The Roles of Directors from Related Industries on Enterprise Innovation

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

3. Research Design

3.1. Sample Selection and Data Sources

3.2. Variable Definition

3.3. Model Design

4. Analysis of Empirical Results

4.1. Descriptive Statistics

4.2. Baseline Regression

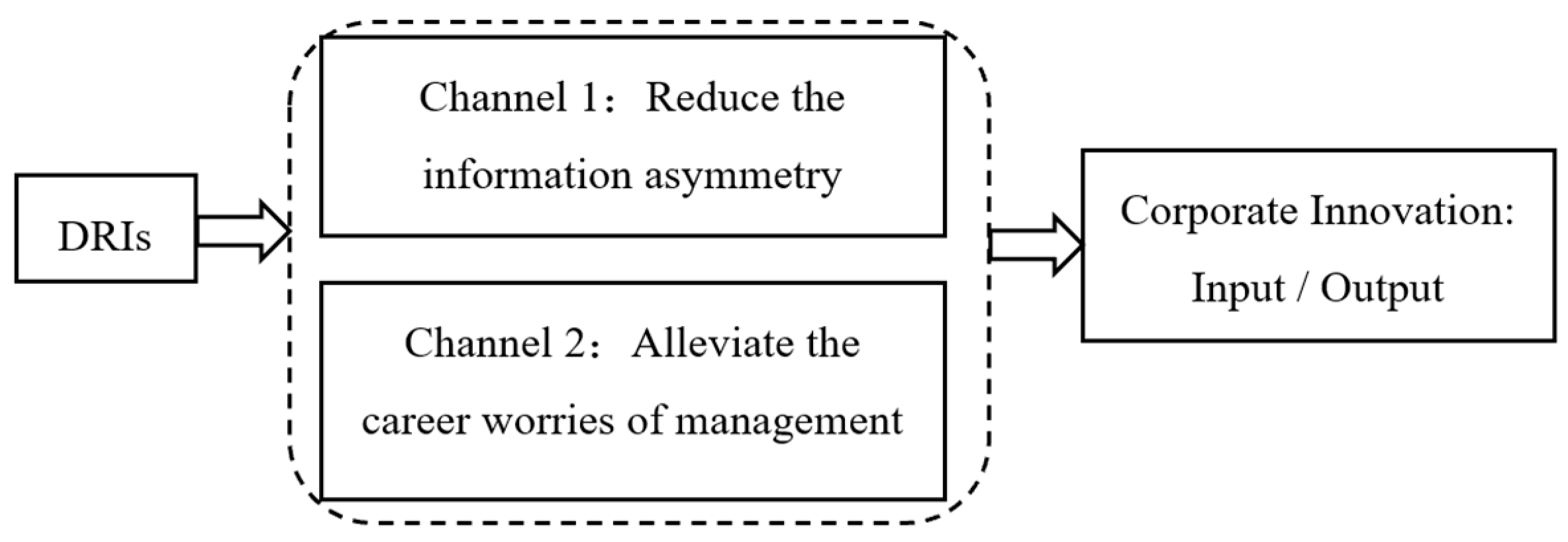

4.3. Mechanism Test

4.3.1. Information Supply Channels

4.3.2. Channel for Relieving Executives’ Career Worries

4.4. Economic Consequences

5. Robustness Test

5.1. Discussion on Endogenous Issues

5.2. Other Robustness Tests

6. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Porter, M.E. Capital disadvantage: America’s failing capital investment system. Harv. Bus. Rev. 1992, 70, 65–83. [Google Scholar] [PubMed]

- Cheng, X.; Li, Q. Does Customer Concentration Affect Enterprise Innovation: The Perspective of Industry Forward Correlation. Bus. Manag. J. 2020, 42, 42–58. [Google Scholar] [CrossRef]

- Meng, Q.; Bai, J.; Shi, W. Customer Concentration and Enterprise Technological Innovation: Help or Hinder? A Study Based on the Individual Characteristics of Customers. Nankai Bus. Rev. 2018, 21, 62–73. [Google Scholar]

- Beck, T.; Demirgüç-Kunt, A.; Maksimovic, V. Financial and Legal Constraints to Growth: Does Firm Size Matter? J. Financ. N. Y. 2005, 60, 137–177. [Google Scholar] [CrossRef]

- Chu, Y.; Tian, X.; Wang, W.; Science, M. Corporate Innovation Along the Supply Chain. Manag. Sci. 2019, 65, 2445–2466. [Google Scholar] [CrossRef]

- Yu, M. How can manufacturer benefiting from supply chain innovation. Stud. Sci. Sci. 2021, 39, 375–384. [Google Scholar] [CrossRef]

- Martínez-Noya, A.; García-Canal, E. The framing of knowledge transfers to shared R&D suppliers and its impact on innovation performance: A regulatory focus perspective. R&D Manag. 2016, 46, 354–368. [Google Scholar] [CrossRef]

- Martínez-Noya, A.; García-Canal, E. Innovation performance feedback and technological alliance portfolio diversity: The moderating role of firms’ R&D intensity. Res. Policy 2021, 50, 104321. [Google Scholar] [CrossRef]

- Basole, R.C.; Bellamy, M.A.; Park, H. Visualization of Innovation in Global Supply Chain Networks. Decis. Sci. 2017, 48, 288–306. [Google Scholar] [CrossRef]

- Cruz-González, J.; López-Sáez, P.; Navas-López, J.E. Absorbing knowledge from supply-chain, industry and science: The distinct moderating role of formal liaison devices on new product development and novelty. Ind. Mark. Manag. 2015, 47, 75–85. [Google Scholar] [CrossRef]

- Dass, N.; Kini, O.; Nanda, V.; Onal, B.; Wang, J. Board Expertise: Do Directors from Related Industries Help Bridge the Information Gap? Rev. Finance Stud. 2014, 27, 1533–1592. [Google Scholar] [CrossRef]

- Nanda, V.; Onal, B. Incentive contracting when boards have related industry expertise. J. Corp. Financ. Amst. Neth. 2016, 41, 1–22. [Google Scholar] [CrossRef]

- Burns, N.; Minnick, K.; Raman, K. Director Industry Expertise and Voluntary Corporate Disclosure. Q. J. Financ. 2020, 10, 2050012. [Google Scholar] [CrossRef]

- Ke, R.; Li, M.; Zhang, Y. Directors’ Informational Role in Corporate Voluntary Disclosure: An Analysis of Directors from Related Industries. Contemp. Account. Res. 2020, 37, 392–418. [Google Scholar] [CrossRef]

- Chen, X.; Liu, Z.; Zhu, Q. Performance evaluation of China’s high-tech innovation process: Analysis based on the innovation value chain. Technovation 2018, 74–75, 42–53. [Google Scholar] [CrossRef]

- Xu, S.; Lian, G.; Song, M.; Xu, A. Do global innovation networks influence the status of global value chains? Based on a patent cooperation network perspective. Humanit. Soc. Sci. Commun. 2024, 11, 892. [Google Scholar] [CrossRef]

- Chen, S.; Sun, G. Directors from Related Industries,Innovation Ability and Total Factor Productivity of Enterprises. Res. Econ. Manag. 2022, 43, 37–58. [Google Scholar] [CrossRef]

- Li, W.; Zheng, M. Is it Substantive Innovation or Strategic Innovation? Impact of Macroeconomic Policies on Micro-enterprises’ Innovation. Econ. Res. J. 2016, 51, 60–73. [Google Scholar]

- Jiang, X.; Shen, D.; Li, Y. Does Accounting Information Comparability Affect Corporate Innovation. Nankai Bus. Rev. 2017, 20, 82–92. [Google Scholar]

- He, Y.; Yu, W.; Yang, M. CEOs with Rich Career Experience, Corporate Risk-taking and the Value of Enterprises. China Ind. Econ. 2019, 9, 155–173. [Google Scholar] [CrossRef]

- Zhang, C.; Li, Z.; Xu, J.; Luo, Y. Accounting information quality, firm ownership and technology innovation: Evidence from China. Int. Rev. Financ. Anal. 2024, 93, 103118. [Google Scholar] [CrossRef]

- Zuo, Z.; Lin, Z. Government R&D subsidies and firm innovation performance: The moderating role of accounting information quality. J. Innov. Knowl. 2022, 7, 100176. [Google Scholar] [CrossRef]

- Bowen, F.E.; Rostami, M.; Steel, P. Timing is everything: A meta-analysis of the relationships between organizational performance and innovation. J. Bus. Res. 2010, 63, 1179–1185. [Google Scholar] [CrossRef]

- Solow, R.M. Technical Change and the Aggregate Production Function. Rev. Econ. Stat. 1957, 39, 312–320. [Google Scholar] [CrossRef]

- Atanassov, J. Do Hostile Takeovers Stifle Innovation? Evidence from Antitakeover Legislation and Corporate Patenting. J. Financ. N. Y. 2013, 68, 1097–1131. [Google Scholar] [CrossRef]

- Bernstein, S. Does Going Public Affect Innovation? J. Financ. N. Y. 2015, 70, 1365–1403. [Google Scholar] [CrossRef]

- Granovetter, M. Economic Action and Social Structure: The Problem of Embeddedness. Am. J. Sociol. 1985, 91, 481–510. [Google Scholar] [CrossRef]

- Omer, T.C.; Shelley, M.K.; Tice, F.M. Do Director Networks Matter for Financial Reporting Quality? Evidence from Audit Committee Connectedness and Restatements. Manag. Sci. 2020, 66, 3361–3388. [Google Scholar] [CrossRef]

- Chang, M.-L.; Cheng, C.-F.; Wu, W.-Y. How Buyer-Seller Relationship Quality Influences Adaptation and Innovation by Foreign MNCs’ Subsidiaries. Ind. Mark. Manag. 2012, 41, 1047–1057. [Google Scholar] [CrossRef]

- Ling, R.; Pan, A.; Li, B. Can Supply Chain Finance Improve the Innovation Level of Enterprises? J. Financ. Econ. 2021, 47, 64–78. [Google Scholar] [CrossRef]

- Bidault, F.; Castello, A. Why Too Much Trust Is Death to Innovation. MIT Sloan Manag. Rev. 2010, 51, 33–38. [Google Scholar]

- Liu, B.; Huang, K.; Jiu, L. Can Independent Director Interlocks Improve Accounting Information Comparability? Account. Res. 2019, 4, 36–42. [Google Scholar]

- Liang, S.; Fu, R.; Yang, X. Concurrent independent directors in the same industry and accounting information comparability. China J. Account. Res. 2022, 15, 100268. [Google Scholar] [CrossRef]

- Chen, A.; Chen, F.; He, C. Industry Chain Linkage and Frim’s Innovation. China Ind. Econ. 2021, 9, 80–98. [Google Scholar] [CrossRef]

- Lee, H.L. Aligning Supply Chain Strategies with Product Uncertainties. Calif. Manag. Rev. 2002, 44, 105–119. [Google Scholar] [CrossRef]

- Faleye, O.; Hoitash, R.; Hoitash, U. The costs of intense board monitoring. J. Financ. Econ. 2011, 101, 160–181. [Google Scholar] [CrossRef]

- Kamien, M.I.; Muller, E.; Zang, I. Research Joint Ventures and R&D Cartels. Am. Econ. Rev. 1992, 82, 1293–1306. [Google Scholar]

- Zhao, X.; Wang, Y.; Li, J.; Li, X. The impact of director network distance on enterprise investment returns. Financ. Res. Lett. 2024, 66, 105697. [Google Scholar] [CrossRef]

- Hughes, B.; Wareham, J. Knowledge arbitrage in global pharma: A synthetic view of absorptive capacity and open innovation. R&D Manag. 2010, 40, 324–343. [Google Scholar] [CrossRef]

- Petersen, M.A.; Rajan, R.G. Does Distance Still Matter? The Information Revolution in Small Business Lending. J. Financ. N. Y. 2002, 57, 2533–2570. [Google Scholar] [CrossRef]

- Prahalad, C.K. The Future of Competition: Co-Creating Unique Value with Customers. Acad. Manag. Exec. 2004, 18, 155–157. [Google Scholar] [CrossRef]

- Graham, J.R.; Harvey, C.R.; Rajgopal, S. The economic implications of corporate financial reporting. J. Account. Econ. 2005, 40, 3–73. [Google Scholar] [CrossRef]

- Priest, G.L. The Current Insurance Crisis and Modern Tort Law. Yale Law J. 1987, 96, 1521–1590. [Google Scholar] [CrossRef]

- Meng, Q.; Wu, W.; Yu, S. Fund Managers’ Career Concern and Their Investment Style. Econ. Res. J. 2015, 50, 115–130. [Google Scholar]

- Huo, C.; Zhang, Y. Impact of CEO Career Concerns on Corporate Strategic Orientation—The Moderating Role of External Supervision Pressure and Internal Performance Pressure. Soft Sci. 2022, 36, 103–109. [Google Scholar] [CrossRef]

- Li, D.; Wang, J.; Zhang, Y. Relationship networks,ownership type and R&D expenditures. Sci. Res. Manag. 2017, 38, 75–82. [Google Scholar] [CrossRef]

- Belenzon, S.; Shamshur, A.; Zarutskie, R. CEO’s age and the performance of closely held firms. Strateg. Manag. J. 2019, 40, 917–944. [Google Scholar] [CrossRef]

- Ya, K.; Luo, F.; Li, Q. Economic Policy Uncertainty, Financial Asset Allocation and Innovation Investment. Financ. Trade Econ. 2018, 39, 95–110. [Google Scholar]

- Ahern, K.R.; Harford, J. The Importance of Industry Links in Merger Waves. J. Financ. N. Y. 2014, 69, 527–576. [Google Scholar] [CrossRef]

- Patatoukas, P.N. Customer-Base Concentration: Implications for Firm Performance and Capital Markets. Account. Rev. 2010, 87, 363–392. [Google Scholar] [CrossRef]

- Ye, K.; Liu, X. Tax Collection and Management, Income Tax Cost and Earnings Management. Manag. World 2011, 5, 140–148. [Google Scholar] [CrossRef]

- Li, F.; Qin Li Shi, Y. Pursuing Progress While Ensuring Stability:Can Over-Appointment of Directors by Ultimate Controllers Spur Corporate Innovation? Financ. Trade Econ. 2021, 42, 96–110. [Google Scholar] [CrossRef]

- Berg, T.; Horsch, P.; Schmid, M. Sharing a Director with a Peer. Work. Pap. Finance. 2015. Available online: http://ideas.repec.org/p/usg/sfwpfi/201507.html (accessed on 17 March 2024).

- Wen, Z.; Zhang, L.; Hou, J.; Liu, H. Testing and application of the mediating effects. Acta Psychol. Sin. 2004, 36, 614–620. [Google Scholar]

- Shao, S.; Lv, C. Can the Actual Controllers’ Directly Holding Stocks Increase the Company’s Value?: A Study from the Evidence of China’s Private Listed Companies. J. Manag. World 2015, 5, 134–146+188. [Google Scholar] [CrossRef]

- Hu, G.; Zhao, Y.; Hu, J. Directors’ and Officers’ Liability Insurance,Tolerance of Failure and Enterprise Independent Innovation. J. Manag. World 2019, 35, 121–135. [Google Scholar] [CrossRef]

- Jiang, X.; Zhu, L.; Yi, Z. Internet Public Opinion and Corporate Innovation. China Econ. Q. 2021, 21, 113–134. [Google Scholar] [CrossRef]

- Li, J.; Zhao, X. Employment Protection and Enterprise’s Innovation—An Empirical Analysis Based on the Labor Contract Law. China Econ. Q. 2020, 19, 121–142. [Google Scholar] [CrossRef]

- Meng, Q.; Li, X.; Zhang, P. Can Employee Stock Ownership Plan Promote Corporate Innovation? Empirical Evidence from the Perspective of Employees. J. Manag. World 2019, 35, 209–228. [Google Scholar] [CrossRef]

| Variable Name | Variable Code | Variable Declaration |

|---|---|---|

| Explained variables (Dependent variables) | ||

| Innovation investment | RD | Natural logarithm of R&D input plus 1 |

| Innovation output | Patent | The natural logarithm of the total number of patent applications plus 1. |

| Explanatory variables (Independent variables) | ||

| Directors from related industries | DRI_Val | If the part-time director is an executive or a non-independent director in a related industry chain, the weight is set to 1, and the weight is set to 0.5 if the part-time director is an independent director. Finally, all directors are weighted and divided by the board size of the company. |

| DRI_Dum | If DRIs_Val is greater than 0, the value is 1, otherwise it is 0. | |

| Mechanism test variables (Information supply channels) | ||

| Inventory management efficiency | InvHold | The ratio of the ending inventory balance to the ending total assets |

| ICP | Calculated by 365 times the average inventory occupancy divided by the operating cost. | |

| Information environment of industry chain related industries | EM | The revised Jones (1991) model of performance matching was used to estimate the earnings management level of the firm. For details, see Section 3.2. |

| analyst | Calculate the degree of concern of analysts in related industries in the industrial chain and sort. For details, see Section 3.2. | |

| Mechanism test variables (Channel for relieving executives’ career worries) | ||

| Enterprise risk-taking | ROA volatility | The standard deviation (Sd_ROA) and Range (Range_ROA) of ROA adjusted by the industry average in the years t, t + 1, and t + 2 are used to measure the risk-taking level of enterprises |

| Management’s occupational anxiety | Tenure | Tenure is measured by the average Tenure of company executives |

| Turn | the stock turnover rate (Turn) is measured by the average annual turnover rate of individual stocks adjusted by the industry average. | |

| Control variables | ||

| Size | Size | Take the natural logarithm of total assets |

| Leverage ratio | Lev | Asset-liability ratio, total liabilities/total assets |

| Profitability | ROA | (total profit + financial expenses)/total assets |

| Growth opportunity | TobinQ | Company market value/total assets |

| Speed of development | Growth | The growth rate of the company’s operating income |

| Cash flow | CashFlow | Net increase in cash and cash equivalents/total assets |

| Duration | CorpAge | The natural logarithm is obtained by adding 1 to the establishment time of the company. |

| Capital density | CapInt | Natural logarithm of net fixed assets per capita |

| Management shareholding ratio | MHold | Number of shares held by management/total share capital |

| The largest shareholder’s shareholding ratio | Top1 | Number of shares held by the largest shareholder/total share capital |

| Duality | Dual | Chairman concurrently serves as general manager, the variable value is equal to 1, otherwise it is 0. |

| Property right nature | SOE | The actual controller of the company is state-owned, and the variable value is equal to 1, otherwise it is equal to 0. |

| Proportion of independent directors | Indep | Number of independent directors/total number of company directors |

| Board size | BoardSize | The number of directors of the company plus 1, takes the natural logarithm. |

| Institutional shareholding ratio | InstOwn | Number of shares held by institutional investors/total share capital |

| Industry competition | HHI | Herfindal industry index |

| Variables | Num | Mean | SD | Min | Med | Max |

|---|---|---|---|---|---|---|

| RD | 22,456 | 13.460 | 7.693 | 0 | 17.240 | 21.490 |

| Patent | 22,441 | 2.344 | 1.781 | 0 | 2.398 | 6.809 |

| DRI_Val | 22,456 | 0.272 | 0.226 | 0 | 0.222 | 1.056 |

| DRI_Dum | 22,456 | 0.655 | 0.475 | 0 | 1 | 1 |

| Size | 22,456 | 22.080 | 1.264 | 19.770 | 21.900 | 25.990 |

| Lev | 22,456 | 0.433 | 0.205 | 0.052 | 0.431 | 0.869 |

| ROA | 22,456 | 0.059 | 0.053 | −0.129 | 0.054 | 0.238 |

| TobinQ | 22,456 | 2.546 | 1.750 | 0.861 | 1.987 | 10.470 |

| Growth | 22,456 | 0.214 | 0.481 | −0.521 | 0.128 | 3.273 |

| CashFlow | 22,456 | 0.005 | 0.086 | −0.254 | 0.003 | 0.310 |

| CorpAge | 22,456 | 2.760 | 0.364 | 1.609 | 2.833 | 3.434 |

| CapInt | 22,456 | 12.520 | 1.134 | 9.482 | 12.490 | 15.710 |

| Mhold | 22,456 | 0.120 | 0.194 | 0 | 0.001 | 0.681 |

| Top1 | 22,456 | 0.353 | 0.149 | 0.087 | 0.334 | 0.750 |

| Dual | 22,456 | 0.241 | 0.428 | 0 | 0 | 1 |

| SOE | 22,456 | 0.424 | 0.494 | 0 | 0 | 1 |

| Indep | 22,456 | 0.372 | 0.053 | 0.333 | 0.333 | 0.571 |

| BoardSize | 22,456 | 1.867 | 0.239 | 1.099 | 1.946 | 2.398 |

| InstOwn | 22,456 | 0.783 | 0.759 | 0.006 | 0.582 | 4.533 |

| HHI | 22,456 | 0.145 | 0.167 | 0.014 | 0.089 | 1 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| RD | RD | Patent | Patent | |

| DRI_Val | 1.346 *** | 0.368 *** | ||

| (4.426) | (4.577) | |||

| DRI_Dum | 0.630 *** | 0.166 *** | ||

| (5.158) | (5.305) | |||

| Size | 1.142 *** | 1.157 *** | 0.649 *** | 0.654 *** |

| (11.813) | (12.070) | (25.332) | (25.655) | |

| Lev | −1.652 *** | −1.675 *** | −0.319 *** | −0.325 *** |

| (−3.277) | (−3.324) | (−2.753) | (−2.807) | |

| ROA | 2.213 * | 2.235 * | 1.632 *** | 1.639 *** |

| (1.788) | (1.804) | (5.049) | (5.070) | |

| TobinQ | 0.050 | 0.052 | 0.025 ** | 0.025 ** |

| (1.102) | (1.147) | (2.102) | (2.148) | |

| Growth | −0.067 | −0.067 | −0.021 | −0.022 |

| (−0.742) | (−0.742) | (−0.998) | (−1.002) | |

| CashFlow | −0.362 | −0.386 | 0.084 | 0.077 |

| (−1.058) | (−1.131) | (0.972) | (0.898) | |

| CorpAge | −2.221 *** | −2.209 *** | −0.271 *** | −0.268 *** |

| (−9.074) | (−9.035) | (−3.988) | (−3.953) | |

| CapInt | −0.505 *** | −0.511 *** | −0.182 *** | −0.184 *** |

| (−5.990) | (−6.088) | (−9.008) | (−9.128) | |

| Mhold | 2.473 *** | 2.420 *** | 0.259 ** | 0.244 ** |

| (6.748) | (6.621) | (2.338) | (2.207) | |

| Top1 | 0.088 | 0.099 | −0.168 | −0.166 |

| (0.164) | (0.183) | (−1.096) | (−1.079) | |

| Dual | 0.208 | 0.211 | 0.093 ** | 0.093 ** |

| (1.482) | (1.502) | (2.369) | (2.390) | |

| SOE | −0.255 | −0.260 | 0.015 | 0.015 |

| (−1.191) | (−1.210) | (0.292) | (0.275) | |

| Indep | −2.367 | −2.202 | −0.206 | −0.159 |

| (−1.550) | (−1.446) | (−0.489) | (−0.379) | |

| Boardsize | 0.482 | 0.328 | 0.005 | −0.036 |

| (1.375) | (0.938) | (0.052) | (−0.391) | |

| InstOwn | −0.066 | −0.069 | −0.063 *** | −0.063 *** |

| (−0.743) | (−0.773) | (−2.739) | (−2.767) | |

| HHI | −0.160 | −0.191 | −0.069 | −0.078 |

| (−0.263) | (−0.315) | (−0.486) | (−0.550) | |

| IND | control | control | control | control |

| YEAR | control | control | control | control |

| _cons | −8.326 *** | −8.420 *** | −10.145 *** | −10.178 *** |

| (−3.296) | (−3.357) | (−15.689) | (−15.766) | |

| N | 22,456 | 22,456 | 22,441 | 22,441 |

| r2_a | 0.526 | 0.526 | 0.466 | 0.466 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Explained variable | InvHold | InvHold | ICP | ICP |

| DRI_Val | −0.019 *** | −54.445 *** | ||

| (−2.802) | (−3.451) | |||

| DRI_Dum | −0.006 ** | −20.531 *** | ||

| (−2.208) | (−2.692) | |||

| CONTROLS | control | control | control | control |

| YEAR&IND | control | control | control | control |

| N | 22,456 | 22,456 | 22,454 | 22,454 |

| r2_a | 0.487 | 0.487 | 0.478 | 0.478 |

| Panel A: Measure information asymmetry by the earnings management degree (EM) of related industries | ||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| EM | low | tall | low | tall | low | tall | low | tall |

| Explained variable | RD | RD | RD | RD | Patent | Patent | Patent | Patent |

| DRI_Val | 0.896 *** | 1.849 *** | 0.240 *** | 0.432 *** | ||||

| (3.295) | (5.909) | (3.433) | (6.109) | |||||

| DRI_Dum | 0.486 *** | 0.895 *** | 0.125 *** | 0.227 *** | ||||

| (4.025) | (5.924) | (4.011) | (6.654) | |||||

| CONTROLS | control | control | control | control | control | control | control | control |

| YEAR&IND | control | control | control | control | control | control | control | control |

| N | 7482 | 7485 | 7482 | 7485 | 7480 | 7480 | 7480 | 7480 |

| r2_a | 0.575 | 0.511 | 0.575 | 0.511 | 0.417 | 0.477 | 0.417 | 0.478 |

| Chi2 Test (p-Value) | 5.27 ** | 4.37 ** | 3.55 * | 4.95 ** | ||||

| (0.022) | (0.037) | (0.059) | (0.026) | |||||

| Panel B: Measure information asymmetry by the degree of concern of industry analyst | ||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Analyst | tall | low | tall | low | tall | low | tall | low |

| Explained variable | RD | RD | RD | RD | Patent | Patent | Patent | Patent |

| DRI_Val | 0.966 *** | 1.596 *** | 0.270 *** | 0.463 *** | ||||

| (4.282) | (6.567) | (4.715) | (7.970) | |||||

| DRI_Dum | 0.471 *** | 0.737 *** | 0.131 *** | 0.200 *** | ||||

| (4.384) | (6.607) | (4.779) | (7.498) | |||||

| CONTROLS | control | control | control | control | control | control | control | control |

| YEAR&IND | control | control | control | control | control | control | control | control |

| N | 11,231 | 11,225 | 11,231 | 11,225 | 11,225 | 11,216 | 11,225 | 11,216 |

| r2_a | 0.564 | 0.495 | 0.564 | 0.495 | 0.501 | 0.424 | 0.501 | 0.423 |

| Chi2 Test (p-Value) | 3.57 * | 2.94 * | 5.38 ** | 3.36 * | ||||

| (0.059) | (0.087) | (0.020) | (0.067) | |||||

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Sd_ROA | Sd_ROA | Range_ROA | Range_ROA | |

| DRI_Val | 0.035 ** | 0.063 ** | ||

| (2.126) | (2.122) | |||

| DRI_Dum | 0.020 * | 0.036 * | ||

| (1.682) | (1.683) | |||

| CONTROLS | control | control | control | control |

| YEAR&IND | control | control | control | control |

| N | 16,740 | 16,740 | 16,740 | 16,740 |

| r2_a | 0.065 | 0.065 | 0.064 | 0.065 |

| Panel A: Measuring executives’ career worries by turnover rate | ||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Turn | low | tall | low | tall | low | tall | low | tall |

| Explained variable | RD | RD | RD | RD | Patent | Patent | Patent | Patent |

| DRI_Val | 1.028 *** | 1.718 *** | 0.356 *** | 0.386 *** | ||||

| (4.495) | (7.098) | (6.186) | (6.680) | |||||

| DRI_Dum | 0.442 *** | 0.781 *** | 0.165 *** | 0.167 *** | ||||

| (3.939) | (7.254) | (6.451) | (5.877) | |||||

| CONTROLS | control | control | control | control | control | control | control | control |

| YEAR&IND | control | control | control | control | control | control | control | control |

| N | 11,224 | 11,229 | 11,224 | 11,229 | 11,226 | 11,212 | 11,226 | 11,212 |

| r2_a | 0.539 | 0.514 | 0.539 | 0.514 | 0.423 | 0.497 | 0.423 | 0.496 |

| Chi2 Test | 4.22 ** | 4.74 ** | 0.12 | 0.00 | ||||

| (p-Value) | (0.040) | (0.029) | (0.724) | (0.976) | ||||

| Panel B: Measuring executives’ career worries by their tenure. | ||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Tenure | short | long | short | long | short | long | short | long |

| Explained variable | RD | RD | RD | RD | Patent | Patent | Patent | Patent |

| DRI_Val | 1.867 *** | 0.807 *** | 0.396 *** | 0.336 *** | ||||

| (7.873) | (3.490) | (6.909) | (5.774) | |||||

| DRI_Dum | 0.781 *** | 0.479 *** | 0.171 *** | 0.157 *** | ||||

| (6.856) | (4.552) | (6.215) | (5.937) | |||||

| CONTROLS | control | control | control | control | control | control | control | control |

| YEAR&IND | control | control | control | control | control | control | control | control |

| N | 11,224 | 11,231 | 11,224 | 11,231 | 11,216 | 11,224 | 11,216 | 11,224 |

| r2_a | 0.520 | 0.536 | 0.520 | 0.537 | 0.469 | 0.464 | 0.468 | 0.464 |

| Chi2 Test | 10.12 *** | 3.75 * | 0.53 | 0.14 | ||||

| (p-Value) | (0.002) | (0.053) | (0.465) | (0.712) | ||||

| Panel A: The empirical results with innovation input (RD) as intermediary variable. | ||||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| DRI | DRI_Val | DRI_Val | DRI_Val | DRI_Dum | DRI_Dum | DRI_Dum |

| Explained variable | TobinQ | RD | TobinQ | TobinQ | RD | TobinQ |

| DRI | 0.099 *** | 1.472 *** | 0.093 ** | 0.032 * | 0.622 *** | 0.029 |

| (2.599) | (8.762) | (2.439) | (1.767) | (7.837) | (1.629) | |

| RD | 0.004 *** | 0.004 ** | ||||

| (2.644) | (2.561) | |||||

| CONTROLS | control | control | control | control | control | control |

| YEAR& IND | control | control | control | control | control | control |

| N | 21,855 | 21,855 | 21,855 | 21,855 | 21,855 | 21,855 |

| Adj-R2 | 0.439 | 0.525 | 0.439 | 0.438 | 0.520 | 0.439 |

| Sobel Z (p-Value) | 2.551 | 2.434 | ||||

| (0.011) | (0.015) | |||||

| Panel B: The empirical results with innovation output(patent) as intermediary variable. | ||||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| DRI | DRI_Val | DRI_Val | DRI_Val | DRI_Dum | DRI_Dum | DRI_Dum |

| Explained variable | TobinQ | Patent | TobinQ | TobinQ | Patent | TobinQ |

| DRI | 0.104 *** | 0.394 *** | 0.091 ** | 0.033 * | 0.174 *** | 0.027 |

| (2.732) | (9.471) | (2.369) | (1.817) | (8.887) | (1.475) | |

| Patent | 0.035 *** | 0.035 *** | ||||

| (5.599) | (5.663) | |||||

| CONTROLS | control | control | control | control | control | control |

| YEAR& IND | control | control | control | control | control | control |

| N | 21,840 | 21,840 | 21,840 | 21,840 | 21,840 | 21,840 |

| Adj-R2 | 0.438 | 0.456 | 0.439 | 0.438 | 0.456 | 0.439 |

| Sobel Z (p-Value) | 4.820 | 4.776 | ||||

| (0.000) | (0.000) | |||||

| Panel A: The empirical results with innovation input (RD) as intermediary variable. | ||||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| DRI | DRI_Val | DRI_Val | DRI_Val | DRI_Dum | DRI_Dum | DRI_Dum |

| Explained variable | ROA | RD | ROA | ROA | RD | ROA |

| DRI | 0.009 *** | 1.323 *** | 0.008 *** | 0.003 *** | 0.622 *** | 0.003 *** |

| (4.868) | (7.836) | (4.514) | (4.120) | (7.837) | (3.763) | |

| RD | 0.001 *** | 0.001 *** | ||||

| (6.681) | (6.710) | |||||

| CONTROLS | control | control | control | control | control | control |

| YEAR& IND | control | control | control | control | control | control |

| N | 21,855 | 21,855 | 21,855 | 21,855 | 21,855 | 21,855 |

| Adj-R2 | 0.126 | 0.520 | 0.128 | 0.126 | 0.520 | 0.128 |

| Sobel Z (p-Value) | 7.836 | 7.837 | ||||

| (0.000) | (0.000) | |||||

| Panel B: The empirical results with innovation output(patent) as intermediary variable. | ||||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| DRI | DRI_Val | DRI_Val | DRI_Val | DRI_Dum | DRI_Dum | DRI_Dum |

| Explained variable | ROA | Patent | ROA | ROA | Patent | ROA |

| DRI | 0.008 *** | 0.394 *** | 0.007 *** | 0.003 *** | 0.174 *** | 0.003 *** |

| (4.836) | (9.471) | (4.035) | (4.076) | (8.887) | (3.321) | |

| Patent | 0.004 *** | 0.004 *** | ||||

| (12.645) | (12.704) | |||||

| CONTROLS | control | control | control | control | control | control |

| YEAR& IND | control | control | control | control | control | control |

| N | 21,840 | 21,840 | 21,840 | 21,840 | 21,840 | 21,840 |

| Adj-R2 | 0.126 | 0.456 | 0.132 | 0.126 | 0.456 | 0.132 |

| Sobel Z (p-Value) | 7.580 | 7.282 | ||||

| (0.000) | (0.000) | |||||

| Variables | Matching | Average/Mean Value | Standard Deviation (%) | Reduction in Standard Deviation (%) | T Test | ||

|---|---|---|---|---|---|---|---|

| Processing Group | Processing Group | T Value | p Value | ||||

| Size | Front matching | 22.24 | 21.76 | 39.90 | 27.820 | 0.000 | |

| After matching | 21.81 | 21.82 | −0.50 | 98.70 | −0.350 | 0.727 | |

| Lev | Front matching | 0.443 | 0.415 | 13.60 | 9.740 | 0.000 | |

| After matching | 0.418 | 0.418 | 0.00 | 99.80 | 0.020 | 0.984 | |

| ROA | Front matching | 0.060 | 0.058 | 4.10 | 2.910 | 0.004 | |

| After matching | 0.059 | 0.059 | 0.60 | 84.50 | 0.380 | 0.707 | |

| TobinQ | Front matching | 2.456 | 2.716 | −14.70 | −10.59 | 0.000 | |

| After matching | 2.684 | 2.672 | 0.60 | 95.60 | 0.370 | 0.708 | |

| Growth | Front matching | 0.211 | 0.219 | −1.70 | −1.190 | 0.235 | |

| After matching | 0.210 | 0.214 | −0.80 | 52.10 | −0.480 | 0.633 | |

| CashFlow | Front matching | 0.006 | 0.001 | 5.90 | 4.230 | 0.000 | |

| After matching | 0.003 | 0.002 | 0.90 | 84.50 | 0.530 | 0.596 | |

| CorpAge | Front matching | 2.775 | 2.731 | 12.00 | 8.630 | 0.000 | |

| After matching | 2.739 | 2.737 | 0.40 | 96.40 | 0.260 | 0.793 | |

| CapInt | Front matching | 12.57 | 12.43 | 12.80 | 9.040 | 0.000 | |

| After matching | 12.43 | 12.44 | 0.00 | 99.80 | −0.010 | 0.991 | |

| Mhold | Front matching | 0.109 | 0.140 | −15.80 | −11.49 | 0.000 | |

| After matching | 0.138 | 0.137 | 0.50 | 96.50 | 0.310 | 0.755 | |

| Top1 | Front matching | 0.354 | 0.352 | 1.10 | 0.810 | 0.420 | |

| After matching | 0.350 | 0.351 | −1.00 | 10 | −0.620 | 0.537 | |

| Dual | Front matching | 0.233 | 0.255 | −5.10 | −3.680 | 0.000 | |

| After matching | 0.256 | 0.254 | 0.30 | 94.30 | 0.170 | 0.863 | |

| SOE | Front matching | 0.453 | 0.368 | 17.20 | 12.22 | 0.000 | |

| After matching | 0.370 | 0.376 | −1.30 | 92.70 | −0.760 | 0.447 | |

| Indep | Front matching | 0.371 | 0.374 | −4.80 | −3.380 | 0.001 | |

| After matching | 0.374 | 0.373 | 1.10 | 76.20 | 0.670 | 0.504 | |

| BoardSize | Front matching | 1.884 | 1.835 | 20.90 | 14.86 | 0.000 | |

| After matching | 1.839 | 1.843 | −1.80 | 91.40 | −1.080 | 0.282 | |

| InstOwn | Front matching | 0.794 | 0.763 | 4.10 | 2.930 | 0.003 | |

| After matching | 0.752 | 0.763 | −1.40 | 65 | −0.870 | 0.384 | |

| HHI | Front matching | 0.138 | 0.158 | −11.70 | −8.590 | 0.000 | |

| After matching | 0.147 | 0.149 | −1.20 | 89.40 | −0.740 | 0.460 | |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| RD | RD | Patent | Patent | |

| DRI_Val | 1.737 *** | 0.391 *** | ||

| (4.912) | (4.537) | |||

| DRI_Dum | 0.653 *** | 0.161 *** | ||

| (4.919) | (4.886) | |||

| Size | 1.042 *** | 1.067 *** | 0.595 *** | 0.600 *** |

| (9.274) | (9.541) | (20.096) | (20.408) | |

| Lev | −1.767 *** | −1.784 *** | −0.298 ** | −0.302 ** |

| (−3.077) | (−3.107) | (−2.356) | (−2.385) | |

| ROA | 4.052 *** | 4.068 *** | 1.900 *** | 1.903 *** |

| (2.919) | (2.924) | (5.493) | (5.499) | |

| TobinQ | 0.016 | 0.019 | 0.012 | 0.013 |

| (0.306) | (0.368) | (0.937) | (0.991) | |

| Growth | −0.183 | −0.180 | −0.049 * | −0.049 * |

| (−1.580) | (−1.553) | (−1.885) | (−1.858) | |

| CashFlow | −0.881 ** | −0.904 ** | −0.062 | −0.068 |

| (−2.030) | (−2.084) | (−0.583) | (−0.638) | |

| CorpAge | −2.651 *** | −2.654 *** | −0.281 *** | −0.281 *** |

| (−10.092) | (−10.096) | (−3.979) | (−3.986) | |

| CapInt | −0.502 *** | −0.509 *** | −0.177 *** | −0.178 *** |

| (−5.501) | (−5.594) | (−8.417) | (−8.498) | |

| Mhold | 2.222 *** | 2.139 *** | 0.300 *** | 0.281 ** |

| (5.757) | (5.546) | (2.610) | (2.451) | |

| Top1 | −0.468 | −0.473 | −0.297 * | −0.298 * |

| (−0.764) | (−0.773) | (−1.818) | (−1.825) | |

| Dual | 0.315 ** | 0.322 ** | 0.105 ** | 0.106 ** |

| (1.972) | (2.014) | (2.505) | (2.544) | |

| SOE | −0.362 | −0.357 | 0.014 | 0.016 |

| (−1.446) | (−1.423) | (0.250) | (0.274) | |

| Indep | −0.502 | −0.230 | −0.117 | −0.056 |

| (−0.292) | (−0.134) | (−0.258) | (−0.123) | |

| BoardSize | 0.721 * | 0.580 | −0.051 | −0.082 |

| (1.831) | (1.475) | (−0.504) | (−0.826) | |

| InstOwn | −0.081 | −0.080 | −0.049 ** | −0.049 * |

| (−0.766) | (−0.757) | (−1.967) | (−1.956) | |

| HHI | −0.625 | −0.663 | −0.096 | −0.104 |

| (−0.910) | (−0.969) | (−0.651) | (−0.708) | |

| IND | control | control | control | control |

| YEAR | control | control | control | control |

| _cons | −5.593 * | −5.924 ** | −8.967 *** | −9.049 *** |

| (−1.919) | (−2.033) | (−12.468) | (−12.599) | |

| N | 14,300 | 14,300 | 14,291 | 14,291 |

| r2_a | 0.518 | 0.518 | 0.413 | 0.413 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| RD Stage I | RD Stage II | Patent Stage I | Patent Stage II | |

| DRI_Val | 1.207 *** | 0.366 *** | ||

| (3.876) | (4.479) | |||

| DRI_Dum | 0.570 *** | 0.165 *** | ||

| (4.625) | (5.196) | |||

| Size | 1.042 *** | 1.051 *** | 0.648 *** | 0.651 *** |

| (9.521) | (9.614) | (23.314) | (23.442) | |

| Lev | −1.668 *** | −1.690 *** | −0.319 *** | −0.326 *** |

| (−3.312) | (−3.355) | (−2.756) | (−2.812) | |

| ROA | 1.805 | 1.807 | 1.627 *** | 1.628 *** |

| (1.446) | (1.447) | (4.983) | (4.984) | |

| TobinQ | 0.047 | 0.048 | 0.025 ** | 0.025 ** |

| (1.025) | (1.061) | (2.098) | (2.139) | |

| Growth | −0.043 | −0.042 | −0.021 | −0.021 |

| (−0.471) | (−0.461) | (−0.977) | (−0.965) | |

| CashFlow | −0.478 | −0.504 | 0.082 | 0.074 |

| (−1.385) | (−1.465) | (0.944) | (0.852) | |

| CorpAge | −2.138 *** | −2.124 *** | −0.270 *** | −0.266 *** |

| (−8.610) | (−8.567) | (−3.932) | (−3.880) | |

| CapInt | −0.4900 *** | −0.495 *** | −0.182 *** | −0.184 *** |

| (−5.809) | (−5.889) | (−8.993) | (−9.095) | |

| Mhold | 2.681 *** | 2.642 *** | 0.262 ** | 0.250 ** |

| (7.052) | (6.955) | (2.322) | (2.219) | |

| Top1 | 0.244 | 0.260 | −0.166 | −0.162 |

| (0.447) | (0.476) | (−1.064) | (−1.033) | |

| Dual | 0.194 | 0.195 | 0.092 ** | 0.093 ** |

| (1.380) | (1.393) | (2.359) | (2.375) | |

| SOE | −0.342 | −0.349 | 0.014 | 0.012 |

| (−1.581) | (−1.617) | (0.266) | (0.226) | |

| Indep | −2.956 * | −2.832 * | −0.214 | −0.176 |

| (−1.903) | (−1.824) | (−0.500) | (−0.413) | |

| BoardSize | 0.106 | −0.046 | 0.0001 | −0.046 |

| (0.281) | (−0.123) | (0.001) | (−0.460) | |

| InstOwn | −0.073 | −0.075 | −0.063 *** | −0.063 *** |

| (−0.818) | (−0.849) | (−2.739) | (−2.772) | |

| HHI | −0.013 | −0.034 | −0.067 | −0.073 |

| (−0.021) | (−0.056) | (−0.468) | (−0.515) | |

| IMR | −1.245 ** | −1.290 ** | −0.016 | −0.035 |

| (−2.267) | (−2.377) | (−0.125) | (−0.276) | |

| _cons | −4.147 | −4.070 | −10.093 *** | −10.061 *** |

| (−1.284) | (−1.260) | (−12.964) | (−12.897) | |

| N | 22,456 | 22,456 | 22,441 | 22,441 |

| r2_a | 0.5259 | 0.5259 | 0.4658 | 0.4657 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| Stage I | stage Ⅱ | Stage I | stage Ⅱ | Stage I | stage Ⅱ | Stage I | stage Ⅱ | |

| DRI_Val | RD | DRI_Dum | RD | DRI_Val | Patent | DRI_Dum | Patent | |

| Ind_DRI | 0.921 *** | 1.678 *** | 0.920 *** | 1.678 *** | ||||

| (13.983) | (11.464) | (14.957) | (11.459) | |||||

| Prvn_ DRI | 0.965 *** | 1.470 *** | 0.966 *** | 1.472 *** | ||||

| (15.505) | (12.546) | (15.509) | (12.560) | |||||

| DRIs_Val | 4.700 *** | 0.798 ** | ||||||

| (3.255) | (2.327) | |||||||

| DRIs_Dum | 2.921 *** | 0.500 ** | ||||||

| (3.316) | (2.423) | |||||||

| Size | 0.034 *** | 1.018 *** | 0.051 *** | 1.033 *** | 0.035 *** | 0.633 *** | 0.051 *** | 0.636 *** |

| (9.409) | (9.095) | (8.607) | (9.463) | (9.423) | (22.131) | (8.618) | (22.710) | |

| Lev | −0.001 | −1.605 *** | 0.028 | −1.692 *** | −0.001 | −0.313 *** | 0.027 | −0.328 *** |

| (−0.047) | (−3.183) | (0.813) | (−3.355) | (−0.044) | (−2.703) | (0.809) | (−2.837) | |

| ROA | 0.101 ** | 1.810 | 0.191 ** | 1.725 | 0.099 ** | 1.581 *** | 0.187 ** | 1.567 *** |

| (2.043) | (1.434) | (2.044) | (1.353) | (2.000) | (4.828) | (1.992) | (4.762) | |

| TobinQ | 0.002 | 0.042 | 0.002 | 0.047 | 0.002 | 0.024 ** | 0.002 | 0.025 ** |

| (1.177) | (0.915) | (0.424) | (1.030) | (1.193) | (2.014) | (0.445) | (2.088) | |

| Growth | −0.003 | −0.049 | −0.008 | −0.040 | −0.003 | −0.019 | −0.008 | −0.018 |

| (−0.948) | (−0.533) | (−1.124) | (−0.434) | (−0.917) | (−0.883) | (−1.099) | (−0.811) | |

| CashFlow | 0.014 | −0.395 | 0.067 ** | −0.523 | 0.014 | 0.079 | 0.069 ** | 0.057 |

| (1.026) | (−1.135) | (2.131) | (−1.480) | (1.039) | (0.915) | (2.183) | (0.645) | |

| CorpAge | −0.014 | −2.184 *** | −0.467 ** | −2.111 *** | −0.014 | −0.266 *** | −0.047 ** | −0.254 *** |

| (−1.428) | (−8.778) | (−2.547) | (−8.366) | (−1.444) | (−3.893) | (−2.572) | (−3.689) | |

| CapInt | −0.008 ** | −0.476 *** | −0.007 | −0.494 *** | −0.008 ** | −0.179 *** | −0.007 | −0.182 *** |

| (−2.559) | (−5.552) | (−1.228) | (−5.836) | (−2.576) | (−8.713) | (−1.240) | (−8.950) | |

| Mhold | −0.099 *** | 2.789 *** | −0.124 *** | 2.689 *** | −0.099 *** | 0.300 *** | −0.125 *** | 0.284 ** |

| (−5.924) | (7.054) | (−3.616) | (6.919) | (−5.924) | (2.598) | (−3.628) | (2.497) | |

| Top1 | −0.040 * | 0.192 | −0.096 ** | 0.288 | −0.040 * | −0.155 | −0.096 ** | −0.139 |

| (−1.841) | (0.353) | (−2.366) | (0.526) | (−1.859) | (−1.002) | (−2.364) | (−0.886) | |

| Dual | 0.005 | 0.190 | 0.007 | 0.193 | 0.005 | 0.090 ** | 0.007 | 0.091 ** |

| (0.819) | (1.347) | (0.575) | (1.370) | (0.835) | (2.302) | (0.575) | (2.321) | |

| SOE | 0.021 *** | −0.316 | 0.049 *** | −0.364 * | 0.021 *** | 0.008 | 0.049 *** | −0.001 |

| (2.594) | (−1.466) | (3.419) | (−1.683) | (2.589) | (0.143) | (3.413) | (−0.011) | |

| Indep | 0.277 *** | −3.265 ** | 0.326 *** | −2.914 * | 0.279 *** | −0.322 | 0.328 *** | −0.264 |

| (4.293) | (−2.053) | (2.813) | (−1.861) | (4.312) | (−0.743) | (2.833) | (−0.616) | |

| BoardSize | −0.027 * | 0.571 | 0.187 *** | −0.100 | −0.026 * | 0.016 | 0.188 *** | −0.099 |

| (−1.931) | (1.607) | (7.298) | (−0.263) | (−1.910) | (0.175) | (7.320) | (−0.990) | |

| InstOwn | −0.001 | −0.064 | 0.002 | −0.076 | −0.001 | −0.062 *** | 0.002 | −0.064 *** |

| (−0.277) | (−0.722) | (0.359) | (−0.849) | (−0.307) | (−2.732) | (0.324) | (−2.806) | |

| HHI | −0.051 *** | 0.025 | −0.060 | −0.034 | −0.052 *** | −0.045 | −0.060 | −0.055 |

| (−2.903) | (0.040) | (−1.569) | (−0.056) | (−2.916) | (−0.314) | (−1.565) | (−0.386) | |

| IND | control | control | control | control | control | control | control | control |

| YEAR | control | control | control | control | control | control | control | control |

| _cons | −0.803 *** | −6.272 ** | −1.465 *** | −5.763 ** | −0.804 *** | −9.882 *** | −1.467 *** | −9.790 *** |

| (−8.808) | (−2.313) | (−9.431) | (−2.096) | (−8.514) | (−14.634) | (−9.441) | (−14.297) | |

| N | 22,456 | 22,456 | 22,456 | 22,456 | 22,441 | 22,441 | 22,441 | 22,441 |

| r2_a | 0.152 | 0.517 | 0.107 | 0.507 | 0.152 | 0.463 | 0.107 | 0.458 |

| F-Statistics | 39.44 | 152.24 | 32.45 | 147.46 | 39.40 | 124.78 | 32.43 | 123.64 |

| Hansen-J (p value) | 0.023 | 0.211 | 0.064 | 0.000 | ||||

| (0.879) | (0.665) | (0.800) | (0.990) | |||||

| Anderson-Rubin (p value) | 5.90 | 5.90 | 5.02 | 5.02 | ||||

| (0.003) | (0.003) | (0.007) | (0.007) | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liang, W.; Song, S.; Xie, Y.; Liu, S. The Roles of Directors from Related Industries on Enterprise Innovation. Sustainability 2024, 16, 6960. https://doi.org/10.3390/su16166960

Liang W, Song S, Xie Y, Liu S. The Roles of Directors from Related Industries on Enterprise Innovation. Sustainability. 2024; 16(16):6960. https://doi.org/10.3390/su16166960

Chicago/Turabian StyleLiang, Wen, Simiao Song, Ying Xie, and Sanhong Liu. 2024. "The Roles of Directors from Related Industries on Enterprise Innovation" Sustainability 16, no. 16: 6960. https://doi.org/10.3390/su16166960

APA StyleLiang, W., Song, S., Xie, Y., & Liu, S. (2024). The Roles of Directors from Related Industries on Enterprise Innovation. Sustainability, 16(16), 6960. https://doi.org/10.3390/su16166960