1. Introduction

Organizations are progressively attempting to lower their environmental impact and energy costs, which aligns with the global sustainability-oriented trend. As an approach to such an initiative, many organizations and corporates are sourcing energy from renewable generation sources (RES). Renewable energy is gradually being raised from operational and technical activity to a strategic and commercial focus in an organization’s energy strategy. Corporates may implement a renewable energy plan in a variety of ways, including renewable power, heat, and transportation, all of which have connected benefits [

1,

2].

Renewable electricity solutions involve either directly constructing an asset, or acquiring green power from a third party’s project, both of which make it possible to obtain renewable energy certificates [

3,

4]. This research focuses on a combination of methods that a corporation includes in a power purchase agreement (PPA) to acquire power from a renewable energy asset. Corporate PPAs have been proven a fitting tool for addressing sustainable initiatives, development risks, and finance opportunities. They may, therefore, help considerably in enhancing and expediting the deployment of renewables [

5].

The renewable corporate sourcing sector in Europe, which includes both PPAs and other kinds of corporate sourcing, has enormous potential. Long-term PPAs are used by renewable energy plant developers to ensure a project’s future revenue and provide lenders with assurance that loans will be returned; in other words, to improve a project’s bankability in the absence of predictable income from government assistance programs [

6,

7]. However, these PPAs come with a lot of risks that most corporates are not familiar with [

8]. Traditionally, utilities with a strong grasp of the energy market and broad, diversified portfolios of projects and technology have managed to cope with the risks associated with long-term energy contracts in Europe. They have had to devise complex procedures in order to accommodate an increasing proportion of fluctuating renewable energy costs. Corporates are increasingly interested in signing long-term PPAs as renewables become the primary energy technology for big energy corporations and new renewable energy suppliers enter the market. It is crucial that they realize the risks to which they may be exposed. During the last few years, different pricing PPA mechanisms have been explored by counterparties. However, fixed-price structures have dominated amongst commercial pricing mechanisms for renewable PPAs. The unpredictability of the wholesale power prices across Europe and the probability of additional price cannibalization of wind and solar capture prices by means of increased renewable penetration in the system is of the essence for developing new PPA structures. A vast number of offtakers are becoming more interested in alternate PPA pricing scenarios [

9,

10].

PPAs can also be conducted through various energy storage management strategies, used to mitigate energy consumption. Organizations can acquire storage capacity to supplement their renewable energy purchases using battery PPAs. By incorporating batteries into a renewable project, surplus energy can be stored during periods of high production and low power prices and sold back to the grid during times of low production and high-power prices. There are two categories of battery storage power purchase agreements (PPAs): a combined PPA that covers both renewable energy (usually from solar) and energy storage, and a separate PPA contract that only focuses on battery storage. There are two major categories of battery storage PPAs, namely, a combined PPA that covers both renewable energy (usually from solar) and energy storage, and a separate PPA contract that only focuses on battery storage [

11,

12]. A battery storage PPA that is structured accurately to reflect both the RES producer’s and the offtaker’s needs can reap pricing benefits. The seller can secure a stable revenue stream to support project financing, while the buyer gains an effective hedge against battery storage price fluctuations. Additionally, there are advantages in terms of reduced need for balancing and shaping during unpredictable output periods, as the battery can take over. This will make power more environmentally friendly by reducing reliance on purchasing fossil-fuel-based electricity from the grid during low production periods. Sustainability-related strategies can also be formulated via the implementation of such schemes. Thus, there is further impetus for increased storage to ensure availability of green power at all times of day [

13,

14].

While exploring diverse PPA contracting practices, it is crucial to employ a consistent approach to comprehending corporate PPAs based on the country-specific market environment that impacts them [

15]. This introduction outlines the key characteristics of corporate PPAs that are assigned by a range of contractual techniques. Such characteristics may be specific to corporate PPAs, such as the term, volume, or price, or they may encompass broader variables that impact the structure of a corporate PPA, such as the relevant power market. This also introduces sustainability-related indicators that examine typical risks that must be addressed. Contributing to this means discussing the views of several parties involved, such as the corporate buyer, the developer, and the financiers. Inputs on such observations are derived from a large-scale organization. These tenets are then used for a more extensive analysis of various contracting approaches to attain the aim of this study and fill the existing literature gap.

The literature currently lacks a comprehensive assessment of sustainability indicators that aid the integration of the sustainability philosophy into PPAs, as well as a multicriteria decision analysis (MCDA) approach to assess this integration. In response to the presented research gap, this study highlights the potential for PPA practitioners to utilize the proposed MCDA approach to evaluate various PPA pricing structures and successfully implement the sustainability initiatives that organizations aspire to integrate into their tactics, particularly within the triple bottom line (TBL) framework. This research introduces a novel approach for assessing the integration of sustainability indicators within PPAs to reveal sustainable energy strategies, which fills a significant gap in the existing literature and offers valuable insights for PPA practitioners seeking to align with sustainability goals. The objective of this research is to offer practitioners an understanding of the available alternatives by presenting an overview of different PPA pricing structures along with an analysis of sustainability-related implications and settlement considerations as a way of supporting the overall research aim. This paper outlines the specific methodological steps used to reveal sustainable energy strategies for PPAs. The aim of this research is to introduce a multicriteria decision analysis-based method, namely PROMETHEE, to evaluate the implementation of sustainability-related strategies using PPAs. By utilizing the proposed approach to compare different PPA structures, it is intended to reveal stakeholders’ needs, allowing PPA practitioners to follow sustainable energy strategies. The contribution to the overall body of knowledge includes conducting extensive empirical research and presenting a novel method for evaluating the use of sustainability indicators in PPAs for revealing sustainable strategies; this study addresses a crucial void in the current body of literature and provides beneficial perspectives for PPA professionals aiming to align with sustainable objectives.

Figure 1 provides a summary of the main aspects of this research.

2. Literature Review

Recent studies and reports have highlighted the importance of conducting more PPA deals in order to attain a sustainable society [

9,

16,

17]. The corporate sourcing business in Europe has exploded in recent years. During 2014, the European corporate PPA market developed to a total capacity of more than 8 GW for offsite projects. In 2018, contracts for commercial and industrial onsite renewables totaled 1.3 GW and 2.1 GW, respectively. Over 2.5 GW of offsite PPAs were signed in 2019 alone [

18]. The need for sustainability, as expressed through renewable energy projects, arises from a shortage of natural resources, leading the whole PPA theme to new insights and scientific “green” solutions [

6]. Corporates act on several motives for trying to obtain power from renewables, but the capability of stabilizing energy costs is crucial for PPA transactions. While decarbonization obligations are frequently highlighted as the initial impetus for considering renewable corporate sourcing, most corporates identify the capacity of a PPA to minimize energy cost volatility and provide long-term savings on energy bills as the critical business justification [

19].

Long-term PPAs, the most common agreements, vary between 10 and 15 years, are used by RES developers to ensure the project’s future revenue, and provide lenders a guarantee that their loans will be refunded in order to enhance the project’s feasibility (bankability of the project) in the event of the absence of governmental funding [

15]. Nevertheless, risks still exist (e.g., development, volume, performance, etc.), and PPAs can become problematic for both counterparties, as these kinds of deals are brand-new to practitioners [

20]. Through the defined process and the use of indicators, this research attempts to highlight such types of risks.

PPAs can be introduced into a wide variety of schemes depending on the counterparties’ needs and purposes. The accounting aspect of this sort of transaction also may be complicated, causing the PPA signing procedure to be delayed. The impact on financial statements may be severe, depending on how the agreement is constructed. PPAs can be categorized depending on the offtaker, energy transmission, volume produced, the chosen price mechanism, number of counterparties, and location of markets. In this research, the focus is on pricing mechanisms.

Figure 2 presents the most common types of PPAs and highlights in orange and bold printing the most used types in European markets as extracted from interviewees’ expertise along with relevant publicly available reports and articles [

18,

21,

22].

The needs between corporates, industries, and utilities usually vary and are typically explored on a case-by-case basis by practitioners. In most cases, offtakers are interested in implementing sustainability strategies, meaning reducing CO

2 emissions and making environmental claims, contributing to society-related concerns, and achieving financial benefits (TBL). They usually have specific energy needs and seek a PPA with a tailored volume and price structure. Furthermore, contract clauses may vary, depending on the sustainability focus they want to reveal in the PPA deal [

5].

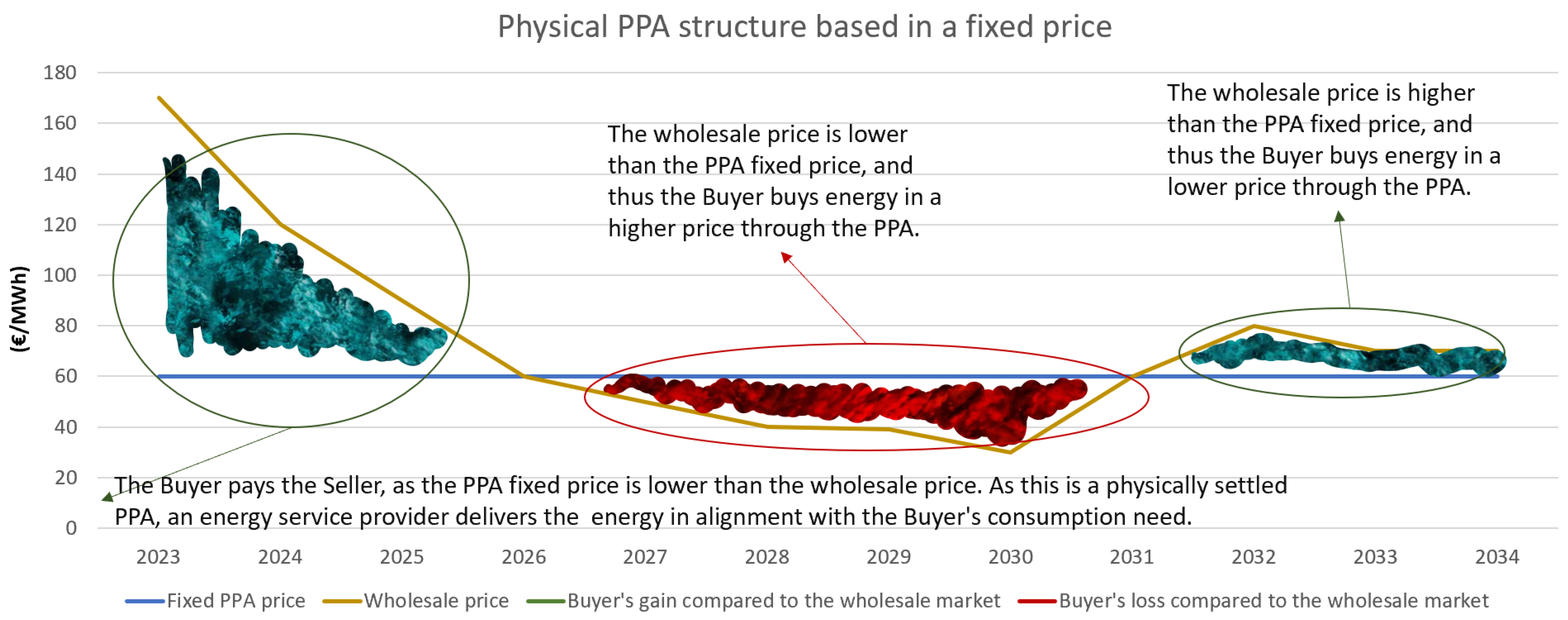

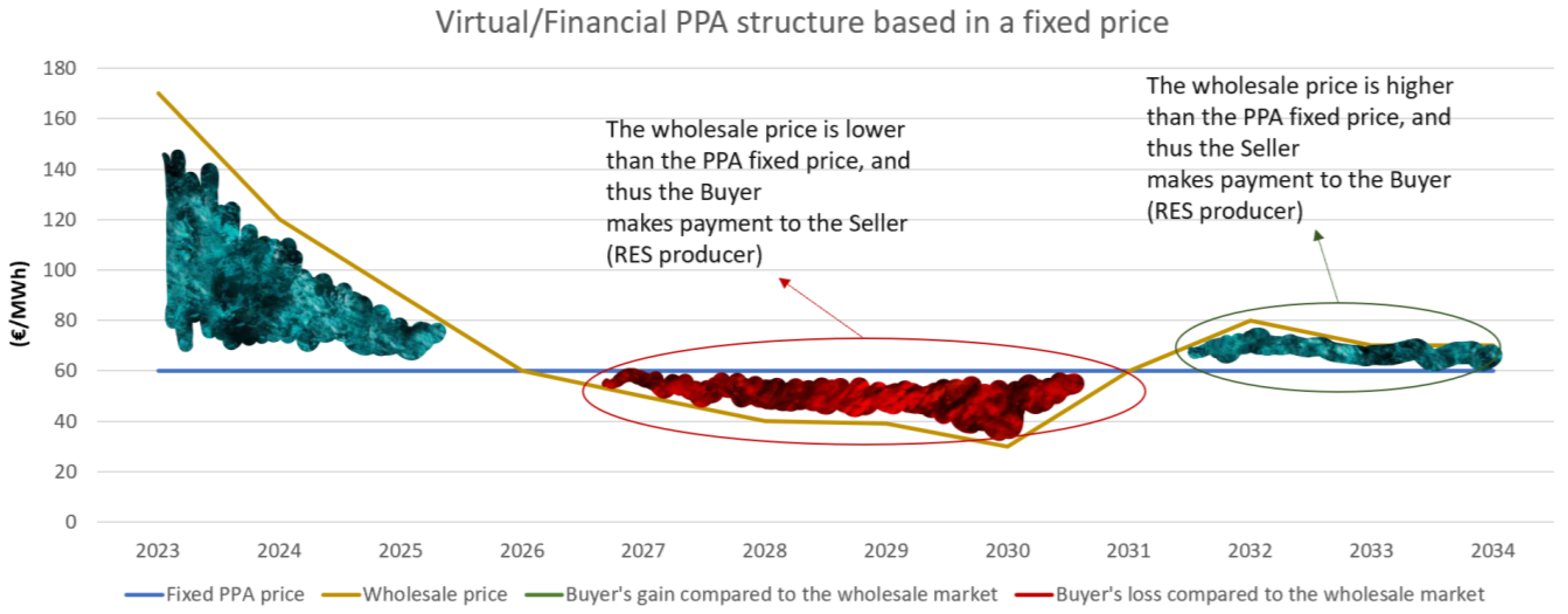

Physical PPAs represent a direct relationship between the offtaker and the RES producer, implying that the latter physically delivers the specified energy volume with the help of an energy provider (

Figure 3). Virtual/financial PPAs (VPPAs), on the other hand, offer options to offtakers regardless of geographical distance. In these VPPAs, no physical energy exchange is involved, and it mainly includes a net cash settlement of the difference between the market spot price (wholesale market), and PPA agreed/fixed price (

Figure 4). VPPAs may be typically used for hedging strategies against future spot price fluctuations [

5,

23].

Pay-as-produced (PAP) volume structures refer to PPAs in which a fixed tariff is paid for the energy produced, regardless of current or future market prices. It can cover all of the production or a percentage. PAP PPAs tend to be the most popular volume structure across Europe, offering a perfect alternative for the financial security subsidy schemes that may be inclined to fade. RES producers transfer key PPA risks (price, cannibalization, and profile) to the offtaker [

24]. However, in regions with the most active growth of renewables capacity, offtakers are finding PAP contracts less attractive, and baseload PPAs are the next phase of commercial PPA structures. Baseload PPA structures offer a fixed delivery production profile. They can be defined in an annual or a monthly profile and are usually chosen from RES producers and off-takers seeking a fixed delivery energy profile. Such a structure includes specific production for each hour of the year/month, constantly throughout the agreed term [

25]. A route-to-market strategy is a commercially motivated way of reaching, selling, and transacting to increase revenue and profit within a defined target market or segment. In the route-to-market volume structure, the offtaker bears the volume risk, and there are no delivery profile commitments; the RES producer will receive a lower price for the electricity provided compared to a fixed-volume PPA. Route-to-market PPAs are often addressed to a utility with power trading capabilities [

26].

Analyzing the most used pricing structures, constitute the central research path of this paper. Using a fixed scheme combined with an escalation and–indexation structure, the authors address the scenario in which the offtaker secures a starting power price that remains the same or, in most cases, rises/decreases according to a contractual profile. The phases can be determined in nominal terms, not including inflation as measured by changes in consumer price index (CPI) in terms of the annual growth rate and in index, or in factual terms by adding inflation indexation. As an alternative, a straightforward predetermined percentage increase/decrease every year may be used. Floating price, market discount with caps and floors introduces a pricing structure in which the offtaker attains a market discount (set percentage or amount) throughout the PPA tenor. In return, the offtaker offers the power producer with a floor or cap price, ensuring a minimum/maximum price for plant output and safeguarding the project’s bankability. This structure is based on a similar approach to the VPPA, under which the parties’ energy payments are subject to the wholesale market price and follow the approach of a contract for difference (CfD) mechanism (

Figure 5). Collar and reverse-collar structures present a key difference to the previous structure, which is that there is no discount to market. A collar requires a project to assume more wholesale energy price risk that the offtaker is liable to (minimum and maximum price defined). The RES producer becomes the party at risk whenever the wholesale market price falls below the defined floor price but, in exchange, the producer benefits from an upside when the power market exceeds the defined cap. PPAs that follow this pricing structure express parties’ desire to constrain the volatility of power prices. However, high floor prices can potentially result in a higher agreed PPA strike price. Hybrid structures (% of output) contain a fixed percentage of the production of the RES plant (e.g., 80%) which is contracted at a fixed price. The remaining percentage of the output (e.g., 20%) is contracted at a floating price with a discount to the market. The RES producer is keener to proceed with such a structure as there is the choice to enhance output with wholesale power prices and in sufficient parallel demand to cover the offtaker. The PPA match most likely concludes with large electricity offtakers that are also “vulnerable” to power prices. Finally, in a clawback structure, which is the less popular amongst counterparties across Europe, mainly due to its complexity, the offtaker locks in a PPA price but benefits from downward market price movements, subject to limitations defined in the agreement. Upward price movements are charged to the RES producers until they have clawed back the amount gained by the offtaker (relative to the PPA price). The RES producer faces a loss cap following this, in which the price reverts to the PPA price, providing a floor (also determined relative to the PPA price) to total project revenues for the RES producer. This structure’s philosophy is based on a contractual provision whereby revenues already paid to a counterparty must be returned to the other counterparty, sometimes with a penalty [

21,

23,

25].

Cross-border PPAs (XB PPAs) refer to bilateral contracts between an RES producer and an offtaker who are located in different countries. In principle, the scheme is the same as any other PPA structure but with the added complication of dealing with a cross-border price risk and potentially differing regulatory frameworks. The transmission of energy between countries (physical cross-border PPA) depends on acquiring interconnector physical transmission rights (PTRs) and financial transmission rights (FTRs) at auction. This offers several challenges and might not always be feasible. On the other hand, XB virtual PPAs encourage competition among all market participants. Buyers are persuaded to sign PPAs to mitigate economic risks and make environmental claims. Governments and energy markets are being urged to assist and execute these new transactions, and RES producers construct more efficient projects, regardless of the PPA market present. In a multi-buyer structure, multiple offtakers can form a group and enter a PPA with a large RES Producer. Similarly, a team of RES producers can sign a PPA as a unity. This allows for another vital form of PPAs, multi-producer PPAs, which also combine the benefits of different RES technologies (wind and solar) [

22,

27].

This literature review search of previous empirical studies on PPAs and practitioners’ use of sustainability-related indicators for enhancing the selection process by is limited. As the whole PPA theme is a new trend across Europe and the world, the relevant literature is very limited, and this paper is an effort to contribute to the overall body of knowledge and assist in filling this gap. Indicators have previously been cited as significant fundamental aspects that contribute to sustainability initiatives [

28,

29,

30,

31,

32]. Nevertheless, a holistic consideration of sustainability-related indicators that contribute to the integration of sustainability philosophy within PPAs and a multicriteria decision analysis-based method to assess this process has not yet been proposed and remains as a gap in the literature. Subsequent to this perception, this research reveals that the sustainability initiatives organizations desire to implement in their own philosophies (TBL scenario) can be achieved by PPA practitioners that utilize the proposed approach to compare different PPA pricing structures.

3. Materials and Methods

3.1. Research Instrument

This section provides a detailed account of the materials and methods utilized throughout the various stages of this study. To meet the aim of the paper and identify the appropriate sustainability indicators in a PPA context that contribute towards a suitable pricing structure, this research strategy follows a qualitative approach, namely focus groups, and analyzes variations and commonalities to compare different PPA pricing structures using a set of sustainability indicators in order to reveal the appropriate PPA scenario for allowing practitioners to make decisions that steer them toward sustainable practices. Focus groups were conducted in view of seeking expert opinions on the validation of each indicator and the pricing scenarios. This essentially involved providing the respondents with a list of indicators and a brief description, and then calling on them to enter a discussion around each indicator and express their views on several PPA-related aspects, such as schemes, development initiatives, and effort. A series of distinct geographical, socioeconomic, political, and cultural views were analyzed using the guidance of three research questions:

How are sustainable energy strategies framed in terms of the aim and scope of the various PPA structures?

How do practitioners view offtakers’ needs in order to identify the appropriate scenario, and what drives such initiatives?

Which key sustainability conditions for PPA contractual management do practitioners investigate and subsequently use?

Based on previous study approaches [

30,

33], the authors planned the process in order to provide ease, accurate depiction, understandability, and appropriateness to the aim of this research. The philosophy behind the Materials and Methods section lies in the lay focus-group participants who evaluated the usefulness of the indicators for sustainability strategies in PPAs. In this research, the authors conceptualized sense-making as an interactive process by which meaning was created in a dialogue between PPA practitioners and shaped by previous experience, various arguments, and ideas. Previous contacted PPA deals in various European countries have commonly contributed to sense-making proposals. Such sense-making resources guided the researchers to explore the usefulness of the MCDA method for practitioners who enrich their PPA deals with sustainability.

The research design follows the methodological principles of focus group conversations, which suggest both homogeneity and heterogeneity between the groups to enable a broad “map of views” [

34]. This is to permit fruitful and successful conversations towards the aim and the objectives of the current research discussions within the groups while simultaneously guaranteeing robust results regarding PPA initiatives. Each focus group discussion lasted between one and 2 h. Some of the experts participated more than once in a focus group, as they were identified as PPA experts in more than one country. All of the respective experts/respondents from the case study’s organization were leading ongoing PPA business as country heads. This expertise made them ideal candidates for focus group discussions. All focus group discussions were transcribed in key bullet points.

It is worth mentioning that focus group conversations constitute experience-based opinions that cannot be further generalized as market standards in the respective countries analyzed. The goal of such initiatives is to capture experts’ sense-making processes and reveal key elements that can aid future practitioners. Subsequently, this research reveals PPA experts’ insights through an in-depth exploration of how various PPA pricing structures adjust sustainability strategies. Thus, the authors focused on the discussion of sustainability strategies and PPAs in which the experts showcase a high level of awareness and interest.

This study included three focus group conversations with 12 PPA experts (

Table 1). The focus groups were held at the organization’s headquarters in Germany for the participants’ convenience, in view of reflecting the sustainability philosophy in daily PPA operations. Additionally, the researchers planned focus groups with experts active in different countries to enable the participants to generate a broad map of views and perspectives from diverse sociocultural contexts.

3.2. The PROMETHEE Method for Implementing Sustainable Strategies within PPAs

The PROMETHEE (preference ranking organization method for enrichment evaluation) methodology constitutes a multicriteria decision aid (MCDA) technique. Many MCDA approaches for ranking alternatives based on a range of criteria have been established in recent years [

35]. Their development was motivated by practitioners’ desire to deliver researchers enhanced decision-making procedures fit for real-life multiple-criteria choice scenarios [

36]. Eliciting, modeling, and representing preference data are essential steps in providing decision-makers with appropriate choice analyses and aids [

37]. The need to apply such techniques in the energy sector has grown rapidly over the last few years, as various relevant applications of MCDA techniques can effectively address decision-making resolutions to practitioners [

38]. Following Stanitsas, Kirytopoulos [

33], this research uses one of the most modern MCDA methodologies, the PROMETHEE method, for deeper exploration into the PPA decision process.

The PROMETHEE multicriteria technique provides guidance to a choice issue in which a series of similar options, in author’s case, the various PPA pricing alternatives, must be evaluated using contradictory criteria. The PROMETHEE technique requires the creation of the selected PPA alternatives as proposed in

Table 2, in which alternatives are considered based on the selected criteria, in author’s case, TBL-related indicators. According to the previous literature [

35,

39], the following are some additional prerequisites for using PROMETHEE: (a) the relative importance of the specified criteria (in the current case, the weights) and (b) information on the individually defined preference function of the participants concerning a comparison between the alternatives in terms of each criterion.

The weights are generally subjective positive values computed separately from the criterion measurement units. These values show the relative importance of each criterion. The greater the weight’s value, the greater the applicability of the relevant criterion, and vice versa [

40]. According to Angelis and Kanavos [

41], weight selection is critical in MCDA techniques for the reason that it represents practitioners’ insights and priorities.

The PROMETHEE method’s preference structure is built on pairwise comparisons. This means that for each criterion, a distinct preference function must be created for each pair of alternatives, expressing the degree of preference for an option over an alternative. According to Stanitsas, Kirytopoulos [

33], the PROMETHEE approach includes six preference functions to represent the relevance of the alternatives for a particular criterion/indicator, as well as weights to disclose the criterion’s relative importance: Type I (usual criterion); Type II (quasi-criterion); Type III (V-shape criterion); Type IV (level criterion); Type V: (V-shape criterion); and Type VI (Gaussian criterion) [

42,

43].

Following the previous literature, PROMETHEE analysis better fits the targets set for sustainable project delivery [

43,

44,

45]. The long-term commitment induced by entering PPAs and the uncertainty of future shaping and firming costs require a tool in which risks are reduced by conducting thorough analysis. To this end, this research suggests the utilization of PROMETHEE to compare different PPA structures and reveal the appropriate PPA scenario for allowing practitioners to make decisions towards sustainable practices.

3.3. Case Study and Expertise Input

The case study was conducted at ABO Wind, an international engineering, development, and RES construction project organization, specializing in project management consultancy, headquartered in Europe. The organization is actively developing and implementing extensive sustainability approaches to fulfill international sustainable design requirements and standards for its RES projects. Furthermore, it seeks to integrate PPAs with sustainable values by adopting novel practices. In that matter, the case study organization openly discusses its sustainability strategy and assesses load and generation characteristics (e.g., overall electricity consumption and demand shape, procurement, and risk policy) with corporates. Depending on the outcome of the first step, the case study organization assesses potential projects from the existing pipeline or viable project set-ups and proposes the best-suited solution to the corporate’s needs. Based on the corporate’s decision, the case study organization offers a term sheet, including all commercial terms, for execution. In author’s case study, the proposed method (PROMETHEE) was conducted with the organization to demonstrate opportunities for additional improvements in the aforementioned process. Through decision-making, the PROMETHEE method was used for comparing the different PPA pricing structures and revealing the appropriate PPA scenario for allowing practitioners to make decisions towards sustainable practices, and the inputs were gathered using focus group conversations. By using a set of TBL-related indicators, a more effective decision-making process was revealed. The experts were all in key managerial positions and responsible for implementing PPA deals to the organization’s operations in 16 different countries.

4. Assessing Sustainability Strategies for PPAs Using Indicators

The research process and the methodological approach of the study are analytically described in this section.

Figure 6 depicts the sequential arrangement of activities that were carried out in distinct phases during the research. The most important phases, also indicated in the figure below, concern: (1) The case study, which extracted understanding of the studied organization’s experience. The case study selection was derived by identifying the organization and its internal PPA expertise. The most used PPA structures were set as alternatives to the PROMETHEE method. (2) The identification of sustainability-related indicators based on the triple bottom line scenario (TBL) scenario (environmental, social, economic) that were extracted by Stanitsas, Kirytopoulos [

31]. Throughout the focus groups, data were collected from PPA experts holding managerial positions at the studied organization. The results of the assessment were used to assess each alternative against each criterion. (3) In order to evaluate the incorporation of sustainability principles to reveal sustainable PPA strategies, the MCDA-based method known as PROMETHEE was utilized. This method involves examining various scenarios encompassing all possible combinations of TBL-related criteria (indicators) to ensure reliable outcomes. (4) The resultant ranking order of each PPA pricing structure was determined for each analyzed scenario. (5) The final conclusions and recommendations were then formulated.

Considering the purpose of aiding PPA practitioners in understanding the core pricing concepts that result in successful deals and the selection process that needs to take place to enable sustainability initiatives through implementing RES projects, the research process in

Figure 6 arises. The presented method’s contribution to the use of sustainability-related indicators for successful contract management when implementing PPA deals is twofold: (1) This study confirms PPA experts’ valuable feedback (beliefs and attitudes as extracted from the focus group process) as providing understanding for unwrapping alternatives. The findings are significant in terms of implementing sustainability initiatives. This insight is equally substantial for comprehending stakeholder participation in PPA deals. (2) It advances the related body of knowledge as an addition to the insufficiently researched PPA theme, in which it is contended that promising outcomes in this unknown field might be obtained by using indicators such as stakeholder attributes and lifecycle management. To meet this paper’s aim, the researchers’ intention when developing the research process and methodological approach was to strengthen awareness and consideration of key PPA contemplations and stakeholders’ valuable insights. Thus, the prementioned key steps constituted the basis for each progression.

The advancement of renewable energy initiatives is primarily motivated by the goal of promoting environmental consciousness and conservation, preserving social welfare, and ensuring economic wellbeing. Under this notion, the focus of this study leads toward the integration of sustainability philosophy in PPAs as a way of promoting TBL initiatives. By these means, PPA practitioners can settle on the appropriate scenario while directing their efforts to certain sustainability aspects (environmental, social, and economic—

Table 3,

Table 4 and

Table 5). The MCDA-based method can therefore guide them toward this path. The proposed model illustrates how this method can offer significant insights to organizations that aim to execute PPAs while simultaneously seeking sustainable outcomes. Practitioners may benefit from developing and implementing the analyzed approach in their search for PPA initiatives in order to investigate set-ups transparently and promote schemes that improve overall project sustainability. The PROMETHEE tool introduces simplicity and robust outcomes under the notion of sustainability.

By following the dataset presented in the tables below, PPA structures were weighed using PROMETHEE (calculation and analysis were then carried out using Excel spreadsheets). The assigned weights of the considered criteria were extracted from the case study organization’s internal expertise during the focus group discussions. Feedback, using a five-point Likert scale, was received to evaluate the contribution of each indicator to sustainability strategies. All the responses were subsequently analyzed by researchers using the Microsoft Excel application to follow the relative importance index (RII) method to reveal the weights indicated in the tables below. Equation (1) reveals the formula that was used to calculate the relative index [

30,

46,

47]. The higher the weight, the higher the importance of sustainable energy strategies for PPAs according to the experts’ feedback.

W shows the weighting value of each indicator, provided by the respondent.

A is the highest weight.

N is the total number of respondents.

is the total number of responses that were evaluated with the number i (i = 1 to 5/Likert scale).

5. Results

The Visual PROMETHEE software, as part of the methodological approach of the analysis, was used to calculate the positive and negative flows for each alternative according to the weight of each criterion. The results are dependent on net Phi flow, which occurs using the addition of the positive outranking flow (Phi+), which states the degree to which the PPA alternative outranks other alternatives, and the negative outranking flow (Phi−), which states the degree to which the PPA alternative is outranked by all other alternatives [

48,

49]. Following the aim of this research as expressed using a case study, the positive outranking flow (Phi+) revealed the degree to which a PPA structure dominated over the others in terms of the use of TBL-related sustainability indicators and thus, the degree of their consideration by the PPA practitioners to reach the final choice. Correspondingly, the negative outranking flow (Phi−) revealed the degree to which each PPA structure was dominated by other structures, denoting minor integration/utilization of the sustainable indicators in the PPA structure to reach the desired sustainability initiatives, and it exhibited a possibility for the incorporation and utilization of these indicators to further advance sustainability objectives.

In order to comprehend the efficacy of the technique, it is important to assess the fact that the scrutinized alternatives could have displayed more favorable characteristics had Phi possessed a greater value.

Table 6,

Table 7,

Table 8 and

Table 9 showcase the Phi values (the results from Visual PROMETHEE software for the analyzed scenarios).

Table 6 presents Scenario 1, which encompasses all of the sustainable indicators, including environmental-, social-, and economic-related. A fixed, escalation–indexation PPA pricing structure exhibited the highest score. Based on the analysis, it can be inferred that the sustainable indicators were deeply integrated into the internal PPA processes as a means of achieving sustainability objectives. It seemed that practitioners who utilized these indicators or similar sustainability (TBL)-related ones, consider them as contributing towards such initiatives. Considering that the full spectrum of sustainability is better addressed using all TBL-related criteria and the fact that fixed, escalation–indexation PPA pricing structure scores in the highest-ranking place create additional value in this scenario.

Scenario 2 (

Table 7) contains the environmental criteria. Following the results of this scenario, the fixed, escalation–indexation pricing structure dominated again, followed by hybrid structures (% of output). The present environmental issues appear to be a global concern. Emphasis on brand and additionality may lead offtakers to agree on higher-risk PPA structures (e.g., longer time period) in order to achieve a sustainable strategy. This structure offers all stakeholders with long-term visibility that is simple to explain and widely understood. Buyers seek to secure a long-term power price, contributing to overall environmental sustainability and further supporting green energy, while improving their position towards the wholesale market.

Scenario 3 (

Table 8) includes the social criteria. It seemed that the hybrid structures (% of output) scored higher than the others, with clawback scoring second place. Failure to meet buyer expectations can lead to failure of a PPA contract, and social benefits that derive from agreement by way of social acceptance can be endangered. Buyers seek a short-term strategy to minimize social risks and a proactive lens to maximize social and community benefits. Thus, these two structures seem more fitting for organizations that target short-term benefits in regard to power prices or an inclination towards additional green power.

Finally, Scenario 4 (

Table 9) comprises the economic criteria. In this case, a floating price and discount to market with caps and floors pricing structure ranked first, followed by the fixed, escalation andindexation structure already popular to practitioners. The results can be interpreted from an economic perspective in which developers seek lending opportunities. Visibility regarding revenue over the PPA term is clearly realized by the banks, and thus the bankability of the project increases. Banks’ attention to the PPA term swings away from forecasted wholesale prices, offtakers’ creditworthiness, and contract strength. Knowing the significance and placement of caps and floors is critical for this pricing structure. The positioning of the floor, in particular, is critical to the RES project’s level of income security.

The three top respondent preferences revealing the PPA structure for achieving each desired sustainability initiative are highlighted in

Figure 7.

6. Discussion

Existing research on PPAs provides limited direction on how sustainability strategies can be achieved using such bilateral agreements [

50]. Most researchers approach sustainability in projects through the enhancement of all three dimensions of the TBL while preserving basic principles such as risk, cost, time, quality, and effort within an acceptable range, which can be vital for PPAs [

4,

51]. However, in their study, Ray and Chakraborty [

52] indicated the complex and lengthy process of PPA deals under the sustainability concept, which cannot be identified as a part of the TBL umbrella but rather in terms of the economic aspect. According to Stanitsas and Kirytopoulos [

4], each project’s perspective differs, and the aspects that contribute to the overall sustainability should be determined case by case. This should also be the case for PPAs that present elevated intricacy and request careful consideration in order for practitioners to address the desired sustainability concerns. A way for practitioners to guide themselves through this process is via the use of TBL-related indicators as defined in this study.

The objective of this research is to provide an overview of various pricing structures as well as commentary on risk implications and settlement considerations to assist practitioners in understanding the potential alternatives accessible to them. The aim of this research is to introduce a multicriteria decision analysis-based method, namely PROMETHEE, to evaluate the implementation of sustainability-related strategies using PPAs. The authors’ intention lies in revealing the PPA pricing structure most appropriate to stakeholders’ needs by using the suggested method to assess alternatives, allowing PPA practitioners to follow sustainable energy strategies. The authors designed and introduced a succinct, easily understandable process that is based on 21 predefined sustainability indicators, which, according to the authors, are of vital meaning when determining PPAs. The purpose of the conducted focus group conversations with the organization’s experts is to deliver simplicity, proper description, comprehensibility, and suitability in the interest of this research’s aims and to practically align with practitioners in terms of using the proposed MCDA method for their sustainability-related needs. This method was chosen as a way to explore not only individual experts’ views on PPA-related topics but also how sense-making occurs in action. The PROMETHEE method allowed for the analysis of four distinct stakeholder attitude scenarios, depending on the sustainability dimension that the focus was on, in order to reveal the most fitting PPA pricing structure. In the case examined, the results revealed a preference towards fixed pricing structures in which a standard price is introduced, allowing the counterparties to predict their revenues regardless of market fluctuations. This provides both parties long-term price certainty and greater predictability in business operations.

In particular, the focus group conversations and the MCDA method, which investigated the abovementioned indicators, contribute to enforcing a solid basis for sustainability strategies. The combination of these two research methods was intended to draw out the potential for reaching the aim of this study. This study makes a distinct contribution to both theory and practice by elucidating fundamental sustainability strategies for PPAs through the use of sustainability-related indicators at the decision stage, used by PPA practitioners, thereby enriching the existing body of knowledge. The practical implications of these findings involve assisting senior management in devising strategies that bolster the execution of sustainable initiatives. As the PPA theme is constantly evolving and there is unique and large flexibility in the schemes that can be introduced to constantly changing European power markets, it is the authors’ belief that the findings generally apply to most organizations.

The authors’ intention lies in the establishment of a widely accepted strategy through the use of sustainability indicators at the PPA contractual stage that leads to sustainable results. The academic contribution of this research focuses on revealing the most fitting indicators (strategies) as they are communicated from the practitioners’ perspective in order to deepen the understanding of vital PPA endeavors. PPA practitioners can look upon these indicators and to aid in achieving sustainable results from future deals.

The methodological limitations of this study stem from the fact that MCDA results are dependent on post-hoc analysis and may contain inaccuracies. Thus, more studies to cross-check the precision and the applicability of the extracted indicators for delivering sustainable results into PPAs are essential. A common limitation of research papers addressed to results is that, in most cases, they cannot be generalized until they are repeated in multiple cases. As the feedback received in this study comes only from one large-scale organization, more participants could differentiate the concluding results.

Finally, future research may focus on the practical, evidence-based experience and exploitation of these indicators by PPA practitioners in delivering sustainable strategies. Also, fine-tuning of the alternatives, be they pricing, volume, or other possible alternatives, for different types of organizations would move this research forward. A potential avenue for future research could involve examining the feasibility of these indicators before and during the contract negotiation process. Comparison between the contractual/negotiation stages of PPAs can reveal valuable assumptions. By considering the constantly transforming nature of energy markets, it is highly unlikely that the proposed pricing PPA structures will become any simpler, as they must correspond to a unique risk–benefit balance between RES producers and offtakers. This allows counterparties to select the PPA structure that best meets their needs and aids in adapting to volatility in the wholesale power market.

7. Conclusions

Amongst the various PPAs’ advantages (stabilizing electricity costs, hedging, etc.), PPAs can also be leveraged as a powerful tool for creating sustainability initiatives. They constitute an outstanding mechanism for environmental sustainability initiatives such as the displacement of greenhouse gas emissions, cleaner air from reduced pollution, and water savings. PPA buyers also can utilize energy attribute certificates (EACs) produced from a project for their own green power, claiming the environmental attributes of the clean energy the project produces [

19,

53].

Regarding social sustainability, gains come with community engagement (local infrastructure, grants to, services, etc.); local employment, indigenous community benefits through cultural and landscape protections; actively regenerating landscapes through tree-planting, invasive species removal; land for multiuse purposes; co-investment and co-ownership opportunities, etc.

On the economic sustainability side, PPAs are usually perceived in terms of financing considerations. As mentioned in the Results section, some pricing structures tend to be less popular than others; however, counterparties need to find common ground. Both sides are usually in favor of the long-term price visibility that fixed price PPAs offer, as the reduced-price visibility lowers the value of the PPA, which is directly related to the RES asset, and, consequently, acquiring funding from banks is key to these deals.

By utilizing the proposed approach to compare various PPA pricing structures, practitioners can make informed decisions regarding sustainable strategies. The authors devised an MCDA technique to introduce PPA initiatives transparently and encourage schemes that enhance the projects’ overall sustainability. A series of key learnings that derive from this research via the utilization of the proposed model occur for PPA practitioners. It is vital for PPA tenders and negotiations to include sustainability benefits. A PPA is of enormous value to both parties, which, if implemented using the MCDA method, provides clarity and promotes sustainability-oriented schemes.

This paper aimed to reveal the path towards the identification of the most suitable PPA pricing structure based on stakeholders’ needs using an MCDA-based method, namely PROMETHEE, that evaluates various alternatives, enabling PPA practitioners to implement sustainable energy strategies. The methodological approach followed the development of a concise and understandable process based on 21 predefined sustainability indicators that they deemed essential when determining sustainability strategies using PPAs. The purpose of the focus group discussions with the organization’s experts was to ensure that the proposed MCDA method was simple, clear, and appropriate for the research objectives and could be practically applied by practitioners for their sustainability-related requirements. Amongst the comparison of all TBL criteria and the environmental-related ones, the fixed, escalation and–indexation PPA pricing structure obtained the highest score, showcasing high applicability when it comes to PPAs; suggesting that the analyzed sustainability indicators were highly integrated into the internal PPA processes, enabling the achievement of sustainability strategies. The research revealed that the full spectrum of sustainability is better addressed by all TBL-related criteria, and the fixed, escalation–and indexation PPA pricing structure’s top ranking adds further value to this scenario. By evaluating the social sustainability indicators, the hybrid structures received the highest score (% of output). When buyers’ expectations are not met, PPA contracts may fail, and social benefits derived from PPA agreements in terms of social acceptance may be at risk. Buyers prefer a short-term strategy to reduce social risks and a proactive approach to maximize social and community benefits. In reference to the economic criteria, the floating price, discount to market with caps and floors pricing structure dominated. These findings can be understood from the developer/RES producer perspective, as they seek opportunities for financing. The banks can clearly see the revenue stream over the PPA term, increasing the project’s bankability, especially with the placement of a floor that determines the RES project’s level of income security.

By incorporating sustainability strategies into contracts in a manner that incentivizes price, the delivery risk is mitigated, ultimately guaranteeing both an increase in final price and project certainty.

The proposed model urges practitioners to be flexible and collaborative in their approaches to achieve the best results. By utilizing open-ended criteria as an input for the model to set the sustainability orientation and provide flexibility, practitioners maintain dialogue using contract negotiations to deliver sustainability opportunities.

To effectively implement a MCDA-based technique, practitioners need to understand all available options (anything that can be of use for the sustainability of the project). They also need to align stakeholders from the beginning of the process and make their intentions known. Finally, it is important for practitioners to define the shortlisting process before the request for procurement (RFP) and to identify how they are going to measure sustainability success. Ultimately, PPAs will continue to shift organizations in a more sustainable direction, improving our societies.

Author Contributions

Conceptualization, M.S.; Methodology, M.S.; Validation, K.K.; Investigation, M.S.; Writing—review & editing, M.S.; Visualization, M.S.; Supervision, K.K.; Project administration, M.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Acknowledgments

The successful execution of this research was made possible owing to collaboration with ABO Wind, a major European organization specializing in engineering, design, and construction. The authors would like to express their gratitude for the organization’s generous assistance. Additionally, the authors extend their appreciation to all the respondents who provided their time and feedback, thereby contributing significant insights to the study. The authors would also like to thank the editor and the reviewers who provided constructive feedback that was incorporated in the paper.

Conflicts of Interest

The authors affirm that they have no conflict of interest to disclose. Moreover, the large-scale organization, ABO Wind, did not exert any direct or indirect influence on this study’s design, data collection, analysis, interpretation, or manuscript preparation.

References

- Thaher, Y.A.Y.; Jaaron, A.A.M. The impact of sustainability strategic planning and management on the organizational sustainable performance: A developing-country perspective. J. Environ. Manag. 2022, 305, 114381. [Google Scholar] [CrossRef] [PubMed]

- Stanitsas, M.; Kirytopoulos, K.; Vareilles, E. Facilitating sustainability transition through serious games: A systematic literature review. J. Clean. Prod. 2019, 208, 924–936. [Google Scholar] [CrossRef]

- Haratian, M.; Tabibi, P.; Sadeghi, M.; Vaseghi, B.; Poustdouz, A. A renewable energy solution for stand-alone power generation: A case study of KhshU Site-Iran. Renew. Energy 2018, 125, 926–935. [Google Scholar] [CrossRef]

- Stanitsas, M.; Kirytopoulos, K. Underlying factors for successful project management to construct sustainable built assets. Built Environ. Proj. Asset Manag. 2022, 12, 129–146. [Google Scholar] [CrossRef]

- Mendicino, L.; Menniti, D.; Pinnarelli, A.; Sorrentino, N. Corporate power purchase agreement: Formulation of the related levelized cost of energy and its application to a real life case study. Appl. Energy 2019, 253, 113577. [Google Scholar] [CrossRef]

- Jain, S. Exploring structures of power purchase agreements towards supplying 24x7 variable renewable electricity. Energy 2022, 244, 122609. [Google Scholar] [CrossRef]

- Bruck, M.; Sandborn, P. Pricing bundled renewable energy credits using a modified LCOE for power purchase agreements. Renew. Energy 2021, 170, 224–235. [Google Scholar] [CrossRef]

- Gabrielli, P.; Aboutalebi, R.; Sansavini, G. Mitigating financial risk of corporate power purchase agreements via portfolio optimization. Energy Econ. 2022, 109, 105980. [Google Scholar] [CrossRef]

- Słotwiński, S. The Significance of the “Power Purchase Agreement” for the Development of Local Energy Markets in the Theoretical Perspective of Polish Legal Conditions. Energies 2022, 15, 6691. [Google Scholar] [CrossRef]

- Marron, S.T.; Tyurin, E.N.; Wile, J.H.; Trader, G. Everyone wins: Renegotiating purchase power agreements. Electr. J. 1997, 10, 76–82. [Google Scholar] [CrossRef]

- Niu, Y.; Jiao, L.; Korneev, A. Credit development strategy of China’s banking industry to the electric power industry. Herit. Sustain. Dev. 2022, 4, 53–60. [Google Scholar] [CrossRef]

- Gabrielli, P.; Hilsheimer, P.; Sansavini, G. Storage power purchase agreements to enable the deployment of energy storage in Europe. iScience 2022, 25, 104701. [Google Scholar] [CrossRef] [PubMed]

- Duraković, B.; Mešetović, S. Thermal performances of glazed energy storage systems with various storage materials: An experimental study. Sustain. Cities Soc. 2019, 45, 422–430. [Google Scholar] [CrossRef]

- Crespi, E.; Colbertaldo, P.; Guandalini, G.; Campanari, S. Energy storage with Power-to-Power systems relying on photovoltaic and hydrogen: Modelling the operation with secondary reserve provision. J. Energy Storag. 2022, 55, 105613. [Google Scholar] [CrossRef]

- Ghiassi-Farrokhfal, Y.; Ketter, W.; Collins, J. Making green power purchase agreements more predictable and reliable for companies. Decis. Support Syst. 2021, 144, 113514. [Google Scholar] [CrossRef]

- Setya Budi, R.F.; Hadi, S.P. Indonesia’s deregulated generation expansion planning model based on mixed strategy game theory model for determining the optimal power purchase agreement. Energy 2022, 260, 125014. [Google Scholar] [CrossRef]

- Miller, N.W. Unshackled: Hawai’i’s Innovative New Power Purchase Agreements for Hybrid Solar Photovoltaic and Energy Storage Projects [Technology Leaders]. IEEE Electrif. Mag. 2022, 10, 7–97. [Google Scholar] [CrossRef]

- Re-Source|European Platform for Corporate Renewable Energy Sourcing. Risk Mitigation for Corporate Renewable PPAs; Re-Source: Brussels, Belgium, 2020. [Google Scholar]

- Taghizadeh-Hesary, F.; Yoshino, N.; Rasoulinezhad, E.; Rimaud, C. Power purchase agreements with incremental tariffs in local currency: An innovative green finance tool. Glob. Financ. J. 2021, 50, 100666. [Google Scholar] [CrossRef]

- Harada, L.N.; Coussi, M. Power purchase agreements: An emerging tool at the centre of the European energy transition a focus on France. Eur. Energy Environ. Law Rev. 2020, 29, 195–205. [Google Scholar] [CrossRef]

- WBCSD. Pricing Structures for Corporate Renewable PPAs; WBCSD: Geneva, Switzerland, 2021; p. 19. [Google Scholar]

- WBCSD. Cross-Border Renewable PPAs in Europe: An Overview for Corporate Buyers; WBCSD: Geneva, Switzerland, 2020; p. 40. [Google Scholar]

- Deloitte. Accelerate Accounting for Power Purchase Agreements; Deloitte Global: Helsinki, The Netherland, 2022. [Google Scholar]

- Akinci, E.; Ciszuk, S. Nordic PPAs—Effects on Renewable Growth and Implications for Electricity Markets. In Energy Insight 84; The Oxford Institute for Energy Studies, Ed.; 2021; Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2021/02/Insight-84-Nordic-PPAs-effects-on-renewable-growth-and-implications-for-electricity-markets.pdfp (accessed on 1 February 2021).

- Pexapark. Deconstructing Baseload PPA; Pexapark: Wiesenstrasse, Switzerland, 2021. [Google Scholar]

- Rauch, J.N. The Effect of Different Market Conditions on the Hedge Value of Long-Term Contracts for Zero-Fuel-Cost Renewable Resources. Electr. J. 2013, 26, 44–51. [Google Scholar] [CrossRef]

- Aryal, S.; Dhakal, S. Medium-term assessment of cross border trading potential of Nepal’s renewable energy using TIMES energy system optimization platform. Energy Policy 2022, 168, 113098. [Google Scholar] [CrossRef]

- Ali, B.; Hedayati-Dezfooli, M.; Gamil, A. Sustainability assessment of alternative energy power generation pathways through the development of impact indicators for water, land, GHG emissions, and cost. Renew. Sustain. Energy Rev. 2023, 171, 113030. [Google Scholar] [CrossRef]

- Kim, G.; Park, K.; Jeon, H.W.; Okudan Kremer, G.E. Usage dynamics of environmental sustainability indicators for manufacturing and service systems. J. Clean. Prod. 2022, 360, 132062. [Google Scholar] [CrossRef]

- Stanitsas, M.; Kirytopoulos, K. Investigating the significance of sustainability indicators for promoting sustainable construction project management. Int. J. Constr. Manag. 2021, 23, 434–448. [Google Scholar] [CrossRef]

- Stanitsas, M.; Kirytopoulos, K.; Leopoulos, V. Integrating sustainability indicators into project management: The case of construction industry. J. Clean. Prod. 2021, 279, 123774. [Google Scholar] [CrossRef]

- Rajabi, S.; El-Sayegh, S.; Romdhane, L. Identification and assessment of sustainability performance indicators for construction projects. Environ. Sustain. Indic. 2022, 15, 100193. [Google Scholar] [CrossRef]

- Stanitsas, M.; Kirytopoulos, K.; Aretoulis, G. Evaluating Organizational Sustainability: A Multi-Criteria Based-Approach to Sustainable Project Management Indicators. Systems 2021, 9, 58. [Google Scholar] [CrossRef]

- Wibeck, V.; Linnér, B.-O.; Alves, M.; Asplund, T.; Bohman, A.; Boykoff, M.T.; Feetham, P.M.; Huang, Y.; Nascimento, J.; Rich, J.; et al. Stories of Transformation: A Cross-Country Focus Group Study on Sustainable Development and Societal Change. Sustainability 2019, 11, 2427. [Google Scholar] [CrossRef]

- Andreopoulou, Z.; Koliouska, C.; Galariotis, E.; Zopounidis, C. Renewable energy sources: Using PROMETHEE II for ranking websites to support market opportunities. Technol. Forecast. Soc. Chang. 2018, 131, 31–37. [Google Scholar] [CrossRef]

- Wiecek, M.; Ehrgott, M.; Fadel, G.; Figueira, J. Multiple criteria decision making for engineering. Omega-Int. J. Manag. Sci. 2008, 36, 337–339. [Google Scholar] [CrossRef]

- Doumpos, M.; Zopounidis, C. Preference disaggregation and statistical learning for multicriteria decision support: A review. Eur. J. Oper. Res. 2011, 209, 203–214. [Google Scholar] [CrossRef]

- Carriço, N.J.G.; Gonçalves, F.V.; Covas, D.I.C.; Almeida, M.d.C.; Alegre, H. Multi-criteria Analysis for the Selection of the Best Energy Efficient Option in Urban Water Systems. Procedia Eng. 2014, 70, 292–301. [Google Scholar] [CrossRef]

- Angilella, S.; Pappalardo, M.R. Assessment of a failure prediction model in the European energy sector: A multicriteria discrimination approach with a PROMETHEE based classification. Expert Syst. Appl. 2021, 184, 115513. [Google Scholar] [CrossRef]

- Karasakal, E.; Eryılmaz, U.; Karasakal, O. Ranking using PROMETHEE when weights and thresholds are imprecise: A data envelopment analysis approach. J. Oper. Res. Soc. 2022, 73, 1978–1995. [Google Scholar] [CrossRef]

- Angelis, A.; Kanavos, P. Multiple Criteria Decision Analysis (MCDA) for evaluating new medicines in Health Technology Assessment and beyond: The Advance Value Framework. Soc. Sci. Med. 2017, 188, 137–156. [Google Scholar] [CrossRef]

- Banihashemi, S.; Hosseini, M.R.; Golizadeh, H.; Sankaran, S. Critical success factors (CSFs) for integration of sustainability into construction project management practices in developing countries. Int. J. Proj. Manag. 2017, 35, 1103–1119. [Google Scholar] [CrossRef]

- Vinodh, S.; Jeya Girubha, R. PROMETHEE based sustainable concept selection. Appl. Math. Model. 2012, 36, 5301–5308. [Google Scholar] [CrossRef]

- Tong, L.; Pu, Z.; Chen, K.; Yi, J. Sustainable maintenance supplier performance evaluation based on an extend fuzzy PROMETHEE II approach in petrochemical industry. J. Clean. Prod. 2020, 273, 122771. [Google Scholar] [CrossRef]

- Wu, Y.; Wang, J.; Hu, Y.; Ke, Y.; Li, L. An extended TODIM-PROMETHEE method for waste-to-energy plant site selection based on sustainability perspective. Energy 2018, 156, 1–16. [Google Scholar] [CrossRef]

- Waris, M.; Shahir Liew, M.; Khamidi, M.F.; Idrus, A. Criteria for the selection of sustainable onsite construction equipment. Int. J. Sustain. Built Environ. 2014, 3, 96–110. [Google Scholar] [CrossRef]

- Olomolaiye, P.O.; Wahab, K.A.; Price, A.D.F. Problems influencing craftsmen’s productivity in Nigeria. Build. Environ. 1987, 22, 317–323. [Google Scholar] [CrossRef]

- Abdullah, L.; Chan, W.; Afshari, A. Application of PROMETHEE method for green supplier selection: A comparative result based on preference functions. J. Ind. Eng. Int. 2019, 15, 271–285. [Google Scholar] [CrossRef]

- Arikan, A.; Sanlidag, T.; Sayan, M.; Uzun, B.; Uzun Ozsahin, D. Fuzzy-Based PROMETHEE Method for Performance Ranking of SARS-CoV-2 IgM Antibody Tests. Diagnostics 2022, 12, 2830. [Google Scholar] [CrossRef]

- Pawan, W. 11—Peer-to-peer energy trading with blockchain: A case study. In Blockchain-Based Systems for the Modern Energy Grid; Padmanaban, S., Dhanaraj, R.K., Holm-Nielsen, J.B., Krishnamoorthi, S., Balusamy, B., Eds.; Academic Press: Cambridge, MA, USA, 2023; pp. 171–188. [Google Scholar] [CrossRef]

- Fernández-Sánchez, G.; Rodríguez-López, F. A methodology to identify sustainability indicators in construction project management—Application to infrastructure projects in Spain. Ecol. Indic. 2010, 10, 1193–1201. [Google Scholar] [CrossRef]

- Ray, M.; Chakraborty, B. Impact of demand flexibility and tiered resilience on solar photovoltaic adoption in humanitarian settlements. Renew. Energy 2022, 193, 895–912. [Google Scholar] [CrossRef]

- Gohdes, N.; Simshauser, P.; Wilson, C. Renewable entry costs, project finance and the role of revenue quality in Australia’s National Electricity Market. Energy Econ. 2022, 114, 106312. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).