Multiple Virtual Power Plants Transaction Matching Strategy Based on Alliance Blockchain

Abstract

:1. Introduction

- (1)

- We firstly propose a transaction matching mechanism among multi-VPPs to make VPPs achieve a power balance through direct transactions among VPPs as much as possible. Moreover, the pricing update strategy of VPPs is designed to make VPPs have higher trading flexibility.

- (2)

- We introduce the alliance blockchain technology where each VPP node has a certain amount of computation, thus avoiding the traditional problem of large computations and improving the system efficiency.

- (3)

- We analyze the coordinated operation of multiple VPPs in multiple time scales and their market trading behavior.

2. Two-Stage Game Model

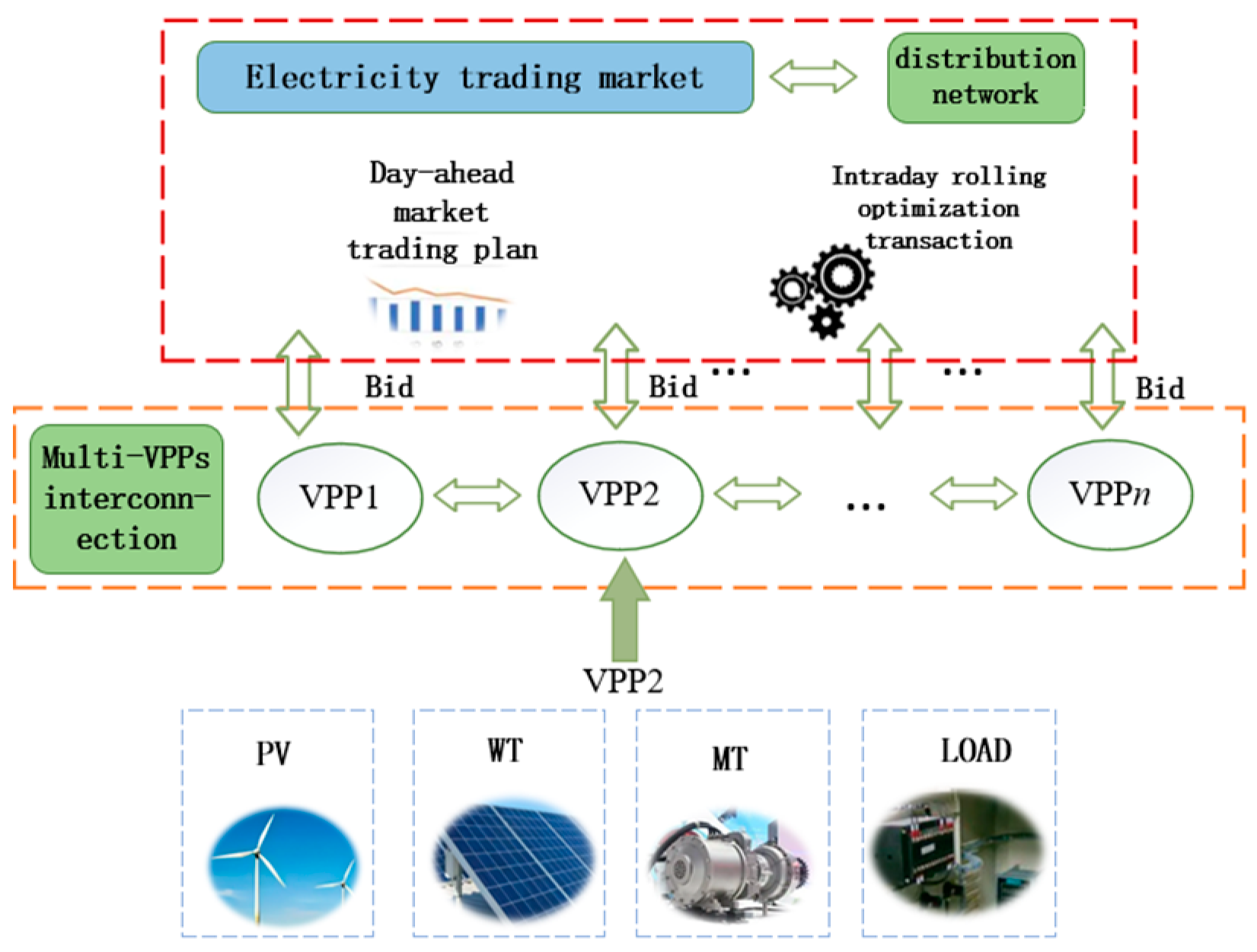

2.1. Multi-VPPs System Framework

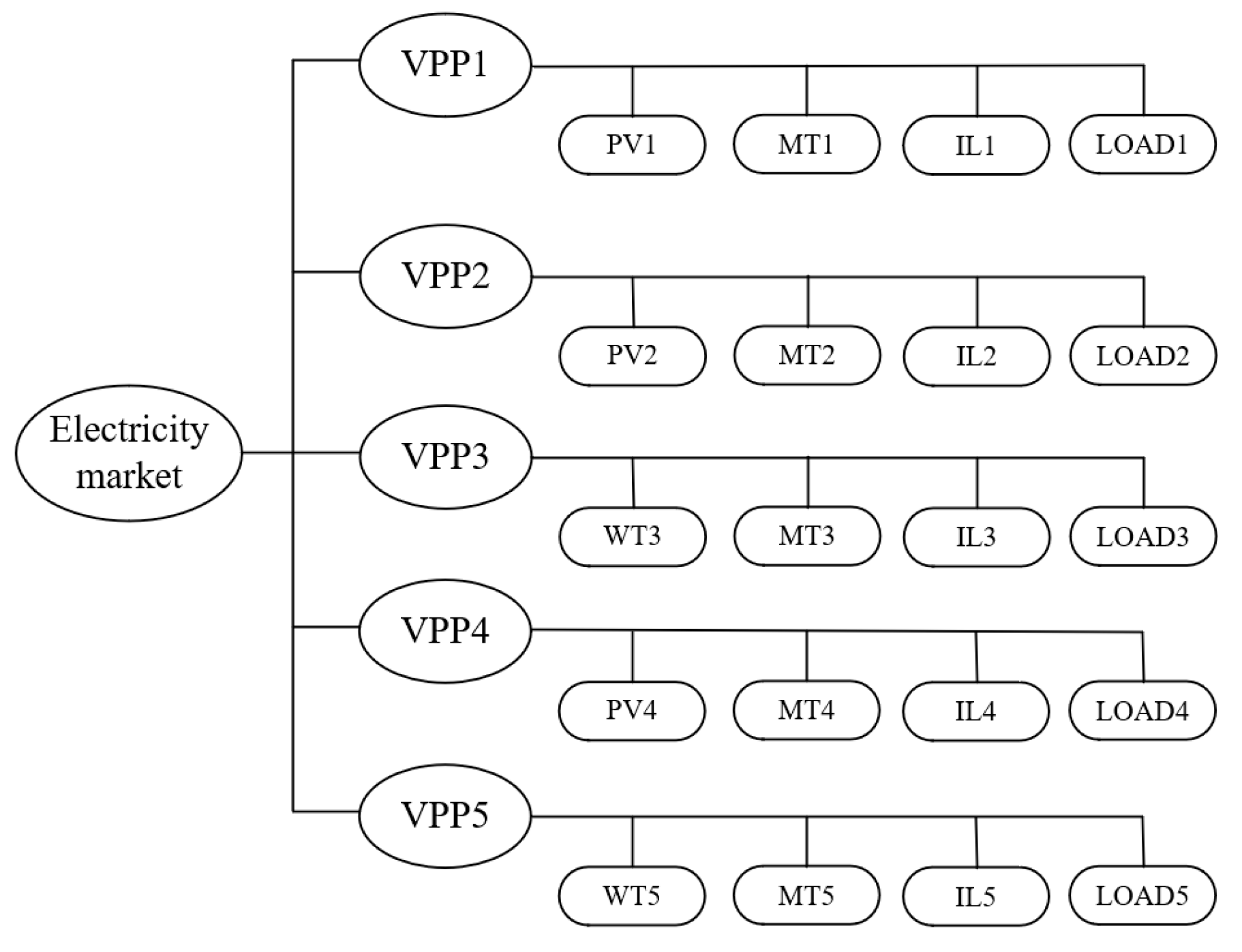

- All stakeholders in the region, including wind power (WT), photovoltaic (PV), and various loads and micro gas turbines (MT), create their own power generation and consumption behavior through a cooperative game to minimize the total cost of the virtual power plant according to their own demand and forecast, while ensuring that the interests of each device are not compromised, and they then report the information to a VPP after the game is completed.

- Each VPP integrates the information of all units in its own region, calculates the interactive power with the outside, determines its initial offer, and then updates its trading price according to current trading status until it reaches the trading goal. After all the power-shortage VPPs have purchased the corresponding power or all the power-surplus VPPs have sold the corresponding power, the remaining power will be traded within the distribution network.

- Each VPP will submit its respective trading strategy to the power market for review and approval, and the trading will be completed after the review is approved.

2.2. Day-Ahead Two-Stage Game Model

2.2.1. First Stage of Game Model

2.2.2. Second Stage of Game Model

2.2.3. Constraint Condition

- MT output and climbing constraint

- 2.

- IL cut-off volume and duration constraints

- 3.

- The operating constraints of the renewable energy units are the same as those of the conventional model and are not repeated in this paper.

2.3. Intraday Trading

3. Transaction Process under Alliance Blockchain

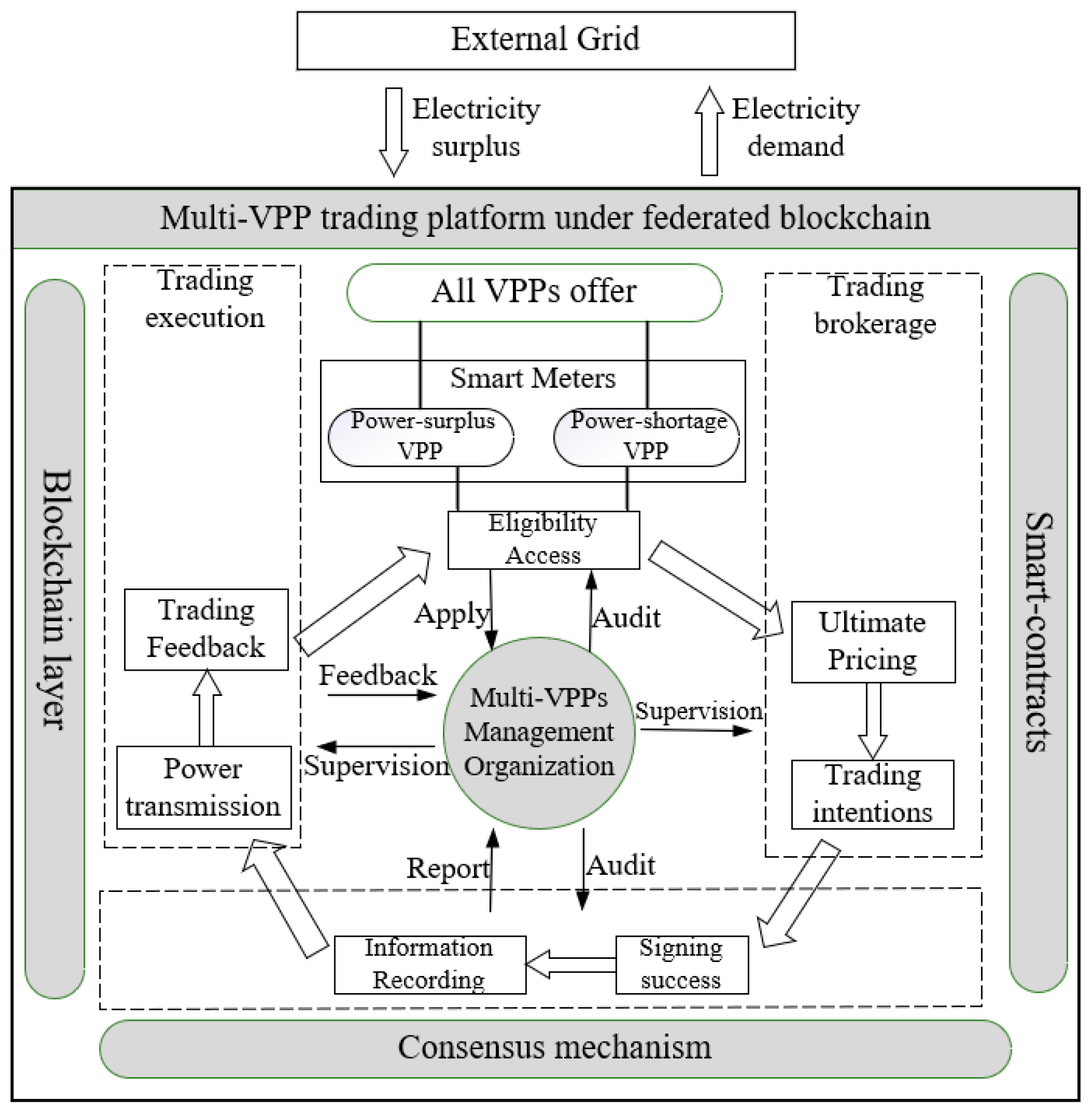

- Weak centralization. For multi-regional VPPs coordinated trading, if fully decentralized, each VPP will set its own electricity price and trading behavior with the goal of maximizing its own economic benefits. Similarly disadvantageous, full centralization brings a large amount of computation to the central node and reduces the efficiency of the system. Therefore, this paper establishes a multi-VPPs management organization as a pre-selected node, whose role is to review node qualifications, supervise the entire transaction, write information and provide follow-up feedback.

- Each VPP in the alliance blockchain can join the blockchain as a node by the consensus mechanism and participate in the block writing process after the review of the preselected node. Likewise, each VPP can read the block data, which is convenient for multi-VPPs to grasp the trading information of other subjects and make their own correct gaming choices.

- Smart contract. On the platform of a blockchain, after the trading is completed between multi-VPPs, the trading settlement can be automatically executed on the smart contract using electronic signature, thus improving efficiency.

- Firstly, each VPP internally determines its own market trading behavior and electricity price after gaming, joins the blockchain platform through a consensus mechanism, and uploads its own trading information through smart meters to build a global trading information database. At this point, the multi-VPPs management organization is required to audit its historical creditworthiness as well as power generation capacity, and after the audit is passed, it obtains an electronic signature to register as a block.

- Secondly, under the supervision of the multi-VPPs management organization and according to the trading aggregation mechanism in this paper, direct trading is completed between VPPs, and after reaching the trading, both parties provide their own electronic signatures, sign smart contracts and obtain keys, and the multi-VPPs management organization stores all the smart contracts.

- Finally, both parties of the trading only need to carry out power transmission according to the contract requirements. If there is a breach of contract during the execution of the trading, the multi-VPPs management organization will record it on the record and deduct some of its credit scores. In the future, scrutiny in the future qualification access reviews will be strengthened.

4. Solving Method

5. Case Study

5.1. Illustrations

5.2. Analysis of Simulation Results

5.2.1. Optimization Results in the First Stage

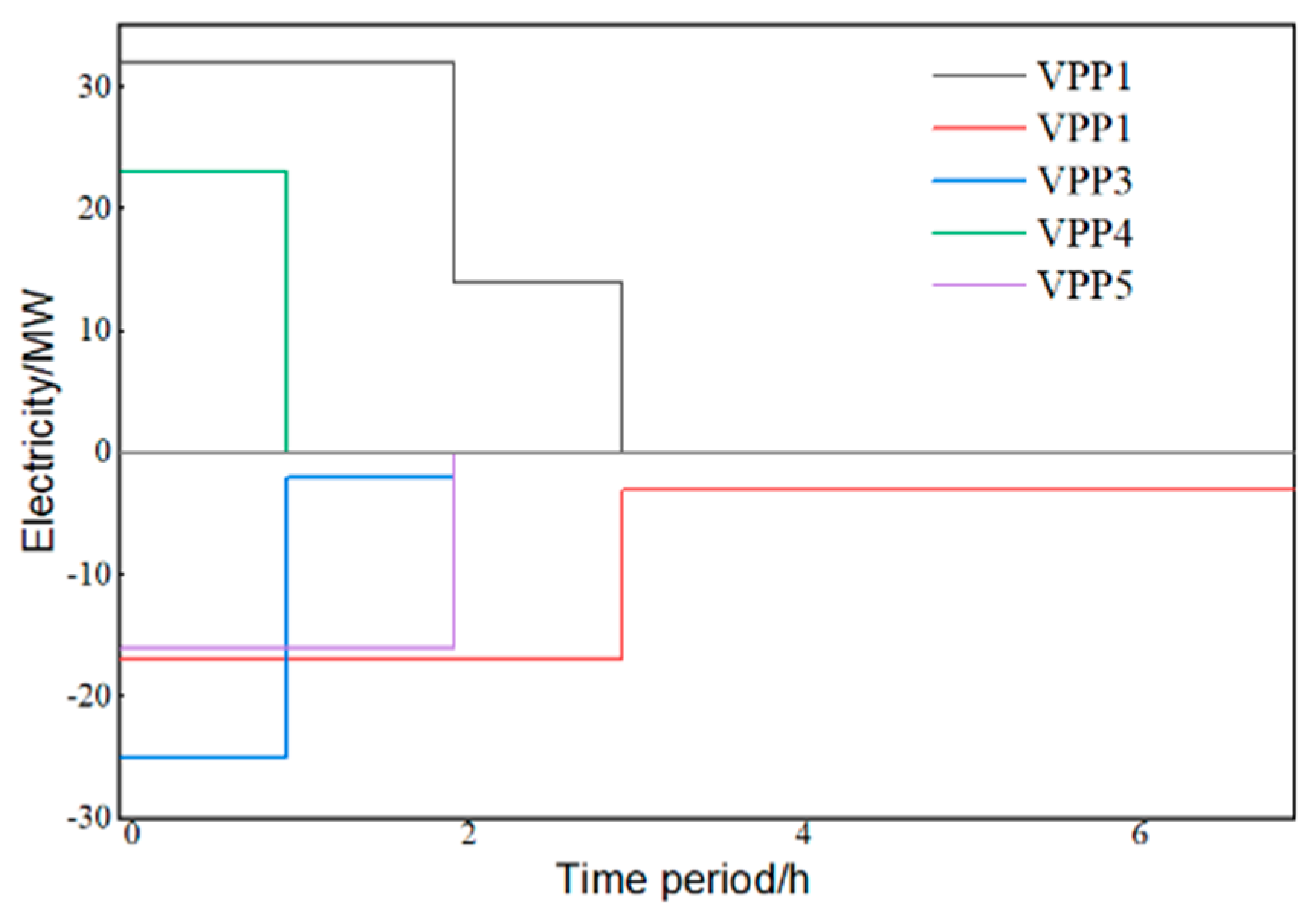

5.2.2. Analysis of the Transaction Matching Process

5.2.3. Comparative Analysis of Methods

- Economic analysis

- 2.

- Efficient analysis

6. Conclusions

- Compared with other traditional gaming methods, the transaction matching strategy proposed in this paper can ensure that the overall benefits of the multi-VPPs group are maximized while ensuring that the benefits of each VPP are not compromised. The reason is that the weight of direct transactions among multi-VPPs is increased. Moreover, it can flexibly set the price and select the trading partners to improve the flexibility of trading.

- The comparison of the solution speed shows that the proposed method in this paper can greatly improve the efficiency of the system. Using the blockchain technology, the original centralized problem can be decomposed into several problems, and each VPP can conduct distributed computing to improve the system solving speed and ensure the normal operation of the system.

- In this paper, multi-VPPs can participate in the day-ahead trading market and the intraday trading market. The simulation example proves that this method can be applied to the short time scale of intraday trading and compensate for the day-ahead trading to improve the system accuracy.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Rui, W.; Qiuye, S.; Dazhong, M.; Xuguang, H. Line Impedance Cooperative Stability Region Identification Method for Grid-Tied Inverters under Weak Grids. IEEE Trans. Smart Grid 2020, 11, 2856–2866. [Google Scholar] [CrossRef]

- Wang, Y.; Zhang, Y.; Qi, X.; Wang, M.; Wang, X. A Bi-Level Optimization Model for Virtual Power Plant Membership Selection Considering Load Time Series. Sustainability 2023, 15, 2138. [Google Scholar] [CrossRef]

- Rui, W.; Qiuye, S.; Pinjia, Z.; Yonghao, G.; Dehao, Q.; Peng, W. Reduced-Order Transfer Function Model of the Droop-Controlled Inverter via Jordan Continued-Fraction Expansion. IEEE Trans. Energy Convers. 2020, 35, 1585–1595. [Google Scholar] [CrossRef]

- Wang, Y.; Ai, X.; Tan, Z.; Yan, L.; Liu, S. Interactive dispatch modes and bidding strategy of multiple virtual power plants based on demand response and game theory. IEEE Trans. Smart Grid 2016, 7, 510–519. [Google Scholar] [CrossRef]

- Gholami, K.; Behi, B.; Arefi, A.; Jennings, P. Grid-Forming Virtual Power Plants: Concepts, Technologies and Advantages. Energies 2022, 15, 9049. [Google Scholar] [CrossRef]

- Li, Y.; Gao, D.W.; Gao, W.; Zhang, H.; Zhou, J. A Distributed Double-Newton Descent Algorithm for Cooperative Energy Management of Multiple Energy Bodies in Energy Internet. IEEE Trans. Ind. Inform. 2021, 17, 5993–6003. [Google Scholar] [CrossRef]

- Mei, G.; Gong, J.; Zheng, Y. Scheduling strategy for multi-energy complementary virtual power plant considering the correlation between wind and solar output and carbon emission quota. Proc. CSU-EPSA 2021, 33, 62–69. [Google Scholar]

- Wang, R.; Sun, Q.; Ma, D.; Liu, Z. The Small-Signal Stability Analysis of the Droop-Controlled Converter in Electromagnetic Timescale. IEEE Trans. Sustain. Energy 2019, 10, 1459–1469. [Google Scholar] [CrossRef]

- Zhou, B.; Lu, L.; Gao, H.; Tan, X.; Wu, H. Optimal trading strategy for virtual power plants based on two-stage stochastic programming. Power Constr. 2018, 39, 70–77. [Google Scholar]

- Wang, R.; Sun, Q.; Hu, W.; Li, Y.; Ma, D.; Wang, P. SoC-Based Droop Coefficients Stability Region Analysis of the Battery for Stand-Alone Supply Systems with Constant Power Loads. IEEE Trans. Power Electron. 2021, 36, 7866–7879. [Google Scholar] [CrossRef]

- Dong, L.; Tu, S.; Li, Y.; Pu, T. A Stackelberg game model for dynamic pricing and energy management of multiple virtual power plants using metamodel-based optimization method. Power Grid Technol. 2020, 44, 973–981. [Google Scholar]

- Feng, C.; Liang, B.; Li, Z.; Liu, W.; Wen, F. Peer-to-Peer Energy Trading under Network Constraints Based on Generalized Fast Dual Ascent. IEEE Trans. Smart Grid 2022, 14, 1441–1453. [Google Scholar] [CrossRef]

- Zhou, B.; Zhang, Y.; Zang, T.; Cao, Q.; Zhang, Y.; Peng, H. Blockchain-based master-slave game for optimal operation of multiple virtual power plants. Power Syst. Autom. 2022, 46, 155–163. [Google Scholar]

- Cruz-De-Jesús, E.; Martínez-Ramos, J.L.; Marano-Marcolini, A. Optimal Scheduling of Controllable Resources in Energy Communities: An Overview of the Optimization Approaches. Energies 2023, 16, 101. [Google Scholar] [CrossRef]

- Liu, Z.; Huang, B.; Hu, X.; Du, P.; Sun, Q. Blockchain-Based Renewable Energy Trading Using Information Entropy Theory. IEEE Trans. Netw. Sci. Eng. 2023. [Google Scholar] [CrossRef]

- Damisa, U.; Nwulu, N.I.; Siano, P. Towards Blockchain-Based Energy Trading: A Smart Contract Implementation of Energy Double Auction and Spinning Reserve Trading. Energies 2022, 15, 4084. [Google Scholar] [CrossRef]

- Liu, Z.; Xu, Y.; Zhang, C.; Elahi, H.; Zhou, X. A blockchain-based trustworthy collaborative power trading scheme for 5G-enabled social internet of vehicles. Digit. Commun. Netw. 2022, 8, 976–983. [Google Scholar] [CrossRef]

- Huang, B.; Liu, L.; Zhang, H.; Li, Y.; Sun, Q. Distributed Optimal Economic Dispatch for Microgrids Considering Communication Delays. IEEE Trans. Syst. Man Cybern. Syst. 2019, 49, 1634–1642. [Google Scholar] [CrossRef]

- Chen, Y.; Wei, Z.; Xu, Z.; Wenjin, H.; Guoqiang, S.; Yizhou, Z. Optimal scheduling strategy of multiple virtual power plants under electricity market reform. Autom. Electr. Power Syst. 2019, 43, 42–49. [Google Scholar]

- Huang, B.N.; Zheng, S.; Wang, R.; Wang, H.; Xiao, J.F.; Wang, P. Distributed optimal control of DC microgrid considering balance of charge state. IEEE Trans. Energy Convers. 2022, 37, 2162–2174. [Google Scholar] [CrossRef]

- Wang, R.; Ma, D.; Li, M.-J.; Sun, Q.; Zhang, H.; Wang, P. Accurate Current Sharing and Voltage Regulation in Hybrid Wind/Solar Systems: An Adaptive Dynamic Programming Approach. IEEE Trans. Consum. Electron. 2022, 68, 261–272. [Google Scholar] [CrossRef]

- Li, Z.Y.; Shahidehpour, M.; Liu, X. Cyber-secure decentralized energy management for IoT-enabled active distribution networks. J. Mod. Power Syst. Clean Energy 2018, 6, 900–917. [Google Scholar] [CrossRef]

- Wang, R.; Li, W.; Sun, Q.; Li, Y.; Gui, Y.; Wang, P. Fully Distributed Dynamic Edge-Event-Triggered Current Sharing Control Strategy for Multi-Bus DC Microgrids with Power Coupling. IEEE Trans. Ind. Inform. 2022, 19, 5667–5678. [Google Scholar] [CrossRef]

| Evaluation Dimension | Public Chain | Alliance Chain | Private Chain |

|---|---|---|---|

| Node Access | No license required | License required | License required |

| Read Permissions | All nodes | All nodes | Central node only |

| Modify Permissions | All nodes | Pre-selected Nodes | Central node only |

| Centrality | Decentralized | Weakly centralized | Fully centralized |

| Efficiency | Low | Higher | Low |

| Security | Low | Higher | High |

| VPP | The First Round | The Second Round | ||

|---|---|---|---|---|

| Expected Trading Power (MW) | Trading Quotation (CNY/MW) | Expected Trading Power (MW) | Trading Quotation (CNY/MW) | |

| VPP1 | 32 | 0.82 | 32 | 0.82 |

| VPP2 | −17 | 0.71 | −17 | 0.71 |

| VPP3 | −2 | 0.72 | −2 | 0.72 |

| VPP4 | 0 | 0 | 0 | 0 |

| VPP5 | −16 | 0.72 | −16 | 0.72 |

| Matching Round | Trading Participants | Trading Power (MW) | Trading Price (CNY/MW) |

|---|---|---|---|

| 1 | VPP4–VPP3 | 23 | 0.785 |

| 2 | VPP1–VPP3 | 2 | 0.77 |

| VPP1–VPP5 | 16 | 0.77 | |

| 3 | VPP1–VPP2 | 14 | 0.8 |

| 4 | Distribution network–VPP5 | −16 | 0.72 |

| VPP | Scenario 1 | Scenario 2 | Scenario 3 |

|---|---|---|---|

| VPP1 | 173,684 | 190,122 | 190,936 |

| VPP2 | 155,389 | 175,638 | 157,256 |

| VPP3 | 177,529 | 180,537 | 187,235 |

| VPP4 | 186,239 | 195,891 | 217,439 |

| VPP5 | 142,234 | 179,025 | 147,682 |

| Total | 835,075 | 921,213 | 900,548 |

| Scenario | Trading Benefits (CNY) | Solving Time (s) |

|---|---|---|

| Scenario 3 | 900,548 | 31.8 |

| Scenario 4 | 853,287 | 65.2 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chu, T.; An, X.; Zhang, W.; Lu, Y.; Tian, J. Multiple Virtual Power Plants Transaction Matching Strategy Based on Alliance Blockchain. Sustainability 2023, 15, 6939. https://doi.org/10.3390/su15086939

Chu T, An X, Zhang W, Lu Y, Tian J. Multiple Virtual Power Plants Transaction Matching Strategy Based on Alliance Blockchain. Sustainability. 2023; 15(8):6939. https://doi.org/10.3390/su15086939

Chicago/Turabian StyleChu, Tianfeng, Xingchen An, Wuyang Zhang, Yan Lu, and Jiaqi Tian. 2023. "Multiple Virtual Power Plants Transaction Matching Strategy Based on Alliance Blockchain" Sustainability 15, no. 8: 6939. https://doi.org/10.3390/su15086939

APA StyleChu, T., An, X., Zhang, W., Lu, Y., & Tian, J. (2023). Multiple Virtual Power Plants Transaction Matching Strategy Based on Alliance Blockchain. Sustainability, 15(8), 6939. https://doi.org/10.3390/su15086939