The Impact of Industrial Linkage Structures on Urban Economic Resilience in China in the Context of the COVID-19 Shock

Abstract

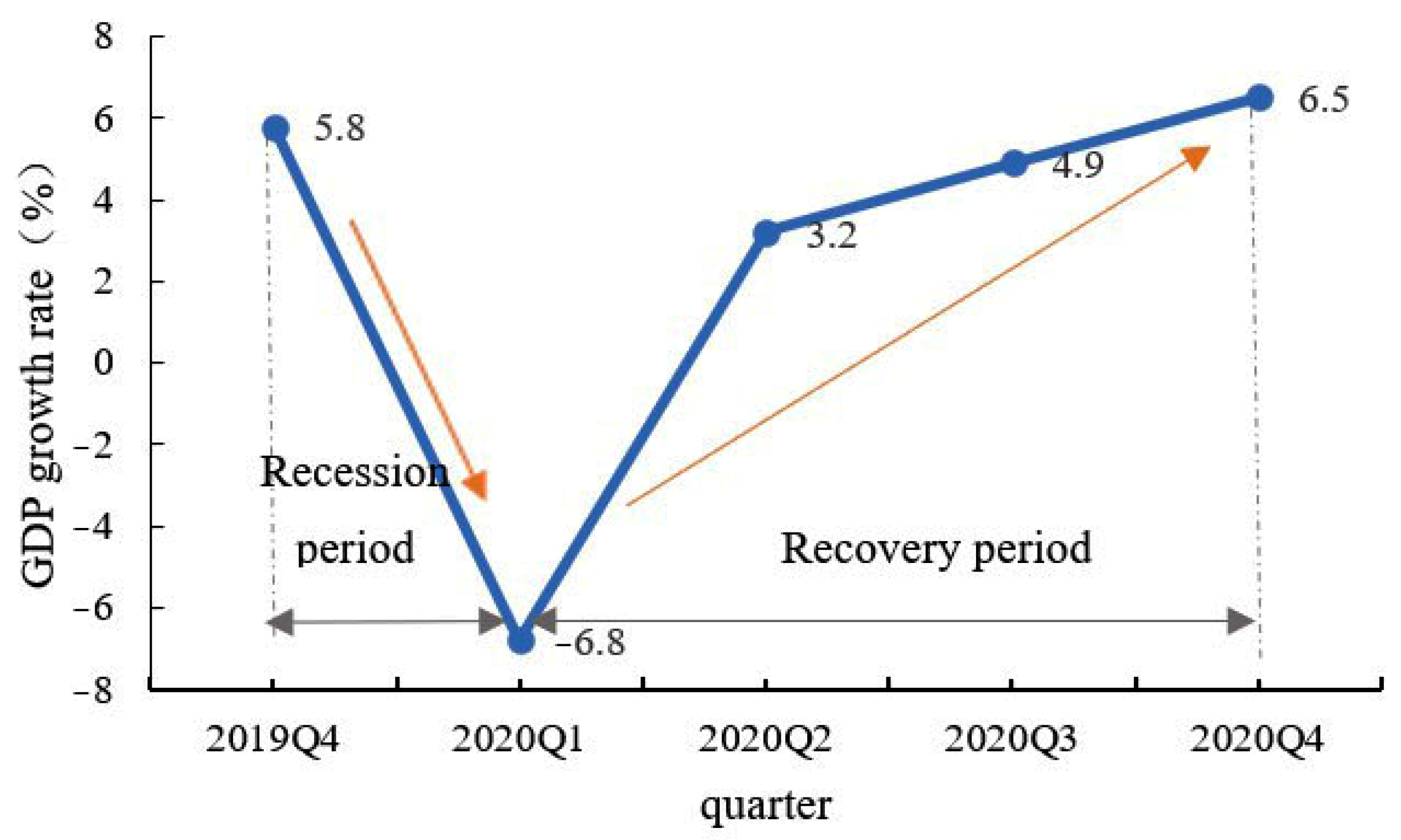

:1. Introduction

2. Data and Methods

2.1. Study Area

2.2. Methods

2.2.1. The Characteristics of Industrial Linkage Structures Based on Complex Network Theory

- (1)

- Centrality

- (2)

- Diversity

2.2.2. Centrality and Diversity at City Level

2.2.3. Urban Economic Resilience

2.2.4. The Impact of the Industrial Linkage Structures on Economic Resilience

2.3. Data Sources

3. Results

3.1. Characteristics of Industrial Linkage Structure

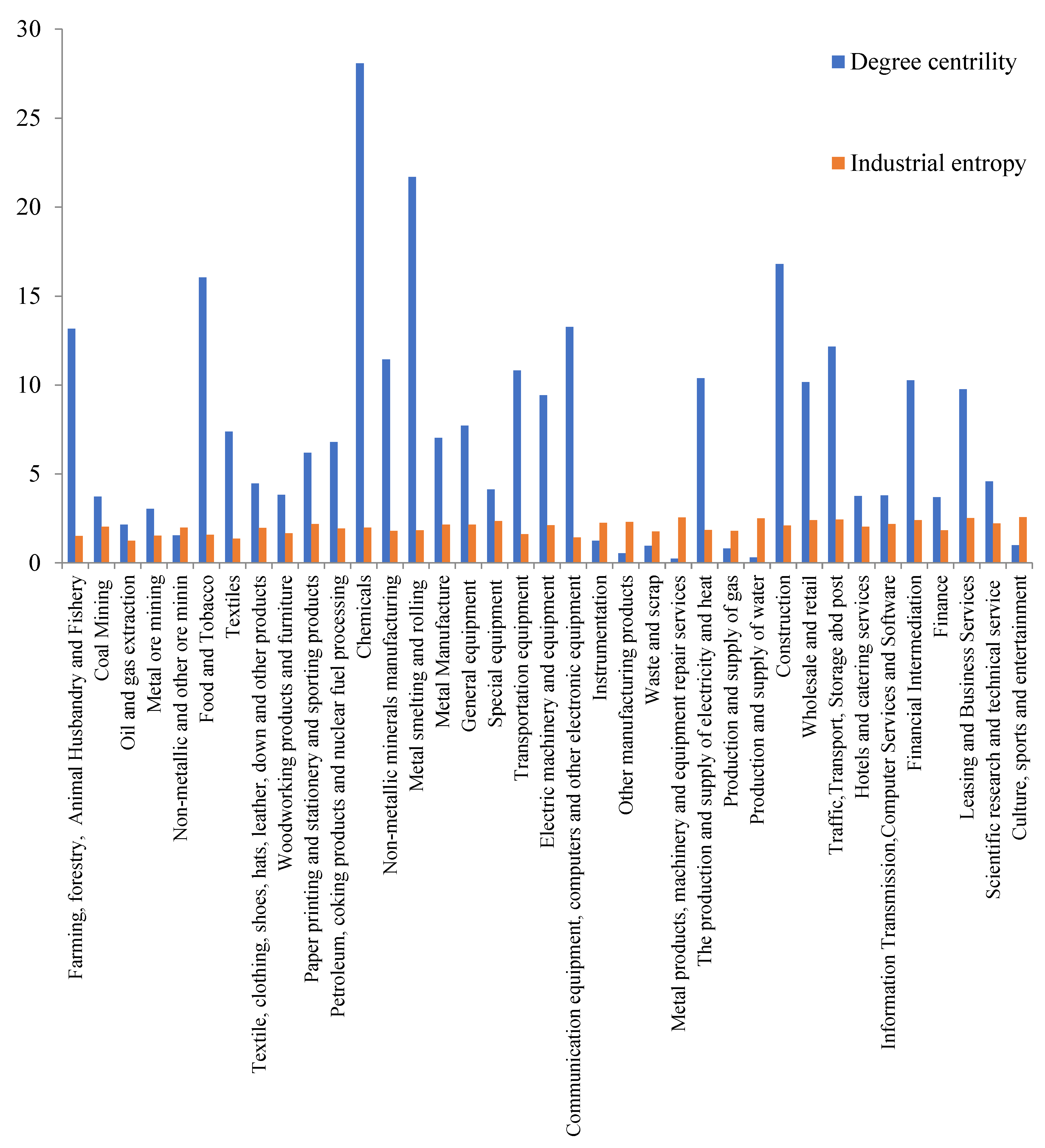

3.1.1. Characteristics of Industrial Linkage Structure: By Industry

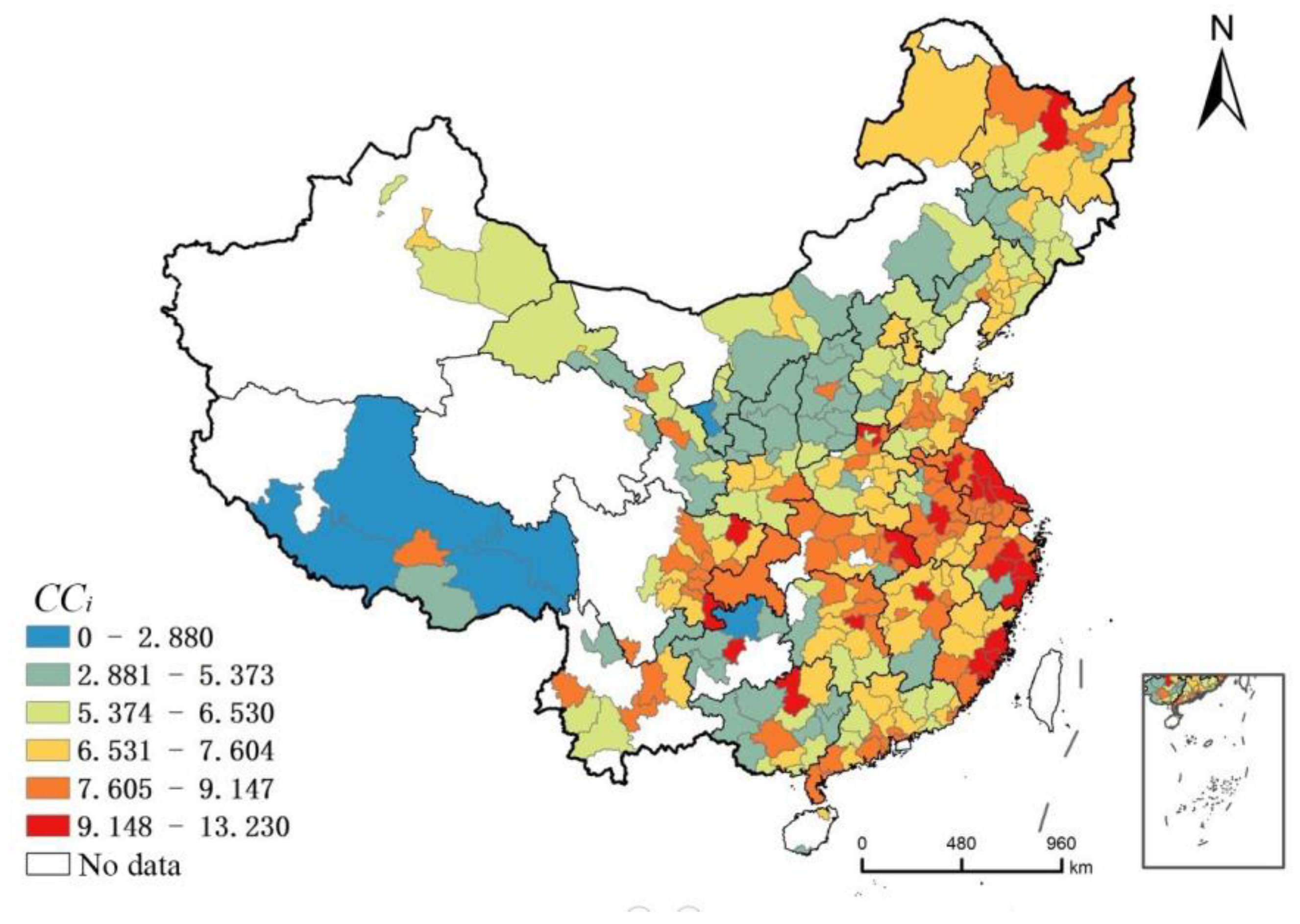

3.1.2. Characteristics of Industrial Linkage Structures: By City

- (1)

- Centrality

- (2)

- Diversity

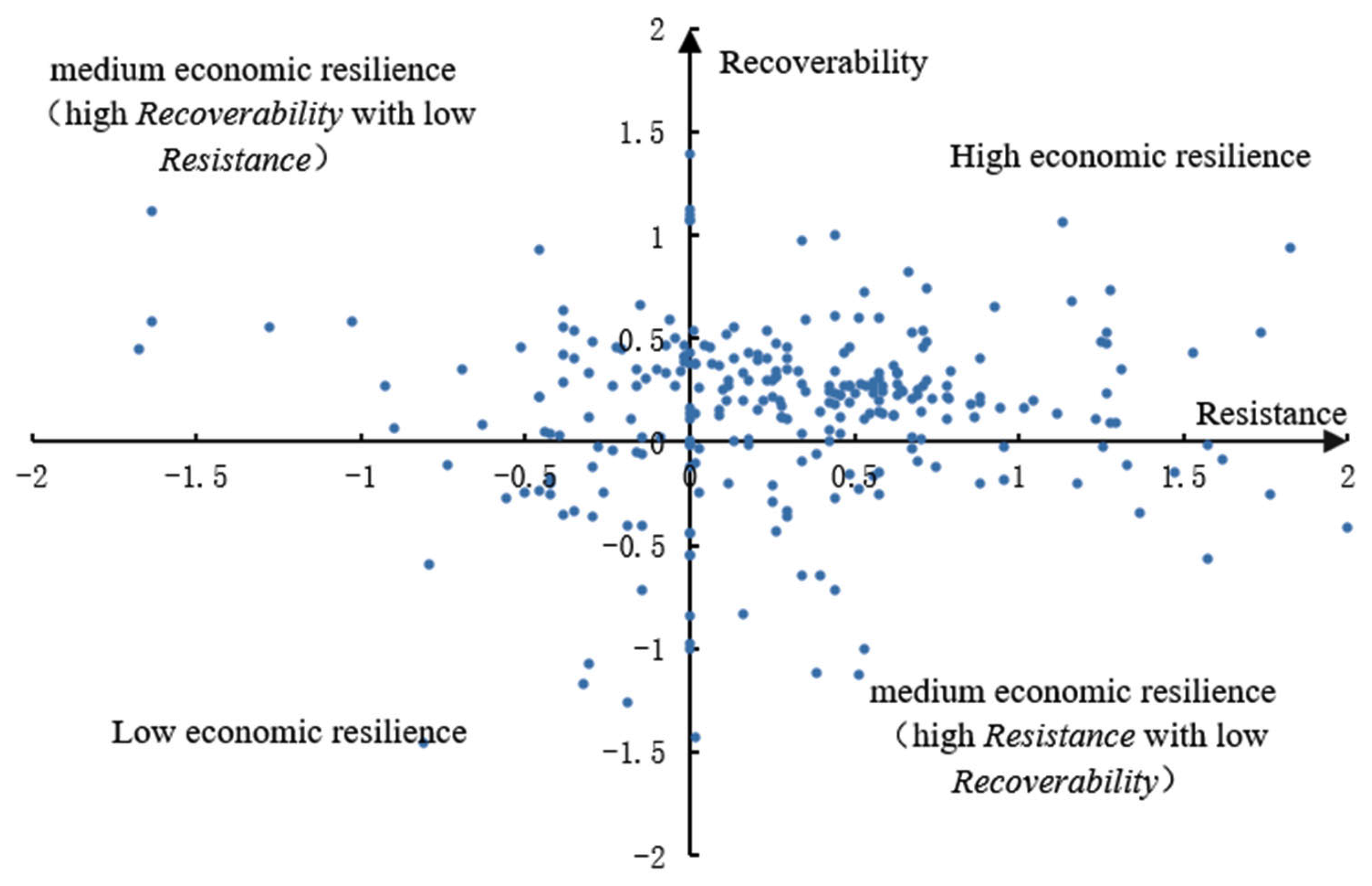

3.2. Urban Economic Resilience

3.3. Analysis of the Impact of the Industrial Linkage Structure on Economic Resilience

3.3.1. Regression Analysis: By Cities across the Country

3.3.2. Regression Analysis: By Cities with Different Population Sizes

3.3.3. Countermeasures to Enhance the Economic Resilience of China’s Cities

- (1)

- Enhancing the diversity of industrial linkage structures can effectively improve urban economic resilience. Individual cities should focus on advantageous industries, actively introduce related industries, encourage the interpenetration and reorganization among factors of production in the industrial network, and advance the development of interindustrial integration. Improving the diversity of urban industrial linkage structures can enhance the economic resilience of cities. Therefore, local governments should accelerate the cultivation or introduction of workers and firms with interdisciplinary talents. At the same time, they should promote interindustry linkage development through preferential policies, such as fiscal, financial, and taxation incentives. This could help provide a talent base and policy support for improving the diversity of industrial linkage structures.

- (2)

- Megacities with populations exceeding 6 million should also focus on enhancing the diversity of industrial linkage structures, but in slightly different ways. These cities should leverage positive externalities and knowledge spillover effects created by the diversity of the industrial linkage structures to enhance the innovation capacity and core competitiveness of related industries. Local governments should encourage and guide multinational corporations to further develop into additional industries related to their main business and promote the diversification of products and trade. These should further enhance the economic resilience of cities. At the same time, if centrality is too high, it may indicate that an industry is overdeveloped. This may increase competition within the industry and inhibit the flow and sharing of information and technology. Therefore, local governments should control the growth boundary of centrality and support the development of small and medium enterprises, in to prevent excessive centrality from increasing the vulnerability of the economic system.

- (3)

- In larger cities, with a population of 3–6 million, urban industries should both enhance diversity and improve centrality. Based on the industries giving the cities the most advantages, cities should expand and strengthen leading industries, encourage the development of advantageous industrial clusters, balance the relationship between industrial centrality and diversity, and create more high-end industrial chains with competitive advantages. Local governments should also establish multidirectional and networked trade, encourage an increase in the division of labor and the implementation of supply chain systems for industries, optimize the allocation of production factors, and diversify the positioning of industries in regional, domestic, and international markets.

- (4)

- For small and medium-sized cities with a population of less than 3 million, particularly those in the northwest, southwest and northeast of China, centrality is mainly caused by the local economy’s reliance on a single leading industry development mode. Therefore, urban industrial development should focus on coordinating the double effect of centrality, developing related supporting industries around leading industries, actively exploring the development direction of industrial transformation and upgrades, and expanding new development paths for the cities. Local governments can introduce relevant preferential finance and taxation policies to drive enterprises to invest in technological innovation and promote the transformation and upgrading of traditional or resource-based industries.

4. Conclusions and Discussion

4.1. Conclusions

- (1)

- Chemicals, metal smelting and rolling processing, construction, food and tobacco, agriculture, forestry, animal husbandry and fishery, communication equipment, computer and other electronic equipment, wholesale and retail, and finance industries have higher centrality of industrial linkage structure. Cities with high centrality are located in East China, Central China, and the Chengdu–Chongqing city cluster in western China.

- (2)

- Culture, sports and entertainment, water production and supply, leasing and business services, transportation, storage and postal services, finance, wholesale, and retail industries have higher diversity of industrial linkage structure. Cities with high diversity are located in the Yangtze River Delta city cluster, Pearl River Delta city cluster, Western Taiwan Straits city cluster, the middle reaches of the Yangtze River city cluster, and the Chengdu–Chongqing city cluster.

- (3)

- Most cities in China have high economic resilience. The regression analysis results show that the centrality has a significant and positive correlation with both Resistance and Recoverability for cities across the country. The square of centrality has a negative correlation with Resistance and Recoverability, indicating an inverted U-shaped nonlinear relationship between centrality and urban economic resilience. The diversity has a significant and positive correlation with both Resistance and Recoverability.

- (4)

- For cities with different population sizes, the centrality and diversity of industrial linkage structures have different effects on urban economic resilience. The economic resilience of cities can be improved by enhancing the diversity of industrial linkage structures. Excessive centrality may have a negative impact on Recoverability for cities with populations of more than 600 million and less than 3 million. Therefore, cities should adjust the centrality and diversity of industrial linkage structure by developing different industrial policies to enhance economic resilience.

4.2. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Godschalk, D.R. Urban Hazard Mitigation: Creating Resilient Cities. Nat. Hazards Rev. 2003, 4, 136–143. [Google Scholar] [CrossRef]

- Atun, F. Understanding Effects of Complexity in Cities During Disasters. In Understanding Complex Urban Systems: Multidisciplinary Approaches to Modeling; Understanding Complex Systems; Walloth, C., Gurr, J.M., Schmidt, J.A., Eds.; Springer International Publishing: Cham, Switzerland, 2014; pp. 51–65. ISBN 978-3-319-02996-2. [Google Scholar]

- Pretorius, O.; Drewes, E.; Aswegen, M.V. Fostering a Resilient Regional Economy in the SADC through Regional Integration. Reg. Sci. Policy Pract. 2017, 9, 217–228. [Google Scholar] [CrossRef]

- Hess, M.; Yeung, H.W.-C. Whither Global Production Networks in Economic Geography? Past, Present, and Future. Environ. Plan. Econ. Space 2006, 38, 1193–1204. [Google Scholar] [CrossRef]

- Pavlínek, P. Global Production Networks, Foreign Direct Investment, and Supplier Linkages in the Integrated Peripheries of the Automotive Industry. Econ. Geogr. 2018, 94, 141–165. [Google Scholar] [CrossRef]

- Xi, J. Major Issues Concerning China’s Strategies for Mid-to-Long-Term Economic and Social Development. Seek. Knowl. 2020, 21, 4–7. [Google Scholar]

- Zhai, G.; Li, S.; Chen, J. Reducing Urban Disaster Risk by Improving Resilience in China from a Planning Perspective. Hum. Ecol. Risk Assess. Int. J. 2015, 21, 1206–1217. [Google Scholar] [CrossRef]

- Davoudi, S.; Brooks, E.; Mehmood, A. Evolutionary Resilience and Strategies for Climate Adaptation. Plan. Pract. Res. 2013, 28, 307–322. [Google Scholar] [CrossRef]

- MacKinnon, D.; Derickson, K.D. From Resilience to Resourcefulness: A Critique of Resilience Policy and Activism. Prog. Hum. Geogr. 2013, 37, 253–270. [Google Scholar] [CrossRef]

- Simmie, J.; Martin, R. The Economic Resilience of Regions: Towards an Evolutionary Approach. Camb. J. Reg. Econ. Soc. 2010, 3, 27–43. [Google Scholar] [CrossRef]

- Amirzadeh, M.; Sobhaninia, S.; Sharifi, A. Urban Resilience: A Vague or an Evolutionary Concept? Sustain. Cities Soc. 2022, 81, 103853. [Google Scholar] [CrossRef]

- Doran, J.; Fingleton, B. US Metropolitan Area Resilience: Insights from Dynamic Spatial Panel Estimation. Environ. Plan. Econ. Space 2018, 50, 111–132. [Google Scholar] [CrossRef]

- Boschma, R. Towards an Evolutionary Perspective on Regional Resilience. Reg. Stud. 2015, 49, 733–751. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P.; Gardiner, B.; Tyler, P. How Regions React to Recessions: Resilience and the Role of Economic Structure. Reg. Stud. 2016, 50, 561–585. [Google Scholar] [CrossRef]

- Balland, P.-A.; Rigby, D.; Boschma, R. The Technological Resilience of US Cities. Camb. J. Reg. Econ. Soc. 2015, 8, 167–184. [Google Scholar] [CrossRef]

- Suire, R.; Vicente, J. Clusters for Life or Life Cycles of Clusters: In Search of the Critical Factors of Clusters’ Resilience. Entrep. Reg. Dev. 2014, 26, 142–164. [Google Scholar] [CrossRef]

- Rose, A.; Krausmann, E. An Economic Framework for the Development of a Resilience Index for Business Recovery. Int. J. Disaster Risk Reduct. 2013, 5, 73–83. [Google Scholar] [CrossRef]

- Marana, P.; Labaka, L.; Sarriegi, J.M. A Framework for Public-Private-People Partnerships in the City Resilience-Building Process. Saf. Sci. 2018, 110, 39–50. [Google Scholar] [CrossRef]

- Cutter, S.L.; Barnes, L.; Berry, M.; Burton, C.; Evans, E.; Tate, E.; Webb, J. A Place-Based Model for Understanding Community Resilience to Natural Disasters. Glob. Environ. Change 2008, 18, 598–606. [Google Scholar] [CrossRef]

- Graziano, P.; Rizzi, P. Vulnerability and Resilience in the Local Systems: The Case of Italian Provinces. Sci. Total Environ. 2016, 553, 211–222. [Google Scholar] [CrossRef]

- Giannakis, E.; Bruggeman, A. Regional Disparities in Economic Resilience in the European Union across the Urban–Rural Divide. Reg. Stud. 2020, 54, 1200–1213. [Google Scholar] [CrossRef]

- Cainelli, G.; Ganau, R.; Modica, M. Does Related Variety Affect Regional Resilience? New Evidence from Italy. Ann. Reg. Sci. 2019, 62, 657–680. [Google Scholar] [CrossRef]

- Lian, C.; Haimes, Y. Managing the Risk of Terrorism to Interdependent Infrastructure Systems through the Dynamic Inoperability Input-Output Model. Syst. Eng. 2006, 9, 241–258. [Google Scholar] [CrossRef]

- Newman, M.E.J. Assortative Mixing in Networks. Phys. Rev. Lett. 2002, 89, 208701. [Google Scholar] [CrossRef]

- Chopra, S.S. Graph Theoretic Approaches to Understand Resilience of Complex Systems. Available online: http://d-scholarship.pitt.edu/25797/ (accessed on 23 November 2020).

- Niu, Q.; Zeng, A.; Fan, Y.; Di, Z. Robustness of Centrality Measures against Network Manipulation. Phys. Stat. Mech. Its Appl. 2015, 438, 124–131. [Google Scholar] [CrossRef]

- Albert, R.; Jeong, H.; Barabási, A.-L. Error and Attack Tolerance of Complex Networks. Nature 2000, 406, 378–382. [Google Scholar] [CrossRef] [PubMed]

- Sun, S.; Wu, Y.; Ma, Y.; Wang, L.; Gao, Z.; Xia, C. Impact of Degree Heterogeneity on Attack Vulnerability of Interdependent Networks. Sci. Rep. 2016, 6, 32983. [Google Scholar] [CrossRef]

- Frenken, K.; Oort, F.V.; Verburg, T. Related Variety, Unrelated Variety and Regional Economic Growth. Reg. Stud. 2007, 41, 685–697. [Google Scholar] [CrossRef]

- Han, Y.; Goetz, S.J. Predicting US County Economic Resilience from Industry Input-Output Accounts. Appl. Econ. 2019, 51, 2019–2028. [Google Scholar] [CrossRef]

- Eagle, N.; Macy, M.; Claxton, R. Network Diversity and Economic Development. Science 2010, 328, 1029–1031. [Google Scholar] [CrossRef]

- Cellini, R.; Torrisi, G. Regional Resilience in Italy: A Very Long-Run Analysis. Reg. Stud. 2014, 48, 1779–1796. [Google Scholar] [CrossRef]

- Lapuh, L. Socio-Economic Characteristics of Resilient Localities—Experiences from Slovenia. Reg. Stud. Reg. Sci. 2018, 5, 149–156. [Google Scholar] [CrossRef]

- Martin, R. Regional Economic Resilience, Hysteresis and Recessionary Shocks. J. Econ. Geogr. 2012, 12, 1–32. [Google Scholar] [CrossRef]

- van Bergeijk, P.A.G.; Brakman, S.; van Marrewijk, C. Heterogeneous economic resilience and the great recession’s world trade collapse. Pap. Reg. Sci. 2017, 96, 3–12. [Google Scholar] [CrossRef]

| Intermediate Demand | Final Demand | Output | ||||||

|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | … | n | ||||

| Intermediate Input | 1 | x11 | x12 | x13 | … | x1n | f1 | X1 |

| 2 | x21 | x22 | x23 | … | x2n | f2 | X2 | |

| 3 | x31 | x32 | x33 | … | x3n | f3 | X3 | |

| … | … | … | … | … | … | … | … | |

| s | xn1 | xn2 | xn3 | … | xnn | fn | Xn | |

| Value-add | v1 | v2 | v3 | … | Vn | |||

| Input | X1 | X2 | X3 | … | Xn | |||

| Resistance | Recoverability | |||

|---|---|---|---|---|

| Coefficient and t Regression 1 | Coefficient and t Regression 2 | Coefficient and t Regression 1 | Coefficient and t Regression 2 | |

| CCi | 0.132 (1.237) * | 0.153 (1.384) * | 0.142 (1.292) * | 0.141 (1.236) * |

| CCi_sq | −0.124 (−1.063) * | −0.118 (−0.932) * | ||

| CIEi | 0.583 (4.079) *** | 0.594 (4.188) *** | 0.524 (2.042) ** | 0.624 (2.462) ** |

| The proportion of tertiary industry in GDP | −0.038 (−0.65) | −0.041 (−0.688) | −0.052 (−0.867) | −0.054 (−0.888) |

| The proportion of urban construction land in urban area | 0.01 (0.165) | 0.07 (0.11) | −0.044 (−0.67) | −0.05 (−0.762) |

| Ratio of local fiscal revenue to expenditure | 0.332 (3.476) *** | 0.341 (3.526) *** | 0.185 (1.86) ** | 0.191 (1.879) ** |

| N | 298 | 298 | 298 | 298 |

| F | 8.178 *** | 6.588 *** | 4.687 ** | 4.112 ** |

| R2 | 0.405 | 0.389 | 0.359 | 0.315 |

| >6 Million | 3–6 Million | <3 Million | ||||

|---|---|---|---|---|---|---|

| Resistance Coefficient and t | Recoverability Coefficient and t | Resistance Coefficient and t | Recoverability Coefficient and t | Resistance Coefficient and t | Recoverability Coefficient and t | |

| CCi | 0.397 (1.656) * | −0.253 (−1.468) * | 0.495 (2.622) ** | 0.194 (0.956) | 0.248 (1.391) * | −0.280 (−1.623) * |

| CIEi | 1.975 (2.681) ** | 0.534 (2.123) * | 1.007 (4.322) *** | 0.105 (0.461) | 0.949 (3.972) *** | 0.314 (1.384) |

| F | 6.446 *** | 4.274 ** | 4.976 *** | 1.782 | 2.838 ** | 2.335 * |

| R2 | 0.419 | 0.313 | 0.390 | 0.136 | 0.284 | 0.241 |

| N | 63 | 63 | 111 | 111 | 124 | 124 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ye, S.; Cao, M. The Impact of Industrial Linkage Structures on Urban Economic Resilience in China in the Context of the COVID-19 Shock. Sustainability 2023, 15, 5011. https://doi.org/10.3390/su15065011

Ye S, Cao M. The Impact of Industrial Linkage Structures on Urban Economic Resilience in China in the Context of the COVID-19 Shock. Sustainability. 2023; 15(6):5011. https://doi.org/10.3390/su15065011

Chicago/Turabian StyleYe, Shanshan, and Mingming Cao. 2023. "The Impact of Industrial Linkage Structures on Urban Economic Resilience in China in the Context of the COVID-19 Shock" Sustainability 15, no. 6: 5011. https://doi.org/10.3390/su15065011