Enhancing Renewable Energy Integration in Developing Countries: A Policy-Oriented Analysis of Net Metering in Pakistan Amid Economic Challenges

Abstract

1. Introduction

- To provide the current state of NM in Pakistan from a techno-economic perspective, and public perceptions of net-metered connections.

- To identify the policy framework deficiencies, issues encountered by users and stakeholders, and bottlenecks impeding the growth of net-metered connections.

- To determine the financial sources and incentive programs for NM supplied by domestic banks, SBP, the private sector, and other organizations.

- To identify the issues, roadblocks, and bottlenecks that restrict citizens from obtaining and using financial services in developing countries like Pakistan.

- To indicate financing issues in getting concessionary loans from bank financing institutes.

- NM program evaluation across the complete supply chain, from solar PV system installation through connection tracking and potential future financial rewards.

- Policy suggestions to make the techno-economic and administrative framework for NM more people-centric.

- A future road map for boosting the development of net-metered connections should be considered, and policy recommendations based on economically and technologically sound objectives should be proposed.

- To examine the technical and financial difficulties and challenges faced by stakeholders in installing NM technology, several solutions will be proposed.

- To incorporate stakeholders’ perspectives in future NM regimes.

- To offer a composite methodology along with a stakeholders’ survey supported by quantitative analysis.

- This study will serve as a guideline for developing countries to address the limitations in their respective NM regime.

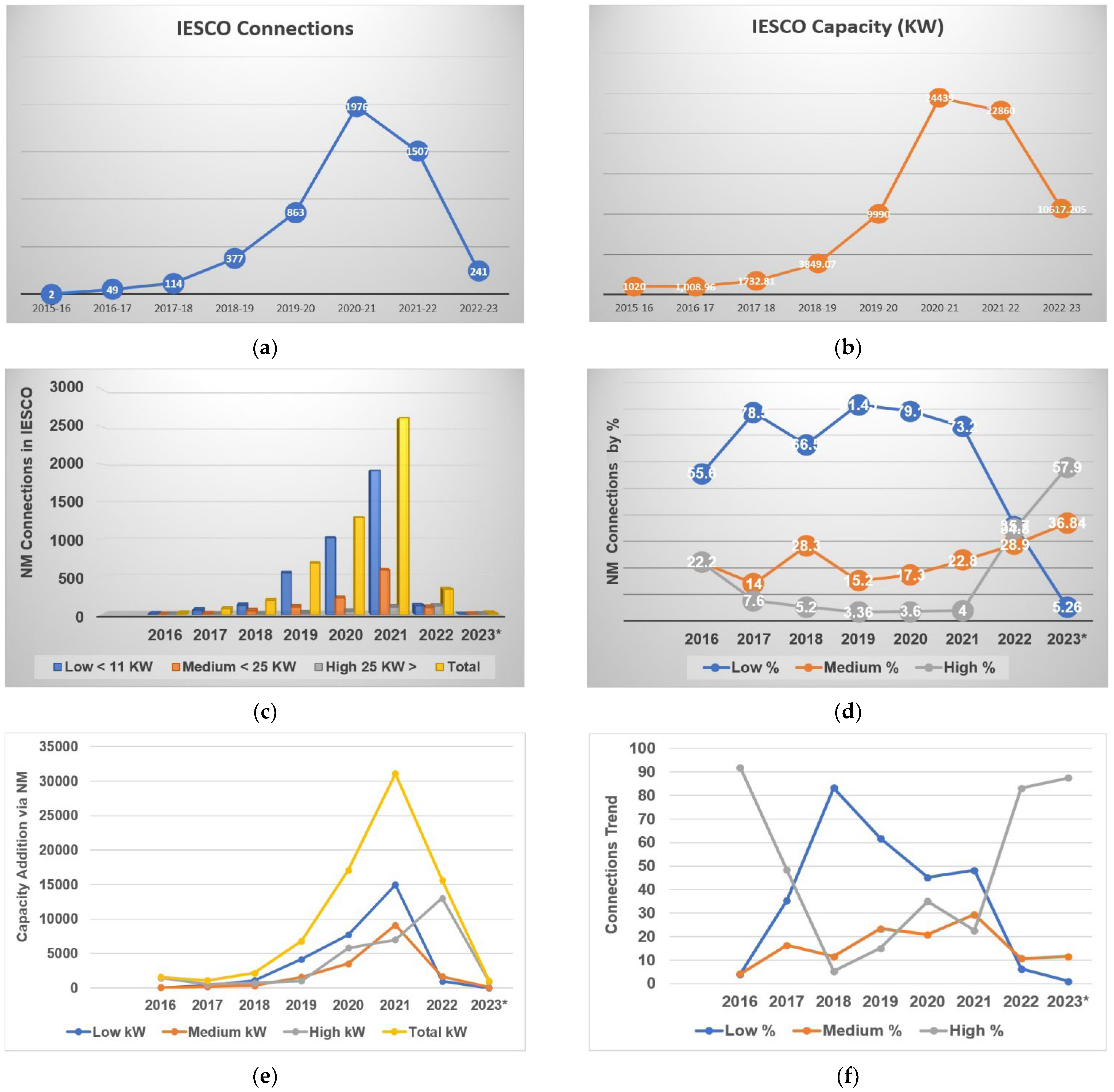

2. Data of Net-Metering Systems in Pakistan

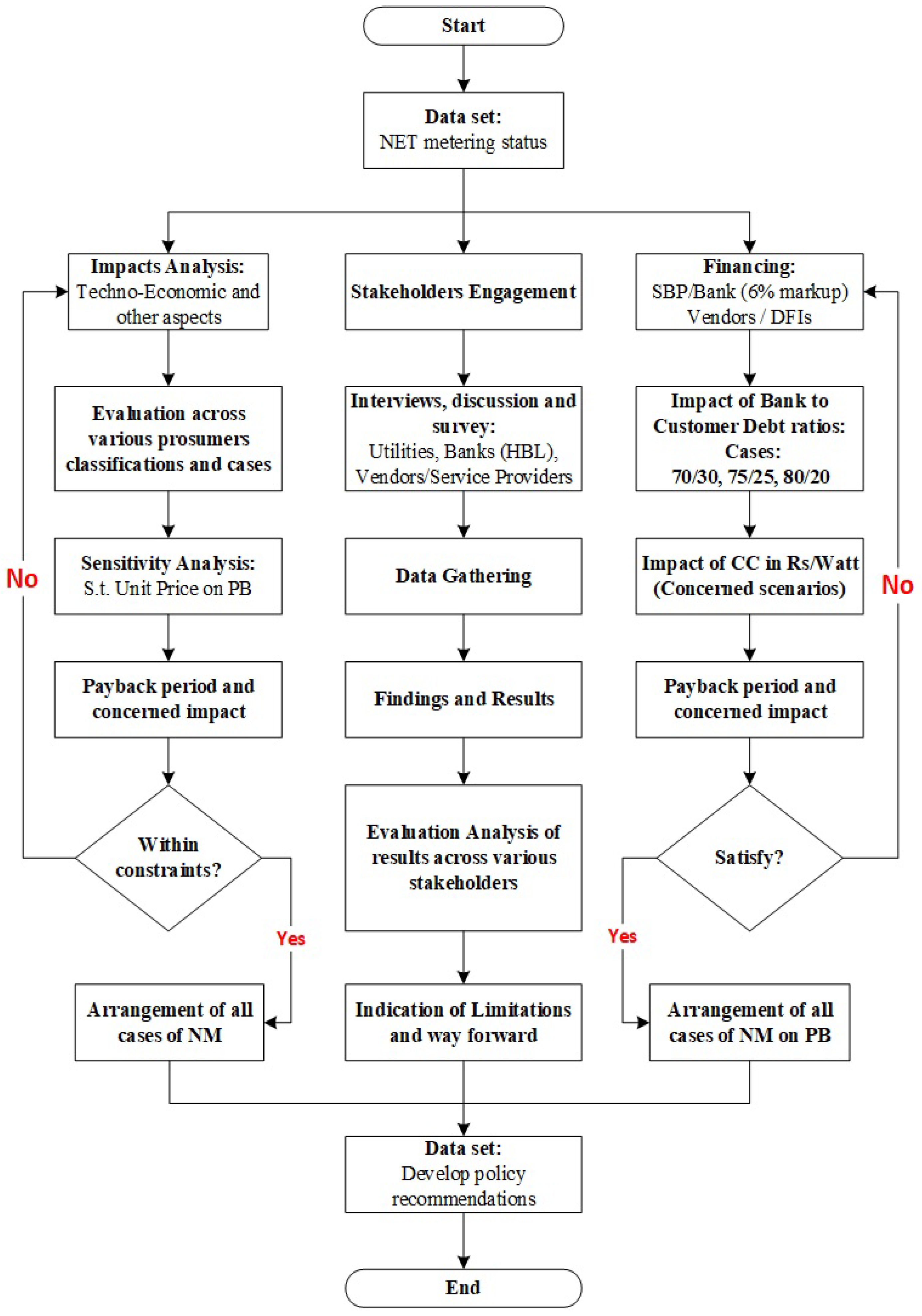

3. Methodology

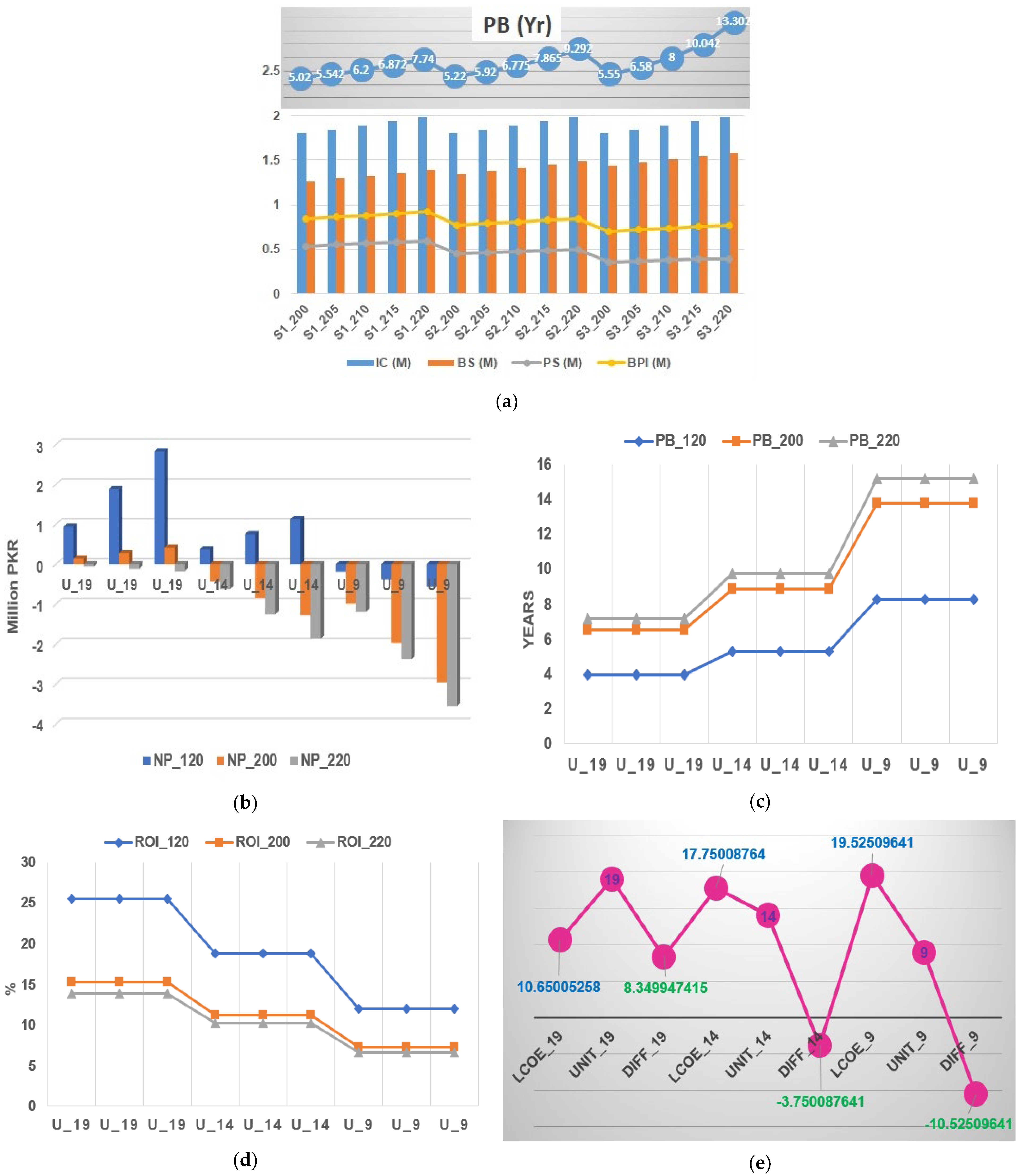

3.1. Methodology Contingent-1: Techno-Economic Analysis

3.2. Methodology Contingent-2: Stakeholder Engagement

3.3. Methodology Contingent-3: Financing Mechanisms and Impact Analysis

4. Results and Discussions

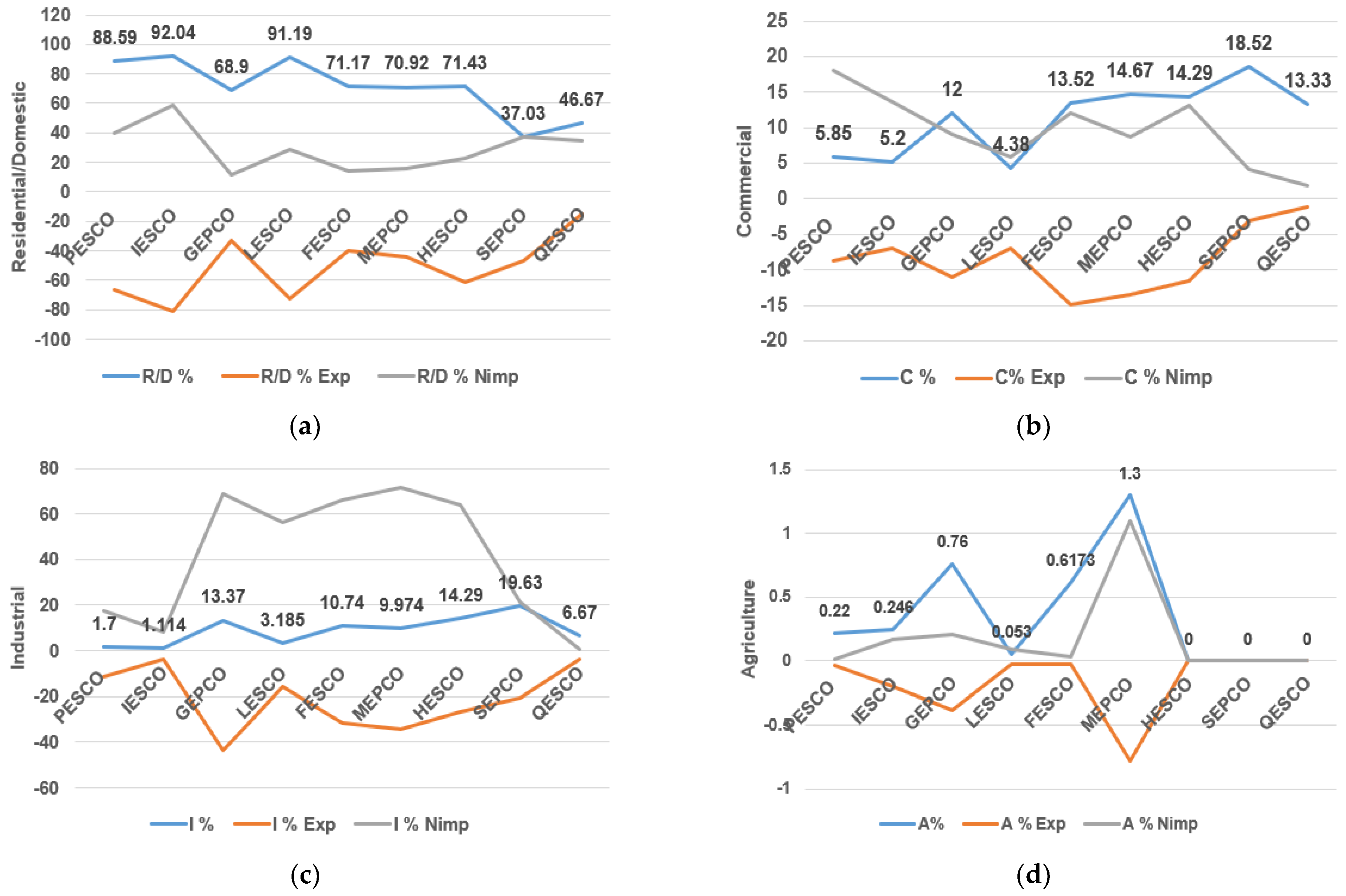

4.1. Analysis of Methodology Contingent-1: In-Depth Techno-Economic Analysis

4.1.1. Sensitivity Analysis across Consumer Categories

4.1.2. Sensitivity Analysis across Averaged Capacity

4.2. Analysis of Methodology Contingent-2: Stakeholder Engagement

4.2.1. Survey across Utilities, Industries, Vendors, and Consumers

4.2.2. Focused Group Discussions with Banks Representatives

- Is incentive scheme for renewable energy program (ISREP) extended by 2024?

| HBL: | Validity period has extended while other instructions remain unchanged. |

| SBP: | It has been extended till June 2024 as of yet. |

| Bank Alfalah: | Currently, temporary closed. Banks are financing on their standard markup rates. |

- 2.

- What is the extension plans for Incentive scheme for renewable energy program (ISREP) in future?

| HBL: | It has extended by June 2024. |

| SBP: | It has been extended till June 2024 as of yet. |

| Bank Alfalah: | It will be extended in future. Currently, markup prices are very high. |

- 3.

- Are financing streams/incentives schemes still available at 6% mark-up for Cat-II for solar and NM by SBP and other banks?

| HBL: | Yes. Maximum end user rate is 6%. |

| SBP: | Yes, they are. |

| Bank Alfalah: | In some of the cases, state bank is refinancing on 6% rates. |

- 4.

- Do you think that the challenges and concerns faced by the users in Pakistan in availing concessionary financing from banks mainly goes around which of the following?

| HBL: | Major issue is economic conditions and import LC clearance. |

| SBP: | Keeping proper financial record, good credit history and relationship with the bank. |

| Bank Alfalah: | Shortage of funds. |

- 5.

- Do you think that the normal public users in Pakistan can avail concessionary financing from banks for NM and solar installation at low or medium scale and high payback periods may be allowed from the banks?

| HBL: | Maximum tenure of financing is twelve years including maximum grace period of two years under Cat-I while maximum ten years for Cat-II and Cat-III. |

| SBP: | Yes. |

| Bank Alfalah: | Yes. High payback period must be granted so the average person can also avail this facility, as there is great shortfall in electricity resources. |

- 6.

- Do you think that high interest rate of bank will negatively impact a normal person with average income regarding installation of PV based NM system if borrow the amount from bank?

| HBL: | If consumer does not avail state banks scheme, commercial rates will be charged which are higher. |

| SBP: | Definitely, if not borrowed under the scheme. |

| Bank Alfalah: | Yes, high markup rates will affect general public as most of the people are salaried class and cannot afford standard markup rates offered by banks. |

- 7.

- According to you, which sort of financial instrument will be suitable for Pakistan in Future? Such as feed-in-tariffs (FiTs), tax incentives, soft loans and grants, green bonds and crowd funding?

| HBL: | Soft loans and grants. Green bond is another option. |

| SBP: | Tax incentives will be better. |

| Bank Alfalah: | Government should have to launch subsidized schemes with low rates and long-term repayment period. |

4.3. Analysis of Methodology Contingent-3: Financing Mechanisms and Impact Analysis

4.3.1. Financial Streams from State Bank of Pakistan

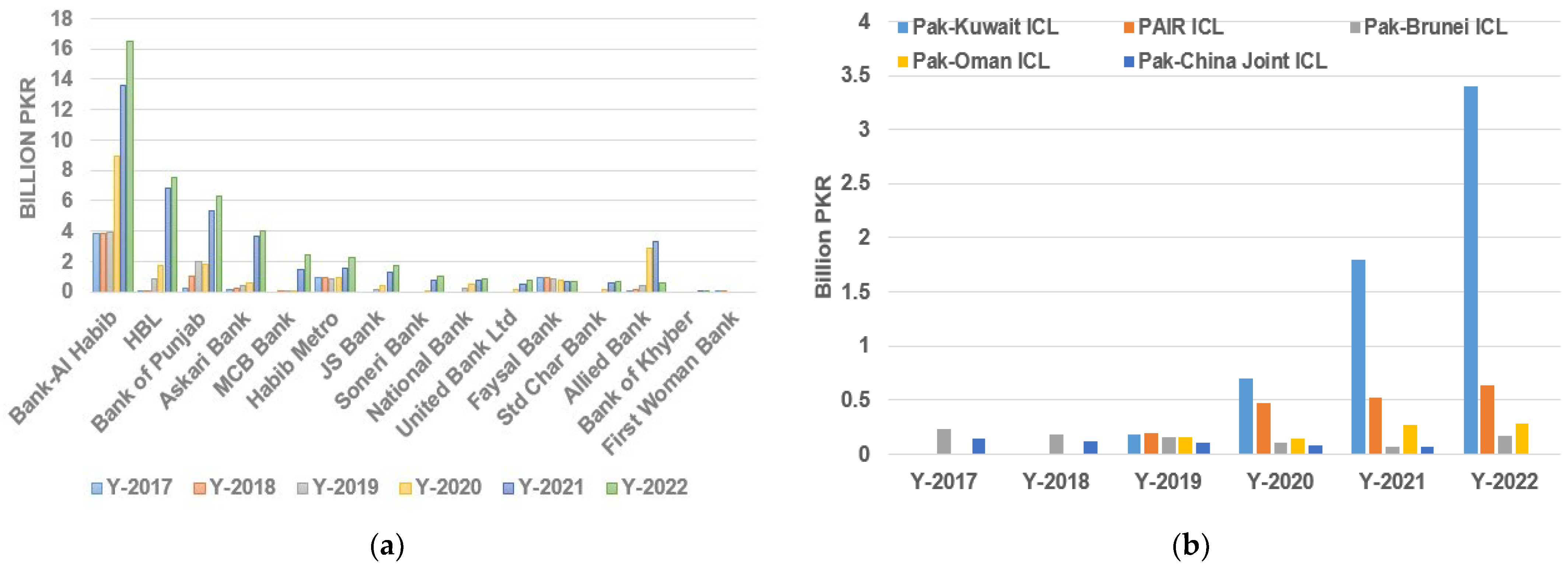

4.3.2. Current Financing Status of Banks under ISREP

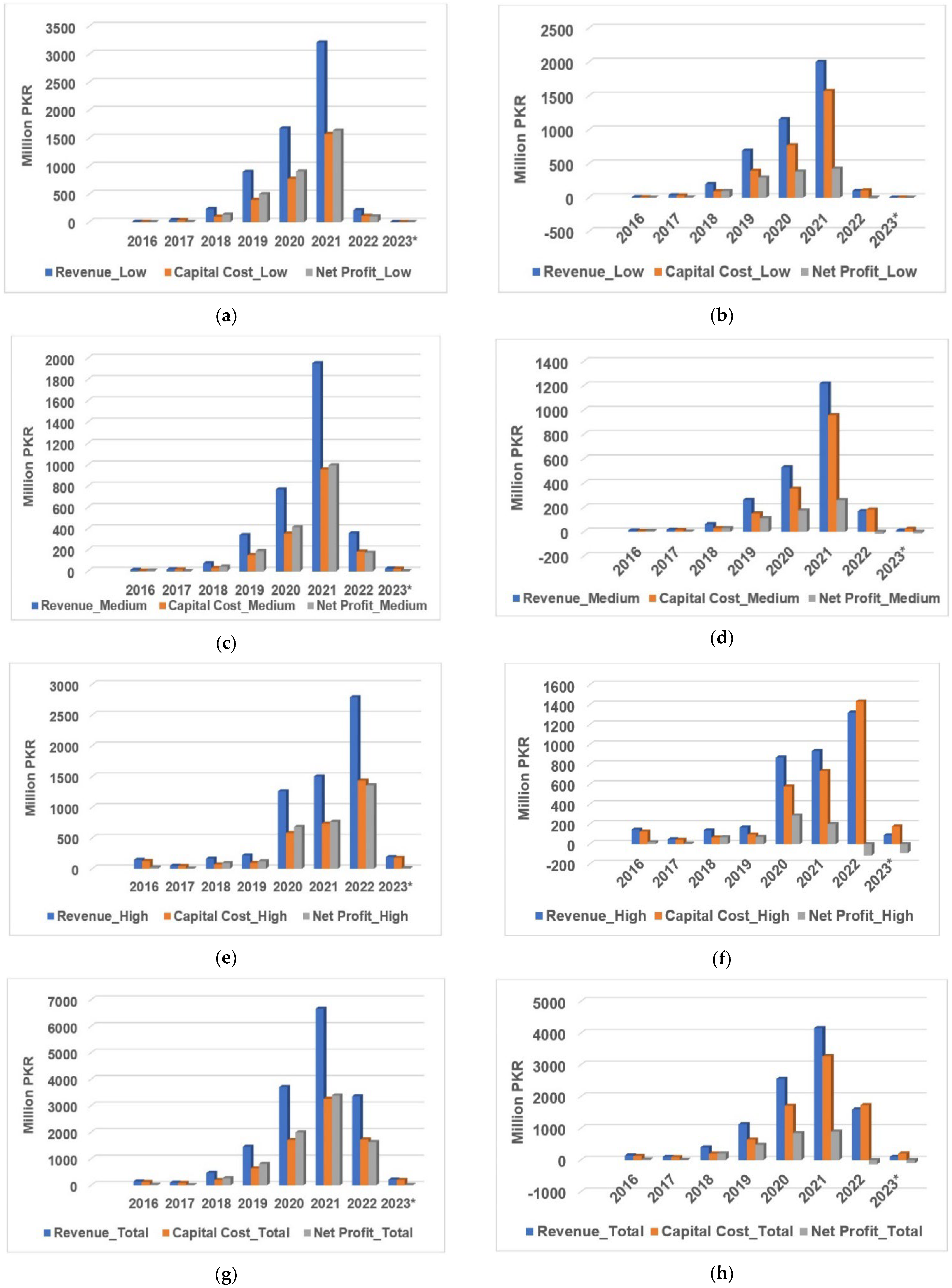

4.3.3. Banking Financing Mechanism-Based Analysis

4.3.4. Banking Sustainability Based Analysis

5. Key Challenges in Availing Concessionary Financing

5.1. Financial Challenges of Renewable Project Funding

5.2. Enhancing National Energy Security

5.3. Techno-Economic Viability Analysis

5.4. Policy Implications

5.5. Navigating Market Uncertainty and Utility Complexities

5.6. Financial Considerations amidst Prevailing Economic Realities

6. Conclusions and Policy Implications

- In the context of techno-economic aspects, recommendations are directed at optimizing resource allocation within the NM framework. To address the imbalanced distribution of NM participation between residential and industrial sectors, concerted efforts should be channeled towards enhancing NM deployment in the industrial sector. This would result in reduced electricity costs for industrial products. Pertaining to the disruption in the electricity balance, particularly in IESCO, effective NM planning is crucial, aligning optimal capacity installation with actual consumer loads. Clear communication from regulatory bodies, like NEPRA, regarding the cessation of the generation license regime is imperative. Conducting pre- and post-NM installation surveys, adjusting licensing regulations to include periodic visits, and establishing caps on high-capacity connections are advised. These short- to medium-term measures primarily target utilities and industries.

- In the context of stakeholder engagement, recommendations aim to increase NM integration through collaborative efforts. Focusing on socio-financial impacts, alignment with the IGCEP 2022–2031 framework is advocated. Special consideration is given to large-capacity consumers, who can influence payback mechanisms during peak demand periods. Encouraging technological innovations, like peer-to-peer communication and blockchain, can incentivize grid support and trading. The transition from NAPPP to NAEPP should be carefully phased in to maintain economic viability. NM planning is emphasized for meeting national energy mix targets, enhancing energy governance, and bolstering energy security. Closer ties between energy stakeholders and academia are sought, fostering shared knowledge and resources for effective NM modeling.

- In the context of financing mechanisms, strategies should be provided to address challenges in green financing. Issues like reimbursement difficulties, logistics delays, and supply chain disruptions must be urgently resolved. To improve accessibility to financing, banks should diversify their offerings tailored to various NM project types. Government subsidies, tax incentives, and green financing frameworks are suggested to incentivize investment. Collaboration between government, financial institutions, and the private sector is advocated through public–private partnerships and microfinance initiatives. The enhancement of the State Bank of Pakistan’s financing scheme and the issuance of green bonds or renewable energy funds are put forth as viable options. Capacity building for banks, guarantee mechanisms, research sharing, and the establishment of a database for successful projects will enhance the financing landscape for NM projects.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

List of Abbreviations

| CTBCM | Competitive Trading Bilateral Contract Market |

| DFIs | Development Finance Institutions |

| DISCO | Distribution Company |

| EPP | Energy Purchase Price |

| EYB | Energy Yearbook |

| FDI | Foreign Direct Investment |

| FESCO | Faisalabad Electric Supply Company Limited |

| FY | Financial Year |

| GBG | Green Banking Guidelines |

| GDP | Gross Domestic Product |

| GOP | Government of Pakistan |

| GST | General Sales Tax |

| GWh | Gigawatt hours |

| HESCO | Hyderabad Electric Supply Company Limited |

| IESCO | Islamabad Electric Supply Company Limited |

| IFI/IFC | International Finance Institutions/Corporations |

| IGCEP | Indicative Generation Capacity Expansion Plan |

| IPP | Independent Power Producer |

| ISREP | Incentive Scheme for Renewable Energy Program |

| KE | K-Electric Limited |

| kV/KVA | Kilo Volt/Kilovolt Ampere |

| kWh | Kilowatt hours |

| LESCO | Lahore Electric Supply Company Limited |

| MEPCO | Multan Electric Power Company Limited |

| MVA | Megavolt Ampere |

| MW | Megawatt |

| MWh | Megawatt hours |

| MYT | Multi-year Tariff |

| NAEPP | National Average Energy Purchase Price |

| NAPPP | National Average Power Purchase Price |

| NEPRA | National Electric Power Regulatory Authority |

| NM | Net Metering |

| NPCC | National Power Control Centre |

| NTDC | National Transmission and Dispatch Company Limited |

| O&M | Operation and Maintenance |

| PBP | Payback Period |

| PAEC | Pakistan Atomic Energy Commission |

| PEPCO | Pakistan Electric Power Company Limited |

| PESCO | Peshawar Electric Supply Company Limited |

| PPA | Power Purchase Agreement |

| PPIB | Private Power and Infrastructure Board |

| QESCO | Quetta Electric Supply Company Limited |

| SCADA | Supervisory Control and Data Acquisition |

| SEPCO | Sukkur Electric Power Company Limited |

| T&D | Transmission and Distribution |

| TESCO | Tribal Area Electricity Supply Company Limited |

| WAPDA | Water and Power Development Authority |

Appendix A

| NAPPP | R_Low | CC_Low | NP_Low | R_Med | CC_Med | NP_Med | R_High | CC_High | NP_High |

|---|---|---|---|---|---|---|---|---|---|

| 2016 | 5.84 | 5.04 | 0.8 | 11.9 | 5.136 | 6.764 | 145.822 | 125.862 | 19.96 |

| 2017 | 35.77 | 32.806 | 2.97 | 16.431 | 15.07 | 1.3626 | 48.717 | 44.677 | 4.04 |

| 2018 | 234.63 | 98.64 | 136 | 73.23 | 30.784 | 42.442 | 163.73 | 68.832 | 94.9 |

| 2019 | 896.27 | 397.72 | 498.55 | 339.42 | 150.62 | 188.8 | 217.4 | 96.47 | 120.93 |

| 2020 | 1676.1 | 772.7423 | 903.3384 | 769 | 354.54 | 414.455 | 1260 | 581 | 679 |

| 2021 | 3209.32 | 1574.055 | 1635.27 | 1952.42 | 957.59 | 994.83 | 1500.23 | 735.81 | 764.42 |

| 2022 | 211.62 | 108.7345 | 102.89 | 357 | 183.42 | 173.58 | 2789.43 | 1433.26 | 1356.2 |

| 2023 * | 2.10016 | 1.962 | 0.1382 | 24.953 | 23.311 | 1.6415 | 189.96 | 177.46 | 12.496 |

| NAEPP | R_Low | CC_Low | NP_Low | R_Med | CC_Med | NP_Med | R_High | CC_High | NP_High |

|---|---|---|---|---|---|---|---|---|---|

| 2016 | 5.84 | 5.04 | 0.8 | 11.9 | 5.136 | 6.764 | 145.822 | 125.862 | 19.96 |

| 2017 | 35.7724 | 32.806 | 2.97 | 16.431 | 15.07 | 1.3626 | 48.717 | 44.677 | 4.04 |

| 2018 | 199.3464 | 98.64 | 100.71 | 62.214 | 30.784 | 31.43 | 139.111 | 68.832 | 70.28 |

| 2019 | 694.37 | 397.72 | 296.65 | 262.962 | 150.62 | 112.343 | 168.424 | 96.47 | 71.955 |

| 2020 | 1157.149 | 772.7423 | 384.406 | 530.9 | 354.54 | 176.367 | 869.82 | 581 | 288.96 |

| 2021 | 2003.3 | 1574.055 | 429.2 | 1218.72 | 957.59 | 261.13 | 936.46 | 735.81 | 200.652 |

| 2022 | 100.24 | 108.7345 | −8.5 | 169.1 | 183.42 | −14.3265 | 1321.03 | 1433.26 | −111.95 |

| 2023 * | 0.9948 | 1.962 | −0.9672 | 11.82 | 23.311 | −11.491 | 89.98 | 177.46 | −87.48 |

| NAPP | R_Total | CC_Total | NP_Total | NAEPP | R_Total | CC_Total | NP_Total |

|---|---|---|---|---|---|---|---|

| 2016 | 163.561 | 125.5615 | 37.7 | 2016 | 163.5615 | 125.862 | 37.7 |

| 2017 | 100.92 | 92.55 | 8.37 | 2017 | 100.92 | 92.55 | 8.37 |

| 2018 | 471.583 | 198.252 | 273.331 | 2018 | 400.672 | 198.25 | 202.42 |

| 2019 | 1453.1 | 644.8 | 808.3 | 2019 | 1125.76 | 644.81 | 480.95 |

| 2020 | 3705 | 1708.14 | 1996.86 | 2020 | 2557.87 | 1708.14 | 849.72 |

| 2021 | 6662 | 3267.5 | 3394.5 | 2021 | 4158.5 | 3267.45 | 891.05 |

| 2022 | 3358 | 1725.4 | 1632.6 | 2022 | 1590.64 | 1725.41 | −134.8 |

| 2023 * | 217.0078 | 202.732 | 14.276 | 2023* | 102.8 | 202.7 | −100.1 |

| Year | Low <11 KW (Avg Cap) | Medium <25 KW (Avg Cap) | High 25 KW> (Avg Cap) | Low <11 KW MWh | Medium <25 KW MWh | High 25 KW > MWh |

|---|---|---|---|---|---|---|

| 2016 | 6.3 | 16.05 | 361.52 | 26.944 | 68.643 | 1546.15 |

| 2017 | 6.225 | 16.12 | 87.6 | 30.367 | 78.637 | 427.333 |

| 2018 | 6.94 | 14.87 | 76.48 | 78.197 | 167.549 | 861.742 |

| 2019 | 7.52 | 15.1 | 44.2 | 84.732 | 170.14 | 498.03 |

| 2020 | 7.561 | 15.9 | 123.588 | 85.183 | 179.154 | 1392.67 |

| 2021 | 7.83 | 15.35 | 66.74 | 88.225 | 172.96 | 752 |

| 2022 | 8.17 | 17.015 | 109.5 | 92.056 | 191.661 | 1233.8 |

| 2023 * | 9.81 | 16.65 | 80.6632 | 110.535 | 187.605 | 908.88 |

| NAPP | R_Low | CC_Low | NP_Low | R_Med | CC_Med | NP_Med | R_High | CC_High | NP_High |

|---|---|---|---|---|---|---|---|---|---|

| 2016 | 0.512 | 0.504 | 0.08 | 1.30421 | 1.284 | 0.02021 | 29.377 | 28.922 | 0.455 |

| 2017 | 0.577 | 0.53 | 0.048 | 1.4941 | 1.3702 | 0.124 | 8.12 | 7.45 | 0.6733 |

| 2018 | 1.5053 | 0.6246 | 0.8807 | 3.2253 | 1.3383 | 1.887 | 16.59 | 6.8832 | 9.70533 |

| 2019 | 1.61 | 0.7144 | 0.896 | 3.233 | 1.4345 | 1.8 | 9.4625 | 4.2 | 5.2635 |

| 2020 | 1.6185 | 0.756 | 0.8625 | 3.40393 | 1.59 | 1.814 | 31.483 | 14.71 | 16.78 |

| 2021 | 1.69833 | 0.8222 | 0.8762 | 3.33 | 1.612 | 1.718 | 14.476 | 7.0077 | 7.47 |

| 2022 | 1.749 | 0.8987 | 0.8504 | 3.642 | 1.8711 | 1.77 | 23.442 | 12.045 | 11.397 |

| 2023 * | 2.10016 | 1.962 | 0.1382 | 3.5645 | 3.33 | 0.2345 | 17.27 | 16.133 | 1.137 |

| NAEPP | R_Low | CC_Low | NP_Low | R_Med | CC_Med | NP_Med | R_High | CC_High | NP_High |

|---|---|---|---|---|---|---|---|---|---|

| 2016 | 0.512 | 0.504 | 0.08 | 1.30421 | 1.284 | 0.02021 | 29.377 | 28.922 | 0.455 |

| 2017 | 0.577 | 0.53 | 0.048 | 1.4941 | 1.3702 | 0.124 | 8.12 | 7.45 | 0.6733 |

| 2018 | 1.2623 | 0.6246 | 0.6377 | 2.705 | 1.3383 | 1.367 | 13.911 | 6.8832 | 7.028 |

| 2019 | 1.2473 | 0.7144 | 0.5329 | 2.5045 | 1.4345 | 1.07 | 7.33 | 4.2 | 3.13 |

| 2020 | 1.1308 | 0.756 | 0.3761 | 2.381 | 1.59 | 0.791 | 18.51 | 14.71 | 6.15 |

| 2021 | 1.0463 | 0.8222 | 0.2242 | 2.0513 | 1.61175 | 0.4395 | 8.9187 | 7.0077 | 1.911 |

| 2022 | 0.8285 | 1.634 | −0.8255 | 1.725 | 3.402 | −1.677 | 11.1 | 12.045 | −10.8 |

| 2023 * | 0.9948 | 1.962 | −0.9672 | 1.69 | 1.915 | −0.225 | 8.18 | 16.133 | −1.1 |

| Parameters | SBP | Bank Al Habib | Soneri Bank | Faysal Bank | JS Bank | Meezan Bank |

|---|---|---|---|---|---|---|

| Capacity (MW) | Upto-1 MW | Upto-1 | 0.004–1 | 0.004–0.02 | - | 1 |

| Target Consumers | AB, SME, Residential, commercial | AB, SME, Residential, commercial | AB, SME, Residential, commercial | Residential | Residential only | Residential only |

| Program Name | SBP Scheme for Renewable Energy | - | Soneri Renewable Energy Finance | Faysal Islami Solar Solutions | JS Ghar Apna Solar Solution | Mera Pakistan Mera Ghar |

| Eligibility | Ownership of premises only, only vendor based | Bank Statement of last 1 year, NOC from owner, electricity bill of last 1 year | Banking account in soneri Bank, Age (25–65), Vendor Based | Age (21–60), Minimum salary of 100 k PKR | Ownership of home, Account in JS bank, Authorized Vendors | Approved vendors only, Bank account statement |

| Loan Limit(M) | 400 | 1.5–400 | 3–5 | 0.1–3 | 0.3–3.5 | 0.1–2 |

| Debt Ratio | 80/20 | 75/25 | 80/20 | 85/15 | 80/20 | 85/15 |

| Tenure (Years) | 10 | 10 + 0.25 | 10 | 07 | 3–7 | 1–5 |

| Security | Undertaking of ultimate owner, Lease agreement | - | Property Mortgage for financing above Rs. 3 Million | - | - | - |

| Category | II | II | II | II | II | II |

| Mark up (%) | 6 | 6 | 3–5 | 6 | 6 | 6 |

| Amount (Billion PKR)/Year | Y-2017 | Y-2018 | Y-2019 | Y-2020 | Y-2021 | Y-2022 | Rank of Bank |

|---|---|---|---|---|---|---|---|

| Bank-Al Habib | 3.885 | 3.885 | 3.947 | 8.959 | 13.589 | 16.51 | 1 |

| HBL | 0.07 | 0.105 | 0.831 | 1.716 | 6.805 | 7.531 | 2 |

| Bank of Punjab | 0.242 | 1.025 | 2.011 | 1.859 | 5.347 | 6.3347 | 3 |

| Askari Bank | 0.126 | 0.224 | 0.43 | 0.579 | 3.673 | 4.008 | 4 |

| MCB Bank | 0 | 0.028 | 0.085 | 0.075 | 1.443 | 2.455 | 5 |

| Habib Metro | 0.971 | 0.963 | 0.845 | 0.983 | 1.593 | 2.248 | 6 |

| JS Bank | 0 | 0 | 0.134 | 0.433 | 1.322 | 1.71 | 7 |

| Soneri Bank | 0 | 0 | 0 | 0.08 | 0.809 | 0.987 | 8 |

| National Bank | 0 | 0 | 0.236 | 0.481 | 0.74 | 0.816 | 9 |

| United Bank Ltd. | 0 | 0 | 0 | 0.147 | 0.513 | 0.761 | 10 |

| Faysal Bank | 0.971 | 0.963 | 0.897 | 0.81 | 0.718 | 0.67 | 11 |

| Standard Chartered Bank | 0 | 0 | 0 | 0.144 | 0.593 | 0.6814 | 12 |

| Allied Bank | 0.013 | 0.159 | 0.426 | 2.898 | 3.331 | 0.617 | 13 |

| Bank of Khyber | 0 | 0 | 0 | 0 | 0.054 | 0.106 | 14 |

| First Woman Bank | 0.087 | 0.078 | 0 | 0 | 0 | 0 | 15 |

| Total (Borrowing) ISREP | 6.365 | 7.43 | 9.842 | 19.164 | 40.53 | 45.4351 | From SBP |

| DFI | Y-2017 | Y-2018 | Y-2019 | Y-2020 | Y-2021 | Y-2022 | Rank of DFI/IFI |

|---|---|---|---|---|---|---|---|

| Pak-Kuwait ICL | 0 | 0 | 0.18 | 0.694 | 1.7986 | 3.3942 | 1 |

| PAIR ICL | 0 | 0 | 0.194 | 0.479 | 0.52043 | 0.636 | 2 |

| Pak-Brunei ICL | 0.229 | 0.183 | 0.153 | 0.105 | 0.066 | 0.17531 | 3 |

| Pak-Oman ICL | 0 | 0 | 0.159 | 0.14 | 0.266 | 0.28 | 4 |

| Pak-China Joint ICL | 0.15 | 0.123 | 0.102 | 0.081 | 0.064422 | - * | 5 |

| Total (Borrowing) SBP | 0.379 | 0.306 | 0.788 | 1.499 | 2.715452 | 4.48551 | From SBP |

| Bank Case | Scenario (Rs/Watt) | Initial Capital (IC) (M-PKR) | Bank Share (BS) (M-PKR) | Personal Investment (PI) (M-PKR) | Bank Payment Installment (M-PKR) | Average Payback (Years) |

|---|---|---|---|---|---|---|

| Case-1 70/30 (%) | S1_200 | 1.8 | 1.26 | 0.54 | 0.299119 | 5.02 |

| S2_205 | 1.845 | 1.2915 | 0.5535 | 0.306597 | 5.542 | |

| S3_210 | 1.89 | 1.323 | 0.567 | 0.314075 | 6.2 | |

| S4_215 | 1.935 | 1.3545 | 0.5805 | 0.321553 | 6.872 | |

| S5_220 | 1.98 | 1.386 | 0.594 | 0.329031 | 7.74 | |

| Case-2 75/25 (%) | S1_200 | 1.8 | 1.35 | 0.45 | 0.320485 | 5.22 |

| S2_205 | 1.845 | 1.38375 | 0.46125 | 0.328497 | 5.92 | |

| S3_210 | 1.89 | 1.4175 | 0.4725 | 0.336509 | 6.775 | |

| S4_215 | 1.935 | 1.45125 | 0.48375 | 0.344522 | 7.865 | |

| S5_220 | 1.98 | 1.485 | 0.495 | 0.352534 | 9.292 | |

| Case-3 80/20 (%) | S1_200 | 1.8 | 1.44 | 0.36 | 0.341851 | 5.55 |

| S2_205 | 1.845 | 1.476 | 0.369 | 0.350397 | 6.58 | |

| S3_210 | 1.89 | 1.512 | 0.378 | 0.358943 | 8 | |

| S4_215 | 1.935 | 1.548 | 0.387 | 0.36749 | 10.042 | |

| S5_220 | 1.98 | 1.584 | 0.396 | 0.376036 | 13.302 |

Appendix B

References

- Khan, M.M.A.; Asif, M.; Stach, E. Rooftop PV potential in the residential sector of the Kingdom of Saudi Arabia. Buildings 2017, 7, 46. [Google Scholar] [CrossRef]

- Ismail, A.M.; Ramirez-Iniguez, R.; Asif, M.; Munir, A.B.; Muhammad-Sukki, F. Progress of solar photovoltaic in ASEAN countries: A review. Renew. Sustain. Energy Rev. 2015, 48, 399–412. [Google Scholar] [CrossRef]

- Study on Technical Issues and Financial Viability of Net-Metering Mechanisms Perspective of Distribution Utilities. Available online: https://www.saarcenergy.org/wp-content/uploads/2022/01/22-12-2021-Study-on-Technical-Issues-and-Financial-Viability-of-Net-Metering-Mechanisms.pdf (accessed on 15 January 2023).

- Hardship Clause of Germany’s Renewable Energy Sources Act (EEG 2017). Available online: https://www.bmwi.de/Redaktion/EN/Downloads/renewable-energy-sources-act-2017.pdf%3Fblob%3DpublicationFile%26v%3D3 (accessed on 23 May 2024).

- Zahid, H.; Umer, F.; Rashid, Z.; Raheem, A.; Shakoor, R.; Hussain, G.A. Critical Analysis and Application of Net-Metering Practice in MEPCO. Int. J. Photoenergy 2020, 2020, 1–13. [Google Scholar] [CrossRef]

- National Average Power Purchase Price (NAPPP). Available online: https://www.nepra.org.pk/tariff/Tariff/Ex-WAPDA%20DISCOS/2022/TRF100%20MFPA%20XWDISCOs%20Aug%202022%2014-10-2022%2019795-04.pdf (accessed on 20 January 2023).

- National Average Energy Purchase Price (NAEPP) Pakistan. Available online: https://nepra.org.pk/Admission%20Notices/2019/09-September/CPPA-G%20Report%20on%20PPP.pdf (accessed on 22 January 2023).

- Indicative Generation Capacity Expansion Plan (IGCEP) 2022-31. Available online: https://nepra.org.pk/licensing/Licences/IGCEP/IGCEP%202022-31%20.pdf (accessed on 16 January 2023).

- Alternative and Renewable Energy Policy 2019. Available online: https://www.aedb.org/images/Draft_ARE_Policy_2019_-_Version_2_July_21_2019.pdf (accessed on 26 January 2023).

- Blumschein, E. An Analysis of Net-Metering Policy Adoption in the United States. IEEE Trans. Sustain. Energy 2015, 6, 385–392. [Google Scholar]

- Wang, Y.; Hao, L. Economic Analysis of Net Metering: A Cost-Benefit Approach. IEEE Trans. Power Syst. 2018, 33, 1007–1016. [Google Scholar]

- Azimoh, C.L.; Dzobo, O.; Mbohwa, C. Investigation of net metering as a tool for increasing electricity access in developing countries. In Proceedings of the IEEE Electrical Power and Energy Conference (EPEC), Saskatoon, SK, Canada, 22–25 October 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Thakura, J.; Chakrabortya, B. Sustainable Net Metering Model for Diversified India. CUE2015-Applied Energy Symposium and Summit 2015: Low carbon cities and urban energy systems. Energy Procedia 2016, 88, 336–340. [Google Scholar]

- Park, J.; Song, E. Net-Metering Program Case Study: Ensuring Policy Stability for Renewable Energy Adoption. In Proceedings of the IEEE PES Innovative Smart Grid Technologies Conference (ISGT), Sarajevo, Bosnia and Herzegovina, 21–25 October 2018; pp. 1–5. [Google Scholar]

- Smith, M.; Johnson, K. Consumer Barriers to Net Metering Adoption: A Survey-Based Study. In Proceedings of the IEEE International Conference on Sustainable Energy Technologies (ICSET), Hanoi, Vietnam, 14–16 November 2016; pp. 1–6. [Google Scholar]

- Lee, S.; Kim, H. Econometric Analysis of Net Metering Impact on Electricity Prices and Utility Revenue. In Proceedings of the IEEE Power & Energy Society General Meeting, Atlanta, GA, USA, 4–8 August 2019; pp. 1–5. [Google Scholar]

- Kim, S.; Park, H. Legal and Regulatory Challenges of Net Metering in South Korea. In Proceedings of the IEEE International Conference on Electric Power and Energy Conversion Systems (EPECS), Istanbul, Turkey, 5–7 October 2020; pp. 1–5. [Google Scholar]

- Jacobson, D.; Dickerman, L. Distributed intelligence: A critical piece of the microgrid puzzle. Electr. J. 2019, 32, 10–13. [Google Scholar] [CrossRef]

- Rahman, A.; Hu, R. Integration of Energy Storage with Net-Metering Systems: Technical Challenges and Opportunities. IEEE Trans. Power Syst. 2020, 35, 152–162. [Google Scholar]

- Gupta, R.; Das, S. Grid Integration Challenges of Net-Metering in a Distributed Energy Environment. In Proceedings of the IEEE Innovative Smart Grid Technologies Conference (ISGT), Washington, DC, USA, 18–21 February 2019; pp. 1–5. [Google Scholar]

- Masrur, H.; Senjyu, T.; Islam, M.R.; Abbas, Z.; Kouzani, A.Z.; Mahmud, M.A.P. Resilience-Oriented Dispatch of Microgrids Considering Grid Interruptions. IEEE Trans. Appl. Supercond. 2021, 31, 5401405. [Google Scholar] [CrossRef]

- Kinab, E.; Elkhoury, M. Renewable energy use in Lebanon: Barriers and solutions. Renew. Sustain. Energy Rev. 2012, 16, 4422–4431. [Google Scholar] [CrossRef]

- Kannan, N.; Vakeesan, D. Solar energy for future world: A review. Renew. Sustain. Energy Rev. 2016, 62, 1092–1105. [Google Scholar] [CrossRef]

- Mondal, A.H.; Kamp, L.M.; Pachova, N.I. Drivers, barriers, and strategies for implementation of renewable energy technologies in rural areas in Bangladesh—An innovation system analysis. Energy Policy 2010, 38, 4626–4634. [Google Scholar] [CrossRef]

- Karakaya, E.; Sriwannawit, P. Barriers to the adoption of photovoltaic systems: The state of the art. Renew. Sustain. Energy Rev. 2015, 49, 60–66. [Google Scholar] [CrossRef]

- Brown, E.; White, L. Environmental Impact Assessment of Net-Metering: A Comparative Analysis. IEEE Access 2018, 6, 62527–62536. [Google Scholar]

- Jia, X.; Du, H.; Zou, H.; He, G. Assessing the effectiveness of China’s net-metering subsidies for household distributed photovoltaic systems. J. Clean. Prod. 2020, 262, 121161. [Google Scholar] [CrossRef]

- Engelken, M.; Römer, B.; Drescher, M.; Welpe, I.M.; Picot, A. Comparing drivers, barriers, and opportunities of business models for renewable energies: A review. Renew. Sustain. Energy Rev. 2016, 60, 795–809. [Google Scholar] [CrossRef]

- Khan, S.N.; Kazmi, S.A.A. Integrative decision-making framework for techno-economic planning and sustainability assessment of renewable dominated standalone hybrid microgrids infrastructure at provincial scale of Pakistan. Energy Conv. Manag. 2022, 270, 116168. [Google Scholar] [CrossRef]

- Akinwale, Y.O.; Ogundari, I.O.; Ilevbare, O.E.; Adepoju, A.O. A descriptive analysis of public understanding and attitudes of renewable energy resources towards energy access and development in Nigeria. Int. J. Energy Econ. Policy 2014, 4, 636–646. [Google Scholar]

- Darghouth, N.R.; Barbose, G.; Wiser, R. The impact of rate design and net metering on the bill savings from distributed PV for residential customers in California. Energy Policy 2011, 39, 5243–5253. [Google Scholar] [CrossRef]

- Qureshi, Z.A.; Kazmi, S.A.A.; Mushtaq, S.; Anwar, M. An integrated assessment framework of renewable based Microgrid deployment for remote isolated area electrification across different climatic zones and future grid extensions. Sustain. Cities Soc. 2024, 101, 105069. [Google Scholar] [CrossRef]

- Thakur, J.; Chakraborty, B. Impact of compensation mechanisms for PV generation on residential consumers and shared net metering model for developing nations: A case study of India. J. Clean. Prod. 2019, 218, 696–707. [Google Scholar] [CrossRef]

- Yamamoto, Y. Pricing electricity from residential photovoltaic systems: A comparison of feed-in tariffs, net metering, and net purchase and sale. Sol. Energy 2012, 86, 2678–2685. [Google Scholar] [CrossRef]

- Kabir, M.A.; Farjana, F.; Choudhury, R.; Kayes, A.I.; Ali, M.S.; Farrok, O. Net-metering and Feed-in-Tariff policies for the optimum billing scheme for future industrial PV systems in Bangladesh. Alex. Eng. J. 2023, 63, 157–174. [Google Scholar] [CrossRef]

- Khatri, S.A.; Mirjat, N.H.; Harijan, K.; Uqaili, M.A.; Shah, S.F.; Shaikh, P.H.; Kumar, L. Kumar An Overview of the Current Energy Situation of Pakistan and the Way Forward towards Green Energy Implementation. Energies 2023, 16, 423. [Google Scholar] [CrossRef]

- GOP. Pakistan Energy Demand Forecast (2021–2030); Ministry of Planning, Development & Special Initiatives, Government of Pakistan: Islamabad, Pakistan, 2021.

- NEPRA. State of Industry, 2016–2023; National Electric Power Regulatory Authority, Government of Pakistan. Available online: https://nepra.org.pk/publications/State%20of%20Industry%20Reports.php (accessed on 1 January 2023).

- Arif, M.S. Residential Solar Panels and Their Impact on the Reduction of Carbon Emissions Reduction of Carbon Emissions using Residential Solar Panels Spring 2013. pp. 1–18. Available online: https://nature.berkeley.edu/classes/es196/projects/2013final/ArifM_2013.pdf (accessed on 26 January 2023).

- Best Practices in Sustainable Finance. Available online: https://www.cbd.int/financial/privatesector/several-privatebestpractices.pdf (accessed on 27 January 2023).

- Net Billing Schemes Innovation Landscape Brief. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2019/Feb/IRENA_Net_billing_2019.pdf?la=en&hash=DD239111CB0649A9A9018BAE77B9AC06B9EA0D25 (accessed on 27 January 2023).

- Policy Brief # 82 Green Financing to Support Energy Transition: Options and Challenges for Pakistan Muhammad Umar Ayaz and Zahid Majeed September. 2022. Available online: https://sdpi.org/assets/lib/uploads/Green%20Financing%20to%20Support%20Energy%20Transition%20Options%20and%20Challenges%20for%20Pakistan%20pb-82.pdf (accessed on 27 January 2023).

- Report on In-Depth Analysis of Green Banking Guidelines, Indus Consortium and NED University. Available online: https://www.sbp.org.pk/smefd/circulars/2017/C8-Annex.pdf (accessed on 27 January 2023).

- Impact and Sustainability Report of HBL. 2021. Available online: https://www.hbl.com/assets/documents/HBL_Impact_Report_23-4-_22_-_Final_PDF.pdf (accessed on 31 January 2023).

- MTahir, M.U.; Siraj, K.; Shah SF, A.; Arshad, N. Evaluation of Single-Phase net Metering to Meet Renewable Energy Targets: A Case Study from Pakistan. Energy Policy 2023, 172, 113311. [Google Scholar]

- Iliopoulos, T.G.; Fermeglia, M.; Vanheusden, B. The EU’s 2030 Climate and Energy Policy Framework: How net metering slips through its net. Rev. Eur. Comp. Int. Environ. Law 2020, 29, 245–256. [Google Scholar] [CrossRef]

| DISCOs | 2015–2016 | 2016–2017 | 2017–2018 | 2018–2019 | 2019–2020 | 2020–2021 | 2021–2022 |

|---|---|---|---|---|---|---|---|

| PESCO | - | - | 37.56 (2) | 96.6 (10) | 3200.84 (131) | 6064 (525) | 12,510 (392) |

| TESCO | - | - | - | - | - | 298.08 (1) | 175.23 (1) |

| IESCO | 1020 (2) | 1008.96 (49) | 1732.81 (114) | 3849.07 (377) | 9990 (863) | 24,439 (1976) | 22,860 (1507) |

| GEPCO | - | 11 (3) | 1190.37 (31) | 908.64 (56) | 4720 (134) | 11,138 (433) | 23,290 (513) |

| LESCO | - | 468.2 (36) | 3204.43 (142) | 7154.44 (348) | 14,980 (886) | 41,126 (2170) | 62,390 (1790) |

| FESCO | - | 305 (2) | 217.6 (13) | 258.17 (24) | 3960 (152) | 14,879 (564) | 26,620 (558) |

| MEPCO | - | 470.57 (10) | 251.96 (7) | 1129.94 (47) | 4300 (166) | 17,928 (876) | 46,980 (1018) |

| HESCO | - | - | 10.08 (1) | 220 (6) | 951 (11) | 4130 (64) | |

| SEPCO | - | - | 964.91 (1) | 469 (5) | 136 (7) | 2290 (13) | |

| QESCO | - | - | 6.18 (1) | 20 (1) | 326 (4) | 220 (9) | |

| K-Electric | - | - | 288.4 (28) | 4270.21 (253) | 12,240 (730) | 23,885 (1357) | 41,450 (1078) |

| Others | - | 52.95 (6) | 84.79 (13) | 501.02 (49) | 2770 (260) | 5009 (494) | 540 (89) |

| Total | 1020 (2) | 2316.68 (106) | 7007.91 (350) | 19,149.24 (1167) | 56,869.84 (3334) | 146,179.1 (8418) | 243,455.2 (7032) |

| Year | <11 KW Low | <25 KW Medium | 25 KW > High | Total | Low % | Medium % | High % |

|---|---|---|---|---|---|---|---|

| 2016 | 10 | 4 | 4 | 18 | 55.6 | 22.2 | 22.2 |

| 2017 | 62 | 11 | 6 | 79 | 78.5 | 14 | 7.5 |

| 2018 | 127 | 54 | 10 | 191 | 66.5 | 28.3 | 5.2 |

| 2019 | 558 | 104 | 23 | 685 | 81.45 | 15.2 | 3.36 |

| 2020 | 1022 | 223 | 47 | 1292 | 79.1 | 17.3 | 3.6 |

| 2021 | 1915 | 596 | 103 | 2614 | 73.2 | 22.8 | 4 |

| 2022 | 121 | 98 | 118 | 339 | 35.7 | 28.9 | 34.8 |

| 2023 * | 1 | 7 | 11 | 19 | 5.26 | 36.84 | 57.9 |

| Total | 3816 | 1097 | 322 | 5237 | 72.87 | 21 | 6.15 |

| S# | Participants | Participants Classification | Responses |

|---|---|---|---|

| 1 | Utilities | GEPCO (2); PESCO (2); LESCO (4); IESCO (1); NTDC (2); NEPRA (1): | 12 |

| Industry, Vendors, Installers | Mavetech (Pvt.) Limited (1); Crysto Solar Energy (Pvt.) Limited (1); Professional Energy Solutions (1); SunWatts Energy System (1) | 4 | |

| Consumers: | 5.4 kW (Low); 12 kW (Medium); 25.6 kW (High) | 3 | |

| 2 | Banks | SBP, HBL, Bank Alfalah | 3 |

| 3 | Focused Group Discussion | HBL | 1 |

| Sr. # | Questions (Policy Perspective) | Response |

|---|---|---|

| 1 | NM planning is important for energy policy. | 4.54 (91%) |

| 2 | Achieve Energy Mix targets set by Government policies/regulatory authorities. | 4.27 (85%) |

| 3 | NM improves scientific input to energy policy. | 4.13 (83%) |

| 4 | Policy and planning institutions capacity do implement NM. | 3.6 (72%) |

| 5 | Constraints importance within policy and planning institutions for NM. | 4.3 (85.3%) |

| 6 | Poor training in policy analysis and formulation. | 3.67 (73%) |

| 7 | Energy economics, planning, and policy. | 4.8 (96%) |

| 8 | Policy Making and formulation. | 5.0 (100%) |

| 9 | Involvement in policy activities. | 4.47 (89%) |

| 10 | Rate potential stakeholders as future partners in the NM policy. | 4.0 (80%) |

| 11 | Development of financial and policy formulation. | 4.0 (80%) |

| 12 | Coordination with planning and policy institutions. | 4.47 (89%) |

| Sr. # | Questions (Technical Perspective) | Response |

|---|---|---|

| 1 | Techno-economic-social infrastructure with NM can reduce energy shortfall. | 4.0 (80%) |

| 2 | NM planning improves the diverse energy resources and technologies. | 4.54 (91%) |

| 3 | NM contributes to electrical power grid modernization | 4.13 (83%) |

| 4 | NM encourages the consumer on using renewable energy. | 5.0 (100%) |

| 5 | Current energy modeling capabilities are adequate to meet NM needs. | 3.6 (72%) |

| 6 | Modeling of grid dynamics, behavior, and performance. | 3.0 (60%) |

| 7 | Modeling of energy efficiency. | 3.54 (71%) |

| 8 | Modeling of techno-economic impacts of NM-based systems. | 3.40 (68%) |

| 9 | Lack of technical knowledge regarding NM. | 3.5 (70%) |

| 10 | Lack of sufficient data on NM. | 3.2 (64%) |

| 11 | Lack of information and communication technologies (ICT) infrastructure. | 3.67 (73%) |

| 12 | Lack of ICT to send monitoring data over real time. | 3.67 (73%) |

| 13 | Extent to which your organization/self are involved in NM planning and domains. | 3.67 (73%) |

| 14 | Provision of data | 3.67 (73%) |

| 15 | Provision of expertise, research, or analysis. | 3.07 (61%) |

| 16 | Model formulation and execution. | 3.40 (68%) |

| 17 | Optimal NM planning for optimal systems for 25 years beyond license period. | 5.0 (100%) |

| 18 | Fundamentals and basics of techno-economic models. | 4.4 (88%) |

| 19 | NM analysis. | 4.7 (93%) |

| 20 | NM pilot projects, testing, and implementation. | 4.34 (87%) |

| 21 | Data management. | 4.27 (85%) |

| 22 | Suitability of the modeling tools for NM planning and understanding. | 4.13 (83%) |

| 23 | Resources Sharing | 4.0 (80%) |

| 24 | Maintaining the best practices. | 4.0 (80%) |

| 25 | Maintain the high standards and reduce mal practices | 4.0 (80%) |

| 26 | Upgrade the knowledge pool. | 4.0 (80%) |

| 27 | Resources utilization for national cause. | 4.0 (80%) |

| Sr. # | Questions (Economics and Finance) | Response |

|---|---|---|

| 1 | Awareness of various technical and financial models used for NM? | 3.8 (76%) |

| 2 | NM improves the socio-economic status of prosumers. | 4.20 (84%) |

| 3 | Modeling of integrated energy supply and demand planning and optimization. | 3.13 (63%) |

| 4 | Modeling of energy finance. | 3.27 (65%) |

| 5 | Modeling of concerned energy markets. | 3.3 (67%) |

| 6 | NM rates should be more than or equal to the units purchased by National Grid. | 5.0 (100%) |

| 7 | Inadequate resources and finance. | 3.66 (73%) |

| 8 | Need for NM education regarding equipment quality and financial mechanisms? | 5.0 (100%) |

| 9 | Financial support mechanisms | 2.80 (56%) |

| 10 | Investment in financial model building. | 4.27 (85%) |

| 11 | Investment in financial model implementation. | 4.27 (85%) |

| 12 | Sharing of financial resources. | 4.14 (83%) |

| 13 | Support by stakeholders for modeling technical and financial designs. | 4.54 (91%) |

| Sr. # | Questions (Energy Security and Governance) | Response |

|---|---|---|

| 1 | NM improves the energy governance. | 4.07 (81%) |

| 2 | NM improves future energy security and sustainability. | 4.40 (88%) |

| 3 | Modeling of environmental, social, and political impacts of NM systems. | 3.33 (67%) |

| 4 | Weak coordination among experts from different domains. | 4.0 (80%) |

| 5 | Weak coordination among governmental institutions. | 4.0 (80%) |

| 6 | Retention issues of trained personnel. | 4.13 (83%) |

| 7 | Insufficient incentives and motivation. | 3.73 (75%) |

| 8 | Administrative support. | 3.13 (63%) |

| 9 | Environmental and social aspects of NM. | 4.6 (92%) |

| 10 | Project management. | 4.54 (91%) |

| 11 | Involvement in planning activities. | 4.47 (89%) |

| 12 | Coordination with other research organizations and universities. | 4.54 (91%) |

| Sr. # | Questions (Stakeholders Engagement and Capacity Building) | Response |

|---|---|---|

| 1 | Industries can play a vital role in assisting NM policies. | 4.0 (80%) |

| 2 | Importance of training for the organizations involved in NM planning. | 4.0 (80%) |

| 3 | Machine learning and Artificial Intelligence. | 4.13 (83%) |

| 4 | Long-range energy alternative planning and Energy Plan (EnergyPlan) | 4.07 (81%) |

| 5 | Utilization of other concerned software. | 4.47 (89%) |

| 6 | Coordination level among energy planning institutions and universities. | 4.53 (91%) |

| 7 | Training on the process of data management. | 4.53 (91%) |

| 8 | Training on the process model building. | 4.53 (91%) |

| 9 | Training on the process implementation. | 4.53 (91%) |

| 10 | Involvement in data management process. | 4.34 (87%) |

| 11 | Sharing of human resources. | 4.14 (83%) |

| 12 | Rate the need for stakeholders’ engagement | 4.0 (80%) |

| 13 | Accessibility to capacity building | 4.0 (80%) |

| 14 | Coordination among stakeholders. | 4.0 (80%) |

| 15 | Upgrading the capacity building programs. | 4.0 (80%) |

| 16 | Increase the capacity building via training/short courses. | 4.0 (80%) |

| 17 | Rate the favor and need for stakeholder’s collaboration. | 4.0 (80%) |

| 18 | Stakeholders to host various NM awareness and training events. | 4.0 (80%) |

| 19 | Train professionals for future needs. | 4.0 (80%) |

| 20 | Labs with high performance computers | 4.4 (88%) |

| 21 | Long-term subscriptions to modeling software. | 4.4 (88%) |

| 22 | Advanced training for faculty and key personnel. | 4.6 (92%) |

| 23 | Capacity building courses from basic to expert level. | 4.54 (91%) |

| 24 | Should stakeholders send concerned personal for training on NM aspects? | 3.94 (79%) |

| Category-I (Cat-I) | |

| Scope: | Financing is accessible for renewable projects with capacities ranging from over 1 MW to 50 MW. |

| Net Metering: | Not applicable. |

| Maximum Tenure: | Financing terms span a maximum of 12 years, including a grace period of up to 2 years. |

| Creditor Limit: | A single entity may secure financing up to Rs. 6 billion at a 6% interest rate, excluding KIBOR. |

| Category-II (Cat-II) | |

| Scope: | Aligned with NEPRA’s NM Regulations, financing is extended to renewable energy projects/solutions of around 1 MW. |

| Net Metering: | NM facilities are available, encompassing both self-consumption and surplus electricity sale to DISCOs. |

| Maximum Tenure: | The financing duration is capped at 10 years, with a grace period of up to 3 months. |

| Creditor Limit: | A singular entity can access financing up to Rs. 400 million at a 6% interest rate, without considering KIBOR. |

| Category-III (Cat-III) | |

| Scope: | Financing is targeted towards Renewable Energy Investment Entities (RE-IEs) exclusively, established to invest in renewable energy generation through project installations (~5 MW). These entities engage in selling electricity or engaging in deferred payment arrangements involving renewable energy equipment lease, rental, or sale to ultimate owners/users. |

| Net Metering: | Not applicable. |

| Maximum Tenure: | RE-IEs are eligible for financing up to a maximum of 10 years, along with a grace period of up to 6 months. |

| Creditor Limit: | The borrowing limit for a RE-IE is capped at Rs. 2 billion, carrying a 6% annual markup. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khan, N.S.; Kazmi, S.A.A.; Anwar, M.; Mughal, S.U.R.; Ullah, K.; Rathi, M.K.; Salal, A. Enhancing Renewable Energy Integration in Developing Countries: A Policy-Oriented Analysis of Net Metering in Pakistan Amid Economic Challenges. Sustainability 2024, 16, 6034. https://doi.org/10.3390/su16146034

Khan NS, Kazmi SAA, Anwar M, Mughal SUR, Ullah K, Rathi MK, Salal A. Enhancing Renewable Energy Integration in Developing Countries: A Policy-Oriented Analysis of Net Metering in Pakistan Amid Economic Challenges. Sustainability. 2024; 16(14):6034. https://doi.org/10.3390/su16146034

Chicago/Turabian StyleKhan, Noor Saleem, Syed Ali Abbas Kazmi, Mustafa Anwar, Saqib Ur Rehman Mughal, Kafait Ullah, Mahesh Kumar Rathi, and Ahmad Salal. 2024. "Enhancing Renewable Energy Integration in Developing Countries: A Policy-Oriented Analysis of Net Metering in Pakistan Amid Economic Challenges" Sustainability 16, no. 14: 6034. https://doi.org/10.3390/su16146034

APA StyleKhan, N. S., Kazmi, S. A. A., Anwar, M., Mughal, S. U. R., Ullah, K., Rathi, M. K., & Salal, A. (2024). Enhancing Renewable Energy Integration in Developing Countries: A Policy-Oriented Analysis of Net Metering in Pakistan Amid Economic Challenges. Sustainability, 16(14), 6034. https://doi.org/10.3390/su16146034