Development of Digital Transformation Maturity Assessment Model for Collaborative Factory Involving Multiple Companies

Abstract

1. Introduction

2. Literature Review

2.1. DX Assessment Models

2.2. Collaboration for DX

3. DX Maturity Assessment Model for Digital Collaboration Factory

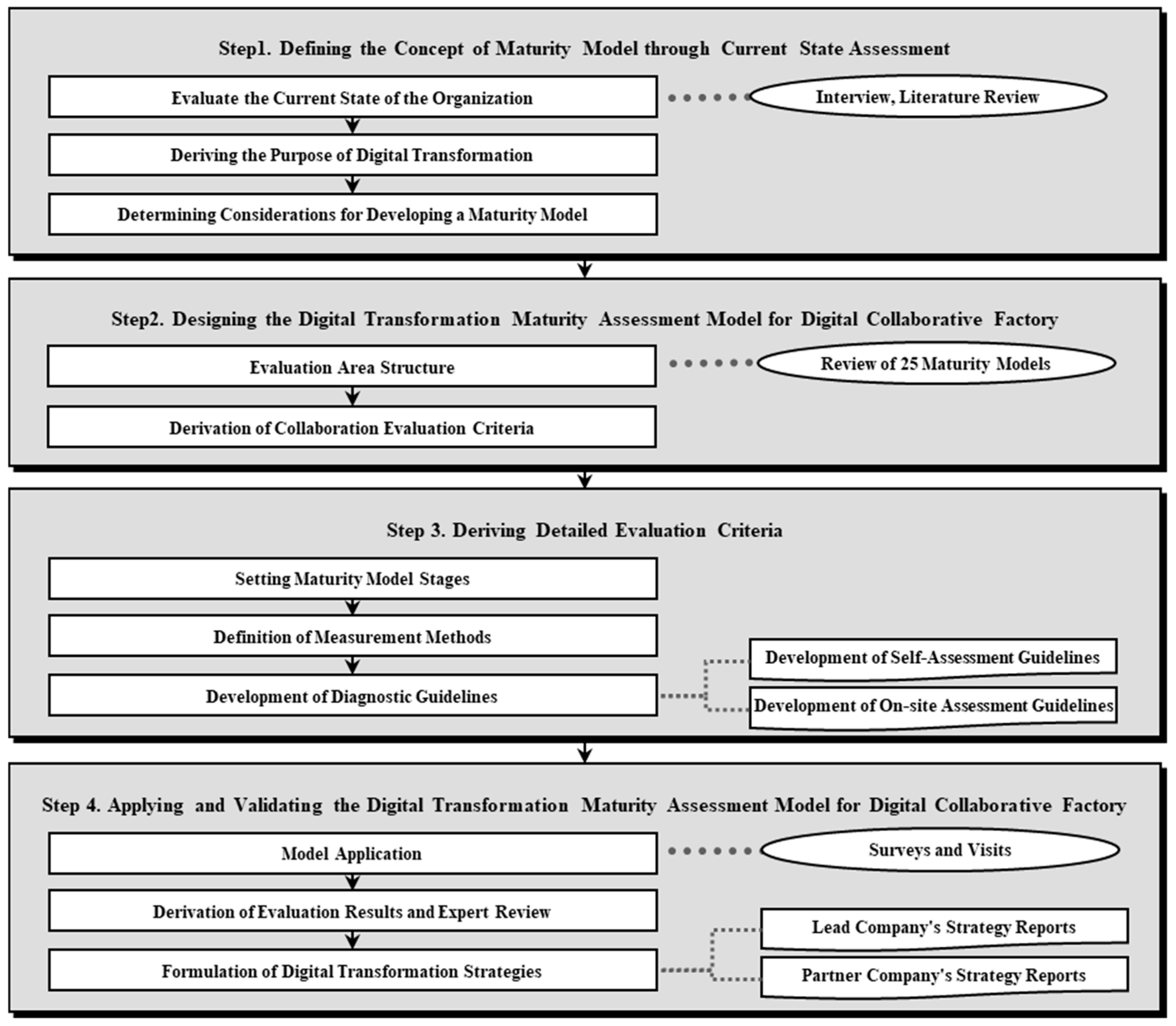

3.1. Research Method

- (1)

- Stepwise approach and systematicity: The study consisted of four stages, with clear objectives and corresponding tasks at each stage. In the first and second stage, the need for a clear roadmap for DX processes was recognized, which led to the proposal of developing a maturity assessment model to fulfill this need. The third stage involved systematically developing the model based on a maturity model development framework [28]. De Bruin et al. [28] proposed a methodology to generalize the major stages of maturity model development, which are (1) Scope, (2) Design, (3) Populate, (4) Test, (5) Deploy, and (6) Maintain. Finally, the model was validated through multiple case studies involving the lead company and seven partner companies.

- (2)

- Research motivation and future orientation: Evaluating existing research revealed deficiencies in DX roadmap areas, prompting a proposal to develop a maturity model based on established frameworks such as KS X9001-3.

- (3)

- Case studies and industrial application: Multiple case studies were conducted to validate the model, and DX levels were measured in two organizations operating in different industries and company sizes.

- (4)

- Expert participation and consensus: A panel of experts was convened before developing this model to define DX processes and measurement frameworks. The panel consisted of smart factory experts from academia, industry, and research institutes, who jointly defined DX processes.

- (1)

- Step 1. Defining the Concept of Maturity Model through Current-State Assessment

- (2)

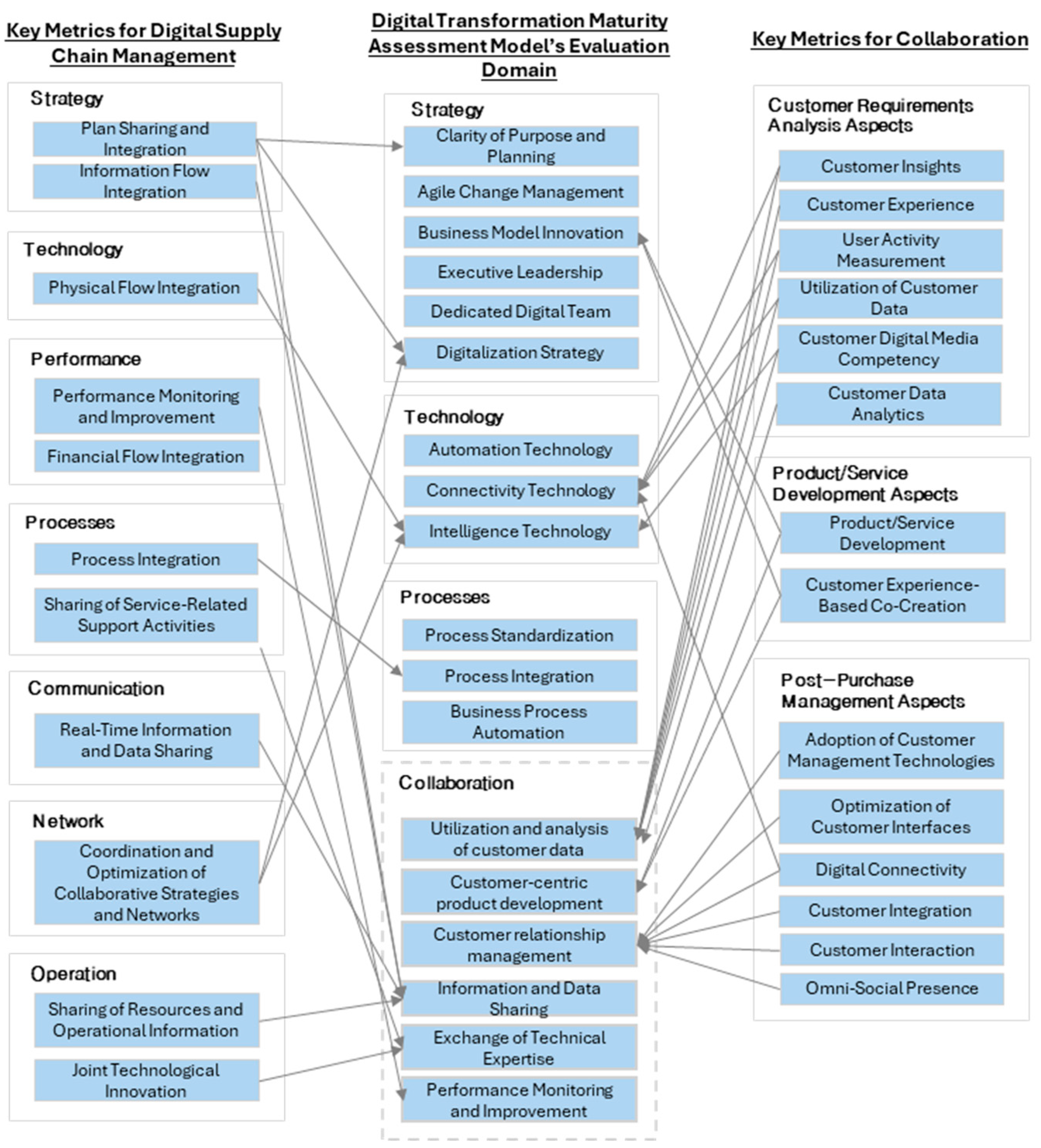

- Step 2. Designing the DX Maturity Assessment Model for Digital Collaborative Factory

- Human resources and cultural collaboration: This involves building trust between organizations and fostering a collaborative atmosphere [57].

- (1)

- Collaboration through product/service exchange involves the supplier evaluating quality factors for the customer firm, which is critical for assessing and maintaining the business relationship between the supplier and the customer firm [71].

- (2)

- Collaboration via information exchange involves assessing the supplier’s ability to provide requested information appropriately for the customer firm [71].

- (3)

- Collaboration through financial exchange requires the supplier to provide timely payments and accurate records according to the customer firm’s demands, which highlights the importance of convenient payment methods and swift invoice processing [71].

- (4)

- Collaboration via social exchange involves building trust and understanding between the customer firm and the supplier [71].

- (1)

- Collaboration from the perspective of analyzing customer requirements emphasizes understanding the requirements of customers and the ability to deliver excellent customer experience [75].

- (2)

- Collaboration from the perspective of product/service development involves using customer feedback to create products and services that enhance customer satisfaction; this defines collaboration as a means for product and process innovation [76].

- (3)

- Collaboration from the perspective of post-purchase management emphasizes continuously understanding customer demands and focusing on actions that transform digital customer experience [77].

- (3)

- Step 3. Deriving Detailed Evaluation Criteria

- (4)

- Step 4. Applying and Validating the DX Maturity Assessment Model for Digital Collaborative Factory

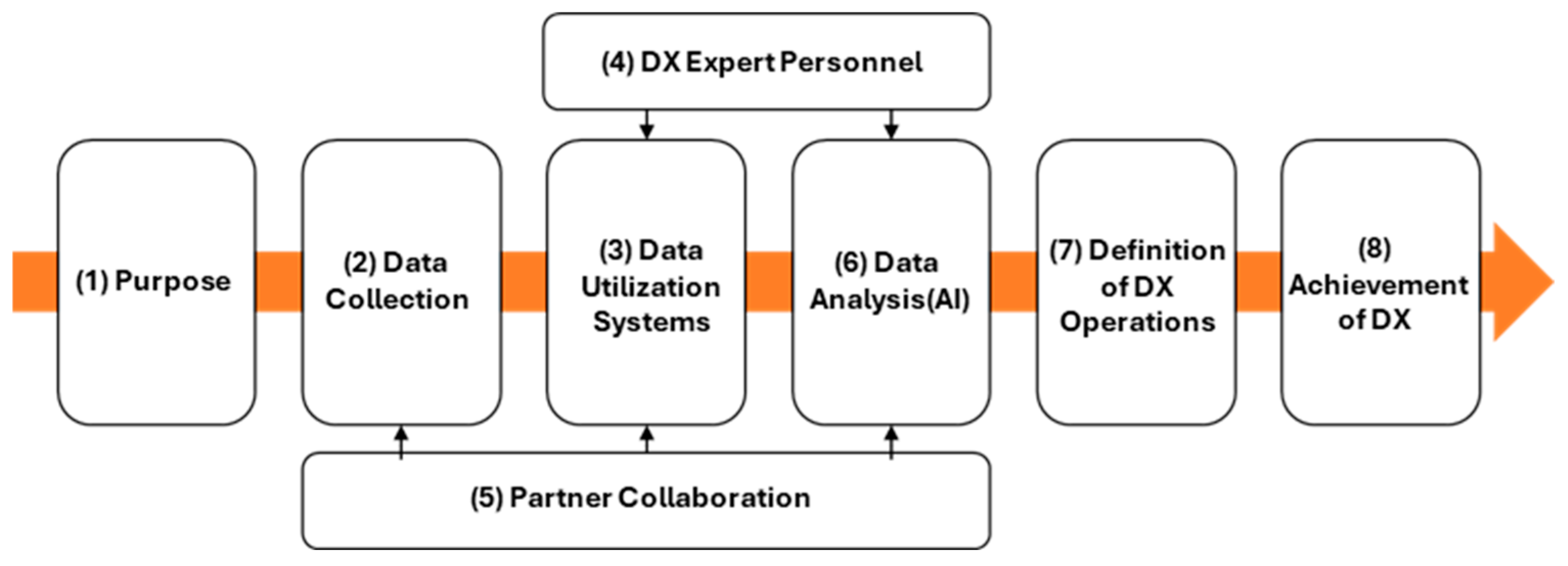

3.2. Proposal of DX Maturity Assessment Model for Digital Collaborative Factory

- (1)

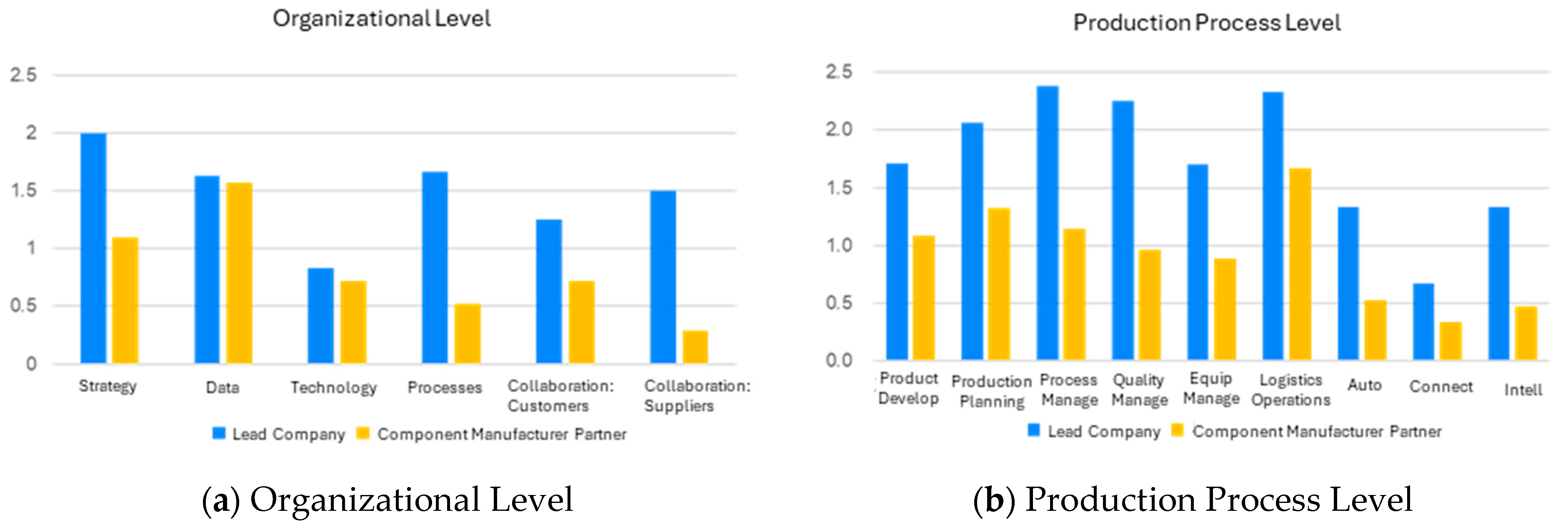

- Organizational Level: Managers represent the evaluation subjects for assessing the DX status and comparing levels with other companies.

- (2)

- Production Process Level: Field stakeholders constitute the evaluation subjects for deriving detailed improvement suggestions.

4. Illustration

4.1. Overview of Evaluation Method

- (1)

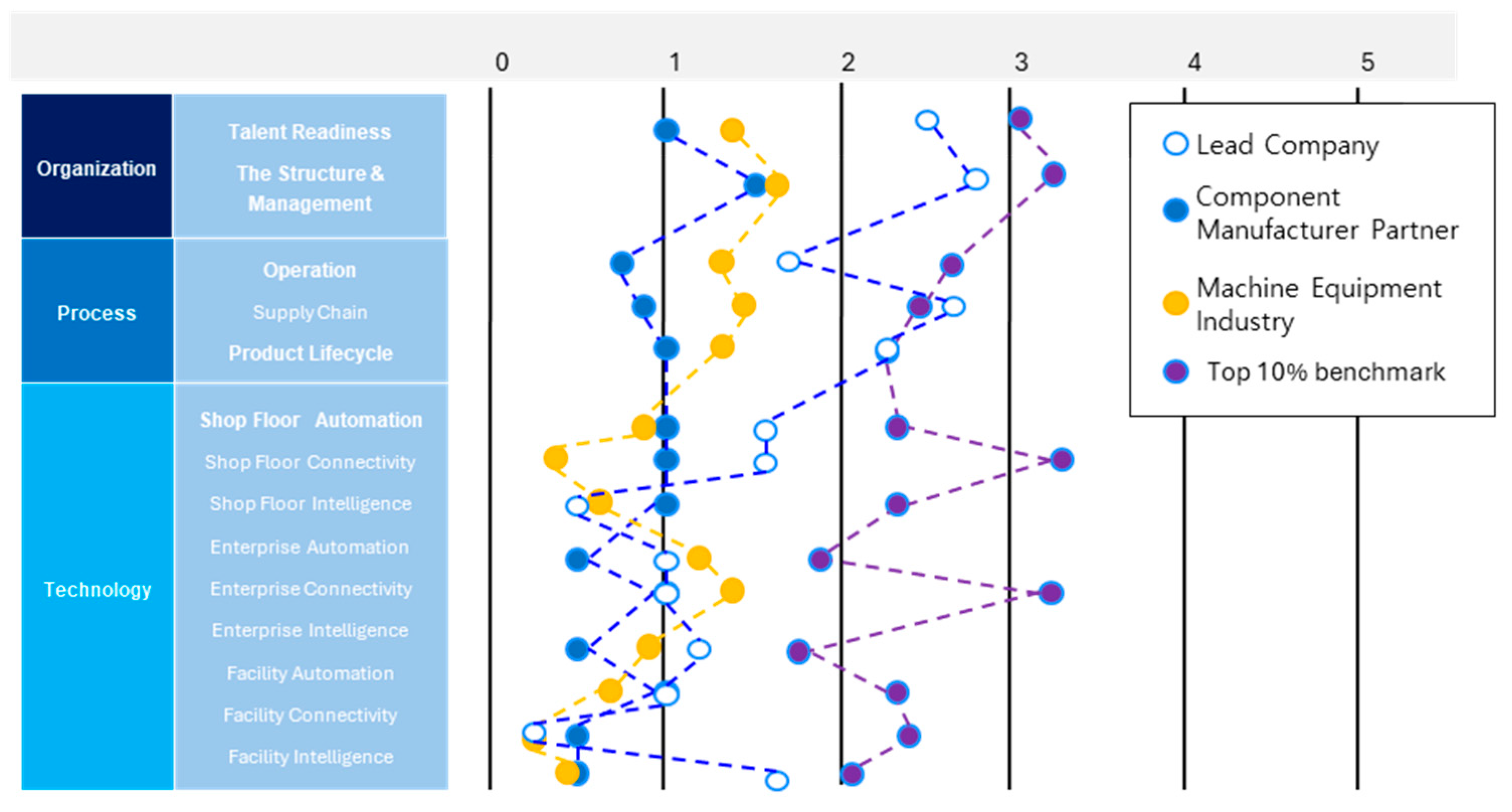

- The Talent Readiness pillar emphasizes the ability of organization members to lead and deliver the Fourth Industrial Revolution for value creation. It connects to the digitalization strategies in the proposed model’s strategy section—including digital organizational structures, leadership, and agile change management—and their alignment with capturing new opportunities and innovations in business models.

- (2)

- The Structure and Management pillar pertains to the system elements that regulate the allocation and control of roles within an organization. It highlights how interactions among members contribute to achieving organizational objectives. This can be linked to the collaboration section of the proposed model, encompassing communication with customers and collaboration with suppliers, as well as the clarity of objectives and plans, digitalization strategies, and business model innovation in the strategy section.

4.2. Self-Assessment Results

4.3. On-Site Assessment and Strategic Formulation Results

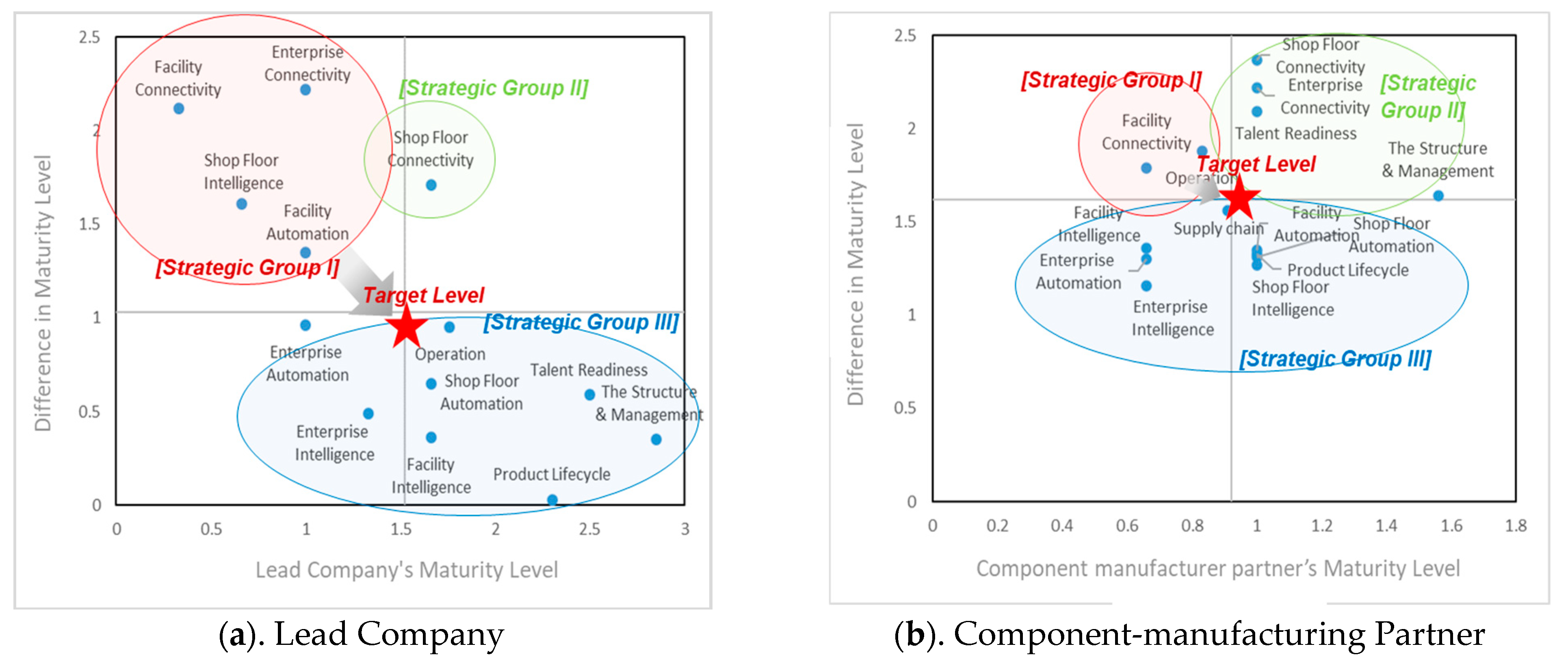

4.3.1. Lead Company

4.3.2. Component-Manufacturing Partner

4.3.3. Comparison of Strategic Planning Results between Lead Company and Component-Manufacturing Partner

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Vaska, S.; Massaro, M.; Bagarotto, E.M.; Mas, F.D. The digital transformation of business model innovation: A structured literature review. Front. Psychol. 2021, 11, 539363. [Google Scholar] [CrossRef] [PubMed]

- Büyüközkan, G.; Göçer, F. Digital Supply Chain: Literature review and a proposed framework for future research. Comput. Ind. 2018, 97, 157–177. [Google Scholar] [CrossRef]

- Iddris, F. Digital supply chain: Survey of the literature. Int. J. Bus. Res. Manag. 2018, 9, 47–61. [Google Scholar]

- Osterrieder, P.; Budde, L.; Friedli, T. The smart factory as a key construct of industry 4.0: A systematic literature review. Int. J. Prod. Econ. 2020, 221, 107476. [Google Scholar] [CrossRef]

- Shi, Z.; Xie, Y.; Xue, W.; Chen, Y.; Fu, L.; Xu, X. Smart factory in Industry 4.0. Syst. Res. Behav. Sci. 2020, 37, 607–617. [Google Scholar] [CrossRef]

- Sufian, A.T.; Abdullah, B.M.; Ateeq, M.; Wah, R.; Clements, D. Six-Gear Roadmap towards the Smart Factory. Appl. Sci. 2021, 11, 3568. [Google Scholar] [CrossRef]

- Kumar, R.S.; Pugazhendhi, S. Information sharing in supply chains: An overview. Procedia Eng. 2012, 38, 2147–2154. [Google Scholar] [CrossRef]

- Appio, F.P.; Frattini, F.; Petruzzelli, A.M.; Neirotti, P. Digital transformation and innovation management: A synthesis of existing research and an agenda for future studies. J. Prod. Innov. Manag. 2021, 38, 4–20. [Google Scholar] [CrossRef]

- Jung, M.-A.; Hong, J.-I. Digital Transformation status and Implications of Technologically Innovative SME Enterprises. STEPI Insight 2022, 287, 1–38. [Google Scholar]

- Kim, J.-H.; Park, C.-S. The Impact on Supply Chain Integration of Competitive Advantage on Information Communication Technology Capabilities. J. Korea Port Econ. Assoc. 2016, 32, 151–163. [Google Scholar]

- Gin, D.B.S. The Prioritisation Matrix Smart Industry Readiness Index—Catalysing the transformation of manufacturing. In Smart Industry Readiness Index; EDB: Singapore, 2020. [Google Scholar]

- Gökalp, E.; Martinez, V. Digital transformation capability maturity model enabling the assessment of industrial manufacturers. Comput. Ind. 2021, 132, 103522. [Google Scholar] [CrossRef]

- Lim, H.; Choi, B.; Song, J.H. Developing Building Blocks for Leading Successful Digital Transformation: Multiple Case Study Analysis for 10 Korean Public Corporations. Korea Bus. Rev. 2021, 25, 61–100. [Google Scholar] [CrossRef]

- Davenport, T.H.; Westerman, G. Why so many high-profile digital transformations fail. Harv. Bus. Rev. 2018, 9, 15. [Google Scholar]

- Henriette, E.; Feki, M.; Boughzala, I. The shape of digital transformation: A systematic literature review. In Proceedings of the 9th Mediterranean Conference on Information Systems, Greece, Samos, 7 December 2015. [Google Scholar]

- Schallmo, D.; Williams, C.A.; Boardman, L. Digital transformation of business models—Best practice, enablers, and roadmap. Int. J. Innov. Manag. 2017, 21, 1740014. [Google Scholar] [CrossRef]

- Wang, H.; Feng, J.; Zhang, H.; Li, X. The effect of digital transformation strategy on performance: The moderating role of cognitive conflict. Int. J. Confl. Manag. 2020, 31, 441–462. [Google Scholar] [CrossRef]

- Chang, T.-W.; Yoon, B.; Jun, S.; Lee, J.; Kim, H. A Study on Digital Maturity Assessment for Digital Industrial Innovation. J. Soc. E-Bus. Stud. 2022, 27, 95–111. [Google Scholar] [CrossRef]

- Agrawal, P.; Narain, R. Digital supply chain management: An Overview. IOP Conf. Ser. Mater. Sci. Eng. 2018, 455, 012074. [Google Scholar] [CrossRef]

- Meier, C. Digital supply chain management. In Digital Enterprise Transformation; Routledge: London, UK, 2016; pp. 231–262. [Google Scholar] [CrossRef]

- Kim, G.-S. Strategies for enhancing customer centricity through digital transformation. Korean Soc. Qual. Manag. Spring Acad. Present. Pap. Collect. 2021, 2021, 26. [Google Scholar]

- Kim, Y.; Park, J.-S. Digital Supply Chain Management and Performance in Chinese Companies: The Role of Artificial Intelligence Big Data Usage. J. Korean Soc. Supply Chain Manag. 2021, 21, 27–35. [Google Scholar] [CrossRef]

- Wycisk, C.; McKelvey, B.; Hülsmann, M. “Smart parts” supply networks as complex adaptive systems: Analysis and implications. Int. J. Phys. Distrib. Logist. Manag. 2008, 38, 108–125. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A.; Sokolov, B.; Ivanova, M. Literature review on disruption recovery in the supply chain. Int. J. Prod. Res. 2017, 55, 6158–6174. [Google Scholar] [CrossRef]

- Shin, Y.-H.; Mun, C.-S. An Exploratory Study on the Impact of Emerging New Technologies on Postal Logistics Services–Focusing on IoT, Big Data, and Drones. In Proceedings of the Korean Institute of Industrial Engineers Spring Conference, Jeju, Republic of Korea, 8–11 April 2015; pp. 2061–2064. [Google Scholar]

- Deloitte, L. Digital maturity model achieving digital maturity to drivegrowth. In Presentation of Deloitte, TM Forum Digital Maturity Model; Deloitte Development LLC: New York, NY, USA, 2018. [Google Scholar]

- Cho, Y. Strategies for the Digital Transformation of SMEs. Mon. KIET Ind. Econ. 2022, 280, 7–22. [Google Scholar]

- De Bruin, T.; Rosemann, M.; Freeze, R.; Kaulkarni, U. Understanding the main phases of developing a maturity assessment model. In Proceedings of the Australasian Conference on Information Systems (ACIS), Sydney, Australia, 29 November–2 December 2005. [Google Scholar]

- Lichtblau, K.; Stich, V.; Bertenrath, R.; Blum, M.; Bleider, M.; Millack, A.; Schmitt, K.; Schmitz, E.; Schröter, M. IMPULS-Industrie 4.0-Readiness, Impuls-Stiftung des VDMA, Aachen-Köln; IMPULS: Bremen, Germany, 2015. [Google Scholar]

- Schuh, G.; Anderl, R.; Gausemeier, J.; Ten Hompel, M.; Wahlster, W. Industrie 4.0 maturity index. Manag. Digit. Transform. Co. Munich 2017, 61, 11–54. [Google Scholar]

- Schumacher, A.; Erol, S.; Sihn, W. A maturity approach for assessing Industry 4.0 readiness and maturity of manufacturing enterprises. Procedia Cirp 2016, 52, 161–166. [Google Scholar] [CrossRef]

- Aagaard, A.; Presser, M.; Collins, T.; Beliatis, M.; Skou, A.K.; Jakobsen, E.M. The role of digital maturity assessment in technology interventions with industrial internet playground. Electronics 2021, 10, 1134. [Google Scholar] [CrossRef]

- Gill, M.; VanBoskirk, S. The digital maturity model 4.0. In Benchmarks: Digital Transformation Playbook; Forrester Research, Inc.: Cambridge, MA, USA, 2016. [Google Scholar]

- Grebe, M.; Rüßmann, M.; Leyh, M.; Roman Franke, M.; Anderson, W. How Bionic Companies Translate Digital Maturity into Performance; BCG-The Boston Consulting Group: Munich, Germany, 2020. [Google Scholar]

- KPMG. Are You Ready for Digital Transformation? Measuring Your Digital Business Aptitude. 2016. Available online: https://assets.kpmg.com/content/dam/kpmg/pdf/2016/04/measuring-digital-business-aptitude.pdf (accessed on 30 July 2024).

- Schumacher, A.; Nemeth, T.; Sihn, W. Roadmapping towards industrial digitalization based on an Industry 4.0 maturity model for manufacturing enterprises. Procedia Cirp 2019, 79, 409–414. [Google Scholar] [CrossRef]

- De Carolis, A.; Macchi, M.; Negri, E.; Terzi, S. A maturity model for assessing the digital readiness of manufacturing companies. Advances in Production Management Systems. In Proceedings of the Path to Intelligent, Collaborative and Sustainable Manufacturing: IFIP WG 5.7 International Conference, APMS 2017, Hamburg, Germany, 3–7 September 2017. Proceedings, Part I. [Google Scholar] [CrossRef]

- Wulf, J.; Mettler, T.; Brenner, W. Using a digital services capability model to assess readiness for the digital consumer. MIS Q. Exec. 2017, 16, 171–195. [Google Scholar]

- Kane, G.C.; Palmer, D.; Phillips, A.N. Achieving Digital Maturity; MIT: Cambridge, MA, USA, 2017. [Google Scholar]

- CISCO. 2020 Asia Pacific SMB Digital Maturity Study; Cisco: San Jose, CA, USA, 2020. [Google Scholar]

- A Sanchez, M.; I Zuntini, J. Organizational readiness for the digital transformation: A case study research. Rev. Gest. Tecnol. Manag. Technol. 2018, 18, 70–99. [Google Scholar] [CrossRef]

- Matt, C.; Hess, T.; Benlian, A. Digital transformation strategies. Bus. Inf. Syst. Eng. 2015, 57, 339–343. [Google Scholar] [CrossRef]

- Schumann, C.-A.; Tittmann, C. Digital business transformation in the context of knowledge management. In Proceedings of the European Conference on Knowledge Management, Udine, Italy, 3–4 September 2015. [Google Scholar]

- Wolf, M.; Semm, A.; Erfurth, C. Digital transformation in companies–challenges and success factors. In Proceedings of the Innovations for Community Services: 18th International Conference, I4CS 2018, Žilina, Slovakia, 18–20 June 2018. [Google Scholar] [CrossRef]

- Kobzev, V.; Izmaylov, M.; Skvortsov, S.; Capo, D. Digital transformation in the Russian industry: Key aspects, prospects and trends. In Proceedings of the International Scientific Conference-Digital Transformation on Manufacturing, Infrastructure and Service, New York, NY, USA, 18–19 November 2020. [Google Scholar] [CrossRef]

- Choi, S.; Kim, H. e-Transformation Level Assessment Model. Inf. Syst. Rev. 2005, 15, 219–239. [Google Scholar]

- Williams, C.; Schallmo, D.; Lang, K.; Boardman, L. Digital maturity models for small and medium-sized enterprises: A systematic literature review. In Proceedings of the ISPIM Conference Proceedings, Florence, Italy, 16–19 June 2019. [Google Scholar]

- Kim, H.; Ji, I. A Study on the Service Quality of Smart Factory Support Policy Using Kano Model and PCSI. J. Korea Converg. Soc. 2020, 11, 9–18. [Google Scholar] [CrossRef]

- Berger, S.; Bitzer, M.; Häckel, B.; Voit, C. Approaching digital transformation-development of a multi-dimensional maturity model. In Proceedings of the European Conference on Information Systems, Virtual, 15 June 2020. [Google Scholar]

- Verina, N.; Titko, J. Digital transformation: Conceptual framework. In Proceedings of the International Scientific Conference “Contemporary Issues in Business, Management and Economics Engineering, Vilnius, Lithuania, 9–10 May 2019. [Google Scholar] [CrossRef]

- Lee, H.L.; Whang, S. Information sharing in a supply chain. Int. J. Manuf. Technol. Manag. 2000, 1, 79–93. [Google Scholar] [CrossRef]

- Schlüter, F.; Hetterscheid, E. Supply chain process oriented technology-framework for Industry 4.0. In Proceedings of the Hamburg International Conference of Logistics (HICL), Hamburg, Germany, 12–13 October 2017. [Google Scholar] [CrossRef]

- Nam, H.; Lee, S.K. A Study on the Effect of Internal and External Supply Chain Risk Management on Performance through Supply Chain Resilience. Glob. Bus. Adm. Rev. 2022, 19, 121–141. [Google Scholar] [CrossRef]

- Gu, M.; Yang, L.; Huo, B. The impact of information technology usage on supply chain resilience and performance: An ambidexterous view. Int. J. Prod. Econ. 2021, 232, 107956. [Google Scholar] [CrossRef]

- Huo, B.; Qi, Y.; Wang, Z.; Zhao, X. The impact of supply chain integration on firm performance: The moderating role of competitive strategy. Supply Chain Manag. Int. J. 2014, 19, 369–384. [Google Scholar] [CrossRef]

- Bi, R.; Davison, R.; Smyrnios, K. The role of top management participation and IT capability in developing SMEs’ competitive process capabilities. J. Small Bus. Manag. 2019, 57, 1008–1026. [Google Scholar] [CrossRef]

- Lopez-Cabrales, A.; Valle, R.; Herrero, I. The contribution of core employees to organizational capabilities and efficiency. Hum. Resour. Manag. 2006, 45, 81–109. [Google Scholar] [CrossRef]

- Chen, L.; Zhao, X.; Tang, O.; Price, L.; Zhang, S.; Zhu, W. Supply chain collaboration for sustainability: A literature review and future research agenda. Int. J. Prod. Econ. 2017, 194, 73–87. [Google Scholar] [CrossRef]

- Li, W.; Chen, J.; Chen, B. Supply chain coordination with customer returns and retailer’s store brand product. Int. J. Prod. Econ. 2018, 203, 69–82. [Google Scholar] [CrossRef]

- Zhao, Y.; Lee, C.W. Effect of Strategic Partnership on Corporate Performance in Supply Chain Management. Glob. Bus. Adm. Rev. 2023, 20, 107–129. [Google Scholar] [CrossRef]

- Park, S.T.; Kim, T.U.; Kim, M.R. Digitization of Supply Chain Management: Key Elements and Strategic Impacts. J. Digit. Converg. 2020, 18, 109–120. [Google Scholar] [CrossRef]

- Glynn, M.S.; Woodside, A.G. Business-to-Business Marketing Management: Strategies, Cases and Solutions. Emerald Group Publishing: Bingley, UK, 2012. [Google Scholar]

- Grewal, R.; Chakravarty, A.; Saini, A. Governance mechanisms in business-to-business electronic markets. J. Mark. 2010, 74, 45–62. [Google Scholar] [CrossRef]

- Zimmerman, A.; Blythe, J. Business to Business Marketing Management: A Global Perspective; Routledge: London, UK, 2017. [Google Scholar] [CrossRef]

- Witell, L.; Kristensson, P.; Gustafsson, A.; Löfgren, M. Idea generation: Customer co-creation versus traditional market research techniques. J. Serv. Manag. 2011, 22, 140–159. [Google Scholar] [CrossRef]

- Kim, K.K.; Umanath, N.S. Information transfer in B2B procurement: An empirical analysis and measurement. Inf. Manag. 2005, 42, 813–828. [Google Scholar] [CrossRef]

- Fahey, L. Competitor intelligence: Enabling B2B marketing strategy. In Handbook of Business-to-Business Marketing; Edward Elgar Publishing: Cheltenham and Camberley, UK, 2022; pp. 138–158. [Google Scholar] [CrossRef]

- Weinstein, A.; Jin, Y.; Barrett, H. Strategic Innovation in B2B Technology Markets: A Need for a Process Perspective. J. Supply Chain Oper. Manag. 2013, 11, 64. [Google Scholar]

- Ha, H.-Y. An Empirical Test of the Relationship between Business Performance and Trust in B2B Relationships: The Moderating Effect of Relational Length. Acad. Cust. Satisf. Manag. 2020, 22, 95–111. [Google Scholar] [CrossRef]

- Sohail, M.S.; Alashban, A.A. Industrial buyer supplier relationship: Perspectives from an emerging middle east market. Int. J. Bus. Emerg. Mark. 2009, 1, 341–360. [Google Scholar] [CrossRef]

- Hâkansson, H. Industrial Marketing and Purchasing of Industrial Goods: An Interaction Approach; Wiley: London, UK, 1982. [Google Scholar]

- Chang-bong, K.; Kyeong-wook, J. A Study on the Effect of Korean Exporting SMEs’ Use of B2B Export Cross Border E-commerce Platform on Corporate Performance. Korea Logist. Rev. 2021, 31, 1–14. [Google Scholar]

- Ko, K.S.; Huh, J.J.; Oh, J.I. A Study on the Factors that Affect the Adoption of a Smart Factory—Focusing on the Comparison between Customers and Suppliers. Korea Bus. Rev. 2021, 25, 129–151. [Google Scholar] [CrossRef]

- Waryoba, F.D. The effect of information and communication technology on business performance. Rev. Romana De Econ. 2022, 55, 84–102. [Google Scholar]

- Adesanoye, O. Integrated marketing communication tools and customers’ perception and attitudes to the brands of selected Nigerian banks. Acta Univ. Danubius. Commun. 2019, 13, 26–40. [Google Scholar]

- Yang, H.K. The Effects of User Innovation and R&D Cooperation with Customers on the Innovation Performance of Korean Manufacturing Firms. J. Korea Technol. Innov. Soc. 2021, 24, 161–188. [Google Scholar]

- Park, K.; Jun, J.-H.; Chang, H.-S. The SCM Characteristics and Relationship Control on RTE Characteristics. J. Inf. Syst. 2014, 23, 25–47. [Google Scholar] [CrossRef]

- Correani, A.; De Massis, A.; Frattini, F.; Petruzzelli, A.M.; Natalicchio, A. Implementing a digital strategy: Learning from the experience of three digital transformation projects. Cal. Manag. Rev. 2020, 62, 37–56. [Google Scholar] [CrossRef]

- Wang, S.; Wan, J.; Li, D.; Zhang, C. Implementing smart factory of industrie 4.0: An outlook. Int. J. Distrib. Sens. Netw. 2016, 12, 3159805. [Google Scholar] [CrossRef]

- Li, B.; Zhao, Q.; Jiao, S.; Liu, X. DroidPerf: Profiling memory objects on android devices. In Proceedings of the 29th Annual International Conference on Mobile Computing and Networking, Miami, FL, USA, 30 September–4 October 2013; pp. 1–15. [Google Scholar] [CrossRef]

| Classification | Criterion | Characteristic |

|---|---|---|

| Scope | Focus of Model | ① Domain-Specific ② General |

| Development Stakeholders | ① Academia ② Practitioners ③ Government ④ Combination | |

| Context Information | Audience | ① Internal ② External ③ Executives, Management ④ Auditors, Partners |

| Method of Application | ① Self Assessment ② Third-Party Assisted ③ Certified Practitioner | |

| Driver of Application | ① Internal Requirement ② External Requirement ③ Both | |

| Respondents | ① Management ② Staff ③ Business Partners ④ Combination | |

| Application | ① 1 entity/1 region ② Multiple entities/single region ③ Multiple entities/multiple regions |

| No. | Model Name (Year of Release) | Refer | Domain/Area Classification | |||

|---|---|---|---|---|---|---|

| Strategy/Organization | Process | Technology/Data | Collaboration | |||

| 1 | Industrie 4.0 Readiness Model (2015) | [29] | ○ | ○ | ○ | - |

| 2 | Industrie 4.0 Maturity Index (2017) | [30] | ○ | ○ | ○ | - |

| 3 | Digital Transformers-Digital Maturity Assessment (2016) | [31] | ○ | ○ | ○ | ○ |

| 4 | Smart Industry Readiness Index (2020) | [11] | ○ | ○ | ○ | - |

| 5 | Digital Maturity Assessment Tool (2021) | [32] | ○ | ○ | ○ | ○ |

| 6 | The Digital Maturity Model 4.0 (2016) | [33] | ○ | - | ○ | - |

| 7 | Digital Acceleration Index (2020) | [34] | ○ | ○ | ○ | ○ |

| 8 | The five Digital Business Aptitude domains (2016) | [35] | ○ | ○ | - | ○ |

| 9 | Industry 4.0 Maturity Model (2019) | [36] | ○ | ○ | ○ | ○ |

| 10 | Digital REadiness Assessment MaturitY model (2017) | [37] | ○ | ○ | ○ | - |

| 11 | Digital Services Capability Mode (2017) | [38] | ○ | ○ | ○ | ○ |

| 12 | Global Digital Maturity Status (2017) | [39] | ○ | ○ | - | - |

| 13 | Asia Pacific SMEs Digital Maturity Study (2020) | [40] | ○ | ○ | ○ | - |

| 14 | Organizations digital readiness framework (2018) | [41] | - | ○ | - | ○ |

| 15 | Digital transformation framework (2015) | [42] | ○ | ○ | ○ | - |

| 16 | Digital Business Transformation in the Context of Knowledge Management (2015) | [43] | ○ | ○ | ○ | - |

| 17 | Obstacles and possibilities of digitalization (2018) | [44] | ○ | ○ | - | ○ |

| 18 | Key changes preceding digital transformation (2020) | [45] | ○ | - | ○ | ○ |

| 19 | e-Transformation Level Assessment Model (2005) | [46] | - | - | ○ | ○ |

| 20 | Digital Maturity Model (2019) | [47] | ○ | ○ | ○ | - |

| 21 | Smart Factory Level Confirmation System | [48] | ○ | ○ | ○ | - |

| 22 | DX-CMM (2021) | [12] | ○ | ○ | ○ | - |

| 23 | Digital Transformation Maturity Model (2020) | [49] | ○ | ○ | ○ | ○ |

| 24 | Development of DT Competitiveness Analysis Model (2021) | [13] | ○ | ○ | - | ○ |

| 25 | DX Competency Model (2017) | [50] | ○ | - | ○ | ○ |

| Evaluation Area | Evaluation Item | Evaluation Levels |

|---|---|---|

| Strategy | Clarity of Purpose and Plan, Digital Strategy | ① Informal, ② Structured, ③ Continuous, ④ Integrated, ⑤ Adapted, ⑥ Forward looking |

| Agile Change Management, Digital Dedicated Organization | ① None, ② Formalization, ③ Development, ④ Implementation, ⑤ Scaling, ⑥ Adaptive | |

| Business Model Innovation | ① Same as past, ② Improved, ③ Firm First, ④ Domestic First, ⑤ World First, ⑥ Change Paradigm | |

| Leadership of Executives | ① Unfamiliar, ② Limited Understanding, ③ Informed, ④ Semi-dependent, ⑤ Independent, ⑥ Adaptive | |

| Data | Data Management, Data Quality, Data Security | ① None, ② Formalization, ③ Development, ④ Implementation, ⑤ Scaling, ⑥ Adaptive |

| Data Utilization | ① None, ② Systematic collection, ③ Data processing, ④ Data analytics, ⑤ Internally Shared, ⑥ Used for Decision-making | |

| Collaboration | Communication with Customers | ① None, ② Attempted Introduction, ③ Problem Sharing, ④ Sharing Planning Information, ⑤ Joint Work Introduction, ⑥ Decision making |

| Collaboration with Suppliers | ① Informal, ② Communicating, ③ Cooperating, ④ Coordinating, ⑤ Collaborating, ⑥ Integrated | |

| Process | Product Development, Production Planning, Process Management, Quality Management, Equipment Management, Logistics Operations | ① None, ② Manual/Automated, ③ Systematized and Monitoring, ④ Automatic Monitoring and Exception Control, ⑤ Integration and Optimization, ⑥ Autonomous Operation |

| Process Standardization, Process Integration | ① None, ② Planned, ③ Defined, ④ Partially Applicated, ⑤ Entirely Applicated, ⑥ Improved | |

| Business Process Automation | ① None, ② Basic, ③ Advanced, ④ Full, ⑤ Flexible, ⑥ Converged | |

| Technology | Automation | ① None, ② Introduction of Automation Technology, ③ Advanced Automation Technology Introduction, ④ Highest-Level Automation Technology Introduction, ⑤ Situation Improvement and Flexibility, ⑥ Interaction and Integration |

| Connectivity | ① None, ② Introduction of Connectivity Technology, ③ Interoperable, ④ Information Security, ⑤ Real-time Service, ⑥ Task Management Service | |

| Intelligence | ① Presence/Absence of Enterprise System Technology, ② Computerization of Work Processes, ③ Change Detection through Monitoring, ④ Assessment Results, ⑤ Data Prediction, ⑥ Data and Environmental Change Adaptability |

| Evaluation Criteria | Evaluation Content | Question Guideline | Expected Answers and Conditions |

|---|---|---|---|

| 0. None | Confirm the presence or absence of a dedicated organization for promoting digital strategy | Does a collaboration system exist for each organization to promote the digital strategy? | (Yes) A collaboration system and a dedicated organization exist (No) No collaboration system exists for promoting digital strategy |

| 1. Formalization | Confirm the establishment of plans to form a dedicated organization for promoting digital strategy | Are you planning to form a dedicated organization for the digital strategy? | (Yes) Planning to form a dedicated organization (No) Not planning to form a dedicated organization. |

| 2. Development | Confirm whether the dedicated organization has been formed and official work has begun | Have you formed a dedicated organization and assigned specific tasks? | (Yes) A dedicated organization has been formed, and tasks have been assigned (No) No specialized tasks exist |

| 3. Implementation | Confirm whether the dedicated organization is performing its tasks | Is the dedicated organization performing assigned tasks after being formed? | (Yes) Tasks are being performed with periodic restructuring (No) There are no clearly assigned tasks |

| 4. Scaling | Confirm whether the dedicated organization is being expanded company-wide | Is the dedicated organization being expanded company-wide? | (Yes) Company-wide expansion is in progress with periodic restructuring (No) Company-wide expansion is not in progress |

| 5. Adaptive | Confirm whether the dedicated organization is being continuously restructured to adapt to the environment | Is the dedicated organization being continuously restructured to adapt to the environment? | (Yes) Periodic restructuring is in progress (No) Progressing without specific restructuring efforts |

| Evaluation Criteria | Evaluation Content | Question Guideline | Expected Answers and Conditions |

|---|---|---|---|

| 0. None | Confirm infrastructure is in place to provide timely information | Are there platforms and systems for information provision, and communication devices prepared? If not, are attempts being made to do this? | No information is provided separately/all work is done by hand |

| 1. Attempted Introduction | Confirm that company is attempting to build an infrastructure that can provide timely information | Are you planning to form a dedicated organization for the digital strategy? | There is no infrastructure yet to provide information, but plans are in place for future introduction and development |

| 2. Problem Sharing | Confirm that problem sharing and solutions are provided to customers in a timely manner | Have you formed a dedicated organization and assigned specific tasks? | Professional servers provide the necessary information through digitized systems |

| 3. Sharing Planning Information | Confirm that company can deliver business plan to customers in a timely manner | Is company providing customers with their business plans in a timely manner, such as production schedules, product/service launches, etc.? | (Yes) Provide business plans to customers in a timely manner to ensure that their plans are not disrupted (No) We do not share our business plans |

| 4. Joint Work Introduction | Confirm that that company is working with customers in real time | Can customers share production plans or business plan modifications and supplements in real time, and is this possible to collaborate? | (Yes) Customers can modify their product changes and plans through the platform (No) The ability to work with customers is not ready |

| 5. Decision making | Confirm that business management decisions are being made in collaboration with customers in a timely manner | Based on the customer’s modifications, the production schedule, and plan are re-established, and are these done in real time? | (Yes) Production plans are quickly re-established to meet customer requirements (No) Customer requirements are reflected through a series of administrative processes after confirmation by the company |

| Evaluation Criteria | Evaluation Content | Question Guideline | Expected Answers and Conditions |

|---|---|---|---|

| 0. None | Product/service quality sharing is performed through the platform | Do company provide products/services to corporate (B2B) customers? Are product/service quality information being produced shared through the platform to corporate (B2B) customers? If not, are any attempts being made to do so? | Unable to check quality information |

| 1. Attempted Introduction | Confirm that attempts are being made to share product/service quality sharing through the platform | Are you planning to form a dedicated organization for the digital strategy? | We are developing a platform to share quality information |

| 2. Problem Sharing | Confirm that the platform provides product/service quality issues | Have you formed a dedicated organization and assigned specific tasks? | Basic quality information and problems of products and services are shared through our site |

| 3. Sharing Planning Information | Confirm that the platform provides product/service planning information | Can the platform provide product/service planning information so that enterprise (B2B) customers can check the production schedule or quality information of their products? | (Yes) Enterprise (B2B) customers are providing on the platform to track their products and know their production schedules (No) Not prepared at that level |

| 4. Joint Work Introduction | Confirm that company is operating a platform that allows you to collaborate by sharing product/service information | Do company operates a platform that allows you to collaborate by sharing product/service information? | (Yes) Corporate (B2B) customers can understand their product situation and communicate through the platform when a problem arises (No) Only check the production schedule and quality information of the product, but there is no platform function for communication |

| 5. Decision-making | Confirm decisions are being made to integrate platform quality information and use analytics to improve mature product/service quality | Is company collecting and analyzing quality information data shared within the platform to improve quality standards and quality? | (Yes) The feedback provided within the platform is collected and analyzed to define major problems and include them in the quality standards (No) Not collecting or analyzing data within a separate platform |

| Evaluation Criteria | Evaluation Content | Question Guideline | Expected Answers and Conditions |

|---|---|---|---|

| 0. None | Confirm that activities related to customer-based product development are carried out through digitized systems | Can customers experience and comment on their products in advance through a digitized system? | (Yes) Virtual model or simulation of the product provides customers with the opportunity to experience the actual product (No) Does not support product experience and opinion presentation through digitized systems |

| 1. Attempted Introduction | Confirm that customers can experience the product through digitized systems | Can the digitalized system allow customers to experience the product? | (Yes) Digitalized systems (e.g., VR) enable customers to simulate and experience products in a virtual world (No) Does not provide an experience through a digitized system, focusing on the actual experience of a product or service |

| 2. Problem Sharing | Confirm that the digitized system can recognize and comment on the customer’s experienced products | Can the digitized system recognize and comment on the products the customer has experienced? | (Yes) Digital simulation or virtual experience enables the customer to identify problems or inconveniences while using the product, records them through the system or provides feedback (No) Experience is possible, but does not discuss issues |

| 3. Sharing Planning Information | Confirm that a digitized system can suggest a product development plan based on customer experience | With the digitized system, can the customer suggest a product development plan based on the customer’s experience? | (Yes) Customers are proposing improvement ideas based on their experience in product design, functionality, usability, etc. (No) Collect and analyze data indirectly, but no direct development plan proposals are made by the customer |

| 4. Joint Work Introduction | Confirm that the digitized system allows customers to collaborate on product development | Can customers jointly develop products through digitalized systems? | (Yes) Customers can collaborate with companies to develop products at various stages, including product idea presentation, design suggestion, feedback provision, prototype testing, and QA testing (No) Product development does not perform development tasks directly to customers due to security, intellectual property rights, confidential information, etc. |

| 5. Decision making | Confirm that the customer is making product development decisions with a digitized system | Are customers making product development decisions through digitized systems? | (Yes) We are developing customer engagement products that collect customer feedback and analyze it in real time to make decisions about product development. Participate in decision making about product characteristics, design, functionality, price, release schedule, etc. (No) Consider various factors and derive decisions by considering security, technical constraints, cost-effectiveness, and strategic goals. Customer participation does not have a decisive effect on decision making |

| Evaluation Criteria | Evaluation Content | Question Guideline | Expected Answers and Conditions |

|---|---|---|---|

| 0. Informal | Confirm that exchange activity processes are introduced with suppliers to complement technical capabilities | Is company conducting exchange activities to supplement technical capabilities with suppliers using digital technology? | (Yes) Remote control between computers to complement technical capabilities is carried out (No) Does not engage in exchange activities to supplement technical capabilities with suppliers |

| 1. Communicating | Confirm formal performance of exchange activity process to complement supplier and technical capabilities | Is company officially conducting exchange activities to complement technical capabilities with suppliers using digital technology? | (Yes) conducting exchanges to complement technical capabilities through formal communication with suppliers (No) No formal communication is in progress |

| 2. Cooperating | Confirm cooperative performance of exchange activity processes to complement supplier and technical capabilities | Does company mutually cooperate in exchange activities to supplement technical capabilities with suppliers using digital technology? Is company working on any improvements? | (Yes) Organizational improvement is carried out through exchanges to complement technical capabilities in cooperation with suppliers (No) No additional improvements are made |

| 3. Coordinating | Check whether the results of exchange activities to complement supplier and technical capabilities reflect the business plan | Will the results of exchange activities to complement technical capabilities with suppliers using digital technology be reflected in the establishment of the company’s business plan? | (Yes) The results of exchanges to complement the technology capabilities with suppliers are reflected in the establishment of the company’s business plan (No) Not reflected in business plan |

| 4. Collaborating | Confirm that the exchange activity process is collaborated with the supplier to complement the technical capabilities | Is the exchange activity to complement technical capabilities with suppliers using digital technology done through collaboration? | (Yes) Technical capability supplement exchange is carried out through collaboration with suppliers (No) No separate collaboration is performed |

| 5. Integrated | Confirm integrated organization of exchange activity process to complement supplier and technical capabilities | Are the exchange activities to complement technical capabilities with suppliers using digital technology carried out through the integrated organization? | (Yes) Technical capability supplement exchange is carried out (No) No separate integrated organization |

| No. | Company Type | Business Description | Analysis Type |

|---|---|---|---|

| 1 | Lead Company | Manufacturing and retail of forklifts, industrial machinery, and electronic machinery | On-site assessment and self-assessment |

| 2 | Component Manufacturer Partner | Production of forklift overhead guards | On-site assessment and self-assessment |

| 3 | Component Manufacturer Partner | Production of excavator cabins and covers | Self-assessment |

| 4 | Component Manufacturer Partner | Production of automotive parts and molds | Self-assessment |

| 5 | Component Manufacturer Partner | Production of forklift frames (chassis floors), masts, fork movers, etc. | Self-assessment |

| 6 | Component Manufacturer Partner | Production of forklift cabins | Self-assessment |

| 7 | Component Manufacturer Partner | Production of forklift frames (chassis floors), masts, and carriages | Self-assessment |

| 8 | Component Manufacturer Partner | Production of transmissions, pumps, and travel motors | Self-assessment |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, K.; Song, Y.; Park, M.; Yoon, B. Development of Digital Transformation Maturity Assessment Model for Collaborative Factory Involving Multiple Companies. Sustainability 2024, 16, 8087. https://doi.org/10.3390/su16188087

Lee K, Song Y, Park M, Yoon B. Development of Digital Transformation Maturity Assessment Model for Collaborative Factory Involving Multiple Companies. Sustainability. 2024; 16(18):8087. https://doi.org/10.3390/su16188087

Chicago/Turabian StyleLee, Keeeun, Youngchul Song, Minyoung Park, and Byungun Yoon. 2024. "Development of Digital Transformation Maturity Assessment Model for Collaborative Factory Involving Multiple Companies" Sustainability 16, no. 18: 8087. https://doi.org/10.3390/su16188087

APA StyleLee, K., Song, Y., Park, M., & Yoon, B. (2024). Development of Digital Transformation Maturity Assessment Model for Collaborative Factory Involving Multiple Companies. Sustainability, 16(18), 8087. https://doi.org/10.3390/su16188087