Abstract

This study uses data from 1980 to 2020 to analyze the explanatory power of renewable energy (RE), green finance (GF), and public health expenditure (PUHE) for environmental quality (ecological footprint: EF) in the Kingdom of Saudi Arabia (KSA). In order to examine the long- and short-term effects, we ran both linear autoregressive distribution (ARDL) and nonlinear autoregressive distribution (NARDL) models. The empirical results showed that, when estimating the ARDL model, all variables have an impact on the environment’s long-term quality, which has increased. Furthermore, the NARDL model supports the existence of significant positive or negative shocks that support an unbalanced relationship with the movement of variables over the short and long term. Overall, the study demonstrates the critical role of factors that can enhance the environment in the KSA setting. In light of this, we advise policymakers to encourage the use of additional renewable energy sources and to expedite their efforts to do so in order to slow down environmental damage.

1. Introduction

In recent decades, the fate of our planet has come under scrutiny. Global warming, the sea level rise, water waste, deforestation, and an increase in greenhouse gases are among the more prevalent climate changes. This climate change has produced a significant threat to the health of the ecosystem and civilization. As a result, ecologists, economists, political decision-makers, international organizations, and many scientific academics have focused on measures to protect the environment. In fact, experts believe that the ecological footprint (EF) effect has been recurring over time since antiquity. The employment of technology to drive economic expansion has exacerbated environmental degradation. Knowledge of the problem and the causes of the harm is critical to developing successful solutions. Ref. [1] claim that while economic growth requires more resources and more industry to expedite production, the environment is progressively becoming worse. As a result, this outcome leads to increased waste and pollution, as well as environmental damage (Environmental Kuznets Curve). Replacing antiquated technologies with more modern and environmentally friendly ones is the best way to sustain the current economic climate and reduce the impact of pollution (renewable energy). However, ref. [2] asserted that advancements in technology and the economy have a detrimental effect on people’s health as well. Governments have tried to adopt sustainable energy sources and make green finance (GF) more widely available in order to combat this detrimental impact. This procedure makes it easier to invest in environmental sustainability. Hence, integrating GF into climate change mitigation programs is a recent proposal, as demonstrated by [3]. Indeed, earlier research has offered a number of explanations for the detrimental consequences of economic development on the environment, especially those connected to economic expansion, and has also offered some strategies for preserving environmental quality.

To provide further context to the above, this essay makes an effort to discuss how public health spending, technological innovation, green finance, and renewable energy affect environmental quality (EF) in the Saudi context. For a variety of reasons, the KSA was chosen as a case study. First, the KSA fulfils its obligation to the environment by examining projects and initiatives pertaining to environmental protection. The creation of the Environment Fund in 2019, which intends to aid to the financial sustainability of the environmental and meteorological sectors, is one of the most notable of these initiatives. Second, the Kingdom of Saudi Arabia has the largest environmental rebuilding project in history (in 2014), which is tied to post-Gulf War reforms, and it has cost the Kingdom more than 1.1 billion US dollars. Finally, the KSA has acted quickly to create a more sustainable future with the introduction of Vision 2030 in 2016. Since its inception in 2021, the Saudi Green Initiative has merged environmental protection, energy conversion, and sustainability programs in the Kingdom to meet its overarching objectives of offsetting and limiting environmental carbon pollution, increasing the use of pure energy, and battling climate change.

As a result, our study is distinct from earlier empirical studies in a number of ways. Firstly, this is the first study in the KSA setting to attempt to show a connection between several factors that contribute to the deterioration of environmental quality. To the best of our knowledge, no studies have connected RE, technical advancement, spending on public health, and GF with the EF in the KSA, which has not been examined in any prior research. Second, using a multi-step technique that combines the ARDL and NARDL methodologies, we add to the body of literature on this subject by concentrating on the short- and long-term effects of factors on environmental quality. With this methodology, both symmetric and asymmetric influences on environmental quality are demonstrated. Several studies have examined the opportunities and challenges of environmental sustainability in the context of Saudi Arabia. Energy usage, energy prices, and economic activity in Saudi Arabia were examined by [4]. They employed a Johansen multivariate cointegration approach, which revealed long-run unidirectional causality between energy consumption and economic growth and CO2 emissions, bidirectional causality between carbon dioxide emissions and economic growth, and long-run unidirectional causality between energy pricing and economic growth and CO2 emissions. Using the Time-Varying Parameters Vector Autoregressive Model with stochastic volatility, ref. [5] looked at the intertemporal dynamics of electricity use, real GDP (oil and non-oil), and CO2 emissions in Saudi Arabia from 1971 to 2010. The findings demonstrate that electricity consumption, CO2 emissions shocks, and real GDP shocks under high- and low-volatility regimes have asymmetric impacts on these variables. These effects can be either positive or negative. Ref. [6] investigated the variables that contributed to Saudi Arabia’s environmental improvement between 1990 and 2014. The authors demonstrated how foreign commerce, foreign direct investment, economic growth, and financial development all have a favorable impact on the environment. The latest research by [7] examined how economic and technological factors affect environmental quality. They demonstrated a significant causality effect across variables (apart from technological transfer) over the long term using an autoregressive distributed lag (ARDL) and vector error correction model (VECM). Electric power consumption and environmental quality, as well as imported technology and environmental quality, do, nevertheless, have a short-term causal relationship. The impact of health spending and R&D in enhancing health outcomes by lowering CO2 emissions was evaluated by [8] in the same context. Utilizing data for Saudi Arabia from 2000 to 2018, the dynamic ordinary least squares (DOLS) method demonstrates how spending on R&D and health can lower CO2 emissions, which can then enhance health outcomes. Accordingly, our study differs from previous empirical works on several points. First, this is the first study in the KSA context that aims to provide evidence on the nexus between different determinants of environmental quality degradation. To the best of our knowledge, no researchers have linked RE technological innovation, public health expenditure, and GF with the EF in the KSA, which is not studied in any preceding study. Second, we complement the literature on this issue by focusing on the short- and long-term effects of variables on environmental quality by conducting a multi-step methodology that applies the ARDL and NARDL approaches. This methodology provides evidence of both symmetric and asymmetric effects on environmental quality.

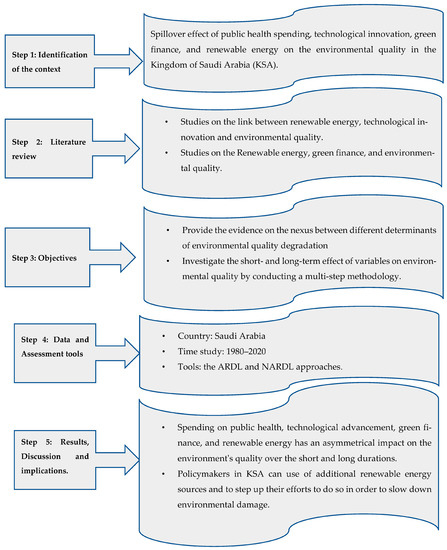

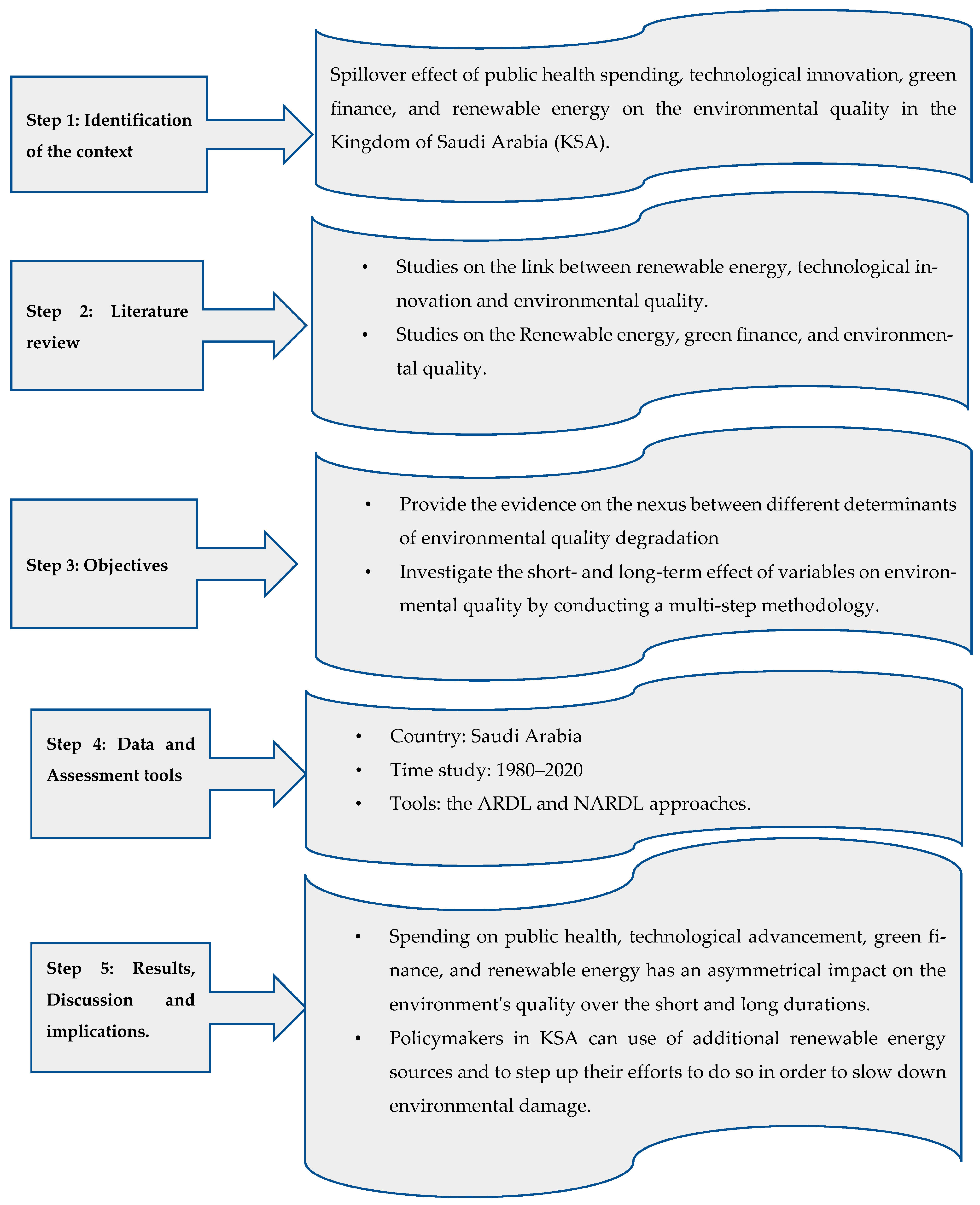

The following outlines the structure of this study. An overview of the literature on renewable energy, IT, GF, spending on public health, and the EF is given in Section 2. Section 3 describes the methodology. The results and findings are then presented and discussed in Section 4. Finally, Section 5 lists the limitations and provides some prospective policy recommendations.

2. Literature Review

In order to demonstrate the relationship between the various environmental quality criteria, this study divides a review of the literature into at least three separate sub-sections. We start by examining the connection between RE, IT, and environmental quality. The relationship between GF, RE, and environmental quality is the subject of our second investigation. Third, we take into account the connection between RE, public health spending, and environmental quality. As shown in Table 1, the results for the environmental relationship are mixed.

Table 1.

Summary of empirical studies.

2.1. Link between RE, IT, and Environmental Quality

Previous academics have looked into the relationship between RE, IT, and environmental quality. Let us start with [23], which illustrates the severity of factors impacting R&D tendencies in the energy sector. The authors view this as the key to addressing important energy-related economic and political difficulties, as well as other pertinent environmental concerns such as the fight against climate change. In a similar framework, [24] ran a quantitative panel regression in the Asian region from 1990 to 2019. Their findings indicate that rising economic growth, IT, and RE have all been associated with considerable increases in carbon dioxide (CO2) emissions.

However, improvements in mechanical development and greater sustainable energy use can reduce carbon dioxide emissions, suggesting that not all innovative advancements are associated with higher environmental quality. Nevertheless, [25,26] highlighted that the exploitation of technological innovation improves using RE and therefore lowers environmental quality impacts. Moreover, using a variety of statistical methodologies, including VECM, DOLS, FMOLS, GMM, ARDL, and NARDL, all of these investigations demonstrate different relationships between technological advancement and environmental quality.

According to [27], it is crucial to examine the relationship between development and the environment, especially regarding how technological improvements affect the climate. As a result, the researchers’ investigation included the Canadian case for the years 1989 to 2020 using the dynamic time series ARDL model. The findings show that both short- and long-term technological advancements have resulted in environmental damage. However, financial growth also promotes the production of renewable energy sources and energy sources to worsen environmental deterioration.

Moreover, [2] looked into how the development of mechanical technology and sustainable energy sources affected the environment in Asia Pacific nations. The results of the researchers’ study in the Asian region, which was based on the quantitative panel regression approach, revealed that the presence of quantitative regression resulted in the use of both biomass energy and IT to lower climatic quality. Ref. [28] provided an example of how RE, IT diversification, and capitalization are required to improve stable environmental quality. Time series analysis was utilized by the authors to study the BRICS region from 1990 to 2018. According to the findings of their research, RE permits an increase in production, which helps to distribute revenue in society. Because of this, it is possible to adopt methods that are cleaner and more energy-efficient, preserving the environment. In addition, in order to enhance environmental quality through cutting-edge technology, a number of empirical studies have attempted to provide an accurate examination of the elements impacting environmental quality. However, in order to be more accurate, this variable needs costly resources.

2.2. Renewable Energy, Green Finance, and Environmental Quality Nexus

Financial support is necessary to invest in RE and safeguard natural resources in order to improve environmental quality. As a result, the GF has been recognized since 2010, and the Green Climate Fund (GCF) is in charge of managing the distribution of financial aid to developing countries in order to reduce and stabilize climate change [29]. Furthermore, GF was seen as being crucial to funding environmental initiatives; therefore, different governmental and commercial financial institutions have a variety of asset categories, such green loans, green funds, green bonds, and others, to assist investment in this field. As a result, GF is swiftly becoming one of the most preferred forms of financing. Hence, by looking at the nature of the RE, GF, and environmental quality interaction, researchers have recently made progress in this regard. Few studies have looked into the nuances of this relationship; however, refs. [13,14,16,30,31] have all cited GF as a crucial element in enhancing environmental quality. Nevertheless, because GF is a contemporary method used to maintain environmental quality, its foundations are rather constrained. This makes it possible to assess the situation using some real-world examples. In contrast to [32], who found a decline in the environmental impact of GF, ref. [14] demonstrated a beneficial effect of GF on the quality of the environment. Ref. [33] demonstrated that while GF has negative effects on its externals, it does have a statistically significant favorable impact on the quality of the domestic environment. The effect of GF can be thought of as heterogeneous among sub-samples, as with other dual effects of GF on environmental quality. The authors investigated how GF, RE production, and energy efficiency are related.

In their investigation, the researchers used data envelope analysis (DEA) from 2016 through 2020. The findings revealed the potential for energy efficiency projects to boost worldwide spending on renewable energy, which might have slowed the advancement of green efforts. Consequently, the emphasis on sustainable energy is not related to science and technology but rather is a policy approach to secure financing in both advanced and emerging nations. Furthermore, when examining the potential connection between GF and climate change mitigation, ref. [34] discovered that GF is associated with investment risk. To evaluate the typical causal effects, the authors used the divergence of differences (DID) and DLC methods. The findings demonstrated that over the study period from 2005 to 2019, the N-11 countries experienced a reduction in the effects of environmental change due to the factors that determined the growth of GF. These findings support the notion that as direct unknown business expansion and carbon dioxide levels rise, so does the usage of sustainable energy sources. Hence, GF must be adopted in order to safeguard human health and lessen the impact of climate change on nations.

2.3. Renewable Energy, Public Health Expenditure, and Environmental Quality Nexus

Renewable energies are an essential and alternative source of energy to reduce pollution and ensure better human health. Many human health problems, such as cancers, cardiovascular and thoracic diseases, and others, are linked to environmental deterioration as a result of long-term effects. Therefore, environmental pollution negatively affects human life. Public health spending is typically regarded as one of the requirements for sustaining a sustainable environment. Normal CO2 emission decreases are good for the environment and human health. The World Health Organization (WHO) estimates that 6.5 million people die from air pollution each year.

The health status of individuals is inferred from the consumption of health products such as health services, where health expenditure factors are specified. Ref. [19] demonstrate the importance of health spending in improving environmental quality by examining the relationship between the environment and health spending. The authors argue that the increase in health expenditure ensures a livable and clean environment for human existence. For this reason, health expenditure is an important determinant of environmental quality. In the same context, ref. [35] proved, in their study based on Taiwan over the period 1995 Q1–2016 Q4, that spending on health positively affects economic performance and contributes to decreased positive externalities of government issues. This results is related to healthcare and environmental policies with conflicting interests between private and social. In addition, when the economy is experiencing growth in Taiwan’s expansion phase, health spending may have a positive impact on environmental pollution. Consequently, the acceleration of growth and production stimulates increased public expenditure to deal with the effects of pollution production and energy consumption. Therefore, a positive relationship links the quality of the environment and health expenditure. Similarly, refs. [18,22,36] demonstrate the importance of increasing investment in the RE sector to support health and reduce environmental degradation. The analysis uses 15 ECOWAS countries’ time series from 1995 to 2014 and is based on pooled OLS, fixed effects, and the GMM system. The findings indicate that there are two categories of health spending: public and private. Thus, all health issues necessitate significant outlays in order to guarantee a healthy existence. Similar to this, ref. [37] used a structural equation model to investigate the connection between Southeast Asian members’ public health spending, RE, and environmental quality. The findings demonstrate that while RE can enhance the environment, it does not foster more favorable conditions for sustainable development. To further examine the connections between RE, health spending, and the environment, ref. [38] employs ARDL models. The findings thus demonstrate that between 1982 and 2016, healthcare and RE spending had a considerable impact on the environment in Japan and the US. Hence, introducing and diversifying RE is necessary to lessen environmental pressure, but using technological innovation is even more crucial for environmental quality. The impact of investment on human morals and renewable energy usage in China between 1998 and 2020 was empirically demonstrated by [39]. They analyzed the non-linear ARDL technique for estimation as the main topic of their study. The authors discovered that spending on technology raises the standard of the environment. The findings of their research demonstrate that investing in technology has good effects on health and wellbeing.

Furthermore, ref. [40] examined the relationship between RE, carbon dioxide emissions, and health issues in Pakistan from 1998 to 2017. The authors adopted the approach of simultaneous equations. The authors found that adopting renewable energy ensures a healthy environment since the increase in the volume of exchange of RE contributes positively to CO2 emission levels. Therefore, carbon dioxide increases medical costs. On the contrary, renewable energy is negatively related to health costs and CO2 emissions. The importance of RE improves the quality of the environment and reduces medical expenses. For this reason, public health must be maintained by the use of RE. Similarly, the acceleration of technological advancements has an impact on activities, according to [41]. The quality of life has undergone numerous changes as a result. As a result, this process has harmed people’s health. In order to support their claims, the authors used a global indicator to gauge environmental quality. They used panel and ARDL approaches for their empirical investigation, which was focused on two elements, biocapacity and environmental footprints, for Asian countries from 1980 to 2018. The findings imply that spending on healthcare and RE usage both contribute significantly to rising occupancy. The authors contend that, as a result, governments must devote significant resources to the RE and health sectors.

Overall, we find that the existing literature is rather silent on the potential explanatory power of public health spending, technological innovation, green finance, and renewable energy for environmental quality in the Saudi context. In this paper, we contribute to the existing literature by testing both the symmetric and asymmetric influences of public health spending, technological innovation, green finance, and renewable energy on environmental quality using a NARDL approach.

3. Data and Methodology

3.1. Data

This paper intends to analyze the relationship between EF, RE, GF, technological innovation, and public health expenditure in the KSA between 1980 and 2020. Refs. [42,43] were used as data sources (2022). The choice of the period in the present study is based on the availability of data (see Appendix A). Additionally, the statistics are changed in logarithmic form. We have used the ecological footprint (EF) in this paper as measure of the environmental quality. Renewable energy consumption noted (RE) is measured as a percentage, public health expenditure from (% of GDP) noted (PUHE), and technological innovation (TI) for patent applications resident. Green finance noted (GF) measures the level of investment in GF relative to the market. The development of this new financial technique by the government leads to improvements in the quality of the environment. We develop this hypothesis by referring to the work of [44], who proposed a measure of GF. In this study, to obtain the index of GF, we retain green credit at 85% and government energy conservation and environmental protection expenditure as 15%. The formula is as follows:

GF development = [green credit × 85%] + [government energy conservation and environmental protection expenditure × 15%].

3.2. Empirical Models

Examining the relationship between EF, RE consumption, IT, public health spending, and the GF in the KSA is the goal of the current study. The model shows a relationship between the various explicative variables and the dependent variable EF (renewable energy, technology innovation, public health expenditure, and green finance). To assess the relationship between the aforementioned variables over the short and long term, we first use the ARDL calculated on time series. In order to analyze the asymmetric nexus between variables, a Nonlinear Autoregressive Distributed Lag (NARDL) analysis is taken into consideration. We begin by displaying the following environment function:

The model is defined as follows:

The following equation presents the natural logarithm of variables from Equation (2):

The ARDL model is expressed as follows:

signifies the first difference and designates the residual term.

The NARDL model is differentiated into linear integration and nonlinear co-integration. Ref. [2] presented the advantages of the NARDL model. This method permits the detection of asymmetric evidence. Thus, the ordinary equation form of this model is as follows (Equation (4)). This study splits RE, PUHE, TI, and GF into two groups:

We define two groups to measure the impact of shocks. The first group detects the positive shock in , while the second group captures the negative effects of shock in

Equation (13) presents the positive and negative series in the NARDL model. We estimate long-term links by testing the existence of cointegration between variables in Equation (13). Thus, we can test the delay levels for the F statistic in the model with the null hypothesis is tested

The acceptance of the alternative hypothesis depends on the statistical value F, which must be greater than the superior limit values. However, if the estimated F statistic value is smaller than the tabulated inferior limit value, long-term associations between the variables do not exist.

4. Empirical Results and Discussion

4.1. Descriptive Statistics

The KSA series’ descriptive statistics and correlations are listed in Table 2. Skewness for the majority of variables is greater than −1 but less than 1. The p-value is more than 0.05 for each variable. The kurtosis criterion is 3 for EF, RE, and GF but quite close to 3 for TI and PUHE. The Jarque–Bera test statistics show a positive result greater than zero.

Table 2.

Descriptive statistics and correlation matrix.

As a result, the findings show that the series has a normal distribution. The correlation analysis results show a strong correlation between the endogenous variable (FE) and the exogenous variables (RE, TI, PUHE, GF). Similar to this, every other relationship between the various variables has a positive correlation. According to the positive correlation, changes in one variable will have a positive impact on the other variables, but changes in one variable that have a negative impact will have the opposite effect on the other variables.

4.2. Unit Root Analysis

Our methodical approach begins with the stationarity examination. We apply the augmented Dickey–Fuller test (ADF) test to verify whether the time series is stationary or not. Similarly, one of the most frequently used statistical tests is the Phillips–Perron (PP) test. It is used as an ADF test to validate stationarity in the null hypothesis. In this context, an econometric method tests whether the mean and the variance change over time or not, by considering the autoregressive structure of the time series. Thus, the condition in the unit root test considers the null hypothesis when the data are not stationary, while the alternative hypothesis of this test considers that the data are stationary. In another step, before estimating the ARDL model, we should test the order of stationarity. The series must be stationary at or maximum at the first difference I(0) or I(1). The results described in Table 3 reveal that all the variables are stationary with the first difference.

Table 3.

Results of unit root tests.

4.3. Cointegration Analysis

After testing the results of long-term relationships between variables, the cointegration between variables is confirmed. The Johansen test findings are shown in Table 4, and they show that there are cointegration links between the variables. Thus, the null hypothesis means that cointegration cannot be dismissed. After this, the study used the ARDL methodology to provide a more flexible assessment of the cointegration [45]. The ARDL test can be used to determine whether the variables are cointegrated into the series if they are integrated into the level and the first difference, I(0) and I(1). A test of integration, however, is dependent on the F statistic, which is computed to compare the statistic value with the maximum and minimum crucial value limits. For the purpose of considering the existence cointegration hypothesis, [46] set this requirement. Hence, if the F statistic surpasses the superior critical value, then cointegration is present. In contrast, if the F statistic is smaller than the inferior critical value, the cointegration theory is disproven. Moreover, the presence of cointegration remains unsatisfactory if the F statistic is between the superior and inferior critical value limits. In this work, we examined the relationships between variables using ARDL modeling and we proved the cointegration in the short and long term.

Table 4.

Results of Johansen cointegration test.

Table 5 provides the results of the lag order selection tests. Results of the AIC criteria have been used to make a decision regarding the lag (min AIC criteria).

Table 5.

Order of optimal lags.

4.4. Results of ARDL and NARDL Models

To examine the evidence for a short- and long-term relationship between variables, we estimate the ARDL model (Equation (4)). The findings in Table 6 demonstrate that the RE has both a short- and long-term negative and significant impact on EF. This demonstrates that one degree of environmental degradation in the KSA is substantially associated with 18.4% of RE. This effect can be attributed to the KSA’s ongoing efforts to promote the consumption of RE.

Table 6.

Results of ARDL estimates.

These results are in concordance with the findings of [2,47,48,49,50] who revealed that the acceleration of the use of RE improves the quality of the environment. Thus, Saudi Arabi has a favorable territory, which is a significant opportunity for the deployment of new energy policies that promote the development of solar panels, for example, for the production of electricity. Recently, Saudi Arabia has investigated different forms of RE, such as solar energy and geothermal energy [51]. In the same context, [52] as well as [53] consider the Kingdom as one of the most important countries with many clean energy sources, such as wind and solar. Hence, their studies find that the association between renewable energy and environmental degradation is very rare. In the same context, PUHE has a negative and significant short- and long-term effect on the EF. The results are similar to the findings of [20] that indicate that the efficiency of the health services provided by different institutions and the infrastructure maintained by the government to access healthcare and invest in long-term health can explain this result. Moreover, we note that public health expenditure is a very strong predictor of environmental quality. In this context, Saudi Arabia has applied a strategy of reducing PUHE and increasing the use of renewable energy to achieve the goals of sustainable development [54]. On the other hand, the short-term effect of TI and GF on the EF is a significant and positive effect (insignificant in long term). The results show that, despite the importance of innovative technology, especially in the optimization and exploitation of renewable energies to enhance environmental quality, it seems inadequate for the KSA. This is considered a solution for the KSA to install more solar panels, wind turbines, and wastewater treatment plants. In this sense, innovative technology will improve the environmental quality. The increase in GF means that all aspects of green investment benefit the environment and can reduce carbon and greenhouse gas emissions. Therefore, the KSA has several attractive green energy production areas, especially in the coastal areas of the Arabian Gulf and the Red Sea. Moreover, the KSA has the financial capacity to exploit the renewable energy sector [10]. This is in accordance with [55], who illustrated that as non-renewable energy sources are eliminated, renewable energy will be produced, which will reduce the emissions of fossil fuels and many other types of air pollution, leading to the improvement of environmental quality. This is an important opportunity to attract more investments in environmentally cleaner technologies using financial incentives, tools, and tax credits in the long term.

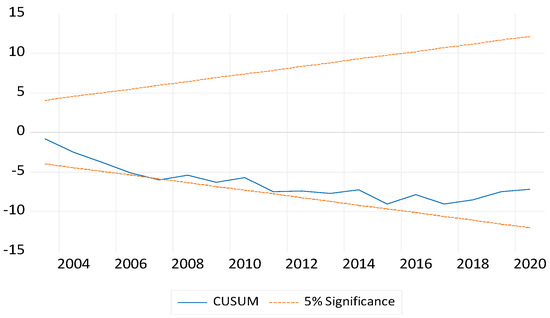

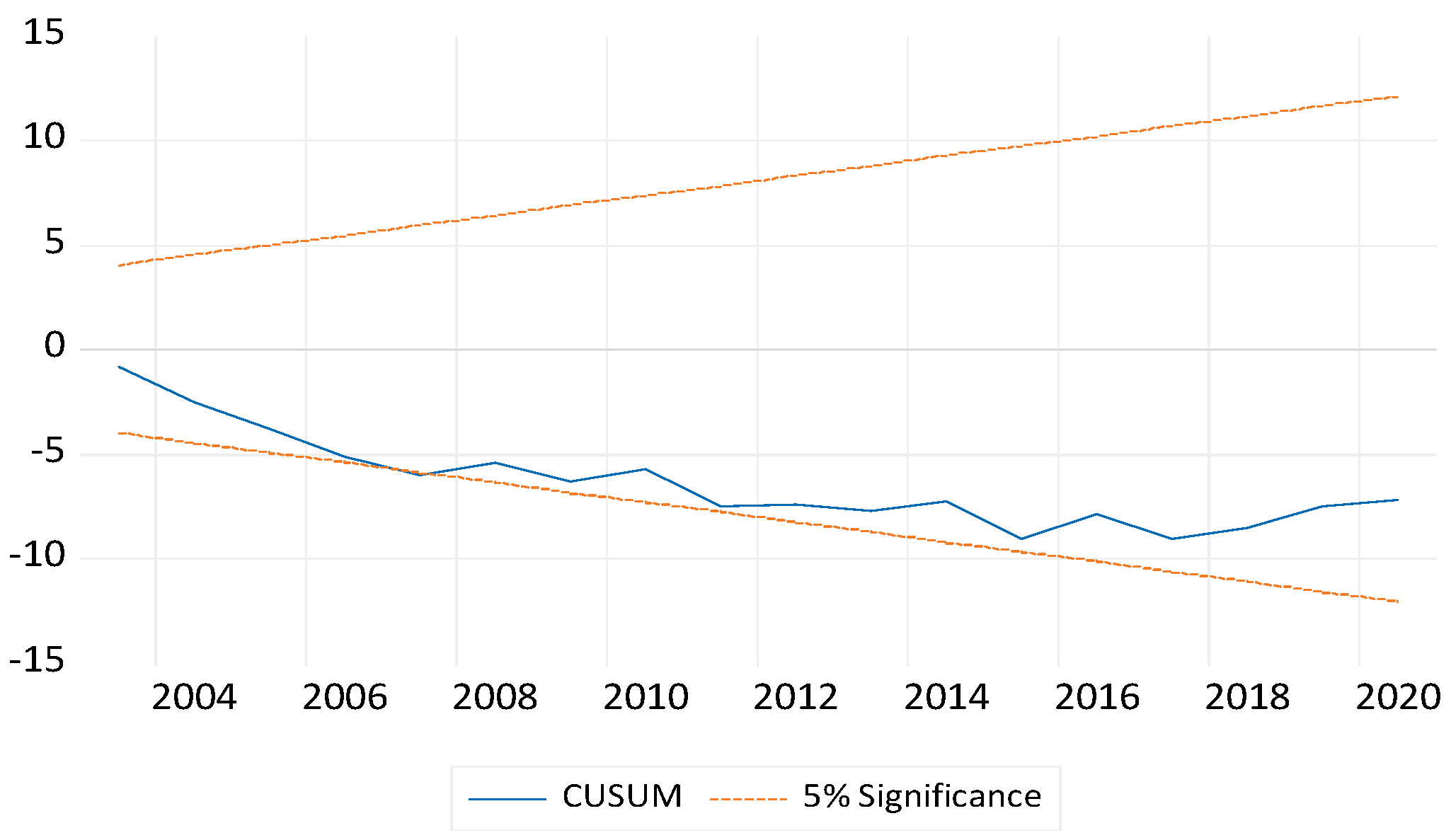

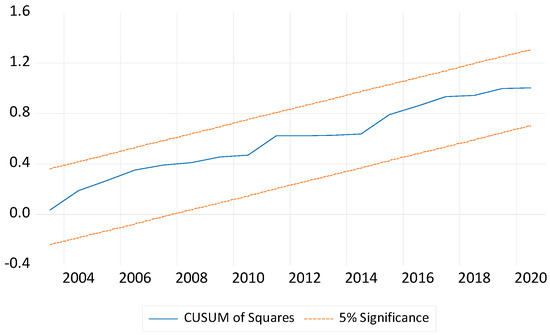

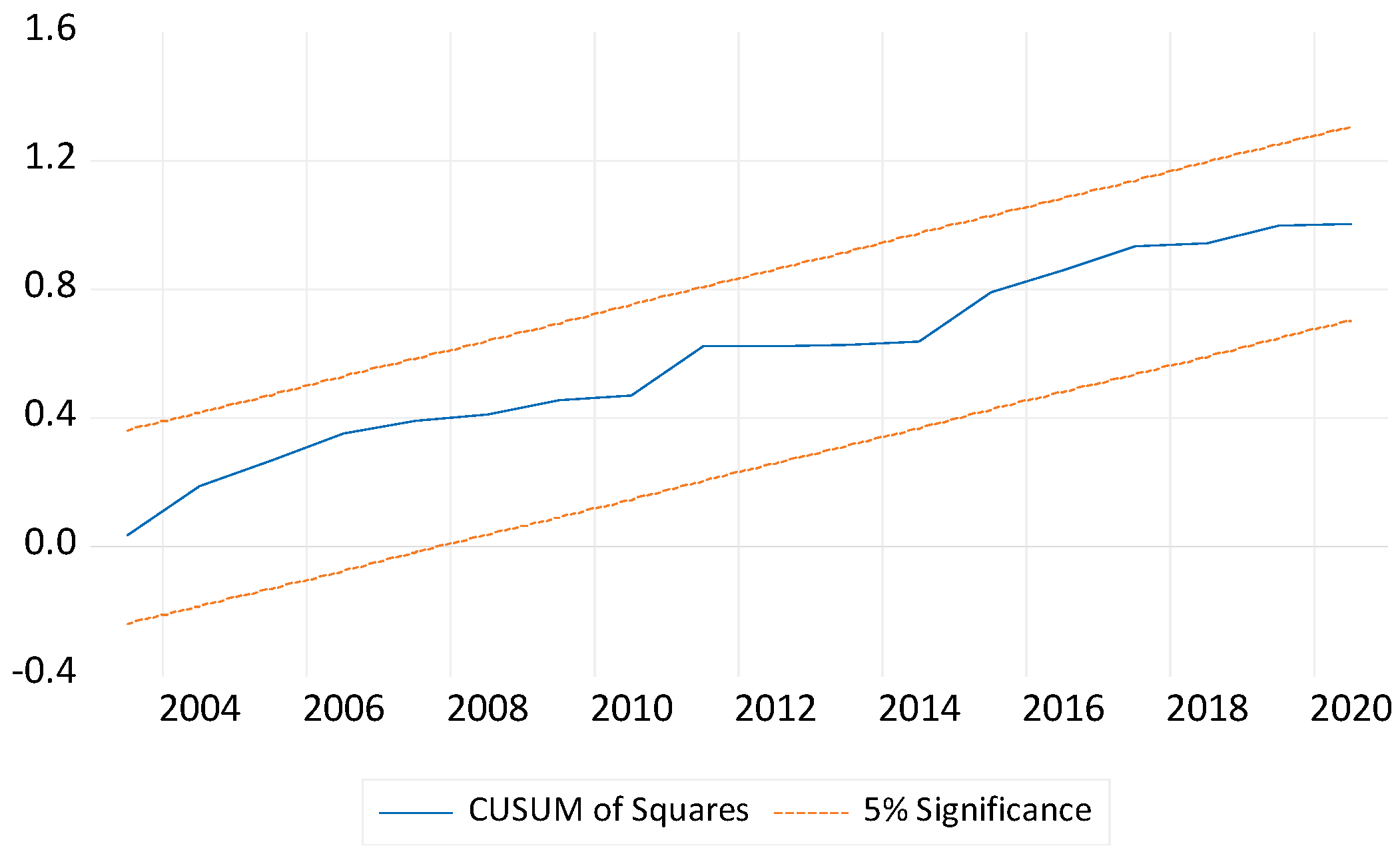

Table 6 displays the estimated coefficient of the ECM, which is positive and significant at 18.4%, for the stability of various models over the analysis period. The Breusch–Godfrey test and the serial correlation LM indicate that the model does not contain autocorrelation or heteroscedasticity. Additionally, the model’s significance at the 1% level is confirmed by the F statistic, which assesses the significance of each regressor in the model. The stability of the model is also supported by CUSUM (see Appendix B) and CUSUMsq (see Appendix C). As a result, we confirm that there is no autocorrelation between the regression analyses’ residuals.

The study suggested looking into the asymmetries’ short- and long-term effects after performing an ARDL analysis. An NARDL model will be taken into consideration as a result. The impacts of both positive and negative shocks to the variables (such as public health spending, innovation in technology, and GF on environmental quality) on the EF are shown in Table 7.

Table 7.

Result estimates of NARDL.

The outcomes of both positive and negative shocks to RE, TI, PUHE, and GF show a significant short-term impact on EF. These findings imply that there is an asymmetric relationship between various variables. The majority of the variables’ TI, PUHE, and GF have a significant and positive long-term impact on the quality of the environment, according to the results of the nonlinear ARDL model estimation in Table 7. The link between these factors is therefore asymmetric. In actuality, a 1% positive or negative shock to the variables causes a long-term drop in EF. Thus, the quality of the ecosystem is significantly impacted by this decline. Both a positive and negative shock to RE, however, has no discernible effects on EF. We reach the conclusion that RE does not have a disproportionate effect on environmental quality. Moreover, NARDL estimation indicates that the positive and the negative shocks of RE, TI, PUHE, and GF have a significant impact on EF in the short term. Regarding the diagnostic tests, Table 7 shows that the F statistic is significant, which indicates the existence of an asymmetric effect. By referring to the LM-BPG test, we confirm the absence of autocorrelation and heteroscedasticity in the model. In addition, the stability of the model was corroborated by the CUSUM and CUSUMsq.

5. Conclusions and Policy Implications

The purpose of this study was to investigate the connections between RE consumption, technological innovations, and expenditure on public health, GF, and the environmental footprint. As plotted in Figure A3 of Appendix D, the ARDL approach demonstrated that every factor affects the environmental quality, which undergoes long-term improvements. NARDL also validates the link between various model variables. More specifically, the existence of an asymmetric link between the movement of variables over the short and long term is justified by positive or negative shocks. Moreover, the study demonstrated the great significance of factors that can raise the environmental quality in the KSA setting.

The following are the main results obtained from short- and long-term estimates. Renewable energy contributes to improvements in the environment. Additionally, the increase in the investment of green financing systems, and the increase in the use of modern technologies, ameliorate the process of production. On the other hand, the economy in the Kingdom of Saudi Arabia is environmentally friendly, especially as it possesses wealth that enables it to produce renewable energy and thus reduces consumption while continuing sustainable growth [10].

In the same context, and through the results that we obtained in our research, we propose several recommendations and implications for Saudi policymakers, represented in the following. (i) Improving the standards of living, offering proper energy, supporting and promoting the manufacture of new medicines, and franchising energy-assisted medical devices, as energy is a pivotal determinant of the modern healthcare sector. In this regard, there is an urgent need for modern, efficient, reliable, and affordable energy policies emphasizing the use of renewable and clean energies in the country. (ii) Participating in the promotion of the emergence and development of players involved (consumers and producers) in the field of renewable energies and encourage investment in this sector. Renewable energy will be produced when non-renewable energy sources are phased out, resulting in a decrease in fossil fuel emissions and many other types of air pollution [55]. (iii) Identifying and exploiting innovative financing mechanisms for the development of renewable energies, particularly carbon finance. (iv) Developing bilateral and multilateral cooperation in the field of renewable energies. (v) Promoting access to medical technologies and innovation, as the transfer of environmentally sound technologies contributes to sustainable development and the reduction of health costs in the long term. (vi) Establishing a climate technology center and network to, among other things, strengthen networks, partnerships, and capacities for the transfer of green technologies.

An important limitation of this study is that it does not present results chronologically, geographically, or from an energy or socioeconomic perspective. In addition, the research did not consider a comparative analysis with other MENA economies. Future research can use newly emerging techniques and more macroeconomic factors to address these flaws, which will strengthen the results of this study.

Author Contributions

Conceptualization, K.T. and R.T.; methodology, R.T.; software, K.T. and R.T.; validation, K.T., R.T. and B.K.; formal analysis, H.T.; investigation, R.T.; resources, B.K.; data curation, R.T.; writing—original draft preparation, K.T., R.T. and B.K.; writing—review and editing, H.T., R.T. and B.K.; visualization, R.T.; supervision, K.T. and R.T.; project administration, B.K.; funding acquisition, B.K. All authors have read and agreed to the published version of the manuscript.

Funding

This study has been funded by the Scientific Research Deanship at the University of Ha’il—Saudi Arabia, through project number RG-21073.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data have been downloaded from the World Development Indicators (2022) and from Saudi official web statistics (2022).

Acknowledgments

This study has been funded by the Scientific Research Deanship at the University of Ha’il—Saudi Arabia, through project number RG-21073.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

Appendix A

Table A1.

A summary of variables.

Table A1.

A summary of variables.

| Variable | Meaning | Unit | Source |

|---|---|---|---|

| EF | Ecological footprint | Global hectares | WDI (2020) |

| RE | Renewable energy (consumption) | % of total final energy consumption | WDI (2020) |

| TI | Technological innovation | % indexed application residents | WDI (2020) |

| PUHE | Public heath expenditure | % of GDP | WDI (2020) |

| GF | Green finance index | % calculated | WDI (2020) |

Appendix B

Figure A1.

The plot of CUSUM.

Figure A1.

The plot of CUSUM.

Appendix C

Figure A2.

The plot of CUSUMsq.

Figure A2.

The plot of CUSUMsq.

Appendix D

Figure A3.

A summary of the entire research process.

Figure A3.

A summary of the entire research process.

References

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Zafar, M.W.; Sinha, A.; Ahmed, Z.; Qin, Q.; Zaidi, S.A.H. Effects of biomass energy consumption on environmental quality: The role of education and technology in Asia-Pacific Economic Cooperation countries. Renew. Sustain. Energy Rev. 2021, 142, 110868. [Google Scholar] [CrossRef]

- Zang, H.; Cheng, L.; Ding, T.; Cheung, K.W.; Wang, M.; Wei, Z.; Sun, G. Estimation and validation of daily global solar radiation by day of the year-based models for different climates in China. Renew. Energy 2019, 135, 984–1003. [Google Scholar] [CrossRef]

- Alshehry, A.S.; Belloumi, M. Energy consumption, carbon dioxide emissions and economic growth: The case of Saudi Arabia. Renew. Sustain. Energy Rev. 2015, 41, 237–247. [Google Scholar] [CrossRef]

- Mezghani, I.; Haddad, H.B. Energy consumption and economic growth: An empirical study of the electricity consumption in Saudi Arabia. Renew. Sustain. Energy Rev. 2017, 75, 145–156. [Google Scholar] [CrossRef]

- Omri, A.; Euchi, J.; Hasaballah, A.H.; Al-Tit, A. Determinants of environmental sustainability: Evidence from Saudi Arabia. Sci. Total Environ. 2019, 657, 1592–1601. [Google Scholar] [CrossRef]

- Kahouli, B.; Alrasheedy, B.B.; Chaaben, N.; Triki, R. Understanding the relationship between electric power consumption, technological transfer, financial development and environmental quality. Environ. Sci. Pollut. Res. 2021, 29, 17331–17345. [Google Scholar] [CrossRef]

- Kahouli, B.; Nafla, A.; Trimeche, H.; Kahouli, O. Understanding how information and communication technologies enhance electric power consumption and break environmental damage to reach sustainable development. Energy Build. 2022, 255, 111662. [Google Scholar] [CrossRef]

- Ullah, S.; Ozturk, I.; Majeed, M.T.; Ahmad, W. Do technological innovations have symmetric or asymmetric effects on environmental quality? Evidence from Pakistan. J. Clean. Prod. 2021, 316, 128239. [Google Scholar] [CrossRef]

- Kahia, M.; Omri, A.; Jarraya, B. Does green energy complement economic growth for achieving environmental sustainability? evidence from Saudi Arabia. Sustainability 2020, 13, 180. [Google Scholar] [CrossRef]

- Usman, M.; Ma, Z.; Zafar, M.W.; Waheed, A.; Li, M. Analyzing the determinants of clean energy consumption in a sustainability strategy: Evidence from EU-28 countries. Environ. Sci. Pollut. Res. 2021, 28, 54551–54564. [Google Scholar] [CrossRef] [PubMed]

- Deng, Z.; Liu, J.; Sohail, S. Green economy design in BRICS: Dynamic relationship between financial inflow, renewable energy consumption, and environmental quality. Environ. Sci. Pollut. Res. 2022, 29, 22505–22514. [Google Scholar] [CrossRef]

- Khan, M.A.; Riaz, H.; Ahmed, M.; Saeed, A. Does green finance really deliver what is expected? An empirical perspective. Borsa Istanb. Rev. 2022, 22, 586–593. [Google Scholar] [CrossRef]

- Zhou, X.Y.; Caldecott, B.; Hoepner, A.G.; Wang, Y. Bank green lending and credit risk: An empirical analysis of China’s Green Credit Policy. Bus. Strategy Environ. 2022, 31, 1623–1640. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N.; Phoumin, H. Analyzing the characteristics of green bond markets to facilitate green finance in the post-COVID-19 world. Sustainability 2021, 13, 5719. [Google Scholar] [CrossRef]

- Sinha, A.; Mishra, S.; Sharif, A.; Yarovaya, L. Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modelling. J. Environ. Manag. 2021, 292, 112751. [Google Scholar]

- Baloch, M.A.; Ozturk, I.; Bekun, F.V.; Khan, D. Modeling the dynamic linkage between financial development, energy innovation, and environmental quality: Does globalization matter? Bus. Strategy Environ. 2021, 30, 176–184. [Google Scholar] [CrossRef]

- Cinaroglu, S.; Baser, O. The relationship between medical innovation and health expenditure before and after health reform. Health Policy Technol. 2018, 7, 379–387. [Google Scholar] [CrossRef]

- Alimi, O.Y.; Ajide, K.B.; Isola, W.A. Environmental quality and health expenditure in ECOWAS. Environ. Dev. Sustain. 2020, 22, 5105–5127. [Google Scholar] [CrossRef]

- Ibukun, C.O.; Osinubi, T.T. Environmental quality, economic growth, and health expenditure: Empirical evidence from a panel of African countries. Afr. J. Econ. Rev. 2020, 8, 119–140. [Google Scholar]

- Ganda, F. The non-linear influence of trade, foreign direct investment, financial development, energy supply and human capital on carbon emissions in the BRICS. Environ. Sci. Pollut. Res. 2021, 28, 57825–57841. [Google Scholar] [CrossRef] [PubMed]

- Dong, F.; Li, Y.; Qin, C.; Sun, J. How industrial convergence affects regional green development efficiency: A spatial conditional process analysis. J. Environ. Manag. 2021, 300, 113738. [Google Scholar] [CrossRef] [PubMed]

- Bicil, İ.M.; Erkul, A.; Türköz, K. Energy R&D trends and sustainable energy strategies in IEA countries: Efficiency, dependency, and environmental dynamics. Environ. Sci. Pollut. Res. 2022, 29, 60012–60023. [Google Scholar]

- Esquivias, M.A.; Sugiharti, L.; Rohmawati, H.; Rojas, O.; Sethi, N. Nexus between Technological Innovation, Renewable Energy, and Human Capital on the Environmental Sustainability in Emerging Asian Economies: A Panel Quantile Regression Approach. Energies 2022, 15, 2451. [Google Scholar] [CrossRef]

- Magazzino, C.; Forte, F.; Giolli, L. On the Italian public accounts’ sustainability: A wavelet approach. Int. J. Financ. Econ. 2022, 27, 943–952. [Google Scholar] [CrossRef]

- Venetsanos, K.; Angelopoulou, P.; Tsoutsos, T. Renewable energy sources project appraisal under uncertainty: The case of wind energy exploitation within a changing energy market environment. Energy Policy 2002, 30, 293–307. [Google Scholar] [CrossRef]

- Khan, M.K.; Babar, S.F.; Oryani, B.; Dagar, V.; Rehman, A.; Zakari, A.; Khan, M.O. Role of financial development, environmental-related technologies, research and development, energy intensity, natural resource depletion, and temperature in sustainable environment in Canada. Environ. Sci. Pollut. Res. 2022, 29, 622–638. [Google Scholar] [CrossRef]

- Sharma, R.; Sinha, A.; Kautish, P. Examining the nexus between export diversification and environmental pollution: Evidence from BRICS nations. Environ. Sci. Pollut. Res. 2021, 28, 61732–61747. [Google Scholar] [CrossRef]

- Pan, S.L.; Carter, L.; Tim, Y.; Sandeep, M.S. Digital sustainability, climate change, and information systems solutions: Opportunities for future research. Int. J. Inf. Manag. 2022, 63, 102444. [Google Scholar] [CrossRef]

- Gianfrate, G.; Peri, M. The green advantage: Exploring the convenience of issuing green bonds. J. Clean. Prod. 2019, 219, 127–135. [Google Scholar] [CrossRef]

- Yang, B.; Jahanger, A.; Usman, M.; Khan, M.A. The dynamic linkage between globalization, financial development, energy utilization, and environmental sustainability in GCC countries. Environ. Sci. Pollut. Res. 2021, 28, 16568–16588. [Google Scholar] [CrossRef] [PubMed]

- Zhang, D.; Mohsin, M.; Rasheed, A.K.; Chang, Y.; Taghizadeh-Hesary, F. Public spending and green economic growth in BRI region: Mediating role of green finance. Energy Policy 2021, 153, 112256. [Google Scholar] [CrossRef]

- Chang, L.; Wang, J.; Xiang, Z.; Liu, H. Impact of green financing on carbon drifts to mitigate climate change: Mediating role of energy efficiency. Front. Energy Res. 2021, 9, 785588. [Google Scholar] [CrossRef]

- Nawaz, M.A.; Seshadri, U.; Kumar, P.; Aqdas, R.; Patwary, A.K.; Riaz, M. Nexus between green finance and climate change mitigation in N-11 and BRICS countries: Empirical estimation through difference in differences (DID) approach. Environ. Sci. Pollut. Res. 2021, 28, 6504–6519. [Google Scholar] [CrossRef]

- Wu, C.F.; Li, F.; Hsueh, H.P.; Wang, C.M.; Lin, M.C.; Chang, T. A dynamic relationship between environmental degradation, healthcare expenditure and economic growth in wavelet analysis: Empirical evidence from Taiwan. Int. J. Environ. Res. Public Health 2020, 17, 1386. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Adams, S.; Owusu, P.A.; Leirvik, T.; Ozturk, I. Mitigating degradation and emissions in China: The role of environmental sustainability, human capital and renewable energy. Sci. Total Environ. 2020, 719, 137530. [Google Scholar] [CrossRef]

- Khan, J.; Awan, N.; Islam, M.M.; Murlink, O. Healthcare Capacity, Health Expenditure, and Civil Society as Predictors of COVID-19 Case Fatalities: A Global Analysis. Front. Public Health 2020, 8, 247. [Google Scholar] [CrossRef]

- Pata, U.K. Do renewable energy and health expenditures improve load capacity factor in the USA and Japan? A new approach to environmental issues. Eur. J. Health Econ. 2021, 22, 1427–1439. [Google Scholar] [CrossRef]

- Shah, M.H.; Salem, S.; Ahmed, B.; Ullah, I.; Rehman, A.; Zeeshan, M.; Fareed, Z. Nexus Between Foreign Direct Investment Inflow, Renewable Energy Consumption, Ambient Air Pollution, and Human Mortality: A Public Health Perspective from Non-linear ARDL Approach. Front. Public Health 2022, 9, 814208. [Google Scholar] [CrossRef]

- Ullah, S.; Ozturk, I.; Sohail, S. The asymmetric effects of fiscal and monetary policy instruments on Pakistan’s environmental pollution. Environ. Sci. Pollut. Res. 2021, 28, 7450–7461. [Google Scholar] [CrossRef]

- Li, F.; Chang, T.; Wang, M.C.; Zhou, J. The relationship between health expenditure, CO2 emissions, and economic growth in the BRICS countries—Based on the Fourier ARDL model. Environ. Sci. Pollut. Res. 2022, 29, 10908–10927. [Google Scholar] [CrossRef] [PubMed]

- Global Development Indicators. 2022. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 21 February 2023).

- Saudi Government Site Statistics. Available online: https://www.stats.gov.sa/en (accessed on 21 February 2023).

- Xie, H.; Ouyang, Z.; Choi, Y. Characteristics and influencing factors of green finance development in the Yangtze river delta of China: Analysis based on the spatial durbin model. Sustainability 2020, 12, 9753. [Google Scholar] [CrossRef]

- Pesaran, H.H.; Shin, Y. Generalized impulse response analysis in linear multivariate models. Econ. Lett. 1998, 58, 17–29. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Wang, Y.L.; Zhao, C.; Guan, X.Y.; Yaqoob, T. Strengthening climate prevention through economic globalization, clean energy, and financial development in N11 countries: Evidence from advance panel estimations. Econ. Res.-Ekon. Istraživanja 2022, 35, 5014–5036. [Google Scholar] [CrossRef]

- Uzar, U. Political economy of renewable energy: Does institutional quality make a difference in renewable energy consumption? Renew. Energy 2020, 155, 591–603. [Google Scholar] [CrossRef]

- Ike, G.N.; Usman, O.; Alola, A.A.; Sarkodie, S.A. Environmental quality effects of income, energy prices and trade: The role of renewable energy consumption in G-7 countries. Sci. Total Environ. 2020, 721, 137813. [Google Scholar] [CrossRef]

- AlNemer, H.A.; Hkiri, B.; Tissaoui, K. Dynamic Impact of Renewable and Non-Renewable Energy Consumption on Co2 Emission and Economic Growth in Saudi Arabia: Fresh Evidence from Wavelet Coherence Analysis. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4185433 (accessed on 21 February 2023).

- Al-Douri, Y.; Waheeb, S.A.; Voon, C.H. Review of the renewable energy outlook in Saudi Arabia. J. Renew. Sustain. Energy 2019, 11, 015906. [Google Scholar] [CrossRef]

- Amran, Y.M.; Alyousef, R.; Alabduljabbar, H.; El-Zeadani, M. Clean production and properties of geopolymer concrete. A review. J. Clean. Prod. 2020, 251, 119679. [Google Scholar] [CrossRef]

- Balabel, A.; Alwetaishi, M.; Abdelhafiz, A.; Issa, U.; Sharaky, I.A.; Shamseldin, A.K.; Al-Harthi, M. Potential of Solatube technology as passive daylight systems for sustainable buildings in Saudi Arabia. Alex. Eng. J. 2022, 61, 339–353. [Google Scholar] [CrossRef]

- Almulhim, T.; Al Yousif, M. An Analysis of Renewable Energy Investments in Saudi Arabia: A Hybrid Framework Based on Leontief and Fuzzy Group Decision Support Models. SSRN 2022, 4183286. [Google Scholar] [CrossRef]

- Zaghdoudi, T.; Tissaoui, K.; Hakimi, A.; Ben Amor, L. Dirty versus renewable energy consumption in China: A comparative analysis between conventional and non-conventional approaches. Ann. Oper. Res. 2023, 1–22. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).