1. Introduction

A report on the limits of the growth, together with the 1973 and 1979 oil shocks, sounded the alarm about the effects of energy consumption on economic growth and the environment. Indeed, apart from economic aspects, environmental aspects have been neglected in the industrialization process of many countries. Therefore, the Rio Earth Summit (1992) cast opprobrium and came to the conclusion that the various economies wishing to sustain their development should no longer solely focus on economic aspects but must, more importantly, closely consider environmental protection. From traditional, classical, or neoclassical theories to contemporary theories, energy has had a prominent role in the productive process of the economy. Although it is well recognized that energy has a significant impact on economic growth, the fact remains that its impact on the environment should not be neglected. Forster [

1] and Luptacik and Shubert [

2] argued that we cannot explore the relationship between energy consumption and economic growth without integrating the environmental component. Meadows report in 1972 and the studies of Georgescu-Roegen [

3], Hall et al. [

4], and Kaufmann [

5] are the first documents that mentioned environment in an economic analysis. The introduction of environmental issues into growth analysis gave rise to the concept of sustainable development.

The relationship between economic growth and the environment remains a subject of discussion among various researchers and policymakers. Economic theory suggests a positive relationship between economic growth and environmental degradation. As in early stages, increased economic activity increases the use of fossil fuels that are harmful to the environment in the absence of clean technologies. However, after this occurs to some extent, economic development then contributes to environmental sustainability via a change in economic structures. This famous relationship between economic growth and the environment is known as the environmental Kuznets curve (EKC) hypothesis. EKC was named after Kuznets [

6], who suggested that income inequality first increases and then decreases as economic development progresses. It is famously known for its inverted U-shaped relationship. Later, Grossman and Krueger [

7] advanced a similar type of association between economic growth and environment. Many controversial empirical works explored the relationship between energy consumption, economic growth, and the environment. However, if the empirical literature recognizes the impact of fossil fuel consumption on economic growth and the environment in the case of industrialized countries, this relationship is a paradox in the case of less developed and developing countries. The Middle East and North Africa (MENA) region is the part of the world that holds the greatest potential in terms of energy resources. In 2020, Middle Eastern countries held 48.3% of the world-proven oil reserves and 40.3% of the world-proven natural gas reserves altogether; of these, Saudi Arabia held 17.2% of the world-proven oil reserves, Iran held 9.1% of the world-proven oil reserves and 17.1% of the world-proven natural gas reserves, Iraq held 8.4% of the world-proven oil reserves, and Qatar held 13.1% of the world-proven natural gas reserves (Energy Institute Statistical Review of World Energy, 2023) (

https://www.energyinst.org/statistical-review, accessed on 23 October 2023).

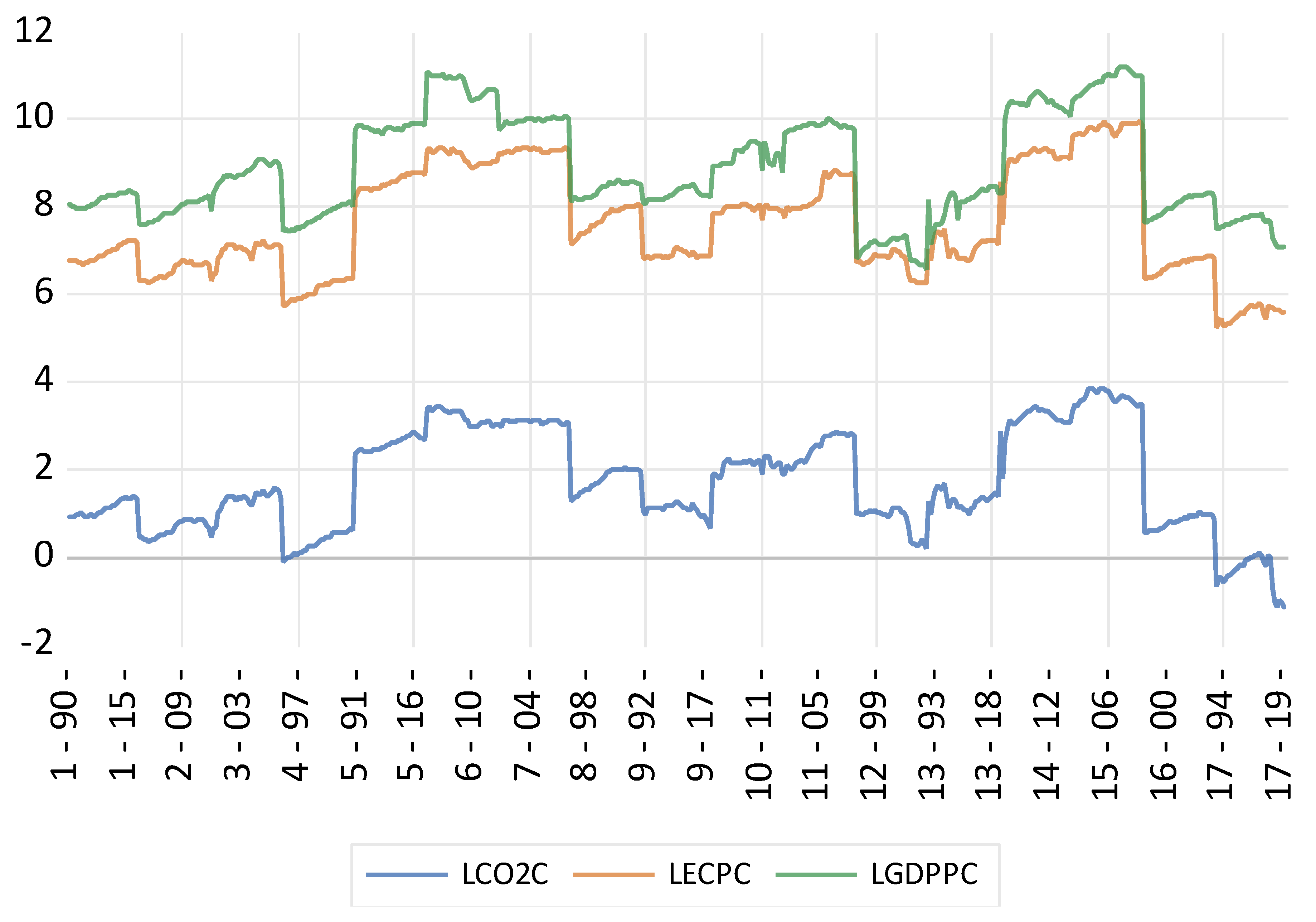

The issue of growth based on energy consumption and its potential effects on the environment is no longer solely a matter for countries with high levels of pollution but must also be the responsibility of countries that aspire to development. Nevertheless, MENA is a minor polluter; it has enormous energy resources whose use could allow it to develop. However, respecting the agreements and summits regarding the climate—in particular, the reduction of carbon emissions with the aim of protecting the environment—is of importance. The objective of this article is to analyze the symmetric and asymmetric influence of energy consumption and economic growth on CO

2 emissions in a panel of 17 MENA countries using a panel linear autoregressive distributed lag (ARDL) model for annual data from 1990 to 2020. Our results could help policymakers take the necessary precautions to limit the impact of energy consumption on environmental degradation in MENA countries. The novelty of this study lies firstly in its contribution and distinction from previous studies that did not address the asymmetric impact of energy use on CO

2 emissions. Moreover, to our knowledge, this is the first study to simultaneously analyze the symmetric and asymmetric impacts of changes in energy consumption on environmental sustainability in MENA countries. The impacts of positive and negative changes in energy consumption on CO

2 emissions were estimated using the panel nonlinear ARDL (NARDL) model developed by Shin et al. [

8]. This model permitted us to distinguish between the impact of increases in energy consumption and decreases in energy consumption on CO

2 emissions. This caused our study to be one of the few works to use a more innovative econometric approach for the case of MENA countries. Secondly, our research is among the few works that considered a relatively long and very recent period (1990–2020) for a large group of MENA countries. Thirdly, the results of panel ARDL models were checked for their robustness.

This article is organized as follows. In

Section 2, we present a review of the literature.

Section 3 shows the data and methodology. In

Section 4, we report the empirical results and present discussions. In

Section 5, we check for the robustness of the results. Finally, we present the conclusions and policy implications in

Section 6.

2. Literature Review

The EKC model has been used to study the relationship between environment, energy, and economic growth. Most studies using this model have found that pollution increases with economic growth until a turning point, where the relationship between pollution and growth reverses. Grossman and Krueger [

7] originally developed the link between growth and the environment. According to the EKC hypothesis, economies, especially those in development, have a trajectory of CO

2 emissions and GDP in the form of an inverted “U”. At some point, economies experiencing GDP growth also experience an increase in environmental degradation until they reach a turning point where society seeks a healthy environment that reduces CO

2 emissions. Stern [

9] criticized the EKC hypothesis and proposed alternative approaches such as decomposition of emissions. Additionally, Stern criticized the econometric methods used in empirical studies validating the EKC.

Since the 1990s, many studies have been conducted on the relationship between growth and the environment using cross-section, time series, and panel data, as well as different methodologies and environmental indicators. The findings of these studies are controversial, even for the same country or group of countries. Some studies support the EKC hypothesis, while others do not. For example, studies by [

10,

11,

12], support the EKC hypothesis, while studies by [

13,

14] do not. Many other studies have found mixed results [

15,

16,

17].

Among the first group of studies supporting the EKC, Haggar [

10] investigated the existence of a long-term equilibrium relationship between greenhouse gas (GHG) emissions, energy consumption, and economic growth for the Canadian industrial sector using cointegration techniques during the period of 1990 to 2007. The results show that energy consumption has a significant impact on GHG emissions. Moreover, the EKC hypothesis was validated. Alshehry and Belloumi [

18] analyzed the relationship between economic growth, aggregate and disaggregate fossil fuels consumption, and carbon dioxide emissions for Saudi Arabia using the Johansen cointegration technique and annual data from 1971 to 2012. They found the presence of a long-run relationship between the different variables. In addition, there is evidence of the presence of bidirectional causality between natural gas consumption and CO

2 emissions and unidirectional causality from economic growth to CO

2 emissions in both the short and long run. Alvarado et al. [

11] investigated the energy-growth-environment nexus using panel data techniques in 151 countries during the period of 1980 to 2016. Their results validated the EKC hypothesis and showed that energy consumption has a positive and significant impact on environmental indicators. Alharthi et al. [

12] studied the influence of real income, renewable and non-renewable energy consumption, and urbanization on CO

2 emissions in MENA countries using quantile techniques over the period 1990–2015. They found that increases in renewable energy consumption led to a reduction in CO

2 emissions, whereas high levels of non-renewable energy consumption led to high levels in CO

2 emissions. In addition, their results validated the EKC hypothesis for the group of MENA countries.

Among the second group of studies, Nasir et al. [

13] analyzed the EKC hypothesis for the case of Australia by studying the influence of economic growth and energy consumption on CO

2 emissions during the period of 1980 to 2014. They included different control variables such as industrialization, trade openness, and financial development. Their main finding reported that the EKC hypothesis is not validated. They explained this result via the positive influence of financial development, energy consumption, and trade openness on CO

2 emissions in the long term. Similarly, Kongkuah et al. [

14] investigated the dynamic causal relationship between energy consumption, economic growth, and CO

2 emissions in China by including urbanization and international trade as control variables. Their main results indicate that the EKC hypothesis is not validated, whereas both economic growth and energy consumption have positive and significant effects on China’s CO

2 emissions in the long run.

In the case of the third group of studies, Ahmad et al. [

15] explored the validity of the EKC in Croatia for the period 1992:1 to 2011:1 by estimating an ARDL model. The results demonstrated the existence of the EKC in the long term but its non-existence in the short term. In the same line, Hove and Tursoy [

16] studied the EKC for a panel of 24 emerging countries using the generalized method of moments (GMM) for a panel data model over the period 2000–2017. They found that real GDP has a negative and significant effect on CO

2 emissions but a positive impact on nitrous oxide emissions. In addition, the square of real GDP increases CO

2 emissions but decreases nitrous oxide emissions. Not later, Majeed and Mazhar [

17] explored the EKC hypothesis for the case of 76 high-, middle-, and low-income countries during the period of 1961 to 2018. Their findings are mixed and they depend on the data and methods used and countries investigated.

Recent studies have also investigated the asymmetric impact of energy consumption on environmental indicators. For example, Azam et al. [

19] explored the non-linear effects of disaggregate energy (natural gas, nuclear energy, and renewable energy) on economic growth and CO

2 emissions in a selected sample of leading polluter countries by estimating panel fixed and random effects models during the period of 2000 to 2016. Their main finding indicates that renewable energy consumption reduces CO

2 emissions in the selected sample of countries. Not later, Majeed et al. [

20] studied the asymmetric impacts of disaggregate energy consumption and economic growth on environmental quality in Pakistan using a NARDL model over the period 1971–2014. They found that positive changes in oil and gas consumption have positive effects on the environment, and negative changes have negative effects. Liu et al. [

21] studied the asymmetric impacts of economic development and energy consumption on CO

2 emissions in China using different time series techniques over the period 1990–2020. The results of the Granger causality test indicate that energy consumption causes economic development and dioxide carbon emissions. In addition, the findings of impulse response functions show that energy consumption and agroforestry development affect CO

2 emissions in China.

In the case of MENA countries, some studies have investigated the EKC hypothesis. Kahia et al. [

22] investigated the influence of renewable energy consumption and economic growth on CO

2 emissions in a selected group of MENA countries using the panel vector autoregressive model during the period of 1980 to 2012. Their results report that economic growth leads to pollution, whereas an increase in renewable energy consumption leads to decreases in CO

2 emissions. Dkhili [

23] analyzed the relationship between CO

2 emissions, economic growth, and renewable energy by controlling for international trade and FDI for a selected group of MENA countries using panel data techniques over the period 1990–2018. The findings show a long-term decline between renewable energy and CO

2 emissions. More recently, Alkasasbeh et al. [

24] studied the effects of energy consumption and economic growth on CO

2 emissions in five MENA countries using panel cointegration techniques and the Dumitrescu and Hurlin panel causality test over the period 1980 to 2020. The results show the presence of a long-run relationship between the three variables in the presence of structural breaks. Moreover, economic growth leads to environmental degradation in the investigated countries.

The above literature summary provides a good overview of information from ongoing discussions on how energy consumption and economic growth affect environmental indicators. However, it is clear from the literature review that these studies have varying results. Overall, the results of empirical studies on the EKC hypothesis are controversial and vary depending on the country, region, study period, type of data, and econometric techniques used. This study aims to fill the gap in the literature by analyzing the symmetric and asymmetric effect of energy consumption on environmental sustainability in MENA countries and by including a large sample of MENA countries in the study.

6. Conclusions

We analyzed the symmetric and asymmetric impacts of energy consumption and economic growth on environmental quality in a selected sample of 17 MENA countries from 1990 to 2020 using the EKC panel ARDL and NARDL models. The results of the symmetric and asymmetric panel ARDL models indicate that energy consumption has a positive and significant effect on the environment. An increase in energy use leads to environmental degradation while a decrease in energy use leads to an improvement in the environment in MENA countries. Additionally, the results of the PMG estimator support the EKC hypothesis, showing that an increase in economic activity leads to an increase in pollution, but with a high level of real GDP per capita, pollution decreases. Overall, the results demonstrate that increasing energy use leads to an increase in CO2 emissions in both the short and long run. The long-run results of PMG estimator were confirmed by FMOLS and DOLS methods.

Our findings indicate that economic growth leads to environmental degradation only in the long run, while energy consumption has both short-run and long-run impacts on the environment in MENA countries. This can be explained by the direct, instantaneous, and continuous impact of energy consumption on the environment, as opposed to the potential effects (scale, composition, and technique effects) of economic growth on the environment. According to the EKC hypothesis, the scale effect of economic growth induces pollution, while the composition and technique effects lead to a reduction in pollution in the long run [

38]. In the long run, changes in production composition and improved technology lead to reducing environmental degradation, with the scale effect outweighing the composition and technique effects of economic growth in the MENA region. Therefore, MENA countries should invest in less-polluting technologies and transition their economic activities to be based on technology-intensive service activities. Additionally, countries in the Middle East and North Africa, which are rich in oil, should focus on reducing energy use and adopting energy efficiency measures.

Furthermore, the results of the causality tests indicate a bidirectional causality between energy consumption and CO2 emissions, as well as between economic growth and CO2 emissions. This suggests that increased energy consumption can increase CO2 emissions, and vice versa, indicating a dependence on fossil fuels for economic growth in the MENA region, resulting in significant CO2 emissions. Additionally, the two-way link between economic growth and CO2 emissions indicates bilateral effects, with environmental policies designed to reduce CO2 emissions having a significant impact on production, while accelerated growth policies can significantly increase CO2 emissions in the MENA region.

In conclusion, these results suggest that MENA countries need to implement policies to mitigate the negative impacts of rising energy use and economic growth on the environment. Cooperation and communication between countries for better controlled development is essential, as well as the development of energy-efficient and environmentally friendly infrastructure systems and the transition to renewable energy sources.

One limitation of this study is the exclusion of data from some countries in the MENA region, and future work could focus on comparing major oil exporters and importers separately. Additionally, including other control variables in the models could provide further insights. Despite these limitations, our results remain significant for countries in the Middle East and North Africa region.