The “Butterfly Effect” of Volatility in Net International Capital Flows: An Analysis of Co-Movement Characteristics and Influencing Factors

Abstract

:1. Introduction

2. Literature Review

3. Methodology and Data

3.1. Methodology

3.2. Data

4. Co-Movement Characteristics of Volatility in Net International Capital Flows: A Network Analysis Approach

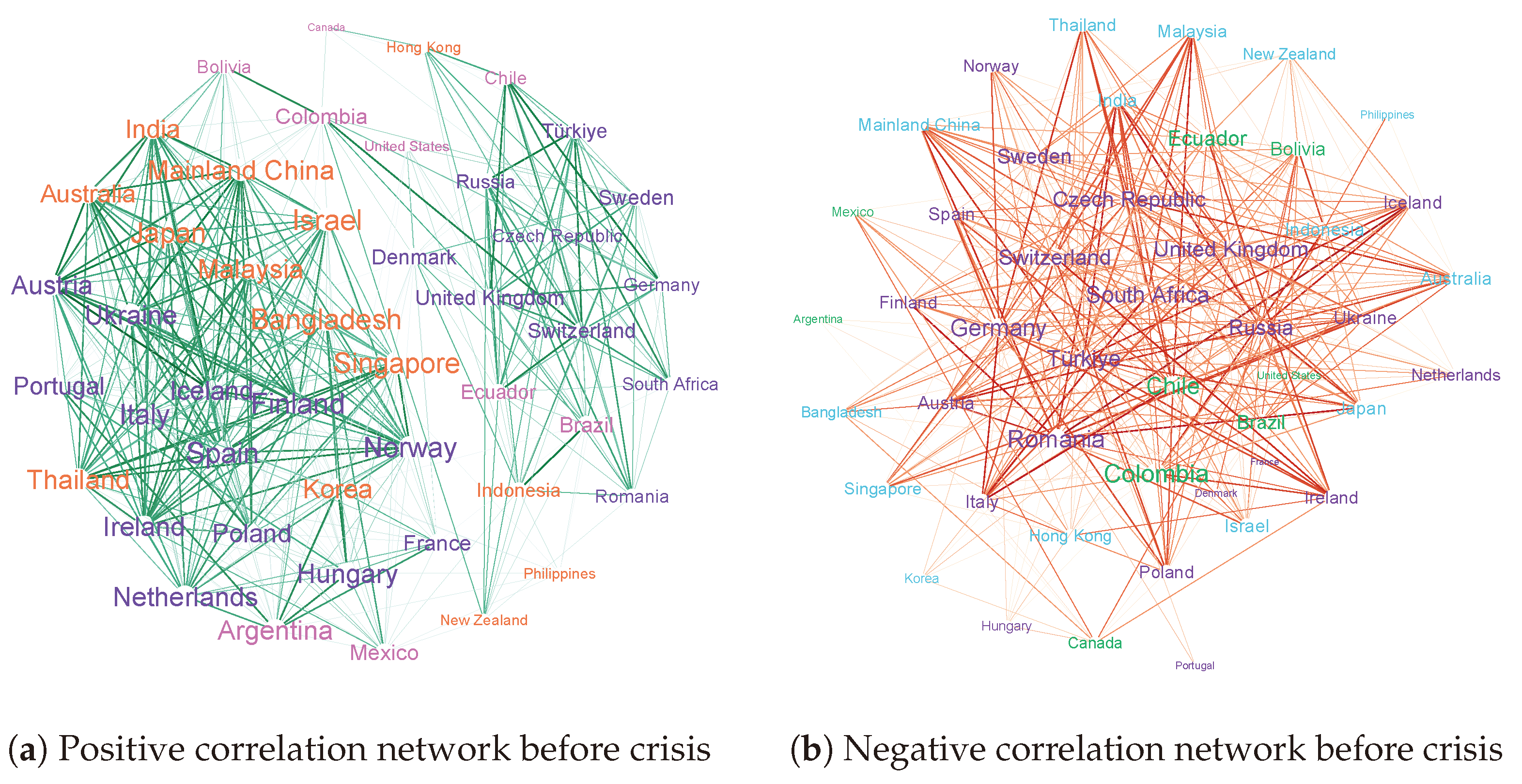

4.1. Co-Movement Characteristics of Volatility in Net Private Capital Flows

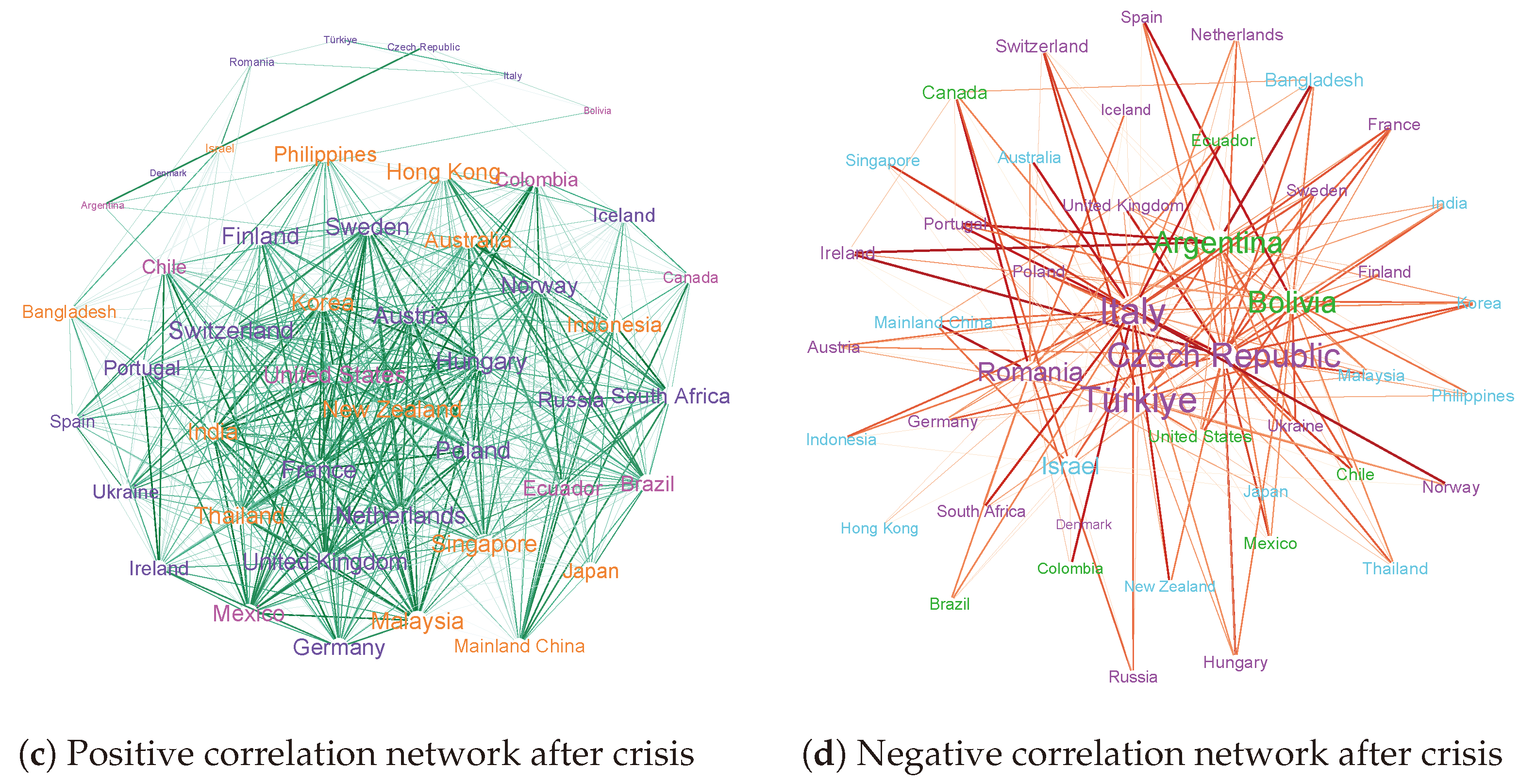

4.2. Co-Movement Characteristics of Volatility in Net Direct Investment Flows

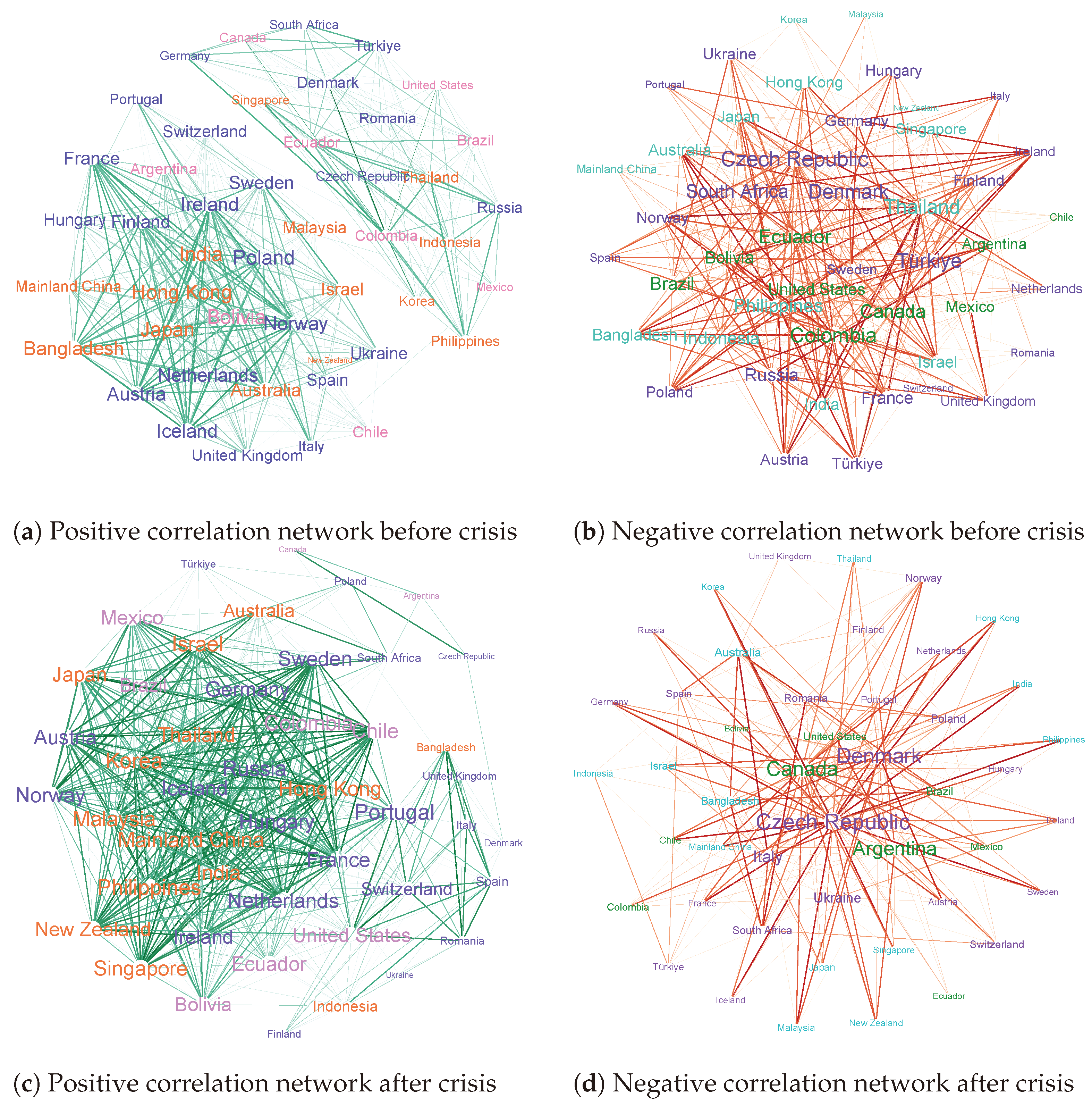

4.3. Co-Movement Characteristics of Volatility in Net Portfolio Investment Flows

4.4. Co-Movement Characteristics of Volatility in Net Other Investment Flows

5. Factors Influencing the Co-Movement of Volatility in Net International Capital Flows—Based on the MRQAP Method

5.1. Model Construction

5.2. Baseline Results

5.3. Heterogeneity Analysis

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| MRQAP | Multiple Regression Quadratic Assignment Procedure. |

Appendix A

| Emerging and Developing Economies (21) | Advanced Economies (25) | |||||

|---|---|---|---|---|---|---|

| Asia-Pacific Region | The Americas Region | European Region | Africa Region | Asia-Pacific Region | The Americas Region | European Region |

| Mainland China | Argentina | Hungary | South Africa | Hong Kong, China | United States | Austria |

| India | Bolivia | Poland | Japan | Canada | Czech Republic | |

| Bangladesh | Brazil | Romania | Korea | Denmark | ||

| Indonesia | Chile | Russia | Singapore | Finland | ||

| Malaysia | Colombia | Türkiye | Israel | France | ||

| Philippines | Ecuador | Ukraine | Australia | Germany | ||

| Thailand | Mexico | New Zealand | Iceland | |||

| Ireland | ||||||

| Italy | ||||||

| The Netherlands | ||||||

| Norway | ||||||

| Portugal | ||||||

| Spain | ||||||

| Sweden | ||||||

| Switzerland | ||||||

| United Kingdom | ||||||

References

- Lee, H.H.; Park, C.Y.; Byun, H.s. Do contagion effects exist in capital flow volatility? J. Jpn. Int. Econ. 2013, 30, 76–95. [Google Scholar] [CrossRef]

- Rey, H. Dilemma Not Trilemma: The Global Financial Cycle and Monetary Policy Independence; Technical Report; National Bureau of Economic Research: Cambridge, MA, USA, 2015. [Google Scholar]

- Xu, X.; Zeng, Z.; Xu, J.; Zhang, M. Fuzzy Dynamical System Scenario Simulation-Based Cross-Border Financial Contagion Analysis: A Perspective From International Capital Flows. IEEE Trans. Fuzzy Syst. 2017, 25, 439–459. [Google Scholar] [CrossRef]

- Peng, D.; Ye, Y.; Chen, Q. Impact of cross-border capital flows on foreign exchange market stability. Financ. Res. Lett. 2024, 62, 105155. [Google Scholar] [CrossRef]

- Forbes, K.J.; Warnock, F.E. Capital flow waves—Or ripples? Extreme capital flow movements since the crisis. J. Int. Money Financ. 2021, 116, 102394. [Google Scholar] [CrossRef]

- Wang, F.; Pan, C.; Wang, W. Impact of US monetary policy uncertainty on RMB exchange rate volatility: The role of international capital flows. Financ. Res. Lett. 2023, 58, 104582. [Google Scholar] [CrossRef]

- Giudici, P.; Spelta, A. Graphical network models for international financial flows. J. Bus. Econ. Stat. 2016, 34, 128–138. [Google Scholar] [CrossRef]

- Ahelegbey, D.F.; Giudici, P.; Hashem, S.Q. Network VAR models to measure financial contagion. N. Am. J. Econ. Financ. 2021, 55, 101318. [Google Scholar] [CrossRef]

- Minoiu, C.; Reyes, J.A. A network analysis of global banking: 1978–2010. J. Financ. Stab. 2013, 9, 168–184. [Google Scholar] [CrossRef]

- Cerutti, E.; Claessens, S.; Ratnovski, L. Global liquidity and cross-border bank flows. Econ. Policy 2017, 32, 81–125. [Google Scholar] [CrossRef]

- Mercado, R.; Noviantie, S. Financial flows centrality: Empirical evidence using bilateral capital flows. J. Int. Financ. Mark. Inst. Money 2020, 69, 101255. [Google Scholar] [CrossRef]

- Jackson, M.O.; Pernoud, A. Systemic Risk in Financial Networks: A Survey. Annu. Rev. Econ. 2021, 13, 171–202. [Google Scholar] [CrossRef]

- Zhao, H.; Li, Y.; Sai, Q.; Ren, Y. Cross-border credit networks, banking risk contagion and suppression effects. Soc. Netw. 2023, 73, 130–141. [Google Scholar] [CrossRef]

- Li, S.; Yang, H. Interactions of International Portfolio Flows: An Empirical Study Based on Network Analysis. Procedia Comput. Sci. 2017, 122, 826–833. [Google Scholar] [CrossRef]

- Ahn, S.J.; Jung, J.W.; Koo, H.K.; Ahn, S. An analysis of the evolution of global financial network of the coordinated portfolio investment survey. Int. Rev. Financ. 2023, 23, 437–459. [Google Scholar] [CrossRef]

- Calvo, S.G.; Reinhart, C. Capital Flows to Latin America: Is There Evidence of Contagion Effects? The World Bank: Washington, DC, USA, 1996. [Google Scholar]

- Chuhan, P.; Perez-Quiros, G.; Popper, H. International Capital Flows: Do Short-Term Investment and Direct Investment Differ? World Bank Publications: Washington, DC, USA, 1996. [Google Scholar]

- Puy, D. Mutual funds flows and the geography of contagion. J. Int. Money Financ. 2016, 60, 73–93. [Google Scholar] [CrossRef]

- Monetary, I.M.F.; Department, C.M. Global Financial Stability Report April 2023: Safeguarding Financial Stability amid High Inflation and Geopolitical Risks; International Monetary Fund: Washington, DC, USA, 2023. [Google Scholar]

- Gori, F.; Lepers, E.; Mehigan, C. Capital flow deflection under the magnifying glass. Int. J. Financ. Econ. 2024, 29, 3758–3778. [Google Scholar] [CrossRef]

- Correa, R.; Paligorova, T.; Sapriza, H.; Zlate, A. Cross-Border Bank Flows and Monetary Policy. Rev. Financ. Stud. 2021, 35, 438–481. [Google Scholar] [CrossRef]

- Agénor, P.R.; Jackson, T.P.; Pereira da Silva, L.A. Global banking, financial spillovers and macroprudential policy coordination. Economica 2023, 90, 1003–1040. [Google Scholar] [CrossRef]

- Sarno, L.; Tsiakas, I.; Ulloa, B. What drives international portfolio flows? J. Int. Money Financ. 2016, 60, 53–72. [Google Scholar] [CrossRef]

- Ftiti, Z.; Ameur, H.B.; Louhichi, W.; Anastasiou, D.; Awijen, H. Revisiting Capital Flow Drivers: Regional Dynamics, Constraints, and Geopolitical Influences. J. Int. Money Financ. 2024, 142, 103049. [Google Scholar] [CrossRef]

- Masson, M.P.R. Contagion: Monsoonal Effects, Spillovers, and Jumps between Multiple Equilibria; International Monetary Fund: Washington, DC, USA, 1998. [Google Scholar]

- Ghosh, A.R.; Qureshi, M.S.; Kim, J.I.; Zalduendo, J. Surges. J. Int. Econ. 2014, 92, 266–285. [Google Scholar] [CrossRef]

- Amiti, M.; McGuire, P.; Weinstein, D.E. International bank flows and the global financial cycle. IMF Econ. Rev. 2019, 67, 61–108. [Google Scholar] [CrossRef]

- Koepke, R. What drives capital flows to emerging markets? A survey of the empirical literature. J. Econ. Surv. 2019, 33, 516–540. [Google Scholar] [CrossRef]

- Avdjiev, S.; Gambacorta, L.; Goldberg, L.S.; Schiaffi, S. The shifting drivers of global liquidity. J. Int. Econ. 2020, 125, 103324. [Google Scholar] [CrossRef]

- Feng, C.; Han, L.; Vigne, S.; Xu, Y. Geopolitical risk and the dynamics of international capital flows. J. Int. Financ. Mark. Inst. Money 2023, 82, 101693. [Google Scholar] [CrossRef]

- Pagliari, M.S.; Hannan, S.A. The volatility of capital flows in emerging markets: Measures and determinants. J. Int. Money Financ. 2024, 145, 103095. [Google Scholar] [CrossRef]

- Neanidis, K.C. Volatile capital flows and economic growth: The role of banking supervision. J. Financ. Stab. 2019, 40, 77–93. [Google Scholar] [CrossRef]

- Forbes, K.J.; Warnock, F.E. Capital flow waves: Surges, stops, flight, and retrenchment. J. Int. Econ. 2012, 88, 235–251. [Google Scholar] [CrossRef]

- Dekker, D.; Krackhardt, D.; Snijders, T.A. Sensitivity of MRQAP tests to collinearity and autocorrelation conditions. Psychometrika 2007, 72, 563–581. [Google Scholar] [CrossRef]

- Li, L.; Derudder, B.; Shen, W.; Kong, X. Exploring the dynamics of the disaggregated intercity corporate network in the Yangtze River Delta, China: A relational event approach. J. Geogr. Syst. 2022, 24, 115–140. [Google Scholar] [CrossRef]

- Zhang, W.; Zhuang, X.; Lu, Y.; Wang, J. Spatial linkage of volatility spillovers and its explanation across G20 stock markets: A network framework. Int. Rev. Financ. Anal. 2020, 71, 101454. [Google Scholar] [CrossRef]

| Times Periods | Average Degree | Network Density | Average Clustering Coefficient | Average Path Length |

|---|---|---|---|---|

| 2000Q1–2020Q4 | 30.696 | 0.682 | 0.724 | 1.3179 |

| 2000Q1–2008Q2 | 24.565 | 0.546 | 0.695 | 1.4821 |

| 2009Q3–2020Q4 | 31.348 | 0.697 | 0.757 | 1.3034 |

| Times Periods | Average Degree | Network Density | Average Clustering Coefficient | Average Path Length |

|---|---|---|---|---|

| 2000Q1–2020Q4 | 31.826 | 0.707 | 0.758 | 1.2928 |

| 2000Q1–2008Q2 | 28.609 | 0.636 | 0.756 | 1.3662 |

| 2009Q3–2020Q4 | 27.087 | 0.602 | 0.675 | 1.3981 |

| Times Periods | Average Degree | Network Density | Average Clustering Coefficient | Average Path Length |

|---|---|---|---|---|

| 2000Q1–2020Q4 | 31.174 | 0.693 | 0.731 | 1.3072 |

| 2000Q1–2008Q2 | 31.783 | 0.706 | 0.796 | 1.2937 |

| 2009Q3–2020Q4 | 34.087 | 0.757 | 0.836 | 1.2435 |

| Times Periods | Average Degree | Network Density | Average Clustering Coefficient | Average Path Length |

|---|---|---|---|---|

| 2000Q1–2020Q4 | 31.696 | 0.704 | 0.752 | 1.2957 |

| 2000Q1–2008Q2 | 31.957 | 0.710 | 0.824 | 1.3014 |

| 2009Q3–2020Q4 | 31.13 | 0.692 | 0.802 | 1.3082 |

| Variables | Private Capital Flow | Direct Investment Flow | Portfolio Investment Flow | Other Investment Flow |

|---|---|---|---|---|

| Trade intensity | 0.038 * | −0.046 ** | 0.021 | 0.042 * |

| Economic growth rate differentials | −0.108 | 0.027 | −0.188 ** | −0.024 |

| Interest rate spread | −0.714 ** | −0.038 | 0.026 | −0.158 * |

| Inflation rate differentials | 0.102 | 0.071 | −0.119 | −0.017 |

| Differences in capital controls | 0.056 * | −0.056 * | 0.106 *** | −0.113 ** |

| Geographical adjacency | 0.309 *** | −0.009 | −0.012 * | 0.056 ** |

| Both belong to the same economic organization | 0.156 *** | 0.004 | 0.067 | 0.129 * |

| Constant | 0.150 *** | 0.015 *** | 0.279 *** | 0.154 *** |

| R-squared | 0.158 | 0.010 | 0.099 | 0.098 |

| Observations | 2070 | 2070 | 2070 | 2070 |

| Variables | Private Capital Flow | Direct Investment Flow | Portfolio Investment Flow | Other Investment Flow |

|---|---|---|---|---|

| Trade intensity | 0.193 * | −0.108 ** | −0.111 *** | 0.043 |

| Economic growth rate differentials | −0.059 | 0.047 | −0.078 | −0.065 |

| Interest rate spread | −0.192 ** | −0.034 | −0.041 | −0.114 |

| Inflation rate differentials | 0.006 | 0.033 | −0.018 | 0.021 |

| Differences in capital controls | −0.068 | −0.054 | −0.036 | −0.191 ** |

| Geographical adjacency | 0.073 | 0.142 ** | 0.002 | 0.202 *** |

| Both belong to the same economic organization | 0.119 * | −0.003 | 0.095 | 0.084 |

| Constant | 0.150 *** | 0.027 *** | 0.120 *** | 0.194 *** |

| R-squared | 0.145 | 0.038 | 0.034 | 0.133 |

| Observations | 462 | 462 | 462 | 462 |

| Variables | Private Capital Flow | Direct Investment Flow | Portfolio Investment Flow | Other Investment Flow |

|---|---|---|---|---|

| Trade intensity | 0.035 | 0.002 | 0.031 | 0.013 |

| Economic growth rate differentials | −0.171 ** | −0.039 | 0.042 | −0.036 |

| Interest rate spread | 0.008 | 0.155 * | −0.381 ** | −0.300 * |

| Inflation rate differentials | −0.029 | −0.197 ** | 0.194 | 0.491 *** |

| Differences in capital controls | 0.155 * | 0.006 | 0.198 * | −0.070 |

| Geographical adjacency | −0.033 | 0.010 | −0.139 ** | −0.021 |

| Both belong to the same economic organization | 0.036 | 0.076 | −0.112 | 0.002 |

| Constant | 0.110 *** | −0.066 *** | 0.476 *** | 0.265 *** |

| R-squared | 0.062 | 0.017 | 0.067 | 0.067 |

| Observations | 552 | 552 | 552 | 552 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, H.; Tan, J. The “Butterfly Effect” of Volatility in Net International Capital Flows: An Analysis of Co-Movement Characteristics and Influencing Factors. Sustainability 2024, 16, 7302. https://doi.org/10.3390/su16177302

Luo H, Tan J. The “Butterfly Effect” of Volatility in Net International Capital Flows: An Analysis of Co-Movement Characteristics and Influencing Factors. Sustainability. 2024; 16(17):7302. https://doi.org/10.3390/su16177302

Chicago/Turabian StyleLuo, Hang, and Jianwei Tan. 2024. "The “Butterfly Effect” of Volatility in Net International Capital Flows: An Analysis of Co-Movement Characteristics and Influencing Factors" Sustainability 16, no. 17: 7302. https://doi.org/10.3390/su16177302