. The fourth step is to test the symbols of β1 × γ2 and γ1. Table 5 shows that β1, γ2, and γ1 are all positive numbers, and β1 × γ2 and γ1 have the same sign. Therefore, the model belongs to the partial-mediation effect, and the proportion of mediation effect in the total effect is β1γ2/α1.

Table 5.

Regression results of the mediating effect of e-commerce embeddedness.

In conclusion, the degree of e-commerce embeddedness plays a part in the mediating effect in the impact of digital transformation on manufacturing enterprises’ independent- and collaborative-R&D investments, product-innovation output, and process-innovation output. Among the influences of digital transformation on enterprises’ independent-R&D investment, the proportion of the mediating effect of e-commerce embeddedness in the total effect is β1γ2/α1 = 0.0668 × 1.397/0.456 = 0.205. Similarly, among the influences of digital transformation on enterprises’ collaborative-R&D investment, product-innovation output and process-innovation output, the mediating effect of e-commerce embeddedness accounts for 0.107, 0.340 and 0.074, respectively, of the total effect. Therefore, hypothesis 2 of this paper is verified.

4.4. Moderating-Effect Analysis

According to the literature analysis, we use Equations (8) and (9) to construct a moderating model to verify how human capital affects manufacturing-enterprise innovation when it comes to digitalization. The moderating-effect regression results of managerial human capital are shown in Table 6. Managerial human capital has a certain positive impact on cooperative-R&D investment and process-innovation output, and a significant positive impact on independent-R&D investment and product-innovation output. Further analysis shows that the coefficients of the interaction terms Digital × manager_cap are all positive, and the coefficients of independent-R&D investment and product-innovation output are significantly positive at the 1% level. This indicates that the human capital of managers moderates manufacturing-enterprise innovation in the context of digital transformation, In particular, the role of managerial human capital in moderating the effect of digital transformation on independent-R&D investment and product-innovation output is significant.

Table 6.

The moderating-effect results of managerial human capital.

The moderating-effect regression results of employee human capital are shown in Table 7. Employee human capital has a significant positive impact on independent-R&D investment and product-innovation output, and a certain negative impact on cooperative-R&D investment and process-innovation output. Further analysis shows that the coefficients of Digital × employee_cap are positive and negative. The coefficient of R&D investment is significantly negative at 1%, and the coefficient of product-innovation output is significantly positive at 5%. Other coefficients are not significant. This indicates that employee human capital plays a significant negative moderating role in the relationship between digital transformation and cooperative-R&D investment. In the relationship between digital transformation and enterprise product-innovation output, employee human capital plays a significant positive moderating role. The possible reasons are as follows: (1) An enterprise with a higher human capital of employees (higher education level of employees) has stronger R&D capability and less knowledge spillover through the influence of digital transformation on R&D cooperation. In this case, the need for enterprises to control their own knowledge outflow will have a significant negative impact on R&D cooperation [40]. Therefore, in order to prevent knowledge outflow, enterprises with high employee human capital will strengthen independent-R&D investment and weaken cooperative-R&D investment. (2) The more educated the employees are, the stronger their learning ability and absorptive ability, and the more breakthrough innovations the enterprise has achieved through the influence of digital transformation on product research and development. Compared with product innovation, process innovation is relatively simple, and belongs to progressive innovation, including improving process flow, providing training for employees, improving production flexibility, and so on. The higher the employee’s human capital, the more mature the employee’s skills, and the less the enterprise invests in employee training. At the same time, the more breakthrough innovations employees make, the less complementary process innovation they have. In conclusion, the hypothesis-3 parts of this paper have been verified.

Table 7.

The moderating-effect results of employee human capital.

5. Conclusions and Discussion

5.1. Conclusions

Based on the review of existing studies, we comprehensively apply the resource-based view, network-embeddedness theory, and resource-complementarity theory to build a theoretical model of digital transformation affecting manufacturing enterprises’ innovation and verify the model and hypothesis with the microdata of Chinese enterprises investigated by the World Bank. This paper empirically examines the impact of digital transformation on manufacturing-enterprise innovation and its mechanisms and boundary conditions. The main conclusions are as follows:

(1) Digital transformation can have a significant positive impact on manufacturing-enterprise innovation, that is, hypothesis H1 is verified. In particular, enterprises’ independent-R&D investment is more affected by digital transformation than cooperative-R&D investment; innovations in products are more impacted by digital transformation than innovations in processes. From the perspective of resource-based view theory, it is indicated that enterprises improve the organization’s digital-application ability and expand the enterprise’s resource-acquisition boundary through digital-investment behavior. Meanwhile, the deep integration of digital transformation and enterprise organization strengthens the uniqueness and non-substitutability of enterprise resources. Unrepeatable enterprise resources empower the key links of enterprise innovation, thereby promoting enterprise-innovation investment and innovation output, making it a source of long-term competitive advantage for enterprises.

(2) The degree of e-commerce embeddedness plays a partial mediating role among manufacturing enterprises as they adapt to digital transformation; that is, hypothesis H2 is verified. Based on the network-embeddedness theory, the purpose of this part is primarily to examine the mechanisms by which digital transformation impacts manufacturing innovation. The results show that e-commerce embeddedness has a partial mediating effect in the impact of digital transformation on manufacturing enterprises’ independent- and collaborative-R&D investments, product- innovation output, and process-innovation output. Among them, the mediating effect of e-commerce embeddedness on digital transformation and the output of enterprises’ product innovation accounts for the highest proportion. Consequently, digital transformation improves e-commerce embedding in manufacturing enterprises, and further promotes the innovation of manufacturing enterprises by strengthening the relationship of enterprise embeddedness, expanding enterprise-embeddedness resources, and improving enterprise-embeddedness structure.

(3) Manufacturing enterprises’ independent-R&D investment and product-innovation output are significantly moderated by managerial human capital. However, this moderating effect does not contribute significantly to cooperative-R&D investment and process innovation due to digital transformation. This shows that, from the perspective of resource-complementarity theory, human capital of managers, as an effective complementary resource in digital transformation, acts as a moderating force for enterprises’ innovation in the context of digital transformation. Employee human capital has a significant negative moderating effect on the impact of digital transformation on cooperative-R&D investment of manufacturing enterprises, and has a significant positive moderating effect on the relationship between digital transformation and product-innovation output. This indicates that enterprises with higher employee human capital have a stronger research-and-development capability, and their demand for knowledge protection exceeds the demand for knowledge spillover. Meanwhile, due to their strong independent-research-and-development capability, enterprises are more able to achieve breakthrough product innovation. At this point, considering digitization, the moderating effect of employee human capital is not significant in influencing enterprise independent-R&D investment and process-innovation output, that is, hypothesis H3 is verified.

5.2. Discussion

Compared with other studies that do not emphasize industrial background [5,17,23], this paper focuses on the manufacturing industry, regards enterprise digital transformation as an important resource for enterprises, and analyzes its transmission mechanisms for facilitating enterprise innovation using network-embeddedness theory. This paper conducts a useful exploration on how to open the ‘mechanism black box’ between enterprises’ digital transformation and manufacturing enterprises’ innovation. Existing research believes that enterprise human capital plays an important role in the process of enterprise digital transformation [3,18]. This paper innovatively introduces it into the model, to study the boundary role of human capital between digital transformation and manufacturing-enterprise innovation. Our research conclusions have some theoretical and practical implications.

5.2.1. Theoretical Implications

This paper makes the following main contributions to the theory:

(1) Research on digital transformation mainly focuses on the impact of enterprises’ performance, and most does not emphasize the research background [5,17,23]. This paper mainly focuses on the manufacturing industry, and studies how digital transformation affects manufacturing enterprises’ innovation. For an in-depth understanding of digital transformation and enterprise innovation, focused research is crucial.

(2) Taking into account resource-based theory, network-embeddedness theory, and the complementarity theory of resources, we investigated the mechanisms involved in, and the boundary conditions associated with, digital transformation, on the innovation of manufacturing enterprises, which is an expansion of the existing theoretical-application scenarios, and further enriches the theoretical research on digital transformation and enterprise innovation. Globally, countries are developing their digital economies vigorously and integrating them with their real economies, so that certain theories of digital transformation and manufacturing-enterprise innovation may provide some theoretical guidance.

5.2.2. Practical Implications

Several implications are provided for manufacturing enterprises’ innovation practices and policies in this paper:

(1) Despite some progress, the manufacturing industry still has a long way to go in the transformation from informatization to digitalization. Digital transformation plays a crucial role in the informatization and transformation of manufacturing enterprises. It is necessary to make full use of digital transformation to expand enterprise resources, and enhance the non-substitutability of enterprise resources through the deep integration with enterprise operations, so as to further enhance the innovation ability and sustainable competitive advantage of enterprises, and create an effective path for manufacturing enterprises to cope with the digital wave.

(2) Efforts should be made to fully understand the mechanisms of digital transformation and innovation in manufacturing enterprises, to use e-commerce platforms to obtain consume-preference information, to strengthen the connection with suppliers, customers, and cooperative enterprises, and to use digital transformation to gradually improve the degree of enterprise e-commerce embeddedness, including relational embeddedness, structural embeddedness, and resource embeddedness, so as to further promote enterprise innovation and transformation.

(3) Full attention should be paid to the combination of digital resources and other enterprise resources, and relevant policies should be formulated to ensure its smooth implementation. Developing training plans for managers and ordinary employees, improving the human capital of managers and employees to enhance the enterprises’ independent-research-and-development capabilities and breakthrough product-innovation capabilities, are necessary. In view of the negative moderating of employee human capital regarding digital transformation and enterprise cooperative innovation, policymakers should improve the patent-protection system, encourage innovation and sharing, and reduce the self-protectionism among enterprises, so that enterprises participating in cooperation can obtain spillover effects.

6. Limitations and Prospects

The research in this paper has obtained some theoretical and practical implications, but there are still some shortcomings to be improved. First, the digital transformation measured in this paper is a specific investment amount, without distinguishing hardware investment and software investment. In the context of digital transformation, the digital investment of enterprises is not only reflected in software and hardware, but also includes the investment in enterprise data-mining ability, data technology, and data regarding personnel-collaboration ability, etc. In the future, we can further explore how this type of investment affects manufacturing-enterprise innovation. Secondly, the cross-sectional data used in this paper cannot show the dynamic evolution of digital transformation and manufacturing enterprises’ innovation. In the future, secondary panel data or multi-period survey data can be considered to study how manufacturing enterprises innovate in a dynamic way as a result of digital transformation.

Author Contributions

Conceptualization, X.G. and X.C.; methodology, X.G.; software, X.G.; formal analysis, X.G. and X.C.; data curation, X.G.; writing—original draft preparation, X.G.; writing—review and editing, X.G. and X.C.; supervision, X.C.; project administration, X.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Foundation of China (grant numbers: 21ZDA033 and 21BGL223); the National Natural Science Foundation of China (grant number: 72071104); and the Key project of Jiangsu Social Science Foundation (grant number: 20GLA007).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ren, F.; Shi, C.; Li, D. The Impact of Information Technology Investment on Firm Profitability. Commer. Res. 2012, 4, 37–44. [Google Scholar] [CrossRef]

- Tang, C.-P.; Huang, T.C.-K.; Wang, S.-T. The impact of Internet of things implementation on firm performance. Telemat. Inform. 2018, 35, 2038–2053. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, T.N.; Yi, X.W. Research on the Synergistic Effect of R&D Expenditures for IT investment: A Contingent View of Internal Organizational Factors. J. Manag. World 2020, 36, 77–89. [Google Scholar] [CrossRef]

- Zhou, S.; Qiao, Z.; Du, Q.; Wang, G.A.; Fan, W.; Yan, X. Measuring Customer Agility from Online Reviews Using Big Data Text Analytics. J. Manag. Inf. Syst. 2018, 35, 510–539. [Google Scholar] [CrossRef]

- Xue, L.; Zhang, Q.; Zhang, X.; Li, C. Can Digital Transformation Promote Green Technology Innovation? Sustainability 2022, 14, 7497. [Google Scholar] [CrossRef]

- Zhou, W.H.; Wang, P.C.; Yang, M. Digital Empowerment Promotes Mass Customization Technology Innovation. Stud. Sci. Sci. 2018, 36, 1516–1523. [Google Scholar] [CrossRef]

- Liu, H.; Wang, P.; Li, Z. Is There Any Difference in the Impact of Digital Transformation on the Quantity and Efficiency of Enterprise Technological Innovation? Taking China’s Agricultural Listed Companies as an Example. Sustainability 2021, 13, 12972. [Google Scholar] [CrossRef]

- Hilbolling, S.; Berends, H.; Deken, F.; Tuertscher, P. Complementors as connectors: Managing open innovation around digital product platforms. R&D Manag. 2020, 50, 18–30. [Google Scholar] [CrossRef]

- Zhan, Y.; Tan, K.H.; Ji, G.; Chung, L.; Tseng, M. A big data framework for facilitating product innovation processes. Bus. Process. Manag. J. 2017, 23, 518–536. [Google Scholar] [CrossRef]

- Svahn, F.; Mathiassen, L.; Lindgren, R. Embracing Digital Innovation in Incumbent Firms: How Volvo Cars Managed Competing Concerns. MIS Q. 2017, 41, 239–254. [Google Scholar] [CrossRef]

- AlNuaimi, B.K.; Singh, S.K.; Ren, S.; Budhwar, P.; Vorobyev, D. Mastering digital transformation: The nexus between leadership, agility, and digital strategy. J. Bus. Res. 2022, 145, 636–648. [Google Scholar] [CrossRef]

- Li, L.; Lin, J.; Turel, O.; Liu, P.; Luo, X. The impact of e-commerce capabilities on agricultural firms’ performance gains: The mediating role of organizational agility. Ind. Manag. Data Syst. 2020, 120, 1265–1286. [Google Scholar] [CrossRef]

- Haaker, T.; Ly, P.T.M.; Nguyen-Thanh, N.; Nguyen, H.T.H. Business model innovation through the application of the Internet-of-Things: A comparative analysis. J. Bus. Res. 2021, 126, 126–136. [Google Scholar] [CrossRef]

- Gao, S.; Ma, X.; Zhao, X. Entrepreneurship, Digital Capabilities, and Sustainable Business Model Innovation: A Case Study. Mob. Inf. Syst. 2022, 2022, 5822423. [Google Scholar] [CrossRef]

- Su, Y.-S.; Zheng, Z.-X.; Chen, J. A multi-platform collaboration innovation ecosystem: The case of China. Manag. Decis. 2018, 56, 125–142. [Google Scholar] [CrossRef]

- Yang, W.; Ji, L.X.; Zhou, Q. Impact of Firms’ Digital Transformation on the Innovation Ecosystem:A Multi-agent Model Con-sidering Dynamic of Market Size. Chin. J. Manag. Sci. 2022, 30, 223–232. [Google Scholar] [CrossRef]

- Kleis, L.; Chwelos, P.; Ramirez, R.V.; Cockburn, I. Information Technology and Intangible Output: The Impact of IT Investment on Innovation Productivity. Inf. Syst. Res. 2012, 23, 42–59. [Google Scholar] [CrossRef]

- Wang, L.N.; Zhang, G.P. Information Technology, Human Capital and Innovation of Start-up Firms: An Empirical Study Based on Enterprise-Level Data of China. Sci. Sci. Manag. S. T. 2018, 39, 111–122. Available online: http://www.ssstm.org/CN/Y2018/V39/I04/111 (accessed on 5 December 2022).

- Zhang, Y.H.; Zhuang, Z.Z.; Li, Z.W. Can E-commerce Promote Innovation of Traditional Manufacturing? J. Quant. Technol. Econ. 2018, 35, 100–115. [Google Scholar] [CrossRef]

- Zhao, X.; Sun, X.; Zhao, L.; Xing, Y. Can the digital transformation of manufacturing enterprises promote enterprise innovation? Bus. Process. Manag. J. 2022, 28, 960–982. [Google Scholar] [CrossRef]

- Liu, H.; Ke, W.; Wei, K.K.; Hua, Z. The impact of IT capabilities on firm performance: The mediating roles of absorptive capacity and supply chain agility. Decis. Support Syst. 2013, 54, 1452–1462. [Google Scholar] [CrossRef]

- Gómez, J.; Salazar, I.; Vargas, P. Does Information Technology Improve Open Innovation Performance? An Examination of Manufacturers in Spain. Inf. Syst. Res. 2017, 28, 661–675. [Google Scholar] [CrossRef]

- Ravichandran, T.; Han, S.; Mithas, S. Mitigating Diminishing Returns to R&D: The Role of Information Technology in Innovation. Inf. Syst. Res. 2017, 28, 812–827. [Google Scholar] [CrossRef]

- Li, R.; Rao, J.; Wan, L. The digital economy, enterprise digital transformation, and enterprise innovation. Manag. Decis. Econ. 2022, 43, 2875–2886. [Google Scholar] [CrossRef]

- Cong, H.; Zou, D.; Wu, F. Influence mechanism of multi-network embeddedness to enterprises innovation performance based on knowledge management perspective. Clust. Comput. 2017, 20, 93–108. [Google Scholar] [CrossRef]

- Chaudhuri, R.; Chatterjee, S.; Vrontis, D.; Vicentini, F. Effects of human capital on entrepreneurial ecosystems in the emerging economy: The mediating role of digital knowledge and innovative capability from India perspective. J. Intellect. Cap. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Li, X.Y.; Chen, G.Q. Research on the Relationship Between Information Technology Input, Technological Innovation Dynamic Capabilities and Enterprise Performance. Sci. Tech. Prog. Policy 2019, 36, 100–107. [Google Scholar] [CrossRef]

- Han, M.M.; Zhang, S.F.; Gu, X.G. Can Information Sharing Enhance Enterprise Productivity? Evidence from Survey Data of Chinese Manufacturing Enterprises. Ind. Econ. Res. 2020, 42–56. [Google Scholar] [CrossRef]

- Zheng, C.D.; Wang, Q.; Liu, W.X.; Ni, L.L.; Wu, Y.Z. Influences of Characteristics of E-Business Market on Product Innovation: An Empirical Study. J. Manag. Sci. 2014, 27, 90–102. [Google Scholar] [CrossRef]

- Lu, R.Y.; Zhou, Y.; Ding, Y.W.; Zhou, D.M.; Feng, X. Enterprise Innovation Network: Tracing, Evolution and Research Prospect. J. Manag. World 2021, 37, 217–233. [Google Scholar] [CrossRef]

- Zhang, Y.; Liang, Q.Z.; Fan, P.H. A Meta-analysis of the Relationship Between Network Embeddedness and Innovation Per-formance. Sci. Res. Manag. 2016, 37, 80–88. [Google Scholar] [CrossRef]

- Zhou, L.Q.; Zhang, L.P.; Zhang, S.Z. R&D Cooperation and Firm Innovation: An Empirical Study of Chinese Manufacturing Industry. Jiangsu Soc. Sci. 2016, 27, 47–55. [Google Scholar] [CrossRef]

- Chi, M.M.; Zhao, J.; Shen, X.K. The Formation Process of Cooperative E-business Capabilities: The Moderated Effects of IT-embedded and Formal. Control Manag. Rev. 2013, 25, 135–144. [Google Scholar] [CrossRef]

- Shi, J.W.; Liu, Y. Investment in Information Technology and Innovation Performance of Industrial Enterprises: Empirical Ev-idence from Chinese Listed Companies. J. Zhongnan Univ. Econ. Law. 2021, 126–137. [Google Scholar] [CrossRef]

- Bratti, M.; Felice, G. Are Exporters More Likely to Introduce Product Innovations? World Econ. 2012, 35, 1559–1598. [Google Scholar] [CrossRef]

- Pan, S.Y.; Jiang, H.W. The Promoting Effect of Financing Constraints on Corporate Innovation Research. Soc. Sci. Front. 2020, 242–248. Available online: https://www.shkxzx.cn/?mod=datas&act=viewfulltext&id=2991 (accessed on 16 December 2022).

- Wang, Y.; Li, H.Y. Dealing with Endogeneity Issues in Management Research: A Review and Solutions. Q. J. Manag. 2017, 2, 20–47. Available online: https://bus.sysu.edu.cn/qjm/node/277 (accessed on 20 December 2022).

- Wen, Z.L.; Ye, B.J. Analyses of Mediating Effects: The Development of Methods and Models. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Chun, H.; Mun, S.-B. Determinants of R&D cooperation in small and medium-sized enterprises. Small Bus. Econ. 2011, 39, 419–436. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).