Abstract

With the development of digital technologies, the impact of digital transformation on corporate performance in environmental, social responsibility, and governance areas warrants further research. This study aims to delve into how digital transformation may impact a company’s ESG performance from the perspective of supply chain resilience. We collect non-financial listed companies in China’s A-shares from 2009 to 2022 as research samples. The results show that digital transformation can significantly improve the ESG performance. Digital transformation can enhance supply chain resilience, namely by reducing supplier and customer concentration to improve a company’s ESG performance. We also reveal that non-heavy polluting companies, high-tech companies, and companies in the eastern regions are more sensitive to digital transformation in terms of ESG performance. This paper contributes to examining the relationship between digital transformation and corporate ESG performance, providing both a theoretical foundation and practical recommendations for guiding companies in achieving digital transformation and improving their ESG performance.

1. Introduction

As global environmental concerns, social inequality, and governance issues intensify, the significance of corporate ESG (Environmental, Social, and Governance) performance grows [1]. Originating from ethical investment practices, ESG now sets benchmarks for corporate sustainability [2,3]. Notably, the 2019 European Green Deal has spurred climate-focused legislation, such as the Carbon Border Adjustment Mechanism (CBAM) and the Corporate Sustainability Reporting Directive (CSRD) in the EU, central to ESG disclosure. Concurrently, the U.S. Sustainability Accounting Standards Board (SASB) has worked to embed sustainability metrics into accounting standards. Similarly, China updated its Corporate Governance Code for Listed Companies in September 2018 to require ESG and social responsibility disclosures. These global movements align with the United Nations’ Sustainable Development Goals (SDGs), which aim for a sustainable and equitable world by 2030, underscoring the urgent need for effective ESG strategies to drive economic and social transformation toward sustainability. Consequently, how corporate strategies and behaviors enhance their ESG levels has become a focal point in both academic and practical realms, reflecting a critical intersection of business performance and societal expectations.

Amidst growing adherence to ESG principles and supportive policies, an increasing number of companies are prioritizing ESG management. Environmentally, these firms are reducing greenhouse gas emissions and boosting energy efficiency, with many investing in ecological projects to lessen their operational impacts. Socially, they are enhancing employee welfare through equitable pay and advancement opportunities. In governance, improvements in board independence and diversity are increasing decision-making transparency and accountability. Consequently, ESG reporting has become commonplace among leading global companies, with disclosure rates climbing significantly: 79% for the N100 companies and 96% for the G250. This shift has also heightened focus on the environmental and social performance of supply chains, leading to stricter procurement standards and compliance requirements that promote transparency, accountability, and sustainable practices industry-wide.

Digital transformation is increasingly recognized as essential for enhancing operational efficiency and financial performance in businesses [4]. It involves the comprehensive reinvention of business models, cultures, and market approaches through digital technologies. Parida et al. [5] noted that digitization improves access to operational resources and reduces costs, fostering innovation. Current research has found that digital transformation significantly impacts various aspects, including corporate performance, innovation, total factor productivity, and risk-taking levels [6,7,8,9]. Digital transformation has not only reshaped business models and management mechanisms but has also significantly enhanced companies’ Environmental, Social, and Governance (ESG) performance. Vogler and Eisenegger [10] highlighted its positive effects on corporate social responsibility and reputation. By adopting advanced digital technologies, companies can more effectively manage their resources and reduce energy consumption and emissions, thereby achieving significant progress in environmental protection [11,12]. Digital transformation can also enhance ESG performance by improving production efficiency and fostering innovation [13,14,15,16]. Although some scholars have examined the relationship between digital transformation and corporate ESG performance, there are still some research gaps in this area. These gaps include the following limitations: (1) existing studies often focus on the observable outcomes of digital transformation on Environmental, Social, and Governance (ESG) performance. However, there is a lack of detailed exploration into the internal mechanisms that influence these effects. Understanding these internal mechanisms is crucial for a more comprehensive assessment of how digital transformation impacts ESG performance. (2) There is a gap in research regarding how the effects of digital transformation on ESG performance may vary based on different contextual factors. The differential impact has not been adequately studied, which is important for offering more tailored recommendations. Understanding how various circumstances influence the effectiveness of digital transformation in achieving ESG goals can provide companies with more nuanced guidance as they plan and implement their digital development strategies.

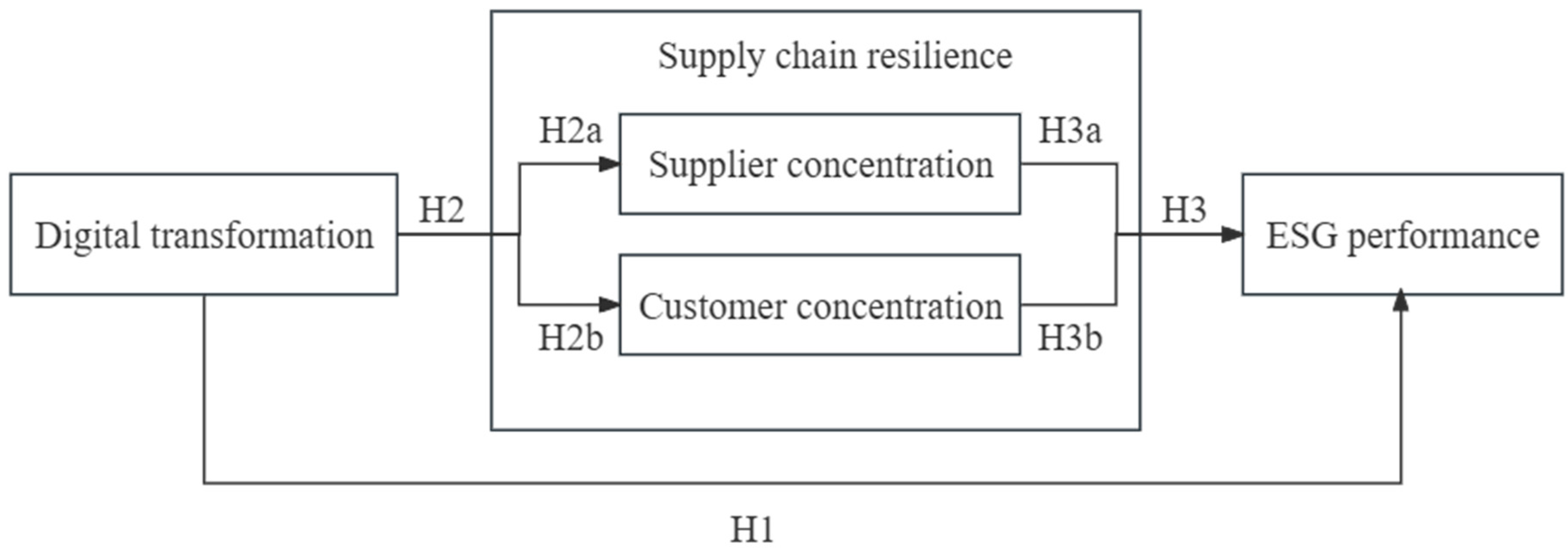

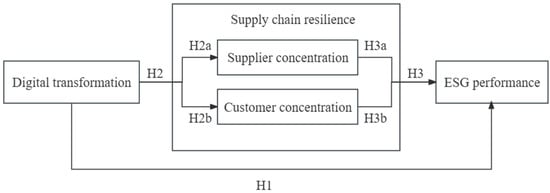

In response to the above research gaps, this paper utilizes Chinese A-share listed companies from 2009 to 2022 as a research sample. It investigates whether and how digital transformation affects corporate ESG performance based on the diffusion of innovation theory, resource-based view theory, and stakeholder theory. These theories suggest that digital transformation significantly influences supply chain resilience. Hence, this study explores whether digital transformation impacts corporate ESG performance through the mediating factor of supply chain resilience. Additionally, it assesses how the effect of digital transformation on ESG performance differs across regions, pollution levels, and technological advancements. This approach not only broadens the research scope of digital transformation but also furnishes valuable insights and guidance for companies aiming to leverage digital strategies to advance their ESG objectives.

The innovative aspects and expected contributions of this study are as follows: (1) this study focuses on examining the impact of digital transformation on corporate ESG performance through the mediation of supply chain resilience. This perspective provides a new dimension for understanding how digital transformation promotes corporate ESG performance, enriching the understanding of its impact mechanisms. It emphasizes the role of digital transformation in reshaping the external relationships of firms. Digitalization not only alters internal operational models but also strengthens connections with suppliers, customers, and other stakeholders. Attention to this external network can help firms achieve better ESG outcomes; (2) the existing literature on the mediation effect of supply chain resilience often considers it in general terms, and this study differentiates supply chain resilience into two dimensions: reducing customer concentration and reducing supplier concentration. It analyzes how digital transformation enhances adaptability and resilience in the face of market fluctuations, environmental changes, or other external pressures; (3) by incorporating variations in the regional context, technological level, and pollution intensity, this research provides a more comprehensive perspective on the differential impact of digital transformation on corporate ESG performance. This approach aids firms in developing more targeted digital and ESG strategies.

The paper is structured as follows: Section 2 reviews the existing literature on digital transformation, supply chain management, and ESG, developing the research hypotheses. Section 3 outlines the methodology, including data collection, models, and estimation techniques. Section 4 presents the analysis results, offering empirical evidence to support the hypotheses. Finally, Section 5 concludes the paper, discussing the implications of the findings.

2. Literature Review and Hypotheses Development

2.1. Digital Transformation and Enterprise ESG Performance

The concept of ESG (Environmental, Social, and Governance) criteria was first explicitly introduced in 2004 through the United Nations Global Compact initiative. Since then, it has gained increasing traction as companies worldwide recognize the importance of aligning their operations with sustainability performance indicators [17,18]. Research on ESG has been more established and accepted in Western countries, where a robust system supports and integrates ESG practices into mainstream business operations.

In the United States, the trend toward sustainable investment has led to a surge in ESG-related investment products, including Exchange-Traded Funds (ETFs), which have grown significantly in both number and size. The European Union, too, has been proactive in legislating ESG principles, exemplified by the Non-Financial Reporting Directive (NFRD). This directive mandates the incorporation of ESG principles into legal frameworks, ensuring systematic consideration of environmental, social, and governance issues. Furthermore, the EU’s “Sustainable Finance Strategy” is designed to incentivize investors to direct capital toward environmentally friendly technologies and sustainable business models.

China, with its commitment to carbon peaking and carbon neutrality targets, has seen a rapid expansion of ESG practices. The Chinese government has ramped up its regulatory efforts to oversee corporate non-financial performance in environmental and social spheres, compelling businesses to prioritize and enhance their ESG performance for sustainable high-quality growth.

Despite these advancements, the implementation of ESG policies encounters several hurdles. One major challenge is the inconsistency and quality of ESG information disclosure. A scarcity of quantitative data compromises transparency, comparability, and reliability. Additionally, divergent methodologies employed by various rating agencies in evaluating ESG performance, characterized by differing indicators, weights, and scopes, undermine the uniformity of assessment outcomes [19]. Moreover, while academic research suggests a positive correlation between strong ESG practices and financial performance, the long-term financial returns of ESG investments are less tangible compared to short-term financial metrics. This ambiguity can deter companies from fully committing to ESG initiatives [20]. Another issue pertains to the lack of a precise definition for ESG funds in China, which results in few funds genuinely adopting professional ESG strategies, such as screening, integration, and shareholder engagement activities.

Within the context of the digital economy, digital transformation is seen as a pivotal strategy for companies to enhance their ESG performance. Existing research has examined the impact of digital transformation on ESG performance based on various theoretical frameworks, including agency theory [16], dynamic capabilities theory [21], and strategic goals [22]. Some scholars argue that digital transformation positively influences ESG performance, while others suggest that it has both positive and negative effects [23,24]. Despite these multiple perspectives, the causal relationship between digital transformation and ESG performance remains unclear. Moreover, there is a lack of research focusing on the specific pathways through which digital transformation affects ESG performance. The current literature primarily analyzes the impact of digital technology on environmental indicators but lacks a systematic analysis based on the comprehensive nature of ESG. Therefore, further research is needed to explore the impact of digital transformation on ESG performance. This study aims to provide new empirical evidence on the influence and mechanisms between digital transformation and ESG performance by drawing on the diffusion of innovation theory, resource-based view theory, and stakeholder theory.

Drawing upon the diffusion of innovation theory, the proliferation of digital technologies spurs enterprises to adopt innovative management and operational paradigms, which in turn elevates their overall ESG profile [25]. The essence of digital transformation lies in its profound impact on both internal processes and external interactions. By integrating advanced digital technologies, businesses can streamline their operations, improve efficiency, and reduce resource waste and energy consumption [26]. This optimization not only enhances a company’s green innovation capabilities but also strengthens its commitment to social responsibility. Additionally, digital transformation can enable businesses to shift toward service-centric models by leveraging innovative technologies. As companies adopt a more service-oriented mindset, they place greater emphasis on product quality, brand reputation, and external image [9]. Throughout this transformation, businesses are increasingly likely to consider their social and environmental impacts, adopting practices and strategies that align with ESG standards. These innovations not only boost a company’s market competitiveness but also significantly enhance its overall ESG performance.

In line with the resource-based view theory, digital transformation can significantly bolster ESG performance by optimizing the utilization and distribution of corporate resources. The Resource-Based View (RBV) highlights that a firm’s sustained competitive advantage primarily comes from its unique resources and capabilities, which must be valuable, rare, inimitable, and supported by the organization [27]. During digital transformation, resources such as information technology and data analytics are considered strategic assets that can optimize resource allocation and boost total factor productivity. Improving total factor productivity is crucial for firms to alleviate financing constraints and invest more in ESG initiatives [28]. Additionally, digital tools offer more precise environmental data analysis and risk forecasting capabilities, helping firms develop more effective environmental management strategies [29] and thereby enhance their ESG performance.

Stakeholder theory posits that digital transformation enhances transparency and information dissemination, catering to stakeholders’ demands for corporate social responsibility and information accessibility, thus enriching the social and governance facets of corporate performance [30]. As digitalization advances, internal control information disclosure becomes more robust, lending greater transparency to the supply chain. Stakeholders, encompassing investors, consumers, and regulatory authorities, gain easier access to monitor a company’s ESG performance, promoting informational parity. This enhanced visibility and external scrutiny motivate companies to prioritize ESG performance to align with stakeholder expectations. Grounded in these observations, the following hypothesis is put forth:

H1.

Digital transformation can effectively improve the ESG performance of enterprises.

2.2. Digital Transformation and Supply Chain Resilience

The innovation and pilot application of industrial supply chains have entered a new stage, a pattern of integrated development among large, medium, and small enterprises is forming, autonomous control capabilities are being strengthened, and a preliminary supply chain risk management mechanism has been established [31]. However, the modernization of supply chains still faces a series of challenges. The rise of global trade protectionism and the impact of the COVID-19 pandemic have posed severe challenges to global supply chains. The relationships among participants in vertical industrial chains are not only cooperative but also involve significant competitive pressures. This competition is manifested in opportunistic behaviors such as concealing information or actions between trading partners [32], and also in the way that upstream and downstream trading entities leverage their advantageous positions within the supply chain and strong bargaining power to exert pressure on companies that centralize supply chain configurations [33]. Increased external environmental uncertainty and systemic risks make centralized supply chains more prone to production interruptions and severe economic losses [34]. Traditional supply chain operations often suffer from slow market response, low levels of information sharing between upstream and downstream, and high operational risks, severely limiting the efficient operation of corporate supply chains. There is an urgent need to deeply integrate with digital technology and move into a new phase of digital supply chains [35].

The progress of digital transformation has illuminated new pathways for bolstering supply chain resilience. The “2021 China Enterprise Digital Transformation Index Report” underscores that digitization has emerged as a pivotal enabler for Chinese firms to fortify supply chain resilience amid the global health crisis. From an organizational resilience standpoint, prior research demonstrates that digital transformation facilitates enhanced agility. An examination of supply chain responsiveness across diverse enterprise scales reveals that augmenting supply chain flexibility, resilience, and elasticity is critical for cultivating novel green supply chain paradigms in a dual-circulation setting [36]. Studies on the impact of digital transformation on supply chains have consistently highlighted that digital technologies predominantly elevate supply chain efficiency by refining the precision of supply–demand alignment and curtailing external transactional expenses [37].

Presently, scholars have engaged in extensive discourse on the interplay between digital transformation and supply chain resilience, with distinct emphases observed between domestic and international academics. Domestic scholars tend to probe the theoretical underpinnings of how digitalization impacts supply chain resilience, whereas international researchers concentrate on the technical dimensions, such as the role of blockchain and artificial intelligence in enhancing supply chain resilience. This paper synthesizes both theoretical and technical perspectives to explore the inherent linkages between digital transformation and supply chain resilience.

According to the diffusion of innovation theory, digital transformation greatly enhances supply chain resilience on multiple levels by introducing emerging technologies and methods. The use of digital technologies enables real-time monitoring and forecasting, allowing for the early identification of potential risks and challenges. This capability improves the supply chain’s ability to foresee and respond to disruptions, thereby mitigating the impact of risks on supply chain stability [38]. Concurrently, the widespread adoption of digital technologies promotes greater information transparency and facilitates a more efficient flow of resources and information among supply chain participants [39]. This optimized configuration not only increases resource utilization efficiency but also enhances coordination and reduces information delays, improving overall supply chain coherence and flexibility. Ultimately, the broad dissemination of technological innovations transforms supply chain management into a more intelligent and adaptable system, significantly boosting overall supply chain resilience.

From the resource-based view theory, digital development provides a resource advantage for enterprises [40]. Digital transformation enhances key resources in supply chain management by introducing advanced technologies. These technologies improve information processing capabilities, allowing the supply chain to acquire and analyze data in real time. This enhancement boosts the supply chain’s ability to forecast market dynamics and potential risks. With greater information transparency and processing efficiency, the supply chain can respond more swiftly and accurately to changes, optimizing resource allocation and scheduling. This optimization enables the supply chain to demonstrate greater adaptability and stability in the face of various internal and external disruptions, leading to more effective resource utilization. Consequently, digital transformation not only improves overall supply chain efficiency and coordination but also strengthens resilience in complex and uncertain environments.

According to stakeholder theory, digital transformation promotes the participation and collaboration of various stakeholders in the supply chain, improving the transparency of information exchange and decision making, and thus enhancing overall supply chain resilience [41]. By mitigating reliance on any single supplier or customer, companies can reduce the risk of supply chain disruption and increase their resilience.

This paper argues that by utilizing data analysis tools, businesses can better understand market demands and identify new customer groups and market opportunities. This aids in expanding the customer base, reducing reliance on a single or a few large customers, and thus decreasing customer concentration. Digital supply chain platforms can provide comprehensive data on suppliers, enabling businesses to assess and compare the performance and risks of different suppliers. Through such systems, companies can make broader supplier selections, reducing dependence on any single supplier and ultimately decreasing supplier concentration. By decreasing both customer and supplier concentration, digital transformation diversifies and decentralizes the supply chain. This ensures that even if one link faces issues, the entire chain is not severely impacted, thereby increasing overall resilience and adaptability. Based on the preceding analysis, this paper posits the following research hypotheses:

H2.

Digital transformation contributes to enhancing the resilience of the supply chain.

H2a.

Digital transformation facilitates the reduction in customer concentration.

H2b.

Digital transformation is conducive to diminishing supplier concentration.

2.3. Supply Chain Resilience and Enterprise ESG Performance

ESG (Environmental, Social, and Governance) investing embodies a philosophy centered on the sustainable development of corporations. It advocates for the consideration of a company’s environmental stewardship, social responsibility, and governance practices when making investment choices. Empirical research has demonstrated that various factors, including debt servicing capability, profitability, capital structure, corporate performance, and operational systems, significantly influence a firm’s ESG performance [2,42,43]. This paper explores the impact of supply chain resilience on enterprise ESG performance from a novel perspective.

Suppliers and customers are important stakeholders for companies and significantly influence corporate ESG performance. The current literature indicates that excessive customer concentration can lead to corporate path dependence, pushing companies into a state of myopia. This state often results in a lack of focus on enhancing innovation capabilities and adversely affects the operational cash flow of the business. Consequently, companies fail to prioritize or develop the capacity to improve their performance in social and environmental responsibilities, thereby diminishing their ESG performance [36,44,45,46]. High customer concentration may lead to path dependency in companies, resulting in corporate myopia and a lack of focus on social responsibility [44]. Additionally, excessive concentration in the supply chain can reduce a company’s bargaining power, potentially overlooking the overall efficiency and flexibility of the supply chain, increasing supplier risk, elevating the degree of tax avoidance, and leading to cost pressures and compliance risks. This, in turn, heightens the vulnerability of business operations [47,48]. Reducing supplier concentration and customer concentration helps enterprises enhance bargaining power and flexibility. This aids in diversifying risks and increasing profitability. The diversification of risks and enhancement of profitability promote overall business stability, which positively impacts the company’s performance in environmental, social, and governance (ESG) aspects. This thesis proposes the following hypotheses:

H3.

Supply chain resilience contributes to the enhancement of enterprise ESG performance.

H3a.

Diminished customer concentration facilitates the improvement in enterprise ESG performance.

H3b.

Reduced supplier concentration aids in the enhancement of enterprise ESG performance.

The study framework is shown in Figure 1.

Figure 1.

The study framework.

3. Research Design

3.1. Sample Selection and Data Collection

For the purpose of this study, we assembled an initial dataset comprising A-share listed companies in China over the period from 2009 to 2022. To uphold the integrity and precision of our findings, several adjustments were made to refine the initial sample.

➀ According to the industry classification of the China Securities Regulatory Commission (CSCR), all companies in the financial industry are excluded; ➁ excluded ST and ∗ST companies; ➂ excluded enterprises with serious lack of financial indicators or other relevant information; and ➃ removed extreme values for all continuous variables in the sample and reduces 1% with winsor method. Finally, 17,542 observations were obtained.

3.2. Variable Definition

- Explanation Variable

The ESG performance metric adopted for this study is derived from a benchmark ESG rating system [42]. This rating system categorizes firms across nine tiers, evaluated quarterly. Each tier is quantified on a scale of 1 to 9, with the yearly average score representing the firm’s ESG performance for that fiscal year;

- Interpretive Variables

Inspired by the methodology outlined by Wu et al. [26], the study utilizes text analysis and word frequency statistics to construct an index reflecting the degree of digital transformation within companies. By employing web crawler technology, the research captures digital technology mentions within annual reports from 2009 to 2022, constructing a digital transformation intensity index based on the frequency of such references;

- Mediation Variables

➀ Supplier Concentration (supplier_con): Adopting the approach of Dhaliwal et al. [47], the study calculates supplier concentration as the ratio of total purchases from the top five suppliers to the annual total procurement volume.

➁ Customer Concentration (customer_con): Following Patatoukas [49], customer concentration is gauged by determining the proportion of sales attributed to the top five customers relative to the company’s annual sales;

- Control Variables

The internal factors of the enterprises themselves may interfere with the research results. Therefore, this study starts from the enterprise level, considers the business status of the enterprise, the corporate structure, and the property nature, and selects the following variables that may affect the results as control variables by referring to the relevant literature [16,26,50]: Top1, Lev, Roa, Growth, Size, Age, Board, Dual, and Soe. All variables are summarized in Table 1.

Table 1.

Definition and measurement of variables.

3.3. Model Construction

In order to verify hypothesis 1 that digital transformation can effectively improve the ESG performance of enterprises, the following benchmark regression model is constructed:

The subscript i indicates the enterprise and t is the year. The explained variable is enterprise ESG performance (ESG), the core explanatory variable is enterprise digital transformation (DCG), and the control is the control variable at the enterprise level. “industry” is the fixed effect of the industry level and “year” is the fixed effect of the year. “ε” is the residual term.

4. Empirical Results and the Analysis

4.1. Descriptive Statistics

Table 2 shows the descriptive statistics of this paper. The mean of the explanatory variable ESG score is 4.161 with a standard deviation of 1.034. The minimum value is 1 and the maximum value is 8. This indicates that there is a large variation in ESG performance among firms and some firms have not paid attention to ESG performance. The mean value of firms’ digital transformation (DCG) is 1.546 with a standard deviation of 1.439. The minimum value is 0 and the maximum value is 5.182. This suggests that there are large differences in the degree of digital transformation among firms and that some firms have not yet engaged in digital transformation.

Table 2.

Descriptive statistics of the variables.

4.2. Benchmark Regression Analysis

The test results of the benchmark regression model in this paper are shown in Table 3. Column (1) of Table 3 shows the regression results for firms’ digital transformation with only the core explanatory variables. The results show that firms’ digital transformation positively contributes to firms’ ESG performance at the 1% significance level. Columns (2) and (3) of Table 3 show the regression results after adding the relevant control variables in turn. The results show that the contribution of corporate digital transformation to ESG performance remains significant at the 1% level. This suggests that digital transformation can improve corporate ESG performance by enhancing the connection between firms and stakeholders and leading to better social responsibility. This verifies that the research hypothesis H1 holds true.

Table 3.

Benchmark regression.

4.3. Mediation Effect Analysis

Based on the above analysis, this paper believes that the digital transformation of enterprises will affect the performance of enterprises ESG by reducing supplier concentration and customer concentration. In order to test the above action mechanism, a stepwise mediation effect model is constructed on the basis of model (1):

where M is the mediating variable and other variables are the same as above.

4.3.1. Supplier Concentration Degree

In our analysis, supplier concentration is quantified by the ratio of the total purchase value from the top five suppliers to the annual aggregate procurement amount. The regression outcomes, presented in Table 4, reveal that digital transformation exerts a substantial effect in diminishing supplier concentration, as evidenced in Column (1). Furthermore, Column (2) demonstrates that both digital transformation and the subsequent enhancement of supply chain resilience contribute notably to augmenting corporate ESG performance. Notably, the coefficient associated with digital transformation in Column (2) is diminished compared to that observed in Table 3 (Column 3), suggesting that supplier concentration operates as a mediating factor between digital transformation and the continuous innovation capacity of enterprises. The results confirm that digital transformation can enhance corporate ESG performance by reducing supplier concentration.

Table 4.

Test of the mediation effect.

4.3.2. Customer Concentration Degree

In this study, customer concentration is gauged by the proportion of sales to the top five customers relative to the company’s annual revenue. As illustrated in Column (3) of Table 4, digital transformation exhibits a marked capability to diminish customer concentration. Column (4) further elucidates that digital transformation, coupled with reduced customer concentration, significantly bolsters corporate ESG performance. Notably, the coefficient associated with digital transformation in Column (4) is lower than that in Table 3, Column (3), suggesting that customer concentration operates as a mediating factor between digital transformation and the continuous innovation capacity of enterprises. This result demonstrates that digital transformation can improve corporate ESG performance by reducing customer concentration.

It can be concluded that the mediating effect of current supply chain resilience on digital transformation and corporate ESG performance is reflected at the levels of supplier concentration and customer concentration. Digital transformation helps companies reduce supplier and customer concentration by enhancing supply chain transparency and market access capabilities, thereby diversifying risks and enhancing business resilience. In reducing supplier concentration, decreasing reliance on a single or a few customers and suppliers helps businesses diversify their operational risks. In supply chain management, this diversification allows companies greater flexibility in choosing suppliers that excel in environmental protection and social responsibility. Additionally, this diversification strategy also reduces the risk to corporate reputation and operations caused by suppliers’ environmental non-compliance. In terms of reducing customer concentration, a diversified customer base strengthens a company’s position across various markets and enhances its resistance to economic fluctuations. Lowering the concentration of customers and suppliers helps build a more diverse and equitable business ecosystem. This diversification not only helps companies better adapt to different cultures and societal needs in the global market but also strengthens social responsibility through the promotion of inclusive supply chain practices.

4.4. Robustness Test

4.4.1. Replacement of the Core Explanatory Variables

Considering the potential issues of omitted variables and model specificity, we use the method of replacing core explanatory variables to validate the reliability of the research findings. According to Wu Fei’s previous measurement of the digital level, digital technology is divided into artificial intelligence (AI), blockchain, cloud computing (CC), big data (BD), and digital application. A digital dictionary is built and then the logarithm of the word frequency is obtained. Table 5 shows the regression results after the replacement of the independent variables. It can be seen that the coefficient of the five dimensions of digital transformation is all positive. Most of the coefficients of digital indicators pass the robustness test of a 1% significant level, that is, the conclusions obtained by the benchmark regression model are robust and credible. The coefficient of blockchain is significant at the 5% significant level. Blockchain technology is currently in the research and development stage, which requires significant investment and has not yet been widely used. From the results, it is observed that the implementation of digital applications in enterprises is still not thorough or has not been effectively integrated with the core business processes and strategic goals of the enterprises. Therefore, their potential positive effects have not been fully realized. This approach ensures that the results are not only applicable to the specific variable choices used but also remain robust across different definitions and measurements of the variables, thereby enhancing the generalizability and stability of the findings.

Table 5.

Test results for replacing the core explanatory variables.

4.4.2. Eliminate the Samples Listed in the Current Year

Some of the companies in the study sample have just gone public, so they have few rating reference indicators. To avoid these samples affecting the regression results, we removed the samples listed in that year and then performed the regression. The results are shown in Table 6. The test results indicate a continued positive impact between digital transformation and ESG, which is significant at the 1% level, thereby confirming the reliability of the research findings.

Table 6.

Excluding the test results of the listed samples in the current year.

4.5. Endogeneity Test

4.5.1. Tool Variable Method

Considering the causal effect and missing variables of endogenous problems, this paper will lag the digital transformation as its own tool variables (DCG_IV); the reason is that the current enterprise ESG performance cannot affect the enterprise digital transformation. At the same time, the digital transformation of lag variables related to itself meets the use of tool variables. Next, this paper uses the two-stage least squares (2SLS) estimation for the regression of the instrumental variables, and the results are shown in Table 7. In the first stage, the digital transformation (DCG_IV) of the enterprise lag is significantly positively correlated with the degree of digital transformation, satisfying the correlation of instrumental variables; in the second stage, there is still a positive impact between the digital transformation and ESG, which is significant at the 1% level. Therefore, the core assumption of this paper is that H1 holds true.

Table 7.

Test results for the tool variable method.

4.5.2. Add Regional Control Variables

Due to regional differences, regression results may be influenced by regional legacy variables. To further control for omitted variable issues, this study included the economic development level and development level of the technology market as control variables in the model. The measurement methods for the variables are as follows: the level of economic development is adjusted using the per capita index for price deflation and the level of technology market development is measured by the ratio of technology market transaction volume to regional GDP. The regression results are shown in Table 8. After controlling for the various feature variables, the results for both the main effects and the mediation effects did not change significantly, thereby confirming the reliability of the research findings. The test results remain significant at the 1% level, indicating that hypothesis H1 holds true.

Table 8.

Test results for adding the regional control variables.

4.6. Heterogeneity Test

China exhibits the typical characteristics of a large country economy, with significant differences in both microstructural subjects and regional structures. These differences can result in substantially varied aftereffects of equal shocks from specific factors. A company’s technological level determines its capacity for innovation and depth of technology application in digital transformation, impacting its resource optimization and operational transparency. The level of pollution directly reflects a company’s environmental responsibility. High-pollution companies face greater challenges in environmental management and green production, potentially leading to significant differences in ESG performance compared to low-pollution companies. Geographical location encompasses multiple factors such as the economic development level, policies and regulations, and cultural differences in the region where a company operates. These factors collectively influence a company’s operations and strategic decisions, affecting its ESG performance and digital transformation strategies. Based on these considerations, to improve the estimation efficiency of the regression equations and to deconstruct the differential characteristics in a more detailed manner, this paper classifies the differences in enterprise attributes from a micro perspective (“heavy polluting enterprises vs. non-heavy polluting enterprises” and “high-tech enterprises vs. non-high-tech enterprises”), as well as the differences in enterprise geography from a macro perspective (“East vs. Midwest” region). Since these three variables each cover different key aspects of a company’s operations, they hold unique value in the analysis. This makes them valuable for helping researchers uncover the specific challenges and opportunities that different types of companies face during digital transformation, thereby providing customized ESG improvement strategies. To ensure the robustness of the results, we used the Fisher combined test method and conducted 1000 Bootstrap replications. The obtained empirical p-values indicate that the coefficients differ significantly between the groups.

4.6.1. Heterogeneity Analysis of the Pollution Degree of Enterprises

The results are shown in Table 9 (1) (2). Compared with heavily polluting enterprises, digital transformation has a stronger promotion effect on the ESG performance of non-heavy polluting enterprises. The empirical p-value obtained through the Bootstrap method is 0.034, which is significant at the 5% level. This further confirms the significance of the coefficient difference between groups. The possible reason is that non-heavy polluting enterprises may find it easier to identify innovations combined with environmental protection, such as reducing energy consumption through intelligence and optimizing supply chain management to reduce waste emissions. However, heavy-polluting industries are mostly traditional industries with simple business models and limited efficiency increases. Heavy-polluting enterprises usually face stricter environmental regulatory requirements, which may lead them to be more cautious in digital transformation to avoid causing new environmental problems or increasing compliance costs. Non-heavy polluting companies have relatively less pressure in this regard and can be more flexible to implement digital strategies. With increasing social demands for corporate social responsibility, non-heavy polluting companies may be more willing to demonstrate their commitment to environmental protection and enhance their corporate image through digital transformation. While heavily polluting enterprises obtain the attention of the public and investors due to environmental problems and the digital transformation on the ESG score may be less effective than that of non-heavy polluting enterprises, digital transformation may require enterprises to reconfigure internal resources because non-heavy polluting enterprises have a good technical and management foundation it is easier to realize. In heavy-polluting enterprises, the reallocation of resources may encounter more resistance from the existing production modes and management systems. Therefore, due to the advantages of non-heavy polluting enterprises in technology application, industry characteristics, regulatory requirements, social responsibility, and resource reallocation, their improvement in the ESG of enterprises through digital transformation is more obvious.

Table 9.

Shows the tests of heterogeneity.

4.6.2. Heterogeneity Analysis of the High-Tech Level of Enterprises

The results are shown in Table 9 (3) (4). Compared with non-high-tech enterprises, digital transformation has a stronger promotion effect on the ESG performance of high-tech enterprises. The empirical p-value obtained through the Bootstrap method is 0.000, which is significant at the 1% level. This further confirms the significance of the coefficient difference between groups. The possible reasons are the following. The possible reason is that high-tech firms usually have stronger capabilities and resources in technological innovation, and digital transformation can further enhance the green technological innovation capability of these firms, which leads to a better performance on the environmental protection dimension of ESG, while for non-high-tech firms, due to technological constraints, the portion of the digital transformation that serves to improve the green innovation capability of the firms is not obvious. For high-tech enterprises, digital transformation means easier to obtain financial support and subsequent investment in ESG-related projects and activities to promote the progress in social responsibility and corporate governance. For non-high-tech enterprises, due to technical limitations, the role of digital transformation in improving the green innovation capability is not obvious. With the advancement of digital transformation, high-tech enterprises are more vulnerable to the attention of external stakeholders, including investors and regulatory agencies. This focus creates greater legitimacy pressure, forcing companies to pay more attention to ESG performance to meet external expectations and standards.

4.6.3. Test of the Heterogeneity of Enterprise Location Distribution

The results, as shown in Table 9 (5) (6), indicate that digital transformation has a stronger impact on the ESG performance of firms in the East compared to those in the Midwest. The empirical p-value obtained through the Bootstrap method is 0.000, which is significant at the 1% level. This further confirms the significance of the coefficient difference between groups. The reasons are as follows:

Firstly, Eastern region companies typically have a higher technological foundation and greater innovation capabilities, allowing them to adopt and integrate digital technologies more quickly. This results in more significant improvements in Environmental (E), Social (S), and Governance (G) aspects. In contrast, companies in the central and western regions may have weaker technological foundations and innovation capabilities. As a result, the implementation and impact of digital transformation may require more time and resources, leading to slower improvements in ESG performance.

Secondly, companies in the eastern regions usually have more resources and funding to support digital transformation projects. These resources can be used to acquire advanced technologies, hire specialized talent, and make continuous technological improvements, thereby enhancing ESG performance more rapidly and effectively. In contrast, central and western companies may face limitations in resources and funding, leading to more challenges and bottlenecks in their digital transformation processes, making their ESG improvements less significant compared to eastern companies.

Lastly, the eastern regions typically have more comprehensive policy support and market environments, creating favorable conditions for digital transformation. Governments may provide more incentives and support policies to promote improvements in ESG performance. Additionally, ESG requirements and standards in eastern markets are likely higher, encouraging companies to undertake digital transformation more actively. In contrast, central and western regions may lag in policy support and market environments, resulting in more external obstacles and limitations for companies in their digital transformation and ESG improvement efforts.

5. Conclusions and Implications

5.1. Research Conclusions

As digital technology continues to advance and permeate various sectors, its role in driving green and low-carbon transformations becomes increasingly significant, offering powerful tools for both enterprises and societies to pursue sustainable development pathways. This paper conducts an empirical investigation using non-financial listed companies in China’s A-shares from 2009 to 2022 as research samples to examine the impact of digital transformation on ESG (Environmental, Social, and Governance) performance, delving into the mediating role of supply chain resilience. Our empirical findings reveal the following.

First, digital transformation significantly enhances the ESG performance of enterprises. The adoption of new technologies and management methods can accelerate a company’s adaptation to environmental, social, and governance (ESG) standards. By integrating advanced digital tools, companies can more efficiently monitor and enhance their ESG performance. Digital transformation helps firms accumulate and optimize resources, thereby boosting their competitiveness in the ESG sector. According to stakeholder theory, digital transformation allows companies to better identify and respond to stakeholder needs, improve transparency and communication, and, consequently, enhance the credibility and effectiveness of their ESG efforts. Overall, digital transformation not only improves a company’s ability to meet ESG standards but also optimizes resource allocation and stakeholder relations, driving comprehensive improvements in ESG performance. The robustness of this conclusion is confirmed through a series of endogeneity treatments and robustness tests.

Second, digital transformation can enhance supply chain resilience by reducing supplier and customer concentration. Improving supply chain resilience contributes to better ESG performance for the company. In a word, corporate digital transformation enhances ESG performance by improving supply chain resilience, specifically by reducing supplier and customer concentration. This occurs through two main mechanisms: digital transformation helps alleviate information asymmetry between upstream and downstream businesses in the supply chain and diversifies business partner choices, thus reducing supply chain concentration. This disperses business risks, alleviates financing constraints, and promotes improved ESG performance. Additionally, digital transformation increases transparency and diversification in business cooperation through technological innovation, enhancing supply chain resilience, reducing path dependency, and preventing ESG investment deficiencies caused by opportunistic behaviors.

Lastly, due to convenient internal and external conditions, the positive impact of digital transformation on ESG performance is more pronounced in companies outside heavy-pollution industries, in high-tech sectors, and in those situated in eastern regions.

5.2. Implications

The conclusions of this paper have practical implications for enterprises aiming for high-quality digital transformation and improved ESG performance.

First, improving the level of digital transformation is crucial for sustainable growth. Governments should introduce relevant policies and provide incentives such as tax breaks and financial support to encourage digital processes in enterprises and help reduce the input costs of digital technology. They can also promote the construction of digital infrastructure and the cultivation of digital talents, supporting cooperation between educational institutions and enterprises. Additionally, establishing a national unified ESG evaluation index system and promoting the ESG investment concept can prompt enterprises to fulfill their social responsibilities through digital channels and achieve high-quality development. Furthermore, policies should be tailored to the regulatory environment. In a stringent regulatory setting, the government should ensure that companies meet high ESG standards by strengthening compliance management, providing technical support and training, introducing incentives, and promoting transparency and reporting. In contrast, in a more lenient regulatory environment, the government can encourage voluntary digital transformation to improve ESG performance by offering economic incentives, guiding industry standards, promoting voluntary certification, and fostering collaboration. Companies should recognize that digital transformation is not only a process of technological upgrading but also an opportunity for innovation. By investing in new technologies, they can improve operational efficiency and reduce resource waste, thereby enhancing their environmental performance.

Second, enterprises should focus on optimizing supply chain management and improving supply chain resilience to enhance overall stability and risk resistance, thereby promoting social responsibility fulfillment. Companies should actively invest in cutting-edge technologies to improve supply chain transparency and efficiency by reducing supplier and customer concentration. Optimizing production processes and enhancing technological innovation through internal optimization and external pressure can improve product quality and market competitiveness, ultimately achieving energy savings and emission reductions. Additionally, enterprises should strengthen collaboration with upstream and downstream supply chain partners and use digital tools for risk management to ensure supply chain stability and security, reducing risk costs and improving ESG performance.

Third, the specific implementation of digital transformation should be tailored to each enterprise’s development situation. For heavily polluting enterprises, the initial step should be implementing advanced real-time pollution monitoring systems and data analytics platforms. This involves installing IoT sensors to continuously track air and water pollutant concentrations and using data analytics tools to predict and manage potential environmental risks. Next, adopting intelligent production processes is essential, such as employing automated control systems to reduce emissions and waste during production. Finally, optimizing compliance management and reporting mechanisms is crucial. This includes establishing a comprehensive digital compliance tracking system that automatically updates and records changes in environmental regulations and generating transparent ESG reports to showcase the company’s environmental efforts and achievements to the public and regulatory bodies. For non-high-tech enterprises, the first priority is investing in upgrading digital infrastructure, such as implementing Enterprise Resource Planning (ERP) systems and smart devices to enhance production and operational efficiency. Additionally, digital training platforms should be utilized for employee skill enhancement programs, improving adaptability in a digital environment. Simultaneously, advancing social responsibility projects, such as initiating and managing community service activities through digital platforms, can boost the company’s social impact and brand reputation. For enterprises in central and western regions, leveraging the successful digital transformation experiences of eastern enterprises can provide valuable insights. The first step is to establish the necessary digital infrastructure to support foundational aspects of digital transformation. Subsequently, utilizing local resources and policy support is essential, including actively applying for government subsidies and technical assistance programs to drive the adoption of digital technologies. Finally, enhancing local employment and skills training through digital platforms, such as setting up remote learning centers, can improve the technical capabilities and job opportunities of the local workforce, thereby strengthening overall governance and social responsibility.

5.3. Research Limitations and Perspectives

This study has several limitations. Firstly, the heterogeneity analysis in this research only considers three factors: pollution levels, technological advancement, and geographic region. However, differences in the impact of digital transformation on corporate ESG performance may also be influenced by other factors, such as sector structure. Future research should include additional factors like sector structure in the heterogeneity analysis to provide a deeper understanding of how supply chain resilience mechanisms vary under different conditions.

Secondly, the sample in this study is limited to Chinese A-share listed companies. There are inherent differences between domestic and international firms, as well as between listed and non-listed companies, which may restrict the generalizability of the findings. Future studies should seek to expand the sample scope to enhance the generalizability and robustness of the conclusions.

Thirdly, this research uses the frequency of terms related to digital transformation in corporate annual reports as a proxy for measuring the extent of digital transformation. However, this approach does not guarantee that companies are actively engaged in digital transformation practices and may not fully reflect the depth and effectiveness of digital transformation. Future research should aim to identify more accurate indicators to measure the extent of digital transformation, thereby improving measurement precision.

Author Contributions

Conceptualization, M.Z.; methodology, Z.H.; software, M.Z.; validation, M.Z.; formal analysis, M.Z; investigation, Z.H; data curation, M.Z.; writing—original draft preparation, M.Z.; writing—review and editing, Z.H.; visualization, M.Z.; supervision, Z.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data are available from the corresponding author on reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Townsend, B. From SRI to ESG: The origins of socially responsible and sustainable investing. J. Impact ESG Invest. 2020, 1, 10–25. [Google Scholar] [CrossRef]

- Alareeni, B.A.; Hamdan, A. ESG impact on performance of US S&P 500-listed firms. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 1409–1428. [Google Scholar]

- Zeng, Q.; Ma, F.; Lu, X.; Xu, W. Policy uncertainty and carbon neutrality: Evidence from China. Financ. Res. Lett. 2022, 47, 102771. [Google Scholar] [CrossRef]

- Attaran, M. Digital technology enablers and their implications for supply chain management. Supply Chain. Forum Int. J. 2020, 21, 158–172. [Google Scholar] [CrossRef]

- Parida, V.; Sjödin, D.; Reim, W. Reviewing literature on digitalization, business model innovation, and sustainable industry: Past achievements and future promises. Sustainability 2019, 11, 391. [Google Scholar] [CrossRef]

- Appio, F.P.; Frattini, F.; Petruzzelli, A.M.; Neirotti, P. Digital transformation and innovation management: A synthesis of existing research and an agenda for future studies. J. Prod. Innov. Manag. 2021, 38, 4–20. [Google Scholar] [CrossRef]

- Gaglio, C.; Kraemer-Mbula, E.; Lorenz, E. The effects of digital transformation on innovation and productivity: Firm-level evidence of South African manufacturing micro and small enterprises. Technol. Forecast. Soc. Change 2022, 182, 121785. [Google Scholar] [CrossRef]

- Peng, Y.; Tao, C. Can digital transformation promote enterprise performance?—From the perspective of public policy and innovation. J. Innov. Knowl. 2022, 7, 100198. [Google Scholar] [CrossRef]

- Zhao, C. Research on the impact of digital transformation on corporate social responsibility. Contemp. Econ. Sci. 2022, 44, 109–116. [Google Scholar]

- Vogler, D.; Eisenegger, M. CSR communication, corporate reputation, and the role of the news media as an agenda-setter in the digital age. Bus. Soc. 2021, 60, 1957–1986. [Google Scholar] [CrossRef]

- Cioacă, S.I.; Cristache, S.E.; Vuță, M.; Marin, E.; Vuță, M. Assessing the impact of ICT sector on sustainable development in the European Union: An empirical analysis using panel data. Sustainability 2020, 12, 592. [Google Scholar] [CrossRef]

- Jones, P.; Wynn, M. The leading digital technology companies and their approach to sustainable development. Sustainability 2021, 13, 6612. [Google Scholar] [CrossRef]

- Hongjun, X.; Zhen, Y.; Meiyu, L. The social responsibility promotion effect of enterprise digitalization: An examination of internal and external dual paths. Econ. Manag. 2021, 11, 52–69. [Google Scholar]

- Swain, A.K.; Cao, R.Q. Using sentiment analysis to improve supply chain intelligence. Inf. Syst. Front. 2019, 21, 469–484. [Google Scholar] [CrossRef]

- Wang, H.; Jiao, S.; Bu, K.; Wang, Y.; Wang, Y. Digital transformation and manufacturing companies’ ESG responsibility performance. Financ. Res. Lett. 2023, 58, 104370. [Google Scholar] [CrossRef]

- Wu, S.; Li, Y. A study on the impact of digital transformation on corporate ESG performance: The mediating role of green innovation. Sustainability 2023, 15, 6568. [Google Scholar] [CrossRef]

- Hanelt, A.; Bohnsack, R.; Marz, D.; Antunes Marante, C. A systematic review of the literature on digital transformation: Insights and implications for strategy and organizational change. J. Manag. Stud. 2021, 58, 1159–1197. [Google Scholar] [CrossRef]

- Rajesh, R. Exploring the sustainability performances of firms using environmental, social, and governance scores. J. Clean. Prod. 2020, 247, 119600. [Google Scholar] [CrossRef]

- Widyawati, L. Measurement concerns and agreement of environmental social governance ratings. Account. Financ. 2021, 61, 1589–1623. [Google Scholar] [CrossRef]

- Edmans, A. The end of ESG. Financ. Manag. 2023, 52, 3–17. [Google Scholar] [CrossRef]

- Su, X.; Wang, S.; Li, F. The impact of digital transformation on ESG performance based on the mediating effect of dynamic capabilities. Sustainability 2023, 15, 13506. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Creating shared value. Harv. Bus. Rev. 2011, 89, 62–77. [Google Scholar]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Wang, Y.; Gao, Y. Firm Digital Transformation and ESG Performance: Evidence from Chin’s A-share Listed Firms. J. Financ. Econ. 2023, 49, 94–108. [Google Scholar]

- Rogers, E.M.; Singhal, A.; Quinlan, M.M. Diffusion of innovations. In An Integrated Approach to Communication Theory and Research; Routledge: London, UK, 2014; pp. 432–448. [Google Scholar]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise digital transformation and capital market performance: Empirical evidence from stock liquidity. Manag. World 2021, 37, 130–144. [Google Scholar]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Wei, P.; Xie, T.; Wang, Z.; Ma, L. Digital economy: An innovation driver for total factor productivity. J. Bus. Res. 2022, 139, 303–311. [Google Scholar]

- Elkington, J. The triple bottom line. Environ. Manag. Read. Cases 1997, 2, 49–66. [Google Scholar]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Li, P.; Zhao, X. The impact of digital transformation on corporate supply chain management: Evidence from listed companies. Financ. Res. Lett. 2024, 60, 104890. [Google Scholar] [CrossRef]

- Williamson, O.E. The Economic Institutions of Capitalism: Firms, Markets, Relational Contracting; Free Press: New York, NY, USA, 1985; Volume 48. [Google Scholar]

- Porter, M.E. How Competitive Forces Shape Strategy; Macmillan Education UK: London, UK, 1989; pp. 133–143. [Google Scholar]

- Birge, J.R.; Capponi, A.; Chen, P.C. Disruption and rerouting in supply chain networks. Oper. Res. 2023, 71, 750–767. [Google Scholar] [CrossRef]

- Panigrahi, S.S.; Bahinipati, B.; Jain, V. Sustainable supply chain management: A review of literature and implications for future research. Manag. Environ. Qual. Int. J. 2019, 30, 1001–1049. [Google Scholar] [CrossRef]

- Zheng, S.; Zhang, Q.; Zhang, P. Can customer concentration affect corporate ESG performance? Financ. Res. Lett. 2023, 58, 104432. [Google Scholar] [CrossRef]

- Wang, X.; Kumar, V.; Kumari, A.; Kuzmin, E. Impact of digital technology on supply chain efficiency in manufacturing industry. In Digital Transformation in Industry: Digital Twins and New Business Models; Springer International Publishing: Cham, Switzerland, 2022; pp. 347–371. [Google Scholar]

- Brandon-Jones, E.; Squire, B.; Autry, C.W.; Petersen, K.J. A contingent resource-based perspective of supply chain resilience and robustness. J. Supply Chain Manag. 2014, 50, 55–73. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A. A digital supply chain twin for managing the disruption risks and resilience in the era of Industry 4.0. Prod. Plan. Control 2021, 32, 775–788. [Google Scholar] [CrossRef]

- Zhang, H.; Zhang, Q. How does digital transformation facilitate enterprise total factor productivity? The multiple mediators of supplier concentration and customer concentration. Sustainability 2023, 15, 1896. [Google Scholar] [CrossRef]

- Jones, T.M.; Wicks, N.C. Convergent stakeholder theory. In Business Ethics and Strategy, Volumes I and II; Routledge: London, UK, 2018. [Google Scholar]

- Lin, Y.; Fu, X.; Fu, X. Varieties in state capitalism and corporate innovation: Evidence from an emerging economy. J. Corp. Financ. 2021, 67, 101919. [Google Scholar] [CrossRef]

- Ronalter, L.M.; Bernardo, M.; Romaní, J.M. Quality and environmental management systems as business tools to enhance ESG performance: A cross-regional empirical study. Environ. Dev. Sustain. 2023, 25, 9067–9109. [Google Scholar] [CrossRef]

- Pan, J.; Yu, M.; Liu, J.; Fan, R. Customer concentration and corporate innovation: Evidence from China. N. Am. J. Econ. Financ. 2020, 54, 101284. [Google Scholar] [CrossRef]

- Wen, W.; Ke, Y.; Liu, X. Customer concentration and corporate social responsibility performance: Evidence from China. Emerg. Mark. Rev. 2021, 46, 100755. [Google Scholar] [CrossRef]

- Zhu, M.; Yeung, A.C.; Zhou, H. Diversify or concentrate: The impact of customer concentration on corporate social responsibility. Int. J. Prod. Econ. 2021, 240, 108214. [Google Scholar] [CrossRef]

- Dhaliwal, D.; Judd, J.S.; Serfling, M.; Shaikh, S. Customer concentration risk and the cost of equity capital. J. Account. Econ. 2016, 61, 23–48. [Google Scholar] [CrossRef]

- Huang, H.H.; Lobo, G.J.; Wang, C.; Xie, H. Customer concentration and corporate tax avoidance. J. Bank. Financ. 2016, 72, 184–200. [Google Scholar] [CrossRef]

- Patatoukas, P.N. Customer-base concentration: Implications for firm performance and capital markets: 2011 American accounting association competitive manuscript award winner. Account. Rev. 2012, 87, 363–392. [Google Scholar] [CrossRef]

- Hu, J.; Han, Y.; Zhong, Y. How digital transformation affects corporate ESG performance: Evidence from Chinese listed companies. Ind. Econ. Rev. 2023, 1, 105–123. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).