Unlocking Green Patterns: The Local and Spatial Impacts of Green Finance on Urban Green Total Factor Productivity

Abstract

1. Introduction

2. Literature Review

3. Theoretical Analysis and Hypotheses

4. Research Design

4.1. Econometric Model

4.1.1. Baseline Regression Model

4.1.2. Mechanism Analysis Model

4.2. Variable

4.2.1. Independent Variable

4.2.2. Dependent Variable

4.2.3. Other Control Variables

4.2.4. Mechanism Variables

4.3. Data Source

5. Empirical Results

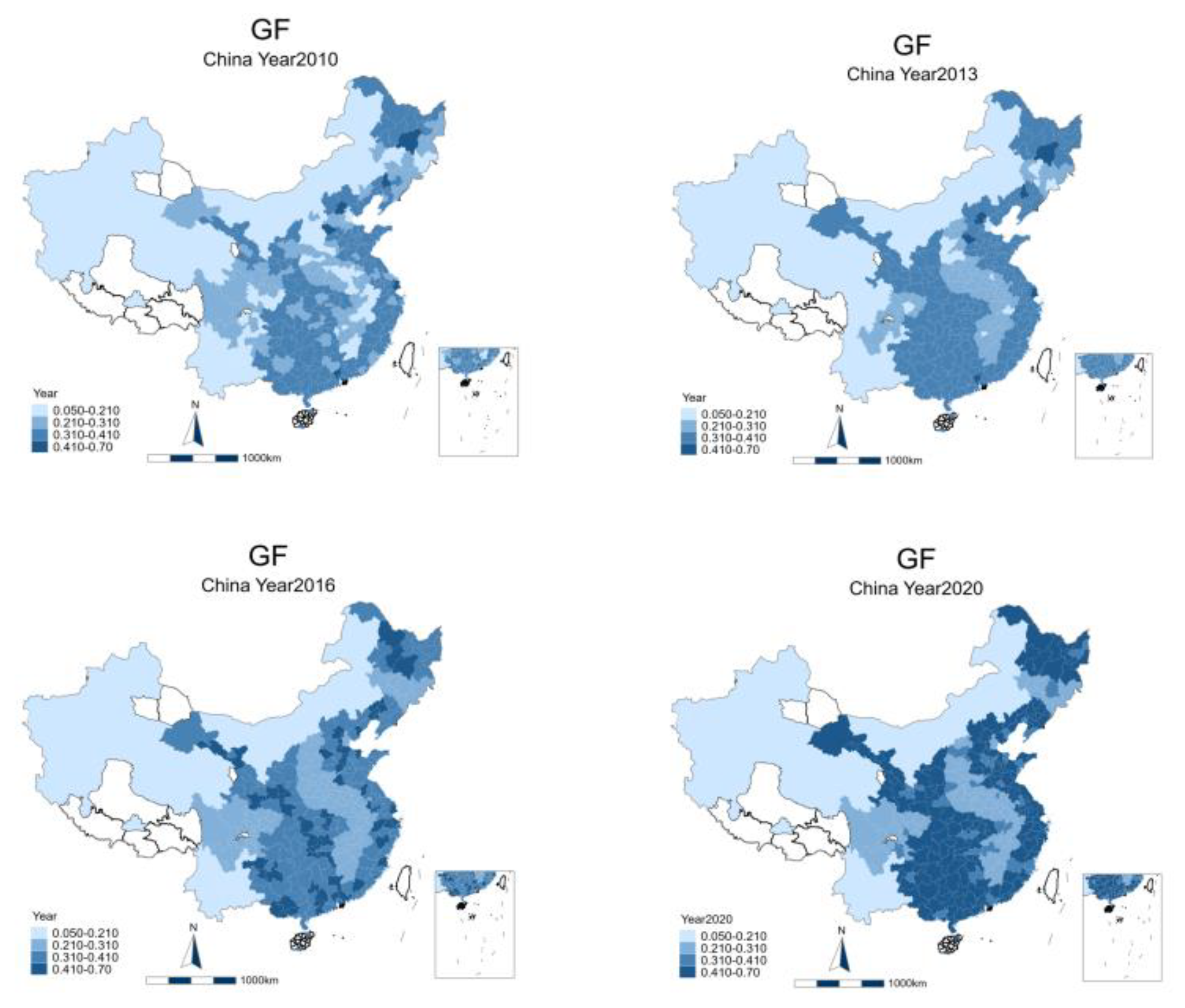

5.1. Spatial Correlation Analysis

5.2. Benchmark Regression

5.3. Mechanism Analysis

5.4. Robustness Test

5.4.1. Replacement Estimation Model

5.4.2. Replacement Weight Matrix

5.4.3. Exclusion of Special Samples

5.5. Heterogeneity Test

6. Conclusions and Policy Implication

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Chen, D.; Hu, H.; Wang, N.; Chang, C.P. The impact of green finance on transformation to green energy: Evidence from industrial enterprises in China. Technol. Forecast. Soc. Chang. 2024, 204, 123411. [Google Scholar] [CrossRef]

- Tan, L.; Gao, D.; Liu, X. Can Environmental Information Disclosure Improve Energy Efficiency in Manufacturing? Evidence from Chinese Enterprises. Energies 2024, 17, 2342. [Google Scholar] [CrossRef]

- Hunjra, A.I.; Zhao, S.; Tan, Y.; Bouri, E.; Liu, X. How do green innovations promote regional green total factor productivity? Multidimensional analysis of heterogeneity, spatiality and nonlinearity. J. Clean. Prod. 2024, 467, 142935. [Google Scholar] [CrossRef]

- Wang, P.; Xue, W.; Wang, Z. Fog and haze control and enterprise green total factor productivity-evidence from China. Financ. Res. Lett. 2024, 65, 105561. [Google Scholar] [CrossRef]

- Gao, D.; Zhou, X.; Liu, X. The Bright Side of Uncertainty: The Impact of Climate Policy Uncertainty on Urban Green Total Factor Energy Efficiency. Energies 2024, 17, 2899. [Google Scholar] [CrossRef]

- Gao, D.; Zhou, X.; Mo, X.; Liu, X. Unlocking sustainable growth: Exploring the catalytic role of green finance in firms’ green total factor productivity. Environ. Sci. Pollut. Res. 2024, 31, 14762–14774. [Google Scholar] [CrossRef]

- Zhao, J. Impact of green finance on low-carbon transformation: Spatial spillover effects in China. N. Am. J. Econ. Financ. 2024, 74, 102202. [Google Scholar] [CrossRef]

- Zhang, Z.; Zhang, L. Government green procurement policies and corporate green total factor productivity. Financ. Res. Lett. 2024, 65, 105556. [Google Scholar] [CrossRef]

- Gao, L.; Huang, R. Digital transformation and green total factor productivity in the semiconductor industry: The role of supply chain integration and economic policy uncertainty. Int. J. Prod. Econ. 2024, 274, 109313. [Google Scholar] [CrossRef]

- Fan, L.; Peng, B.; Lin, Z.; Zou, H.; Du, H. The Effects of Green Finance on Pollution and Carbon Reduction: Evidence from China’s Industrial Firms. Int. Rev. Econ. Financ. 2024, 95, 103490. [Google Scholar] [CrossRef]

- Lian, Y.; Dong, H.; Cao, H. The effect of digital economy and environmental regulation on green total factor productivity: Evidence from China. Glob. Financ. J. 2024, 62, 101010. [Google Scholar] [CrossRef]

- Zhou, L.; Fan, J.; Hu, M.; Yu, X. Clean air policy and green total factor productivity: Evidence from Chinese prefecture-level cities. Energy Econ. 2024, 133, 107512. [Google Scholar] [CrossRef]

- Lee, C.C.; Lee, C.C. How does green finance affect green total factor productivity? Evidence from China. Energy Econ. 2022, 107, 105863. [Google Scholar] [CrossRef]

- Lin, J.; Zhang, L.; Dong, Z. Exploring the effect of green finance on green development of China’s energy-intensive industry—A spatial econometric analysis. Resour. Environ. Sustain. 2024, 16, 100159. [Google Scholar] [CrossRef]

- Guo, Q.T.; Dong, Y.; Feng, B.; Zhang, H. Can green finance development promote total-factor energy efficiency? Empirical evidence from China based on a spatial Durbin model. Energy Policy 2023, 177, 113523. [Google Scholar] [CrossRef]

- Zhang, H.; Geng, C.; Wei, J. Coordinated development between green finance and environmental performance in China: The spatial-temporal difference and driving factors. J. Clean. Prod. 2022, 346, 131150. [Google Scholar] [CrossRef]

- Tina Dacin, M.; Goodstein, J.; Richard Scott, W. Institutional theory and institutional change: Introduction to the special research forum. Acad. Manag. J. 2002, 45, 45–56. [Google Scholar] [CrossRef]

- Zhao, C. Is low-carbon energy technology a catalyst for driving green total factor productivity development? The case of China. J. Clean. Prod. 2023, 428, 139507. [Google Scholar] [CrossRef]

- Zhao, X.; Benkraiem, R.; Abedin, M.Z.; Zhou, S. The charm of green finance: Can green finance reduce corporate carbon emissions? Energy Econ. 2024, 134, 107574. [Google Scholar] [CrossRef]

- Huang, Y.; Chen, C.; Lei, L.; Zhang, Y. Impacts of green finance on green innovation: A spatial and nonlinear perspective. J. Clean. Prod. 2022, 365, 132548. [Google Scholar] [CrossRef]

- Song, X.; Zhang, L.; Ren, S. How does green credit affect industrial green transformation? Mechanism discussion and empirical test. Heliyon 2024, 10, e33312. [Google Scholar] [CrossRef] [PubMed]

- Xin, B.; Zhou, L.; Gonzalez, E.D.S. Does green finance reform hit urban employment?—Evidence from China’s green finance pilot policy. Cities 2024, 152, 105239. [Google Scholar] [CrossRef]

- Shi, R.; Zhou, H.; Li, X.; Zhao, X. Green finance, investor preferences, and corporate green innovation. Financ. Res. Lett. 2024, 66, 105676. [Google Scholar] [CrossRef]

- Wang, C.; Qiu, J.; Chen, B.; Deng, X. Green finance, green culture and corporate green management innovation: Evidence from Chinese listed companies. Financ. Res. Lett. 2024, 67, 105774. [Google Scholar] [CrossRef]

- Lin, T.X.; Li, L.; Padhan, H.; Pruseth, S.K.; Patel, G.; Haouas, I. The impact of green finance funds on industrial productivity cycles: Evidence from developing economies. Technol. Forecast. Soc. Chang. 2024, 208, 123706. [Google Scholar] [CrossRef]

- Yi, H.; Hao, L.; Liu, A.; Zhang, Z. Green finance development and resource efficiency: A financial structure perspective. Resour. Policy 2023, 85, 104068. [Google Scholar] [CrossRef]

- Zhang, T.; Zhao, F. A study on the relationships among green finance, environmental pollution and economic development. Energy Strategy Rev. 2024, 51, 101290. [Google Scholar] [CrossRef]

- Yin, X.; Xu, Z. An empirical analysis of the coupling and coordinative development of China’s green finance and economic growth. Resour. Policy 2022, 75, 102476. [Google Scholar] [CrossRef]

- Yuan, X.; Zhang, J.; Shi, J.; Wang, J. What can green finance do for high-quality agricultural development? Fresh insights from China. Socio-Econ. Plan. Sci. 2024, 94, 101920. [Google Scholar] [CrossRef]

- Ma, D.; Zhu, Y.; Yang, Y. How Green finance affects export production quality: Fresh evidence from China. Energy Econ. 2024, 131, 107381. [Google Scholar] [CrossRef]

- Wang, H.; Cui, H.; Zhao, Q. Effect of green technology innovation on green total factor productivity in China: Evidence from spatial durbin model analysis. J. Clean. Prod. 2021, 288, 125624. [Google Scholar] [CrossRef]

- Feng, C.; Zhong, S.; Wang, M. How can green finance promote the transformation of China’s economic growth momentum? A perspective from internal structures of green total-factor productivity. Res. Int. Bus. Financ. 2024, 70, 102356. [Google Scholar] [CrossRef]

- Wei, N. Green finance, market integration, and regional economic resilience. Financ. Res. Lett. 2024, 67, 105777. [Google Scholar] [CrossRef]

- Wu, J.; Xia, Q.; Li, Z. Green innovation and enterprise green total factor productivity at a micro level: A perspective of technical distance. J. Clean. Prod. 2022, 344, 131070. [Google Scholar] [CrossRef]

- Chai, S.; Zhang, K.; Wei, W.; Ma, W.; Abedin, M.Z. The impact of green credit policy on enterprises’ financing behavior: Evidence from Chinese heavily-polluting listed companies. J. Clean. Prod. 2022, 363, 132458. [Google Scholar] [CrossRef]

- Yue, H.; Zhou, Z.; Liu, H. How does green finance influence industrial green total factor productivity? Empirical research from China. Energy Rep. 2024, 11, 914–924. [Google Scholar] [CrossRef]

- Jiang, Y.; Guo, Y.; Bashir, M.F.; Shahbaz, M. Do renewable energy, environmental regulations and green innovation matter for China’s zero carbon transition: Evidence from green total factor productivity. J. Environ. Manag. 2024, 352, 120030. [Google Scholar] [CrossRef] [PubMed]

- Chen, F.; Zeng, X.; Guo, X. Green finance, climate change, and green innovation: Evidence from China. Financ. Res. Lett. 2024, 63, 105283. [Google Scholar] [CrossRef]

- Xiao, Y.; Chen, K. Green finance, natural resource dependence and environmental quality: Evidence from China. Resour. Policy 2024, 92, 104977. [Google Scholar] [CrossRef]

- Liu, Y.; He, Z. Synergistic Industrial Agglomeration, New Quality Productive Forces and High-quality Development of the Manufacturing Industry. Int. Rev. Econ. Financ. 2024, 94, 103373. [Google Scholar] [CrossRef]

- Su, X.; Qiao, R.; Xu, S. Impact of green finance on carbon emissions and spatial spillover effects: Empirical evidence from China. J. Clean. Prod. 2024, 457, 142362. [Google Scholar] [CrossRef]

- Wang, J.; Guo, D. Siphon and radiation effects of ICT agglomeration on green total factor productivity: Evidence from a spatial Durbin model. Energy Econ. 2023, 126, 106953. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of super-efficiency in data envelopment analysis. Eur. J. Oper. Res. 2002, 143, 32–41. [Google Scholar] [CrossRef]

- Li, Y.; Chen, Y. Development of an SBM-ML model for the measurement of green total factor productivity: The case of pearl river delta urban agglomeration. Renew. Sustain. Energy Rev. 2021, 145, 111131. [Google Scholar] [CrossRef]

- Tian, X.; Zhang, H. Analysis of the impact factors of industrial structure upgrading on green total factor productivity from the perspective of spatial spillover effects. Heliyon 2024, 10, e28660. [Google Scholar] [CrossRef]

- Zaidi SA, H.; Ashraf, R.U.; Khan, I.; Li, M. Impact of natural resource depletion on energy intensity: Moderating role of globalization, financial inclusion and trade. Resour. Policy 2024, 94, 105112. [Google Scholar] [CrossRef]

- Gao, D.; Feng, H.; Cao, Y. The spatial spillover effect of innovative city policy on carbon efficiency: Evidence from China. Singap. Econ. Rev. 2024, 1–23. [Google Scholar] [CrossRef]

- Lee, C.C.; Wang, C.S.; He, Z.; Xing, W.W.; Wang, K. How does green finance affect energy efficiency? The role of green technology innovation and energy structure. Renew. Energy 2023, 219, 119417. [Google Scholar] [CrossRef]

- Nepal, R.; Liu, Y.; Wang, J.; Dong, K. How does green finance promote renewable energy technology innovation? A quasi-natural experiment perspective. Energy Econ. 2024, 134, 107576. [Google Scholar] [CrossRef]

- Yu, D.; Li, X.; Yu, J.; Li, H. The impact of the spatial agglomeration of foreign direct investment on green total factor productivity of Chinese cities. J. Environ. Manag. 2021, 290, 112666. [Google Scholar] [CrossRef] [PubMed]

- Li, G.; Gao, D.; Li, Y. Impacts of market-based environmental regulation on green total factor energy efficiency in China. China World Econ. 2023, 31, 92–114. [Google Scholar] [CrossRef]

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | N | Mean | SD | Min | Max |

| GTFP | 2760 | 0.650 | 0.319 | 0.000 | 1.800 |

| GF | 2760 | 0.327 | 0.978 | 0.000 | 0.624 |

| Loed | 2760 | 16.48 | 0.886 | 14.26 | 19.54 |

| ISR | 2760 | 0.024 | 0.064 | 0.000 | 0.182 |

| Rg | 2760 | 0.022 | 0.021 | 0.000 | 0.041 |

| Erc | 2760 | 0.034 | 0.014 | 0.000 | 0.012 |

| Ufd | 2760 | 2.240 | 1.100 | 0.588 | 12.62 |

| Fdc | 2760 | 0.494 | 0.221 | 0.000 | 1.541 |

| Variables | I | z | p-Value |

|---|---|---|---|

| 2010 | 0.183 | 3.441 | 0.000 |

| 2011 | 0.221 | 4.397 | 0.000 |

| 2012 | 0.174 | 4.878 | 0.000 |

| 2013 | 0.243 | 8.122 | 0.000 |

| 2014 | 0.233 | 6.486 | 0.000 |

| 2015 | 0.307 | 7.046 | 0.000 |

| 2016 | 0.352 | 9.782 | 0.000 |

| 2017 | 0.369 | 11.497 | 0.000 |

| 2018 | 0.409 | 8.716 | 0.000 |

| 2019 | 0.389 | 9.703 | 0.000 |

| 2020 | 0.411 | 10.248 | 0.000 |

| 2021 | 0.420 | 9.304 | 0.000 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Geographical distance matrix | Economic weight matrix | |||||

| GF | 0.437 ** | 0.332 *** | 0.215 ** | 0.544 *** | 0.359 *** | 0.308 *** |

| (2.32) | (3.17) | (2.14) | (4.40) | (4.39) | (3.42) | |

| W*GF | 0.280 *** | 0.251 *** | 0.173 *** | 0.349 *** | 0.284 ** | 0.208 ** |

| (3.07) | (4.85) | (3.10) | (5.36) | (2.45) | (2.37) | |

| W*GTFP | 0.411 * | 0.354 ** | 0.271 ** | 0.276 ** | 0.347 ** | 0.314 ** |

| (1.72) | (2.20) | (1.99) | (2.32) | (2.16) | (2.29) | |

| Constant | 1.621 *** | 1.536 *** | 1.339 *** | 1.646 ** | 1.821 ** | 1.739 *** |

| (3.54) | (2.98) | (2.62) | (2.37) | (1.99) | (2.59) | |

| Control | × | √ | √ | × | √ | √ |

| City FE | × | × | √ | × | × | √ |

| Year FE | × | √ | √ | × | √ | √ |

| R2 | 0.245 | 0.327 | 0.387 | 0.217 | 0.386 | 0.409 |

| N | 2760 | 2760 | 2760 | 2760 | 2760 | 2760 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Geographical distance matrix | Economic weight matrix | |||||

| Direct effect | Indirect effect | Total effects | Direct effect | Indirect effect | Total effects | |

| GF | 0.377 ** | 0.292 *** | 0.669 ** | 0.232 *** | 0.258 *** | 0.490 *** |

| (2.32) | (3.17) | (2.14) | (4.40) | (4.39) | (3.42) | |

| (1) | (2) | (3) | |

|---|---|---|---|

| Energy Use Efficiency | Resource Mismatch Degree | New Quality Productivity | |

| GF | 0.263 *** | −0.175 ** | 0.382 ** |

| (3.31) | (−2.32) | (2.31) | |

| W*GF | 0.116 ** | −0.149 * | 0.185 *** |

| (2.45) | (−1.86) | (4.55) | |

| W*GTFP | 0.396 ** | −0.323 ** | 0.349 * |

| (1.98) | (−1.97) | (1.79) | |

| Constant | 1.167 *** | 1.352 *** | 1.387 *** |

| (2.66) | (3.37) | (3.65) | |

| Control | √ | √ | √ |

| City FE | √ | √ | √ |

| Year FE | √ | √ | √ |

| R2 | 0.451 | 0.317 | 0.538 |

| N | 2760 | 2760 | 2760 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Control Lag GTFP | Geographic Adjacency Matrix | Economic Distance Matrix | Exclude 2020 Data | |

| GF | 0.264 ** | 0.124 ** | 0.415 *** | 0.338 *** |

| (2.37) | (2.31) | (3.30) | (2.69) | |

| W* GF | 0.243 *** | 0.185 ** | 0.249 * | 0.286 ** |

| (2.69) | (2.55) | (1.86) | (2.06) | |

| W*GTFP | 0.122 * | 0.267 ** | 0.372 *** | 0.199 *** |

| (1.75) | (2.45) | (2.97) | (2.68) | |

| L. GTFP | 0.329 ** | |||

| (2.22) | ||||

| Constatnt | 1.139 *** | 0.944 *** | 1.058 *** | 1.769 *** |

| (3.88) | (2.58) | (2.99) | (2.73) | |

| Control | √ | √ | √ | √ |

| City FE | √ | √ | √ | √ |

| Year FE | √ | √ | √ | √ |

| R2 | 0.574 | 0.324 | 0.378 | 0.408 |

| N | 2430 | 2760 | 2760 | 2557 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Inland City | Coastal City | Developed City | Developing City | |

| GF | 0.338 | 0.505 *** | 0.641 *** | 0.216 |

| (1.02) | (2.60) | (2.71) | (1.58) | |

| W* GF | 0.311 | 0.393 *** | 0.385 *** | 0.412 |

| (1.55) | (4.06) | (3.25) | (0.94) | |

| W*GTFP | 0.562 ** | 0.649 * | 0.228 *** | 0.311 * |

| (2.31) | (1.90) | (3.25) | (1.71) | |

| Constatnt | 1.287 ** | 1.587 *** | 2.215 *** | 1.834 *** |

| (2.21) | (3.28) | (2.96) | (2.77) | |

| Control | √ | √ | √ | √ |

| City FE | √ | √ | √ | √ |

| Year FE | √ | √ | √ | √ |

| R2 | 0.258 | 0.339 | 0.425 | 0.358 |

| N | 1793 | 957 | 1091 | 1659 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xiang, J.; Tan, L.; Gao, D. Unlocking Green Patterns: The Local and Spatial Impacts of Green Finance on Urban Green Total Factor Productivity. Sustainability 2024, 16, 8005. https://doi.org/10.3390/su16188005

Xiang J, Tan L, Gao D. Unlocking Green Patterns: The Local and Spatial Impacts of Green Finance on Urban Green Total Factor Productivity. Sustainability. 2024; 16(18):8005. https://doi.org/10.3390/su16188005

Chicago/Turabian StyleXiang, Jiyou, Linfang Tan, and Da Gao. 2024. "Unlocking Green Patterns: The Local and Spatial Impacts of Green Finance on Urban Green Total Factor Productivity" Sustainability 16, no. 18: 8005. https://doi.org/10.3390/su16188005

APA StyleXiang, J., Tan, L., & Gao, D. (2024). Unlocking Green Patterns: The Local and Spatial Impacts of Green Finance on Urban Green Total Factor Productivity. Sustainability, 16(18), 8005. https://doi.org/10.3390/su16188005