The Impact of Population Aging on Green Innovation: An Empirical Analysis Based on Inter-Provincial Data in China

Abstract

1. Introduction

2. Review of the Literature

3. Methodology and Data

3.1. Empirical Models

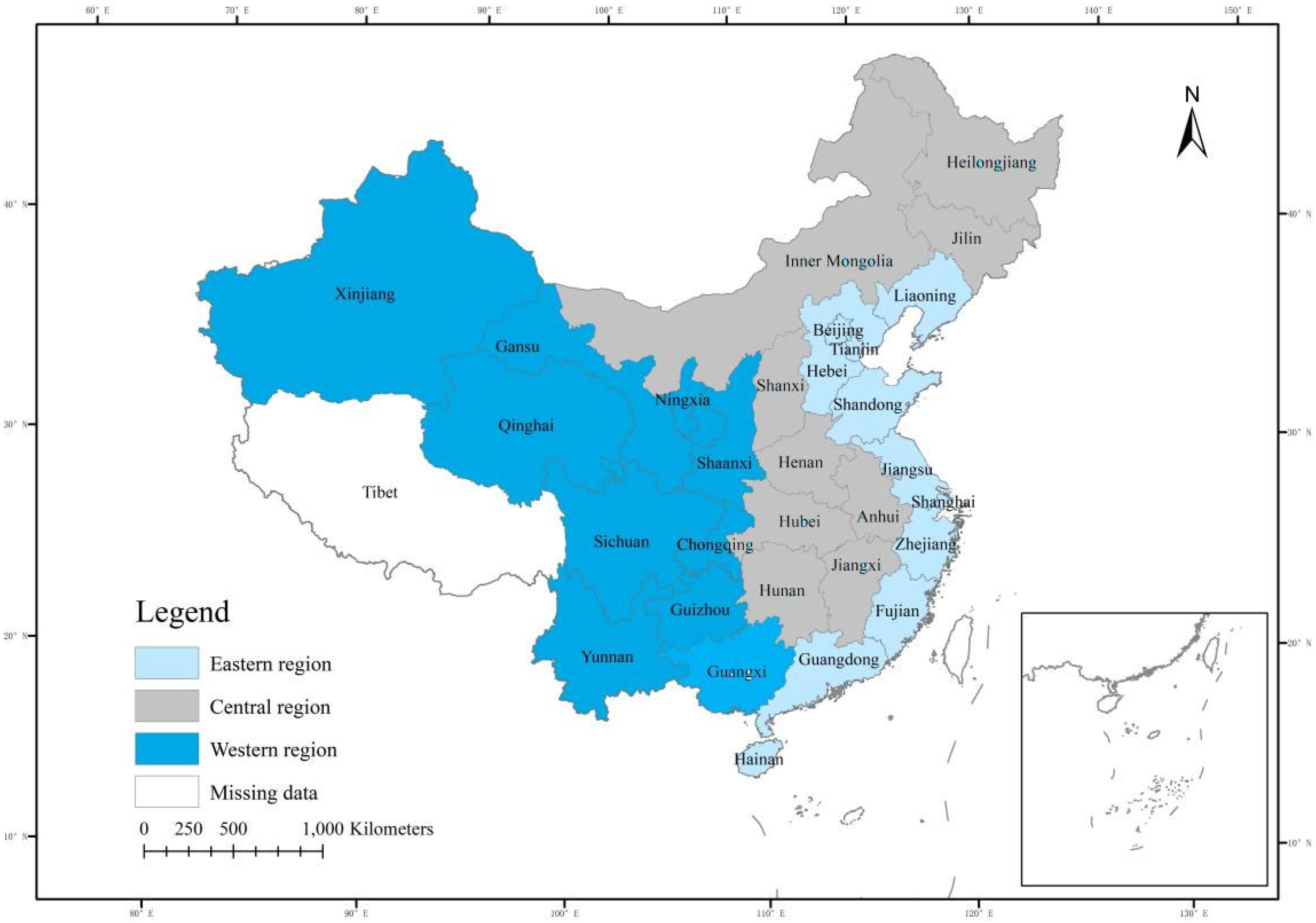

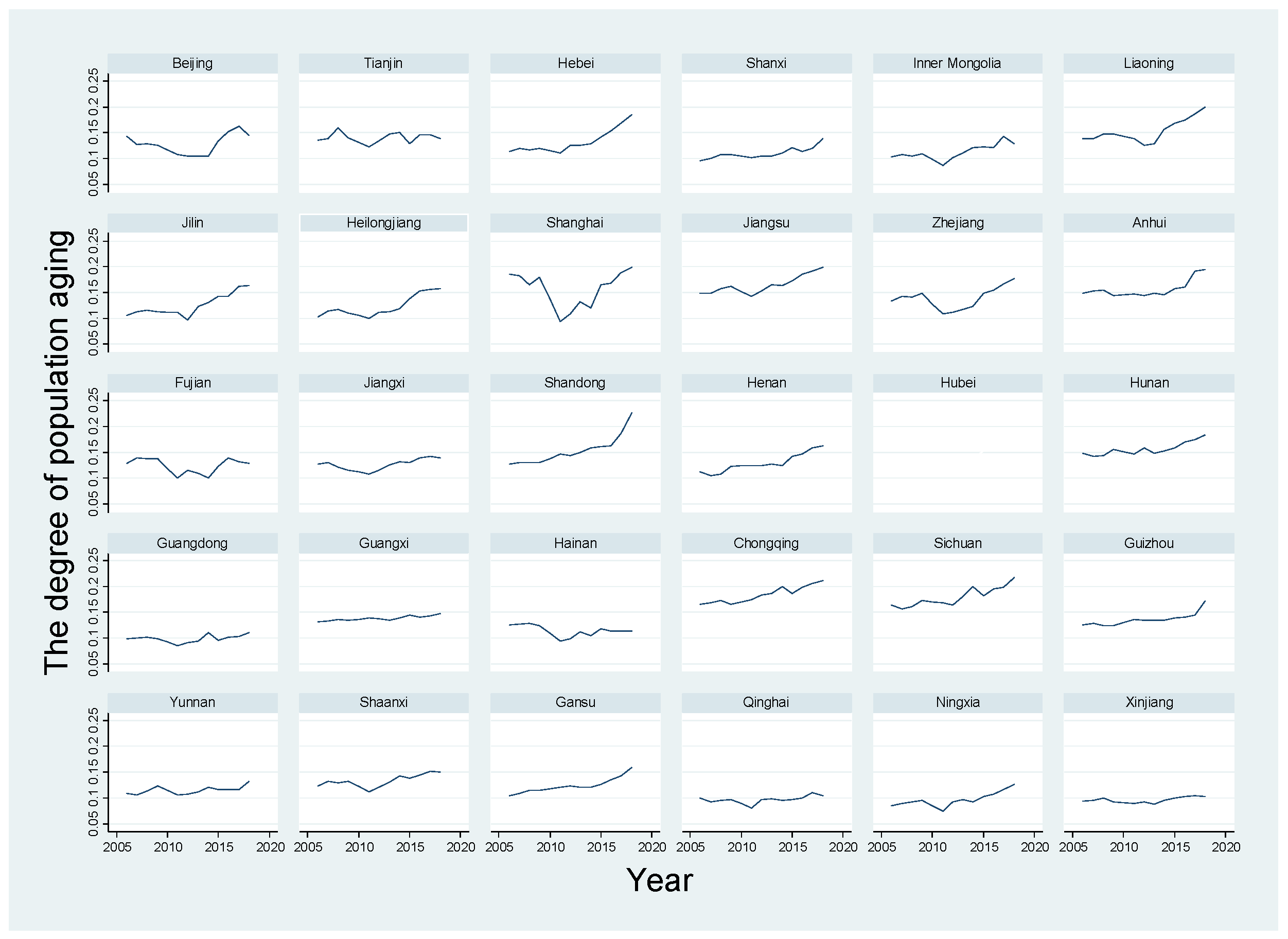

3.2. Sample Selection

3.3. Variables

3.3.1. Dependent Variable

3.3.2. Measuring Population Aging

3.3.3. Conditioning Variables

4. Empirical Results and Discussion

4.1. Model Tests

4.2. Threshold Effects of Population Aging on Green innovation

4.3. Regional Heterogeneity Effects

4.4. Moderating Role of Regional Economic Conditions

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Tomislav, K. The concept of sustainable development: From its beginning to the contemporary issues. Zagreb Int. Rev. Econ. 2018, 21, 67–94. [Google Scholar]

- Sachs, J. The AGE of Sustainable Development; Columbia University Press: New York, NY, USA, 2015. [Google Scholar]

- Manioudis, M.; Meramveliotakis, G. Broad strokes towards a grand theory in the analysis of sustainable development: A return to the classical political economy. New Polit. Econ. 2022, 27, 866–878. [Google Scholar] [CrossRef]

- Romer, P. Increasing Returns and Long-Run Growth. J. Polit. Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Todaro, M.P.; Smith, S.C. Economic Development, 8th ed.; Pearson Education Limited: Harlow, UK, 2003. [Google Scholar]

- Shiva, V. Resources. In The Development Dictionary: A Guide to Knowledge as Power, 2nd ed.; Sachs, W., Ed.; Zed Books: London, UK; New York, NY, USA, 2010; pp. 228–242. [Google Scholar]

- Sachs, W. Environment. In The Development Dictionary: A Guide to Knowledge as Power, 2nd ed.; Sachs, W., Ed.; Zed Books: London, UK; New York, NY, USA, 2010; pp. 24–37. [Google Scholar]

- Fang, Z.; Razzaq, A.; Mohsin, M.; Irfan, M. Spatial spillovers and threshold effects of internet development and entrepreneurship on green innovation efficiency in China. Technol. Soc. 2022, 68, 101844. [Google Scholar] [CrossRef]

- Shen, N.; Zhou, J.J. Research on the efficiency of green innovation and the mechanism of key factors in China from the perspective of technological heterogeneity: Based on hybrid DEA and structural equation model. J. Ind. Eng. Manag. 2018, 32, 46–53. [Google Scholar]

- Chen, Z.; Zhang, X.; Chen, F. Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Chang. 2021, 168, 12. [Google Scholar] [CrossRef]

- Yuan, G.; Ye Qin, S.Y. Financial innovation, 0744, information screening and industries’ green innovation—Industry-level evidence from the OECD. Technol. Forecast. Soc. Chang. 2021, 171, 120998. [Google Scholar] [CrossRef]

- England, R.S. Aging China: The Demographic Challenge to China’s Economic Prospects; Greenwood Publishing Group: Westport, CT, USA, 2005; pp. 1–10. [Google Scholar]

- Cuaresma, J.C.; Lábaj, M.; Pružinsky, P. Prospective ageing and economic growth in Europe. J. Econ. Age 2014, 3, 50–57. [Google Scholar] [CrossRef]

- Nishimura, K.G.; Minetaki, K.; Shirai, M.; Kurokawa, F. Effects of Information Technology and Aging Work Force on Labor Demand and Technological Progress in Japanese Industries: 1980–1998; Center for International Research on the Japanese Economy: Tokyo, Japan, 2002. [Google Scholar]

- Short, S.; Zhai, F. Looking locally at China’s one-child policy. Stud. Fam. Plan. 1998, 29, 373–387. [Google Scholar] [CrossRef]

- James, P. The sustainability cycle: A new tool for product development and design. J. Sustain. Prod. Des. 1997, 2, 52–57. [Google Scholar]

- García-Pozo, A.; Sánchez-Ollero, J.L.; Marchante-Lara, M. Eco-innovation and management: An empirical analysis of environmental good practices and labour productivity in the Spanish hotel industry. Innovation 2015, 17, 58–68. [Google Scholar] [CrossRef]

- Chen, Y.S.; Lai, S.B.; Wen, C.T. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Chang, C.H.; Chen, Y.S. Green organisational identity and green innovation. Manag. Decis. 2013, 51, 1056–1070. [Google Scholar] [CrossRef]

- Saunila, M.; Ukko, J.; Rantala, T. Sustainability as a driver of green innovation investment and exploitation. J. Clean. Prod. 2018, 179, 631–641. [Google Scholar] [CrossRef]

- Hilkenmeier, F.; Fechtelpeter, C.; Decius, J. How to foster innovation in SMEs: Evidence of the effectiveness of a project-based technology transfer approach. J. Technol. Transf. 2021, 1–29. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Toward a new conception of the environmentcompetiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Kraus, S.; Breier, M.; Dasí-Rodríguez, S. The art of crafting a systematic literature review in entrepreneurship research. Int. Entrep. Manag. J. 2020, 16, 1023–1042. [Google Scholar] [CrossRef]

- Cheng, Y.; Awan, U.; Ahmad, S.; Tan, Z. How do technological innovation and fiscal decentralization affect the environment? A story of the fourth industrial revolution and sustainable growth. Technol. Forecast. Soc. Chang. 2021, 162, 120398. [Google Scholar] [CrossRef]

- Acemoglu, D. When does labor scarcity encourage innovation? J. Polit. Econ. 2010, 118, 1037–1078. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. Secular stagnation? The effect of aging on economic growth in the age of automation. Am. Econ. Rev. 2017, 107, 174–179. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. The race between man and machine: Implications of technology for growth, factor shares, and employment. Am. Econ. Rev. 2018, 108, 1488–1542. [Google Scholar] [CrossRef]

- Madsen, J.B.; Damania, R. Labour Demand and Wage-induced Innovations: Evidence from the OECD countries. Int. Rev. Appl. Econ. 2001, 3, 323–334. [Google Scholar] [CrossRef]

- Antonelli, C.; Quatraro, F. The Effects of Biased Technological Changes on Total Factor Productivity: A Rejoinder and New Empirical Evidence. J. Technol. Transf. 2014, 2, 281–299. [Google Scholar] [CrossRef]

- Cutler, D.; Poterba, J.; Sheiner, L.; Summers, L. An Aging Society: Opportunity or Challenge. Brook. Pap. Econ. Act. 1990, 21, 1–73. [Google Scholar] [CrossRef]

- Tan, Y.; Liu, X.; Sun, H.; Zeng, C. Population ageing, labour market rigidity and corporate innovation: Evidence from China. Res. Policy 2022, 51, 104428. [Google Scholar] [CrossRef]

- Wachsen, E.; Blind, K. More labor market flexibility for more innovation? Evidence from employer-employee linked micro data. Res. Policy 2016, 5, 941–950. [Google Scholar] [CrossRef]

- Hoxha, S.; Kleinknecht, A. When labour market rigidities are useful for innovation. Evidence from German IAB firm-level data. Res. Policy 2020, 49, 104066. [Google Scholar] [CrossRef]

- Kleinknecht, A. The (Negative) impact of supply-side labor market reforms on productivity: An overview of the evidence. Camb. J. Econ. 2021, 44, 445–464. [Google Scholar] [CrossRef]

- Gordo, L.R.; Skirbekk, V. Skill demand and the comparative advantage of age: Jobs tasks and earnings from the 1980s to the 2000s in Germany. Labour Econ. 2013, 22, 61–69. [Google Scholar] [CrossRef]

- Cai, J.; Stoyanov, A. Population Ageing and Comparative Advantage. J. Int. Econ. 2016, 4, 1–21. [Google Scholar] [CrossRef]

- Prettner, K.; Bloom, D.E.; Strulik, H. Declining fertility and economic well-being: Do education and health ride to the rescue? Labour Econ. 2013, 22, 70–79. [Google Scholar] [CrossRef] [PubMed]

- Bloom, D.E.; Canning, D.; Graham, B. Longevity and life cycle savings. Scand. J. Econ. 2003, 105, 319–338. [Google Scholar] [CrossRef]

- Maestas, N.; Mullen, K.J.; Powell, D. The effect of population aging on economic growth, the labor force and productivity. In NBER Working Paper; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 2016; p. 22452. [Google Scholar]

- Tressel, T.; Scarpetta, S. Boosting Productivity via Innovation and Adoption of New Technologies: Any Role for Labor Market Institutions? World Bank Publications: Washington, DC, USA, 2004. [Google Scholar]

- Bassanini, A.; Nunziata, L.; Venn, D. Job protection legislation and productivity growth in OECD countries. Econ. Policy 2009, 24, 349–402. [Google Scholar] [CrossRef]

- Bartelsman, E.J.; Gautier, P.A.; De Wind, J. Employment protection, technology choice, and worker allocation. Int. Econ. Rev. 2016, 57, 787–826. [Google Scholar] [CrossRef]

- Noda, H. Population Ageing and Creative Destruction. J. Econ. Res. 2011, 1, 29–58. [Google Scholar]

- Gonzales, E.M.; Niepelt, D. Ageing, Government Budgets, Retirement and Growth. Eur. Econ. Rev. 2012, 1, 97–115. [Google Scholar] [CrossRef]

- Verhaeghen, P.; Salthouse, T.A. Meta-analyses of age-cognition relations in adulthood: Estimates of linear and nonlinear age effects and structural models. Psychol. Bull. 1997, 122, 231–249. [Google Scholar] [CrossRef]

- Behaghel, L.; Greenan, N. Training and Age—Biased Technical Change. Ann. Stat. 2010, 99/100, 317–342. [Google Scholar] [CrossRef]

- Ashworth, M.J. Preserving Knowledge Legacies: Workforce Aging, Turnover and Human Resource Issues in the US Electric Power Industry. Int. J. Hum. Resour. Manag. 2006, 9, 1659–1688. [Google Scholar] [CrossRef]

- Nusbaum, E.C.; Silvia, P.J. Are Intelligence and Creativity Really so Different? Fluid Intelligence, Executive Processes, and Strategy Use in Divergent Thinking. Intelligence 2011, 1, 36–45. [Google Scholar] [CrossRef]

- Jones, B.F. Age and Great Invention. Rev. Econ. Stat. 2010, 1, 1–14. [Google Scholar] [CrossRef]

- Kanfer, R.; Ackerman, P. Individual Differences in Work Motivation: Further Exploration of a Trait Framework. Appl. Psychol. 2000, 3, 470–482. [Google Scholar] [CrossRef]

- Lancia, F.; Prarolo, G. A Politico-economic Model of Ageing, Technology Adoption, and Growth. J. Popul. Econ. 2012, 3, 989–1018. [Google Scholar] [CrossRef]

- Friedberg, R.M. The impact of mass migration on the Israeli labor market. Q. J. Econ. 2001, 116, 1373–1408. [Google Scholar] [CrossRef]

- Frosch, K.; Tivig, T. Age, Human Capital and the Geography of Innovation. Labour Mark. Demogr. Chang. 2009, 6, 137–146. [Google Scholar]

- Xie, X.; Zhu, X. Population Aging, Technological Innovation and Economic Growth. China Soft Sci. 2020, 6, 42–53. (In Chinese) [Google Scholar]

- Yang, X.; He, L.; Xia, Y.; Chen, Y. Effect of government subsidies on renewable energy investments: The threshold effect. Energy Policy 2019, 132, 156–166. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold Effect in Non-dynamic Panels: Estimation, Testing, and Inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef]

- Hansen, B.E. Sample Splitting and threshold estimation. Econometrica 2000, 68, 575–603. [Google Scholar] [CrossRef]

- Lin, S.; Sun, J.; Marinova, D.; Zhao, D. Evaluation of the green technology innovation efficiency of China’s manufacturing industries: DEA window analysis with ideal window width. Technol. Anal. Strat. Manag. 2018, 30, 1166–1181. [Google Scholar] [CrossRef]

- Zhang, J.; Kang, L.; Li, H.; Ballesteros-Pérez, P.; Skitmore, M.; Zuo, J. The impact of environmental regulations on urban Green innovation efficiency: The case of Xi’an. Sustain. Cities Soc. 2020, 57, 102123. [Google Scholar] [CrossRef]

- Zhu, L.; Luo, J.; Dong, Q.; Zhao, Y.; Wang, Y.; Wang, Y. Green technology innovation efficiency of energy-intensive industries in China from the perspective of shared resources: Dynamic change and improvement path. Technol. Forecast. Soc. Chang. 2021, 170, 120890. [Google Scholar] [CrossRef]

- Zhao, N.; Liu, X.; Pan, C.; Wang, C. The performance of green innovation: From an efficiency perspective. Socio-Econ. Plan. Sci. 2021, 78, 101062. [Google Scholar] [CrossRef]

- Fan, F.; Lian, H.; Liu, X.; Wang, X. Can environmental regulation promote urban green innovation efficiency? An empirical study based on Chinese cities. J. Clean. Prod. 2021, 287, 125060. [Google Scholar] [CrossRef]

- Li, J.; Du, Y. Spatial effect of environmental regulation on green innovation efficiency: Evidence from prefectural-level cities in China. J. Clean. Prod. 2021, 286, 125032. [Google Scholar] [CrossRef]

- Miao, C.-L.; Duan, M.-M.; Zuo, Y.; Wu, X.-Y. Spatial heterogeneity and evolution trend of regional green innovation efficiency–an empirical study based on panel data of industrial enterprises in China’s provinces. Energy Policy 2021, 156, 112370. [Google Scholar] [CrossRef]

- Chen, X.; Liu, X.; Gong, Z.; Xie, J. Three-stage super-efficiency DEA models based on the cooperative game and its application on the R&D green innovation of the Chinese high-tech industry. Comput. Ind. Eng. 2021, 156, 107234. [Google Scholar]

- Lin, B.; Luan, R. Are government subsidies effective in improving innovation efficiency? Based on the research of China’s wind power industry. Sci. Total Environ. 2020, 710, 136339. [Google Scholar] [CrossRef]

- Sun, H.; Edziah, B.K.; Kporsu, A.K.; Sarkodie, S.A.; Taghizadeh-Hesary, F. Energy efficiency: The role of technological innovation and knowledge spillover. Technol. Forecast. Soc. Chang. 2021, 167, 120659. [Google Scholar] [CrossRef]

- Jacobs, R. Alternative Methods to Examine Hospital Efficiency: Data Envelopment Analysis and Stochastic Frontier Analysis. Health Care Manag. Sci. 2001, 4, 103–115. [Google Scholar] [CrossRef]

- Qian, L.; Xiao, R.; Chen, Z. Study of Industrial Enterprises’ Technology Innovation Efficiency and Regional Disparities in China—Based on the Theory of Meta-Frontier and DEA Model. Econ. Theory Bus. Manag. 2015, 1, 26–43. (In Chinese) [Google Scholar]

- Song, W.; Han, X. The bilateral effects of foreign direct investment on green innovation efficiency: Evidence from 30 Chinese provinces. Energy 2022, 261, 125332. [Google Scholar] [CrossRef]

- Earnhart, D. Regulatory factors shaping environmental performance at publiclyowned treatment plants. J. Environ. Econ. Manag. 2004, 48, 655–681. [Google Scholar] [CrossRef]

- Kammerer, D. The effects of customer benefit and regulation on environmental product innovation.: Empirical evidence from appliance manufacturers in Germany. Ecol. Econ. 2009, 68, 2285–2295. [Google Scholar] [CrossRef]

- Shuai, S.; Fan, Z. Modeling the role of environmental regulations in regional green economy efficiency of China: Empirical evidence from super efficiency DEA-Tobit model. J. Environ. Manag 2020, 261, 110227. [Google Scholar] [CrossRef] [PubMed]

- Song, W.; Han, X. A bilateral decomposition analysis of the impacts of environmental regulation on energy efficiency in China from 2006 to 2018. Energy Strategy Rev. 2022, 43, 100931. [Google Scholar] [CrossRef]

- Sonia Ben, K.; Natalia, Z.-S. The pollution haven hypothesis: A geographic economy model in a comparative study. Fond. Eni Enrico Mattei 2008, 44223. [Google Scholar]

- Zhao, Q.W.; Zhang, C. Foreign direct investment and China’s technical efficiency improvement: An empirical analysis based on stochastic frontiers production model. World Econ. Stud. 2009, 6, 61–67. [Google Scholar]

- Han, J.; Miao, J.; Shi, Y.; Miao, Z. Can the semi-urbanization of population promote or inhibit the improvement of energy efficiency in China? Sustain. Prod. Consump. 2021, 26, 921–932. [Google Scholar] [CrossRef]

- Fan, G.; Wang, X.; Zhu, H. Neri Index of Marketization of China’s Provinces 2011 Report; Economic Science Press: Beijing, China, 2011. [Google Scholar]

- Hausman, J.A. Specification tests in econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Clarke-Sather, A.; Qu, J.; Wang, Q.; Zeng, J.; Li, Y. Carbon inequality at the sub-national scale: A case study of provincial-level inequality in CO2 emissions in China 1997–2007. Energy Policy 2011, 39, 5420–5428. [Google Scholar] [CrossRef]

- Pan, X.F.; Zhang, J.; Li, C.Y.; Quan, R.; Li, B. Exploring dynamic impact of foreign direct investment on China’s CO2 emissions using Markov-switching vector error correction model. Comput. Econ. 2018, 52, 1139–1151. [Google Scholar] [CrossRef]

- Stucki, T.; Woerter, M.; Arvanitis, S.; Peneder, M.; Rammer, C. How different policy instruments affect green product innovation: A differentiated perspective. Energy Policy 2018, 114, 245–261. [Google Scholar] [CrossRef]

| Variable | Definition | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| gie | Green innovation efficiency measured by SFA approach | 0.371 | 0.190 | 0.116 | 0.942 |

| old | The percentage of the population aged 65 years and older in the total population | 0.133 | 0.279 | 0.074 | 0.227 |

| uban | The proportion of urban population to total population | 0.541 | 0.136 | 0.275 | 0.896 |

| grf | The green finance index estimated using the entropy value method | 0.155 | 0.094 | 0.050 | 0.759 |

| trade | The ratio of total import and export trade to GDP | 0.311 | 0.367 | 0.017 | 1.765 |

| hgui | The ratio of regional GDP to regional total energy consumption | 1.270 | 0.607 | 0.257 | 3.928 |

| taxl | The share of total tax revenue to GDP | 0.080 | 0.030 | 0.041 | 0.200 |

| market | The NERI index of marketization | 6.511 | 1.916 | 2.330 | 11.710 |

| edu | The average number of years of education | 8.845 | 0.987 | 6.594 | 12.555 |

| Variable | VIF | 1/VIF |

|---|---|---|

| uban | 7.68 | 0.130 |

| grf | 5.48 | 0.182 |

| edu | 5.36 | 0.187 |

| hgui | 4.29 | 0.233 |

| trade | 4.22 | 0.237 |

| market | 3.9 | 0.256 |

| taxl | 2.68 | 0.374 |

| old | 1.5 | 0.667 |

| MeanVIF | 4.39 |

| Coefficients | ||||

|---|---|---|---|---|

| (b) | (B) | (b − B) | sqrt(diag(V_b − V_B)) | |

| Variables | iv | ols | Difference | S.E. |

| old | 0.002 | 0.000 | 0.001 | 0.002 |

| uban | −0.538 | −0.512 | −0.027 | 0.064 |

| grf | −0.622 | −0.688 | 0.066 | 0.048 |

| trade | 0.016 | 0.018 | −0.001 | 0.023 |

| hgui | 0.091 | 0.104 | −0.013 | 0.012 |

| taxl | 1.800 | 1.767 | 0.033 | 0.187 |

| market | 0.007 | 0.005 | 0.002 | 0.005 |

| edu | −0.053 | −0.051 | −0.002 | 0.007 |

| _cons | 0.890 | 0.886 | 0.004 | 0.045 |

| chi2(9) | 4.76 | |||

| Prob > chi2 | 0.8545 | |||

| Durbin (score) chi2(1) | 1.003 (p = 0.3165) | |||

| Wu-Hausman F(1,320) | 0.976 (p = 0.3240) | |||

| Types of Threshold Model Tests | Threshold Quantity | F Value | p Value | Threshold Value (%) |

|---|---|---|---|---|

| No Control Variables | Single Threshold | −358.000 *** | 0.000 | 12.200 |

| Double Threshold | 2.466 *** | 0.000 | 18.000 | |

| Triple Threshold | 3.2599 *** | 0.000 | 18.700 | |

| Control Variables | Single Threshold | −351.000 *** | 0.000 | 13.700 |

| Double Threshold | 8.804 *** | 0.000 | 15.900 | |

| Triple Threshold | 5.683 *** | 0.000 | 17.500 | |

| Change the sample time period | Single Threshold | 8.813 *** | 0.000 | 13.700 |

| Double Threshold | 11.549 *** | 0.000 | 15.900 | |

| Triple Threshold | 8.169 *** | 0.000 | 18.000 | |

| old lagged one period | Single Threshold | −351.000 *** | 0.000 | 13.400 |

| Double Threshold | 13.602 *** | 0.000 | 15.900 | |

| Triple Threshold | 10.688 *** | 0.000 | 18.300 |

| Variable: old Is the Threshold Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|---|---|---|---|

| grf | 0.0682 ** (2.050) | 0.0731 ** (2.220) | ||||||

| trade | 0.0266 *** (4.722) | 0.0327 *** (5.151) | 0.0338 *** (5.378) | |||||

| hgui | −0.0327 *** (−15.435) | −0.0275 *** (−11.745) | −0.0284 *** (−12.063) | −0.0198 *** (−6.83) | −0.0262 *** (−6.188) | −0.025 *** (−5.963) | ||

| taxl | −0.1651 *** (−4.542) | −0.1683 *** (−3.040) | ||||||

| market | 0.0015 ** (2.433) | 0.0008 (1.347) | 0.0006 (1.038) | 0.0007 (1.088) | ||||

| old_1 | −0.013 *** (−7.403) | −0.0038 *** (−5.160) | −0.0042 *** (−6.472) | −0.0041 *** (−6.355) | −0.0043 *** (−6.673) | −0.0036 *** (−5.726) | −0.0036 *** (−5.684) | −0.0039 *** (−6.172) |

| old_2 | −0.012 *** (−7.894) | −0.0034 *** (−5.342) | −0.0036 *** (−6.236) | −0.0035 *** (−6.255) | −0.0037 *** (−6.627) | −0.0032 *** (−5.757) | −0.0031 *** (−5.747) | −0.0034 *** (−6.275) |

| old_3 | −0.013 *** (−10.539) | −0.0025 *** (−3.746) | −0.0032 *** (−6.253) | −0.0032 *** (−6.286) | −0.0034 *** (−6.644) | −0.0028 *** (−5.647) | −0.0028 *** (−5.630) | −0.0031 *** (−6.193) |

| old_4 | −0.012 *** (−12.105) | −0.0031 *** (−5.230) | −0.0025 *** (−5.339) | −0.0025 *** (−5.425) | −0.0027 *** (−5.839) | −0.0024 *** (−5.266) | −0.0024 *** (−5.219) | −0.0027 *** (−5.838) |

| Variable: old Is the Threshold Variable | Model Estimation Results | Robustness Tests | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Change the Sample Time Period | old Lagged One Period | ||||||||

| Eastern Region | Central Region | Western Region | Eastern Region | Central Region | Western Region | Eastern Region | Central Region | Western Region | |

| grf | 0.114 ** (2.442) | 0.287 * (1.932) | 0.030 (0.299) | 0.124 *** (3.072) | 0.552 *** (4.795) | 0.046 (0.538) | 0.092 *** (2.727) | 0.224 * (1.946) | −0.025 (−0.343) |

| trade | 0.021 *** (2.863) | −0.0009 (−0.050) | 0.081 *** (4.5656) | 0.0194 *** (3.378) | −0.0152 (−1.095) | 0.059 *** (3.775) | 0.010 (1.645) | −0.007 (−0.517) | 0.059 *** (4.777) |

| hgui | −0.039 *** (−4.741) | −0.047 *** (−4.633) | 0.0205 ** (2.462) | −0.042 *** (−6.350) | −0.064 *** (−7.978) | 0.023 *** (2.694) | −0.040 *** (−7.155) | −0.041 *** (−4.984) | 0.021 *** (3.368) |

| taxl | −0.10 (−1.189) | 0.133 (1.162) | −0.007 (−0.086) | −0.098 (−1.541) | 0.233 ** (2.459) | −0.005 (−0.062) | −0.120 * (−1.841) | 0.237 (1.565) | −0.001 (−0.019) |

| market | 0.0001 (0.1243) | 0.0014 (0.936) | 0.0006 (0.536) | 0.0004 (0.706) | 0.001 (−0.033) | 0.0002 (0.202) | 0.0008 (1.287) | 0.0007 (0.681) | 0.0007 (0.812) |

| old_1 | −0.0049 *** | −0.0061 *** | −0.0026 ** | −0.0044 *** | −0.006 *** | −0.0029 *** | −0.0041 *** | −0.0053 *** | −0.0026 *** |

| (−2.652) | (−2.707) | (−2.492) | (−2.961) | (−4.417) | (−3.241) | (−4.970) | (−5.640) | (−3.261) | |

| old_2 | −0.0032 ** | −0.0049 ** | −0.0018 * | −0.031 *** | −0.0046 *** | −0.0023 *** | −0.0032 *** | −0.0048 *** | −0.002 *** |

| (−2.462) | (−2.353) | (−1.836) | (−2.537) | (−3.878) | (−2.623) | (−5.008) | (−6.705) | (−2.571) | |

| old_3 | −0.002 *** (−4.173) | −0.005 *** (−2.708) | −0.002 *** (−2.634) | −0.0022 *** (−3.869) | −0.006 *** (−4.859) | −0.002 ** (−2.004) | −0.003 *** (−4.9849) | −0.005 *** (−6.170) | −0.001 * (−1.734) |

| old_4 | −0.002 *** (−2.576) | 0.004 * (−1.738) | −0.004 *** (−3.628) | −0.002 ** (−2.023) | −0.005 *** (−4.715) | −0.002 *** (−2.900) | −0.0016 *** (−3.307) | −0.0047 *** (−5.531) | −0.002 *** (−2.764) |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

|---|---|---|---|---|---|---|

| Condition_Ⅰ | The value of uban is less than or equal to 0.421 | The value of grf is less than or equal to 0.103 | The value of trade is less than or equal to 0.132 | The value of hgui is less than or equal to 0.946 | The value of edu is less than or equal to 8.054 | The value of market is less than or equal to 5.720 |

| old_1 | −0.004 *** (−6.082) | −0.0021 *** (−4.768) | −0.003 *** (−6.571) | −0.001 * (−1.859) | −0.0014 *** (−3.405) | −0.002 *** (−5.214) |

| Condition_Ⅱ | The value of uban is greater than 0.421 and less than or equal to 0.493 | The value of grf is greater than 0.103 and less than or equal to 0.148 | The value of trade is greater than 0.132 and less than or equal to 0.437 | The value of hgui is greater than 0.946 and less than or equal to 1.568 | The value of edu is greater than 8.054 and less than or equal to 9.555 | The value of market is greater than 5.720 and less than or equal to 5.940 |

| old_2 | −0.004 *** (−6.098) | −0.002 *** (−4.572) | −0.0021 *** (−4.898) | −0.0015 *** (−3.778) | −0.0010 ** (−2.417) | −0.0017 *** (−3.941) |

| Condition_Ⅲ | The value of uban is greater than 0.493 and less than or equal to 0.700 | The value of grf is greater than 0.148 and less than or equal to 0.284 | The value of trade is greater than 0.437 and less than or equal to 1.155 | The value of hgui is greater than 1.568 and less than or equal to 2.883 | The value of edu is greater than 9.555 and less than or equal to 10.654 | The value of market is greater than 5.940 and less than or equal to 6.180 |

| old_3 | −0.005 *** (−7.650) | −0.001 *** (−3.281) | −0.001 ** (−2.043) | −0.002 *** (−4.622) | −0.002 *** (−4.455) | −0.002 *** (−5.546) |

| Condition_Ⅳ | The value of uban is greater than 0.700 | The value of grf is greater than 0.284 | The value of trade is greater than 1.155 | The value of hgui is greater than 2.883 | The value of edu is greater than 10.654 | The value of market is greater than 6.180 |

| old_4 | 0.002 *** (3.497) | −0.001 *** (−4.483) | 0.0005 (0.991) | −0.002 *** (−5.666) | −0.003 *** (−6.073) | −0.002 *** (−4.585) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Y.; Jia, M. The Impact of Population Aging on Green Innovation: An Empirical Analysis Based on Inter-Provincial Data in China. Sustainability 2023, 15, 3305. https://doi.org/10.3390/su15043305

Liu Y, Jia M. The Impact of Population Aging on Green Innovation: An Empirical Analysis Based on Inter-Provincial Data in China. Sustainability. 2023; 15(4):3305. https://doi.org/10.3390/su15043305

Chicago/Turabian StyleLiu, Yu, and Mingde Jia. 2023. "The Impact of Population Aging on Green Innovation: An Empirical Analysis Based on Inter-Provincial Data in China" Sustainability 15, no. 4: 3305. https://doi.org/10.3390/su15043305

APA StyleLiu, Y., & Jia, M. (2023). The Impact of Population Aging on Green Innovation: An Empirical Analysis Based on Inter-Provincial Data in China. Sustainability, 15(4), 3305. https://doi.org/10.3390/su15043305