Analyzing the Effects of Governmental Policy and Solar Power on Facilitating Carbon Neutralization in the Context of Energy Transition: A Four-Party Evolutionary Game Study

Abstract

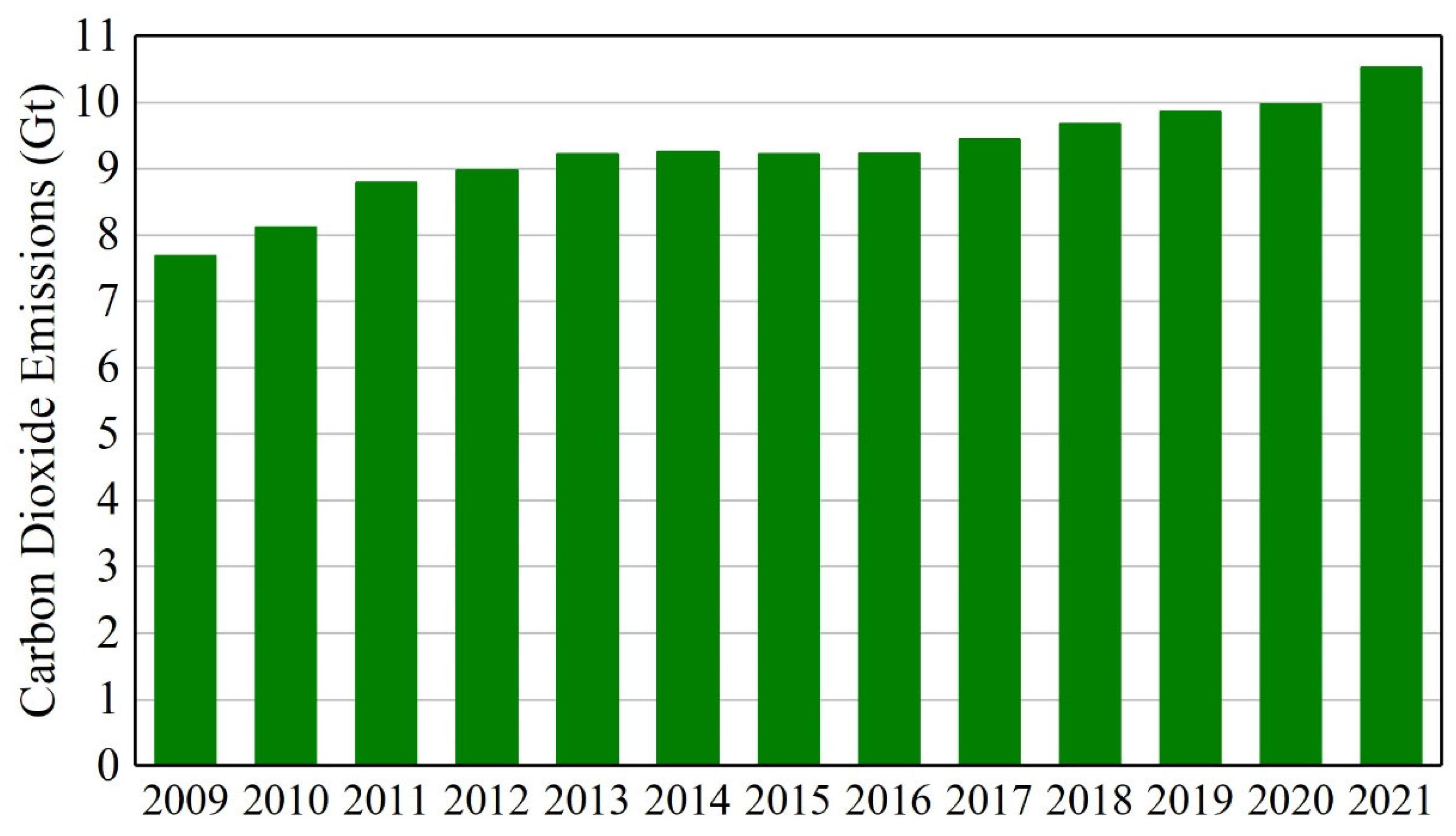

:1. Introduction

2. Modeling Method

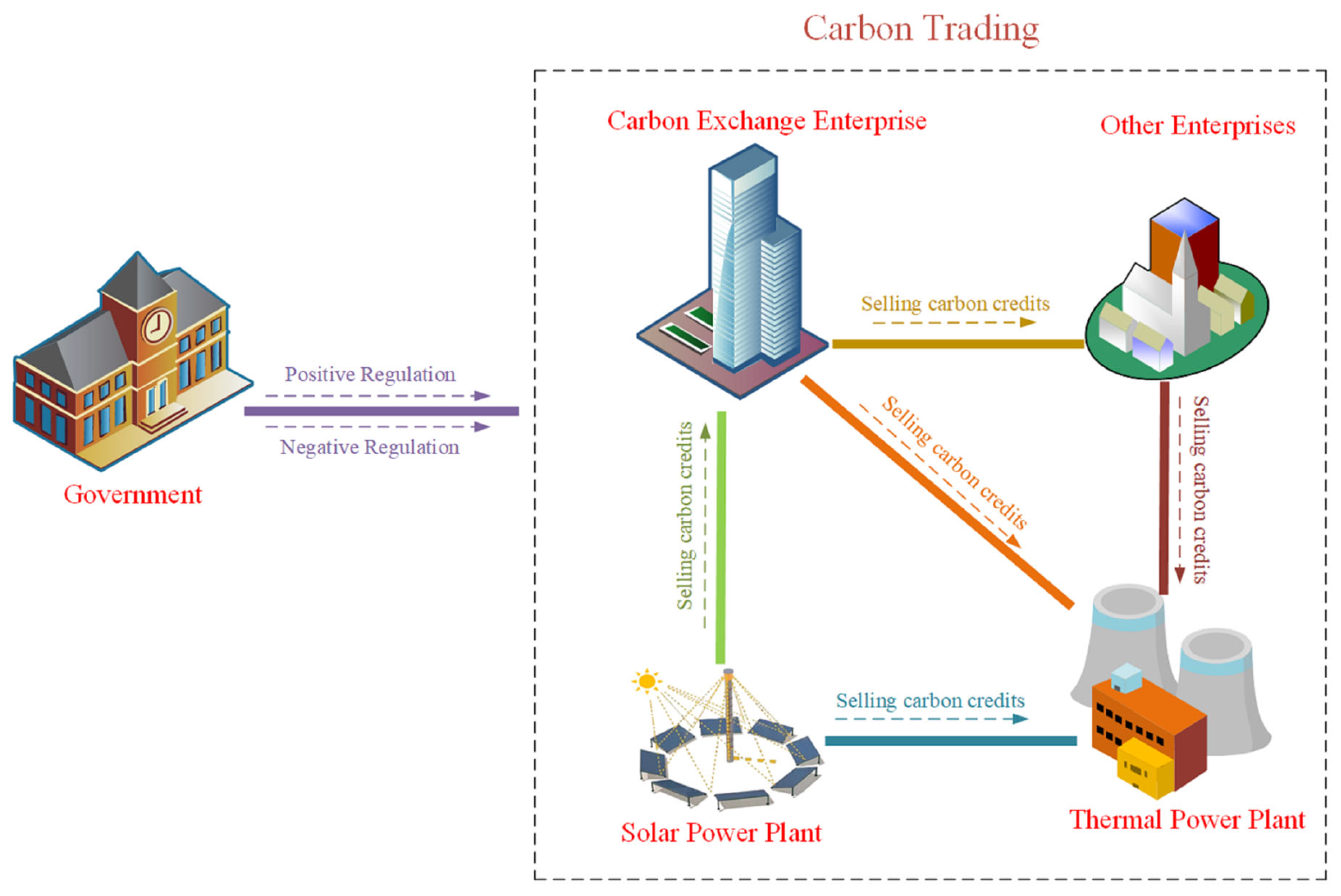

2.1. Problem Introduction

2.2. Formulas for the EGT Modeling

3. Results and Discussion

3.1. Assumptions and Initial Parameters

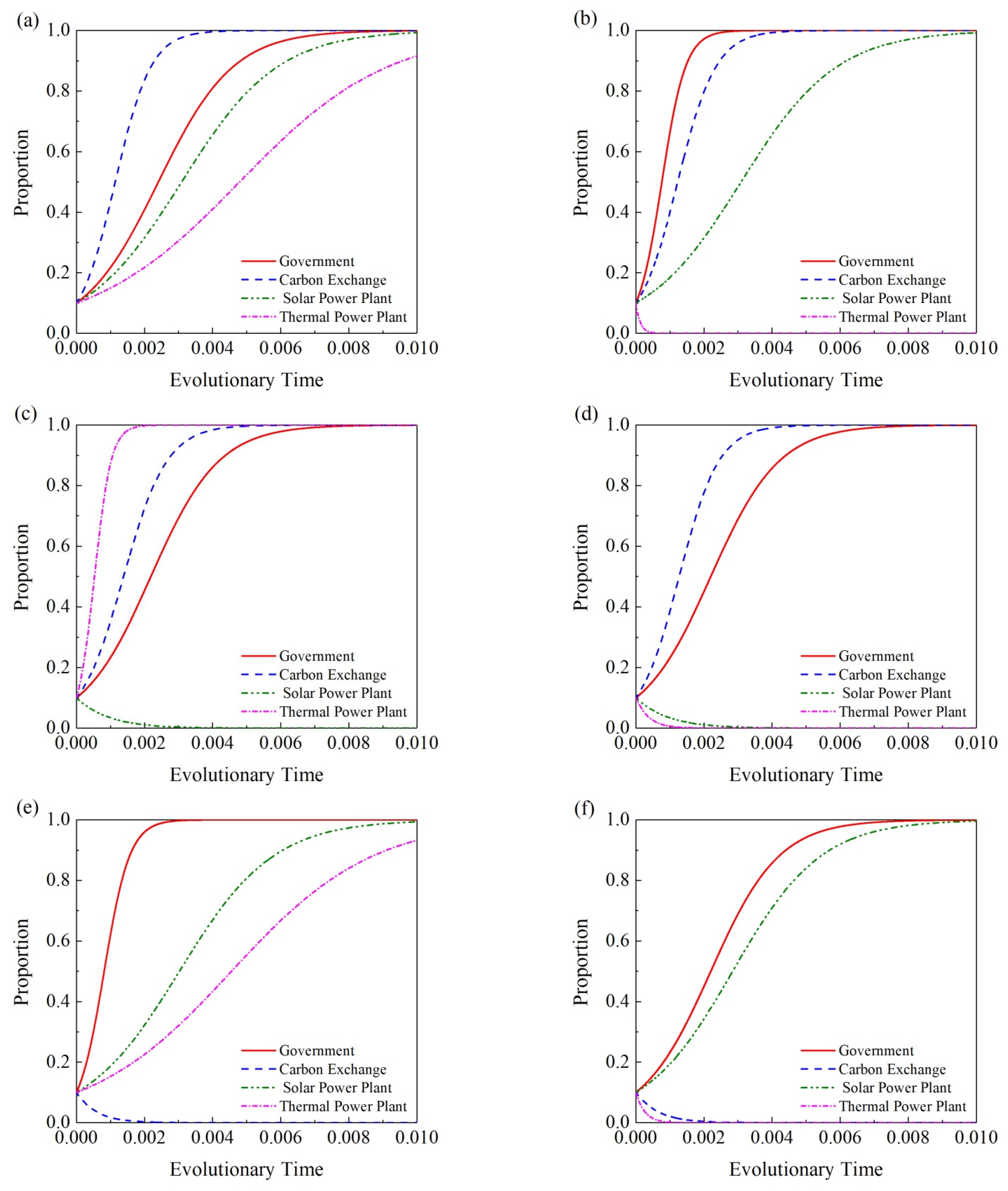

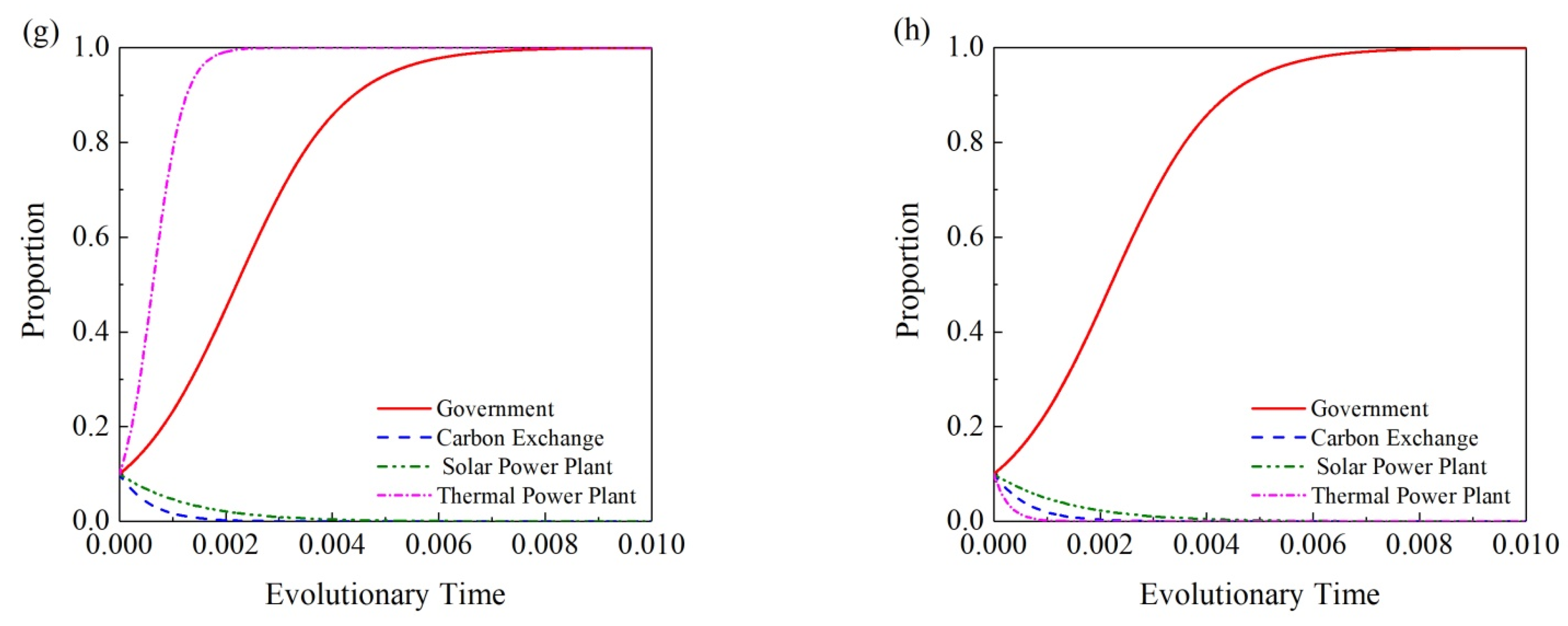

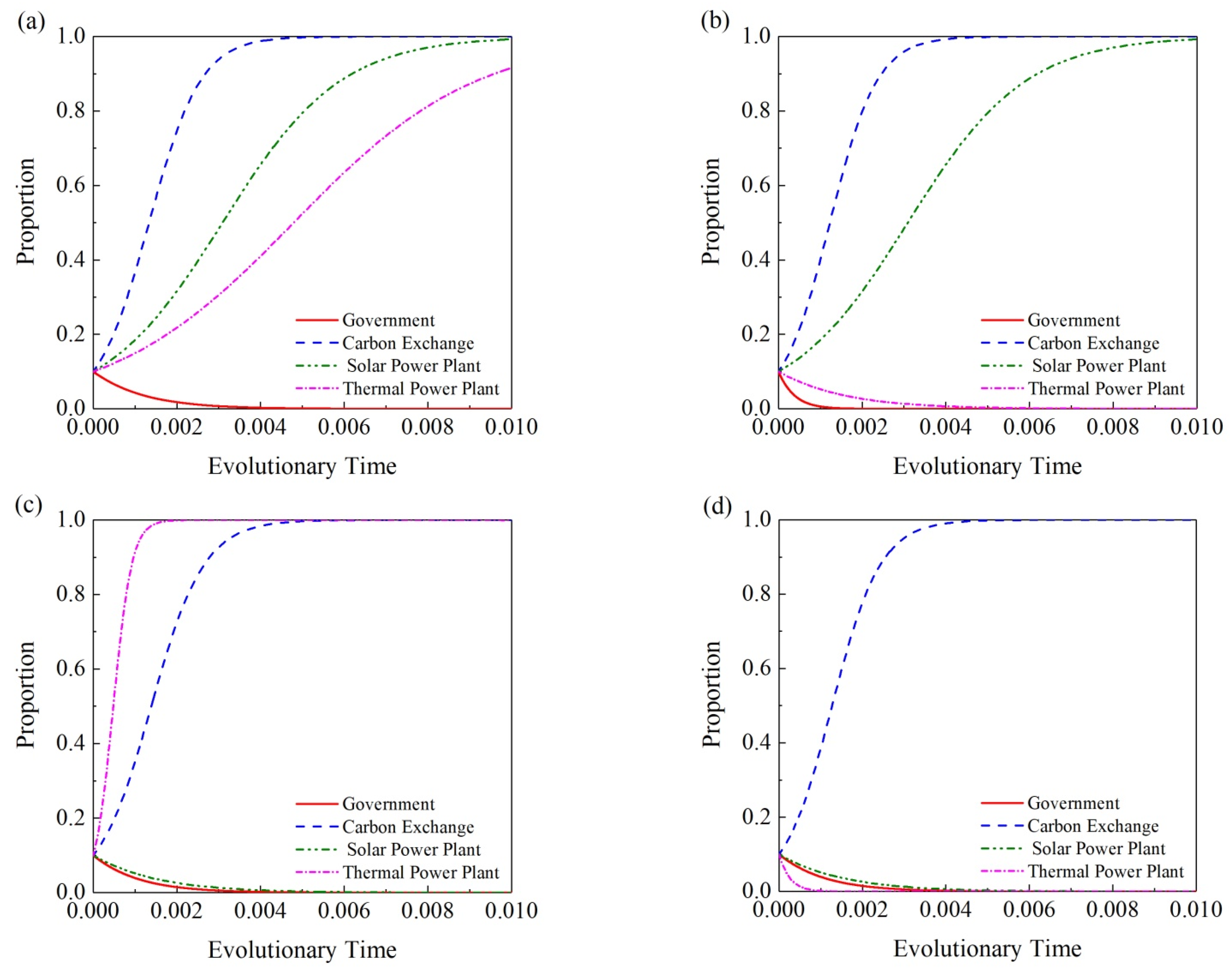

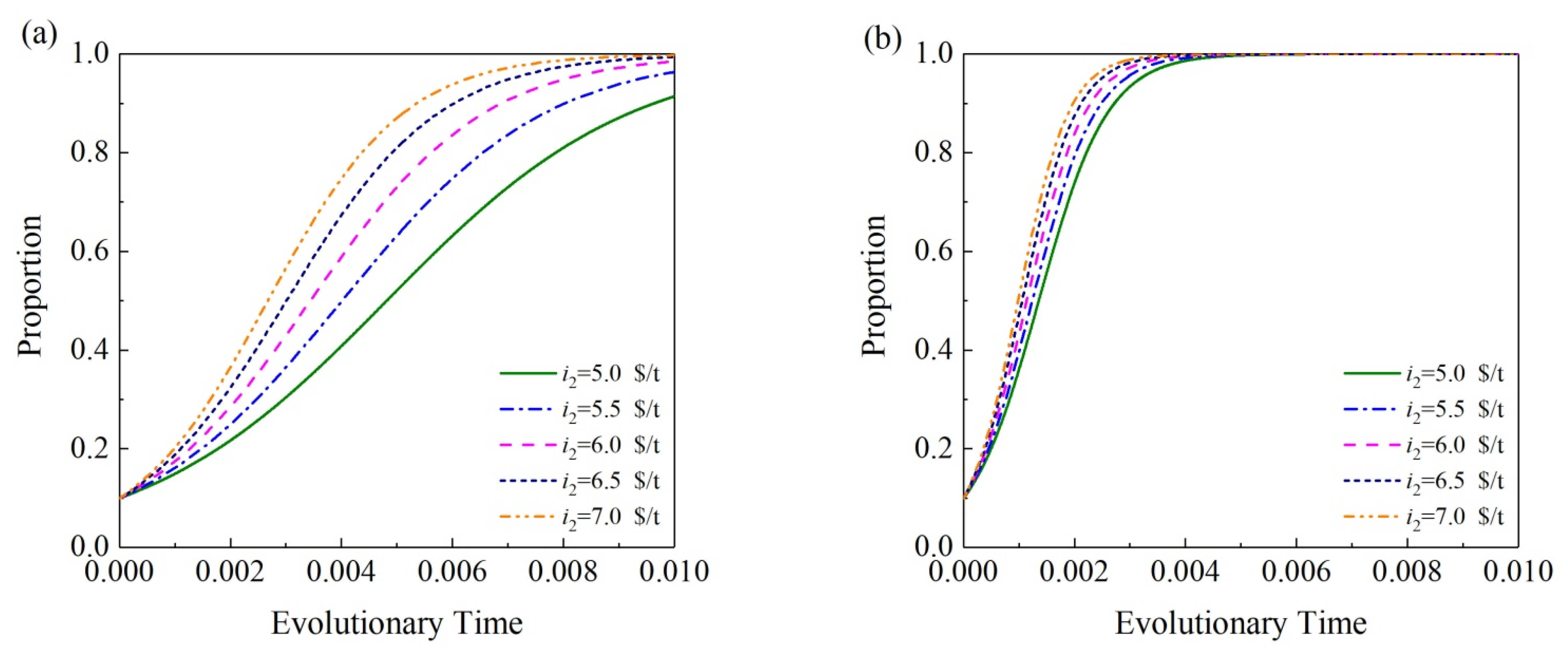

3.2. Evolutionary Stable Strategy Analysis

3.3. Influence Analysis Results of Key Factors

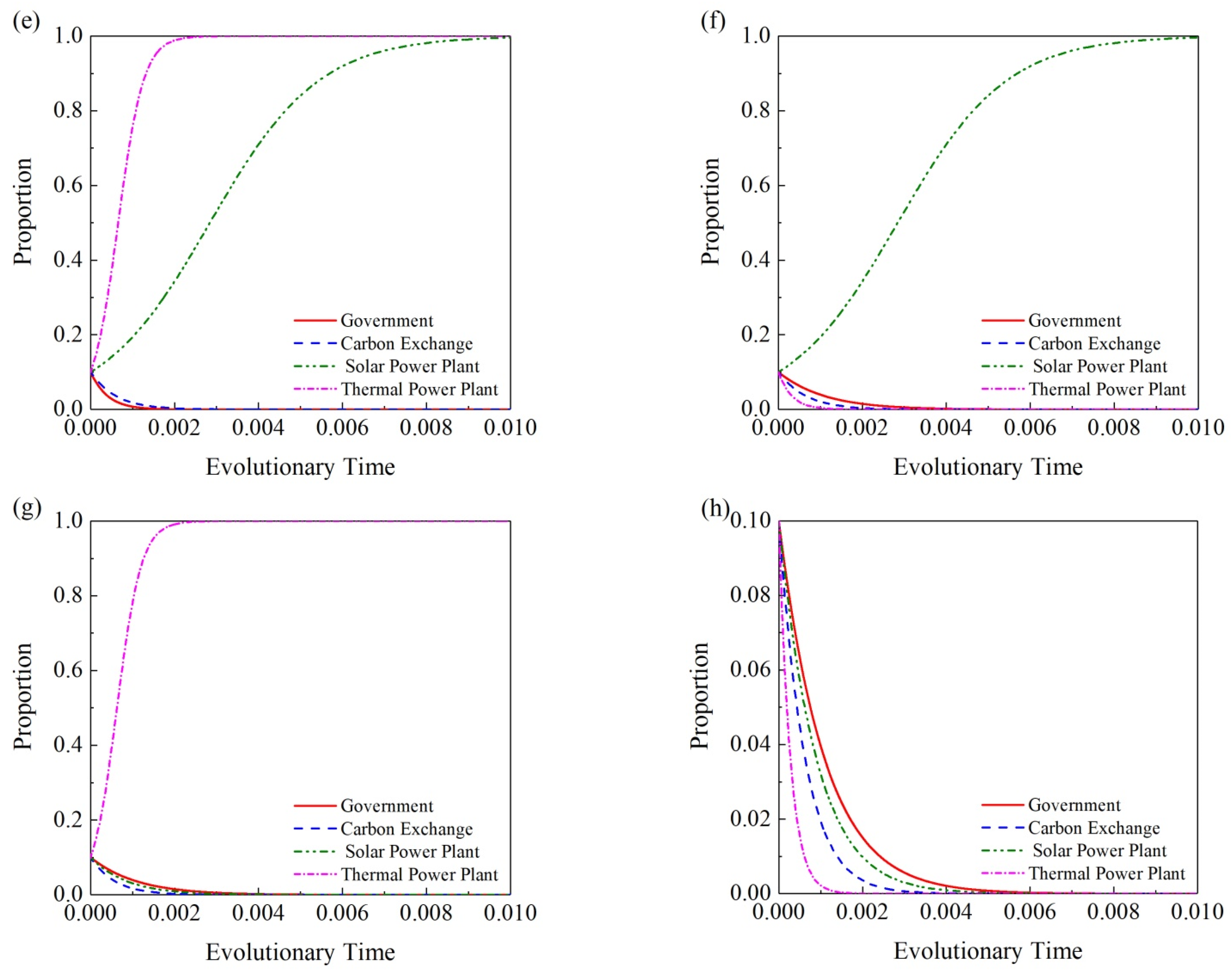

3.3.1. Sale Prices of CEQ of the STPP Sold to the CEE

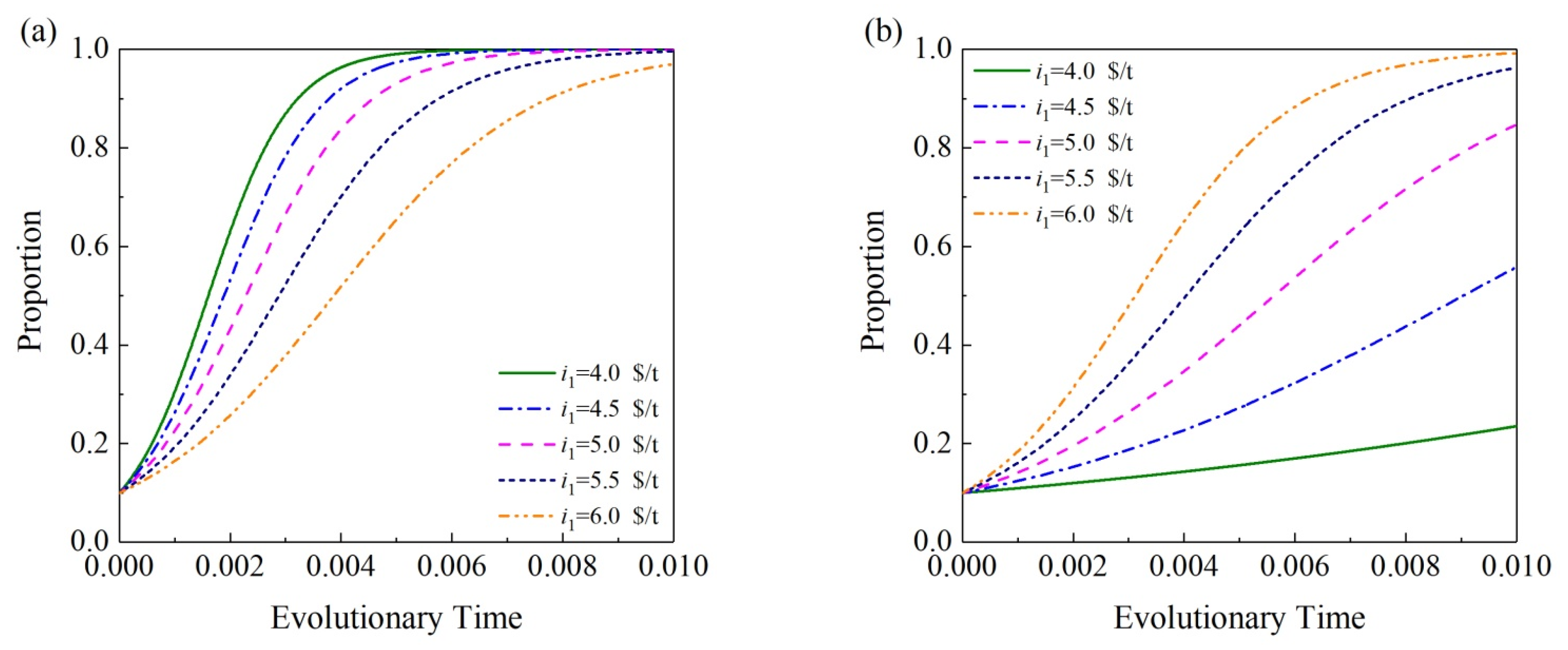

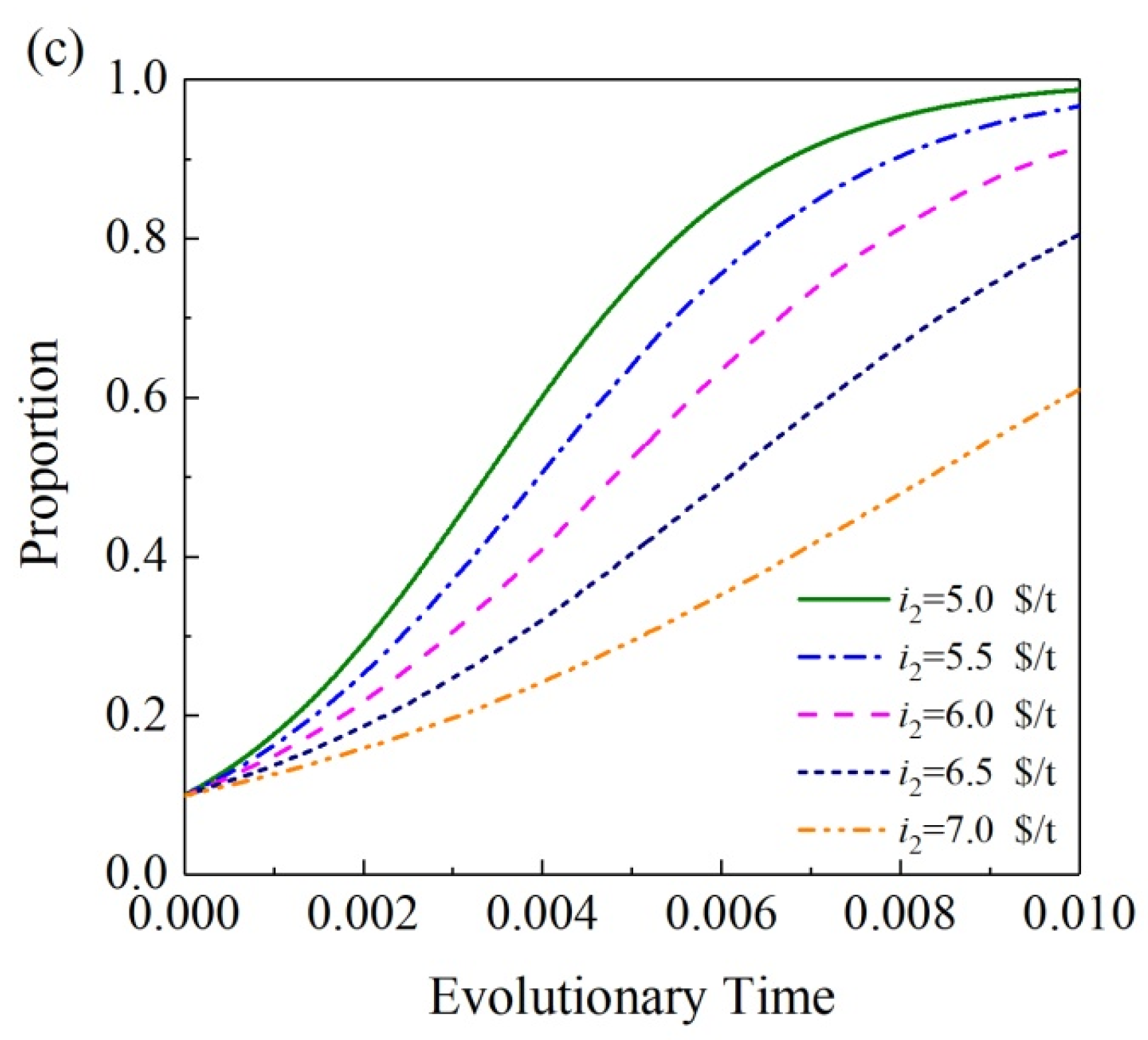

3.3.2. Sale Prices of CEQ of the CEE Sold to the CTPP

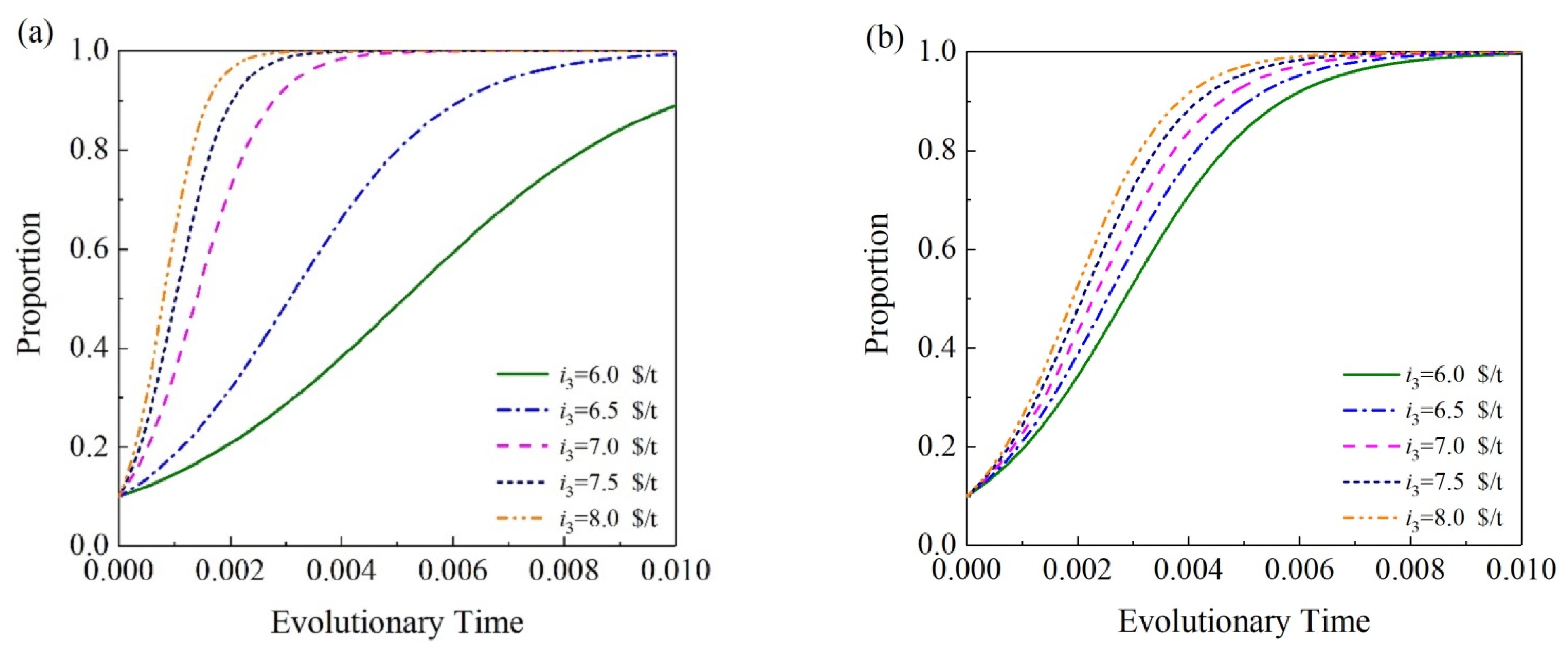

3.3.3. Sale Prices of CEQ of the CEE Sold to Outside Organizations

3.3.4. Sale Prices of CEQ of the STPP Sold to the CTPP

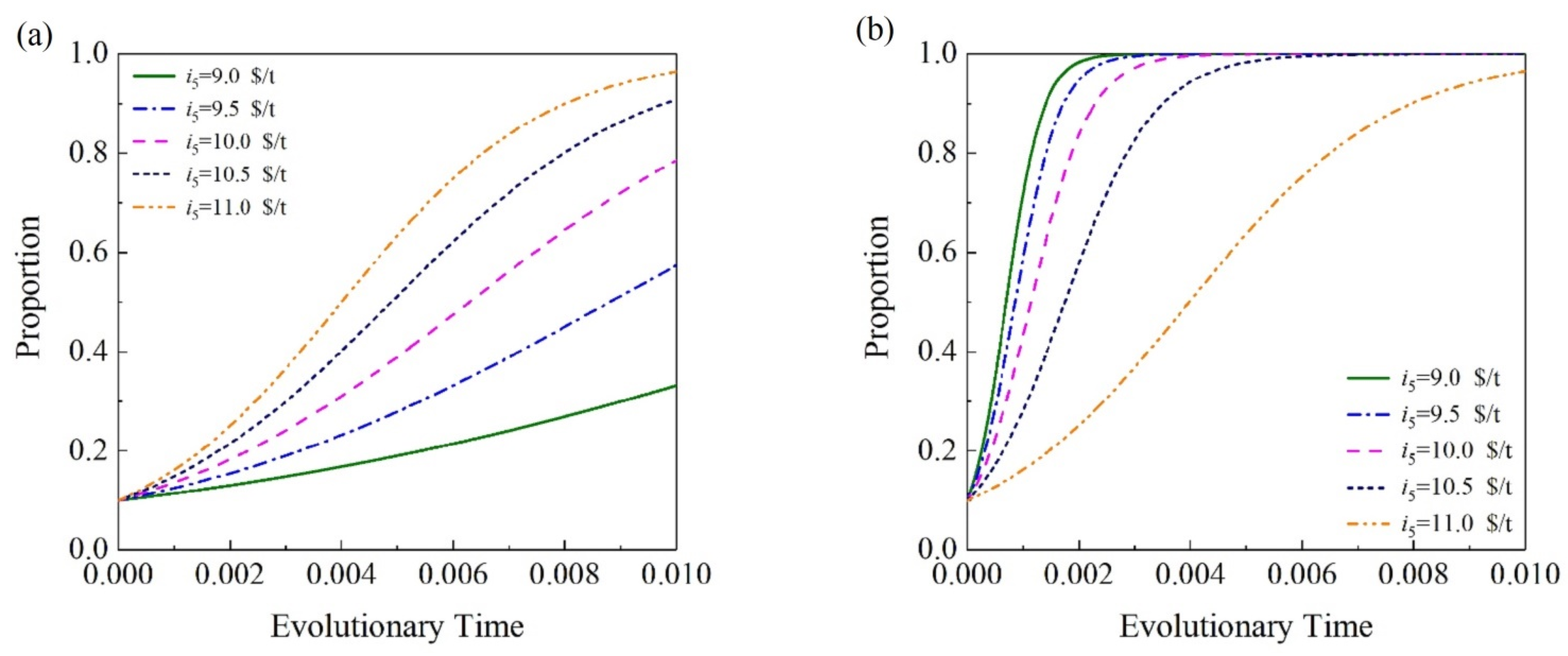

3.3.5. Sale Prices of CEQ Sold to the CTPP by Outside Organizations

3.3.6. Carbon Emission Penalty

3.3.7. Green Electricity Subsidy

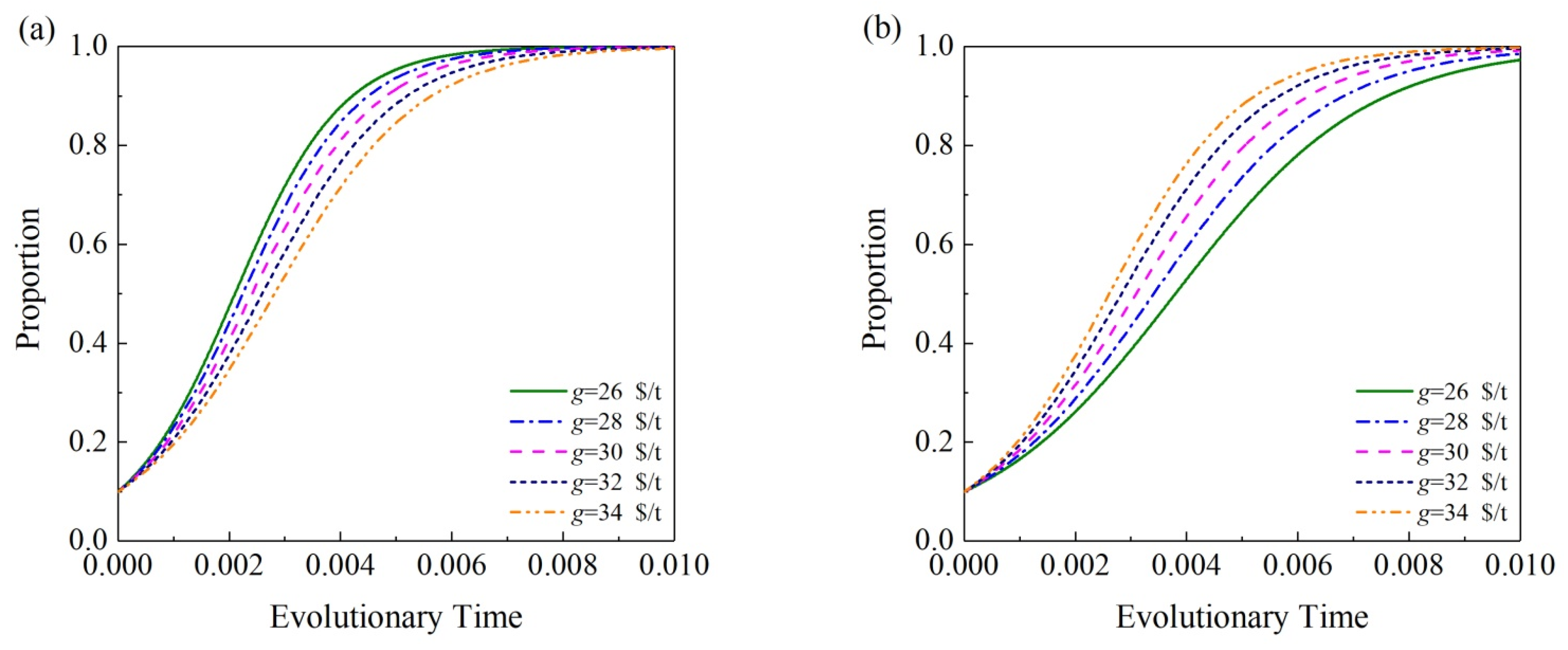

3.3.8. Carbon Trading Tax

4. Brief Summary

- (a)

- Effect evaluations of typical factors on the PPP project considering the influences of dynamic government policies;

- (b)

- Feasibility investigation of the PPP project considering the governmental negative regulation on the developments of solar and coal-fired electricity production;

- (c)

- Study on the PPP project considering both the electric and carbon trading markets.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| C1 | carbon emission quota held by the CEE (t) |

| C2 | annual free carbon emission quota held by the STPP (t) |

| C3 | annual carbon emission quantity of the CTPP (t) |

| g | green electricity subsidy coefficient of the STPP (USD/t) |

| G | annual zero carbon emission rewards of the CTPP (USD) |

| i1 | sale prices of carbon emission quota of the STPP sold to the CEE (USD/t) |

| i2 | sale prices of carbon emission quota of the CEE sold to the CTPP (USD/t) |

| i3 | sale prices of carbon emission quota of the CEE or STPP sold to outside organizations (USD/t) |

| i4 | sale prices of carbon emission quota of the STPP sold to the CTPP (USD/t) |

| i5 | sale prices of carbon emission quota sold to the CTPP by outside organizations (USD/t) |

| k | carbon trading tax coefficient (%) |

| K | carbon trading tax coefficient (%) |

| R | carbon emission penalty coefficient (USD/t) |

| Subscripts | |

| cee | carbon exchange enterprise |

| govt | government |

| stpp | solar thermal power plant |

| ctpp | coal-fired thermal power plant |

| Abbreviations | |

| CEE | carbon exchange enterprise |

| CEQ | carbon emission quota |

| EGT | evolutionary game theory |

| ESS | evolutionary stable strategy |

| GOVT | government |

| IPSO | improved particle swarm optimization |

| PPP | public–private partnership |

| RDF | replicator dynamic formula |

| STPP | solar thermal power plant |

| CTPP | coal-fired thermal power plant |

References

- Liu, Q.; Chen, Y.; Tian, C.; Zheng, X.-Q.; Li, J.-F. Strategic deliberation on development of low-carbon energy system in China. Adv. Clim. Chang. Res. 2016, 7, 26–34. [Google Scholar] [CrossRef]

- BP. Energy Institute Statistical Review of World Energy, 71st ed.; BP Company: London, UK, 2022. [Google Scholar]

- Cachola, C.D.S.; Ciatta, M.; Santos, A.A.D.S.; Peyerl, D. Deploying of the carbon capture technologies for CO2 emission mitigation in the industrial sectors. Carbon Capture Sci. Technol. 2023, 7, 100102. [Google Scholar] [CrossRef]

- Ketabchi, M.R.K.; Babamohammadi, S.; Davies, W.G.; Gorbounov, M.; Soltani, S.M. Latest advances and challenges in carbon capture using bio-based sorbents: A state-of-the-art review. Carbon Capture Sci. Technol. 2023, 6, 100087. [Google Scholar] [CrossRef]

- Chen, J.; Xu, Y.; Liao, P.; Wang, H.; Zhou, H. Recent Progress in Integrated CO2 Capture and Conversion Process Using Dual Function Materials: A State-of-the-Art Review. Carbon Capture Sci. Technol. 2022, 4, 100052. [Google Scholar] [CrossRef]

- Shu, Z.; Sun, H.; Williams, P.T.; Wu, C. Recent advances in integrated CO2 capture and utilization: A review. Sustain. Energy Fuels 2021, 5, 4546–4559. [Google Scholar]

- Kijewska, A.; Bluszcz, A. Research of varying levels of greenhouse gas emissions in European countries using the k-means method. Atmos. Pollut. Res. 2016, 7, 935–944. [Google Scholar] [CrossRef] [Green Version]

- Fell, H.; Johnson, J.X. Regional disparities in emissions reduction and net trade from renewables. Nat. Sustain. 2021, 4, 358–365. [Google Scholar] [CrossRef]

- Xue, P.; Liu, J.; Liu, B.; Zhu, C. Impact of Urbanisation on the Spatial and Temporal Evolution of Carbon Emissions and the Potential for Emission Reduction in a Dual-Carbon Reduction Context. Sustainability 2023, 15, 4715. [Google Scholar] [CrossRef]

- Wang, L. Low Carbon Management of China’s Hotel Tourism through Carbon Emission Trading. Sustainability 2023, 15, 4622. [Google Scholar] [CrossRef]

- Wang, Z.; Zhou, X. Can Innovation-Driven Policy Reduce Chinaʹs Carbon Emission Intensity?—A Quasi-Natural Experiment Based on the National Innovative City Pilot Policy. Sustainability 2023, 15, 4383. [Google Scholar] [CrossRef]

- Zhang, C.; Su, B.; Zhou, K.; Yang, S. Decomposition analysis of China’s CO2 emissions (2000–2016) and scenario analysis of its carbon intensity targets in 2020 and 2030. Sci. Total Environ. 2019, 668, 432–442. [Google Scholar] [CrossRef]

- Zhang, S.; Wang, C.; Yu, C. The evolutionary game analysis and simulation with system dynamics of manufacturer’s emissions abatement behavior under cap-and-trade regulation. Appl. Math. Comput. 2019, 355, 343–355. [Google Scholar] [CrossRef]

- Wang, G.; Chao, Y.; Jiang, T.; Lin, J.; Peng, H.; Chen, H.; Chen, Z. Analyzing the effects of government policy and solar photovoltaic hydrogen production on promoting CO2 capture and utilization by using evolutionary game analysis. Energy Strategy Rev. 2023, 45, 101044. [Google Scholar] [CrossRef]

- Wang, G.; Chao, Y.; Cao, Y.; Jiang, T.; Han, W.; Chen, Z. A comprehensive review of research works based on evolutionary game theory for sustainable energy development. Energy Rep. 2022, 8, 114–136. [Google Scholar] [CrossRef]

- Kang, K.; Zhao, Y.; Zhang, J.; Qiang, C. Evolutionary game theoretic analysis on low-carbon strategy for supply chain enterprises. J. Clean. Prod. 2019, 230, 981–994. [Google Scholar] [CrossRef]

- Xu, J.; Zhu, M.; Zhao, S.; Xie, Y. Leader-follower game-theoretic method towards carbon-economy trade-off in a key construction project group. J. Environ. Manag. 2019, 233, 499–512. [Google Scholar] [CrossRef]

- Antoci, A.; Borghesi, S.; Iannucci, G.; Russu, P. Emission permits, innovation and sanction in an evolutionary game. Econ. Politica 2020, 37, 525–546. [Google Scholar] [CrossRef]

- Zhao, T.; Liu, Z. A novel analysis of carbon capture and storage (CCS) technology adoption: An evolutionary game model between stakeholders. Energy 2019, 189, 116352. [Google Scholar] [CrossRef]

- Shi, Y.; Han, B.; Zeng, Y. Simulating policy interventions in the interfirm diffusion of low-carbon technologies: An agent-based evolutionary game model. J. Clean. Prod. 2020, 250, 119449. [Google Scholar] [CrossRef]

- Rocha, A.; Salomão, G. Environmental Policy Regulation and Corporate Compliance in Evolutionary Game Models with Well-mixed and Structured Populations. Eur. J. Oper. Res. 2019, 279, 486–501. [Google Scholar] [CrossRef]

- Ghazi, S.; Dugdale, J.; Khadir, T. A Multi-Agent based Approach for Simulating the Impact of Human Behaviours on Air Pollution. Informatica 2015, 39, 501–505. [Google Scholar]

- Zhao, R.; Zhou, X.; Han, J.; Liu, C. For the sustainable performance of the carbon reduction labeling policies under an evolutionary game simulation. Technol. Forecast. Soc. Chang. 2016, 112, 262–274. [Google Scholar] [CrossRef]

- Fan, R.; Dong, L. The dynamic analysis and simulation of government subsidy strategies in low-carbon diffusion considering the behavior of heterogeneous agents. Energy Policy 2018, 117, 252–262. [Google Scholar] [CrossRef]

- Halat, K.; Hafezalkotob, A. Modeling carbon regulation policies in inventory decisions of a multistage green supply chain: A game theory approach. Comput. Ind. Eng. 2019, 128, 807–830. [Google Scholar] [CrossRef]

- Zhao, R.; Gareth, N.; Han, J.; Neighbour, G.; McGuire, M.; Deutz, P. Using game theory to describe strategy selection for environmental risk and carbon emissions reduction in the green supply chain. J. Loss Prev. Process Ind. 2012, 25, 927–936. [Google Scholar] [CrossRef]

- Cui, H.; Zhao, T.; Wu, R. CO2 emissions from China’s power industry: Policy implications from both macro and micro perspectives. J. Clean. Prod. 2018, 200, 746–755. [Google Scholar] [CrossRef]

- Barone, G.; Buonomano, A.; Forzano, C.; Palombo, A.; Panagopoulos, O. Solar thermal collectors. Energy Convers. Manag. 2019, 195, 1079–1097. [Google Scholar] [CrossRef]

- Wang, G.; Chao, Y.; Jiang, T.; Chen, Z. Facilitating developments of solar thermal power and nuclear power generations for carbon neutral: A study based on evolutionary game theoretic method. Sci. Total Environ. 2022, 814, 151927. [Google Scholar] [CrossRef]

- Wang, G.; Wang, S.; Cao, Y.; Chen, Z. Design and performance evaluation of a novel hybrid solar-gas power and ORC-based hydrogen-production system. Energy 2022, 251, 123945. [Google Scholar] [CrossRef]

- Wang, G.; Wang, B.; Yuan, X.; Lin, J.; Chen, Z. Novel design and analysis of a solar PVT system using LFR concentrator and nano-fluids optical filter. Case Stud. Therm. Eng. 2021, 27, 101328. [Google Scholar] [CrossRef]

- Fang, J.; Liu, Q.; Guo, S.; Lei, J.; Jin, H. Spanning solar spectrum: A combined photochemical and thermochemical process for solar energy storage. Appl. Energy 2019, 247, 116–126. [Google Scholar] [CrossRef]

- Wang, G.; Wang, T.; Han, W. Cyclic and standby behavior evaluations of liquid lead-bismuth eutectic thermal energy storage tank for concentrated solar power. Case Stud. Therm. Eng. 2022, 29, 101729. [Google Scholar] [CrossRef]

- Muhammad, M.D. Review of PCMS and heat transfer enhancement methods applied in parabolic trough solar plants thermal storage systems. Niger. J. Technol. 2018, 37, 96–107. [Google Scholar] [CrossRef]

- Zhang, H.L.; Baeyens, J.; Degrève, J.; Cacères, G. Concentrated solar power plants: Review and design methodology. Renew. Sustain. Energy Rev. 2013, 22, 466–481. [Google Scholar] [CrossRef]

- Pramanik, S.; Ravikrishna, R.V. A review of concentrated solar power hybrid technologies. Appl. Therm. Eng. 2017, 127, 602–637. [Google Scholar] [CrossRef]

- Singh, G.K. Solar power generation by PV (photovoltaic) technology: A review. Energy 2013, 53, 1–13. [Google Scholar] [CrossRef]

- Wang, G.; Shen, F.; Wang, F.; Chen, Z. Design and experimental study of a solar CPV system using CLFR concentrator. Sustain. Energy Technol. Assess. 2020, 40, 100751. [Google Scholar] [CrossRef]

- Wang, G.; Zhang, Z.; Chen, Z. Design and performance evaluation of a novel CPV-T system using nano-fluid spectrum filter and with high solar concentrating uniformity. Energy 2023, 267, 126616. [Google Scholar] [CrossRef]

- Liu, Y.; Hu, P.; Zhang, Q.; Chen, Z. Thermodynamic and optical analysis for a CPV/T hybrid system with beam splitter and fully tracked linear Fresnel reflector concentrator utilizing sloped panels. Sol. Energy 2014, 103, 191–199. [Google Scholar] [CrossRef]

- Wang, G.; Wang, F.; Shen, F.; Chen, Z.; Hu, P. Novel design and thermodynamic analysis of a solar concentration PV and thermal combined system based on compact linear Fresnel reflector. Energy 2019, 180, 133–148. [Google Scholar] [CrossRef]

- Wang, G.; Dong, B.; Chen, Z. Design and behaviour estimate of a novel concentrated solar-driven power and desalination system using S-CO2 Brayton cycle and MSF technology. Renew. Energy 2021, 176, 555–564. [Google Scholar] [CrossRef]

- Khawaji, A.; Kutubkhanah, I.; Wie, J. Advances in seawater desalination technologies. Desalination 2008, 221, 47–69. [Google Scholar] [CrossRef]

- Charcosset, C. A review of membrane processes and renewable energies for desalination. Desalination 2009, 245, 214–231. [Google Scholar] [CrossRef]

- Mohammadi, K.; Saghafifar, M.; Ellingwood, K.; Powell, K. Hybrid concentrated solar power (CSP)-desalination systems: A review. Desalination 2019, 468, 114083. [Google Scholar] [CrossRef]

- Wang, G.; Wang, C.; Chen, Z.; Hu, P. Design and performance evaluation of an innovative solar-nuclear complementarity power system using the S-CO2 Brayton cycle. Energy 2020, 197, 117282. [Google Scholar] [CrossRef]

- Garcia, H.E.; Chen, J.; Kim, J.S.; Vilim, R.B.; Binder, W.R.; Sitton, S.M.B.; Boardman, R.D.; McKellar, M.G.; Christiaan, J.J.; Paredis, C.J. Dynamic performance analysis of two regional Nuclear Hybrid Energy Systems. Energy 2016, 107, 234–258. [Google Scholar] [CrossRef] [Green Version]

- Wang, G.; Yin, J.; Lin, J.; Chen, Z.; Hu, P. Design and economic analysis of a novel hybrid nuclear-solar complementary power system for power generation and desalination. Appl. Therm. Eng. 2021, 187, 116564. [Google Scholar] [CrossRef]

- Wang, G.; Cao, Y.; Wang, S.; Chen, Z.; Hu, P. Design and preliminary performance analysis of a novel solar-gas combined cycle system. Appl. Therm. Eng. 2020, 172, 115184. [Google Scholar] [CrossRef]

- Kodama, T.; Gokon, N. Thermochemical cycles for high-temperature solar hydrogen production. Chem. Rev. 2010, 72, 119–128. [Google Scholar]

- Li, Z.; Luo, W.; Zhang, M.; Feng, J.; Zhou, Z. Photoelectrochemical cells for solar hydrogen production: Current state of promising photoelectrodes, methods to improve their properties, and outlook. Energy Environ. Sci. 2013, 6, 347–370. [Google Scholar] [CrossRef]

- Wang, G.; Chao, Y.; Chen, Z. Promoting developments of hydrogen powered vehicle and solar PV hydrogen production in China: A study based on evolutionary game theory method. Energy 2021, 237, 121649. [Google Scholar] [CrossRef]

- Batidzirai, B.; Trotter, P.A.; Brophy, A.; Stritzke, S.; Moyo, A.; Twesigye, P.; Puranasamriddhi, A.; Madhlopa, A. Towards people-private-public partnerships: An integrated community engagement model for capturing energy access needs. Energy Res. Soc. Sci. 2021, 74, 101975. [Google Scholar] [CrossRef]

- Shrimali, G.; Sen, V. Scaling reliable electricity access in India: A public-private partnership model. Energy Sustain. Dev. 2020, 55, 69–81. [Google Scholar] [CrossRef]

- Smith, J. Evolution and the Theory of Games; Cambridge University Press: Cambridge, UK, 1982. [Google Scholar]

- Allen, B.; Lippner, G.; Chen, Y.; Fotouhi, B.; Momeni, N.; Yau, S.-T.; Nowak, M.A. Evolutionary dynamics on any population structure. Nature 2017, 544, 227–230. [Google Scholar] [CrossRef] [Green Version]

- Seven Carbon Markets in China. Available online: http://www.tanpaifang.com/tanhangqing/ (accessed on 1 February 2023).

- Chen, W.; Hu, Z. Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. J. Clean. Prod. 2018, 201, 123–141. [Google Scholar] [CrossRef]

- Administrative Committee of Beijing Economic and Technological Development Zone. Several Measures to Implement the New Development Concept and Accelerate the High-Quality Development of Yizhuang New Town, Ver. 3.0; Administrative Committee of Beijing Economic and Technological Development Zone: Beijing, China, 2021.

- China Association for Comprehensive Utilization of Resources. Research Report on Clean Production of China’s Photovoltaic Industry; China Association for Comprehensive Utilization of Resources: Beijing, China, 2020. [Google Scholar]

- Ministry of Ecology and Environment of the People’s Republic of China. Implementation Plan for Total Quota Setting and Allocation of National Carbon Emission Trading in 2019–2020 (Power Generation Industry); Ministry of Ecology and Environment of the People’s Republic of China: Beijing, China, 2020.

- State Administration of Taxation. Notice of the Ministry of Finance and the State Administration of Taxation on Vat Policies such as Input Tax Deduction of Leased Fixed Assets; State Administration of Taxation: Beijing, China, 2017.

| Case | Mode | GOVT Teamwork | CEE Teamwork | STPP Teamwork | CTPP Teamwork |

|---|---|---|---|---|---|

| 1 | (1, 1, 1, 1) | Yes | Yes | Yes | Yes |

| 2 | (1, 1, 1, 0) | Yes | Yes | Yes | No |

| 3 | (1, 1, 0, 1) | Yes | Yes | No | Yes |

| 4 | (1, 1, 0, 0) | Yes | Yes | No | No |

| 5 | (1, 0, 1, 1) | Yes | No | Yes | Yes |

| 6 | (1, 0, 1, 0) | Yes | No | Yes | No |

| 7 | (1, 0, 0, 1) | Yes | No | No | Yes |

| 8 | (1, 0, 0, 0) | Yes | No | No | No |

| 9 | (0, 1, 1, 1) | No | Yes | Yes | Yes |

| 10 | (0, 1, 1, 0) | No | Yes | Yes | No |

| 11 | (0, 1, 0, 1) | No | Yes | No | Yes |

| 12 | (0, 1, 0, 0) | No | Yes | No | No |

| 13 | (0, 0, 1, 1) | No | No | Yes | Yes |

| 14 | (0, 0, 1, 0) | No | No | Yes | No |

| 15 | (0, 0, 0, 1) | No | No | No | Yes |

| 16 | (0, 0, 0, 0) | No | No | No | No |

| Participants | Parameters | Values |

|---|---|---|

| GOVT | k1 | 6.0% |

| k2 | 6.0% | |

| k3 | 6.0% | |

| k4 | 6.0% | |

| S1 | USD 50,000.0 | |

| S2 | USD 25,000.0 | |

| CEE | i1 | 5.0 USD/t |

| i2 | 6.0 USD/t | |

| i3 | 7.0 USD/t | |

| C2 | 150.0 t | |

| STPP | i4 | 5.5 USD/t |

| g | 30.0 USD/t | |

| C1 | 33.0 t | |

| CTPP | i5 | 10.0 USD/t |

| G | USD 80,000.0 | |

| C3 | 180.0 t | |

| R | 10.0 USD/t |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chao, Y.; Wang, G. Analyzing the Effects of Governmental Policy and Solar Power on Facilitating Carbon Neutralization in the Context of Energy Transition: A Four-Party Evolutionary Game Study. Sustainability 2023, 15, 5388. https://doi.org/10.3390/su15065388

Chao Y, Wang G. Analyzing the Effects of Governmental Policy and Solar Power on Facilitating Carbon Neutralization in the Context of Energy Transition: A Four-Party Evolutionary Game Study. Sustainability. 2023; 15(6):5388. https://doi.org/10.3390/su15065388

Chicago/Turabian StyleChao, Yuechao, and Gang Wang. 2023. "Analyzing the Effects of Governmental Policy and Solar Power on Facilitating Carbon Neutralization in the Context of Energy Transition: A Four-Party Evolutionary Game Study" Sustainability 15, no. 6: 5388. https://doi.org/10.3390/su15065388