Decisions and Coordination of E-Commerce Supply Chain Considering Product Quality and Marketing Efforts under Different Power Structures

Abstract

1. Introduction

- In the e-commerce supply-chain system, when product quality and marketing efforts are independently managed, will there be free-riding behavior due to reliance on each other’s efforts?

- When both e-commerce platform operators and suppliers seek to maximize their profits, will the overall performance of the supply chain decline?

- How can the interests of supply-chain members be coordinated when they work together?

2. Literature Review

2.1. Supply-Chain Research under Different Power Structures

2.2. Impact of Product Quality on the Supply Chain

2.3. Impact of Marketing Efforts on the Supply Chain

2.4. Research on Coordination Contracts in Supply Chains

3. Research Methodology

3.1. Introduction to the Methodology

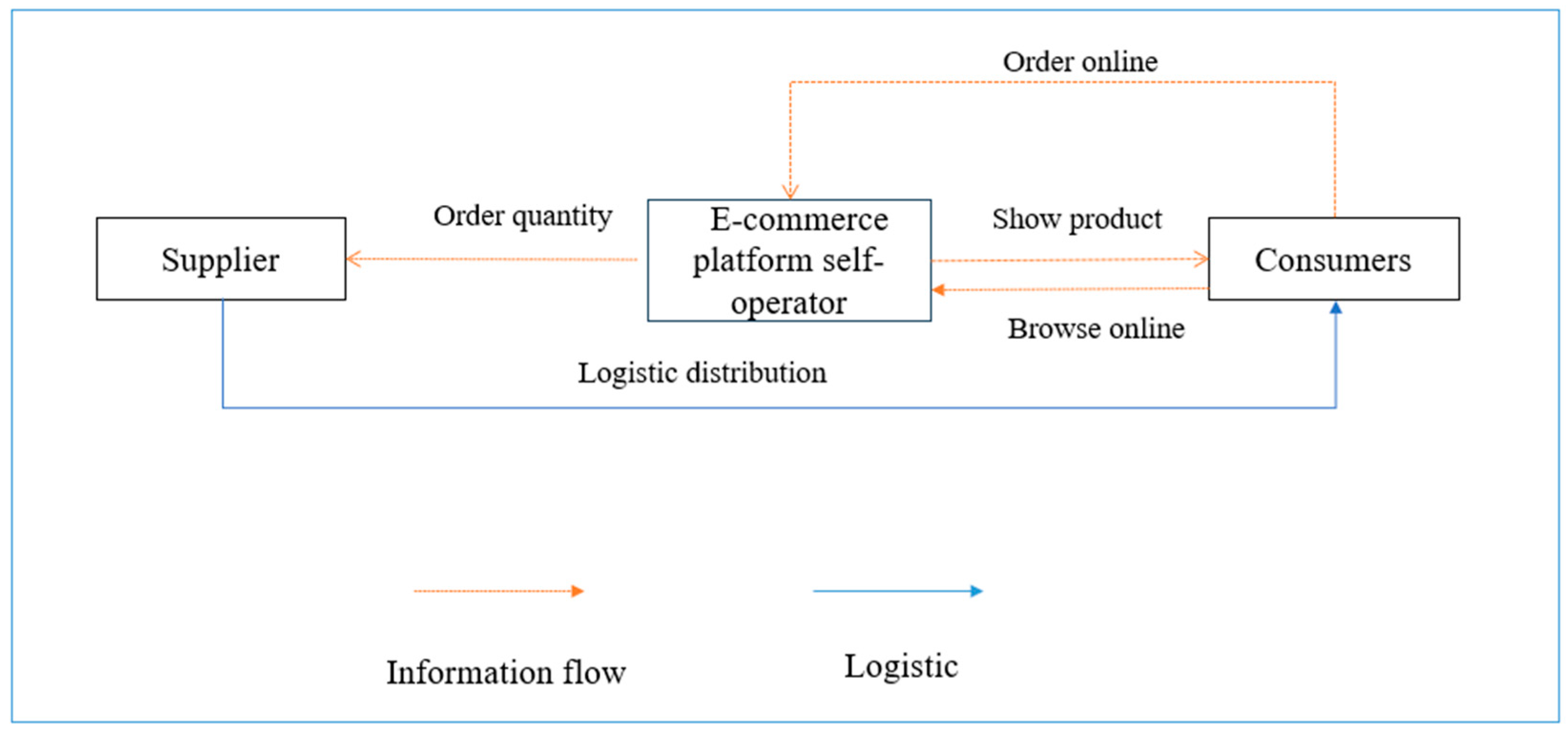

3.2. Research Problem and Assumptions

4. Supply-Chain Model Analysis

4.1. Centralized Decision-Making Model

4.2. Decentralized Decision-Making Model Dominated by the Supplier

4.3. Decentralized Decision-Making Model Dominated by the E-Commerce Platform Self-Operator

4.4. Comparison and Analysis of the Decision Models

5. Supply-Chain Coordination Contract Model

5.1. “Cost-Sharing + Compensation Contract” Model

5.2. Coordination of Supply-Chain Contracts and Pareto Improvement

6. Case Analysis

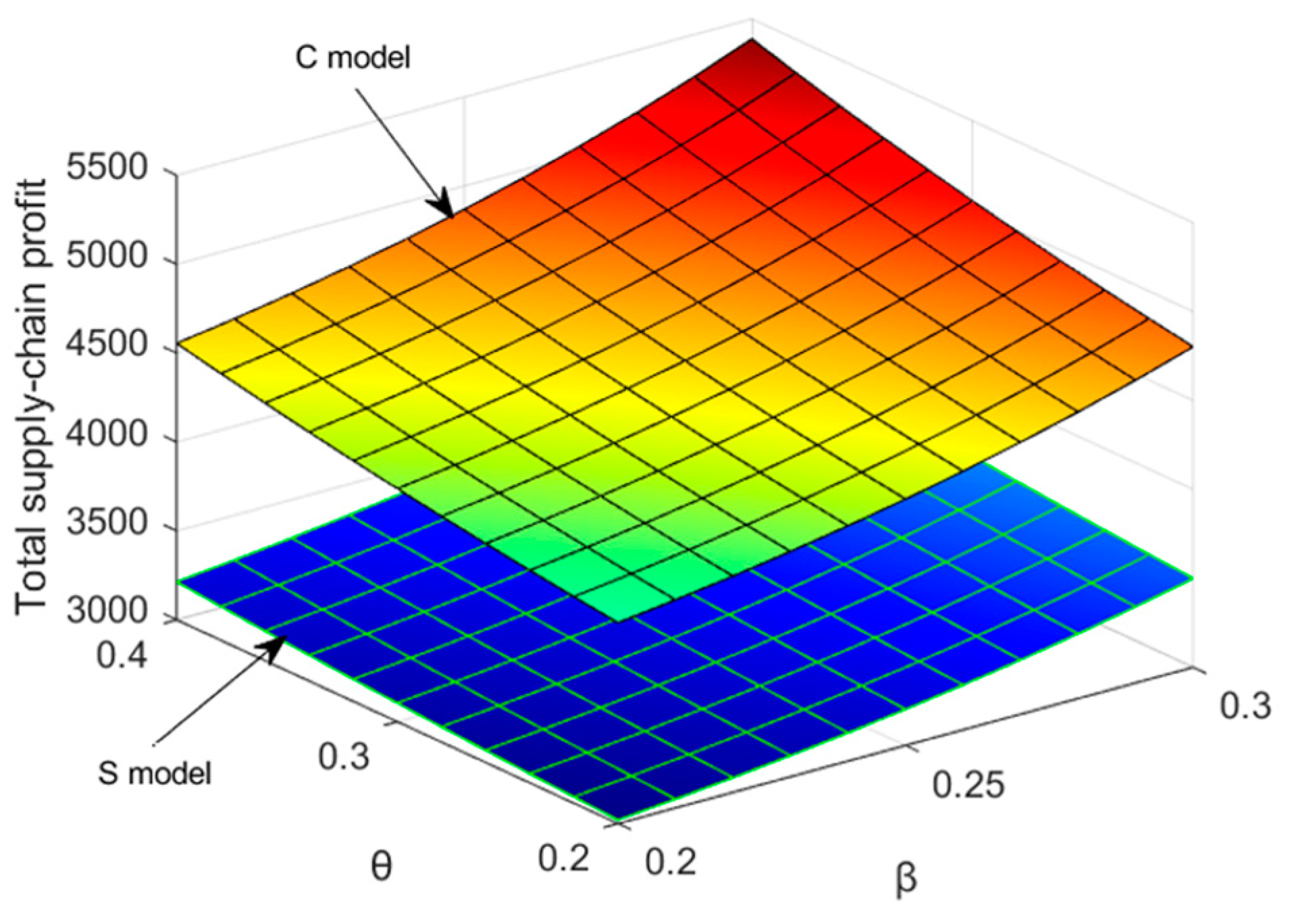

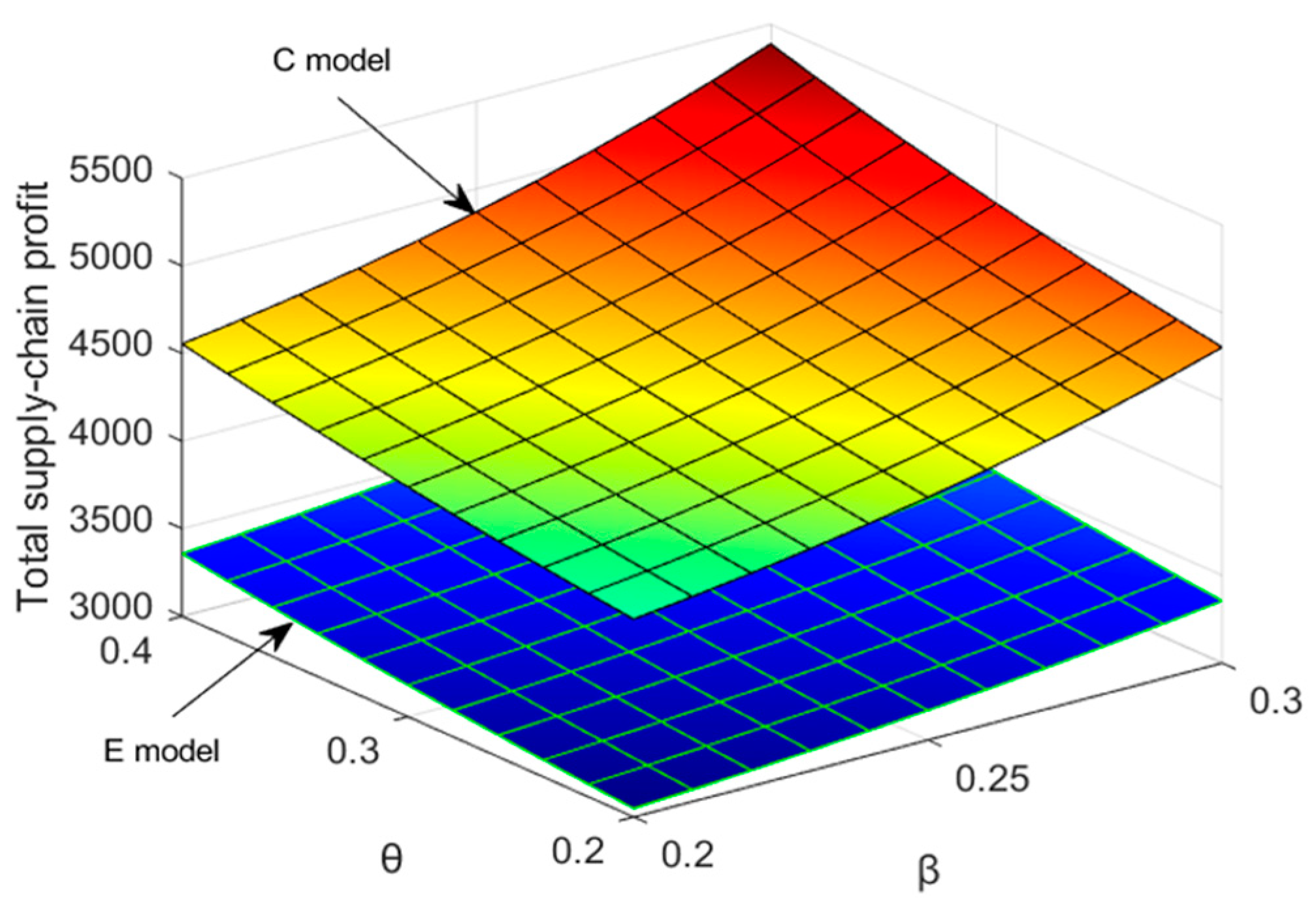

6.1. Comparison of Supply-Chain Performance between the Three Modes

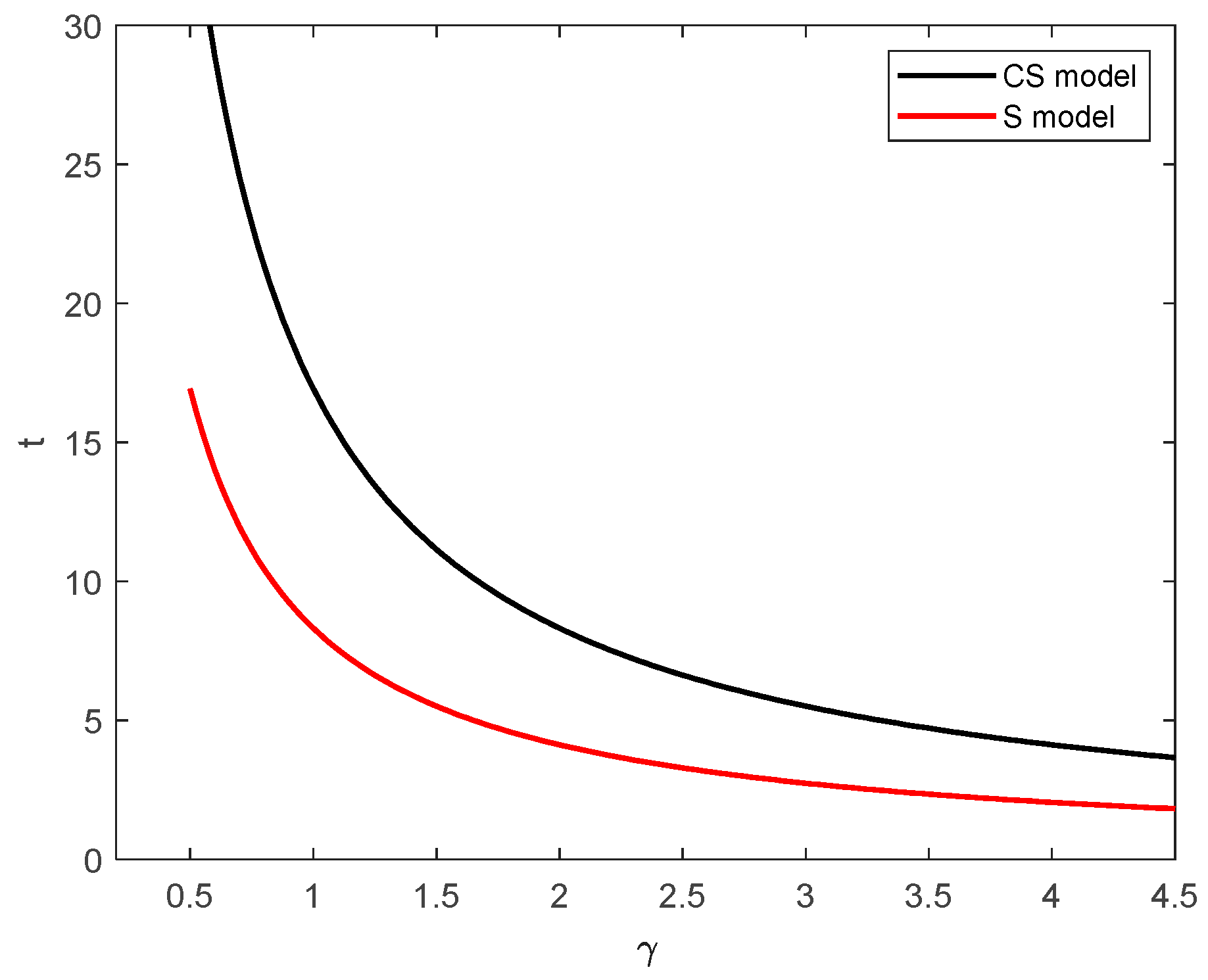

6.2. Sensitivity Analysis

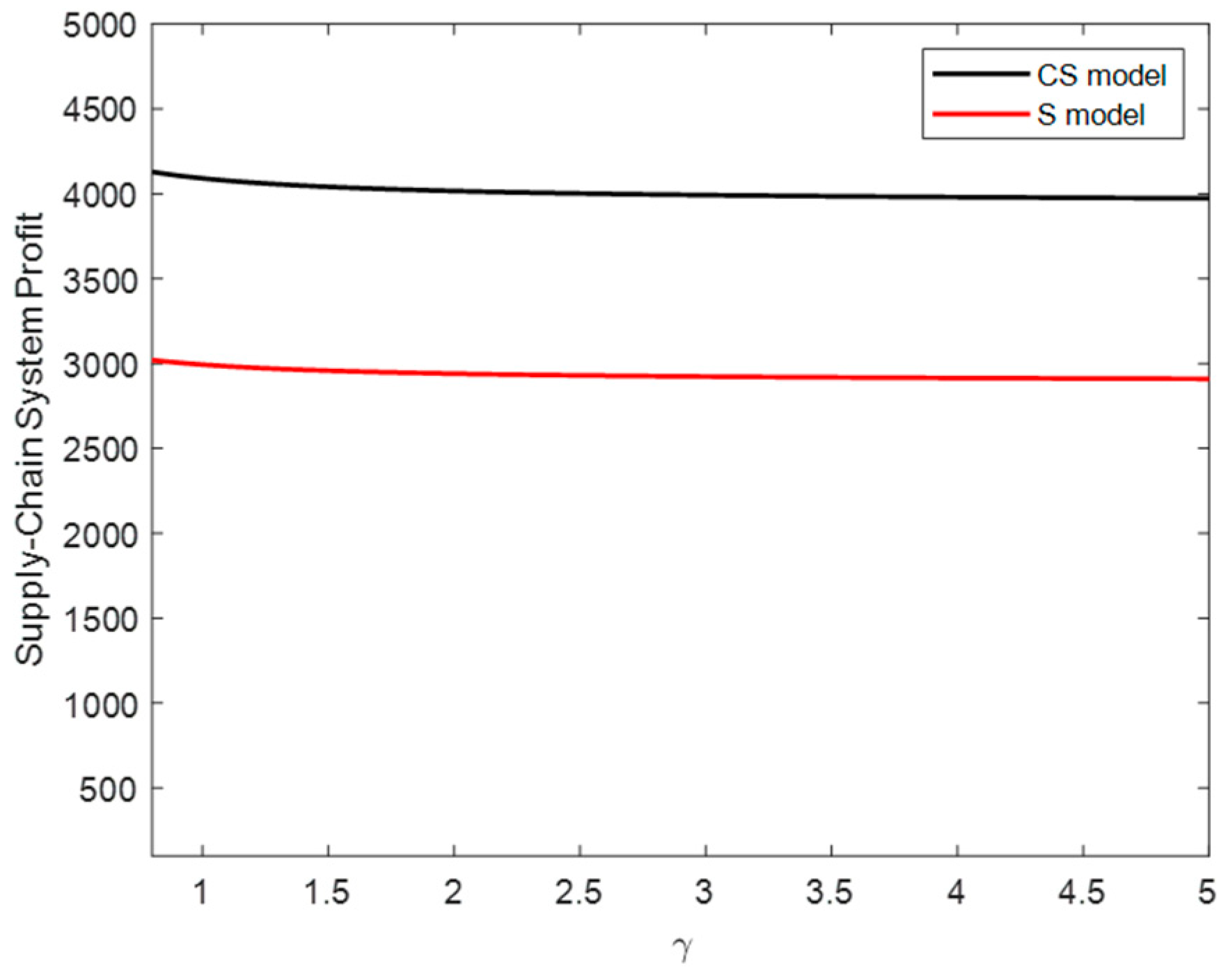

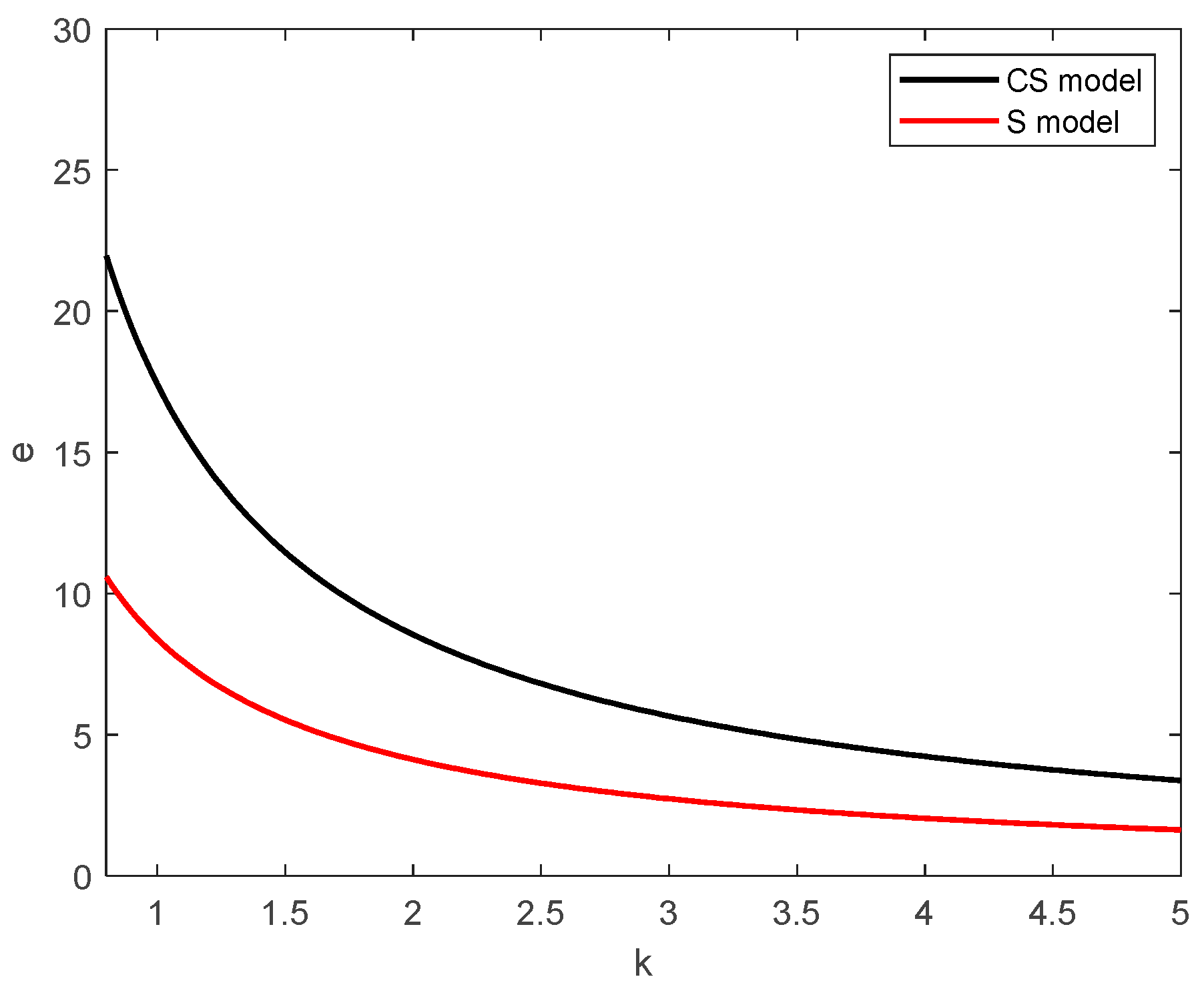

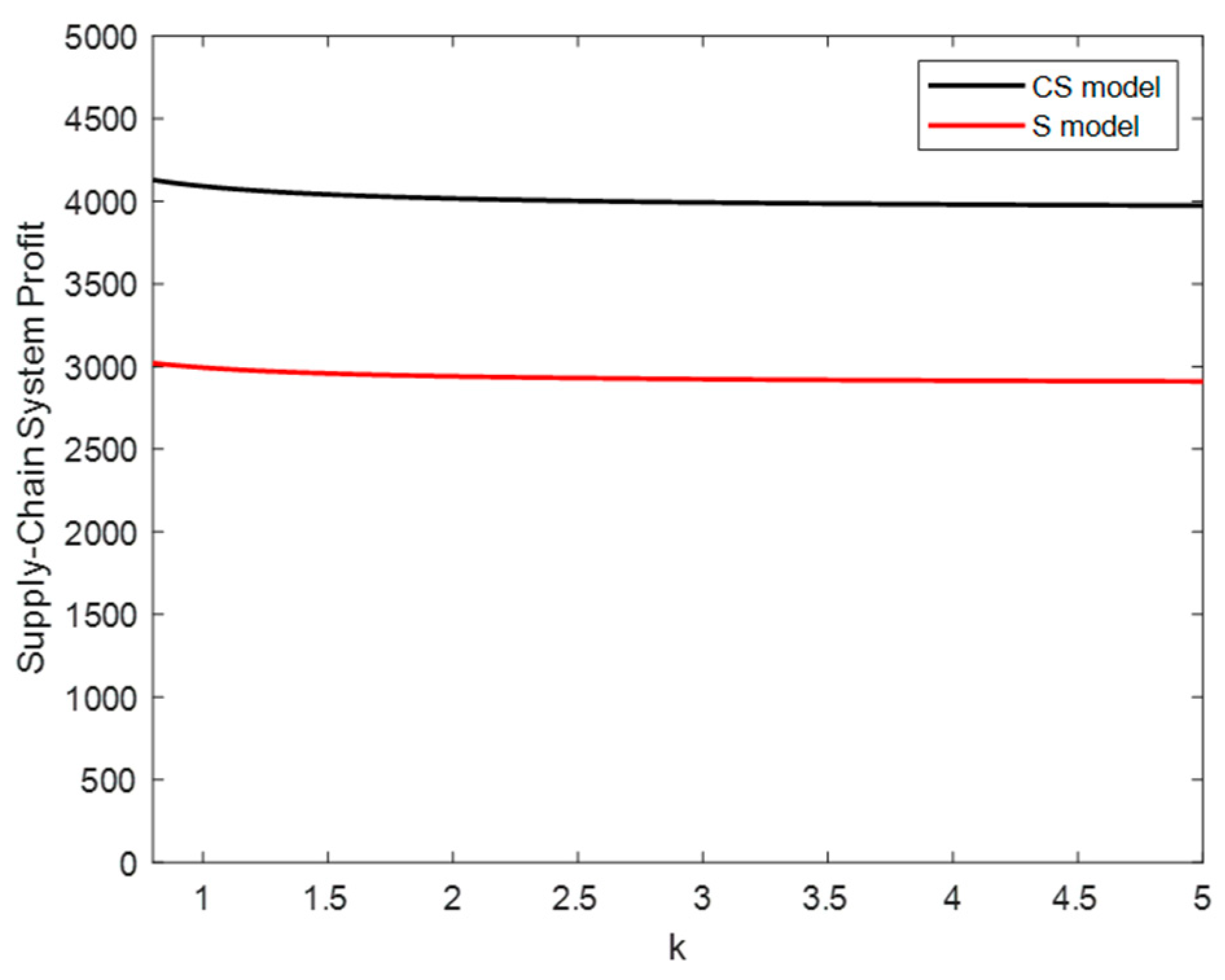

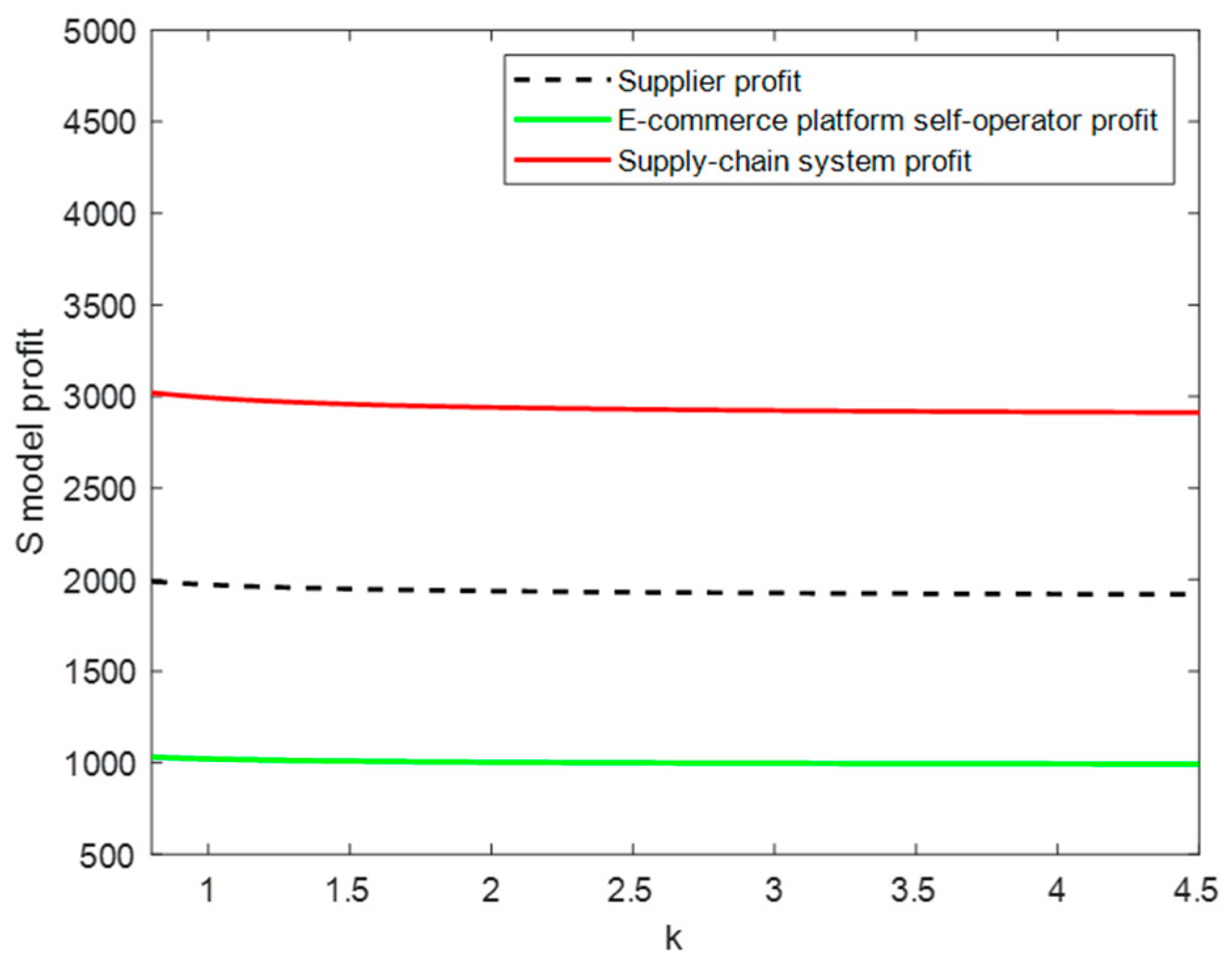

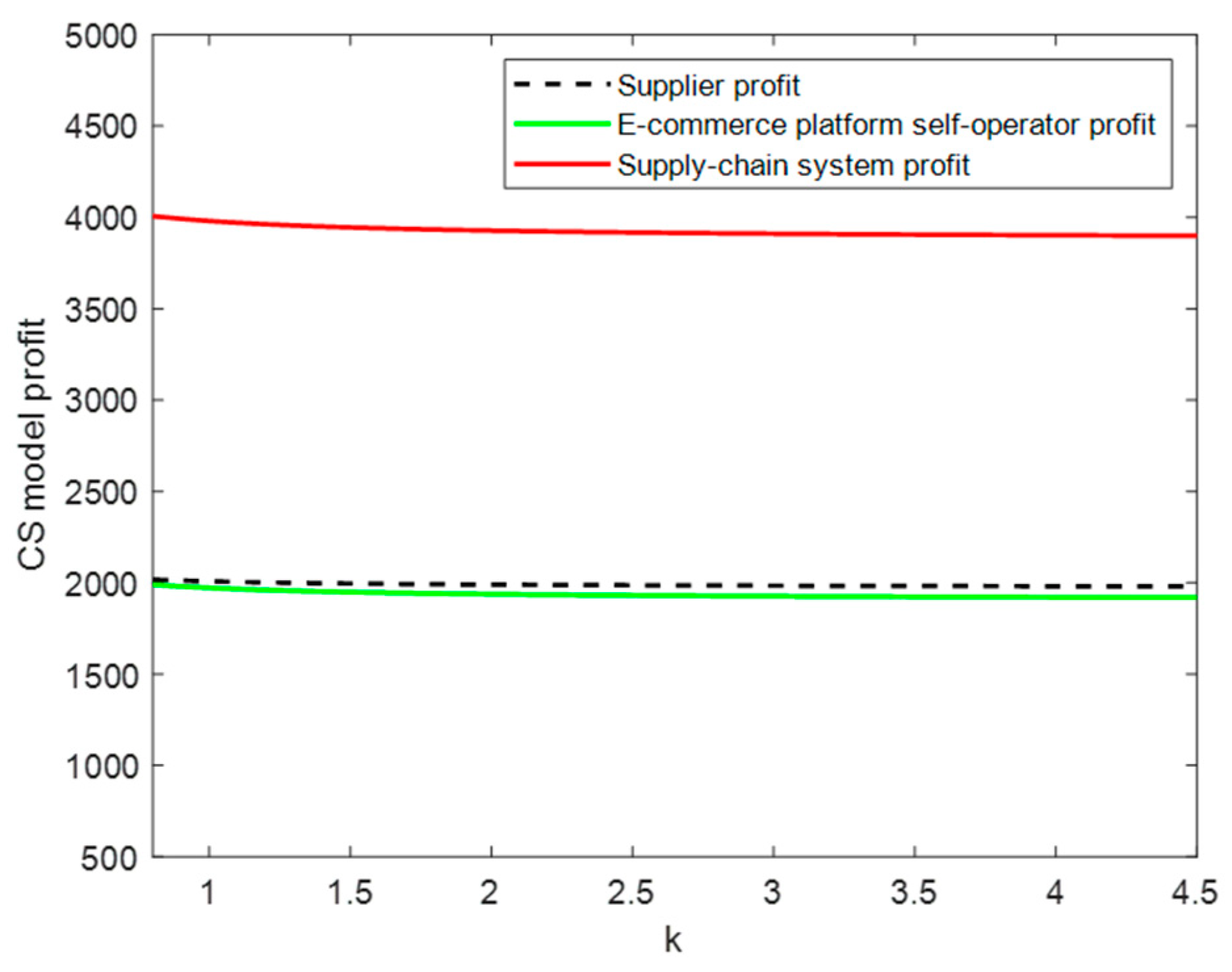

6.3. Impact of and on Supply-Chain Parameters in the CS Model and S Model

6.4. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wan, X.; Chen, J. The relationship between platform choice and supplier’s efficiency- evidence from China’s online to offline (O2O) e-commerce platforms. Electron. Market. 2019, 29, 153–166. [Google Scholar] [CrossRef]

- Sulastri, R.E. The influence of product quality and promotion on consumer purchase decisions. J. Manaj. Bisnis. 2023, 7, 604–612. [Google Scholar] [CrossRef]

- Isidora, K.; Marija, K. Conjoint analysis of green consumer preferences for electronic products. Int. J. Qual. Res. 2022, 16, 559–575. [Google Scholar]

- Anand, H.; Alun, E. Brand preferences for consumer electronics in the United Arab Emirates. Int. J. Intell. Enterp. 2022, 9, 422–437. [Google Scholar]

- Ana, B.R.; Francesca, S.; Kristine, D.V.; Tammo, H.A.; Bijmolt, T.H. The effect of electronic word of mouth on sales: A meta-analytic review of platform, product, and metric factors. J. Mark. Res. 2016, 53, 297–318. [Google Scholar]

- Niu, B.Z.; Dong, J.; Dai, Z.P.; Liu, Y.Q. Sales data sharing to improve product development efficiency in cross-border e-commerce. Electron. Commer. Res. Appl. 2022, 51, 101112. [Google Scholar] [CrossRef]

- Mulyadi, H. Brand image analysis of sales with product quality as Samsung electronics Indonesia intervening variables. J. Sos. Dan Sains 2022, 3, 49–55. [Google Scholar]

- Prabhakar, M.K. Sheltronics installs electronic draft auto leveler technology at Gomuki Spinning Mills: New technology helps adhere to stringent quality standards and improve productivity. Text. Mag. 2017, 58, 70–72. [Google Scholar]

- Gong, W.W.; Liu, X.C.; Zhu, X.C.; Chen, J.X. Product quality control strategy based on supply chain network equilibrium in the direct broadcasting economy. Comput. Integr. Manuf. Syst. 2023, 29, 1684–1695. [Google Scholar]

- Wang, X.T.; Han, X.H.; Chen, Y. Optimal manufacturer strategy for live-stream selling and product quality. Electron. Commer. Res. Appl. 2024, 64, 101372. [Google Scholar] [CrossRef]

- Huang, F.Y.; Xiong, D.; Ma, C. Optimal decisions and channel coordination of a green supply chain with marketing effort and fairness concerns. Appl. Math. Nonlinear. Sci. 2023, 8, 909–926. [Google Scholar] [CrossRef]

- Subhajit, S.; Adel, F.A.; Md, A.K.; Amalesh, K.M. Optimal strategies for green investment, sharing contract and advertisement effort in a supply chain coordination problem. Ain. Shams. Eng. J. 2023, 15, 102595. [Google Scholar]

- Fan, J.C.; Fu, H.; Li, Y.H. The research on quality and coordination in supply chains under channel power structures and liability cost sharing. Syst. Eng. Pract. 2020, 40, 1767–1779. [Google Scholar]

- Lu, L.J.; Menezes, M.B.C. Supply chain vertical competition and product proliferation under different power structures. Int. J. Prod. Econ. 2024, 267, 109097. [Google Scholar] [CrossRef]

- Wang, W.; Liu, X.J.; Zhang, W.S.; Gao, G.; Zhang, H. Coordination of a green supply chain with one manufacturer and two competing retailers under different power structures. Discrete Dyn. Nat. Soc. 2019, 2019, 3453850. [Google Scholar] [CrossRef]

- Wen, H.; Zheng, B.R.; Cao, X.G.; Li, J.Z. Pricing and coordination of dual channel closed-loop supply chain with different channel power structure. Oper. Res. Manag. 2020, 29, 65–74. [Google Scholar]

- Wang, S.D.; Zhou, Y.W.; Min, J.; Zhong, Y.G. Coordination of cooperative advertising models in a one-manufacturer two-retailer supply chain system. Comput. Ind. Eng. 2011, 61, 1053–1071. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.J. Free or bundled: Channel selection decisions under different power structures. Omega 2015, 53, 11–20. [Google Scholar] [CrossRef]

- Feng, Q.H.; Liu, T. Research on the choice and coordination strategy of service channels in product and service supply chain considering power structure. Oper. Res. Manag. Sci. 2022, 31, 31–38. [Google Scholar]

- Chen, K.B.; Kong, Y.Q.; Lei, D. Pricing and green input decisions of a competitive supply chain with consumers’ product preference and different channel powers. China J. Manag. Sci. 2023, 31, 1–10. [Google Scholar]

- Jena, S.K.; Meena, P. Competitive sustainable processes and pricing decisions in omnichannel closed-up supply chains under different channel power structures. J. Retail. Consum. Serv. 2022, 69, 103114. [Google Scholar] [CrossRef]

- Andriani, D.P.; Tseng, F.S. Pricing and investment decisions when facing heterogeneous customers under different supply chain power structures. Alex. Eng. J. 2023, 78, 390–405. [Google Scholar] [CrossRef]

- Cao, X.G.; Kong, Y.Q.; Lei, D. Decision-making of closed-loop supply chain strategic alliance considering the quality level of remanufactured products and patent protection. Asia-Pac. J. Oper. Res. 2020, 37, 2050021. [Google Scholar] [CrossRef]

- Xu, B.; Zhang, Z.H.; Li, X.Q. Research on the coordination of quality behavior of supply 3 chain of e-commerce platform under C2B model of gig-grade e-commerce based on differential game. J. Theor. Appl. Electr. Commer. Res. 2022, 17, 1409–1430. [Google Scholar] [CrossRef]

- Zhang, Z.; Liu, S.; Niu, B. Coordination mechanism of dual-channel closed-loop supply chains considering product quality and return. J. Clean. Prod. 2020, 248, 119273. [Google Scholar] [CrossRef]

- Zhang, S.; Zhao, C.; Liu, Q.W. Cooperative incentive model of supply chain quality control based on cost-sharing contract. J. Phys. Conf. Ser. 2021, 1910, 012031. [Google Scholar] [CrossRef]

- Amirhossein, S.; Ali, H.D.; Mohammad, K.; Jurgita, A.; Edmundas, K.Z.; Farbod, Z. Multi-objective sustainable closed-loop supply chain network design considering multiple products with different quality levels. Systems 2022, 10, 94. [Google Scholar] [CrossRef]

- Ahmed, M.A.; Saadany, E.; Jaber, M.Y. Coordinating a two-level supply chain with production interruptions to restore process quality. Comput. Ind. Eng. 2008, 54, 95–109. [Google Scholar]

- Lin, Z.B.; Luo, C. A Study on supply chain product quality decision and coordination based on manufacturer’s process innovation capability. J. Fuzhou. Univ. (Philo. Soc. Sci.) 2021, 35, 50–58. [Google Scholar]

- Li, G.; Wu, H.M.; Sethi, S.P.; Zhang, X. Contracting green product supply chains considering marketing efforts in the circular economy era. Int. J. Prod. Econ. 2021, 234, 108041. [Google Scholar] [CrossRef]

- Taylor, T.A. Supply chain coordination under channel rebates with sales effort effects. Manag. Sci. 2002, 48, 992–1007. [Google Scholar] [CrossRef]

- Xie, W.Y.; Chen, B.; Huang, F.Y.; He, J. Coordination of a supply chain with a loss-averse retailer under supply uncertainty and marketing efforts. J. Ind. Manag. Optim. 2021, 17, 3393. [Google Scholar] [CrossRef]

- Li, M.; Gao, G.J. Coordination of supply chain cost-sharing contract considering green R&D investment and marketing efforts under low carbon background. Int. Core J. Eng. 2022, 8, 281–294. [Google Scholar]

- Taleizadeh, A.A.; Sane-Zerang, E.; Choi, T.M. The effect of marketing efforts on dual-channel closed-loop supply chain systems. IEEE. Trans. Syst. Man. Cybern. Syst. 2018, 48, 265–276. [Google Scholar] [CrossRef]

- Guo, J.S.; Yang, P.; Zhou, Y.W.; Yang, Y.Z. Dual channel supply chain coordination strategy based on uniform pricing and promotion. Oper. Res. Manag. Sci. 2021, 30, 99–107. [Google Scholar]

- Li, M.X.; Chen, K.B. Channel structure selection in a competitive supply chain under consideration of marketing efforts strategy. Soft Comput. 2022, 26, 12155–12177. [Google Scholar] [CrossRef]

- Chang, S.; Hu, B.; He, X.H. Supply chain coordination in the context of green marketing efforts and capacity expansion. Sustainability 2019, 11, 5734. [Google Scholar] [CrossRef]

- Huang, H.W.; Chen, Z.S.; Wu, S.; Jiao, J.F.; Wang, X.J. Pricing and coordination of dual channel based on sales effort under two-part pricing contract. Comput. Integer. Manuf. Syst. 2022, 28, 2998–3008. [Google Scholar]

- Sousa, N. Breaking barriers: Unveiling challenges in virtual reality adoption for tourism business managers. Tour. Hosp. Manag. 2024, 30, 269–282. [Google Scholar] [CrossRef]

- Jorge, F.; Sousa, N.; Losada, N. Can virtual reality be used to create memorable tourist experiences to influence the future intentions of wine tourists? J. Tour. Dev. 2023, 43, 67–76. [Google Scholar]

- Fadi, A.; David, F.; Mizan, R.; Nuzhat, N. A new era of strategic investment decision-making practices in UK companies: Towards sustainable supply chains and circular economy. Theor. Econ. Lett. 2023, 13, 666–682. [Google Scholar]

- Zhang, Y.C.; Feng, Y.; Zhou, J.H. Simulation and Optimization to Systematic Dynamic Model of Contract Coordination Quality Control in Closed-loop Supply Chain. Syst. Eng. 2018, 36, 105–112. [Google Scholar]

- Wang, W.B.; Chen, M.X.; Lin, W.Y.; Bian, W.L. Pricing and coordination in a dual-channel supply chain with product variety under the countervailing power of the retailer. IEEE Access 2021, 9, 18817–18830. [Google Scholar] [CrossRef]

- Mohammad, R.R.; Saeed, Y.; Atieh, F. A hierarchical revenue-sharing contract in electronic waste closed-loop supply chain. Waste Manag. 2020, 115, 121–135. [Google Scholar]

- Shen, Q.; Xu, L.L.; Yang, W.M.; Liu, X.B.; Hou, Y.X. The optimization of quality control in dual channel supply chains with uncertain demand. China J. Manag. Sci. 2019, 27, 128–136. [Google Scholar]

- Kou, J.; Zhang, X.M.; Zhou, M.S.; Dan, B. Pricing and coordination strategy of product and extended warranty in product service supply chain. J. Syst. Manag. 2020, 29, 601–607. [Google Scholar]

- Chen, Z.S.; Wu, S.; Govindan, K.; Wang, X.J.; Chin, K.S.; Martínez, L. Optimal pricing decision in a multi-channel supply chain with a revenue-sharing contract. Ann. Oper. Res. 2022, 318, 67–102. [Google Scholar] [CrossRef]

- Hu, H.J.; Li, Y.K.; Li, M.D. Decisions and coordination of green supply chain considering big data targeted advertising. J. Theor. Appl. Electr. Commer. Res. 2022, 17, 1035–1056. [Google Scholar] [CrossRef]

- Wang, Y.Y.; Yu, Z.Q.; Shen, L.; Fan, R.J.; Tang, R.Y. Decisions and coordination in e-commerce supply chain under logistics outsourcing and altruistic preferences. Mathematics 2021, 9, 253. [Google Scholar] [CrossRef]

- Lin, Q.; Qin, X.H. Optimal decision and contract coordination of e-commerce supply chain based on altruistic preference. J. Math. Pract. Theory 2021, 51, 287–299. [Google Scholar]

- Saha, S.; Banaszak, Z.A.; Bocewicz, G.K.; Nielsen, I.E. Pricing and quality competition for substitutable green products with a common retailer. Oper. Res. 2021, 22, 3713–3746. [Google Scholar] [CrossRef]

- He, Y.; Wang, H.; Guo, Q.; Xu, Q.Y. Coordination through cooperative advertising in a two-period consumer electronics supply chain. J. Retail. Consum. Serv. 2019, 50, 179–188. [Google Scholar] [CrossRef]

- Guo, H.X.; Liu, Z.; Hu, B.; Lin, H.D.; Shi, L.H.; Meng, C.C. Pricing and coordination mechanism of supply chain considering product recycling under asymmetric power. Math. Probl. Eng. 2021, 2021, 5579655. [Google Scholar] [CrossRef]

- Heydari, J.; Ghasemi, M. A revenue sharing contract for reverse supply chain coordination under stochastic quality of returned products and uncertain remanufacturing capacity. J. Clean. Prod. 2018, 197, 607–615. [Google Scholar] [CrossRef]

- Hosseini-Motlagh, S.-M.; Nematollahi, M.; Nouri, M. Coordination of green quality and green warranty decisions in a two-echelon competitive supply chain with substitutable products. J. Clean. Prod. 2018, 196, 961–984. [Google Scholar] [CrossRef]

- Modak, N.M.; Panda, S.; Sana, S.S. Three-echelon supply chain coordination considering duopolistic retailers with perfect quality products. Int. J. Prod. Econ. 2016, 182, 564–578. [Google Scholar] [CrossRef]

- Jiang, Y.; Ma, S.H. Study on supply chain sales strategy for perishable product with advance selling and quality disclosure. Ind. Eng. Manag. 2018, 23, 85–90. [Google Scholar]

- He, X.C.; He, Q.H. Investigation on quantization of quality of product. Hunan Metall. 2000, 28, 45–48. [Google Scholar]

- Wang, Y.Y.; Shen, L.; Han, Q. E-commerce supply chain model considering product quality and altruistic preference concern. Chin. J. Manag. Sci. 2021, 29, 123–134. [Google Scholar]

- Kasulaitis, B.; Babbitt, C.W.; Tyler, A.C. The role of consumer preferences in reducing material intensity of electronic products. J. Ind. Ecol. 2021, 25, 435–447. [Google Scholar] [CrossRef]

- Alessandro, S.O.; Gustavo, Q.S.; Dirceu, D.S.; Matheus, A.R.S.; Francisco, D.A.D.S.M. Impacts of service guarantees on consumers’ perceived quality and satisfaction in e-commerce. Int. J. Qual. Reliab. Manag. 2023, 40, 2559–2580. [Google Scholar]

- Liu, C.; Huang, W.L.; Zheng, B.R.; Yang, C. The decision-making of manufacturer stimulating supplier innovation considering marketing effort and innovation capability. Syst. Eng. Theory Pract. 2017, 37, 3040–3051. [Google Scholar]

- Liu, G.W.; Zhang, J.X.; Tang, W.S. Strategic transfer pricing in a marketing–operations interface with quality level and advertising dependent goodwill. Omega 2015, 56, 1–15. [Google Scholar] [CrossRef]

- Fu, C.Y.; Cheng, S.S.; Yi, Y.X. Dynamic control of product innovation, advertising effort, and strategic transfer-pricing in a marketing-operations interface. Math. Probl. Eng. 2019, 2019, 8418260. [Google Scholar] [CrossRef]

- Ma, D.Q.; Hu, J.S. Dynamic quality improvement input and marketing effort coordination strategies considering delay phenomenon. Oper. Res. Manag. Sci. 2021, 30, 181–190. [Google Scholar]

- Alotosh, D.; Biswajit, S.; Bikash, K.D.; Isha, S.; Liu, Y.; Shu-Kai, S.; Suman, K.S.; Lakshmi, T. The impact of sales effort on a dual-channel dynamical system under a price-sensitive stochastic demand. J. Retail. Consum. Serv. 2024, 76, 103561. [Google Scholar]

- Zhang, K.J.; Ma, M.Q. Research on dual-channel supply chain coordination considering fresh e-tailer’s returns. J. Donghua Univ. (Nat. Sci. Ed.) 2021, 47, 116–123. [Google Scholar]

- Cai, X.Q.; Chen, J.; Xiao, Y.B.; Xu, X.L. Optimization and coordination of fresh product supply chains with freshness-keeping efforts. Prod. Oper. Manag. 2010, 19, 261–278. [Google Scholar] [CrossRef]

- Zhu, M.L. Dual-channel supply chain coordination considering quality control under revenue-sharing contract. J. Trans. Eng. Inform. 2021, 19, 81–92. [Google Scholar]

| References | Focus | Power Structure | Quality of Products | Marketing Efforts | Coordination Mechanism |

|---|---|---|---|---|---|

| Lu et al. [14] | Operating costs | Yes | No | No | Nash equilibrium |

| Wang et al. [17] | Green cost | Yes | No | No | Tariff contracts |

| Chen et al. [18] | Green products | Yes | Yes | No | Cost-sharing covenants |

| Cao et al. [23] | Remanufacturing of waste products | Yes | Yes | No | No |

| Xu et al. [24] | Product grade | No | Yes | No | Cooperation and coordination mechanism |

| Zhang et al. [25] | Quality control | No | Yes | Yes | No |

| Li et al. [30] | Green level of the product | No | No | Yes | Contractual deeds |

| Taleizadeh et al. [34] | Dual-channel | Yes | No | Yes | Two-part tariff contract |

| Zhang et al. [42] | Product quality | No | Yes | No | Quality reward and punishment–revenue-sharing contract |

| Lin et al. [50] | Altruistic preference | Yes | No | No | Service cost sharing |

| This paper | Product quality, marketing efforts | Yes | Yes | Yes | Cost sharing + compensation deeds |

| Parameters | Descriptions |

|---|---|

| Sales price | |

| Product quality level | |

| Marketing effort level | |

| Market demand | |

| Sensitivity coefficient of market demand to price, | |

| Sensitivity coefficient of consumers to the level of marketing Efforts of e-commerce platform self-operator, | |

| Marketing effort cost factor, | |

| Sensitivity coefficient of consumers to the quality level of supplier products, | |

| Wholesale price | |

| Cost of the product | |

| Product quality cost factor, | |

| Potential market demand for electronics | |

| Profit function of the supplier | |

| Profit function of the e-commerce platform self-operator | |

| Profit function of supply-chain system |

| Parameter | |||||||

|---|---|---|---|---|---|---|---|

| Value | 100 | 10 | 0.8 | 0.2 | 0.5 | 0.2 | 0.6 |

| Decision-Making Patterns | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| C model | 97.85 | 35.14 | 21.96 | - | 45.68 | - | - | 4128.97 | |

| Decentralized model | S model | 133.5 | 16.94 | 10.59 | 91.16 | 25.41 | 1990.09 | 1030.9 | 3020.99 |

| E model | 133.04 | 17.17 | 10.73 | 52.92 | 25.75 | 1031.7 | 2017.35 | 3049.06 | |

| CS model | 98 | 35 | 21.91 | 10.36 | 52.58 | 1991.43 | 2137.54 | 4128.97 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ren, H.; Luo, Z. Decisions and Coordination of E-Commerce Supply Chain Considering Product Quality and Marketing Efforts under Different Power Structures. Sustainability 2024, 16, 5536. https://doi.org/10.3390/su16135536

Ren H, Luo Z. Decisions and Coordination of E-Commerce Supply Chain Considering Product Quality and Marketing Efforts under Different Power Structures. Sustainability. 2024; 16(13):5536. https://doi.org/10.3390/su16135536

Chicago/Turabian StyleRen, Haiping, and Zhen Luo. 2024. "Decisions and Coordination of E-Commerce Supply Chain Considering Product Quality and Marketing Efforts under Different Power Structures" Sustainability 16, no. 13: 5536. https://doi.org/10.3390/su16135536

APA StyleRen, H., & Luo, Z. (2024). Decisions and Coordination of E-Commerce Supply Chain Considering Product Quality and Marketing Efforts under Different Power Structures. Sustainability, 16(13), 5536. https://doi.org/10.3390/su16135536