Sustainable Development of the China Railway Express under the Belt and Road Initiative: Focusing on Infrastructure Reliability and Trade Facilitation

Abstract

1. Introduction

- i.

- Investigating the influence of qualitative factors such as transport service (“software”) and infrastructure (“hardware”) on transportation cost, and further influence on the selection of shipper transportation routes, thereby reflecting the change of the freight volume of transportation routes

- ii.

- Quantifying infrastructure reliability and trade facilitation to demonstrate the important role of other influencing factors beyond transportation costs in enhancing the competitive advantage in terms of traffic routes

- iii.

- Applying a spatial friction model based on the electrical resistance theory to study the impact of transportation route selection based on the change of transportation cost

2. Literature Review

2.1. Transportation Infrastructure Improvement

2.2. Trade Facilitation Influence

3. Methodology

3.1. Qualitative Factors Quantified and Related Transport Costs (Step 1)

3.1.1. Infrastructure Reliability Quantified

3.1.2. Trade Facilitation Quantified

3.1.3. Costs Relevant to Goods Transportation in Transport Process

3.2. Spatial Friction Functions (Step 2)

4. Case Application and Numerical Illustration

4.1. Data Collection

- 1.

- Infrastructure reliability

- 2.

- Trade facilitation

- 3.

- Distance

- 4.

- Transport cost

4.2. Analysis and Discussion

4.2.1. Comparison and Analysis of Four Routes Based on Transport Flow Friction Percentages

4.2.2. Sensitivity Analysis

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ma, Y.; Johnson, D.; Wang, J.Y.; Shi, X. Competition for rail transport services in duopoly market: Case study of China Railway (CR) Express in Chengdu and Chongqing. Res. Transp. Bus. Manag. 2021, 38, 100529. [Google Scholar] [CrossRef]

- Qi, Y.; Harrod, S.; Psaraftis, H.N.; Lang, M. Transport service selection and routing with carbon emissions and inventory costs consideration in the context of the Belt and Road Initiative. Transp. Res. Part E 2022, 159, 102630. [Google Scholar] [CrossRef]

- Feng, F.L.; Zhang, J.Q.; Liu, C.G. Integrated pricing mechanism of China Railway Express whole-process logistics based on the Stackelberg game. Physic A Stat. Mech. Its Appl. 2023, 609, 128373. [Google Scholar] [CrossRef]

- Kundu, T.; Sheu, J.B. Analyzing the effect of government policy intervention on cross-border freight transportation flows: The Belt and Road perspective. Transp. A Transp. Sci. 2019, 15, 1360–1381. [Google Scholar] [CrossRef]

- Li, X.Y.; Xie, C.; Bao, Z.Y. A multimodal multi-commodity network equilibrium model with service capacity and bottleneck congestion for China-Europe containerized freight flows. Transp. Res. Part E Logist. Transp. Rev. 2022, 164, 102786. [Google Scholar] [CrossRef]

- Zeng, Q.C.; Wang, W.Y.; Grace Qu, C.R.; Li, K.X. Impact of the Carat Canal on the evolution of hub ports under China’s Belt and Road initiative. Transp. Res. Part E 2018, 117, 96–107. [Google Scholar] [CrossRef]

- Wen, X.; Ma, H.-L.; Choi, T.-M.; Sheu, J.-B. Impacts of the Belt and Road Initiative on the China-Europe trading route selections. Transp. Res. Part E Logist. Transp. Rev. 2019, 122, 581–604. [Google Scholar] [CrossRef]

- Arvis, J.F.; Ojala, L.; Shepherd, B.; Ulybina, D.; Wiederer, C. Connecting to Compete 2023 Trade Logistics in an Uncertain Global Economy [Online]; World Bank: Washington, DC, USA, 2023. [Google Scholar]

- Du, Y.W.; Yang, N.; Wen, Z.; Li, C.X. A reliability-based consensus model for multi-attribute group decision-making with analytically evidential reasoning approach. Math. Probl. Eng. 2018, 2018, 1651857. [Google Scholar] [CrossRef]

- Herrero, A.G.; Xu, J.W. China’s Belt and Road Initiative: Can Europe expect trade gains? China World Econ. 2017, 25, 84–99. [Google Scholar] [CrossRef]

- Yang, D.; Pan, K.; Wang, S. On service network improvement for shipping lines under the one belt one road initiative of China. Transp. Res. Part E Logist. Transp. Rev. 2018, 117, 82–95. [Google Scholar] [CrossRef]

- Hidirov, S.; Guler, H. Reliability, availability and maintainability analyses for railway infrastructure management. Struct. Infrastruct. Eng. 2019, 15, 1221–1233. [Google Scholar] [CrossRef]

- Muravev, D.; Hu, H.; Zhou, H.S.; Pamucar, D. Location optimization of CR Express international logistics centers. Symmetry 2020, 12, 143. [Google Scholar] [CrossRef]

- Soyres, F.D.; Mulabdic, A.; Ruta, M. Common Transport Infrastructure: A Quantitative Model and Estimates from the Belt and Road Initiative. J. Dev. Econ. 2020, 143, 102415. [Google Scholar] [CrossRef]

- Tan, L.; Hu, X.; Tang, T.; Yuan, D. A lightweight metro tunnel water leakage identification algorithm via machine vision. Eng. Fail. Anal. 2023, 150, 107327. [Google Scholar] [CrossRef]

- Hu, X.; Tan, L.; Tang, T. M2BIST-SPNet: RUL prediction for railway signaling electromechanical devices. J. Supercomput. 2024, 80, 16744–16774. [Google Scholar] [CrossRef]

- National Development and Reform Commission (NDRC) of People’s Republic of China. Vision and Actions on Jointly Building Silk Road Economic Belt and 21st-Century Maritime Silk Road. Available online: http://hr.mofcom.gov.cn/artcle/chnanews/201503/20150300925990.shtml (accessed on 28 March 2023).

- Chen, D.; Peng, S.F.; Lian, F.; Yang, Z. Optimization of a Japan-Europe multimodal transportation corridor. Transp. Res. Part A Policy Pract. 2023, 175, 103782. [Google Scholar] [CrossRef]

- Wang, S.H.; He, Y.; Chen, H. Can raising trade barriers curb industrial pollution emissions? Energy Environ. 2023, 34, 2454–2477. [Google Scholar] [CrossRef]

- Johns, M.B.; Clarke, J.L.; Kerswell, C.; McLinden, G. Trade Facilitation Challenges and Reform Priorities for Maximizing the Impact of the Belt and Road Initiative; Discussion Paper; World Bank: Washington, DC, USA, 2018. [Google Scholar] [CrossRef]

- Wang, J.X.J.; Yau, S. Case studies on transport infrastructure projects in belt and road initiative: An actor network theory perspective. J. Transp. Geogr. 2018, 71, 213–223. [Google Scholar] [CrossRef]

- Ramasamy, B.; Yeung, M.C.H. China’s one belt one road initiative: The impact of trade facilitation versus physical infrastructure on exports. World Econ. 2019, 42, 1673–1694. [Google Scholar] [CrossRef]

- Wang, S.H.; Wang, H. Factor market distortion, technological innovation, and environmental pollution. Environ. Sci. Pollut. Res. 2022, 29, 87692–87705. [Google Scholar] [CrossRef]

- Liang, Y.; Guo, L.; Li, J.L.; Zhang, S.; Fei, X.Y. The impact of trade facilitation on cross-border E-commerce transactions: Analysis based on the marine and land cross-border logistical practices between China and countries along the Belt and Road. Water 2021, 13, 3567. [Google Scholar] [CrossRef]

- Pang, D.M. Analysis of International Customs Cooperation Mechanisms and the Promotion of Trade Facilitation under the Belt and Road Initiative. Glob. Trade Cust. J. 2023, 18, 294–301. [Google Scholar] [CrossRef]

- Li, B.M.; Zeng, C. Research on the impact of trade facilitation on China’s export potential: Take the countries along the Belt and Road as an example. Decis. Inf. 2023, 9, 65–77. (In Chinese) [Google Scholar]

- Gul, N.; Iqbal, J.; Nosheen, M.; Wohar, M. Untapping the role of trade facilitation indicators, logistics and information technology in export expansion and diversification. J. Int. Trade Econ. Dev. 2024, 33, 369–389. [Google Scholar] [CrossRef]

- Chen, L.J.; Zhang, W. China OBOR in perspective of High-speed Railway (HSR) Research on OBOR economic expansion strategy of China. Adv. Econ. Bus. 2015, 3, 303–321. [Google Scholar] [CrossRef]

- Sarker, M.N.I.; Hossin, M.A.; Yin, X.H.; Sarkar, M.K. One Belt One Road Initiative of China: Implication for Future of Global Development. Mod. Econ. 2018, 9, 623–638. [Google Scholar] [CrossRef]

- Lian, F.; He, Y.; Yang, Z. Competitiveness of the China-Europe Railway Express and liner shipping under the enforced sulfur emission control convention. Transp. Res. Part E Logist. Transp. Rev. 2020, 135, 101861. [Google Scholar] [CrossRef]

- McGinnis, M.A. The relative importance of cost and service in freight transportation choice: Before and after deregulation. Transp. J. 1990, 30, 12–19. [Google Scholar] [CrossRef]

- Zhang, Y.R.; Meng, Q.; Ng, S.H. Shipping efficiency comparison between Northern Sea Route and the conventional Asia-Europe shipping route via Suez Canal. J. Transp. Geogr. 2016, 57, 241–249. [Google Scholar] [CrossRef]

- Zheng, W.J.; Xu, X.H.; Wang, H.W. Regional logistics efficiency and performance in China along the Belt and Road Initiative: The analysis of integrated DEA and hierarchical regression with carbon constraint. J. Clean. Prod. 2020, 276, 123649. [Google Scholar] [CrossRef]

- Maliszewska, M.; Mensbrugghe, D.V.D. The Belt and Road Initiative: Economic, Poverty and Environmental Impacts; Policy Research Working Paper; No. WPS 8814; World Bank: Washington, DC, USA, 2019. [Google Scholar]

- RailFreight. Malaszewicze-Brest Border Crossing Main Bottleneck on New Silk Road. Available online: https://www.railfreight.com/beltandroad/2018/03/29/malzewicze-brest-border-crossing-main-bottleneck-on-new-silk-road/?gdpr=deny (accessed on 3 May 2021).

- RailFreight. Four Ways to Speed up Trains on the New Silk Road. Available online: https://www.railfreight.com/beltandroad/2020/01/30/four-ways-to-speed-up-trains-on-the-new-silk-road/ (accessed on 3 March 2021).

- Rodemann, H.; Templar, S. The enablers and inhibitors of intermodal rail freight between Asia and Europe. J. Rail Transp. Plan. Manag. 2014, 4, 70–86. [Google Scholar] [CrossRef]

- Jakóbowski, J.; Popawski, K.; Kaczmarski, M. The Silk Railroad. The EU-China Rail Connections: Background, Actors, Interests; Varsovie Centre for Eastern Studies/OSW Studies: Warsaw, Poland, 2018. [Google Scholar]

- Bollobás, B. Modern Graph Theory. Grad. Texts Math. 1998, 184, 39–66. [Google Scholar]

- Reis, V. Analysis of mode choice variables in short-distance intermodal freight transport using an agent-based model. Transp. Res. Part A Policy Pract. 2014, 61, 100–120. [Google Scholar] [CrossRef]

- Demir, E.; Hrušovský, M.; Jammernegg, W.; Woensel, T.V. Green intermodal freight transportation: Bi-objective modeling and analysis. Int. J. Prod. Res. 2019, 57, 6162–6180. [Google Scholar] [CrossRef]

- Jiang Y l Sheu, J.B.; Peng, Z.X.; Yu, B. Hinterland patterns of China Railway (CR) express in China under the Belt and Road Initiative: A preliminary analysis. Transp. Res. Part E Logist. Transp. Rev. 2018, 119, 189–201. [Google Scholar] [CrossRef]

| Arc | Route 1 | Route 2 | Route 3 | Route 4 |

|---|---|---|---|---|

| Arc 1 | Zhengzhou–Erenhot (SRG) | Zhengzhou–Alashankou (SRG) | Zhengzhou–Kashgar (SRG) | Zhengzhou–Shanghai (SRG) |

| Arc 2 | Erenhot−Brest (BRG) | Alashankou−Brest (BRG) | Kashgar−Gwadar (SRG) | Shanghai–the Suez Canal (V) |

| Arc 3 | Brest–Hamburg (SRG) | Brest–Hamburg (SRG) | Gwadar–Hamburg (V) | the Suez Canal–Hamburg (V) |

| Index | Route 1 | Route 2 | Route 3 | Route 4 |

|---|---|---|---|---|

| Total distance, km | 10,454 | 10,245 | 20,026 | 23,735 |

| Chinese standard gauge distance, km | 1400 | 3606 | 3945 | 998 |

| Foreign broad gauge distance, km | 7954 | 5539 | - | - |

| Foreign standard gauge distance, km | 1100 | 1100 | 3000 | - |

| Seaborne distance, nm | - | - | 7063 | 12277 |

| Period, days | 15 | 15 | 21 | 32 |

| Index | Route 1 | Route 2 | Route 3 | Route 4 |

|---|---|---|---|---|

| Chinese unit cost, USD/FEU·km (standard gauge) | 0.6 | 0.6 | 0.6 | 0.4 |

| Foreign unit cost, USD/FEU·km (broad gauge) | 0.441 | 0.694 | - | - |

| Foreign unit cost, USD/FEU·km (standard gauge) | 0.864 | 0.864 | 0.6 | - |

| Foreign unit cost, USD/FEU·nm (seaborne container) | - | - | 0.16 | 0.16 |

| (un)Loading unit cost, USD/FEU | 1000 | 1000 | 1165 | 1165 |

| Forwarding cost, USD/FEU | 1500 | 1500 | 1629 | 1700 |

| Total freight costs, USD/FEU | 7798 | 9458 | 8091 | 5229 |

| External variable μ(USD) | 60,000.00 | 60,000.00 | 60,000.00 | 60,000.00 |

| External variable ρ(USD) | 40,000.00 | 40,000.00 | 40,000.00 | 40,000.00 |

| Degree of Trade Facilitation (Infrastructure Reliability Is 1) | Route 1 | Route 2 | Route 3 | Route 4 |

|---|---|---|---|---|

| 0 | 0.2489 | 0.2631 | 0.2406 | 0.2474 |

| 0.2 | 0.2487 | 0.2658 | 0.2387 | 0.2468 |

| 0.4 | 0.2482 | 0.2700 | 0.2359 | 0.2459 |

| 0.6 | 0.2473 | 0.2772 | 0.2312 | 0.2443 |

| 0.8 | 0.2450 | 0.2926 | 0.2217 | 0.2406 |

| 1 | 0.2337 | 0.3485 | 0.1927 | 0.2252 |

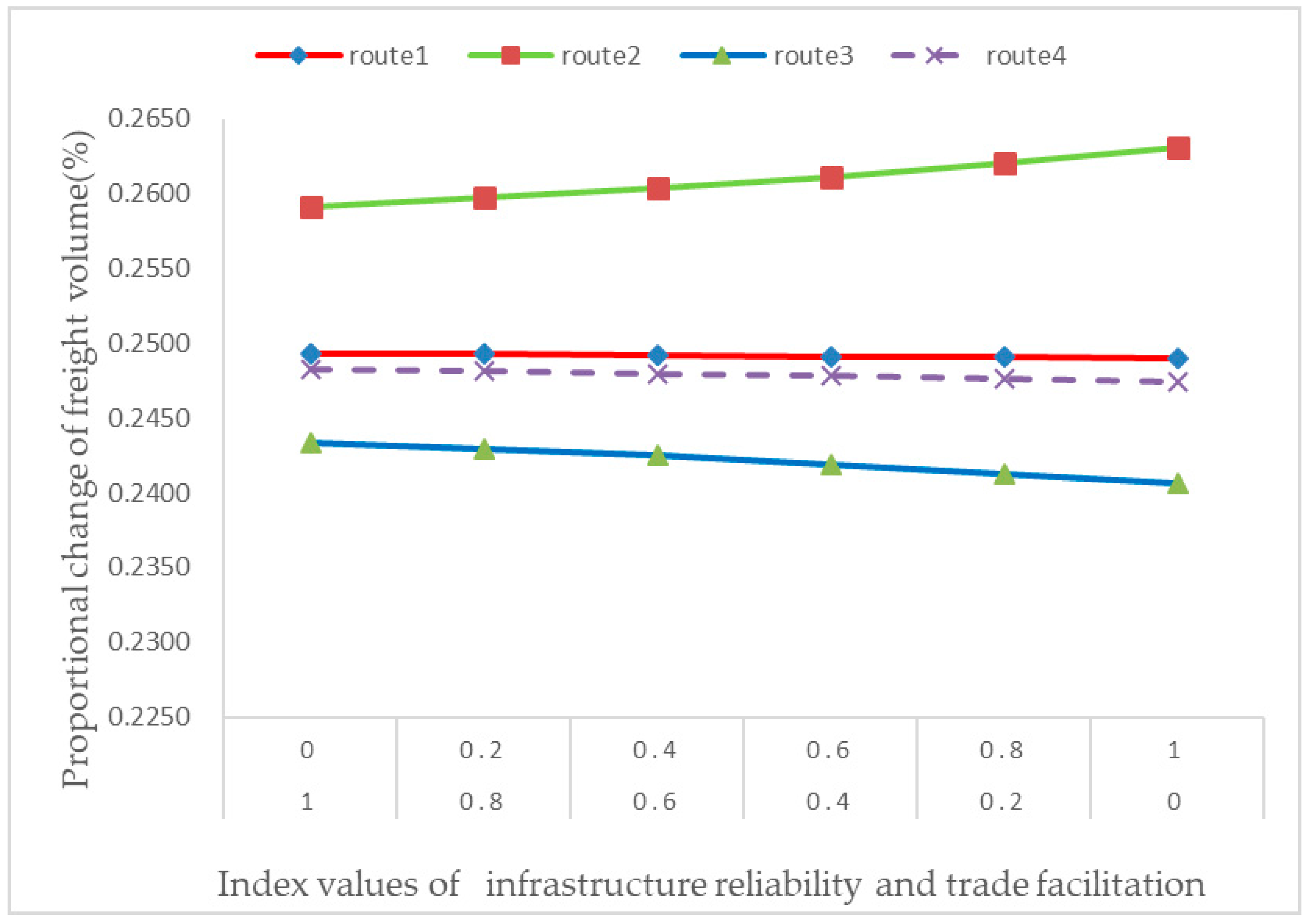

| Degree of Infrastructure Reliability (Trade Facilitation Is 1) | Route 1 | Route 2 | Route 3 | Route 4 |

|---|---|---|---|---|

| 0 | 0.2493 | 0.2591 | 0.2433 | 0.2482 |

| 0.2 | 0.2491 | 0.2611 | 0.2419 | 0.2478 |

| 0.4 | 0.2488 | 0.2643 | 0.2397 | 0.2472 |

| 0.6 | 0.2482 | 0.2700 | 0.2359 | 0.2459 |

| 0.8 | 0.2465 | 0.2832 | 0.2274 | 0.2429 |

| 1 | 0.2337 | 0.3485 | 0.1927 | 0.2252 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, Q.; Xiao, Y.; Wang, G.; Cui, D. Sustainable Development of the China Railway Express under the Belt and Road Initiative: Focusing on Infrastructure Reliability and Trade Facilitation. Sustainability 2024, 16, 8167. https://doi.org/10.3390/su16188167

Yu Q, Xiao Y, Wang G, Cui D. Sustainable Development of the China Railway Express under the Belt and Road Initiative: Focusing on Infrastructure Reliability and Trade Facilitation. Sustainability. 2024; 16(18):8167. https://doi.org/10.3390/su16188167

Chicago/Turabian StyleYu, Qin, Yun Xiao, Guangmin Wang, and Di Cui. 2024. "Sustainable Development of the China Railway Express under the Belt and Road Initiative: Focusing on Infrastructure Reliability and Trade Facilitation" Sustainability 16, no. 18: 8167. https://doi.org/10.3390/su16188167

APA StyleYu, Q., Xiao, Y., Wang, G., & Cui, D. (2024). Sustainable Development of the China Railway Express under the Belt and Road Initiative: Focusing on Infrastructure Reliability and Trade Facilitation. Sustainability, 16(18), 8167. https://doi.org/10.3390/su16188167