Research on a Prediction Model and Influencing Factors of Cross-Regional Price Differences of Rebar Spot Based on Long Short-Term Memory Network

Abstract

:1. Introduction

2. Literature Review

2.1. Influencing Factors of Price Differences between Regions

2.2. Cross-Regional Arbitrage between Futures and Spot

2.3. Prediction Model of Spot Regional Price Differences

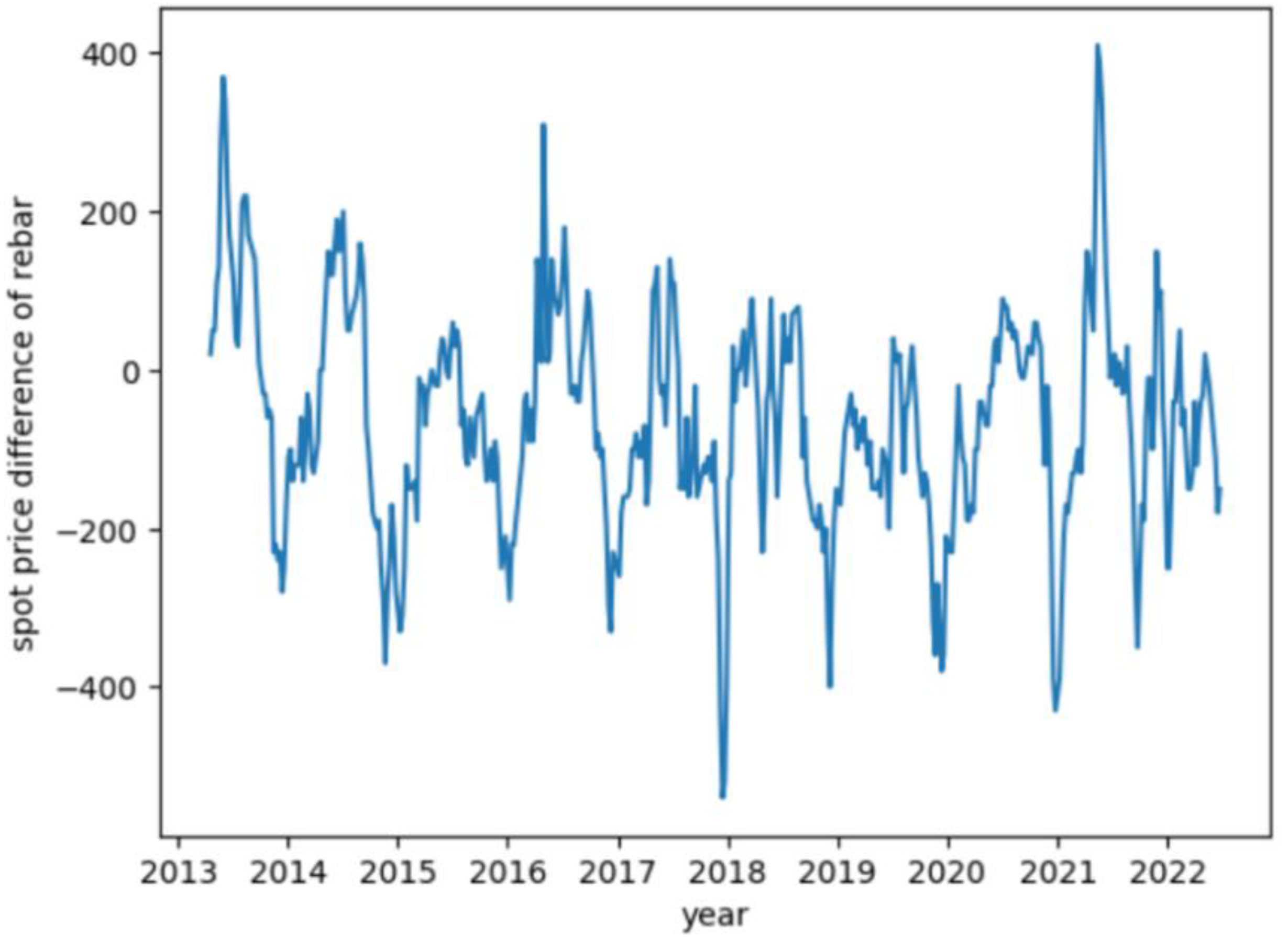

3. Data Preparation

3.1. Data Selection

3.2. Data Preprocessing

4. Materials and Methods of Spot Spread Forecast

4.1. Time Window Optimization

4.2. Experimental Design

5. Result and Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Francis, S.; Kallummal, M. India’s Comprehensive Trade Agreements: Implications for Development Trajectory. Econ. Polit. Wkly. 2013, 48, 109–122. [Google Scholar]

- Lin, B.; Tan, Z. Exploring arbitrage opportunities between China’s carbon markets based on statistical arbitrage pairs trading strategy. Environ. Impact Assess. Rev. 2023, 99, 107041. [Google Scholar] [CrossRef]

- Shen, H. Building a digital silk road? Situating the internet in China’s belt and road initiative. Int. J. Commun. 2018, 12, 19. [Google Scholar]

- Dreger, C.; Kosfeld, R. Do regional price levels converge? Jahrb. Nationalokon. Stat. 2010, 230, 274–286. [Google Scholar] [CrossRef]

- Board, J.; Sutcliffe, C. The dual listing of stock index futures: Arbitrage, Spread Arbitrage, and Currency risk. J. Futures Mark. 1996, 16, 29. [Google Scholar] [CrossRef]

- Olivier, M.; Albert, B. Market Power and Spatial Arbitrage between Interconnected Gas Hubs. Energy J. 2018, 39, 62. [Google Scholar]

- Butters, R.A.; Spulber, D.F. The extent of the market and integration through factor markets: Evidence from wholesale electricity. Econ. Inq. 2020, 58, 1076–1108. [Google Scholar] [CrossRef]

- Lee, C.K.M. Strategic procurement from forward contract and spot market. Ind. Manag. Data Syst. 2014, 114, 778–796. [Google Scholar] [CrossRef]

- Kim, S.; Yun, D.; Park, W.; Jang, Y.I. Bond strength prediction for deformed steel rebar embedded in recycled coarse aggregate concrete. Mater. Des. 2015, 83, 257–269. [Google Scholar] [CrossRef]

- Li, M.; Sun, H.; Agyeman, F.O. Analysis of Potential Factors Influencing China’s Regional Sustainable Economic Growth. Appl. Sci. 2021, 11, 10832. [Google Scholar] [CrossRef]

- Kim, K.; Lim, S. Price discovery and volatility spillover in spot and futures markets: Evidences from steel-related commodities in China. Appl. Econ. Lett. 2019, 26, 351–357. [Google Scholar] [CrossRef]

- Kapl, M.; Muller, W. Prediction of steel prices: A comparison between a conventional regression model and MSSA. Statist. Interface 2010, 3, 369–375. [Google Scholar] [CrossRef] [Green Version]

- Adli, K. Forecasting steel prices using ARIMAX model: A case study of Turkey. Int. J. Bus. Manag. Technol. 2020, 12, 70–87. [Google Scholar]

- Shyu, Y.; Chang, C. A hybrid model of MEMD and PSO-LSSVR for steel price forecasting. Int. J. Eng. Manag. Res. 2022, 12, 30–40. [Google Scholar] [CrossRef]

- Liu, Z.; Wang, Y.; Zhu, S.; Zhang, B.; Wei, L. Steel prices index prediction in China based on BP neural network. In Proceedings of 4th International Conference on Logistics, Informatics and Service Science, LISS 2014, Berkeley, CA, USA, 23 July 2014; Springer: Berlin/Heidelberg, Germany, 2015; pp. 603–608. [Google Scholar]

- Ou, T.; Cheng, C.; Chen, P.; Perng, C. Dynamic cost forecasting model based on extreme learning machine-A case study in steel plant. Comput. Ind. Eng. 2016, 101, 544–553. [Google Scholar] [CrossRef]

- Liu, Y.; Li, H.; Guan, J.; Liu, X.; Guan, Q.; Sun, Q. Influence of different factors on prices of upstream, middle and downstream products in China’s whole steel industry chain: Based on Adaptive Neural Fuzzy Inference System. Resour. Policy 2019, 60, 134–142. [Google Scholar] [CrossRef]

- Xu, Y.; Wang, Z.; Wu, Z. A CNN-BiLSTM-based Multi-feature Integration Model for Stock Trend Prediction. Data Anal. Knowl. Discov. 2021, 5, 126–137. [Google Scholar]

- Qi, T.; Jiang, H. Exploring Stock Price Trend Using Seq2Seq Based Automatic Text Summarization and Sentiment Mini. Manag. Rev. 2021, 33, 257–269. [Google Scholar]

- Wu, G.H.; Jiang, X.L.; Deng, S.Y. A Characteristic Analysis and Countermeasure Study of the Hedging of Listed Companies in China Stock Markets. J. Asian Finan. Econ. Bus 2021, 8, 147–158. [Google Scholar]

- Yang, X.; Zhang, C.; Yang, Y.; Wu, Y.; Yun, P.; Ali, W. China’s Carbon Pricing Based on Heterogeneous Tail Distribution. Sustainability 2020, 12, 2754. [Google Scholar] [CrossRef] [Green Version]

- Ke, S. Domestic market integration and regional economic growth—China’s recent experience from 1995–2011. World Dev. 2015, 66, 588–597. [Google Scholar] [CrossRef]

- Zhang, M.; Xie, J. Spatial Correlation of Regional Prices and Influencing Factors of Transmission Differences in China: An Empirical Study Based on Dynamic Spatial Panel Model. J. Financ. Econ. 2012, 38, 12. [Google Scholar]

- Li, J. Analysis of China’s Economic Downturn: From the Perspective of Macro-control. In Proceedings of the 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022), Harbin, China, 21–23 January 2022; Atlantis Press: Paris, France, 2022; pp. 988–994. [Google Scholar]

- Li, H.; Wang, B.; Ren, E.; Wu, C. Empirical analysis of the influencing factors on iron ore prices. In Proceedings of the 2nd International Conference on Artificial Intelligence, Management Science and Electronic Commerce (AIMSEC), Zhengzhou, China, 8–10 August 2011; pp. 3004–3008. [Google Scholar]

- Wang, H.; Sheng, H.; Zhang, H. Influence factors of international gold futures price volatility. Trans. Nonferr. Metals Soc. China 2019, 29, 2447–2454. [Google Scholar] [CrossRef]

- Sverdrup, H.U.; Ragnarsdottir, K.V. A system dynamics model for platinum group metal supply, market price, depletion of extractable amounts, ore grade, recycling and stocks-in-use. Resour. Conserv. Recycl. 2016, 114, 130–152. [Google Scholar] [CrossRef]

- Zeng, Y.; Dong, C.; Mikael, H.; Sun, J.; Shi, D. Can the Shanghai LNG Price Index indicate Chinese market? An econometric investigation using price discovery theory. Front. Energy 2020, 14, 726–739. [Google Scholar] [CrossRef]

- Cao, C.; Ghysels, E.; Hatheway, F. Price discovery without trading: Evidence from the Nasdaq preopening. J. Financ. 2000, 55, 1339–1365. [Google Scholar] [CrossRef]

- Cudjoe, G.; Breisinger, C.; Diao, X. Local impacts of a global crisis: Food price transmission, consumer welfare and poverty in Ghana. Food Policy 2010, 35, 294–302. [Google Scholar] [CrossRef]

- Popatl, M.; Griffith, G.; Mounter, S.; Cacho, O. Infrastructure investments, regional trade agreements and agricultural market integration in Mozambique. Food Security 2021, 14, 9–22. [Google Scholar] [CrossRef]

- Figueiredo, N.C.; da Silva, P.P.; Bunn, D. Weather and market specificities in the regional transmission of renewable energy price effects. Energy 2016, 114, 188–200. [Google Scholar] [CrossRef] [Green Version]

- Shi, Y.; Wu, F.; Chu, L.K.; Sculli, D.; Xu, Y.H. A portfolio approach to managing procurement risk using multi-stage stochastic programming. J. Operat. Res. Soc. 2011, 62, 1958–1970. [Google Scholar] [CrossRef]

- Willems, B.; Kupper, G. Arbitrage in Energy Markets: Price Discrimination under Congestion. Energy J. 2010, 31, 41–66. [Google Scholar] [CrossRef] [Green Version]

- Rui, X.; Feng, L.; Feng, J. A gas-on-gas competition trading mechanism based on cooperative game models in China’s gas market. Energy Rep. 2020, 6, 365–377. [Google Scholar] [CrossRef]

- Kumar, S. Price discovery and market efficiency: Evidence from agricultural commodities futures markets. S. Asian J. Manag. 2004, 11, 32. [Google Scholar]

- Jiang, M.; An, H.; Jia, X.; Sun, X. The influence of global benchmark oil prices on the regional oil spot market in multi-period evolution. Energy 2016, 118, 742–752. [Google Scholar] [CrossRef]

- Kannika, D.; James, W. Prequential forecasting in the presence of structure breaks in natural gas spot markets. Empir. Econ. 2019, 59, 2363–2384. [Google Scholar]

- Zhou, X.; Li, M. Shock Transfer in Futures and Spot Markets: An Agent-Based Simulation Modelling Method. Discr. Dyn. Nat. Soc. 2021, 2021, 7386169. [Google Scholar] [CrossRef]

- Hua, R.; Lu, B.; Chen, B. Price discovery process in the copper markets: Is Shanghai futures market relevant? Rev. Futur. Mark. 2010, 18, 299–312. [Google Scholar]

- Su, X.; Zhu, H.; Yang, X. Heterogeneous Causal Relationships between Spot and Futures Oil Prices: Evidence from Quantile Causality Analysis. Sustainability 2019, 11, 1359. [Google Scholar] [CrossRef] [Green Version]

- Xu, C.; Zhang, D. Market openness and market quality in gold markets. J. Futur. Mark. 2019, 39, 384–401. [Google Scholar] [CrossRef]

- Liu, G. Technical trading behaviour: Evidence from Chinese rebar futures market. Comput. Econ. 2019, 54, 669–704. [Google Scholar] [CrossRef] [Green Version]

- Ma, Y. Iron ore spot price volatility and change in forward pricing mechanism. Resour. Policy 2013, 38, 621–627. [Google Scholar] [CrossRef] [Green Version]

- Evren, A.; Elif, M. Chinese steel market in the post-futures period. Resour. Policy 2014, 42, 10–17. [Google Scholar]

- Engle, R.F.; Granger, C.W.J. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econom. J. Economet. 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Booth, G.G.; Tse, Y. Long Memory in Interest Rate Futures Markets: A Fractional Cointegration Analysis. J. Futur. Mark. 1995, 15, 573–584. [Google Scholar] [CrossRef]

- Andreou, E.; Ghysels, E. Predicting the VIX and the volatility risk premium: The role of short-run funding spreads Volatility Factors. J. Economet. 2020, 220, 366–398. [Google Scholar] [CrossRef]

- Li, X.D.; Zhang, B. Price discovery for copper futures in informationally linked markets. Appl. Econ. Lett. 2009, 16, 1555–1558. [Google Scholar] [CrossRef]

- Mou, Y.; He, Q.; Zhou, B. Detecting the spatially non-stationary relationships between housing price and its determinants in China: Guide for housing market sustainability. Sustainability 2017, 9, 1826. [Google Scholar] [CrossRef] [Green Version]

- Bigman, D.; Goldfarb, D.; Schechtman, E. Futures Market Efficiency and the Time Content of the Information Sets. J. Futur. Mark. 1983, 3, 321–334. [Google Scholar] [CrossRef]

- Mehmanpazir, F.; Khalili-Damghani, K.; Hafezalkotob, A. Modeling steel supply and demand functions using logarithmic multiple regression analysis (case study: Steel industry in Iran). Resour. Policy 2019, 63, 101409. [Google Scholar] [CrossRef]

- Alcalde, R.; Urda, D.; Armino, C.; García, S.; Manzanedo, M.; Herrero, Á. Non-linear Neural Models to Predict HRC Steel Price in Spain. In Proceedings of the 17th International Conference on Soft Computing Models in Industrial and Environmental Applications (SOCO 2022), Salamanca, Spain, 5–7 September 2022; Springer Nature: Cham, Switzerland, 2022; pp. 186–194. [Google Scholar]

- Chou, M. An application of fuzzy time series: A long range forecasting method in the global steel price index forecast. Rev. Econ. Financ. 2013, 3, 90–98. [Google Scholar]

- Hsu, Y.-C.; Chen, A.-P.; Chang, J.-H. An inter-market arbitrage trading system based on extended classifier systems. Expert Syst. Appl. 2011, 38, 3784–3792. [Google Scholar] [CrossRef]

- Park, H.; James, W.; Bessler, D.A. Price interactions and discovery among natural gas spot markets in North America. Energy Policy 2007, 36, 290–302. [Google Scholar] [CrossRef]

| Primary Factors | Secondary Factors |

|---|---|

| Macroscopical | Macroeconomic factors (liquidity indicators, macroeconomic indicators, inflation indicators, exchange rates) |

| Supply | Inventory level, suspension, and resumption of steel production, inflow of foreign resources, outflow of own resources |

| Policy | Air pollution prevention and control regulations, environmental supervision, energy control, financial subsidies, production restriction policies |

| Demand | Real-estate projects and infrastructure projects (investment), terminal industrial clusters (sales), market trading sentiment |

| Cost | Freight, raw material price, energy consumption factors |

| Technology | Production and smelting technology |

| Economy | Economic growth rate, the return of funds from steel mills |

| Climate | Climate impacts the use and storage costs; climate affects construction and therefore demand |

| Market | The number of steel traders |

| Category | Index | Remarks |

|---|---|---|

| Supply and demand Relationship | Rebar inventory | Supply, weekly data |

| Steel output | Supply, monthly data | |

| Construction area of commercial housing | Demand, monthly data | |

| New commercial housing construction area | Demand, monthly data | |

| Investment in commercial housing development | Demand, monthly data | |

| Cost | Domestic coastal freight of iron ore | Freight, daily data |

| Wholesale diesel price | Freight, daily data | |

| Steelmaking pig iron price | Raw materials, daily data | |

| Secondary metallurgical coke price | Raw materials, daily data | |

| Scrap price | Raw materials, daily data | |

| Macroeconomics and industry | China Commodity Price Index—Steel | Weekly data |

| Ferrous metal smelting and rolling industry: Cost of products sold/net accounts receivable/number of business units | Monthly data | |

| Consumer price index | Monthly data | |

| Macroeconomic climate index | Monthly data | |

| Policy | Government expenditure—energy conservation and environmental protection | Annual data |

| Spot price | Rebar spot price | Daily data |

| Time Window | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| MSE | 0.606 | 0.559 | 0.555 | 0.546 | 0.543 |

| MAE | 0.063 | 0.059 | 0.059 | 0.060 | 0.060 |

| Experiment | Index |

|---|---|

| Experiment 1 | Cross-regional price differences |

| Experiment 2 | Cross-regional price differences, Inventory |

| Experiment 3 | Cross-regional price differences, Inventory, Transportation costs |

| Experiment 4 | Cross-regional price differences, Inventory, Transportation costs, Steel production and demand |

| Experiment 5 | Cross-regional price differences, Inventory, Transportation costs, Steel production and demand, Macroeconomic indicators, Industry index |

| Experiment | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| MSE | 0.543 | 0.523 | 0.519 | 0.525 | 0.647 |

| Antinormalized MAE | 54.607 | 53.419 | 52.428 | 52.220 | 57.928 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, S.; Liu, S.; Zong, H.; Sun, Y.; Wang, W. Research on a Prediction Model and Influencing Factors of Cross-Regional Price Differences of Rebar Spot Based on Long Short-Term Memory Network. Sustainability 2023, 15, 4951. https://doi.org/10.3390/su15064951

Wu S, Liu S, Zong H, Sun Y, Wang W. Research on a Prediction Model and Influencing Factors of Cross-Regional Price Differences of Rebar Spot Based on Long Short-Term Memory Network. Sustainability. 2023; 15(6):4951. https://doi.org/10.3390/su15064951

Chicago/Turabian StyleWu, Sen, Shuaiqi Liu, Huimin Zong, Yiyuan Sun, and Wei Wang. 2023. "Research on a Prediction Model and Influencing Factors of Cross-Regional Price Differences of Rebar Spot Based on Long Short-Term Memory Network" Sustainability 15, no. 6: 4951. https://doi.org/10.3390/su15064951

APA StyleWu, S., Liu, S., Zong, H., Sun, Y., & Wang, W. (2023). Research on a Prediction Model and Influencing Factors of Cross-Regional Price Differences of Rebar Spot Based on Long Short-Term Memory Network. Sustainability, 15(6), 4951. https://doi.org/10.3390/su15064951