Gold Production and the Global Energy Transition—A Perspective

Abstract

:1. Introduction

2. Global Gold Production and Costs

3. Environmental Impacts from Gold Mining

4. Gold Mining and the Energy Transition

5. The Potential for Greenhouse Gas Abatement in Gold Mining

- Scope 1—direct GHG emissions from sources that are owned or controlled by the company.

- Scope 2—indirect GHG emissions from the generation of purchased electricity, steam, and heat/cooling consumed by the company.

- Scope 3—other indirect GHG emissions are a consequence of the activities of the company but occur from sources not owned or controlled by the company, i.e., along the value chain.

- -

- All producers have publicly-reported their emission reduction plans.

- -

- Emission reduction targets are typically to abate Scope 1 and Scope 2 emissions by ~30% by 2030, and net-zero Scope 1 and 2 emissions by 2050.

- -

- Industry-wide emission reduction reporting metrics remain inconsistent. Baseline emission reduction metrics vary between companies, with one or more emissions per tonne of processed ore, emissions per ounce produced, and emissions per ounce of gold-equivalent produced cited with respect to Scope 1 and 2 emissions.

- -

- Moves towards the analysis of, reporting on, and reduction in Scope 3 emissions are now emerging across the major gold producers but are less advanced than the focus on Scope 1 and 2 emissions.

- -

- Companies do not report on the benchmarking of their emission intensity relative to other gold producers.

- -

- Overall, we consider the climate action and reporting of the gold industry to be broadly aligned with that of global miners of other commodities.

| Gold Producer [Source] | 2021 Production (Moz) | Selected Emission Reduction Actions |

|---|---|---|

| Newmont Corp. [42] | 5.95 |

|

| Barrick Gold Corp. [43] | 4.46 |

|

| Navoi Mining & Metallurgical [44] | 2.83 |

|

| PJSC Polyus [45] | 2.68 |

|

| AngloGold Ashanti Ltd. [46] | 2.47 |

|

| Gold Fields Ltd. [47] | 2.19 |

|

| Agnico Eagle Mines Ltd. [48] | 2.09 |

|

| Kinross Gold Corp. [49] | 2.06 |

|

| Newcrest Mining Ltd. [50] | 1.75 |

|

| Harmony Gold Mining Co. Ltd. [51] | 1.57 |

|

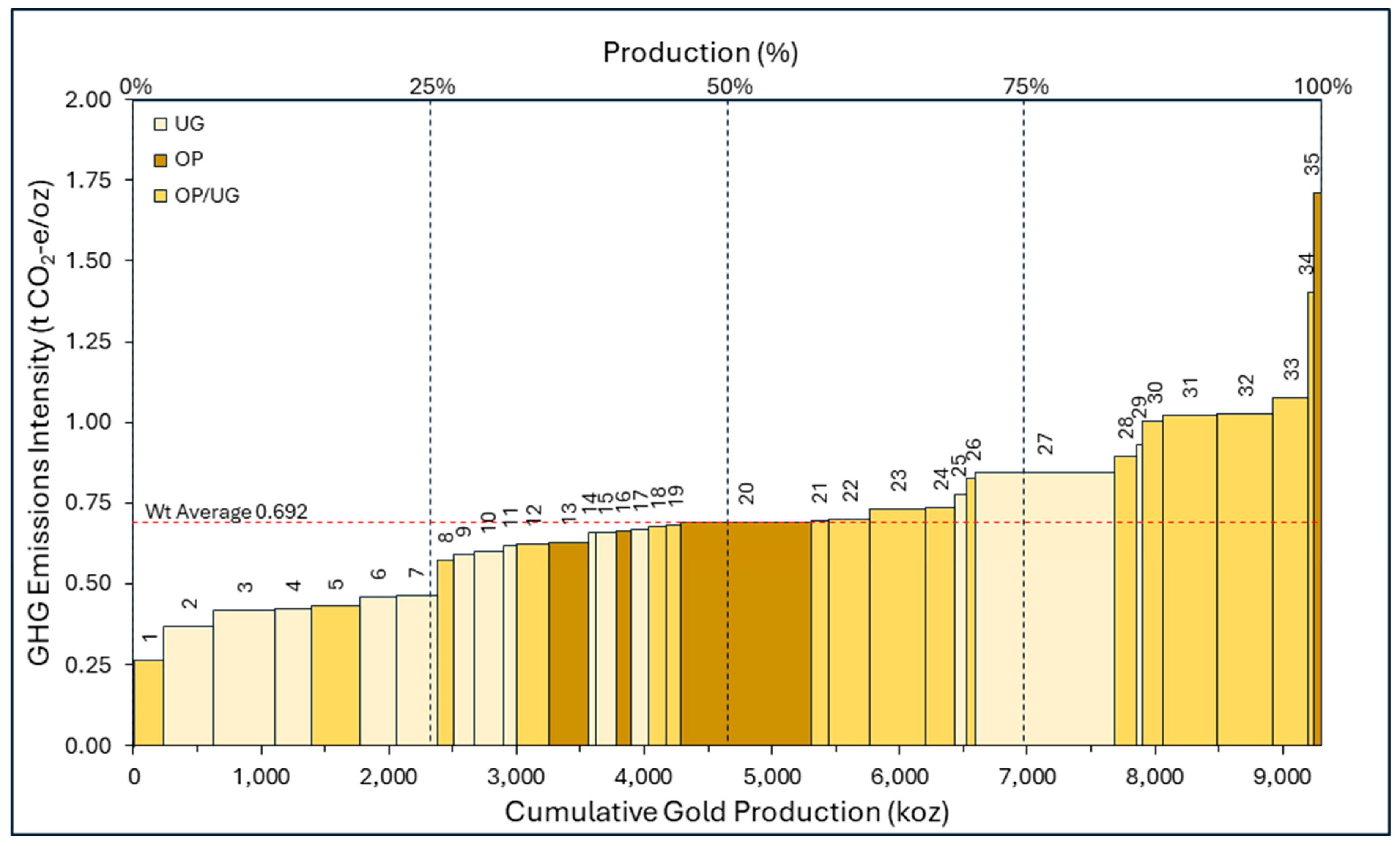

6. Empirical Analysis of Australian Gold Mining Greenhouse Gas Emissions

7. New Business Models in Gold—In-Ground Storage as Green Gold?

8. Summary, Conclusions and Future Research

- -

- Gold only has a minor role to play in terms of new uses in emerging technologies linked to the energy transition.

- -

- Gold is mined in many countries, including many developing countries, placing the gold industry in a situation where the energy transition will inevitably affect the gold industry, and gold mining companies are embracing the energy transition.

- -

- The provision of renewable energy infrastructure to power gold mining and processing operations may act to bring forward the broader adoption of green energy solutions in those regions in which gold mining is undertaken. Gold, thus, has a unique but indirect role to play in facilitating the transition to net-zero emissions.

- -

- Considerable potential exists to lower the environmental footprint of gold mining, including the reduction in carbon emissions from energy consumption and in mining and processing, for example through fleet electrification.

- -

- Gold mining companies are already responding to the opportunity to lower their emissions. The major global gold miners have all committed to emission reduction plans and have commenced emission abatements. Typical targets include a 30% reduction in Scope 1 and 2 emissions by 2030 and net-zero emissions, again across Scopes 1 and 2, by 2050.

- -

- “Green production” is an emerging trend across many metals; however, in many cases, it lacks a formal definition.

- -

- New zero-emission business models may emerge whereby “green gold”, as a new class of investment asset, is not actually mined but stored in the ground in perpetuity in a natural “vault”.

- -

- The market value of such green gold, using in-ground unmined gold resources owned by exploration companies, has been shown to track the gold price. Investors in gold who are conscious of the negative environmental externalities of gold mining can, thus, potentially gain exposure to the gold price without the need for the gold mining of the in-ground assets to take place.

Author Contributions

Funding

Informed Consent Statement

Conflicts of Interest

References

- Bernstein, P.L. The Power of Gold: The History of an Obsession; John Wiley & Sons: Hoboken, NJ, USA, 2012; 448p. [Google Scholar]

- International Energy Authority (IEA). Final List of Critical Minerals. 2022. Available online: https://www.iea.org/policies/15271-final-list-of-critical-minerals-2022 (accessed on 24 March 2024).

- Schodde, R.C. Long term trends in gold exploration. In Proceedings of the NewGenGold Conference, Perth, Australia, 12–13 November 2019. [Google Scholar]

- Silver, D. Rise of Mining Royalty Companies; Society for Mining, Metallurgy & Exploration: Englewood, CO, USA, 2023; 232p. [Google Scholar]

- Baur, D.G.; Trench, A.; Ulrich, S. Green gold. J. Sustain. Financ. Invest. 2021, 13, 1200–1227. [Google Scholar] [CrossRef]

- World Gold Council. Global Mine Production. 2023. Available online: https://www.gold.org/goldhub/data/gold-production-by-country (accessed on 24 March 2024).

- S&P Global. Top Producing Companies: Gold. 2023. Available online: https://www.capitaliq.spglobal.com/web/client?auth=inherit#industry/topProducingCompanies (accessed on 24 March 2024).

- S&P Global. Gold Prices. 2023. Available online: https://www.capitaliq.spglobal.com/web/client?auth=inherit#industry/priceChart (accessed on 24 March 2024).

- Phillips, G.N.; Powell, R. A practical classification of gold deposits, with a theoretical basis. Ore Geol. Rev. 2015, 65, 568–573. [Google Scholar] [CrossRef]

- Ulrich, S.; Kanakis, M.; Groves, D.; Hagemann, S.; Sykes, J.; Trench, A. Is grade king in gold? A preliminary analysis of gold production costs at Australian and New Zealand mines. In Proceedings of the 49th New Zealand Branch Annual Conference on Exploration, Mining and New Zealand’s Mineral Resources, Wellington, New Zealand, 3–6 September 2016; Australian Institute of Mining & Metallurgy (AusIMM): Auckland, New Zealand, 2017; pp. 438–453. [Google Scholar]

- World Gold Council. Publication of the World Gold Council’s Guidance Note on Non-GAAP Metrics—All-In Sustaining Costs and All-In Costs. World Gold Council, 2013. 4p. Available online: https://www.gold.org/download/file/3180/guidance_on_all_in_costs_pr.pdf (accessed on 24 March 2024).

- Gianfrate, G. All that glitters: Gold mining companies’ market reaction at the issuance of the “All-in Sustaining Costs” guidance. J. Account. Public Policy 2017, 36, 468–476. [Google Scholar] [CrossRef]

- Ulrich, S. Australian & New Zealand Gold Operations. March Quarter 2023. 6p. Available online: https://www.aurumanalytics.com.au/pdf/2023_Q1_Aurum_Analytics_Quarterly_Gold_Report_Final.pdf (accessed on 24 March 2024).

- Ulrich, S.; Trench, A.; Hagemann, S. Grade-cost relationships within Australian underground gold mines—A 2014–2017 empirical study and potential value implications. Resour. Policy 2019, 61, 29–48. [Google Scholar] [CrossRef]

- Laker, M.C. Environmental Impacts of Gold Mining—With Special Reference to South Africa. Mining 2023, 3, 205–220. [Google Scholar] [CrossRef]

- Kumah, A. Sustainability and gold mining in the developing world. J. Clean. Prod. 2006, 14, 315–323. [Google Scholar] [CrossRef]

- Mudd, G.M. Global trends in gold mining: Towards quantifying environmental and resource sustainability. Resour. Policy 2007, 32, 42–56. [Google Scholar] [CrossRef]

- Mudd, G.M. The Environmental sustainability of mining in Australia: Key megatrends and looming constraints. Resour. Policy 2010, 35, 98–115. [Google Scholar] [CrossRef]

- Finnie, B.; Stuart, J.; Gibson, L.; Zabriskie, F. Balancing environmental and industry sustainability: A case study of the US gold mining industry. J. Environ. Manag. 2009, 90, 3690–3699. [Google Scholar] [CrossRef]

- Ouoba, Y. Economic sustainability of the gold mining industry in Burkina Faso. Resour. Policy 2017, 51, 194–203. [Google Scholar] [CrossRef]

- Amegbey, N.A.; Adimado, A.A. Incidents of cyanide spillage in Ghana. Miner. Process. Extr. Metall. 2003, 112, 126–130. [Google Scholar] [CrossRef]

- Eisler, R. Health risks of gold miners: A synoptic review. Environ. Geochem. Health 2003, 25, 325–345. [Google Scholar] [CrossRef] [PubMed]

- Aragon, F.M.; Rud, J.P. Natural Resources and Local Communities: Evidence from a Peruvian Gold Mine. Am. Econ. J. Econ. Policy 2013, 5, 1–25. [Google Scholar] [CrossRef]

- Pereira, V.; Tuffour, J.; Patnaik, S.; Temouri, Y.; Malik, A.; Singh, S.K. The quest for CSR: Mapping responsible and irresponsible practices in an intra-organizational context in Ghana’s gold mining industry. J. Bus. Res. 2021, 135, 268–281. [Google Scholar] [CrossRef]

- Bloch, R.; Owusu, G. Linkages in Ghana’s gold mining industry: Challenging the enclave thesis. Resour. Policy 2012, 37, 434–442. [Google Scholar] [CrossRef]

- Tuokuu, F.X.D.; Gruber, J.S.; Idemudia, U.; Kayira, J. Challenges and opportunities of environmental policy implementation: Empirical evidence from Ghana’s gold mining sector. Resour. Policy 2018, 59, 435–445. [Google Scholar] [CrossRef]

- Ulrich, S.; Trench, A.; Hagemann, S. Greenhouse Gas Emissions and Production Cost Footprints in Australian Gold Mines. J. Clean. Prod. 2020, 267, 122118. [Google Scholar] [CrossRef]

- World Gold Council. Gold’s Role in a Low-Carbon Economy. 2019. Available online: https://www.gold.org/goldhub/research/gold-investor/gold-investor-february-2019/13644 (accessed on 24 March 2024).

- Cameron, D.; Holliday, R.; Thompson, D. Gold’s future role in fuel cell systems. J. Power Sources 2003, 118, 298–303. [Google Scholar] [CrossRef]

- Qwabe, L.Q.; Dasireddy, V.; Singh, S.; Friedrich, H.B. Preferential CO oxidation in a hydrogen-rich stream over gold supported on Ni–Fe mixed metal oxides for fuel cell applications. Int. J. Hydrogen Energy 2016, 41, 2144–2153. [Google Scholar] [CrossRef]

- Bagherzadeh-Khajehmarjan, E.; Shakouri, S.M.; Nikniazi, A.; Ahmadi-Kandjani, S. Boosting the efficiency of luminescent solar concentrator devices based on CH3NH3PbBr3 perovskite quantum dots via geometrical parameter engineering and plasmonic coupling. Org. Electron. 2022, 109, 106629. [Google Scholar] [CrossRef]

- Evarts, E.C. Lithium batteries: To the limits of lithium. Nature 2015, 526, 93–95. [Google Scholar] [CrossRef] [PubMed]

- Graedel, T.E.; Miatto, A.U.S. Cobalt: A Cycle of Diverse and Important Uses. Resour. Conserv. Recycl. 2022, 184, 106441. [Google Scholar] [CrossRef]

- Lu, W.; Li, X.; Zhang, H. The next generation vanadium flow batteries with high power density—A perspective. Phys. Chem. Chem. Phys. 2018, 20, 23–35. [Google Scholar] [CrossRef] [PubMed]

- Heijlen, W.; Franceschi, G.; Duhayon, C.; Van Nijen, K. Assessing the adequacy of the global land-based mine development pipeline in the light of future high-demand scenarios: The case of the battery-metals nickel (Ni) and cobalt (Co). Resour. Policy 2021, 73, 102202. [Google Scholar] [CrossRef]

- Trench, A.; Sykes, J.P. Rare Earth Permanent Magnets and Their Place in the Future Economy. Engineering 2020, 6, 115–118. [Google Scholar] [CrossRef]

- Fremstad, A.; Paul, M. The impact of a carbon tax on inequality. Ecol. Econ. 2019, 163, 88–97. [Google Scholar] [CrossRef]

- Ulrich, S.; Trench, A.; Hagemann, S. Gold mining greenhouse gas emissions, abatement measures, and the impact of a carbon price. J. Clean. Prod. 2022, 340, 130851. [Google Scholar] [CrossRef]

- Elberry, A.M.; Thakur, J.; Veysey, J. Seasonal hydrogen storage for sustainable renewable energy integration in the electricity sector: A case study of Finland. J. Energy Storage 2021, 44, 103474. [Google Scholar] [CrossRef]

- Akinbami, O.M.; Oke, S.R.; Bodunrin, M.O. The state of renewable energy development in South Africa: An overview. Alex. Eng. J. 2021, 60, 5077–5093. [Google Scholar] [CrossRef]

- World Resources Institute (WRI); World Business Council for Sustainable Development (WBCSD). The Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (Revised Edition). World Resources Institute and World Business Council for Sustainable Development, 2004. 116p. Available online: https://ghgprotocol.org/sites/default/files/standards/ghg-protocol-revised.pdf (accessed on 24 March 2024).

- Newmont Corporation. Climate Report. 2022. 69p. Available online: https://s24.q4cdn.com/382246808/files/doc_downloads/2023/05/Newmont-2022-Climate-Report.pdf (accessed on 24 March 2024).

- Barrick Sustainability Report. 2022. 116p. Available online: https://s25.q4cdn.com/322814910/files/doc_downloads/sustainability/Barrick_Sustainability_Report_2022.pdf (accessed on 24 March 2024).

- Navoi Mining and Metallurgical Combinat JSC. Sustainability Report. 2021. 97p. Available online: https://www.ngmk.uz/uploads/photo/about-ngmk/infos/2021%20GRI%20en.pdf (accessed on 24 March 2024).

- Polyus Climate Strategy. 2022. 16p. Available online: https://polyus.com/en/investors/presentations/ (accessed on 24 March 2024).

- AngloGoldAshanti. Roadmap to Net Zero. Our Strategy to Reduce Carbon Emissions—2030 Targets. 12 October 2022. 17p. Available online: https://www.anglogoldashanti.com/sustainability/environment/energy-climate-change/ (accessed on 24 March 2024).

- Gold Fields Limited. Climate Change Report. 2022. 36p. Available online: https://www.goldfields.com/pdf/investors/integrated-annual-reports/2022/ccr-2022-report.pdf (accessed on 24 March 2024).

- Agnico Eagle. Climate Action Report. 2022. 31p. Available online: https://s21.q4cdn.com/374334112/files/doc_downloads/Sustainability/Climate-Action-/AgnicoEagle_ClimateChangeActionReport_Final.pdf (accessed on 24 March 2024).

- Kinross Gold Corporation. Sustainability and ESG Report. 2022. 173p. Available online: https://s2.q4cdn.com/496390694/files/doc_downloads/2023/ESG/updated/Kinross-2022-Sustainability-and-ESG-Report.pdf (accessed on 24 March 2024).

- Newcrest Mining Limited. 2022 Sustainability Report. November 2022. 108p. Available online: https://www.newcrest.com/sites/default/files/2022-11/221107_Newcrest%202022%20Sustainability%20Report_0.pdf (accessed on 24 March 2024).

- Harmony Gold Mining. ESG Report. 2022. 95p. Available online: https://www.har.co.za/22/download/HAR-ESG22.pdf (accessed on 24 March 2024).

- Wappler, M.; Unguder, D.; Lu, X.; Ohlmeyer, H.; Teschke, H.; Lueke, W. Building the green hydrogen market—Current state and outlook on green hydrogen demand and electrolyzer manufacturing. Int. J. Hydrogen Energy 2022, 47, 33551–33570. [Google Scholar] [CrossRef]

- Smart, K. Review of Recent Progress in Green Ammonia Synthesis: Decarbonisation of fertiliser and fuels via green synthesis. Johns. Matthey Technol. Rev. 2022, 66, 230–244. [Google Scholar] [CrossRef]

- Gabaldón-Estevan, D.; Criado, E.; Monfort, E. The green factor in European manufacturing: A case study of the Spanish ceramic tile industry. J. Clean. Prod. 2014, 70, 242–250. [Google Scholar] [CrossRef]

- Zhou, G.-T.; Wang, Y.-L.; Qi, T.-G.; Zhou, Q.-S.; Liu, G.-H.; Peng, Z.-H.; Li, X.-B. Toward sustainable green alumina production: A critical review on process discharge reduction from gibbsitic bauxite and large-scale applications of red mud. J. Environ. Chem. Eng. 2023, 11, 109433. [Google Scholar] [CrossRef]

- Mahmood, A.A.; Hossain, R.; Sahajwalla, V. Investigation of the effect of laminated polymers in the metallic packaging materials on the recycling of aluminum by thermal disengagement technology (TDT). J. Clean. Prod. 2020, 274, 122541. [Google Scholar] [CrossRef]

- Jin, C.; Nai, J.; Sheng, O.; Yuan, H.; Zhang, W.; Tao, W.; Lou, X.W. Biomass-based materials for green lithium secondary batteries. Energy Environ. Sci. 2021, 14, 1326–1379. [Google Scholar] [CrossRef]

- Tang, D.; Yin, H.; Cheng, X.; Xiao, W.; Wang, D. Green production of nickel powder by electroreduction of NiO in molten Na2CO3-K2CO3. Int. J. Hydrogen Energy 2016, 41, 18699–18705. [Google Scholar] [CrossRef]

- Muslemani, H.; Liang, X.; Kaesehage, K.; Ascui, F.; Wilson, J. Opportunities and challenges for decarbonizing steel production by creating markets for ‘green steel’ products. J. Clean. Prod. 2021, 315, 128127. [Google Scholar] [CrossRef]

- Elango, G.; Kumaran, S.M.; Kumar, S.S.; Muthuraja, S.; Roopan, S.M. Green synthesis of SnO2 nanoparticles and its photocatalytic activity of phenolsulfonphthalein dye. Spectrochim. Acta Part A Mol. Biomol. Spectrosc. 2015, 145, 176–180. [Google Scholar] [CrossRef] [PubMed]

- Crasto, D.; Dass, A. Green Gold: Au30(S-t-C4H9)18 Molecules. J. Phys. Chem. 2013, 117, 22094–22097. [Google Scholar] [CrossRef]

- Adams, R.G. Modern Management in the Global Mining Industry, 1st ed.; Emerald Publishing Limited: Bingley, UK, 2019. [Google Scholar]

- Harries, K.J.C. Mining Royalty Agreements Between Private Parties: The Relationship Between Payor and Recipient. J. Energy Nat. Resour. Law 1996, 14, 354–381. [Google Scholar] [CrossRef]

| Rank (Lowest to Highest Emissions Intensity) | Gold Mining Centre | GHG Emissions Intensity (CO2-e/oz) | Au Produced koz | Mine Type |

|---|---|---|---|---|

| 1 | Agnew | 0.26 | 239.0 | OP/UG |

| 2 | Fosterville | 0.37 | 384.7 | UG |

| 3 | Tanami | 0.42 | 484.0 | UG |

| 4 | Granny Smith | 0.42 | 288.0 | UG |

| 5 | St Ives | 0.43 | 377.0 | OP/UG |

| 6 | Ernest Henry | 0.46 | 283.6 | UG |

| 7 | Jundee | 0.46 | 320.2 | UG |

| 8 | Mt Magnet | 0.57 | 127.9 | OP/UG |

| 9 | Kalgoorlie Operations | 0.59 | 161.2 | UG |

| 10 | Deflector, Rothsay & Mt Monger | 0.60 | 228.5 | UG |

| 11 | Meekatharra Gold Operations | 0.62 | 112.6 | UG |

| 12 | Carosue Dam | 0.62 | 243.2 | OP/UG |

| 13 | Gruyere | 0.63 | 315.0 | OP |

| 14 | Fortnum Gold Operations | 0.66 | 53.7 | UG |

| 15 | Peak, Hera & Dargues | 0.66 | 158.3 | UG |

| 16 | Karlawinda | 0.66 | 120.0 | OP |

| 17 | Gwalia | 0.67 | 138.1 | UG |

| 18 | Beta Hunt & Higginsville | 0.67 | 133.9 | OP/UG |

| 19 | Edna May | 0.68 | 113.1 | OP/UG |

| 20 | Boddington | 0.69 | 1025.0 | OP |

| 21 | Mungari | 0.70 | 135.6 | OP/UG |

| 22 | Duketon | 0.70 | 327.3 | OP/UG |

| 23 | Tropicana | 0.73 | 437.0 | OP/UG |

| 24 | Sunrise Dam | 0.74 | 232.0 | OP/UG |

| 25 | Cue Gold Operations | 0.78 | 82.7 | UG |

| 26 | Tomingley | 0.83 | 70.3 | OP/UG |

| 27 | Cadia | 0.84 | 1096.4 | UG |

| 28 | King of the Hills & Darlot | 0.90 | 162.9 | OP/UG |

| 29 | Cracow | 0.93 | 48.2 | UG |

| 30 | Thunderbox | 1.00 | 159.8 | OP/UG |

| 31 | KCGM | 1.02 | 432.2 | OP/UG |

| 32 | Telfer | 1.03 | 433.6 | OP/UG |

| 33 | Cowal | 1.08 | 276.3 | OP/UG |

| 34 | Norseman & Nicolsons | 1.40 | 47.9 | OP/UG |

| 35 | Mt Rawdon | 1.71 | 53.7 | OP |

| Exposure | Gold Mining | Gold Exploration | Physical Gold | Gold ETFs | Gold Royalty | Green Gold |

|---|---|---|---|---|---|---|

| Gold price | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Capital costs | ✓ | X | X | X | X | X |

| Operating costs | ✓ | X | X | X | X | X |

| Corporate costs | ✓ | ✓ | X | X | ✓ | X |

| Environmental impact | ✓ | X | ✓ | ✓ | ✓ | X |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Trench, A.; Baur, D.; Ulrich, S.; Sykes, J.P. Gold Production and the Global Energy Transition—A Perspective. Sustainability 2024, 16, 5951. https://doi.org/10.3390/su16145951

Trench A, Baur D, Ulrich S, Sykes JP. Gold Production and the Global Energy Transition—A Perspective. Sustainability. 2024; 16(14):5951. https://doi.org/10.3390/su16145951

Chicago/Turabian StyleTrench, Allan, Dirk Baur, Sam Ulrich, and John Paul Sykes. 2024. "Gold Production and the Global Energy Transition—A Perspective" Sustainability 16, no. 14: 5951. https://doi.org/10.3390/su16145951