What Drives the Sustainability Reporting Intentions of Firms?

Abstract

:1. Introduction

2. Theoretical Background and Hypothesis Development

2.1. Hypothesis Development

2.1.1. Attitude

2.1.2. Subjective Norm

2.1.3. Perceived Behavioural Control

2.1.4. Dynamic Capabilities

2.1.5. Cultural Tightness–Looseness

2.1.6. Sustainability Commitment

2.1.7. Perceived Cost and Perceived Benefit

3. Methodology

3.1. Research Design

3.2. Data Collection

3.3. Data Analysis Procedures

3.4. Descriptive Statistics of the Respondents

3.5. Descriptive Statistics of Constructs

3.6. Reliability and Validity

4. Discussion of Results

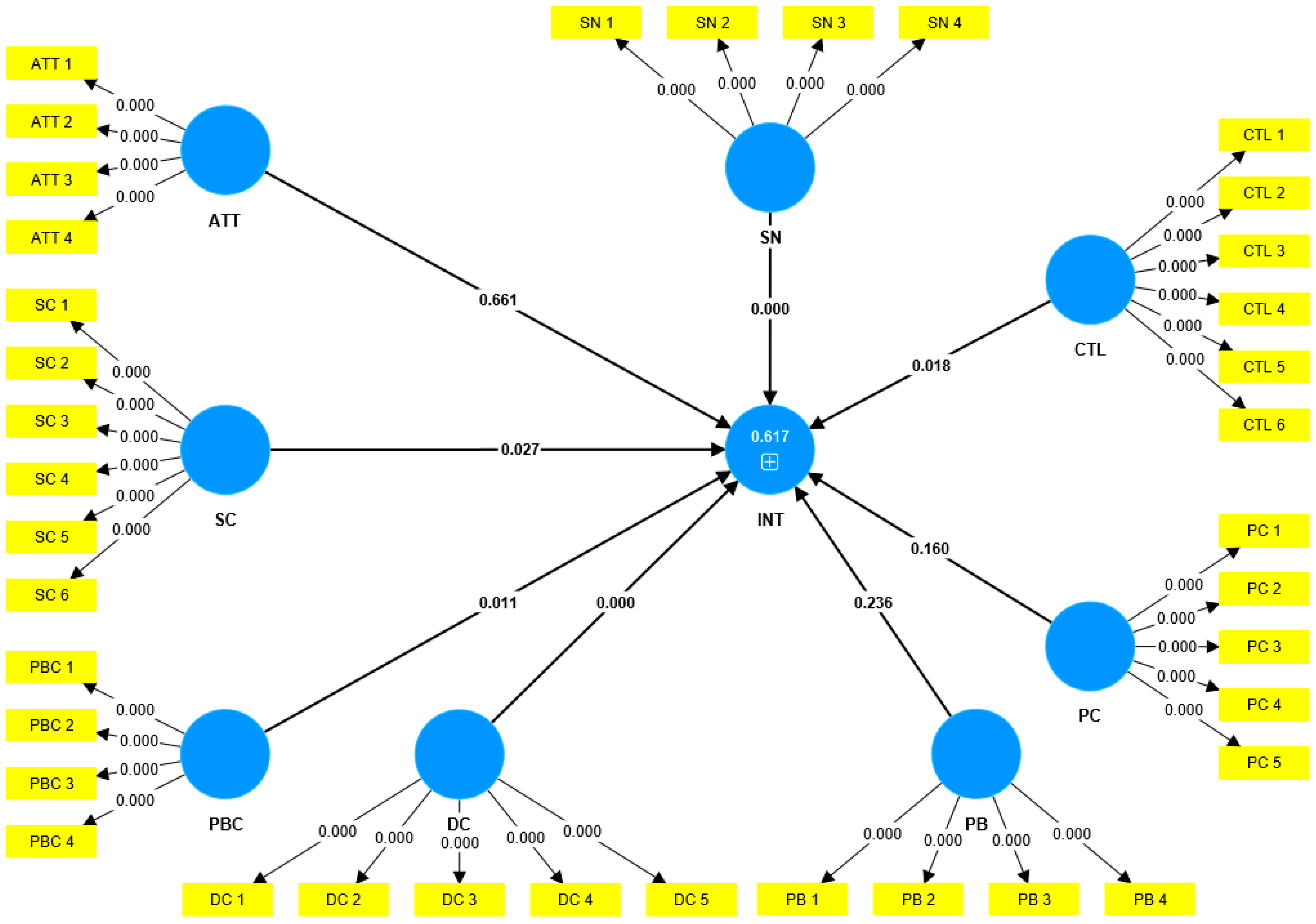

Structural Model Analysis

5. Conclusions

Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- McGrath, L.; Hynes, S.; McHale, J. The Air we Breathe: Estimates of Air Pollution Extended Genuine Savings for Europe. Rev. Income Wealth 2022, 68, 161–188. [Google Scholar] [CrossRef]

- Boakye, D.J.; TIngbani, I.; Ahinful, G.; Damoah, I.; Tauringana, V. Sustainable environmental practices and financial performance: Evidence from listed small and medium-sized enterprise in the United Kingdom. Bus. Strateg. Environ. 2020, 29, 2583–2602. [Google Scholar] [CrossRef]

- Vazquez-Brust, D.; Smith, A.M.; Sarkis, J. Managing the transition to critical green growth: The “Green Growth State”. Futures 2014, 64, 38–50. [Google Scholar] [CrossRef]

- Ingley, C.B. Company growth and Board attitudes to corporate social responsibility. Int. J. Bus. Gov. Ethics 2008, 4, 17–39. [Google Scholar] [CrossRef]

- Tuokuu, F.X.D.; Gruber, J.S.; Idemudia, U.; Kayira, J. Challenges and opportunities of environmental policy implementation: Empirical evidence from Ghana’s gold mining sector. Resour. Policy 2018, 59, 435–445. [Google Scholar] [CrossRef]

- Fusco, F.; Ricci, P. What is the stock of the situation? A bibliometric analysis on social and environmental accounting research in public sector. Int. J. Public Sect. Manag. 2019, 32, 21–41. [Google Scholar] [CrossRef]

- Welbeck, E.E.; Owusu, G.M.Y.; Bekoe, R.A.; Kusi, J.A. Determinants of environmental disclosures of listed firms in Ghana. Int. J. Corp. Soc. Responsib. 2017, 2, 11. [Google Scholar] [CrossRef]

- KPMG. Big Shifts, Small Steps: Survey of Corporate Responsibility 2022. Available online: https://assets.kpmg.com/content/dam/kpmg/se/pdf/komm/2022/Global-Survey-of-Sustainability-Reporting-2022.pdf (accessed on 25 April 2023).

- Mion, G.; Adaui, C.R.L. Mandatory nonfinancial disclosure and its consequences on the sustainability reporting quality of Italian and German companies. Sustainability 2019, 11, 4612. [Google Scholar] [CrossRef]

- Jackson, G.; Bartosch, J.; Avetisyan, E.; Kinderman, D.; Knudsen, J.S. Mandatory Non-financial Disclosure and Its Influence on CSR: An International Comparison. J. Bus. Ethics 2020, 162, 323–342. [Google Scholar] [CrossRef]

- Stubbs, W.; Higgins, C.; Milne, M. Why do companies not produce sustainability reports? Bus. Strateg. Environ. 2013, 22, 456–470. [Google Scholar] [CrossRef]

- Ali, W.; Frynas, J.G.; Mahmood, Z. Determinants of Corporate Social Responsibility (CSR) Disclosure in Developed and Developing Countries: A Literature Review. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 273–294. [Google Scholar] [CrossRef]

- Tauringana, V. Sustainability reporting challenges in developing countries: Towards management perceptions research evidence-based practices. J. Account. Emerg. Econ. 2021, 11, 194–215. [Google Scholar] [CrossRef]

- Buallay, A. Between cost and value: Investigating the effects of sustainability reporting on a firm’s performance. J. Appl. Account. Res. 2019, 20, 481–496. [Google Scholar] [CrossRef]

- Buallay, A.M. Benefits and Costs of Disclosing Sustainability Reports. In International Perspectives on Sustainability Reporting; Emerald Publishing Limited: Leeds, UK, 2022; pp. 77–80. [Google Scholar] [CrossRef]

- De Villiers, C.; Alexander, D. The institutionalisation of corporate social responsibility reporting. Br. Account. Rev. 2014, 46, 198–212. [Google Scholar] [CrossRef]

- Hossain, M.M.; Alam, M.; Islam, M.A.; Hecimovic, A. Do stakeholders or social obligations drive corporate social and environmental responsibility reporting? Managerial views from a developing country. Qual. Res. Account. Manag. 2015, 12, 287–314. [Google Scholar] [CrossRef]

- Amoako, K.O.; Lord, B.R.; Dixon, K. Insights from the websites of five plants operated by Newmont Mining Corporation. Meditari Account. Res. 2017, 25, 186–215. [Google Scholar] [CrossRef]

- Rahaman, A.S.; Lawrence, S.; Roper, J. Social and environmental reporting at the VRA: Institutionalised legitimacy or legitimation crisis? Crit. Perspect. Account. 2004, 15, 35–56. [Google Scholar] [CrossRef]

- Singh, G.; Sharma, S.; Sharma, R.; Dwivedi, Y.K. Investigating environmental sustainability in small family-owned businesses: Integration of religiosity, ethical judgment, and theory of planned behavior. Technol. Forecast. Soc. Chang. 2021, 173, 121094. [Google Scholar] [CrossRef]

- Thoradeniya, P.; Lee, J.; Tan, R.; Ferreira, A. Sustainability reporting and the theory of planned behaviour. Account. Audit. Account. J. 2015, 28, 1099–1137. [Google Scholar] [CrossRef]

- Zharfpeykan, R.; Askarany, D. Sustainability Reporting and Organisational Factors. J. Risk Financ. Manag. 2023, 16, 163. [Google Scholar] [CrossRef]

- Owusu, G.M.Y.; Ofori-Owusu, C. Analysis of the structure and evolution of sustainability accounting research: A 41-year review. Meditari Account. Res. 2024; ahead-of-print. [Google Scholar] [CrossRef]

- Ajzen, I. The Theory of Planned Behavior. Organistional Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Benk, S.; Çakmak, A.F.; Budak, T. An investigation of tax compliance intention: A theory of planned behavior approach. Eur. J. Econ. Financ. Adm. Sci. 2011, 28, 180–188. [Google Scholar]

- Armitage, C.J.; Conner, M. Efficacy of the theory of planned behaviour: A meta-analytic review. Br. J. Soc. Psychol. 2001, 40, 471–499. [Google Scholar] [CrossRef]

- Ajzen, I. Perceived behavioral control, self-efficacy, locus of control, and the theory of planned behavior. J. Appl. Soc. Psychol. 2002, 32, 665–683. [Google Scholar] [CrossRef]

- Kwakye, T.O.; Welbeck, E.E.; Owusu, G.M.Y.; Anokye, F.K. Determinants of intention to engage in Sustainability Accounting & Reporting (SAR): The perspective of professional accountants. Int. J. Corp. Soc. Responsib. 2018, 3, 11. [Google Scholar] [CrossRef]

- Chen, X.; Weerathunga, P.R.; Nurunnabi, M.; Kulathunga, K.M.M.C.B.; Samarathunga, W.H.M.S. Influences of behavioral intention to engage in environmental accounting practices for corporate sustainability: Managerial perspectives from a developing country. Sustainability 2020, 12, 5266. [Google Scholar] [CrossRef]

- Acheampong, O.; Dogbe, C.S.K.; Iddris, F. Sustainability Reporting by Owner-Managers of SMEs: The Perspective of Theory of Planned Behavior (TPB). Probl. Zarządzania Manag. Issues 2022, 2022, 27–46. [Google Scholar] [CrossRef]

- Beddewela, E.; Herzig, C. Corporate social reporting by MNCs’ subsidiaries in Sri Lanka. Account. Forum 2013, 37, 135–149. [Google Scholar] [CrossRef]

- Flannery, B.L.; May, D.R. Environmental ethical decision making in the U.S. metal-finishing industry. Acad. Manag. J. 2000, 43, 642–662. [Google Scholar] [CrossRef]

- Sharma, S.; Singh, G.; Sharma, R. For it is in giving that we receive: Investigating gamers’ gifting behaviour in online games. Int. J. Inf. Manag. 2021, 60, 102363. [Google Scholar] [CrossRef]

- Chen, M.F.; Tung, P.J. Developing an extended Theory of Planned Behavior model to predict consumers’ intention to visit green hotels. Int. J. Hosp. Manag. 2014, 36, 221–230. [Google Scholar] [CrossRef]

- Paul, J.; Modi, A.; Patel, J. Predicting green product consumption using theory of planned behavior and reasoned action. J. Retail. Consum. Serv. 2016, 29, 123–134. [Google Scholar] [CrossRef]

- Wang, S.; Wang, J.; Li, J.; Zhou, K. How and when does religiosity contribute to tourists’ intention to behave pro-environmentally in hotels? J. Sustain. Tour. 2020, 28, 1120–1137. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Knowl. Strateg. 2009, 18, 77–116. [Google Scholar] [CrossRef]

- Efrat, K.; Hughes, P.; Nemkova, E.; Souchon, A.L.; Sy-Changco, J. Leveraging of Dynamic export capabilities for competitive advantage and performance consequences: Evidence from China. J. Bus. Res. 2018, 84, 114–124. [Google Scholar] [CrossRef]

- Vogel, R.; Güttel, W.H. The dynamic capability view in strategic management: A bibliometric review. Int. J. Manag. Rev. 2013, 15, 426–446. [Google Scholar] [CrossRef]

- Barrales-Molina, V.; Benitez-Amado, J.; Perez-Arostegui, M.N. Managerial perceptions of the competitive environment and dynamic capabilities generation. Ind. Manag. Data Syst. 2010, 110, 1355–1384. [Google Scholar] [CrossRef]

- Khan, O.; Bellini, N.; Daddi, T.; Iraldo, F. Effects of behavioral intention and dynamic capabilities on circular economy adoption and performance of tourism SMEs. J. Sustain. Tour. 2023, 31, 1777–1796. [Google Scholar] [CrossRef]

- Bresciani, S.; Rehman, S.U.; Alam, G.M.; Ashfaq, K.; Usman, M. Environmental MCS package, perceived environmental uncertainty and green performance: In green dynamic capabilities and investment in environmental management perspectives. Rev. Int. Bus. Strateg. 2023, 33, 105–126. [Google Scholar] [CrossRef]

- Nasution, M.D.T.P.; Rafiki, A.; Lubis, A.; Rossanty, Y. Entrepreneurial orientation, knowledge management, dynamic capabilities towards e-commerce adoption of SMEs in Indonesia. J. Sci. Technol. Policy Manag. 2021, 12, 256–282. [Google Scholar] [CrossRef]

- Essid, M.; Berland, N. Adoption of environmental management tools: The dynamic capabilities contributions. Sustain. Account. Manag. Policy J. 2018, 9, 229–252. [Google Scholar] [CrossRef]

- Pelto, P.J. The differences between “tight” and “loose” societies. Trans-Action 1968, 5, 37–40. [Google Scholar] [CrossRef]

- Gelfand, M.J.; Nishii, L.H.; Raver, J.L. On the nature and importance of cultural tightness-looseness. J. Appl. Psychol. 2006, 91, 1225–1244. [Google Scholar] [CrossRef]

- Gelfand, M. Rule Makers, Rule Breakers: Tight and Loose Cultures and the Secret Signals That Direct Our Lives; Scribner: New York, NY, USA, 2019; 384p, Available online: https://books.google.it/books?hl=it&lr=&id=bLSkDwAAQBAJ&oi=fnd&pg=PA1&dq=Gelfand,+M.+(2019).+Rule+Makers,+Rule+Breakers:+Tight+and+Loose+Cultures+and+the+Secret+Signals+That+Direct+Our+Lives.+Scribner.&ots=PBy1D34Fwu&sig=K-QlHgHGUMAPHbqfoSbYtVn9i5c&redir_ (accessed on 15 April 2024).

- Contu, F.; Di Santo, D.; Baldner, C.; Pierro, A. Examining the Interaction between Perceived Cultural Tightness and Prevention Regulatory Focus on Life Satisfaction in Italy. Sustainability 2023, 15, 1865. [Google Scholar] [CrossRef]

- Di Santo, D.; Talamo, A.; Bonaiuto, F.; Cabras, C.; Pierro, A. A Multilevel Analysis of the Impact of Unit Tightness vs. Looseness Culture on Attitudes and Behaviors in the Workplace. Front. Psychol. 2021, 12, 652068. [Google Scholar] [CrossRef]

- Aktas, M.; Gelfand, M.J.; Hanges, P.J. Cultural Tightness–Looseness and Perceptions of Effective Leadership. J. Cross. Cult. Psychol. 2016, 47, 294–309. [Google Scholar] [CrossRef]

- Keogh, P.D.; Polonsky, M.J. Environmental commitment: A basis for environmental entrepreneurship? J. Organ. Chang. Manag. 1998, 11, 38–49. [Google Scholar] [CrossRef]

- Öhman, J.; Sund, L. A didactic model of sustainability commitment. Sustainability 2021, 13, 3083. [Google Scholar] [CrossRef]

- Jansson, J.; Nilsson, J.; Modig, F.; Hed Vall, G. Commitment to Sustainability in Small and Medium-Sized Enterprises: The Influence of Strategic Orientations and Management Values. Bus. Strateg. Environ. 2017, 26, 69–83. [Google Scholar] [CrossRef]

- Ajzen, I. Attitudes, Personality and Behaviour; McGraw-Hill Education: Maidenhead, UK, 2005. [Google Scholar]

- Burzis Homi, U. The Adoption and Implementation of Environmental Management Systems in New Zealand Hotels: The Managers’ Perspective. Master’s Thesis, Auckland University of Technology, Auckland, New Zealand, 2010. [Google Scholar]

- Tu, J.C.; Huang, H.S. Analysis on the relationship between green accounting and green design for enterprises. Sustainability 2015, 7, 6264–6277. [Google Scholar] [CrossRef]

- Dillman, D.A. Mail and Internet Surveys: The Tailored Design Method—2007 Update with New Internet, Visual, and Mixed-Mode Guide (Google eBoek); John Wiley & Sons: Hoboken, NJ, USA, 2011; ISBN 1118044630. Available online: http://books.google.com/books?hl=nl&lr=&id=d_VpiiWp51gC&pgis=1 (accessed on 15 April 2024).

- Diamantopoulos, A.; Sarstedt, M.; Fuchs, C.; Wilczynski, P.; Kaiser, S. Guidelines for choosing between multi-item and single-item scales for construct measurement: A predictive validity perspective. J. Acad. Mark. Sci. 2012, 40, 434–449. [Google Scholar] [CrossRef]

- Chen, R.; Wang, J.; Herath, T.; Rao, H.R. An investigation of email processing from a risky decision making perspective. Decis. Support. Syst. 2011, 52, 73–81. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. The relationship between environmental commitment and managerial perceptions of stakeholder importance. Acad. Manag. J. 1999, 42, 87–99. [Google Scholar] [CrossRef]

- Gelfand, M.J.; Raver, J.L.; Nishii, L.; Leslie, L.M.; Lun, J.; Lim, B.C.; Duan, L.; Almaliach, A.; Ang, S.; Arnadottir, J.; et al. Differences between tight and loose cultures: A 33-nati on study. Environment 2011, 53, 3–4. [Google Scholar] [CrossRef]

- Fornell, C.; Bookstein, F.L. Two Structural Equation Models: LISREL and PLS Applied to Consumer Exit-Voice Theory. J. Mark. Res. 1982, 19, 440–452. [Google Scholar] [CrossRef]

- Chin, W.W. The Partial Least Squares Approach to Structural Equation Modelling. In Modern Methods for Business Research; Marcoulides, G.A., Ed.; Lawrence Erlbaum Associates: Mahwah, NJ, USA, 1998; Volume 295. [Google Scholar]

- Chin, W. Partial Least Squares for Is Researchers: An Overview and Presentation of Recent Advances Using the Pls Approach. In Proceedings of the 21st International Conference on Information Systems ICIS 2000, Brisbane, Australia, 10–13 December 2000; pp. 741–742. [Google Scholar]

- Gefen, D.; Straub, D. A Practical Guide To Factorial Validity Using PLS-Graph: Tutorial And Annotated Example. Commun. Assoc. Inf. Syst. 2005, 16, 5. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. The use of partial least squares path modeling in international marketing. Adv. Int. Mark. 2009, 20, 277–319. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Partial Least Squares Structural Equation Modeling. In Handbook of Market Research (Issue July); Springer: Berlin/Heidelberg, Germany, 2021. [Google Scholar] [CrossRef]

- Ab Hamid, M.R.; Sami, W.; Mohmad Sidek, M.H. Discriminant Validity Assessment: Use of Fornell & Larcker criterion versus HTMT Criterion. J. Phys. Conf. Ser. 2017, 890, 012163. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A New Criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Ringle, C.M.; Sarstedt, M.; Sinkovics, N.; Sinkovics, R.R. A perspective on using partial least squares structural equation modelling in data articles. Data Brief 2023, 48, 109074. [Google Scholar] [CrossRef]

- Henseler, J. Partial Least Squares Path Modeling. In Advanced Methods for Modeling Markets; Leeflang, P., Wieringa, J., Bijmolt, T., Pauwels, K., Eds.; International Series in Quantitative Marketing; Springer: Cham, Switzerland, 2017; pp. 3–27. [Google Scholar] [CrossRef]

- Kline, R.B. Principles and Practice of Structural Equation Modeling; Guilford Publications: New York, NY, USA, 2023; Volume 1. [Google Scholar]

- O’Brien, R.M. A caution regarding rules of thumb for variance inflation factors. Qual. Quant. 2007, 41, 673–690. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-Reports in Organizational Research: Problems and Prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.; Ringle, C.M.; Sarstedt, M.; Danks, N.P.; Ray, S. Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R: A Workbook; Springer: Cham, Switzerland, 2021; ISBN 9783030805180. [Google Scholar] [CrossRef]

- Chin, W.W. How to Write Up and Report PLS Analyses. In Handbook of Partial Least Squares; Springer: Berlin/Heidelberg, Germany, 2010; pp. 655–690. [Google Scholar]

- Hunt, C.B.; Auster, E.R. Proactive Environmental Management: Avoiding the Toxic Trap. MITSloan Manag. Rev. 1990, 31, 7. [Google Scholar]

- Claudy, M.C.; Peterson, M.; O’Driscoll, A. Understanding the Attitude-Behavior Gap for Renewable Energy Systems Using Behavioral Reasoning Theory. J. Macromark. 2013, 33, 273–287. [Google Scholar] [CrossRef]

- Akroush, M.N.; Zuriekat, M.I.; Al Jabali, H.I.; Asfour, N.A. Determinants of purchasing intentions of energy-efficient products: The roles of energy awareness and perceived benefits. Int. J. Energy Sect. Manag. 2019, 13, 128–148. [Google Scholar] [CrossRef]

- Salim, T.A.; El Barachi, M.; Mohamed, A.A.D.; Halstead, S.; Babreak, N. The mediator and moderator roles of perceived cost on the relationship between organizational readiness and the intention to adopt blockchain technology. Technol. Soc. 2022, 71, 102108. [Google Scholar] [CrossRef]

- Alsoufi, A.; Ali, H. Customers’ Perception of M-Banking Adoption in Kingdom of Bahrain: An Extended of TAM. Int. J. Manag. Inf. Technol. 2014, 6, 1–13. Available online: https://arxiv.org/ftp/arxiv/papers/1403/1403.2828.pdf (accessed on 15 April 2024).

| Group A: Respondents’ Firm Profile | Group B: Respondents’ Demographic Statistics | ||||

| Industry Type | Frequency | % | Gender | Frequency | % |

| Financial services | 51 | 9.8 | Female | 174 | 34 |

| Manufacturing and agro-processing | 190 | 37 | Male | 344 | 66 |

| Power, mining, energy, and petroleum | 100 | 19 | |||

| IT and others (logistics, transport, consultancy etc.) | 177 | 34 | |||

| Ownership Type | Frequency | % | Educational Background | Frequency | % |

| Locally owned | 353 | 68 | Bachelor’s degree | 212 | 41 |

| Foreign-owned | 79 | 15 | Master’s degree | 241 | 47 |

| Mixed ownership | 84 | 16 | Doctoral degree | 46 | 8.9 |

| Undisclosed | 2 | 0.4 | Undisclosed | 19 | 3.7 |

| Firm Age: Years in Operation | Frequency | % | Age | Frequency | % |

| Up to 15 years | 268 | 52 | 26 to 35 years | 219 | 42 |

| 16 to 30 years | 99 | 19 | 36 to 45 years | 159 | 31 |

| 31 to 45 years | 19 | 3.7 | 46 to 55 years | 102 | 20 |

| 46 to 60 years | 25 | 4.8 | Above 55 years | 38 | 7.3 |

| Above 60 years | 41 | 7.9 | |||

| Undisclosed | 66 | 13 | |||

| Item | Mean | SD |

|---|---|---|

| Attitude towards Sustainability Reporting Intention (ATT) | ||

| It is good for my company to engage in sustainability reporting. | 5.579 | 1.556 |

| It is rewarding for my company to engage in sustainability reporting. | 5.727 | 1.476 |

| It is valuable for my company to engage in sustainability reporting. | 5.727 | 1.464 |

| It is meaningful for my company to engage in sustainability reporting. | 5.767 | 1.480 |

| Overall | 5.700 | 1.494 |

| Subjective Norm (SN) | ||

| Most of my company’s stakeholders (shareholders, employees, community, etc.) think that my company should engage in sustainability reporting. | 5.168 | 1.639 |

| Most of the internal stakeholders (employees and management) would approve of my company engaging in sustainability reporting. | 5.267 | 1.609 |

| Most organisations whose opinions are valued by my company engage in sustainability reporting. | 5.058 | 1.731 |

| Many companies similar to my company engage in sustainability reporting. | 5.031 | 1.784 |

| Overall | 5.131 | 1.691 |

| Perceived Behavioural Control (PBC) | ||

| It is easy for my company to engage in sustainability reporting. | 4.797 | 1.914 |

| It is possible for my company to engage in sustainability reporting. | 5.471 | 1.552 |

| The decision to engage in sustainability reporting is under my company’s authority. | 5.337 | 1.598 |

| The decision to engage in sustainability reporting is under my company’s control. | 5.147 | 1.658 |

| Overall | 5.188 | 1.681 |

| Sustainability Reporting Intention (INT) | ||

| My company is committed to engage in or continue sustainability reporting. | 4.903 | 1.723 |

| My company plans to engage in or continue sustainability reporting. | 4.921 | 1.798 |

| My company has the intention to engage in or continue sustainability reporting. | 4.959 | 1.846 |

| My company is willing to engage in or continue sustainability reporting. | 4.988 | 1.848 |

| Overall | 4.943 | 1.804 |

| Dynamic Capabilities (DCs) | ||

| My company is aware of developments in corporate sustainability reporting. | 5.260 | 1.546 |

| My company quickly adapts to new reporting requirements, either mandatory or voluntary. | 5.233 | 1.526 |

| My company is able to effectively deploy resources, including the appropriate technology to improve reporting requirements. | 5.136 | 1.590 |

| My company regularly provides training for employees on topical and contemporary issues, including sustainability reporting. | 4.928 | 1.812 |

| My company absorbs new knowledge to improve reporting to stakeholders. | 5.130 | 1.712 |

| Overall | 5.137 | 1.637 |

| Sustainability Commitment (SC) | ||

| My company has a sustainability action plan. | 4.864 | 1.953 |

| My company has a written document describing its sustainability action plan. | 4.803 | 1.977 |

| My company communicates its sustainability action plan to shareholders or stakeholders. | 4.922 | 1.866 |

| My company communicates its sustainability action plan to employees. | 4.965 | 1.847 |

| My company has an environment, health, and safety (EHS) unit/department. | 5.229 | 1.755 |

| My company has a board or management committee dedicated to dealing with sustainability issues. | 4.940 | 1.885 |

| Overall | 4.954 | 1.881 |

| Perceived Benefit (PB) | ||

| Sustainability reporting increases economic benefits to my company. | 5.192 | 1.607 |

| Sustainability reporting improves the corporate image. | 5.505 | 1.514 |

| Sustainability reporting improves monitoring of environmental impacts of my company. | 5.390 | 1.533 |

| Sustainability reporting will help my company to contribute to sustainable development. | 5.529 | 1.436 |

| Overall | 5.404 | 1.523 |

| Perceived Cost (PC) | ||

| A significant amount of work is required to adopt sustainability reporting. | 5.576 | 1.503 |

| A significant learning effort is required to gain sufficient knowledge of sustainability reporting. | 5.601 | 1.525 |

| It is significantly more expensive to prepare our company’s sustainability reporting when it is adopted. | 5.444 | 1.644 |

| It is significantly more expensive to have our sustainability report audited/reviewed/compiled to gain more credibility from stakeholders. | 5.435 | 1.583 |

| Sustainability reporting increases the complexity of reporting because of the need to restructure my company’s conventional accounting system. | 5.219 | 1.636 |

| Overall | 5.455 | 1.578 |

| Cultural Tightness–Looseness (CTL) | ||

| There are many social norms in my company that we are supposed to abide by. | 5.142 | 1.582 |

| In my company, we agree on what behaviours are appropriate versus inappropriate in most situations. | 5.444 | 1.530 |

| There are very clear sustainable reporting expectations for how employees should act in most situations in my company. | 5.252 | 1.617 |

| In my company, if someone acts in an inappropriate way, others will strongly disapprove. | 5.445 | 1.609 |

| Employees almost always comply with social norms in my company. | 5.349 | 1.521 |

| Employees have a great deal of freedom in deciding how they want to behave in most situations. | 4.849 | 1.882 |

| Overall | 5.247 | 1.624 |

| Constructs | Indicators | Indicator Loading | Composite Reliability (CR.) | Convergent Validity (AVE) | Variance Inflation Factor (VIF) |

|---|---|---|---|---|---|

| Attitude (ATT) | ATT 1 | 0.908 | 0.954 | 0.839 | 2.034 |

| ATT 2 | 0.921 | ||||

| ATT 3 | 0.927 | ||||

| ATT 4 | 0.908 | ||||

| Subjective Norm (SN) | SN 1 | 0.870 | 0.938 | 0.790 | 2.528 |

| SN 2 | 0.914 | ||||

| SN 3 | 0.901 | ||||

| SN 4 | 0.871 | ||||

| Perceived Behaviour Control (PBC) | PBC 1 | 0.813 | 0.900 | 0.693 | 2.428 |

| PBC 2 | 0.811 | ||||

| PBC 3 | 0.873 | ||||

| PBC 4 | 0.833 | ||||

| Dynamic Capabilities (DC) | DC 1 | 0.809 | 0.936 | 0.746 | 0.746 |

| DC 2 | 0.881 | ||||

| DC 3 | 0.862 | ||||

| DC 4 | 0.880 | ||||

| DC 5 | 0.883 | ||||

| Sustainability Commitment (SC) | SC 1 | 0.892 | 0.952 | 0.768 | 2.912 |

| SC 2 | 0.921 | ||||

| SC 3 | 0.929 | ||||

| SC 4 | 0.906 | ||||

| SC 5 | 0.703 | ||||

| SC 6 | 0.888 | ||||

| Perceived Benefit (PB) | PB 1 | 0.861 | 0.936 | 0.786 | 2.411 |

| PB 2 | 0.877 | ||||

| PB 3 | 0.903 | ||||

| PB 4 | 0.905 | ||||

| Perceived Cost (PC) | PC 1 | 0.871 | 0.936 | 0.744 | 1.733 |

| PC 2 | 0.869 | ||||

| PC 3 | 0.846 | ||||

| PC 4 | 0.871 | ||||

| PC 5 | 0.856 | ||||

| Cultural Tightness–Looseness (CT-L) | CTL 1 | 0.825 | 0.922 | 0.665 | 1.960 |

| CTL 2 | 0.847 | ||||

| CTL 3 | 0.854 | ||||

| CTL 4 | 0.826 | ||||

| CTL 5 | 0.837 | ||||

| CTL 6 | 0.692 | ||||

| Sustainability Reporting Intentions (INT) | INT 1 | 0.916 | 0.967 | 0.880 | |

| INT 2 | 0.950 | ||||

| INT 3 | 0.948 | ||||

| INT 4 | 0.939 |

| ATT | CTL | DC | INT | PB | PBC | PC | SC | SN | |

|---|---|---|---|---|---|---|---|---|---|

| ATT | |||||||||

| CTL | 0.490 | ||||||||

| DC | 0.510 | 0.626 | |||||||

| INT | 0.475 | 0.557 | 0.754 | ||||||

| PB | 0.573 | 0.611 | 0.734 | 0.628 | |||||

| PBC | 0.657 | 0.571 | 0.741 | 0.686 | 0.656 | ||||

| PC | 0.465 | 0.640 | 0.516 | 0.382 | 0.569 | 0.413 | |||

| SC | 0.343 | 0.556 | 0.807 | 0.684 | 0.684 | 0.623 | 0.416 | ||

| SN | 0.636 | 0.516 | 0.710 | 0.731 | 0.617 | 0.748 | 0.422 | 0.673 |

| Paths | Coefficients | T Statistics | p Values |

|---|---|---|---|

| ATT → INT | −0.019 | 0.439 | 0.661 |

| CTL → INT | 0.109 | 2.360 | 0.018 |

| DC → INT | 0.260 | 3.771 | 0.000 |

| PB → INT | 0.074 | 1.185 | 0.236 |

| PBC → INT | 0.119 | 2.542 | 0.011 |

| PC → INT | −0.058 | 1.405 | 0.160 |

| SC → INT | 0.140 | 2.210 | 0.027 |

| SN → INT | 0.288 | 5.202 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ofori-Owusu, C.; Owusu, G.M.Y.; Agyenim-Boateng, C.; Welbeck, E.E.S. What Drives the Sustainability Reporting Intentions of Firms? Sustainability 2024, 16, 5052. https://doi.org/10.3390/su16125052

Ofori-Owusu C, Owusu GMY, Agyenim-Boateng C, Welbeck EES. What Drives the Sustainability Reporting Intentions of Firms? Sustainability. 2024; 16(12):5052. https://doi.org/10.3390/su16125052

Chicago/Turabian StyleOfori-Owusu, Charles, Godfred Matthew Yaw Owusu, Cletus Agyenim-Boateng, and Edem Emerald Sabah Welbeck. 2024. "What Drives the Sustainability Reporting Intentions of Firms?" Sustainability 16, no. 12: 5052. https://doi.org/10.3390/su16125052