Financial Security as a Basis for the Sustainable Development of Small and Medium-Sized Renewable Energy Companies—A Polish Perspective

Abstract

1. Introduction

2. Literature Review

2.1. Importance of Renewable Energy Sources

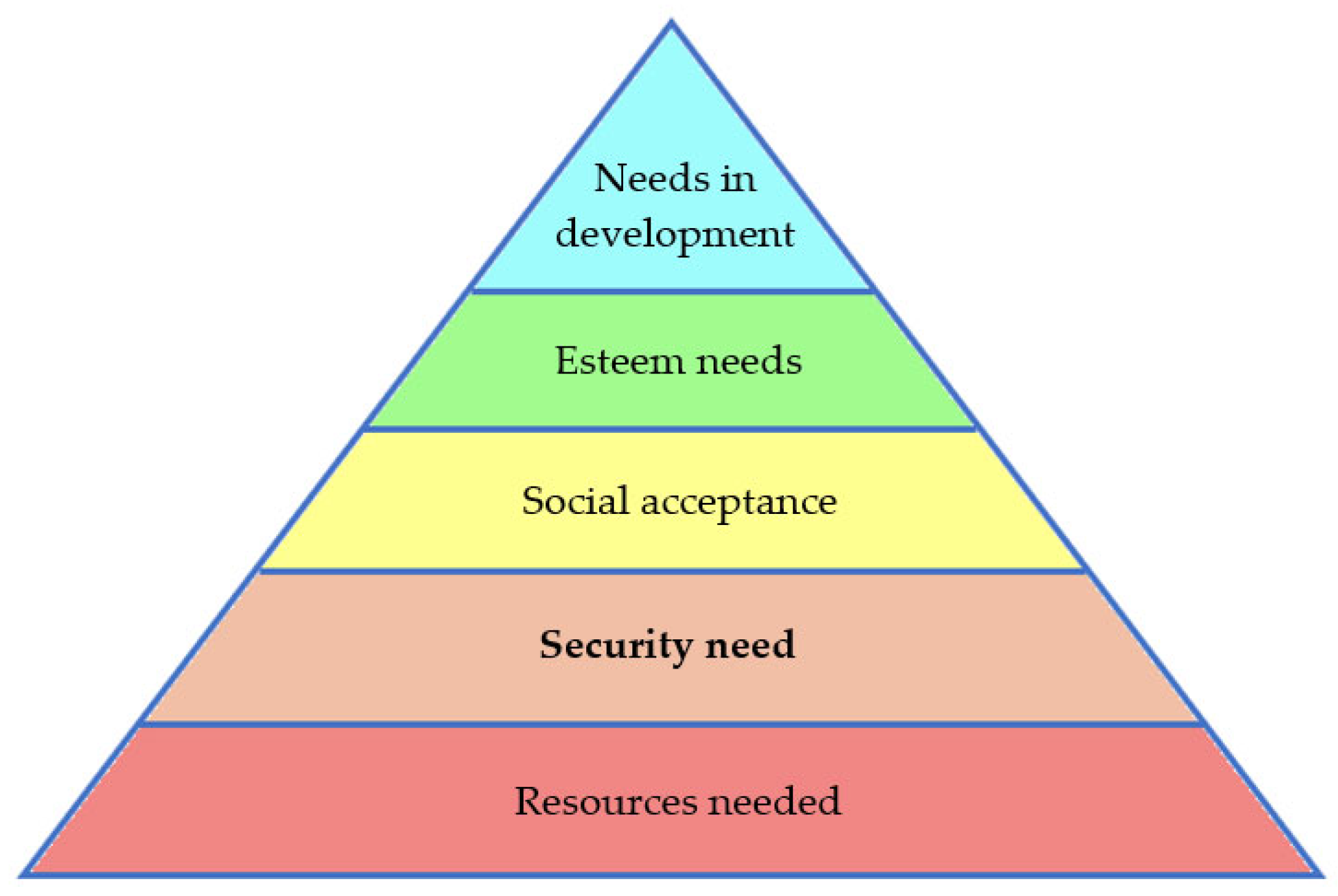

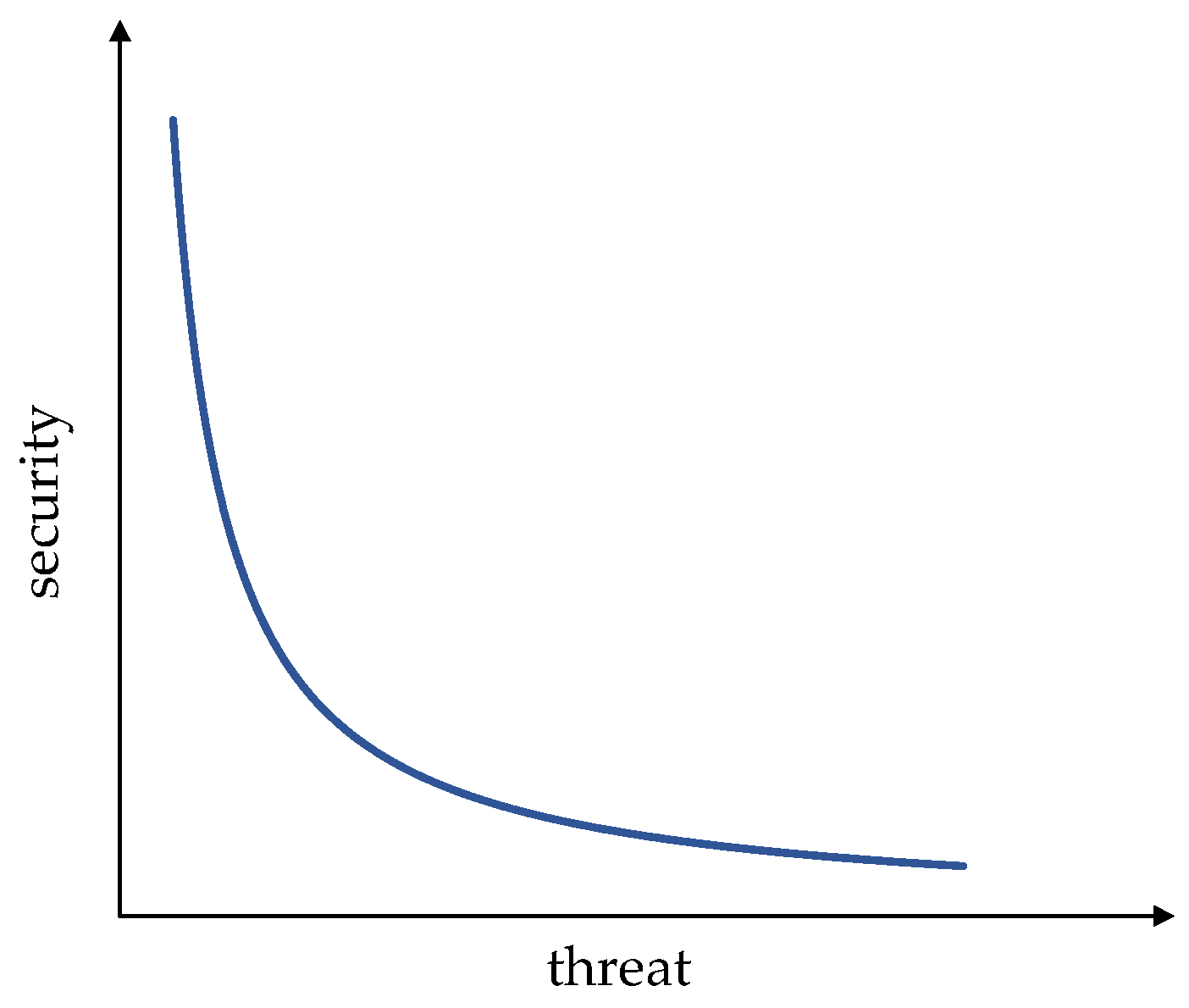

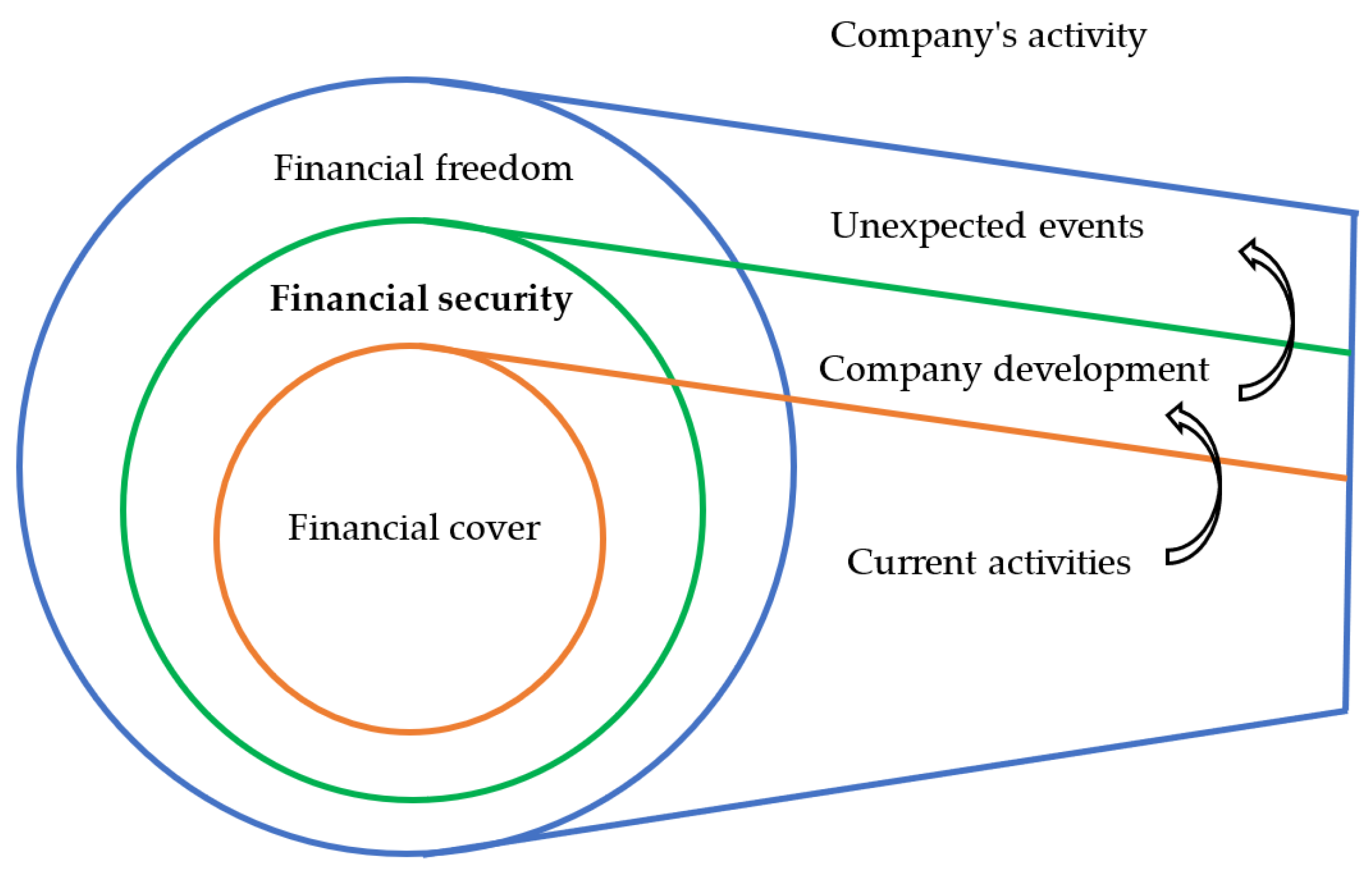

2.2. Financial Security

3. Materials and Methods

3.1. Data Collection

3.2. Financial Analyses

3.3. Statistical Methods

4. Results of Empirical Research

4.1. Descriptive Statistics

4.2. Comparison of the Groups of Renewable Energy Companies

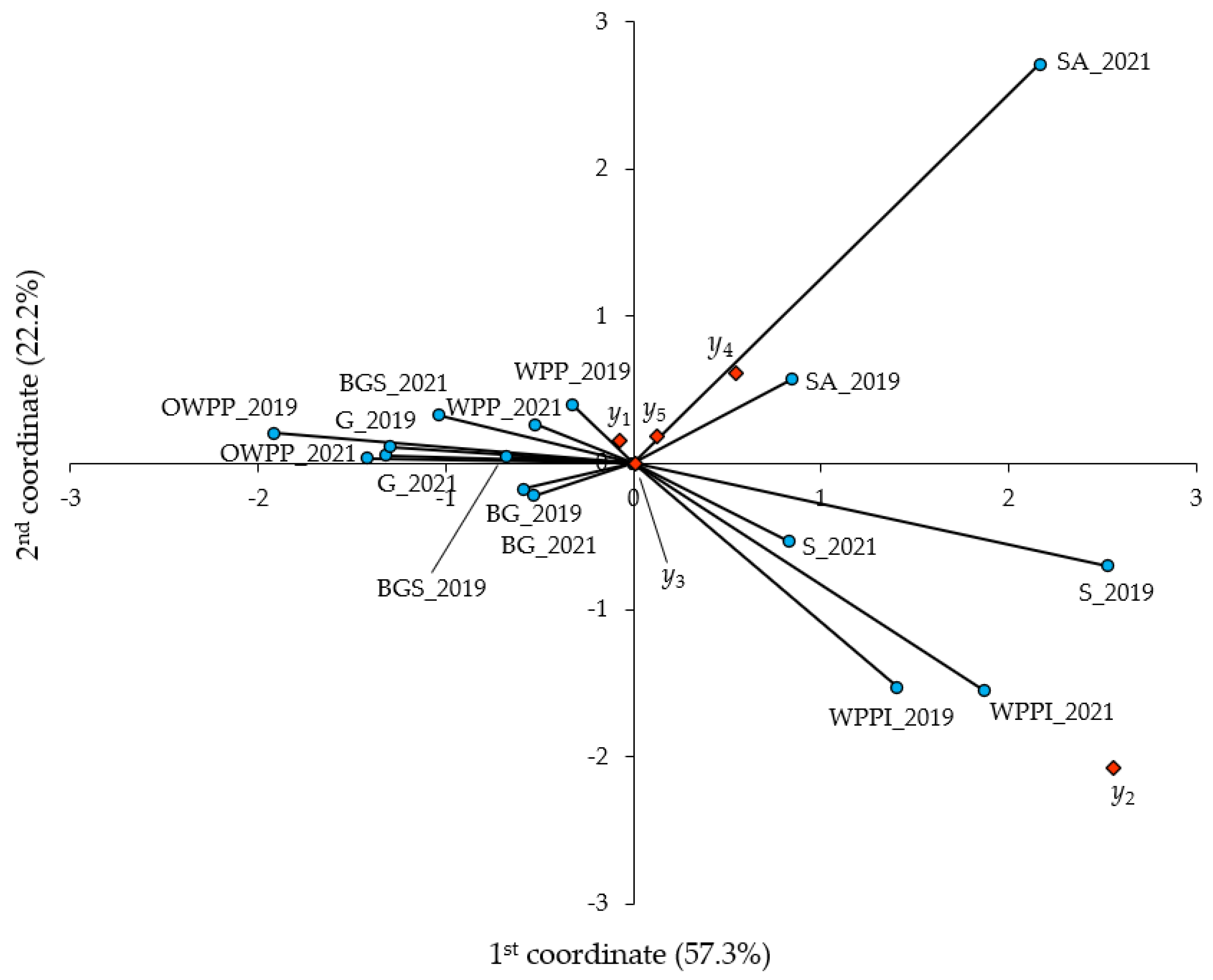

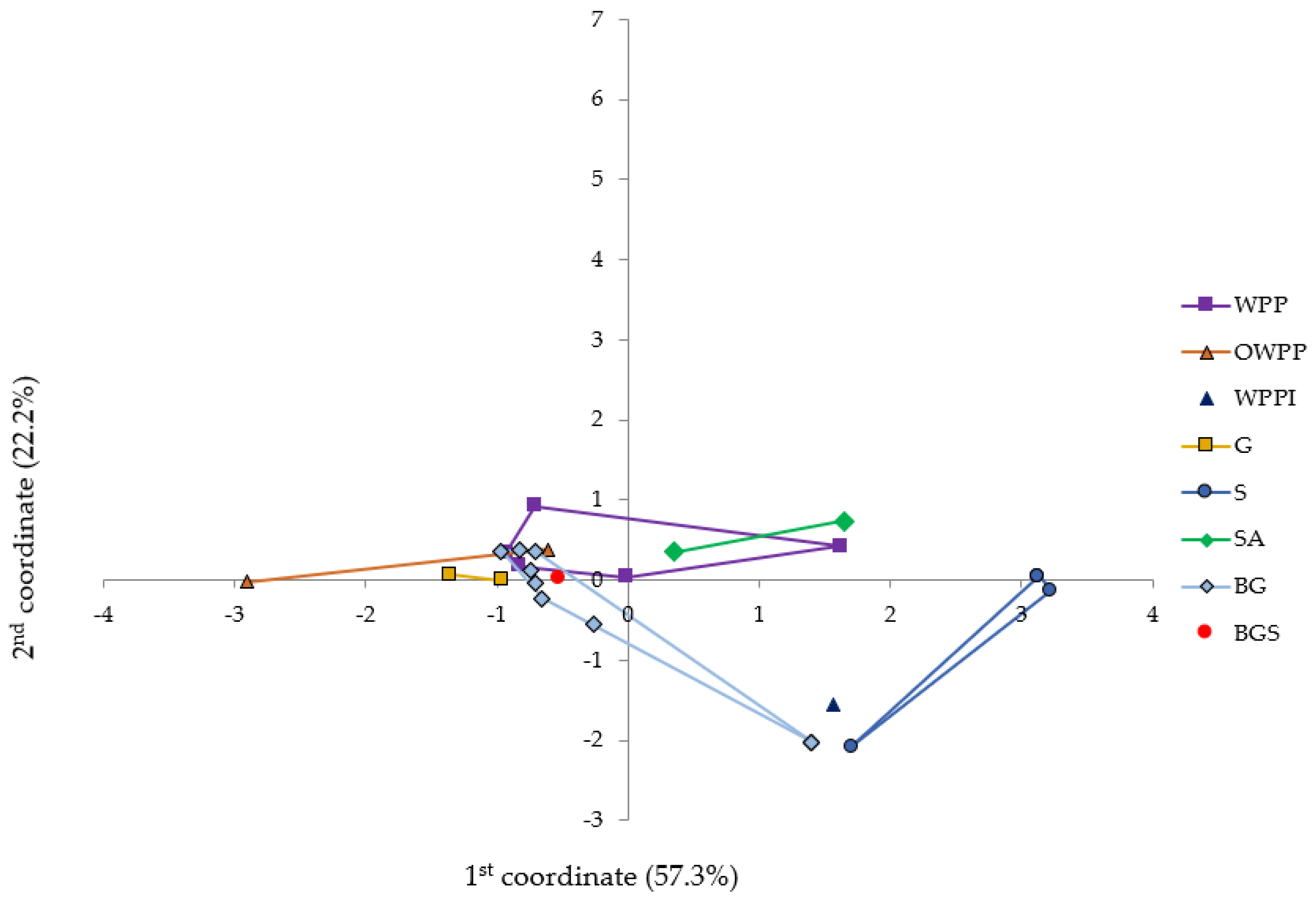

4.3. Differentiation of Renewable Energy Companies in Terms of Financial Security

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Manowska, A.; Bluszcz, A.; Chomiak-Orsa, I.; Wowra, R. Towards Energy transformation: A case study of EU countries. Energies 2024, 17, 1778. [Google Scholar] [CrossRef]

- Durmuş, Ş.H.N. A bibliometric analysis study of renewable energy’s public health benefits. J. Energy Syst. 2023, 7, 132–157. [Google Scholar] [CrossRef]

- Simionescu, M.; Păuna, C.B.; Diaconescu, T. Renewable Energy and economic performance in the context of the european green deal. Energies 2020, 13, 6440. [Google Scholar] [CrossRef]

- Chrzanowski, M.; Zawada, P. Fraction separation potential in the recycling process of photovoltaic panels at the installation site—A conceptual framework from an economic and ecological safety perspective. Energies 2023, 16, 2084. [Google Scholar] [CrossRef]

- Rahman, A.; Farrok, O.; Haque, M.M. Environmental impact of renewable energy source based electrical power plants: Solar, wind, hydroelectric, biomass, geothermal, tidal, ocean, and osmotic. Renew. Sustain. Energy Rev. 2022, 161, 112279. [Google Scholar] [CrossRef]

- Zandi, G.; Haseeb, M. The importance of green energy consumption and agriculture in reducing environmental degradation: Evidence from Sub-Saharan African countries. Int. J. Financ. Res. 2019, 10, 215. [Google Scholar] [CrossRef]

- Wang, L.; Chang, H.L.; Rizvi, S.K.A.; Sari, A. Are eco-innovation and export diversification mutually exclusive to control carbon emissions in G-7 countries? J. Environ. Manag. 2020, 270, 110829. [Google Scholar] [CrossRef] [PubMed]

- Ji, X.; Umar, M.; Ali, S.; Ali, W.; Tang, K.; Khan, Z. Does fiscal decentralization and eco-innovation promote sustainable environment? A case study of selected fiscally decentralized countries. Sustain. Dev. 2021, 29, 79–88. [Google Scholar] [CrossRef]

- Czerwińska-Kayzer, D.; Bieniasz, A. Financial safety of companies producing feed for livestock. Ann. Pol. Assoc. Agric. Agribus. Econ. 2016, 18, 64–69. [Google Scholar]

- Timmons, D.; Harris, J.M.; Roach, B. The Economics of Renewable Energy; Global Development and Environment Institute, Tufts University: Medford, MA, USA, 2014; Available online: https://www.bu.edu/eci/files/2019/06/RenewableEnergyEcon.pdf (accessed on 8 July 2024).

- Žarković, M.; Lakić, S.; Ćetković, J.; Pejović, B.; Redzepagic, S.; Vodenska, I.; Vujadinović, R. Effects of renewable and non-renewable energy consumption, GHG, ICT on Sustainable Economic Growth: Evidence from Old and New EU Countries. Sustainability 2022, 14, 9662. [Google Scholar] [CrossRef]

- EEA. Harm to Human Health from Air Pollution in Europe: Burden of Disease 2023. Available online: https://www.eea.europa.eu/publications/harm-to-human-health-from-air-pollution/ (accessed on 24 February 2024).

- Holdren, J.P.; Smith, K.R. Energy, the environment, and health. In World Energy Assessment: Energy and the Challenge of Sustainability; Communications Development Incorporated: Washington, DC, USA, 2015; Volume 3, pp. 62–110. Available online: https://www.undp.org/sites/g/files/zskgke326/files/publications/chapter3.pdf (accessed on 8 July 2024).

- Mujtaba, G.; Shahzad, S. Air pollutants, economic growth and public health: Implications for sustainable development in OECD countries. Environ. Sci. Pollut. Res. 2021, 28, 12686–12698. [Google Scholar] [CrossRef] [PubMed]

- Aunan, K.; Hansen, M.H.; Wang, S. Introduction: Air pollution in China. China Q. 2018, 234, 279–298. [Google Scholar] [CrossRef]

- Flaga-Maryańczyk, A.; Baran-Gurgul, K. The impact of local anti-smog resolution in Cracow (Poland) on the concentrations of PM10 and BaP based on the results of measurements of the state environmental monitoring. Energies 2022, 15, 56. [Google Scholar] [CrossRef]

- Kroll, A.; Amézaga, J.; Younger, P.; Wolkersdorfer, C. Regulation of mine waters in the European Union: The contribution of scientific research to policy development. Mine Water Environ. 2002, 21, 193–200. [Google Scholar] [CrossRef]

- Staniszewski, R.; Niedzielski, P.; Sobczyński, T.; Sojka, M. Trace elements in sediments of rivers affected by brown coal mining: A potential environmental hazard. Energies 2022, 15, 2828. [Google Scholar] [CrossRef]

- The Paris Agreement. United Nations Framework Convention for Climate Change; The Paris Agreement: Paris, France, 2016; pp. 1–60. Available online: https://unfccc.int/sites/default/files/resource/parisagreement_publication.pdf (accessed on 8 July 2024).

- IRENA. Energy Transition Holds Key to Tackle Global Energy and Climate Crisis. Available online: https://www.irena.org/news/pressreleases/2022/Mar/Energy-Transition-Holds-Key-to-Tackle-Global-Energy-and-Climate-Crisis (accessed on 24 February 2024).

- Eurostat Database. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 3 July 2024).

- Yu, B.; Fang, D.; Yu, H.; Zhao, C. Temporal-spatial determinants of renewable energy penetration in electricity production: Evidence from EU countries. Renew. Energy 2021, 180, 438–451. [Google Scholar] [CrossRef]

- Kacperska, E.; Łukasiewicz, K.; Pietrzak, P. Use of renewable energy sources in the European Union and the Visegrad Group Countries—Results of cluster analysis. Energies 2021, 14, 5680. [Google Scholar] [CrossRef]

- Brodny, J.; Tutak, M.; Bindzár, P. Assessing the level of renewable energy development in the European Union Member States. A 10-year perspective. Energies 2021, 14, 3765. [Google Scholar] [CrossRef]

- Wałachowska, A.; Ignasiak-Szulc, A. Comparison of renewable energy sources in ‘New’ EU Member States in the context of national energy transformations. Energies 2021, 14, 7963. [Google Scholar] [CrossRef]

- Gajdzik, B.; Nagaj, R.; Wolniak, R.; Bałaga, D.; Žuromskaitė, B.; Grebski, W.W. Renewable energy share in European industry: Analysis and extrapolation of trends in EU countries. Energies 2024, 17, 2476. [Google Scholar] [CrossRef]

- Kryszk, H.; Kurowska, K.; Marks-Bielska, R.; Bielski, S.; Eźlakowski, B. Barriers and prospects for the development of renewable energy sources in Poland during the energy crisis. Energies 2023, 16, 1724. [Google Scholar] [CrossRef]

- Agarwal, T.; Verma, S.; Gaurh, A. Issues and challenges of wind energy. In Proceedings of the 2016 International Conference on Electrical, Electronics, and Optimization Techniques (ICEEOT), Chennai, India, 3–5 March 2016; pp. 67–72. [Google Scholar] [CrossRef]

- Tagne, R.F.T.; Dong, X.; Anagho, S.G.; Kaiser, S.; Ulgiati, S. Technologies, challenges and perspectives of biogas production within an agricultural context. The case of China and Africa. Environ. Dev. Sustain. 2021, 23, 14799–14826. [Google Scholar] [CrossRef]

- Tawalbeh, M.; Al-Othman, A.; Kafiah, F.; Abdelsalam, E.; Almomani, F.; Alkasrawi, M. Environmental impacts of solar photovoltaic systems: A critical review of recent progress and future outlook. Sci. Total Environ. 2021, 759, 143528. [Google Scholar] [CrossRef] [PubMed]

- Delas, V.; Nosova, E.; Yafinovycha, O. Financial security of enterprises. Procedia Econ. Financ. 2015, 27, 248–266. [Google Scholar] [CrossRef]

- Zięba, R. Institutionalisation of European Security: Concepts-Structures–Functioning; Scholar: Warszawa, Poland, 2004; p. 461. [Google Scholar]

- Kraś, I. Policy of the Central Bank and financial security of a state. Przegl. Strateg. 2013, 1, 185–200. [Google Scholar] [CrossRef][Green Version]

- Karbownik, L. The concept and areas of creation and assurance of the enterprise financial security. Acta Univ. Lodz.—Folia Econ. 2012, 267, 63–77. [Google Scholar]

- Davydenko, N.M. Genesis of enterprise financial security. Econ. Process. Manag. Int. Sci. E-J. 2015, 2. Available online: https://essuir.sumdu.edu.ua/bitstream-download/123456789/40296/1/Davydenko.pdf;jsessionid=2DAA72119D63A7D8D938630FCE498E67 (accessed on 8 July 2024).

- Crockett, A. Why is financial stability a goal of public policy. Econ. Rev. 1997, 4, 8–12. [Google Scholar]

- Redo, M.; Siemiątkowski, P. External Financial Security of the State; Nicolaus Copernicus University in Toruń: Toruń, Poland, 2017; p. 161. [Google Scholar] [CrossRef]

- Sylkin, O.; Kryshtanovych, M.; Zachepa, A.; Bilous, S.; Krasko, A. Modeling the process of applying anti-crisis management in the system of ensuring financial security of the enterprise. Bus. Theory Pract. 2019, 20, 446–455. [Google Scholar] [CrossRef]

- Sosnovska, O.; Zhytar, M. Financial architecture as the base of the financial safety of the enterprise. Balt. J. Econ. Stud. 2018, 4, 334–340. [Google Scholar] [CrossRef]

- Melnychenko, O. Is artificial intelligence ready to assess an enterprise’s financial security? J. Risk Financ. Manag. 2020, 13, 191. [Google Scholar] [CrossRef]

- Raczkowski, K. Financial security. In Economics of National Security in Outline; Płaczek, J., Ed.; Difin: Warsaw, Poland, 2014; pp. 299–324. [Google Scholar]

- Chmelíková, G. Possibilities and limits for capital structure optimalising model design of Czech dairy industry. Agric. Econ. 2002, 48, 321–326. [Google Scholar] [CrossRef]

- Reverchuk, N.Y. Economical Security Management of Enterprise Structures; LBI NBU: Lviv, Ukraine, 2004; p. 195. [Google Scholar]

- Gospodarchuk, G.; Suchkova, E. Financial stability: Problems of inter-level and cross-sectoral equilibrium. Equilib. Q. J. Econ. Econ. Policy 2019, 14, 53–79. [Google Scholar] [CrossRef]

- Blakyta, G.; Ganushchak, T. Enterprise financial security as component of the economic security of the state. Invest. Manag. Financ. Innov. 2018, 15, 248–256. [Google Scholar] [CrossRef]

- National Court Register. Available online: https://web.archive.org/web/20230327163623/https://www.arch.ms.gov.pl/en/national-registers/national-court-register/ (accessed on 30 September 2023).

- Dz, U. 2021 poz. 2376. Available online: https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20210002376 (accessed on 30 September 2023).

- Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on Common Rules for the Internal Market for Electricity and Amending Directive 2012/27/EU (Recast). Text with EEA Relevance. Available online: http://data.europa.eu/eli/dir/2019/944/oj (accessed on 30 September 2023).

- Pitera, R. Financial Ratios as a Source of Information about the Company’s Financial Condition; Silva Rerum: Poznan, Poland, 2015; p. 112. [Google Scholar]

- Czerwińska-Kayzer, D.; Florek, J.; Staniszewski, R.; Kayzer, D. Application of canonical variate analysis to compare different groups of food industry companies in terms of financial liquidity and profitability. Energies 2021, 14, 4701. [Google Scholar] [CrossRef]

- Zuba, J. Influence of indebtedness on the profitability and the financial safety of chosen milk co-operatives in Poland. Ann. Pol. Assoc. Agric. Agribus. Econ. 2014, 16, 344–349. [Google Scholar]

- Borowiec, L.; Kacprzak, M.; Król, A. Information value of individual and consolidated financial statements for indicative liquidity assessment of Polish Energy Groups in 2018–2021. Energies 2023, 16, 3670. [Google Scholar] [CrossRef]

- Kusak, A. Financial Liquidity. Analysis and Management; Scientific Publishing House of the Faculty of Management of the University of Warsaw: Warsaw, Poland, 2006; p. 221. [Google Scholar]

- Wasilewski, M.; Ganc, M.A. dynamic and static view of the financial security of dairy cooperatives. Ann. Pol. Assoc. Agric. Agribus. Econ. 2021, 23, 109–119. [Google Scholar] [CrossRef]

- Kirkham, R. Liquidity analysis using cash flow ratios and traditional ratios: The telecommunications sector in Australia. J. New Bus. Ideas Trends 2012, 10, 1–13. Available online: http://www.jnbit.org (accessed on 28 July 2020).

- Sharma, D.S. The role of cash flow information in predicting corporate failure: The state of the literature. Financ. Manag. 2001, 27, 3–28. [Google Scholar] [CrossRef]

- Panova, E. Determinants of capital structure in Russian small and medium manufacturing enterprises. Equilib. Q. J. Econ. Econ. Policy 2020, 15, 361–375. [Google Scholar] [CrossRef]

- Pluta, W.; Michalski, G. Short-Term Capital Management. How to Maintain Financial Liquidity, 2nd ed.; C.H. Beck: Warsaw, Poland, 2013; p. 154. [Google Scholar]

- Kramoliš, J.; Dobeš, K. Debt as a financial risk factor in SMEs in the Czech Republic. Equilib. Q. J. Econ. Econ. Policy 2020, 15, 87–105. [Google Scholar] [CrossRef]

- Kajananthan, R.; Velnampy, T. Liquidity, solvency and profitability analysis using cash flow ratios and traditional ratios: The telecommunication sector in Sri Lanka. Res. J. Financ. Account. 2014, 5, 163–171. Available online: https://core.ac.uk/download/pdf/234630372.pdf (accessed on 8 July 2024).

- Jaworski, J.; Czerwonka, L. Determinants of Enterprises’ Capital structure in energy industry: Evidence from European Union. Energies 2021, 14, 1871. [Google Scholar] [CrossRef]

- Ritcher, F.; Petrusch, E. Internationale Entwicklung der Rentabilität und der Eigenkapitalentwicklung von Industriebetrieben, vergleichen anhand aggregierter Bilanzdaten. J. Betriebswirtschaft 1983, 33, 130–141. [Google Scholar]

- Kamar, K. Analysis of the effect of return on equity (ROE) and debt to equity ratio (DER) on stock price on cement industry listed in Indonesia Stock Exchange (IDX) in the year of 2011–2015. Int. J. Bus. Manag. 2017, 19, 66–76. [Google Scholar] [CrossRef]

- Robinson, T.; Henry, E.; Pirie, W.; Broihahn, M. International Financial Statement Analysis, 3rd ed.; John Wiley & Sons Inc.: Hoboken, NJ, USA, 2015; p. 1072. [Google Scholar]

- Nurlaela, S.; Mursito, B.; Kustiyah, E.; Istiqomah, I.; Hartono, S. Asset turnover, capital structure and financial performance consumption industry company in Indonesia Stock. Exchange. Int. J. Econ. Financ. 2019, 9, 297–301. [Google Scholar] [CrossRef]

- Wang, G.; Bai, J.; Xing, J.; Shen, J.; Dan, E.; Zheng, X.; Zhang, L.; Liu, P.; Feng, R. Operational efficiency and debt cost: The mediating effect of carbon information disclosure in Chinese Listed Companies. Sustainability 2023, 15, 1512. [Google Scholar] [CrossRef]

- Florek, J.; Stanisławska, J.; Czerwinska-Kayzer, D. The financial situation of the food industry in Poland in comparison with 2005 and 2010. Ann. Pol. Assoc. Agric. Agribus. Econ. 2015, 17, 41–48. [Google Scholar]

- Sajnóg, A.; Koko, E.; Kayzer, D.; Barałkiewicz, D. Chemometric approach to find relationships between physiological elements and elements causing toxic effects in herb roots by ICP-MS. Sci. Rep. 2021, 11, 20683. [Google Scholar] [CrossRef]

- Zydlik, Z.; Kayzer, D.; Zydlik, P. The influence of some climatic conditions on the yield and fruit quality of replanted apple orchard. Pol. J. Environ. Stud. 2024, 33, 4493–4501. [Google Scholar] [CrossRef]

- Kayzer, D.; Frankowski, P.; Zbierska, J.; Staniszewski, R. Evaluation of trophic parameters in newly built reservoir using canonical variates analysis. In Proceedings of the XLVIII Seminar of Applied Mathematics, Boguszów-Gorce, Poland, 9–11 September 2018; Volume 23, p. 00019. [Google Scholar] [CrossRef]

- Kupiec, J.M.; Staniszewski, R.; Kayzer, D. Assessment of water quality indicators in the Orla river nitrate vulnerable zone in the context of new threats in Poland. Water 2022, 14, 2287. [Google Scholar] [CrossRef]

- Krzanowski, W.J. Principles of Multivariate Analysis: A User’s Perspective, 2nd ed.; Oxford University Press: New York, NY, USA, 2000; p. 608. [Google Scholar]

- Campbell, N.A.; Atchley, W.R. The geometry of canonical variate analysis. Syst. Biol. 1981, 30, 268–280. [Google Scholar] [CrossRef]

- Lejeune, M.; Caliński, T. Canonical analysis applied to multivariate analysis of variance. J. Multivar. Anal. 2000, 72, 100–119. [Google Scholar] [CrossRef]

- Sukiennik, M. The analysis of mining company liquidity indicators. J. Min. Geoengin. 2012, 36, 339–344. [Google Scholar]

- Tóth, M.; Čierna, Z.; Serenčéš, P. Benchmark values for liquidity ratios in Slovak agriculture. Acta Sci. Pol. Oecon. 2013, 12, 83–90. [Google Scholar]

- Anuara, H.; Chin, O. The development of debt to equity ratio in capital structure model: A case of micro franchising. Procedia Econ. Financ. 2016, 35, 274–280. [Google Scholar] [CrossRef]

- Sierpińska, M.; Jachna, T. Assessment of Enterprises According to World Standards; PWN: Warszawa, Poland, 2007; p. 406. [Google Scholar]

- Gołaś, Z. Effect of inventory management on profitability: Evidence from the Polish food industry: Case study. Agric. Econ./Zeměd. Ekon. 2020, 66, 234–242. [Google Scholar] [CrossRef]

- Toudas, K.; Archontakis, S.; Boufounou, P. Corporate bankruptcy prediction models: A comparative study for the construction sector in Greece. Computation 2024, 12, 9. [Google Scholar] [CrossRef]

- Pavlicko, M.; Mazanec, J. Minimalistic logit model as an effective tool for predicting the risk of financial distress in the Visegrad Group. Mathematics 2022, 10, 1302. [Google Scholar] [CrossRef]

- Prado, J.W.; Carvalho, F.M.; Benedicto, G.C.; Lima, A.L.R. Analysis of credit risk faced by public companies in Brazil: An approach based on discriminant analysis, logistic regression and artificial neural networks. Estud. Gerenc. 2019, 35, 347–360. [Google Scholar] [CrossRef]

- Zhu, Y.; Xie, C.; Sun, B.; Wang, G.-J.; Yan, X.-G. Predicting China’s SME credit risk in supply chain financing by logistic regression, artificial neural network and hybrid models. Sustainability 2016, 8, 433. [Google Scholar] [CrossRef]

- Olbryś, J.; Majewska, E. Assessing commonality in liquidity with principal component analysis: The case of the Warsaw Stock Exchange. J. Risk Financ. Manag. 2020, 13, 328. [Google Scholar] [CrossRef]

- Sabău-Popa, C.D.; Simut, R.; Droj, L.; Bențe, C.C. Analyzing financial health of the SMES listed in the AERO Market of Bucharest Stock Exchange using principal component analysis. Sustainability 2020, 12, 3726. [Google Scholar] [CrossRef]

- Boratyńska, K. The theoretical aspects of measuring the costs of corporate bankruptcy. Equilib. Q. J. Econ. Econ. Policy 2014, 9, 43–57. [Google Scholar] [CrossRef][Green Version]

- Ogachi, D.; Ndege, R.; Gaturu, P.; Zoltan, Z. Corporate bankruptcy prediction model, a special focus on listed companies in Kenya. J. Risk Financ. Manag. 2020, 13, 47. [Google Scholar] [CrossRef]

- Mokrišová, M.; Horváthová, J. Domain knowledge features versus LASSO features in predicting risk of corporate bankruptcy—DEA approach. Risks 2023, 11, 199. [Google Scholar] [CrossRef]

- Issa, S.; Bizel, G.; Jagannathan, S.K.; Gollapalli, S.S.C. A comprehensive approach to bankruptcy risk evaluation in the financial industry. J. Risk Financ. Manag. 2024, 17, 41. [Google Scholar] [CrossRef]

- Deloof, M. Does working capital management affect profitability of Belgian firms? J. Bus. Financ. Account. 2003, 30, 373–587. [Google Scholar] [CrossRef]

- Lazaridis, I.; Tryfonidis, D. The relationship between working capital management and profitability of listed companies in the Athens Stock Exchange. J. Financ. Manag. Anal. 2006, 19, 26–35. [Google Scholar]

- Bieniasz, A.; Czerwińska-Kayzer, D.; Gołaś, Z. Analiza Rentowności Przedsiębiorstwa z Wykorzystaniem Metody Różnicowania. J. Agribus. Rural Dev. 2008, 3, 23–32. Available online: http://www1.up.poznan.pl/jard/index.php/jard/article/view/924/758 (accessed on 8 July 2024).

- Bieniasz, A. Determinants of return on equity of companies in the food industry. Res. Pap. Wrocław Univ. Econ. 2015, 399, 8–15. [Google Scholar] [CrossRef]

- Olaoye, F.O.; Adekanbi, J.A.; Oluwadare, O.E. Working capital management and firms’ profitability: Evidence from quoted firms on the Nigerian Stock Exchange. Intell. Inf. Manag. 2019, 11, 43–60. [Google Scholar] [CrossRef]

- Gajdosikova, D.; Valaskova, K.; Kliestik, T.; Machova, V. COVID-19 Pandemic and its impact on challenges in the construction sector: A case study of Slovak enterprises. Mathematics 2022, 10, 3130. [Google Scholar] [CrossRef]

- Petitjean, M. Eco-friendly policies and financial performance: Was the financial crisis a game changer for large US companies? Energy Econ. 2019, 80, 502–511. [Google Scholar] [CrossRef]

- Ramiah, V.; Zhao, Y.; Moosa, I. Working capital management during the global financial crisis: The Australian experience. Qual. Res. Financ. Mark. 2014, 6, 332–351. [Google Scholar] [CrossRef]

| Name of Companies | Quantity | Mark |

|---|---|---|

| Onshore wind power plants | 5 | WPP |

| Offshore wind power plants | 2 | OWPP |

| Onshore wind power plants with installation of systems | 1 | WPPI |

| Geothermal heat plant | 2 | G |

| Solar power plants | 3 | S |

| Solar power plants with installation of systems | 2 | SA |

| Biogas plant | 9 | BG |

| Biogas plant with solar power | 1 | BGS |

| Name of the Indicator | Mark | The Formula of the Indicator |

|---|---|---|

| Current ratio | ||

| Current debt ratio | ||

| Total debt ratio | ||

| Return on assets | ||

| Total asset turnover ratio |

| Statistics | (%) | (%) | (%) | ||

|---|---|---|---|---|---|

| mean | 3.1 | 31.0 | 76.9 | 3.5 | 0.9 |

| minimum | 0.3 | 1.5 | 5.0 | −51.5 | 0.0 |

| lower quartile | 0.8 | 4.8 | 37.5 | −4.2 | 0.3 |

| median | 1.5 | 16.3 | 76.1 | 4.3 | 0.4 |

| upper quartile | 3.5 | 48.4 | 95.5 | 16.8 | 0.9 |

| maximum | 21.7 | 94.6 | 227.8 | 45.8 | 4.0 |

| standard deviation | 4.3 | 32.2 | 52.3 | 22.0 | 1.2 |

| skewness | 3.5 | 1.0 | 1.2 | −0.9 | 1.7 |

| Statistics | (%) | (%) | (%) | ||

|---|---|---|---|---|---|

| mean | 3.9 | 26.1 | 57.9 | 7.5 | 1.2 |

| minimum | 0.3 | 0.6 | 0.5 | −3.8 | 0.0 |

| lower quartile | 1.1 | 5.8 | 19.7 | 0.5 | 0.3 |

| median | 2.0 | 10.0 | 67.6 | 3.7 | 0.5 |

| upper quartile | 5.6 | 34.1 | 90.7 | 11.4 | 1.0 |

| maximum | 17.2 | 92.5 | 108.2 | 37.5 | 12.3 |

| standard deviation | 4.4 | 31.5 | 36.2 | 10.8 | 2.4 |

| skewness | 1.8 | 1.3 | −0.35 | 1.5 | 4.2 |

| OWPP | 8.64 | ||||||

| WPPI | 9.42 | 14.80 | |||||

| G | 4.19 | 2.76 | 10.81 | ||||

| S | 10.54 | 22.92 | 2.40 | 16.02 | |||

| SA | 1.90 | 10.96 | 5.70 | 6.35 | 4.69 | ||

| BG | 2.75 | 2.85 | 5.85 | 1.96 | 10.48 | 3.45 | |

| BGS | 0.98 | 5.45 | 8.38 | 1.79 | 11.38 | 2.77 | 1.58 |

| WPP | OWPP | WPPI | G | S | SA | BG |

| OWPP | 1.51 | ||||||

| WPPI | 9.81 | 13.78 | |||||

| G | 1.32 | 1.40 | 13.77 | ||||

| S | 2.95 | 6.13 | 2.42 | 5.14 | |||

| SA | 14.78 | 20.79 | 18.58 | 19.78 | 12.80 | ||

| BG | 0.31 | 1.17 | 8.10 | 1.34 | 2.32 | 16.97 | |

| BGS | 0.77 | 2.19 | 13.31 | 1.14 | 5.13 | 18.40 | 1.43 |

| WPP | OWPP | WPPI | G | S | SA | BG |

| WPP | OWPP | WPPI | G | S | SA | BG | BGS |

|---|---|---|---|---|---|---|---|

| 0.89 | 2.27 | 0.24 | 0.02 | 3.15 | 8.46 | 0.55 | 0.23 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kayzer, D.; Czerwińska-Kayzer, D.; Florek, J.; Staniszewski, R. Financial Security as a Basis for the Sustainable Development of Small and Medium-Sized Renewable Energy Companies—A Polish Perspective. Sustainability 2024, 16, 5926. https://doi.org/10.3390/su16145926

Kayzer D, Czerwińska-Kayzer D, Florek J, Staniszewski R. Financial Security as a Basis for the Sustainable Development of Small and Medium-Sized Renewable Energy Companies—A Polish Perspective. Sustainability. 2024; 16(14):5926. https://doi.org/10.3390/su16145926

Chicago/Turabian StyleKayzer, Dariusz, Dorota Czerwińska-Kayzer, Joanna Florek, and Ryszard Staniszewski. 2024. "Financial Security as a Basis for the Sustainable Development of Small and Medium-Sized Renewable Energy Companies—A Polish Perspective" Sustainability 16, no. 14: 5926. https://doi.org/10.3390/su16145926

APA StyleKayzer, D., Czerwińska-Kayzer, D., Florek, J., & Staniszewski, R. (2024). Financial Security as a Basis for the Sustainable Development of Small and Medium-Sized Renewable Energy Companies—A Polish Perspective. Sustainability, 16(14), 5926. https://doi.org/10.3390/su16145926