Asset Structure, Asset Utilization Efficiency, and Carbon Emission Performance: Evidence from Panel Data of China’s Low-Carbon Industry

Abstract

:1. Introduction

2. Review of Literature

2.1. Carbon Emissions and Influencing Factors

2.2. Asset Structure, Enterprise Performance, and Carbon Emissions

2.3. Corporate Financial Performance, Asset Utilization Efficiency, and Carbon Emissions

2.4. Research Hypothesis

3. Research Methods

3.1. Samples

3.2. Variables

3.2.1. Explained Variable

3.2.2. Explanatory Variables

3.2.3. Control Variables

3.3. Model Construction

4. Empirical Results

4.1. Descriptive Results

4.2. Regression Analysis

4.3. Robustness Check

4.4. Endogeneity Test

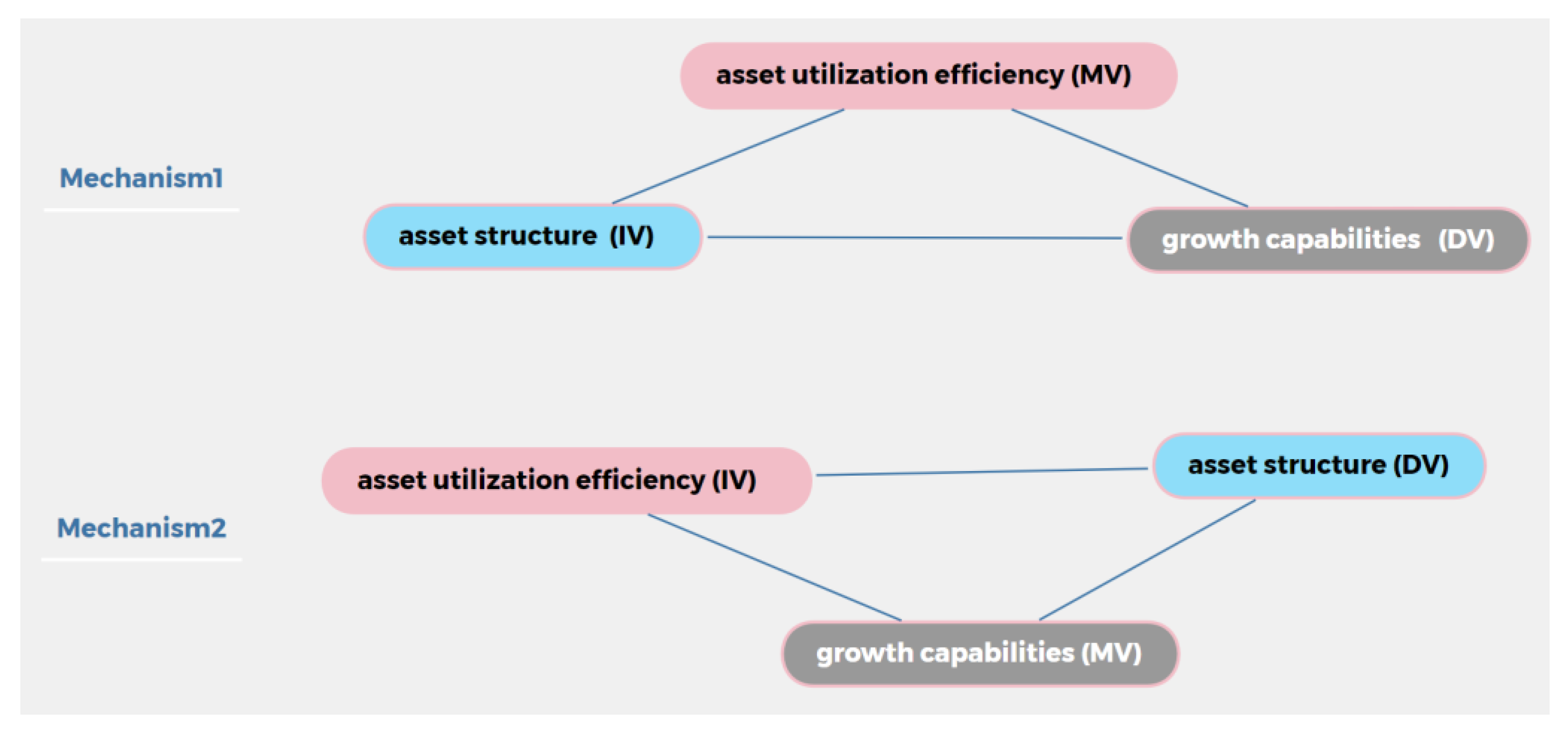

4.5. Further Investigation

5. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Li, W.; Wang, W.; Wang, Y.; Ali, M. Historical Growth in Total Factor Carbon Productivity of the Chinese Industry—A Comprehensive Analysis. J. Clean. Prod. 2018, 170, 471–485. [Google Scholar] [CrossRef]

- Zhu, C.; Wang, M.; Du, W. Prediction on Peak Values of Carbon Dioxide Emissions from the Chinese Transportation Industry Based on the SVR Model and Scenario Analysis. J. Adv. Transp. 2020, 2020, 8848149. [Google Scholar] [CrossRef]

- Jiang, T.; Yang, J.; Huang, S. Evolution and Driving Factors of CO2 Emissions Structure in China’s Heating and Power Industries: The Supply-Side and Demand-Side Dual Perspectives. J. Clean. Prod. 2020, 264, 121507. [Google Scholar] [CrossRef]

- Emrouznejad, A.; Yang, G. A Framework for Measuring Global Malmquist–Luenberger Productivity Index with CO2 Emissions on Chinese Manufacturing Industries. Energy 2016, 115, 840–856. [Google Scholar] [CrossRef] [Green Version]

- Wang, X.; Zhang, L.; Qin, Y.; Zhang, J. Analysis of China’s Manufacturing Industry Carbon Lock-in and Its Influencing Factors. Sustainability 2020, 12, 1502. [Google Scholar] [CrossRef] [Green Version]

- Liu, J.; Wei, D.; Wu, L.; Yang, H.; Song, X. Synergy and Heterogeneity of Driving Factors of Carbon Emissions in China’s Energy-Intensive Industries. Ecol. Indic. 2022, 142, 109161. [Google Scholar] [CrossRef]

- Dong, H.; Liu, W.; Liu, Y.; Xiong, Z. Fixed Asset Changes with Carbon Regulation: The Cases of China. J. Environ. Manag. 2022, 306, 114494. [Google Scholar] [CrossRef]

- Wang, W.; Zhang, Y.-J. Does China’s Carbon Emissions Trading Scheme Affect the Market Power of High-Carbon Enterprises? Energy Econ. 2022, 108, 105906. [Google Scholar] [CrossRef]

- Jiakui, C.; Abbas, J.; Najam, H.; Liu, J.; Abbas, J. Green Technological Innovation, Green Finance, and Financial Development and Their Role in Green Total Factor Productivity: Empirical Insights from China. J. Clean. Prod. 2022, 382, 135131. [Google Scholar] [CrossRef]

- Yu, J.; Yu, Y.; Jiang, T. Structural Factors Influencing Energy Carbon Emissions in China’s Service Industry: An Input–Output Perspective. Environ. Sci. Pollut. Res. 2022, 29, 49361–49372. [Google Scholar] [CrossRef]

- Jing, M.; Zheng, W. Economic Development Advantages of Low-Carbon Economy under Waterway Transportation. IOP Conf. Ser. Mater. Sci. Eng. 2020, 780, 062029. [Google Scholar] [CrossRef]

- He, Z.; Liu, Z.; Wu, H.; Gu, X.; Zhao, Y.; Yue, X. Research on the Impact of Green Finance and Fintech in Smart City. Complexity 2020, 2020, 6673386. [Google Scholar] [CrossRef]

- Chen, H.; Long, R.; Niu, W.; Feng, Q.; Yang, R. How Does Individual Low-Carbon Consumption Behavior Occur?—An Analysis Based on Attitude Process. Appl. Eng. 2014, 116, 376–386. [Google Scholar] [CrossRef]

- Song, Y.; Li, Y.; Liu, T. Carbon Asset Remolding and Potential Benefit Measurement of Machinery Products in the Light of Lean Production and Low-Carbon Investment. Technol. Forecast. Soc. Chang. 2022, 186, 122166. [Google Scholar] [CrossRef]

- Ashraf, N.; Comyns, B.; Tariq, S.; Chaudhry, H.R. Carbon performance of firms in developing countries: The role of financial slack, carbon prices and dense network. J. Clean. Prod. 2020, 253, 119846. [Google Scholar] [CrossRef]

- Miah, M.D.; Hasan, R.; Usman, M. Carbon Emissions and Firm Performance: Evidence from Financial and Non-Financial Firms from Selected Emerging Economies. Sustainability 2021, 13, 13281. [Google Scholar] [CrossRef]

- Mubeen, R.; Han, D.; Abbas, J.; Hussain, I. The Effects of Market Competition, Capital Structure, and CEO Duality on Firm Performance: A Mediation Analysis by Incorporating the GMM Model Technique. Sustainability 2020, 12, 3480. [Google Scholar] [CrossRef] [Green Version]

- Parvin, S.S.; Hossain, B.; Mohiuddin, M.; Cao, Q. Capital Structure, Financial Performance, and Sustainability of Micro-Finance Institutions (MFIs) in Bangladesh. Sustainability 2020, 12, 6222. [Google Scholar] [CrossRef]

- Ju, S.; Tang, H. Competition and operating efficiency of manufacturing companies in E-commerce environment: Empirical evidence from Chinese garment companies. Appl. Econ. 2022, 55, 2113–2128. [Google Scholar] [CrossRef]

- Santos, E.; Lisboa, I.; Eugénio, T. The Financial Performance of Family versus Non-Family Firms Operating in Nautical Tourism. Sustainability 2022, 14, 1693. [Google Scholar] [CrossRef]

- Xu, T.; Kang, C.; Zhang, H. China’s Efforts towards Carbon Neutrality: Does Energy-Saving and Emission-Reduction Policy Mitigate Carbon Emissions? J. Environ. Manag. 2022, 316, 115286. [Google Scholar] [CrossRef] [PubMed]

- Wang, H.; Gu, K.; Sun, H.; Xiao, H. Reconfirmation of the Symbiosis on Carbon Emissions and Air Pollution: A Spatial Spillover Perspective. Sci. Total Environ. 2023, 858, 159906. [Google Scholar] [CrossRef]

- Yang, Z.; Gao, W.; Han, Q.; Qi, L.; Cui, Y.; Chen, Y. Digitalization and Carbon Emissions: How Does Digital City Construction Affect China’s Carbon Emission Reduction? Sustain. Cites Soc. 2022, 87, 104201. [Google Scholar] [CrossRef]

- Avenyo, E.K.; Tregenna, F. Greening Manufacturing: Technology Intensity and Carbon Dioxide Emissions in Developing Countries. Appl. Energy 2022, 324, 119726. [Google Scholar] [CrossRef]

- Mirziyoyeva, Z.; Salahodjaev, R. Renewable Energy and CO2 Emissions Intensity in the Top Carbon Intense Countries. Renew. Energy 2022, 192, 507–512. [Google Scholar] [CrossRef]

- Pan, X.; Uddin, M.K.; Ai, B.; Pan, X.; Saima, U. Influential Factors of Carbon Emissions Intensity in OECD Countries: Evidence from Symbolic Regression. J. Clean. Prod. 2019, 220, 1194–1201. [Google Scholar] [CrossRef]

- Kuo, R.J.; Hsu, C.W.; Chen, Y.L. Integration of Fuzzy ANP and Fuzzy TOPSIS for Evaluating Carbon Performance of Suppliers. Int. J. Environ. Sci. Technol. 2015, 12, 3863–3876. [Google Scholar] [CrossRef] [Green Version]

- Li, L.; Fan, F.; Ma, L.; Tang, Z. Energy Utilization Evaluation of Carbon Performance in Public Projects by FAHP and Cloud Model. Sustainability 2016, 8, 630. [Google Scholar] [CrossRef] [Green Version]

- Busch, T.; Lewandowski, S. Corporate Carbon and Financial Performance: A Meta-Analysis. J. Ind. Ecol. 2017, 22, 745–759. [Google Scholar] [CrossRef]

- Yan, D.; Lei, Y.; Li, L. Driving Factor Analysis of Carbon Emissions in China’s Power Sector for Low-Carbon Economy. Math. Probl. Eng. 2017, 2017, 4954217. [Google Scholar] [CrossRef] [Green Version]

- Parthan, B.; Osterkorn, M.; Kennedy, M.; Hoskyns, S.J.; Bazilian, M.; Monga, P. Lessons for Low-Carbon Energy Transition: Experience from the Renewable Energy and Energy Efficiency Partnership (REEEP). Energy Sustain. Dev. 2010, 14, 83–93. [Google Scholar] [CrossRef]

- Alam, M.S.; Safiullah, M.; Islam, M.S. Cash-Rich Firms and Carbon Emissions. Int. Rev. Financ. Anal. 2022, 81, 102106. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Does It Really Pay to Be Green? Determinants and Consequences of Proactive Environmental Strategies. J. Account. Public Policy 2011, 30, 122–144. [Google Scholar] [CrossRef]

- Zhu, B.; Xu, C.; Wang, P.; Zhang, L. How Does Internal Carbon Pricing Affect Corporate Environmental Performance? J. Bus. Res. 2022, 145, 65–77. [Google Scholar] [CrossRef]

- Ukhriyawati, C.; Ratnawati, T.; Riyadi, S. The Influence of Asset Structure, Capital Structure, Risk Management and Good Corporate Governance on Financial Performance and Value of the Firm through Earnings and Free Cash Flow as an Intervening Variable in Banking Companies Listed in Indonesia Stock Exchange. Int. J. Proj. Manag. 2017, 12, 249. [Google Scholar] [CrossRef] [Green Version]

- Batrancea, I.; Morar, I.-D.; Masca, E.; Catalin, S.; Bechis, L. Econometric Modeling of SME Performance. Case of Romania. Sustainability 2018, 10, 192. [Google Scholar] [CrossRef] [Green Version]

- Meng, Q.; Zhou, Y. Enterprise Economic Performance Evaluation Based on 5 G Network and Embedded Processing System. Microprocess. Microsyst. 2021, 80, 103603. [Google Scholar] [CrossRef]

- Susan, M. The Impact of Corporate Governance, Capital Structure, Company Size, and Assets Structure on Financial Performance: A Study on the Corporate Governance Perception Index Participants. Int. J. Trade Glob. Mark. 2022, 15, 42. [Google Scholar] [CrossRef]

- Muñoz, F. Carbon-Intensive Industries in Socially Responsible Mutual Funds’ Portfolios. Int. Rev. Financ. Anal. 2021, 75, 101740. [Google Scholar] [CrossRef]

- Coase, R.H. The Nature of the Firm. Economica 1937, 4, 386–405. [Google Scholar] [CrossRef]

- Ganda, F. Carbon Performance, Company Financial Performance, Financial Value, and Transmission Channel: An Analysis of South African Listed Companies. Environ. Sci. Pollut. Res. 2022, 29, 28166–28179. [Google Scholar] [CrossRef] [PubMed]

- Lewandowski, S. Corporate Carbon and Financial Performance: The Role of Emission Reductions. Bus. Strategy Environ. 2017, 26, 1196–1211. [Google Scholar] [CrossRef]

- Yagi, M.; Managi, S. Decomposition Analysis of Corporate Carbon Dioxide and Greenhouse Gas Emissions in Japan: Integrating Corporate Environmental and Financial Performances. Bus. Strategy Environ. 2018, 27, 1476–1492. [Google Scholar] [CrossRef]

- Hanlon, M.; Maydew, E.L.; Saavedra, D. The Taxman Cometh: Does Tax Uncertainty Affect Corporate Cash Holdings? Rev. Account. Stud. 2017, 22, 1198–1228. [Google Scholar] [CrossRef] [Green Version]

- Riddick, L.A.; Whited, T.M. The Corporate Propensity to Save. J. Finance 2007, 64, 1729–1766. [Google Scholar] [CrossRef]

- Hoffmann, V.H.; Busch, T. Corporate Carbon Performance Indicators. J. Ind. Ecol. 2008, 12, 505–520. [Google Scholar] [CrossRef]

- Akguc, S.; Al Rahahleh, N. Effect of Shariah Compliance on Operating Performance: Evidence from GCC Countries. Emerg. Mark. Financ. Trade 2018, 54, 2874–2896. [Google Scholar] [CrossRef]

- Huang, J. Corporate Social Responsibility and Financial Performance: The Moderating Role of the Turnover of Local Officials. Finance Res. Lett. 2021, 46, 102497. [Google Scholar] [CrossRef]

- Nishitani, K.; Kaneko, S.; Komatsu, S.; Fujii, H. How Does a Firm’s Management of Greenhouse Gas Emissions Influence Its Economic Performance? Analyzing Effects through Demand and Productivity in Japanese Manufacturing Firms. J. Product. Anal. 2014, 42, 355–366. [Google Scholar] [CrossRef]

- Yu, P.; Hao, R.; Cai, Z.; Sun, Y.; Zhang, X. Does Emission Trading System Achieve the Win-Win of Carbon Emission Reduction and Financial Performance Improvement?—Evidence from Chinese A-Share Listed Firms in Industrial Sector. J. Clean. Prod. 2022, 333, 130121. [Google Scholar] [CrossRef]

- Chen, Y.; Xu, Z.; Zhang, Z.; Ye, W.; Yang, Y.; Gong, Z. Does the Carbon Emission Trading Scheme Boost Corporate Environmental and Financial Performance in China? J. Clean. Prod. 2022, 368, 133151. [Google Scholar] [CrossRef]

- Alvarez, I.G. Impact of CO2 Emission Variation on Firm Performance. Bus. Strategy Environ. 2012, 21, 435–454. [Google Scholar] [CrossRef]

- Trumpp, C.; Guenther, T. Too Little or Too Much? Exploring U-Shaped Relationships between Corporate Environmental Performance and Corporate Financial Performance. Bus. Strategy Environ. 2015, 26, 49–68. [Google Scholar] [CrossRef]

- de Lima, C.R.M.; Barbosa, S.B.; de Castro Sobrosa Neto, R.; Bazil, D.G.; de Andrade Guerra, J.B.S.O. Corporate Financial Performance: A Study Based on the Carbon Efficient Index (ICO2) of Brazil Stock Exchange. Environ. Dev. Sustain. 2021, 24, 4323–4354. [Google Scholar] [CrossRef]

- Lee, K.-H.; Min, B.; Yook, K.-H. The Impacts of Carbon (CO2) Emissions and Environmental Research and Development (R&D) Investment on Firm Performance. Int. J. Prod. Econ. 2015, 167, 1–11. [Google Scholar] [CrossRef]

- Wang, L.; Li, S.; Gao, S. Do Greenhouse Gas Emissions Affect Financial Performance?—An Empirical Examination of Australian Public Firms. Bus. Strategy Environ. 2013, 23, 505–519. [Google Scholar] [CrossRef]

- Sohl, T.; Vroom, G.; McCann, B.T. Business Model Diversification and Firm Performance: A Demand-Side Perspective. Strateg. Entrep. J. 2020, 14, 198–223. [Google Scholar] [CrossRef]

- Shrivastava, P. Environmental Technologies and Competitive Advantage. Strateg. Manag. J. 1995, 16, 183–200. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar] [CrossRef]

- Delmas, M.A.; Nairn-Birch, N.; Lim, J. Dynamics of Environmental and Financial Performance. Organ. Environ. 2015, 28, 374–393. [Google Scholar] [CrossRef]

- Hart, S.L.; Ahuja, G. Does It Pay to Be Green? An Empirical Examination of the Relationship between Emission Reduction and Firm Performance. Bus. Strategy Environ. 1996, 5, 30–37. [Google Scholar] [CrossRef]

- Hughes, K.E., II; Reynolds, J.K. Uncertainty Associated with Future Environmental Costs and the Market’s Differential Response to Earnings Information. J. Bus. Financ. Account. 2001, 28, 1351–1386. [Google Scholar] [CrossRef]

- Ichsani, S.; Zaenudin, A.I.N.; Damayanti, G.N.; Tresia, V.; Putri, V.A. The Effect of Financial Ratio on Firm Value: Empirical Evidence from Listed Firms in the IDX30 Index. J. Asian Financ. Econ. Bus. 2021, 8, 103–112. [Google Scholar] [CrossRef]

- Ritchie, H.; Roser, M.; Rosado, P. CO2 and Greenhouse Gas Emissions. Our World in Data. 2020. Available online: https://ourworldindata.org/co2-and-greenhouse-gas-emissions (accessed on 2 April 2023).

- Shan, Y.; Guan, D.; Zheng, H.; Ou, J.; Li, Y.; Meng, J.; Mi, Z.; Liu, Z.; Zhang, Q. China CO2 emission accounts 2016–2017. Sci Data 2020, 7, 54. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Belkhir, L.; Bernard, S.; Abdelgadir, S. Does GRI Reporting Impact Environmental Sustainability? A Cross-Industry Analysis of CO2 Emissions Performance between GRI-Reporting and Non-Reporting Companies. Manag. Environ. Qual. Int. J. 2017, 28, 138–155. [Google Scholar] [CrossRef]

- Greenhouse Gas Protocol. 2015. Available online: https://ghgprotocol.org/sites/default/files/standards/ghg-protocol-revised.pdf (accessed on 12 December 2022).

- Shahnia, C.; Purnamasari, E.D.; Hakim, L.; Endri, E. Determinant of Profitability: Evidence from Trading, Service and Investment Companies in Indonesia. Accounting 2020, 6, 787–794. [Google Scholar] [CrossRef]

- Hussein Alsufy, F.J. The Impact of Capital Structure Components on the Total Assets Turnover: Evidence from Amman Stock Exchange. Int. Bus. Res. 2019, 12, 71. [Google Scholar] [CrossRef]

- Alessi, L.; Ossola, E.; Panzica, R. What Greenium Matters in the Stock Market? The Role of Greenhouse Gas Emissions and Environmental Disclosures. J. Financ. Stab. 2021, 54, 100869. [Google Scholar] [CrossRef]

- Zhang, T. The Impact of Carbon Emission Constraints to Enterprise Performance Based on Threshold Regression. Master’s Thesis, Shandong Normal University, Jinan, China, 2015. [Google Scholar] [CrossRef]

- Zhang, W.; Lin, W.; Li, Z. How the Growth Rate Influences Low-Carbon Sustainable Production Performance under Different Disposabilities in China’s Manufacturing Industries? J. Clean. Prod. 2020, 249, 119349. [Google Scholar] [CrossRef]

- Cong, Y.; Freedman, M. Corporate Governance and Environmental Performance and Disclosures. Adv. Account. 2011, 27, 223–232. [Google Scholar] [CrossRef]

| Sectors | Frequency | Percent | Cumulation |

|---|---|---|---|

| Gas production and supply industry | 4 | 2.23 | 2.23 |

| Food manufacturing industry | 4 | 2.23 | 4.47 |

| Wine, beverage, and refined tea manufacturing industry | 5 | 2.79 | 7.26 |

| Ferrous metals mining and dressing | 6 | 3.35 | 10.61 |

| Manufacture of general machinery | 18 | 10.06 | 20.67 |

| Manufacture of medicines | 9 | 5.03 | 25.70 |

| Metal products manufacturing | 5 | 2.79 | 28.49 |

| Car industry | 10 | 5.59 | 34.08 |

| Non-ferrous metal mining and dressing | 10 | 5.59 | 39.66 |

| Manufacture of electrical machinery and equipment | 9 | 5.03 | 44.69 |

| Manufacture of instruments and meters | 4 | 2.23 | 46.93 |

| Manufacture of electronic equipment | 21 | 11.73 | 58.66 |

| Water production and supply | 5 | 2.79 | 61.45 |

| Financial industry | 50 | 27.93 | 89.39 |

| Chemical fiber manufacturing industry | 3 | 1.68 | 91.06 |

| Special purpose equipment | 14 | 7.82 | 98.88 |

| Transportation equipment | 2 | 1.12 | 100.00 |

| Total | 179 | 100.00 |

| Variables | Proxy Variables | Symbolics | Explanations | |

|---|---|---|---|---|

| Explained variable | Carbon Emission Performance | Carbon Emission Intensity (Contrary indicator) | CarboEm | Corporate emission advantage in the process of applying low-carbon technologies, energy restructuring, low-carbon projects, and so on. |

| Explanatory variables | Asset structure | Fixed asset ratio | FixedRa | Long-term occupation of capital and measured by the ratio of fixed assets to total assets. |

| Asset utilization efficiency | Total asset turnover ratio | TotalRa | The match between asset investment scale and sales. | |

| Control variables | Size | Asset | Asset | Resources formed by past transactions or events of the enterprise, owned or controlled by the enterprise, and expected to bring economic benefits to the enterprise. |

| Profitability | Operating income | Sales | Income from the main business or other businesses. | |

| Return on total assets | ROA | Ratio of net profit to average total assets. | ||

| Growth capabilities | Sustainable growth rate | SustaGr | (current net profit/beginning shareholders’ equity) × current earnings retention rate. | |

| Equity concentration | Shareholding ratio of the first largest shareholder | ShareRa1 | The shareholding distribution of major shareholders can measure the shareholding structure and stability of the company. | |

| SR of the top 5 shareholders | ShareRa5 | |||

| Stock liquidity | Proportion of tradable A-shares | TradaSP | RMB ordinary stocks. | |

| Variables | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| CarboEm | 179 | 0.533 | 1.718 | 0.001 | 10.96 |

| FixedRa | 179 | 0.132 | 0.126 | 0.001 | 0.487 |

| TotalRa | 179 | 0.58 | 0.503 | 0.024 | 1.814 |

| Sales (a million yuan) | 179 | 723.52 | 1162.005 | 18.365 | 8242.46 |

| Asset (a million yuan) | 179 | 12,104.713 | 36,348.178 | 56.345 | 221,244 |

| ROA | 179 | 0.036 | 0.04 | −0.136 | 0.141 |

| SustaGr | 179 | 0.078 | 0.088 | −0.395 | 0.299 |

| ShareRa1 | 179 | 0.401 | 0.179 | 0.121 | 0.885 |

| ShareRa5 | 179 | 0.670 | 0.178 | 0.304 | 0.988 |

| TradaSP | 179 | 1.136 | 4.9 | 0 | 66.274 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

|---|---|---|---|---|---|---|---|---|---|---|

| (1) CarboEm | 1.000 | |||||||||

| (2) FixedRa | −0.514 *** | 1.000 | ||||||||

| (0.000) | ||||||||||

| (3) TotalRa | 0.097 | 0.400 *** | 1.000 | |||||||

| (0.197) | (0.000) | |||||||||

| (4) Sales | 0.422 *** | −0.301 *** | 0.009 | 1.000 | ||||||

| (0.000) | (0.000) | (0.900) | ||||||||

| (5) Asset | 0.313 *** | −0.581 *** | −0.576 *** | 0.752 *** | 1.000 | |||||

| (0.000) | (0.000) | (0.000) | (0.000) | |||||||

| (6) ROA | −0.196 *** | 0.287 *** | 0.447 *** | −0.044 | −0.271 *** | 1.000 | ||||

| (0.009) | (0.000) | (0.000) | (0.544) | (0.000) | ||||||

| (7) SustaGr | 0.322 *** | −0.140 | 0.288 *** | 0.280 *** | 0.105 | 0.602 *** | 1.000 | |||

| (0.000) | (0.062) | (0.000) | (0.000) | (0.162) | (0.000) | |||||

| (8) ShareRa1 | 0.042 | −0.131 * | 0.200 *** | 0.024 | −0.059 | 0.050 | 0.149 ** | 1.000 | ||

| (0.578) | (0.081) | (0.007) | (0.749) | (0.430) | (0.502) | (0.047) | ||||

| (9) ShareRa5 | 0.210 *** | −0.303 *** | −0.018 | 0.120 | 0.151 ** | −0.073 | 0.142 * | 0.778 *** | 1.000 | |

| (0.005) | (0.000) | (0.806) | (0.111) | (0.044) | (0.331) | (0.058) | (0.000) | |||

| (10) TradaSP | −0.252 *** | 0.196 *** | 0.072 | −0.260 | −0.271 | 0.118 | −0.141 | −0.247 | −0.465 | 1.000 |

| (0.001) | (0.009) | (0.336) | (0.000) | (0.000) | (0.117) | (0.061) | (0.001) | (0.000) |

| (1) Fixed-Effect Model 1 | (2) Random-Effect Model 1 | (3) FGLS (Feasible General Least Square Estimation) Model 1 | |

|---|---|---|---|

| Variables | CarboEm | ||

| FixedRa | −0.001 | −0.005 *** | −0.003 *** |

| (−0.58) | (−4.59) | (−4.63) | |

| TotalRa | 0.007 | 0.003 | 0.024 |

| (0.05) | (0.05) | (1.14) | |

| Fix × Tot | 0.009 * | 0.009 *** | 0.004 *** |

| (1.97) | (3.84) | (2.74) | |

| Sales | 0.071 | 0.076 ** | 0.018 * |

| (1.08) | (2.44) | (1.84) | |

| Asset | −0.030 | −0.057 ** | −0.014 * |

| (−0.40) | (−2.12) | (−1.68) | |

| ROA | −0.019 ** | −0.017 *** | −0.005 ** |

| (−2.37) | (−4.53) | (−2.41) | |

| SustaGr | 0.473 ** | 0.461 *** | 0.127 ** |

| (2.14) | (4.13) | (2.32) | |

| ShareRa1 | 0.054 | −0.220 * | −0.059 |

| (0.22) | (−1.66) | (−1.28) | |

| ShareRa5 | 0.360 | 0.283 ** | 0.067 |

| (1.21) | (2.06) | (1.45) | |

| TradaSP | 0.001 | 0.001 | 0.000 |

| (1.30) | (0.88) | (0.39) | |

| Constant | 0.150 | 0.572 *** | 0.888 *** |

| (0.32) | (3.81) | (15.19) | |

| Observations | 179 | 179 | 171 (8 observations dropped because only 1 obs in group) |

| R-squared(within) | 0.118 | 0.087 | |

| Number of idcode | 44 | 44 | 36 |

| idcode FE | YES | YES | YES |

| year FE | YES | YES | YES |

| (1) Fixed-Effect Model 1 | (2) Random-Effect Model 1 | (3) FGLS (Feasible General Least Square Estimation) Model 1 | |

|---|---|---|---|

| Variables | CarboEm | ||

| QuassRa | 0.025 | 0.075 ** | 0.037 *** |

| (0.53) | (2.45) | (3.13) | |

| TotalRa | 0.056 | 0.169 ** | 0.061 ** |

| (0.41) | (2.23) | (2.47) | |

| Qua × Tot | 0.006 | 0.111 * | 0.048 ** |

| (0.07) | (1.79) | (2.24) | |

| Sales | 0.106 | 0.008 | −0.002 |

| (1.62) | (0.25) | (−0.21) | |

| Asset | −0.082 | 0.015 | 0.010 |

| (−1.24) | (0.54) | (1.29) | |

| ROA | −0.015 * | −0.022 *** | −0.008 *** |

| (−1.95) | (−5.13) | (−3.29) | |

| SustaGr | 0.369 * | 0.600 *** | 0.175 *** |

| (1.71) | (4.84) | (3.01) | |

| ShareRa1 | 0.002 | −0.280 * | −0.117 ** |

| (0.01) | (−1.92) | (−2.18) | |

| ShareRa5 | 0.371 | 0.305 ** | 0.101 * |

| (1.23) | (2.01) | (1.87) | |

| TradaSP | 0.001 | −0.000 | −0.000 |

| (1.04) | (−0.05) | (−0.48) | |

| Constant | 0.328 | 0.209 | 0.739 *** |

| (0.76) | (1.43) | (11.41) | |

| Observations | 179 | 179 | 171 (8 observations dropped because there was only 1 obs in the group) |

| R-squared | 0.094 | 0.047 | |

| Number of idcode | 44 | 44 | 36 |

| idcode FE | YES | YES | YES |

| Year FE | YES | YES | YES |

| Instruments | GMM-Type | Standard |

|---|---|---|

| For difference equations | L (2/.).CarboEm L(1/.).ShareRa1 L(1/.).ShareRa5 L(1/.).TradaSP L(2/.).SustaGr L(2/.).Sales L(2/.).ROA | D.TotalRa D.FixedRa D. Fix × Tot D.Sales D.Asset D.ROA D.SustaGr D.ShareRa1 D.ShareRa5 D.TradaSP |

| For level equations | LD.CarboEm D.ShareRa1 D.ShareRa5 D.TradaSP LD.SustaGr LD.Sales LD.ROA | _cons |

| Arellano-Bover/Blundell-Bond Panel Dynamic Data Model 2 | ||

|---|---|---|

| Variables | CarboEm | |

| L | 0.732 *** (21.55) | 0.786 *** (23.28) |

| L2 | 0.345 *** (2.68) | 0.097 (1.06) |

| L3 | −0.334 ** (−2.50) | −0.146 ** (−2.40) |

| FixedRa | −0.002 *** (−4.89) | - |

| QuassRa | - | 0.020 (0.98) |

| TotalRa | 0.004 (0.12) | - |

| Fix *Tot | 0.002 ** (2.44) | - |

| Qua *Tot | - | 0.055 ** (2.55) |

| Sales | 0.020 (1.62) | 0.001 (0.13) |

| L1Sales | −0.009 (−1.50) | |

| Asset | −0.017 (−1.54) | 0.007 (1.53) |

| ROA | −0.004 *** (−3.16) | −0.011 *** (−4.93) |

| L1ROA | - | 0.004 ** (2.36) |

| SustaGr | −0.115 ** (−2.52) | 0.124 * (1.72) |

| L1SustaGr | - | 0.001 (0.01) |

| ShareRa1 | 0.003 (0.08) | −0.098 ** (−2.52) |

| L1ShareRa1 | - | 0.062 ** (2.04) |

| ShareRa5 | 0.007 (0.39) | 0.04 (1.01) |

| L1ShareRa5 | - | −0.049 (−1.30) |

| TradaSP | 0 (−0.78) | 0.002 * (1.70) |

| L1TradaSP | - | −0.002 (−1.57) |

| Constant | 0.364 *** (9.77) | 0.166 ** (2.24) |

| Mean dep | 0.959 | 0.959 |

| SD dep | 0.116 | 0.116 |

| Number of obs | 53 | 53 |

| Number of instruments | 62 | 62 |

| Chi-square | 193,200.636 | 694,132.917 |

| Arellano-Bond test ZAR1 | 2Z= −0.920, p = 0.357 | 2Z = −1.380, p = 0.168 |

| Sargan test OVRID | chi2 (48) = 25.301, p = 0.997 | chi2 (42) = 19.078, p = 0.999 |

| Linear Model (with Ordinary Least Squares) | |||

|---|---|---|---|

| SustaGr | TotalRa | SustaGr | |

| FixedRa | −0.003 *** | −0.005 *** | −0.003 *** |

| (0.001) | (0.002) | (0.001) | |

| TotalRa | 0.045 | ||

| (0.034) | |||

| Sales | 0.030 *** | 0.373 *** | 0.014 |

| (0.009) | (0.020) | (0.015) | |

| Asset | −0.009 | −0.326 *** | 0.006 |

| (0.007) | (0.016) | (0.013) | |

| ROA | 0.021 *** | 0.018 *** | 0.020 *** |

| (0.002) | (0.004) | (0.002) | |

| ShareRa1 | 0.010 | 0.323 ** | −0.004 |

| (0.069) | (0.155) | (0.069) | |

| ShareRa5 | 0.022 | −0.180 | 0.030 |

| (0.076) | (0.171) | (0.076) | |

| TradaSP | −0.001 * | −0.001 | −0.001 |

| (0.000) | (0.001) | (0.000) | |

| _cons | 0.515 *** | 0.753 *** | 0.482 *** |

| (0.075) | (0.170) | (0.079) | |

| N | 179.000 | 179.000 | 179.000 |

| r2 | 0.536 | 0.822 | 0.541 |

| Linear Model (with Ordinary Least Squares) | |||

|---|---|---|---|

| FixedRa | SustaGr | FixedRa | |

| TotalRa | −9.447 *** | 0.072 ** | −7.494 ** |

| (3.279) | (0.034) | (3.196) | |

| SustaGr | - | - | −26.993 *** |

| - | - | (7.050) | |

| Sales | 6.122 *** | −0.004 | 6.001 *** |

| (1.463) | (0.015) | (1.408) | |

| Asset | −7.507 *** | 0.028 ** | −6.756 *** |

| (1.153) | (0.012) | (1.127) | |

| ROA | 0.409 ** | 0.019 *** | 0.924 *** |

| (0.182) | (0.002) | (0.221) | |

| ShareRa1 | 0.913 | −0.007 | 0.721 |

| (6.905) | (0.072) | (6.645) | |

| ShareRa5 | −16.500 ** | 0.079 | −14.372 ** |

| (7.420) | (0.077) | (7.162) | |

| TradaSP | −0.039 | −0.001 | −0.054 |

| (0.041) | (0.000) | (0.040) | |

| _cons | 48.188 *** | 0.340 *** | 57.363 *** |

| (6.973) | (0.073) | (7.125) | |

| N | 179.000 | 179.000 | 179.000 |

| r2 | 0.463 | 0.502 | 0.506 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dan, E.; Shen, J.; Zheng, X.; Liu, P.; Zhang, L.; Chen, F. Asset Structure, Asset Utilization Efficiency, and Carbon Emission Performance: Evidence from Panel Data of China’s Low-Carbon Industry. Sustainability 2023, 15, 6264. https://doi.org/10.3390/su15076264

Dan E, Shen J, Zheng X, Liu P, Zhang L, Chen F. Asset Structure, Asset Utilization Efficiency, and Carbon Emission Performance: Evidence from Panel Data of China’s Low-Carbon Industry. Sustainability. 2023; 15(7):6264. https://doi.org/10.3390/su15076264

Chicago/Turabian StyleDan, Erli, Jianfei Shen, Xinyuan Zheng, Peng Liu, Ludan Zhang, and Feiyu Chen. 2023. "Asset Structure, Asset Utilization Efficiency, and Carbon Emission Performance: Evidence from Panel Data of China’s Low-Carbon Industry" Sustainability 15, no. 7: 6264. https://doi.org/10.3390/su15076264

APA StyleDan, E., Shen, J., Zheng, X., Liu, P., Zhang, L., & Chen, F. (2023). Asset Structure, Asset Utilization Efficiency, and Carbon Emission Performance: Evidence from Panel Data of China’s Low-Carbon Industry. Sustainability, 15(7), 6264. https://doi.org/10.3390/su15076264