Abstract

Since the beginning of 2023, the so-called reusable packaging obligation has been in place in Germany in order to reduce the amount of waste from takeaway packaging. Catering companies will then be obliged to offer reusable packaging as an alternative to disposable plastic takeaway packaging. As part of the pilot project ‘Mehrweg Modell Stadt’ (‘Reusable city model’), an open infrastructure for reusable cups is in trial in Mainz and Wiesbaden. The project was subjected to a scientific monitoring process, which included the implementation of quantitative surveys among various stakeholders within the value chain, namely consumers, catering companies, and other companies engaged in the project. This was conducted over two time periods: August 2023 to September 2023, and February to March 2024. The results show a discrepancy between consumers’ attitudes and their actual behavior: Despite a high level of sustainability awareness and perceived positive benefits of reusable packaging, perceived barriers stand in the way of actual use. The biggest challenges for companies are the lack of consumer demand, practical handling and hygiene requirements. The results of this quantitative social research provide important insights for the development of targeted measures to promote the use of reusable packaging in takeaway catering and contribute to the discussion on closing the attitude–behavior gap along the entire value chain.

1. Introduction

In recent years, the convenience and time-saving nature of takeaway meals in a fast-paced consumer society has led to a steady increase in waste generated by disposable food and drink packaging. In 2017 alone, packaging waste from meal and snack boxes in Germany amounted to almost 120,000 tons, which corresponds to almost 329 tons of waste per day from takeaway catering [1]. This considerable amount of waste prompted Germany to introduce mandatory reusable packaging from 1 January 2023. According to section 33 of the Packaging Act [2], catering businesses and restaurants in Germany are now obliged to offer reusable packaging as an alternative to disposable plastic packaging for takeaway food and drinks. The reusable option may not be offered at a higher price or under worse conditions than the disposable option. Furthermore, companies are obliged to explicitly indicate the availability of reusable packaging. Exceptions to this rule are permitted for small businesses with a sales area of less than 80 m² and fewer than six employees.

The German obligation to offer reusable packaging in the out-of-home catering sector can be derived from a series of national and EU-wide regulations that jointly pursue the goal of reducing the environmental impact of single-use plastics and promoting the circular economy.

The genesis of this development can be traced back to the Single-Use Plastics Directive (Directive (EU) 2019/904) [3], which came into force in 2019. The directive’s objective is to reduce the consumption of single-use plastics throughout the EU. A crucial aspect of the directive is the requirement for member states to implement measures to reduce the utilization of single-use packaging and to promote more sustainable alternatives. Furthermore, the directive stipulates that manufacturers will be held responsible for the costs of waste management and cleaning up plastic waste.

Concurrently, the European Green Deal was initiated, a comprehensive strategy to make the EU climate-neutral by 2050 [4]. A number of measures are being implemented as part of this plan, including the promotion of clean energy, the improvement of energy efficiency and the reduction of pollution. Furthermore, the Green Deal supports the development of a circular economy, whereby products and materials are used, repaired, reused and recycled for as long as possible.

At the national level, Germany implements these European requirements through the Packaging Act (VerpackG) [2] and the Circular Economy Act (KrWG) [5], among other legislative instruments. The Packaging Act contains specific provisions for the reduction of packaging waste and the promotion of reusable packaging. This is where the obligation to use reusable packaging comes into play, which came into force on 1 January 2023. On 4 March 2024, the European Parliament and the European Council reached a provisional agreement on the revised rules of an EU packaging regulation to reduce, reuse and recycle packaging, increase safety and promote the circular economy [3].

Targets are set for the use of reusable packaging in the food service industry. By 2023, 10% of all takeaway food and 20% of all drinks are to be served in reusable packaging, with the targets being increased, respectively, to 40% and 80% by 2040 [6]. The fact that these regulatory requirements are necessary is also illustrated by the very low proportion of reusable packaging in Germany in 2022: of 13.7 billion packages for food and drinks, only 0.74% were sold in reusable alternatives [7]. The food service industry was the most relevant sector here, accounting for 97.9% of all single-use packaging waste generated (hotel sector: 0.4%, catering sector: 1.7%) [7].

The introduction and expansion of reusable systems has been met with numerous reservations among restaurateurs and system operators. Studies by the WWF [7] and the Institute for Social-Ecological Research and Education (ECOLOG) [8] cite a lack of information regarding the use of reusable containers. Companies lack the capacity to deal with this issue. Language barriers and cost pressure exacerbate the problem. It is also unclear how many companies are subject to the reusable container obligation. If only the number of employees is taken as a criterion, 38.6% of companies are affected by the obligation. No reliable figures can be found based on sales area [7,8]. Looking deeper into the cost pressures, the costs for companies are simply too high, due to limited storage options, logistical challenges at peak times and the need to book deposits. Catering companies in particular also struggle with providing reusable food containers. Finally, many of the companies surveyed in both studies also report low customer demand for returnable containers.

Despite these challenges, most of the companies surveyed have a fundamentally positive attitude towards the use of reusable containers, both for reasons of environmental protection and waste avoidance and as a way of differentiating themselves from the competition. One year after the introduction of the reusable offer obligation in the German food service industry, reliable and comprehensive figures on reusable use are not yet available. However, according to the results of a comparative study by the WWF after one year of the reusable offer obligation in Germany, an initial success has been achieved [9]. In 2023, a total of 14.6 billion disposable packaging units were sold in the takeaway food service sector, compared to 13.6 billion in 2022. The market share of reusable packaging increased from 0.74% to 1.6% during this period, with the share for food at 0.3% and for beverages at 7.0% [9].

In qualitative interviews with system operators, it was reported that the demand from restaurants for reusable systems increased at the turn of the year but decreased again in the summer. This suggests that, despite the positive changes, there are still significant challenges to overcome in order to establish the sustainable use of reusable packaging in the catering sector [9].

Among consumers, the success of reusable systems is strongly influenced by attractive, convenient offers, acceptance, demographic aspects and education. Current studies show that barriers for end consumers are inconveniences in the use of reusable cups and containers, hygiene concerns, the need to pay a deposit or the need for app registration, and the lack of or invisible offers of reusable options [8,10,11]. Therefore, the technical and organizational design of innovative reusable systems can only be implemented in combination with social and societal factors in order to achieve a significant increase in the reusable rate in takeaway gastronomy [12].

Against this legal background and in light of the obligation to offer reusable packaging, numerous pilot projects have been initiated over the past year with the aim of establishing a joint, cross-system and cross-provider take-back system. This encompasses the development of effective organizational structures for return and rinsing logistics, as well as the establishment of shared digital interfaces [13].

One of these projects, the pilot project ‘Mehrweg Modell Stadt’ [14], was monitored and evaluated as part of this scientific study. Initiated by the Reusable-to-go initiative, the objective is to increase the reuse rate in the cities of Mainz and Wiesbaden by setting up a comprehensive take-back infrastructure. Reusable takeaway coffee cups can be returned at all outlets and at reverse vending machines in public spaces. This pilot project is being monitored scientifically by the universities of applied sciences Umwelt-Campus Birkenfeld (Hochschule Trier) and Technische Hochschule Mittelhessen on behalf of the Environment Ministries of Hesse and Rhineland-Palatinate over a period from July 2023 to May 2024 in order to gain insights into the usage behavior and acceptance of reusable coffee cups [14].

In this context, the research questions are aimed at gaining insights into the so-called attitude–behavior gap of end consumers regarding the use of reusable packaging on the one hand and the economic and organizational challenges of the participating catering companies and companies involved in the value chain on the other. On the basis of a holistic analysis of the influencing factors within the value chain of the various stakeholders, optimization potentials are to be identified in order to achieve an increase in the reusability rate. At the same time, it is to be examined whether the introduction of an overarching take-back infrastructure can have an impact on acceptance and usage behavior.

2. Materials and Methods

To answer the questions posed and to obtain empirical data, the method of quantitative social research with the implementation of standardized surveys was chosen. Due to the holistic view of the value chain, the stakeholders involved were surveyed: out-of-home catering, consumers and reverse logistics and supply chain management (e.g., logistics companies, cleaning companies, IT service providers and system providers). Consumers were surveyed online and on site in the city centers of Mainz and Wiesbaden at two different measurement points, five months apart, to obtain a comprehensive picture of their usage behavior and acceptance of reusable packaging. The second measurement point was during the test phase of the pilot project’s overarching return system. This made it possible to investigate its potential influence on acceptance and usage behavior. The companies were surveyed online to capture their perspectives and experiences with reusable packaging.

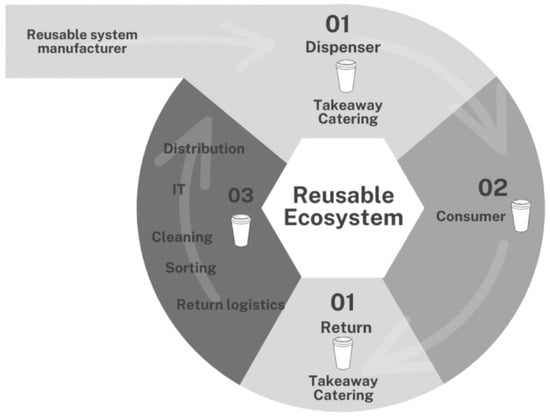

Figure 1 illustrates the three stakeholder groups in the value chain of the reusable system under consideration: Stakeholder group 01: Takeaway catering; Stakeholder group 02: Consumer; Stakeholder group 03 = Reverse logistics and supply chain management.

Figure 1.

Stakeholders in scientific study ‘Mehrweg Modell Stadt’.

2.1. Survey of Companies

The survey of the companies included takeaway catering companies as well as other companies from the areas of logistics, IT service providers, cleaning services and system manufacturers. The questionnaire was developed on the basis of operationalized concepts and in close cooperation with the initiators of the pilot project “Mehrweg Modell Stadt”. It contains questions on the current use of reusable containers in the companies surveyed, as well as on obstacles and possible solutions for the use of reusable systems. The data were collected online between mid-January and mid-March 2024. The questionnaire was sent by e-mail to companies in the Mainz/Wiesbaden area and to various associations with the request to forward it. The mailing list consisted of approximately 300 addresses. Despite these efforts, the response rate was very low at 4% for take-away catering companies (12 participating take-away companies) and 4.7% for further companies (14 participating further companies). The data were analyzed using the SPSS statistical program [15]. Due to the limited sample size (12 individuals in the takeaway company group and 14 individuals in the further company group), inferential statistical analyses were not a viable option as they have low statistical power and are susceptible to bias and error probabilities. In contrast, descriptive analyses offered a comprehensive overview of the data, circumventing the methodological limitations previously discussed.

2.2. Consumer Survey

Standardized surveys were used to determine the level of consumer acceptance of reusable food and beverages, identify barriers and challenges to the use of reusable food and beverages, and analyze potential demographic differences. The procedure, implementation and evaluation of the consumer survey were based on the methodology of Mayer [16].

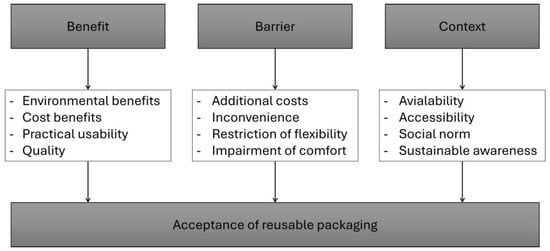

The surveys conducted in the cities of Mainz and Wiesbaden required a random sample of 385 each (simple random sample: n = 385). The measurement model was developed based on the literature review. It assumed that the acceptance of reusable packaging for takeaway food and beverages is influenced by perceived benefits, barriers and context. The theoretical terms were broken down dimensionally and operationalized to map the respective benefit, barrier, and context dimensions. Figure 2 illustrates the operationalization of the three dimensions.

Figure 2.

Operationalization of the theoretical concepts of benefit, barrier and context.

As can be seen from the figure, the perceived benefits relate to the environmental benefits, cost benefits and practicality that reusable takeaway can have over disposable. However, there are also barriers to the adoption of reusable takeaway, such as possible additional costs, perceived inconveniences, and restrictions on flexibility and convenience. The context dimension, which includes the availability and accessibility of reusable takeaway, as well as social norms, also plays a role.

The following hypotheses were derived from this assumption:

- H1: The perceived benefit of reusable packaging has a significant positive influence on the acceptance of reusable packaging in out-of-home gastronomy.

- H2: The perceived barriers of reusable packaging have a significant negative influence on the acceptance of reusable packaging in out-of-home gastronomy.

- H3: The higher the approval of the context dimension, the higher the acceptance of reusable packaging in out-of-home catering.

- H4: The higher the sustainability awareness, the higher the acceptance.

After a pre-test to ensure comprehensibility, a questionnaire was designed based on the operationalized terms and slightly modified. Data collection occurred on two campaign days in August 2023 in the cities of Mainz (14 August 2023) and Wiesbaden (17 August 2023), as well as online from 14 August to 30 September 2023. A second survey of end consumers will be conducted at a second measurement point in the cities of Mainz (13 March 2024) and Wiesbaden (12 March 2024), as well as online from 1 March to 31 March 2024. The first measurement point achieved a sample size of 402 respondents, while the second time point had 99 respondents. The results of these surveys are currently being analyzed using the statistical software SPSS [15].

3. Results

The results of surveys, both of companies and of consumers, are presented below. Only the results of the first measurement point are presented in the consumer survey.

3.1. Survey of Companies

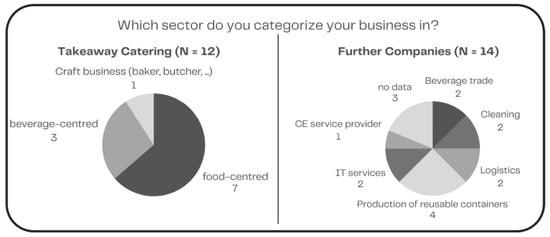

The sample of the business survey comprised a total of 12 takeaway catering companies (TC) and 14 further companies (FC). Figure 3 provides an overview of the sectoral affiliation of the companies; multiple responses were possible for the other companies.

Figure 3.

Sector of surveyed companies.

The respondent takeaway catering companies were seven micro-enterprises with fewer than 10 employees, two small enterprises (19–49 employees), one medium enterprise (50 to 250 employees), and one large enterprise with more than 250 employees (Definition based on the European Commission Recommendation (2003/361/EC) according to turnover and employee size classes). One company did not respond to this question. The majority of companies (7) were food-oriented (restaurants, pubs, snack bars, cafés, ice cream parlors [17]), three companies were beverage-oriented (pubs, discotheques and dance halls, bars, entertainment venues, other beverage-oriented gastronomy [17]), and one company was a craft business (bakery or butchery).

The sample of further companies surveyed included two micro, three small, two medium and four large companies. The sectors included beverages (2), cleaning (2), logistics (2), production of reusable containers (4), IT services (2) and circular economy service providers (1). Three companies did not respond.

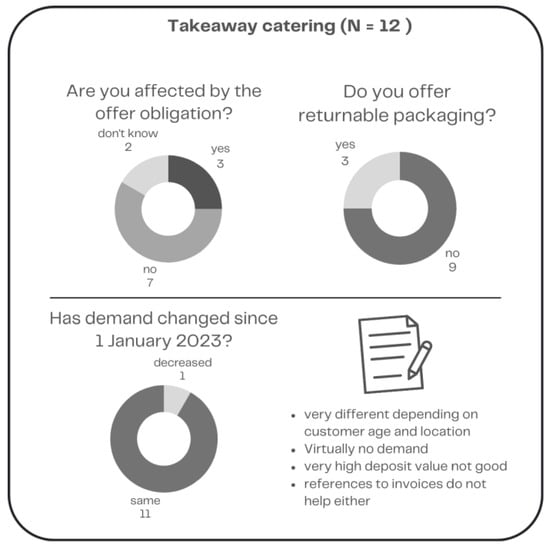

Not all of the restaurants surveyed were affected by the obligation to offer reusable options or already offer reusable options. Figure 4 shows the distribution of the companies surveyed. The chart also contains information on the development of consumer demand and selected direct statements from the companies surveyed.

Figure 4.

Information on the reusable supply obligation of the companies surveyed and consumer demand.

Six of the restaurants surveyed are legally required to offer reusable options, because they have sufficient square footage and employees. Only three of the respondents were already offering reusable options at the time of the survey in early 2024.

Reasons cited for companies not yet offering reusable packaging included lack of guest acceptance and demand, high cost, not fully developed solutions, complicated implementation, and hygiene concerns.

Consumer demand for reusable packaging is perceived by caterers to be very low and has not changed since the introduction of the reusable packaging obligation on 1 January 2023. One company even reported a decrease in demand. Demand for reusable packaging varies depending on the age of the consumer and the location of the business. However, disposable packaging is preferred by the majority of consumers. The high level of the deposit is also cited as an obstacle

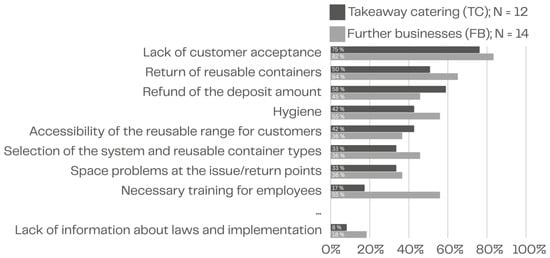

The takeaway restaurants and further companies were asked about the difficulties they perceive in providing reusable options for takeaway food and drinks (see Figure 5).

Figure 5.

Perceived challenges for companies.

The lack of customer acceptance is the biggest challenge for both stakeholder groups, both for takeaway restaurants and for further companies (TC: 75%; FC: 82%). Returning the deposit (TC: 58%; FC: 45%) and reusable containers (TC: 50%; FC: 64%) are also seen as a significant hurdle. Almost half of the total sample expressed hygiene concerns (TC: 42%; FC: 55%). Around a third of respondents saw challenges in the accessibility of reusable containers for customers (TC: 42%; FC: 36%), the selection of suitable containers for drinks and food (TC: 33%; FC: 45%), as well as the space available at delivery and return points (TC: 33%; FC: 36%). There were slight differences of opinion between the companies surveyed when it came to staff training. The further companies saw a greater need for action here than the catering companies (TC: 17%; FC: 55%). In contrast, a lack of information was perceived as a problem by very few companies (TC: 8%; FC: 18%).

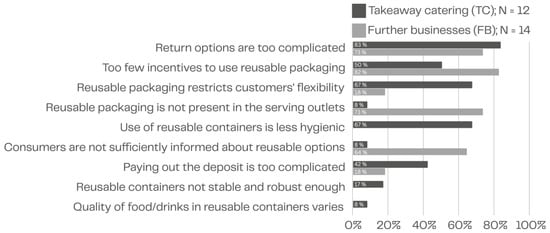

The views of the two stakeholder groups varied considerably with regard to the challenges associated with offering a reusable system to customers (Figure 6).

Figure 6.

Perceived challenges for customers.

There was an overall consensus that returning reusable containers is very inconvenient. This view was shared by 83% of takeaway restaurants and 73% of other companies.

From this point on, the opinions of the two groups diverged. The takeaway catering companies identified the greatest challenges as being the limited flexibility of customers (67%) and the hygiene of reusable containers (67%). In their opinion, there were too few incentives for the use of reusable containers (50%), e.g., through discounts or bonus points. The selection and deposit systems were also criticized by 42% as being too complicated.

Opinions on the information and presentation of reusable options varied widely. The out-of-home gastronomy sector considered neither the presentation of reusable containers nor the lack of information about them (8%) to be a problem. An 82% share of respondents from further companies, on the other hand, believed that there were too few incentives to use reusable containers. In addition, 73% of respondents believed that the presentation of reusable containers at the point-of-sale was poor, and 64% believed that customers were not sufficiently informed about the reusable offer. Contrary to the takeaway sector, other companies did not see a problem with the hygiene of reusable containers or the stability or possible loss of quality of food and beverages (0%).

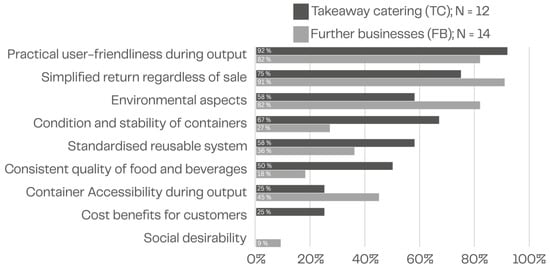

The question as to which aspect is particularly important in terms of offering reusable food in takeaway restaurants yielded the following results (see Figure 7).

Figure 7.

Important aspects when using reusable systems.

The two most important issues for both stakeholder groups were practical usability for serving operations, such as stackability (92% TC and 82% FC), and simplified return regardless of sale (75% for TC and 91% for FC). Environmental aspects such as waste avoidance, climate protection and resource conservation were a high priority for further companies in particular (82%), while only 58% of catering companies considered this aspect to be particularly important. The quality and stability of the containers played an important role for restaurants (67%), while only 27% of further companies emphasized this aspect. A uniform reusable system for all was supported by 58% of restaurants and 36% of further companies. Consistent perceived quality was important for 50% of restaurants and 18% of further companies. Social desirability, on the other hand, played little to no role for the respondents.

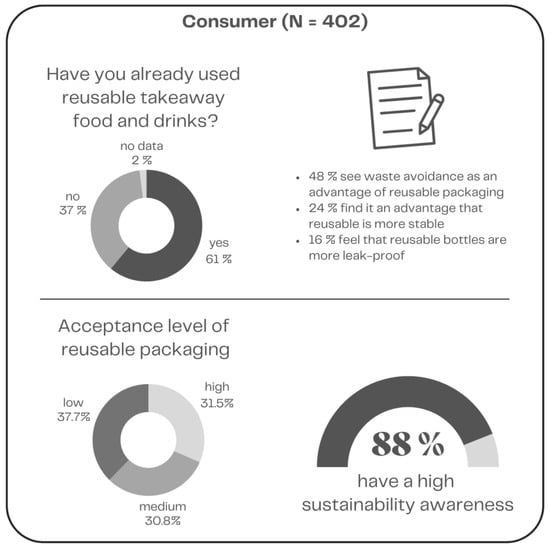

3.2. Consumer Survey

Of 402 people surveyed, 59.5% stated that they were female, 32.3% male and 2.2% that they were diverse/non-binary (6% not specified). The largest age group was the 25–34 age group with 20.4%, followed by the 55–64 age group with 18.7%. The group of 14–18-year-olds was the least represented, with 4.7%. Of the respondents, 2.2% did not wish to state their age. In addition to determining the benefit, context and barrier dimensions presented, the correspondence between the stated sustainability awareness and acceptance of reusable packaging among consumers was analyzed. At the first measurement time, 88% of respondents had a high level of sustainability awareness, but at the same time had a low to medium level of acceptance. Just under 25% of respondents had a high level of sustainability awareness and a low level of acceptance, whereas 30% had a high level of sustainability awareness with a medium level of acceptance, and only 32% of respondents had a high level of sustainability awareness with a high level of acceptance.

For consumers, this illustrates the discrepancy between attitude and actual action. The formulated hypotheses H1, H3 and H4 could not be verified, while H2 could be accepted. It can be concluded that although the respondents had a high level of sustainability awareness, a high context dimension, and a positive evaluation of the benefits of reusable packaging, the perceived barriers stood in the way of using reusable packaging or using it more frequently. At measurement point 1, the economic barrier was perceived as an obstacle. According to this, 60% would use reusable packaging more frequently if it were cheaper than the disposable alternative. In addition, 44% felt that returning reusable packaging was inconvenient and limited their flexibility.

The results highlight the need to make reusable packaging more economically advantageous for the end consumer. For example, rebates or a bonus program for the use of reusable packaging could be considered. However, an even greater effect can be expected if disposable packaging is taxed according to the Tübingen model, in which caterers have to pay a packaging tax of EUR 0.50 per item if disposable packaging is used for takeaway food and beverages [18].

The removal of return barriers for the final consumer is another important step towards increasing the reusability rate and thus towards the resource-conserving recycling of packaging. Figure 8 also summarizes the perceived benefits of reusable packaging for consumers.

Figure 8.

Consumer survey results.

Although 88% of respondents had a high level of sustainability awareness, they had only a low to medium level of acceptance, once again highlighting the discrepancy between attitudes and actual behavior. Just under half of respondents also saw waste reduction as an advantage of using reusable packaging over disposable packaging. In addition, 24% of respondents considered reusable containers to be more stable than disposable ones, and 16% of consumers surveyed also considered reusable containers to be more leak-proof.

4. Discussion

When reflecting on the quantitative surveys of consumers and companies carried out as part of the Reusable City Model project, it is important to note several critical points that may influence the interpretation of the results. Firstly, the participation of companies in the survey was low despite a large distribution list. This could have affected the representativeness of the results and raises questions about their generalizability. It is worth considering whether a different methodology, such as personal surveys or interviews, could lead to higher participation and more meaningful results. Additionally, while this study focused on urban areas compared with services and user behaviors in rural areas, future studies should aim for broader geographical coverage to obtain a more comprehensive understanding of the situation. It is important to consider these limitations when interpreting the study’s results.

Nevertheless, the results are largely in line with the studies cited in the introduction: Companies face significant challenges due to low customer acceptance and demand for reusable packaging, despite providing sufficient information about it. Additionally, return systems for reusables are often considered too cumbersome, leading to logistical challenges for establishments offering them and a lack of flexibility for customers. Many catering companies prefer disposable containers due to hygiene concerns about reusable ones.

According to the latest figures from the German Hotel and Restaurant Association e. V. (DEHOGA), it is unsurprising that companies are reacting cautiously to the new task of introducing and offering reusable packaging. The catering industry has experienced significant sales losses in recent years, with the number of taxable companies in the food-intensive sector decreasing by 11.7% between 2019 and 2021, and by as much as 31.4% in the beverage-intensive sector. In general, businesses are experiencing a decline in guest numbers due to a drop in consumption, with 64.5% reporting subdued expectations. This decline is expected to intensify, particularly due to the increase in VAT from 7% to 19% effective 1 January 2024, a measure introduced in Germany during the pandemic. Consequently, 90.6% of companies are planning to raise their prices, while 69.4% are reducing or eliminating investments, and 28.1% are even laying off employees. Currently, companies are facing significant challenges due to the increasing costs of food and beverages (83.8%), energy (79.5%), personnel (76.0%), rising bureaucracy (75%), and the acute shortage of employees (65.2%) [19].

In summary, companies may lack the personnel and financial capacity to introduce a reusable concept.

The surveys reveal a classic chicken-and-egg problem regarding the use of reusable cups in the to-go sector. On one hand, food services report low demand for reusable options from customers, which has prompted them to continue offering mainly disposable cups. However, customers have expressed a desire for more reusable options and claim that companies do not advertise them enough. This dilemma has resulted in a low reusable cup rate, accounting for less than 10% of the total amount of takeaway food and drink packaging sold.

Companies and customers appear to be in a holding pattern, each waiting for the other to take the initiative. Although both sides are generally willing to use or offer reusable packaging, they are prevented from taking action themselves due to perceived passivity of the other side.

This paradox highlights a discrepancy between consumers’ attitudes and their actual behavior when it comes to using reusable packaging, a conclusion that is also reflected by Klöpper and colleagues [9]. The survey results indicate a discrepancy between theory and practice despite positive attitudes towards reusable packaging. Therefore, it is necessary to intensify efforts to promote reusable systems and involve all stakeholders, including politicians, companies, and consumers. Further research is needed to identify specific barriers and opportunities that influence the implementation and use of reusable systems. Examining international projects, such as those in Switzerland [20] or in Aarhus, Denmark [21], where reusable systems are being tested on a large scale, can provide valuable insights. To develop effective strategies for increasing the use of reusable systems and contributing to sustainability, it is essential to have a comprehensive understanding of these factors.

Overall, reusable systems have the potential to be an environmentally friendly solution. However, for efficient and environmentally friendly adaptation, it is crucial to consider and optimize the critical influencing factors and system parameters. According to Kleinhückelkotten and colleagues [8], high circulation rates of reusable systems are decisive, with just 10 to 15 cycles being sufficient for a positive climate balance. However, further research is needed to determine the factors that can encourage all stakeholders to make greater use of reusable systems and increase the number of rounds.

5. Conclusions

A division of responsibility could be established among politicians, companies, and consumers. Politicians should create further clear legal regulations, eliminate information deficits, and introduce controls and sanctions to ensure compliance with the obligation to offer reusable packaging. Targeted information and awareness-raising campaigns aimed at both restaurateurs and customers could help to break up the paradox. These campaigns could highlight the benefits of reusable cups while providing practical tips and guidance on how to use and offer them. Financial support for companies offering reusable options could increase the use of reusable cups.

Restaurateurs should actively promote the reusable packaging to make customers aware of this sustainable alternative. Incentive systems, such as discounts, could encourage customers to use reusable packaging instead of disposable ones. A neutral and organized structure for information and organization could facilitate the joint collection, cleaning, and return of reusable packaging. This, in turn, could increase the rate of reusable packaging in out-of-home catering. By overcoming logistical challenges and promoting the use of reusable packaging, a significant increase in the rate of reusable packaging could be achieved.

Finally, customers have a crucial role in promoting sustainable practices in out-of-home catering by actively demanding reusable solutions.

The results, findings and conclusions of this study will be used in the future to formulate specific requests to policy makers. The main objective is to further promote and support reusable packaging systems. At the same time, these policy demands are intended to adapt and improve the regulatory framework to further facilitate and increase the use of reusable packaging.

Author Contributions

Conceptualization, K.T., A.M. and S.H. (Stefanie Hillesheim); methodology, K.T., A.M. and S.H. (Stefanie Hillesheim); validation, K.T., A.M. and S.H. (Stefanie Hillesheim); investigation, K.T, A.M. and S.H. (Stefanie Hillesheim); resources, K.T, A.M. and S.H. (Stefanie Hillesheim); writing—original draft preparation, K.T., A.M. and S.H. (Stefanie Hillesheim); writing—review and editing, H.R. and S.H. (Susanne Hartard); visualization, K.T., A.M. and S.H. (Stefanie Hillesheim); project administration, K.T., A.M., S.H. (Stefanie Hillesheim), H.R. and S.H. (Susanne Hartard); funding acquisition, H.R. and S.H. (Susanne Hartard). All authors have read and agreed to the published version of the manuscript.

Funding

This study was funded by the Rhineland-Palatinate Ministry for Climate Protection, Environment, Energy and Mobility and the Hessian Ministry for Agriculture and Environment, Viticulture, Forestry, Hunting and Homeland.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Acknowledgments

We would like to thank the initiators of the pilot project ‘Mehrweg Modell Stadt’, the Reusable to Go initiative, for their support. Information on the pilot project can be found at the following website: www.mehrwegstadt.de (accessed on 11 April 2024) [14].

Conflicts of Interest

The authors declare that they are not aware of any competing financial interests or personal relationships that could influence the work in this paper.

References

- Istel, K.; Detloff, K. Disposable Tableware and To-Go Packaging: Waste Generation in Germany 1994 to 2017. NABU (Naturschutzbund Deutschland) e.V. 2018. Available online: https://www.nabu.de/imperia/md/content/nabude/abfallpolitik/2018_nabu_broschuere_einweggeschirr_to-go.pdf (accessed on 26 March 2024).

- German Federal Government, German Packaging Act. Available online: https://www.gesetze-im-internet.de/verpackg/VerpackG.pdf (accessed on 6 April 2024).

- Council of the European Union, Proposal for a Regulation of The European Parliament and of the Council on Packaging and Packaging Waste, Amending Regulation (EU) 2019/1020 and Directive (EU) 2019/904, and repealing Directive 94/62/EC, 15 03 2024. Available online: https://data.consilium.europa.eu/doc/document/ST-7859-2024-INIT/en/pdf (accessed on 9 April 2024).

- The European Green Deal. Available online: https://ec.europa.eu/stories/european-green-deal/ (accessed on 3 June 2024).

- Circular Economy Act [KrWG]. 2012. Available online: https://www.bmuv.de/fileadmin/Daten_BMU/Download_PDF/Abfallwirtschaft/kreislaufwirtschaftsgesetz_en_bf.pdf (accessed on 4 June 2024).

- The Packaging Act. Available online: https://www.verpackungsgesetz.com/themen/die-neue-europaeische-verpackungsverordnung-eu-verpackv-2025/ (accessed on 11 April 2024).

- Schüler, K.; Wedekind, N.; Burger, A. Reusable Food in German Gastronomy: Status Quo, Challenges and Potentials, 2023rd ed.; WWF: Berlin, Germany, 2023; Available online: https://nbn-resolving.org/urn:nbn:de:101:1-2023020216540582897799 (accessed on 11 April 2024).

- Kleinhückelkotten, S.; Behrendt, D.; Neitzke, H.P. Reusable Food in Takeaway Gastronomy: Basic Study on the Project ‘Climate Protection is(s)t Reusable’. 2022. Available online: https://esseninmehrweg.de/wp-content/uploads/2022/09/Studie_Mehrweg-Takeaway-Gastronomie_2022.pdf (accessed on 26 March 2024).

- Klöpper, L.; Nguyen, U.; Schüler, K.; Wedekind, N.; Wilhelm, J.; Griestop, L.; Kraas, C. Reusable Packaging in German Gastronomy: A Reality Check One Year after the Introduction of the Reusable Packaging Obligation; WWF: Berlin, Germany, 2024. [Google Scholar]

- Elisabeth, S.; Alexander, P.; Klara, W.; Janne, W. (Use of (Reusable) Containers for Takeaway Food. In Results of a Representative Survey; Zentrum Technik und Gesellschaft, TU: Berlin, Germany, 2024; Available online: https://pur-precycling.de/wp-content/uploads/2024/05/Bericht_Mehrweg_Repraesentativbefragung_PuR.pdf (accessed on 3 May 2024).

- Jiang, X.; Dong, M.; He, Y.; Shen, J.; Jing, W.; Yang, N.; Guo, X. Research on the Design of and Preference for Collection Modes of Reusable Takeaway Containers to Promote Sustainable Consumption. Int. J. Environ. Res. Public Health 2020, 17, 4764. [Google Scholar] [CrossRef] [PubMed]

- Mich, A. Between attitude and behavior: Attitude-Behavior-Gap in reusable use in takeaway gastronomy. In Proceedings of the 13th Scientific Congress on Circular and Resource Economy, Wien, Austria, 15–16 February 2024; pp. 355–358. [Google Scholar]

- Böckel, A.; Pietzke, A.; Wilts, H.; Seyring, N. Piloting of Infrastructure for the Return of Reusable Packaging. Handout on Impact Measurement. March 2024. Available online: https://www.mehrwegverband.de/wp-content/uploads/2024/05/230415-Handreichung-Pilotierung-von-Infrastruktur-zur-Ruecknahme-von-Mehrwegverpackungen_compressed.pdf (accessed on 2 June 2024).

- Pilot Project ‘Reusable City Model’. Available online: www.mehrwegstadt.de (accessed on 26 March 2024).

- IBM. SPSS Statistics. (Version 29.0.2.0). 2024. Available online: https://www.ibm.com/products/spss-statistics (accessed on 24 March 2024).

- Mayer, H.O. Interview and written survey. In Fundamentals and Methods of Empirical Social Research, 6th ed.; Oldenbourg Wissenschaftsverlag: Munich, Germany, 2018. [Google Scholar]

- Packaging Tax of the City of Tübingen. Available online: https://www.tuebingen.de/33361.html (accessed on 10 April 2024).

- DEHOGA. Hospitality Industry 2023. Balance Sheet & Outlook. Results of the DEHOGA Survey. 2023. Available online: https://www.dehoga-bundesverband.de/fileadmin/Startseite/06_Presse/DEHOGA-Booklet_Gastgewerbe_2023_-_Bilanz_und_Ausblick.pdf (accessed on 2 April 2024).

- Federal Statistical Office. Classification of Economic Activities: With Explanatory Notes. Federal Statistical Office. 2008. Available online: https://www.destatis.de/DE/Methoden/Klassifikationen/Gueter-Wirtschaftsklassifikationen/Downloads/klassifikation-wz-2008-3100100089004-aktuell.pdf (accessed on 25 March 2024).

- Kooky. Available online: https://www.kooky2go.com/en/home (accessed on 11 April 2024).

- De Lorenzo, D. Danish City First To Test Return System For Reusable Coffee Cups. Forbes. Available online: https://www.forbes.com/sites/danieladelorenzo/2024/01/17/danish-city-first-to-tests-return-system-for-disposible-coffee-cups (accessed on 11 April 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).