Impact of Government Subsidies, Competition, and Blockchain on Green Supply Chain Decisions

Abstract

:1. Introduction

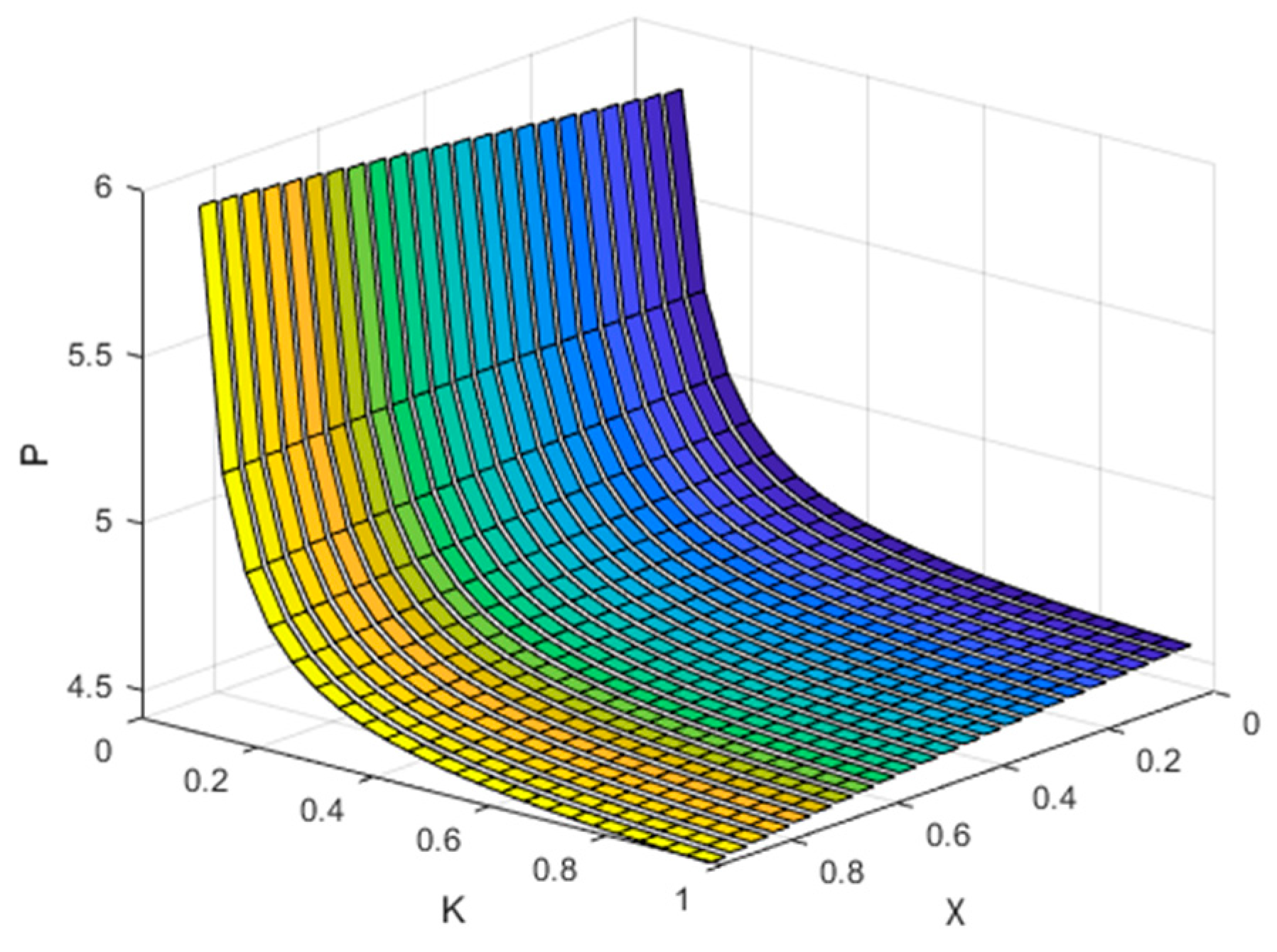

- How do consumers’ preferences for green products and the difficulty of research and development affect product pricing and product greenness?

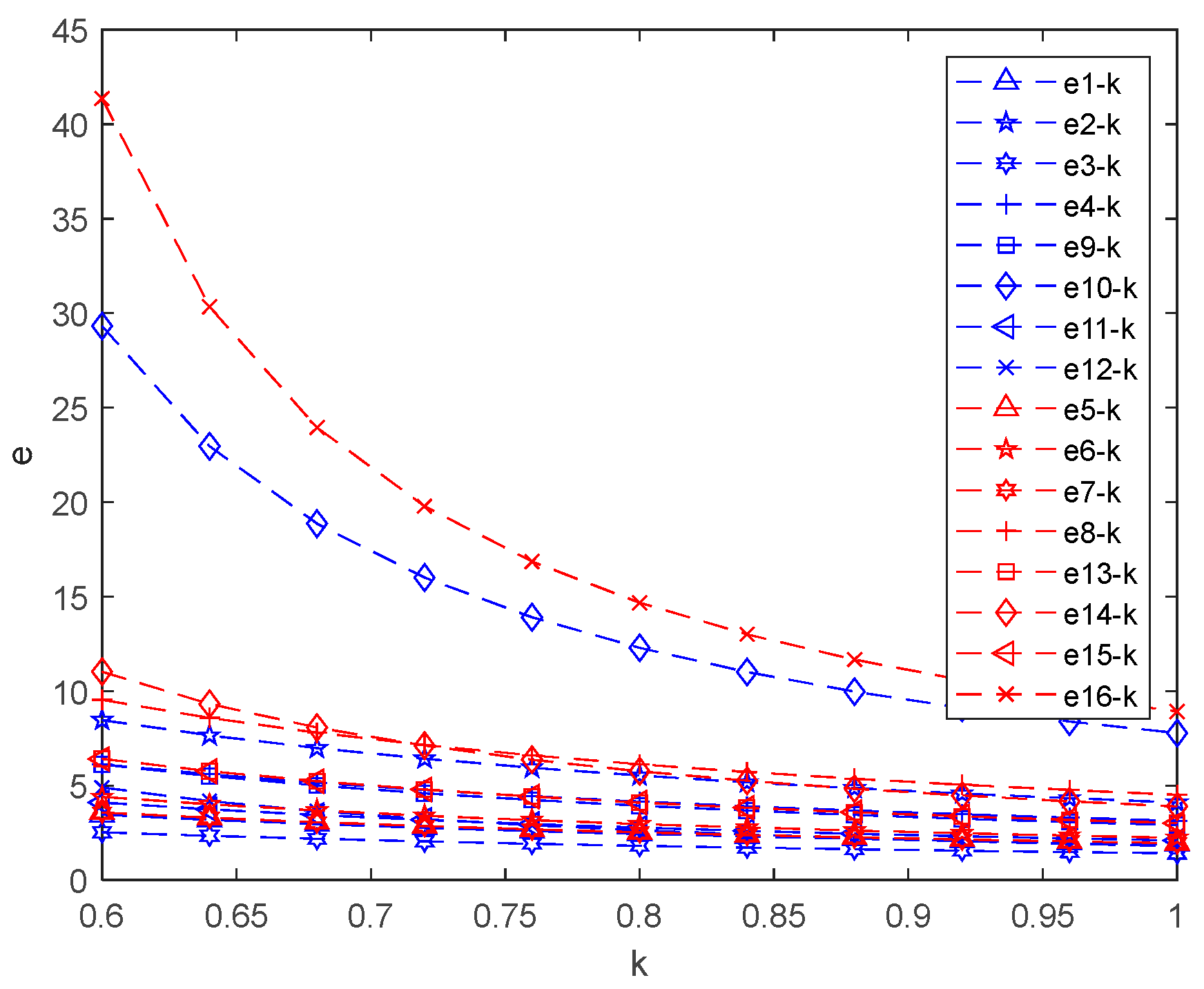

- How do government technology subsidies and product subsidies work in different competition and cooperation relationships between enterprises? Which decision model is more beneficial to the maximization of social welfare?

- How do the government’s product subsidies and technology subsidies for enterprises affect the green degree of products and enterprise profits under different R&D models? Does R&D difficulty play a role?

- In what kind of enterprise relationship is blockchain easier to apply?

2. Literature Review

2.1. Green Technology Innovation Subsidy

2.2. Inter-Firm Competition and Cooperative R&D

2.3. Application of Blockchain Technology

3. Problem Description and Basic Assumptions

3.1. Symbol Description

3.2. Problem Description

3.3. Conditional Assumptions

4. Modeling and Solution

4.1. Strategy 1

4.2. Strategy 2

4.3. Strategy 3

4.4. Strategy 4

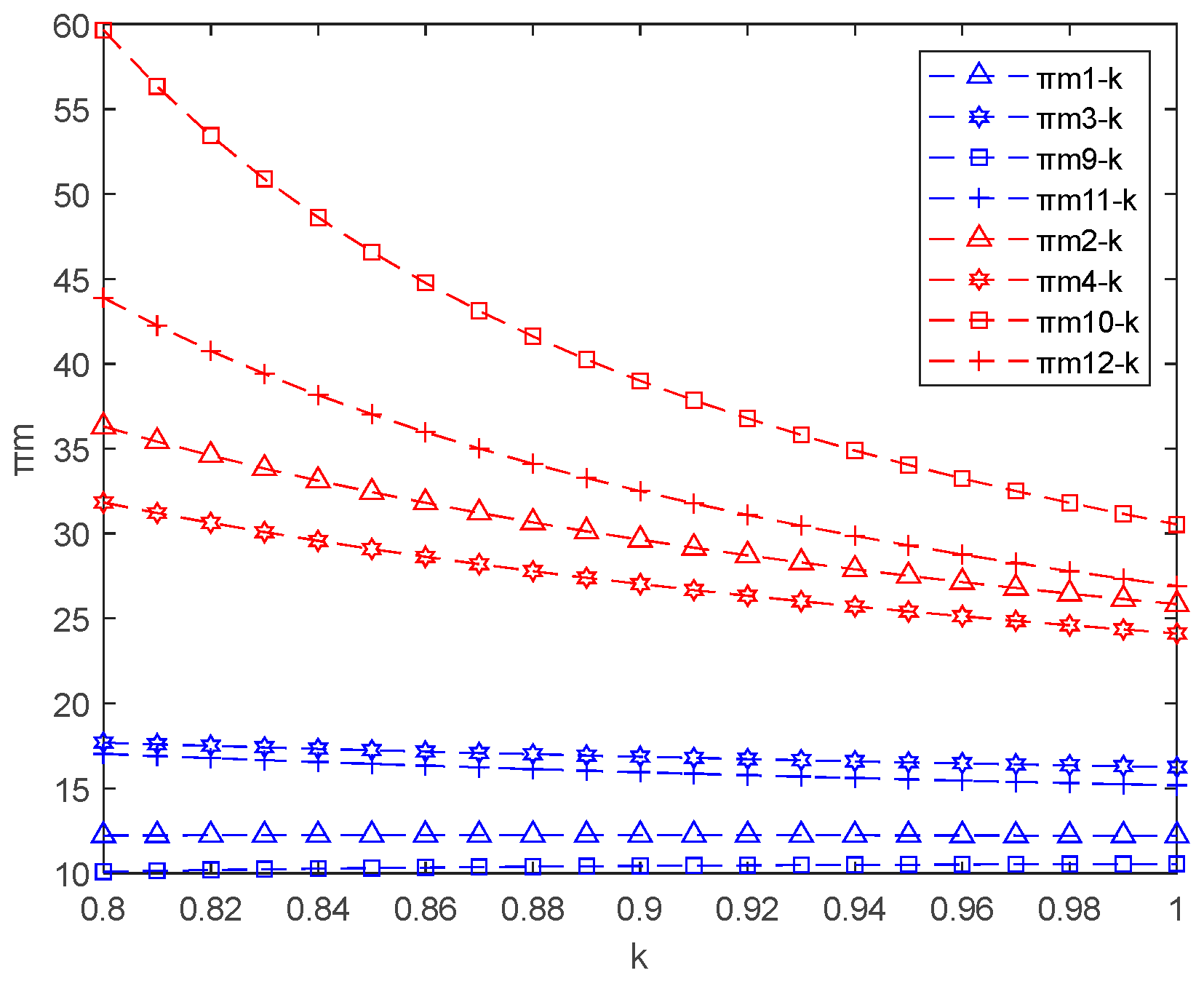

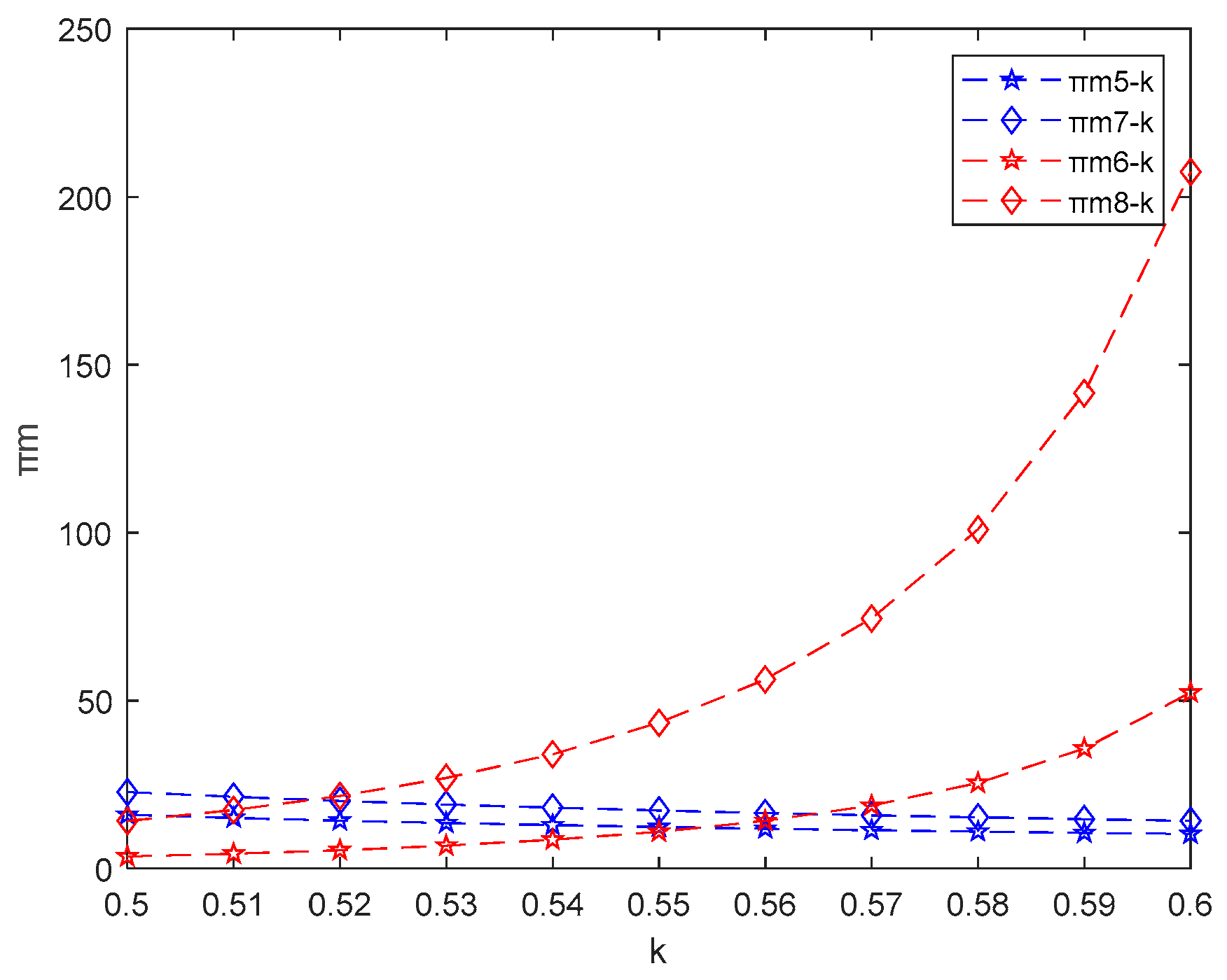

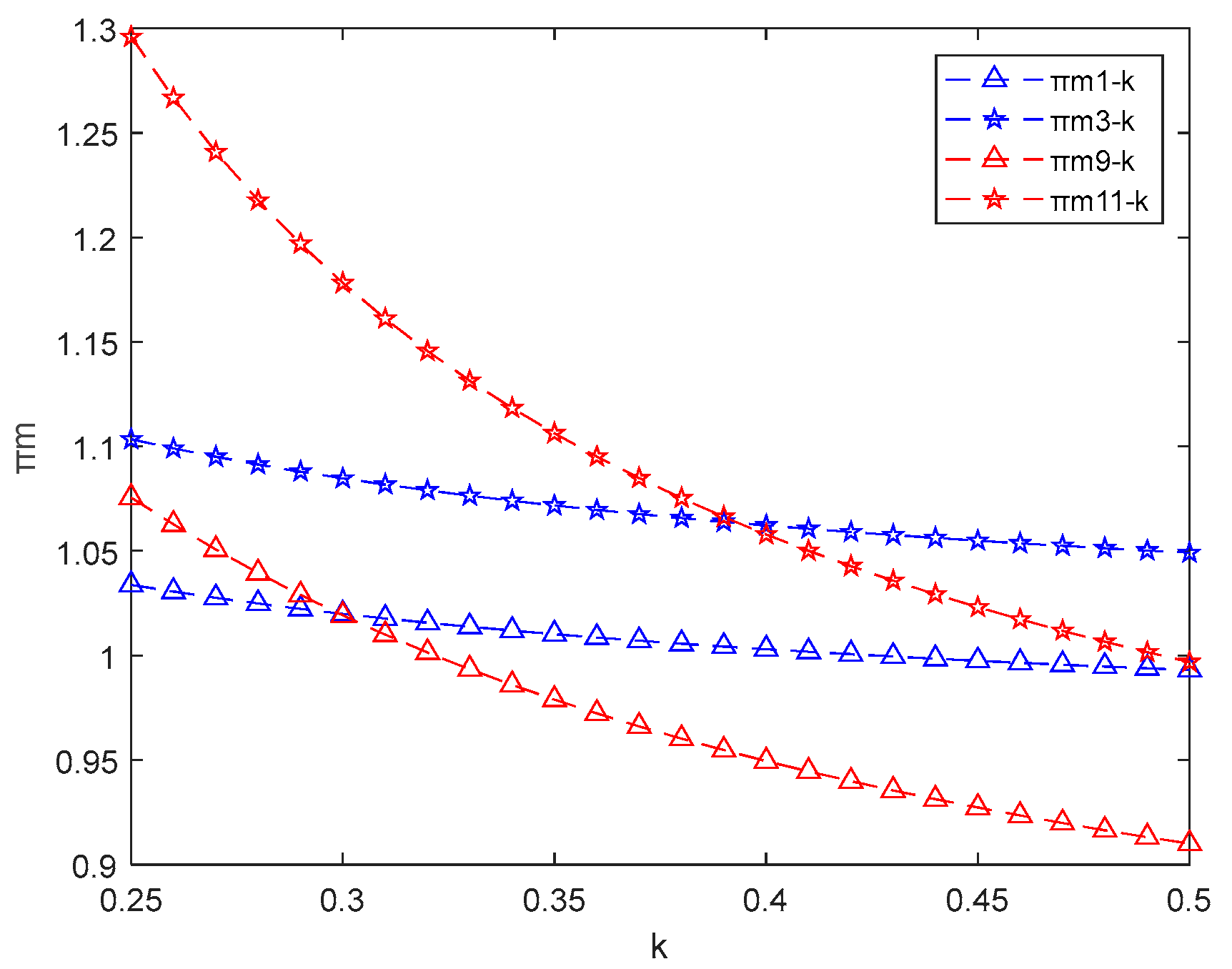

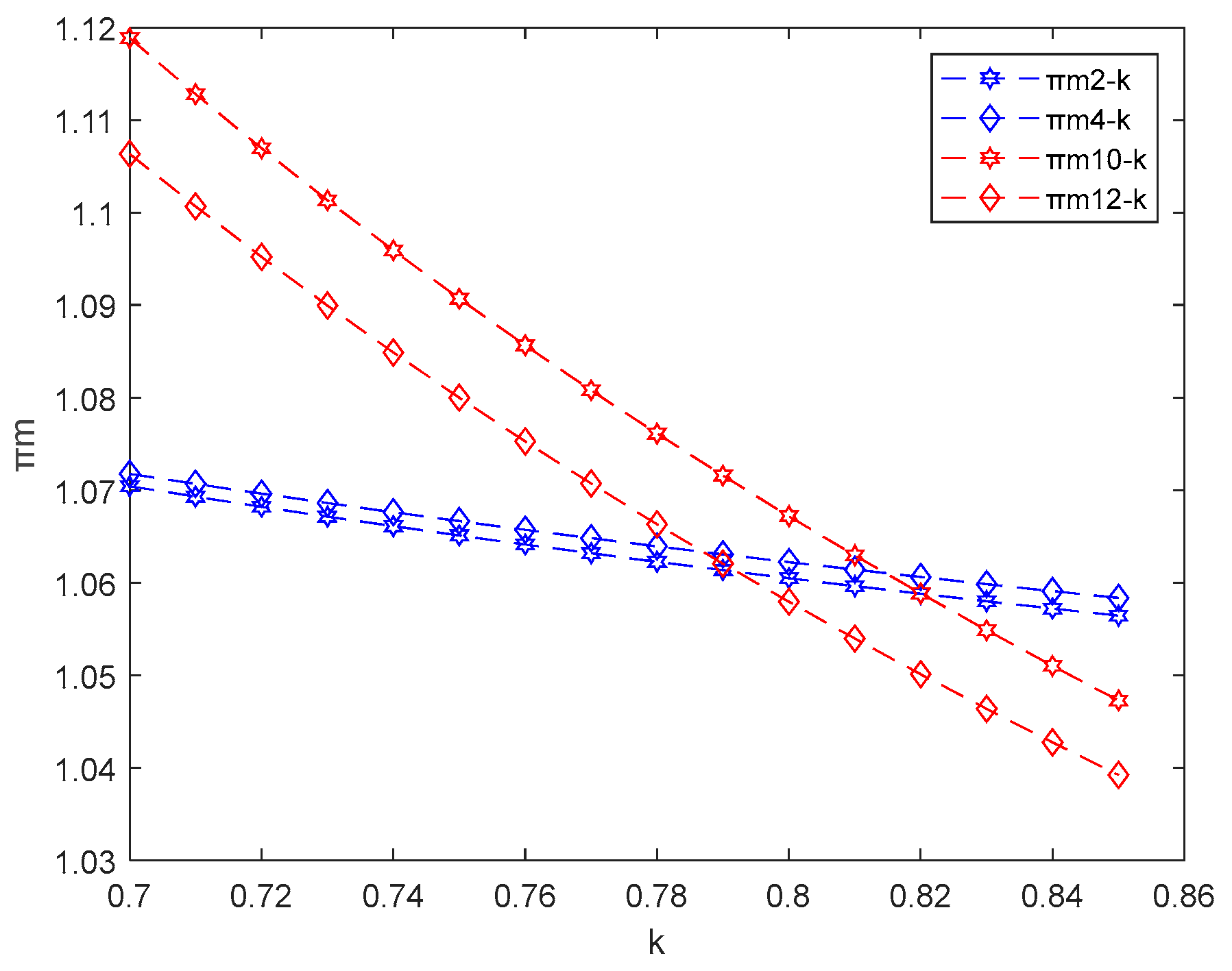

5. Analysis of Results

6. Analysis of Results

7. Conclusions

- (1)

- This study has different findings from the literature regarding the effect of the R&D difficulty coefficient. Mohsin et al. found that increased R&D difficulty of green products decreases the selling price of products [57]; Koh et al. showed that increased product substitutability decreases the selling price of products [58]. However, we demonstrated that increased difficulty in green product R&D reduces product selling prices but decreases social welfare. Furthermore, when R&D is less difficult, green product prices increase with the degree of product substitutability or with the intensity of competition perceived by consumers.

- (2)

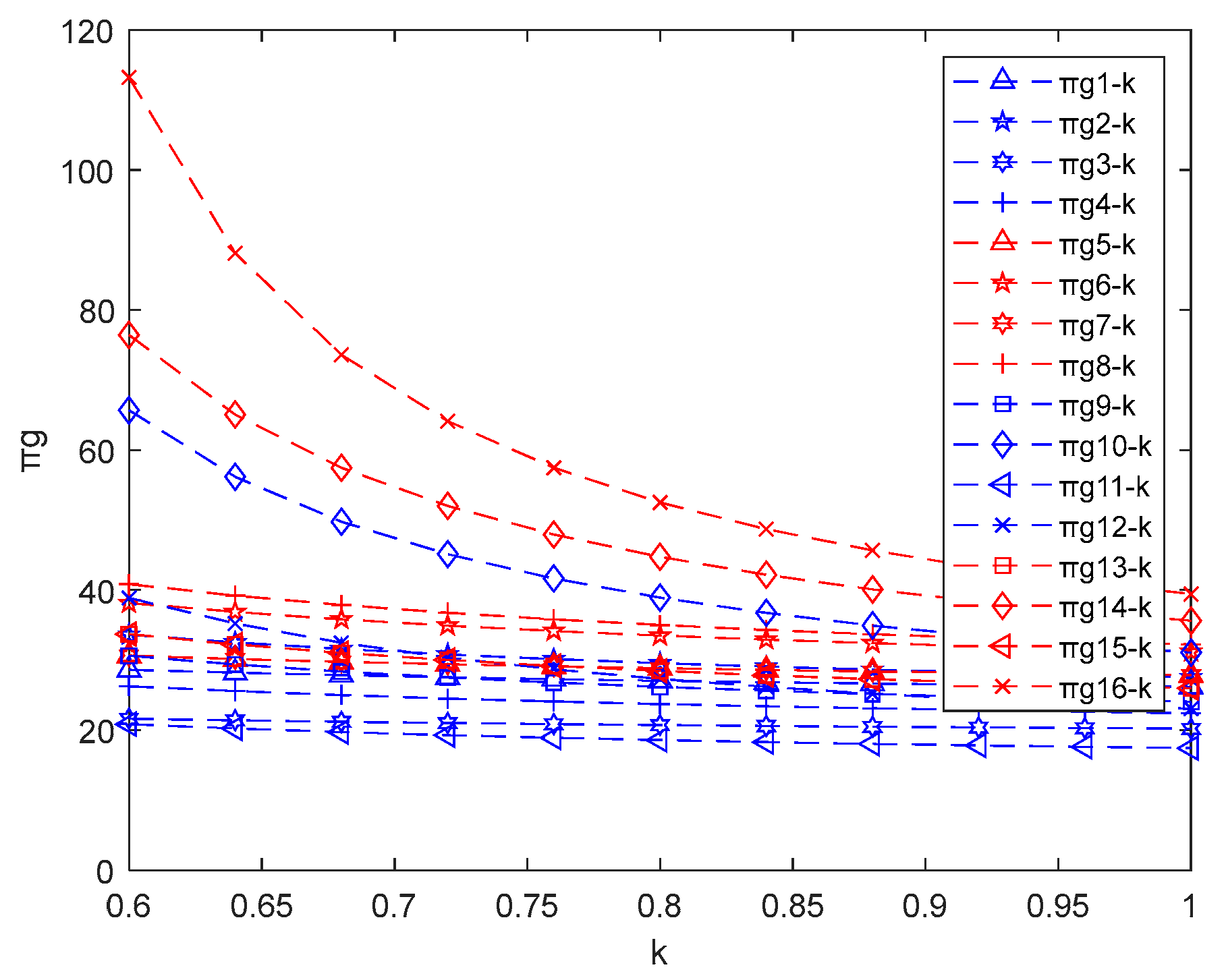

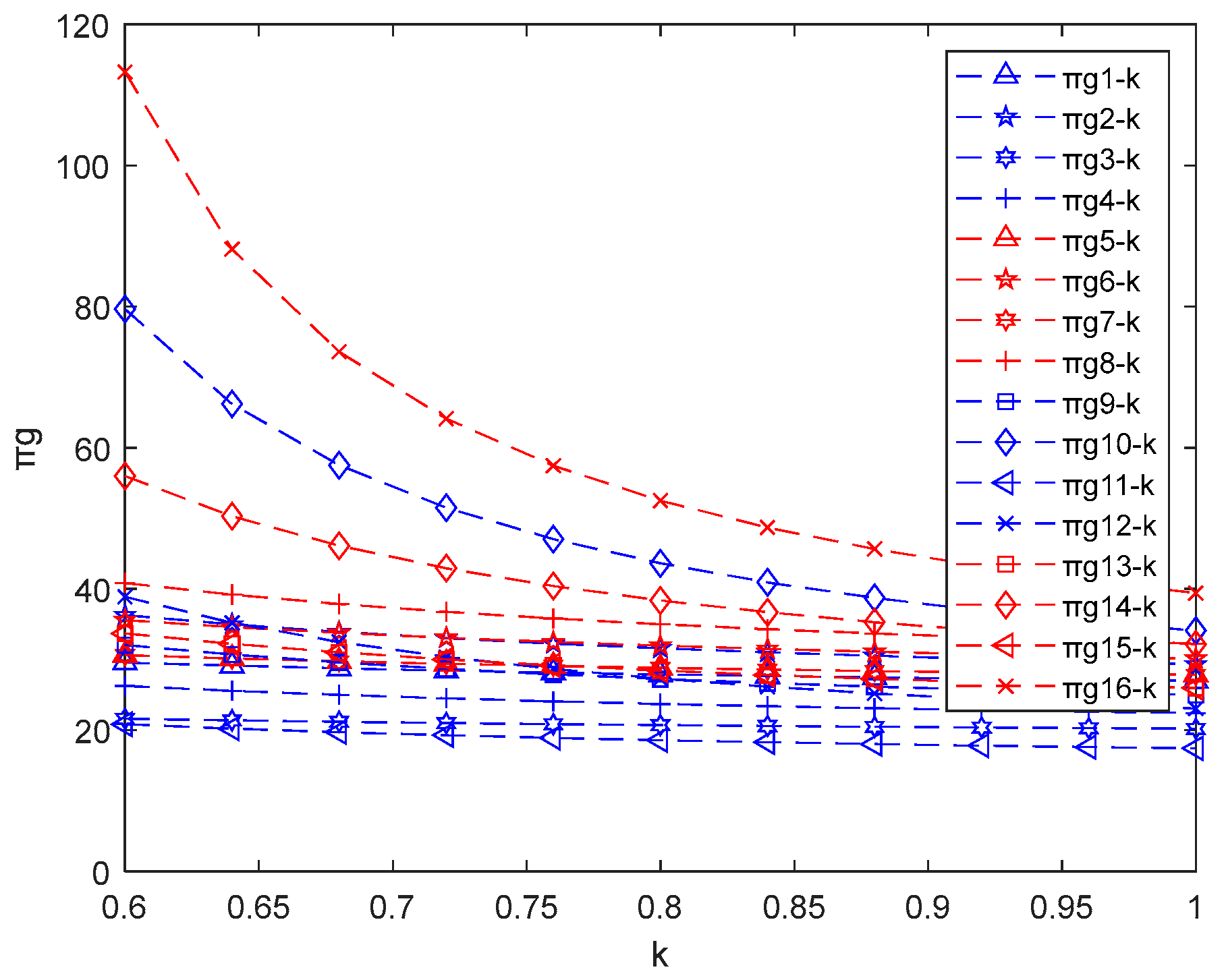

- Regarding the government’s choice of subsidies to obtain higher social welfare, Bian et al. indicated that output subsidies can obtain higher social welfare [20]. However, the difficulty of R&D and the intensity of competition of the product are not considered. In contrast, this paper proposes that the government chooses output subsidies for social welfare optimization and technology subsidies for carbon emission reduction rate optimization when firms with high R&D difficulty and competitive intensity choose co-R&D in competition.

- (3)

- Regarding which R&D method manufacturers choose to obtain higher profits, Zhou et al. stated that joint R&D can obtain higher social welfare. However, the difficulty of R&D and the intensity of competition of the product are not considered. When the government subsidizes the technology to the firms, joint R&D can gain higher profits compared to the firms’ own R&D; under the output subsidy, independent R&D can gain higher profits when the R&D is less difficult, and joint R&D can gain higher profits when the R&D is more difficult.

- (4)

- Extending the decision model by including government R&D blockchain for manufacturers to use blockchain for a fee. When the government subsidizes output, firms can earn higher profits without blockchain compared to using blockchain; Under the technology subsidies, firms can earn higher profits by using blockchain for a fee when R&D is less difficult but can earn higher profits without blockchain when R&D is more difficult.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Merino-Saum, A.; Baldi, M.G.; Gunderson, I.; Oberle, B. Articulating natural resources and sustainable development goals through green economy indicators: A systematic analysis. Resour. Conserv. Recycl. 2018, 139, 90–103. [Google Scholar] [CrossRef]

- Li, L. China’s manufacturing locus in 2025: With a comparison of “Made-in-China 2025” and “Industry 4.0”. Technol. Forecast. Soc. Change 2018, 135, 66–74. [Google Scholar] [CrossRef]

- Ranjan, A.; Jha, J.K. Pricing and coordination strategies of a dual-channel supply chain considering green quality and sales effort. J. Clean. Prod. 2019, 218, 409–424. [Google Scholar] [CrossRef]

- Lou, G.; Lai, Z.; Ma, H.; Fan, T. Coordination in a composite green-product supply chain under different power structures. Ind. Manag. Data Syst. 2020, 120, 1101–1123. [Google Scholar] [CrossRef]

- Li, Y.; Tong, Y.; Ye, F.; Song, J. The choice of the government green subsidy scheme: Innovation subsidy vs. product subsidy. Int. J. Prod. Res. 2020, 58, 4932–4946. [Google Scholar] [CrossRef]

- Abbas, H.; Tong, S. Green Supply Chain Management Practices of Firms with Competitive Strategic Alliances—A Study of the Automobile Industry. Sustainability 2023, 15, 2156. [Google Scholar] [CrossRef]

- Xu, J.; Duan, Y. Pricing and greenness investment for green products with government subsidies: When to apply blockchain technology? Electron. Commer. R. A 2022, 51, 101108. [Google Scholar] [CrossRef]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2019, 57, 2117–2135. [Google Scholar] [CrossRef] [Green Version]

- Xu, X.; Zhang, M.; Dou, G.; Yu, Y. Coordination of a supply chain with an online platform considering green technology in the blockchain era. Int. J. Prod. Res. 2021, 1–18. [Google Scholar] [CrossRef]

- Yu, J.J.; Tang, C.S.; Sodhi, M.S.; Knuckles, J. Optimal subsidies for development supply chains. Manuf. Serv. Oper. Manag. 2020, 22, 1131–1147. [Google Scholar] [CrossRef]

- Ling, Y.; Xu, J.; Ülkü, M.A. A game-theoretic analysis of the impact of government subsidy on optimal product greening and pricing decisions in a duopolistic market. J. Clean. Prod. 2022, 338, 130028. [Google Scholar] [CrossRef]

- Meng, Q.; Wang, Y.; Zhang, Z.; He, Y. Supply chain green innovation subsidy strategy considering consumer heterogeneity. J. Clean. Prod. 2021, 281, 125199. [Google Scholar] [CrossRef]

- Fu, Y.; Wang, X.; Tang, Y.; Li, W.; Gong, Z.; Zhang, W. A Horizontal Competition-Cooperation Game of Technological Innovation in an Automobile Cluster Supply Chain. Sci. Program. 2022, 2022, 2220733. [Google Scholar] [CrossRef]

- Yang, R.; Tang, W.; Zhang, J. Technology improvement strategy for green products under competition: The role of government subsidy. Eur. J. Oper. Res. 2021, 289, 553–568. [Google Scholar] [CrossRef]

- De Giovanni, P. Blockchain and smart contracts in supply chain management: A game theoretic model. Int. J. Prod. Econ. 2020, 228, 107855. [Google Scholar] [CrossRef]

- Niu, B.; Dong, J.; Liu, Y. Incentive alignment for blockchain adoption in medicine supply chains. Transp. Res. Part E Logist. Transp. Rev. 2021, 152, 102276. [Google Scholar] [CrossRef]

- Dong, C.; Chen, C.; Shi, X.; Ng, C.T. Operations strategy for supply chain finance with asset-backed securitization: Centralization and blockchain adoption. Int. J. Prod. Econ. 2021, 241, 108261. [Google Scholar] [CrossRef]

- Hong, I.H.; Chiu, A.S.; Ganda, L. Impact of subsidy policies on green products with consideration of consumer behaviors: Subsidy for firms or consumers? Resour. Conserv. Recycl. 2021, 173, 105669. [Google Scholar] [CrossRef]

- Zhang, J.J.; Guan, J. The time-varying impacts of government incentives on innovation. Technol. Forecast. Soc. Change 2018, 135, 132–144. [Google Scholar] [CrossRef]

- Bian, J.; Zhang, G.; Zhou, G. Manufacturer vs. consumer subsidy with green technology investment and environmental concern. Eur. J. Oper. Res. 2020, 287, 832–843. [Google Scholar] [CrossRef]

- Jung, S.H.; Feng, T. Government subsidies for green technology development under uncertainty. Eur. J. Oper. Res. 2020, 286, 726–739. [Google Scholar] [CrossRef]

- Chen, S.; Su, J.; Wu, Y.; Zhou, F. Optimal production and subsidy rate considering dynamic consumer green perception under different government subsidy orientations. Comput. Ind. Eng. 2022, 168, 108073. [Google Scholar] [CrossRef]

- Gao, Y.; Hu, Y.; Liu, X.; Zhang, H. Can public R&D subsidy facilitate firms’ exploratory innovation? The heterogeneous effects between central and local subsidy programs. Res Policy. 2021, 50, 104221. [Google Scholar]

- Wang, W.; Zhang, R. Green Supply Chain Operations Decision and Government Subsidy Strategies under R & D Failure Risk. Sustainability 2022, 14, 15307. [Google Scholar] [CrossRef]

- Bai, Y.; Song, S.; Jiao, J.; Yang, R. The impacts of government R&D subsidies on green innovation: Evidence from Chinese energy-intensive firms. J. Clean. Prod. 2019, 233, 819–829. [Google Scholar]

- Lee, S.H.; Park, C.H. Environmental regulations in private and mixed duopolies: Taxes on emissions versus green R&D subsidies. Econ. Syst. 2021, 45, 100852. [Google Scholar]

- Zuo, W.; Li, Y.; Wang, Y. Research on the optimization of new energy vehicle industry research and development subsidy about generic technology based on the three-way decisions. J. Clean. Prod. 2019, 212, 46–55. [Google Scholar] [CrossRef]

- Dong, Z.; He, Y.; Wang, H. Dynamic effect retest of R&D subsidies policies of China’s auto industry on directed technological change and environmental quality. J. Clean. Prod. 2019, 231, 196–206. [Google Scholar]

- Mardones, C.; Velásquez, A. Macroeconomic, intersectoral, and environmental effects of R&D subsidies in Chile: An input-output approach. Technol. Forecast. Soc. Change 2021, 173, 121112. [Google Scholar]

- Wu, T.; Yang, S.; Tan, J. Impacts of government R&D subsidies on venture capital and renewable energy investment—An empirical study in China. Resour. Policy 2020, 68, 101715. [Google Scholar]

- Ishikawa, N.; Shibata, T. R&D competition and cooperation with asymmetric spillovers in an oligopoly market. Int. Rev. Econ. Financ. 2021, 72, 624–642. [Google Scholar]

- Esenduran, G.; Kemahlıoğlu-Ziya, E.; Swaminathan, J.M. Impact of take-back regulation on the remanufacturing industry. Prod. Oper. Manag. 2017, 26, 924–944. [Google Scholar] [CrossRef]

- Gernsheimer, O.; Kanbach, D.K.; Gast, J. Coopetition research-A systematic literature review on recent accomplishments and trajectories. Ind. Mark. Manag. 2021, 96, 113–134. [Google Scholar] [CrossRef]

- Ahn, J.M.; Minshall, T.; Mortara, L. Understanding the human side of openness: The fit between open innovation modes and CEO characteristics. R D Manag. 2017, 47, 727–740. [Google Scholar] [CrossRef] [Green Version]

- Weber, B.; Heidenreich, S. When and with whom to cooperate? Investigating effects of cooperation stage and type on innovation capabilities and success. Long Range Plan. 2018, 51, 334–350. [Google Scholar] [CrossRef]

- Ko, Y.; Chung, Y.; Seo, H. Coopetition for Sustainable Competitiveness: R&D Collaboration in Perspective of Productivity. Sustainability 2020, 12, 7993. [Google Scholar]

- Carree, M.; Lokshin, B.; Alvarez, H.A. Technology partnership portfolios and firm innovation performance: Further evidence. J. Eng. Technol. 2019, 54, 1–11. [Google Scholar] [CrossRef]

- Fan, Z.P.; Huang, S.; Wang, X. The vertical cooperation and pricing strategies of electric vehicle supply chain under brand competition. Comput. Ind. Eng. 2021, 152, 106968. [Google Scholar] [CrossRef]

- Zhang, F.; Zhang, Z.; Xue, Y.; Zhang, J.; Che, Y. Dynamic green innovation decision of the supply chain with innovating and free-riding manufacturers: Cooperation and spillover. Complexity 2020, 2020, 8937847. [Google Scholar] [CrossRef]

- Zhang, X.; Chen, T.; Shen, C. Green investment choice in a duopoly market with quality competition. J. Clean. Prod. 2020, 276, 124032. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Zhou, M. Firms’ green R&D cooperation behaviour in a supply chain: Technological spillover, power and coordination. Int. J. Prod. Econ. 2019, 218, 118–134. [Google Scholar]

- Dai, R.; Zhang, J.; Tang, W. Cartelization or Cost-sharing? Comparison of cooperation modes in a green supply chain. J. Clean. Prod. 2017, 156, 159–173. [Google Scholar] [CrossRef]

- Zheng, Z.; Xie, S.; Dai, H.N.; Chen, X.; Wang, H. Blockchain challenges and opportunities: A survey. Int. J. Web Grid Serv. 2018, 14, 352–375. [Google Scholar] [CrossRef]

- Sundarakani, B.; Ajaykumar, A.; Gunasekaran, A. Big data driven supply chain design and applications for blockchain: An action research using case study approach. Omega 2021, 102, 102452. [Google Scholar] [CrossRef]

- Dutta, P.; Choi, T.M.; Somani, S.; Butala, R. Blockchain technology in supply chain operations: Applications, challenges and research opportunities. Transp. Res. Part E Logist. Transp. Rev. 2020, 142, 102067. [Google Scholar] [CrossRef] [PubMed]

- Centobelli, P.; Cerchione, R.; Del Vecchio, P.; Oropallo, E.; Secundo, G. Blockchain technology for bridging trust, traceability and transparency in circular supply chain. Inf. Manag. 2021, 59, 103508. [Google Scholar] [CrossRef]

- Wamba, S.F.; Queiroz, M.M.; Trinchera, L. Dynamics between blockchain adoption determinants and supply chain performance: An empirical investigation. Int. J. Prod. Econ. 2020, 229, 107791. [Google Scholar] [CrossRef]

- Lim, M.K.; Li, Y.; Wang, C.; Tseng, M.L. A literature review of blockchain technology applications in supply chains: A comprehensive analysis of themes, methodologies and industries. Comput. Ind. Eng. 2021, 154, 107133. [Google Scholar] [CrossRef]

- Liu, Y.; Ma, D.; Hu, J.; Zhang, Z. Sales mode selection of fresh food supply chain based on blockchain technology under different channel competition. Comput. Ind. Eng. 2021, 162, 107730. [Google Scholar] [CrossRef]

- Köhler, S.; Pizzol, M. Technology assessment of blockchain-based technologies in the food supply chain. J. Clean. Prod. 2020, 269, 122193. [Google Scholar] [CrossRef]

- Zhou, F.; Liu, Y. Blockchain-Enabled Cross-Border E-Commerce Supply Chain Management: A Bibliometric Systematic Review. Sustainability 2022, 14, 15918. [Google Scholar] [CrossRef]

- Bai, Y.; Fan, K.; Zhang, K.; Cheng, X.; Li, H.; Yang, Y. Blockchain-based trust management for agricultural green supply: A game theoretic approach. J. Clean. Prod. 2021, 310, 127407. [Google Scholar] [CrossRef]

- Rane, S.B.; Thakker, S.V.; Kant, R. Stakeholders’ involvement in green supply chain: A perspective of blockchain IoT-integrated architecture. Manag. Environ. Qual. 2020, 32, 1166–1191. [Google Scholar] [CrossRef]

- Bag, S.; Viktorovich, D.A.; Sahu, A.K.; Sahu, A.K. Barriers to adoption of blockchain technology in green supply chain management. J. Glob. Oper. Strateg. Source 2020, 14, 104–133. [Google Scholar] [CrossRef]

- Liu, P.; Long, Y.; Song, H.C.; He, Y.D. Investment decision and coordination of green agri-food supply chain considering information service based on blockchain and big data. J. Clean. Prod. 2020, 277, 123646. [Google Scholar] [CrossRef]

- Barman, A.; Das, R.; De, P.K.; Sana, S.S. Optimal Pricing and Greening Strategy in a Competitive Green Supply Chain: Impact of Government Subsidy and Tax Policy. Sustainability 2021, 13, 9178. [Google Scholar] [CrossRef]

- Mohsin, A.K.M.; Hossain, S.F.A.; Tushar, H.; Iqbal, M.M.; Hossain, A. Differential game model and coordination model for green supply chain based on green technology research and development. Heliyon 2021, 7, e07811. [Google Scholar] [CrossRef]

- Koh, K.; Jeon, S.; Lee, J. The effects of price competition on firms’ operations and market price: Evidence from a retail gasoline market. Energy. Econ. 2022, 108, 105889. [Google Scholar] [CrossRef]

| Literature | Green Product Supply Chain | Government Subsidy Policy | R&D Relationship | Competition And Cooperation Relationship | Blockchain Technology |

|---|---|---|---|---|---|

| Ling et al. (2022) [11] | √ | √ | √ | ||

| Yang et al. (2021) [14] | √ | √ | √ | √ | |

| Wu et al. (2021) [30] | √ | √ | √ | ||

| Xu et al. (2021) [9] | √ | √ | |||

| Liu et al. (2021) [49] | √ | ||||

| Zhang et al. (2020) [39] | √ | √ | √ | ||

| Bai et al. (2021) [52] | √ | √ | |||

| Liu et al. (2020) [55] | √ | √ | |||

| Zhang et al. (2020) [40] | √ | √ | √ | ||

| Chen et al. (2019) [41] | √ | √ | √ | ||

| Bian et al. (2020) [20] | √ | √ | |||

| This paper | √ | √ | √ | √ | √ |

| Notation | Description |

|---|---|

| Basic market demand | |

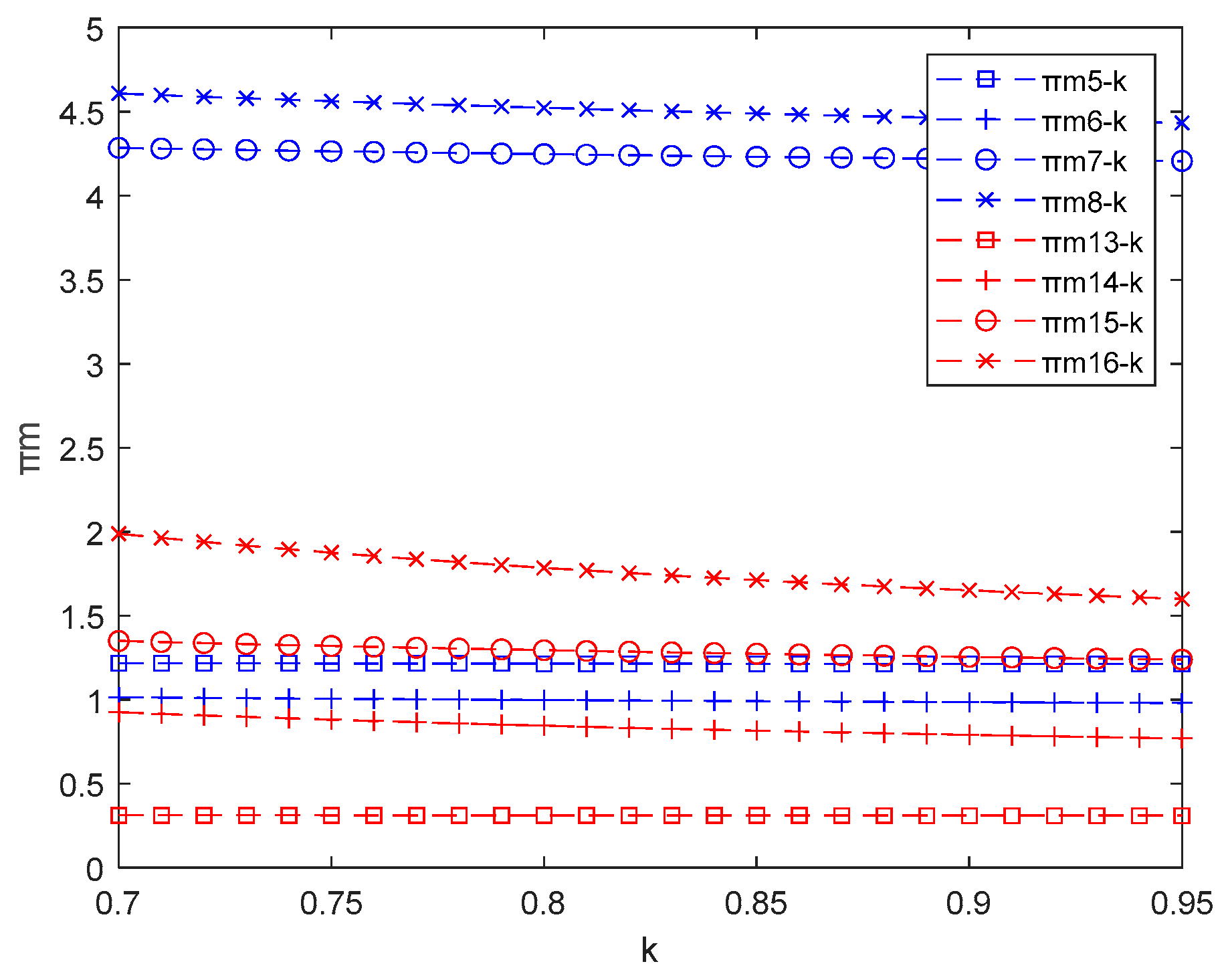

| k | Carbon reduction factor |

| γ | The degree of substitutability between products, i.e., the intensity of competition, 0 < γ < 1 |

| Consumer greenness sensitivity coefficient, i.e., consumer greenness preference, 0 < < 1 | |

| The degree of increased competition among products as perceived by consumers, 0 < < 1 | |

| Cost-sharing ratio of manufacturer 1 in case of joint R&D, 0 < λ < 1 | |

| Consumer green trust. | |

| Wholesale price of product i, the manufacturer’s decision variable | |

| Greenness of product i, the manufacturer’s decision variable | |

| Greenness of products under joint R&D, decision variables for manufacturers | |

| Retail price of product i, the retailer’s decision variable | |

| Market demand of manufacturer i | |

| Manufacturer 1, 2 benefits | |

| Retailer benefits | |

| Government benefits | |

| Product production cost | |

| the carbon emission reduction allowance factor | |

| Unit low-carbon product subsidy amount | |

| Blockchain unit costs for manufacturers | |

| Government building blockchain costs |

| Technology Subsidy | Production Subsidy | |||||

|---|---|---|---|---|---|---|

| Not using Blockchain | Individual R&D | Joint R&D | Individual R&D | Joint R&D | ||

| Non-cooperation | 1 | 2 | Non-cooperation | 5 | 6 | |

| Cooperation | 3 | 4 | Cooperation | 7 | 8 | |

| Using Blockchain | Individual R&D | Joint R&D | Individual R&D | Joint R&D | ||

| Non-cooperation | 9 | 10 | Non-cooperation | 13 | 14 | |

| Cooperation | 11 | 12 | Cooperation | 15 | 16 | |

| Technology Subsidy | Production Subsidy | |||||

|---|---|---|---|---|---|---|

| Individual R&D | Joint R&D | Individual R&D | Joint R&D | |||

| Blockchain not used | Non-cooperation | Non-cooperation | ||||

| Cooperation | Cooperation | |||||

| Using Blockchain | Non-cooperation | Non-cooperation | ||||

| Cooperation | Cooperation | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, J.; Yan, X. Impact of Government Subsidies, Competition, and Blockchain on Green Supply Chain Decisions. Sustainability 2023, 15, 3633. https://doi.org/10.3390/su15043633

Song J, Yan X. Impact of Government Subsidies, Competition, and Blockchain on Green Supply Chain Decisions. Sustainability. 2023; 15(4):3633. https://doi.org/10.3390/su15043633

Chicago/Turabian StyleSong, Jinxuan, and Xu Yan. 2023. "Impact of Government Subsidies, Competition, and Blockchain on Green Supply Chain Decisions" Sustainability 15, no. 4: 3633. https://doi.org/10.3390/su15043633